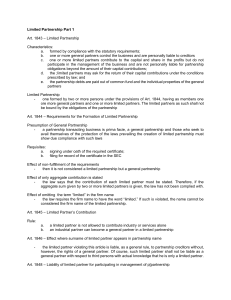

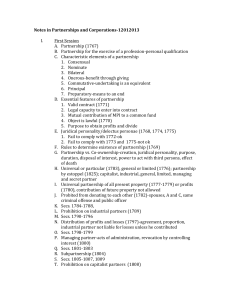

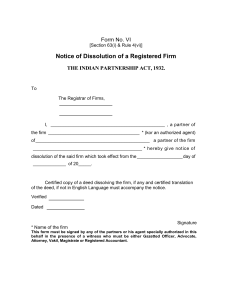

LAW ON PARTNERSHIP CHAPTER ONE General Provisions ARTICLE DETAILS Elements 1. Intention to form a partnership 2. Participation in profits and losses 3. Community of interests 1767 Definition, Elements, Characteristics, and Essential features Characteristics - CBPNOCPP - Consensual - Bilateral (reciprocal rights and obligations) - Preparatory (entered as a means to an end) - Nominate (special designation in law) - Onerous (gains benefit through giving) - Commutative (undertaking of one is equal to all) - Principal (existence not dependent on other) - Preparatory, entered into as a means to an end Essential features of a partnership Two or more persons bind 1. Valid contract themselves to contribute 2. Legal capacity money, property, or 3. Mutual contribution industry to a common 4. Lawful object fund with the intention of 5. Primary purpose to obtain and divide profits dividing the profits among themselves. Existence of a valid contract 1. Partnership relation fundamentally contractual May also be for - Created by agreement the exercise of a - Excludes: relations that don’t come from a profession contract (religious societies, conjugal partnerships, etc.) - Not created/implied by law or operation a. Form - evidenced by terms of contract; oral, written, express, or implied b. Articles of partnership c. Requisites Legal capacity of the parties to enter into the contract General rule: any person may be a partner who is capable of entering into contractual relations. Those who cannot consent to a contract of partnership are: a. Unemancipated minors b. Insane persons c. Deaf-mutes who do not know how to write d. Persons suffering from civil interdiction, and e. Incompetents under guardianship Exceptions: Persons prohibited from giving each other donations or advantages cannot enter into a universal partnership (Art. 1782) - Married woman be a partner w/o husband’s consent, but latter can object under certain conditions Capacity of partnership/corporation to be a partner a) Partner can be a partner in another partnership b) Corporation can be a partner? Yes, with limitations. There should be a law that allows this. i) Can go into joint venture partnership ii) Allowed if agreement is two partners manage the partnership so that management of corporate interest is not surrendered iii) Foreign corporation as a limited partner/limited partnership only for investment purposes, no management. Mutual contribution of money, property, or industry to a common fund 1) Existence of proprietary interest is required a) Money - legal tender; checks, notes, etc. must be cashed in to be contributed b) Property - real, personal; corporeal or incorporeal c) Industry - work or services of the party associated; personal efforts or intellectual i) Must receive share in profits and not just salary Legality of object Unlawful: contrary to law, morals, good customs, public order, and public policy 1. Effect of illegality: contract inexistent and void ab initio; no partnership can arise from this contract 2. Business partnership is not permitted to engage in an enterprise where the law requires a specific form of business combination a. E.g. Banks should be corporations under the General Banking Law Purpose to obtain profits 1) Very reason for partnership’s existence - intention to realize and divide profit 2) Can be the principal aim, doesn’t have to be the exclusive goals - Can have moral, social, spiritual ends Sharing of profits a) Doesn’t have to be in equal shares b) Not a definite evidence or partnership Sharing of losses a) Necessary corollary of sharing in profits b) Agreement on system of sharing losses is not necessary i) Stipulation that excludes one or more partners from sharing in profits or losses is void (Article 1799); if stipulation is subsequent, then only the stipulation is void but not the contract itself Partnership, a juridical person As a separate person, a partnership can: - Enter into contracts Juridical personality of - Acquire and possess property of all kinds partnership is separate - Incur obligations and distinct from partners - Bring civil or criminal actions - Be insolvent, even if partners aren’t Even in failure to comply with requirements of Art. Partners cannot be held liable for Partnership’s 1772, par. 2 obligations; unless the juridical personality is used for 1768 illegal purposes Effect of failing to comply with statutory requirements Art. 1772: Partnerships must appear in a public instrument, recorded by SEC Failure to comply: Partnership still has personality, partners are still liable Art. 1773: When immovable property is contributed Failure to comply: Partnership contract is void Art. 1775: Articles are kept secret among members Failure to comply: Partnership contract is void Organizing a partnership is not an absolute right Art. 1769-1789 Discussed September 5, 2022 (Mon) Persons not partners as to each other, also not partners as to third persons a. Partnership, a matter of intention b. Partnership by estoppel i. When persons by their acts, consent, representations have misled third persons into believing in a non-existent partnership then they are liable 1769 Rules to determine if a partnership exists Co-ownership alone does not equal a partnership Art. 848: ownership of undivided thing belongs to different persons - Co-ownership does not establish the existence of a partnership But co-ownership is an essential element Note: profits must be derived from an undertaking to be a partnership; co-owner of a business makes one a partner Partnership vs. Co-ownership 1) Creation a) P: created by contract/agreement b) CO: created by law 2) Juridical personality a) P: separate personality b) CO: none 3) Purpose a) P: realization of profit b) CO: common enjoyment of undivided thing 4) Duration a) P: no limitation b) CO: no agreement > 10 years 5) Disposal of interest a) P: can dispose partnership capital to an assignee (make him a partner) w/ consent of other partners (delectus personae) b) CO: can dispose it freely 6) Power to act with third persons a) P: partner can bind the partnership b) CO: only binds the co-owner, not others 7) Effect of death a) P: death dissolves partnership b) CO: does not necessarily dissolve Partnership vs. Conjugal partnership of gains Partnership vs. Voluntary association Sharing of gross returns alone does not equal a partnership Whether or not they have a joint/common right or interest to the property generating the profits - Only an indicator, does not establish one - All elements must be present A person’s receipt of shares of profits in a business is prima facie evidence of partnership, unless profits were received as the following When someone receives profit shares from a business, then you can safely assume (prima facie) that he is a partner of such business. But upon investigation, if the following are sources of their profit, then that inference cannot be made: 1) Debt by installments 2) Wages of an employee/rent to a landlord 3) Annuity to a widow/representative to deceased partner 4) Interest of a loan 5) Consideration for the sale of goodwill of a business or other property Rules to determine existence of partnership 1) Where terms of contract are unclear a) Generally: all essential features/characteristics must be present (use Article 1769) 2) Where existence disputed a) Can be disputed/questioned by an affected party b) Issue is a factual matter and must be decided based on existing circumstances (court decision) 1770 Object or purpose of partnership Two main points from the article: 1. Legality of the objects 2. Community of benefit or interest of the partner Partnership Effects of an unlawful partnership must have a 1. Contract is void ab initio; partnership never legal object and purpose existed in the eyes of the law 2. Profits are confiscated in favor of the government Unlawful partnerships 3. Instrument and proceeds of crime are also are dissolved, profits confiscated in favor of the government are confiscated for State 4. Contributions of partners will not be confiscated a. Unless they fall under #3 1771 Can be constituted in any form Public instrument is required for partnerships with immovable property General rule: no special form is needed for the validity or existence of a partnership For immovable property, When immovable property or real rights are contributed: public instrument is public instrument will be necessary necessary - Otherwise, contract is void 1772 Registration of partnership Requirements if partnership capital (money or property) Partnerships with is