ECON 247 Assignment 1B: Economics Principles & Market Analysis

advertisement

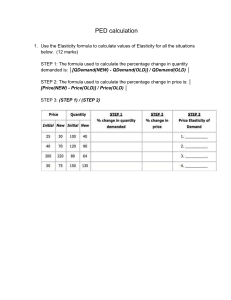

1 ECON 247: Assignment 1B Due Date: After you have completed Unit 5 Credit Weight: 10% of your final grade My comments are in RED. Your score is 99 out of 100. 6/6 1. Which economic principle is applicable in each of the following cases? Justify your answer. (2 marks each) a. David is a sportsperson who makes an annual average salary of $1 million. He started his professional career right after completing high school. David’s father wanted him to get a four-year university degree. The total annual cost of attending university is $15,000. After a long discussion with his father, David decided not to go to university. Principle 2: Opportunity cost: In this case David’s decision to attend university is not only affected by the cost of attending university, but the cost of giving up his annual salary ($1 million) over a 4-year period. b. When the government imposes a price ceiling (rent control), landlords do not build new apartments and do not maintain the existing ones. Principle 4: People Respond to Incentives Government intervention in the rent market restricts the ability of the Invisible Hand to guide the market to desirable outcomes through changes in prices. By artificially stopping the increase of rent prices, governments are incentivizing the buyer side of the rental market to seek out independent housing or move into rent controlled markets. This incentive signals rental unit suppliers that the foreseeable demand for housing is large enough that there is little incentive to maintain or improve existing property (as the lowered rent price will bring customers regardless). It also signals rental unit suppliers that there is little room for expansion in rent prices in the foreseeable future, so there is little incentive to purchase additional rental units as their margins are capped. ECON247v11_Assignment_1B © Athabasca University March 4, 2021 2 c. To tackle the problem of recession, the Bank of Canada increases the money supply by lowering the overnight interest rate. The increase in money supply lowers the interest rate which in turn increases investment. This increase in investment would increase employment in the short run and increase the price level at the same time. Principle 10: Society faces a short-run trade-off between inflation and unemployment When the fall in overnight rate increases the money supply, this stimulates the level of spending in the economy on goods and services and thus increases demand at all price points. Over time, this higher demand contributes to a higher price level because firms respond to increased demand by increasing their prices, but this also incentivizes firms to expand their production capability by hiring more labour (ie. Increase employment). Thus, in the short run, government policies tend to push inflation (higher price level) and unemployment in opposite directions as an increased money supply can lead to high prices and low unemployment. 7/8 a. Identify each of the following topics as being part of microeconomics or macroeconomics: i. (1 mark each) The average wage rate for unskilled workers is low in the developing world. Macroeconomics x (-1) ii. An increase in government expenditures is used to increase employment during a recession. Macroeconomics iii. total production of automobiles in Canada. Microeconomics iv. Under a balanced budget fiscal policy, the government attempts to balance the budget every year. Macroeconomics ECON247v11_Assignment_1B © Athabasca University March 4, 2021 3 b. Which of the following statements are positive and which are normative? (1 mark each) i. If consumer income increases, other things being equal, the demand for normal goods will increase. Positive ii. Canadian workers deserve an increase in the minimum wage. Normative iii. During a recession, unemployment can be expected to increase. Positive iv. Class sizes should not be more than 35. Normative 4/4 3. Production Point A B U a. Good X Good Y 5 8 5 10 5 5 Suppose the following table shows the production possibilities for an economy. (1 mark each) For good X, what is the opportunity cost of moving from point A to B? The opportunity cost of making 3 additional units of Good X is making 5 less units of Good Y. Thus, the opportunity cost for moving from Point A to Point B in terms of one unit of Good X is 5/3 units of Good Y. b. For good Y, what is the opportunity cost of moving from point B to A? The Opportunity cost of making 5 additional units of Good Y is making 3 less units of Good X. Thus, the opportunity cost for moving from Point B to point A in terms of one unit of Good Y at point B is 3/5 units of Good X. c. For good Y, what is the opportunity cost of moving from point U to A? ECON247v11_Assignment_1B © Athabasca University March 4, 2021 4 The opportunity cost of making 5 additional units of Good Y is making 0 additional/less units of Good X. Thus, the opportunity cost for one unit of Good Y at point U is 0/5 units of Good X. d. Suppose points A and B are on the production possibility frontier. What conclusion can be drawn about production point U? Production point U is inside the production possibility frontier, and is an inefficient market outcome. 