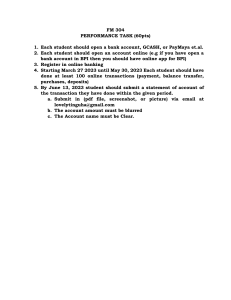

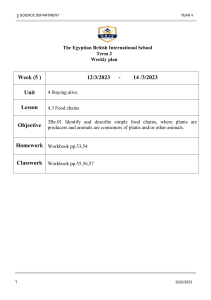

Risk Mgmt & Insurance ACFN 2081 Chapter 1 RISK AND RELATED CONCEPTS 4/10/2023 1 Objectives After completing this unit, students will be able to: Define and understand the concept of risk. Understand the difference between risk, uncertainty and probability. Understand the word hazard and peril and its relationship with risk. Identify the different types of risk. 4/10/2023 2 Risk …..meaning There is no single definition for risk:• Risk is the potential variations in the outcomes that could occur over a specified period in a given situation. • Risk is objectified uncertainty about the occurrence of an undesired event. • Risk is condition in which there is a possibility of an adverse (unfavorable) deviation(variations) from a desired outcome that is expected or hoped for. • Risk is the dispersion of actual from expected results. • Risk is possibility of loss. [[[[SO 4/10/2023 3 RISK AND UNCERTAINTY • Uncertainty refers to a feelings characterized by doubt, based on the lack of knowledge about what will or will not happen in the future. • Uncertainty is doubt about our ability to predict the future. • Uncertainty arises when an individual perceives risk. • Uncertainty is a subjective concept, so it cannot be measured directly by any acceptable yardstick. Since it is a state of mind, uncertainty varies across individuals. • On the other hand, risk refers to a condition or combination of circumstances in which there is a possibility of loss. • It is what a person believes to be the state of the world and the confidence he/she has in this belief. • Unlike uncertainty, risk can be measured. Example 1: Take the risk of cancer from cigarette smoking, Consider a child playing in the middle of a busy road 4/10/2023 4 RISK AND PROBABILITY Probability is a chance that an event will occur in a single possible event, While risk is the variation in the possible outcomes. This means risk depends on the entire probability distribution. There is no risk if the probability of occurrence is 0 or 1. • In between these two extremes there could be several occurrences of the events with their corresponding probability of occurrence. Under this situation there is risk. 4/10/2023 5 RISK, PERIL AND HAZARD Peril refers to a specific or prime cause of loss. Example house burns because of fire, the peril is the fire. • Common perils that cause property damage included fire, lightning, windstorm, hail, tornadoes, earth quakes, theft and robbery. • Thus, peril refers to the prime source of a specific loss. Hazards are conditions that create or increase the chance of loss arising from a given peril. It facilitates the occurrence of perils. Example: location of building, windy weather, house on a riverbank…etc Activity: Mr. Biniyam built a house near by Beressa river; a flood came and destroyed the house. What is the peril? And what is the hazard? 4/10/2023 6 Types of hazards A) Physical hazard is a physical condition that increases the likelihood of loss. Example: Location of the property, Type of construction , Existence of dry forest, the nature of the road, etc B) Moral hazard is dishonesty or character defects in an individual that increases the frequency or severity of loss. Examples: Faking an accident to collect from an insurer, Inflating the amount of the claim, Intentionally burning unsold merchandise that is insured etc. 4/10/2023 7 C) Morale hazard refers to the carelessness or indifference to a loss because of the existence of insurance. Examples: Leaving car keys in an unlocked car, Leaving a door unlocked, failing to follow safety rule properly. D) Legal Hazard • Refers to characteristics of the legal system or regulatory environment that increase the frequency or severity of loss. 4/10/2023 8 THE CLASSIFICATION OF RISK 1. Pure Vs Speculative Risk • Pure risk refers to a situation in which only a LOSS or NO LOSS would occur. Example: Fire at a factory, Car accident, flood, theft, etc. pure risk includes; 1. Personal risk is a risk that affects individuals. It includes; Premature death, Insufficient retirement income, poor health, and Unemployment. 2. Property risk is a risk when a property is damaged or lost. This refers to losses associated with ownership of property. • There are two major types of loss in the damage of property; Direct :- results from the physical damage, destruction, or theft of the property, such as fire damage to a home. Indirect loss:- also called consequential loss. It results Indirectly from the occurrence of a direct physical damage or theft loss, e.g., the additional living expenses after a fire. 4/10/2023 9 3. Liability risk is the possibility of loss arising from intentional or unintentional damage made to other persons or to their property. • It involves the possibility of being held legally liable for bodily injury or property damage to someone else. • The court of law may order that person to pay substantial damages to the person who is injured. – Motorists are being held legally liable for the negligent operation of their vehicles. – Producers are also being sued because of defective products that harm or injure customers. 