P3,000 or more: P3,000 in capital or more 1. Contract must appear in public instruments shall appear in a public 2. Must be recorded or registered with the SEC instrument (SEC) Note: this does not affect the formation of the Failure to comply: partnership or their liability to third persons partners continue to be liable to third persons 1773 Void partnership if immovable property is contributed but not signed in a public instrument Partnership with contribution of immovable property Requirements: 1. Contract must be in a public instrument 2. Inventory of contributed property, signed by the parties, attached to public instrument Effects of noncompliance: 1. On contracting parties a. No partnership; void contract 2. On third persons a. De facto or estoppel partnership may still exist for them b. Art. 1773 is intended to protect them Acquisition or conveyance of property by partnership - Recognizes the existence of the partnership as a 1774 person Contributions to the partnership/bought by the Immovable property and partnership, can be stated in the name of the interest therein can be partnership acquired and dispose in partnership name - Partnership is considered as a person under the law - If bought under partnership name, then it can only be sold under partnership name 1775 Partnership where articles are kept secret, no juridical personality Secret partnerships without juridical personality - Essential that all partners are fully informed of the agreement and all matters affecting partnership - Not considered a person under the law - Violates one element/requisite of a partnership Will be governed by provisions on co-ownership (1669) Classifications of partnerships 1) Subject matter a) Universal partnership i) Of all present property (1778), or ii) Of profits (1780) b) Particular partnership (1783) 2) Liability a) General b) Limited 1776 As to object: either universal or particular As to liability: may be general or limited Duration: at will or fixed Legality: de jure or de facto 3) Duration a) At will: no time specified, can be terminated at anytime by mutual agreement b) With a fixed term: dissolution once undertaking is complete 4) Legality a) De jure: complied with all legal reqs b) De facto: failed to comply 5) Representation a) Ordinary: actually exists; among partners and to third persons b) Ostensible/By estoppel: in reality not a partnership but considered one by others 6) Publicity a) Secret - not known to the public b) Open/notorious - known to the public 7) Purpose a) Commercial/trading b) Professional/non-trading Kinds of partners 1. Under the civil code a. Capitalist - contributes money/property b. Industrial - contributes industry/service c. General - either capitalist/industrial, liability extends to their separate property d. Limited - liability limited to contribution e. Managing - manages the business f. Liquidating - in charge of winding up affairs g. Partner by estoppel - not a partner but liable as a partner for protection of 3rd persons h. Continuing partner - continues business after dissolution i. Surviving partner - remaining partner after dissolution due to death of one j. Subpartner - not member, contracts with a partner with reference to latter’s share in partnership 2. Other classifications a. Ostensible partner - active, publicly known b. Secret partner - active, not publicly known c. Silent partner - not active, publicly known d. Dormant partner - not active, not known e. Original partner - member since formation f. Incoming partner - about to be member g. Retiring partner - withdrawing partner A universal partnership may refer to all the present property or to all the profits 1777 Universal partnership: all present property or all profits Universal partnership of all present property, defined in - Article 1778 - Article 1779 Universal partnership of all present profit, defined in - Article 1780 1778 Partnership of all present property Universal partnership of all present property Partners contribute all the properties that actually belong to them at the time partnership is constituted - Contributed to a common fund - Intention to divide it and all the profits it generates among themselves The following become the common property of the partners: 1. Property that belonged to each of them at the time the partnership was constituted 2. Profits generated from the property contributed Contribution of future property General rule: future properties cannot be contributed Future properties that cannot be contributed: a. Inheritance b. Legacy c. Donation Exception: the fruits of the abovementioned future properties Reason: has to be a determinate thing Property of each partners at time of constitution of contract becomes common property of all and all the profits therein 1779 Universal partnership of all present property Stipulation for other profits can be made, but property acquired subsequently cannot be included (except fruits) 1780 - All present property of the partners Considered as donation Excludes future property With limitation, accdg to laws on donation If there is no real property involved or interest in real property and rights, then present is actually the time of concept. Excludes future property Exception: could be expressly agreed by the properties. Must be expressly stipulated. - Exclude: contributions in property of inheritance, legacy or donation - Inheritance: everything you will receive - Legacy: you will receive through will - Donation: received from a party Universal partnership of profits explained Universal partnership of profits All that the partners may acquire by their industry or work during the existence of the partnership Im/movable property possessed at time of contract shall belong Universal - all, everything Universal partnership of profits - all profits are contributed exclusively to each other - Personal profit of the partner derived from his industry Profit from his business or profit from use of his property E.g. partner is habal-habal driver, profit from that job will be donated to the partnership Pro: Present property is not contributed, but profit from your industry Con: as long as the partnership continues, there will always be a contribution of your profits 1781 Universal partnership without specifying its nature is only a universal partnership of profits 1782 Persons who cannot enter a universal partnership 1783 Particular partnership Persons who are prohibited from giving each other any donations or advantages Not allowed to enter universal partnerships Why not extend to particular partnerships too? - Sir fernandez Partnership that is not universal If it’s not all the property, or not all the profit, then it is particular End of September 7, 2022, Wednesday session CHAPTER TWO Obligations of the Partners Section 1. Obligations of the Partners Among Themselves September 12, Monday session ARTICLE KEYWORDS AND DETAILS 1784 Partnership begins the moment contract is executed Unless stipulated otherwise 1785 Continuing a partnership with a fixed term or particular undertaking Partnership with fixed term or particular undertaking is being continued at will even term or undertaking is completed Effect: Rights and duties remain the same as they were upon termination - Must be consistent with the partnership at will Prima facie evidence of continuation of 1786 Each partner is indebted to Partnership for promises to contribute Bound for warranty in case of eviction Liable for fruits thereof from time it should have been delivered 1787 Appraisal of goods contributed must follow manner prescribed in contract Liabilities of each partner Absence of stipulation: appraisal by partners’ chosen expert 1788 Partner who fails to deliver on promise to contribute 1789 Industrial partner 1790 1791 Liability for interest and damages Starts from time he should have complied with his obligation Industrial partner cannot engage in business for himself Unless partnership expressly permits him to do so Presumption No stipulation, then there is a presumption that the contribution of each partner is equal In case of an imminent loss of the business, partners may be forced to contribute additional shares to the capital, with the exception of the industrial partner This provision to force a partner to contribute, 1792 A partner has received his share of partnership credit General rule: a partner who receives partnership credit is not allowed to appropriate such payment because he is acting for and behalf of the partnership 1793 Exception (1793): Instead of money given as share of the profits, what was agreed by the partners is to divide the creidt among themselves as shared Partners agreed that instead of money as