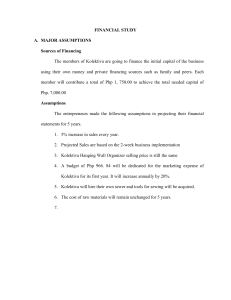

Engineering Economics Assignment: Cost Analysis & Decision Making

advertisement

1. Problem Definition 2. Development of Alternatives 3. Development of prospective outcomes 4. Selection of a decision criterion 5. Analysis and comparison of alternatives. 6. Selection of the preferred alternative 7. Performance monitoring and post evaluation of results. ENGG 404 Engineering Economics Assignment No. 1 Solve the following carefully. Apply the seven steps in engineering economic analysis procedure. 1. Sara needs 22.5 gallons of gasoline to top off his automobile’s gas tank. If she drives an extra eight miles (round trip) to a gas station on the outskirts of town, She can save $0.15 per gallon on the price of gasoline. Suppose gasoline costs $3.90 per gallon and Sara’s car gets 30 mpg for in-town driving. Should Sara make the trip to get less expensive gasoline? Each mile that Sara drives creates one pound of carbon dioxide. Each pound of CO2 has a cost impact of $0.0 on the environment. What other factors (cost and otherwise) should Sara consider in her decision making? If Sara buy gasoline at her currect place, the cost of the gasoline will be: (22.5 gallons)($3.90/gallon) = $87.75 Now, if she drives additional 8 miles for more gallons (30 mile/gallon) = 8 miles/gallon Let x be no. of gallons 30x = 8 x = 0.2666666667 Sara needs (22.5 + 0.2666666667) gallons = 22.76666667 gallons Therefore the cost is (22.76666667 gallons)($3.90/gallon) = $88.79 Money saved by Sara $87.75 2. Lenlen just wrecked his new Nissan, and the accident was his fault. The owner of the other vehicle got two estimates for the repairs: one was for Php 40,150, and the other was for Php42,600. Lenlen is thinking of keeping the insurance companies out of the incident to keep his driving record “clean.” Lenlen’s deductible on his comprehensive coverage insurance is Php25,000, and he does not want his premium to increase because of the accident. In this regard, Lenlen estimates that his semi-annual premium will rise by Php3000 if he files a claim against his insurance company. In view of the above information, Lenlen’s initial decision is to write a personal check for Php 40,150 payable to the owner of the other vehicle. Did Lenlen make the most economical decision? What other options should Lenlen have explored? In your answer, be sure to state your assumptions and quantify your thinking. (1) The problem is that Lenlen decides to pay Php 40,150 to the owner of the other vehicle while his comprehensive coverage insurance amounts to Php 25,000 plus the additional Php 3,000 semi-annualy. Assumption: Lenlen will keep his Nissan for five more years and his premiums do not change each subsequent year. (2) Lenlen has two options: (a) Write a personal check for Php 40,150 (b) File a claim to the insurance company (3) In the first option, the dilemma will cost Lenlen Php 40,150. In the second option, Lenlen will pay deductible Php 25,000 in advance from his own pocket when he files a claim to the insurance company. Moreover, he will pay an additional insurance premium of Php 3,000 on semi-annual basis for the five years that he keeps the car. Assuming that Lenlen keeps his Nissan for five more years, Lenlen will end up paying Php 25,000 + (Php 3,000 x 2 payments/year) x 5 years = Php 55,000. This amount is obviously more than paying Php 40,150 straight from his pocket. Therefore, Lenlen have made the most economical choice of writing a personal check for Php 40,150 to the other owner of the vehicle right away. (4) One criterion could be to minimize the expected loss of money. Based from the computation, option (a) is a more economical choice. (5) Exercising option (b) is not that bad if Lenlen do not have enough money to pay Php 40,150 immediately. However, option (a) is a more economical and recommendable alternative. (6) Option (a) is the preferred alternative since it will save Lenlen Php 14,850. (7) Lenlen should stick with his initial decision of writing a check amounting to Php 40,150 payable to the owner of the other vehicle since it will save him Php 14,850 assuming that he will keep his Nissan for five more years and that his premiums do not change each subsequent year. 3. Henry Ford’s Model T was originally designed and built to run on ethanol. Today, ethanol (190-proof alcohol) can be produced with domestic stills for about $0.85 per gallon. When blended with gasoline costing $4.00 per gallon, a 20% ethanol and 80% gasoline mixture costs $3.37 per gallon. Assume fuel consumption at 25 mpg and engine performance in general are not adversely affected with this 20–80 blend (called E20). a. How much money can be saved for 15,000 miles of driving per year? b. How much gasoline per year is being converted if one million people use the E20 fuel? Assumption: Fuel consumption is at 25 mpg and engine performance in general are not adversely affected with