4/10/2023 10 Speculative Risk • Defined as a situation in which either PROFIT or LOSS is possible. Investing money in shares is a good example. • People are more adverse to pure risks as compared to speculative risks. • In speculative risk situation, people may deliberately create the risk when they realize that the favorable outcome is, indeed, so promising. 4/10/2023 11 Comparisons between pure risk and speculative risks • Private insurers generally insure only pure risks. With some exceptions, speculative risks are not considered insurable and other techniques for coping with risk must be used (i.e speculation ) • Only pure risks are predictable, i.e. the law of large numbers can be applied more easily to pure risks than to speculative risks. while, speculative risks are not predictable; it is more difficult to apply the law of large numbers in order to predict future loss experience. • Society may benefit from a speculative risk even though a loss occurs. eg. a firm produces computers more cheaply which force a competitor into bankruptcy. 4/10/2023 12 2. Fundamental Vs Particular Risk • Fundamental risk is a risk that affects the entire economy or large number of persons or groups within the economy. Examples: high inflation, social change, political intervention, unemployment, war, famine, volcanoes and other natural ‘disasters’ like Hurricanes, Katrina, Tsunami. Particular risk refers to a risk that affects only individuals and not the entire community. Particular risks are much more personal both in their cause and effect. Examples: burning of a house, car theft Particular risks are insurable while fundamental risks are not insurable. • Particular risks are insurable if they belong to the category of pure risk only. For example, “loss in business” is a particular risk since it affects only the owner of the business but it is not insurable because it is not pure risk. 4/10/2023 13 3) Financial Vs Non-Financial Risk • A financial risk is a risk that results in losses that can be expressed in financial terms. Examples of financial risk include physical damage to a property, theft of property or lost business profit following a fire. • Non-financial risk refers to a loss that does not have financial implications. Examples: choice of a marriage partner, the selection of an item from a restaurant menu, the selection of a career, having children. • The two risks can occur simultaneously. For example, in the case of premature death the financial risk is loss of income (salary), while the non-financial risks are loss of emotional support, loss of moral, loss of motivation. 4/10/2023 14 4) Dynamic Vs Static Risk Dynamic risk refers to losses originates from changes in the overall economy such as price level changes, changes in consumer tastes, income distribution, technological changes, political changes and the like. They are less predictable and hence beyond the control of risk managers. Static risks refer to those losses that can take place even though there were no changes in the overall economy. They are predictable and could be controlled to some extent by taking loss prevention measures. • Static risks are insurable, because they are predictable whereas dynamic risks are not insurable. 4/10/2023 15 5) Objective vs Subjective Risk Objective risk is defined as the relative variation of the actual loss from expected loss. • Objective risk can be statistically measured by some measure of dispersion, such as the standard deviation or the coefficient of variation. • For example assume that a property insurer has 10,000 houses insured over a long period and, on average, 1 percent, or 100 houses, burn each year. However, it would be rare for exactly 100 houses to burn each year. In some years, as few as 90 houses may burn, while in other years, as many as 110 house my burn. Thus, there is a variation of 10 houses from the expected number of 100, or a variation of 10 percent. This relative variation of actual loss from expected loss is known as objective risk. 4/10/2023 16 Subjective risk is defined as uncertainty based on a person’s mental condition or state of mind (mental uncertainty). • A subjective risk is a psychological uncertainty that stems from the individual’s mental attitude or state of mind. • Some writers have used the word “uncertainty” to be synonymous with subjective risk as defined here. • Two persons in the same situation may have a different perception of risk, and their conduct may be altered accordingly. 4/10/2023 17 Risk related to business activities Business risk: associated with physical operation of risk including variation in sales, costs, profits, etc. Financial risk: associated with debt financing including debt payment, bankruptcy, stock price decline, etc. Interest rate risk: results from change in interest rate. Purchasing power risk: arises under inflationary situation. Market risk: refers to stock price variability caused by market forces. 4/10/2023 18 Burden of risk on society The size of an emergency fund will be increased. Worry and fear are present Loss of certain goods and services. In the absence of insurance, individuals and business firms would have to maintain large emergency funds to pay for unexpected losses. The risk of a liability lawsuit may discourage innovation, depriving society of certain goods and services. 