sharing in the profit, they agreed that credits or receivables will be divided among the partners. Partners responsibility to the partnership when damage has been imparted by his fault 1794 Courts can lessen this responsibility if through the extraordinary effort of the partnership, unusual gains have been realized Risk of loss 1795 Basic principle: owner bears the loss 1796 Part 1797 1798 1799 Articles of partnership = contract of partnership Partner as manager - can do all acts of administration Opposite of act of administration: act of strict dominion Act of strict dominion - act that only an owner can do ● E.g. borrowing a book, can i read the book? Yes. Can I hold the book or hold it upside down while reading? Yes. Can I tear a page from the book? 1800 No. Can I change the color of the book? No. Can I laminate all the pages of the book? No. Partner who has been ● Acts which we say no to are acts of strict dominion appointed as manager in ● Act of strict dominion must be approved by all the the articles of the members partnership 1800: Managing partner is appointed, he can do all acts of administration even if the other partners disagree - Even if his interest in the partnership is only 1% - He can be removed, but with just or lawful cause - Appointed but not under the articles of partnership, he can be removed for any cause, or even the absence of cause - Appointed under the articles of partnership, then he can only be removed with just or lawful cause 1801 If no one is appointed the managing partner, then everyone is a managing partner Situation where there are multiple managing partners - Does not state their role or designation, whether finance or purchases or receivables - Then he can do all acts of administration independent of other managing partners - Does not need the consent of other partners - Each can act independently and individually and also bind the partnership Case: a partner opposes the decision of another partner, then it can be voted by all the managing partners - Deadlock, submit to all the partners then controlling interest will prevail - Controlling interest: the capital of the partnership Situation with express stipulation that all managing partners consent in order to bind the partnership 1802 Multiple managing partners, exception to 1801 Absent managing partner: invalid, wait for him to come back Exception: delay in the decision will cause grave damage and danger to the partnership Rules in appointing managers 1803 No one appointed as manager, then everyone is Rules when manner of management is not agreed upon 1) 2) Someone is appointed as manager, then all decisions go to them; other partners have consented to let this managing partner act on behalf of everyone - However just limited to acts of administration - Acts of strict dominion, all partners should agree - End of September 12, Monday session Contract of sub partnership Subpartner - a person who a partner may associate with in his share, without consent of the other partners 1804 Contract of sub partnership 1. Nature a. Partnership within a partnership b. Distinct and separate from the main partnership c. Just because someone who is not a partner is receiving shares from the partnership will not prevent the formation of a sub partnership 2. Right of person associated with partner’s share a. Is not a member of main partnership because lacks consent of other partners b. Sub Partnership agreements do not affect Main c. Subpartner does not acquire rights and liabilities of original partner Subpartner/associates only entitled to profits and surplus, cannot manage or enter partnership premises Can he become a partner? Yes, but all partners have to consent. To be an associate, you don’t need their consent 1805 Partnership books at the agreed principal place of the partnership At any reasonable hour, partners must have access to a copy 1806 Partners must give info of everything affecting the partnership Keeping of partnership books 1. Duty to keep partnership books a. Falls on managing partner or active partner, or a chosen partner b. Presumed that partners are knowledgeable on contents of the books 2. Rights a. 3. Access Duty to render information to any partner or the legal representative of any deceased/disabled partner Principle: mutual trust and confidence - No concealment, whether on demand or just to disclose material facts - Info must be used for partnership purposes If a partner asks another partner for partnership details, then the latter must provide, given the limitations. 1807 Partners are accountable for any benefit and hold as trustee for it any profits derived by him without the consent of the others from any transaction connected with the partnership or any use by him of its property Partner accountable as fiduciary Partners’ fiduciary duties 1. 2. 3. 4. 5. Act for common benefit Begins during formation of partnership Continues after dissolution of partnership Account for secret and similar profits Account for earnings accruing even after termination of partnership 6. Make full disclosure of information belonging to partnership 7. Not acquire interest/right adverse to partnership Prohibition against partner engaging in business 1. Prohibition is relative 2. Reason for prohibition 1808 Capitalist partners cannot personally engage in businesses similar to partnership’s (unless stipulated otherwise) Effect of violating this prohibition 1809 Partner’s right to a formal account arises if he is: 1) wrongfully excluded, 2) right exists under agreed terms, 3) provided by art. 1807, 4) other just circumstances Effect of violation If capitalist partner engages in business similar to the partnership’s, then he must: 1. Bring to the partnership funds any profits he has gained from such transactions, and 2. Shall personally bear any losses incurred Examples: 1. Partnership sells burgers, partner sells hotdogs a. Similar 2. Partnership sells pork skin to chicharon makers in carcar, partner sells chicharon a. Not similar 3. Partnership sells soft drinks, partner sells burgers a. Not similar Right of partner to a formal account Formal account - comprehensive audit, updated financial statements of the partnership; not similar to right to full and true information, this is more of a hassle to obtain General rule: during existence of partnership, partner is not entitled to a formal account of partnership affairs Exception: formal accounting even before dissolution can be justified under the following circumstances 1. Partner is wrongfully excluded from the business or possession of property by his co-partners 2. Right exists under the terms of any agreement 3. As provided by Article 1807 4. Other circumstances render it just and reasonable Prescriptive period Nature of action for accounting CHAPTER TWO Obligations of the Partners Section Two. Property rights of a partner. ARTICLE KEYWORDS AND DETAILS Extent of property rights of a partner 1. Principal rights 2. Related rights 1810 Property rights of a partner are: 1. Rights in specific partn. property 2. Interest in partnership 3. Participate in management Partnership property vs. Partnership capital 1. Changes in value a. Property - variable, may change as market value fluctuates b. Capital - constant, amount fixed by agreement 2. Assets included a. Property - not only original capital contributions but all property subsequently acquired b. Capital - aggregate of the individual contributions made by the partners Ownership of certain property 1. Used by partnership 2. Acquired by a partner with partnership funds 3. Carried in books as an asset 4. Other factors indicating property ownership Nature of a partner’s right in specific partnership property 1811 Specific partnership property; partners are co-owners Incidents of co-ownership Partner is a co-owner with his partners of a specific partnership property Incidents of co-ownership: 1. partner cannot use it personally and without the consent of other partners a. “he has no right to possess such property for any other purpose without the consent of his partners;” 2. “Not assignable” not transferable, because it is not only owned by him but by the entire partnership as well Personal creditors of a partner cannot go after partnership property, either This partnership property also cannot be subject to legal support, i.e. wife asks husband for support, who has no money just the partnership property; wife cannot go after the partnership property This is as long as the partnership is still ongoing 1812 A partner’s interest in the partnership is his share of the profits and surplus Interest of partner in the partnership 1813 Previously, we stated that the sub partner can only receive what Subpartner cannot enjoy the rights of the partner 1814 So can the partner just transfer all his assets to the partnership so that he can evade liabilities to personal creditors? 