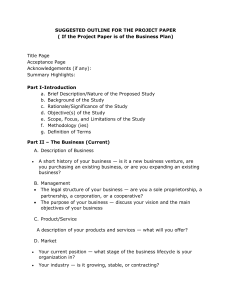

Summary Part 1: The Contemporary Business World Business essentials Chapter 1: The global business environment Define the nature of global business, describe the external environments of business, and discuss how these environments affect the success or failure of organizations. (pp. 33–37). A business is an organization that sells goods or services to earn profits. The prospect of earning profits, the difference between a business’s revenues and expenses, encourages people to open and expand businesses. Businesses produce most of the goods and services that Americans consume and employ most working people. A healthy business environment supports innovation and contributes to the quality of life and standard of living of people in a society. The external environment of business refers to everything outside its boundaries that might affect it. Both the domestic and the global business environment affect virtually all businesses. The domestic business environment is the environment in which a business conducts its operations and derives its revenues. The global business environment also refers to the international forces that affect a business, for example, international trade agreements, economic conditions, and political unrest. The technological, political-legal, sociocultural, and economic environments are also important. The technological environment includes all of the ways by which firms create value for their constituents. Technology includes human knowledge, work methods, physical equipment, electronics, telecommunications, and various processing systems that are used to perform business functions. The political-legal environment reflects the relationship between business and government, usually in the form of government regulation of business. The sociocultural environment includes the customs, mores, values, and demographic characteristics of the society in which an organization function. Sociocultural processes also determine the goods and services that a society is likely to value and accept. The economic environment refers to the relevant conditions that exist in the economic. Describe the different types of global economic systems according to the means by which they control the factors of production. (pp. 37–42) (1) Labor, or human resources, includes the physical and intellectual contributions people make while engaged in business. (2) Capital, includes all financial resources needed to operate a business. (3) Entrepreneurship, are an essential factor of production. They are the people who accept the risks and opportunities associated with creating and operating businesses. Virtually every business will rely on physical resources, the tangible things organizations use to conduct their business. (4) Physical resources, resources include raw materials, storage and production facilities, computers, and equipment. (5) Information resources are essential to the success of a business enterprise. Information resources include data and other information used by business. A planned economy relies on a centralized government to control factors of production and make decisions. Under communism, the government owns and operates all sources of production. In a market economy, individuals—producers and consumers—control production and allocation decisions through supply and demand. A market is a mechanism for exchange between the buyers and sellers of a particular product or service. Sellers can charge what they want, and customers can buy what they choose. The political basis of market processes is capitalism, which fosters private ownership of the factors of production and encourages entrepreneurship by offering profits as an incentive. Most countries rely on some form of mixed market economy—a system featuring characteristics of both planned and market economies. Socialism may be considered a planned economy or a mixed economy, with government ownership of selected industries but considerable private ownership, especially among small businesses. Show how markets, demand, and supply affect resource distribution in the global market, identify the elements of private enterprise, and explain the various degrees of competition in the global economic system. (pp. 42–46) Decisions about what to buy and what to sell are determined by the forces of demand and supply. - Demand is the willingness and ability of buyers to purchase a product or service. Supply is the willingness and ability of producers to offer a product or service for sale. A demand and supply schedule reveals the relationship among different levels of demand and supply at different price levels. The point at which the demand and supply curves intersect is called the market or equilibrium price. If a seller attempts to sell above the market price, he or she will have a surplus where the quantity supplied exceeds the demand at that price. Conversely, a shortage occurs when a product is sold below the equilibrium price and demand outstrips supply. Market economies reflect the operation of a private enterprise system, a system that allows individuals to pursue their own interests without government restriction. Private enterprise requires the presence of four elements: 1) Private property rights, 2) Freedom of choice, 3) Profits and 4) Competition. Economists have identified four degrees of competition in a private enterprise system: 1) Perfect competition exists when all firms in an industry are small, there are many of them, and no single firm is powerful enough to influence prices. 2) Monopolistic competition, where numerous sellers try to differentiate their product from that of the other firms. 