4/10/2023 19 THE END 4/10/2023 20 CHAPTER TWO THE RISK MANAGEMENT 4/10/2023 21 Objectives • After completing this unit, students will be able to: Explain the meaning and definition of risk management Understand the role of risk managers Elaborate steps in risk management process 4/10/2023 22 RISK MANAGEMENT DEFINED • Risk Management is defined as a systematic process for the identification and evaluation of pure loss exposures faced by an organization or individual, and for the selection and implementation of the most appropriate techniques for treating such exposures. • Risk Management is the executive function of dealing with specified risks facing the business enterprise. • In general, the risk manager deals with pure, not speculative risk. 4/10/2023 23 Duties of risk manager 1. To recognize exposures to loss; the risk manager must be aware of the possibility of each type of loss. 2. To estimate the frequency and size of loss; to estimate the probability of loss from various sources. 3. To decide the best and most economical method of handling the risk of loss, whether it be by assumption, avoidance, self-insurance, reduction of hazards, transfer, commercial insurance, or some combination of these methods. 4. To administer the programs of risk management, including the tracks of constant revaluation of the programs, record keeping and the like. 4/10/2023 24 OBJECTIVES OF RISK MANAGEMENT 1) Pre-loss objectives- risk management objectives prior to the occurrence of the loss: These includes:- Economy: Economic way of handling potential risks or losses. -Analysis of the cost of safety programs - Reduction of Anxiety: Peace of mind & the reduction of anxiety. - Meeting Legal obligations:- Eg. government regulations 2) Post-loss objectives -After the occurrence of the loss. - Mere survival of the firm Continuation of operation Stability of earning Continued growth of the firm Meet social responsibility 4/10/2023 25 THE RISK MANAGEMENT PROCESSES 1. Identifying potential losses (risk identification) 2. Evaluating potential losses (Measuring the losses) 3. Selection of the risk management tools 4. Implementing the program 5. Controlling/monitoring 4/10/2023 26 4/10/2023 27 1st Identifying potential losses (RI) • RI is the process by which a business systematically and continuously identifies personal, property and liability loss exposures as soon as or before they emerge. • Failure to identify all the exposures of the firm or family means that the risk manager will have no opportunity to deal with these unknown exposures intelligently. • Identification technique are designed to develop information on source of risk hazards, risk factors, peril, and exposure to loss. • The sources of risk includes physical, social, legal, operational, political, economic and cognitive environment. • Risk exposures includes:- physical asset, financial asset, liability & Human Asset exposures. 4/10/2023 28 Techniques of risk identification • • • • • Risk analysis questionnaire Financial statement method Flow-chart method: pdn, svc & money flows On-site inspection Planned interaction with other departments & also outside suppliers and professional orgns. • Statistical records of past losses • Analysis of the environment The choice of the technique depends on the nature of the business, the size of the business, and the availability of in house expertise. 4/10/2023 29 2nd Risk Measurement • Risk measurement refers to the measurement of the potential loss as to its size and the probability of occurrence. 2 dimensions will be measured: 1. Loss frequency is the probability that a single unit will suffer one type of loss from a single peril. 2. Loss severity: measured by maximum possible loss (worst loss that could possibly happen) & maximum probable loss (worst loss that is likely to happen) • Probability is a measure of the likelihood that a given event will take place. i.e. 0 ≤ p(A)≤ 1 for any event A • The probability of any impossible event is 0, where as the probability of any event that is certain to occur is 1. 4/10/2023 30 Method of valuing potential direct property losses • • • • • • • • Original cost: paid at its acquisition Original cost less depreciation: Market value: Tax appraised value: value placed upon property for tax The economics/use value: measuring the PV of the income e.g. NI=50,000 for 3 yrs change it to PV…. Reproduction value: replacing at the exact current price Replacement cost for new: replacing with new property that is not exactly the same Replacement cost for new less depn and obsolescence: 4/10/2023 31 Probability Distribution & risk measurement • Probability distribution shows the probability of occurrence for each outcome. • Using PD it’s possible to measure The total dollar losses per year (physical period) The number of occurrences per year The dollar losses per occurrence The total dollar losses per year Example: consider the following hypothetical example of probability distribution of vehicle accident repair costs in a fleet of vehicles(similar in type of use) operated by a firm. 4/10/2023 32 Year No of Amount accidents of loss probability Expected amount of loss 1 0 0 0.606 0 2 1 1,000 0.273 273 3 2 2,000 0.100 200 4 3 4,000 0.015 60 5 3 10,000 0.003 30 6 2 20,000 