1814 is the remedy for creditors CHAPTER TWO Obligations of the Partners Section 3. Obligations of the Partners with Regard to Third Persons. 1815 Requirement of a firm name Liability of partnership after the assets of the partnership property had been exhausted One of the cons of partnership 1816 Residual liability 1817 Stipulation that exempts property of partners from residual liabilities Residual liability: partners are personally liable using their personal property How to divide? According to their interest in the partnership Remember: an industrial partner is a general partner so he is also liable (he is not liable for losses, but for liabilities) with the right of reimbursement from other partners… confusing Lfgjhs Confusing As to third persons, that stipulation is void As to the partners, that stipulation is valid 1818 Every partner is an agent to the partnership 1819 Acts for partnership, binds partnership As long as it is within acts of administration and partner is authorized; does not need the pre consent of other partners. - Does not include acts of strict dominion, here all partners must agree and consent Example: partner admits the secret ingredients in making chorizo is roll over the chorizo so that the sweat is the secret ingredient 1820 If that partner is involved in the production process, then was partner at time of admission, then it is an admission of the partnership If purchasing manager did the same, then not an admission of the partnership Either way, can be used as evidence against the partnership 1821 Notice vs. Knowledge Safe to presume that we all have cellular phones, if someone texts you it is considered as notice. The moment you read it, it is considered as knowledge. Notice and knowledge Notice to the partner is knowledge to the partnership Example: 1822 Partner’s liability to a person outside the partnership for his wrongful act or act of omission 1823 Misapplication of a third party’s money or property 1) Within scope of authority 2) In course of its business 1824 Partners are solidarily liable for everything Liability arising from a partner’s: wrongful act, omission (1822) or breach of trust (1823) 1) Solidarily liable (Art. 1824) - Whether innocent or guilty, all partners are solidarily liable with the partnership itself 2) Different from Article 1816 a) Article 1822-25: i) Solidary liability ii) For civil obligations (law) caused by wrongful acts/omissions b) Article 1816: i) Joint and subsidiary liability ii) For contractual obligations or partnership liability 3) Wider liability a) Imposed to protect those who rely on the partnership in good faith, whether authority is real or apparent 4) Injured party can charge against partnership or any partner chargeable from 1822-23 5) Criminal liability for criminal acts a) Non-acting partner in a lawful business: not liable for a criminal act his partner does b) Partner aware he is operating under an illegal business: criminally liable Requisites for liability 1) Partner must be guilty of a wrongful act or omission, OR 2) He is acting in the ordinary course of the business, or with the authority of co-partners even if unconnected with the business Partnership is not liable if the partner acted on his own and not for the benefit of the partnership in the course of some transaction not connected with the partnership business. Partner by estoppel; partnership by estoppel Estoppel: silence means yes - A third person represents themselves as a partner in an existing partnership or nonexistent partnership - One of the partners in a partnership represents another third person as a partner although the other partners have not consented 1. Meaning and effect of Estoppel 1825 2. When is a person a partner by estoppel? Liability arising from a partner or partnership by estoppel 3. When does a partnership become liable because of a partner by estoppel? a. All partners consented to this representation b. Partner by estoppel is not actually a partner, but an agent of the partnership 4. When is the liability pro rata? a. No existing partnership ■ But those who represented as partners (direct) consented b. Existing partnership ■ But not all, some partners here consented to the representation 5. When is liability separate? a. No existing partnership ■ Not all, some of those who represented as partners consented b. Existing partnership ■ None of the partners here consented to this representation 6. Estoppel does not create partnership a. Estoppel creates a liability ■ Against partners by estoppel ■ For protection for those who gave credit to the “partnership” in good faith 1826 Extent of incoming partner’s liability Newly admitted partner is liable as if he had been a partner when these were incurred Liability of incoming partner is limited to 1. His share in the partnership property a. For existing obligations at the time he enters the partnership 2. His separate property a. For subsequent obligations the partnership enters into after he is admitted Liability will be satisfied only out of partnership property, unless stipulated otherwise 1827 Priority of partnership creditors over partner with the partnership property Private creditors can ask the attachment and public sale of the share of the partner in partnership assets Preferences of credits CHAPTER THREE Dissolution and Winding up Dissolution, winding up, and termination, defined. 1. Dissolution ○ Change in relation of partners; caused by partner ceasing to be associated in carrying on of business (Art. 1828) ○ Any time the partner leaves 1828 Dissolution, Winding up, and Termination 2. Winding up ○ Process of settling affairs after dissolution ■ Collection and distribution of assets ■ Payment of debts ■ Determining value of each partner’s interest ○ Final step after dissolution 3. Termination ○ All partnership affairs are settled ○ Point in time of end of the partnership life Partnership is not terminated by dissolution 1829 Dissolution ≠ Termination Significance of dissolution: So that no new business partnerships will be undertaken, affairs should be liquidated, distribution made to those entitled. Dissolution does NOT mean extinguishment. Partnership continues until winding up is completed. 1830 Causes of Dissolution Causes of Dissolution: 1. Without violation of agreement between partners a. Termination of definite term or particular undertaking specified in the agreement, and partners do not extend b. Express will of any partner without consent of other partners, without breach of contract and in good faith c. Express will of all partners who have not assigned their interests or suffered them to 2. 3. 4. 5. be charged for their separate debts, either before or after termination, - Agreement to dissolve must be unanimous d. Expulsion of any partner In violation of agreement between partners, - Any partner has the power and can expressly withdraw for sufficient reasons (even if other partners wish to continue), but in case of unjustified withdrawal, withdrawing partner is liable for damages but cannot be compelled to remain in the partnership When the business of the partnership becomes unlawful, its continuance becomes illegal Loss of specific thing a. If a specific thing to be contributed by a partner is lost before delivery, the partnership is dissolved. Partner fails to perform obligation. b. If the loss happens after delivery, partnership is NOT DISSOLVED. But partnership assumes the loss on the thing is acquires ownership of, and partners may contribute additional capital to save the venture c. Loss where only use or enjoyment contributed - Loss before or after delivery dissolves partnership - Partner that reserves ownership bears the loss - Because partnership only has the right to use or enjoy it, the ownership still belongs to the contributing partner, who shall bear the loss Death of any partner - Automatically dissolves partnership - Surviving partners have no authority to continue the business, except to the extent of winding up - Partnership agreement may include that death, withdrawal or admission of a partner will not dissolve partnership. But if such is the case, the estate of deceased partner shall not be liable after dissolution beyond the extent of his capital or interest 6. Insolvency of partner or partnership - Insolvent partner is unable to fulfill partnership obligations - Insolvent partnership renders its property to the partners resulting in their inability to resume business 7. Civil interdiction of any partner - Civil interdiction