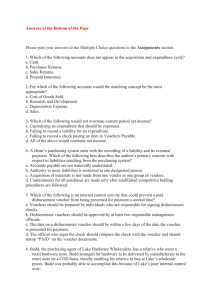

FEDILLAGA, LUKE YSMAEL V. BSA - 4 ARC438 SUMMARY OF AUDIT OF LIABILITIES SUBSTANTIVE AUDIT PROCEDURES: The auditor’s PSP for liabilities typically include the following: 1. Reconciling GL and SL; 2. Performing purchase and accounts payable cut-off; 3. Confirming liabilities to debtors; 4. Inspecting supporting documents such as contracts, invoices, receiving reports, etc.; 5. Searching for unrecorded liabilities; 6. Testing the accuracy of interest expense, interest payable, amortization of discount or premium. 7. Evaluating valuation of liabilities denominated in foreign currencies. 8. Reviewing compliance with terms of debt agreements. 9. Performing analytical review procedures to liabilities and related accounts; and 10. Evaluating proper FS presentation and adequacy of Disclosure. RECONCILIATION OF SL WITH GL ASSERTION 1. SL - GL RECONCILIA TION COMPLETENE SS AND VALUATION DEFINITION/EXPLANATION Purpose: a) To see if liabilties in total appearing in the FS conforms or reconcile with its breakdown. b) Starting point of all other substantive procedures. Generally, what to do? 1. Obtain a copy of AP GL and SL. 2. Test the clerical accuracy (footing & cross footing) c) Reconcile SL and GL, any material difference, investigate the reconciling items, particularly any unusual non-standard journal entry. Purpose: a) To verify whether the transaction if completely recorded in the proper accounting period. In performing cut-off test, AP and Purchases cut-off test is normally conducted jointly in verifying the purchases (inventory) and payables recorded. 2. PURCHASES & ACCOUNTS PAYABLE CUT-OFF TEST EXISTENCE, COMPLETENE SS AND OBLIGATION How to perform the test? 1. Obtain and examine invoices form suppliers and other entities and other documentation supporting transactions recorded in the purchase journal and cash disbursements journal immediately before after the reporting date. Determine if the transactions are properly recorded in the proper period; and 2. Review cut offs in related areas such as purchase and inventories, paying particular attention to goods in transit. However, there are instances that AP Confirmation is necessary when the following conditions exist: For Accounts Payable: 1. Controls over the recording of vendor’s invoices and receiving reports are ineffective. 2. There are few transactions involving large amounts; or There are numerous old balances. * Upon receipt of confirmation replies, the auditor should reconcile the information confirmed by the creditor to the accounting records, and follow up and resolve any differences noted. 3. CONFIRMATI ON OF LIABILITIES FROM CREDITORS EXISTENCE , VALUATIO N AND OBLIGATIO N For Notes Payable: a) As compared to AP, NP is supported by a promissory notes and may be given for a variety of reasons, example: i. Purchase of merchandise in the ordinary course of business. ii. In settlement of a long outstanding amount; iii. In return for loans from affiliates, shareholders, banks or other financial institution; or iv. To raise money in the short- term money markets (commercial paper) * Upon receipt of the confirmation replies the auditor should agree with the information confirmed bythe creditor to the accounting records, and follow up and resolve any differences noted. b) In NP verification and its related accounts, the auditor may either: i. Confirm the notes payable; or ii. Review supporting documentation as to * Amounts owed * Terms * Collateral * Restrictions and; Debtor’s compliance with the loan provisions and identify liens, security interests, and assets pledged as loan collateral. INSPECTION OF SUPPORTING DOCUMENTATIONS ASSERTION DEFINITION/EXPLANATION How to perform? a. Accounts Payable - vouch entries in the Voucher Register or in the Purchase Journal to supporting . 1. Vouchers 2. Invoices 3. Receiving Reports 4. Purchase order 1. INSPECTIO N OF SUPPORTING DOCUMENTS EXISTENCE, VALUATION AND OBLIGATION b. Lease Liability - examine the lease contract and determine whether: 1. Is it really a lease transaction? (Right to use the asset has been provided by a lessor to a lessee). 