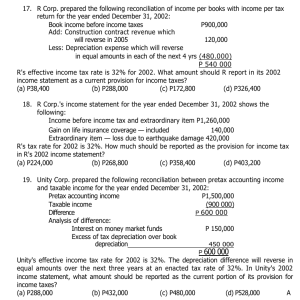

Topic Number 1a 1b 1c 2a 2b 3 4 5a 5b 6a 6b 6c 7a 7b 7c 7d 7e 8a 8b 8c 9a 9b 10a 10b 11a 11b 11c 12a 12b 12c 13a 13b 14a 14b 15 16a 16b 16c Topic Name COST CLASSIFACTIONS &MARGINAL COSTING THEORY MARGINAL COSTING WORKSHEET MARGINAL COSTING - LIMITING FACTOR WORKSHEET ABSORPTION COSTING THEORY ABSORPTION COSTING WORKSHEET COSTING PROFIT STATEMENTS BUSINESS PLANNING THEORY O LEVEL REVISION THEORY O LEVEL REVISION WORKSHEET DEPRECIATION THEORY DEPRECIATION WORKSHEET DEPRECIATION PAST PAPERS PARTNERSHIP THEORY PARTNERSHIP FINAL ACCOUNTS WORKSHEET CHANGES IN PARTNERSHIP WORKSHEET CHANGES IN PARTNERSHIP PAST PAPERS DISSOLUTION OF PARTNERSHIP LIMITED COMPANIES THEORY LIMITED COMPANIES WORKSHEET LIMITED COMPANIES (SHARES ISSUE WITH APPLICATION) INCOMPLETE RECORDS THEORY INCOMPLETE RECORDS WORKSHEET RATIOS THEORY RATIOS WORKSHEET CONTROL ACCOUNTS THEORY CONTROL ACCOUNTS WORKSHEET CONTROL ACCOUNTS PAST PAPERS ERROR AND SUSPENSE THEORY CORRECTION OF ERRORS WORKSHEET CORRECTION OF ERRORS PAST PAPERS BANK RECONCILIATION THEORY BANK RECONCILIATION WORKSHEET INVENTORY VALUATION THEORY INVENTORY VALUATION WORKSHEET ACCOUNTING CONCEPTS (THEORY) FINANCIAL ACCOUNTING KEYPOINTS FORMATS EXAM TIPS OMAIR MASOOD CEDAR COLLEGE Page Number 2-14 15-30 31-39 40-44 45-75 76-85 86-87 88-93 94-125 126-128 129-155 156-160 161-163 164-173 174-190 191-200 201-213 214-219 220-237 238-242 243-244 245-267 268-273 274-286 287 288-308 309-314 315 316-322 323-330 331 332-338 339 340-343 344-346 347-349 350-355 356 1 ( COST!ACCOUNTING! ( What!is!Cost!Accounting?! ! Cost(accounting(is(basically(the(determination(of(cost(whether(for(a(specified(thing(or(activity.(To( determine(cost,(we(need(to(apply(accounting(and(costing(principles(and(techniques.(The(cost(accounting( information(is(used(within(the(business(for(planning,(controlling(and(decision(making.( ( What!is!a!Cost!Centre?! ! Cost(centre(is(the(area(or(a(department(in(a(business(for(which(cost(are(accumulated.(There(are(two( main(types(of(Cost(Centres( • Production(Cost(Centre:(Departments(which(are(involved(directly(in(production(of(a(product.(For( example,(Moulding,(Cutting(or(Assemble(Department.( • Service(Cost(Centre:(Departments(in(which(production(doesn’t(take(place(but(they(provide( service(to(the(production(departments.(For(example:(store(Department(or(Maintenance( Department.( What!is!a!Cost!Unit?! Costs(are(always(related(to(some(object(or(function(or(service.(For(example,(the(cost(of(a(car,(a(haircut,(a( ton(of(coal(etc.(Such(units(are(known(as(cost(units(and(can(be(defined(as( ( ‘A(unit(of(product(or(service(in(relation(to(which(costs(are(determined’.( ( Cost(unit(may(be(units(of(production,(e.g.(kilos(of(cement,(gallons(of(beer(OR(may(be(units(of(service,( e.g.(consulting(hours,(Patient(nights,(Kilowatt(hour.( ( How!is!cost!classified?! ! There(are(three(possible(classifications( ( • Type!1:!Direct!and!Indirect!Cost!(classification!as!per!traceability!of!cost)! ( Direct(cost:(This(includes(all(such(cost(which(can(easily(be(traced(to(the(item(being(manufactured.(E.g.( Direct(Material,(Direct(Labour(and(Direct(Expenses((royalties(or(artwork).(There(can(also(be(Direct(Selling( Cost(like(Installation(or(Sales(Commission.( ( Indirect(Cost:(All(the(cost(which(cannot(be(easily(traced(to(the(item(is(the(Indirect(Cost.(These(are(widely( known(as(Overheads.(Overheads(can(be(production(or(non5production((selling(and(administration).( ( ( OMAIR MASOOD CEDAR COLLEGE 2 • Type!2:!Production!and!NonAProduction!Cost!(classification!as!per!function)! Any(cost(which(is(incurred(in(manufacturing(the(item(is(referred(as(Production(Cost.(All(the(other(cost(is( Non(production((Selling()(,(Non(production(((Administration()(,(Non(Production(((Financial(charges).((( ! • Type!3:!Variable!and!Fixed!Cost!(!classification!as!per!behavior!of!cost)! Variable(Cost:(Those(cost(that(change(in(total(in(direct(proportion(to(changes(in(level(of(activity.(An( increase/decrease(in(activity(brings(proportional(increase/decrease(in(total(variable(cost.(E.g.(Direct( Material,(Direct(Labor.(Always(remember(Variable(Cost(per(Unit(will(remain(constant.( ( Fixed(cost:(Those(cost(that(DOES(NOT(change(regardless(of(changes(in(activity(level.(E.g.(Rent,( Depreciation(etc.(Fixed(Cost(does(not(change(in(Total(but(Fixed(Cost(per(unit(will(decrease(as(more(units( are(produced.( ( Semi(Variable((Mixed)(Cost:(Include(both(fixed(and(variable(elements.(For(example(Repairs,( Maintenance(and(Electricity.( (( ( ( For(example(the(cost(of(a(service:($2(per(unit(produced(up(to(a(maximum(of($5(000(per(year(will(show( the(following(pattern(on(a(graph:( ( ( OMAIR MASOOD CEDAR COLLEGE 3 Another(example(of(semi5variable(costs(in(the(form(of(standing(charge(of($2(500(for(maintenance( charges(for(a(specific(level(plus(a(charge(of($(5(per(unit(to(a(maximum(of($10(000(per(year,(will(show(the( following(outline(on(a(graph:( ( ( The(graphs(for(the(fixed(cost(per(unit(and(variable(cost(per(unit(look(exactly(opposite(to(total(fixed(costs( and(total(variable(costs(graphs.(Although(total(fixed(costs(are(constant,(the(fixed(cost(per(unit(changes( with(the(number(of(units.(The(variable(cost(per(unit(is(constant.( ( ((((((((((((((( ( ( What!is!the!difference!between!direct!cost!and!variable!cost?! ! The(direct(cost(is(directly(related(to(a(product(and(it(can(be(easily(traced(to(the(item(being(manufactured( but(it(does(not(include(any(type(of(variable(overheads.(The(variable(cost(includes(all(direct(cost(and( variable(overheads(as(well.(For(e.g.(the(variable(part(of(the(electricity.( ( ! ! ! OMAIR MASOOD CEDAR COLLEGE 4 What!is!a!Sunk!Cost?! ! This(is(an(expenditure(which(has(already(been(incurred(and(it(has(no(importance(in(future(decision( making(since(the(cost(has(already(been(spent.(For(example,(a(business(conducts(a(feasibility(study(of( buying(a(new(machine(and(incurs(an(expense(of($5(000.(Now(whether(the(machine(is(brought(or(not,! $5,000(has(already(been(spent(and(cannot(be(recovered,(so(we(should(not(consider(them(in(decision( making.(This(cost(is(treated(as(an(expense(in(the(profit(and(loss(account(for(the(year.(Other(example( would(be(cost(incurred(on(market(research(before(launching(a(new(product.( ( What!is!the!effect!on!variable!cost!line!for!bulk!purchase!discount!on!purchase!of!raw!materials?! ! Sometimes,(suppliers(offer(bulk(purchase(discount(to(a(manufacturing(business.(For(example,(if(a( business(purchases(1(000(units,(a(price(of($5(may(be(charged(per(unit.(On(additional(1(000(units,(the( price(may(be(reduced(to($4.50(per(units(and(so(on.(It(will(reflect(the(following(image(on(the(graph(paper( and(it(is(known(as(saw@tooth$curve.( ( ( ( ( ( ( ( What!is!Stepped!Cost?! This(is(type(of(cost(which(is(constant(till(a(certain(level(of(Activity((Relevant(Range)(but(it(will(increase( significantly(as(the(activity(level(increases.(For(example(Rent(is(constant(till(the(factory(maximum( capacity(is(reached(but(then(we(need(another(factory(to(increase(production(so(the(rent(will(double.((If( we(plot(this(on(a(graph(it(will(look(like.( ( ( ( ( OMAIR ( ( ( ( MASOOD CEDAR COLLEGE 5 (((((((((((((((((((((((((((((((( ( ( ( Marginal!Costing! MARGINAL COSTING THEORY ( It(is(a(costing(technique(for(decision(making,(which(is(based(on(marginal((variable)(cost(of(a(product.(It( emphasizes(on(cost(behavior(and(clearly(distinguishes(between(variable(cost(and(fixed(cost.(It(is(based( on(the(principle(that(due(to(change(in(level(of(activity(only(the(variable(cost(change(and(the(fixed(cost( remain(constant.( ( What!is!a!marginal!cost?! This(is(all(the(variable(cost(to(produce(and(sell(a(unit.(It(may(be(described(as(the(additional(cost(to( produce(and(sell(each(additional(unit.(This(includes(Direct(Material((DM),(Direct(Labor((DL),(Direct( Expenses,(Variable(Production(Overheads(and(Variable(Admin(Overheads(and(Variable(Selling( Overheads.(Basically(the(entire(possible(variable(cost.( ( Contribution/(unit(=(Total(Contribution/(number(of(units( What!is!Contribution?! ( This(is(amount(left(to(cover(for(fixed(cost(and(profit.( Note:(Sales(–(Variable(Cost(=(Contribution(–(Fixed(Cost(=(Profit( ( ( So(Contribution(=(Fixed(Cost(+(Profit( Total(Contribution(=(Sales(–(Variable(Cost((Marginal(Cost)( ( (As(mentioned(above(the(amount(for(fixed(cost(and(profit.( Contribution/(unit(=(Selling(Price/(unit(–(Variable(Cost( ( (( ( ( Or( (( Contribution/(unit(=(Total(Contribution/(number(of(units( (( ( Note:(Sales(–(Variable(Cost(=(Contribution(–(Fixed(Cost(=(Profit( ( ( So(Contribution(=(Fixed(Cost(+(Profit( ( ( ( ( As(mentioned(above(the(amount(for(fixed(cost(and(profit.( ( USES!OF!MARGINAL!COSTING!(INCLUDES!THE!RULES!FOR!DECISION! ( MAKING)! ( (( Marginal(costing(is(widely(used(by(the(managers(in(making(various(business(decisions.(The(concept(is( ( that,(it(is(assumed(that(the(fixed(cost(will(not(change(so(all(decisions(are(based(keeping(this(fact(in(mind.( ( ( ( • Provides(quick(calculation(of(total(cost.(As(the(fixed(cost(remains(constant(and(only(the(variable( ( cost(changes( ( ( ( Total(Cost(=((variable(cost/(unit(x(no.(of(units)(+(Fixed(cost( ( • Provides(quick(calculation(of(profit(at(different(levels(( ( ( ((((((Profit(=((Contribution/(unit(x(no.(of(units)(–(Fixed(Cost( ( • Used(in(break5even(analysis((see(below)( ( Marginal(costing(is(widely(used(by(the(managers(in(making(various(business(decisions.(The(concept(is( • Helps(in(making(decision(on(whether(to(make(a(product(or(buy(from(outside.( that,(it(is(assumed(that(the(fixed(cost(will(not(change(so(all(decisions(are(based(keeping(this(fact(in(mind.( ( ( ( Rule:!Only(buy(from(outside(if(his(price(is(lower(than(our(variable(cost(to(produce( • Provides(quick(calculation(of(total(cost.(As(the(fixed(cost(remains(constant(and(only(the(variable( ( (variable(cost(to(producer(does(not(include(variable(selling(overheads)( cost(changes( ( ( ( Total(Cost(=((variable(cost/(unit(x(no.(of(units)(+(Fixed(cost( • Helps(in(decision(making(on(acceptance(or(rejection(of(special(orders(under(idle(capacity.( (( • (Provides(quick(calculation(of(profit(at(different(levels(( Rule:!Accept(all(orders(under(idle(capacity(as(long(as(it(covers(the(variable(cost.( ( ((((((Profit(=((Contribution/(unit(x(no.(of(units)(–(Fixed(Cost( (( In(other(words,(it(gives(a(positive(contribution.( • (Used(in(break5even(analysis((see(below)( • Helps(in(making(decision(on(whether(to(continue(or(discontinue(a(product.( ( USES!OF!MARGINAL!COSTING!(INCLUDES!THE!RULES!FOR!DECISION! MAKING)! • Helps(in(making(decision(on(whether(to(make(a(product(or(buy(from(outside.( CEDAR COLLEGE ( ( Rule:!Only(buy(from(outside(if(his(price(is(lower(than(our(variable(cost(to(produce( ( (variable(cost(to(producer(does(not(include(variable(selling(overheads)( ( OMAIR MASOOD 6 ( ( ( ( ( ( ( ( ( MARGINAL(COSTING( Breakeven!Analysis! ( ( ( ( ( ABSORPTION(COSTING( 1. ( It(is(based(on(total(production(cost(including( It(is(based(only(on(variable(cost.( variable(and(fixed(costs.( 2. ( It(divides(cost(into(production(and(non( It(divides(cost(between(variable(and(fixed.( production( 3. ( Stocks(include(the(total(production(cost((DM,( Stocks(include(only(the(variable(production( Rule:!Continue(products(giving(positive(contribution(unless(a(replacement(product(can( DL,(VPOH(and(FPOH)( cost((DM,(DL(and(VPOH)( 4. ( generate(more(positive(contribution.(Discontinue(the(product(giving(negative( It(is(more(suitable(for(external(use(as(the( It(is(more(suitable(for(internal(use(as( profit(and(loss(is(based(on(this.( decisions(are(based(on(this( contribution.(This(is(because(the(fixed(cost(should(be(ignored(as(it(doesn’t(changes(with( 5. ( decision(to(continue(or(discontinue.(Hence(a(product(which(is(making(a(loss((negative( Treats(fixed(cost(as(a(product(cost.( Treats(Fixed(cost(as(a(period(cost.( 6. ( Gives(Gross(Profit( Gives(Contribution.( net(profit)(but(is(giving(a(positive(contribution(should(not(be(discontinued.( 7. ( Required(adjustment(for(Over(and(Under( No(adjustment(is(required(as(actual(fixed(cost( Absorbed.( is(taken.( Similarly(a(product(which(might(give(a(positive(contribution(should(be(added(to(current(product( ( range.(( ( Formulas:! Contribution!to!Sales!Ratio!=!Contribution!per!unit/!Selling!price!per!unit!Or! !!!!!!!!!!(csratio)!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!Total!Contribution/Total!Sales! ( COMPARISON!OF!ABSORPTION!AND!MARGINAL!COSTING! Breakeven(in(Units(=( Fixed(Cost(/(Contribution(per(unit( ( Breakeven(in(value((Sales(Revenue)(=(Breakeven(in(Units(x(Selling(Price(/(Unit(or((Fixed(Cost/Cs(Ratio( Margin!of!Safety:!!! ABSORPTION(COSTING( MARGINAL(COSTING( 1. ( It(is(based(on(total(production(cost(including( It(is(based(only(on(variable(cost.( This(represents(the(difference(between(the(actual((or(budgeted)(level(of(activity(and(the(breakeven(level( variable(and(fixed(costs.( of(activity.(For(e.g.(if(a(factory(produces((or(plans(or(produce)(6(000(units(and(the(breakeven(is(at(2(000( 2. ( It(divides(cost(into(production(and(non( It(divides(cost(between(variable(and(fixed.( units,(this(means(4(000(units(are(in(margin(of(safety.( production( Margin(of(safety(provides(an(assessment(of(risk((by(indicating(the(extent(to(which(expected(output(can( 3. ( Stocks(include(the(total(production(cost((DM,( Stocks(include(only(the(variable(production( fall((before(a(loss(is(made(.(It(shows(the(ability(to(withstand(adverse(trading(conditions(( DL,(VPOH(and(FPOH)( cost((DM,(DL(and(VPOH)( 4. ( It(is(more(suitable(for(external(use(as(the( It(is(more(suitable(for(internal(use(as( ( profit(and(loss(is(based(on(this.( decisions(are(based(on(this( Margin(of(Safety(in(Units:(=(Sales((Units)(–(Breakeven(Units( 5. ( Treats(fixed(cost(as(a(product(cost.( Treats(Fixed(cost(as(a(period(cost.( ( 6. ( Gives(Gross(Profit( Gives(Contribution.( Margin(of(Safety(in(Value:(=(Margin(of(Safety(in(Units(x(Selling(Price(per(Unit( 7. ( Required(adjustment(for(Over(and(Under( No(adjustment(is(required(as(actual(fixed(cost( ( Absorbed.( is(taken.( Margin(of(Safety(as(a(%(=(Margin(of(Safety(units(/(Sales((Units)(x(1(000( ( Sales(for(Target(Profit(=(Fixed(Cost(+(Target(Profit( ( ( ( ( (C(S(Ratio( ( Assumption! Limitations! Formulas:!( 1. ( Fixed(Cost(remains(constant.( Fixed(cost(might(change(at(some(level( Contribution!to!Sales!Ratio!=!Contribution!per!unit/!Selling!price!per!unit!Or! 2. ( Total(cost(are(divided(into(variable(and( It(is(difficult(to(perfectly(do(that.(( !!!!!!!!!!(csratio)!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!Total!Contribution/Total!Sales! fixed.( Majority(of(cost(are(semi5variable.( ( 3. ( Variable(cost(per(unit(remains(constant( Economies(of(scale(and(bulk(discounts( Breakeven(in(Units(=( Fixed(Cost(/(Contribution(per(unit( and(is(perfectly(proportional( will(affect(this.( Breakeven(in(value((Sales(Revenue)(=(Breakeven(in(Units(x(Selling(Price(/(Unit(or((Fixed(Cost/Cs(Ratio( 4. ( Selling(Price(unit(remains(constant.( Increase(in(sales(volume(may(require(a( price(reduction( Margin!of!Safety:!!! 5. ( Technology(and(efficiency(remain( Changes(in(them(will(definitely(take( unchanged( place.( 6. ( There(are(no(stock(levels( Every(business(will(have(stock(levels( ( Note:(due(to(the(assumptions,(the(usefulness(of(breakeven(analysis(is(limited.( ( Breakeven!Analysis! OMAIR MASOOD ( ( ( CEDAR COLLEGE 7 ( ( ( ( ( Example:( (Through(Diagram( ( ( Fixed(Cost( ( (=( $20(000( ( ( Variable(Cost(/(Unit(( =( $6( ( ( Selling(Price(/(Unit( =( $10( ( ( Units( ( ( =( 10(000(Units( ( ( How!is!breakAeven!found!on!the!graph?! ( Continuing(the(above(example,(the(following(steps(are(illustrated(to(draw((break5even(graph:( ( Step(1:( The(horizontal(line(is(knows(as(X5axis.(Draw(X5axis(for(number(of(units(at(the(distance(of( 1(000(each(and(up(to(10(000(units.(The(vertical(line(is(known(as(Y5axis.(Draw(Y5axis(for( cost(and(revenue(up(to($100(000(at(the(distance(of($10(000(each(on(the(graph(paper.( ’ ( ( ( Where(the(two(axes(meet(is(called(the(origin(and(it(denotes(zero(for(both(axes.( ( ( ( ( ( ( ( Where(the(two(axes(meet(is(called(the(origin(and(it(denotes(zero(for(both(axes.( ( Step(2:( ( Draw(fixed(cost(line(parallel(to(x5axis(for($20(000(as(follows:( ( ( ( ( ( ( ( Step(2:( ( OMAIR Draw(fixed(cost(line(parallel(to(x5axis(for($20(000(as(follows:( MASOOD CEDAR COLLEGE 8 p(3:( ( ( ( ( ( ( ( ( ( ( ( ( ( Step(3:( ( ( Draw(total(cost(line.(It(will(begin(from($20(000(on(Y5axis.(The(total(costs(are(equal(to( fixed(cost(plus(variable(cost(that(is($20(000(+(($6(x(10(000(=($60(000)(=($80(000,(as( follows:( Draw(total(cost(line.(It(will(begin(from($20(000(on(Y5axis.(The(total(costs(are(equal(to( fixed(cost(plus(variable(cost(that(is($20(000(+(($6(x(10(000(=($60(000)(=($80(000,(as( follows:( Step(4:( ( Draw(sales(revenue(line,(it(will(begin(from(origin.(The(total(sales(revenue(is($100(000( (i.e.($10(x(10(000)( OMAIR MASOOD CEDAR COLLEGE 9 Step(4:( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( Step(5:( Draw(sales(revenue(line,(it(will(begin(from(origin.(The(total(sales(revenue(is($100(000( (i.e.($10(x(10(000)( ( Mark(the(Break5Even(point.(The(break5even(point(is(the(interaction(of(total(sales(line( and(total(cost(line,(as(follows:( ( ( ( ( ( ( ( ( OMAIR MASOOD ( ( ( ( CEDAR COLLEGE 10 (( ( ( ( ( Step(6:( ( ( ( ( ( ( ( ( ( ( ( ( ( ( E!=!Margin(of( (Safety(ratio( Mark(the(following(point(on(the(break5even(chart:( A(=(Profit( C!=!Margin(of( Safety(in(value( B(=(Loss( C(=(Margin(of(safety(in(value( D(=(Margin(of(safety(in(units( E(=(Margin(of(safety(percentage.( B!=!Loss! A!=!Profit! D!=!Margin(of( safety(in(units( E!=!Margin(of( (Safety(ratio( ( ( ( ( ( ( ( ( ( ( ( ( ( What!is!profitAvolume!chart?! C!=!Margin(of( Safety(in(value( ( A!=!Profit! B!=!Loss! D!=!Margin(of( safety(in(units( ( ! ( The(profit5volume(chart(is(the(alternate(graphical(method(used(for(breakeven(analysis.(It(shows(the( ( relationship(between(costs(and(revenues(and(it(basically(focuses(on(profits(and(losses(at(different(level( ( of(activities.(It(shows(break5even(point(when(the(profit(and(loss(line(intersects(the(sales(line.(The(sales( ( line(may(be(based(on(sales(units(or(sales(revenue.(The(profit5volume(chart(is(very(useful(to(show(the( ( breakeven(point(for(range(of(products.( (( ( How!is!profitAvolume!chart!drawn?! (! ( The(following(steps(are(involved(to(draw(the(profit5volume(chart:( (( ( Step(1:( The(vertical(line(is(known(as(Y5axis(and(has(origin(at(the(central(point(because(the(X5axis( ( begins(from(the(central(point.(Draw(Y5axis(for(profits(and(losses(at(the(distance(of( ( $10,000(each.(All(the(points(above(the(origin(represent(amounts(of(profit(at(different( What!is!profitAvolume!chart?! level(of(sale(an(all(the(points(below(origin(represent(amounts(of(loss(at(different(level(of( sale.(The(horizontal(line(is(known(as(X5axis,(which(may(be(used(for(sale(in(units(or(value.( OMAIR MASOOD CEDAR COLLEGE Draw(X5axis(for(number(of(units(at(the(distance(of(1(000(each(and(up(to(10(000(units.( The(X5axis(begins(from(the(center(of(Y5axis.( 11 breakeven(point(for(range(of(products.( ( How!is!profitAvolume!chart!drawn?! ! The(following(steps(are(involved(to(draw(the(profit5volume(chart:( ( Step(1:( The(vertical(line(is(known(as(Y5axis(and(has(origin(at(the(central(point(because(the(X5axis( begins(from(the(central(point.(Draw(Y5axis(for(profits(and(losses(at(the(distance(of( $10,000(each.(All(the(points(above(the(origin(represent(amounts(of(profit(at(different( level(of(sale(an(all(the(points(below(origin(represent(amounts(of(loss(at(different(level(of( sale.(The(horizontal(line(is(known(as(X5axis,(which(may(be(used(for(sale(in(units(or(value.( Draw(X5axis(for(number(of(units(at(the(distance(of(1(000(each(and(up(to(10(000(units.( The(X5axis(begins(from(the(center(of(Y5axis.( ( ( ( ( ( ( ( ( Step(3:( ( ( ( ( Step(2:( ( Draw(the(profit(and(Loss(points,(as(follows:( (For(example,(if(the(business(sells(10(000(units,(as(budgeted,(it(is(it(is(expected(to(earn(an( amount(of(profit(of($20(000(I.e.(10(000(x(($10(–($6(=($4)(=($40(000(contribution(minus(( fixed(cost($20(000(=profit($20(000.(If(no(unit(is(produced(or(sold,(business(will(earn(no(( contribution(and(the(fixed(cost(will(result(into(a(loss(of(the(business.( ( OMAIR MASOOD CEDAR COLLEGE Connect(the(profit(and(loss(points(as(drawn(in(step(2(above.(The(point(at(which(the(( profit(and(loss(line(intersects(the(sale(line,(it(is(known(as(break5even(point.( 12 Step(3:( ( ( ( ( Connect(the(profit(and(loss(points(as(drawn(in(step(2(above.(The(point(at(which(the(( profit(and(loss(line(intersects(the(sale(line,(it(is(known(as(break5even(point.( Step(4:( ( ( ( ( The(profit5volume(chart(may(be(used(to(find(out(the(amount(of(profit(and(loss(at(( different(level(of(output.( ( ( ( ( For(example,(the(amount(of(profit(at(8(000(units(or(loss(at(3(000(units(can(be(( determined(on(the(chart(as(follows:( ( ( ! ! Note:!if!there!is!more!than!one!product!then!Profit!is!plotted!against!Sales.! What!is!cash!breakAeven?! 13 OMAIR MASOOD CEDAR COLLEGE Cash(break5even(determines(the(level(of(sales(at(which(the(business(generates(enough(cash(to(meet(its( operating(cash(requirements.(The(cash(break5even(does(not(consider(the(non5cash(expense,(like( depreciation,(which(is(excluded(from(total(fixed(costs.( Example:( ( ! ! Note:!if!there!is!more!than!one!product!then!Profit!is!plotted!against!Sales.! What!is!cash!breakAeven?! Cash(break5even(determines(the(level(of(sales(at(which(the(business(generates(enough(cash(to(meet(its( operating(cash(requirements.(The(cash(break5even(does(not(consider(the(non5cash(expense,(like( depreciation,(which(is(excluded(from(total(fixed(costs.( Example:( The(following(information(is(taken(from(the(foregoing(example:( ( ( ( Selling(Price( $10(per(unit( ( ( ( Variable(costs( $6(per(unit( ( ( ( Fixed(costs( $20(000(per(annum((including(depreciation(of($4(000)( Illustration:( Cash(Break5even( Total(fixed(costs(–(Depreciation((=($20(000(–($4(000((=(((4(000(units((( In(units(( ((((((=( (((((((((Contribution(per(Unit( ( ((($4( ( To(convert(in(value(simply(multiply(the(units(with(selling(price( ( ( Business!Planning!(!This!is!only!important!for!theory!)! OMAIR MASOOD CEDAR COLLEGE 14 MARGINAL COSTING WORKSHEET MARGINAL COSTING ( WORKSHEET 1) Q1. Following data is available for ABC Manufacturing Company for production & sale of 4000 units. $ Sale 80000 Direct Material (DM) 40000 Direct Labor (DL) 16000 Variable Overheads (VOH) 4000 Fixed Overheads 10000 REQUIRED: Calculate Profit if o 2000 units are produced and sold o 6000 units are produced and sold Q2. Following Data is available for Target Ltd for production & sale of 1200 units Sale Direct Material (DM) Direct Labor (DL) Overheads (60% Fixed) REQUIRED: Calculate Profit if $ 96000 24000 18000 30000 o 2000 units are produced and sold o 500 units are produced and sold Q3. Sindh manufacturing Co has the following cost information Selling Price / Unit DM/Unit DL/Unit VOH/Unit Fixed Overheads $45 2kgs/Unit @$5/kg 3 hours/unit @$8/hour $2 $20000 REQUIRED: Calculate Profit if o 10000 units are produced and sold o 2500 units are produced and sold OMAIR MASOOD CEDAR COLLEGE 15 Q4. Punjab manufacturing Co has the following cost information. Selling Price / Unit DM/Unit DL/Unit VOH/Unit Fixed Overheads $25 3kgs/Unit @$2/kg 45 mins/unit @$10/hour $3 $5000 REQUIRED: Calculate Profit if o 10000 units are produced and sold o 5000 units are produced and sold Q5. Jackson Ltd manufactures a single product which sells at £30 per unit. The costs per unit are expected to be: Direct materials: 3 metres at £5 per metre Direct labour: 15 minutes at £12 per hour Variable manufacturing overheads at £3 per unit The total fixed overheads are expected to be £52500 per year. REQUIRED: Calculate Profit if o 10000 units are produced and sold o 20000 units are produced and sold Q6. Selling Price / Unit DM/Unit $ 13 DL/Unit $8 VOH/Unit $2 Fixed Overheads $5 REQUIRED: Calculate Profit at $ 30 (assuming 5000 units) o 5000 Units o 10000 Units Q7. Selling Price / Unit $56 DM/Unit 0.5 kg per unit each Kg is $30 DL/Unit 2 hours per unit at the rate of $5 per hour VOH/Unit $8 Fixed Overheads $5 (assuming 8000 units) o Calculate profit at 5000 units, 10000 units, and 8000 units. OMAIR MASOOD CEDAR COLLEGE 16 Q8. Following information is available for two levels of activity. Sales DM DL Production Overheads 4000 Units $ 64000 12000 18000 20000 10000 Units $ 160000 30000 45000 38000 REQUIRED: Calculate: (i) (ii) (iii) Variable Cost / Units Fixed Cost Profit if 7000 units are produced and Profit if 15000 units are produced. Q9. Following information is available for two level of activity Sales DM DL Production Overheads 2000 Units $ 30000 10000 8000 5000 10000 Units $ 150000 50000 40000 21000 REQUIRED: Calculate: I. II. III. Variable Cost / Unit Fixed Cost Profit if 7000 units are produced Profit if 9000 units are produced OMAIR MASOOD CEDAR COLLEGE 17 Q10. Following information is available for two level of activity Sales DM DL Production Overheads Marketing Overheads 5000 Units $ 100000 12000 18000 40000 10000 10000 Units $ 200000 24000 36000 60000 10000 REQUIRED: Calculate: o Variable Cost / Unit o Fixed Cost (total) o Profit if 7000 units are produced and Profit if 15000 units are produced Q11. Following information is available for two level of activity 5000 Units $ 110000 15000 18000 5000 30000 10000 15000 10000 Units $ 220000 30000 36000 10000 40000 10000 18000 Sales DM DL Royalties (Direct Expenses) Production Overheads Marketing Overheads Administration REQUIRED: Calculate: o Variable Cost / Unit o Fixed Cost (total) o Profit if 5000 units are produced and Profit if 20000 units are produced OMAIR MASOOD CEDAR COLLEGE 18 5000 Units 10000 Units $ $ Sales 110000 220000 DM 15000 30000 DL 18000 36000 Royalties (Direct Expenses) 5000 10000 Productioninformation Overheads is available for30000 40000 Q12. Following two level of activity Marketing Overheads 10000 10000 5000 Units 10000 Units Administration 15000 15000 $ $ REQUIRED: 110000 220000 Calculate:Sales o Variable Cost / Unit DM 15000 30000 o Fixed DL Cost (total) 18000 36000 o Profit if 7000 units are produced Profit if 15000 units are produced Royalties (Direct Expenses) 5000 10000 Production Overheads 30000 40000 Marketing Overheads 10000 10000 Administration 15000 15000 REQUIRED: Calculate: o Variable Cost / Unit o Fixed Cost (total) o Profit if 7000 units are produced Profit if 15000 units are produced Q13.Nadeem manufacturing manufactures one product which sells for $32 per unit. The company plans to manufacture 40000 units. Annual cost are expected to be. Variable Cost Semi Variable Cost ($80000 are fixed) Other Fixed Cost $360000 $280000 $340000 In the year ended 31st March 2003, 46000 units were produced and sold. Q13.Nadeem manufacturing manufactures one product which sells for $32 per unit. REQUIRED: The company plans to manufacture 40000 units. Annual cost are expected to be. (i) Calculate the planned profit for the$360000 year ended 31st March 2003 Variable Cost (ii)Variable Calculate the actualare profit for the year ended 31st March 2003 Semi Cost ($80000 fixed) $280000 Other Fixed Cost $340000 Q14. In themanufacturing year ended 31sthas March 2003, 46000 units were and sold. ABC the following information forproduced 6000 units $ REQUIRED: Sale 180000 (i) Calculate the planned profit for the year ended 31st March 2003 DM(ii) 72000 Calculate the actual profit for the year ended 31st March 2003 DL 48000 VOH 15000 FOH 10000 If Selling Price is reduced by 10% the units will increase to 8000 units. Additionally supplier will allow a 2% discount on all material. Labor will demand a 5% increase. Calculate profit at 6000 units and 8000 units. OMAIR MASOOD Q15. CEDAR COLLEGE Zaloum Ltd manufactures baseball caps which sell for $9 each. 19 If Selling Price is reduced by 10% the units will increase to 8000 units. Additionally supplier will allow a 2% discount on all material. Labor will demand a 5% increase. Calculate profit at 6000 units and 8000 units. Q15. Zaloum Ltd manufactures baseball caps which sell for $9 each. The material used to make the caps costs $16 per meter. Each cap uses 0.125 meters. The craftsmen working at the factory ware paid $8 per hour. Each cap takes 15 minutes to Make. The monthly fixed costs are $60000. o Calculate the contribution per cap. State the formula used. o Explain why the calculation of contribution per cap is useful to the management The price of raw materials has increased by 40%. At the same time, a wage increase of 5% has been agreed and fixed costs have increased by $3100. Calculate the new contribution per cap. Q16. Mr. John produces a product called ‘Shaly’. It takes 4 kgs of material to make one shaly and each kg cost $3. The labor takes 30 minutes to make it and is paid $12 per hour. Fixed Production Overheads amount to $20000 per month. Additionally John also pays his salesman a commission of $2 for every unit sold. In the month of September 5000 shalys were produced and sold. (a) Calculate the total cost of 5000 shark for the month of September. Make a statement in a good format. Also show total cost / unit. At the start of October it was decided with the sales staff that their commission will be as follows: Until 5000 units: $1.75 / Unit Over 5000 units: $2.5 / Unit It was also agreed that if sales fall to the level of 3000 units, no commission will be paid Calculate the total cost for the month of October if (i) 4000 shalys were sold (ii) 7000 shalys were sold (iii) 3001 shalys were sold (iv) 3000 shalys were sold (v) 2900 shalys were sold Q17 Mr. X produces a product called ‘X-Phone’. It takes 0.25 kgs of material to make one X-Phone and each kg cost $13. The labor takes 90 minutes to make it and is paid $12 per hour. Fixed Production Overheads amount to $10000 per month. Additionally John also pays his salesman a commission of $2 for every unit sold. In the month of September 5000 X-Phones were produced andCOLLEGE sold. OMAIR MASOOD CEDAR (a) Calculate the total cost of 5000 X-Phones for the month of September. Make a statement in a good format. Also show total cost / unit. 20 (ii) (iii) (iv) (v) 7000 shalys were sold 3001 shalys were sold 3000 shalys were sold 2900 shalys were sold Q17 Mr. X produces a product called ‘X-Phone’. It takes 0.25 kgs of material to make one X-Phone and each kg cost $13. The labor takes 90 minutes to make it and is paid $12 per hour. Fixed Production Overheads amount to $10000 per month. Additionally John also pays his salesman a commission of $2 for every unit sold. In the month of September 5000 X-Phones were produced and sold. (a) Calculate the total cost of 5000 X-Phones for the month of September. Make a statement in a good format. Also show total cost / unit. At the start of October it was decided with the sales staff that their commission will $2 for every X-Phone. If sales exceed 6000 X-Phones the commission will increase by $0.5 on every X-Phone sold. If sales drop below 4000 X-Phones the commission will be $1 for every X-Phone sold. It was also agreed that if sales fall to the level of 3000 units, no commission will be paid. REQUIRED: Calculate the total cost for the month of October if I. II. III. IV. V. 7000 X-Phones were sold 4000X-Phones were sold 3001 X-Phones were sold 3000 X-Phones were sold 6000 X-Phones were sold Q18. Selling Price / Unit $25 DM/Unit $8 DL/Unit $10 VOH/Unit $2 Fixed Overheads $25000 Production Capacity = 8000 units Calculate: (i) (ii) (iii) (iv) (v) (vi) (vii) Breakeven point in units Contribution to sales ratio (CS ratio) Breakeven point in value How many units should be produced in order to make a profit of $3000 The Margin of safety in units The Margin of safety in value The Margin of safety as a percentage Q19. The following budget is based on the full production capacity of 12000 units OMAIR MASOOD CEDAR COLLEGE Sales DM $ 240000 96000 21 (iv) (v) (vi) (vii) How many units should be produced in order to make a profit of $3000 The Margin of safety in units The Margin of safety in value The Margin of safety as a percentage Q19. The following budget is based on the full production capacity of 12000 units Sales DM DL Production Overheads (20% fixed) Sales overheads (50%) $ 240000 96000 36000 20000 24000 Calculate: I. II. III. IV. V. VI. VII. Breakeven point in units Contribution to sales ratio (CS ratio) Breakeven point in value How many units should be produced in order to make a profit of $20000 The Margin of safety in units The Margin of safety in value The Margin of safety as a percentage Q20. Mr. Change is considering buying a new machine for a new product line there are two options available. The cost and revenue details associated with both the options are as follows: OPTION A Production Capacity = 5000 units Selling Price / Unit = $15 DM /Unit = $3 DL / Unit = $5 VOH / Unit = $2 Fixed Cost = $10000 OPTION B Production Capacity = 5000 units Selling Price / Unit = $16 DM /Unit = $3 DL / Unit = $3 VOH / Unit = $1 Fixed Cost = $27000 For both options, A and B Calculate: OMAIR MASOOD I. II. CEDAR COLLEGE Breakeven point in units Contribution to sales ratio (CS ratio) 22 DM /Unit = $3 DL / Unit = $3 VOH / Unit = $1 Fixed Cost = $27000 For both options, A and B Calculate: I. II. III. IV. V. VI. Breakeven point in units Contribution to sales ratio (CS ratio) Breakeven point in value The Margin of safety in units The Margin of safety in value The Margin of safety as a percentage Calculate at which level of output both option 1 and option 2 will give the same profit? Q21. Tracey Kent owns a photographer’s studio. Each portrait sells for $38 and costs $12 to produce. Unfortunately, for the year ending 30 November 2004 her fixed overheads are expected to rise from the previous year’s figure of $42250 to $52000. REQUIRED: (a) State the formula used to calculate the number of portraits required to break even (b) Calculate the number of portraits required to break even for: (c) (i) the year ended 30 November 2003 (ii) the year ending 30 November 2004 Calculate the required change in selling price for the year ending 30 November 2004, if Tracey wishes to maintain the same level of break – even as that for the year ended 30 November 2003. Q22. Ranjeev Ali has decided to open his own business making leather jackets. He is not sure whether to produce high quality jackets or low quality jackets. If Ranjeev produces high quality jackets, he will use good quality material, each jacket will take longer to complete, and he will have to employ higher quality skilled labour. He will also have higher fixed costs Ranjeev will be able to sell each high quality jacket at a higher price, but he would sell more jackets if he produced low quality jackets. Ranjeev has prepared some estimated figures, shown below: High Quality Jacket Material costs per square metre $11 Material required per jacket (sq metres) 3 Labour costs per hour $15 OMAIR MASOOD CEDAR COLLEGE Labour time per jacket (hours) 4 Fixed Costs per month $2300 Selling Price per jacket $149 Low Quality Jacket $8 3 $13 3 $2000 $99 23 (c) Calculate the required change in selling price for the year ending 30 November 2004, if Tracey wishes to maintain the same level of break – even as that for the year ended 30 November 2003. Q22. Ranjeev Ali has decided to open his own business making leather jackets. He is not sure whether to produce high quality jackets or low quality jackets. If Ranjeev produces high quality jackets, he will use good quality material, each jacket will take longer to complete, and he will have to employ higher quality skilled labour. He will also have higher fixed costs Ranjeev will be able to sell each high quality jacket at a higher price, but he would sell more jackets if he produced low quality jackets. Ranjeev has prepared some estimated figures, shown below: Material costs per square metre Material required per jacket (sq metres) Labour costs per hour Labour time per jacket (hours) Fixed Costs per month Selling Price per jacket Estimated number of sales per month (units) High Quality Jacket $11 3 $15 4 $2300 $149 160 Low Quality Jacket $8 3 $13 3 $2000 $99 210 REQUIRED: (a) (b) (c) (d) Calculate the expected break even point in units for a month, for both the high quality jacket and the low quality jacket. Calculate the margin of safety in units for one month, for both the high quality jacket and the low quality jacket. Calculate the expected profit for a month, for both the high quality jacket and the low quality jacket. Evaluate which type of jacket Ranjeev should produce. OMAIR MASOOD CEDAR COLLEGE 24 Q23. Bodger Ltd has been in the business of buying and selling washing machines for some year, but has decided to look at the possibility of manufacturing its own brand. At present, under Option 1, machines are bought in for $280 and sold for $400. You have been asked to compare this with the two new options under assessment. Under Option 1 fixed costs are minimal and are not taken into account. The figures are as follows: Unit costs Direct Materials Direct Labour Variable Overheads Fixed Costs Unit Selling Price Option 2 $ 50 70 30 $30000000 $370 Option 3 $ 50 30 20 $50000000 $420 All costs relating to the wasting machines are included in the above. The directors expected to sell at least 200000 machines per annum. REQUIRED: (a) Calculate, to the nearest whole number, the break-even point in units and in value for option 2 and 3. (b) Calculate which the three options is most profitable at the following levels. (i) (ii) (iii) 190000 units 240000 units 290000 units (c) Calculate the level in units at which option 2 and 3 show the same net profit. (d) Calculate the minimum level of production at which it is better to manufacture rather than buy in inventory. OMAIR MASOOD CEDAR COLLEGE 25 MARGINAL COSTING ( Worksheet 2) Q1 Q24. Fernando manufactures 3 types of refrigerator for Household, Business and Factory use. The following data apply to the year ended 30 April 2007. Sales (units) Total sales value ($) Total costs Direct material Direct labour Variable overheads Fixed overheads Profit (loss) Household Business Factory Total 2400 240000 $ 96000 72000 24000 _57600 249600 (9600) 900 108000 $ 45000 28800 13500 _27000 114300 (6300) 2250 360000 $ 112500 94500 45000 _67500 319500 40500 5550 708000 $ 253500 195300 82500 _152100 683400 24600 REQUIRED: (a) For the year ended 30 April 2007 calculate for each type of refrigerator: (i) the contribution per unit; (ii) the contribution as a percentage of sales. Give answers to a maximum of two decimal places. Working must be shown. (b) (c) Calculate the break-even point for each type of refrigerator in both units and dollars. Give your answers to the nearest whole number. Working must be shown The table at the beginning of the question shows that both the Household and the Business models appear to be making a loss. Explain why Fernando should not cease production of these two types of refrigerator. OMAIR MASOOD CEDAR COLLEGE 26 manufacture of all three products. Data for the year ended 30 April 2005 was as follows: four three two drawer 12 drawer drawer $ $ $ Q2. Q25. Total sales 410 400 123 900 427 500 3 Hoi Poloi plc makes 3 types of filing cabinet, four-drawer, three-drawer and two-drawer. The Total variable costs 304 000 88 500 285 000 business uses general purpose machines which are equally suitable to be used in the Allocated fixed costs 98 000 48 000 135 000 manufacture of all three products. Profit (Loss) 8 400 (12 600) 7 500 For Examiner's Use Data for the year ended 30 April 2005 was as follows: It had been proposed that the three-drawer cabinet be discontinued, as it was making a loss. four three two drawer drawer drawer $ $ $ REQUIRED Total sales 410 400 123 900 427 500 Total variable costs 304 000 88 500 285 000 (a) State whether this proposal should have been agreed, giving your reasons. Allocated fixed costs 98 000 48 000 135 000 Profit (Loss) 8 400 (12 600) 7 500 It had been proposed that the three-drawer cabinet be discontinued, as it was making a loss. REQUIRED (a) State whether this proposal should have been agreed, giving your reasons. [5] Sales and cost data for the year ended 30 April 2006 were as follows: four drawer REQUIRED Sales in units 13 15 000 three drawer two drawer 6 000 30 000 For Examiner's Use [5] (b) unit for each product.$8 RawCalculate materials the selling price per$12 Variable overheads $3 $2 Unit contribution $7 $6 Sales and cost data for the year ended 30 April 2006 were as follows: Machine hours per unit 0.5 0.5 Machine operators are paid $10 per hour. four three Allocation of fixed costs $98 000 $48 000 drawer 13 drawer Sales in units REQUIRED 15 000 6 000 $4 $2 $5 0.4 two $135 000 drawer For Examiner's Use 30 000 [3] Raw materials $12 $8 $4 (b) Calculate the selling price $3 per unit for each product. Variable overheads $2 $2 Unit contribution $7 $6 $5 (c) Calculate forunit each product the point in value. 14 Machine hours per 0.5 break-even 0.5both units and sales0.4 Machine operators are paid $10 per hour. (d) Calculate for each profit year000 ended 30 April 2006. Allocation of fixed costs product the $98 000or loss for the $48 $135 000 15 © UCLES 2006 9706/02/M/J/06 To try to improve profits for the year ending 30 April 2007, it has been suggested that a better quality, more easily worked, raw material be purchased. This would increase the cost of raw materials by five percent (5 %) but would offer savings of ten percent (10 %) on labour. Sales and other costs would remain unchanged. For Examiner's Use For Examiner's Use [3] (c) Calculate for each product the break-even point in both units and sales value. REQUIRED (e) Calculate for each product and in total the profit or loss if this suggestion is put into effect. © UCLES 2006 OMAIR MASOOD 9706/02/M/J/06 CEDAR COLLEGE 27 Break-even point 16 000 units 16 REQUIRED (ii) budgeted contribution to sales (C / S) ratio (to two decimal places) (a) Calculate the budgeted fixed costs for the year ending 31 December 2018. 15 Q26. 4 16 following budgeted data is available for the Ken produces components for mobile telephones. The year ending 31 December 2018: (ii) budgeted contribution to sales (C / S) ratio (to two decimal places) Selling price Direct materials Direct labour Direct expenses Break-even point Per unit $ 5.25 0.50 0.75 0.25 16 000 units [2] REQUIRED (a) Calculate the budgeted fixed costs for the year ending 31 December 2018. [3] (c) State the meaning of C / S ratio. Additional information [2] The budgeted profit for the year ending 31 December 2018 is $75 000. (c) State the meaning of C / S ratio. REQUIRED [1] (b) Calculate for the year ending 31 December 2018: 16 [2] (i) budgeted number of units to be sold (d) (ii) (i) budgeted State thecontribution name given the(Cdifference between the budgeted total sales[1] units and the to to sales / S) ratio (to two decimal places) budgeted break-even sales units. (c) State the meaning of C / S ratio. [3] (d) (i) State the name given to the difference14between the budgeted total sales units and the [1] 4 budgeted break-even sales units. Additional information 17wishes to know the break-even point. Rahel manufactures a single product X and (ii) Explain the significance of this difference to a business. The budgeted profit for the year ending 31 December 2018 is $75 000. [1] (e) Prepare the break-even chart for Ken based on 18the relevant data. Clearly identify the area of REQUIRED profit, the area of loss and the break-even point. REQUIRED (ii) Explain the significance of this difference to a business. (a) State what meant by of break-even point.analysis. 14 (f) threeislimitations a break-even (b) Calculate for the year ending 31 December 2018: [1] (Jun17/P21/Q4a-f) (i) budgeted number of units to be sold 1 manufactures a single product X and wishes to know the break-even point. Rahel (d) (i) State the name given to the difference14 between the budgeted total sales units and the budgeted break-even sales units. [1] Q27. REQUIRED 4 Rahel manufactures a single product X and wishes to know the break-even point. [1] Additional information (a) State what is meant by break-even point. REQUIRED The(ii) following budgeted informationofisthis available for product X. Explain the significance difference to a business. [2] 2 (a) State what is meant by break-even point. 16 Selling price per unit $2.00 [2] [2] over[1] © UCLES 2017 9706/21/M/J/17 [Turn Contribution to sales ratio 62.5% 4 (d) Calculate Fixed costs the margin of safety. $50 000 Production and sales 100 000 units Additional information in units (c) (i) State the meaning of C / S ratio. REQUIRED The 3following budgeted information is available for product X. [2] 15 Additional information (b) Calculate the break-even point in units and $ 16 revenue. Selling price per unit $2.00 [2] 16 (c) 2017 Prepare break-even chart62.5% for product X. © UCLES 9706/21/M/J/17 The followingatobudgeted information is available for product X. Contribution sales ratio (d) 2017 Calculate (i) in unitsthe margin of safety. 9706/21/M/J/17 © UCLES © UCLES 9706/21/M/J/17 [Turn over Fixed costs the margin of safety. $50 000 (d) 2017 Calculate [1] Selling priceand persales unit $2.00 Production 100 000 units [3] (i) in units [2] Contribution to sales ratio 62.5% (i) in units (ii) as a percentage Additional information Fixed costs $50 000 REQUIRED (d) (i) State the name given to the difference between the budgeted total sales units and the Production and sales 100 (Jun16/P21/Q2a-d) (Jun16/P23/Q2a-d) budgeted break-even sales 000 units.units Ken Calculate is considering increasing the selling price and to $6.00 per unit from 1 January 2019. He expects (b) the break-even point in units $ revenue. that all costs will remain unchanged. REQUIRED [1] (i) in units (ii) inMASOOD revenue OMAIR CEDAR COLLEGE REQUIRED (b) Calculate the break-even indifference units andto$ arevenue. (ii) Explain the significancepoint of this business. [4] 9706/21/M/J/17 the number of units Ken must sell each month so the budgeted total contribution is (ii) a percentage (i) as in units (ii) asinformation a percentage the same as in 2018. Additional © UCLES (g) 2017 Calculate [1] 28 He has prepared the following profit/volume (P / V) chart for product X for the year ending 80 14 31 December 2016. 4 60 Lin, a manufacturer, makes$three 000s products: X, Y and Z. He uses cost-volume-profit (CVP) analysis in his business. 40 80 14 (P / V) chart for product X for the year ending He has prepared the following profit/volume Q28. 31 December 2016. 20 products: X, Y and Z. He uses cost-volume-profit (CVP) analysis 4 Lin, a manufacturer, makes 60 three A in his business. $ 000s He has prepared the following profit/volume (P / V) chart for product X for the year ending 400 31 December 2016. 80 20 40 60 –20 20 $ 000s 60 A 80 – 40 400 13 13 20 40 60 60 REQUIRED B –– 60 20 20 REQUIRED 40 A (b) Calculate for product–Wye: 80 – 40 0 (b) Calculate for product20Wye: Sales units 000s 40 60 (i) the revised contribution per unit A 20 B ––20 60 (i) the revised contribution per unit 0 REQUIRED 20 40 60 Identify from the P –/––V chart for the year ending 31 December 2016: 80 20 40 Sales units 000s (i) what point A 20 000 represents – 40 B – 60 REQUIRED (a) B – 60 [4] – 80 Identify from the P / V chart for the year ending 31 December 2016: Sales units 000s – 80 (ii) the revised break-even point in units (i) what point A 20 000 represents Sales units 000s whatrevised point Bbreak-even ($60 000) represents (ii) the point in units REQUIRED (a) [4] [1] REQUIRED (a) (a) Identify from the P / V chart for the year ending 31 December 2016: Identify from the P / V chart for the year ending 31 December 2016: [1] [1] [2] (i) what point A 20 000 represents (i) what point A 20 000 represents (ii) what point B ($60 000) represents 15 the revised margin (b) (iii) State what is meant by of P /safety V ratio.in units revised margin of safety in unitsof CVP analysis. (c) (iii) Statethe two benefits and two drawbacks [2] [1] [1] [1] [1] [1] (ii) whatpoint point B B ($60 Benefits 000)represents represents (ii) what ($60000) (Mar16/P22/Q4a-c) 1 Additional information (b) State what is meant by P / V ratio. Q29. Additional information Another division of Hobbs Limited also manufactures one product, the Exe. Another Limited alsoyear manufactures one product, (b) following Statedivision whatdata is of meant by P / V for ratio. The isHobbs available the ending 30 June 2016. the Exe. (b) State what is meant by P / V ratio. The selling following data is available for the$20 year ending 30 June 2016. Unit price 2 © UCLES 2016 Unit variable costs $15 9706/22/F/M/16 Unit selling price $20000 Budgeted fixed costs per annum $30 Unit variable costs $15 units Budgeted sales 8000 Budgeted fixed costs per annum $30 000 Budgeted sales 8000 units REQUIRED [1] [1] [1] [1] [1] [1] 14 REQUIRED Drawbacks the monthly break-even point in revenue. 9706/22/F/M/16 (d) Prepare a break-even chart for product Exe for the year ending 30 June 2016. Clearly (c) indicate Calculate monthly break-even 1 thethe areas of profit and loss. point in revenue. (c) 2016 Calculate © UCLES © UCLES 2016 OMAIR © UCLES 2016 2 9706/22/F/M/16 MASOOD CEDAR COLLEGE 9706/22/F/M/16 [2] 29 [2] Direct materials Direct labour Variable overheads 2.50 1.40 1.10 15 Total fixed costs $120 000 per annum Sales per annum (units) 200 000 (e) State three assumptions the accountant must make when preparing a break-even chart. www.maxpapers.com REQUIRED 1 (Nov15/P22/Q3c-e) 11 (a)(iii) Using the data for the product D946 calculate the following: margin of safety in current units and as a percentage of sales. www.maxpapers.com Q30. For Examiner’s 10 Use (i) break – even point in units and sales value; .................................................................................................................................. 2 3 Debussy currently produces one product for which the following information is available: For .................................................................................................................................. .................................................................................................................................. Examiner’s Use Product D946 $ per unit .................................................................................................................................. .................................................................................................................................. 3 Selling price 6.00 .................................................................................................................................. Direct.................................................................................................................................. materials 2.50 [3] Direct labour 1.40 Variable overheads 1.10 .................................................................................................................................. .................................................................................................................................. Additional information Total .................................................................................................................................. fixed costs $120 000 per annum .................................................................................................................................. The company uses marginal costing in order to calculate its break-even point for its ‘make or buy’ Sales per annum (units) 200 000 decisions. .................................................................................................................................. .................................................................................................................................. REQUIRED REQUIRED .................................................................................................................................. .................................................................................................................................. (a) Using the data for the current product D946 calculate the following: (f) State three further reasons why a business might use a marginal costing system. ............................................................................................................................. [6] .................................................................................................................................. (i) break – even point in units and sales value; 1 (ii) .................................................................................................................................. profit for the year, showing the contribution per unit; 11 .................................................................................................................................. www.maxpapers.com (iii) ............................................................................................................................. margin of safety in units and as a percentage of sales. [4] .