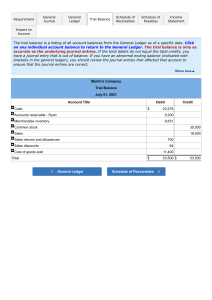

INTRODUCTION TO ACCOUNTING CONTROL ACCOUNTS REVIEW QUESTIONS QUESTION ONE Using the following information, construct both a sales ledger and purchase ledger control account for the month end of January 2019 and so calculate the creditor and debtor final position. Tshs Debtors at 1 January 27,971,000 Creditors at 1 January 15,725,000 Credit sales 42,500,000 Returns from debtors 800,000 Returns to suppliers 650,000 Payment received from debtors 35,675,000 Bad debts written off 450,000 Payment to creditors 19,750,000 Credit purchases for month 22,750,000 Discounts allowed 400,000 Discounts received 380,000 QUESTION TWO Sopenyope proves the accuracy of its sales and purchase ledgers by preparing monthly control accounts. At 1 May 2018 the following balances existed in the company's accounting records, and the control accounts agreed: Sales ledger control account Purchase ledger control account Debit Tshs 188,360,000 120,000 Credit Tshs 2,140,000 89,410,000 The following are the totals of transactions which took place during May 2018, asextracted from the company's records. Credit sales Credit purchases Returns inwards Returns outwards Cash received from customers Cash paid to suppliers Cash discounts allowed Cash discounts received Irrecoverable debts written off Contra settlements Tshs 101,260,000.0 68,420,000.0 9,160,000.0 4,280,000.0 91,270,000.0 71,840,000.0 1,430,000.0 880,000.0 460,000.0 480,000.0 At 31 May 2018 the balances on the customers and supplier personal accounts were extracted and totalled as follows: Debit balances Tshs To be ascertained 90,000 Sales ledger Purchase ledger Credit balances Tshs 2,680,000 To be ascertained Required: Prepare sales and purchases ledger control accounts. QUESTION THREE Consider the following balances Sales ledger Balances at 1st May 2017 Tshs 89,300,000 Purchases ledger Tshs75,210,000 Next enter the transaction from the list for May 2017 in relevant control account Credit sales Credit purchases Returns inwards Returns outwards Cash received from customers Cash paid to suppliers Cash discounts allowed Cash discounts received Irrecoverable debts written off Contra settlements Tshs 101,260,000.0 68,420,000.0 9,160,000.0 4,280,000.0 91,270,000.0 71,840,000.0 1,430,000.0 880,000.0 460,000.0 480,000.0 QUESTION FOUR Uhobhokile is a wholesaler. He prepares control accounts at the end of each month. The following information relates to the month ended 30 April 2019. Sales ledger control account balance 1 April 2019 Cheques received from credit customers Discount allowed Bad debts written off Cash sales Credit sales Returns inwards Tshs 64,350,000 136,800,000 5,250,000 7,900,000 10,750,000 153,400,000 8,100,000 Required: Prepare the sales ledger control account for the month ended 30 April 2019. QUESTION FIVE On 1 April 2018, Yebweyebwe sales ledger control account showed the following balances: Tshs20,450,000 debit and Tshs. 600,000 credit. During April the following transactions were recorded: Credit sales Tshs 50,500,000 Cash sales 10,000,000 Returns from credit customers Receipts from credit customers Refunds to credit customers Discount allowed Bad debt written off 700,000 48,600,000 750,000 1,200,000 800,000 On 1 May 2018, Yebweyebwe’s sales ledger control account showed a credit balance of Tshs180,000. The debit balance is to be determined. REQUIRED Prepare the sales ledger control account for the month of April 2018. Balance the account and bring down the balances. QUESTION SIX The following information is available from the books of Kijuna for August 2019. Trade receivables at 1 August 2019 Credit sales Cash sales Sales returns from credit customers Cheques received from credit customers Discount allowed Bad debts written off Interest charged on overdue accounts REQUIRED Tshs 27,520,000 32,400,000 19,970,000 1,700,000 40,150,000 780,000 2,900,000 600,000 Prepare the sales ledger control account for August. Balance the account and bring down the balance on 1 September 2019 QUESTION SEVEN Tsang is in business buying and selling goods on credit. The following information is available for the month of March 2019. Tshs Revenue (sales) 65,000,000,000 Inventory (stock) 1 March 3,400,000,000 Trade payables (creditors) 1 March 1,700,000,000 Payments to suppliers 47,000,000,000 Discount received 300,000,000 Inventory (stock) 31 March 2,900,000,000 Ordinary goods purchased 47,900,000,000 Wages & expenses 2,500,000,000 REQUIRED Prepare the purchase ledger control account showing the balance of trade payables (creditors) at 31 March 2019. QUESTION EIGHT Mtoto Mary buys and sells on credit. She supplied the following information for the month ended 31 May 2016. 