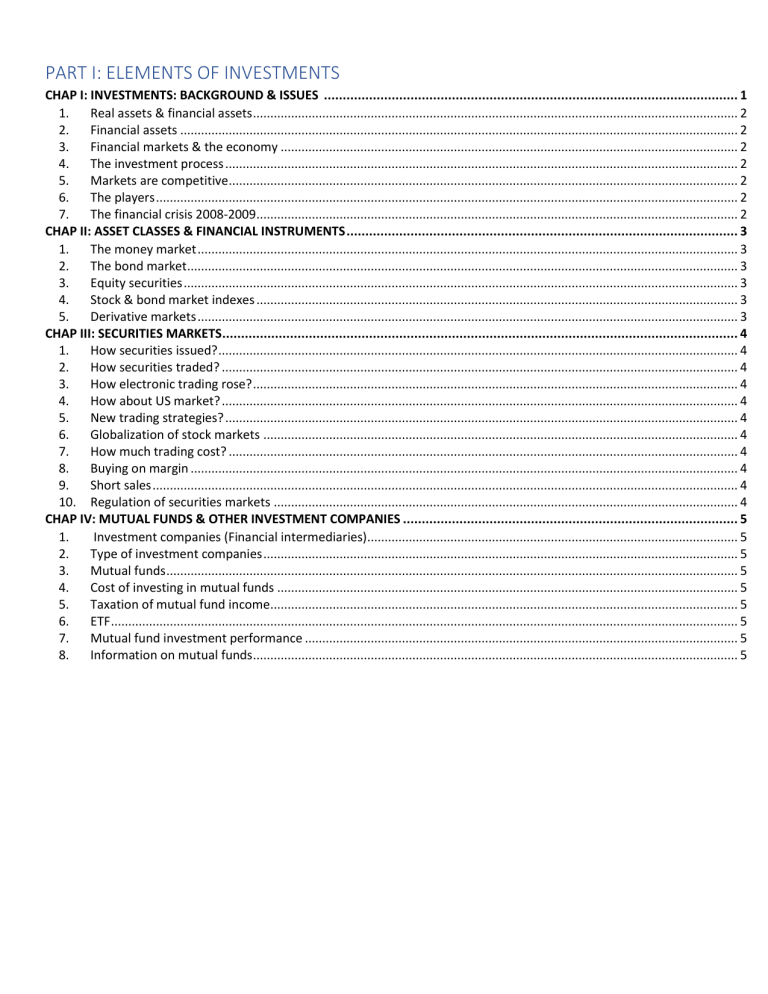

PART I: ELEMENTS OF INVESTMENTS CHAP I: INVESTMENTS: BACKGROUND & ISSUES .............................................................................................................. 1 1. Real assets & financial assets ............................................................................................................................................ 2 2. Financial assets ................................................................................................................................................................. 2 3. Financial markets & the economy .................................................................................................................................... 2 4. The investment process .................................................................................................................................................... 2 5. Markets are competitive................................................................................................................................................... 2 6. The players ........................................................................................................................................................................ 2 7. The financial crisis 2008-2009........................................................................................................................................... 2 CHAP II: ASSET CLASSES & FINANCIAL INSTRUMENTS ........................................................................................................ 3 1. The money market ............................................................................................................................................................ 3 2. The bond market............................................................................................................................................................... 3 3. Equity securities ................................................................................................................................................................ 3 4. Stock & bond market indexes ........................................................................................................................................... 3 5. Derivative markets ............................................................................................................................................................ 3 CHAP III: SECURITIES MARKETS......................................................................................................................................... 4 1. How securities issued? ...................................................................................................................................................... 4 2. How securities traded? ..................................................................................................................................................... 4 3. How electronic trading rose? ............................................................................................................................................ 4 4. How about US market? ..................................................................................................................................................... 4 5. New trading strategies? .................................................................................................................................................... 4 6. Globalization of stock markets ......................................................................................................................................... 4 7. How much trading cost? ................................................................................................................................................... 4 8. Buying on margin .............................................................................................................................................................. 4 9. Short sales ......................................................................................................................................................................... 4 10. Regulation of securities markets ...................................................................................................................................... 4 CHAP IV: MUTUAL FUNDS & OTHER INVESTMENT COMPANIES ......................................................................................... 5 1. Investment companies (Financial intermediaries)........................................................................................................... 5 2. Type of investment companies ......................................................................................................................................... 5 3. Mutual funds ..................................................................................................................................................................... 5 4. Cost of investing in mutual funds ..................................................................................................................................... 5 5. Taxation of mutual fund income....................................................................................................................................... 5 6. ETF ..................................................................................................................................................................................... 5 7. Mutual fund investment performance ............................................................................................................................. 5 8. Information on mutual funds............................................................................................................................................ 