3) Oligopoly, which exists when an industry has only a few sellers. It is usually quite difficult to enter the market in an oligopoly and the firms tend to be large. 4) Monopoly, which monopoly exists when there is only one seller in a market. A firm operating in a monopoly has complete control over the price of its products Explain the importance of the economic environment to business and identify the factors used to evaluate the performance of an economic system. (pp. 46–54) Economic indicators are statistics that show whether an economic system is strengthening, weakening, or remaining stable. The two key goals of the U.S. system are economic growth and economic stability. Growth is assessed by aggregate output, the total quantity of goods and services produced by an economic system. Although gains in productivity can create growth, the balance of trade and the national debt can inhibit growth. While growth is an important goal, some countries may pursue economic stability. Economic stability means that the amount of money available in an economic system and the quantity of goods and services produced in it are growing at about the same rate. The two key threats to stability are inflation and unemployment. The government manages the economy through two sets of policies: fiscal policies (such as tax increases) and monetary policies that focus on controlling the size of the nation’s money supply Chapter 3: Entrepreneurship, New ventures, and Business Ownership. Define small business, discuss its importance to the U.S. economy, and explain popular areas of small business. (pp. 102–107) A small business is independently owned and managed and has relatively little influence in its market. Most U.S. businesses are small businesses and employ fewer than 20 people. Small businesses are vitally important to the economy because of (1) job creation, (2) innovation, and (3) contributions to big business. The most common types of small businesses are firms engaged in (1) services, (2) retailing, and (3) construction. Services comprise the largest sector, in part because most service businesses require relatively little capital to start. In contrast, there are relatively fewer small businesses who manufacture products because the start-up costs are often high. Explain entrepreneurship and describe some key characteristics of entrepreneurial personalities and activities. (pp. 107–108) Entrepreneurs are people who assume the risk of business ownership. Some entrepreneurs have a goal of independence and financial security, and others want to launch a new venture that can be grown into a large business. Most successful entrepreneurs are resourceful and concerned about customer relations. They have a strong desire to be their own bosses and can handle ambiguity and surprises. Today’s entrepreneur is often an open-minded leader who relies on networks, business plans, and consensus and is just as likely to be female as male. Finally, although successful entrepreneurs understand the role of risk, they do not necessarily regard what they do as being risky. Describe distinctive competence, the business plan, and the start-up decisions made by small businesses and identify sources of financial aid avail- able to such enterprises. (pp. 108–112). A new business must first understand its potential distinctive competence, such as the ability to identify a niche (or unmet need) in an established market. Another distinctive competence is the ability to serve a new unexploited market. Still another is the ability to move quickly to take advantage of new opportunities, often called “first-mover advantage.”After identifying a potential distinctive competence, the next step in entrepreneurship is developing abusiness plan. A business plan summarizes business strategy for the new ven- ture and shows how it will be implemented. The key elements of a business plan are setting goals and objectives, sales forecasting, and financial planning. Business plans are increasingly important because creditors and investors demand them as tools for deciding whether to finance or invest.Entrepreneurs must also decide whether to buy an existing business, operate a franchise, or start from scratch. Entrepreneurs who choose to buy an existing business have better chances for success compared to those who start from scratch because of existing relationships with vendors and customers. Franchises provide considerable support in setup and operation, but franchise costs can be high and severely cut into profits. Starting a business from scratch can be the most risky, yet rewarding, way to start a new business.To start a new business, it is essential to have money to finance the operation. Common funding sources include personal funds, family and friends, savings, lenders, investors, and governmental agencies. Lending institutions are more likely to finance an existing business than a new business because the risks are better understood. Venture capital companies are groups of small investors seeking to make profits on companies with rapid growth potential. Most of these firms do not lend money but rather invest it, supplying capital in return for partial ownership. New businesses may also seek funding from small business investment companies (SBICs) as well as through Small Business Administration (SBA) programs Discuss the trends in small business start-ups and identify the main reasons for success and failure among small businesses. (pp. 113–116). Five trends have helped facilitate the growth in new businesses started in the United States every year. These trends are: (1) the emergence of e-commerce, (2) crossovers from big business, (3) increased opportunities for minorities and women, (4) new