2016 Tshs May 1 Trade receivables 5,687,000,000 31 Credit sales 72,641,000,000 Receipts from credit customers 64,500,000,000 Credit notes issued to customers 8,242,000,000 Cash discounts allowed 1,894,000,000 Bad debts 800,000,000 Contra entry 300,000,000 The sales journal had been under-cast by Tshs. 86,000,000. A cheque received and banked on 8 May from John Bakery for Tshs.2,300,000,000 had been returned by the bank because of insufficient funds. REQUIRED Prepare the sales ledger control account for the month ended 31 May 2016. Balance the account at that date and bring the balance down on 1 June 2013. QUESTION NINE The following information was obtained from the books of Sambwiya Mbwile. 1 April 2017 Sales ledger’s balance Purchases ledger’s balance 30 April 2017 Credit sales for month Credit purchases for month Cash sales for month Cash purchases for month Sales returns for month Purchase returns for month Cheques received from trade receivables Tshs in ‘000,000’ 7 190 4 120 46 300 29 900 14 360 9 750 1 070 940 38 900 Cheques paid to trade payables 28 100 Discounts allowed 1 060 Discounts received 760 Balance in sales ledger set off against balance in purchases Ledger 90 Interest charged to customers on overdue accounts 20 Interest charged by supplier on overdue account 10 REQUIRED (a) Select the appropriate items and prepare the purchases ledger control account for the month of April. (b) Select the appropriate items and prepare the sales ledger control account for the month of April. QUESTION TEN The following information was obtained from the books of John Cooes. Tshs in thousands 1 February 2019 Trade receivables balance 14 900 Dr Trade payables balance 17 160 Cr 28 February 2019 Cheques received from trade receivables 45 800 Cheque from trade receivable later Dishonoured 200 Cheques paid to trade payables 32 500 Discount allowed 2 700 Discount received 910 Purchases returns 3 800 Bad debts 1 800 Cash sales 10 500 Credit Sales 64 500 Credit Purchases 48 800 Set off 650 1 March 2019 Trade receivables balance 600 Cr Trade payables balance 450 Dr REQUIRED Prepare the purchases ledger control account and sales ledger control account in the month of February 2019. QUESTION ELEVEN The total of the debtor balances was Tshs..5,692,348. Sales ledger control account balance was Tshs..8,115,740 Upon investigation you discover the following errors in the subsidiary ledger: (a) A debit balance of Tshs..89,577 was listed as Tshs..98,577. (b) An invoice to a customer for Tshs..1,275,050 was entered on the credit side of the customer’s account. (c) A credit note to a customer for Tshs..100,000 was not posted from the sales returns day book. (d) A credit balance of Tshs..8,854 was listed as though it were a debit balance. Required: Reconcile the total of the list of debtor balances to the balance on the sales ledger QUESTION TWELVE The Sales Ledger Control Account of PATA CHOCHOTE Ltd for the year ended 31st December 2021 has been prepared from the following information: Tshs. Debit balance b/d 1st January 2021 128,540 Credit balance b/d 1st January 2021 2,800 Total for the year 1st January 2021 to 31st December 2021 Credit Sales 1,144,200 Cheques received from customers 1,046,200 Cash received from customers 7,100 Sales returns from customers 12,000 Discounts allowed 2,480 Dishonoured cheques 5,000 Contras purchases ledger 10,640 Irrecoverable debts 6,500 The Sales Ledger Control Account balance, which is part of the double entry system, failed to agree with the total receivables of Tshs.189,380 as shown by the Schedule of Receivables. The following errors were subsequently discovered: (i) A customer had returned goods to PC Ltd at the selling price of Tshs. 2,400. The goods had been bought on credit. No entries had been made to record the return of the goods in the accounts of Pata Chochote Ltd. (ii) The discounts allowed column in the cash book had been overcast by Tshs. 1,080. (iii) No contra entry had been made in the receivables account in the sales ledger in respect of purchases by PC Ltd of goods at a list price of Tshs.2,000. Pata Chochote Ltd received a trade discount of 10% on these goods. This transaction had been correctly dealt with in the Sales Ledger