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. (b) Prepare the contribution to sales (profit/volume) graph, using the chart below, for the .................................................................................................................................. .................................................................................................................................. 2current product D946. Clearly show the profit at the current sales level. .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. $000 .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. 3 For Examiner’s Use .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. (ii) ............................................................................................................................. [6] .................................................................................................................................. .................................................................................................................................. [6] ’000 units profit for the year, showing the contribution per unit; .................................................................................................................................. ............................................................................................................................. [4] [Total: 30] .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. © UCLES 2010 (Nov10/P21/Q3a-b) or (Nov10/P22/Q3a-b)9706/22/O/N/10 .................................................................................................................................. [4] ............................................................................................................................. [4] .................................................................................................................................. (b) Prepare the contribution to sales (profit/volume) graph, using the chart below, for the current product D946. Clearly show the profit at the current sales level. .................................................................................................................................. $000 .................................................................................................................................. ............................................................................................................................. [4] OMAIR MASOOD CEDAR COLLEGE © UCLES 2015 9706/22/O/N/15 30 MARGINAL COSTING LIMITING (WORKSHEET 1) MARGINAL COSTINGFACTOR LIMITING FACTOR WORKSHEET Q1. Q1. 3 9 Blue Skies Ltd manufactures three types of tent: Beach, Explorer and Family. For Examiner's Use 10 The company provides the following forecast data for the year ending 30 April 2013: (ii) Calculate the total contribution and profit for the year based on forecast Beach Explorer Family demand. Forecast demand (units) Per Unit Selling price Raw materials Direct labour Variable overhead 30 000 40 000 24 000 $ 70 30 8 6 $ 130 36 20 26 $ 200 54 38 48 For Examiner's Use The same waterproof material is used in the manufacture of each tent. The cost of material is estimated to be $6 per square metre. Fixed costs for the year ending 30 April 2013 are estimated to be $3 500 000. . REQUIRED (a) Calculate the unit contribution for each product. (i) 10 Calculate the total contribution and profit for the year based on forecast demand. (ii) For Examiner's Use [5] There is only one supplier capable of producing waterproof tent material of the required quality. They have informed Blue Skies Ltd that the maximum amount they can supply in the year will be 546 000 square metres. REQUIRED Calculate the contribution per square metre for each product produced. (b) 11 (c) Using the quantity of material that is available for production, calculate the number of each type of tent that should be produced so that total profit is maximised. For Examiner's Use [5] [5] [3] There is only one supplier capable of producing waterproof tent material of the required quality. OMAIR MASOOD © UCLES 2012 CEDAR COLLEGE 9706/21/M/J/12 They have informed Blue Skies Ltd that the maximum amount they can supply in the [Turn over year will be 546 000 square metres. © UCLES 2012 REQUIRED 9706/21/M/J/12 31 [7] (d) Using the quantity of material that is available, prepare a marginal cost profit statement. Clearly show the contribution made by each type of tent and the total profit made in the year. 10 3 12 Apex. The following forecast information for Clarke Limited manufactures one product, the the Apex is available for the year ending 31 December 2014: (e) The directors determine that at least 27 000 units of the Beach tent have to be produced inPer theunit: coming year. Selling price $45.50 material ($4 cost per metre) $14.00the contribution made by Prepare a Direct revised marginal statement to show Direct ($12 per made hour) in the year. $18.00 tent labour and total profit each type of Variable production overhead $ 3.00 4 000 units 10 Q2. Fixed overheads are forecast to be $23 100 for the year. 3 Clarke Limited manufactures one product, the Apex. The following forecast information for the Apex is available for the year ending 31 December 2014: REQUIRED For Examiner's Use For Examiner's Use Sales demand Perbreakeven unit: (a) Calculate the point in units for the sales of the Apex. Selling price $45.50 Direct material ($4 per metre) $14.00 Direct labour ($12 per hour) $18.00 Variable production overhead $ 3.00 Sales demand © UCLES 2012 For Examiner's Use [5] 4 000 units 9706/21/M/J/12 [Turn over Fixed overheads are forecast to be $23 100 for the year. REQUIRED (a) Calculate the breakeven point in units for the sales of the Apex. [4] (b) Calculate the margin of safety for the Apex in terms of revenue. [4] (b) Calculate the margin of safety for the Apex in terms of revenue. [3] [5] [Total: 30] OMAIR MASOOD CEDAR COLLEGE [3] Permission to reproduce items where third-party owned material protected by copyright is included has been sought and cleared where possible. Every reasonable effort has been made by the publisher (UCLES) to trace copyright holders, but if any items requiring clearance have unwittingly been included, the publisher will be pleased to make amends at the earliest possible opportunity. © UCLES 2013 9706/22/M/J/13 University of Cambridge International Examinations is part of the Cambridge Assessment Group. Cambridge Assessment is the brand name of University of 32 and overheads the Cord.are Both products use the direct material and products. the same grade of direct Fixed expected to double as asame result of producing all three labour as the Apex. The following forecast information is available for the year ending 31 December 2014: REQUIRED Examiner's Use (c) CalculatePer the unit: contribution per unit of the Bond and Bond the Cord. Cord Selling price $52.00 $67.50 11 Direct material ($4 per metre) $16.00 $20.00 labour ($12 per $24.00 $30.00 ClarkeDirect Limited has decided to hour) introduce two new products in addition to the Apex; the Bond Variable production overhead $ 4.00 5.00 and the Cord. Both products use the same direct material and$the same grade of direct labour as the Apex. The following forecast information is available for the year ending Sales demand 6 000 units 2 000 units 31 December 2014: For Examiner's Use [2] Perare unit: Fixed overheads expected to double as a resultBond of producing allCord three products. Selling price $52.00 $67.50 Direct material ($4 per metre) $16.00 $20.00 REQUIRED (d) Calculate the total quantity of direct material required by Clarke Limited for the year Direct labour ($12 per hour) $24.00 $30.00 ending 31 December 2014. Variable production 4.00 (c) Calculate the contribution peroverhead unit of the Bond $and the Cord. $ 5.00 Sales demand 6 000 units 2 000 units Fixed overheads are expected to double as a result of producing all three products. REQUIRED (c) Calculate the contribution per unit of the Bond and the Cord. [2] (d) Calculate the total quantity of direct material required by Clarke Limited for the year ending 31 December 2014. [4] [2] (e) Clarke Limited has been told that due to a shortage of direct material, only 40 000 metres will be available for quantity the year.ofCalculate the maximum forecast profitLimited for Clarke (d) Calculate the total direct material required by Clarke for the year Limitedending for the 31 year ending 312014. December 2014 using 40 000 metres of direct material. December Q3 Reed Ltd manufactures three products A, B and C. Budgeted costs and selling prices © UCLES 2013 three months ending 30 September 9706/22/M/J/13 [Turn over for the 1999 were as follows: A B C 6000 8000 [4]5000 $ $ $ Selling price per unit 45 44 37 costsLimited has been told that due to a shortage of direct material, only 40 000 (e) Unit Clarke Direct labour 6 9 metres will be available for the year. Calculate the maximum forecast profit for Clarke 6 Direct materials 20 using 40 000 metres 24 of direct material. 16 Limited for the year ending 31 December 2014 [4] 2 Variable overheads 4 3 Sales (units per month) The total fixed costs are $100000 per month, and are unavoidable. (e) Clarke Limited has been told that due to a shortage of direct material, only 40 000 metres will be available for the year. Calculate the maximum forecast profit for Clarke TheLimited company has year been ending advised31byDecember its supplier that, due 40 to 000 a material its material for the 2014 using metresshortage, of direct material. requirement for the month of September will be reduced by 15%. Material costs are $4 per 9706/22/M/J/13 [Turn over kilo for all products. REQUIRED: © UCLES 2013 (a) A statement to show the net profit for July 1999, clearly showing the contribution per unit for each product. © UCLES 2013 9706/22/M/J/13 [Turn over (b) A statement to show the maximum net profit for the three months ending 30th September 1998 taking into account the material shortage for the month of September 1998, clearly showing the total contribution for each product. OMAIR MASOOD CEDAR COLLEGE 33 Q4. Passabuck Ltd makes three products: Meenibuck, Teenibuck and Deluxibuck for which the following details are given: Product Direct material (kilos per unit) Direct labour (hours per unit) Direct expenses (per unit) Selling price per unit Meenibuck 5 4 $7 $74 Teenibuck 7 6 $4 $85 Deluxibuck 10 8 $9 $115 Further information: (i) (ii) (iii) (iv) (v) All three products are made from material X. Material X costs $3 per kilo. All three products require the same type of labour which is paid at $7 per hour. Total fixed costs amount to $70000. Budgeted production (based upon maximum demand) is: Menibuck 2000 units Teenibuck 2400 units Deluxibuck 1800 units It has now been discovered that the supply of material X is limited to 38000 kilos. REQUIRED: (a) Calculate the contribution per kilo of material X used for each product. [12] (b) Prepare a production budget based on your calculation in (a) to give maximum profit from the material available [11] OMAIR MASOOD CEDAR COLLEGE 34 Q5. Simons Limited is a small manufacturing company currently making three different types of chair. Each chair is made from the same raw materials by the same labour force. The managing director presents to you the following details of revenue and cost per unit for the year ended 30 April 1990. Type of Chair Number of chair made and sold in the last year Selling price Raw material Operating labour Manufacturing overheads Variable Fixed Standard 5000 Per unit $ 100 16 16 Deluxe 2000 Per unit $ 120 20 20 Super 3000 Per unit $ 150 28 28 4 8 7 10 9 14 Manufacturing fixed overheads are apportioned to the three products in proportion to prime costs (i.e. materials and operating labour). Selling costs are fixed at $160000. All units produced can be sold as soon as they are made and no Inventory are kept. The directors have been considering their plans for the year ending 30 April 1991. The directors intend to introduce a new design of chair to be called the ‘Executive Chair’. Raw material will cost $40 per unit. Operating labour costs $4 per hour throughout the factory and it will take 9 hours to manufacture one ‘Executive’ Chair. Because of labour shortages in the region, only 59300 hours of operating labour will be available to the entire company in the coming year. Variable manufacturing overhead will amount to $9 per unit for the ‘Executive Chair’. In the coming year the price of the ‘Super’ Chair will be raised to $170. The price of the ‘Standard’ and ‘Deluxe’ Chairs will not be increased. It is not thought that the unit sales of each of the three existing chair models can be increased. The fixed selling costs of the company will be increased to $175000 but other costs will not change. REQUIRED: (a) Prepare a statement to show the contribution made by each product during the year ended 30 April 1990 and calculate the company’s total profit for the year. (b) Calculate the selling price of the new ‘Executive’ chair if the company wishes to make a contribution per ‘Executive’ chair of $165. (c) The directors decide to go ahead and introduce the ‘Executive’ chair. Prepare a budget for the year ended 30 April 1991 to produce the maximum profit on the basis that market research indicates that 2500 ‘Executive’ chairs can be made and sold. OMAIR MASOOD CEDAR COLLEGE [9] [5] [11] 35 Machine hours Variable overhead Fixed overhead Maximum monthly demand 1.00 $2.40 $10.00 100 units 2.50 $3.20 $25.00 120 units 5.00 $3.20 $50.00 60 units Fixed overheads are forecast to be $7000 per month. 10 Y Limited has enough resources and capacity to meet the maximum monthly demand. Q6. 4 Y Limited manufactures three products, Exe, Wye and Zed. The following budgeted information is REQUIRED available for the month of July 2017: (a) Calculate the contribution per unit for each product. Per unit Exe Wye Selling price $96.00 $128.00 Direct material at $4 per kilo 7 kilos 9 kilos Direct labour at $8 per hour 3 hours 4 hours Machine hours 1.00 2.50 Variable overhead $2.40 $3.20 Fixed overhead $10.00 $25.00 Maximum monthly demand 100 units 120 units Zed $140.00 15 kilos 4 hours 5.00 $3.20 $50.00 60 units 11 month. Fixed overheads are forecast to be $7000 per Y Limited has enough resources and capacity to meet the maximum monthly demand. REQUIRED (a) Calculate the contribution per unit for each product. [3] [3] (b) Prepare a statement to show the maximum contribution and maximum profit that Y Limited can earn for the month of July 2017. (c) Calculate the total machine hours required to meet maximum demand for the month of July 2017. 12 Additional information Due to a machine breakdown, only 500 machine hours will be available for July 2017 production. REQUIRED (d) Calculate the maximum contribution and the maximum profit for the month of July 2017, taking into account the limited machine hours available. [3] [1] (b) Prepare a statement to show the maximum contribution and maximum profit that Y Limited © UCLES 2017 can earn for the month of July 2017.9706/23/M/J/17 © UCLES 2017 OMAIR MASOOD 9706/23/M/J/17 CEDAR COLLEGE 36 16 Q7. 4 S Limited manufactures three different products. The following budgeted information is available: Products Monthly sales revenue Unit costs Direct materials ($1 per kilo) Direct labour Variable overheads A $ 72 000 B $ 27 000 C $ 165 000 6 2 17 1 9 7 2 3 8 1 (b) Selling Prepareprice a statement budgeted profit per unit to show the maximum 18 27 33 the company will make in December 2017 taking into account the shortage in materials but without the minimum Total production monthly fixed overheads are expected to be $138 000. requirement. The directors of S Limited have been informed thatforonly $39 0002017 worth of direct materials would Budgeted profit statement December be available in December 2017. All products use the same type of direct material and no Contribution price increase would occur due to the per unit Total shortage. No changes are anticipated in selling prices, fixed overheads or unit variable costs. Production (units) $ $ Due to an increased demand, the directors do not want to discontinue any of the products and wish toProduct produceAa minimum of 1000 units of each. Product B REQUIRED (a) Prepare ProductaCstatement to show the maximum budgeted profit the company will make in December 2017 taking into account the shortage in materials and minimum production requirement. Total contribution 17 Product A Product B Product C Less: Fixed overheads (b) Prepare a statement to show the maximum budgeted profit the company will make in Contribution per /unit December taking Budgeted2017 profit loss($) into account the shortage in materials but without the minimum production requirement. [6] Contribution per limiting factor ($) Budgeted profit statement for December 2017 Ranking (c) Advise the directors of S Limited whether or not they should produce a minimum of 1000 Contribution units of each product. Justify your answer. Budgeted profit statement for December per2017 unit Total Production (units) $ $ Contribution per unit Total Product A Production (units) $ $ Product Product B A Product Product C B Total contribution Product C Less: Fixed overheads Total contribution Budgeted profit / loss Less: Fixed overheads [6] Budgeted profit / loss [11] (c) Advise the directors of S Limited whether or not they should produce a minimum of 1000 units of each product. Justify your answer. © UCLES 2017 9706/23/O/N/17 [7] OMAIR MASOOD © UCLES 2017 37 CEDAR COLLEGE 9706/23/O/N/17 [Turn over [4] Q8. Additional information Rahel is considering opening another factory to produce two new products: Y and Z. The following information is available. Direct material Direct labour ($5 per hour) Variable overhead Y $ per unit 2 10 1.5 Z $ per unit 4 5 1.5 Selling price 23 18 Forecast demand for April is 4000 units of Y and 6000 units of Z. REQUIRED (e) Calculate the contribution per unit of each product Y and Z. 17 Additional information During April, fixed costs are forecast to be $60 000. REQUIRED [2] (f) Calculate the forecast profit for the new factory for the month of April. [1] Additional information During April, direct labour hours are expected to be limited to 10 000 hours. REQUIRED © UCLES 2016 9706/23/M/J/16 (g) Calculate the revised profit taking into account the limited direct labour hours. OMAIR MASOOD CEDAR COLLEGE [5] 38 Q9. Fairymead Pottery produces three ceramic products: mugs, plates and bowls. Each product is produced and sold in sets. Initial budget costs and selling prices for the next financial year as follows: Product Costs Variable costs per set Direct wages: Potters (£8 per hour) Packers (£6 per hour) Direct Materials: China Clay (£2 per kilo) Colouring Glaze Variable overheads Selling price per set Expected sales Mugs $ Plates $ Bowls $ 12 2 12 1 8 1 8 1 1 6 4 1 2 10 4 2 1 6 43 38 36 No. of sets 4000 No. of sets 3000 No. of sets 2000 The total annual fixed costs for the business are $50000. Changed circumstances: Since drafting this budget, Fairymead Pottery has learnt that several China Clay pits will cease production causing a shortage of China clay and an increase in its price. The cost per kilo of China Clay will now rise by 50% and the maximum that can be obtained Fairymead Pottery for its next financial year is estimated to be 25000 kilos. No other changes in costs and selling prices are expected. REQUIRED: (a) Using the initial budgeted costs and sales, calculate: (i) The contribution for each product (ii) The total budgeted profit for the next financial year. (b) Given the changed circumstances, calculate the contribution per unit for each product and the maximum profit that Fairymead Pottery can now earn in the next financial year. (c) A business has two products which are not performing well. Explain what action the business management should take in the case of a product: (i) which is providing a small positive contribution; (ii) which has a negative contribution. OMAIR MASOOD CEDAR COLLEGE 39 ( ( ( ( ( ABSORPTION COSTING (((((((((((((((((((((((((((((((((((((((((((((((((((( ABSORPTION!COSTING! THEORY ( What!is!Absorption!Costing?! ! It(is(a(costing(method(in(which(the(overheads((estimated)(of(a(manufacturing(business(are(charged(first( to(a(cost(centre((departments)(by(means(of(allocation(and(apportionment(and(then(a(predetermined( overhead(absorption(rate(is(calculated(to(charge(the(amount(of(overheads(onto(a(job(or(a(product.(The( overheads(may(be(absorbed(on(the(basis(of(activity(like(direct(labor(hours,(machine(hours(or(direct(labor( cost(or(direct(material(cost.(The(basis(of(absorption(depends(upon(the(intensity(of(the(department.(E.g.( a(machine(intensive(department(would(use(machine(hours.( ( What!is!Overhead!Absorption!rate?! ( A(manufacturer(needs(to(calculate(the(total(cost(of(the(product(before(he(actually(produces(it.(This(is( because(once(the(total(cost(is(determined,(he(or(she(can(set(the(selling(price.(Since(the(Overhead(cost(is( not(easy(to(trace,(a(rate(is(calculated(in(order(to(trace(the(overheads(as(per(the(level(of(activity.(For( example,(if(the(overhead(Absorption(Rate(is($3(per(direct(labor(hour(and(a(particular(unit(requires(4( hours(of(labour,(the(amount(of(Overheads(charged(will(be($3(x(4(hours(=($12.( ( Formula(for(Overhead(Absorption(Rate((OAR)(=( (((((((((((((Budgeted(Overheads(((((((((((_( ( ( ( ( ( ( Budgeted(Activity((e.g.(Labor(hours)( ( !Why!do!we!use!Budgeted!figures?! As(mentioned(above,(cost(has(to(be(determined(before(the(actual(production(takes(place.(The(actual( overheads(and(activity(is(not(known(at(that(point.(This(would(make(it(impossible(to(quote(the(selling( price(to(the(customer.( ( How!are!Overheads!Allocated!and!Apportioned!to!the!departments?! ! Firstly(all(the(overheads(are(split(amongst(the(department(by(using(suitable(basis.(For(some(overheads( we(don’t(need(to(use(basis(because(they(are(pre(allocated,(e.g.(indirect(materials((they(are(usually( divided(between(the(departments),(and(some(overheads(need(to(be(apportioned(using(suitable(basis,( e.g.(rent(can(be(split(on(basis(of(floor(area.(Once(all(the(overheads(are(shared(to(departments((Primary( Apportionment),(the(cost(of(service(departments(is(re5apportioned((Secondary(Apportionment)(to(the( production(department(since(they(provide(service(to(the(production(departments.( (( Some(factories(do(not(split(the(overheads(into(different(departments(and(just(calculate(a(single( overhead(absorption(rate(for(the(whole(factory.(This(method(is(less(accurate(than(the(method(in(which( separate(rates(are(calculated(for(each(department.( ( ( What!is!Over!or!Under!absorption!of!overheads?! ( The(Overhead(Absorption(Rate(is(calculated(using(budgeted(figures(but(the(actual(figures(of(overheads( and(activity(are(always(different.(This(causes(a(difference(between(the(amount(of(overheads(absorbed( and(the(actual(overheads(spend.( ( OMAIR MASOOD CEDAR COLLEGE Remember(Absorbed(Overheads(mean(the(amount(of(overheads(we(have(applied(to(our(cost(of( production.( ( Absorbed(Overheads(=(Budgeted(Overheads( x((((((Actual(Activity( 40 Some(factories(do(not(split(the(overheads(into(different(departments(and(just(calculate(a(single( overhead(absorption(rate(for(the(whole(factory.(This(method(is(less(accurate(than(the(method(in(which( separate(rates(are(calculated(for(each(department.( ( ( What!is!Over!or!Under!absorption!of!overheads?! ( The(Overhead(Absorption(Rate(is(calculated(using(budgeted(figures(but(the(actual(figures(of(overheads( and(activity(are(always(different.(This(causes(a(difference(between(the(amount(of(overheads(absorbed( and(the(actual(overheads(spend.( ( Remember(Absorbed(Overheads(mean(the(amount(of(overheads(we(have(applied(to(our(cost(of( production.( ( Absorbed(Overheads(=(Budgeted(Overheads( x((((((Actual(Activity( ( ( ( ((Budgeted(Activity( ! To(determine(the(amount(of(overhead(absorbed(and(under(absorbed(always(compare(the(Absorbed( Overheads(with(Actual(Overheads.( ( Over(Absorption(occurs(when(Absorbed(Overheads(are(more(that(the(Actual(Overheads((that’s(why(its( called(Over(Absorbed,(Absorbed(is(more).(This(basically(means(we(have(over(charged(the(cost.((Should( be(treated(as(a(gain(in(the(profit(statement(because(profit(is(understated).( ( Under(Absorption(occurs(when(Absorbed(Overheads(are(less(than(the(Actual(Overheads((that’s(why(it’s( called(Under(Absorbed,(Absorbed(is(less).(This(basically(means(we(have(under(charged(the(cost.((Should( be(treated(as(a(loss(in(profit(statement(because(profit(is(overstated)( ( Another!way!is!using!this!formula! This(can(be(calculated(by(comparing(budgeted(OAR(with(the(Actual(OAR.(( Formula((((Budgeted(OAR(–ACTUAL(OAR()((*(Actual(Hours( Positive(answer(would(give(over(absorbed(and(negative(will(give(under(absorbed.( ( ( What!are!different!types!of!Overhead!Absorption!Rates!(OAR)! !Overhead!absorption!rate!can!be!calculated!on!different!basis.!Remember!that!best!methods!to!use! are!either!machine!hour!or!labor!hour!,!depending!upon!if!the!department!(or!the!factory)!is!machine! intensive!or!labor!intensive.!But!following!OAR’S!are!used!by!different!businesses.! 1. Machine!Hours! 2. Labor!Hours! 3. Direct!Wages!(Direct!Labor!Cost)!! 4. Direct!Material!(Direct!Material!Cost)! 5. Prime!Cost! 6. Per!Unit!Rate! ! ! ! ! Which!Rate!is!Most!Appropriate!?! (Like(I(said(before(time(based(rates(like(machine(hour(and(labor(hour(are(the(most(appropriate( depending(on(the(intensity(of(the(factory.(The(other(rates(are(useful(when( !Per!Unit!Rate!:!(If(all(products(produced(are(very(similar(in(nature((( OMAIR MASOOD CEDAR COLLEGE !Direct!Labor!Cost!Rate!:!If(similar(products(and(labor(is(paid(uniformly( Direct!Material!Cost!Rate!:!(Material(of(uniform(value(,(production(time(proportional(to( material(usage(,similar(type(of(equipment(used(in(all(products( 41 6. Per!Unit!Rate! ! ! ! ! Which!Rate!is!Most!Appropriate!?! (Like(I(said(before(time(based(rates(like(machine(hour(and(labor(hour(are(the(most(appropriate( depending(on(the(intensity(of(the(factory.(The(other(rates(are(useful(when( !Per!Unit!Rate!:!(If(all(products(produced(are(very(similar(in(nature((( !Direct!Labor!Cost!Rate!:!If(similar(products(and(labor(is(paid(uniformly( Direct!Material!Cost!Rate!:!(Material(of(uniform(value(,(production(time(proportional(to( material(usage(,similar(type(of(equipment(used(in(all(products( ( However(the(machine(hour(rate(((if(capital(intensive()(and(labor(hour(rate(((if(labor(intensive()( are(used(most(widely.( ! What!are!the!problems!with!using!preAdetermined!(!Budgeted!OAR)!?! ! Use(of(estimated(data(can(lead(to(inaccurate(costing(and(results(in(over(or(under(absorption(of( overheads.(If(the(cost(absorbed(is(too(low(((under(absorbed)(this(will(lead(to(an(understated(cost(which( will(effects(profit(of(the(business(((as(our(selling(price(based(on(budgeted(cost(will(be(low).(On(the(other( hand(if(absorbed(cost(is(too(high(((over(absorbed)((this(will(overstate(cost(making(the(product( uncompetitive(and(will(reduce(demand.( (( (What!is!a!good!format!to!show!the!total!cost!of!any!order/job/unit/batch?! ( Direct(Material( Direct(Labor( Direct(production(expense((if(any)(e.g.(royalties(or(artwork.( Prime(Cost( Factory(Overheads( Department(A( Department(B( Cost(of(Production( Selling(and(Admin(cost((if(any)( Installation(or(Delivery( General(Admin(Overheads( Total(Cost( +( +( =( Add:( +( +( =( Add:( ( ( =( ( (((((((((((((((((((((((((((((((( ( ( ( Marginal!Costing! ( It(is(a(costing(technique(for(decision(making,(which(is(based(on(marginal((variable)(cost(of(a(product.(It( emphasizes(on(cost(behavior(and(clearly(distinguishes(between(variable(cost(and(fixed(cost.(It(is(based( on(the(principle(that(due(to(change(in(level(of(activity(only(the(variable(cost(change(and(the(fixed(cost( remain(constant.( ( 42 OMAIR MASOOD CEDAR COLLEGE What!is!a!marginal!cost?! This(is(all(the(variable(cost(to(produce(and(sell(a(unit.(It(may(be(described(as(the(additional(cost(to( produce(and(sell(each(additional(unit.(This(includes(Direct(Material((DM),(Direct(Labor((DL),(Direct( Expenses,(Variable(Production(Overheads(and(Variable(Admin(Overheads(and(Variable(Selling( ( ( ( ( ( 5 ( (5 5( 1. 5 5 2. 5 3. 5 5 4. 5 5 5. 6. 7. ( ( In(most(question(they(don’t(mention(depreciation,(that(doesn’t(mean(there(is(no(depreciation,( COMPARISON!OF!ABSORPTION!AND!MARGINAL!COSTING! use(the(above(formula(to(determine.((Don’t(forget(the(depreciation(like(idiots).( ( Cash(banked(will(come(on(the(debit(side(of(bank(and(credit(side(of(cash(account.( Loan(is(as(long(term(liability(unless(payable(within(one(year.(If(nothing(is(written,(assume(long( ABSORPTION(COSTING( MARGINAL(COSTING( term.( ( It(is(based(on(total(production(cost(including( It(is(based(only(on(variable(cost.( variable(and(fixed(costs.( POOP(is(for(expenses.( ( It(divides(cost(into(production(and(non( It(divides(cost(between(variable(and(fixed.( OPPO(is(for(incomes.( production( Net(realizable(value(=(current(selling(price(–(any(expenses((repairs)( ( Stocks(include(the(total(production(cost((DM,( Stocks(include(only(the(variable(production( We(always(ignore(replacement(cost(in(stock(valuation.( DL,(VPOH(and(FPOH)( cost((DM,(DL(and(VPOH)( Perpetual(methods(are(those(where(we(make(a(table.( ( It(is(more(suitable(for(external(use(as(the( It(is(more(suitable(for(internal(use(as( Markup(is(on(cost((cost(is(100)( profit(and(loss(is(based(on(this.( decisions(are(based(on(this( ( Treats(fixed(cost(as(a(product(cost.( Treats(Fixed(cost(as(a(period(cost.( Margin(is(on(sales((Sales(is(100)( ( Gives(Gross(Profit( Gives(Contribution.( ( Required(adjustment(for(Over(and(Under( No(adjustment(is(required(as(actual(fixed(cost( Absorbed.( is(taken.( ( COST(ACCOUNTING( ( ( SOME IMPORTANT KEYPOINTS FOR COSTING 5 Cost(centre(means(departments.( Breakeven!Analysis! 5 If(a(business(doesn’t(split(overheads(into(different(departments,(they(will(only(have(one( Formulas:! Overhead(absorption(rate(for(the(whole(factory((also(called(blanket(OAR).( Contribution!to!Sales!Ratio!=!Contribution!per!unit/!Selling!price!per!unit!Or! 5 Absorption(costing(means(total(costing.(It(is(used(to(calculate(total(cost.( !!!!!!!!!!(csratio)!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!Total!Contribution/Total!Sales! 5 We(only(use(OAR(to(calculate(the(overheads(for(a(unit/job/order/batch.( ( 5 OAR(can(be(calculated(on(any(basis(like(machine(hours,(labour(hours,(unit,(labour(cost((direct( Breakeven(in(Units(=( Fixed(Cost(/(Contribution(per(unit( wages),(material(cost(etc.( Breakeven(in(value((Sales(Revenue)(=(Breakeven(in(Units(x(Selling(Price(/(Unit(or((Fixed(Cost/Cs(Ratio( 5 If(no(basis(are(given(use(either(labour(hours(or(machine(hours(depends(on(what(is(more( Margin!of!Safety:!!! (intensity).( 5 Absorbed(Overheads(=(OAR(x(Actual(Activity.( 5 Over(absorbed(means(Absorbed(are(more(than(actual(overheads( 5 Under(absorbed(means(Absorbed(are(less(than(actual(overheads.( 5 Usually(if(actual(activity(is(above(budget,(we(will(OVER(ABSORB( 5 If(actual(activity(is(below(budget,(we(will(UNDER(ABSORB( 5 Total(cost(is(cost(of(Production(+(the(non5production(cost.( 5 Stocks(can(only(include(production(cost.(In(absorption(costing,(we(use(total(production(cost( whereas(in(marginal(we(use(only(variable(production(cost.( 5 Marginal(costing(is(about(decision(making.( 5 Decisions(are(based(on(contribution(not(profits.(It(is(assumed(that(fixed(cost(will(still(be( incurred.( 5 (contribution/unit(x(#(of(units)(–(Fixed(Cost(=(Profit.( 5 Lower(breakeven(point(is(better.(Higher(margin(of(safety(is(better.( 5 Positive(contribution(product(or(department(should(never(be(closed(down.( 5 Positive(contribution(product(should(be(accepted(under(idle(capacity.( OMAIR MASOOD CEDAR COLLEGE 43 5 5 5 5 5 5 5 5 5 5 5 5 5 5 When(deciding(on(if(we(should(buy(from(outside(or(not,(we(only(consider(variable(production( cost((ignore(Variable(Selling(cost)( Only(change(the(fixed(cost(if(the(question(tells(you(to.( Only(make(Profit(Statement(on(absorption(if(the(question(says(so.(Otherwise(always(marginal.( Profit(+(Fixed(Cost(=(Total(Contribution.( If(firm(makes(a(single(product,(profit(volume(chart(will(be(Profit(against(units.( If(firm(makes(multiple(products,(Profit(Volume(chart(will(be(Profit(against(Sales(Revenue((Total( Sales).( Direct(Labour(per(hour(=(Wage(rate(per(hour.( Normal(level(of(activity(is(budgeted(level(of(activity.(Fixed(production(Overheads/unit(is( calculated(using(this.( In(calculating(contribution(per(unit(we(need(direct(labour(per(unit.( MARGINAL(COSTING(=(SALES(–(VARIABLE(COST(=(CONTRIBUTION(–(FIXED(COST(=(NET(PROFIT.( In(marginal(costing,(we(always(take(the(total(fixed(cost.((We(never(calculate(it(on(per(unit(as(per( normal(level(of(activity).( ABSORPTION(COSTING(=(SALES(–(PRODUCTION(COST(=(GROSS(PROFIT(–(NON(PRODUCTION( COST(=(NET(PROFIT.( Under(absorbed(is(added(to(Cost(and(Over(absorbed(is(subtracted.(We(only(have(to(do(this(in( ( absorption(statement.( In(marginal(costing,(we(always(take(the(total(fixed(cost.((We(never(calculate(it(on(per(unit(as(per( normal(level(of(activity).( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( OMAIR MASOOD CEDAR COLLEGE 44 ABSORPTION COSTING WORKSHEET ABSORBTION)COSTING)()WORKSHEET)1)) ) Q1. Xander Ltd. has three production departments – Moulding, Assembly and Finishing – and two service departments – personnel and Maintenance. Indirect overheads are apportioned as follows: Overhead Cost Basis of apportionment Rent and Rates $55,200 Floor area Depreciation 15% Cost of machinery Power $43,650 Kilowatt hours Indirect wages $314,250 as shown Moulding Assembly Finishing Personnel Maintenance Number of employees 200 250 200 190 200 Floor area (sq. meters) 2,500 1,900 2,000 1,200 1,000 Direct labour hours 32,000 31,200 30,000 Direct machine hours 31,000 22,500 2,000 Power (kw hours) 6,000 6,550 600 650 750, Indirect wages ($) 24,000 45,000 25,500 75,000 144,750 650,000 700,000 520,000 170,000 320,000 Cost of machinery ($) Personnel costs are split amongst all the other departments on the basis of number of employees. Maintenance costs are split amongst the three production departments on the basis of floor area. REQUIRED: Prepare an Overhead Analysis Sheet ! ! ! ! ! ! OMAIR MASOOD CEDAR COLLEGE 45 Q2.) Duke plc had estimated the following factory indirect costs for its financial year ended 30 November 2007. $ 2,120,000 Indirect wages Repairs and maintenance 410,000 Rent and rates 53,000 Insurance of machinery 24,000 Insurance of premises 28,000 Electricity – power 48,000 Depreciation of machinery 14,000 Consumables 21,150 Additional Information Production Departments Machining Service Department Assembly Canteen Maintenance Machine cost ($) 617,500 332,500 - - Direct machine hours 202,500 22,500 - - 55,500 314,500 - - 9,000 8,000 1,000 2,000 Power usage (%) 55 35 5 5 Number of employees 70 104 10 16 9,550 9,800 550 1,250 Direct labour hours Floor area (sq. meters) Consumables ($) The proportion of work done by each service department was: Machining Assembly Canteen Maintenance Canteen (%) 35 60 - 5 Maintenance (%) 80 20 - - REQUIRED: Overhead Analysis Sheet OMAIR MASOOD CEDAR COLLEGE 46 Q3.!Debbie, Harry and Co plc have three production departments, Cutting, Assembly and Painting, and two service departments, Canteen and Maintenance.! Indirect overheads for the year ended 31 October 1996 are estimated to be: Basis of apportionment/allocation Cost Rent and rates Depreciation $20,000 Cost of machinery/equipment 12% Inspection $82,500 Welfare $32,500 Administration $57,000 Indirect wages $122,000 Power Floor area $21,000 No. of employees – production departments only Direct Labor Hours Number of employees Allocation as given By a meter (KWH) Data related to the departments is as follows: Cutting Assembly Painting Maintenance 14 12 7 2 120 110 190 100 $25,000 $18,000 $17,500 $17,500 3,000 2,500 1,000 200 Direct labour hours 20,000 30,000 15,000 Direct machine hours 25,000 10,000 15,000 $12,000 $15,000 $13,000 No. of employees Floor space (sq. meters) Cost of machinery/equipment Power (Kw hour) Indirect wages $38,000 Canteen 3 280 $22,000 300 $44,000 Canteen costs are split amongst all other departments on the basis of the number of employees, and maintenance costs are distributed among the production departments on the basis of floor area. REQUIRED: Overhead Analysis Sheet ! ! ! ! ! ! ! ! ! ! OMAIR MASOOD CEDAR COLLEGE 47 Q4.!The Clang Company manufactures parts for the car industry. The company has two productions departments and a works canteen that provides meals and refreshments for the two production departments ! The following information is available: Department Canteen A B Floor area (m2) 13,000 10,000 Staff employed 30 70 Power used (Kwh) 1,200 300 Cost of machinery $80,000 $20,000 2,000 10 100 $5,000 The following budgeted costs for the month of May have not been apportioned to a department. $ 10,000 Rent and rates Insurance of machinery Heating and lighting expenses Supervisory wages 2,625 7,500 12,100 4,800 Power Depreciation of machinery 9,030 REQUIRED: (a) Prepare a statement showing the apportionment of overheads for the month of May (Overhead Analysis Sheet) ! OMAIR MASOOD CEDAR COLLEGE 48 ! ! ABSORBTION COSTING ( WORKSHEET 2) Q5. ABSORBTION COSTING ( WORKSHEET 2) Q1. .Innisfail Enterprises Ltd had estimated the following factory indirect costs for the year ended 30 April Q1. .Innisfail Enterprises Ltd had estimated the following factory indirect costs for the year ended 30 April 2007. 2007. $ $ 900,000 900,000 Indirect wages Indirect wages 200,000 200,000 Machinery repairs Machinery repairs 60,000 60,000 Machinery insurance Machinery insurance 180,000 180,000 Machinery depreciation Machinery depreciation 80,000 80,000 Premises insurance Premises insurance 220,000 220,000 Heat Heat and light and light 19,000 19,000 Sundries Sundries The following additional information is available. The following additional information is available. Service Department Service Department Production Departments Production Departments A Machine cost (£) Machine cost (£) DirectDirect machine hourshours machine DirectDirect labour hourshours labour DirectDirect labour cost (£) labour cost (£) A B B Catering Catering Repairs Repairs 1,000,000 1,000,000 600,000 600,000 - - 600,000 600,000 20,000 20,000 - - 46,200 46,200 107,800 107,800 - - 750,000 750,000 1,500,000 1,500,000 - - FloorFloor area (sq. areameters) (sq. meters) 8,4008,400 7,0007,000 Number of employees Number of employees 36 36 66 66 6 6,0706,070 930 930 8,000 8,000 Sundries (£) (£) Sundries 700 700 6 - - - - - - - - 1,400 1,400 12 12 4,000 4,000 The proportion of work carried outthe byservice the service departments The proportion of work carried out by departments is: is: Departments Departments A A B B Catering Catering Repairs Repairs Repairs Repairs (%) (%) 75 75 25 25 - - - - Catering Catering (%) (%) 29 29 65 65 6 6 - - The company calculates the overhead absorption for department on basis of machine hours The company calculates the overhead absorption rate rate for department A onA basis of machine hours and and for for department the basis of labor department B on B theonbasis of labor hourshours REQUIRED: REQUIRED: (a) Overhead Analysis (a) Overhead Analysis SheetSheet (b) Overhead Absorption for both department A B. and B. (b) Overhead Absorption RatesRates for both department A and ! ! ! OMAIR MASOOD ! CEDAR COLLEGE 49 Accounts+–+9706++ AS+–+Level++ + + + + + + ++++++++++++OMAIR+MASOOD+ ! Q2! Q6. 3 10 Highlander Limited has two production departments, Machining and Assembling, and one service department, Maintenance. The following estimates had been made for year 1. Annual budgeted information Machining Number of employees Assembling Maintenance Total 160 120 120 400 7 000 5 000 4 000 16 000 Power (kilowatt hours) 70 000 52 500 17 500 140 000 Direct machine hours 14 000 400 - 14 400 1 000 6 000 - 7 000 Floor area (square metres) Direct labour hours $ Indirect material $ $ 300 268 320 888 2 720 1 480 860 5 060 52 000 48 000 - 100 000 Indirect wages Value of machinery $ Annual budgeted overheads Rent Machinery depreciation Power Supervision of employees Indirect materials Indirect labour Total overheads $ 12 800 10 000 7 200 6 400 888 5 060 42 348 ! ! 11 REQUIRED (a) Apportion the budgeted overheads to the three departments and re-apportion the maintenance department costs to the two production departments on the basis of the value of machinery. ! Overhead Analysis Sheet ! Overheads Basis of Apportionment Additional information 12 Machining Assembling Maintenance Totals $ $ $ $ The Machining department overhead absorption rate is applied on a machine hour basis. The Rent Assembling department overhead absorption rate is applied on a direct labour hour basis. floor area © UCLES 2015 9706/21/O/N/15 REQUIRED Machinery value of depreciation machinery (b) Calculate overhead absorption rates for each of the two production departments. Calculations should be to two decimal places. Power kw hours ! (i) Machining department Supervision of number of employees employees ! Indirect materials allocated ! Indirect labour allocated OMAIR MASOOD ! ! (ii) Assembling department re-apportionment of maintenance department overheads CEDAR COLLEGE ! [3] 50 2! Accounts+–+9706++ AS+–+Level++ + + + + + + ++++++++++++OMAIR+MASOOD+ Q3! Q7. 12 Kapoor Limited is a company which has two production departments, machining and finishing, and two service departments, maintenance and canteen. The following information is available. 3 The forecast overheads for the year ending 31 March 2015 were as follows. $ 32 000 28 400 28 000 26 000 11 000 9 000 Power Machine depreciation Supervision Rent and rates Buildings insurance Light and heat The following additional information is available. Number of employees Floor area (square metres) Net book value of machinery ($) Kilowatt hours Maintenance department hours Machining 16 12 000 140 000 6 000 66% Finishing 24 14 000 25 000 3 000 34% Maintenance 8 3 000 13 000 2 000 – Canteen – 1 000 2 000 1 000 – ! ! ! 13 REQUIRED (a) Apportion the forecast overheads to the four departments and re-apportion the service departments’ costs to production departments using a suitable basis for each. Basis Total $ Machining 14 $ Finishing $ Maintenance $ ! Canteen $ Additional information Power The following information for the year is also provided. Machine Machining Finishing 14 depreciation 8 000 Budgeted machine hours 58 000 000 42 000 Budgeted direct labour hours 26 Additional information Supervision Maintenance 4 000 12 000 Canteen – – ! The following information for the year is also provided. REQUIRED ! Rent and rates Machining Finishing Maintenance Canteen to two (b) Calculate an appropriate overhead absorption rate for each production department 8 000 4 000 – Budgeted 58 000 decimalmachine places. hours ! 42 000 12 000 – Budgeted direct labour hours 26 000 Buildings insurance REQUIRED Light heat an appropriate overhead absorption rate for each production department to two (b) and Calculate decimal places. ! Total apportioned ! overheads © UCLES 2015 9706/22/M/J/15 Reapportionment of canteen Additional information Subtotal [4] The actual results for the year ended 30 March 2015 were as follows. Reapportionment OMAIR MASOOD maintenance ! ofAdditional information Factory overheads ! COLLEGE Machining Finishing CEDAR $56 980 $82 436 41 295 Direct labour hours 27 410 Total The actual results for thehours year ended 30 March 2015 were as follows. 7 310 Direct machine 56 120 REQUIRED Machining Finishing [4] 3! 51 4 ABSORBTION)COSTING)(WORKSHEET)3)) ) ) 12 Q1.) Q8. Bruna Limited is a manufacturing company. It operates three production departments and two service departments. The costs are allocated to each department as follows: Production departments Machining $ 253 000 205 000 Indirect labour Other indirect overhead costs Assembly $ 290 000 90 000 Finishing $ 340 100 225 000 Service departments Stores $ 52 000 88 000 Canteen $ 78 000 92 000 The service departments costs are allocated to the production departments as follows: Stores in proportion to the number of stores requisitions Canteen in proportion to number of employees. The following information is available: Machining 15 000 45 000 5 6 300 Direct labour hours Machine hours Number of employees Number of stores requisitions Assembly 60 000 30 000 6 4 500 13 ! !REQUIRED Finishing 40 000 25 000 9 7 200 ! (a) Calculate, to two decimal places, a suitable overhead absorption rate for each of the three production departments. ! ! ! ! 14 Additional information Bruna Limited has been approached by a customer to quote for one of their products. This will require the following: Direct materials Direct labour 20 kilos at $5 per kilo 10 hours at $9 per hour Direct labour hours and machine hours required in each department will be: Direct labour hours Machine time Machining 5 2 hours Assembly 3 30 minutes Finishing 2 20 minutes It is the company’s practice to achieve a gross margin of 40% on all its products. REQUIRED (b) Calculate the total price to quote to the customer. ) ) ) ) © UCLES 2016 OMAIR MASOOD ! 9706/22/M/J/16 CEDAR COLLEGE 52 Q2. Q9. A manufacturing business owned by Gui Boratto has three production departments: machining, assembly and finishing. The following are the expected expenses for the forthcoming year. $ 13,200 Rent and rates 60,000 Depreciation of machinery 30,000 Supervisors salary 15,000 Machinery insurance The following departmental information is available: Floor area (sq. m) Value of machinery Number of employees Machining Assembly 50 300 $600,000 $24,000 6 6 Finishing 400 $36,000 3 All employees work a 40 hour week for 45 weeks per year. REQUIRED: (a) Calculate the overhead absorption rate for each department, based on direct labour hours. Gui Boratto has received an order from Y Ltd. The order will require following direct cost Direct Material 60 kilograms @ $12 per Kilogram. Direct Labor Machining 3 hours @ $11 per hour Assembly 5 hours @$13 per hour Finishing 2 hours @$14 per hour (b) Calculate the total cost of the order. ) OMAIR MASOOD CEDAR COLLEGE 53 ABSORBTION)COSTING)(WORKSHEET)4)) ! Q1.! Q10. ! 3 PAGE 274 10 PAGE 275 Tattersall Ltd manufactures a single product.11They have two production and two service departments. For Examiner’s Use For Examiner’s Use (b) Calculate the overhead absorption rate for each production department. The following information relates to a four-week period. State the bases used. Production Departments Service Departments Show your answer to two decimal places. Machining Assembly Maintenance Canteen Overheads $143 500 $154 700 $165 800 $176 900 .......................................................................................................................................... Direct machine hours 18 845 14 050 – – .......................................................................................................................................... Direct labour hours 6 065 20 350 – – .......................................................................................................................................... The service departments’ overheads are apportioned to the production departments on the following basis: .......................................................................................................................................... Machining Assembly Canteen .......................................................................................................................................... Maintenance 60% 30% 10% Canteen 40% 60% – .......................................................................................................................................... .......................................................................................................................................... REQUIRED PAGE 275 .......................................................................................................................................... (a) Prepare an overhead absorption apportionment table clearly showing the reapportionment 11 of the service departments’ overheads to the appropriate departments for one period. .......................................................................................................................................... ! (b) Calculate the overhead absorption rate for each production department. For .......................................................................................................................................... Examiner’s .......................................................................................................................................... Use State the bases used. .......................................................................................................................................... ................................................................................................................................... [8] Show your answer to two decimal places. ! .......................................................................................................................................... The manager of Tattersall Ltd calculates selling price per unit based on full cost plus a 25% .......................................................................................................................................... mark-up. .......................................................................................................................................... .......................................................................................................................................... The costs per unit are: .......................................................................................................................................... .......................................................................................................................................... Materials 3 metres at $4 per metre .......................................................................................................................................... Labour 7 hours at $8 per hour .......................................................................................................................................... .......................................................................................................................................... Each unit takes 3 hours in the machining department and 4 hours in the assembly .......................................................................................................................................... department. .......................................................................................................................................... All overheads are fixed. .......................................................................................................................................... ! .......................................................................................................................................... .......................................................................................................................................... REQUIRED PAGE 276 .......................................................................................................................................... 12 .......................................................................................................................................... (c) Calculate the full cost per unit. .......................................................................................................................................... (d) .......................................................................................................................................... Calculate the selling price per unit. ! .