9/9 4. Answer the questions below using the data in the following table, which shows a market for a product that has significant social benefits. Price $16ffff 12ffff 8ffff 4ffff 2ffff a. Quantity Demanded 10 20 30 40 45 Quantity Supplied 70 60 50 40 35 What would the equilibrium price and quantity be? The equilibrium price would be $4, and the equilibrium quantity would be 40. (1 mark) b. Suppose the price is currently at $2. What problem would exist in the economy? What would you expect to happen to the price? (2 marks) The quantity demanded exceeds the quantity supplied, and there is a shortage that exists in the economy. There would be an upward pressure on the price so that it reaches a level where suppliers are more willing to sell the good, and the price would increase. b. Suppose the price is currently $12. What problem would exist in the economy? What would you expect to happen to the price? The quantity supplied exceeds the quantity demanded, and there is a surplus that exists in the economy. There would be a downward pressure on the price so that it reaches a level where buyers are more willing to buy the good, and the price would fall. (2 marks) d. Using the midpoint method, calculate the price elasticity of demand if the price changes from $12 to $8. Is this elastic, inelastic, or unit elastic? (2 marks) ECON247v11_Assignment_1B © Athabasca University March 4, 2021 5 The price change from $12 to $8 is a 40% decrease, because the change in price is $4 and the mid-point is 10 (12 + 8/2), 4/10. The Quantity Demanded change from 20 to 30 units is a 40% increase, because the change in quantity demanded is 10 units and the mid-point is 25 (20+30/2), 10/25. Thus, the price elasticity of demand for a price change from $12 to $8 is 1 (40% change in price/ 40% change in quantity demanded), or unit elastic. e. A government subsidy is given to the consumers that increases demand by 20 units at each price. what are the new equilibrium price and quantity? (2 marks) A government subsidy that incentives buyers will cause a rightward shift in the demand curve (as quantity demanded increases at each price point) and result in an increased equilibrium price and equilibrium quantity. In this case, the new equilibrium price would be $8 and the new equilibrium quantity would be 50 units. ECON247v11_Assignment_1B © Athabasca University March 4, 2021 6 6/6 5. a. Describe the short run and long run impact of a binding price ceiling (rent control) on the housing market. Include the important role of elasticity of demand and supply in your answer. (3 marks) The housing market is regulated by a relatively inelastic demand in the short-run, because renters are usually under 1 year+ lease terms and cannot change their housing situation quickly. The housing market is also regulated by a relatively inelastic supply in the shortrun, because landlords tend to make decisions regarding purchasing or selling rental units over a longer time period and cannot respond quickly in the short-run. Thus, a binding price celling like rent control would cause a small shortage in the housing market as neither buyers nor sellers can make significant changes to their housing arrangements. In the long run, supply of housing is more elastic as landlords would reduce their purchase of additional rental units over the long run, as well as neglect management of their current units (as they cannot increase their rent beyond a certain point). Additionally, the demand for housing is elastic in the long run because renters can respond to lower rents by seeking out their own independent units and moving closer to rent-controlled areas. The combination of elastic demand and supply over the long run with a binding price ceiling like rent control results in a severe shortage in the housing market. b. Consider the following labour market: QDL = 70 – 2W QSL = 10 + 4W Calculate the equilibrium level of wage rate and level of employment. Calculate the level of unemployment if the price floor (minimum wage) is set at $15. (3 marks) At the equilibrium, quantity of labour demanded equals quantity supplied so to calculate the equilibrium level of wage rate, you can calculate W by making the equations equal (70 2W = 10 + 4W). Substituting W in either equation will hence provide the equilibrium quantity demanded or quantity supplied, which are the same at equilibrium. Thus, the equilibrium level of wage rate is $10 and the equilibrium quantity of