is a legal restraint against a person, which renders him unable to validly give consent and his capacity is limited 8. Right to expel partner - In absence of express agreement, no right (even a majority vote) to expel members 1831 When the court shall decree dissolution On application by or for a partner, the court shall decree a dissolution whenever: 1. A partner was declared insane 2. A partner in any way incapable of performing duty of partnership contract 3. A partner has been guilty of misconduct 4. A partner willfully or persistently breaches contract 5. The business can only be resumed at a loss 6. Other situations that render a dissolution equitable Application of 1813-1814 1. After termination of specific term or particular undertaking 2. Any time if partnership was a partnership at will when the interest was assigned or when the charging order was issued 1832 General Rule on Authority after Dissolution Dissolution terminates all authority of any partner to act for the partnership, except to the extent necessary to wind up partnership affairs or to complete transactions begun but unfinished. This shall apply when: 1. The dissolution IS NOT by act, insolvency, and death of a partner, 2. The dissolution IS by act, insolvency, and death of a partner, as required by Art. 1833 3. For persons, not partners, in Art. 1834 Where dissolution IS caused by act, insolvency, and death of a partner, each partner is liable to co-partners for his share of any liability created by any partner acting for the partnership, as if the partnership has not been dissolved. 1833 1834 Exception: 1. The dissolution being by act of any partner, the partner acting for the partnership had knowledge of the dissolution, or 2. The dissolution being by the death or solvency, the partner acting for the partnership had knowledge or notice of the dissolution After dissolution, a partner can bind the partnership: 1. By an act appropriate for winding up partnership or completing unfinished transactions at dissolution 2. By any transaction which would bind the partnership if dissolution had not taken place, provided the other party to the transaction: a. Had extended credit to the partnership before dissolution and had no knowledge or notice of dissolution, or b. Even if credit was not extended, party knew about the partnership before dissolution, had no knowledge nor notice of dissolution (and dissolution was not advertised in regular place of partnership) - Liability of partner under A, shall be satisfied using partnership assets alone if before dissolution, the partner: i. Unknown as a partner to person contracted with, and ii. Unknown and inactive in partnership affairs, that the partnership reputation cannot be said to have been in any degree due to his connection with it Partnership NOT BOUND by any act of a partner after dissolution: 1. When partnership is dissolved due to unlawful business, unless the act is appropriate for wind up, or 2. Where the partner has become insolvent, or 3. Where partner had no authority to wind up partnership affairs, except by a transaction with a party who a. Had extended credit to the partnership before dissolution and had no knowledge or notice of dissolution, or b. Even if credit was not extended, party knew about the partnership before dissolution, had no knowledge nor notice of dissolution (and dissolution was not advertised in regular place of partnership) Note: 1834 does not affect 1825 Dissolution does not itself discharge the existing liability of any partner. Unless, there is an agreement between that partner, the partnership creditor, and the person continuing the business. 1835 Individual property of the deceased partner shall be liable for all partnership obligations incurred while he was a partner, but subject to prior payment of his separate debts. 1836 Unless otherwise agreed, partners who have not wrongfully dissolved the partnership or legal representative of the last surviving partner, not insolvent, has the right to wind up partnership affairs, given that any partner, his legal representative, upon cause shown may obtain wind up by court. Right of partner to application of partnership property 1837 Rights when Dissolution on dissolution, if dissolution is caused: 1. Without violation of partnership agreement, or is With or Without Violation of Contract 2. In violation of partnership agreement Rights when dissolution is caused without violation of partnership agreement: 1. To have partnership property applied to discharge liabilities of the partnership, and 2. To have surplus, if any, applied to pay in cash, the net amount owed to partners When dissolution is caused by expulsion of partner without violation (bona fide): Expelled partner may be discharged of liabilities by payment or agreement between him, creditors, and partners. He has the right to receive in cash the next amount due to him. If dissolution is rightful, no partner is liable for any loss as result of dissolution. Rights when dissolution is caused with violation: 1. Rights of partners who has not caused wrongful dissolution: a. To have partnership property applied for in payment of its liabilities and to receive in cash his share of surplus b. To be compensated for damages caused by wrongful partner c. To continue business in the same name during agreed term of partnership, by themselves or jointly with others d. To possess partnership property if business is resumed 2. Rights of partners who caused wrongful dissolution: a. If business is not continued i. To have property applied to discharge its liabilities and receive in cash his share of surplus less damages caused by his wrongful dissolution b. If business is continued i. To have the value of his interest in the partnership at the time of dissolution ascertained and paid in cash or secured by bond approved ii. 1838 Rescind Partnership Contract by court, and To be released from all existing and future partnership liabilities Right of partner to rescind partnership contract: If one is induced by fraud or misinterpretation to become a partner, the contract is voidable or annullable. If the contract is annulled, the injured party is entitled to compensation. However, until partnership contract is annulled by court, partnership relations exist, and the defrauded partner is liable for all obligations to third persons. Rights of defrauded partner when partnership contract is rescinded: 1. A lien on, or retention of, the surplus of partnership property after satisfying partnership liabilities for any sum paid or contributed by him, 2. To subrogation in place of partnership creditors after payment of partnership liabilities, and 3. Right to compensation by guilty partner against all debts and liabilities of partnership Liquidation and distribution of assets of dissolved partnership (aka winding up): - Reducing property to cash - Distributing proceeds - Partners have implied authority to sell property and collect obligations due 1839 Liquidation and Distribution of Assets Rules in settling accounts after dissolution: 1. Assets of the partnership are a. Partnership property (including goodwill) b. Contribution of partners necessary for payment of all liabilities as in Art. 1797 2. Application of assets IN ORDER: a. Those owing to partnership creditors b. Those owing to partners other than for capital and profits, such as loans given by partners or advances for business expenses c. Those owing for the return of capital contributed by partners, and d. Share of profits, if any, due to each partner 3. Rights of partners when ASSETS are INSUFFICIENT: - If there is capital loss, it requires contribution - Any partner or legal representative (to the extent paid in excess of his share in liability), or assignee, or person appointed by court has the right to enforce contributions of the partners as in Art. 1797 - If any partner does not pay his share of the loss, remaining partners may sue non-paying partner for indemnification 4. Liability of deceased partner’s individual property - Liable for his share of contributions necessary to satisfy partnership liabilities while he was still a partner 5. Priority to payment of partnership creditors - When partnership property and individual properties are in the possession of the court for distribution: - Partnership creditors shall be paid first from partnership property - Separate creditors from individual property 6. Distribution of property of insolvent partner IN ORDER: a. To those owing to his separate creditors b. To those owing to partnership creditors, and c. To those owing to partners by way of contribution 1840 Rights of Creditors on Dissolution by Change in Membership, and Business is Continued In dissolution of partnership by change in membership, creditors of dissolved partnership are also creditors of partnership continuing business: 1. Admission of partner - Admission of new partner, any partner retires and assigns his rights to two or more partners, or to one or more partners and one or more third persons, and business is resumed without liquidation of partnership affairs 2. Retirement of all except one partner - When all except one partner retire and assign their rights to remaining partner 3. 