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... ................................................................................................................................... [8] .......................................................................................................................................... .......................................................................................................................................... The manager of Tattersall Ltd calculates selling price per unit based on full cost plus a 25% .......................................................................................................................................... .......................................................................................................................................... mark-up. .......................................................................................................................................... ................................................................................................................................... [3] .......................................................................................................................................... OMAIR MASOOD CEDAR COLLEGE The costs per unit are: ................................................................................................................................... [8] (e) Calculate the number of units Tattersall Limited has to produce and sell in each period .......................................................................................................................................... Materials 3 metres at $4 per metre to break-even. © UCLES 2011 9706/21/O/N/11 Labour 7 hours at $8 per hour ................................................................................................................................... [5] .......................................................................................................................................... ! For Examiner’s Use 54 Q2. 16 Q11. 4 Rajesh is a manufacturer with a trading year end of 31 December. He currently uses absorption costing. The business operates two production cost centres and two service cost centres. Details of these cost centres and the budgeted overhead costs for the whole business for the year ended 31 December 2015 are as follows: Overhead Depreciation Machinery maintenance Power Rent of premises $ 8 750 27 000 15 370 63 510 Basis of apportionment Non-current assets at cost Machine hours Kilowatt hours Floor area The following information is also available: Floor area (square metres) Kilowatt hours Non-current asset at cost ($) Stores requisitions Staff Direct labour hours Machine hours Production cost centres Service cost centres Machining 750 3 750 90 000 150 20 2 300 14 100 Stores 150 750 12 000 3 - Assembly 500 2 500 30 000 75 30 13 900 2 650 Canteen 50 250 8 000 - REQUIRED (a) Apportion the overhead costs to the four cost centres and re-apportion the service cost centres costs to production cost centres using a suitable basis. Total $ Production cost centres Machining Assembly $ $ Service cost centres Stores Canteen $ $ Depreciation Machinery maintenance Power Rent of premises Re-apportionment of canteen Re-apportionment of stores Total overhead cost 17 [8] ! 9706/23/O/N/16 rates for each production cost centre correct to two (b) Calculate suitable overhead absorption decimal places. © UCLES 2016 OMAIR MASOOD CEDAR COLLEGE ! 55 Q3. Q12. Spurway manufactures two types of surfboard; ‘Winner’ and ‘Surf King’ whole selling prices are $300 and $900 respectively. Each surfboard passes through two manufacturing departments, Moulding and Finishing. In Moulding, each ‘Winner’ requires 3 hours of labour and each ‘Surf King’ 9 hours. In Finishing each ‘Winner’ requires 2 hours of labour and each ‘Surf King’ 5 hours. Labour in Moulding is paid $4 per hour and in Finishing $5 per hour. The surfboards are made from fiberglass, studs and cord. The quantities of materials used in making one unit are as follows: ‘Winner’ Fiberglass 40 kilos Studs 10 Cord 20 meters ‘Surf King’ 90 kilos 240 75 meters Material prices are $3 per kilo for fiberglass, $7.20 per dozen for studs and $0.60 per meter for cording. (Note: one dozen = 12 studs) Other annual costs are as follows: Indirect wages – Indirect materials – $ Moulding Dept. 75,000 Finishing Dept. 120,000 Stores 60,000 Canteen 30,000 Moulding Dept. 154,530 Finishing Dept. 175,515 Stores Canteen $ 285,000 4,025 25,150 359,220 450,000 Rent and rates Depreciation on plant and machinery 420,000 150,000 Power Building insurance & heat & light 25,500 1,969,720 OMAIR MASOOD CEDAR COLLEGE 56 Other information is as follows; Cost centre Area in sq. meters Book Value of plant & machinery $000 Horsepower of plant & machinery Direct Labour hours Number of employees Moulding Dept. 10,000 1,000 70% 330,000 hours 200 Finishing Dept. 5,000 200 30% 210,000 hours 150 10,000 150 - - 50 5,000 50 - - 25 30,000 1,400 100% 540,000 hours 425 Stores Canteen Number of Stores notes issued 10,000 5,000 15,000 REQUIRED: (a) A production overhead analysis and apportionment schedule, showing the bases of your apportionment. Allocate the costs of the service departments to the production departments. (b) Calculate overhead recovery rates for the Moulding and Finishing departments, on the basis of direct labour hours. (c) Calculate the full cost of making one unit of each product. ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! OMAIR MASOOD CEDAR COLLEGE 57 (a) Explain what is meant by ‘batch costing’. 14 Q4.! Q13. 4 Anna has a manufacturing business with two production departments and two service [2] departments. She makes circuit boards for electronic games using batch costing. Additional REQUIREDinformation ! The budgeted annual data for Anna is available: (a) following Explain what is meant by ‘batch costing’. Production departments Assembly Machining $36 000 $50 000 6 000 3 500 2 500 5 500 Overheads Direct labour hours Machine hours Service departments Stores Canteen $6 250 $2 500 – – – – The following information is also available: [2] Assembly Machining Additional information Number of orders 800 1200 Use of canteen 65% The following budgeted annual data for Anna is 25% available: Overheads REQUIRED REQUIRED REQUIRED Direct labour hours ! (b) Machine hours Re-apportion the 15 Production departments 15 15 Assembly Machining $36 000 $50 000 ! 6 000 3 500 2 500 5 500 service departments’ costs Stores – 10% Service departments Stores Canteen $6 250 $2 500 – – ! – – to the production departments using a suitable (b) using a suitable (b) Re-apportion Re-apportionthe theservice servicedepartments’ departments’costs coststotothe theproduction productiondepartments departments using a suitable basis for each. basis for The following information is also available: basis foreach. each. Number of orders Use of canteen Assembly Machining Stores Assembly Assembly Machining Stores Assembly Machining Machining Stores – 800 1200 $$ !! $!$! $! $! $!$! 65% 25% Allocated overheads 36 000 Allocated overheads 36000 000 36 0005050 000 Allocated overheads 10% 6250 6250 50 000 Stores Canteen Canteen $! $! $! Canteen $! 2500 2500 6250 2500 Re-apportionment ofof Re-apportionment Re-apportionment of canteen canteen canteen Subtotal Subtotal Subtotal Re-apportionment Re-apportionmentofof stores stores Total Total Re-apportionment of stores Total © UCLES 2017 ! 9706/21/O/N/17 [3] ! [3] (c) Calculate a suitable overhead absorption rate for each production department to two (c) Calculate a suitable overhead absorption rate for each production department to two decimal places. ! decimal places. ! [3] (c) Calculate a suitable overhead absorption rate for each production department to two ! decimal places. ! © UCLES 2017 9706/21/O/N/17 [4] [4] OMAIR MASOOD CEDAR COLLEGE 58 [4] Q14. Hazydaze Limited has calculated following Overhead Absorption Rates for its two production departments. Cutting : $7 per Machine Hour Finishing : $12 per Labor Hour During the year an order was received which will require the following. Material: 60 Kgs of Plastic @ $10 per kg 10 Kgs of Steel @$16 per kg Labor: 30 hours in cutting@$20 per hour 50 hours in Finishing@$18 per hour Machine Hours: 80 hours in Cutting 5 hours in Finishing Other Direct Production Cost : $320 Selling and Admin : 10 % of total cost of production Required: (a) Prepare a Job order cost sheet to show total cost of the order (b) If a markup of 20% is required calculate the selling price of the order OMAIR MASOOD CEDAR COLLEGE 59 Q15. Mr Lakha is into construction business. He has to quote the selling price for this new order received from Mr Max. The order will require the following direct cost and timing Direct Materials Cement Steel Others Direct Labor Department A Department B Direct Production Expense Machine hours Department A Department B 400 Kg @ $40 per Kg 800 Kg @ $250 per kg $1700 600 hours @$20 per hour 700 hours @$30 per hour $4000 1200 hours 200 hours Mr Lakha has already calculated overhead absorbtion rates for two departments as follows . Department A : $35 per machine hour Department B : $50 per labor hour. Mr lakha also absorbs the selling and admin overheads on the basis of 10 % of cost of production. A final 30% markup is added to total cost to arrive at the selling price. Required: (a) A Job order cost sheet in as much detail as possible clearly showing prime cost , cost of production and total cost (b) Calculate the Selling price to be quoted to Mr Max OMAIR MASOOD CEDAR COLLEGE 60 & PAPER&2&QUESTIONS! ! & Q1.& & Q16. 4 & Q1.& & & PAPER&2&QUESTIONS! 5 Coalbrook Engineering has estimated the following factory indirect costs for its next financial year. £5 Indirect wages 1 480 500 4 Coalbrook Engineering has estimated the following factory indirect costs for its next financial year. Repairs and maintenance 241 400 Rent and rates 48£000 Insurance ofwages premises 23 400 Indirect 1 480 500 Insurance of and machinery 18 600 Repairs maintenance 241 400 Rent andof rates 48 000 000 Depreciation machinery 12 Insurance of premises 23 600 400 Heating and lighting 31 Insurance of machinery 18 250 600 Sundries 20 Depreciation of machinery 12 000 Heating and lighting 31 600 The company wishes to calculate a suitable overhead Sundries 20 250 absorption rate for each of its two production departments and the following information is available: The company wishes to calculate a suitable overhead absorption rate for each of its two production departments and the following information is available: Production Departments Service Departments Machining Finishing Production Departments Machine cost (£) 240 000 120 000 Machining Finishing DirectMachine machine hours 209 000 8 800 cost (£) 240 000 120 000 DirectDirect labour hours hours 42 000 180 000 machine 209 000 8 800 Floor Direct area (square metres) 742 000 3 000 500 labour hours 000 180 Number of area employees 42 Floor (square metres) 770 000 3 500 Number 70 42 Sundries (£) of employees 6 110 3 564 Sundries (£) 6 110 3 564 Canteen Stores Service Maintenance Departments – 40 000 – Canteen Maintenance Stores – 2 200 – – 40 000 – – – – 2 200– – 1– 400 – 700 – 1 400 7 1 400 7 700 14 1 400 7 14 7 5 155 3 675 1 746 3 675 1 746 5 155 The proportion of work done by service departments is: The proportion of work done by service departments is: Canteen (%) (%) Canteen Maintenance (%) (%) Maintenance Stores Stores (%) (%) Machining Machining 5050 8080 6060 Finishing Finishing 40 40 20 20 30 30 Canteen Canteen – – – – – – Maintenance StoresStores Maintenance 4 6 6 4 – – – – 10 10 – – REQUIRED REQUIRED (a)* For Coalbrook Engineering, calculate, using appropriate bases, the overhead absorption rate (a)* For Coalbrook calculate, using appropriate bases, the overhead absorption for each of Engineering, the two production departments. [21] rate for each of the two production departments. [21] (b) For Coalbrook Engineering, calculate the production cost of job 1912 (where appropriate to two decimalEngineering, places), using calculate the following (b) For Coalbrook theinformation: production cost of job 1912 (where appropriate to two decimal places), using the following information: Direct materials (£) Direct labour (£) DirectMachine materials (£) hours DirectLabour labourhours (£) & & & & & & & & (c) & & (d) & & Machine hours Labour hours Machining 320 Machining 130 32010 130 5 10 5 Finishing 70 Finishing 50 70 4 50 8 4 8 [4] (c) Explain why a business might recover less in overheads than the amount spent on overheads during a period. [4] & [4] & Explain why a business might recover less in overheads than the amount spent on overheads (d) Activity based costing is sometimes used as an alternative to traditional methods of overhead duringabsorption. a period.Explain two limitations of activity based costing. [4] [4] Activity based costing is sometimes used as an alternative to traditional methods of overhead Total marks [33] absorption. Explain two limitations of activity based costing. [4] F014/RB Jun10 © OCR 2010 Total marks [33] © OCR 2010 ! F014/RB Jun10 ! OMAIR MASOOD CEDAR COLLEGE 61 $60 Limited manufactures toy soldiers. The company has three Cleary 1 B $70 C production departments (moulding, sanding and painting) and two !D $80 departments (canteen and maintenance). service Total: 7 marks Required a Explain the following terms: Q2.& Structured questions Q17. & i cost centre marks] three 1 Cleary Limited manufactures toy soldiers. The company has[2 production (moulding, sanding and painting) and two unit. ii cost departments service departments (canteen and maintenance). [1 marks] Required Additional information Explain the following terms: a centre cost i Estimated indirect overheads for the year ended 30 April 2016 are as [2 marks] follows: unit. ii costinformation Relevant on the five departments is as follows: Relevant information on the five departments is as follows: & & [1 marks] Additional information Estimated indirect overheads for the year ended 30 April 2016 are as follows: & ! & Canteen costs are shared among all the other departments on the ! basiscosts of number of employees. costs are shared Canteen are shared among allMaintenance the other departments on the among three production departments on thecosts basisare of floor area. basisthe of number of employees. Maintenance shared among the three production departments on the basis of floor area. Required ontable the five departments as follows: b Relevant Completeinformation the following to show the total is overheads Required apportioned to each production department. Relevant information ontable the five departments as follows: the following to show the total is overheads b Complete apportioned to each production department. Relevant information on the five departments is as follows: ! Canteen costs are shared among all the other departments on the basiscosts of number of employees. costs are on shared Canteen are shared among allMaintenance the other departments the among production departments on thecosts basisare of floor area. basisthe of three number of employees. Maintenance shared among the production departments on the basis of floor area. & three Required & b Complete the following table to show the total overheads Required apportioned to each production the following table to showdepartment. the total overheads b& Complete [10 marks] (a) Overheadto Analysis Sheet apportioned each production department. & Canteen costs are shared among all the other departments on the [10 marks] & & Additional basis of information number of employees. Maintenance costs are shared among the information three production departments on the basis of floor area. Additional & & The following table shows the budgeted hours for each production cost centre forshows the year 30 April 2016: The& following table theended budgeted hours for each production Required cost& centre for the yearthe ended 30 April 2016: following table to show the total overheads b Complete & &! & & apportioned to each production department. Required Required (b) c Calculate to two decimal places a suitable overhead absorption c Calculate to two places a suitabledepartments overhead absorption rate for eachdecimal of the three production for the year rate for each 30 of the production departments for the year ending Aprilthree 2016. [10 marks] ending 30 April 2016. [6[10 marks] marks] & [6 marks] ! Additional information Additional information Additional information To make one toy soldier requires direct material of $50. This table The following table shows budgeted hours each production To make onethe toyfollowing soldier requires direct material offor $50. This table shows timesthe and direct costs also required: costthe centre for the yearand ended 30 costs April 2016: shows following times direct also required: OMAIR MASOOD Required CEDAR COLLEGE [10 marks] 62 Required c Calculate to two decimal places a suitable overhead absorption rate for each of the three production departments for the year ending 30 April 2016. [6 marks] Additional information To make one toy soldier requires direct material of $50. This table shows the following times and direct costs also required: The company budgets to make a margin of 40% on each toy soldier. The Company budgets to make a profit markup of 40%. Required d (b) Calculate the the budgeted selling of soldier. one toy soldier. Calculate selling price of price one toy [6 marks] & & & ! OMAIR MASOOD CEDAR COLLEGE 63 ! ABSORPTION*COSTING*(WORKSHEET*7)* PAGE 506 ABSORBTION)WORKSHEET)6)) Q1.* Q18 ) Q1.) 9 Argon is a manufacturing business divided into three separate departments, machining, finishing and stores. 3 For Examiner's Use The total estimated costs for the three months ending 31 October 2013 are as follows: Depreciation of plant Lighting and heating Plant insurance Rent Supervision $ 6 000 4 500 4 800 18 000PAGE 507 25 000 10 The following information is available for the 508 three departments: PAGE (ii) Re-apportion stores costs to each production department on the basis of the 11 number of orders. Machining Finishing Stores Floor area (sq metres) 5000 4500 500 Actual figures for the three months ended 31 October 2013 are: Number of employees 12 8 5 Value of plant ($000’s) 86 8 2 Machining Finishing Number of orders from Stores 3600 1480 Direct labour hours 1 430 5 000 BudgetedMachine machinehours hours 42506 000 820 805 BudgetedOverheads direct labour hours 1200 4950 incurred $48 340 $22 780 REQUIRED REQUIRED For Examiner's Use For Examiner's Use PAGE 507 (i) Apportion the costs to the three departments using the mostdepartment suitable basis. Clearly (c)(a)Calculate the amount of overhead absorbed production for the 10 for each state the basis31you have used. three months ended October 2013. [5] (ii) Re-apportion stores costs to each production department on the basis of the number of orders. ! (b) Calculate to two decimal places the forecast overhead absorption rate for the PAGE 508 machining and finishing departments for the three months ending 31 October 2013. ! 11 ! For Examiner's Use !!! Actual figures for the three months ended 31 October 2013 are: Direct labour hours Machine hours Overheads incurred Machining 1 430 6 000 $48 340 For Examiner's Use Finishing 5 000 805 $22 780 REQUIRED [5] (c) Calculate the amount of overhead absorbed for each production department for the [6] three months ended 31 October 2013. ! (b) Calculate to two decimal places the forecast overhead absorption rate for the machining and finishing departments for the three months ending 31 October 2013. !!!! 509 for each production department. (d) Calculate the amount of under or overPAGE absorption ! [6] 12 !!!! (e) Explain what is meant by over and under absorption of overheads and how each will arise. * * * * * * © UCLES 2013 [5] ! For Examiner's Use * [4] [6] [Turn over 9706/23/O/N/13 [6] (d) Calculate the amount of under or over absorption for each production department. OMAIR MASOOD CEDAR COLLEGE [4] [Total: 30] 64 * Q2.* Q19 6 Q2.( Q4. 4 JAR plc has estimated the following factory indirect costs for its next financial year. £ Indirect wages 900 000 Repairs and maintenance of machinery 150 000 Canteen 62 000 Insurance of machinery 41 000 Insurance of premises 32 000 Depreciation of machinery 30 000 Heating and lighting 38 000 12 500 Consumables 1 265 500 The management accountant wishes to calculate a suitable overhead absorption rate for each of the two production departments and the following information is available: Production Departments Service Departments Machining Assembly Maintenance Canteen Machine cost (£) 300 000 100 000 – – Direct machine hours 380 000 20 000 – – Direct labour hours 50 000 250 000 – – Premises area (square metres) 10 800 9600 2400 1200 (b) Appropriate Overhead Absorption Rate for Each production department ( 4 Marks) Number of employees Consumables (£) 75 96 20 9 6200 3490 1600 1210 The proportion of work carried out by the service departments is: Machining Assembly Maintenance Canteen Maintenance (%) 80 20 – – Canteen (%) 40 45 15 – The actual results for the year were as follows: Machining Assembly Factory indirect costs (£) 690 000 577 000 Direct machine hours 370 000 19 600 52 000 260 000 Direct labour hours ( ( REQUIRED REQUIRED:( © OCR 2013 ( 7 F014/01/RB Jan13 (a) The overhead absorption rate for each of the production departments, using the machine hour (a) Overhead Sheetdepartment showing both and Secondary Apportionment ( 18 Marks) [20] rate for Analysis the machining andPrimary the labour hour rate for the assembly department. ( ( (b) Using the actual figures provided, calculate the amount of overhead which would be over or under [6] (b) Appropriate Absorption Rate for Each production department ( 4 Marks) absorbedOverhead by each production department. ( (c) Using the actualhow figures calculate therate amount of over or under absorption both production (c) Discuss an , inaccurate of overhead absorption caninadversely affect the profits of a departments. business. ( 5 Marks) [9] ( ( (d) Discuss how an inaccurate overhead absorption can adversely affect the profits of the business. ( 3 Marks) ( ( * * * * * OMAIR MASOOD Total marks [35] CEDAR COLLEGE 65 ( ( ABSORBTION(COSTING(( ABSORBTION(COSTING(( Q3.) Q20. Q1.(On 1 July 2001 Belo Ltdacquires acquires another another factory to to expand its its Q1.(On 1 July 2001 Belo Ltd factoryininorder order expand $ production capacity. This factory has three production departments: moulding, production capacity. This factory has three production departments: moulding, assembly paint shop. Thereisisalso also aa service service department: stores. TheThe accountant assembly and and paint shop. There department: stores. accountant must apportion the overheads of the factory to the three production departments. must apportion the overheads of the factory to the three production departments. Table gives details of the departments and the budgeted overhead expenses for the six Table gives details of the departments and the budgeted overhead expenses for the six months to 31 December 2001 together with data for Product Q.( months to 31 December 2001 together with data for Product Q.( Department statistics for six months ending 31 December 2001 Department statistics for six months ending 31 December 2001 Stores Production Departments Production Departments Moulding Moulding Area in sq. meters AreaMachinery in sq. meters at cost Machinery at cost No. of workers 8000 6000 $80,000 8000 $40,000 700 30 Paint shop Assembly 6000 $80,000 30 No.workers of store requisitions No. of Assembly Paint shop 5000 5000 $20,000 $40,000 40 $20,000 20 500 40 30020 Budgeted overheads for six months to 31 December 2001 No. of store requisitions Stores 700 500 $ Budgeted overheads for six months to 31 December 2001 1000 - 1000 10 10 300 Rent 90,000 Lighting & heating 23,000 $ Rent Insurance of premises Lighting & heating Canteen costs Insurance of premises 90,000 6,000 23,000 54,000 6,000 Machinery is to be depreciated at 30% per annum on cost. All workers will work 35 hours per week and there will be 24 working weeks in the 54,000 Canteen costs six months to 31 December 2001. Machinery is to be depreciated at 30% per annum on cost. Product Q passes through all three departments in the course of manufacture and the All workers will workdepartments 35 hours is: per week and there will be 24 working weeks in the time taken in each six months to 31 2001.1¾ hours; paint shop 1½ hours. Moulding 2¼ December hours; Assembly Product QREQUIRED: passes through all three departments in the course of manufacture and the time taken(a)in Prepare each departments is: the apportionment of the factory overheads to the a table to show Moulding 2¼production hours; Assembly 1¾for hours; paint shop hours. 2001. departments the six months to 1½ 31 December (b) Calculate for each production department an hourly overhead rate. (Your REQUIRED: calculations should be to three decimal places.) (a) Prepare a table to show the to apportionment ofunit theoffactory to the (c) Calculate the total overhead be added to each Productoverheads Q. production departments for the six months to 31 December 2001. $ (b) Calculate for each production department an hourly overhead rate. (Your $ calculations should be to three decimal places.) $ (c) Calculate the total overhead to be added to each unit of Product Q. $ $ $ OMAIR MASOOD CEDAR COLLEGE $ 66 Required ! e Advise the directors whether or not they should change to a single overhead absorption rate for the factory. Justify your answer. [5 marks] & Q3.& Q21. Total: 30 2 Auckland (Manufacturers) Limited has two manufacturing departments: i machining ii assembly. It also has two service departments: i maintenance ii power house. The budgeted information in the table below is available for the coming year: Further information is also available as follows: & Required a Complete the following table to analyse the above indirect costs between the four departments showing the bases of apportionment you have used. Required a Complete the following table to analyse the above indirect costs between the four departments showing the bases of apportionment you have used. [5 marks] b Complete the following table to reapportion the costs of the service departments over the two production departments using appropriate bases. & & [5 marks] ! OMAIR MASOOD CEDAR COLLEGE b Complete the following table to reapportion the costs of the service departments over the two production departments using [3 marks] appropriate bases. c Calculate to two decimal places a suitable overhead absorption & & 67 ! [3 marks] c Calculate to two decimal places a suitable overhead absorption rate for each production department. Explain the the difference overhead [4 marks] dd Explain difference between betweenoverhead overheadallocation allocationand and overhead apportionment. apportionment. [4[4 marks] & marks] Additional information information Additional & & The actual data for Auckland (Manufacturers) Limited for the year The actual data for Auckland (Manufacturers) Limited for the year was: was: Required Required e Explain what is meant by over-absorption of overheads? e Explain what is meant by over-absorption of overheads?[3 marks] [3 marks] f Calculate the over- or under-absorption of overheads for each department. the over- or under-absorption of overheads for each f Calculate 4 department. [4 marks] 4 [4 marks] Additional information Total for this question: 54 marks Q22. Additional information Total for 54 marks The company manufactures a single product in batches of this 100.question: The 3 cost of manufacturing a batch has been calculated at $9 500. The The company manufactures a singleThe product in batches of 100. The Ltdnormally manufactures one the product. following information relates to the two 3 Jameson directors mark-up cost by 30% to arrive at a selling price. cost of manufacturing a batch has been calculated at $9 500. The Jameson Ltd manufactures one product. The following information relates to the two production and two service departments for one four-week period. productionnormally and two service departments forby one30% four-week period. Required directors mark-up the cost to arrive at a selling price. g Calculate the budgeted selling price of a single unit of product. Production departments Service departments Required Production departments Service departments [2 marks] Machining Assembly Maintenance Canteen selling price of a single unit of product.Canteen g Calculate the budgeted & Machining Assembly Maintenance Overheads £143 500 £154 700 £165 800 £176 Overheads information £143 500 £154 700 £165 800 [2 marks] £176 900 900 & Additional machine 18 845 050 – Direct machinehours hours 18 845 1414 050 – – – & Direct A customer is willing to place an order for20300 units. However, they Additional information Direct labour hours 6 065 350 – – Direct labour hours 065 20 350 – – & want a discount of 20% on the usual selling price. The company has Acapacity customer is willing to place an order fordirectors 300 units. However, they todepartments’ manufacture the order, but the are unhappy & The The service departments’ overheads are apportioned to to thethe production departments on theon the service overheads are apportioned production departments want agiving discount of 20% on the usual selling price. The company has about a discount. following basis: & following basis: capacity to manufacture the order, but the directors are unhappy Required & about giving a discount. Machining Assembly Advise the directorsMachining whether or not they shouldCanteen accept the order Assembly Canteen & hMaintenance 60% 30% 10% Required 60% 30% 10% Canteen 40% 60% – & Maintenance or not they h Advise the directors whether Canteen 40% 60%should accept – the order & & REQUIRED & REQUIRED & (a) Prepare an overhead apportionment schedule apportioning the service departments’ overheads to the appropriate departments for one period. (8 marks) (a) an overhead apportionment schedule apportioning the service departments’ & Prepare to the appropriate departments for one period. (8 marks) & (b)overheads Calculate the overhead absorption rates for each production department. State the bases used and give a reason for each choice. (8 marks) & Calculate (b) the overhead absorption rates for each production department. State the bases ! used and give a reason for each choice. OMAIR MASOOD CEDAR COLLEGE The manager of Jameson Ltd calculates selling price per unit based on full cost plus a 25% mark-up. (8 marks) 68 The manager of Jameson Ltd calculates selling price per unit based on full cost plus a Themark-up. costs per unit are: 25% overheads to the appropriate departments for one period. (8 marks) (b) Calculate the overhead absorption rates for each production department. State the bases used and give a reason for each choice. (8 marks) The manager of Jameson Ltd calculates selling price per unit based on full cost plus a 25% mark-up. The costs per unit are: materials: 3 metres at £4 per metre; labour: 7 hours at £8 per hour. Each unit takes 3 hours in the machining department and 4 hours in the assembly department. All overheads are fixed. 5 Task 3 REQUIRED 5 5 Total for this task: 21 marks (c) Calculate the full cost per unit. (5 marks) Azhara Ltd produces a range of products. Task 3 Total for this task: 21 marks 5 Task 3 Total for this task: 21 marks (d) Calculate the selling price per unit. (3 marks) There are 2 production departments, assembly and finishing, and 1 service department, Azhara Ltd produces a range of products. maintenance. Azhara Ltd produces a range products. (e)3 Calculate theofnumber of units Jameson Ltd has to produce and sell in each period to 21 marks Task Total for this task: Q23. break even. (4 marks) There are 2 production departments, and finishing, and 1 service department, The are following budgeted information assembly isassembly available forfinishing, the departments for thedepartment, year ending There 2 production departments, and and 1 service Azhara Ltd produces a range of products. maintenance. 31 October 2010. maintenance. (f) Explain two limitations of break-even analysis. (4 marks) There are 2 production departments, assembly and finishing, and 1 year service department, The following budgeted information available for the departments the ending The following budgeted information is is available for the departments forfor the year ending Assembly Finishing Maintenance maintenance. October 2010. 3131 October 2010. Overheads £120 000 £340 000 £80 000 The following budgeted information is available for the departments for the year ending G/C28652/Jun08/ACC7 Assembly Finishing Maintenance Direct labour hours 36 000 62 000 – Finishing Maintenance 31 October 2010. Assembly Direct machine hours 48 000 51 000 –000 Overheads £120 000 £340 000 £80 Overheads £120 000 £340 000 £80 000 Assembly6262 Finishing Direct labour hours 000 000 – Direct labour hours 3636 000 000 –Maintenance The maintenance department overheads are apportioned to the production departments on the Direct machine hours 48 000£120 000 5151 000 Direct 000 – – £80 000 Overheads £340 000 department. basismachine of 60% tohours the assembly 48 department and 40%000 to the finishing Direct labour hours 36 000 62 000 – The maintenance department overheads are apportioned the production departments the The maintenance department overheads are apportioned to to the production departments onon the Direct machine hours 48 000 51 000 – basis of 60% to the assembly department and 40% to the finishing department. basis of 60% to the assembly department and 40% to the finishing department. REQUIRED The maintenance department overheads are apportioned to the production departments on the Calculate the overhead absorption rate for each production department. State the bases 0 8 REQUIREDbasis of 60% to the assembly department and 40% to the finishing department. REQUIRED used and give a reason for each choice. (12 marks) 0088 Calculate the overhead absorption rate forfor each production department. the bases Calculate the overhead absorption rate each production department.State State the bases REQUIRED used and give a reason for each choice. (12 marks) used and give a reason for each choice. (12 marks) The unit selling price of product Z is calculated at full cost plus 25%. Each unit has costs of £32 and requiresabsorption 2 machinerate hours and 1.5 labour hours. Calculate the overhead for each production department. State the bases 0 direct 8 used and give a reason each choice. The unit selling price of of product Zfor is is calculated at at fullfull cost plus 25%. unit has The unit selling price product Z calculated cost plus 25%.Each Each unit has (12 marks) costs of of £32 and requires 2 machine hours and 1.5 labour hours. direct costs £32 and requires 2 machine hours and 1.5 labour hours. REQUIREDdirect The unit selling price of product Z is calculated at full cost plus 25%. Each unit has Calculate the selling of and one requires unit of product Z. hours and 1.5 labour hours. (5 marks) 0 9 direct costsprice of £32 2 machine REQUIRED REQUIRED 0099 Calculate the selling price of of one unit of of product Z.Z. (5 marks) Calculate the selling price one unit product marks) REQUIRED It has been suggested to the financial director that he should base the selling (5 price on the cost obtained through using Activity Based Costing (ABC). Calculate the selling price of one unit of product Z. base the selling price (5 marks) 0It has 9 been suggested to to the financial director that hehe should It has been suggested the financial director that should base the selling price on the cost obtained through using Activity Based Costing (ABC). REQUIRED on the cost obtained through using Activity Based Costing (ABC). It has been suggested to the financial director that he should base the selling price onbenefits the costofobtained through using Activity Based REQUIRED Explain two using ABC compared with using theCosting current (ABC). method to calculate 1 0 REQUIRED 1 1 0 0 the selling price. OMAIR MASOOD CEDAR COLLEGE (4 marks) 69 Explain two benefits of using ABC compared with using the current method to calculate REQUIRED Explain two benefits of using ABC compared with using the current method to calculate the selling price. (4 marks) the selling price. (4 marks) Explain two benefits of using ABC compared with using the current method to calculate 1 0 the selling price.Turn over for the next task (4 marks) PAGE 564 564 PAGE 12 PAGE 564 12 Q2.! Q2.! Q24. !! Q2.! Q3.* 33 12 ! Chester manufactures clothing. clothing. The The work work takes takes place place in in three three production production departments departments –– Chester Limited Limited manufactures sewing and finishing. In In clothing. addition,The the work business has twoinservice service departments stores and 3 cutting, Chester Limited manufactures takeshas place three production departments –and cutting, sewing and finishing. addition, the business two departments –– stores maintenance. cutting, sewing and finishing. In addition, the business has two service departments – stores and maintenance. maintenance. The overheads for for the the year year ending ending 31 31 March March 2014 2014 were were as as follows: follows: The budgeted budgeted overheads The budgeted overheads for the year ending 31 March 2014 were as follows: $$ $ Indirect wages 185 400 400 185 Indirect wages 185 400 Rent and rates 38 500 500 38 Rent and rates 38 500 Power Power 32 600 600 32 32 600 Light and heat Light and heat 18 800 800 18 18 800 Machine depreciation Machine depreciation 73 700 73 73 700 700 Buildings Buildingsinsurance insurance 18 200 18 18 200 200 * The following The followinginformation informationisisavailable. available. Cutting Cutting Cutting Numberofofindirect indirectemployees employees Number Floor space(square (squaremetres) metres) Floor space Net bookvalue valueofofmachinery machinery($) ($) REQUIRED Net book REQUIRED Sewing Sewing Sewing 33PAGE 565 555 PAGE PAGE 565 565 13 000 13 13 666 000 55 000 000 000 000 86 000 000 86 000 64 64 000 64 000 000 Finishing Finishing Finishing Stores Stores Maintenance Maintenance Stores Maintenance 333 4 44 5 55 333000 000 000 333000 000 000 4 000 44000 000 12 12 000 12000 000 - -- 5 000 55000 000 Machine hours 40 000 50 000 000 - - a single overhead - (a) State oneadvantage advantageand and one one40 disadvantage to Chester44Limited using hours 000 50 000 Machine 000 50 000 000 000 ofof - aa single (a) State one disadvantage to disadvantage to Chester Chester4Limited Limited of using using single overhead overhead absorption rate. absorption rate. Direct labour hours 84 000 22 000 56 000 - Direct labour hours Raw Advantage material issues Raw Advantage material issues * * 84 000 000 22 22 000 000 56 56 000 000 75% 75% 75% 17.5% 17.5% 17.5% 2.5% 2.5% 2.5% -- -- -- 5% 5% 5% - Chester Limited uses a single overhead rate to absorb all overheads on a direct labour hour basis. Chester Limited uses a single overhead rate to to absorb absorb all all overheads overheads on on aa direct directlabour labourhour hourbasis. basis. ! ! ! ! Disadvantage Disadvantage PAGE 565 PAGE PAGE 565 13565 ! * !! 13 13 REQUIRED REQUIRED REQUIRED (a) State one advantage and one disadvantage to Chester Limited of using a single overhead absorption rate. (a) State State one and (a) one advantage advantage and one one disadvantage disadvantage to to Chester Chester Limited Limited of of using using aa single single overhead overhead ! [4] absorption rate. absorption rate. ! [4] Advantage [4]! ! !! ! Advantage Advantage !! (b) Calculate, correct to two decimal places, the overhead absorption rate for the year ending 31 Marchcorrect 2014. to (b) Calculate, (b) Calculate, correct to two two decimal decimal places, places, the the overhead overhead absorption absorption rate rate for for the the year yearending ending ! ! 31 March 2014. !! 31 March 2014. !! ! Disadvantage ! !! [1] Disadvantage ! 2014 ©!UCLES 9706/23/M/J/14 Disadvantage ! ! [1] © UCLES 2014 9706/23/M/J/14 [1] !! ! 2014 © UCLES 9706/23/M/J/14 !! * ! ! ! [4] * !! ! [4] !! CEDAR COLLEGE * OMAIR MASOOD [4] (b) Calculate, correct to two decimal places, the overhead absorption rate for the year ending * 31 March 2014. (b) Calculate, Calculate, correct * (b) correct to to two two decimal decimal places, places, the the overhead overhead absorption absorption rate rate for for the the year yearending ending 31 March 2014. 31 March 2014. * * 70 PAGE 566 14 ! Additional information The directors of Chester Limited are considering changing the basis for recovering overheads to calculate a separate overhead absorption rate for each production department. REQUIRED (c) Apportion the costs to the five departments and re-apportion the service departments’ costs to production departments using a suitable basis. Total $ Cutting $ Sewing $ Finishing $ Stores $ Maintenance $ Indirect wages Rent and rates Power Light and heat Machine depreciation PAGE 567 15 Buildings insurance (d) Calculate, correct to two decimal places, appropriate overhead absorption rates for each production department. Reapportion stores Reapportion maintenance PAGE 567 [10] ! 15 (d) Calculate, correct to two decimal places, appropriate overhead absorption rates for each production department. [6] ! ! Additional information The actual results for the year were as follows: Cutting Sewing Factory overheads $168 180 $146 320 $51 870 © UCLES 2014 Direct labour hours 9706/23/M/J/14 85 200 20 950 58 140 42 330 52 450 4 280 Direct machine hours Finishing [6] REQUIRED Additional information (e) Calculate the under- or over-absorption of overheads for each production department. ! The actual results for the year were asCEDAR follows: COLLEGE OMAIR MASOOD Cutting Sewing *! $ $ ! *! Cutting Sewing Finishing * ! Factory overheads $168 180 $146 320 $51 870 Finishing $ ! 71 * ABSORBTION)COSTING)(WORKSHEET)7)) ! Q25. Q1.) Q2.! The factory of Stamford Limited is organized into four cost centres. The company manufactures different types of industrial valves. At present, Stamford Limited uses a single production overhead absorption rate calculated by dividing total budgeted production overheads by total budgeted Direct labour hours . Given below are the budgeted costs and other data for the year ended 31 December 2000. Machine Production Direct Labour hours Overheads hours $ Cost centre A 900000 25000 60000 Cost centre B 840000 50000 70000 Cost centre C 495000 45000 5000 Cost centre D 310000 62000 30000 Actual costs and actual times relating to Job XY32, which was completed during October 2000. Machine Direct Direct Labour Direct Wages hours Materials hours $ $ Cost centre A 1200 350 150 100 Cost centre B 260 680 110 25 Cost centre C 175 180 30 Nil Cost centre D 290 240 35 30 Selling price are calculated by adding to price, cost production overheads based on the predetermined absorption rate, and then adding a mark-up of 40% to the total production cost. The newly appointed accountant at Stamford has suggested that if separate overhead absorption rates were calculated for each cost centre, it would provide a more accurate basis for determining job costs. REQUIRED: (a) Calculate the present overhead absorption rate based on the budgeted figures for the year ended 31 December 2000. (b) Using the rate calculated in (a) above, calculate the production overhead allocated to Job XY32, together with the total production cost and selling price for the job. (c) Comment on the proposal from the new accountant that calculating overhead production rates separately for each cost centre would result in more accurate job costing. (d) Assuming the accountant’s advice is followed; calculate suitable overhead absorption rates for each cost entre, stating in each case the basis you have used. (e) Using the rates calculated in (d) above, recalculate the total overhead to be applied to Job XY32, and also recalculate the total production cost and selling price for the job. ! ! ! OMAIR MASOOD ! CEDAR COLLEGE 72 ABSORPTION COSTING WORKSHEET 10 ABSORPTION COSTING WORKSHEET 10 10 ABSORPTION COSTING WORKSHEET ABSORPTION COSTING WORKSHEET 10 Q26. Q1. Q1. Innisfail Enterprises Ltd isLtd a manufacturing business. It currently absorbs its overheads usingusing the following Innisfail Enterprises is a manufacturing business. It currently absorbs its overheads the following methods. methods. Production Department A: Direct machine hourshours for Department A. A. Production Department A: Direct machine for Department Production Department B: Percentage directdirect labourlabour cost for B. B. Production Department B: Percentage costDepartment for Department Innisfail Enterprises Ltd had the following factory indirect costs costs for the 30 April Innisfail Enterprises Ltdestimated had estimated the following factory indirect foryear the ended year ended 30 April 2007.2007. $ $ 900,000 900,000 Indirect wageswages Indirect 200,000 200,000 Machinery repairs Machinery repairs 60,000 60,000 Machinery insurance Machinery insurance 180,000 180,000 Machinery depreciation Machinery depreciation 80,000 80,000 Premises insurance Premises insurance 220,000 220,000 Heat Heat and light and light 150,000 150,000 Catering Catering 19,000 19,000 Sundries Sundries The following additional information is available. The following additional information is available. Service Department Service Department Production Departments Production Departments A Machine cost (£) Machine cost (£) DirectDirect machine hourshours machine DirectDirect labourlabour hourshours DirectDirect labourlabour cost (£) cost (£) B A B Catering Catering Repairs Repairs 1,000,000 1,000,000 600,000 600,000 - - 600,000 600,000 20,000 20,000 - - 46,200 46,200 100,000 100,000 - - 750,000 750,000 1,400,000 1,400,000 - - FloorFloor area (sq. areameters) (sq. meters) 8,4008,400 Number of employees Number of employees 36 Sundries (£) (£) Sundries 7,0007,000 66 36 6,0706,070 66 930 930 700 700 6 6 8,0008,000 - - - - - - - - 1,4001,400 12 12 4,0004,000 The proportion of work carried out byout thebyservice departments is: is: The proportion of work carried the service departments Departments Departments A B A B Catering Catering Repairs Repairs Repairs (%) (%) Repairs 75 75 25 25 - - Catering (%) (%) Catering 29 29 65 65 6 6 OMAIR MASOOD CEDAR COLLEGE - - - - 73 REQUIRED: (a)Overhead analysis sheet REQUIRED: (b)Calculate the overhead recovery rate for each department. (a)Overhead analysis sheet (b)Calculate the overhead recovery rate for each department. The Factory has recently received an order which will require the following The Factory has recently received an order which will require the following Direct Material : 40 kgs @10 per kg Direct Labor : Direct Material : 40 kgs @10 per kg Dept A : 6 hours @12 per hour Direct Labor : Dept B : 8 hours @$14 per hour Dept A : 6 hours @12 per hour Machine Hours : Dept B : 8 hours @$14 per hour Dept A : 13 hours Machine Hours : Dept B : 2 hours Dept A : 13 hours Dept B : 2 hours (c) Caclualte the total cost of the order PAGE 358 (c) Caclualte the total cost of the order ABSORBTION)COSTING)WORKSHEET)8)) ABSORPTION*COSTING*(WORSKHEET*8)* 11 PAGE 358 ! ) ABSORPTION*COSTING*(WORSKHEET*8)* Q2. ABSORBTION)COSTING)WORKSHEET)8)) 11 Q1)) Q27. Q1.! ! Q2. Q1) Ltd uses one factory overhead recovery rate which 3 Wigmore Q1.! PAGE 359 For Examiner's Use For is a percentage of total direct labour costs. The rate is calculated from the following budgeted data. 3 Wigmore Ltd uses one factory overhead 12 recovery rate which is a percentage of total PAGE 359 direct labour costs. The rate is calculated from budgeted data.machine Department Factory Direct labour the following Direct labour Direct 12 (b) Prepare a detailed cost statement to calculate the selling overheads costs hoursprice for job 787. hours Department Factory Direct Direct labour Direct machine $ $ labour (b) Prepare a150 detailed to calculate the overheads hours hours Production 000 cost statement 500 costs 000 120selling 000 price for job7787. 000 $ $ Assembly 450 000 1 000 000 225 000 10 000 Production 7–000 Packing 360150 000000 900500 000000 200120 000000 Assembly 450 000 1 000 000 225 000 10 000 000the following 900information. 000 200 000 – ThePacking cost sheet for job 787360 shows The cost sheet for job 787 shows the following Department Direct labour Direct labourinformation. Direct machine Direct material costs hours hours costs Department Direct Direct labour Direct machine Direct $ labour $ material costs hours costs Production 2 400 400 80hours 180 Assembly 1 100$ 700 90 150 $ Production 2 400 Packing 1 000 650400 – 80 170180 Assembly 1 100 700 90 150 PAGE 360 PAGE 360 ) Packing 1 000 of 20% are13 650 to the total factory – 170 General administration expenses added cost. The selling 13PAGE 360 ) price 360 to the customer is based on a 25% PAGE net profit margin. ) 13 General administration expenses are added to the total factory cost. The selling Direct labour hour rate of 20% 13 ) price (ii) (ii) Direct labour hour rate to the customer is based on a 25% net profit margin. REQUIRED Direct labour hour (ii) (ii)Direct labour hour raterate Production Production REQUIRED (a) Calculate the current factory overhead rate for Wigmore Ltd. Production Production PAGE 359 ) (a) ) ) For Examiner's Use For Examiner's Use ) For For Examiner's Examiner's Use For Use For Examiner's Examiner's Use Use Calculate the current factory overhead 12 rate for Wigmore Ltd. ) PAGE 359 12 (b) Prepare a detailed cost statement to calculate the selling price for job 787. Assembly Assembly (b) Prepare a detailed cost statement to calculate the selling price for job 787. Assembly Assembly ) (c) Examiner's Use [6]) For Examiner's Use For [6] Examiner's Use ) Calculate the overhead rate for each department using the following methods: [3] ) )! ) ) ! (ii) !) the overhead rate forcost each department using the following methods: (c) (i) Calculate Percentage of direct labour PAGE 360 PAGE 360 Packing 13cost360 (i) Production Percentage of direct labour Packing 13PAGE PAGE 360 Packing Packing 1313 Production (ii) Direct labour hour rate Direct labour hour rate Direct labour hour (ii) (ii)Direct labour hour raterate Production Production !) (d) [3] ! For For Examiner's )[3] Examiner's Use For Use For [3] Examiner's )[3] Examiner's Use Use [3] ! ! Assembly Production Production Using the direct labour hour rates calculated in (c) (ii), prepare a detailed cost (d) Using the direct labour hour rates calculated in job (c) 787. (ii), prepare a detailed cost statement toAssembly calculate the new selling price for ) statement to calculate new hour selling price for job 787. (d) Using the directthe labour rates calculated in (c) (ii), prepare a detailed cost Using the direct labour hour rates calculated in job (c) 787. (ii), prepare a detailed cost statement to calculate the new selling price for ! ) (d) ) statement to calculate the new selling price for job 787. MASOOD CEDAR COLLEGE Assembly ! )OMAIR ) Assembly ! Packing !) !) Assembly ) Assembly ) ) !) ! ) !))!) ) ! ! 74! Packing ) [3] 5 Q28. 