employment is 50. If a minimum wage or price floor of $15 is enacted, the quantity of labour supplied will be greater than the quantity of labour demanded. At a wage of $15, the quantity demanded of labour is 70 – 2(15) = 40. Comparatively, the quantity supplied of labour at a wage of $15 is 10 + 4 (15) = 70. Therefore, 30 members of the labour force (QS – QD = 70 – 40 = 30) would be unemployed if a minimum wage of $15 is enacted. ECON247v11_Assignment_1B © Athabasca University March 4, 2021 7 3/3 6. How would the following price changes affect the total revenue? That is, would total revenue increase, decrease, or remain unchanged? (3 marks) a. Price rises and demand is inelastic. When demand is inelastic, a rise in prices would increase total revenue because the fall in quantity is proportionally smaller than the rise in price. The additional revenue from selling units at a higher price offsets the reduction in revenue from selling fewer units. Total revenue for a good that has inelastic demand usually moves in the same direction as price, ie. A decrease in price would result in a decrease in total revenue. c. Price falls and demand is elastic. When demand is elastic, a fall in prices would increase total revenue because the rise in quantity is proportionally larger than the fall in price. The additional revenue from selling more units offsets the reduction in revenue from selling units at a lower price. Total revenue for a good that has elastic demand usually moves in the opposite direction as price, ie. A rise in price would result in an decrease in total revenue. d. Price rises and demand is of unit elasticity. When demand is unit elastic, a rise in price would not change total revenue because the rise in price is proportional to the fall in quantity. Unit elastic demand results in a constant total revenue at all combinations of price and quantity because any change in price is balanced by the change in quantity. 10/10 7. a. List four determinants of the price elasticity of supply. (2 marks) An important determinant of price elasticity of supply is the time frame being considered, because firms usually have limited capacity to respond to price changes in the short run but are more responsive in the long-run. A few more determinants of prise elasticity of supply are barriers to entry (how quickly can other firms begin production and start selling), the nature or durability of a good, and mobility in factors of production. b. Evaluate the following statement: “A farmer is producing wheat (a necessity) on his land. The total production of wheat is Q1 bushels. The price per bushel is $P1. Due to the introduction of new hybrid seed, the farmer’s productivity increases, and total production increases from Q1 to Q2. At the same time, the increase in ECON247v11_Assignment_1B © Athabasca University March 4, 2021 8 production lowers the price from $P1 to $P2. The introduction of new hybrid seed improves the living standard of the farmer.” (3 marks) In this farmer’s case, an introduction of a new hybrid seed would increase the total productivity and thus increase the quantity the farmer is willing to supply at every price, which would result in a rightward shift in the supply curve. As wheat is a necessity, relatively inexpensive, and does not have many close substitutes, the price elasticity of demand for wheat is inelastic, which means a reduction in price due to technological advancement will result in a reduction in total revenue. The reduction in price has a proportionally larger impact on the total revenue than the increase in quantity sold, so the farmer would make less total revenue as a result of the introduction of the new hybrid seed. This may improve the living standard of society because less farmers are required to make more food due to increased productivity, but it does not improve the living standard of any individual farmer as their total revenue will continue to fall as farming techniques improve. c. Assume that the income elasticity of demand for good X is –3.69, and the crossprice elasticity is –1.16. What would happen to demand for X if there is an increase in income and an increase in price of Y at the same time? Explain your answer. (5 marks) On its own, an increase in income for good X would result in a reduction in quantity demanded because a negative income elasticity of demand indicates that good X is an inferior good and the demand for inferior goods usually moves in an opposite direction from income. Inferior goods, such as a bus ticket or instant noodles, are goods that are purchased when income is low, and are usually replaced by normal goods, such as a cab ride or a take-out dinner, when income increases. On its own, an increase in price of good Y would result in a decrease in quantity demanded of good X because a negative crossprice elasticity indicates that good X and good Y are