Whitepaper

Equity Factor Risk Models

Version #1.1 · 31st of July 2020

www.bitadata.com

LOG OF AMENDMENTS

3

Introduction and Background

General Information

Literature Review on Factor Models

Factor Structure Overview 1. Estimation Universe 2. Sector Factors 3. Style Factors

3.1. STYLE FACTORS DEFINITIONS

Methodology 1. Security and Portfolio Level Factor Exposures

1.1. Style Factor Exposures

1.2. Binary Factor Exposures

2. Factor Returns Estimation 3. Risk Estimation

4

Summary and Conclusions 16

References

17

CONTACT

18

5

6

7

7

8

8

11

11

11

12

12

15

1) 06.05.2020

- Version #1.0. First publication of this whitepaper. 2) 31.07.2020

- Version #1.1. General edits.

3

About the BITA Equity Risk Model

Equity Risk modeling is a powerful tool that provides insights for risk management, performance attribution,

and portfolio construction. In this document, we provide the methodology, and the implementation process

of the BITA Global Equity Risk Model, a fundamental multi-factor model developed by BITA for the

identification of sources of a portfolio’s risk. Combined with some other tools, the BITA Equity Risk Model is

used by investors to evaluate quantitative investment strategies within the BITACore environment.

About BITA

BITA is a Germany-based Fintech that provides enterprise-grade indexes, data, and infrastructure to

institutions operating in the passive and quantitative investment space. Thanks to BITA’s innovative index

software, designed to outperform other existing solutions in terms of flexibility and speed, BITA is able to

provide independent, methodologically-sound indexes that both are investable and replicable by customers

and stakeholders. All of BITA’s methodologies and processes are completely transparent and available

publicly.

About this Document

This document is published to serve as a guidebook of the methodology adopted in the construction,

calculation and management of the BITA Equity Risk Model.

Any methodological changes or alterations to this document are performed by the BITA Data Management

Board and authorized by the BITA Oversight Function, following the directives of the Regulation (EU)

2016/2011 “Benchmark Regulation” (BMR). The BITA Equity Risk Model outputs are owned, calculated,

administered and disseminated by BITA GmbH.

4

The BITA Global Equity Risk Model and the closely related Single country, and Regional Models are tools to

understand and manage sources of performance and risk in diversified global (or single market) portfolios.

Additionally, the models can be paired with a portfolio optimizer, such as the BITA Index Optimizer, to build

risk/return optimized investment strategies. Global coverage demands balancing ubiquity and granularity. Factors that capture the behavior of one

industry or market might fail on another. To address this issue, we could be joining many specialized models.

However, accuracy in the linkages is poor, and the interpretation of the exposures to a large set of

redundant factors might be unclear. Alternatively, a huge set of factors has high in-sample explanatory

power but blunders on the dynamic future. The BITA Global Equity Risk Model is built to capture risks affecting diversified global portfolios. Portfolios

invested in a Single market or specific Region are best served by a model covering solely that market.

5

One of the main objectives of multiple factor models is to describe asset returns and their covariance matrix

as a function of a finite number of risk attributes. These kinds of models are based on one of the basic

principles of financial theory: there is no reward without risk. The Capital Asset Pricing Model (CAPM), first

presented by Sharpe (1964), uses stock beta as the only relevant risk measure, meaning that the market can

be considered as the first and most important equity factor. The Arbitrage Pricing Theory, presented by

Ross (1976), postulates a more general multiple factor structure for the generation of returns. However, it

neither specifies the nature, nor the number of these factors. In general, a factor can be defined as any characteristic relating a group of securities that is relevant in

explaining their returns and risk. Beyond the market factor, researchers generally look for factors that are

persistent over time and have strong explanatory power over a broad range of stocks. Because factors

cannot be directly observed, there is a keen debate about their definition and estimation. Currently, there are

three main categories of factors: macroeconomic, statistical, and fundamental. Macroeconomic factors

include measures such as surprises in inflation or GDP, surprises in the yield curve, and other measures of

the macro economy. Statistical factor models identify factors using statistical techniques such as principal

components analysis (PCA).