4. 5. 6. who continues business without liquidation of partnership affairs, either alone or with others Retirement or death of any partner - When any partner retires or dies but dissolved partnership is resumed, with consent of retired partners or representative of deceased partner, but without liquidation of partnership affairs When all partners assign their rights to one or more third persons who promise to pay the debts and who continue the business of dissolved partnership When any partner causes wrongful dissolution, and remaining partners continue the business under Art. 1837, either alone or with others, and without liquidation of partnership affairs When a partner is expelled, and remaining partners continue the business either alone or with others, without liquidation Rights of creditors of partnership dissolved by change in membership which is continued: - Creditors of dissolved partnership becomes creditors of the person or partnership continuing the business - Creditors treated alike, given equal rights to partnership property If business is continued after dissolution, the creditors of the dissolved partnership have a prior right to any claim of the retired partner or his representative against the person continuing partnership, on account of retired or deceased partner’s interest in the dissolved partnership or on account of any consideration promised for interest or his right in partnership property. The continuing partner’s use of the partnership name or deceased partner’s name as part thereof, shall not itself make the deceased partner’s individual property liable for any debts contracted by partnership. Liability of persons continuing business of dissolved partnership: 1. Liability of new or incoming partners shall be satisfied out of partnership property only, unless otherwise stipulated 2. No.4 only applies if the third person promises to pay the debt. Otherwise, creditors of dissolved partnership have no claim on partnership continuing the business or its property 1841 Dissolution by Death of Partner When any partner retires or dies and the business is continued without settlement of accounts, the retiring partner or legal representative of deceased partner shall have the right: 1. To have the value of the interest of the retiring or deceased partner in the partnership ascertained as of dissolution date 2. To receive, as an ordinary creditor, an amount equal to the value of his share in the dissolved partnership with interest, or at his option, instead of interest, the profits attributable to the use of his right In dissolution by death of partner, business continues: - If partner/s do so without the consent of deceased partner’s estate, they do so without any risk to the estate - If partner/s do with with the consent of deceased partner’s estate, in effect, the estate becomes a new partner, and would be answerable for all debts and losses incurred after deceased partner’s death but only to the extent of his share of partnership assets 1842 Partner’s right to account of his interest 1. Accrual of right - To demand an accounting of his interest accrues to any partner or legal representative after dissolution, in the absence of a stipulation to the contrary 2. Person liable to render an account a. Winding up partner b. Surviving partner c. Person or partnership When liquidation IS NOT REQUIRED - Liquidation is not necessary when there is already a settlement or agreement as to what the partners shall receive. CHAPTER FOUR Limited Partnership ARTICLE DETAILS Concept of a limited partnership Form of business composed of two classes of partners: general and limited; there should be at least one of each 1843 Limited partnership Concept, Characteristics, Difference between General Partnership 1. Limited partners a. Liability to 3rd persons limited only to their capital contributions b. Not personally liable for partnership debts Characteristics of a limited partnership 1. Formation ○ Compliance with statutory requirements (Art. 1844) 2. General partners ○ One or more controls business ○ Are personally liable (Art. 1845 and 1850) 3. Limited partners ○ One or more contributes capital and shares in profit ○ Does not participate in management ○ Not personally liable beyond their contributions (Art. 1845, 1848, 1856) 4. Limited partners can ask for return of their capital as prescribed by law (Art. 1844, 1857) 5. Partnership debts are paid out of ○ Common fund, and ○ Individual properties of general partners Limited partner: investor, same liability as a stockholder - Exception to the general rule that all partners are liable pro rata Differences between a general and limited 1. Liability a. General - personally liable b. Limited - only to capital contribution 2. Management a. General - can have a right in the management of the business even without capital contribution b. Limited - no share in the management, rights limited (Art. 1851); becomes liable as general partner once he partakes in control (Art. 1848) 3. Capital contributions a. General - money, property, or industry b. Limited - money or property only 4. I don't understand this one 5. Interest or Assignee a. General - cannot be assigned without consent of the other partners b. Limited - freely assignable; assignee acquires rights of limited partner subject to qualifications 6. Name of partner a. General - may appear in the firm name b. Limited - cannot appear in the firm name 7. Prohibition from other business a. General - prohibited from ■ Capitalist - same business as partnership ■ Industrial - own business b. Limited - no prohibition at all 8. Retirement, death, insolvency, etc. a. General - dissolves partnership b. Limited - does not dissolve partnership Other differences: ● Constitution ○ General - any form or contract ○ Limited - after compliance with requirements of the law ● Name ○ General - firm name ○ Limited - must be followed by word “Limited” ● Different dissolution and winding up processes 1844 Formation of limited partnership Requirements: 1. Certificate (what should be included) 2. File certificate with SEC Limited partnership is formed when there is compliance in good faith to the requirements Limited partnership not created by mere voluntary agreement Formal proceeding and not a mere voluntary agreement like in a general partnership Otherwise: liability of limited partner becomes the same as that of a general partner Requirements for formation Two essential requirements: 1. Certificate or articles of limited partnership ○ Must contain enumerations in Art. 1844 ○ Must be signed and sworn to 2. Certificate must be filed with the SEC - No time for filing is specified by Article 1844, must be within reasonable period, depends on circumstances Execution of prescribed certificate Substantial compliance in good faith is sufficient Strict compliance to legal requirements is not necessary ● Substantial compliance in good faith: sufficient ● No substantial compliance: ○ Becomes general partnership to third persons ○ All members are liable as general partners Presumption of general partnership Partnership transacting business is a general partnership by prima facie Construction on provisions of limited partnership Who may become limited partners - Partnership cannot become a limited partner - Existing general partnership can become a limited partnership - Partner in a former GP can become a limited partner in an LP 1845 Limited partner’s contribution ● Only money and property ● Services are not allowed, otherwise: ○ Considered general industrial partner, and ○ Not exempt from personal liability Contributions of a limited partner: - Cash, property but not services - Can be general and limited at the same time (Article 1853) Cannot be industrial and limited at the same time Example in page 287 ● Contribution of limited partners must be made before partnership formation (Art. 1844[f]) 1846 Name of limited partner should not appear in the firm name Unless: 1. Same name as general partner 2. It was named so before limited partner Otherwise, limited partner is liable as a general partner Surname of limited partner appearing in the partnership name Effect: liable to partnership creditors as a general partner, without the rights of a general partner - Does not apply if creditors know that he was not a general partner in the first place Exceptions to the article 1. The surname of the limited partner is also the surname of the general partner 2. Before he became a limited partner, the business has already been using his surname Liability for false statement in certificate False statement in the certificate caused third party to suffer, any partner is liable if the following requisites are present 1847 False statement on the certificate Suffered party can hold liable anyone who knew of false statement (two conditions) 1. Partner knew of the false statement ○ Upon signing certificate, or ○ After signing certificate and had enough time to cancel, amend, or file cancellation/amendment but failed to 2. Third party seeking liability relied on the false statement when they transacted with the partnership 3. Third party suffered a loss because of No. 2 Art 1847: This does not make limited partner liable as a general partner; just a statutory penalty 1848 Limited partner cannot be liable as a general partner Liability of limited partner for participating in management of partnership LP becomes liable as a GP once he starts to manage partnership Unless he takes part in the management of the business 1849 Additional limited partners after formation can be admitted by amending certificate Active management of partnership business contemplated - Only talks about active management of business - Does not comprehend mere giving of advice, where general partners may follow or not Admission of additional limited partners Acceptable as long as there is proper amendment to certificate, signed and sworn to by all partners and the new limited partner/s Rights, powers, and liabilities of a general partner 1. Right of control and unlimited personal liability ○ Applicable to general partners 2. Acts of administration and acts of strict dominion ○ Acts of administration: yes ○ Acts of strict dominion: no, beyond scope of authority of general partner 1850 Rights and powers of general partners Acts GPs cannot do without consent of the limited partners (7) Acts that general partners cannot do without consent of limited partners Acts of general partners that need consent of limited partners , and why 1. Act in contravention to certificate ○ Violates agreement of partners in cert. 2. Act that makes it impossible to carry on ordinary business of the partnership 3. Confessing judgment against partnership 4. Possess/assign own rights on partnership property, and use for other purposes ○ 2-4 prejudices interests of limited partners 5. Admit a person as a general partner 6. Admit a person as a limited partner, unless agreed upon in certificate ○ 5-6 because of the highly fiduciary nature of partnerships 7. Continue business with partnership property even after death, retirement, insolvency, etc. of GP, unless agreed upon in certificate ○ Should result in dissolution of partnership Effect in case of violation General partner that violates Art. 1850 is liable for damages to limited partners Other limitations General rights of a limited partner Partner only to a certain extent, limited compared to a general partner Specific rights of a limited partner Mostly to protect his investment 1. Require that partnership books be kept at principal place of business (1805) 2. Inspect and copy partnership books at any 1851 reasonable hour 3. Demand true and full information of all things Rights of limited partner affecting the partnership (1806) that are same as general partner 4. Demand a formal account of partnership affairs when just and reasonable (1809) 5. Ask for dissolution and winding up by court decree (1831, 1857[4]) 6. Receive share of profits or other compensation (1856) 7. Receive return of his contribution, in excess of liabilities (1857) 1852 Person contributes money and property believing he is a limited partner, but certificate says otherwise Exception to Art. 1844 Video explanation bc its so lisod Partner’s status when failure to create limited partnership Status: general partner Status of partner erroneously believing himself to be a limited partner Exception: if he believes, in good faith, that he was a limited partner and that the following conditions have been met 1. Renounces interests in the profit and other compensation once he finds out of the mistake ○ No creditors, no need to renounce 2. His surname is not in the partnership name 3. He does not participate in the management of the business Status of heirs who are admitted as partners after the death of the original general partner Status: Limited partner, ordinarily - For their protection One person, general and limited at the same time Acceptable, but should be stated in the certificate signed, sworn to, and recorded in the SEC 1853 Person can be a general and limited partner at the same time 1854 Limited partner loans money to the partnership Allowable and prohibited transactions for limited partners Generally: rights and powers of general partner, hence liable with personal property to third persons However: he is entitled to recover from the general partners the amount he has paid to such third persons; and in settling accounts after dissolution, he shall have priority over general partners in the return of their respective contributions Allowable transactions A limited partner (not also a general partner and does not participate in management) can engage in the following transactions: 1. Granting loans to the partnership 2. Transacting other business with it 3. Receiving a pro rata share of assets with the partnership creditors (provided he is not a general partner) Prohibited transactions 1. Receiving or holding as collateral security any partnership property 2. Receiving payment, conveyance, or release from liability if it prejudices right of third persons Any violation is presumed attempt to defraud creditor Sir’s lecture On limited partner loaning money to partnership: - If the partnership assets are not enough to pay liabilities, then limited partner is considered an ordinary creditor (paid first before anyone) - But: unlike ordinary creditors, ltd partners cannot hold collateral on partnership assets Limited partner cannot demand return of his investment if it will result in insolvency of the partnership 1855 Preference and priority between several limited partners Can be agreed, must be in the certificate If not, then all limited partners are equal Preferred limited partners Agreement of all the members general and limited should be in the certificate on giving priority over the following: 1. Return of contributions, 2. Compensation by way of income, or 3. Any other matter If such agreement is absent: Presumed all limited partners are equal Compensation of limited partners Limited partner has right to profit and compensation, but it is subject to the following conditions: 1856 1. Must be an excess of partnership assets over partnership liabilities (3rd party creditors have priority over the limited partner’s rights) 2. Preferential rights of partnership creditors Compensation of limited partners should come after the third-party Partners (general, limited, etc.) will always have the creditors residual interest only Additional: cannot exercise right to profit and compensation if it results in partnership insolvency (liabilities > assets) Requisites for return of contribution of limited partner First paragraph A limited partner can receive a return of their contributions when all the following is present: 1857 Return of contribution of a limited partner ● Requisites ● When it can be rightfully demanded ● Right of limited partner to cash return ● When limited partner can ask for dissolution 1. All partnership liabilities are paid ○ Unpaid: assets should be enough to cover the liabilities to third persons 2. Consent of all members ○ Except: return can be rightfully demanded, then not a requisite 3. Certificate is canceled or amended ○ Reflects the deduction of the contribution Number 1 and 3 are important to consider when a limited partner can rightfully demand their return When return of contribution a matter of right Second paragraph Assuming No. 1 and 3 of first paragraph have been complied with, then limited partner can rightfully demand return: 1. On dissolution of partnership, or 2. On date of return specified in the certificate, or 3. After 6 months (180 days) has passed since limited partner gave notice asking for 1) or 2) ○ 6 months is the default period of time if this was not fixed in the certificate Right of limited partner to cash in return for contribution