4 Coalbrook Engineering has estimated the following factory indirect costs for its next financial year. £ 1 480 500 241 400 48 000 23 400 18 600 12 000 31 600 20 250 Indirect wages Repairs and maintenance Rent and rates Insurance of premises Insurance of machinery Depreciation of machinery Heating and lighting Sundries The company wishes to calculate a suitable overhead absorption rate for each of its two production departments and the following information is available: Production Departments Machine cost (£) Direct machine hours Direct labour hours Floor area (square metres) Number of employees Sundries (£) Machining 240 000 209 000 42 000 7 000 70 6 110 Finishing 120 000 8 800 180 000 3 500 42 3 564 Service Departments Canteen – – – 1 400 7 3 675 Maintenance 40 000 2 200 – 700 14 1 746 Stores – – – 1 400 7 5 155 Canteen – – – Maintenance 6 – 10 Stores 4 – – The proportion of work done by service departments is: Canteen (%) Maintenance (%) Stores (%) Machining 50 80 60 Finishing 40 20 30 Coal Engineering budgets to consume 100,000 kilos of Direct Material at the rate of £39.36 REQUIRED per Kilo in its Finishing department throughout the year. (a)* For Coalbrook Engineering, calculate, using appropriate bases, the overhead absorption rate REQUIRED for each of the two production departments. [21] Calculate theEngineering, overhead absorption rate for Machining usingappropriate Direct (b)a) For Coalbrook calculate the production cost ofdepartment job 1912 (where to two decimalhours places), the following information: Machine andusing for Finishing Department as a percentage of Direct Material consumed. Machining Finishing b) Direct Calculate the price quoted for the70 job order 1920 using the following materials (£) to be 320 information. Coal Engineering charges a Direct labour (£) 130 50profit margin of 40% on their orders Machine hours Labour hours 10 5 Machining 4 8 Finishing [4] Direct Materials (£) 320 70 Direct Labor (£) 130 (c) Explain why a business might recover less in 50 overheads than the amount spent on overheads duringMachine a period.Hours [4] 10 4 Labor Hours 5 8 (d) Activity based costing is sometimes used as an alternative to traditional methods of overhead absorption. Explain two limitations of activity based costing. [4] Total marks [33] © OCR 2010 OMAIR MASOOD F014/RB Jun10 CEDAR COLLEGE 75 Accounts(–(9706(( (((((((((((((((((OMAIR(MASOOD( Accounts(–(9706(( ( ( ( ( ( ( ( ( ( ( ( ( (((((((((((((((((OMAIR(MASOOD( Accounts(–(9706(( ( ( ( ( ( ( (((((((((((((((((OMAIR(MASOOD( AS(–(Level(( AS(–(Level(( Accounts(–(9706(( ( ( ( ( ( ( (((((((((((((((((OMAIR(MASOOD( Accounts(–(9706(( (((((((((((((((((OMAIR(MASOOD( Accounts(–(9706(( ( ( ( ( ( ( ( ( ( ( ( ( (((((((((((((((((OMAIR(MASOOD( AS(–(Level(( ! AS(–(Level(( ! AS(–(Level(( Accounts(–(9706(( ( ( ( ( ( ( (((((((((((((((((OMAIR(MASOOD( AS(–(Level(( ( ( ( ( (((((((((((((((((OMAIR(MASOOD( (((((((((((((((((OMAIR(MASOOD( WORKSHEET !Accounts(–(9706(( Accounts(–(9706(( ( (COSTING ( ( ( ( PROFIT ( ( ( STATEMENTS ( Accounts(–(9706(( ( ( ( ( (((((((((((((((((OMAIR(MASOOD( AS(–(Level(( ! ! ! AS(–(Level(( Accounts(–(9706(( ( ( ( ( ( (((((((((((((((((OMAIR(MASOOD( AS(–(Level(( ! AS(–(Level(( Accounts(–(9706(( ( ( ( WS ( 2) 2)( ( ( (((((((((((((((((OMAIR(MASOOD( COSTING PROFIT STATEMENTS ( ( WS COSTING PROFIT STATEMENTS !! AS(–(Level(( ! COSTING PROFIT STATEMENTS ( WS 2) AS(–(Level(( COSTING PROFIT ( WS 2)( WSthe COSTING(((PROFIT(STATEMENTS)(((((Examples( 1 STATEMENTS Q1. Following information available costingrecords recordsof ofAkon AkonManufacturing Manufacturing COSTING PROFIT STATEMENTS 2) COSTING PROFIT STATEMENTS ( WS 2)from !EXAMPLE COSTING(((PROFIT(STATEMENTS)(((((Examples( Q1. Following information is isavailable from the costing ! COSTING PROFIT STATEMENTS ( WS 2) COSTING(((PROFIT(STATEMENTS)(((((Examples( st Q1. Following information is available from the costing records of Akon Q1. Following information is available from the costing records of Akon Manufacturing ! st1 ( Jan COSTING PROFIT STATEMENTS (2)WS 2) ( the COSTING PROFIT STATEMENTS ( WS COSTING(((PROFIT(STATEMENTS)(((((Examples( Q1. ! Following information is available from the records of records Akon Manufacturing which started trading Q1. Following information is2006. from of Akon Manufacturing Manufacturing Accounts(–(9706(( ( on (WS (2) costing (((((((((((((((((OMAIR(MASOOD( COSTING PROFIT STATEMENTS (2006. which started trading 1 Accounts(–(9706(( ( on ( available ( from ( the costing ( ( costing (((((((((((((((((OMAIR(MASOOD( st( Jan st Q1. Following information is available records of Akon Manufacturing ! stSTATEMENTS COSTING PROFIT ( WS 2) Jan 2006. which started trading on 1 st Jan 2006. which started trading on 1 AS(–(Level(( Q1. Following information is available from the costing records of Akon Manufacturing Accounts(–(9706(( ( ( ( ( ( ( (((((((((((((((((OMAIR(MASOOD( Q1. Following information is available from the costing records of Akon Manufacturing ! Jan 2006. which started trading on 1 is COSTING PROFIT STATEMENTS WScosting Q1.AS(–(Level(( Following information from Manufacturing 2006. which started trading on 1Jan Accounts(–(9706(( ( available ( Jan ( ( the (2) (records( of Akon (((((((((((((((((OMAIR(MASOOD( st ststis which started trading on 2006. AS(–(Level(( Q1. Following information available from thestcosting records of Akon Manufacturing st 111Jan which started trading on 2006. ! !which st Jan 2006. which started trading on AS(–(Level(( Q1. Following information is available from the costing records of Akonended Manufacturing Jan 2006. started trading on 1 For st st st year ended Dec For For the year Dec ! which started trading st31 st3131 Jan 2006. 1the Foron the ended 31 Dec the year ended Dec styear st st st st ! which started trading For the year ended 31 Dec For the year ended 31 Dec Jan 2006. on 1 st For the year ended 31 Dec For the year ended 31 For the year ended 31 Dec For the year ended 31 Dec COSTING PROFIT STATEMENTS ( WS 2) ended 2006 2007 st st st 31 Dec st ended For the year For the year 31stDec Dec COSTING PROFIT STATEMENTS (year WS 2) 2006 2007 For the year ended 31 For the year ended 31 stDec For the stDec For the ended 31 Dec year ended 31 Dec 2006 2007 st st For the year ended 31 st Dec the year ended 31 Dec Foristhe year ended 31 Dec For the For year ended 31$22 Dec COSTING STATEMENTS ( WS 2006 2007 2006 2007 Q1.Price/Unit Following PROFIT information available from the2) costing records of Akon Manufacturing st Selling $18 COSTING PROFIT STATEMENTS ( WS 2) 2006 2007 2006 2007 Q1. Following information is available from the costing records of Akon Manufacturing For the year ended 31 Dec For the year ended 31 Dec 2006 2007 st st SellingPrice/Unit Price/Unit $18 $22 Selling $18 $22 2006 the year ended Dec records For 2007 the ended 31 Dec 2006 2007 Q1. Following information isFor available from the31costing of year Akon Manufacturing Selling Price/Unit $18 $22 which started trading onst 1st Jan Selling Price/Unit $18 $22 Direct material/Unit $2 $3 Selling Price/Unit $18 $22 Q1. Following information isst2006. available from the costing records of Akon Manufacturing 2006 2007 which started trading on 1 Jan 2006. Selling Price/Unit $18 $22 Direct material/Unit $2 $3 Selling Price/Unit $18 $22 Direct material/Unit $2 $3 2006 2007 Selling Price/Unit $18 $22 Selling Price/Unit $18 $22 which started trading on 1 Jan 2006. Direct material/Unit $2 $3 st Direct material/Unit $2 Direct material/Unit $2$5 $3 Selling Price/Unit $18 2006. which started trading on 1 Jan Direct Labour/Unit $6 $3 Direct material/Unit $2 $3 Direct Labour/Unit $5 $6$22 Direct material/Unit $2 $3 st Selling Price/Unit $18 $22 Direct material/Unit $2 $3 Direct Labour/Unit $5 $6 Direct material/Unit $2 $3st Dec For the year ended 31 Dec For the year ended 31 Direct Labour/Unit $5 $6 st st Direct Labour/Unit $5 $6 Direct material/Unit $2 $3 Direct Labour/Unit $5 $6 For the year ended 31 Dec For the year ended 31 Dec Direct Labour/Unit $5 $6 Variable Prod/OH/Unit $1 $1.5 Variable Prod/OH/Unit $1 $1.5 st Direct material/Unit $2 $3 Direct Labour/Unit $5$1 Direct Labour/Unit $5 31st Dec For the$6 2006 2007 Direct Labour/Unit $5 $6 31$6 For$1the year ended year$1.5 ended Dec Variable Prod/OH/Unit Variable Prod/OH/Unit $1.5 Variable Prod/OH/Unit $1 $1.5 Direct Labour/Unit $5 $6 For2006 the year ended 31st Dec For2007 the year ended 31st Dec Variable Prod/OH/Unit $1 $1.5 Variable Prod/OH/Unit $1 $1.5 VariableSelling OH/Unit $2 $2 Direct Labour/Unit $5 $6 VariableSelling OH/Unit $2 $2 Variable Prod/OH/Unit $1 $1.5 Selling Price/Unit $18 $22 2006 2007 Variable Prod/OH/Unit $1 $1.5 Variable Prod/OH/Unit $1 $1.5 VariableSelling OH/Unit $2 $2 VariableSelling OH/Unit $2 $2 Variable Prod/OH/Unit $1 $1.5 VariableSelling OH/Unit $2$2$22006 $2 2007 Selling Price/Unit $18 $22 VariableSelling OH/Unit $2 $2 Annual fixed Prod OH $40000 $40000 Variable Prod/OH/Unit $1 $1.5 VariableSelling OH/Unit $2 VariableSelling OH/Unit $2 $2 Direct material/Unit $3 $22 Annual fixed Prod OH $40000 $40000 Selling Price/Unit $18 VariableSelling OH/Unit $2 Annual fixed Prod OH $40000 $40000 VariableSelling OH/Unit $2 VariableSelling OH/Unit $2 $2$2 $2 Annual fixed Prod OH $40000 $40000 Selling Price/Unit $18 $22 Direct material/Unit $2 $3 Annual fixed Prod OH $40000 $40000 VariableSelling OH/Unit $2 $2 Annual Fixed Admin OH $10000 $14000 Direct Labour/Unit $5 $6 Annual fixed Prod OH $40000 $40000 Annual fixed Prod OH $40000 $40000 Direct material/Unit $2 $3 Annual fixed Prod OH $40000 Annual Fixed Admin OH $10000 $14000 Annual Fixed Admin OH $10000 $14000 Annual fixed Prod OH $40000 $40000 Annual fixed Prod OH $40000 $40000 Direct material/Unit $2 $3 $40000 Annual Fixed Admin OH $10000 $14000 Direct Labour/Unit $5 $6 Annual fixed Prod $40000 $40000 Annual Fixed Admin OH $10000 $14000 Variable Prod/OH/Unit $1$40000 $1.5 Annual fixed Prod OH $40000 Annual Fixed Admin OHOH $10000 $14000 Units Produced 10000 Units 10000 Units Annual Fixed Admin OH $10000 $14000 Direct Labour/Unit $5 $6 Units Produced 10000 Units 10000 Units Annual Fixed Admin OH $10000 $14000 Annual Fixed Admin OH $10000 $14000 Units Produced 10000 Units 10000 Units Annual Fixed Admin OH $10000 $14000 Direct Labour/Unit $5 $6 Variable Prod/OH/Unit $1 $1.5 Units Produced 10000 Units 10000 Units Annual Fixed Admin $10000 $14000 VariableSelling OH/Unit $2 $2 Annual Fixed AdminOH OH 10000 $10000 $14000 Variable Prod/OH/Unit $1 $1.5Units Units Produced Units 10000 Units Units Sold 8000 Units 9000 Units Units Produced 10000 Units 10000 Units Units Produced 10000 Units 10000 Units Sold 8000 Units 9000 Units Units Produced 10000 Units 10000 Units Variable Prod/OH/Unit $1 $1.5 Units Produced 10000 Units 10000 VariableSelling OH/Unit $2 $2 Produced 10000 Units 10000 Units Sold 8000 Units 9000 Units Units Sold 8000 Units 9000 Units Annual fixed Prod OH $40000 Units Produced 10000 10000 Units Units VariableSelling OH/Unit 8000 $2Units $2Units Sold Units 9000$40000 Units Units Produced 10000 Units 10000 Units Units Sold 8000 Units 9000 Units UnitsUnits Sold 8000 Units 9000 Units Sold 8000 Units 9000 Units VariableSelling OH/Unit $2Units $2 Annual fixed Prod OH $40000 $40000 Sold 8000 Units 9000 UnitsUnits Units Sold 8000 9000 Annual Fixed Admin OH $10000 $14000 Units Sold 8000 Units 9000 Units Annual fixed Prod OH $40000 $40000 Units Sold 8000 Units 9000 Units ! REQUIRED: REQUIRED: Annual fixed Prod $40000 $40000 Annual Fixed Admin OH OH $10000 $14000 Units Produced 10000 Units 10000 Units Annual Fixed Admin OH $10000 $14000 REQUIRED: REQUIRED: REQUIRED: ! Annual Fixed Admin OH $10000 $14000 REQUIRED: ! • Units 10000 Units 10000 Units REQUIRED: Prepare a profit statement using the costing forboth both years. • Produced Prepare a profit statement using themarginal marginal costing format format for years. Units Sold 8000 UnitsUnits 9000 Units !! Units Produced 10000 10000 Units REQUIRED: REQUIRED: ! •!REQUIRED: REQUIRED: Units Produced 10000 Units 10000 Units Prepare a profit statement using the marginal costing format for both years. • Prepare a profit statement using the marginal costing format for both years. Units Sold 8000 Units 9000 Units • Prepare a profit statement using the marginal costing format for both years. ! • Prepare a profit statement using the marginal costing format for both years. • Prepare a profit statement using the marginal costing format for both years. • Prepare profit statement using the absorption costing format for both years. REQUIRED: Units Sold 8000marginal Units • ! Prepare profit statement usingusing the absorption costing format for9000 both years. Prepare a profit statement the costing format for both years. • aaprofit Prepare astatement profit statement using the Units marginal costing format for both years. Units 8000 Units 9000 Units Prepare statement using the marginal costing format for both years. ! •• •Prepare • ••Prepare Prepare aSold profit using the absorption costing format for both years. REQUIRED: a profit statement using the absorption costing format for both years. • Prepare a profit statement using the marginal costing format for both years. ! a profit statement using the absorption costing format for both years. • Prepare reconciliation statement to reconcile the two profits for both years. • Prepare a profit statement using the absorption costing format for both years. Prepare a profit statement using the absorption costing format for both years. • ! Prepare a reconciliation statement to reconcile the two profits for both years. • Prepare a profit statement using the marginal costing format for both years. ! • Prepare a profit statement using the absorption costing format for both years. • Prepare a profit statement using the absorption costing format for both years. REQUIRED: • Prepare a profit profit statement using the marginal costing format forboth both years. Prepare areconciliation profit statement using the absorption costing format for both years. • • Prepare a reconciliation statement toreconcile reconcile the two profits for years. REQUIRED: •!• •Prepare statement tousing the two profits for both years. a statement the absorption costing format for both •aPrepare Prepare a reconciliation statement to reconcile the two profits for both years. ! •Prepare Prepare a reconciliation statement to reconcile two profits for both years. a reconciliation statement to reconcile the two profits for both years. REQUIRED: Prepare profit statement using the absorption costing format foryears. bothyears. years. •Prepare Prepare a areconciliation statement toreconcile reconcile theformat two for both !! •• •Prepare Prepare a aprofit statement using the marginal costing format forprofits both years. •Following statement to the two profits for both years. aareconciliation profit statement using the absorption costing forfor both years. • reconciliation Prepare profit statement using the marginal costing format both years. Q2. information is available for Empire Manufacturing • Prepare a statement to reconcile the two profits for both years. ! • Prepare a profit statement using the marginal costing format for both years. Q2. ! Following information is available for Empire Manufacturing Prepare a reconciliation statement to reconcile the two profits for both years. !! ••• •Prepare a profit statement using the absorption costing format for both years. Prepare reconciliation statement to reconcile the format two profits for both years. Prepare aainformation reconciliation to reconcile the two profits for both years. Q2. Following is available for Empire Manufacturing • information Prepare profit statement using the absorption costing for both years. Q2. information Following isstatement available forEmpire Empire Manufacturing Q2. ! Following isaaavailable for Empire Manufacturing •information Prepare profit statement using the absorption costingfor format for both years. !! Following information isavailable available for Manufacturing Q2. Following information is available for Empire Manufacturing Q2.!Q2. Following is for Empire Manufacturing • Prepare a reconciliation statement to reconcile the two profits both years. EXAMPLE 2 st st Q2. Following information is available for ended Empire • Prepare a reconciliation statement to reconcile the two for both For the year 31stManufacturing For theprofits year ended 31years. Dec st • Prepare aisreconciliation statement to reconcile the for both years. !Q2. thefor year ended 31 Fortwo theprofits year ended Q2.! Following information available Empire Manufacturing st st 31 Dec Following information isFor available for Empire Manufacturing Q2. Following information is available for Empire Manufacturing st st ! Dec 2006 2007 For theFor yearthe ended 31 For the year ended 31 Dec st st year ended 31 For the year ended 31 Q2. Following information is available for Empire Manufacturing stDec st st the year ended st For the year ended 31 For 31 Dec Dec 2006 2007 For the year ended 31 For the year ended 31 Dec Q2.Selling Following information is available for Empire Manufacturing For the year ended 31 For the year ended 31 Dec st st stst $30 $28 Dec 2006 2007 Q2.Price/Unit Following information For is available for Empire Manufacturing Dec 2006 2007 For the year ended 31 For year ended 31 Dec the year ended 31 For the year ended 31 Dec Q2. Following information is available for Empire Manufacturing st st Dec 2006 2007 Selling Price/Unit $30 $28 Dec 2006 2007 Dec 2006 2007 st st For the year ended 31 For the year ended 31 Dec Direct material/Unit $12 $13 Selling Price/Unit $30 $28 st st Selling Price/Unit $30 $28 Dec 2006ended 2007 For theFor year ended 31 st31For year ended 31 Dec Dec 2006 2007 the year For the year ended 31 st the stDec st st Direct material/Unit $12 $13 Selling Price/Unit $30 $28 Selling Price/Unit $30 $28 st Dec 2006 2007 Selling Price/Unit $30 $28 Direct Labour/Unit $7 $4 For theFor year ended 31 For the year ended 31 Dec the year ended 31 For the year ended 31 Dec Direct material/Unit $12 $13 For the year ended 31 For the year ended 31 Dec Direct material/Unit $12 $13 st st Selling Price/Unit $30 $28 Dec 2006 2007 Selling Price/Unit $30 $282007 For the year ended 31 For2007 the year ended 31 Dec Dec 2006 Direct material/Unit $12 $13 Selling Price/Unit $30 $28 Direct Labour/Unit $7 $42007 Direct material/Unit $12 $13 Dec 2006 Variable Prod/OH/Unit $2 $1.5 Direct material/Unit $12 $13 Direct Labour/Unit $7 $4 Dec 2006 Dec 2006 2007 Direct Labour/Unit $7 $4 Direct material/Unit $12 $13 Dec 2006 2007 Direct material/Unit $12 $13 Direct Labour/Unit $7 $4 Selling Price/Unit $30 $28 Direct material/Unit $12 $13$28 Variable Prod/OH/Unit $2 $1.5 Selling Price/Unit $30 Selling Price/Unit $30 $28 Direct Labour/Unit $7$2 $4 VariableSelling OH/Unit $3 $4 Variable Prod/OH/Unit $1.5 Selling Price/Unit $30 $28 Direct Labour/Unit $7$2 $4 Variable Prod/OH/Unit $1.5 Selling Price/Unit $30 $28 Selling Price/Unit $30 $28 Direct Labour/Unit $7 $4 Direct Labour/Unit $7 $4 Variable Prod/OH/Unit $2 $1.5 Direct material/Unit $12 $13 VariableSelling OH/Unit $3 Annual fixed Prod OH $20000 $20000 Direct material/Unit $12$7 $13 Direct Labour/Unit $4 $13 Variable Prod/OH/Unit $2$3 $1.5$4$13 Direct material/Unit $12 Direct material/Unit $12 VariableSelling OH/Unit $4 Variable Prod/OH/Unit $2 $1.5 VariableSelling OH/Unit $3 $4 Direct material/Unit $12 $13 Direct material/Unit $12 Variable Prod/OH/Unit $2 $2$3 $1.5 $4$4 Variable Prod/OH/Unit $1.5 $13 VariableSelling OH/Unit Direct Labour/Unit $7 $4 Annual Fixed Admin OH $14000 Annual fixed Prod OH $20000 $20000 Direct Labour/Unit VariableSelling OH/Unit $3$10000 $4 $20000 Annual fixed Prod OH $20000 $20000 Variable Prod/OH/Unit $2 $1.5 $4 Direct Labour/Unit $7$3 $4 VariableSelling OH/Unit $3$7 $4 Annual fixed Prod OH $20000 Direct Labour/Unit $7 Direct Labour/Unit $7 $4 VariableSelling OH/Unit $4 VariableSelling OH/Unit $3 $4 $4 Annual fixed Prod OH $20000 $20000 Direct Labour/Unit $7 Variable Prod/OH/Unit $2 $1.5 Units Produced 10000 Units 8000 Units Variable Prod/OH/Unit $2 $1.5 Annual Fixed Admin OH $10000 $14000 Annual Fixed Admin OH $10000 $14000 Annual fixed Prod OH $20000 $20000 Annual Fixed Admin OH $10000 $14000 Annual fixed Prod OH $20000 $20000 VariableSelling OH/Unit $3 $4 $1.5 Variable Prod/OH/Unit $2 $1.5 Variable Prod/OH/Unit $2 $1.5 Variable Prod/OH/Unit $2 Annual fixed Prod OH $20000 $20000 Annual Fixed Admin OH $10000 $14000 VariableSelling OH/Unit $3 $4 Annual fixed Prod OH $20000 $20000 Units Sold 9500 Units 7500 Units VariableSelling OH/Unit $3 $4Units$1.5 Variable Prod/OH/Unit $2 Units Produced 10000 Units 8000 Units Units Produced 10000 Units 8000 Units Units Produced 10000 Units 8000 Annual Fixed Admin OH $10000 $14000 Annual Fixed Admin OH $10000 $14000 VariableSelling OH/Unit $3 $4 Annual Fixed Admin OH $10000 $14000 Annual fixed Prod OH $20000 $20000 VariableSelling OH/Unit $3 $4Units$4 VariableSelling OH/Unit $3 Units Produced 10000 Units 8000 Annual fixed Prod OH $20000 $20000 REQUIRED: Annual Fixed Admin OH $10000 $14000 Annual fixed Prod OH $20000 $20000 Units Sold 9500 Units 7500 Units Units Sold 9500 Units 7500 Units Units Sold 9500 Units 7500 Units VariableSelling OH/Unit $3 $4 Units Produced Units 8000 Units Annual fixed Prod OH 10000 $20000 $20000 Units Produced 10000 Units 8000 Units Units Produced 10000 Units 8000 Units Annual Fixed Admin OH $10000 $14000 Units Sold 9500 Units 7500 Units Annual Fixed Admin OH $10000 $14000 Annual Fixed Admin OH $10000 $14000 Annual fixed Prod OH $20000 $20000 Annual fixed Prod OH $20000 $20000 Units Produced 10000 Units 8000 Units REQUIRED: REQUIRED: REQUIRED: Annual Fixed Admin OH $10000 $14000 Units Sold 9500 Units 7500 Units Annual fixed Prod OH $20000 $20000 Units Sold 9500 Units 7500 Units Units Sold 9500 Units 7500 Units REQUIRED: Units Produced 10000 Units 8000 Units Produced 10000 Units 8000 Units Units Produced 10000 Units 8000 Units Units Units 7500 Units Annual Fixed Admin OH statement $10000 $14000 Annual Fixed OH using $10000 $14000 • Sold Prepare aAdmin profit the9500 marginal costing format for Units both years REQUIRED: Units Produced 10000 Units 8000 Units REQUIRED: Annual Fixed Admin OH $10000 $14000 REQUIRED: Units Sold 9500 Units 7500 Units Units Sold 9500 Units 7500 Units ! Units Sold 9500 Units 7500 Units REQUIRED: 9500 Units 7500 Units Units Produced 10000 Units Units •Prepare Prepare a profit statement using the absorption costing format for8000 both years. Units Produced 10000 Units 8000 •Prepare aSold profit using the marginal costing format for for both years •Units Prepare astatement profit statement using the marginal costing format for both yearsUnits a profit statement using the marginal costing format both years REQUIRED: ! •REQUIRED: Units Produced 10000 Units 8000 Units • Prepare a profit statement using the marginal costing format for both years ! REQUIRED: • REQUIRED: Prepare a reconciliation statement toUnits reconcile the two profits for both years. Units• Units Sold 9500 7500 Units 9500 Units 7500 Units ! •Sold a profit statement using the marginal costing format for both years a profit using the absorption costing format for both years. •aPrepare Prepare astatement profit statement using the absorption costing format for both years. ! a profit statement using the absorption costing format for both years. Units Sold 9500 Units 7500 Units ! profit statement using the marginal costing format for both years • Prepare Prepare a profit statement using the marginal costing format for both years ! • Prepare !•Prepare • Prepare a profit statement using the absorption costing format for both years. •Prepare Prepare a profit statement using the absorption costing format for both years. a profit statement using the marginal costing format for both years !• •• Prepare REQUIRED: REQUIRED: • •aPrepare a reconciliation statement to marginal reconcile the two profits for both years. aPrepare reconciliation statement to reconcile thethe two profits forboth both years. astatement profitstatement statement using the costing format for both years Prepare a profit using the marginal costing format for years • Prepare Prepare reconciliation to reconcile two profits for both years. • •Prepare a statement profit using the absorption costing format for both years. • REQUIRED: a•Prepare profit using the absorption costing format for both years. a reconciliation statement to marginal reconcile the twoformat profits for both years. • Prepare Prepare a statement profit statement using the costing for both years aprofit reconciliation statement to the reconcile the two profits for both years. ! statement using the absorption costing format for both years. ! • •Prepare profit statement using the marginal costing format for both years • a Prepare astatement profit statement using absorption costing format for both years. • Prepare Prepare a aprofit using the absorption costing format for both years. ! • Prepare a profit statement absorption costing format for both • Prepare a reconciliation statement tothe reconcile two profits foryears. bothyears. years. • Prepare a reconciliation statement to using reconcile the twothe profits for both • Prepare a reconciliation statement to reconcile the two profits for both years. • profit Prepare a reconciliation statement to marginal reconcile the two profits for both years. a reconciliation statement tothe reconcile the twocosting profits for both years. Prepare a profit statement using absorption format for both years. •• Prepare Prepare a profit statement using the costing format for both years • • Prepare a statement using the marginal costing format for both years • Prepare a reconciliation to marginal reconcile the two profits for both • Prepare a profit statementstatement using the costing format foryears. both years • Prepare a reconciliation statement to reconcile the two profits for both years. • Prepare a profit statement using the absorption costing format foryears. both years. • Prepare a profit statement using the absorption costing format for both • Prepare a profit statement using the absorption costing format for both years. ! • Prepare a reconciliation statement to reconcile theprofits two profits foryears. both years. • ! Prepare a reconciliation statement to reconcile the two for both • Prepare a reconciliation statement to reconcile the two profits for both years. ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! !! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! OMAIR MASOOD CEDAR COLLEGE 76 COSTING(PROFIT(STATEMENTS((WORKSHEET(3)( ( Q1 COSTING PROFIT STATEMENTS ( WORKSHEET 5) Q9 Q1.( Cornucopia Limited manufactures a single product and has prepared the following data for the years ended 30 September 1990 and 1991. $ 15.00 Selling price per unit Variable cost per unit Direct materials 4.00 Direct labour 5.00 Overhead expense 1.00 Fixed production overhead (budgeted and incurred) Normal activity level Fixed selling and administrative expenses Inventory (in units) Opening Inventory Production Sales Closing Inventory $150,000 per annum 150,000 units per annum $180,000 per annum Years ended 30 September 1990 1991 - 30,000 170,000 140,000 (140,000) (160,000) 30,000 10,000 REQUIRED: (a) Prepare Income statements for the years ended 30 September 1990 and 1991 using firstly the variable (or marginal) costing method and secondly, the absorption costing method. (b) Give figures to reconcile the differences in operating income for both years. ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( OMAIR MASOOD CEDAR COLLEGE 77 ( Q2 ( Q2.( Q10.Nafferton Limited manufacturesa asingle singleproduct product the the variable of of Q10.Nafferton Limited manufactures variablecost coststructure structure has changed not changed several yearsand andisisas asfollows: follows: whichwhich has not for for several years $$ ( 20.00 Selling price unit 20.00 Selling price unit $ $ $ $ Variable cost per unit Direct Variable costmaterials per unit Direct labour Direct materials Direct production expenses Direct labour Direct selling expenses Direct production expenses Direct selling expenses 3.00 8.00 3.00 3.00 8.00 1.00 3.00 1.00 Normal production level 180,000 units per annum Fixed production overhead $108,000 per annum Normal production level 180,000 per annum Fixed selling and administration expenses $75,000 units per annum production and sales for the past two years have been: FixedUnit production overhead $108,000 per annum Years ended 30 April Fixed selling and administration expenses $75,000 per annum Unit production and sales for the past two years have been: 1994 1993 Years ended 30 April units Opening Inventory Production Opening Sales Inventory Closing Production 1993 40,000 units 190,000 20,000 units 160,000 40,000 20,000 20,000 190,000 30,000 160,000 (210,000) (150,000) (210,000) Inventory Sales units 1994 (150,000) REQUIRED: 30,000 Closing 20,000 Inventory (a) Prepare profit and loss statements for the years ended 30 April 1993 and 1994 using firstly the variable (or marginal) costing method and secondly absorption costing method to value Inventory. REQUIRED: (b) Give figures to reconcile the differences in operating income for both years between to two methods. (a) ( ( ( (b) ( ( ( ( Prepare profit and loss statements for the years ended 30 April 1993 and 1994 using firstly the variable (or marginal) costing method and secondly absorption costing method to value Inventory. Give figures to reconcile the differences in operating income for both years between to two methods. OMAIR MASOOD CEDAR COLLEGE ( 78 Q3.( Q3 ( Q11.$ H2O manufactures and sells bottled water. Details are as follows: $ $ 50 Selling price(per case) Direct cost (per case) Material 1 Labour 15 16 Details for the months of September and October are as follows: October September Production of bottled water 1,500 cases 2,000 cases Sales of bottled water 1,200 cases 2,300 cases $14,400 $14,400 Fixed production overheads The normal level of activity for both sales and production is 1,800 cases per month. Fixed production overheads are budgeted at $14,400 a month, and are absorbed on a “per case” basis. The opening Inventory at 1 September was 500 cases. REQUIRED: (a) Prepare profit statements for September and October showing details of inventory valuation using. (i) Absorption (total) costing principles; (ii) Marginal costing principles. (b) Reconcile in figures the profits for each month shown under the two methods of Inventory valuation. Explain why the profits differ under the two methods. ! ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ! ! ! ! ! ! OMAIR MASOOD CEDAR COLLEGE 79 Q5.( Q4 Q13.$ ( 9 Colebrook Limited manufactures one product. The following information is available. 3 Direct material Direct labour Selling price Budgeted fixed overhead Budgeted production $3.20 per unit $2.40 per unit $14.00 per unit $88 000 per month 16 000 units per month The following information is available for February and March 2015. Actual sales (units) Actual production (units) February 13 000 15 000 March 17 000 15 000 There was no inventory of finished units at 1 February 2015. The actual fixed overhead cost was the same as the budgeted cost. REQUIRED (a) Calculate the contribution per unit. $ 10 11 (b) Prepare the income statement for each of the months February and March 2015 using marginal Additional costing. information 11 [2] Colebrook Limited is considering changing to absorption costing. $ Additional information (c) Calculate the overhead absorption rate per unit produced. Colebrook Limited is considering changing to absorption costing. (c) Calculate the overhead absorption rate per unit produced. [1] $ (d) Prepare the income statement for each of the months February and March 2015 using absorption costing. [1] $ 12 3(b)for is on the next page. (d) Prepare the incomeQuestion statement each of the months February and March 2015 using absorption costing. (e) Prepare a statement reconciling the marginal costing profit with the absorption costing profit for February only. $ $ ( $ ( ($ ($ ( ( $ (f) Explain why there is a difference in the profit between the two methods. ©(UCLES 2015 9706/23/M/J/15 $ ( ($ ($ ( ( ( !! ( ( ( ( OMAIR MASOOD [3] [Turn over [4] [Total: 30] [9] 80 CEDAR COLLEGE [11] UCLES2015 2015 ©©UCLES 9706/23/M/J/15 9706/23/M/J/15 [Turn over Q5 Q14.$ Q6.( Ken owns a manufacturing business which makes a single product. The following figures apply for all relevant periods. Per unit Selling price Direct material Direct labour Fixed manufacturing overheads $ 35 9 11 5 Fixed manufacturing overheads are absorbed into product costs at predetermined rates per unit of output. Under- or over-absorbed manufacturing overheads are transferred to profit and loss in the period in which they occur. Normal production is 80 000 units per accounting period. The following information has been acquired for the last three accounting periods. Three months ended Sales Inventory at start of period Inventory at end of period 28 February 31 May 31 August Units Units Units 60,000 80,000 45,000 15,000 -- 35,000 -- 35,000 20,000 REQUIRED: (a)Calculate the profit (or loss) arising in each of the three periods, using absorption costing principles. (b)Recalculate the profit (or loss) arising in each of the three periods using marginal cost principles. (c)Briefly reconcile your answer to part (b) with your answer to part (c) above. ( ( ( ( ( ( ( ( ( ( ( ( (OMAIR MASOOD ( CEDAR COLLEGE 81 Q6 Q7.(Q15 Averages Limited is a manufacturing company making a single product. Over the last three financial periods the following information has been collected: Period 1 Period 2 Period 3 Sales (in units) 50,000 70,000 40,000 Inventory in units at beginning of period 10,000 30,000 - Inventory in units at end of period 30,000 - 20,000 The selling price per unit is $20 and direct material and labour costs per unit total $10 Manufacturing overheads are all fixed costs and are absorbed into product costs at pre-determined rates per unit of output. Any under or overabsorbed manufacturing overheads are transferred to profit and loss account in the period in which they arise. Manufacturing overheads total $300,000 per period and normal production capacity is 60,000 units per period. All prices remained constant over the three periods. REQUIRED: (a) Calculate the profit (or loss) arising in each of the three periods, using absorption costing principles. (b) Recalculate the profit (or loss) arising in each of the three periods using marginal cost principles. (c) Briefly reconcile your answer to part (b) with your answer to part (c) above. ( ( $ ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( OMAIR MASOOD CEDAR COLLEGE 82 12 Q7. 3 Gerry Hatrick Ltd manufactures and sells video cameras. The unit selling price and production costs are as follows: Selling price $ 800 Direct materials Direct labour Variable overheads Fixed overheads 100 90 50 160 For Examiner’s Use The fixed production overheads assume a monthly production of 2000 units. The following monthly costs are also incurred:14 Fixed administrative $80 000 (b) Explain why the profitoverheads found when using absorption costing differs from the profit found Variable sales overheads 10% of sales value in marginal costing. Fixed sales overheads $120 000 .......................................................................................................................................... During the month of September 2005 a total of 2400 units were produced, of which 1800 were.......................................................................................................................................... sold. There was no stock on hand at the beginning of September. 13 .......................................................................................................................................... REQUIRED For Examiner’s Use For Examiner’s Use .......................................................................................................................................... (a) Prepare profit statements for September 2005 using .......................................................................................................................................... (i) Absorption costing 14 (ii) Marginal costing .......................................................................................................................................... (b) Explain why the profit found when using absorption costing differs from the profit found ................................................................................................................................... ......................................................................................................................................[4] in marginal costing. For Examiner’s Use ................................................................................................................................... (c) Calculate the break-even point for September 2005 in sales volume. .......................................................................................................................................... .......................................................................................................................................... ................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... ................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... ................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... ................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... ................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... ................................................................................................................................... ......................................................................................................................................[4] .......................................................................................................................................... ................................................................................................................................... (c) Calculate the break-even point for September 2005 in sales volume. .......................................................................................................................................... ................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... ................................................................................................................................... .......................................................................................................................................... ......................................................................................................................................[8] ................................................................................................................................... .......................................................................................................................................... OMAIR MASOOD CEDAR COLLEGE [Total: 30] ................................................................................................................................... .......................................................................................................................................... © UCLES 2005 9706/02/O/N05 ................................................................................................................................... www.theallpapers.com .......................................................................................................................................... 83 COSTING(PROFIT(STATEMENTS(AND(ABSORBTION(COSTING((EXTRA( QUESTIONS(FOR(PRACTISE()( ( Q8PROFIT(STATEMENTS(( Q2.& Q1.$ $Apex$Manufacturing$produces$wooden$boxes.$The$normal$production$level$has$ always$been$set$at$2500$units.$Following$data$is$available$for$the$year$ended$31st$ December$2017.$$ $ $ Inventory$at$start$ 400$units$($see$note$below)$ Units$Sold$ 2300$units$$ Units$Produced$ 2600$units$ Inventory$at$End$ ??$ $ Note:(In(the(year(ended(31st(December(2016,(the(total(production(cost(per( unit(was($36(and(marginal(cost((per(unit(was($32( ( Following$are$the$details$of$revenue$and$cost$for$the$year$ended$31st$December$ 2017.$$ $ $ $ $$$$$ Selling$Price$per$unit$ 60$ Direct$Material$per$unit$ 10$ Direct$Labour$per$unit$ 17$ Variable$Production$overheads$per$unit$ 7$ Variable$Selling$Overheads$per$unit$ 2$ Fixed$production$overheads$($total)$ $10000$ Fixed$Sales$overheads$($total)$ $8000$ $ ( Required:( ( (a) Profit(statement(for(the(year(ended(31st(December(2017(using(marginal( costing(format.( (b) Profit(statement(for(the(year(ended(31st(December(2017(using(absorbtion( costing(format.( (c) Prepare(a(statement(to(reconcile(both(profit(statements.( ( ( ( ( MASOOD & OMAIR ( & ( & ( CEDAR COLLEGE 84 & ( Q9& ( Q3.& ( ( Q2.(Pumblechook$Ltd$is$a$manufacturing$company$which$uses$a$marginal$costing$ Q2.(Pumblechook$Ltd$is$a$manufacturing$company$which$uses$a$marginal$costing$ & system$for$internal$management$reports.$The$company’s$annual$financial$statements$for$ system$for$internal$management$reports.$The$company’s$annual$financial$statements$for$ external$reporting$purposes$are$based$on$full$absorption$costing.$( external$reporting$purposes$are$based$on$full$absorption$costing.$( The$company$makes$one$single$product$which$sells$for$$100$per$unit.$The$following$data$ The$company$makes$one$single$product$which$sells$for$$100$per$unit.$The$following$data$ refers$to$the$years$ended$30th$June$2014$and$2015:$$ refers$to$the$years$ended$30th$June$2014$and$2015:$$ Per(unit( Per(unit( Direct$material$ Direct$material$ Direct$Labor$ Direct$Labor$ Variable$factory$overheads$ Variable$factory$overheads$ Variable$selling$and$ administration$expense$ Variable$selling$and$ 2014(($)( 2015(($)( 21$ 23$ 19$ 22$ 2014(($)( 21$ 2015(($)( 19$ 8$ 8$ 2$ 2$ administration$expense$ Fixed$Factory$overheads$per$ 132000$ 23$ 22$ 10$ 3$ 10$ 3$ 132000$ annum$ Fixed$Factory$overheads$per$ 132000$ 132000$ $ annum$ $ $ 2014$(Units)$ 2015$(Units)$ Opening$stock$ 0$ 3000$ $ 2014$(Units)$ Closing$stock$ 3000$ 2015$(Units)$ 1500$ Opening$stock$ 0$ Closing$stock$ 3000$ 1500$ 20000$ 23000$ Sales$ 20000$ 3000$ 23000$ The$normal$volume$used$for$the$purpose$of$absorption$costing$is$22,000$units$in$both$ years.$$$ Sales$ Required:($ The$normal$volume$used$for$the$purpose$of$absorption$costing$is$22,000$units$in$both$ years.$$$ a) Prepare$an$internal$management$profit$statement$for$the$year$ended$30th$June$ 2014$and$30th$June$2015$using$marginal$costing. b) Prepare$a$draft$income$statement$for$the$year$ended$30th$June$2014$and$30th$ Required:($ June$2015$using$full$absorption$costing.$ c) Prepare$a$reconciliation$statement$to$reconcile$Marginal$profit$with$Absorption$ a) Prepare$an$internal$management$profit$statement$for$the$year$ended$30th$June$ profit.$ 2014$and$30th$June$2015$using$marginal$costing. b) Prepare$a$draft$income$statement$for$the$year$ended$30th$June$2014$and$30th$ June$2015$using$full$absorption$costing.$ 85 OMAIR MASOOD CEDAR COLLEGE c) Prepare$a$reconciliation$statement$to$reconcile$Marginal$profit$with$Absorption$ & & profit.$ BUSINESS PLANNING THEORY (ONLY FOR THEORY) The management of the business need to plan in advance in order to run a successful business. Planning can be broken down into two parts Long term Planning : ( Strategic or Corporate Planning ): Management identifies the current position of the business by looking at the accounting data. This is the starting point for all future strategies. After analyzing the current position they try to analyze the circumstances that the business is likely to encounter in the period of the plan for e.g likely future demand of the product , influence of competition etc. Short Term Planning: ( Operational Planning ) Operational plans on short term basis are called budgets . They show what management hope to achieve in a future time period in terms of overall plans and individual departmental plans. ADVANTAGES OF BUDGETS The preparation of individual budgets means that planning must take place. Plans need to be prepared in a coordinated way and this requires communication throughout all levels of the business. ● The budgeting process defines areas of responsibility and targets to be achieved by different personnel. ● Budgets can act as a motivating influence at all levels, although this is usually only true when all staff are involved in the preparation of budgets. If budgets are imposed on staff who have had little or no involvement in their development they can have a negative effect on morale and lead to staff feeling demotivated. ● Budgets are a major part of the overall strategic plan of the business and so individual departmental and personal goals are more likely to be an integral part of the ‘bigger picture’. ● Budgets generally lead to a more efficient use of resources at the disposal of the business – leading to a better control of costs. ● OMAIR MASOOD CEDAR COLLEGE 86 DISADVANTAGES OF BUDGETS ● Budgets are only as good as the data being used. If data are inaccurate, the DISADVANTAGES BUDGETS budget will beOF of little use. Should one departmental budget be too optimistic or too pessimistic this will have a knock-on effect on other associated budgets. ● Budgets are only as good as the data being used. If data are inaccurate, the budget will bemight of little use. Should one departmental be too ● Budgets become an overriding goal. This budget could lead to aoptimistic misuse of or too pessimistic this will have a knock-on effect on other associated budgets. resources or incorrect decisions being made. Budgets might become overriding goal. Thisare could lead to a misuse ● Budgets might act asan a demotivator if they imposed rather thanof resources or incorrect decisions being made. negotiated. ● Budgets might act as a demotivator if they are imposed rather than ● Budgets might be based on plans that can be easily achieved – so making negotiated. ● Budgets might lead to departmental rivalry. ● Budgets might be based on plans that can be easily achieved – so making ● Smaller businesses may find that they experience only limited benefits from ● Budgets might lead to departmental rivalry. what can be a lengthy, complicated procedure to implement. ● Smaller businesses may find that they experience only limited benefits from ● While budgets are being prepared, any limiting factors need to be identified what can be a lengthy, complicated procedure to implement. and taken into account. ● While budgets are being prepared, any limiting factors need to be identified and taken into account. ● What is Budgetary Control? Controlling the organization by use of different budgets and evaluating actual What is Budgetary Control? performance using budgets is called Budgetary Control. The advantages and disadvantages of this system areofsame as Budgets Above) Controlling the organization by use different budgets( Mentioned and evaluating actual performance using budgets is called Budgetary Control. The advantages and disadvantages of this system are same as Budgets ( Mentioned Above) ! ! ! ! ALL!THE!SMALL!THINGS.! ! ! ! ! ALL!THE!SMALL!THINGS.! OMAIR MASOOD CEDAR COLLEGE 87 O’ LEVEL REVISION THEORY ACCOUNTING!CYCLE! ! The(Accounting(Cycle(is(a(series(of(steps,(which(are(repeated(every(reporting(period.(The( process(starts(with(making(accounting(entries(for(each(transaction(and(goes(through(closing(the( books.(This(Involves(recording(transactions(in(the(daybooks((books(of(original(entry),(posting( them(to(ledger,(extracting(a(trial(balance(and(finally(drawing(up(financial(statements.( ( Step!1:!!Recording!Transactions!in!Daybooks!(!DAYBOOKS!ARE!ALSO!REFFERED!AS! JOURNALS)! ( Each(transaction(is(recorded(first(in(one(of(the(following(daybook(((book(of(original(entry)( according(to(the(nature(of(the(transaction.( ( 1.(All(goods(sold(on(Credit(((Credit(Sales)(((((….>(Sales(Daybook( 2.(All(goods(purchased(on(Credit((Credit(Purchases)(….>(Purchases(Daybook( 3.(All(goods(sold(on(credit(but(now(returned(by(costumers(..>(Sales(Return((Inwards)(Daybook( 4.(All(goods(purchased(on(credit(but(now(returned(to(suppliers…>(Purchases(Return(Daybook( ( The(above(four(daybooks(only(record(credit(transactions(related(to(movement(in(inventory.( There(are(no(accounts(maintained(inside(the(daybooks.(It(Just(contains(Date,(Name,(Source( document(number(and(Amount.( ( 5.(All(transactions(which(relate(to(receipts(and(payments(through(cash(or(cheque(..>(Cashbook( ( Cash(and(Bank(accounts(are(made(inside(the(cashbook(hence(it(also(serves(the(purpose(of( ledger.( ( 6.(All(other(transactions(…..>(General(Journal( ( (((In(this(we(actually(write(the(double(entry(of(only(those(transactions(which(cannot(be(recorded( in(the(above(five(daybooks.(To(name(a(few( 5 Non(Current(Assets(Purchased(or(Sold(on(Credit( 5 Writing(off(Bad(debts( 5 Entries(for(Provisions(of(doubtful(debts(and(depreciation( 5 Adjustments(for(Prepaid(and(Owings( 5 Correction(of(Errors( ( ( ( ( OMAIR MASOOD CEDAR COLLEGE 88 ! Step!2:!Posting!Transactions!In!Ledgers! ( A(ledger(is(a(book(which(contains(accounts(((the(actual(T(Accounts(guys).(There(are(three(types(of( Ledgers.(In(each(type(we(have(different(type(of(accounts.( ( Sales!Ledger:(This(contains(accounts(of(credit(costumers(((people(to(who(we(sell(goods(on(credit)(–( Trader(Receivables(( ( (At(the(end(of(the(year(all(the(account(balances(in(the(sales(ledger(are(listed(in(a(schedule(which(is(called( list(of(Trade(receivables.(This(shows(the(individual(account(balances((closing)(and(also(the(total(debtors( which(goes(into(the(trail(balance.( ( ((Purchase!Ledger:(This(contains(accounts(of(credit(suppliers(((people(from(whom(we(buy(goods(on( credit)(–(Trader(Payables( ( At(the(end(of(the(year(all(the(account(balances(in(the(purchase(ledger(are(listed(in(a(schedule(which(is( called(list(of(Trade(Payables.(This(shows(the(individual(account(balances((closing)(and(also(the(total( creditors(which(goes(into(the(trail(balance.( ( (( General!Ledger:(This(contains(all(the(other(accounts.(Like(all((assets,(capital(,(liabilities(,expenses( ,incomes(,provisions((literally(all(other(accounts)( ( Please(remember(Sales(and(Purchases(accounts(are(in(the(General(Ledger(cause(they(are(not(our( costumers(or(suppliers(( ( Once(all(the(transactions(are(posted(all(the(accounts(are(balanced(via(inserting(a(balance(C/d(in(all( accounts.( ( Step!3:!Extracting!a!Trial!Balance! ( All(the(closing(balances(in(the(General(Ledger(along(with(the(figure(of(total(trade(receivables(and( payables(are(listed(in(a(trail(balance.(Debit(balances(and(Credit(Balances(are(listed(separately(side(by( side.(The(Sum(of(all(Debits(should(be(equal(to(sum(of(all(credit(balances.(The(trail(balances(is(used(to( check(the(completion(of(the(double(entry.(The(trail(balance(will(balance(because(( 5 For(each(debit(entry(there(is(a(credit(entry(((vice(versa)( 5 The(sum(of(all(debit(entries(is(equal(to(the(sum(of(credit(entries(( ( ( ( OMAIR MASOOD CEDAR COLLEGE 89 ! Step!4:!Closing!Entries!with!Year!end!Adjustments!(Details!in!following!pages)! ( After(making(the(trail(balance(we(also(have(to(adjust(for(certain(items.(Remember(only(Incomes(and( Expenses(are(taken(into(account(while(calculating(profit.(These(accounts(are(closed(by(transferring(them( to(the(income(statement(((the(Profit(and(Loss(Account).(This(process(is(called(Closing(Entries.( Some(common(adjustments(are( 5 Expenses(and(Incomes(are(adjusted(for(prepaid((advance)(and(accruals(Owings)( 5 Non(Current(Assets(are(depreciated(( 5 Provision(for(doubtful(debt(is(adjusted( 5 Closing(inventory(is(valued(by(physical(stock(take(and(it(is(adjusted(in(calculating(cost(of( goods(sold(and(also(for(Balance(Sheet( 5 Adjustments(for(goods(withdrawn(by(owner(or(Stock(Losses( ( Step!5:!Final!Accounts:! An(income(statement(and(Statement(of(Financial(Position(((Balance(Sheet)(is(drawn(which(ends(the( Accounting(Cycle.(Now(by(looking(at(Income(Statement(owner(can(check(his(Profit(and(by(looking(at( statement(of(financial(position(he(can(check(his(worth(and(his(total(resources.( ( ! WHAT!ARE!THE!BENEFITS!OF!KEEPING!FULL!DOUBLE!ENTRY!RECORDS!FOR!THE!BUSINESS?! ! 1. 2. 3. 4. 5. Helps(in(preparation(of(Trial(Balance( Helps(in(preparation(of(Financial(Statements( Less(Chances(of(Errors( Less(Chances(of(Frauds( Improves(the(Accuracy(of(Accounting(Records(( !! ADJUSTMENTS!IN!DETAIL! ADJUSTMENTS!IN!DETAIL! ! !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! ! BAD!DEBTS!AND!PROVISION!FOR!DOUBTFUL(BAD)!DEBTS! BAD!DEBTS!AND!PROVISION!FOR!DOUBTFUL(BAD)!DEBTS! ! ! !! What!is!a!bad!debt?! What!is!a!bad!debt?! ! When(a(costumer(to(whom(goods(were(sold(on(credit(basis,(is(unable(to(pay(his(debt(then(it(results(into( When(a(costumer(to(whom(goods(were(sold(on(credit(basis,(is(unable(to(pay(his(debt(then(it(results(into( ! an(expense(for(the(business.(Selling(goods(on(credit(basis(involves(this(risk(of(bad(debt.(Any(amount(of( an(expense(for(the(business.(Selling(goods(on(credit(basis(involves(this(risk(of(bad(debt.(Any(amount(of( ! debt(which(becomes(irrecoverable(should(be(written(off(as(bad(debt.( debt(which(becomes(irrecoverable(should(be(written(off(as(bad(debt.( ! ( (! !!!!!Debit:!Bad!Debts! !!!!!Debit:!Bad!Debts! ! !!!!!!!!!!!Credit!:!Person!Who!is!Bad!:>/Trade!receivable!! !!!!!!!!!!!Credit!:!Person!Who!is!Bad!:>/Trade!receivable!! ! ! !! What!is!a!Provision!for!bad!debt?! What!is!a!Provision!for!bad!debt?! ! A(business(must(consider(that(some(costumers(might(not(pay(the(amount(owed(by(them;(these(debts( A(business(must(consider(that(some(costumers(might(not(pay(the(amount(owed(by(them;(these(debts( are(considered(to(be(doubtful.(Since(the(business(does(not(know(the(exact(amount(of(the(doubtful( are(considered(to(be(doubtful.(Since(the(business(does(not(know(the(exact(amount(of(the(doubtful( debts((and(also(which(costumer(might(not(pay),(an(estimate(for(such(amount(is(kept(in(a(provision(for( debts((and(also(which(costumer(might(not(pay),(an(estimate(for(such(amount(is(kept(in(a(provision(for( doubtful(debt(account(((this(account(is(not(an(expense(account,(it’s(a(reduction(in(asset(from(the( doubtful(debt(account(((this(account(is(not(an(expense(account,(it’s(a(reduction(in(asset(from(the( statement(of(financial(position).(Provision(is(created(to(reduce(profit(now(for(an(expense(which(might( statement(of(financial(position).(Provision(is(created(to(reduce(profit(now(for(an(expense(which(might( happen(in(future.