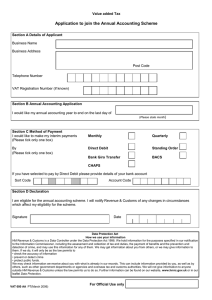

https://aradbranding.com/ By: Dr. Mehrdad Asghari (http://globaljournals.org/GJMBR_Volume18/3-Service-Quality-Gap-and-its-Impact.pdf) 1-7 Customs procedures Based on the definition of customs cooperation council (world customs organization) is the Treatment applied by the customs too goods which are subject to customs control. there are various customs procedures which are dealt with in the annexes to the Kyoto convention: clearance for home use (inward importation) customs warehousing temporary admission for inward processing or temporary admission subject to re-exportation in the same state customs transit and etc. some of the most important ones are discussed in the next part. Customs formalities is defined as: all the operations which must be carried out by the person concerned and by the customs in order to comply with the statutory or regulatory provisions which the customs are responsible for enforcing in connection with the controls of persons at the customs frontier and the clearance of baggage goods and the means of transport at importation exportation and in transit. Outright importation Customs procedure which provides that imported goods may remain permanently in the customs territory. This procedure implies the payment of any import duties and taxes chargeable and the accomplishment of all the necessary customs formalities. The process of importation is discussed in the previous part and as discussed in the previous part an as discussed above the last stage is customs clearance and accomplishing customs formalities for outright importation as shown in below has different stage which are explained in this part. To accomplish the customs formalities, we have to declare the goods at customs and to do this, we need commercial documents. The documents are issued, certified and legalized by different private or governmental (national or foreign) organizations. We should prepare a full set of documents needed and determined by customs administration and declare the goods. The declaration form is completed based on other documents and the goods specifications. Data entry Once the documents are fully checked the merchant or customs broker completes the declaration form and delivers the handwritten form to be typed by the data entry department. This stage is done in the computer or it site and after typing the handwritten declaration the data entry expert returns the printed form to the merchant or customs broker. Declaration The cargo declaration is defined by the CCC (customs cooperation council) as following: Generic term sometimes referred to as freight declaration applied to the documents providing the particulars required by the customs concerning the cargo carried by commercial means of transport. The nature and contents of cargo declaration may vary from country to country according to the means of transport used and the customs by the declarer to be done. The particulars of the cargo may include kind number marks and number of packages brief description of the goods gross weight etc. Also customs declaration is defined as any statement or action in any from prescribed or accepted by the customs giving information or particulars required by the customs. In the stage the broker checks the printed declaration form in case there is no discrepancy and no mistake in the form, the form and documents are delivered to the documentation department. After checking the documents and recognizing the identity of the merchant and custom broker and Art 14 debt checking, the documentation department registers the declaration and allocates a CUTAGE number to the documents and seals all the documents together. In the next s stage the customs controls continues. Assessment The documental and physical assessment is done in the next stage to check the funds payable and enforce the rules related to customs formalities such as customs law and export & import law. Customs law is defined as: The statutory and regulatory provisions concerning the importation and exportation of goods, the administration and enforcing of which are especially charged to the customs, and any regulations made by the customs under their statutory powers. Customs law generally includes provisions concerning: The structure and organization of customs administrations and their functions, powers and responsibilities, as well as the rights and the obligations of the persons concerned. The various customs procedures, together with the conditions and formalities relating to their application The factors relating to the application of import and export duties and taxes The nature and legal consequences of customs offences The ways and means of appeal. Once the cargo is declared, the computer system or the assessment service manager determines the person who is responsible for handling the assessment.in this stage, the documents are checked at the first step, second, the goods are physically and randomly checked, counted, inspected and the information resulted is written on the back of declaration form and in other words, endorsement is done. In addition to rules, two important items to be checked in this stage are customs value, and tariff. The customs value is determined based on the art number 10 of customs law and agreement of customs valuation of the world trade organization. The customs value which is a criterion for determination of customs duties and taxes is on the base of CIF value of the cargo. The determination of tariff is done on the base of harmonized system nomenclature, which is a tariff nomenclature, in Iran and many other countries. A tariff nomenclature is any classification and coding system introduced by national administrations or customs or international economic unions to designate commodities or groups of related commodities for customs tariff purposes. In cases the nature of the cargo is not recognizable for the customs, a sample of the cargo may be sent to laboratory by customs to determine the nature. For example when a metal is declared to the customs, the lab determines the material or nature of the metal. Bank, payment and permit When all the points discussed above are checked by the assessor, and the duties and taxes payable are determined based on the customs value and customs tariff, the declarer pays the amount to bank and receives a receipt of payment which is delivered to the permit unit and the permit or clearance certificate is issued by that department. This permit is printed on a green form which is similar to the declaration form. This form is finally signed by the assessment service manager and the cargo is allowed to be exited from the customs area in this cargo. Exit gate arrangement In this step, the broker gets the documents to the exit gate and takes a permit to load the cargo to be exited from customs area. A vehicle is brought in customs and after the settlement of warehouses costs, the cargo is allowed to be loaded and customs formalities is fully accomplished when the goods leave the customs area and get out of the exit gate. https://aradbranding.com/ By: Dr. Mehrdad Asghari (https://www.researchgate.net/publication/325783335_Service_Quality_Gap_and_its_Impact_on_the_Performance_of_Indian_Health_Insura nce_Companies_Service_Quality_Gap_and_its_Impact_on_the_Performance_of_Indian_Health_Insurance_Companies)