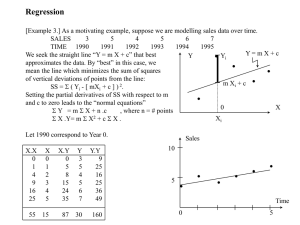

lOMoARcPSD|16442874 Chapter 4 - Regression Analysis Models Operations Management (CAP College Foundation) Studocu is not sponsored or endorsed by any college or university Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) lOMoARcPSD|16442874 Chapter 4 Regression Models TEACHING SUGGESTIONS Teaching Suggestion 4.1: Which Is the Independent Variable? We find that students are often confused about which variable is independent and which is dependent in a regression model. For example, in Triple A’s problem, clarify which variable is X and which is Y. Emphasize that the dependent variable (Y) is what we are trying to predict based on the value of the independent (X) variable. Use examples such as the time required to drive to a store and the distance traveled, the totals number of units sold and the selling price of a product, and the cost of a computer and the processor speed. Teaching Suggestion 4.2: Statistical Correlation Does Not Always Mean Causality. Students should understand that a high r2 doesn’t always mean one variable will be a good predictor of the other. Explain that skirt lengths and stock market prices may be correlated, but raising one doesn’t necessarily mean the other will go up or down. An interesting study indicated that, over a 10-year period, the salaries of college professors were highly correlated to the dollar sales volume of alcoholic beverages (both were actually correlated with inflation). Teaching Suggestion 4.3: Give students a set of data and have them plot the data and manually draw a line through the data. A discussion of which line is “best” can help them appreciate the least squares criterion. Teaching Suggestion 4.4: Select some randomly generated values for X and Y (you can use random numbers from the random number table in Chapter 13 or use the RAND function in Excel). Develop a regression line using Excel and discuss the coefficient of determination and the F-test. Students will see that a regression line can always be developed, but it may not necessarily be useful. Teaching Suggestion 4.5: A discussion of the long formulas and short-cut formulas that are provided in the appendix is helpful. The long formulas provide students with a better 41 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) lOMoARcPSD|16442874 understanding of the meaning of the SSE and SST. Since many people use computers for regression problems, it helps to see the original formulas. The short-cut formulas are helpful if students are performing the computations on a calculator. 42 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) lOMoARcPSD|16442874 ALTERNATIVE EXAMPLES Alternative Example 4.1: The sales manager of a large apartment rental complex feels the demand for apartments may be related to the number of newspaper ads placed during the previous month. She has collected the data shown in the accompanying table. Ads purchased, (X) Apartments leased, (Y) 15 6 9 4 40 16 20 6 25 13 25 9 15 10 35 16 We can find a mathematical equation by using the least squares regression approach. (Note: Round-off error may cause this to be slightly different from a calculator solution.) Leases, Y Ads, X (X – X )2 (X – X )(Y – Y ) 6 15 64 32 4 9 196 84 16 40 289 102 6 20 9 12 13 25 4 6 9 25 4 –2 10 15 64 0 16 35 144 72 Y = 80 Y X = 184 (X – X )2 = 774 (X – X )(Y – Y ) = 306 80 184 10; X 23 8 8 b1 = 306/774 = 0.395 b0 = 10 – 0.395(23) = 0.915 43 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) lOMoARcPSD|16442874 The estimated regression equation is Ŷ = 0.915 + 0.395X or Apartments leased = 0.915 + 0.395 ads placed If the number of ads is 30, we can estimate the number of apartments leased with the regression equation 0.915 + 0.395(30) = 12.76 or 13 apartments Alternative Example 4.2: Given the data on ads and apartment rentals in Alternative Example 4.1, find the coefficient of determination. The following have been computed in the table that follows: SST = 150; SSE = 29.02; SSR = 120.76 (Note: Round-off error may cause this to be slightly different from a computer solution.) X (Y – Ῡ)2 Ŷ = 0.915 + 0.395X (Y – Ŷ )2 ( Yˆ –Ῡ )2 6.00 15.00 16 6.84 0.706 9.986 4.00 9.00 36 4.47 0.221 30.581 16.00 40.00 36 16.715 0.511 45.091 6.00 20.00 16 8.815 7.924 1.404 13.00 25.00 9 10.79 4.884 0.624 9.00 25.00 1 10.79 3.204 0.624 10.00 15.00 0 6.84 9.986 9.986 16.00 35.00 36 14.74 1.588 22.468 80.00 184.00 SST=150.00 80.00 SSE=29.02 SSR=120.76 Y From this the coefficient of determination is r2 = SSR/SST = 120.76/150 = 0.81 Alternative Example 4.3: For Alternative Examples 4.1 and 4.2, dealing with ads, X, and apartments leased, Y, compute the correlation coefficient. Since r2 = 0.81 and the slope is positive (+0.395), the positive square root of 0.81 is the correlation coefficient. r = 0.90. 