0.002 40 7 5 40,000 0.001 40 Sum 16 77,000 1.000 643 mean 2.29 4/10/2023 11,000 33 Solution: • The probability of no birr loss is 0.606 • The probability of some loss = 1- 0.606 = 0.394 • The prob. Of 10,000 or more losses = 0.003+0.002+0.001 = 0.006 • The prob. that sever loss will occur (assume a sever loss is a loss that is equal or higher than 10,000) = 0.003+0.002+0.001 = 0.006 • The expected (average)total birr loss = birr 643. this value indicates the average annual birr loss the business will sustain in the long run if it retains this exposure. • Average loss/yr= 11,000 br 4/10/2023 34 Binomial Probability Distribution • The binomial probability distribution helps a risk manager to measure the probability of exactly r accidents from n number of exposures or number of items exposed to risk. • The probability of exactly r accidents from n number of items exposed to risk is given by: • Where: r denotes number of accidents from n independently exposed units p (r) denotes the probability of getting exactly r number of accidents from n exposed units n denotes number of exposures or items exposed to risk p denotes probability of an accident q=(1-p) denotes the probability of getting no accident 4/10/2023 35 Binomial Probability Distribution(cont…) • Mean (µ) = n.p • Variance (δ^2) = n. p. q • Standard deviation (σ) = √(n.p.q) To use the Binomial probability distribution, the risk manager must be familiar with the following basic assumptions of the distribution to avoid misleading results. 1. A firm has n units independently exposed to risk 2. Each exposure experiences at most one loss during a year 3. There are n trials, each classifiable as "success" or "failure“, i.e. each trial must have 2 possible outcomes 4. Probability must remain constant for each trial 4/10/2023 36 Binomial Probability Distribution(cont…) Example 1. A fleet of 5 delivery trucks are operated by a business. If an accident happens to a particular track, it becomes a total loss. New trucks are purchased at the beginning of every year to make up the lost ones so that the firm always starts the new fiscal period with a fleet of 5 delivery tracks. NUMBEROF NUMBER OF ACCIDENTS TOTAL MONETARY YEAR TRUCKS LOSS 1 5 2 2 5 2 10,000 3 5 3 15,000 4 5 2 10,000 5 5 1 5,000 SUM 25 10 50,000 MEAN 4/10/2023 5 2 10,000 Birr 10,000 37 Binomial Probability Distribution(cont…) • Based on the above information answer the following questions; 1. What is the probability of an accident and no accident? 2. Construct the binomial probability distribution of the number of accidents 3. Calculate the expected number of accidents 4. Find the mean and standard deviation of a binomial probability distribution (number of accidents) 5. Calculate risk relative to the mean number of accidents and risk relative to the number of exposure units 6. Calculate monetary loss per accident over the last five years 7. Calculate the expected total annual monetary loss 8 What is the probability that the firm will incur some birr loss 9. Calculate the standard deviation of total monetary loss 10. Calculate risk relative to the mean monetary loss 4/10/2023 38 Binomial PD…cont’d… 4/10/2023 39 3. The expected number of accidents can be calculated using the following formula; Where: r denotes number of accidents p ( r ) denotes the probability of exactly r accidents No of Accidents (r) Probability, P ( r ) Exp. No. of Accidents r. p (r) 0 0.07776 0 1 0.25920 0.2592 2 0.34560 0.6912 3 0.23040 0.6912 4 0.07680 0.3072 5 0.01024 0.0512 SUM 1.00000 2.0000 4/10/2023 40 Binomial pd…….cont… 4/10/2023 41 Binomial PD……….cont…) 6. Monetary loss per accident = Total monetary loss Total Number of accidents = 50,000/10 = 5,000 birr 7. expected amount of annual monetary loss No of Accidents Monetary Loss Probability Expected M. Loss 0 0 0.07776 0 1 5,000 0.25920 1,296 2 10,000 0.34560 3,456 3 15,000 0.23040 3,456 4 20,000 0.07680 1,536 5 25,000 0.01024 256 SUM 1.000 10,000 So, the expected numbers of accidents in year 6 are 2, and the expected amount of annual monetary loss is 10,000. 4/10/2023 42 8. P (some birr loss) = 1 –p (no birr loss) = 1- 0.7776 = 0.9224 • An alternative way to determine the probability that the business will incur some birr loss is to sum the probabilities for each of the possible total birr loss • 0.25920 + 0.34560 + 0.23040 + 0.07680 + 0.01024 = 0.9224 9. SD of total monetary loss = SD of number of accidents x expected monetary loss per accident = 1.095 X 5,000 = 5,475 10. Risk relative to the mean monetary loss (RM) = SD of total monetary loss = 5475/10,000 = 0.5475 Expected amount of monetary loss (mean) The actual total annual monetary loss could deviate by 54.7% from the expected total annual monetary loss in either direction. 4/10/2023 43 3) TOOLS OF RISK MANAGEMENT • There are two basic approaches: • Risk control measures: it used; 1) To reduce the firm’s expected property, liability, and personnel losses, or 2) To make the annual loss experience more predictable • It includes avoidance, loss prevention and reduction measures, separation, combination, & some transfers. • Risk-financing measures: Funds may be required to repair or restore damaged property, to settle liability claims, or to replace the services of disabled or deceased employees or owners. • purchase of insurance, that are not considered under risk control devices and retention, which includes, “selfinsurance”. 