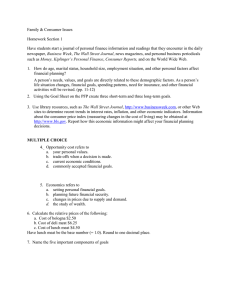

Cultured Meat Industry Analysis: Market, Trends, and Competitors

advertisement

Cultured meat is a type of edible meat which is grown in a lab using animal cells, but without the need for an actual animal to be used in its production. Cultured meat can be described as its own industry entirely but is generally included as a subsector in the rapidly expanding meat alternatives industry. This industry saw total revenues around $7 billion in 2020, a number which is forecasted to nearly double by 2026. This pales in comparison, however, to the revenue in the meat products market, which is around $1 trillion. Cultured meat will not only be able to target the meat alternatives market, but it will be more poised to target traditional meat consumers due to its greater similarities to regular meat than plant-based meat alternatives. In the past five years this industry has seen strong trends toward demand growth, sales growth, and price decrease. This will lead to sustained growth over the next five years, with the ability to gain market share in the global food market. One of the main drivers of increased demand is products’ increase in quality. Meat alternatives products have seen big changes recently to have tastes and textures more akin to real meat, which has been a big reason behind the boost in demand and sales. This will bode well for cultured meats, as they have tastes and textures which are much closer to traditional meat then their plant-based counterparts. Another big trend driving the meat alternatives industry is general distaste toward incumbent meat producers. There have been many cases with big meat companies being accused of animal cruelty of varying degrees. This has left a bad taste in the mouths of consumers, leading some to migrate to the meat alternatives industry. Products in this industry, including cultured meat, are free of any cruelty. Although cultured meat is technically real meat, which would go against the principals of veganism, studies have shown that 38% of vegans are against meat due to animal welfare concerns. This would open the door for cultured meat to take some market share from these plant eating consumers. The same study showed that 38% were vegans due to environmental concerns. This is another strong point for cultured meat, as it requires less land, greenhouse gas emissions, water, and time to produce. It also results in far less water and soil pollution. This is going to be very important going forward, because the world’s growing population will otherwise have a difficult time finding adequate food without water shortages, agricultural space crises, and pollution concerns. Finally, 45% of vegans have chosen the diet due to health concerns. Early studies have shown that cultured meat is much healthier for humans to eat than traditional meats and will almost never contain diseases. All these factors go to show that cultured meat will be a “best of both worlds” solution. This new type of meat will solve many of the environmental, health, and animal cruelty issues a growing number of vegans and vegetarians have with traditional meats. At the same time, it will satisfy the rest of the population’s hunger for meat, with proper taste and texture that just can’t be satisfied by plant-based meats, no matter how hard they try. The meat alternatives industry is expected to see a cumulative annual growth rate (CAGR) around 16% over the next 5 years. However, the cultured meat subsector is expected to be able to capitalize on a much higher CAGR of 410% over the next 10 years, reaching a total revenue of $12.7 billion by 2030. This makes it a very lucrative industry at the current time. The meat alternatives market as a whole has seen a lot of competitive interest in the past few years, with over 300 businesses now operating in the space. Among these are legacy food brands such as Kellogg’s and Conagra with 6.8% and 3.7% respectively, as well as newer plant based only companies such as Beyond Meat with 5.3% and Impossible foods with 2.7%. Currently, the cultured meat industry makes up a very small portion of the total meat alternatives industry, so cultured meat companies generally have a very small share in the meat alternatives market. However, when you look at the cultured meat market alone, there is one company that stands out as the largest competitor: Upside Foods. It’s hard to determine an exact market share for companies in this field as it is a very new idea with no public companies. Upside Foods is often seen as the leader due to its many acquisitions and the fact that it is going to be the first company to achieve production of cultured meat at meaningful scale. While there are several other competitors working on cultivating meat, they are in earlier stages, meaning Upside is by far the biggest competitor and poses the greatest challenge. Through years of research, Upside foods has been able to get the cost of producing its meat from $18,000 per pound down to about $20 per pound. Its products have not hit the shelves quite yet, but when they do, they intend on charging between $10 and $20 per portion, solidifying it in the luxury foods price range. After achieving more scale, Upside believes it can get its price lower in the next few years to be closer to products like Beyond Meat, in the $5-$7 per pound range. As it stands today, not very many people are aware of brands like Upside foods, or even cultured meat in general. Upside foods has done very little with regards to promotion, aside from frequent news stories about the company and interviews with its founders. This has a lot to do with the fact that the company does not have a marketable product to promote, along with the rest of the companies in the industry. Companies like Upside Foods have chosen a distribution technique similar to much of the rest of the food industry, using shipments to grocery stores and restaurants, where the end consumer would buy their product. When taking into account consumers perceptions of cultured meat brands, they are generally positive, due to the fact that they are helping solve a global issue in the food industry, as well as being seen as cruelty-free, environmentally sustainable companies. A small subset of the population which can be described as “meat enthusiasts” may still have a negative perception towards brands like Upside, considering they may see the company as a threat to the traditional “real” meat industry. When our company enters the market, it’s hard to say how some of the major companies would react. Upside has said they welcome increased competition in the industry as it will be an indicator of success and a driver for growth. A big part of Upside’s success has come from its many acquisitions, so one possible outcome of entering the market is that one of the major companies in the industry may try to buy us out. The cultured meat industry is not one with hostile competition. Most companies are happy where they are at and the leaders in the market seem to be too satisfied with the lead they have obtained to be worried about newcomers to the industry. This will give us a good chance for disruption if executed properly.