complements of each other, and the increase in price for one would result in less purchases of that good, and subsequently a reduction in demand for the other. Complementary goods, such as protein powder and a shaker bottle, are usually bought in conjunction and are thus negatively impacted by an increase in price for either good. In conclusion, the demand for X would be significantly reduced when there is an increase in income and an increase in price of Y, because good X is an inferior good and is a complementary good to good Y. ECON247v11_Assignment_1B © Athabasca University March 4, 2021 9 10/10 8. The following table provides data on the price of Y and the quantity demand for X when the income levels are 100 and 200. Suppose the price of X is fixed at $7. Py 0 1 2 3 4 5 6 7 8 9 10 a. QDx (Income $100) 121.5 120.2 118.9 117.6 116.3 115 113.7 112.4 111.1 109.8 108.5 QDx (Income $200) 196.5 195.2 193.9 192.6 191.3 190 188.7 187.4 186.1 184.8 183.5 Calculate income elasticity of demand for good X using the midpoint method when income increases from $100 to $200 and when the price of good Y is fixed at $9. Explain your answer. (5 marks) Income elasticity of demand is calculated as percent change in quantity demanded divided by percent change in income. The mid-point of $100 and $200 is $150, so the percent change in income is (200-100)/150 * 100 = 66.67%. The mid-point of quantity demanded is calculated as (184.8-109.8)/2 = 37.5, so the mid-point is 109.8 + 37.5 or 184.8-37.5 = 147.3. The percent change in quantity demanded is (184.8109.8)/147.3 * 100 = 50.92%. The income elasticity of demand for good X when income increases from $100 to $200 is therefore 50.92%/66.67% = 0.764. Therefore, good X is likely a normal good because its price and income move in the same direction (positive income elasticity of demand) and it is likely a necessity like food or clothing, because consumers tend to buy good X even when income is low. b. Calculate cross price elasticity of demand for good X when the price of good Y decreases from $9 to $8 and when income is $100. Explain your answer. (5 marks) The cross price elasticity of demand is calculated as percent change in quantity demanded of good X divided by the percent change in price of good Y. The mid-point of $9 and $8 is 8.5, so the percent change in price of good Y is calculated as (9-8)/8.5 * 100 = 11.76%. The midpoint of 109.8 and 111.1 is calculated as (109.8-111.1)/2 = 0.65, so the mid-point is 111.1-0.65 or 109.8 + 0.65 = 110.45. The percent change in quantity demanded of good X is (109.8-111.1)/110.45 = -1.177%. Thus, the cross price elasticity of demand for good X when the price of good Y decreases from $9 to $8 is -1.177%/11.76% = -0.10. Therefore, good X and good Y are likely complements of one another because the quantity demanded of one ECON247v11_Assignment_1B © Athabasca University March 4, 2021 10 good goes in the opposite direction when there is a change in price of the other good (negative cross-price elasticity). Thus, an increase in the price of one would result in a reduced demand for the other, and vice versa. 13/13 9. a. What is the difference between a “change in supply” and a “change in quantity supplied”? (5 marks) A change in quantity supplied refers to a movement along the supply curve, in which the quantity supplied changes depending on a shift in the price. The quantity supplied does not change at every price so this change would not affect the entire supply curve. A change in supply occurs when a change occurs in a non-price determinant (time, number of suppliers, barriers to entry, etc.), which affects the quantity supplied at every price point and shifts the supply curve either left or right. A change in supply would affect the equilibrium in a market and change the price and quantity depending on the direction of the shift, but a change in quantity supplied may not change these parameters. Because a change in quantity supplied occurs as a result of a change in price, the price would also change on the demand side of the market and cause a shift along the demand curve. b. How will each of the following events shift the demand and/or the supply curve for bread? Also, indicate the effect of each event on equilibrium price and equilibrium quantity. That is, do equilibrium price and equilibrium quantity rise, fall, or remain unchanged? Or, is the answer indeterminate because it depends on the magnitude of the shift? (8 marks) i. The price of flour decreases. If the price of flour decreases, the cost of producing bread at any price would decrease and the quantity supplied at any price would increase, which would subsequently shift the supply curve right. When there is no change in demand and an increase in supply, the equilibrium price falls and equilibrium quantity rises. ii. Consumer income increases, and bread is a normal good. When