Nowadays, fundamental factors are the mostly widely used factors in the industry. According to this

approach, the sources of risk premia are linked to stock characteristics such as industry membership,

country membership, valuation ratios, and technical indicators. Rosenberg and Marathe (1976) showed the

relevance of these factors in explaining stock returns. Fama-French (1992) found price to book value ratio

and market capitalization to have significant influence on stock returns. Furthermore, a widely range of

studies has shown that industry, country, currency and style factors contribute significantly to active return

of actively managed funds. Style factors that have been proposed and explored include momentum (Carhart

1997), quality (Sloan, 1996), Volatility (Ang et al., 2006), dividend yield (Litzenberger and Ramaswamy, 1979)

and liquidity (Amihud, 2002). Nowadays, multiple factor models have been applied early in investment

practice, mainly because they allow a differentiated and intuitive risk-return analysis decomposition. The BITA Equity Risk Model is a multi-factor risk model which seeks to decompose each asset’s returns

across a set of 18 individual fundamental factors. The 18 factors in the model consist of 11 sector factors

and 7 style factors.

6

1. Estimation Universe

The estimation universe is the set of stocks that is used to estimate the risk model. In order to ensure the

soundness of the model, we must look for representation, liquidity and stability when selecting these

securities. A well-constructed equity index must address these criteria, and therefore serves as an excellent

foundation for the estimation universe. In the following table, we present the estimation universes we use in the different BITA Equity Risk model

variants we offer:

Equity Risk Model Variant

Estimation Universe

BITA Global Fundamental Model (BITA RMGLF1)

BITA Global Universe

Europe Fundamental Model (BITA RMEUF1)

BITA Europe Universe

US Fundamental Model (BITA RMUSF1)

BITA US Universe

As of 2020, the models cover over 14,000 securities in more than 60 countries. Market returns,

capitalizations, and fundamental data are obtained from S&P Capital IQ. BITA’s Equity Risk Models use point-in-time fundamental data, which allows us to address look-ahead bias in

back-tests, and enable more timely updates. We use historical data from January 2008 onwards, and we

update the model on a daily basis.

2. Sector Factors

Sector classification is an important source of common factor risk and accounts for a great deal of

similarities observed in securities behavior.

Sector factors are based on the GICS industry classification:

- Consumer Discretionary

- Consumer Staples

- Energy

- Financials

- Health Care

- Industrials

- Information Technology

- Materials

- Real State

- Communication Services

- Utilities

7

3. Style Factors

Style factors are drivers of return within an asset class; they have historically delivered a return premium

over the long term – capturing a specific risk premium, behavioral anomaly, or structural market impediment. BITA’s Equity Risk Model includes seven factors: Momentum, Size, Value, Quality, Volatility, Liquidity and

dividend Yield. Each factor is the result of a combination of descriptors, which are quantities and ratios

calculated from fundamental and market data. The following is a summary of the structure of each factor

and the descriptors used.

STYLE FACTOR

CLASSIFICATION

Momentum

Momentum (100%)

Size

Size (100%)

Value

Book to Price Ratio (20%)

Cash Flow to Price Ratio (20%)

EBITDA to Enterprise Value Ratio (20%)

Earnings to Price Ratio (20%)

Sales to Enterprise Value Ratio (20%)

Quality

Earnings Variability (34%)

Profitability (33%)

Leverage (31%)

Low Volatility

1/ VLRT: Inverse of volatility return over the

last year (100%)

Liquidity

Liquidity (100%)

Dividend Yield

Dividend Yield (100%)

3.1. STYLE FACTORS DEFINITIONS

This section gives detailed definitions of the descriptors which underlie the style factors in the BITA’s Equity

Risk Model. The method of combining these descriptors into style factors is proprietary to BITA.

a) Momentum:

The momentum exposure is calculated as the local 12-month total returns, after excluding the most recent

month (Return).

8

b) Value:

The Value metric of asset i, Value on day t is calculated as a composite based on the following formula:

Where:

is the Book to Price ratio,

is the Cash Flow to Price ratio,

is the Earnings to Price ratio,

is the EBITDA to Enterprise Value ratio, and

is the Sales to Enterprise Value ratio.

c) Size:

The size metric of an asset, Size on day t is computed by calculating the log of its company's market

capitalization. The formula is:

d) Quality:

Quality is a composite of Profitability and Leverage measures. These measures are based on quarterly data.

Therefore, the quality exposure only changes from quarter to quarter, and we extend such calculations on a

daily basis.

where:

d.1. Profitability We calculate this descriptor as a composite of the following financial ratios:

Where ROE is the Return on Equity (ROE), ROA is the Return on Assets (ROA), and EBITDA Margin is the

Earnings before interests, taxes, depreciation, and amortization divided by revenues.

d.2. Earnings Variability

We calculate this descriptor as the standard deviation of year-on year Earnings per Share (EPS) growth in

the last five fiscal years.