opportunities in global enterprise, and (5)improved rates of survival among small businesses. However, more than half of all small businesses fail. Four basic factors contribute to most small business failure: (1) managerial incompetence or inexperience, (2) neglect, (3) weak control systems, and (4) insufficient capital. Likewise, four basic factors explain most small business success: (1) hard work, drive, and dedication, (2) market demand for the products or services being provided, (3) managerial competence, and (4) luck. Explain sole proprietorships, partnerships, and cooperatives and discuss the advantages and disadvantages of each. (pp. 116–119). a. A sole proprietorship is a business that is owned by one person. The most significant advantage to organizing as a sole proprietorship is the freedom to make decisions. In addition, it is relatively easy to form and operate a sole proprietorship. There are tax benefits for new businesses that are likely to suffer losses in early stages because these losses can offset income from another business or job on the tax return of a sole proprietor. A major drawback is unlimited liability, which is the legal concept that makes the owners of a sole proprietorship personally responsible for all its debts. Another disadvantage is that a sole proprietorship lacks continuity; when the owner dies or leaves the business, it does not continue to exist. Finally, a sole proprietorship depends on the resources of a single individual. b. A general partnership is a sole proprietorship multiplied by the number of partner owners. The biggest advantage is its ability to grow by adding new talent and money. Partners report their share of the partnership’s income, and it is taxed on their individual tax return. Like a sole proprietorship, unlimited liability is a drawback. Partnerships may lack continuity, and transferring ownership may be hard. No partner may sell out without the consent of the others. c. There are also special forms of partnerships, most notably limited partnerships, and master limited partnerships. Cooperatives combine the freedom of sole proprietorships with the financial power of corporations. d. A cooperative is a group of sole proprietorships or partnerships working together to gain greater production or marketing power. Describe corporations, discuss their advantages and disadvantages, and identify different kinds of corporations; explain the basic issues involved in managing a corporation and discuss special issues related to corporate ownership. (pp. 119–124) All corporations share certain characteristics: legal status as separate entities, property rights and obligations, and indefinite life spans. They may sue and be sued; buy, hold, and sell prop- erty; make and sell products; and commit crimes and be tried and punished for them. The biggest advantage of incorporation is limited liability: Investor liability is limited to one’s per- sonal investments in the corporation. Another advantage is continuity; a corporation can last indefinitely and does not end with the death or withdrawal of an owner. Finally, corporations have advantages in raising money. By selling stock, they expand the number of investors and the amount of available funds. Continuity and the ability to sell stock tend to make lenders more willing to grant loans.One disadvantage is that a corporation can be taken over against the will of its manag- ers. Another disadvantage is start-up cost. Corporations are heavily regulated and must meet complex legal requirements in the states in which they’re chartered. The greatest potential drawback to incorporation is double taxation of profits. Profits are taxed first at the level of the corporation and then taxed as dividends when distributed to the stockholders. Corporations may be either private or public. A private, or closely held, corporation has only a small num- ber of owners and shares of stockare not available to the general public. Public corporations are able to sell their stock on the stock exchanges and have the ability to raise large amounts of capital. Special forms of ownership, such as Scorporations, LLCs, and professional corpo- rations, combine the limited liability of a corporation withthe tax treatment of partnerships.Corporations sell shares, called stock, to investors who then become stockholders (or share- holders) and the real owners. Profits are distributed among stockholders in the form of divi- dends, and managers serve at their discretion. The governing body of a corporation is its board of directors. Mostboard members do not participate in dayto-day management but rather hire a team of managers. This team, called officers, is usually headed by a chief executive officer (CEO) who is responsible for overall performance.Several issues have grown in importance in the area of corporate ownership. In a strategic alliance, two or more organizations collaborate on a project for mutual gain. When partners share ownership of a new enterprise, the arrangement is called a joint venture. An employee stock ownership plan (ESOP) allows employees to own a significant share of the corporation through trusts established on their behalf. More stock is now being purchased by institutional investors. A merger occurs when two firms combine to create a new company, and in an acquisi- tion, one firm buys another outright. A divestiture occurs when a corporation sells a part of its existing business operations or sets it up as a new and independent corporation. When a firm sells part of itself to raise capital, the strategy is known as a spin-off. Chapter 4: Understanding the Global Context of Business. Discuss the rise of international business