consumer income increases in the market for a normal good, the quantity demanded at any price increases as more consumers are able to afford the good than before, which would result in a rightward shift in the demand curve. An increase in demand and no change in supply would result in an increase in both equilibrium price and quantity. ECON247v11_Assignment_1B © Athabasca University March 4, 2021 11 iii. The price of lettuce wraps (a substitute for bread) increases, and sellers expect the price of bread to fall next month. When the price of a substitute good like lettuce wraps increases, the quantity demanded for bread increases at any price because consumers are more likely to opt out for the cheaper equivalent. This causes a rightward shift in the demand curve. When sellers foresee a future price reduction and alter their behaviour, the quantity supplied increases at any price (for the remainder of the month) because sellers prioritize selling the good at the maximum available market price. This causes a rightward shift in the supply curve. An increase in both demand and supply would result in a definite increase in equilibrium quantity(two rightward shifts on the x axis), but the magnitude of change in equilibrium price is indeterminate (depending on elasticity, the equilibrium price could be greater, lower, or the same). iv. The number of sellers decreases, and consumers expect the price of bread to be higher next month. When the number of sellers decrease, the overall supply of a good or service would decrease because there are now fewer producers in the market. This would shift the supply curve to the left right, and reduce the quantity supplied at every price point. When consumers expect the price of bread to increase next month, this causes a short-term increase in demand because buyers are incentivized to stock up on bread when prices are still low. This would shift the demand curve to the right and increase the quantity demanded at every price point. In combination, a decrease in supply and an increase in demand would increase the equilibrium price (two upward shifts on the y axis), but the magnitude of change in equilibrium quantity is indeterminate because there is both an upward pressure on the price (reduced supply) and a downward pressure on the price (reduced demand). ECON247v11_Assignment_1B © Athabasca University March 4, 2021 12 10/10 10. a. Based on the following data on taxable income and amount of tax, identify each type of tax system as progressive, regressive, proportional, or lump sum. (4 marks) i. Tax System A: Proportional (6000/40000) * 100 = 15% (12000/80000) * 100 = 15% (18000/120000) * 100 = 15% The tax system is proportional because all tax brackets are taxed the same percentage. ii. Tax System B: Proportional (4000/40000) * 100 = 10% (8000/80000) * 100 = 10% (12000/120000) * 100 = 10% The tax system is proportional because all tax brackets are taxed the same percentage. iii. Tax System C: Regressive (6000/40000) * 100 = 15% (9600/80000) * 100 = 12% (12000/120000) * 100 = 10% The tax system is regressive because each subsequent tax bracket is taxed a smaller percentage than the previous. iv. Tax System D: Lump Sum or regressive (6000/40000) * 100 = 15% (6000/80000) * 100 = 7.5% (6000/120000) * 100 = 5% The tax system is lump sum because all tax brackets pay the same amount in taxes. Taxable Income $40,000 $80,000 $120,000 Tax System A Tax System B Tax System C Tax System D $6,000 $12,000 $18,000 $4,000 $8,000 $12,000 $6,000 $9,600 $12,000 $6,000 $6,000 $6,000 ECON247v11_Assignment_1B © Athabasca University March 4, 2021 13 b. Suppose that the demand and supply functions are linear. An increase in the tax rate will always increase the tax revenue and decrease the deadweight loss. Explain. (6 marks) An increase in the tax rate will not always increase the tax revenue and decrease the deadweight loss, even when demand and supply functions are linear. When tax rates are relatively low, it may be the case that increasing the tax rate would increase tax revenue, but eventually consumers in the market will begin to change their habits and purchasing patterns to reflect the increasing tax rate. This is illustrated by the Laffer Curve, which states that increases in income tax rate after a certain point can lead to diminishing returns because consumers pull out of the market outright (becoming self-employed or starting a business, leaving the country, etc.) or find loopholes to avoid paying it (tax evasion). The Laffer Curve also indicates that when income tax rates reach this point, decreases in the tax rate actually lead to increases in tax revenue because the quantity demanded and supplied of the market is so small that any reduction in the rate greatly increases market participation. Also, deadweight loss in a market with linear demand and supply will always increase as tax rate