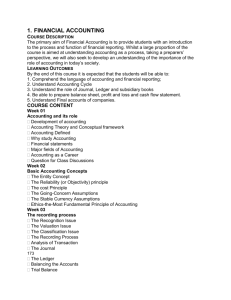

GC WOMEN UNIVERSITY SIALKOT DEPARTMENT OF BUSINESS ADMINISTRATION Course Outline FINANCIAL ACCOUNTING Basic Information Course Name Financial Accounting-I Course Code Mgt- Program BBA Semester Fall 2021 Credit Hours 3 Resource Person Ms. Tajalli Fatima Contact information tajalli.fatima@gcwus.edu.pk Phone: 0331-6705158 Office Hours: 9:am to 11:00 pm (Mon, Tues, Wed, Fri) Course Description: The primary aim of Financial Accounting is to provide students with an introduction to the process and function of financial reporting. Whilst a large proportion of the course is aimed at understanding accounting as a process, taking a preparer’s‟ perspective, we will also seek to develop an understanding of the importance of the role of accounting today. This course is aimed at people with no or limited prior accounting knowledge and provides an understanding of how financial statements are prepared for various types of organizations. Evaluation All the activities held during the session will be evaluated. Final grades for the course will be awarded on the basis of the following breakdown: Assignments: Project: Quizzes: Mid Term Examination: Final Examination: 5% 5% 5% 30% 50% Total: 100% Learning Objectives: Develop a thorough understanding of accounting records and how to record transactions in them. Be able to prepare a set of financial statements for various forms of businesses and non-profit entities. Develop an ability to apply accounting concepts, principles and practices. Be familiar with the basic tools for analyses of financial statements. Prepared by: Tajalli Fatima Course Outline: Accounting and its role, Development of accounting, Accounting Theory and Conceptual framework, Accounting Defined, Why study Accounting, Financial statements, Major fields of Accounting, Accounting as a Career, Basic Accounting Concepts, The recording process, Preparation of Financial Statements, The adjusting and closing entries, Accounting for trading organization, Accounting Systems, Cash and temporary investment, Accounting for debtors and stock, Accounting for property, plant and equipment Text Book: 1. Meigs and Meigs, Accounting for Business Decision, 9th Edition/Latest Edition Supplementary Material: 2. Professor Muhammad Ammanullah Khan: Financial Accounting, Latest Edition 3. Frank Wood?s: Business Accounting 1, Eleventh Edition 4. Williams, Haka, Bettner: Financial & Managerial Accounting, Latest Edition, Prentice Hall Classroom Behavior: During class, all cell phones and pagers must be turned off or set to “vibrate.” If you are on-call for emergencies, please let me know at the beginning of the class. Participant Responsibilities: The Participant is responsible for all information presented in class (unless told otherwise) and all information in the reading assignments, whether covered by the instructor. In case of absence it is the participant’s responsibility to get class notes, handouts, and/or directions from a classmate. Regular student attendance and participation is very important. The material covered in the classroom will be cumulative in nature, and missing classes will tend to put a student "out of sync" in ways that won't be entirely evident until an assignment or examination comes due. If you must miss a class, please let the instructor know - a make-up class can sometimes be arranged, or classroom handouts picked up. Honesty Policy: A Participant found in cheating on any exam/ assignment/ project will receive no credit (i.e. no grade) for that exam/ assignment/ project. Plagiarism is a serious academic offence. Students who plagiarize material for assignments will receive a mark of zero (F) on the assignment and may fail the course. Plagiarism may result in dismissal from a program of study or the college. Plagiarism involves presenting the words of someone else as you own. Plagiarism can be the deliberate use of a whole piece of another person’s writing, but more frequently it occurs when students fail to acknowledge and to document sources from which they have taken material. Prepared by: Tajalli Fatima Topic Breakdown Week 1 2-3 Topics Underlying principles the building blocks Chapter 01 Introduction of accounting Uses and purpose of accounting Types of accounting User of financial Information Types of Business entity The framework of accounting Accounting concepts, standards and processes An introduction to financial statements Construction and use of financial statements Accountability and financial reporting Information Processing 02 4 5-7 Accounts, Debit Credit Rules Recording into the journals, Classification, form of classification Preparation of trial balance What does balance sheet tell us? Structure of balance sheet Capital reserve or shareholders’ equity, liabilities, assets Balance sheet formats An introduction to Accounting Cycle Computerized processing systems. Measuring Business Income 03 "Measurement triggering" transactions and events. The periodicity assumption and its accounting implications. Basic elements of revenue recognition. Basic elements of expense recognition. The adjusting process and related entries. Accrual- versus cash-basis accounting. What does the profit and loss account tell us? Structure of P & L account P& L account formats The Accounting Cycle 04 8 9-10 The accounting cycle, adjusted entries, adjusted trial balance, adjusted balance sheet, closing entries, Worksheet and closing process. Preparation of Financial statements The nature of “optional” revering entries. Classified balance sheets. The importance of business liquidity and the concept of an operating cycle. Mid term Accounting for companies Prepared by: Tajalli Fatima 11-12 13 14-15 05 Company final Accounts Published Annual Report The contents of the Published Accounts Dividends Reserve Dividend payment process Profit and Loss Appropriation Account Statement of Stockholders Equity: Paid-in Capital. Preparation and Interpretation of Cash Flow 09 Long-term Assets: Plant, Property and equipment 10 16 The Company Types of Company Formation of a Public Limited Co, Classes of Shares Ordinary Shares Preference Shares Issuance of Shares Market Value of Shares Share Capital and Share Premium Measurement of costs assigned to property, plant and equipment Principles relating to service life and depreciation The basic concepts and terminology of depreciation The methods of depreciation Recording of disposal of assets Depreciation and its impact on cash flow and income tax Term Quiz-II Recap and revision of course Additional Notes by Instructor (Optional): Classroom conduct is kept in strict review by the instructor. Absenteeism without reason is discouraged and constructive participation and teamwork/ group study in the course is highly encouraged. Prepared by: Tajalli Fatima