Ethiopian Cement Market: Challenges & Prospects - MBA Thesis

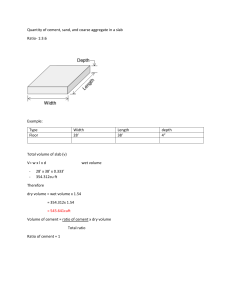

advertisement