4/10/2023 44 Risk Control Tools: A) Avoidance • Avoid the property, person, or activity with which the exposure is associated. • Proactive: never acquiring any interest in an exposure. Example, not building a plant in a flood plain. • Abandonment: avoid an existing loss. E.g. stop manufacturing a highly toxic product, avoid third party liability by not owning a car, Product liability can be avoided by dropping the product, Leasing to avoid the risk of property ownership. • Avoidance is impossible in the following situations For production/service whose expected value exceeds losses Impossible to avoid properties like vehicles, building, inventory, etc. Avoiding risk may create another risk. 4/10/2023 45 It may not be practical or feasible to avoid the exposure. Loss control Measures: LP &LR • These measures refer to the safety actions taken by the firm to prevent the chance occurrence of a loss or reduce its severity. • Loss Prevention: used to reduce/eliminate the chance of loss. Example: Construction using fire insensitive materials, fire alarms, Burglar alarms, Location choice, Educational programs to the public, inspection, Safety measures, Warning posters, etc. • Loss reduction measures try to minimize the severity of the loss once the peril happened. Examples: Installing automatic sprinklers, First aid kit, Evacuation of people, Fire extinguishers, etc. • LP and LR measures must be considered before the Risk manager considers the application of any risk financing measures. • To design effective LP and R measures, it may be helpful to identify the causes of accidents. 4/10/2023 46 Causes of accident and possible LP and R measures Causes of accidents - Working on dangerous equipment with less care - Improper use of equipment - Violating Safety Procedures and Regulations. - Human error, Negligence - Use of inappropriate tools - Lack of protective clothing - Use of defective equipment - Inadequate Knowledge about the job - Working while physically ill - Mental Disturbance of employee 4/10/2023 Loss prevention measures - Safety seminars, inspection at regular times - Training, safety seminars - Safety seminars, warning, dismissal - Training, safety seminars - Provide appropriate tools - Provide necessary protective clothing - Regular inspection and maintenance - Training - Sick leave, don’t allow to work until recovery - Day-off to the employee 47 • • • • • Risk Transfer Accomplished in two ways; Transfer of the activity or the property: For example sells of buildings, hiring a subcontractor for the portion of the project, etc. It differs from avoidance through abandonment in that, to transfer a risk the firm must pass it to someone else. Transfer of the probable loss. The risk, but not the property or activity, may be transferred. Hedging/neutralization: balancing the chance of loss against gain. 4/10/2023 48 Separation and diversification • Separation of the firm’s exposures to loss instead of concentrating them at one location. For example, instead of placing its entire inventory in one warehouse the firm may elect to separate this exposure. • Through this separation the firm increases the number of independent exposure units under its control. • Other things being equal, because of the law of large number, this increase reduces the risk, thus improving the firm’s ability to predict what its loss experience will be. • Diversification: Businesses diversify their product lines so that a decline in profit of one product could be compensated by profits from others. • Deals with most speculative risks and has limited use in dealing with pure losses. • For example farmers diversify their products by growing d/t crops 4/10/2023 49 Risk Financing Tools Retention • The firm retains part or all of the losses that result from a given loss exposure. • Retention can be effectively used in a risk management program when; No other method of treatment(insurance, transfer) is available. The worst possible loss is not serious. Losses are highly predictable. • Retention is passive(unplanned) and active(planned). • Based on past experience, the risk manager can estimate a probable range of frequency and severity of actual losses. If most losses fall within that range, they can be budgeted out of the firm's income. 4/10/2023 50 Insurance • Insurance can be advantageously used for the treatment of loss exposures that have a low probability of loss but the severity of a potential loss is high. • Unlike the risk control transfer, the risk itself is not shifted rather its assumed by somebody else. 4/10/2023 51 Risk Management Matrix Which method should be used? • In determining the appropriate method or methods of for handling losses, a matrix can be used that classifies loss exposures according to frequency and severity. 4/10/2023 52 4. Implement the risk management program After deciding among the alternative tools of risk treatment the risk manager must implement the decisions made. If insurance is to be purchased for example, establishing proper coverage, obtaining reasonable rates, and selecting the insurer are part of the implementation process. 4/10/2023 53 4/10/2023 54