ECO121-Economics Theory and Practice ,9th edition-Patrick Welch,Gerry Welch-2010-(Learnclax.com)

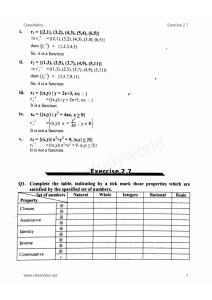

advertisement