increases, because the deadweight loss is the area of a triangle and the area of a triangle depends on the square of its size (if we triple the size of a tax, the base and height of the triangle triple, and the deadweight loss rises by a factor of 32 or 9). Also, it is important to consider the relative demand and supply elasticities at play, as they alter the total tax revenue the government obtains. Tax rates effect the net wage an individual takes home, so an elastic supply in the labour market (labourers respond with large changes in labour supplied to small changes in net wage) and a relatively inelastic demand in the labour market (firms respond with small changes in labour demanded to large changes in net wage) would lead to decrease in tax revenue and increase in deadweight loss, when tax rates are increased. In this case, an increase in the tax rate (a small/medium/large change in net wage) would cause many labourers to drop out of the market so the deadweight loss increases and tax revenue falls. In the case of inelastic supply in the labour market (labourers respond with small changes in labour supplied to large changes in net wage) and a relatively elastic demand in the labour market (firms respond significantly in labour demanded to small changes in net wage) may increase tax revenue when tax rates are increased. In this case, many labourers will not change their employment status over an increased tax rate, so the government may collect more tax revenue than before. However, an elastic demand for labour would increase the deadweight loss because firms would respond to the lowered net wage (increased tax rate = consumers expect a higher wage to offset the net loss) by significantly reducing their labour demanded, which would cause many workers who were comfortably employed at pre-tax increase wages to be out of a job at the post-tax wage rate. ECON247v11_Assignment_1B © Athabasca University March 4, 2021 14 11/11 11. a. List and define different policy options that a government can apply to correct for negative externalities. (4 marks) Negative externalities arise when the cost of producing a good to society is greater than the cost of producing the good to suppliers, because consumption or production generates an external cost to bystanders who are negatively affected but not recipients of the good. 1. Command and Control policies One policy option for governments are command and control policies that look to completely shut down and ban all activities that cause negative externalities. To enforce the policies, governments can set limits on amount of by-product produced (emission standards) or completely forbid certain technologies (banning the sale of gasoline-powered cars, for example). 2. Pigouvian (corrective) taxes Another way for governments to correct for the external cost imposed on bystanders is to impose a corrective tax that equal the difference between the social costs and the private supply cost, which is also called the Piguovian tax. Because the tax increases the price buyers pay and decreases the total revenue of sellers, it effectively internalizes the externality into the market and reduces the external cost on bystanders by incentivizing reduced usage and selling (equillibrium quantity is smaller) . Usually, the amount of tax would equal the external cost imposed on the bystander per unit of production, or $T. 3. Tradable permits Governments can correct for negative externalities using a market-based approach in which they sell permits that set a specific capacity of externality that the wielder can do, such as an amount of by-product (tonnes of pollution, for example). Because firms can trade permits amongst each other at a monetary cost, the external cost of the externality is internalized by imposing it upon the firms who do not reduce the capacity of externality and must buy additional permits. A firm’s willingness to pay for the permit depends on their ability to remedy the negative externality before it reaches the bystanders, and in the market standpoint this willingness is reflected in the market price for permits. An example of this is the ability for a polluting firm to destroy or get rid of pollution before it is dumped into the environment, and this capacity would determine the price they would pay for additional permits to pollute. ECON247v11_Assignment_1B © Athabasca University March 4, 2021 15 b. The Coase Theorem suggests that efficient solutions to externalities can be achieved through bargaining. Under what circumstances does this fail to produce a solution? (3 marks) According to the Coase Theorem, private markets can reach efficient outcomes and solve the problem of externalities through bargaining if transaction costs are low and property rights are well-defined. The assumption in the Coase Theorom is that individuals and firms have quantified their