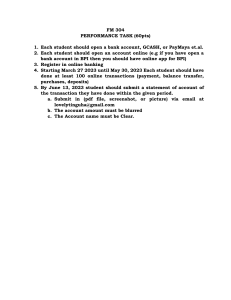

20230227 Session 8 27 February 2023 08:52 Customer Acquisition Costs: Screen clipping taken: 27/02/2023 10:34 - In most cases, you're not profitable with the first transaction You tend to spend more on acquiring them than they pay in their first transaction This is why recurring transactions are critical. It's better to present CAC in a range (since what you consider a marketing/sales expense could be subjecting, especially for larger companies) - For instance, CAC for Dropbox is $233-388. - Annual subscription for Daniel is $120, so they have to retain him as a paying customer for around 4 years to be profitable. There are 2 schools of thought on how to calculate CAC (these cunts can't make up their mind): - Some propose that all marketing and advertising dollars should be included - Others argue that only costs specifically associated with a specific customer should be considered Generic way of calculating CAC: Getting the costs per order: Revenue Model Corresponding Metrics Typical Application Pay per View Cost per Mille (CPM) Display Advertisement Pay per Click Cost per Click (CPC) Search Engine Advertisements Pay per Lead Cost per Lead (CPL) Affiliate Marketing Pay per Order Cost per Order (CPO) Affiliate Marketing Specific way of calculating CAC: -> Calculate the Cost per Order (cost of the final step of getting some gullible bastard to buy your product) Marketing Page 1 Impressions are defined by the ad publishers, but usually, If someone views at least 50% of the pixels for at least 1 second, it counts as an impression. CTR - Clickthrough Rate = Clicks per Impression (Usually less than 1%) CR - Conversion Rate = Conversions per Clicks (Usually 0.1 to 1.5%) From CPM to CPO: From CPC to CPO: Small changes = Big impact (make a better ad, it might make or break your company): Screen clipping taken: 27/02/2023 11:13 Return on Investment: Daniel's turning my mind into yogurt This YouTube vid about Multi-Channel Funnels is NOICE. Most companies calculate CAC giving most (or all) of the value to the last step of the funnel (the last player that scores). There are 4 ways of how this value could be distributed: Marketing Page 2 Screen clipping taken: 28/02/2023 19:22 Marketing attribution can be made using Game Theory: Shapley Value: Screen clipping taken: 27/02/2023 10:37 Read more about this complicated stuff here. FFS Daniel's churning curds outta my mind now ______________________________________________________________________________________________________________ CUSTOMER VALUE MANAGEMENT: Marketing Page 3 Screen clipping taken: 27/02/2023 10:45 A Typical Customer Life Cycle looks like: Screen clipping taken: 27/02/2023 10:46 But if you employ improved acquisition strategies such as: - Organic Improvements (eg: SEO) - Word-of-mouth referrals And , retention & attrition strategies such as: - (Re)-targeting with incentives (eg: Display ads, email, etc) - Educating customers (Eg: blogs, newsletters, etc.) It can look like: Marketing Page 4 Screen clipping taken: 27/02/2023 10:50 So the AIDA concept becomes: Screen clipping taken: 27/02/2023 10:51 Side note: Daniel is a Revolut fanboi ______________________________________________________________________________________________________________ CUSTOMER LOYALTY: Two types of loyalty: - Behavioural Loyalty: refers to the observed actions that customers have demonstrated toward a particular product or service. - Attitudinal Loyalty: refers to a customer’s perceptions and attitudes toward a particular product or service Loyal Customers aren't always profitable: - Loyal customers cost less to serve, but… - they expect something in return for their loyalty and are usually more expensive to manage (especially in B2B) - Loyal customers are willing to pay higher prices for same products, but… - Loyal customers are more familiar with the products and thus are more price sensitive. - Loyal customers effectively market the company (WoM), but… - Only customers with high attitudinal and behavioural loyalty are active WoM marketers. Trends around customer loyalty is changing: read more Marketing Page 5 Screen clipping taken: 27/02/2023 11:10 Daniel is now salting the curds he's churned from my mind. Measuring behavioural loyalty as retention: - Retention (in period t): • Average likelihood that a customer purchases from the focal firm in a period (t), given that this customer has also purchased in the period before (t − 1). • Usually, retention rate refers to the average retention rate of a cohort or segment of customers - Churn (= change and turn): - 1 minus retention rate Daniel says he's teaching a PhD course on "Non-contractual churn predictions" in case someone is interested in having a conversation about it with him. Churn can be used as a basis for action: a) b) c) d) e) Churn is