(This(is(done(to(be(pessimistic,(in(Accounting(we(call(this(being(prudent(or(the( happen(in(future.(This(is(done(to(be(pessimistic,(in(Accounting(we(call(this(being(prudent(or(the( Prudence(Concept.( Prudence(Concept.( !! A(business(usually(keeps(a(general(provision(((an(estimated(%(of(the(all(debtors),(but(it(is(also(possible(to( OMAIR MASOOD CEDAR COLLEGE A(business(usually(keeps(a(general(provision(((an(estimated(%(of(the(all(debtors),(but(it(is(also(possible(to( make(a(specific(provision(against(a(highly(doubtful(debt.(Specific(provision(mean(the(whole(amount(due( make(a(specific(provision(against(a(highly(doubtful(debt.(Specific(provision(mean(the(whole(amount(due( by(a(particular(debtor(is(added(to(the(provision.! by(a(particular(debtor(is(added(to(the(provision.! !! 90 debts((and(also(which(costumer(might(not(pay),(an(estimate(for(such(amount(is(kept(in(a(provision(for( doubtful(debt(account(((this(account(is(not(an(expense(account,(it’s(a(reduction(in(asset(from(the( statement(of(financial(position).(Provision(is(created(to(reduce(profit(now(for(an(expense(which(might( happen(in(future.(This(is(done(to(be(pessimistic,(in(Accounting(we(call(this(being(prudent(or(the( Prudence(Concept.( ! A(business(usually(keeps(a(general(provision(((an(estimated(%(of(the(all(debtors),(but(it(is(also(possible(to( make(a(specific(provision(against(a(highly(doubtful(debt.(Specific(provision(mean(the(whole(amount(due( by(a(particular(debtor(is(added(to(the(provision.! ! For!example!! Trade!Receivables!At!End=!60000! ! Case!1:!Only!General!Provision!of!5%!..!>!provision!=!5%!of!60000!=!$3000! ! Case!2:!A!specific!Provision!of!$2000!and!a!general!provision!of!4%!on!remaining!trade!receivables! !!!!!!!!!Provision!=!2000!(Specific)!+!4%!of!58000!(!general!provision!on!remaining!debtors)! ! !How!is!the!amount!of!provision!estimated?!(!Factors!effecting!it)! ! 5 Age(of(Debts(((Since(how(long(they(owe(us),(higher(the(age(more(likely(bad(debts(((so(high( provision(is(kept(If(majority(of(the(debts(are(owed(for(long)( 5 Historical(percentage(of(actual(bad(debts(from(previous(years( 5 Reputation(of(people(who(us(money(in(the(market( ! 5 Nature(of(Business( What!is!the!difference!between!accounting!treatment!of!Provision!for!doubtful!debts!and!the!actual! 5 Some(specific(debts(may(be(identified(and(full(amount(of(them(is(charged(in(provision.( Bad!debts?! ! ! What!is!the!difference!between!accounting!treatment!of!Provision!for!doubtful!debts!and!the!actual! The!Journal!entry!for!provision:! Bad!debts?! ! ! To!create!/!Increase! The!Journal!entry!for!provision:! !!!!!!!!!Debit!:!Profit!and!Loss!! ! !!!!!!!!!!!!!!Credit!:!Provision!for!doubtful!Debts! ! To!create!/!Increase! !!!!!!!!!Debit!:!Profit!and!Loss!! To!Decrease! !!!!!!!!!!!!!!Credit!:!Provision!for!doubtful!Debts! !!!!!!!!!!!!!Debit!:!Provision!for!doubtful!debts! ! !!!!!!!!!!!!!!!!!!Credit!:!Profit!and!Loss! ( To!Decrease! !!!!!!!!!!!!!Debit!:!Provision!for!doubtful!debts! The(difference(in(accounting(treatment(is(that(the(whole(of(bad(debt(is(treated(as(an(expense(but(only( !!!!!!!!!!!!!!!!!!Credit!:!Profit!and!Loss! the(change(in(provision(is(treated(as(either(an(expense((if(increasing)(or(an(income(((if(decreasing).(When( ( we(write(off(a(bad(debt,(we(remove(the(debtor(from(our(books(but(in(case(of(a(provision(we(don’t(adjust( The(difference(in(accounting(treatment(is(that(the(whole(of(bad(debt(is(treated(as(an(expense(but(only( the(debtor(account(as(a(separate(account(is(maintained.( ! the(change(in(provision(is(treated(as(either(an(expense((if(increasing)(or(an(income(((if(decreasing).(When( ! we(write(off(a(bad(debt,(we(remove(the(debtor(from(our(books(but(in(case(of(a(provision(we(don’t(adjust( ! the(debtor(account(as(a(separate(account(is(maintained.( ! ! ! What!is!Bad!Debt!Recovered?! This(is(when(a(debtor(whose(debt(was(previously(written(off(,(pays(us(back.(This(is(treated(as(an(income( ! in(the(year(in(which(the(debt(is(recovered(.(The(accounting(treatment(is(done(in(two(steps(( ! (( What!is!Bad!Debt!Recovered?! 5 Make(him(or(her(your(debtor((receivable()(as(the(debt(has(been(written(off(previously(and( This(is(when(a(debtor(whose(debt(was(previously(written(off(,(pays(us(back.(This(is(treated(as(an(income( the(account(of(that(costumer(doesn’t(exist(in(our(books( in(the(year(in(which(the(debt(is(recovered(.(The(accounting(treatment(is(done(in(two(steps(( ((((((((Debit(:(Name(of(Person(debtor)( (( 5(((((((((((((Credit:(Bad(debt(recovered(account( Make(him(or(her(your(debtor((receivable()(as(the(debt(has(been(written(off(previously(and( ( the(account(of(that(costumer(doesn’t(exist(in(our(books( 5 Now(record(the(entry(to(receive(the(money( ((((((((Debit(:(Name(of(Person(debtor)( ((((((Debit:(Bank( (((((((((((((Credit:(Bad(debt(recovered(account( (((((((((((((Credit(:(Name(of(person((debtor)( ( !5 Now(record(the(entry(to(receive(the(money( OMAIR MASOOD ((((((Debit:(Bank( ! ! CEDAR COLLEGE (((((((((((((Credit(:(Name(of(person((debtor)( ! 91 Bank!!!!!!!!!!!!!!!!!31000! !!!!!!31000! !!!!!!!!!!!!!!!!!Asset!!!!!!!!!!!!!50000! Prov!for!Depn!!20000! pn!!20000! !!!!!!!!!!!!!!!!!Gain!!!!!!!!!!!!!!1000! !!!!!!!!!!!!!!!!!Asset!!!!!!!!!!!!!50000! sset!!!!!!!!!!!!!50000! !!!!!!!!!!!!!!!!!Gain!!!!!!!!!!!!!!1000! ain!!!!!!!!!!!!!!1000! ! ! ! Adjusting!Entries! Adjusting!Entries! Adjusting!Entries! ! ! To!Adjust!expenses! ! ! To!Adjust!expenses! t!expenses! Prepaid!:!! ! Debit!:!Prepaid!Expense!!(!its!an!asset)! Prepaid!:!! !!!!!Credit!:!Expense!!!!!!!!!!!!(reduces!expense)! Debit!:!Prepaid!Expense!!(!its!an!asset)! paid!Expense!!(!its!an!asset)! ! !!!!!Credit!:!Expense!!!!!!!!!!!!(reduces!expense)! Expense!!!!!!!!!!!!(reduces!expense)! Owing/Accrual!! ! ! Owing/Accrual!! crual!! Debit!:!Expense!!!!!!!!!!!!!!!!!(increases!expense)! ! !!!!!Credit!:!Owing!Expense!(!it!is!a!liability)! Debit!:!Expense!!!!!!!!!!!!!!!!!(increases!expense)! ense!!!!!!!!!!!!!!!!!(increases!expense)! !!!!!Credit!:!Owing!Expense!(!it!is!a!liability)! To!adjust!Incomes:! Owing!Expense!(!it!is!a!liability)! !To!adjust!Incomes:! mes:! Prepaid:!! ! Prepaid:! ! ! Debit:(Income( ( ( (as(the(income(reduces(because(it’s(prepaid)( ( (! (! Credit:(Prepaid(Income( Debit:(Income( ( ((because(it’s(a(current(liability)( (as(the(income(reduces(because(it’s(prepaid)( Debit:(Income( ( ( (as(the(income(reduces(because(it’s(prepaid)( ( ( ( ( Credit:(Prepaid(Income( (because(it’s(a(current(liability)( ( Credit:(Prepaid(Income( (because(it’s(a(current(liability)( Owing/Due! ( Owing/Due! (! e! ! (! Debit:(Owing(Income(( ( (because(it’s(an(asset)( To!adjust!closing!stock! ( (! ( Credit:(Income( ( (as(the(income(increases)( Debit:(Owing(Income(( ( (because(it’s(an(asset)( ! Debit:(Owing(Income(( ( (because(it’s(an(asset)( ( ( ( Credit:(Income( ( (as(the(income(increases)( ( Overstated:!( ( Credit:(Income( (as(the(income(increases)( !To!adjust!closing!stock! ! Debit:(Trading(account( (or(simply(Profit(and(Los)( (! ( ( Credit:(Closing(stock( Overstated:! ( ! ! Debit:(Trading(account( (or(simply(Profit(and(Los)( Understated:! ( Credit:(Closing(stock( !( !( Debit:(Closing(sock( (( ( ( Credit:(Trading(account((or(simply(Profit(and(Loss)( Understated:! ( ! Debit:(Closing(sock( (! ( ( Credit:(Trading(account((or(simply(Profit(and(Loss)( (( ( To!adjust!Opening!stock! ( ( ( Overstated:! !To!adjust!Opening!stock! ! Debit:(Opening(Capital( (( ( ( Credit:(Trading(account((or(simply(Profit(and(Loss)( (Overstated:! ! ! Debit:(Opening(Capital( Understated:! ( Credit:(Trading(account((or(simply(Profit(and(Loss)( !( !( Debit:(Trading(account((or(simply(Profit(and(Loss)( (( ( ( Credit:(Opening(Capital( (Understated:! ! Debit:(Trading(account((or(simply(Profit(and(Loss)( (! OMAIR MASOOD CEDAR COLLEGE ( ( ( Credit:(Opening(Capital( This(is(because(opening(stock(has(opposite(relation(with(profits.(So(if(understated(profits(are( ( overstated(and(we(need(to(reduce(them((debit:(Trading(account).(Also(opening(stock(of(this(year( ( was(closing(stock(of(last(year(so(we(need(to(amend(the(opening(capital.( 92 Understated:! ! ! Debit:(Trading(account((or(simply(Profit(and(Loss)( ( ( ( Credit:(Opening(Capital( ( ( This(is(because(opening(stock(has(opposite(relation(with(profits.(So(if(understated(profits(are( overstated(and(we(need(to(reduce(them((debit:(Trading(account).(Also(opening(stock(of(this(year( was(closing(stock(of(last(year(so(we(need(to(amend(the(opening(capital.( Concept!of!Sale!or!Return!basis:! ! If(we(send(goods(on(sale(or(return(basis(which(means(goods(can(be(returned(by(the(customer(if(not(sold.( When(goods(are(send(nothing(is(recorded,(just(a(memorandum(is(kept.(These(goods(should(not(be( included(in(sales(and(should(be(included(in(closing(stock((since(they(belong(to(us).( ( If(this(is(recorded(as(sales(and(not(included(in(closing(stock,(then(we(need(to:( • Correct(sales:(Cancel(them( ( ( Debit:(Sales( ( ( ( Credit:(Debtor( ( • Correct(Closing(Stock(which(is(understated( ( Note:( We(won’t(have(to(correct(the(stock(if(the(goods(were(included(in(closing(stock.( OMAIR MASOOD CEDAR COLLEGE 93 Accounts(9706As(level- - O LEVEL REVISION WORKSHEET OMAIR-MASOOD- OLEVEL REVISION Q1. The following balances have been taken from the books of Wong Limited. Insurance Wages Commission receivable 1 April 2005 $ 700 prepaid 4300 owing 600 owing 31 March 2006 $ 850 prepaid 4700 owing 920 owing The following transactions relate to the year ended 31 March 2006. All the transactions were through the bank account. Insurance paid Insurance refund Wages Commission receivable $ 5300 400 78700 6200 REQUIRED: (a) Prepare the following ledger accounts. Include in each case, the transfer to the income statement(Profit and Loss Account) for the year ended 31 March 2006, and the balance carried down to the next financial year. (i) Insurance (ii) Wages (iii) Commission receivable (b) Prepare the Statement of Financial position(Balance Sheet) extracts as at 31 March 2006 for Insurance, wages and commission receivable. (c) (i) State the underlying concept involved in preparing the accounts listed in part (a). (ii) Explain why this concept is important. ! OMAIR MASOOD CEDAR COLLEGE 94 Accounts(9706As(level- - OMAIR-MASOOD- Q2. The following information is available for Harry Potter Commission received Electricity Rent 1 January 2006 $ 1040 owing 900 owing 2400 prepaid 31 December 2006 $ 2050 owing 600 owing 3000 prepaid During the year ended 31 December 2006, the following transactions took place. All transactions were carried out through the bank account. Commission received Electricity paid Rent paid $ 3940 7600 29200 REQUIRED: (a) Prepare the following ledger accounts for the year ended 31 December 2006, including in each case the transfer to the income statement(Profit and Loss Account). Dates are not required. (i) Commission Received (ii) Electricity (iii) Rent (b) Discuss the reasons for accounting for accruals and prepayments in the final accounts. ! OMAIR MASOOD CEDAR COLLEGE 95 Accounts(9706As(level- - OMAIR-MASOOD- Q3. The following balances appeared in the sheet of F. Dear, a trader on 30 April 2001: Amounts prepaid by business $ Insurance 110 Rates 200 Amounts accrued (due for payment) Electricity 450 Salaries 600 Amount prepaid to business Rent 400 The cash for the year to 30 April 2002 showed the following payments and receipts: Payments: $ Insurance 390 Rates 2000 Electricity 1540 Salaries 12580 Receipts Rent 5800 On 30 April 2002 the Statement of Financial position included the following balances: Amount prepaid by business $ Insurance 130 Amounts accrued (due for payment) Rates 220 Electricity 300 Salaries 790 Amount prepaid to business Rent 600 F. Deer has four houses, which he rents out to college students at a total annual rent of $6500 REQUIRED: Prepare ledger accounts for the above items, showing clearly all dates, details and transfer entries to the income statement(profit and loss account) for the year 30th April 2002. ! OMAIR MASOOD CEDAR COLLEGE 96 Accounts(9706As(level- - OMAIR-MASOOD- Q4. Allott’s expenditure on his business premises for the years 1996 and 1997 were as follows. 1996 1 January 1 January 3 June 30 December 1997 1 January 19 January 11 November Ground rent Rates Repairs Ground rent $ 1400 620 790 1500 Rates Repairs Repairs 680 220 540 The ground rent paid on 30 December 1996 was for the year 1997 The repairs paid on 19 January was for work completed during 1996 At 31 December 1997, there was a $190 bill for repairs, which had not been paid. REQUIRED: Open a Rent and Rates Account and a Repairs Account in Allott’s books. From the above information, write up both accounts for the years ended 31 December 1996 and 1997. Show clearly the amounts transferred to the income statement(Profit and Loss Account) in each of the two years. ! OMAIR MASOOD CEDAR COLLEGE 97 Accounts(9706As(level- - OMAIR-MASOOD- Q5. On 1 January 2004, Nick Greenwood, a trader, had the following entries in his ledger. Commission received Stationery Rates $800 owing $300 owing $500 prepaid The following information related to the financial year ended 31 December 2004. All transactions were by cheques. (i) Commission received was as follows 14 January 16 November $800 $3000 On 31 December 2004 $700 wasstill owed in commission to Nick Greenwood for the 2004 financial year (ii) Stationery was paid as follows. 19 January 13 November $700 $4100 On 1 January 2004 there was no Inventory of stationery, while at 31 December 2004 Inventory of stationery was $100. There were no outstanding invoices for stationery at 31 December 2004. (iii)Rates were paid as follows. 9 April $2500 24 November $2700 OMAIR-MASOODA refund for rates of $900 was received on 15 December 2004. At 31 December 2004 REQUIRED:rates were prepaid by $200. Accounts(9706As(level- (a) Prepare the following ledger accounts, including in each case the transfer to the Income Statement (Profit and Loss Account), for the year ended 31 December 2004 and the balance carried forward to the next financial year. (i) Commission received (ii) Stationery (iii)Rates (b) Explain the reasons for accounting for accruals and prepayments. ! OMAIR MASOOD CEDAR COLLEGE 98 Accounts(9706As(level- - OMAIR-MASOOD- Q6. Wholesome Foods Ltd provided the following Information for the year ended 31 May 2008. All receipts and payment are by cheques. (i) At 1 June 2007, insurance of $1500 was paid in advance. The following payments were made during the financial year ended 31 May 2008. $ August 2007 March 2008 6000 6400 The payment made in March 2008 included a prepayment of $1600 for the year commencing 1 June 2008. (ii) Wholesome Foods Ltd rents out part of its premises to Healthy Lunches. At 1 June 2007. Healthy Lunches owed $550 for one month’s outstanding rent. On the 1 June 2007, Wholesome Foods Ltd increased the annual rent to $7200 for the year ended 31 May 2008. During the year Healthy Lunches paid the following amounts to Wholesome Foods Ltd. $ June 2007 1750 September 2007 1800 December 2007 1800 March 2008 1800 On 31 May 2008 Healthy Lunches owed Wholesome Foods Ltd one month’s rent. (iii)At 1 June 2007, Wholesome Foods Ltd owed $800 for electricity. During the year ended 31 May 2008, the following payments were made. August 2007 November 2007 March 2008 $ 2600 2800 3400 Accounts(9706-At 31 May 2008, Wholesome Foods Ltd owed $960 for electricity. As(level- OMAIR-MASOOD- (iv) On 31 May 2008, Wholesome Foods Ltd reviewed its outstanding trade receivables which amounted to $36000. The business does not maintain a provision for doubtful debts. It was decided to write off the following as bad debts. $ Peter Plant 600 Sian Leaf 400 ! Sven Baum 300 REQUIRED: (a) Prepare the following ledgerCEDAR accounts COLLEGE for the year ended 31 May 2008. Include in OMAIR MASOOD each case the transfer to the Profit and Loss Account for the financial year and, where appropriate, the balance carried down to the next financial year. Dates are not required. 99 Peter Plant Sian Leaf Sven Baum $ 600 400 300 REQUIRED: (a) Prepare the following ledger accounts for the year ended 31 May 2008. Include in each case the transfer to the Profit and Loss Account for the financial year and, where appropriate, the balance carried down to the next financial year. Dates are not required. (i) (ii) (iii) (iv) Insurance Rent Receivable Electricity Bad Debts (b) The Income statement (Profit and Loss Account) extract for the above accounts for the year ended 31 May 2008. (c) The Statement of Financial position(Balance Sheet) extract as at 31 May 2008 for current assets and current liabilities, showing accounts receivable(debtors), insurance prepaid, rent receivable and electricity owing. (d) Evaluate the usefulness of a double entry book keeping system to Wholesome Foods Ltd. ! OMAIR MASOOD CEDAR COLLEGE 100 Accounts(9706As(level- - OMAIR-MASOOD- Q7.The following information is available for Ali baba Traders for the year ended 31 December 2003. All receipts and payments are by cheques. (i) At 1 January 2003 insurance of $300 was paid in advance. During 2003 payments for insurance were made as follows: $1700 on 26 February 2003 $1400 on 13 November 2003 The payment on 13 November 2003 included a prepayment of $400 for the year commencing 1 January 2004. (ii) At 1 January 2003 sales commission receivable of $500 was owed to the business. During 2003 the following sales commission amounts were received. $860 on 13 January 2003 (this included the $500 outstanding on 1 January 2003) $1900 on 24 March 2003 $2100 on 16 October 2003 At 31 December 2003 sales commission of $640 was owed to the business. (iii)Rent is paid quarterly in advance with due dates being 1 February, 1 May, 1 August and 1 November each year. As at 1 January 2003 rent was prepaid by $1000. A 5% price increase in rent was effective from 1 September 2003 and this increase was included in the quarterly payment made on 1st August 2003. The business always pays the exact amount due for rent on the quarterly dates specified. All are treated as being of equal length. REQUIRED: (a) Prepare the following ledger accounts for the year ended 31 December 2003. Include in each case the transfer to the Profit and Loss Account for the year, and the balance carried down to the next financial year. Dates are not required. (i) Insurance (ii) Sales Commission Receivable (iii)Rent (iv) The Income Statement(Profit and Loss Account) extract for the year ended 31 December 2003, showing insurance, sales commission receivable and rent. (v) The Statement of Financial position(Balance Sheet) extract as at 31 December 2003, showing insurance, sales commission receivable and rent. (b) Discuss two benefits to Ali baba Traders of using a double entry book keeping system. ! OMAIR MASOOD CEDAR COLLEGE 101 Accounts(9706As(level- - OMAIR-MASOOD- Q8(i) During the year to 31 December 20X6, the following debts are found to be bad and are written off on the dates shown: 9 March 30 May 25 June 10 October T Wright, $86 S O’Connor, $111 C Smith, $75 S Proctor, $39 REQUIRED: Show the bad debts account and the effect on the income statement(profit and loss account) for the year ended 31 December 20X6. (ii) The following are the total figures for accounts receivables at the end of each financial year. The provision for doubtful debts is to be maintained at 4% of trade receivables at the year-end. Year ended 31 December 20X1 20X2 20X3 Value of Trade receivable $12,000 $15,000 $14,000 REQUIRED: Assuming no provision for doubtful debts had previously existed you are required to: (a) Construct the provision for doubtful debts account for 20X1, 2 and 3. (b) Show the relevant entries on the profit and loss account for the year ended 31 December 20X1, 2 and 3. (c) Show the accounts receivable on the Statement of Financial position(balance sheet) extracts as at 31 December 20X1, 2 and 3. (iii)As at 1 April 20X8 we were owed $650 from Paul Evans. On 26 July Evans was declared bankrupt. A payment of 35¢ in the $ was received in full settlement. The remaining balance was written off as a bad debt. REQUIRED: Write up the account of Evans, as it would appear in the Sales Ledger. ! OMAIR MASOOD CEDAR COLLEGE 102 Accounts(9706As(level- - OMAIR-MASOOD- Q9Penny Case started business on 1 January 2006. At the end of the first year in business she decided to set up a provision for doubtful debts calculated at 3% of Trade receivable. Trade receivable as at 31 December 2006 amounted to $160000. During the period 1 January 2007 to the 30 November 2007, Penny Case wrote off bad debts totalling $1600. The accounts receivable as at 31 December 2007 amounted to $182000; however, Penny Case has not yet processed the following transactions, which need to be dealt with in the accounts of the business. (i) S.Tapler, an account receivable who owed $5000, had been declared bankrupt in December 2007. Penny Case received payment of $0.40 in the dollar in final settlement. The remainder of the debt is to be written off as bad. (ii) Penny Case has also decided to write off other bad debts totalling $2300. On 31 December 2007 Penny also decided to adjust the provision for doubtful debts to cover a specific debt of $1700, plus a general provision of 3% of the remaining trade receivables. REQUIRED: (a) Calculate the amount which Penny Case should provide as a provision for doubtful debts for the year’s ended: (i) 31 December 2006 (ii) 31 December 2007 (b) The following ledger accounts for the year ended 31 December 2007, showing (where appropriate) the transfer to the final accounts at the end of the year. (i) Provision for Doubtful Debts (ii) Bad Debts (iii)S.Tapler (c) The Income Statement (Profit and Loss Account) extract for the Provision for Doubtful Debts and Bad Debts for the year ended 31 December 2007. (d) The Statement of Financial position(balance sheet) extract as at the 31 December 2007 for trade receivables (net). ! OMAIR MASOOD CEDAR COLLEGE 103 Accounts(9706As(level- - OMAIR-MASOOD- Q-10Paul Cooper started in business on 1 January 1998. At the end of the first year in business his accounts receivable(debtors) amounted to $38,000 and he decided to create a provision for doubtful debts of $1,520. During the years ended 31 December 1999 and 31 December 2000, the following transactions relating to credit sales and accounts receivable(debtors) occurred. Sales Receipt from debtors Sales Returns Discount allowed Bad debts Year ended 31 December 1999 $ 220,000 190,000 1,750 3,700 3,000 Year ended 31 December 2000 $ 250,000 210,000 2,000 2,500 3,700 At 31 December 1999, Paul decided to maintain his provision for doubtful debts at the same percentage as it was on 31 December 1998. At 31 December 2000 he decided that a provision of 6% of his trade receivables would be made. REQUIRED: (a) Calculate the Provision for Doubtful Debts as at 31 December 1999 and 31 December 2000. (b) Explain the purpose and accounting treatment of a business creating a provision for doubtful debt. Make reference to the application of any relevant accounting concept. ! OMAIR MASOOD CEDAR COLLEGE 104 Accounts(9706As(level- - OMAIR-MASOOD- Q11 During the year ended 31 March 2007 Jeremiah lost money through customers not paying the amounts due to him. On 1 April 2007 he set up a provision for doubtful debts account. REQUIRED: (a) (i) Give one reason why Jeremiah decided to set up this account. (ii) Describe two factors Jeremiah might consider when deciding the amount to be provided for in the provision for doubtful debts account. (iii)Explain the difference between the accounting treatment of a bad debt and a doubtful debt. On 1 April 2008, Jeremiah’s provision for doubtful debts account had a balance of $8000. This consisted of an anticipated loss of $2500 which was the total owed by anaccount receivable, Uriah, who had been declared bankrupt, and a general provision of $5500 was created, which was 2½ % of all of his trade receivables. On 31 May 2008 Liew, who owed Jeremiah $1200, paid Jeremiah only $0.40 for every dollar owed. The remainder was written off as a bad debt. On 30 June 2008, Uriah paid Jeremiah $0.35 for every dollar owed, in final settlement of his account. On 28 February 2009 Jeremiah wrote off $300 of overdue debts from various trade receivables. On 31 March 2009 Jeremiah’s total trade receivables amounted to $205 000 and he adjusted his provision for doubtful debts account to 3 % of that amount. REQUIRED: (b) Prepare in Jeremiah’s ledgers the following accounts for the year ended 31 March 2009. (i) Provision for doubtful debts account; (ii) Bad debts account. On 31 March 2009 Khalil, whose debt of $3000 had been written off in 2007, after he unexpectedly left the country, returned and paid the amount due. (iii)Prepare in Jeremiah’s ledgers the bad debts recovered account for the year ended 31 March 2009. ! OMAIR MASOOD CEDAR COLLEGE 105 Accounts(9706As(level- - OMAIR-MASOOD- Q12- Matti Spicer prepared the following added accounts receivable(debtors) schedule for his business on 31 March 2007. Accounts Receivables S. Rosemary U. Tyme H. Ginger V. Turmeric C. Basil D. Bay T. Saffron O. Mint Amount due 1 month 2 months 3 months 4–6 months Over 6 months $ $ $ $ $ $ 300 2500 6350 90 1450 3200 60 2200 200 1900 1350 100 500 5000 100 16150 6100 90 1450 1200 1000 1000 1000 600 400 60 200 7600 1700 490 260 The provision for doubtful debts as at 1 April 2006 was $920. Matti Spicer’s policy for dealing with outstanding accounts receivable(debtors) is to: (i) Write off as bad debts all amounts outstanding for more than 6 months; (ii) Write off as bad debts all amounts under $100 outstanding for 4 to 6 months; (iii)Make specific provision for all other debts outstanding for 4 to 6 months; (iv) Make a general provision of 2½ % on all other debts outstanding. REQUIRED: (a) (b) (c) (d) (e) (i) The Bad Debts Accounts for the year ended 31 March 2007, showing the transfer to the final accounts. (ii) The provision for Doubtful Account for the year ended 31 March 2007, showing the balance carried down. The Statement of Financial position(Balance Sheet) extract for accounts receivable(Debtors) as at 31 March 2007. Identify two ways in which Matti Spicer could reduce bad debts. Explain two reasons why it is important to monitor and control accounts receivable(debtors). Discuss the application of the prudence concept when creating a provision for doubtful debts and the effect this may have on the final accounts. - ! OMAIR MASOOD CEDAR COLLEGE 106 Accounts(9706As(level- - OMAIR-MASOOD- Q13.B. Birds, a sole trader, prepared the following aged debtors schedule at 31 December 2001. Amount 1-2 Outstanding 4-6 Over 6 Debtor 1 month Due months 2-3 months months months $ $ $ $ $ $ S. Kibble 2400 1200 1200 A. Brock 700 400 300 M. Sarich 3100 2800 300 P. Evans 900 300 150 450 R. Collins 50 50 J. Davies 155 155 C. Arnold 80 80 N. Evans 1970 500 520 950 P. Jones 1400 400 200 800 G. Hurley 850 250 600 I. Cole 595 595 K. Bartle 330 330 12530 4645 2655 2800 1050 1380 B. Bird’s policy for dealing with outstanding trade receivables is to: (i) Write off, as bad debts, all amounts outstanding for more than six months. (ii) Make specific provision on all debts outstanding for between four and six months. (iii)Make a general provision for doubtful debts of 3% on all other debts outstanding. The provision for doubtful at 1 January 2001 was $1150. REQUIRED: (a) (i) The Bad Debts Accounts for the year 2001, showing the transfer to the final accounts as at 31 December 2001. (ii) The Provision for Doubtful Debts Accounts for the year 2001, showing the balance carried down as at 31 December 2001. (b) The Statement of Financial position(Balance sheet) extract for accounts receivable(Debtors) as at 31 December 2001. (c) Before making the adjustments for bad debts and provision for doubtful debts, B.Birds has calculated the following for the year ended 31 December 2001: Gross Profit $43800 Expenses $9400 Calculate the net profit for the year ended 31 December 2001, taking into account the adjustments required. (d) Advise B. Bird on three measures she could take to help prevent bad debts. ! OMAIR MASOOD CEDAR COLLEGE 107 Accounts(9706As(level- - OMAIR-MASOOD- Q14Niatax Limited has prepared the following agetrade receivables schedule as at 31 December 2005. Trade Receivables $ up to 30 days 16800 31 to 60 days 12600 61 to 90 days 7100 Over 90 days 1300 Niatax Limited maintains a provision for doubtful debts account. On 1 January 2005, the account Age of Debt had a balance of $800. The bad debts for the year ended 31 December 2004 amounted to $1420. Gillingham Limited, a debtor of $700, has recently been declared bankrupt. This amount had been included in the aged debtors schedule above, as being outstanding for 61 to 90 days. It is to be written off in full immediately from the agedebtors’ schedule. On 2 October 2005, Bay Limited, a trade receivable, ceased trading and Niatax Limited received payment of $0.25 in the dollar in final settlement of the debt of $600. The remainder of the debt was written off in full at that date. Other bad debts written off during the year totalled $350. The policy applied by Niatax Limited for the provision for doubtful debts is on a sliding scale basis as follows. Age of Debt up to 30 days 31 to 60 days 61 to 90 days Over 90 days % 1 2 3 10 REQUIRED: (a) Calculate the amount Niatax Limited should provide as a provision for doubtful debts as at 31 December 2005. (b) Prepare the following ledger accounts for the year ended 31 December 2005, showing the closing entry to the final accounts at the end of the year. (i) Provision for doubtful debts. (ii) Bad debts. (iii)Bay limited. ! OMAIR MASOOD CEDAR COLLEGE 108 Accounts(9706As(level- - OMAIR-MASOOD- (c) Prepare the Statement of Financial position(Balance Sheet) extract as at 31 December 2005 for trade receivables (net). (d) Rather than using its existing policy, Niatax Limited is considering applying a single percentage to all debts as the basis for calculating its provision for doubtful debts. If a change is made, it would use the average of 4% from its current rates. Evaluate: • The existing policy • The alternative policy --using figures to support your comments. Q15. 4 4 2 The following information is available from the books of Ari Soteris. 2 The following information is available from the books of Ari Soteris. 1 April 2014 31 March 2015 1 April £2014 31 March £ 2015 £ Commission received 850 £Accrued 920 Accrued Commission received 850 General expenses 4 100Accrued Prepaid 2920 970 Accrued Accrued General 4 100NilPrepaid 2 970? Accrued Rent expenses balance Rent Nil balance ? Provision for doubtful debts 2 700 Provision 260 700 ? Debtorsfor doubtful debts 000 65 000 Debtors 60 000 65 000 During the year ended 31 March 2015 the following amounts were received or paid (all transactions werethe through the bank During year ended 31 account). March 2015 the following amounts were received or paid (all transactions were through the bank account). £ Commission received 6£700 General expenses 240 Commission receivedpaid 69700 Rent paid 24 500 General expenses paid 9 240 Rent paid 24 500 The rent is due in equal monthly instalments. The payment for rent covered the period from 1 April 31 May 2015.monthly instalments. The payment for rent covered the period from 1 April The2014 rent until is due in equal 2014 until 31 May 2015. The provision for doubtful debts is to be set using the same percentage of debtors as in the previous year. The provision for doubtful debts is to be set using the same percentage of debtors as in the previous year. REQUIRED REQUIRED (a) The following ledger accounts, including in each case the transfer to the Profit and Loss Account for the year ended 31 March 2015 and the balance carried down to the next financial (a) Theyear. following (Dates ledger are notaccounts, required.) including in each case the transfer to the Profit and Loss Account for the year ended 31 March 2015 and the balance carried down to the next financial year. are notReceived required.) (i) (Dates Commission [4] ! (i) (ii)Commission Received General Expenses [4] [4] Rent Expenses (ii)(iii)General [4] [4] Provision for Doubtful Debts (iii)(iv)Rent [4] [4] (b)* Soteris for is Doubtful considering producing the accounts without adjusting for accruals and (iv) AriProvision Debts [4] prepayments. Discuss three reasons why it is considered essential for a business to make adjustments. (b)* Ari these Soteris is considering producing the accounts without adjusting for accruals [11] and prepayments. Discuss three reasons why it is considered essential for a business to make these adjustments. [11] Oxford Cambridge and RSA Copyright Information OCR is committed to seeking permission to reproduce all third-party content that it uses in its assessment materials. OCR has attempted to identify and contact all copyright holders Oxford Cambridge whose work isand usedRSA in this paper. To avoid the issue of disclosure of answer-related information to candidates, all copyright acknowledgements are reproduced in the OCR Copyright OMAIR MASOOD CEDAR COLLEGE Acknowledgements Booklet. This is produced for each series of examinations and is freely available to download from our public website (www.ocr.org.uk) after the live examination series. Copyright Information If OCR has unwittingly failed to correctly acknowledge or clear any third-party content in this assessment material, OCR will be happy to correct its mistake at the earliest possible opportunity. OCR is committed to seeking permission to reproduce all third-party content that it uses in its assessment materials. OCR has attempted to identify and contact all copyright holders whoseFor work is used in thisinformation paper. Toplease avoid contact the issue disclosure of answer-related information to candidates, all copyright acknowledgements are reproduced in the OCR Copyright queries or further theofCopyright Team, First Floor, 9 Hills Road, Cambridge CB2 1GE. Acknowledgements Booklet. This is produced for each series of examinations and is freely available to download from our public website (www.ocr.org.uk) after the live examination series. OCR is part of the Cambridge Assessment Group; Cambridge Assessment is the brand name of University of Cambridge Local Examinations Syndicate (UCLES), which is itself a If OCRdepartment has unwittingly failed to correctly acknowledge or clear any third-party content in this assessment material, OCR will be happy to correct its mistake at the earliest possible of the University of Cambridge. opportunity. 109 Accounts(9706As(level- - OMAIR-MASOOD- Q16. Following balances are available in the books of Omair Masood as at 1st June 2016. $ 600 1400 300 1200 Provision for doubtful debts Rent Prepaid Repair expense owing Commission Income Owing (i) (ii) (iii) (iv) The total Trade Recieveables at 31st May 2017 were $13000, it was decided to setup a specific provision for a debt of $200 and a general provision of 4% on all other Recieveables. Omair has been paying rent quarterly in advance with due dates on 1st November , 1st Febuary ,1st May and 1st August. The rent increased by 20% from 1st April 2017. The business always pays the exact amount due for rent on the quarterly dates specified. During the year ended 31st May 2017 payment made for repair expense was $6000 which included $400 for the year ended 31st May 2018. Omair always receives commission one month in arrear. The commission earned has been constant per month since the start of the business but increased by 20% on 1st January 2017 and then remained at the same level for the rest of the year. REQUIRED: For the year ended 31st May 2017 . (i) (ii) (iii) (iv) Provision for doubtful debt Account Rent Account Repair Expense Account Commission Income Account ! OMAIR MASOOD CEDAR COLLEGE 110 Accounts(9706As(level- - OMAIR-MASOOD- Q17.On 30th April 2007 the following balance were taken from the books of AksharJaberi, a sole trader. Purchases Sales Sales returns and Purchase returns Carriage inwards Carriage outwards Discounts allowed Discounts received Inventory Trade Receivables and Trade Payables Capital Premises Motor vehicles Provision for depreciation of motor vehicles Office equipment Provision for depreciation of office equipment 6% Loan Loan interest Cash Bank Bad debts Salaries Insurance Motor expenses General expenses Rent received Drawings Dr $ 557,000 8,200 2,250 3,250 4,800 Cr $ 952,000 9,600 2,750 36,700 80,150 47,200 805,300 900,000 160,000 40,000 76,000 30,500 100,000 5,500 2,300 12,900 500 62,000 10,500 18,200 32,100 10,000 25,000 1,997,350 1,997,350 The following information is also available. (i) The closing Inventory as at 30th April 2007 was valued at $43,650. (ii) A debt of $650 was considered irrecoverable. The full amount is to be treated as a bad debt in the accounts for the year ended 30th April 2007. (iii)A provision for doubtful debts is to be created at 2% on the remainder of the Trade Receivables. ! OMAIR MASOOD CEDAR COLLEGE 111 Accounts(9706As(level- - OMAIR-MASOOD- (iv) Rent receivable is $12,000 per annum, to date only 10 months’ rent has been received. (v) One month’s loan interest is still due. (vi) The loan commenced on 1st May 2002 and is repayable in full during 2010. (vii) At 30 April 2007 salaries owing amounted to $1,200 while insurance was prepaid by $1,860. (viii) AksharJaberi received an invoice for $600 on 15th April 2007 for repairs to a motor vehicle. To date, the invoice has not been paid. (ix) AksharJaberi had taken goods from the business costing $7,000 for his own use. This has not been recorded in the accounts. (x) Depreciation is to be provided as follows: Motor Vehicles 25% by the reducing balance method. There were no additions or disposals during the year. Equipment 10% by the straight line method. There were no additions or disposals during the year. Premises are not depreciated. REQUIRED: The Income Statement(Trading and Profit and Loss Account) for the year ended 30th April 2007, and the Statement of Financial position(Balance Sheet) as at 30th April 2007. ! OMAIR MASOOD CEDAR COLLEGE 112 Accounts(9706As(level- - OMAIR-MASOOD- Q18.On 31st March 2007 the following information was available from the books of Andy Bowden, a sole trader.- Purchases and Sales Purchase returns Inventory Capital Bank Salaries Discounts Bank interest charges Insurance General expenses 12% Loan Loan interest Premises Provision for depreciation of premises Shop fittings Provision for depreciation of shop fittings Rent received Carriage inwards Trade Receivables and Trade Payables Dr $ 226,000 Cr $ 479,000 600 29,200 104,000 2,000 85,000 1,400 600 8,800 126,000 3,000 60,000 6,000 160,000 9,600 56,000 33,600 4,200 1,400 14,900 715,300 19,300 715,300 The following information is also available. (i) The closing Inventory as at 31st March 2007 was valued at $26,000. (ii) General expenses include a prepayment of $400. (iii)A debt of $700 was considered irrecoverable. The full amount is to be treated as a bad debt in the accounts for the year ended 31st March 2007. (iv) A provision for doubtful debts is to be created as $500 for a specific debt, plus 3% on the remainder of Trade Receivables. (v) The insurance included $300 covering a private insurance for Andy Bowden. (vi) The loan was taken out in November 2004 and is repayable in full during the financial year ended 31st March 2009. (vii) All the shop fittings had been purchased for $56,000 on 1stApril 2003, and depreciation has been charged using the straight line basis. The provision for the depreciation of shop fittings for the year ended 31stMarch 2007 is to be charged using the same method and rate. (viii) Premises are depreciated by 2% per annum on cost using the straight line method. REQUIRED: The Income Statement (Trading and Profit and Loss Account) for the year ended 31st st March 2007, and the Statement of Financial position (Balance Sheet) as at 31 March 2007. ! OMAIR MASOOD CEDAR COLLEGE 113 Accounts(9706As(level- - OMAIR-MASOOD- Q19.On 31 March 2006 the following information was available from the books of Glenn White, a sole trader.Dr $ Trade Payables Trade Receivables Bank Inventory Sales Purchases Carriage inwards Purchase returns Rent and rates Salaries Discount allowed General expenses Bad debts Provision for doubtful debts 8% Loan Loan interest Equipment Provision for depreciation of equipment Motor vehicles Provision for depreciation of motor vehicles Capital Drawings Cr $ 14,600 9,600 700 12,000 378,000 174,000 3,000 4,000 28,400 93,500 1,800 62,200 300 1,500 30,000 2,000 40,000 12,000 30,000 6,000 17,600 7,600 464,400 464,400 The following information is also available. (i) The closing Inventory as t 31 March 2006 was valued at $15,000. (ii) At 31st March 2006, general expenses prepaid amounted to $700. (iii)Martin Griffiths, a debtor included in the Trade Receivables balance above, has recently been declared bankrupt. His debt of $600 is to be written off as a bad debt in the accounts for the year ended 31st March 2006. (iv) A cheque of $500 received from a debtor has not yet been entered inthe accounts. (v) The provision for doubtful debts is to be decreased by $300. (vi) At 31st March 2006, two month’s interest is due on the loan. The loan is repayable in full during the year ended 31st March 2007. (vii) Glenn White acts as an agent for Stormy Limited and is owed commission of $3,700 for the year ended 31st March 2006. (viii) A new motor vehicle was purchased for $18,000 on 1st August 2005. This was the only fixed asset purchased during the year ended 31st March 2006. The full amount is included in the balance shown for motor vehicles. ! OMAIR MASOOD CEDAR COLLEGE 114 Accounts(9706As(level- - OMAIR-MASOOD- (ix) Depreciation is to be provided as follows: Equipment 10% per annum on cost using the straight line method. No residual value is allowed for. Motor Vehicles 25% per annum by the reducing balance method. Depreciation is calculated for each proportion of a year for which motor vehicles are held. There were no fixed asset disposals during the year ended 31st March 2006. REQUIRED: (a) The Income Statement(Trading and Profit and Loss Account) for the year ended 31st March 2006. (b) The Statement of Financial position(Balance sheet) as at 31st March 2006. ! OMAIR MASOOD CEDAR COLLEGE 115 Accounts(9706As(level- - OMAIR-MASOOD- Q20.Laurence Keston, a trader, prepared the following Trial Balance from his accounts on 31st December 2005.Dr $ Sales Purchases Sales returns Discount received Capital Drawings Rates Salaries 10% loan Loan interest Rent received Loss on sale of delivery vehicle Carriage outwards General expenses Insurance Provision for doubtful debts Buildings Machinery Provision for depreciation of machinery Delivery vehicles Provision for depreciation of delivery vehicles Trade Receivables Trade Payables Bank Inventory Cr $ 620,000 270,000 10,000 1,900 231,000 3,400 12,000 130,000 60,000 6,000 5,300 900 3,700 67,846 7,000 2,000 290,000 50,000 18,250 30,000 11,000 57,500 64,600 27,704 48,000 1,014,050 1,014,050 The following information is also available. (i) The closing Inventory as at 31st December 2005 was valued at $56,400. (ii) At 31st December 2005, insurance owing amounted to $400. (iii)During the year Laurence Keston had withdrawn, for his personal use, goods costing $1,600. This had not been recorded in the accounts. (iv) Rent receivable of $800 was owing to the business at 31st December 2005. (v) The loan is repayable in full during 2009. ! OMAIR MASOOD CEDAR COLLEGE 116 Accounts(9706As(level- - OMAIR-MASOOD- (vi) The provision for doubtful debts is to be provided as $700 for a specific debt, plus 3% on the remainder of Trade Receivables. (vii) During the year the business purchased a building for $150,000 and this has been included in the balance of $290,000 shown for buildings in the Trial Balance. In addition to this amount, legal costs of $2,000 incurred in the purchase of the building have been debited to general expenses. (viii) Depreciation is to be provided on all machinery at 25% per annum on cost. Machinery costing $12,000 was purchased on 1st August 2005 and this is included in the balance shown for machinery. Depreciation is calculated for each proportion of the year for which machinery is held. There were no disposals of machinery during the year. (ix) Delivery vehicles are to be depreciated by $6,000 for the year. (x) Buildings are not depreciated. REQUIRED: (a) The Income Statement(Trading and Profit and Loss Account) for the year ended 31st December 2005. (b) The Statement of Financial position(Balance Sheet) as at 31st December 2005. ! OMAIR MASOOD CEDAR COLLEGE 117 Accounts(9706As(level- - OMAIR-MASOOD- Q21.Dave Newman, a trader, prepared the following Trial Balance from his accounts on 31stMarch 2005.Dr $ Capital Drawings Inventory Bank Discounts Purchases and sales Trade Receivables and Trade Payables General expenses Salaries Premises Provision for depreciation of premises Equipment Provision for depreciation of equipment Sales returns Provision for doubtful debts Carriage outwards Carriage inwards Repairs and extension to premises Cr $ 110,000 1,800 11,200 1,500 137,600 24,700 37,400 68,300 80,000 8,200 1900 247,450 26,200 5,600 29,000 9,200 2,500 550 600 800 13,700 409,100 409,100 The following information is also available. (i) The closing Inventory as at 31st March 2005 was valued at $16,300. (ii) As at 31st March 2005, salaries owing amounted to $3,400, while general expenses were prepaid by $550. (iii) A debt of $1,400 was considered irrecoverable. The full amount is to be treated as a bad debt in the accounts for the year ended 31st March 2005. (iv) The provision for doubtful debts is to be adjusted to 2% of Trade Receivables. (v) Of the repairs and extension to premises, $700 related to repairs and the remainder to an extension. (vi) Depreciation is to be provided as follows: Equipment 10% by the reducing balance method. There were no additions or disposals during the year. Premises 2% by the straight line method. This rate applies to the cost value at the year end, regardless of the date of any additions during the year. Bank charges of $600 are outstanding. REQUIRED: (a) The Income Statement (Trading and Profit and Loss Account) for the year ended 31st March 2005. (b) The Statement of Financial position (Balance Sheet) as at 31st March 2005. ! OMAIR MASOOD CEDAR COLLEGE 118 Accounts(9706As(level- - OMAIR-MASOOD- Q22.The following list of balances as at 30th September 1999 has been obtained from the books of Patrick, a retailer:$ st Freehold land, at 1 October 1998, at cost 34,000 Fixtures and fittings, at 1st October 1998 At cost 68,000 Provision for depreciation 19,200 Motor vehicles, at 1st October 1998 At cost 62,000 Provision for depreciation 37,200 st Motor vehicles additions on 1 April 1999 16,000 Inventory, at cost, at 1st October 1998 70,000 Purchases 373,400 Purchases returns 1,200 Sales 564,000 Sales returns 9,600 Salaries 100,000 Rent and insurance 30,800 Electricity 10,400 Discount allowed 1,600 Discount received 900 Trade Receivables 34,000 Trade Payables 24,100 Balance at bank 7,600 Capital account, at 1 October 1998 202,800 Drawings 32,000 Additional information: 1. Inventory, at cost, on 30th September 1999 was $59,000. 2. It has been discovered that there were unrecorded credit sales of $5,600 on 30th September 1999. 3. Patrick’s shop manager receives a commission of 2% of gross profit. This is paid three months after the financial year. 4. The freehold land was let during the year. The rent received, $2,400 has been paid into Patrick’s private bank account. 5. Depreciation is to be provided on the straight line method based on the period of use, at the following annual rate; Fixtures and fittings 2 ½% Motor vehicles 20% REQUIRED: (a) Prepare the Income Statement(Trading and Profit and Loss Account) for the year ended 30th September 1999. (b) Prepare the Statement of Financial position(balance Sheet) as at 30th September 1999. ! OMAIR MASOOD CEDAR COLLEGE 119 Accounts(9706As(level- OMAIR-MASOOD- 2 Q23. 1 - On 31 March 2015 the following information was available from the books of Bill Wylan, a sole trader. Dr £ Sales Purchases Carriage inwards Carriage outwards Commission received Discounts allowed Discounts received Electricity General expenses Debtors Bad debts Provision for doubtful debts Creditors Rent Capital Salaries Insurance Drawings Motor expenses Bank Stock 10% Loan Loan interest Sales returns Purchase returns Equipment Provision for depreciation of equipment Motor vehicles Provision for depreciation of motor vehicles Cr £ 115 000 42 000 3 500 2 600 2 120 1 850 1 920 3 800 7 930 15 740 2 800 488 13 970 22 000 24 835 27 500 3 400 8 700 3 200 1 846 11 100 15 000 1 125 5 150 2 870 10 090 3 436 16 000 188 485 7 000 188 485 ,! ! © OCR 2015 OMAIR MASOOD F011/01/RB May15 CEDAR COLLEGE 120 Accounts(9706As(level- 3 - OMAIR-MASOOD- The following information is also available. (i) The closing stock as at 31 March 2015 was valued at £14 740. (ii) During the year Bill Wylan took stock at a cost price of £1630 from the business for his personal use. This transaction has not been recorded in the accounts. (iii) Bill Wylan has now discovered that a debtor, who owed the business £540, has been declared bankrupt. Bill Wylan has received a cheque to the value of 20p in the pound with the remainder owing to be treated as a bad debt. These adjustments need to be included within the final accounts for the year ended 31 March 2015. (iv) A provision for doubtful debts of 4% of debtors remaining on the books at the end of the year is to be made. (v) Rent for the business premises has remained at £2000 per month throughout the last financial year. (vi) At 31 March 2015, the following amounts were owing: salaries £2500, motor expenses £150; whilst insurance was prepaid £600. (vii) Included in general expenses is the cost of Bill Wylan’s private holiday costing £2300. (viii) The £15 000 loan was taken out in June 2013 and is repayable in full on 30 September 2015. (ix) On 24 March 2015 a cheque for £1500 was received for the disposal of equipment on that date. This transaction has not been recorded in the books. This equipment was purchased on 1 April 2011 at a cost of £2500. (x) Depreciation is to be provided as follows. Equipment: Motor vehicles: 10% per annum using the straight line method. 25% per annum using the reducing balance method. No depreciation is charged on fixed assets sold during the year. REQUIRED (a)* The Trading and Profit and Loss Account for the year ended 31 March 2015 and the Balance Sheet as at 31 March 2015. [44] ! (b) Discuss three problems involved in accounting for depreciation. ! [9] ! ! OMAIR MASOOD CEDAR COLLEGE 121 Accounts(9706As(level! - OMAIR-MASOOD- PAGE 29 Q24! 2 Amah Retto's ledger accounts for the year ended 30 April 2008 showed the following balances: 1 Premises at cost Machinery at cost Provision for depreciation on machinery at 1 May 2007 Provision for doubtful debts at 1 May 2007 Sales Purchases Sales returns Purchases returns Carriage inwards Carriage outwards Rent received Discount allowed Discount received Electricity General expenses Stock at 1 May 2007 Debtors Creditors Bank (Credit) Cash Drawings Long-term loan at 11 % per annum Capital $ 250 000 52 000 15 600 500 243 000 184 000 2 040 1 980 350 800 2 420 1 800 1 300 2 100 9 340 13 500 9 000 11 460 8 260 990 18 600 60 000 ? For Examiner's Use ! Additional information at 30 April 2008 ! 1 Stock was valued at $15 100. 2 No interest had been paid or provided for on the loan, which had been taken out on 1 November 2007. 3 Amah Retto's tenant had paid only eleven months' rent; one month's rent was due and unpaid. 4 Electricity prepaid amounted to $40. 5 General expenses accrued amounted to $50. 6 Debts of $200 were to be written off. OMAIR MASOOD COLLEGE Depreciation was to be providedCEDAR on machinery at 40 % using the reducing (diminishing) 122 balance method. Doubtful debts provision was to be 3 % of debtors at the end of the year. Creditors Bank (Credit) Cash Drawings Accounts(9706Long-term loan at 11 % per annum Capital As(level- - 11 460 8 260 990 18 600 60 000 ? OMAIR-MASOOD- Additional information at 30 April 2008 1 Stock was valued at $15 100. 2 No interest had been paid or provided for on the loan, which had been taken out on 1 November 2007. 3 Amah Retto's tenant had paid only eleven months' rent; one month's rent was due and unpaid. 4 Electricity prepaid amounted to $40. 5 General expenses accrued amounted to $50. 6 Debts of $200 were to be written off. Depreciation was to be provided on machinery at 40 % using the reducing (diminishing) balance method. Doubtful debts provision was to be 3 % of debtors at the end of the year. ! REQUIRED!:! For!the!year!ending!30!April!2008! (!i)!Income!Statement!! As!at!30!April!2008!! © UCLES 2008 9706/02/M/J/08 (ii)!Statement!of!Financial!Position!! ! ! ! ! ! ! ! ! ! OMAIR MASOOD CEDAR COLLEGE 123 Accounts(9706As(level- - OMAIR-MASOOD- ! PAGE 282 Q25.! 