individual benefits and costs related to an activity and are willing to provide monetary or other forms of payment to the party with the greatest marginal cost. If transaction costs are too high, this may impose barriers to entry for negotiations and reduce the efficiency of bargaining, because the increased cost to reaching an agreement may outweigh the benefits. This may occur in markets where oversight and enforcement of an agreement imposes very high costs, such as international peace agreements. If the externality is related to a public good, the lack of property rights (non-excludable and not rival in consumption) reduces the ability of private actors to utilize the Coase Theorem to reach an agreement. As there is no specific party that is entitled to a public good, and the marginal benefits to society are infinitesimal, bargaining is not feasible and government intervention is the likely solution to remedy the problem. If there are too many interested parties to the externality, the Coase Theorem may not be effective because coordination of many interests as well as subsequent enforcement of any agreement would impose very high transaction costs. Also, costs and benefits may be distributed unequally amongst many interested parties because the agreements are not robust and dynamic enough to consider all variations in external costs. c. Define private goods and public goods and give two examples of each. (4 marks) When defining goods in the economy, it is important to identify where they fit within two categories: excludability and rival/non-rival in consumption. Excludability refers to whether access to good or service can be restricted, and the barriers to entry could be physical, economical (cost), etc. Rival/non-rival in consumption refers to whether an individual’s consumption of the good or service diminishes another individual’s potential consumption, such as finite resources and one-time use goods like food items. Private goods are goods or services that are both excludable and rival in consumption, as in an individual’s usage of these goods or services can be prevented and one individual’s use effects another’s. Most goods in the economy are private goods, such as a McDonald’s cheeseburger or a Lithium ion battery. Public goods are goods or services that are neither excludable nor rival in consumption, as in an individual cannot be prevented from accessing these goods or services and their consumption of the good does not effect another’s consumption. Public goods tend to be provided by the government as these characters tend to diminish their profit potential. Two examples of public goods are uncongested non-toll roads or national defence services. ECON247v11_Assignment_1B © Athabasca University March 4, 2021 16 10/10 12. The following table shows the production of meat and wheat produced in tonnes per day for Germany and Canada. (2 marks each) Germany Canada a. Meat 200 200 Wheat 300 150 Which country has absolute advantage in producing wheat? Why? Germany has the absolute advantage in producing Wheat because it produces more tonnes of wheat per day, which indicates that Germany can produce a larger amount of output (wheat) for the same amount of input (time). b. What is the opportunity cost of producing one tonne of meat in Germany? Per day to produce 200 tonnes of meat in Germany, the country must give up the production of 300 tonnes of wheat. Thus, the opportunity cost of producing one tonne of meat is 3/2, or 300 tonnes of wheat divided by 200 tonnes of meat. c. What is the opportunity cost of producing one tonne of wheat in Germany? Per day to produce 300 tonnes of wheat in Germany, the country must give up the production of 200 tonnes of meat. Thus, the opportunity cost of producing one tonne of wheat is 2/3, or 200 tonnes of meat divided by 300 tonnes of wheat. d. Which country has the comparative advantage in producing meat? Why? Per day to produce 200 tonnes of meat in Canada, the country must give up the production of 150 tonnes of wheat. Thus, the opportunity cost of producing one tonne of meat is 3/4, or 150 tonnes of wheat divided by 200 tonnes of meat. Comparing this to the opportunity cost of producing one tonne of meat for Germany (3/2), Canada has a lower opportunity cost and thus a comparative advantage in producing meat. e. Which country has the comparative advantage in producing wheat? Why? Per day to produce 150 tonnes of wheat in Canada, the country must give up the production of 200 tonnes of meat. Thus, the opportunity cost of producing one tonne of wheat is 1.333, or 200 tonnes of meat divided by 150 tonnes of wheat. Comparing this to the opportunity cost of producing one tonne of wheat for Germany (2/3 or 0.67 0.75), Germany has a lower opportunity cost and thus a comparative advantage in producing wheat. ECON247v11_Assignment_1B © Athabasca University March 4, 2021