often calculated as an aggregated number. Propper segmentation in cohort analysis is the key Identify common characteristics in your customer base (e.g., by acquisition channel, customer demographics,…) Group your customers by those characteristics Look for patterns Calculate churn rates for each group Experiment with actions to reduce churn among the group (e.g., newsletter) Churn predictions can be made for contractual & non-contractual settings: Contractual settings: -> This is complicated stuff so here's a tutorial: link Non-contractual settings: Customers in noncontractual settings do not explicitly signal to the firm that they wish to terminate their relationship As a result, the firm does not observe churn, only an absence of behaviour Thus, churn is not modelled directly but must be inferred from a lack of observed transaction activity Key assumption is that customers behave as if they transact randomly around their mean propensity until they “die” at some time that is unobserved by the firm - “Buy ’Till You Die” models (such as Pareto/NBD or BG/NBD) assess the probability that a customer with a given transaction history is still “alive” - Probabilities of being active can be used to determine churn rates and CLVs - -> This is complicated stuff so here's a tutorial: link ______________________________________________________________________________________________________________ CUSTOMER VALUE: Daniel's pressing the salted curds of my mind into a mould. - CLV is “the present value of future profits generated from a customer over her or his life of business with the firm” (Kumar et al., 2010, p. 299) - In contrast to other widely used metrics, CLV is not only backward but also forward looking - CLV for managerial decision making is supported through a bunch of studies: Marketing Page 6 - CLV for managerial decision making is supported through a bunch of studies: • Gupta et al. (2004) confirm the positive link between CLV and firm value • Kumar et al. (2008) show that optimizing resource allocation based on CLV can increase revenues by a factor of 10 CLV models can be used to make critical decisions: • which type of customer (or customer segment) would be most profitable to target • when to scale up or scale down marketing expenditures for a particular customer • how much to spend to acquire new customer, retain existing customer, or cross-sell/up-sell additional products to customers Screen clipping taken: 27/02/2023 11:36 Side note: Gero said this was easy and Daniel thought he was being sarcastic. If the margins & retention rate is constant, the formula can be simplified to: Screen clipping taken: 27/02/2023 11:38 If retention rates are non-constant, the formula is: Marketing Page 7 Screen clipping taken: 27/02/2023 11:40 Alright that’s it, Daniel's officially turned my mind into cheese. Key Metrics: Screen clipping taken: 27/02/2023 11:40 ______________________________________________________________________________________________________________ CUSTOMER SATISFACTION: There is a link between customer satisfaction and retention: - If you're upset, you'll probably leave a bad review but if you're pleased, you're unlikely to leave a positive review. Net Promoter Score: - An index ranging from -100 to 100 that measures the willingness of customers to recommend a company’s products or services to others. - “On a scale of 0 to 10, how likely are you to recommend this company’s product or service to a friend or a colleague?” Marketing Page 8 Screen clipping taken: 27/02/2023 11:46 Pros of NPS: - The beautiful simplicity of a single data point - Easy to set up Cons of NPS: - Benchmarks vary a lot - Lack of context behind scores There is a new version of NPS (NPS 3.0) Screen clipping taken: 27/02/2023 11:50 Earned Growth Rate (Should be positive): - Accounting-based measure that allows to credibly assess the sources of a firm’s advantage and the sustainability of growth generated by loyalty. (Using the NPS 3.0 method) You can also measure customer satisfaction using Product Market Fit: - Ask customers: “How would you feel if you could no longer use the product?” - Measure the percent who answer “very disappointed” - You should have at least 40% answering “very disappointed” Another method is using RFM value: RFM: Recency, Frequency, Monetary Marketing Page 9 RFM: Recency, Frequency, Monetary Assumptions: - Customers who had purchased recently were more likely to buy again versus customers who had not purchased in a while - Customers who had purchased frequently were more likely to buy again versus customers who had made just one or two purchases - Customers who had spent the most money in total were more likely to buy again Daniel's now selling the cheese he's made of my mind to gullible tourists in Barcelona. Screen clipping taken: 27/02/2023 11:58 Marketing Page 10