44 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) lOMoARcPSD|16442874 SOLUTIONS TO DISCUSSION QUESTIONS AND PROBLEMS 4-1. The term least-squares means that the regression line will minimize the sum of the squared errors (SSE). No other line will give a lower SSE. 4-2. Dummy variables are used when a qualitative factor such as the gender of an individual (male or female) is to be included in the model. Usually this is given a value of 1 when the condition is met (e.g. person is male) and 0 otherwise. When there are more than two levels or values for the qualitative factor, more than one dummy variable must be used. The number of dummy variables is one less than the number of possible values or categories. For example, if students are classified as freshmen, sophomores, juniors and seniors, three dummy variables would be necessary. 4-3. The coefficient of determination (r2) is the square of the coefficient of correlation (r). Both of these give an indication of how well a regression model fits a particular set of data. An r2 value of 1 would indicate a perfect fit of the regression model to the points. This would also mean that r would equal –1 or +1. 4-4. A scatter diagram is a plot of the data. This graphical image helps to determine if a linear relationship is present, or if another type of relationship would be more appropriate. 4-5. The adjusted r2 value is used to help determine if a new variable should be added to a regression model. Generally, if the adjusted r2 value increases when a new variable is added to a model, this new variable should be included in the model. If the adjusted r2 value declines or does not increase when a new variable is added, then the variable should not be added to the model. 4-6. The F-test is used to determine if the overall regression model is helpful in predicting the value of the independent variable (Y). If the F-value is large and the p-value or significance level is low, then we can conclude that there is a linear relationship and the model is useful, as these results would probably not occur by chance. If the significance level is high, then the model is not useful and the results in the sample could be due to random variations. 4-7. The SSE is the sum of the squared errors in a regression model. SST = SSE + SSR. 4-8. When the residuals (errors) are plotted after a regression line is found, the errors should be random and should not show any significant pattern. If a pattern does exist, then the assumptions may not be met or another model (perhaps nonlinear) would be more appropriate. 4-9. a. Ŷ = 36 + 4.3(70) = 337 b. Ŷ = 36 + 4.3(80) = 380 c. Ŷ = 36 + 4.3(90) = 423 45 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) lOMoARcPSD|16442874 4-10. a. 4-10. b. Guitar sales = Y YouTube views = X (X – X )(Y – Y ) Ŷ (Y – Yˆ )2 ( Yˆ – Y )2 12.25 87.5 9 1 6.25 225 0.25 7.5 1 0 1 2.25 70 225 0.25 7.5 1 3 1 2.25 10 60 25 2.25 –7.5 1 2 4 0.25 15 80 625 12.25 87.5 1 4 1 6.25 13 50 25 2.25 –7.5 1 1 4 0.25 Y = 69.0 X = 330 1750 29.5 175 Y = 11.5 X = 55 Y X (X – X )2 8 30 625 11 40 12 (Y – Y )2 SST SST = 29.5; SSE = 12; SSR = 17.5 b1 = 175/1750 = 0.1 46 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) 12 17.5 SSE SSR lOMoARcPSD|16442874 b0 = 11.5 – 0.1(55) = 6 The regression equation is Ŷ = 6 + 0.1X. c. Ŷ = 6 + 0.1X = 6 + 0.1(40) = 10. 4-11. See the table for the solution to problem 4-10 to obtain some of these numbers. MSE = SSE/(n – k – 1) = 12/(6 – 1 – 1) = 3 MSR = SSR/k = 17.5/1 = 17.5 F = MSR/MSE = 17.5/3 = 5.83 df1 = k = 1 df2 = n – k – 1 = 6 – 1 – 1 = 4 F0.05, 1, 4 = 7.71 Do not reject H0 since 5.83 7.71. Therefore, we cannot conclude there is a statistically significant relationship at the 0.05 level. 4-12. Using Excel, the regression equation is Ŷ = 6 + 0.1X. F = 5.83, the significance level is 0.073. This is significant at the 0.10 level (0.073 0.10), but it is not significant at the 0.05 level. There is marginal evidence that there is a relationship between demand for sales and YouTube views. 