2. Is appropriately classified as finance or operating leases. - determine whether finance / capital lease obligations are appropriately recorded and required disclosures are made. c. Notes payable and Other obligations (Short term or Long - term) - extract information relevant to the disclosures of notes payable and other obligations in the financial statements. - contact lender and/or legal counsel for the entity, as appropriate, with respect to interpretation of loan agreement terms, restrictions and any other information that may be sought regarding special provisions of notes or loan agreements. - examine the client’s copies of loan agreements (ex. Promissory note) or other short-term lending arrangements (ex. Factoring) to obtain an understanding of the pertinent provisions which include: a. Amount of loans authorized b. Interest rates c. Due Dates / Maturity Period d. Assets Pledged Restrictions imposed (if any 2. SEARCH FOR UNRECORDED LIABILITIES COMPLETEN ESS AND OBLIGATION How to perform: - it is important to remember that this procedure may only be conducted after the reporting date and the auditor performs the following procedures: 1. Examine files of unpaid or unrecorded invoices, unmatched purchase orders and unmatched receiving reports and trace it to the related journal (ex. Purchase Journal) to determine it was properly recorded. 2. Examine the significant recorded purchases between the reporting date and the date of search for unrecorded liabilities to determine if this purchase should be properly included in the current year Financial Statements. 3. Obtain and review minutes of meetings and inspect contracts to identify unrecorded liabilities such as liabilities on pending ligations. 4. Review cash disbursement subsequent to the reporting date (Subsequent payment testing) and check whether this may represent a liability that should be reported on the current year; and 2. TEST THE COMPUTATIO N OF INTEREST EXPENSE, INTEREST PAYABLE AND AMORTIZATIO N OF DISCOUNT AND PREMIUM 5. Request the client to make an appropriate adjustment entry for any unrecorded liability identified by the auditor. How to perform: 1. Obtain the interest rate (nominal or effective rate) and perform recomputation. 2. For long -term debts like bonds payable, in the initial VALUATION issuance (determining the discount or premium), prepare AND an amortization table and compare it with the amounts ACCURACY recorded. If recurring audit, auditor may use the prior year working paper. 3. LIABILITIES DENOMINATE D IN FOREIGN CURRENCIES As required by PAS 21 (The Effects of Changes in Foreign Exchange Rates), monetary liabilities in foreign currency should be translated using the closing rate at VALUATION the reporting date. How to perform? 1. Obtain the closing rate and reperform the translation of the foreign currency denominated payable. 2. Ensure that any foreign currency transaction gain or loss should be reported as part of P/L/ 4. REVIEW COMPLIANCE WITH THE TERMS OF DEBT AGREEMENTS 5. PERFORM ANALYTICAL REVIEW PROCEDURES How to perform? 1. Review the entity’s compliance with the terms, PRESENTATI restrictive covenants or other provisions of debt ON AND agreements to determine whether a default or violation of DISCLOSURE any debt covenant has occurred. - If there has been a default or violation of any debt covenants, the auditor should ensure that this is properly disclosed in the notes to FS and the item should be appropriately presented as current liability in the SFP. EXISTENCE, COMPLETEN Testing the reasonableness of liabilities and related ESS, accounts. OBLIGATION Basic Procedures: S AND a. Comparison of this year’s final balance from previous VALUATION years audited balances. b. Comparison of the relationship between CY accounts payable balances and the CY purchases with the previous year’s figure. c. Comparison of actual closing balances of loand and borrowings with the corresponding budgeted figures, if available. d. Comparison of significant ratios relating to loans and borrowings, with similar ratios for other firms in the same industry if available. e. Comparison of significant ratios of loans and borrowings with the industry norms, if available. f. Comparison of the relationship between CY AP and the CY total current liabilities with previous year’s figures. g. Comparison of the relationship between the CY purchase discount and the CY total purchases with previous year’s figures. h. Comparison of the CY interest expense to the product interest expense and average principal of debt outstanding; and i. Comparison of CY finance lease expense with the corresponding previous year’s figures. After performing some comparisons, the auditor should investigate any significant differences, unexpected changes or the absence of expected changes. ILLUSTRATIVE PROBLEMS: The LYF Company's president, Luke, has a bonus agreement with the business under which she receives 12% of the company's annual net profits (after taxes and bonuses are deducted). The net income for the current year is P5,850,000 before deducting either the bonus or the income tax provision. Taxes on the bonus are deducted, and the rate is 47%. 1. Bonus of Luke a) 12% (5,850,000 - B - (47% x 5,850,000 - B) = 702,000 - 12%B - (2,749,500 + 47%B) = 702,000 - 12%B - 329,940 + 47%B = 372,060 - 74% 1.074B = 372,060 = 399, 592.44 2. Appropriate provision for Income Tax in the year a) 47% (5,850,000 - 399,592.44) = 2,561,691.55