1 2 Kirsty, a sole trader, prepared the following trial balance at 30 April 2011. Rent General expenses Insurance Salaries Electricity Capital Motor expenses Bad debts Drawings Trade receivables Trade payables Cash and cash equivalents Inventory 10% Loan Loan interest Carriage outwards Commission received Ordinary goods purchased Revenue Purchases returns Sales returns Discounts allowed Discounts received Provision for doubtful debts Equipment Provision for depreciation of equipment Motor vehicles Provision for depreciation of motor vehicles $ 4 000 6 000 3 300 14 000 2 000 For Examiner’s Use $ 44 000 4 900 200 6 000 6 200 3 800 2 600 3 600 15 000 1 250 700 730 56 000 108 000 2 500 4 800 600 400 520 48 000 14 400 36 000 200 150 10 800 200 150 ! The following information is also available: 1 The closing inventory at 30 April 2011 was valued at $4200. 2 Included in the general expenses is an item of equipment purchased during the year for $1200. This item has not yet been included in the equipment account. 3 A cheque for $800 received from a credit customer has not yet been entered in the accounts. 4 At 30 April 2011: loan interest owing amounted to $250 electricity owing was $380 insurance was prepaid by $460 5 During the year Kirsty had withdrawn, for her personal use, goods costing $1800. This has not been recorded in the accounts. ! OMAIR6 MASOOD COLLEGE Commission receivableCEDAR of $150 was owing to Kirsty at 30 April 2011. 7 124 The provision for doubtful debts is to be provided for a specific debt of $200, plus 2% of the remaining debtors. Provision for depreciation of equipment Equipment Motor vehicles Provision for depreciation of equipment Provision for depreciation of motor vehicles Motor vehicles Provision for Accounts(9706- depreciation of motor vehicles As(level- - 48 000 36 000 36 000 200 150 200 150 14 400 14 400 10 800 10 800 200 150 200 150 OMAIR-MASOOD- The following information is also available: The following information is also available: 1 The closing inventory at 30 April 2011 was valued at $4200. 1 The closing inventory at 30 April 2011 was valued at $4200. 2 Included in the general expenses is an item of equipment purchased during the 2 Included the general expenses itemincluded of equipment purchasedaccount. during the year forin$1200. This item has not is yetan been in the equipment year for $1200. This item has not yet been included in the equipment account. 3 A cheque for $800 received from a credit customer has not yet been entered in the 3 A cheque for $800 received from a credit customer has not yet been entered in the accounts. accounts. 4 At 30 April 2011: 4 At 30 April loan2011: interest owing amounted to $250 loan interestowing owingwas amounted electricity $380 to $250 electricity owing $380by $460 insurance waswas prepaid ! insurance was prepaid by $460 5 During the year Kirsty had withdrawn, for her personal use, goods costing $1800. 5 During the not yearbeen Kirsty had withdrawn, for her personal use, goods costing $1800. This has recorded in the accounts. This has not been recorded in the accounts. 6 Commission receivable of $150 was owing to Kirsty at 30 April 2011. 6 Commission receivable of $150 was owing to Kirsty at 30 April 2011. 7 The provision for doubtful debts is to be provided for a specific debt of $200, plus 7 The for doubtful debts is to be provided for a specific debt of $200, plus 2%provision of the remaining debtors. 2% of the remaining debtors. © UCLES 2011 9706/22/O/N/11 ! © UCLES 2011 9706/22/O/N/11 PAGE 283 ! 3 8 One half of the 10% loan is repayable during the year ending 30 April 2012, and the balance is repayable after that date. 9 Depreciation is to be provided as follows: For Examiner’s Use Equipment 10% per annum on cost. A full year’s depreciation is provided on all equipment held at 30 April 2011, regardless of the date of purchase. Motor vehicles 25% by the reducing (diminishing) balance method. There were no additions or disposals during the year. REQUIRED (a) Prepare the income statement (trading and profit and loss account) for Kirsty for the PAGE 285 year ended 30 April 2011. ! 5 .......................................................................................................................................... (b) Prepare the statement of financial position (balance sheet) for Kirsty at 30 April 2011. For .......................................................................................................................................... !Examiner’s Use .......................................................................................................................................... ! .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... ! .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... 125 OMAIR MASOOD CEDAR COLLEGE .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... ACCOUNTING!FOR!NON!CURRENT!ASSETS! ACCOUNTING FOR NON CURRENT ASSETS (DEPRECIATION) THEORY ! Whenever(we(spend(money(we(call(it(expenditure.(The(expenditure(can(be(divided(in(two(( ( Capital!Expenditure!! Revenue!Expenditure! Any(expenditure(incurred(on(buying(new( Any(day(to(day(expense(to(run(the(business.( non5current(asset.(We(take(this(to(balance( We(take(this(to(income(statement( Sheet( Usually(one(off((doesn’t(happen(on(daily( Its(recurring(in(nature(((we(have(to(do(it( basis)( again(and(again)( Includes(initial(expenses(incurred(till(we( Usually(occurs(after(we(start(using(the(asset( start(using(the(asset(e.g.(Installation,( delivery(charges( Increases(the(value(of(earning(capability(of( Maintains(the(value(or(earning(capability(of( the(asset(e.g.(Adding(a(Safety(device( the(asset.(E.g.(Repainting(or(Repair( ! In!the!same!way!we!can!have!Capital!receipts!and!Revenue!Receipts!.! ! Capital(Receipts(would(include(money(received(from(capital(transactions(e.g.((taking(a(bank(loan(,(selling( a(non(current(asset(or(additional(capital(introduced(by(the(owners(((note(this(money(coming(in(not( earned(by(the(business(from(profits)(( Revenue(Receipts(are(incomes(generated(from(day(to(day(operations(of(a(business(((taken(to(income( statement)(e.g.(Sale(of(goods(,(Interest(received(rent(received(( ( ( If(these(expenditures(and(receipts(are(treated(in(the(wrong(way(then(both(income(statement(and( balance(sheet(will(be(wrong.( ! ! ! ! ! This(is(an(expense(recorded(to(allocate(a(non(current(asset(cost(over(its(useful(life.(Deprecation(is(used( ! in(accounting(to(try(to(match(the(expense(of(an(asset(to(the(income(that(the(asset(helps(the(business(to( ! earn.(For(example(if(a(business(buys(a(piece(of(equipment(for($1(million(and(expects(to(use(it(over(a(life( ! of(10(years,(it(will(be(depreciated(over(10(years(.((Every(accounting(year,(the(company(will(expense( ! !$100000((assuming(straight(line(,(which(will(be(matched(with(the(money(that(the(equipment(helps(to( !make(each(year.()( !( !The!Double!Entry!for!Depreciation!is!:! ! !Debit!:!Profit!and!Loss!Account!(!Income!Statement)! !!!!!!!!!Credit!:!Provision!for!Depreciation!! Depreciation! ! ! Methods!of!Depreciation:! ! 1. Straight!Line!:!! !!!!!!!!!An(equal(amount(of(deprecation(is(charged(every(year.(It(is(always(calculated(on(cost(.(In(case(of( OMAIR MASOOD CEDAR COLLEGE scrap(value((residual(value)((and(life(given(use(:(Cost(–Scrap/Life(( ! 2. Reducing!Balance!Method:! In(this(deprecation(for(initial(years(in(always(higher(then(the(later(years.(It(is(simply(a(percentage(on(net( 126 ! Which!Method!is!best!to!use?! It(depends(on(the(nature(of(Non(Current(Asset( ( Straight!Line!method(is(appropriate(for(assets(like(office(furniture(and(fittings((which(are(used(evenly( through(out(the(year(useful(life,(and(the(efficiency(of(them(doesn’t(fall(by(great(amount(in(initial(years)( ! Reducing!Balance!Method(is(appropriate(for(assets(like(machinery(or(van.(Since(these(assets(are(more( efficient(when(new,(more(depreciation(is(charged(in(initial(years.(As(the(asset(gets(old(it(looses(efficiency( and(so(we(charge(less(deprecation.(Another(way(to(look(at(it(is(that(the(maintenance(and(repairs(of( asset(will(increase(in(later(years(so(to(maintain(the(overall(expense(it(makes(sense(to(charge(more( !! depreciation(in(initial(years(when(maintenance(is(low(and(then(reduce(it(as(maintenance(increases.( Which!Method!is!best!to!use?! !Which!Method!is!best!to!use?! (It(depends(on(the(nature(of(Non(Current(Asset( It(depends(on(the(nature(of(Non(Current(Asset( Which!Method!is!best!to!use?! How!to!record!disposal!of!Asset:! It(depends(on(the(nature(of(Non(Current(Asset( (( Disposal(of(means(getting(ride(of(the(fixed(asset(.(it(can(be(sold(or(may(be(stolen(or(just(discarded.( Straight!Line!method(is(appropriate(for(assets(like(office(furniture(and(fittings((which(are(used(evenly( (Straight!Line!method(is(appropriate(for(assets(like(office(furniture(and(fittings((which(are(used(evenly( Usually(there(are(4(entries(to(record(sale(of(asset( through(out(the(year(useful(life,(and(the(efficiency(of(them(doesn’t(fall(by(great(amount(in(initial(years)( Straight!Line!method(is(appropriate(for(assets(like(office(furniture(and(fittings((which(are(used(evenly( through(out(the(year(useful(life,(and(the(efficiency(of(them(doesn’t(fall(by(great(amount(in(initial(years)( ! through(out(the(year(useful(life,(and(the(efficiency(of(them(doesn’t(fall(by(great(amount(in(initial(years)( !! 1. Remove!the!Cost!of!the!Asset!Sold! !Reducing!Balance!Method(is(appropriate(for(assets(like(machinery(or(van.(Since(these(assets(are(more( Reducing!Balance!Method(is(appropriate(for(assets(like(machinery(or(van.(Since(these(assets(are(more( Debit!:!Disposal!!!!!!Credit:!Asset!! Reducing!Balance!Method(is(appropriate(for(assets(like(machinery(or(van.(Since(these(assets(are(more( efficient(when(new,(more(depreciation(is(charged(in(initial(years.(As(the(asset(gets(old(it(looses(efficiency( efficient(when(new,(more(depreciation(is(charged(in(initial(years.(As(the(asset(gets(old(it(looses(efficiency( ! efficient(when(new,(more(depreciation(is(charged(in(initial(years.(As(the(asset(gets(old(it(looses(efficiency( and(so(we(charge(less(deprecation.(Another(way(to(look(at(it(is(that(the(maintenance(and(repairs(of( and(so(we(charge(less(deprecation.(Another(way(to(look(at(it(is(that(the(maintenance(and(repairs(of( 2. !Remove!the!Total!Deprecation!! and(so(we(charge(less(deprecation.(Another(way(to(look(at(it(is(that(the(maintenance(and(repairs(of( asset(will(increase(in(later(years(so(to(maintain(the(overall(expense(it(makes(sense(to(charge(more( asset(will(increase(in(later(years(so(to(maintain(the(overall(expense(it(makes(sense(to(charge(more( Debit!:!Provision!for!Depreciation!!!!Credit!:!Disposal! asset(will(increase(in(later(years(so(to(maintain(the(overall(expense(it(makes(sense(to(charge(more( depreciation(in(initial(years(when(maintenance(is(low(and(then(reduce(it(as(maintenance(increases.( depreciation(in(initial(years(when(maintenance(is(low(and(then(reduce(it(as(maintenance(increases.( ! depreciation(in(initial(years(when(maintenance(is(low(and(then(reduce(it(as(maintenance(increases.( (( 3. Record!the!Selling!Price! ( Debit:!Bank!!!!!Credit!:!Disposal! How!to!record!disposal!of!Asset:! How!to!record!disposal!of!Asset:! ! Disposal(of(means(getting(ride(of(the(fixed(asset(.(it(can(be(sold(or(may(be(stolen(or(just(discarded.( Disposal(of(means(getting(ride(of(the(fixed(asset(.(it(can(be(sold(or(may(be(stolen(or(just(discarded.( If!exchanged!then!! Usually(there(are(4(entries(to(record(sale(of(asset( Usually(there(are(4(entries(to(record(sale(of(asset( !!!!!!!!Debit!:!Asset!!!Credit!Disposal! ! ! !! 1. Remove!the!Cost!of!the!Asset!Sold! 1. Remove!the!Cost!of!the!Asset!Sold! 4. Close!the!Disposal!Account! Debit!:!Disposal!!!!!!Credit:!Asset!! Debit!:!Disposal!!!!!!Credit:!Asset!! !!!!!Close!with!income!statement!.!! !! ! 2. !Remove!the!Total!Deprecation!! !Remove!the!Total!Deprecation!! 2. All(of(this(can(be(done(in(one(single(entry(without(using(disposal( Debit!:!Provision!for!Depreciation!!!!Credit!:!Disposal! Debit!:!Provision!for!Depreciation!!!!Credit!:!Disposal! ( !! For(example(( 3. Record!the!Selling!Price! Record!the!Selling!Price! 3. Cost(of(Asset(Sold(=(50000( Debit:!Bank!!!!!Credit!:!Disposal! Debit:!Bank!!!!!Credit!:!Disposal! Net(book(Value((=(30000( !! (Sold(For(28000( If!exchanged!then!! ( If!exchanged!then!! !!!!!!!!Debit!:!Asset!!!Credit!Disposal! !!!!!!!!Debit!:!Asset!!!Credit!Disposal! Note(:(total(depreciation(is(20000(as(NBV(is(30000( !!!! ! 4. 4. Close!the!Disposal!Account! Close!the!Disposal!Account! !!!!!Close!with!income!statement!.!! !!!!!Close!with!income!statement!.!! ! ! All(of(this(can(be(done(in(one(single(entry(without(using(disposal( All(of(this(can(be(done(in(one(single(entry(without(using(disposal( ( ( For(example(( For(example(( Cost(of(Asset(Sold(=(50000( Cost(of(Asset(Sold(=(50000( Net(book(Value((=(30000( Net(book(Value((=(30000( 127 OMAIR(Sold(For(28000( MASOOD CEDAR COLLEGE (Sold(For(28000( ( ( Note(:(total(depreciation(is(20000(as(NBV(is(30000( ! Note(:(total(depreciation(is(20000(as(NBV(is(30000( 4. Close!the!Disposal!Account! !!!!!Close!with!income!statement!.!! ! All(of(this(can(be(done(in(one(single(entry(without(using(disposal( ( For(example(( Cost(of(Asset(Sold(=(50000( Net(book(Value((=(30000( (Sold(For(28000( ( Note(:(total(depreciation(is(20000(as(NBV(is(30000( !! We!can!do! ! Bank!!!!!!!!!!!!!!!!!!!28000! Prov!for!Depn!!!20000! Loss!!!!!!!!!!!!!!!!!!!!!2000! !!!!!!!!!!!!!!!!!!!!!!!!!!Asset!!!!!!!50000! ! If!sold!for!$31000!then! ! Bank!!!!!!!!!!!!!!!!!31000! Prov!for!Depn!!20000! !!!!!!!!!!!!!!!!!Asset!!!!!!!!!!!!!50000! !!!!!!!!!!!!!!!!!Gain!!!!!!!!!!!!!!1000! ! ( Adjusting!Entries! Some(assets(do(appreciate(in(value,(e.g.(Land(and(companies(are(allowed(to(revalue(them.( ! The(journal(entry(for(revaluation(is( ( Revaluation!of!NON!CURRENT!ASSETS!(Only!in!companies)! ( To!Adjust!expenses! Debit:(( Asset((Cost)( ! ( Provision(for(Depn.((Accumulated(Depreciation)( Prepaid!:!! ( ( Credit:( Revaluation(Reserve( (Debit!:!Prepaid!Expense!!(!its!an!asset)! !!!!!Credit!:!Expense!!!!!!!!!!!!(reduces!expense)! For(example:( ! An(asset(which(cost($60(000(and(has(provision(for(depreciation(of($8(000(is(now(revalued(at($75(000.( In(order(to(handle(this,(we(should(just( Owing/Accrual!! (! Debit:( Asset( ( ( 15(000((Cause(it(was(already(at(60(and(we(want(to(make(it(75)( Debit!:!Expense!!!!!!!!!!!!!!!!!(increases!expense)! (!!!!!Credit!:!Owing!Expense!(!it!is!a!liability)! Provision(for(Depn.( 8(000((this(is(always(done(to(cancel(the(depreciation)( ( ( Credit:( Revaluation(Reserve( 23(000( To!adjust!Incomes:! ( ! The(23(000(is(the(difference(between(the(old(Net(Book(Value((60(000(–(8(000)(52(000(and(the(new(value( Prepaid:! 75(000.( (! ! ! Debit:(Income( ( ( (as(the(income(reduces(because(it’s(prepaid)( A(relatively(simpler(case(would(be(where(there(is(no(provision(for(depreciation.(Like(e.g.(Land(at($60(000( ( ( ( Credit:(Prepaid(Income( (because(it’s(a(current(liability)( is(now(revalued(at($75(000.( (( Owing/Due! 15(000( Debit:(Land( (! Credit:(Revaluation(Reserve( 15(000( ! ( !!!!!!!!!!! ! Debit:(Owing(Income(( ( (because(it’s(an(asset)( OMAIR CEDAR COLLEGE ( ( MASOOD ( Credit:(Income( ( (as(the(income(increases)( 128 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( ACCOUNTING FOR NON CURRENT ASSETS ACCOUNTING FOR NON-CURRENT ASSETS (DEPRECIATION) WORKSHEET ! ! Q1. Ken Read started business on 1 January 2004 and the following information is available for the purchase of machinery. 1 January 2004 Purchased machine 1, costing $15000 1 September 2004 Purchased machine 2, costing $18000 1 April 2006 Purchased machine 3, costing $12000 Machine 2 was found to be unsuitable and was sold on 30 September 2005 for $15000. The other two machines were still in use on 31 December2006; all transactions were by cheques. Depreciation Policy Case 1 : Machinery is depreciated at the rate of 10% per annum using the straight line method.A full year’s depreciation is provided in the year that machinery is purchased. No depreciation is provided in the year of disposal. Case 2: Machinery is depreciated at the rate of 10% per annum using the straight line method, with rates being applied for each part of a year. Case 3: Machinery is depreciated at the rate of 10% per annum using the reducing balance method.A full year’s depreciation is provided in the year that machinery is purchased. No depreciation is provided in the year of disposal. Case 4: Machinery is depreciated using the reducing balance Accounts(–(9706(( ( ( at the ( rate ( of 10% ( per annum ( (((((((((((((OMAIR(MASOOD( AS(–(Level(( method, with rates being applied for each part of a year. REQUIRED: For Each Case (a) The following ledger accounts for each of the years ended 31 December 2004, 31 December 2005 and 31 December 2006. (i) Machinery (ii) Provision for Depreciation of Machinery (b) The Disposal of Machinery Account for the year ended 31 December 2005. ! ! (c) Discuss the choice of the depreciation method used by the business. OMAIR MASOOD CEDAR COLLEGE 1 129 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( Q2. Gemma Bay started business on 1 January 1998. The following information is available for the purchases of machinery and office equipment. Machinery 1 January 1998 The machines purchased M1 and M2 costing $15,000 each, and M3 costing $20,000 1 January 2000 Two machines purchased, M4 and M5, costing $12,000 each 1 October 2000 Two machines purchased; M6 costing $15,000 and M7 costing $25,000 Office Equipment 1 January 1998 Office equipment purchased costing $25,000 Machinery is depreciated at the rate of 20% per annum by the reducing balance method. Office equipment is depreciated by the straight line method over an estimated life of 10 years, taking into account a residual value of 10% on cost price. Machine M2 was disposed of on 30 June 1999 for $10,200and Machine M3 was disposed of on 30 September 2000 for $13,000. No office equipment was disposed of during the period. A full year’s depreciation is provided in the year that machinery is purchased. No depreciation is provided in the year of disposal. The financial year end is 31 December. REQUIRED: (a) Prepare the following accounts for each of the years 1998, 1999 and 2000: (i) Machinery Account; (ii) Provision for Depreciation of machinery account. (b) Prepare the machinery Disposals Account for each of the years 1999 and 2000. (c) Prepare the statement of financial position(balance sheet) extract as at 31 December 2000 for Machinery and Office Equipment. (d) Evaluate the choice of the depreciation methods used by the business for each type of fixed asset. ! OMAIR MASOOD ! 130 CEDAR COLLEGE 3 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( Q3. Lucy Kim is in the luxury car hire business. The following information came from her Non-Current Assets. Register on 1 June 1994: Limousine Number KVD392H B123NHY 978GPLK C149USH Cost Price $ 31,250 25,000 27,500 30,000 Date of Purchase 1 June 1990 23 March 1991 26 August 1991 23 January 1993 On 18 May 1995, a new limousine, number MVD346J, was purchased on credit from Archibald Ltd for $35,000. Archibald Ltd agreed a trade in price of $1,200 for B123NHY, which the new limousine replaced. All limousines are depreciated at 40% per annum using the reducing balance method. They have a full year’s depreciation charged against them each financial year, regardless of the date of purchase, except in the financial year of sale, when no depreciation is charged. REQUIRED: (a) For the year ended 31 May 1995 draw up: (i) the Limousines Account (ii) the Provision for Depreciation of limousines Account (iii) the Disposal of Limousine Account. (b) Explain briefly, three methods of calculating depreciation. (c) Give one advantage of using the reducing balance method for deprecating vehicles and suggest with reasons, one other method which would be appropriate. (d) Distinguish between a Provision and a Reserve. ! OMAIR MASOOD ! 131 CEDAR COLLEGE 4 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( Q4. The Bass Rock Minibus company was formed on 1 November 1994. The following details to minibuses purchased and sold during the five years to 31 October 1999. Date of Purchase 1994 1 November 1 November 1995 1 May 1996 1 November 1997 1 May 1999 1 May 1 May Minibus Registration Number Cost Date of Disposal Cash Received M323ABC M324ABC $18,000 $18,000 31 March 1999 30 April 1999 $3,000 $2,800 M555ADR $19,000 30 April 1999 $2,800 P186TTS $21,000 P388VTS $21,500 R234 UTS R235 UTS $22,500 $22,500 16 February 1999 See below On 16 February 1999, minibus P388VTS was involved in an accident and was written off that is, the insurance company decided that it was not worth repairing. They have offered to pay 95% of Bass Rock’s book value of the minibus as at 31 October 1998, and Bass Rock has agreed to accept this. Depreciation is provided at 40% reducing (diminishing balance). A full year’s depreciation is provided for in the financial year in which a minibus is purchased. No depreciation applies in the final year in which a minibus is disposed of. REQUIRED: (i) Draw up the Minibus Provision for Depreciation Account for the year ended 31 October 1999. (ii) Draw up the Asset Disposal Account for minibus P388 VTS. Payment as agreed was received from the insurance company on 18 October 1999. ! OMAIR MASOOD ! 132 CEDAR COLLEGE 5 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( Q5. Stampers Ltd is in the business of stamping out steel plates to various shapes and sizes, to customers specifications. On 1 January 1995, the company’s machine register contained the following information: Serial Number 11 12 13 14 15 Cost Price $12,000 $13,500 $15,000 $14,000 $12,000 Net Book Value $5,520 $6,210 $9,600 $11,480 $9,840 All machines are depreciated over 5 years using the straight line method of providing for depreciation. A full year’s depreciation is charged on all machines owned by Stampers at the end of the financial year, and none is charged at the end of the year in which they are sold. Scrap (Net Residual) value is assumed to be 10% of cost price, after 5 years. On 1 March 1995, machine number 16 was purchased from Farrier & Co. at a cost price of $11,800, less $4000 for machine number 11 which was traded in. REQUIRED: (a) Draw up the Machinery Account, the Sale of Machinery (Machinery Disposal) Account and the Provision for Depreciation Account for the year ended 31 December 1995, showing the opening balances on 1 January 1996 where applicable. (b) Calculate the difference in the profit or loss shown in the Machinery Disposal Account in (a) if machine number 11 had been depreciated at 40% per annum on the reducing balance method. A full year’s depreciation was charged in the year of purchase, but none was charged in the year of sale. (c) Explain why Non-Current Assets are depreciated. ! OMAIR MASOOD ! 133 CEDAR COLLEGE 6 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( Q6. Betax Limited has recently purchased new machinery with the following pricing details. Cost per price list Less 10% trade discount Delivery costs Installation costs $ 60,000 6,000 54,000 1,000 2,000 The machinery maintenance costs are estimated to be $5000 per annum. The business plans to keep the machinery for five years and then dispose it off for an estimated residual value of $4,000. REQUIRED: (a) Calculate the cost figure which should be used as the basis for depreciation. (b) Calculate the annual depreciation charge using the straight line method. (c) Prepare the Disposal of Machinery Account if the machinery is sold for $12000 at the end of four years. (d) ‘Provision for depreciation is made to provide for the replacement of a fixed asset’. Discuss this statement. ! OMAIR MASOOD ! 134 CEDAR COLLEGE 7 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( Q7. Northernden Traders providers the following information for the year ended 31 May 2008. (i) Non-Current Assets at cost as at 1 June 2007 were: Office equipment Motor Vehicles $ 160000 230000 (ii) Provision for depreciation as at 1 June 2007 was as follows: Office equipment Motor vehicles $ 40000 110000 (iii)On 30 November 2007, office equipment which originally cost $26000, with a written down value of $10400, was sold at a loss of $3000. (iv) A motor vehicle which cost $24000 on 1 June 2006 was sold for $14000 on 31 May 2008. (v) Depreciation policy: Office equipment 10% per annum on cost; straight line. Motor vehicles 25% per annum on cost; straight line. Depreciation is applied for each month an asset is owned. There were no purchases of Non-Current Assets during the year ended 31 May 2008. All Non-Current Assets presentwith the business at that date, had been bought within the last three years. REQUIRED: (a) The following ledger accounts for the year ended 31 May 2008. Show the appropriate balances carried down to the next year. (i) Office Equipment (ii) Provision for Depreciation of Office Equipment (iii)Disposal of Office Equipment (iv) Motor Vehicles (v) Provision for Depreciation of Motor Vehicles (vi) Disposal of Motor Vehicles. (b) Discuss two causes of depreciation. ! OMAIR MASOOD ! 135 CEDAR COLLEGE 8 Accounts(–(9706(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( AS(–(Level(( Accounts(–(9706(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( Q8. An extract from Kenneth Bull Ltd.’sStatement of Financial position as at 31 December AS(–(Level(( 2005 showed the following: Q8. An extract from Kenneth Bull Ltd.’sStatement of Financial position as at 31 December 2005 showed the following: Cost Depreciation Net Book To date Value $ $ Cost Depreciation Net $Book Motor vehicles 560000 250000 310000 To date Value Office Equipment 140000 45000 95000 $ $ $ Motor vehicles 560000 250000 310000 Equipment 95000 transactions took During the Office financial year (ended140000 31 December45000 2006) the following place. All transactions were by cheques. During the financial year (ended 31 December 2006) the following transactions took place. transactions were by cheques. MotorAll Vehicles Motor Vehicles DISPOSALS Motor Vehicle DISPOSALS Reference Motor Vehicle MV6 Reference MV6 Purchase Date 1Purchase January 2003 Date 1 January 2003 Disposal Date 30Disposal September 2006 Date 30 September 2006 Original Cost $ Original 19,200Cost $ Sale Proceeds $ Sale2,800 Proceeds $ 19,200 2,800 PURCHASES Motor Vehicle PURCHASES Reference Motor MVVehicle 15 Reference Purchase Date 1Purchase July 2006 Date Cost $ Cost 26,400 $ MV 15 1 July 2006 26,400 Motor vehicles are depreciated at 25% per annum using the straight line method, the rate being charged for each proportion of the year the motor vehicles are owned. Motor vehicles are depreciated at 25% per annum using the straight line method, the No allowance is made for any residual value. All motor vehicles held by the company at rate being charged for each proportion of the year the motor vehicles are owned. 31 December 2006 had been purchased within the previous four years. No allowance is made for any residual value. All motor vehicles held by the company at Office Equipment 31 December 2006 had been purchased within the previous four years. DISPOSALS Office Equipment Office DISPOSALS Equipment Reference Office Equipment OE16 Reference ! ! OE16 ! OMAIR MASOOD ! Purchase Date Purchase 1 July Date 2000 1 July 2000 Disposal Date Disposal 31 March Date 2006 31 March 2006 Original Cost $ Original Cost 12,000 $ Sale Proceeds $ Sale Proceeds 3,200 $ 12,000 3,200 9 CEDAR COLLEGE 9 136 Accounts(–(9706(( Accounts(–(9706(( AS(–(Level(( AS(–(Level(( ( ( ( ( ( ( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( (((((((((((((OMAIR(MASOOD( Office equipment is depreciated at 10% per annum using the straight line method, the Office equipment depreciated at 10%ofper using the equipment straight lineis method, the rate being chargedisfor each proportion theannum year the office owned. No rate being charged of the year office equipment is owned. No allowance is madeforforeach anyproportion residual value. One the item of office equipment which allowance cost is made residual One1995. itemAllofother office equipment which originally $5000 for was any purchased on value. 1 January office equipment had originally cost $5000 was purchased on 1 January 1995. All other office equipment had been purchased within the previous seven years. No items of office equipment have been purchased purchased during withinthe theyear previous years. No items of office equipment have been ended seven 31 December 2006. been purchased during the year ended 31 December 2006. REQUIRED: REQUIRED: (a) The following ledger accounts for the year ended 31 December 2006, showing the (a) balance The following accounts the year ended 31 are December 2006, showing the carried ledger down to the nextfor financial year. Dates not required. balance carried down to the next financial year. Dates are not required. (i) Motor Vehicles (i) Provision Motor Vehicles (ii) for Motor Vehicles (ii) Provision MotorVehicles Vehicles (iii)Disposal offorMotor (iii)Office Disposal of Motor Vehicles (iv) Equipment (iv) Office Equipment (v) Provision for Depreciation of Office Equipment (v) Disposal ProvisionofforOffice Depreciation of Office Equipment (vi) Equipment. (vi) Disposal of Office Equipment. (b) Evaluate Kenneth Bull Ltd.’s policy of using only the straight line method of (b) depreciation. Evaluate Kenneth Bull Ltd.’s policy of using only the straight line method of depreciation. (c) ‘Depreciation is to provide funds for the replacement of a fixed asset’ (c) Discuss ‘Depreciation is to provide funds for the replacement of a fixed asset’ this statement. Discuss this statement. ! ! ! OMAIR MASOOD CEDAR COLLEGE 10 10 137 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( Q9. The following Statement of Financial position extract has been taken from the accounts of Watkins Ltd. as at 31 December 2005. Non-Current Assets Cost Office Equipment $ 163,400 Depreciation To date $ 89,100 Net Book Value $ 74,300 During the year ended 31 December 2006 the following transactions took place in lieu of office equipment. Disposals Disposal Date 30 April 2006 30 June 2006 Purchase Date Original Cost $ 1 January 2003 20,000 1 January 2002 28,000 Additions Date 1 October 2006 Disposal Proceeds $ 3,800 4,920 Cost $ 30,000 Depreciation for office equipment is charged using the straight line method based on a five year life and estimated residual value of 10% of the original cost. Depreciation is applied from the date the piece of the office equipment is bought until it is sold. All transactions were by cheques. REQUIRED: (a) The following ledger accounts for the year ended 31 December 2006. Dates are not required. (i) Office equipment (ii) Disposal of office equipment (b) Discuss Watkins Ltd.’s policy of using the straight line method of depreciation for office equipment. ! OMAIR MASOOD ! 138 CEDAR COLLEGE 11 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( Q10. An extract from Choco Machines’ Statement of Financial position as at 28 February 2006 showed the following: $ Machinery at cost 460,000 Depreciation to date 150,000 310,000 During the year ended 28 February 2007, the following transactions took place. On 1 March 2006 Choco Machines purchased machinery at a cost of $80,000. On 1 September 2006 Choco Machines sold machinery for $24,000. This machinery was originally purchased on 1 March 2004 at a cost price of $60,000. All transactions are by cheques. Depreciation is calculated on a straight line basis. For purposes of calculating depreciation, the business assumes that machinery will have a four year life. It will then be disposed of at an estimated residual value of 10% of its original cost. The rate is charged for each proportion of the year the machinery is owned. All other items of machinery have been purchased within the previous three years. REQUIRED: (a) The following ledger accounts for the year ended 28 February 2007. Include, where appropriate, the balance carried down to the next financial year. (i) Machinery (ii) Provision for Depreciation of Machinery (iii)Machinery Disposals (b) The Statement of Financial position (Balance Sheet) extract as at 28 February 2007 for Machinery. (c) Discuss the problems involved in accounting for depreciation. (d) Advise Choco Machines on why the correct treatment of capital and revenue expenditure is important. ! OMAIR MASOOD ! 139 CEDAR COLLEGE 12 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( Q11. The following information relates to Jafri Holdings’ Non-Current Assets of computer equipment. (i) Account balances at 1 January 2005: • • Computer equipment account Computer equipment’s provision for depreciation account $ 120,000 40,000 (ii) Purchases and sales of computer equipment in 2005 • On 31 March 2005 computer equipment purchases on 1 January 2004 for $16,000 was sold on credit for $11,500 • On 1 July 2005 new computer equipment was purchased on credit at a cost of $10,000 (iii)The policy of Jafri Holdings is to charge depreciation at the rate of 25% on cost using the straight line method. In the year of purchase a full year’s depreciation will be charged. In the year of sale, depreciation will be charged on the proportion of the year for which the asset has been owned. REQUIRED: (a) Prepare, for the year ended 31 December 2005, the: (i) Computer equipment account; (ii) Computer equipment provision for depreciation account; (iii)Disposal account; (iv) Income Statement (Profit and loss account) extract (Clearly show all calculations and workings.) (b) (i) Distinguish between capital expenditure and revenue expenditure. (ii) Explain how the accounting concept of materiality assists in determining whether expenditure is classified as capital expenditure or revenue expenditure. (iii)Evaluate whether it would be prudent to consider training costs for staff to use new equipment as capital expenditure or revenue expenditure. ! OMAIR MASOOD ! 140 CEDAR COLLEGE 13 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( Q12. On 1 April 1995 Northside Motors Limited commenced business as motor vehicle dealers and servicing engineers. During the following two years the company’s transactions included. 1 April 1995 1 August 1995 Purchase of workshop machinery at a cost of $34,000 from the J.Stone. Purchase of breakdown recovery vehicle, K356BMG at a cost of $16,000 from L. Brown. The vehicle was bought in a damaged condition and required major repairs in the company’s workshops. 1 October 1995 Breakdown recovery vehicle K356BMG was fully operational upon leaving the company’s workshops. Workshop costs totalled $9,000. 1 January 1996 A fire in the workshop caused some damage to the company’s machinery. The repairs were done by the company’s own staff at a cost of $500. The company’s insurers agreed to pay $400 in settlement of the repair claim. When undertaking the fire repairs, additional safety devices were installed on the workshop machinery at a cost of $2400. 1 April 1996 A car M936TTJ was transferred from the company’s showroom for permanent use by the company’s workshop manager in the course of his company duties. The vehicle had a sale price of $20,000 in the company’s showroom. This would have produced a gross profit of 30% on the sale price. 1 July 1996 Breakdown recovery vehicle K356BMG was given in part exchange for a new breakdown vehicle N466TLT whose list price was $32,000. The deal was completed with a cheque payment of $13,000 to G. Gates. The depreciation policy of the company requires depreciation to be provided on fixed assets when fully operational as follows: On Workshop Machinery – At 10% per annum on the reducing balance basis. On Motor Vehicles – At 20% per annum on cost. REQUIRED: (a) Prepare the following ledger accounts in the books of Northside Motors Limited for each of the years ended 31 March 1996 and 1997: (i) Workshop Machinery – at cost (ii) Workshop Machinery – provision for depreciation (iii)Motor Vehicles – at cost (iv) Motor Vehicles – provision for depreciation (v) Motor Vehicles – disposal (b) Prepare an extract of the statement of financial position (Balance Sheet) as at 31 March 1997 of Northside Motors Limited in respect to Workshop Machinery and Motor Vehicles. (c) Explain what is meant by a fixed asset. ! OMAIR MASOOD ! 141 CEDAR COLLEGE 14 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( 6 2 Answer Sections A and B. Q13. A Sarah runs a wholesale business. An extract from her statement of financial position (balance sheet) at 31 December 2009 shows: Motor vehicles at cost Motor vehicle accumulated depreciation For Examiner’s Use $371 000 $130 000 During the financial year ended 31 December 2010 the following transactions took place. 1 A motor vehicle purchased on 1 January 2006 for $9200 was sold on 30 June 2010 for $500. 2 A motor vehicle was purchased on 1 April 2010 for $15 000. Depreciation is charged at 20% per annum on cost, with the rate being applied for each part of the year. No allowance is made for any residual value. All motor vehicles held by the company at 31 December 2010 had been purchased within the previous five years. All transactions are by cheque. REQUIRED (a) Prepare the following ledger accounts for the year ended 31 December 2010. (i) Motor vehicles account ........................................................................................................................... ........................................................................................................................... ........................................................................................................................... ........................................................................................................................... ........................................................................................................................... ........................................................................................................................... ....................................................................................................................... [4] (ii) Provision for depreciation of motor vehicles account ........................................................................................................................... ........................................................................................................................... ........................................................................................................................... ........................................................................................................................... (iii) Disposal Account ........................................................................................................................... ! ! ....................................................................................................................... [4] © UCLES 2011 OMAIR MASOOD 9706/23/O/N/11 CEDAR COLLEGE 15 142 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( Q14. Alex's fixed asset accounts and provision for depreciation on fixed asset accounts for the year ended 30th April 2008 were as follows: 2007 1 May 3 June Furniture and equipment account $000 2007 Balance b/d 2 700 5 July Disposal Bank 720 2008 30 April Balance c/d 3 420 $000 450 2 970 3 420 2008 1 May Balance b/d 2 970 Provision for depreciation on furniture and equipment account $000 $000 2007 2007 5 July Disposal 345 1 May Balance b/d 945 2008 2008 30 April Balance c/d 897 30 April Profit & loss 297 1 242 1242 1 May Balance b/d 897 2007 1 May 3 Oct Balance b/d Bank Motor vehicles account $000 2007 1 560 3 Oct 570 2008 30 April 2 130 $000 Disposal Balance c/d 330 1 800 2 130 2008 ! ! 1 May Balance b/d 2007 3 Oct 2008 30 April Provision for depreciation on motor vehicles account $000 2007 Disposal 285 1 May Balance b/d 2008 Balance c/d 840 30 April Profit & loss 1 125 1 May Balance b/d OMAIR MASOOD 1 800 CEDAR COLLEGE $000 675 450 1 125 840 16 143 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( ALTERNATIVE PRESENTATION USING RUNNING BALANCE Furniture and equipment account Dr Cr Balance 2007 $000 $000 $000 1 May Balance b/d 2 700 Dr 3 June Bank 720 3 420 5 July Disposal 450 2 970 Provision for depreciation on furniture and equipment account Dr Cr Balance 2007 $000 $000 $000 1 May Balance b/d 945 Cr 5 July Disposal 345 600 2008 30 April Profit and loss 297 897 Motor vehicles account Dr Cr Balance 2007 $000 $000 $000 1 May Balance b/d 1 560 Dr 3 Oct Disposal 330 1 230 Bank 570 1 800 Provision for depreciation on motor vehicles account Dr Cr Balance 2007 $000 $000 $000 1 May Balance b/d 675 Cr 3 Oct Disposal 285 390 2008 30 Apr Profit and loss 450 840 During the year ended 30th April 2009 the following transactions took place: 1. On 1st June 2008 new equipment was purchased for $540 000. On 3 December 2008 new furniture was purchased for $80 000. On 3 September 2008 equipment which had been purchased on 31stMarch 2006 for $300 000 was sold for $132 000. 2. On 1stFebruary 2009 three new motor vehicles were purchased for $80 000 each. On the same date a vehicle which had cost $56 000 on 15th May 2005 was sold for $20,000. A full year’s depreciation is provided for on all Non-Current Assets in use at the end of the financial year but none is provided for in the year of disposal of a fixed asset. The rates of depreciation applied on cost for the year ended 30thApril 2008 continue to be applied for the year ended 30thApril 2009. ! ! OMAIR MASOOD CEDAR COLLEGE 17 144 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( REQUIRED: (a) Prepare the following accounts for the year ended 30th April 2009: (i) Furniture and equipment (ii) Motor vehicles (iii) Provision for depreciation on furniture and equipment (iv) Provision for depreciation on Motor vehicles (v) Disposal of furniture and equipment (vi) Disposal of motor vehicles (b)Explain the term depreciation and give one example. ! ! OMAIR MASOOD CEDAR COLLEGE 18 145 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( Q15. Depreciation has been described as the measure of the wearing out, consumption or other reduction in the useful economic life of a fixed asset. (a) Give three causes of depreciation, and for each give an example of the type of fixed asset for which that cause is appropriate. (b) In the accounts of Clarkson Limited, the schedule of Non-Current Assets for the year ended 31 March 1993 appeared as follows. Plant & Motor Total Non-Current Assets Machinery Vehicles $000 $000 $000 Cost: At beginning of year 1900 1100 3000 Additions during the year 600 400 1000 Disposals (350) (500) (850) Cost 31 March 1993 2150 1000 3150 Depreciation: At beginning of year 780 420 1200 Charge for the year 215 250 465 On disposals (260) (400) (660) Depreciation, 31 March 1993 735 270 1005 Net book value at end of year 1415 730 2145 During the year ended 31 march 1994 the following charges took place in the NonCurrent Assets: 1. New plant and equipment costing $450,000 was purchased on 1 October 1993. Plant which cost $200,000 on 1 June 1989 was sold for $100,000 in November 1993. 2. Three new motor vehicles were purchased on 1 March 1994 for $140,000 each. A part exchange allowance of $30,000, per vehicle, was received for two vehicles which each cost $100,000 on 1 February 1991. 3. A vehicle which cost $180,000 on 31 December 1992 was involved in an accident on 2 November 1993, following which the insurance company declared it to be irreparable and paid compensation in full settlement of $105,000. 4. The company’s policy is to depreciate the cost of all Non-Current Assets in use at the end of the financial year using the straight line method. No depreciation is provided on an asset in the year in which it is sold or otherwise disposed of. The same rates of depreciation have been used for many years. REQUIRED: for part (c) (i) Calculate the profits or losses arising from the disposals of Non-Current Assets in the year ended 31 March 1994. (ii) Prepare a Schedule of Non-Current Assets fort the year ended 31 March 1994 as it would appear in the Company’s accounts using the same format as shown in the 1993 accounts. Q16. In the published accounts of Mechanical Pic the schedule of Non-Current Assets for the year ended 31 May 1987 appeared as follows ! ! OMAIR MASOOD CEDAR COLLEGE 146 19 Accounts(–(9706(( AS(–(Level(( ( ( ( ( Q16. ( ( (((((((((((((OMAIR(MASOOD( 8 Richard commenced business on 1 May 2011. At the end of the first year of trading an extract from his statement of financial position showed: 2 Non-current assets Freehold land and Buildings Machinery Motor vehicle Cost Accumulated Depreciation $ 2 000 16 000 3 600 $ 100 000 64 000 12 000 Net book value $ 98 000 48 000 8 400 Richard has a policy to depreciate non-current assets as follows: 9 • Buildings at 2% per annum on cost. • (ii)Machinery atfor 25% per annum of onmotor cost. vehicles Provision depreciation • Motor vehicles at 30% per annum using the reducing balance method. • Depreciation is charged for each month of ownership. On 1 August 2012 additional machinery, costing $18 000, was purchased. On 1 January 2013 a new motor vehicle costing $24 000 was purchased. On the same date the old motor vehicle was traded in. Richard received an allowance of $2 600 against the cost of the new vehicle. The vehicle disposed had originally cost $12 000 and was purchased on 1 May 2011. All payments and receipts for purchases and disposals were in cash. REQUIRED (a) Prepare the following ledger accounts for the year ended 30 April 2013. Dates are not required. (i) Motor vehicles (at cost) 9 (ii) Provision for depreciation of motor vehicles [5] (iii) Disposal of motor vehicles [5] ! ! © UCLES 2014 OMAIR MASOOD 9706/21/M/J/14 CEDAR COLLEGE 21 147 [5] (iii) Disposal of motor vehicles [5] Accounts(–(9706(( AS(–(Level(( ( ( ( ( Q17. ( ( (((((((((((((OMAIR(MASOOD( 6 SMC Limited is a wholesale business. An extract from their statement of financial position at 31 December 2012 showed: 2 Non-current Assets Fittings and fixtures Equipment $ 240 000 60 000 $ 96 000 18 000 $ 144 000 42 000 SMC Ltd has a policy to depreciate fittings and fixtures at 20% per annum on cost (straight line method) and equipment at 10% per annum on cost. Depreciation is charged for each month of ownership. No allowance is made for any residual value. 7 All fittings and fixtures held by the company at the end of the financial year had been purchased within the previous four years. All equipment had been purchased within the previous seven REQUIRED years. (a)During Prepare journal entries to record 2013 the following (narratives are not the year ended 31 December the following transactions tookrequired). place: (i) The purchase of the equipment. Purchases 1 January 2013 fittings and fixtures $16 000, purchased on credit from Walker. Account Debit 1 July 2013 equipment $14 000, purchased on credit from Arcadia Limited. $ Credit $ 7 Disposals REQUIRED 31 March 2013 equipment (original cost $8 000, bought on 1 January 2010) was sold for $6 000. (a) Prepare journal entries to record the following (narratives are not required). Disposal proceeds were received in full by cheque. (i) The purchase of the equipment. [2] Debit Credit $ $ 7 (ii) The depreciation charge for fittings and fixtures for the year ended 31 December 2013. Account Account REQUIRED Debit Credit $ $ (a) Prepare journal entries to record the following (narratives are not required). (i) The purchase of the equipment. [2] Account Debit Credit (ii) The depreciation charge for fittings and fixtures for the year ended 31 December 2013. $ $ Account Debit Credit $ $ (iii) The depreciation charge for equipment for the year ended 31 December 2013. [4] 8 Account (iv) The disposal of equipment. Debit $ Credit $ [2] Account Debit Credit $ $ [4]2013. (ii) The depreciation charge for fittings and fixtures for the year ended 31 December (iii)2014 The © UCLES ! Account Debit2013. depreciation charge for equipment for the year ended 31 December 9706/22/M/J/14 Account OMAIR MASOOD ! $ CEDAR COLLEGE Debit $ Credit $ Credit [4]148 $ 22 Net Book Value Depreciation charge for the year 1880 1200 400 3480 40 400 100 540 Accounts(–(9706(( ( is charged ( ( year( of purchase ( (((((((((((((OMAIR(MASOOD( A full year’s depreciation in the and( no depreciation is charged in the year of disposal. AS(–(Level(( Buildings and machinery are depreciated using the straight line method. Q18. 8 Motor vehicles are depreciated using the reducing (diminishing) balance method. Helen Ossetia provides the following information for the year ended 31 May 2013. REQUIRED 2 Non-current assets Buildings Machinery Motor vehicles (a) Explain why Helen needs to depreciate her assets.$000 9 non-current $000 $000 Total $000 (c) used by Helen at 31 May 2013 700 to depreciate each CostCalculate the rate of depreciation 2000 2000 4700class of non-current asset. Accumulated depreciation (120) (800) (300) (1220) at 31 May 2013 Net Book Value 1880 1200 400 3480 Depreciation charge for the year 40 400 100 540 A full year’s depreciation is charged in the year of purchase and no depreciation is charged in the year of disposal. Buildings and machinery are depreciated using the straight line method. Motor vehicles are depreciated using the reducing (diminishing) balance method. REQUIRED (a) Explain why Helen needs to depreciate her non-current assets. [3] (b) State three causes of depreciation of motor vehicles. 9 1 (c) Calculate the rate of depreciation used by Helen at 31 May 2013 to depreciate each class of non-current asset. [4] 2 (d) Explain why machinery is usually depreciated using the straight line method while motor vehicles are usually depreciated using the reducing balance method. 3 [3] [3] © UCLES 2014 9706/23/M/J/14 (b) State three causes of depreciation of motor vehicles. 1 2 3 [3] [4] [4] (d) Explain why machinery is usually depreciated using the straight line method while motor vehicles are usually depreciated using the reducing balance method. © UCLES 2014 9706/23/M/J/14 OMAIR MASOOD ! 149 CEDAR COLLEGE ! © UCLES 2014 9706/23/M/J/14 [Turn over 23 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( 10 10 Additional information Additional information During the year ended 31 May 2014: During the year ended 31 May 2014: 1 Helen bought new machinery costing $720 000 and sold old machinery which had cost 000. The old machinery hadcosting been bought on 1 and December 2011. sold old machinery which had cost 1 $160 Helen bought new machinery $720 000 $160 000. The old machinery had been bought on 1 December 2011. 2 Helen bought a new motor vehicle. She traded in an old vehicle valued at $40 000 and paid 000, by cheque. balance of $160 2 the Helen bought a new motor vehicle. She traded in an old vehicle valued at $40 000 and paid the balance of $160 000, by cheque. The trade in vehicle had cost $100 000 and had a net book value of $60 000 at the date of disposal. The trade in vehicle had cost $100 000 and had a net book value of $60 000 at the date of disposal. 3 A new building costing $1 000 000 was completed during the year. 3 A new building costing $1 000 000 was completed during the year. REQUIRED REQUIRED (e) Complete the non-current asset schedule below for the year ended 31 May 2014. (e) Complete the non-current asset schedule below for the year ended 31 May 2014. Buildings Buildings $000 $000 COST COST Balance at 31 May 2013 Balance at 31 May 2013 Additions Additions Disposals Disposals Balance at 31 May 2014 Balance at 31 May 2014 Machinery Motor vehicles Machinery Motor vehicles $000 $000 $000 $000 2000 2000 2000 2000 120 800 Total Total $000 $000 700 700 4700 4700 300 1220 DEPRECIATION DEPRECIATION Balance at 31 May 2013 Balance at 31 May 2013 Charge for the year 120 800 300 1220 Charge for the year Disposals Disposals Balance at 31 May 2014 Balance at 31 May 2014 NBV at 31 May 2014 NBV at 31 May 2014 NBV at 31 May 2013 NBV at 31 May 2013 1880 1200 1880 1200 400 400 3480 3480 [16] [16] [Total: 30] [Total: 30] © UCLES 2014 © UCLES 2014 ! ! OMAIR MASOOD 9706/23/M/J/14 9706/23/M/J/14 CEDAR COLLEGE 150 24 Accounts(–(9706(( ( by depreciation ( ( of non-current ( ( ( (a) State what is meant 9 assets. AS(–(Level(( 3 (((((((((((((OMAIR(MASOOD( Miu is a sole trader and prepares her financial statements to 31 May each year. She depreciates her motor vehicles using the reducing balance method at a rate of 20% per annum.[1] Depreciation is charged monthly. 9 Q19. 