4-13. (Y) 93 78 84 73 84 64 64 95 76 (X) 98 77 88 80 96 61 66 95 69 (X – X )2 285.235 16.901 47.457 1.235 221.679 404.457 228.346 192.901 146.679 711 730 1544.9 (Y – Y )2 196 1 25 36 25 225 225 256 9 998 (X – X )(Y – Y ) 236.444 4.111 34.444 6.667 74.444 301.667 226.667 222.222 36.333 Y 91.5 76 84.1 78.2 90 64.1 67.8 89.3 70 1143 b1 = 1143/1544.9 = 0.74 b0 = (711/9) – 0.74 (730/9) = 18.99 a. Ŷ = 18.99 + 0.74X b. Ŷ = 18.99 + 0.74(83) = 80.41 47 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) (Y – Yˆ )2 2.264 4.168 0.009 26.811 36.188 0.015 14.592 32.766 35.528 ( Ŷ – Y )2 156.135 9.252 25.977 0.676 121.345 221.396 124.994 105.592 80.291 152.341 845.659 lOMoARcPSD|16442874 c. r2 = SSR/SST = 845.629/998 = 0.85; r = 0.92; this means that 85% of the variability in the final average can be explained by the variability in the first test score. 48 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) lOMoARcPSD|16442874 4-14. See the table for the solution to problem 4-13 to obtain some of these numbers. MSE = SSE/(n – k – 1) = 152.341/(9 – 1 – 1) = 21.76 MSR = SSR/k = 845.659/1 = 845.659 F = MSR/MSE = 845.659/21.76 = 38.9 df1 = k = 1 df2 = n – k – 1 = 9 – 1 – 1 = 7 F0.05, 1, 7 = 5.59 Because 38.9 5.59, we can conclude (at the 0.05 level) that there is a statistically significant relationship between the first test grade and the final average. 4-15. F = 38.86; the significance level = 0.0004 (which is extremely small) so there is definitely a statistically significant relationship. 4-16. a. Ŷ = 33,478 + 62.4(1,860) = 149,542. b. The predicted average selling price for a house this size would be $149,542. Some will sell for more and some will sell for less. There are other factors besides size that influence the price of the house. c. Some other variables that might be included are age of the house, number of bedrooms, and size of the lot. There are other factors in addition to these that one can identify. d. The coefficient of determination (r2) = (0.63)2 = 0.3969. 4-17. The multiple regression equation is Ŷ = $90.00 + $48.50X1 + $0.40X2 a. Number of days on the road: X1 = 5; Distance traveled: X2 = 300 miles The amount he may be expected to claim is Ŷ = 90.00 + 48.50(5) + $0.40(300) = $452.50 b. The reimbursement request, according to the model, appears to be too high. However, this does not mean that it is not justified. The accountant should question Thomas Williams about his expenses to see if there are other explanations for the high cost. c. A number of other variables should be included, such as the type of travel (air or car), conference fees if any, and expenses for entertainment of customers, and other transportation (cab and limousine) expenses. In addition, the coefficient of correlation is only 0.68 and r2 = (0.68)2 = 0.46. Thus, about 46% of the variability in the cost of the trip is explained by this model; the other 54% is due to other factors. 49 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) lOMoARcPSD|16442874 4-18. Using computer software to get the regression equation, we get Ŷ = 1.03 + 0.0011X where Ŷ = predicted GPA and X = SAT score. If a student scores 1200 on the SAT, we get Ŷ = 1.03 + 0.0011(1200) = 2.35. If a student scores 2400 on the SAT, we get Ŷ = 1.03 + 0.0011(2400) = 3.67, but this is extrapolating outside the range of X values 4-19. a. A linear model is reasonable from the graph below. b. Ŷ = 5.060 + 1.593X c. Ŷ = 5.060 + 1.593(10) = 20.99, or 2,099,000 people. d. If there are no tourists, the predicted ridership would be 5.06 (100,000s) or 506,000. Because X = 0 is outside the range of values that were used to construct the regression model, this number may be questionable. 4-20. The F-value for the F-test is 52.6 and the significance level is extremely small (0.00002) which indicates that there is a statistically significant relationship between number of tourists and ridership. The coefficient of determination is 0.84 indicating that 84% of the variability in ridership from one year to the next could be explained by the variation in the number of tourists. 4-21. a. Ŷ = 24,328 + 3026.67X1 + 6684X2 where Ŷ predicted starting salary; X1 = GPA; X2 = 1 if business major, 0 otherwise. b. Ŷ = 24,328 + 3026.67(3.0) + 6684(1) = $40,092.01. c. The starting salary for business majors tends to be about $6,684 higher than nonbusiness majors in this sample, even after adjusting for variations in GPA. d. The overall significance level is 0.099 and r2 = 0.69. Thus, the model is significant at the 0.10 level and 69% of the variability in starting salary is explained by GPA and major. The model is useful in predicting starting salary. 