5 PART I: ELEMENTS OF INVESTMENTS CHAP I: INVESTMENTS: BACKGROUND & ISSUES 1. 2. 3. 4. - Real assets & financial assets Definitions of real & financial assets? Differences between real & financial assets? The difference of balance sheet between financial & nonfinancial firms? Financial assets Definitions of debt (fixed-income securities), equity & derivatives? Characteristics of each one (risk, ownership, payoff)? Financial markets & the economy Role of financial markets: capital/ risk allocation, consumption timing, separation of management & ownership? Corporate governance & corporate ethics? The investment process Top-down (asset allocation→securities selection) - Bottom-up (particular securities) 5. Markets are competitive - The risk-return trade-off? (higher-risk assets – higher expected returns, diversification) - Efficient markets (passive management or active management?) 6. The players - Demanders of capital (firms), suppliers of capital (households), government (borrowers, lenders) - Financial intermediaries: commercial/ investment bank, investment company, insurance company, credit unions). - How the loaned funds channel from suppliers to demanders through financial intermediaries? - Investment banks: underwriter role & underwriting activities (primary markets & secondary markets). - Investment companies: pooling money & managing funds role (mutual funds, hedge funds, …), venture capitals (angle investors for start-ups) & private equity (not traded publicly). 7. The financial crisis 2008-2009 - Antecedent of the crisis (1998~2002): high-tech bubble (dot com) crisis→ reduced interest, increasing housing price - Housing finance changed: mortgage, securitization, mortgage-backed securities: conforming mortgages & nonconforming mortgages, ARM, CDO, CDS ▶ systemic risk ▶ Financial crisis. - Reform Act PART I: ELEMENTS OF INVESTMENTS CHAP II: ASSET CLASSES & FINANCIAL INSTRUMENTS 1. The money market - T-bills (government-issued, free tax, bank-discounted method→bond-equivalent yield) - CD (bank time deposit, insured by Federal Deposit Insurance Corporation), CP (large corporates-issued, short-term, unsecured, sometimes asset-backed) BA (order to a bank to pay at a future date, traded in secondary markets or used in foreign trade) Eurodollars (dollar-denominated deposits at foreign banks or foreign branches of American banks-outside US), Repos (repurchase agreement at a higher price, short-term), Broker’s call (borrow from brokers (&bank), repay on call of the bank) - Federal funds (banks’ reserve accounts at Federal Reserve System→excess funds→federal funds rate) - LIBOR market (banks lend among themselves, crucial benchmark). - Money market funds (mutual funds: prime funds holding other bonds & government funds holding T-bills) 2. The bond market - T-notes (~10 years) & T-bonds (~30 years) – coupon payments, yield to maturity - Inflation-protected T-bonds (linked to CPI) - Federal agency debt (no explicit insurance from government) - International bonds (international capital markets, foreign currencies, foreign issuers). - Municipal bonds (state & local-issued, federal tax exemption): general obligation bonds & revenue bonds Taxable bond return (after tax) & tax-exempt bond returns (equivalent taxable yield): high-tax-bracket investors - Corporate bonds (private firms-issued, long term, default risk): secured bonds (asset-backed) & unsecured bonds (debenture), subordinated debentures. Callable bonds, convertible bonds. - Mortgage – and asset -backed securities 3. Equity securities agency conflict - Common stocks (residual claim, limited liability, voting right, dividends): shareholders→BoD→Managers - Stock market listings: closing price, changes, trading volume, highest/lowest price, annual dividends, P/E - Preferred stock: similar to debt (fixed stream) & equity (cumulative, before other dividends, tax treatment) - Depository receipts (direct investment in foreign companies, traded in US, satisfying US requirements) 4. Stock & bond market indexes - Stock: DJIA (price-weighted average), S&P500 (value-weighted average), Wilshire 5000 - Bond: Merrill Lynch, Barclays, Citi Broad Investment Grand Bond Index - International Stock Market: Nikkei, 5. Derivative markets - Option: the right, specified price, on or before expiration date - Future contract: obligation, specified price, on expiration date, long position: buyer, short position: delivery PART I: ELEMENTS OF INVESTMENTS CHAP III: SECURITIES MARKETS 1. How securities issued? - Privately held firms (smaller number of shareholders, fewer information disclosure): sell directly to institutional or wealthy investors in a private placement (primary markets only) without registration statements (low liquidity & price) - Publicly traded companies (tremendous shareholders, information-updated obligations): IPO (registration statement & prospectus required) or SEO with support from underwriter syndicate (investment banks) & firm commitment - IPO: prospectus→road shows (potential investors & bookbuilding)→price jump (underprice), after issue 2. How securities traded? Markets: Direct search; broker markets; dealer markets; auction markets. - Orders: market orders; price-contingent orders - Mechanisms: OTC dealer markets (dealer registration→prices quote→negotiation→brokers execution); electronic markets networks (automatically direct trading, no brokers/market makers, anonymity); specialist/DMM (liquid, cheaply, quickly, market makers quote prices, maintain fair & orderly market) 3. How electronic trading rose? - markets Dealer market & DMM market→Technologies (decimalization) & Regulations (centralization, antitrust law) →Electronic 4. How about US market? - NASDAQ: dealer market - NYSE: DMM market - ECNs: both market orders & price-contingent orders, latency (order posted-order delivered) 5. New trading strategies? - Algorithm: small