3 (b) isState three causes of depreciation of non-current assets. REQUIRED Miu a sole trader and prepares her financial statements to 31 May each year. She depreciates her motor vehicles using the reducing balance method at a rate of 20% per annum. Depreciation 1 is monthly. (a)charged State what is meant by depreciation of non-current assets. REQUIRED 2 what is meant by depreciation of non-current assets. (a) State [1] 10 REQUIRED [1] 3 (b) State three causes of depreciation of non-current assets. (c) (i) Prepare the motor vehicles at cost account for the year ended 31 May 2015. [3] 1 (b) State three causes of depreciation of non-current assets. Miu Additional information Motor vehicles at cost account 1 Miu purchased a motor vehicle on 1 June 2013 for $152 000. 2 On 1 March 2015, a new motor vehicle was purchased at a cost of $190 000.The old motor vehicle was part-exchanged at a value of $84 000. 2 The balance was settled by a bank loan repayable over 3 years. 3 10 3 REQUIRED [3] [3] (c) (i) Prepare the motor vehicles at cost account for the year ended 31 May 2015. Additional information Additional information Miu purchased a motor vehicle on 1 JuneMiu 2013 for $152 000. Motor vehicles at cost Miu purchased a motor vehicle on 1 June 2013 for $152account 000. On 1 March 2015, a new motor vehicle was purchased at a cost of $190 000.The old motor On 1 March 2015, a new motor vehicle was purchased at a cost of $190 000.The old motor vehicle was part-exchanged at a value 11 of $84 000. [2] vehicle was part-exchanged at a value of $84 000. (iii)balance Calculate thesettled profit orby loss on disposal of the motorover vehicle purchased on 1 June 2013. The was a bank loan repayable 3 years. The was settled by a bank loan repayable (ii) balance Prepare the depreciation account for the years ended Accounts(–(9706(( ( motor (vehicle ( provision ( for over ( 3 years. ( (((((((((((((OMAIR(MASOOD( 31 May 2014 and 31 May 2015. AS(–(Level(( Miu 11 for depreciation account Motor vehicles provision (iii) Calculate the profit or loss on disposal of the motor vehicle purchased on 1 June 2013. © UCLES 2016 9706/22/M/J/16 [1] [Turn over Additional information Miu is considering the effect it would have on her financial statements if she sold motor vehicles for cash rather than part-exchange them in the future. [2] (ii) Prepare the motor vehicle provision for depreciation account for the years ended REQUIRED [1] 31 May 2014 and 31 May 2015. (d) Advise Miu of the effect on her financial statements if she had not part-exchanged the motor Additional information Miu vehicle but had sold it for $80 000 cash. Motor vehicles provision for depreciation account Miu is considering the effect it would have on her financial statements if she sold motor vehicles for cash rather than part-exchange them in the future. ! REQUIRED © UCLES 2016 9706/22/M/J/16 [Turn over ! (d) Advise Miu of the effect on her financial statements if she had not part-exchanged the motor 25 151 OMAIR CEDAR COLLEGE © UCLES 2016 MASOOD 9706/22/M/J/16 [Turn over vehicle but had sold it for $80 000 cash. Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((OMAIR(MASOOD( Q20. On 1 January 2012 Arpan had the following additional balances in his ledger: £ Machine at cost 36 000 Machine – provision for depreciation ? All machinery was purchased on 1 January 2010 and has a residual value of £2 000. Arpan has depreciated his machinery over a five-year period using the straight line method. He has decided to change his method of depreciation to 25% per annum reducing balance, backdated to the date of machine purchase. The change and adjustment are to be recorded in the Statement of Comprehensive Income for the year ended 31 December 2012. On 1 April 2012 a new machine was purchased: £ Cost 8 000 Installation 1 600 Staff training 2 000 Annual machine insurance 00 400 12 000 He charges a full year’s depreciation on machines in the year of purchase. Required: (c) State one accounting concept which: (i) supports the change of depreciation method proposed by Arpan (ii) does not support the change of depreciation method proposed by Arpan. (4) (d) Distinguish between capital expenditure and revenue expenditure. (4) (e) State, giving your reasons, whether each of the following is capital expenditure or revenue expenditure: ! ! ! ! "! "! #$%&'()!'(*+$,,$+'-( .((/$,!0$%&'()!'(*/1$(%)2 (4) (f) Calculate, showing clearly all workings, the: (i) adjustment required to the provision for depreciation on the machines to 31 December 2011 to account for the change in depreciation method (ii) depreciation charge on all the machines for the year ended 31 December 2012. (g) Prepare, for the year ended 31 December 2012, the: (i) Machinery account (8) (3) (ii) Machinery – provision for depreciation account. (h) Evaluate Arpan’s decision to change the basis of charging depreciation on machines from the straight line method to reducing balance method. (5) (8) (Total 52 marks) Answer space for question 2 is on pages 8 to 16 of the question paper. P42221A 5 ! ! OMAIR MASOOD CEDAR COLLEGE Turn over 27 152 REQUIRED: for part (c) (i) Calculate the profits or losses arising from the disposals of Non-Current Assets in the year ended 31 March 1994. (ii) Prepare a Schedule of Non-Current Assets fort the year ended 31 March 1994 as it would appear in the Company’s accounts using the same format as shown in the Q21.1993 accounts. Accounts(–(9706(( ( ( of Mechanical ( ( Pic the( schedule ( of Non-Current (((((((((((((OMAIR(MASOOD( Q16. In the published accounts Assets for the AS(–(Level(( year ended 31 May 1987 appeared as follows ! ! Non-Current Assets Equipment Vehicles $000 $000 At cost at beginning of year Additions during the year Disposals Total $000 750 210 (130) 460 190 (80) 1,210 400 (210) At cost end of year 830 570 1,400 Depreciation At beginning of year Charge for the year Disposals 300 83 (91) 170 114 (64) 470 197 (155) At end of year 292 220 512 Net Book Value at end of year 538 350 888 19 During the year ended 31 May 1988 the following changes in Non-Current Assets occurred. 1. New equipment was purchased for $175,000 and $200,000 on 1st October 1987 and 1 December 1987 respectively. A machine purchased for $60,000 on 1 April 1984 was sold on 30th September 1987 for $32,000. A machine purchased on 1 October 1981 for $25,000 was sold for scrap on 1 May 1988 realizing $2,000. 2. On 1 January 1988 four new vehicles were purchased costing $20,000 each. A part exchange allowance of $5,000 per vehicle was received for two vehicles which cost $15,000 each on 1st January 1985. Following on accident in May 1988 a vehicle which cost $10,000 on 1st April 1984 was declared a total loss by the insurers. A claim for compensation of $3,000 has been agreed by the insurance company but the money has not yet been received by Mechanical pic. 3. The company’s policy is to depreciate the cost of all Non-Current Assets in use at the end of the financial year using the straight line method. No depreciation is provided on an asset in the year in which it is sold or scrapped or otherwise disposed of. The rates of depreciation used in the year ended 31st May 1987 are also to be used in the year ended 31st May 1988. REQUIRED: Prepare (a) A disposal account showing separately the profits or losses arising from the disposals of equipment and vehicles. (b) A schedule of Non-Current Assets for the year ended 31st May 1988 as it should appear in the Company’s published accounts. This schedule should be in the same format as that shown for 1987. OMAIR MASOOD ! CEDAR COLLEGE 153 (CALCULATION OF DEPRECIATION RATES) DEPRECIATION+EXTRA+QUESTION+(FOR+CALCULATION+OF+RATES)+ ! Q22. Q1. In the published accounts of Cedar Plc the schedule of Non-Current Assets for the year ended 31 May 2016 appeared as follows Non-Current Assets Equipment Vehicles $000 $000 Cost At beginning of year Additions during the year Disposals 2500 400 (200) 1504 400 (100) At end of the year 2700 1804 Depreciation At beginning of year Charge for the year Disposals 1100 540 (80) 800 208 (36) At end of year 1560 972 Net Book Value at end of year 1140 832 During the year ended 31 May 2017 the following changes in Non-Current Assets occurred. 1. New equipment was purchased for $875,000 on 1st October 2016. A Equipment purchased for $260,000 on 1 April 2014 was sold on 31st Jan 2017 for $132,000. 2. On 1 January 2017 a new motor vehicle costing $496000 was purchased in part exchange of a vehicle which cost $200000 on 1st July 2014. The trade allowance on old vehicle was $120000. 3. The company’s policy is to depreciate the cost of all Non-Current Assets in use at the end of the financial year using the straight line method for Equipment and Reducing Balance method for Vehicles. No depreciation is provided on an asset in the year in which it is sold or scrapped or otherwise disposed of. The rates of depreciation used in the year ended 31st May 2016 are also to be used in the year ended 31st May 2017. REQUIRED: Prepare (a) A disposal account showing separately the profits or losses arising from the disposals of equipment and vehicle. (b) A schedule of Non-Current Assets for the year ended 31st May 2017. This schedule should be in the same format as that shown for 2016. (c) What is the difference between capital expenditure and revenue expenditure OMAIR MASOOD 154 CEDAR COLLEGE 28 Q2. Q23. Following Information is available for the year ending 30th June 2017 for Amazing Ltd for its Computer Equipment Computer+Equipment+Account++ ! Balance!b/d! Bank! ! Balance!b/d! $! 130000! 65000! 195000+ 165000! ! Disposal! Balance!c/d! ! ! $! 30000! 165000! 195000+ ! ! ! Provision+for+Depreciation+on+Computer+Equipment+Account++ ! Disposal! Balance!c/d! ! ! $! 23520! 98688! 122208+ ! ! Balance!b/d! Income!Statement! ! Balance!b/d! $! 78000! 44208! 122208+ 98688! ! ! !!!It!is!company’s!policy!to!use!reducing!balance!method!where!full!deprecation!is! charged!in!the!year!of!purchase!and!none!is!charged!in!the!year!of!disposal.! ! Required:+ + (a)!Calculate!the!rate!of!depreciation!used!in!the!year!ended!30th!June!2017.! ! Additional+Information+ + The!same!rate!and!method!of!depreciation!is!continued!to!be!used!for!the!year! ended!30th!June!2018.!Following!transactions!took!place!in!the!year!ended!30th!! June!2018! ! 1. A!new!computer!equipment!was!purchased!on!12th!December!2017! costing!$45000!,!payment!was!made!by!cheque! 2. A!computer!equipment!was!sold!on!1st!February!2018!for!$10000.!This! was!bought!on!1st!March!2016!for!$20000.! 3. A!new!computer!costing!$50000!was!purchased!on!10th!February!2018,! this!computer!will!replace!an!old!computer!which!was!part!exchanged.! Old!computer!was!bought!for!$15000!on!1st!August!2015,!a!trade!in! allowance!of!!$6000!was!given.! ! Required+for+the+year+ended+30th+June+2018.+ ! (b)!Computer!Equipment!Account! (c)!Disposal!Accounts!(!separate!for!each!asset!sold)! (d)!Provision!For!Depreciation!on!Computer!Equipment!Account! ! OMAIR MASOOD 155 CEDAR COLLEGE 29 2 A business depreciates its non-current assets. REQUIRED (a) Explain why a business should comply with the following concepts when accounting for non-current assets. ACCOUNTING Prudence FOR NON-CURRENT ASSETS PAST PAPERS 8 ACCOUNTING ASSETS (PAST PAPERS) Accruals (matching) FOR NON-CURRENT 8 2 AQ1. business depreciates its non-current assets. 2 A business depreciates its non-current assets. REQUIRED REQUIRED (a) Explain why a business should comply with the following concepts when accounting for (a) non-current Explain whyassets. a business should comply with the following concepts when accounting for non-current assets. [4] Prudence Prudence Accruals (matching) Additional information T Limited prepares accounts to 30 June. The following balances are available at 30 June 2017: $ Plant and machinery at cost 174 300 Provision for depreciation 48 700 Accruals (matching) Accruals (matching) On 1 July 2017 the company disposed of a machine which had a net book value of $20 000. The machine had been purchased on 1 July 2015. Additional information [4] 1 October 2017accounts a new machine was purchased for $68 600 paid by cheque. T On Limited prepares to 30 June. 9 Thefollowing companybalances depreciates plant andatmachinery at 20% using the reducing balance method The are available 30 June 2017: calculated on a month-by-month basis. No depreciation is charged in the year of disposal. REQUIRED $10 [4] [4] andthe machinery cost 174on 300 (b) Plant Prepare provisionatfor depreciation plant and machinery account for the year ended 10 Additional Provision for depreciation 30 Juneinformation 2018. Dates are required. 48 700 Additional information Additional information Additional information Provision for depreciation onthe plant andhad machinery Rather than paying immediately, the company had option to pay in book full forvalue the new machine On 1 July 2017 the company disposed of a machine which a net of $20 000. The months from thepurchased date of purchase. TRather Limited prepares accounts to 30 June. T15 Limited prepares accounts to 30 June. machine had been on 1 July 2015. than paying immediately, the company had the option to pay in full for the new machine $ $ 15 months from the date of purchase. REQUIRED The following balances are available at 30 June 2017: The1following balances aremachine available at 30 June 2017: On October 2017 a new was purchased for $68 600 paid by cheque. REQUIRED (c) Explain the impact on the financial statements for the year ended 30 June 2018 of paying for $$ The company depreciates plant and machinery at 20% using the reducing balance method the new machine 15 months from the date of purchase. Plant and machinery atat cost 174 300 Plant and machinery cost 174 300 (c) Explain the impact on the financial statements for theisyear endedin30the June 2018 of paying for calculated on a month-by-month basis. No depreciation charged year of disposal. © UCLES 2018 9706/21/O/N/18 Provision for 48 700 700 Provision for depreciation depreciation 48 the new machine 15 months from the date of purchase. (4+8+3) (Nov18/P21/Q2) On11 July July 2017 2017 the machine which hadhad a net book value of $20 The The On the company companydisposed disposedofofa a machine which a net book value of 000. $20 000. machine had been purchased on 1 July 2015. 8 machine had been purchased on 1 July 2015. Q2. On October aa new was purchased forfor $68 600 paidpaid cheque. 2 On The following2017 information has been extracted from the books ofbyaccount of FA Limited at 11October 2017 newmachine machine was purchased $68 600 by cheque. 1 January 2016. The company depreciates plant and machinery at 20% using the reducing balance method The company depreciates plant and machinery at 20% using the reducing balance method calculated on a month-by-month basis. No depreciation is charged in the year of disposal. $ calculated on a month-by-month basis. No depreciation is charged in the year of disposal. Motor vehicles at cost 124 000 Motor vehicles provision for depreciation 54 250 The following information is also available.9706/21/O/N/18 © UCLES 2018 1 All the company’s motor vehicles had been purchased on 1 January 2014. 2 On 1 July 2016, a new motor vehicle was purchased for $48 000. The cost was settled by [3] a cheque payment of $28 000, the balance by the part exchange of an old motor vehicle. [3] OMAIR MASOOD CEDAR COLLEGE [Total: 15] The vehicle that was part-exchanged had cost $36 000. [Total: 15] 30 company policy is to depreciate motor vehicles at 25% per annum using the reducing 9706/21/O/N/18 balance method. © UCLES 2018 3 The © UCLES 2018 9706/21/O/N/18 156 54 250 on for depreciation $ (b) Analyse the effect on the profit for the year ended 31 December 2016 if FA Limited had Motor vehicles at cost 124 000 always used the straight-line method of depreciation at 20% per annum. Show your ion is also available. Motor vehicles provision for depreciation 54 250 workings. motor vehicles had on 1isJanuary 2014. Thebeen following information also available. 9purchased a new motor vehicle purchased $48 000. Thehad cost waspurchased settled by 1 was All the company’s motor vehicles been ona1 January 2014. Motor vehicles provision forfor depreciation of $28 000, the balance by the part exchange of an old motor vehicle. 2 On 1 July 2016, a new motor vehicle was purchased for $48 000. The cost was settled by a $cheque $ exchange of an old motor vehicle. was part-exchanged had cost payment $36 000.of $28 000, the balance by the part The vehicle that was part-exchanged had cost $36 000. icy is to depreciate motor vehicles at 25% per annum using the reducing 3 The company policy is to depreciate motor vehicles at 25% per annum using the reducing balance method. eciation is charged in the year of purchase, but none in the year of sale. A full year’s depreciation is charged in the year of purchase, but none in the year of sale. REQUIRED wing ledger accounts for the year ended 31 December 2016. (Dates are not s (a) Prepare the following ledger accounts for the year ended 31 December 2016. (Dates are not required.) 9 Motor vehicles at cost Motor vehicles at cost Motor vehicles provision for depreciation $ Disposal of non-current assets $ $ 10 $ $ $ (b) Analyse the effect on the profit for the year ended 31 December 2016 if FA Limited had always used the straight-line method of depreciation at 20% per annum. Show your [5] $ $ workings. (c) Explain two accounting concepts that apply to making the annual charge for depreciation. (6+5+4) 1 (June18/P21/Q2) 10 Q3. 3 Butler operates a small business. He has 2 provided the following information for non-current assets at 31 July 2016. $ Plant and machinery Disposal of non-current assets Cost 195 000 Provision for depreciation 68 250 $ [4] $ During the year ended 31 July 2017, the following transactions took place. [Total: 15] 1 A machine was sold for $25 000. There was a loss on disposal of $3000. The machine had been purchased on 28 May 2016. 2 A machine was purchased by cheque at a cost of $37 500. The following costs were also incurred for the new machine: [5] $ 9706/21/M/J/18 Annual insurance 2825 Installation expenses 4500 (c)9706/21/M/J/18 Explain two accounting concepts that apply to making the annual charge for depreciation. Plant and machinery is depreciated using the reducing balance method at a rate of 20% per 1 annum. © UCLES 2018 9706/21/M/J/18 © UCLES 2018 A full year’s depreciation is charged in the year of purchase. No depreciation is charged in the year of disposal. REQUIRED 2 MASOOD OMAIR CEDAR (a) Prepare the following ledger accounts for COLLEGE the year ended [6] 31 July 2017. Dates are not required. 9706/21/M/J/18 (i) [Turn over Plant and machinery at cost 31 [4] 157 (b) Explain why a business may use reducing balance method of depreciation for plant and Plant and machinery is depreciated using the reducing balance method at a rate of 20% per machinery. annum. epreciation is charged in the year of purchase. No depreciation is charged in the al. A full year’s depreciation is charged in the year of purchase. No depreciation is charged in the year of disposal. REQUIRED he following ledger accounts for the year ended 31 July 2017. Dates are not (a) Prepare the following ledger accounts for the year ended 31 July 2017. Dates are not [3] required. 11 Plant and machinery at cost (ii) (i) REQUIRED Plant and machinery at cost Provision for depreciation on plant and machinery $ $ $ $ and (b) Explain why a business may use reducing balance method of depreciation for plant $ $ machinery. [3] Additional information Butler also purchases loose tools for use in the business. 9 12 (c) Explain two accounting treatments for loose tools. (b) Prepare the provision for depreciation on motor vehicles account for W Limited for the year (d) Explain one fundamental concept relating to depreciation. ended 31 July 2017 (datesaccounting are not required). 1 (3+3+3+4+2) (June18/P22/Q3) 8 8 2 The directors of W Limited have provided the following balances at 1 August 2016: 2 The directors of W Limited have provided the following balances at 1 August 2016: Additional information Accumulated Net book 2 Accumulated Net book Cost depreciation value Butler also purchases loose tools for use in the business. value Cost depreciation [3] $ $ $ [3] $ $ $ Motor vehicles 125 000 43loose 750 tools. 81 250 (c) Explain two accounting treatments for Motor vehicles 125 000 43 750 81 250 Q4. [3] [3] [2] [4] The company policy is to provide depreciation on motor vehicles at 20% per annum using the REQUIRED The 1 company policy is to Depreciation provide depreciation onon motor vehicles at 20% per annum using the reducing balance method. is charged a month-by-month basis. [Total: 15] reducing balance method. Depreciation is charged on a month-by-month basis. © UCLES 2018 9706/22/M/J/18 [Turn over © UCLES 2018 9706/22/M/J/18 b) Explain why a business may use31reducing balance method of depreciation for plant and During the year ended July 2017, the following transactions took place: machinery. During the year ended 31 July 2017, the following transactions took place: 9706/22/M/J/18 1 1 A motor vehicle was purchased on 31 January 2017 at a cost of $28 230. A motor vehicle was purchased on 31 January 2017 at a cost of $28 230. 2 2 A2motor vehicle was sold on 28 February 2017 for $14 600. It had originally been purchased A motor vehicle was sold on 28 February 2017 for $14 600. It had originally been purchased on 30 April 2015 at a cost of $19 500. on 30 April 2015 at a cost of $19 500. 3 3 There were no other additions or disposals of motor vehicles during the year. There were no other additions or disposals of motor vehicles during the year. [4] REQUIRED REQUIRED 9706/22/M/J/18 [Turn over (a) of a a non-current non-current asset asset before before the profit profit (a) State Statethe thedouble double entry entry required required to to record record the the disposal of the 9 disposal or (amounts are are not not required). required). [3] orloss losson ondisposal disposal is is transferred transferred to to the the income income statement statement (amounts (b) Prepare the provision for depreciation on motor vehicles account for W Limited for the year ended 31 July 2017 to (dates are not required). accounts accounts to to be be credited credited accounts to be be debited debited accounts © UCLES 2018 Additional information (c) Calculate the effect on profit for the year of each of transactions 1 and 2. [7] (6+7+2) Butler also purchases loose tools for use in the business. (Nov17/P21/Q2) c) Explain two accounting treatments for loose tools. 1 2 OMAIR MASOOD 158 CEDAR COLLEGE 32 [6] [6] [4] provision for depreciation 32 855 On 1 February 2017, the company bought new equipment, $12 785, and the cost of installing this equipment was $1595. On 31 December 2016 the company sold 8 a motor vehicle which had cost $14 850 on Q5. 1 August 2015. The proceeds of $8900 were paid by cheque. 33 Limited has has been been trading trading for many years and prepares financial KK Limited financial statements statements annually annually to to 30 30April. April. hadcompany’s the following following balances atpolicy depreciation is 2016: as follows: ItItThe had the balances 1 May 9 $$ Plant and equipment 20% on cost per annum Plant and equipment Plant and equipment Motor vehicles 25% reducing balance per annum at cost cost 84 at 84 695 695 provision for depreciation provision for depreciation Depreciation is charged on a month-by-month basis. $$ 32 32855 855 On 11 February February 2017, 2017, the the company company bought bought new new equipment, On equipment, $12 $12 785, 785, and and the the cost cost of of installing installingthis this REQUIRED equipment was $1595. equipment was $1595. (a) 31 (i) December Calculate 2016 the depreciation charge plant and equipment for the $14 year ended On the company company sold for a On 31 December 2016 the sold a motor motor vehicle vehicle which which had had cost cost $14850 850 on on 30 April 2017. Workings must be shown. 1 August 2015. The proceeds of $8900 were paid by cheque. [4] 1 August 2015. The proceeds of $8900 were paid by cheque. The company’s company’s depreciation depreciation policy policy is is as as follows: follows:9 The (b) Explain two accounting concepts which are being applied when depreciation is provided. Plant and and equipment equipment 20% on on cost cost per per annum Plant 20% annum Motor vehicles 25% reducing balance per Motor vehicles 25% reducing balance per annum annum 1 Depreciation is is charged charged on on aa month-by-month month-by-month basis. Depreciation basis. REQUIRED REQUIRED (a) (i) (i) Calculate Calculate the the depreciation depreciation charge charge for [2] (a) for plant plant and and equipment equipment for for the the year year ended ended 2 30 April 2017. Workings must be shown. 30 April 2017. Workings must be shown. (ii) Prepare the motor vehicle disposal account for the year ended 30 April 2017. Workings must be shown. [4] [4] (b) Explain two accounting concepts which are being applied when depreciation is provided. Additional information 1 K Limited is considering purchasing additional plant and equipment costing $30 000. This could be financed by one of the following: [2] [2] Bank loan Issue of ordinary shares (ii) Prepare the motor vehicle disposal account for the year ended 30 April 2017. Workings (ii) motor vehicle disposal account for the year ended 30 April 2017. Workings 2 Prepare must bethe shown. REQUIRED must be shown. (c) Advise the directors which method of finance they should choose. Justify your answer. (Nov17/P22/Q3) (Nov17/P22/Q3) [4] Additional information K Limited is considering purchasing additional plant and equipment costing $30 000. This could be financed by one of the following: © UCLES 2017 9706/22/O/N/17 Bank loan Issue of ordinary shares REQUIRED (c) Advise the directors which method of finance they should choose. Justify your answer. © UCLES 2017 © UCLES 2017 OMAIR MASOOD 9706/22/O/N/17 9706/22/O/N/17 CEDAR COLLEGE [5] [Total: 15] 33 © UCLES 2017 9706/22/O/N/17 [Turn over 159 3 King provided the following information for non-current assets at 1 April 2015. $ Property plant and machinery Land and buildings – cost 252 000 Plant and machinery – cost 123 000 10 Accumulated depreciation Q6. Buildings 21 000 3 King provided the following information for non-current assets at 1 April 2015. Plant and machinery 49 000 $ During the year ended 31 March 2016, the following took place: Property plant and machinery Land and buildings – cost 252 000 1 Land was revalued to $202 500. It had originally cost $182 000. Plant and machinery – cost 123 000 Accumulated depreciation 2 A machine was sold on 30 November 2015. It had a net book value on 1 April 2015 of $46 350 Buildings 21 000 and an original cost of $76 200. Plant and machinery 49 000 3 A machine was purchased on 1 December 2015 at a cost of $62 850. During the year ended 31 March 2016, the following took place: The depreciation policy for non-current assets is as follows: 1 Land was revalued to $202 500. It had originally cost $182 000. 2 Buildings 2% per annum using the straight-line method A machine was sold on 30 November 2015. It had a net book value on 1 April 2015 of $46 350 and an original cost of $76per 200. Plant and machinery 20% annum using the reducing balance method 3 A machine was purchased on 1 Decemberbasis. 2015 at a cost of $62 850. Depreciation is charged on a month-by-month The depreciation policy for non-current assets is as follows: REQUIRED Buildings the 2%total per annum using the straight-line method (a) Calculate depreciation charge for buildings for the year ended 31 March 2016. Plant and machinery 20% per annum using the reducing balance method Depreciation is charged on a month-by-month basis. REQUIRED [1] (a) Calculate the total depreciation charge for buildings for the year ended 31 March 2016. 11 (b) Calculate the total depreciation charge 11 for plant and machinery for the year ended 31 March 2016. (c) Prepare an extract from the statement of financial position at 31 March 2016 for non-current assets. (c) Prepare an extract from the statement of financial position at 31 March 2016 for non-current assets. King King Extract from Statement of Financial atPosition 31 March 2016 Extract from Statement ofPosition Financial at 31 March 2016 [1] (b) Calculate the total depreciation charge for plant and machinery for the year ended Accumulated Accumulated 31 March 2016. Cost / Valuation Depreciation Value Cost / Valuation Depreciation Net BookNet Book Value $ $ $ $ $ $ 12 (d) State three causes of depreciation. (Mar17/P22/Q3) 1 © UCLES 2017 2 [3] 9706/22/F/M/17 [3] 3 © UCLES 2017 OMAIR MASOOD Workings: Workings: (1+3+8+3) 9706/22/F/M/17 CEDAR COLLEGE [3] [Total: 160 15] 34 PARTNERSHIP!ACCOUNTS! PARTNERSHIP THEORY ( A(partnership(is(defined(by(the(Partnership(Act(1890(as(a(relationship,(which(exists(between(two$or( more$persons(who(carry(business(with(a(view$of$profit.$ ( CHARACTERISTICS(OF(PARTNERSHIP( • • • • Partners(are(jointly$and$severally$liable$for(the(debts(of(the(partnership.(They(have( unlimited(liabilities(for(the(debts(of(the(partnership.( The(minimum(number(of(partners(is(usually(two(and(maximum(number(is(twenty,(with( exception(of(banks,(where(the(maximum(number(is(fixed(at(ten(and(some(professional( practices(where(there(is(no(maximum(number.( All(partners(usually(participate(in(the(running(of(their(business.( There(is(usually(a(written(partnership(agreement.( ( THE(PARTNERSHIP(AGREEMENT( ( The(partnership(agreement(is(a(written(agreement(which(sets(up(the(terms(of(the(partnership,( especially(the(financial(arrangements(between(the(partners.( The(contents(of(the(partnership(agreement(can(vary(from(one(partnership(to(another.(A(standard( Partnership(Agreement(may(include(the(following(items:( 1. The(name(of(the(firm,(business(type(and(duration( 2. Capital(contribution.( 3. Profit(sharing(ratios.( 4. Interest(on(Capital.( 5. Partners’(salaries.( 6. Drawings.( 7. Interest(on(drawings.( 8. Arrangements(in(case(of(dissolution,(death(or(retirement(of(partners.( 9. Arrangement(for(settling(disputes.( ! In!absence!of!a!formal!agreement!between!the!partners,!certain!rules!laid!down!by!the!Partnership! Act!1890!are!presumed!to!apply.!These!are:! 1. Residual(profits(are(shared(equally(between(the(partners.( 2. There(are(no(partners’(salaries.( 3. No(interest(is(charged(on(drawings(made(by(the(partners( 4. Partners(receive(no(interest(on(capital(invested(in(the(business.( 5. Partners(are(entitled(to(interest(of(5%(per(annum(on(any(loans(they(advance(to(the(business(in( excess(of(their(agreed(capital.( ( OMAIR MASOOD CEDAR COLLEGE 161 CHANGES(IN(THE(PARTNERSHIP( A(change(in(partnership(is(when(the(agreement(has(to(be(changed(between(the(partners(due(to( ( 5 Admission(of(a(new(partner( 5 Retirement(of(an(existing(partner( 5 Or(simply(change(in(profit(sharing(ratio.( ( Whenever(there(is(a(change(in(a(partnership,(partners(are(allowed(to(revalue(their(assets.((This(is(done( to(make(the(situation(fair(for(all(parties.(Since(the(values(on(the(statement(of(financial(position(might(be( different(from(the(market(so(any(gain(or(loss(is(first(adjusted(between(the(old(partners(For(this(purpose,( they(make(a(revaluation(account.(( ( In(revaluation(account(we(simply(record(the(gains(or(losses(on(each(asset(due(to(revaluation.((This( account(is(then(closed(by(transferring(the(balance(to(partners’(capital(account(in(the(old!profit!sharing! ratio.! ( ( Goodwill!! This(is(an(added(advantage(which(an(old(business(has(over(a(similar(new(business,(due(to(its(location,( brand(value,(costumer(base(etc.( ( Whenever(there(is(a(change(in(partnership(,we(need(to(adjust(for(goodwill,(so(that(the(old(partners( benefit(and(get(the(credit(of(the(efforts(they(have(done(to(make(good(reputation(of(the(business.(The( adjustment(is(done(in(the(capital(accounts(,(where(we(first(create(the(goodwill(in(the(old(profit(sharing( ratio(((thus(giving(credit(to(the(old(partners),(and(then(we(right(it(off(((always()(in(the(new(ratio(((so(that( the(partner(who(is(gaining(stake(in(the(business(actually(pays(for(it().( ( ADVANTAGES!OF!PARTNERSHIP!OVER!SOLE!TRADER! ( 1. 2. 3. 4. Additional(capital(from(other(partners,(and(also(easier(to(get(loans.( Additional(expertise.( Additional(management(time.( Risk((losses)(is(shared.( ( ! DISADVANTAGES!OF!PARTNERSHIOP!OVER!A!SOLE!TRADER! ( 1. Profit(are(shared( 2. Possibility(of(disputes( 3. Loss(of(control( OMAIR MASOOD CEDAR COLLEGE 162 ! ! What!is!a!current!account?! ! Majority(of(partnership(keep(a(fixed(capital(account,(whenever(they(have(fixed(capital(accounts,(they( will(have(to(maintain(a(current(account(for(each(partner.(By(fixed(capital(account,(we(mean(that(all(the( appropriation(and(drawings(will(pass(through(a(temporary(capital(account((current(account),(only( additional(investment(by(a(partner(will(be(recorded(in(the(capital(account.(This(gives(information( relating(to(long(term(and(short(term(aspects(separately.(This(also(helps(to(determine(the(investment( made(by(partner(in(the(business.( Some(partnerships(also(maintain(a(fluctuating(capital(account;(in(this(case(they(will(not(maintain(a( current(account.(All(the(transactions(will(pass(through(the(capital(account.( ( What!is!total!share!of!profit?! ! This(is(different(than(just(the(remaining(share(of(profit(which(we(get(at(the(end(of(appropriation( account.(Total(share(of(profit(means(out(of(this(year’s(net(profit,(how(much(profit(goes(to(a(particular( partner.(As(we(know(interest(on(capital(and(salary(etc(are(deducted(from(net(profit(only(so(they(also( constitute(as(part(of(profit.(Hence,(total(share(of(profit(is:( ( ( Interest(on(capital(+(Salary(+(Remaining(share(of(Profit(–(Interest(on(drawings( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( OMAIR MASOOD CEDAR COLLEGE 163 PARTNERSHIP FINAL ACCOUNTS WORKSHEET PARNTERSHIP*FINAL*ACCOUNTS*(*WS*1)* Q1.* Q1. Khabib*and*Habib*are*in*partnership.*The*following*balances*were*extracted*from*the*books*of* the*partnership*on*31*October*1995:* * * * * £" Capital*Accounts* Khabib* **20*000* Habib* **14*000* * * Current*Accounts*at*1*November* Khabib* *************600*Cr* 1994:* Habib* *************100*Dr* * * Drawings:* Khabib* **14*000* Habib* **12*000* Inventory*at*1*November*1994* **15*500* Purchases* 136*400* Sales* 190*000* Sales*Returns* ****2*000* Rent*and*Insurance* ***5*400* Selling*Expenses* ***8*800* General*Expenses* ***9*000* Provision*for*Doubtful*Debts* ******900* Trade*Receivables* * **16*400* Trade*Payables* * **12*500* Cash*at*bank* * ****7*400* Equipment*and*Fittings* * 21000* Provision*for*Depreciation*on* * 10000* Equipment*and*Fittings* The*additional*information*is*also*available:* 1. Inventory*at*31*October*1995*was*valued*at*£16*300.* 2. The*Rent*and*Insurance*Account*includes*an*insurance*premium*of*£200*paid*in* advance.* 3. Bad*Debts*of*£400*are*to*be*written*off.* 4. The*Provision*for*Doubtful*Debts*is*to*be*adjusted*to*5%*of*the*outstanding* receivables’*balances*at*31*October*1995.* 5. Equipment*and*Fittings*are*to*be*depreciated*by*10%*on*reducing*balance*basis* 6. The*bank*statement*was*received*on*3*November*1995.*It*included*an*entry*of* £200*for*bank*charges.*This*matter*has*not*been*dealt*with*in*the*partnership’s* books.* 7. Khabib*invested*£6000*by*cheque*on*1st*May*1995*this*transaction*was* completely*omitted*from*the*books.* 8. The*partnership*agreement*provides*that:* * a. Interest*is*to*be*allowed*on*partners’*fixed*capital*at*the*rate*of*10%*per* annum.* b. Interest*is*charged*on*Drawings*at*5%*per*annum* * c. Habib*is*to*be*credited*with*an*annual*salary*of*£5*000.* * d. The*remaining*profit*is*to*be*shared*ratio*3:2*respectively.* REQUIRED* The*Income**Statement*for*the*year*ended*31*October*1995* The*Appropriation*Account*for*the*year*ended*31*October*1995.* * * Partners*Current*Accounts*for*the*year*ended*31*October*1995* * * A*Statement*of*Financial*Position*as*at*31*October*1995.* * ******* * * OMAIR MASOOD CEDAR COLLEGE * 164 * * * Q2. Q2.* Gerard*and*Lampard*are*in*partnership*sharing*profits*in*their*fixed*capital*ratio.*The*following* balances*were*extracted*from*the*partnership*books*on*31*May*1997.* * ! Dr." Cr." £" £" Capital*Accounts:* Gerard* * 12*000* Lampard* * 18*000* Current*Account* Gerard* *****300* * Lampard* * *****700* Drawings* Gerard* **6*000* * Lampard* **2*500* * Purchases*and*Sales* 36*000* 65*000* Sales*Returns*and*Purchases*Returns* **1*400* ***1*800* Staff*Salaries*and*Wages* **5*600* * Rent*and*Rates* **3*000* * Administration*Expenses* **2*300* * Cash*at*Bank* **4*000* * Receivables*and*Payables* 10*400* **4*400* Provision*for*Bad*Debts*–*(1*June*1996)* * *****300* Inventory*–*1*June*1996* 10*700* * Motor*Vehicle*at*cost* 28*000* * Provision*for*Depreciation*on** * * Motor*Vehicle*–*1*June*1996* ____**_* ***8*000* * 110"200" 110"200" Additional*Information:* * 1. Inventory*at*31*May*was*valued*at*£11*300." 2. Rates*£300*have*been*paid*in*advance." 3. Administration*expenses*totaling*£200*were*owing*at*31*May1997." 4. The*Provision*for*Bad*Debts*to*be*carried*forward*to*the*year*1997/98*is*to*be* £200." 5. Motor*Vehicle*is*to*be*depreciated*at*20%*per*annum*on*cost." 6. Lampard*uses*the*motor*vehicle*in*non*business*hours*for*personal*uses*,*it*was* decided*that*one*quarter*of*depreciation*should*be*charged*to*him." 7. Selling*expenses*of*£100*were*paid*from*Gerard’s*personal*bank*account"* " 8. The"partnership"agreement"provides"that:" " 1.Interest*is*to*be*allowed*on*partners’*capital*at*5%* * 2.*Gerard*is*to*receive*a*salary*of*£5*000* * *********************************3.*Interest*of*2%*is*charged*on*drawings* * *********************************4.*The*remaining*profit*or*loss*is*to*be*shared*by*the*partners*in*ratio*of*2:3* *********REQUIRED* * (a) Prepare*the*Partnership*Income*Statement*and*an*Appropriation*Account*for* the*year*ended*31*May*1997.* * * * * * ******** " (b) Draw*up*the*Current*Accounts*of*the*partners*and*balance*them*at*31*May*1997. * ********* " (c) Prepare*the*Partnership*Statement*of*Financial*Position*as*at*31*May*1997.***" OMAIR MASOOD CEDAR COLLEGE 165 PARTNERSHIP FINAL ACCOUNTS Q1. Q3. X and Y are in partnership sharing profits and losses in the ratio 3:2. Interest is allowed on capital at 5% per annum. Su is entitled to a salary of $15 000 per annum.The following balances were extracted from the books on 30 April 2012: Land and Buildings (cost) Equipment (cost) Fixtures and fittings (cost) Provisions for depreciation: Land and buildings Equipment Fixtures and fittings Revenue Inventory at 1 May 2011 Purchases Sales Return Purchases Returns Carriage outwards Administration expenses Marketing expenses Wages and salaries Communication expenses Loan interest paid Building works 6% Loan repayable 31 December 2020 Trade receivables Provision for doubtful debts Trade payables Bank Capital accounts: X Y Current accounts: X Y Drawings: X Y OMAIR MASOOD CEDAR COLLEGE $ 200 000 48 000 35 000 14 000 12 000 26 000 380 000 53 750 175 000 11 100 8 900 6 290 25 720 17 800 69 530 8 900 3 600 24 000 80 000 58 000 2 500 20 340 9 150 Cr 120 000 100 000 500 Cr 2 700 Dr 20 000 14 000 166 Additional information: 1. Inventory at 30 April 2012, $38 500. 2. Building works consisted on an extension to the building, $20 000, and repairs to the existing air conditioning, $4 000. 3. Marketing Expenses of $200 were paid from Y’s Personal Bank Account 4. At 30 April 2012 communication expenses, $890, were prepaid and marketing expenses, $4 000, were accrued. 5. Depreciation is to be charged on all non-current assets owned at the end of the year as follows: (i) Buildings at the rate of 2% per annum on cost. (ii) Equipment at the rate of 20% per annum using the diminishing (reducing) balance method. (iii) Fixtures and fittings at the rate of 10% using the straight line method. 6. Trade receivables contain a debt of $3 000 which is considered irrecoverable. 7. The provision for doubtful debts is to be maintained at 6% of remaining trade receivables. 8. X has withdrawn goods worth $1000 for personal use REQUIRED (a) (b) (c) Prepare the Income Statement and Appropriation account of X and Y for the year ended 30 April 2012. Current Accounts for the year ended 31 March 2012 Prepare the Statement of Financial Position of X and Y at 31 March 2012. OMAIR MASOOD CEDAR COLLEGE 167 Q2. Q4. Paul and Mudi are partners in a retail business. The partnership agreement states that they share profits and losses in the ratio 3:2, after allowing interest on capital at the rate of 4% per annum and charging interest on drawings at 2%. The following balances were extracted from the books on 30 September 2009. $ Capital Accounts Paul Mudi Current Accounts Paul Mudi Drawings Paul Mudi Purchases Sales Sales returns Inventory at 1 October 2008 Staff wages General expenses Rent receivable Advertising expenses Rent Fixtures and fittings (at cost) Provision for depreciation of fixtures and fittings Trade Payables Trade Receivables Provision for doubtful debts Bank 30 000 20 000 2 300 Cr 650 Dr 11 000 10 000 139 750 210 000 4 500 12 650 18 000 9 650 6 000 10 000 17 500 24 000 12 600 8 900 16 000 550 16 650 Dr Additional information: 1. Inventory at 30 September 2009 was valued at $15 400. 2. Paul withdrew goods, costing $4 000 from the partnership books. 3. At 30 September 2009: Advertising expenses, $2 850, were prepaid. Rent receivable, $2 000, was due. 4. Depreciation is charged on fixtures and fittings at 15% per annum on cost using the straight line method. 5. The provision for doubtful debts is to be maintained at 5% of receivables. REQUIRED (a) (b) (c) Prepare the Income Statement and Appropriation accounts of Paul and mudi for the year ended 30 September 2009. Current Accounts for the year ended 30 Sepetember 2009 Prepare the Statement of Financial Position of Paul and mudi at 30 September 2009. OMAIR MASOOD CEDAR COLLEGE 168 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( ((((((((((((((((((OMAIR(MASOOD( PARTNERSHIP FINAL ACCOUNTS ( WORKSHEET 2) Q5. Q1. Killim and Jaro are in partnership sharing profits in the ration of 2:1 respectively. Interest of 5% per annum is allowed on capital and 4% is charged on total drawings for the year. The following are the partnership balances at 30 September 2007, after completion of the trading account. $ Gross profit 61,400 General expenses 9,110 Rent, rates and insurance 1,215 Discount allowed 2,010 Discount received 1,910 Wages 14,150 Bank interest (Cr) 1,320 Premises at cost 73,500 Fixtures at valuation 13,100 Trade Receivables 20,200 Trade Payables 27,842 Bank deposit account 60,000 Bank current account (Cr) 1,400 Inventory at 30 September 51,200 2007 Drawings – Killim 12,200 Drawings – Jaro 14,100 Capital account – Killim 120,000 Capital account – Jaro 55,000 Current account – Killim (Cr) 3,050 Current account – Jaro (Dr) 1,147 Additional information at 30September 2007: Depreciation on fixtures is provided for at 25% per annum using the reducing balance method. Jaro is credited with a salary of $20,000 per annum. Wages prepaid amounted to $450. Insurance accrued amount $300. REQUIRED: (a) Prepare an Income Statement(profit and loss) and appropriation account for the year ended 30 September 2007 (b) Prepare Jaro’s current account for the year ended 30 September 2007. The partnership has recently purchased new premises and needs new equipment costing over $100,000 (c) Identify two methods of raising extra finance and state one advantage and one disadvantage of each method. ! ! OMAIR MASOOD CEDAR COLLEGE 169 Accounts(–(9706(( Accounts(–(9706(( AS(–(Level(( AS(–(Level(( ( ( ( ( ( ( ( ( ( ( ( ( ((((((((((((((((((OMAIR(MASOOD( ((((((((((((((((((OMAIR(MASOOD( Q6. Q2. Harold and Kumar are in a partnership business. The partnership agreement allows for a Q2. Harold and Kumar are in a partnership business. The partnership agreement allows for a 1 % per annum interest on cash drawings and a 10% per annum Interest on capital. 1 % per annum interest on cash drawings and a 10% per annum Interest on capital. Partnership salary to Harold of $5000 per annum is also deducted before the profits are Partnership salary to Harold of $5000 per annum is also deducted before the profits are shared in the ratio of 5:3 respectively. The following trial balance is available for the shared in the ratio of 5:3 respectively. The following trial balance is available for the year ended 31st Dec 2007. year ended 31st Dec 2007. Sales Sales Sales Returns Sales Returns Purchases Purchases Purchases Returns Purchases Returns Carriage on purchases Carriage on purchases Carriage on Sales Carriage on Sales Discount received Discount received Discount allowed Discount allowed Rent Rent Office stationary Office stationary Machinery Machinery Provision dep-machinery Provision for for dep-machinery Electricity Electricity Wags Wags Selling expenses Selling expenses Motor Motor vanvan Provision dep-motor Provision for for dep-motor van van Trade Receivables Trade Receivables Cash in hand Cash in hand st st Inventory 1 Jan 2007 Inventory 1 Jan 2007 Cash at bank Cash at bank Trade Payables Trade Payables Capital – Harold Capital – Harold Capital – Kumar Capital – Kumar Drawings – Harold Drawings – Harold Drawing – Kumar Drawing – Kumar Current account – Harold Current account – Harold Current Account – Kumar Current Account – Kumar Provision for for badbad debts Provision debts 6%6% loanloan from Kumar from Kumar Debit Credit Credit Debit ($) ($) ($) ($) 120000 120000 30003000 95000 95000 25002500 1500 1500 10001000 17501750 14001400 40004000 300 300 15000 15000 35003500 75007500 55005500 19501950 45000 45000 50005000 37500 37500 10700 10700 80008000 53400 53400 23000 23000 75000 75000 50000 50000 10000 10000 80008000 75007500 500 500 10001000 20000 20000 st st • •Inventory at 31 DecDec 2007 waswas $40000 Inventory at 31 2007 $40000 • •TheThe provision for bad debts at the endend of the yearyear is toisbe afterafter taking into into provision for bad debts at the of the to adjusted be adjusted taking account a specific provision of $500 and and a general provision of 4% of the account a specific provision of $500 a general provision of 4% of remaining the remaining Trade Receivables. Trade Receivables. • •Machinery is depreciated using 20%20% reducing balance method. Machinery is depreciated using reducing balance method. • • Motor Van is to be depreciated at 10% on cost. Harold usesuses the van in non-business Motor Van is to be depreciated at 10% on cost. Harold the van in non-business hours and 30% of the depreciation must be charged to him. hours and 30% of the depreciation must be charged to him. ! ! ! ! OMAIR MASOOD CEDAR COLLEGE 170 Accounts(–(9706(( AS(–(Level(( • • • • ( ( ( ( ( ( ((((((((((((((((((OMAIR(MASOOD( Kumar has taken goods worth $1000 for his personal use. $150 of selling expenses is still in arrears. Rent includes a payment of $600 paid for 3 months ending 31st Jan 2008. On 1st July 2007 Harold bought some furniture costing $5000 in the business. The transaction was ignored in the books. The furniture must be depreciated at 10% per annum on cost No account has been taken for full year’s interest due on loan from Kumar. REQUIRED: (a) Income Statement (Trading, Profit and Loss a/c) and the Appropriation Account (b) Current Account for both partners (c) Statement of Financial position (Balance sheet) as 31st Dec 2007 ! OMAIR MASOOD ! CEDAR COLLEGE 171 Accounts(–(9706(( AS(–(Level(( ( Q3. The following balances Accounts(–(9706(( ( ( ( Q7. 2004. AS(–(Level(( ( ( ( ( ( ((((((((((((((((((OMAIR(MASOOD( were ( taken (from the of the partnership on 31 August ( books ((((((((((((((((((OMAIR(MASOOD( Q3. The following balances were taken from the books of 2004. Capital A/c – Sara Debit Capital A/C – Zara $ A/c – Sara Capital Current A/c – Sara A/c – Zara Capital Current A/C – Zara Drawings Current A/c – Sara– Sara CurrentDrawings A/c – Zara– Zara 30 Drawings – Sara at 1 September 7,500 Inventory 2003 Drawings – Zara 5,000 Purchases Inventory at 1 September 2003 18,400 Sales Purchases 61,100 Rent and Insurance Sales Selling expenses Rent and Insurance 3,800 Administrative expenses Selling expenses 10,400 Furniture and fittings Administrative expenses 9,700 Trade Receivables Furniture and fittings 15,000 Trade Payables Trade Receivables 19,500 Cash at Bank Trade Payables Cash at Bank 16,870 167,300 Debit $ Credit $ 24,000 15,000 360 the partnership on 31 August Credit $ 24,000 30 15,000 7,500 360 5,000 18,400 61,100 112,900 3,800 112,900 10,400 9,700 15,000 19,500 15,040 16,870 15,040 167,300 167,300 167,300 Additional information: Additional information: 1. 2. 3. 4. 1. Inventory on 31 August 2004 was valued at $19,800. Inventory on 31 August 2004 was valued at $19,800. 2. Insurance amounting to $220 had been paid in advance. Insurance amounting to $220 had been paid in advance. 3.selling The selling expenses itemforofcarriage $300 for on purchases. The expenses includedincluded an item ofan$300 oncarriage purchases. 4. amounted Rent amounted $2400 perNo annum. Nohad payment had been Rent to $2400toper annum. payment been made for themade monthforofthe month of AugustAugust 2004. 2004. 5. Selling expenses of were $1,000 paidfrom by Sara from her personal 5. Selling expenses of $1,000 paidwere by Sara her personal bank accountbank and account and goods goods $1,500 $1,500 were taken fortaken personal by Zara entries been recorded were for use personal usebutbynoZara buthave no entries have been recorded in the books. in the books. 6. Non-Current Assets are to beare depreciated by 10% perbyannum. 6. Non-Current Assets to be depreciated 10% per annum. 7. Zara brought her personal motor van in the business 1 Marchon2004 valuing2004 valuing 7. Zara brought her personal motor van in theonbusiness 1 March $5,000 as his additional capital, which has not been recorded in the books. $5,000 as his additional capital, which has not been recorded in the books. 8. The partnership agreement provides that: 8. The partnership agreement provides that: (i) Interest is to be allowed at 8% per annum on capital. (i) Interest is to be allowed at 8% per annum on capital. (ii) Sara and Zara are entitled for monthly salary of $500 and $400 respectively. (ii) Sara and Zaraisare entitled forper monthly (iii)Interest on drawings charged at 4% annum salary of $500 and $400 respectively. Interestprofits/losses on drawingsare is charged at 4% per annum (iv) All(iii) remaining to be shared by Sara and Zara in the ratio of 3:2 (iv) All remaining profits/losses are to be shared by Sara and Zara in the ratio of 3:2 respectively. respectively. REQUIRED: (a)REQUIRED: The Income Statement and the appropriation a/c for the year. (b) The accountsStatement for both the partners (a)current The Income and the appropriation a/c for the year. (c) Statement of financial position (b) The current accounts for both the partners (c) Statement of financial position ! ! ! ! OMAIR MASOOD CEDAR COLLEGE 172 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( ((((((((((((((((((OMAIR(MASOOD( Q8. Q4. Hook, Line and Sinker are trading in partnership as Angler Traders. The following trial Balance as at 31 October 1997 has been taken from the firm’s accounting records: Non-Current Assets at cost Provision for Depreciation on Non-Current Assets Inventory Trade Receivables Bank Trade Payables Capital Accounts: as at 1 November 1996 Hook Line Sinker Current Accounts: as at 1 November 1996: Hook Line Sinker Drawing: Hook Line Sinker Net Profit for the year ended 31 October $ 184,000 $ 40,000 13,000 7,000 2,000 5,000 80,000 30,000 20,000 12,000 3,000 7,000 16,000 12,000 8,000 242,000 45,000 242,000 Additional information: 1. Hook, Line and Sinker have an agreement which includes the following: a. Partners re to be credited with interest on any loan accounts at the annual rate of 10%. b. Line is to be credited with an annual salary of $12,000. c. Partners are to be credited with interest on their Capital Account balances at the annual rate of 5% d. The balance of net profit is to be shared between Hook, Line and sinker in the ratio of 5:3:2 respectively. 