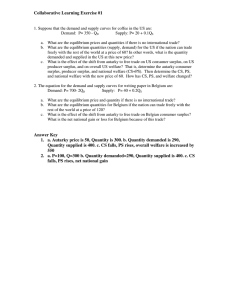

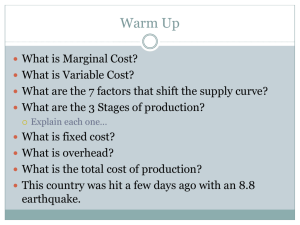

Faculty of Business & Economic Sciences ECO1001 Chapter 5 – Demand and supply applied Clifford Johnson Chapter Outcomes Once you have studied this chapter you should be able to • explain how equilibrium price and quantity in the market is affected by: • Changes in demand • Changes in supply. • predict the effects of simultaneous changes in demand and supply. • analyse the interaction between related markets. • Show the effects of government intervention markets, for example by setting minimum or maximum prices. Demand Determinants of Demand • • • The quantity of goods demanded by an individual (household) in a particular period of time depends on (function of), a) the price of the good, b) prices of related goods, c) income of the individual, d) taste and e) the number of individuals in the household. Symbolically we can denote demand as: • QD = quantity demanded (dependent variable) • Px • Pg • Y Independent variables • T • N QD = f (Px , Pg , Y , T , N, …) Changes in demand • Increase in demand QD : • Px - quantities demanded • Pr • Y Change in • T DEMAND • N QD = f (Px , Pg , Y , T , N, …) • • • Initial E, P0 ,Q0 • DD P1 • NEW E1 ▪ . Q1 Figure: Changes in demand Changes in demand • Decrease in demand QD : • Px – quantities demanded • Pg • Y Change in • T DEMAND • N QD = f (Px , Pg , Y , T , N, …) • • • Initial E, P0 ,Q0 • DD P2 • New E2 ▪ . Q2 Figure: Changes in demand Changes in demand Figure: Examples of changes in demand Changes in demand Figure: Examples of changes in demand continued Changes in demand Figure: Examples of changes in demand continued Supply Determinants of Supply • • The quantity of goods supplied by an individual producer (seller/firm) in a particular period of time depends upon (function of), a) the price of the good, b) prices of alternative output, c) the price of the FOP, d) expected future prices of the good and e) the state of technology. Symbolically we can denote supply as: • QS = quantity supplied (dependent variable) • Px • Pg • Pf Independent variables • Pe • Ty • QS = f (Px , Pg , Pf , Pe , Ty , N …) Changes in supply • Increase in supply QS : • Px - quantities supplied • Pg • Pf CHANGE IN • Pe SUPPLY • Ty • N QS = f (Px , Pg , Pf , Pe , Ty , N …) • • • Initial E, P0 ,Q0 • SS P1 • NEW E1 Q1 Figure: Changes in supply Changes in supply • Decrease in supply QS : • Px - quantities supplied • Pg • Pf CHANGE IN • Pe SUPPLY • Ty • N QS = f (Px , Pg , Pf , Pe , Ty , N …) • • • Initial E, P0 ,Q0 • SS P2 • NEW E2 ▪ . Q2 Figure: Changes in supply Changes in supply Figure: Examples of changes in supply Changes in supply Figure: Examples of changes in supply continued Simultaneous changes in demand and supply Table: Simultaneous changes in demand and supply Simultaneous changes in demand and supply Figure: A simultaneous change in demand and supply Simultaneous changes in demand and supply Figure: A simultaneous increase in demand and decrease in supply continued Interaction between related markets • Fish and meat: Figure - Interaction between the markets for fish and meat Interaction between related markets • Motorcars and tyres Figure: Interaction between markets for motorcars and tyres Government intervention Government intervention • • • Changes in previous section occur in a “competitive market” But sometimes parties are unsatisfied with PRICES and QUANTITIES of goods and services. Government intervenes: • Set maximum prices (price ceilings) • Set minimum prices (price floors) • Subsidise certain goods and services • Taxing certain goods and services Government intervention Government intervention • • • Government sets maximum prices in order to: • Keep prices of basic food prices low, assisting the poor • Avoid exploitation of consumers • Combat inflation • Limit production of certain goods and services If the maximum price above E – no effect on the market If below E, the market is affected (excess demand) Government intervention • Price ceiling (max price) • Point c – above E • No effect • Point a – below E • Excess demand (shortage) • Problem arises with excess DD • “first come first serve” • Rationing system may be - established by producers - (eg. 3 max per customer) • Rationing system may be - established by government - (coupons/tickets) Figure Maximum prices Government intervention • Price ceiling (max price) • Rationing systems cause additional costs. • - Other consequences include: • Black markets (unlawful) • Creates shortages • Prevents markets allocating resources efficiently Figure Maximum prices Government intervention Maximum prices (price ceilings, price control) -The welfare costs of maximum price fixing Figure: The welfare costs of maximum price fixing Government intervention Government intervention • • • • Government sets minimum prices in order to: • Prevent large fluctuations in agricultural product markets • Unstable and uncertain income to farmers If the minimum price below E – no effect on the market If below E, a surplus occurs (excess supply) Government may intervene further by: • Purchasing surplus and exporting it • Storing the surplus (non-perishable goods) • Destroying the surplus • Requesting producers to destroy surplus • Quotas imposed to limit quantities Government intervention • Price floor (min price) • Consequences include: • Artificially higher prices • Benefit accrues to larger companies • Inefficient producers are protected and survive • Disposal causes an additional cost to taxpayers Figure: A minimum price (Textbook page 94) Government intervention Minimum prices (price supports, price floors) – The welfare costs of minimum price fixing - Deadweight loss? - Government revenue? Government intervention Government intervention • Alternative Government intervention include: • Subsidies • Taxes • Quotas (limit quantities supplied) • Import tariffs (import tax) Government intervention • Subsidies Taxes Figures: A subsidy paid to suppliers. A tax on cigarettes Government intervention – The welfare implications of a specific excise tax Figure: The welfare costs of a specific excise tax Government intervention • Quotas Figure: The impact of a production quota Government intervention • Import tariffs Figure: The impact of a specific import tariff Government intervention Import tariffs - The welfare effects of an Import tariff. - Transfer of surplus: - Consumers - Producers - Government? Figure: the welfare costs of a tariff Agricultural prices Figure: An increase in supply as a result of an expected high price of potatoes Speculative behaviour: self-fulfilling expectations Figure: Self-fulfilling expectations