Accounting Principles Quiz: Revenue Recognition & Inventory

advertisement

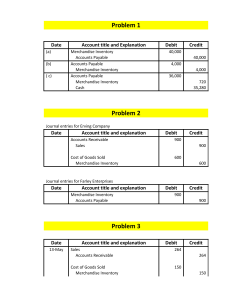

Chapter 5 PRINCIPLES OF ACCTG QUIZ 1. Assume that Atom Electric and Neutron use the contract-based approach for revenue recognition. Atom Electric returned to Neutron Inc. 5 damaged fuses that were sent to recycling. Neutron accepted the return and refunded the $200 Atom had paid for the order. To record this return, Neutron's accountant must A. debit Refund Liability and credit Cash for $200. B. debit Sales Returns and Allowances and credit Cash for $200. C. debit Cash and credit Sales for $200. D. debit Sales Returns and Allowances and credit Accounts Receivable for $200. 2. Assuming the company uses the earnings approach for revenue recognition, in a periodic system, the required entry(ies) to record the sale of merchandise for $1,000 on credit for goods costing the company $600 would be A. a debit to Accounts Receivable and credit to Sales for $1,000. B. a debit to Cost of Goods Sold and credit to Merchandise Inventory for $600. C. a debit to Accounts Receivable and credit to Merchandise Inventory for $1,000. D. both A and C. 3. Assuming the company uses the earnings approach for revenue recognition, sales revenues are usually considered earned when A. an order is received. B. goods have been transferred from the seller to the buyer. C. adjusting entries are made. D. cash is received from credit sales. 4. In a perpetual inventory system, a separate account is maintained for each separate inventory item. These separate accounts are referred to as A. control accounts. B. contra accounts. C. subsidiary accounts. D. purchase accounts. 5. When using the contract-based approach to revenue recognition the amount of revenue recognized reflects the consideration the business expects to receive. TRUE A company shows the following balances: Sales $1,000,000 Sales returns and allowances 250,000 Cost of goods sold 600,000 Operating expenses 75,000 What is the gross profit margin? A. B. C. D. 60% 20% 40% 80% 6. A. B. C. D. A merchandiser differs from a service-type business in that it sells goods to customers. only operates in one country. has more employees. requires more government regulation. 7. If a purchaser returns goods purchased on account to the supplier under a perpetual inventory system, the purchaser would debit A. Accounts Payable. B. Merchandise Inventory. C. Purchase Returns. D. Cost of Goods Sold. 8. Assuming the company uses the earnings approach for revenue recognition, the sales revenue section of an income statement for a retailer would not include A. cost of goods sold. B. sales. C. sales returns and allowances. D. net sales. 9. The Sales Discounts account is a contra revenue account. True 10. Stratton Inc. uses the contract-based approach to revenue recognition offers a 2% sales discount to Murphy Ltd. and reduced Sales by the full 2% at the point of sale. Murphy did not take advantage of the discount when it paid Stratton for the balance owing. When recording the collection on account, Stratton will A. debit Sales for the amount of the discount. B. debit Sales Discounts for the amount of the discount. C. credit Sales for the amount of the discount. D. debit Accounts Receivable the amount of the discount. 11. Assuming the company uses the earnings approach for revenue recognition, a company uses the Sales Returns and Allowances account to record A. customer returns of prior sales. B. a discount received from a supplier to encourage prompt payment. C. a discount offered for a large quantity purchase. D. returns of inventory to suppliers. 12. Assuming the company uses the earnings approach for revenue recognition, a large balance in the Sales Returns and Allowances account may indicate that the merchandise that is being sold is of inferior quality. True 13. FOB shipping point means that the seller is responsible for the freight costs. False 14. A periodic system of inventory will give the company more control over their inventory. False