9

Where:

is the EPS growth

is the average EPS growth over the last five fiscal years

denotes the number EPS growth data points, e.g. 4 in the case of earnings variability

d.3. Leverage This descriptor is calculated as a composite of several leverage measures: where BLev is the Book Value of Leverage, Mlev is the Market Value of Leverage and

Total Assets Ratio.

is the Debt to

e) Low Volatility:

This factor exposure captures market risk that cannot be explained by the market factor, and is calculated

as follows:

Where:

is the return volatility over the last year.

f) Liquidity:

The liquidity factor exposure is calculated using the 3-month average daily volume divided by the shares

outstanding of the instrument in its primary exchange.

g) Yield:

For non-dividend paying stocks, this factor exposure is still calculated, and it will set to be 0.

10

1. Security and Portfolio Level Factor Exposures

1.1. Style Factor Exposures

Style Factors are types of factors related to securities’ fundamental characteristics. Each style factor

consists of one or multiple “atomic” descriptors, which represent the features of an investment. The

advantages of using multiple descriptors are more robust calculations of factor exposure and better

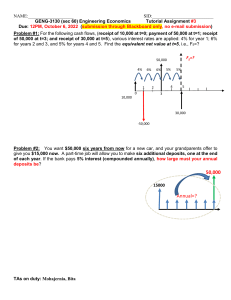

explanatory power. This figure illustrates the factor exposures’ calculation process. Factor returns from the covariance matrix

are used for risk attribution analysis. Specific risk is estimated separately.

If Descriptor

Generate Descriptors

Winsorization

Generate Factors

Standarization

If Factor

Factor Exposures

Data Flow for Factor Exposures Calculation

All style factors in the BITA Global Equity Risk Model and other BITA fundamental equity factor models are

constructed base on the following steps. First, we calculate the descriptors, this can be done using

arithmetic operations of some fundamental values to get a ratio or applying a real function, such as taking

the logarithm of market capitalization. In some cases, this step involves more complex calculations like

estimating the CAPM beta through a time-series regression model. Next, we weight each descriptor with its corresponding market capitalization and winsorize the remaining

values to be within two standard deviations from the mean. After winsorizing, we standardize the descriptors

to have a cap-weighted mean of zero and a standard deviation of 1. Stocks with scores less than minus

three are set to minus three and those with scores greater than three are set to three. The scores are then

recalculated. This process is repeated iteratively until the market-cap-weighted mean of zero and the

standard deviation converge to zeros and one numerically. Thereafter, we linearly combine the standardized scores of the descriptors for the calculation of the factor

exposures. After removing outliers and winsorizing, we re-standardize each factor exposure to have a

market-cap-weighted mean of zero and unit standard deviation. This completes the standardization process.

11

The formula for standardization is:

where Xnk denotes the nth security’s exposure towards factor k , and wn denotes the weight of the nth

security in the underlying universe. Moreover, uk denotes the cross-sectional cap-weighted average of

factor exposure k and sigma the cross-sectional standard deviation of factor exposure k. .

1.2. Binary Factor Exposures

In addition to the aforementioned “style” factors, security’s risk and return are also function of its industry,

currency and country. The matrix of each of these exposures is a set of binary values.

Country: Each security in this universe has a unit exposure to its own country, and 0 exposure to all other

countries.

Sector: In order to calculate the sector exposures, we assign an exposure value of 1 if a security belongs to

the sector and zero to all other sector. Currency: The currency exposures of each security are also binary variable, which equal to one if the share

is denominated in that currency and zero otherwise.

2. Factor Returns Estimation

The most general return attribution model can be written as: appreciation of the asset in local currency

and the repatriation of the asset value back to the base currency of the investor:

where xm represents the exposure to source (in our case, factor) m, and gm the return of the source

(factor).

BITA’s approach to multi-currency attribution starts with the decomposition of asset returns into these

fundamental sources. Once decomposed, the components can be aggregated to the portfolio level and

attributed separately. As a concrete example, consider an investment in a stock from the point of view of a US portfolio manager.

Let

denote the local return of asset in currency .. If currency appreciates by an amount relative

to the numeraire, then the base return of the asset is given by the standard formula:

(1)

12

The cross-term is typically minute and can be safely ignored for risk purposes. The exchange-rate return

depends on the fluctuations of the sport rate over the investment horizon. The exchange rate return of

currency k from time to is given by:

(2)

where Sk(tf) is the spot price in base currency of one unit of currency at time .

Omitting the cross term, and using the equation (1), the base return can be decomposed in an equity

component and a currency component:

(3)

The equity component is the local return of the stock, for which we adopt a multi-factor framework. More

specifically, we propose that the local returns are driven by a relatively small number

of global equity

factors, plus an idiosyncratic component unique to the particular stock,

(4)

Here,

represents the local return of the nth security,

the exposure of the nth security to

towards factor ,

the return of the factor , and un given by the residuals of the cross-sectional

regression, the specific return. The factor exposures are known at the start of each period, and the factor

returns are estimated via cross-sectional regression.