Third paragraph General Rule: limited partner only has right to demand cash for his contribution Exception: 1. Certificate contains stipulation to the contrary 2. All partners (G or L) consent to return made in a form other than cash When limited partner can ask for dissolution Fourth paragraph Generally: limited partner can ask for dissolution by court action Additional grounds for dissolution of partnership upon petition of a limited partner: 1. Demand for return is denied even though he has the right to return, or 2. Contribution is unpaid even though he has a right to return because other liabilities have not been paid or the partnership property is insufficient for their payment Limited partner should ask other partners first; if still they refuse, then limited partner can seek dissolution by judicial decree Liabilities of a limited partner 1858 Liabilities of a limited partner 1. To the partnership a. Difference between ‘Contribution actually made’ and ‘Contribution appeared to have been made on the certificate’ b. Any unpaid contribution that he promised to make in the certificate in the future Liability as trustee Limited partner is considered as a trustee for the partnership for: 1. Specific property of the partnership a. Stated in the certificate as his contribution but has not yet been contributed b. Wrongfully returned to the partner 2. Money or other property wrongfully given to him on account of contribution (solutio indebiti) Requisites for waiver or compromise of liabilities Third paragraph Limited partner’s liabilities can be waived, if all the following are present 1. Waiver or compromise made with consent of all partners, and 2. Waiver or compromise does not prejudice partnership creditors whose claims arose before the change to the certificate Situation: creditor extended credit after filing the change but before amendment of the certificate - Remaining assets are insufficient: Creditor can enforce liabilities of A and B Liability for return of contribution lawfully received Limited partner is liable to the partnership even if the return of contribution was lawfully made - This is to pay creditors whose credit was present before the return Rule: liability cannot exceed what he received (including interest) Effect of change in the relation of limited partners The following does not dissolve the partnership: ● Substitution of existing limited partner (1859) ● Withdrawal, death, insolvency, civil interdiction of an existing limited partner (1860) ● Addition of new limited partners (1849) Rights of assignee of limited partner Assignee: a person to whom a right is transferred by the person holding such rights under the transferred contract - Limited partner can have an assignee 1859 Limited partner’s interest is assignable Substituted limited partner Assignee’s rights When assignee becomes substituted limited partner Assignee has rights to: - Receive share in profits - Other compensation as way of income Note: only to the extent limited partner can Assignee does not have rights to: - Require information - Require account of partnership transactions - Inspect partnership books Assignee has all rights of a limited partner: - When he becomes a substituted limited partner Substituted limited partner’s rights When assignee may become substituted limited partner Substitution of assignee Substituted limited partner: into limited partner does Person admitted to the partnership with all the rights of a limited partner who has died or has assigned their not release assignor interests in a partnership from liability Requisites: 1. All members must consent, 2. Amendment of certificate (Art. 1865), and 3. Amended certificate is registered with the SEC Liability of substituted partner and assignor 1. Substituted partner ○ Liable for all liabilities of his assignor ○ Except: those which he was ignorant of upon becoming limited partner and cannot be ascertained from the certificate 2. Assignor, not released from liabilities to ○ Third parties who suffered by relying on false statements in the certificate (Art. 1847) ○ Creditors who extended credit or whose claims arose before substitution (Art. 1858) 1860 Retirement, death, insolvency, civil interdiction of general partner will dissolve partnership With exception and its conditions Effect RDICi of a general partner Dissolves partnership (Art. 1830) Except: if business is continued by remaining partners as long as either of the following - Right to do so is stated in the certificate, or - With consent of all members Note: certificate must be amended accordingly (Art. 1864, par. 2[5]) Effect of RDICi of a limited partner Does not dissolve partnership (Art. 1861) Except: if they were the only limited partner (Art. 1843) Right of executor on death of a limited partner 1861 Death of limited partner and the rights of his executor Estate of deceased limited partner 1. Rights of limited partner for the purpose of settling his estate (Art. 1851) 2. Right to constitute assignee as substituted limited partner ○ Only if deceased limited partner had the right to do so in the first place, as on the certificate (Art. 1859, par. 4) Liabilities of the estate of deceased limited partner Liable for all liabilities limited partner had contracted Executor - provided in will Administrator - no will ● Either can exercise right as limited partner ● Considered as a limited partner as long as the will has not yet been distributed to the heirs 1862 Personal creditor of limited partner 1863 Order of settling accounts and liabilities of the partnership after dissolution Charging order on the interest of a partner For general partners: causes dissolution For limited partners: does not cause dissolution Hierarchy of payments in case of dissolution 1. Creditors: third parties and limited partners (excluding general partner creditors) 2. Limited partners for share in their profits and compensation by way of income 3. Limited partners for return of their capital contribution 4. General partners: other than capital and profits (loans to partnership by general partners) 5. General partners as to profits 6. General partners as to capital Dissolution of a limited partnership Similar to dissolution of a general partnership 1. Causes a. Misconduct of a general partner, fraud practiced on limited partner by general b. Retirement, death, etc. of general partner (Art. 1860) c. When all limited partners cease to be limited partners (Art. 1864, par. 1) d. Expiration of term (Art. 1844, [1e]) When certificate shall be canceled 1864 Cancellation of certificate Amendment of certificate 1. When the partnership is dissolved ○ For reasons other than expiration of partnership term 2. When all the limited partners cease to be such When certificate shall be amended Article 1864, nos. 1-10 1. Change in the ○ Name ○ Amount and character of limited partner’s contributions Substitution of limited partner Admission of additional limited partner Admission of new general partner General partner dies, retires, etc. but business continues (Art. 1860) 6. Change in the character of the business of the partnership 7. False or erroneous statement in certificate 8. Change in the time stated in the certificate for ○ Dissolution ○ Return of contribution 9. Fixing of time for dissolution of dissolution or return of contribution, when none was specified 10. Members want to change other statements in the certificate ○ To accurately represent their agreement 2. 3. 4. 5. Requirements to amend certificate 1. Amendment is in writing, 2. Signed and sworn to by all members, both current and incoming, and 3. Certificate is filed and recorded with the SEC 1865 Requirements to amend or cancel certificate Requirements to cancel certificate - Must also be in writing - Signed by all members - Filed with the SEC If cancellation was ordered by court: Certified copy of court order is filed with SEC 1866 When limited partner becomes a proper party to enforce proceedings by or against Limited partner as a mere contributor No right of action against third persons against whom the partnership has any enforceable claim When limited partner a proper party 1. Enforce his individual right against the partnership, and recover damages accordingly ○ Vice versa, partnership may proceed against limited partner to enforce liabilities (Art. 1858) 2. Limited partners wrongfully withdrew sums when partnership was insolvent ○ Creditors can go after limited partner ○ Unsatisfied executions against general partners where remedy has been denied to creditors Nature of limited partner’s interest in firm 1867 Existing limited partnerships before Civil Code effectivity Provisions for existing limited partnerships