Control Account. (iv) A credit sale of Tshs. 3,520 to Jaribu Tena Ltd was correctly recorded in the Sales ledger Control Account, but no other entry had been made. (v) A cheque received from a customer for Tshs. 6,900, correctly processed through the books, had subsequently been dishonoured. No entries have yet been made to record this dishonoured cheque. (vi) Dingi Tatizo Ltd, a customer, has recently been declared bankrupt and the debt of Tshs. 3,500 is to be written off, but no entries have yet been made. Required: (a) Prepare a revised Sales Ledger Control Account for the year ended 31 December 2021. (b) Prepare a statement showing the correct total of the Schedule of Receivables for the year ended 31 December, 2021. (c) Discuss TWO advantages to PC Ltd of using control accounts. QUESTION THIRTEEN The following information has been taken from the books of Bob Charles for the financial year ended 30 June 2019. Sales ledger balances at 1 July 2018 Cash received from debtors Discount allowed Return inwards Cash sales Bad debts written off Credit sales for the year Debit balances transferred to purchase ledger accounts Tshs. 62,540,000 212,390,000 3,470,000 4,820,000 58,330,000 1,960,000 249,490,000 3,410,000 The total of Bob Charles’s sales ledger balances amounts to Tshs.80,080,000 which does not agree with the closing balance in the sales ledger control account. The following errors have been discovered. (a) A debtor balance of Tshs.930,000 was omitted from the list of debtors. (b) Return inwards formal was under cast by Tshs.870,000. (c) Fei Toto had returned goods worth Tshs.540,000 but this sum was recorded as Tshs.450,000 in his account. (d) Discount allowed Tshs.270,000 had been posted to the wrong side of debtors account. (e) A debtor was charged with Tshs.80,000 interest but it was overlooked by the accountant. (f) Sales daybook had been over cast by Tshs.1,360,000. (g) Bad debts of Tshs.190,000 is entered in the control account but is not posted to the customer’s account. (h) Discount allowed of Tshs.350,000 had been entered in the cash book but is not entered in the customer’s account. (i) Return inwards Tshs.440,000 from Bakari Nondo had not been recorded in the books. (j) Fiston Mayele was both a customer and a supplier. He had a balance of Tshs.270,000 in the purchase ledger and Tshs.190,000 in the sales ledger. The contra entry was made in Fiston Mayele’s account but no entry was made in the control account. (k) A sales invoice of Tshs.1,490,000 was not entered in the books. (l) A credit sale of Tshs.1,860,000 to Yanick Bangala was entered on the credit side of his account. Required: (i) From the original list of balances, draw up the sales ledger control account for the year ended 30 June 2019. (ii) Show the amendments to be made to the control account. (iii) Draw up a statement amending the total of the sales ledger balance to agree with the new control account balance. QUESTION FOURTEEN On 30 June 2017 Donald Ngoma listed the balances contained in his sales ledger. These balances totaled Tshs.18,040,000 but on the same date the balance of the sales ledger control account was Tshs.18,910,000. After investigation the following errors were found. (a) A debtor balance of Tshs.490,000 had been counted in total credit sales but had not been posted to the customer’s account. (b) Discount allowed of Tshs.60,000 had been entered in the cash book but it is not entered in the customer’s account. (c) Return inward journal was over cast by Tshs.120,000. (d) Returns of Tshs.170,000 from Kamusoko had not been recorded in the books. (e) Claotus Chama was both a customer and a supplier. His purchases ledger balance of Tshs.260,000 has been set-off against his sales ledger balance in the control account but nothing had been recorded in the customer’s account. (f) Sales day book had been over cast by Tshs.460,000. (g) A debtor account was charged with Tshs.20,000 interest but it was not recorded in the control account. (h) Mgalike returned goods worth Tshs.280,000 but this sum was recorded as Tshs.820,000 in his account. (i) A debt of Tshs.110,000 had proved bad but no entry had been passed in the books. (j) Discount allowed of Tshs.80,000 had been posted to the debit side of Mwaisa account. REQUIRED 1. Write up the sale ledger control account. 2. Prepare a statement showing the reconciliation of the original total of the sales ledger balances with the amended sales ledger control account balance.