410 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) lOMoARcPSD|16442874 4-22. a. Let Ŷ = predicted selling price X1 = square footage X2 = number of bedrooms X3 = age The model with square footage: Ŷ = 26,532.24 + 51.03X1; r2 = 0.700 The model with number of bedrooms: Ŷ = 20,331.63 + 41,403.06X2; r2 = 0.4332 The model with age: Ŷ = 182,504.70 – 2,424.91X3; r2 = 0.703 All of these models are significant at the 0.01 level or less. The best model uses age as the independent variable. The coefficient of determination is highest for this, and it is significant. 4-23. The calculations are made using two decimal places. Slight differences may occur if more decimals are used in the calculations. Ŷ = 24,202.38 + 49.70X1 + 1,775.16X2 and r2 = 0.7003. Ŷ = 24,202.38 + 49.70(2000) + 1,775.16(3) = 128,927.90. Notice the r2 value is virtually the same as it was in the previous problem with just square footage as the independent variable. With a t-test p-value of 0.904, adding the number of bedrooms did not add statistically significant information that was not already captured by the square footage. It should not be included in the model. The r2 for this is lower than for age alone in the previous problem. 4-24. Ŷ = 91,446.49 + 29.86X1 + 2,116.86X2 – 1,504.77X3 = and r2 = 0.87. Ŷ = 91,446.49 + 29.86(2000) + 2,116.86(3) – 1,504.77(10) = 142,469.40.. 4-25. With one independent variable, beds, in the model, r2 = 0.88. With just admissions in the model, r2 = 0.974. When both variables are in the model, r2 = 0.975. Thus, the model with only admissions as the independent variable is the best. Adding the number of beds had virtually no impact on r2, and the adjusted r2 decreased slightly. Thus, the best model is Ŷ = 1.518 + 0.6686X where Y = expense and X = admissions. 4-26. Using Excel with Y = MPG; X1 = horsepower; X2 = weight the models are: Ŷ = 53.87 – 0.269X1; r2 = 0.77 Ŷ = 57.53 – 0.01X2; r2 = 0.73. Thus, the model with horsepower as the independent variable is better since r2 is higher. 4-27. Ŷ = 57,69 – 0.17X1 – 0.005X2 where Y = MPG X1 = horsepower X2 = weight r2 = 0.82. This model is better because the coefficient of determination is much higher with both variables than it is with either one individually. 411 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) lOMoARcPSD|16442874 4-28. Let Y = MPG; X1 = horsepower; X2 = weight The model Ŷ = b0 + b1X1 + b2X12 is Ŷ = 69.93 –0.620X1 + 0.001747X12 and has r2 = 0.798. The model Ŷ = b0 + b3X2 + b4X22 is Ŷ = 89.09 – 0.0337X2 + 0.0000039X22 and has r2 = 0.800. The model Ŷ = b0 + b1X1 + b2X12 + b3X2 + b4X22 is Ŷ = 89.2 – 0.51X1 + 0.001889X12 – 0.01615X2 + 0.00000162X22 and has r2 = 0.883. This model has a higher r2 value than the model in 4-28. A graph of the data would show a nonlinear relationship. 4-29. If SAT median score alone is used to predict the cost, we get Ŷ = –11364.7 + 21.6X1 with r2 = 0.22 and a significance level of 0.049. If both SAT and a dummy variable (X2 = 1 for private, 0 otherwise) are used to predict the cost, we get r2 = 0.79. The model is Ŷ = 10988.5 + 4.97X1 + 14065.8X2. This says that a private school tends to be about $14,065 more expensive than a public school when the median SAT score is used to adjust for the quality of the school. The coefficient of determination indicates that about 79% of the variability in cost can be explained by these factors. The model is significant at the 0.001 level. 4-30. Y = 77.19 + 0.047X There is no significant relationship between the number of victories (Y) and the payroll (X). The F-test significance level is 0.51 and r2 = 0.04. This model fails to prove that the payroll impacts the number of victories. Using the equation to predict number of victories for a team with a payroll of $79 million would yield 80.90, but is an unreliable prediction due to the weakness of the model. 