discrepancies, rapid cross-market price comparison, short-term trend, pair trading, derivatives - High-frequency: profit from bid-ask spread, cross-market arbitrage (tiny price discrepancies) - Dark pool: anonymity, avoiding moving price against investors & high-frequency traders, unpriced orders - Bond trading 6. Globalization of stock markets - ICE, NASDAQ, LSE, Deutsche Boerse, CME Group, TSE, HKEX 7. How much trading cost? - Full-service brokers & discount brokers - Trading commission, interest from funds, financial advice, payment for order flow (high-frequency traders, bid-ask spread), price concessions 8. Buying on margin - Margin: portion of the purchase price contributed by investors (remainder borrowed from brokers, banks) – collaterals - Stock value fell→percentage margin fell below maintenance margin→not sufficient collateral to the loan→margin call Buy on margin: greater upside potential & greater downside risk 9. Short sales - Short sale: first, sell the shares borrowing from brokers then later buy & pay back (covering the short position) - Entering a short sale ↔anticipate stock price ’ll fall (selling at higher price and pay back at lower price0 Before paying back, pay dividends to initial owner. Pay back immediately if brokage firm can’t borrow from others. 10. Regulation of securities markets - Registration of new securities & issuance of a prospectus (disclosed relevant facts) - Periodic disclosure of relevant financial information by firms with already-issued securities on secondary markets - Margin requirements & bank lending - Protection for investors from loss of brokage companies or bank failure. - Self-regulation (FINRA, CFA, …) - SOX (allocation of shares in initial public offerings, tainted securities research and recommendations put out to the public, misleading financial statements and accounting practices) - Insider trading prohibition PART I: ELEMENTS OF INVESTMENTS CHAP IV: MUTUAL FUNDS & OTHER INVESTMENT COMPANIES 1. Investment companies (Financial intermediaries) - Activities: collecting individual funds & pooling of assets (portfolios). - Functions: record keeping & admin; diversification & divisibility; professional management; lower transaction costs. - Value of each share NAV = (Market value – liabilities – expenses)/share outstanding. 2. Type of investment companies - Unmanaged: unit investment trust (buying securities, deposited trust & selling redeemable certificate trust). Fixed portfolio, little active management, uniform type of assets, lower management fees, selling price with premium. - Managed: closed-end fund & open-end fund (mutual fund), % difference between price & NAV (premium/discount) Closed-end fund: shares, no redemption, organized exchanges & brokers needed, different from NAV Open-end fund: shares, redeemable (end of the day), back to the fund, at NAV price. - Others (not formally organized): commingled funds (open-end fund with units offered by banks, insurance firms), real estate investment trust (closed-end fund with shares, bonds & mortgages offered by banks, insurance firms, debt ratio 70%), hedge fund (private mutual fund for wealthy or institutional investors, exempt from SEC, speculative policies) ly indirectly 3. Mutual funds: Fund ▶ Management fee Brokers/ Financial markets ▶ Investors commission/ compensation - Investment policy: describing each fund’s prospectus. Investment company manages a complex of mutual funds. Money market fund (prime & government): money market securities, short-term, fixed NAV=$1, no tax implications. Equity fund (incomes & growth): primarily in stock>>>>>fixed-income security>> money market security. Specialized sector fund: equity fund focus on particular industries/ countries. Bond fund: fixed-income sectors. International fund: global, international, regional & emerging market funds. Balanced fund (life-cycle & target-date funds): stable proportion of equities & fixed-income securities, funds of funds. Asset allocation and flexible fund: dramatically vary the proportion allocated in stocks & bonds in accord with forecast. Index fund: match to performance of a broad market index, low cost, small investors, no security analysis. 4. Cost of investing in mutual funds - Operating expenses (administrative expense, advisory fee, advertise, distribution costs): deducted from the portfolio. - Front-end loads (commission or sale charges to brokers): paid once when purchasing securities. - Back-end loads (redemption/exit fee): paid once when redeeming securities, reducing by 1% each year. - 12b-1 fees (included in operating expenses): deducted from the portfolio. Mutual fund returns (rate of return) = (NAV1 -NAV0 + Income & capital gain distributions)/NAV0 , excluding commissions 5. Taxation of mutual fund income - Tax paid only by investors (pass-through status > timing tax management out of control) - Turnover rate: trading (replacing) of assets of a portfolio >> Higher turnover rate can be tax inefficient. 6. ETF (Mutual fund) - Traded throughout the day, tracking specified index, tax advantage, cheaper price >< bid-ask spread, price discrepancy - Nontransparent actively managed ETF (outperforming passive indexes): innovated, portfolio reported once a quarter - return risk return Synthetic ETF (debt secu): payoffs linked to an index (illiquid & thinly traded asset); Investment banks→ETF →Investors fee 7. Mutual fund investment performance - Benchmark for performance: Wilshire5000. - Professional managers or Particular indexes? 8. Information on mutual funds - Prospectus: investment objectives, policies, risks, fund advisers & portfolio managers, fee tables. - The SAI (requested): securities, audited financial statements, directors & officers’ personal investment, commission. - Fund’s annual report: portfolio compositions, financial statement, factors affecting fund performance. - Publications: Morningstar, Yahoo!, Directory of Mutual Fund (ICI).