Alimony and Spousal Support Understanding the Concept, Calculation, and Legal Implications

advertisement

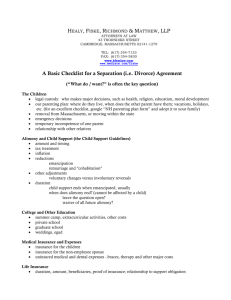

Alimony and Spousal Support: Understanding the Concept, Calculation, and Legal Implications When a couple gets divorced, one of the most significant concerns that arise is the issue of financial support, especially when one spouse is financially dependent on the other. Alimony, or spousal support, is a legal obligation for one spouse to provide financial support to another after separation or divorce. This article will discuss the concept of alimony and spousal support, including what it is, how it is calculated, and the legal implications of receiving or paying it. https://karunasharma.com +918851459843 What is Alimony? Alimony is a legal obligation for one spouse to provide financial support to the other spouse after separation or divorce. Alimony aims to ensure that the financially dependent spouse is not disadvantaged after the separation or divorce. Alimony can be paid for a limited or indefinite period, depending on the circumstances. Source: Canva https://karunasharma.com +918851459843 How is Alimony Calculated? Calculating alimony is not straightforward, and it depends on various factors, including the income and earning potential of both spouses, the length of the marriage, and the standard of living during the marriage. In some states, the court uses a formula to calculate the amount of alimony; in others, it is left to the judge's discretion. The court also considers the dependent spouse's needs, the supporting spouse's ability to pay, and the duration of the support when deciding the amount of alimony. Source: Canva https://karunasharma.com +918851459843 Legal Implications of Alimony There are several legal implications of alimony that both parties need to consider. For the paying spouse, alimony is usually tax-deductible, and the amount paid can be adjusted according to changes in income or other circumstances. However, failing to pay alimony can result in legal consequences, including fines and even imprisonment in some cases. For the receiving spouse, alimony can affect their eligibility for government benefits, such as social security, Medicaid, and other programs. The amount of alimony received can also affect their tax liability. Source: Canva https://karunasharma.com +918851459843 Conclusion In conclusion, alimony and spousal support are essential legal obligations that provide financial support to the dependent spouse after separation or divorce. The calculation of alimony is complex. It depends on several factors, including the income and earning potential of both spouses, the length of the marriage, and the standard of living during the marriage. There are several legal implications of alimony that both parties need to consider, and it is essential to seek legal advice to understand the options and obligations involved. If you're going through a divorce and have questions about alimony or spousal support, contact Karuna Sharma today! Visit https://karunasharma.com/ or call +918851459843 to schedule a consultation with a trusted divorce lawyer. Let us help you navigate the legal complexities of alimony and spousal support. https://karunasharma.com +918851459843 https://karunasharma.com +918851459843