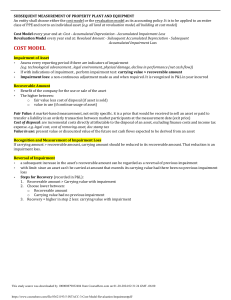

In accounting, revaluation refers to the process of assessing the fair value of an asset or liability that is already recorded in the financial statements. The purpose of revaluation is to ensure that the recorded value of the asset or liability reflects its current market value or economic value. Revaluations can be carried out for various types of assets, such as property, plant, and equipment, intangible assets, and financial instruments. The revaluation process involves determining the current market value of the asset, which may involve obtaining appraisals or conducting market research. Once the current value is determined, the asset's carrying value in the financial statements is adjusted to reflect the new value. The main benefit of revaluation is that it provides a more accurate picture of a company's financial position by reflecting the true value of its assets and liabilities. It can also have implications for the company's financial performance, as changes in the value of assets or liabilities can impact the company's profit or loss. It's important to note that revaluation is not mandatory, and companies may choose to use historical cost accounting instead, which values assets and liabilities based on their original cost. However, in certain cases, such as when market values have significantly increased or decreased, revaluation may be necessary to provide a more accurate representation of the company's financial position.