4-31. Let Y = number of wins; X1 = ERA; X2 = runs; X3 = batting average; X4 = on base percentage. A 0.05 level of significance is assumed for the tests of significance. Other levels such as 0.01 or 0.10 could be used. a. The model with ERA is Ŷ = 155.09 – 17.87X1. The p-value for the F test is 0.0005 so the model is significant, and r2 = 0.65. b. The model with runs is Ŷ = -6.88 + 0.12X3. The p-value for the F test is 0.031 so the model is significant, and r2 = 0.33. c. The model with batting average is Ŷ = 62.25 + 77.90X2.The p-value for the F test is 0.751 so the model is not significant, and r2 = 0.009. d. The model with on-base percentage is Ŷ = -10.34 + 289.01X4. The p-value for the F test is 0.0.278 so the model is not significant and has r2 = 0.10. e). A good model must be statistically significant, so only the model with ERA and the model with runs are helpful. Of these two, the model with ERA has a higher r2 so it is the best of these models. With both ERA and Runs, the p-value for the F test is less than 0.0001 so the model is significant, and r2 = 0.91. If other variables are added to this, r2 is still 0.91, so they do not improve the model. Also, the adjusted r2 value decreases slightly when other variables are added. The equation of this best model with ERA and Runs is Ŷ = 72.32 - 16.88X1 + 0.11X2. 412 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) lOMoARcPSD|16442874 4-32. a. Ŷ = 42.43 + 0.0004X b. Ŷ = -31.54 + 0.0058X c. The correlation coefficient for the first stock is only 0.19 while the correlation coefficient for the second is 0.96. Thus, there is a much stronger correlation between stock 2 and the DJI than there is for stock 1 and the DJI. 413 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) lOMoARcPSD|16442874 CASE STUDIES SOLUTION TO NORTH–SOUTH AIRLINE CASE Northern Airline Data Airframe Cost Year per Aircraft 2001 51.80 2002 54.92 2003 69.70 2004 68.90 2005 63.72 2006 84.73 2007 78.74 Engine Cost per Aircraft 43.49 38.58 51.48 58.72 45.47 50.26 79.60 Average Age (Hours) 6,512 8,404 11,077 11,717 13,275 15,215 18,390 Southeast Airline Data Airframe Cost Engine Cost Average Age Year Per Aircraft per Aircraft (Hours) 2001 13.29 18.86 5,107 2002 25.15 31.55 8,145 2003 32.18 40.43 7,360 2004 31.78 22.10 5,773 2005 25.34 19.69 7,150 2006 32.78 32.58 9,364 2007 35.56 38.07 8,259 Utilizing QM for Windows, we can develop the following regression equations for the variables of interest. Northern Airline—airframe maintenance cost: Cost = 36.10 + 0.0025 (airframe age) Coefficient of determination = 0.7694 Coefficient of correlation = 0.8771 Northern Airline—engine maintenance cost: Cost = 20.57 + 0.0026 (airframe age) Coefficient of determination = 0.6124 Coefficient of correlation = 0.7825 Southeast Airline—airframe maintenance cost: Cost = 4.60 + 0.0032 (airframe age) Coefficient of determination = 0.3904 Coefficient of correlation = 0.6248 Southeast Airline—engine maintenance cost: Cost = 0.671 + 0.0041 (airframe age) Coefficient of determination = 0.4599 Coefficient of correlation = 0.6782 414 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) lOMoARcPSD|16442874 The graphs below portray both the actual data and the regression lines for airframe and engine maintenance costs for both airlines. Note that the two graphs have been drawn to the same scale to facilitate comparisons between the two airlines. Northern Airline: There seem to be modest correlations between maintenance costs and airframe age for Northern Airline. There is certainly reason to conclude, however, that airframe age is not the only important factor. Southeast Airline: The relationships between maintenance costs and airframe age for Southeast Airline are much less well defined. It is even more obvious that airframe age is not the only important factor—perhaps not even the most important factor. 415 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph) lOMoARcPSD|16442874 Overall, it would seem that: 1. Northern Airline has the smallest variance in maintenance costs, indicating that the dayto-day management of maintenance is working pretty well. 2. Maintenance costs seem to be more a function of airline than of airframe age. 3. The airframe and engine maintenance costs for Southeast Airline are not only lower but more nearly similar than those for Northern Airline, but, from the graphs at least, appear to be rising more sharply with age. 4. From an overall perspective, it appears that Southeast Airline may perform more efficiently on sporadic or emergency repairs, and Northern Airline may place more emphasis on preventive maintenance. Ms. Jones’s report should conclude that: 1. There is evidence to suggest that maintenance costs could be made to be a function of airframe age by implementing more effective management practices. 2. The difference between maintenance procedures of the two airlines should be investigated. 3. The data with which she is presently working do not provide conclusive results. 416 Copyright ©2015 Pearson, Inc. Downloaded by Geberly Villarosa (gdcvillarosa@usm.edu.ph)