and describe the major world marketplaces, trade agreements, and alliances. (pp. 136–141). Importing and exporting products from one country to another greatly increases the variety of products available to consumers and businesses. Several forces have combined to spark and sustain globalization. Governments and businesses have become aware of the potential for higher standards of living and increased profits. New technologies make international travel, communication, and commerce faster and less expensive. In addition, some companies expand into foreign markets just to keep up with their competitors. North America, Europe, and Pacific Asia represent three geographic clusters that are the major marketplaces for international business activity. These major marketplaces include relatively more of the upper-middle-income and high-income nations but relatively few low- income and low-middleincome countries. Trade treaties are legal agreements that specify how countries will work together to support international trade. The most significant treaties are (1) the North American Free Trade Agreement (NAFTA), (2) the European Union (EU), (3) the Association of Southeast Asian Nations (ASEAN), and (4) the General Agreement on Tariffs and Trade (GATT). Explain how differences in import–export balances, exchange rates, and foreign competition determine the ways in which countries and businesses respond to the international environment. (pp. 141–147) Economists use two measures to assess the balance between imports and exports. A nation’s balance of trade is the total economic value of all products that it exports minus the total economic value of all products that it imports. - When a country’s imports exceed its exports, it has a negative balance of trade and it suffers a trade deficit. A positive balance of trade occurs when exports exceed imports, resulting in a trade surplus.The balance of payments refers to the flow of money into or out of a country. Payments for imports and exports, money spent by tourists, funding from foreign-aid programs, and proceeds from currency transactions all contribute to the balance of payments. Exchange rates, the rates at which one nation’s currency can be exchanged for that of another, are a major influence on international trade. Most countries use floating exchange rates, in which the value of one currency relative to that of another varies with market conditions. Countries export what they can produce better or less expensively than other countries and use the proceeds to import what they can’t produce as effectively. Economists once focused on two forms of advantage to explain international trade: absolute advantage and comparative advantage. Today, the theory of national competitive advantage is a widely accepted model of why nations engage in international trade. According to this theory, comparative advantage derives from four conditions: (1) factor of production conditions, (2) demand conditions, (3) related and supporting industries, and (4) strategies, structures, and rivalries. Discuss the factors involved in deciding to do business internationally and in selecting the appropriate levels of international involvement and inter- national organizational structure. (pp. 147–151) Several factors enter into the decision to go international. A company wishing to sell products in foreign markets should consider the following questions: 1) Is there a demand for its products abroad? 2) If so, must it adapt those products for international consumption? Companies may also go international through outsourcing and offshoring. After deciding to go international, a firm must decide on its level of involvement. Several levels are possible: I) II) III) Exporters and importers, International firms, and Multinational firms. Different levels of involvement require different kinds of organizational structure. The spectrum of international organizational strategies includes the following: (1) independent agents, (2) licensing arrangements, (3) branch offices, (4) strategic alliances (or joint ventures), and (5) foreign direct investment (FDI). Independent agents are foreign individuals or organizations that represent an exporter in foreign markets. Another option, licensing arrangements, represents a contract under which one firm allows another to use its brand name, operating procedures, or proprietary technology. Companies may also consider establishing a branch office by sending managers overseas to set up a physical presence. A strategic alliance occurs when a company seeking international expansion finds a partner in the country in which it wishes to do business. Finally, FDI is the practice of buying or establishing tangible assets in another country. Describe some of the ways in which economic, legal, and political differences among nations affect international business. (pp. 155–157) Economic differences among nations can be fairly pronounced and can affect businesses in a variety of ways. Common legal and political issues in international business include quotas, tariffs, subsidies, local content laws, and business practice laws. Quotas restrict the number of certain products that can be imported into a country, and a tariff is a tax that a country imposes on imported products. Subsidies are government payments to domestic companies to help them better compete with international companies. Another legal strategy to support a nation’s businesses is implementing local content laws that require that products sold in a country be at least partially made there. Business practice laws control business activities within their jurisdiction and create obstacles for businesses trying to enter new markets