the 20-80 blend (a) How much money can be saved for 15,000 miles of driving per year? 15,000 𝑚𝑖𝑙𝑒𝑠 𝑝𝑒𝑟 𝑦𝑒𝑎𝑟 = 600 𝑔𝑎𝑙𝑙𝑜𝑛𝑠 𝑝𝑒𝑟 𝑦𝑒𝑎𝑟 𝑜𝑓 𝐸20 25 𝑚𝑖𝑙𝑒𝑠 𝑝𝑒𝑟 𝑔𝑎𝑙𝑙𝑜𝑛 Therefore, Savings = 600 gallons/year ($4.00 - $3.37) = $378 per year $378 can be saved for 15,000 miles of driving per year. (b) How much gasoline per year is being converted if one million people use the E20 fuel? Ethanol is produced at a rate of $0.85 per gallon while gasoline cost $4.00 per gallon. Comparatively, ethanol is produced a rate of $4.00 per gallon = $4.70 $0.85 per gallon For 1,000,000 people: 4.70 x 1,000,000 = 4,700,000 gallons/day For gasoline per year: 4,700,000 gallons/day x 365 days = 1,715,500,000 gallons/year 4. Studies have concluded that a college degree is a very good investment. Suppose that a college graduate earns about 75% more money per hour than a high school graduate. If the lifetime earnings of a high-school graduate average Php 1,200,000, what is the expected value of earning a college degree? Calculating the expected value of earning a college degree Expected value = Average earnings of high school graduate + (Average earnings of high school graduate x Rate of excess earnings) Expected value = Php 1,200,000 + (1,200,000 x 0.75) Expected value = Php 1,200,000 + (1,200,000 x 0.75) Expected value = Php 2,100,000 Therefore, the expected value of earning a college degree is Php 2,100,000 5. During your first month as an employee at Greenfield Industries (a large drill-bit manufacturer), you are asked to evaluate alternatives for producing a newly designed drill bit on a turning machine. Your boss’ memorandum to you has practically no information about what the alternatives are and what criteria should be used. The same task was posed to a previous employee who could not finish the analysis, but she has given you the following information: An old turning machine valued at $350,000 exists (in the warehouse) that can be modified for the new drill bit. The in-house technicians have given an estimate of $40,000 to modify this machine, and they assure you that they will have the machine ready before the projected start date (although they have never done any modifications of this type). It is hoped that the old turning machine will be able to meet production requirements at full capacity. An outside company, McDonald Inc., made the machine seven years ago and can easily do the same modifications for $60,000. The cooling system used for this machine is not environmentally safe and would require some disposal costs. McDonald Inc. has offered to build a new turning machine with more environmental safeguards and higher capacity for a price of $450,000. McDonald Inc. has promised this machine before the startup date and is willing to pay any late costs. Your company has $100,000 set aside for the start-up of the new product line of drill bits. For this situation, a. Define the problem. b. List key assumptions. c. List alternatives facing Greenfield Industries. d. Select a criterion for evaluation of alternatives. e. Introduce risk into this situation. f. Discuss how nonmonetary considerations may impact the selection. g. Describe how a post audit could be performed 6. While studying for the engineering economy final exam, you and two friends find yourselves craving a fresh pizza. You can’t spare the time to pick up the pizza and must have it delivered. “Pick-Up-Sticks” offers a 1-1/4-inch-thick (including toppings), 20-inch square pizza with your choice of two toppings for $15 plus 5% sales tax and a $1.50 delivery charge (no sales tax on delivery charge). “Fred’s” offers the round, deep-dish Sasquatch, which is 20 inches in diameter. It is 1-3/4 inches thick, includes two toppings, and costs $17.25 plus 5% sales tax and free delivery. a. What is the problem in this situation? Please state it in an explicit and precise manner. The problem in this situation is that three friends are hungry for a pizza during their final exam and have no time to pick it up themselves. In order to satisfy their hunger they have to decide one feasible outlet to get to order a fresh pizza from the given two choices of outlets. The issue here is that three buddies are hungry for pizza during their final exam and don't have time to go out and get it. To fulfill their hunger, they must choose one of the two possible places from which to order a fresh pizza. b. Systematically apply the seven principles of engineering economy to the problem you have defined in Part (a). c. Assuming that your common unit of measure is dollars (i.e., cost), what is the better value for getting a pizza based on the criterion of minimizing cost per unit of volume? d. What other criteria might be used to select which pizza to purchase? https://www.studocu.com/en-us/document/california-state-university-northridge/engineeringeconomy-and-financial-analysis/mse604-homework1-chapter-1-engineering-economy-costanalysis/17779890