Financial Risk Management and Derivative Instruments (Michael Dempsey) (z-lib.org)

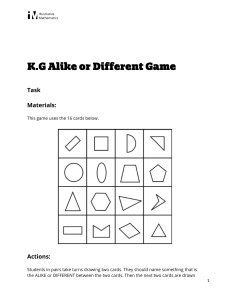

advertisement