Suppose that there are

currencies in the model. Ordering the currencies after the equity factors, we can

express the currency returns as:

(5)

Where

is the exposure of stock nto currency k, and

is the return of the currency with

respect to US dollar. We take the currency exposures xnk to be equal to 1 if k corresponds to the local

currency of stock , and 0 otherwise.

Combining equations (3), (4), and (5), we obtain

Where K=KE+KC

is the total number of combined equity and currency factors.

13

The factor returns over the period are obtained via a cross-sectional regression of asset excess returns on

their associated factor exposures. We estimate the factor returns on a daily basis using the following

multi-factor fundamental model:

With the following constraints to avoid collinearity between the country and sector factors and the common

factor:

where w_{i,t}E_i^is the cap weight of each stock of the estimation universe in country c, and w_{i,t}E_i^{is the

corresponding weight in sector ..These constraints remove the exact collinearities from the factor exposure

matrix, without reducing the explanatory power of the model.

Given the security exposures are given, we run a weighted least squares model to get the factor returns

daily. The model uses regression weights proportional to the square root of market capitalization.

Finally, the resulting factor returns are robust estimates which can be used to calculate a factor covariance

matrix to be used in the remaining model estimation steps.

We do not mean to convey any sense of causality in this model structure. The factors may or may not be the

basic driving forces for security returns. In our view, they are merely dimensions along which to analyze risk.

14

3. Risk Estimation

Factor and specific contributions can be rolled up to the portfolio level. That is, the portfolio active return

can be defined as:

where x_k^ represents the active exposure of factor k., and w_n the active weight.

Following the X-Sigma-Rho framework, we calculate the corresponding risk of the portfolio using the

following formula:

where \sigm iis the factor volatility, \rho(f_k,Ris the correlation between the factor return and the active

return, \sigmais the specific volatility of stock n, and \rho(u_n,Ris the correlation between the specific return

and the active portfolio. The first sum is the total risk due to factors, while the second sum gives the total

specific risk contribution.

We set a rolling window of 30 days in order to forecast risk, that is, every day we calculate volatilities and

correlations over a 30 days period. The factor contribution to risk is then calculated as:

15

BITA’s Equity Risk Model is a tool to help investors understand and manage the risk in diversified global

investment strategies. We use classical techniques in finance to compute risk exposures to each relevant

factor for global equities. The risk model factors loadings and factor returns are fully available, for free,

within the BITACore environment. Further research is to come on common factors that could be useful in

international markets.

16

Ang, A., R. Hodrick, Y. Xing, and X. Zhang (2006). “The cross-section of volatility and expected returns,” The

Journal of Finance, 61(1), 259–299.

Axioma, Inc. (2011) Axioma Robust Risk Model Handbook. Axioma, Inc.

Carhart, M. M. (1997). “On Persistence in Mutual Fund Performance". The Journal of Finance. 52 (1): 57–82

Fama, E., and R. French, (1992). “The Cross-Section of Expected Stock Returns,” Journal of Finance, 47(2),

427-465.

Fama, E., and R. French. (1993). “Common risk factors in the returns on stocks and bonds,” Journal of

Financial Economics 3-56.

Grinold, R., and R. Kahn, (2000). “Active Portfolio Management,” New York, NY: McGraw Hill.

Litzenberger, R. H. and K. Ramaswamy, (1979, “Tbe effects of personal taxes and dividends on capital asset

prices: tbeory and empirical evidence,” Journal of Financial Economics, 7,163-195

Menchero, J., Morozov, A., and P. Shepard, (2010). “Global Equity Risk Modeling,” in J. Guerard, Ed., The

Handbook of Portfolio Construction: Contemporary Applications of Markowitz Techniques, Springer.

Menchero, J., (2010). “Characteristics of Factor Portfolios,” MSCI Barra Research Insight. MSCI Barra

Fundamental Data Methodology Handbook, 2008.

Ross, S. A. (1976). "The Arbitrage Theory of Capital Asset Pricing." Journal of Economic Theory 341-360.

Sharpe, W. F. (1964). “Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk. The

Journal of Finance 425-442.

Sloan, R., (1996) “Do stock prices fully reflect information in accruals and cash flows about future earnings?

The Accounting Review 71, 289-315.

17

For information regarding this

whitepaper or concepts:

BITA GmbH

Karlstrasse 12, Frankfurt am Main,

Hessen 60329 - Germany

info@bitadata.com