2. On 1 November 1996, all partner agreed to transfer half of their capital Account balances to appropriate partners’ loan accounts. The accounts are now to be corrected for this decision. ! ! OMAIR MASOOD CEDAR COLLEGE 173 CHANGES IN PARTNERSHIP ( WORKSHEET 1) Q1. CHANGES WORKSHEET CHANGES IN( PARTNERSHIP WORKSHEET D and P wereIN in PARTNERSHIP partnership sharing profit in the ratio1)3:2. They decided to admit Q as a partner on this date that is willing to bring cash $12,000 as his capital. The profit Q1. sharing will become D 1/2, P 1/3 and Q 1/6. The Balance Sheet as on 1st January 2005 D and P were in partnership sharing profit in the ratio 3:2. They decided to admit Q as before the admission of new partner is as follows: a partner on this date that is willing to bring cash $12,000 as his capital. The profit sharing will become D 1/2, P 1/3 and Q 1/6. The Balance Sheet as on 1st January 2005 Non-Current Assets $ $ before the admission of new partner is as follows: Buildings 10,000 Capital – D 15,000 Motor Van 6,000 Capital – P 10,000 Non-Current Assets $ $ Office Furniture 4,000 Partnership Funds 25,000 Buildings 10,000 Capital – D 15,000 20,000 Motor Van 6,000 Capital – P 10,000 Office Furniture 4,000 Partnership Funds 25,000 Current Assets: 20,000 Inventory 2,000 Trade Receivables 1,200 Current Assets: Bank 2,500 5,700 Current Liabilities 700 Inventory 2,000 25,700 25,700 Trade Receivables 1,200 Bank 2,500 5,700 Current Liabilities 700 25,700 25,700 It is agreed that the assets shall be revalued as follows: It is agreed that the assets shall be revalued as follows: Buildings Motor Van Office Furniture Buildings Inventory Motor Van Office Furniture Goodwill is valued at $9,000 and will not remain in the books. Inventory $ 25,000 4,000 $ 7,000 25,000 1,800 4,000 7,000 1,800 REQUIRED: Goodwill is valued at $9,000 and will not remain in the books. REQUIRED: (a) Draw a revaluation account. (b) Draw capital accounts in columnar from to show the effect of revaluation and (a) Draw a revaluation account. goodwill in admission of new partner. (b) Draw capital accounts in columnar from to show the effect of revaluation and (c) Prepare a Balance Sheet after admission of new partner. goodwill in admission of new partner. (c) Prepare a Balance Sheet after admission of new partner. OMAIR MASOOD CEDAR COLLEGE 174 Q2 L and S were in partnership sharing profits equally. At 31st December 2005, their balances sheet was as follows: $ Non-Current Freehold premises 40,000 Assets: Plant and 15,000 machinery Motor Van 16,000 71,000 Current Assets: Inventory 14,000 Trade 12,000 Receivables Bank 7,500 33,500 Less: Current Liabilities – Trade 7,500 26,000 Payables Capital employed 97,000 Capital – L Capital – S Current A/c – L Current A/c – S 40,000 40,000 80,000 9,000 8,000 17,000 97,000 st L and S agreed to admit B as a partner on 1 January 2006 when the assets were revalued as follows: $ Freehold premises 70,000 Plant and machinery 10,000 Motor Vans 8,000 It was also agreed that Inventory that had cost $7,000 was now worth $3,000, and Trade Receivables at 31st December 2005 included bad debts of $2,000 Goodwill of $ 25,000 is valued but no goodwill account will be kept in the books. The adjustments for the foregoing were made in the books and new partner B was duly admitted as a partner on 1st January 2006 who paid $25,000 in the business bank account They will share profit and loss in future in the ratio 2:2:1 for L, S and B respectively. REQUIRED: (a) Draw revaluation account. (b) Draw partners’ capital accounts, in columnar form. (c) Prepare the Statement of Financial position (Balance Sheet) as at 1st January 2006. OMAIR MASOOD CEDAR COLLEGE 175 CHANGES(IN(PARTNERSHIP(((WORKSHEET(2)( PAGE 402 ! 6 Q3.! 2 Maurice and Ravel had been in partnership for a number of years, sharing profits and losses equally. For Examiner's Use On 1 July 2011, they decided to admit Bach as a partner. Bach paid $39 000 capital into the partnership and also provided a motor van, valued at $8000, for partnership use. A new partnership agreement was drawn up, effective from 1 July 2011 which stated: 1 Profits and losses will be shared by Maurice, Ravel, and Bach in the ratio 2:2:1. 2 Interest on capital is payable at 10% per annum. 3 Interest on drawings is charged at 5% on annual drawings. 4 Ravel would receive an annual salary of $10 000 per annum. Goodwill in the business was valued at $40 000 and the partners agreed that this would not remain in the books. Capital accounts before goodwill – 1 July 2011 Maurice Ravel $120 000 $ 80 000 REQUIRED PAGE 403 (a) ! Prepare the capital accounts for all three 7 partners at 1 July 2011. The following additional information relates to the year ended 30 June 2012 Revenue Revenue (sales) returns Purchases Inventory: 1 July 2011 Inventory: 30 June 2012 General expenses Current accounts – 1 July 2011 Maurice Ravel Maurice Ravel Bach Drawings $ 2 600 000 200 000 1 625 000 120 000 145 000 480 000 17 000 12 000 96 000 120 000 35 000 For Examiner's Use Cr Dr REQUIRED (b) (i) PAGE 404 Prepare the income statement for the year ended 30 June 2012 8 (ii) ! ! PAGE 405 Prepare the appropriation account for the year ended 30 June 2012. 9 [5] (c) ! ! For Examiner's Use Prepare the current accounts for all three partners at 30 June 2012. © UCLES 2012 OMAIR MASOOD 9706/23/O/N/12 CEDAR COLLEGE Fo Exam Us ! ! ! 176 PAGE 340 Q4.! ! ! 6 The following statement of financial position of Mhairi, a sole trader, was drawn up at 30 April 2012. 2 Statement of Financial Position at 30 April 2012 $ $ Non-current assets Equipment Fixtures and fittings $ 232 000 160 000 392 000 Current assets Inventory Trade receivables 86 000 16 000 102 000 Current liabilities Trade payables Bank 38 000 14 000 52 000 Net current assets 50 000 442 000 Financed by Capital Add Profit for the year 400 000 86 000 486 000 44 000 442 000 Less Drawings . Additional information: 1 On 1 May 2012 Mhairi admitted Aiden as a partner. 2 The profit sharing ratio between Mhairi and Aiden was agreed at 3:2. 3 Aiden agreed to pay a cheque to the partnership for $200 000 and bring in vehicles valued at $94 000 and inventory valued at $26 000. 4 341 It was agreed that goodwillPAGE be valued at 2 times the average net profit earned over the past 4 years. Goodwill7is not to be retained in the books. REQUIRED For Examiner's Use The following figures were available: (a) Year Calculate the30 value of the goodwill. ended April Net sales income 2009 2010 2011 2012 $ 200 000 400 000 PAGE 500341 000 860 7 000 Net profit percentage % 6 8 8 10 REQUIRED ! [3] ! (a) Calculate the value of the goodwill. ! ! PAGEand 342Aiden after the admission of Aiden (b) Prepare the capital accounts of Mhairi ! as a partner. 8 ! ! PAGE 343 position of the new partnership at 1 May 2012. © UCLES 2012 Prepare the statement of financial 9706/22/M/J/12 ! (c) ! 9 ! (d) Outline four advantages to Mhairi of forming a partnership with Aiden. [3] 1 ! OMAIR MASOOD ! (b) CEDAR COLLEGE Prepare the capital accounts of Mhairi and Aiden after the admission of Aiden as a partner. ! For Examiner's Use ! For Examiner's Use For Examiner's Use 177 PARTNERSHIP CHANGES ( WORKSHEET 3) Q5. Chan, Tan and Eric were in partnership sharing profits and losses in the ratio Chan 2/3, Tan ¼ and Eric 1/12. Their summarized Balance Sheet as at 31st October 2005 was as follows: $ Non-Current Assets: (at Book Value): Premises Machinery Motor Vehicles Current Assets: Inventory Trade Receivables Less: Provision for doubtful debts Bank $ 120,000 60,000 9,000 $ 189,000 14,200 18,000 360 Current Liabilities: Trade Payables 17,640 16,160 48,000 (12,000) Long-term Liabilities: Loan from Chan 36,000 225,000 (9,000) 216,000 Capital Accounts: Chan Tan Eric 100,000 70,000 46,000 216,000 The partnership did not maintain partners’ current accounts. Chan left the partnership on 31 October 2005 to start his own business. Tan and Eric continued the partnership, sharing profits in the ratio Tan ¾ and Eric ¼. The following adjustments were made. (i) Premises were revalued at $150,000. (ii) Machinery was revalued at $50,000. (iii)Inventory was reduced in value by $1,200. (iv) Increase the Provision for doubtful debts by $800. The value of Goodwill was agreed at $48,000 and the Goodwill account will not remain in the partnership books. Chen agreed to take a machine valued at $20,000 and cash $50,000. The remaining balance of his capital account is to be transferred to his loan account. Other partners introduced $25,000 each, as their additional capital. REQUIRED: (a) Draw up the revaluation account to show the above adjustments. (b) Draw up the three partner’s Capital Accounts, in columnar form, after the adjustments have taken place. (c) Prepare the Statement of Financial position as at 1st November 2005 after the retirement of Chan. OMAIR MASOOD CEDAR COLLEGE 178 Q6. Box, Cox and Gilbert were in partnership sharing profit or loss in the ratio 3:2:1 respectively. On 31st October 2005 the partnership Statement of Financial position (Balance Sheet) was as follows: $ $ NON-CURRENT ASSETS: Land and Building at cost Plant and Machinery at note book value Motor Vehicles at Net Book Value CURRENT ASSESTS: Inventory Trade Receivables Bank and Cash ! ! ! ! ! ! ! ! 250,000 35,000 40,000 325,000 70,000 84,000 43,500 197,500 TRADE PAYABLES: Amount due within one year Trade Payables (51,300) 146,200 ! 471,200 ! TRADE PAYABLES: Amount due after one year ! Loan from Gilbert (10,000) ! 461,200 ! CAPITAL ACCOUNTS ! Box 204,500 ! Cox 119,600 ! Gilbert 137,100 ! 461,200 st Gilbert had decided to retire from the partnership in 1 ! November 2005 and it had been agreed that assets would be revalued. Box and Cox will share profits equally after Gilbert’s retirement. After revaluation, the revalued balances were as follows: $ Land and Buildings Plant and Machinery Motor Vehicles Inventory Trade Receivables 290,000 32,000 36,000 67,900 81,000 A Bad Debts Provision of 3% of the new Trade Receivables’ figure was set up. Goodwill was valued at $36,000, but no Goodwill account is kept .$20,000 was paid to Gilbert out of his capital account. The balance of his Capital account transferred to his Loan Account. REQUIRED: (a) Draw up the Revaluation account to show the above adjustments. (b) Draw up the three partners’ Capital Accounts, in columnar form. (c) Prepare the Statement of Financial position as at 1st November 2005 after retirement of Gilbert. OMAIR MASOOD CEDAR COLLEGE 179 PARTNERSHIP CHANGES (WORKSHEET 4) ! Q7.! 2 2 6 6 Colin, Darim and Emran are in partnership sharing profits and losses in the ratio 3 : 2 : 1. Their statement of financial position at 30 November 2015 was as follows: Colin, Darim and Emran are in partnership sharing profits and losses in the ratio 3 : 2 : 1. Their statement of financial position at 30 November 2015 was as follows: $ Non-current assets (at net book value) Premisesassets (at net book value) Non-current Machinery Premises Motor vehicles Machinery $ 135 000 84 000 000 135 36 84 000 255 36 000 Motor vehicles 255 000 Current assets Current assets Inventory Inventory Trade receivables Trade Bank receivables 56 000 56 000 000 48 48 000 000 21 21 000 000 125 125 000 380 000 Bank Total assets Total assets 380 000 Capital and and liabilities liabilities Capital Capital accounts accounts Capital Colin Colin Darim Darim REQUIRED Emran Emran 7 120 120 000 000 80 80 000 000 40 000 240 000 (a) Prepare the revaluation account on Darim’s retirement on 1 December 2015. Current Current accounts accounts 56 000 000 Colin 56 Colin Revaluation account 16 000 000 Darim 16 Darim 36 000 000 Emran 36 Emran 108 000 000 108 Current liabilities Current liabilities Trade payables 32 000 payables 32 000 TotalTrade capital and liabilities 380 000 Total capital and liabilities 380 000 Additional information Additional information 1 Darim retired on 1 December 2015. Colin and Emran continued in partnership sharing profits Darim retired on 1ratio December 2015. Colin and Emran continued in partnership sharing profits and losses in the 2 : 1. 2 Goodwill was valued at $48 000. It does not appear in the partnership’s financial statements. 1 2 3 3 and losses in the ratio 2 : 1. Goodwill was valued at $48 000. It does not appear in the partnership’s financial statements. Darim took over one of the partnership motor vehicles at a net book value of $8000. Darim took over one of the partnership motor vehicles at a net book value of $8000. 4 The partners agreed to revalue some of the remaining assets as follows: 4 The partners agreed to revalue some of the remaining assets as follows: Premises Motor vehicles Premises Inventory Motor receivables vehicles Trade Inventory 5 ! $ 180 000 25$000 180 000 52 000 25 000 000 46 52 000 Trade agreed receivables 000as part of the amount owing to him on his retirement. The[5] Darim to receive $5046 000 balance owing to him was to remain in the partnership as a loan to be repaid in 2018. 5 Darim agreed to receive $50 000 as part of the amount owing to him on his retirement. The information ! Additional balance owing to him was to remain in the partnership as a loan to be repaid in 2018. To help fund the payment to Darim on his retirement, Emran paid additional capital into the partnership bank account. After this payment had been made the balance on Emran’s capital account was $65 000. Required:! REQUIRED © UCLES 2016 9706/22/M/J/16 (b) (a) Prepare a statement to show how much cash Emran paid into the partnership bank account. Revaluation!Account! © UCLES 2016 9706/22/M/J/16 (b) Capital!Accounts! (c) Statement!of!financial!position! OMAIR MASOOD CEDAR COLLEGE 180 Q8.! 2 10 Alice, Eve and Jean are in partnership sharing profits and losses in the ratio 5 : 3 : 2 respectively. The partnership statement of financial position at 30 June 2016 was as follows: $ 162 000 Non-current assets at net book value Current assets Inventory Trade receivables 17 208 11 376 28 584 190 584 Total assets Capital accounts Alice Eve Jean 76 500 63 000 27 000 166 500 Current accounts Alice Eve Jean 14 112 Debit 8 226 Credit 18 982 Credit 13 096 Current liabilities Trade payables Bank overdraft 8 532 2 456 10 988 190 584 Total capital and liabilities Additional information On 1 July 2016 1 Alice retired from the partnership. 2 Monies due to Alice on her retirement were paid to her from the partnership bank account. 3 Non-current assets were revalued at 20% lower than the net book value. 4 Inventory had a net realisable value of $12 908. 5 An amount of $1990 was written off as an irrecoverable debt. 6 Goodwill was valued at $20 250 and was not to remain in the books of account. 7 Eve and Jean continued in partnership sharing profits and losses in the ratio 3 : 2 respectively. REQUIRED ! (a) (i) State what is meant by net realisable value. (a) Revaluation!Account! (b) Capital!Accounts! (c) Statement!of!Financial!Position! ! [1] 12 (c) Assess the impact of Alice’s retirement on the partnership’s statement of financial position. ! © UCLES 2016 ! 9706/23/O/N/16 ! ! OMAIR MASOOD CEDAR COLLEGE [4] [Total: 15] 181 2 Q9.! 1 3 Alan and Jack have been in partnership for several years, sharing profits and losses equally. They their financial annually to 30 September. (b) (i) prepare State what is meantstatements by goodwill. On 30 September 2014 the balances on their capital accounts were Alan $139 800 and Jack $128 000. On 1 October 2014 the following took place: 1 Max joined the partnership. He paid $27 000 into the partnership bank account and introduced [1] inventory valued at $5000. 2 AlanState transferred 000which from his capital a loan account. Interest on the loan is (ii) three $15 factors affect the account value of into goodwill. to be paid at 10% per annum. The loan is repayable by 30 September 2020. 1 The partners agreed a value for goodwill of $40 000. No goodwill is to be recorded in the books. 4 3 4 Alan, Jack and Max are to share profits and losses in the ratio 2 : 2 : 1 respectively. 2 REQUIRED REQUIRED (c) Prepare the partners’ current accounts for the year ended 30 September 2015. ! (a) Prepare the capital accounts of the partners at 1 October 2014 taking the above into account. 3 Alan, Jack and Max Alan, Jack and Max Current accounts Capital accounts at 1 October 2014 ! [3] Additional information The terms of the new partnership agreement included the following: Interest on capital 7.5% per annum on capital account balances at the end of each financial year Interest on drawings 3% on total drawings for the year Salary to Max $10 000 per annum The following information is also available for the year ended 30 September 2015: Current account balances at 1 October 2014 Drawings for the year ended 30 September 2015 Alan $ 9 500 Credit 16 000 Jack $ 7 500 Credit 24 000 Max $ Nil 8 000 The residual profit to be shared by the partners in the profit 4 sharing ratio is $90 000. 4 ! [6] REQUIRED REQUIRED ! (c) Prepare the partners’ current accounts for the year ended 30 September 2015. (c) Prepare the partners’ current accounts for the year ended 30 September 2015. [7] ! and Max Alan,Alan, Jack Jack and Max Current accounts (d) Calculate the profit for the year ended 30 September 2015 transferred from the income Current accounts statement to the appropriation account. © UCLES 2016 ! 9706/21/O/N/16 ! ! © UCLES 2016 9706/21/O/N/16 [Turn over ! OMAIR MASOOD CEDAR COLLEGE 182 ! Q10.! 10 11 Ben, Stan and Dan have been in partnership for many years sharing profits and losses equally. Their summarised statement of financial position at 31 March 2015 is as follows: 3 REQUIRED $ $ Assetstwo reasons why a partner’s current account may have a debit balance. (a) State Non-current assets 300 000 Current assets 140 000 440 000 Capital accounts Ben Dan Stan 140 000 140 000 140 000 420 000 [2] (b) Current accounts Ben Dan Stanwhy a Explain partner’s capital assets when they retire. 12 000 14 000 (6 000) account 000 goodwill and any revaluation of is credited20with 440 000 On 1 April 2015 Stan retired from the partnership. Ben and Dan will share profits and losses equally. The terms of Stan’s retirement were as follows: 1 Goodwill was valued at $36 000. No goodwill account is to appear in the books of account. 2 Stan will take a motor vehicle in part settlement of the amount due to him. This was valued in the books at $10 000. However, the partners agreed that it was only worth $7000. 3 The remaining non-current assets were revalued at $320 000. All of these adjustments were recorded in the books of account on 1 April 2015. ! [3] REQUIRED:( (c) Prepare the revaluation account for the partnership. ! Prepare!the!Capital!Accounts! ! ! ! ! ! ! © UCLES 2014 9706/02/SP/16 ! [3] ! OMAIR MASOOD CEDAR COLLEGE 183 Q11.! 2 6 Alex and Barry have been in partnership for many years. The terms of the partnership agreement are as follows. 1 2 3 4 5 Interest is payable to the partners on their loan 7 accounts at 10% per annum. Interest on capital is allowed at the rate of 5% per annum. Barry is entitled to a salary of $6000 per annum. Interest on drawings is charged at the rate of 4% on the annual drawings. Profits and losses are shared in the ratio of 3:1. The following balances were taken from their books of account at 31 May 2014. Alex $ 90 000 14 000 Cr 15 000 Capital account Current account Loan account Barry $ 60 000 12 500 Dr 16 000 During the year ended 31 May 2015, drawings for Alex totalled $5000 and for Barry $12 000. 8 After the deduction of loan interest, the draft profit for the year ended 31 May 2015 was $90 000. Additional information REQUIRED The partners agreed that it would be beneficial to admit another partner and on 1 June 2015 (a) Prepare partnership appropriation account for the year ended 31 May 2015. Cesar joined the partnership. ! REQUIRED (b) Prepare the current accounts of Alex and Barry for the year ended 31 May 2015. [7] ! (c) State two possible advantages to Alex and 8Barry of the admission of a new partner. Current accounts Additional information Details Alex Barry Details Alex Barry The partners agreed that it would be beneficial to admit another partner and on 1 June 2015 $ $ $ $ Cesar joined the partnership. REQUIRED .. ... ..... ..... .. .. .. .. .. ... ..... ..... .. (c) State two possible advantages to Alex and Barry of the admission of a new partner. .. ... ..... .. .. .. ..... .. .. .. .. .. ... ..... ..... .. .. [2] .. ! .. ... ..... ..... Additional.. information .. .. .. .. .. ... ..... ..... .. .. .. .. .. .. .. the ... partnership ..... ..... on 1 June .. 2015 .. .. into ... the..... ..... .. account .. and..paid.. $100 000 partnership bank Cesar joined as his capital. .. ... ..... ..... .. .. .. .. .. ... ..... ..... .. .. .. .. .. ... ..... ..... .. .. .. .. .. ... ..... ..... .. .. .. .. It was agreed that the goodwill was to be valued at $60 000 and that no goodwill account would remain in the books of account. The new profit sharing ratio for Alex, Barry and Cesar from 1 June 2015 was to be 3:2:1. .. ... ..... ..... REQUIRED information Additional .. ... ..... ..... .. .. .. .. .. ... ..... ..... .. .. .. .. .. .. .. ... ..... ..... .. .. [2] .. .. .. .. (d) Prepare accounts Alex, Barry Cesar show of bank Cesaraccount on joined the the capital partnership on 1 of June 2015 andand paid $100to000 intothe theadmission partnership Cesar 1 June .. 2015. ... ..... ..... .. .. .. .. .. ... ..... ..... .. .. .. ! .. as his capital. accounts be valued at $60 000 and that no goodwill account would ! It was agreed that the goodwill was toCapital remain in the books of account. Details Alex Barry Cesar Details Alex Barry [8] Cesar ! The new profit sharing $ $ Alex, Barry $9706/21/O/N/15 ratio for and Cesar from 1 June$ 2015 was $to be 3:2:1.$ © UCLES 2015 ! REQUIRED .. .. . .. .. .. .. .. .. .. .. . .. .. .. .. .. .. and of ..Cesar ! (d) ..Prepare .. . the capital .. .. accounts .. .. of Alex, .. Barry .. .. Cesar .. . to show .. ..the admission .. .. .. on 1 June 2015. .. .. . .. .. OMAIR MASOOD .. .. . Details © UCLES 2015 .. .. .. .. .. .. . .. Capital accounts CEDAR COLLEGE .. .. Alex .. .. Barry .. .. Cesar .. .. . Details 9706/21/O/N/15 .. .. .. .. .. .. .. Alex .. .. Barry .. .. Cesar [Turn over .. .. . .. $ .. ..$ .. ..$ .. .. .. . .. $ .. .. $.. .. .. $ .. .. . .. .. .. .. .. . .. .. .. .. .. .. .. .. .. 184 PAGE 488 Q12.! 5 Alec and Jean were in partnership with capitals of $90 000 and $60 000 respectively. 2 For Examiner's Use PAGE On 1 June 2012 Alec had a debit balance on his 489 current account of $2900 and Jean had a credit balance on her current account of $3100. 6 On May 2013 had credit balance current of $3000 and Jean had a (b) 31Calculate theAlec profit fora the year endedon 31his May 2013 account before appropriation. credit balance on her current account of $340. For Examiner's Use The partnership agreement stated: 1 Interest on capital is payable at 5% per annum. 2 Interest on drawings is charged at 8% per annum. 3 Annual partnership salaries were Alec $14 000 and Jean $12 000. 4 Profits and losses are to be shared in the ratio of capital invested. Alec withdrew $20 000 and Jean $22 000 during the year. REQUIRED PAGE 489 (a) Prepare the current account of each partner for the year ended 31 May 2013. ! 6 (b) Calculate the profit for the year ended 31 May 2013 before appropriation. [6] ! (c) Explain the term goodwill. For Examiner's Use PAGE 490 PAGE 490 PAGE 490 ! 7 On 1 June 2013 Alec and Jean agreed 7to 7 admit Chris as a new partner. !!It was agreed that Chris would pay cash into the business for goodwill. On 1 June 2013 Alec and Jean agreed to admit Chris as a new partner. It was agreed that For On 1 June 2013 Alec and Jean agreed to admit Chris as a new partner. It was agreed that Chris!will!pay!$36000!cash!into!the!business!as!his!capital.! For Examiner's Chris would pay cash into the business for goodwill. Examiner's Chris would pay cash into the business for goodwill. Goodwill was valued at $36 000. Use Use In addition Chris also introduced a motor vehicle valued at $12 150 and inventory of $5850. Goodwill was valued at $36 000. Goodwill was valued at $36 partners that000. profits andvehicle lossesvalued are toatbe shared between Alec, Jean and Chris InThe addition Chris agreed also introduced a motor $12 150 and inventory of $5850. Ininaddition Chris also introduced a motor vehicle valued at $12 150 and inventory of $5850. ratio agreed of 3:2:1. Noprofits goodwill to beshared maintained on Alec, the books. The the partners that and account losses areisto be between Jean and Chris The partners agreed that profits and losses are to be shared between Alec, Jean and Chris in the ratio of 3:2:1. No goodwill account is to be maintained on the books. in the ratio of 3:2:1. No goodwill account is to be maintained on the books. ! REQUIRED [4] REQUIRED REQUIRED (d) Prepare the capital accounts of Alec, Jean and Chris after Chris’s admission to the (d) Prepare the capital accounts of Alec, Jean and Chris after Chris’s admission to the partnership. (d) Prepare the capital accounts of Alec, Jean and Chris after Chris’s admission to the partnership. partnership. [6] ! ! ! (c) Explain the term goodwill. ! ! [10] ! © UCLES 2013 OMAIR MASOOD 9706/22/O/N/13 [Turn over 185 CEDAR COLLEGE [4] For Examiner's Use PAGE 213 Q13.! 1 2 Henry and Robin are in partnership with capitals of $120 000 and $80 000 respectively. On 1 June 2010 Henry had a debit balance on his current account of $6 600 and Robin had a credit balance on his current account of $1 000. For Examiner’s Use On 31 May 2011 Henry had a credit balance on his current account of $10 400. The partnership agreement stated: 1 Interest on capital is payable at 8% per annum. 2 The maximum drawings permitted in any one year is 10% of capital invested. 3 Interest on drawings is charged at 5% on total drawings for the year. 4 Annual partnership salaries were Henry: $5 000 and Robin: $4 000. 5 Profits and losses are to be shared in the ratio of capital invested. Both partners withdrew the maximum amount permitted during the year. REQUIRED (a) Prepare the current account of each partner for the year ended 31 May 2011. PAGE 214 ! 3 .......................................................................................................................................... (b) Calculate the profit for the year (net profit) made by the partnership for the year ended .......................................................................................................................................... For 31 May 2011. Examiner’s ! ! ! .......................................................................................................................................... .......................................................................................................................................... Use .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... ......................................................................................................................................[8] .......................................................................................................................................... (c) Before forming a partnership both Henry and Robin were sole traders. .......................................................................................................................................... State four advantages of a partnership compared to a sole trader. .......................................................................................................................................... .......................................................................................................................................... ....................................................................................................................................[14] .......................................................................................................................................... © UCLES 2011 9706/21/M/J/11 OMAIR MASOOD CEDAR COLLEGE .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... 186 ! Q14.! ! 3 12 Rahman, Silva and Thierry have been in partnership for a number of years sharing profits and losses in the ratio 3 : 2 : 1 respectively. The following draft statement of financial position was drawn up at 30 June 2017: $ Non-current assets at net book value Freehold property Plant and machinery Motor vehicles Current assets Inventory Trade receivables Cash and cash equivalents Total assets 120 000 56 000 38 000 42 000 19 400 2 300 $ 214 000 63 700 277 700 Capital and liabilities Capital accounts Rahman 90 000 Silva 60 000 Thierry 30 000 180 000 Current accounts Rahman 42 300 Silva 18 600 Thierry (4 400) 56 500 Non-current liabilities Loan account - Thierry 30 000 Current liabilities 13 Trade payables 11 200 Total capital and liabilities 277 700 ! REQUIRED Thierry decided to retire from the partnership on 30 June 2017 and the following information was (a) Prepare the revaluation account at 30 June 2017. available: ! 1 Rahman and Silva were to continue in partnership sharing profits and losses in the ratio 3 : 2 respectively. 2 Goodwill was to be valued at $48 000. No goodwill account was to be maintained in the books of account. 3 Thierry was to take over one of the motor vehicles at an agreed value of $12 000. The remaining motor vehicles were to be valued at $22 000. 4 The value of inventory was to be written down by $3000. 5 An irrecoverable debt of $200 was to be written off. 6 Thierry agreed not to ask for repayment of his loan to the partnership when he retired. 13 ! REQUIRED (a) Prepare the revaluation account at 30 June 2017. [4] ! (b) Prepare the journal entry to account for goodwill at 30 June 2017. A narrative is not required. 14 9706/23/O/N/17 (c) Prepare a statement to show the total amount due to Thierry on his retirement from the partnership. ! © UCLES 2017 ! OMAIR MASOOD CEDAR COLLEGE ! 187 9 Q15.! ! 3 Amit, Wang and Susi have been trading in partnership for several years and prepare their financial statements annually to 31 March. They have never had a partnership agreement. REQUIRED ! ! ! (a) State four provisions which would apply in the absence of a partnership agreement. 10 1 Additional information ! The statement of financial position for the partnership at 31 March 2016 was as follows: 2 Amit, Wang and Susi Statement of Financial Position at 31 March 2016 $ 3 Assets Non-current assets Freehold premises Fixtures and fittings 4 Current assets Trade receivables Bank account ! ! ! ! ! ! ! ! ! ! ! ! ! Total assets Capital and liabilities Capital accounts Amit Wang Susi 109 000 64 900 173 900 14 500 5 600 20 100 194 000 [4] 40 000 40 000 40 000 120 000 Current accounts Amit 27 600 Wang 18 500 Question 3(b) is on the next page. Susi 22 200 68 300 Current liabilities Trade payables 5 100 Other payables 600 5 700 Total capital and liabilities 194 000 On 1 April 2016 Amit retired from the partnership and the following was agreed: 1 Goodwill was valued at $42 000. A goodwill account is not to be maintained in the books of account. 2 Assets were revalued at the following amounts: Freehold premises Fixtures and fittings Trade receivables $ 120 000 62 200 13 700 9706/22/M/J/17 [Turn over! received $15 000 from the partnership bank account. The remaining balance owed to him was left as an interest-free loan to the partnership to be repaid by 31 March 2021. © UCLES 3 2017 Amit 4 Wang and Susi agreed to continue in partnership and to share profits and losses equally. OMAIR MASOOD © UCLES 2017 CEDAR COLLEGE 9706/22/M/J/17! ! 188 11 ! REQUIRED (b) Prepare the partners’ capital accounts to record the retirement of Amit from the partnership. ! Amit, Wang and Susi Capital accounts ! [6] Additional information Amit has recently advised the partners that he is having financial difficulties. He has asked Wang and Susi for the payment of the balance on his loan account as soon as possible. REQUIRED (c) Advise Wang and Susi whether or not they should agree to Amit’s request. Justify your answer. ! ! Q16.& & 1 ! 2 Tom and Jerry are in partnership. They do not have a formal partnership agreement. The following information is available for the partnership for the year ended 30 November 2015: $ Capital account balances at 30 November 2015 Tom 90 000 [6] Jerry 54 000 Current account balances at 1 December 2014 Additional information Tom 18 000 Credit Amit has recently advised the partners that he is having financial Debitdifficulties. He has asked[5]Wang Jerry 10 800 and Susi for the payment of the balance on his loan account as soon as possible. Drawings for the year [Total: 15] Tom 8 000 REQUIRED Jerry 2 800 © UCLES [TurnJustify over! your (c) 2017 Advise Wang and Susi whether 9706/22/M/J/17 or not they 12 should Profit from operations 600 agree to Amit’s request. answer. Loan from partner account Tom 24 000 Tom made the loan to the partnership on 1 December 2014. Profits had accrued evenly and drawings had been taken evenly throughout the year. Additional information Tom and Jerry prepared a formal partnership agreement to take effect from 1 September 2015. The terms of the agreement were: 1 Interest on capital was to be at a rate of 8% per annum. 2 Interest on drawings was to be at a rate of 3% per annum based on the annual drawings. 3 Tom was to be paid a salary of $16 216 per annum. 4 Profits and losses were to be shared in the ratio 3 : 2 respectively. 5 Loan interest was to be paid at a rate of 4% per annum. [5] [Total: 15] REQUIRED 9706/22/M/J/17 [Turn over! (a) Calculate the profit before appropriation for the nine months ended 31 August 2015 and the three months ended 30 November 2015. © UCLES 2017 & & OMAIR MASOOD CEDAR COLLEGE & 189 (c) Prepare the current accounts for Tom and Jerry for the year ended 30 November 2015. & & 3 (b) Prepare the appropriation account for the nine months ended 31 August 2015 and the three months ended 30 November 2015. Appropriation Account 9 months $ Additional information [8] 3 months $ & & The partnership is considering expansion and will need to purchase additional non-current assets 5 4 & at a cost of $60 000. (f)REQUIRED Discuss possible sources of finance which be ended used to the purchase (c)(i)Prepare thetwo current accounts for Tom and Jerry for could the year 30fund November 2015. of the additional non-current assets. & (d) State the difference between capital and revenue expenditure. 1 & [8] Additional information The partnership is considering expansion and will need to purchase additional non-current assets at a cost of $60 000. REQUIRED (d) State the difference between capital and revenue expenditure. & & 2 (e) Identify and explain one accounting concept relating to depreciation. & & & 5 (f) & [2] (i) Discuss two possible sources of finance which could be used to fund the purchase[2] of the additional non-current assets. 1 (e) Identify and explain one accounting concept relating to depreciation. [6] [8] Additional information (ii) Recommend the most appropriate source of finance for the partnership. Justify your [6] answer. The partnership is considering expansion and will need to purchase additional non-current assets at a cost of $60 000. & & [3] REQUIRED (d) State the difference between capital and revenue expenditure. © UCLES 2016 2 9706/22/O/N/16 [3] [2] [Total: 30] © UCLES 2016 9706/22/O/N/16 [2] [6] (e) Identify and explain one accounting concept relating to depreciation. (ii) Recommend the most appropriate source of finance for the partnership. Justify your answer. © UCLES 2016 9706/22/O/N/16 [Turn over [3] [2] [Total: 30] OMAIR MASOOD © UCLES 2016 © UCLES 2016 190 CEDAR COLLEGE 9706/22/O/N/16 9706/22/O/N/16 [Turn over CHANGES IN PARTNERSHIP (PAST PAPERS) 12 Q1. 3 Aisha, Bilal and Cao have been in partnership for many years sharing profits and losses in the ratio 2 : 2 : 1. Bilal decided to retire from the partnership at 31 January 2018. Their statement of financial position at 31 January 2018 before any adjustments was as follows: Aisha, Bilal and Cao Statement of financial position at 31 January 2018 $ Assets Non-current assets Premises REQUIRED Motor vehicles Fixtures and fittings $ 13 85 000 32 000 7 500 124 500 (a) Prepare a statement to calculate the profit or loss on revaluation at 31 January 2018. Current assets Inventory Trade and other receivables Total assets Capital and liabilities Capital accounts Aisha Bilal Cao Current accounts Aisha Bilal Cao 16 200 4 800 21 000 145 500 48 000 48 000 24 000 120 000 8 400 (1 200) 6 400 13 13600 Current liabilities REQUIRED [3] Trade and other payables 5 600 overdraft 300 profit 11or 900 (a)Bank Prepare a statement to calculate6 the loss on revaluation at 31 January 2018. 500from the partnership. 145 Total capital and liabilities (b) Prepare Bilal’s capital account on his retirement The following information is available. 1 The partners agreed that the value of goodwill at that date was $85 000. 2 It was also agreed that certain assets should be revalued to the following amounts. Premises Inventory $ 114 000 15 000 3 As part of the final settlement, Bilal was entitled to retain one of the motor vehicles at its net book value of $11 400. 4 It was agreed that of the final settlement due to13 Bilal, $20 000 would be paid immediately by cheque and the balance would remain in the business as a loan. REQUIRED © UCLES 2018 [3] 9706/21/O/N/18 (a) Prepare a statement to calculate the profit or loss on revaluation at 31 January 2018. [6] (b) Prepare Bilal’s capital account on his retirement from the partnership. (c) Identify three ways, other than using bank 14 finance, in which a partnership could raise funds to purchase a non-current asset. (d) State three items that may be included in the appropriation account before the division of 1 residual profit. (3+6+3+3) 12 (Nov18/P21/Q3) 23 OMAIR MASOOD 3 [3] CEDAR COLLEGE [3] [Total: 15] © UCLES 2018 9706/21/O/N/18 [Turn over [3] 191 8 2 Jack and Kelly are in partnership. They share profits and losses in the ratio of 2 : 5 respectively. The partners decided to admit Liam as a partner with effect from 1 July 2018. 8 2 The partnership’s statement of financial position immediately prior to Liam’s admission was as Q2. follows. Jack and Kelly are in partnership. They share profits and losses in the ratio of 2 : 5 respectively. The partners decided to admit Liam as a partner with effect from 1 July 2018. Jack and Kelly Summarised statement of financial The partnership’s statement of financial position immediately priorposition to Liam’s admission was as follows. at 30 June 2018 $ Jack and Kelly Assets Summarised statement of financial position Non-current assets 91 400 at 30 June 2018 Current assets 21 700 $ 100 Total assets 113 Assets Capital and liabilities Non-current assets 91 400 Capital accounts Current assets 21 700 Total assets 113 10033 000 Jack Capital and liabilities Kelly 71 000 Capital accounts Current liabilities 9 100 33 000 Jack capital and liabilities Total 113 100 Kelly 71 000 10 Current liabilities The partners do not maintain separate current accounts. 9 100 Total capital and liabilities 113 100 (b) State what is meant by the term ‘goodwill’. The following was agreed. The partners do not maintain separate current accounts. 1 following Assets were revalued upwards by $21 000. The was agreed. 2 1 Goodwill valued at $52 500. Assets werewas revalued upwards by $21 000.No goodwill account was to be maintained in the 2 Goodwill was valued at $52 500. No goodwill account was to be maintained in the partnership’s books of account. In the future profits and losses would be shared in the ratio Jack : Kelly : Liam, 2 : 5 : 3 3 partnership’s books of account. [1] respectively. (c) why profits a partnership maywould makebean adjustment for goodwill when they 2admit : Liam, : 5 : 3a new 3 Explain In the future and losses shared in the ratio Jack : Kelly partner. respectively. 4 The balances of the partners’ capital10 accounts immediately after Liam’s admission should total $120 000 and be in the same ratio as the profit sharing 4 The balances of the partners’ capital accounts immediately afterratio. Liam’s admission should (b) State what is meant by the term ‘goodwill’. total $120 000 and be in the same ratio as the profit sharing ratio. Each partner would either pay funds into, or withdraw funds from, the business bank account in order to achieve this requirement. Each partner would either pay funds into, or withdraw funds from, the business bank account in order to achieve this requirement. REQUIRED REQUIRED 10 [1] next (a) Prepare the partners’ capital accounts to record Liam’s admission as a partner on the (a) Prepare the partners’ capital accounts to record Liam’s admission as a partner on the next page.what is meant by the term ‘goodwill’. (b) page. State [2] (c) Explain why a partnership may make an adjustment for goodwill when they admit a new partner. 11 (d) Explain why partners may agree not to maintain a goodwill account in the books of the Additional information partnership on the admission of a new 11partner. The partners forecast that profit for the year ending 30 June 2019 will be $60 000. This is an [1] Additional information increase of 25% on the current year’s profit. The partners believe that Liam’s admission will result in an improved return on capital employed. The partners forecast that profit for the year ending 30 June 2019 will be $60 000. This is an increase of 25% on a thepartnership current year’smay profit. The partners believe that admission result (c) Explain why make an adjustment forLiam’s goodwill when will they admit a new REQUIRED in anpartner. improved return on capital employed. (e) Advise the partners whether or not they are correct in believing that Liam’s admission will REQUIRED result in an improved return on capital employed in the year ending 30 June 2019. (e) Advise whether or not they are correct in believing that Liam’s admission will Supportthe yourpartners answer with calculations. © UCLES 2018 result in an improved return on capital 9706/22/O/N/18 employed in the year ending 30 June 2019. © UCLES 2018 9706/22/O/N/18 (6+1+2+2+4) (d) Explain why partners may agree not to maintain a goodwill account in the books of the Support your answer with calculations. (Nov18/P22/Q2) partnership on the admission of a new partner. OMAIR MASOOD [2] [2] CEDAR COLLEGE [2] 192 2 Q3. 1 Ashir, Bo and Chan are in partnership. The 4 partnership agreement includes the following terms: 1 Prepare Profits and are shared in the ratio of the partners’ accounts. (b) the losses profit and loss appropriation account for the capital partnership for the year ended 31 December 2016. 2 Interest on capital is 6% per annum. 3 Interest on drawings is 5% calculated on each partner’s total annual drawings. 4 Partners’ loan interest is 12% per annum. 5 Chan receives a salary of $1000 per month. The following information is available at 31 December 2016: $ Capital accounts Ashir Bo Chan Current accounts Ashir Bo Chan Drawings Ashir Bo Chan Fixtures and fittings Cost Provision for depreciation Motor vehicles Cost Provision for depreciation Loan account Ashir Gross profit Operating expenses Staff wages 40 000 30 000 10 000 12 300 8 200 2 600 debit 15 400 12 200 16 400 32 400 21 400 80 000 48 000 10 000 171 620 54 960 32 500 Additional information 1 Operating expenses include a payment of $600 for insurance covering the 12-month period to 31 August 2017. 2 Staff wages owing at 31 December 2016 were $860. 3 Depreciation is to be charged as follows: Fixtures and fittings Motor vehicles 10% per 3 annum using the reducing balance method 20% per annum using the straight-line method REQUIRED 4 (a) Prepare the income statement for the6 partnership for the year ended 31 December 2016. [5] Start with the given gross profit of $171 620. (b) Prepare the profit and loss appropriation account for the partnership for the year ended Additional information 31 December 2016. 6 wished to retire with immediate effect. The partners On 1 January 2017, Chan decided that he (c) Prepare the partners’ current accounts for the year ended 31 December 2016 on the next agreed that as part of his settlement, he could keep one of the motor vehicles at the net book Additional information page. [7] value of $18 000. © UCLES 2018 9706/21/M/J/18 On 1 January 2017, Chan decided that he wished to retire with immediate effect. The partners At that that dateas it was that the total value keep of goodwill $124 000. agreed part agreed of his settlement, he could one of was the motor vehicles at the net book value of $18 000. REQUIRED At that date it was agreed that the total value of goodwill was $124 000. (d) Prepare a statement to calculate the bank settlement due to, or from, Chan on his retirement. REQUIRED (d) Prepare a statement to calculate the bank settlement due to, or from, Chan on his retirement. (June18/P21/Q1a-d) © UCLES 2018 OMAIR MASOOD (5+5+7+4) 9706/21/M/J/18 CEDAR COLLEGE 193 Cash and cash equivalents Other current assets 1 7 450 61 500 293 950 Capital accounts: Paul Angela Current liabilities 145 000 95 000 11 53 950 2 Q4. 293 950 3 Paul and Angela are in partnership sharing profits and losses in the ratio of 3:2 respectively. No separate current accountsisare maintained. The following information available: May 2017, admitted partnership. 1On 1 Rachael paidRachael $75 000 was as capital intointo the the partnership bank account. [2] 2(a) Goodwill at $50to000. No goodwill was toabe maintained (i) Statewas twovalued advantages existing partnersaccount of introducing new partner. in the books of account. 12partners of introducing a new partner. (ii) State two disadvantages to existing 12 1 3 Non-current assets were revalued at $270 000. summarised statement offinancial financial position at 30 30 April April 2017 2017 before theat admission of Rachael Rachael isis 1 assets A statement of position at the admission 4Asummarised Current (excluding cash and cash equivalents) werebefore revalued $40 500. of asfollows: follows: as 5 Current liabilities were revalued at $45 950. 2 $$ 6Non-current Paul, Angela and Rachael225 will 000 share Non-current assets 000 profits and losses in the ratio 5:3:2 respectively. assets 225 Cash 77450 2 equivalents 450 Cashand andcash cash equivalents REQUIRED Other current assets 61 500 Other current assets 61500 293 [2] 293950 950 (b) Calculate the profit or loss from revaluation on 1 May 2017 when Rachael was admitted. Capital Capitalaccounts: accounts: Show how this is divided between the partners. Paul 145 000 Paul 145000 000 Angela 95 (ii) Angela State two disadvantages existing partners of introducing a new partner. 000 95to Profit or loss from revaluation Current liabilities 53 950 Current liabilities 53 950 293 950 1 293 950 [2] The following information is available: The following information is available: 1 1 2 2 Rachael paid $75 000 as capital into the partnership bank account. 2 paid $75 000 as capital into the partnership bank account. Rachael Goodwill was valued at $50 000. No goodwill 14 account was to be maintained in the books of Goodwill was valued at $50 000. No goodwill account was to be maintained in the books of account. account. 3 Non-current assets were revalued at $270may 000.be made when a new partner joins a business. (d) Explain an adjustment for goodwill Division why between partners [2] 3 Non-current assets were revalued at $270 000. 4 Current assets (excluding cash and cash equivalents) were revalued at $40 500. 54 Currentliabilities assets (excluding cash at and cash Current were revalued $45 950.equivalents) were revalued at $40 500. 65 Current liabilities were revalued at $45 950.and losses in the ratio 5:3:2 respectively. Paul, Angela and Rachael will share profits 6 Paul, Angela and Rachael will share profits and losses in the ratio 5:3:2 respectively. REQUIRED [2] REQUIRED (b) Calculate the profit or loss from revaluation on 1 May 2017 when Rachael was admitted. Show how this is divided between the partners. (b) Calculateonthe lossthe from revaluation onaccounts 1 May 2017 when Rachael wasadmission admitted. (c) Prepare, theprofit next or page, partners’ capital on 1 May 2017 after the 14 [2] Show is divided between the partners. Profit orhow lossthis from revaluation of Rachael. (d) Explain why an adjustment for goodwill may be made when a new partner joins a business. Profit or loss from revaluation (e) State two factors that may result in the creation of goodwill for a business. © UCLES 2018 (Mar18/P22/Q3) 1 © UCLES 2018 9706/22/F/M/18 9706/22/F/M/18 (2+2+2+5+2+2) [Turn over Division between partners 2 [2][2] Division between partners [Total: 15] (e) State two factors that may result in the creation of goodwill for a business. © UCLES 2018 1 OMAIR MASOOD 9706/22/F/M/18 CEDAR COLLEGE [Turn over [2] (c) Prepare, on the next page, the partners’ capital accounts on 1 May 2017 after the admission [2] of2 Rachael. 194 8 Q5. 2 James and Lewis have been in partnership for some years sharing profits and losses equally. They had no partnership agreement. Their statement of financial position at 30 September 2015 showed the following information. $ 230 000 60 000 290 000 Non-current assets Net current assets Capital accounts James Lewis 200 000 70 000 270 000 Current accounts Opening balance Share of profit Drawings REQUIRED Closing balance James $ 31 000 15 000 (21 000) 25 000 Lewis $ 17 000 15 000 (37 000) (5 000) 9 20 000 290 000 (a) Prepare the revaluation account. Additional information On 1 October 2015 Ahmed joined the partnership. A partnership agreement was drawn up. The terms set out in the agreement were: 1 Profits and losses are to be shared equally. 2 Interest is to be charged at 5% on drawings. 10 3 Interest is to be allowed at 10% on capital. (c) State the advantages of interest on capital and interest on drawings. The following also took place: 10 (i) Advantage of interest on capital 1 Ahmed introduced capital of $80 000, which he paid into the business bank account. (c) Stateto the advantages the partners of interest on capital and interest on drawings. 2 Goodwill was valued at $60 000 but no goodwill account is to be maintained in the books of (i) Advantage of interest on capital account. 3 to the partners Non-current assets were revalued at $270 10 000. 9 4 The inventory value was to be reduced by $4000. the partnership (c) State thetoadvantages of interest on capital and interest on drawings. REQUIRED (i) Advantage of interest on capital 10 (a) Prepare the revaluation account. 10 to the partnership to the partners (b) Prepare the capital accounts of the partners to record the admission of Ahmed. (c) State the advantages of interest on capital and interest on drawings. [2] (c) State the advantages of interest on capital and interest on drawings. (i) (ii) Advantage of interest ononcapital Advantage of interest drawings (i) Advantage of interest on capital to the to partners the partners [2] to the partners to the partnership [3] (ii) Advantage of interest on drawings © UCLES 2016 to the partners 9706/22/F/M/16 11 to the partnership to the partnership to the partnership (d) Explain how the terms of the partnership agreement will affect James and Lewis.[2] (3+4+2+2+2+2) James of interest on drawings (ii) (i) Advantage to the partnership to the partners (Mar16/P22/Q2) OMAIR MASOOD [2] CEDAR COLLEGE (ii) (ii)Advantage of interest onon drawings Advantage of interest drawings to the partners to the partners 195 [2][2] [3] [2] [4] 6 Q6. 2 Kim, a sole trader, provided the following statement. Statement of financial position at 30 September 2014 $ Non-current assets Motor vehicles Equipment Fixtures and fittings 100 000 80 000 172 000 352 000 Current assets Inventory Trade receivables 105 000 343 000 448 000 Total assets 800 000 Capital and liabilities Opening capital Add profit for the year 600 000 80 000 680 000 88 000 592 000 Less Drawings Current liabilities Trade payables Bank overdraft 192 000 16 000 208 000 Total capital and liabilities 800 000 Additional information 1 On 1 October 2014 Kim admitted Chan as a partner. 2 Goodwill was valued at $120 000 but will not remain in the books of the partnership. 3 The profit sharing ratio was agreed at Kim 60% and Chan 40%. the partnership. In addition he introduced equipment Chan agreed to pay a cheque of $160 000 to 7 valued at $325 000 and inventory valued at $26 000. REQUIRED 8 (a) Prepare the capital accounts of Kim and Chan at 1 October 2014. 9 (b) Prepare a statement of financial position for the partnership at 1 October 2014. 4 (c) State three advantages to Kim of forming a partnership. (June15/P22/Q2a-c) OMAIR MASOOD © UCLES 2015 CEDAR COLLEGE 9706/22/M/J/15 (10+8+3) 196 Q7. 6 9 2 Bill and Charles are in partnership sharing profits and losses in the ratio of 2:1. (d) Prepare the current account of Bill for the 6 months ended 30 June 2014. Each partner draws $2000 cash from the business each month. On 1 October 2013 Bill paid $24 000 into the business bank account. They provided the following information. 9 Capital accounts 1 January 2013 (d) Prepare the current account of Bill for $ the 6 months ended 30 June 2014. Bill 120 000 Charles 60 000 Current accounts Bill Charles 1 January 2013 $ 17 000 Cr 18 000 Cr 31 December 2013 $ 2 160 Cr 2 800 Dr REQUIRED 7 (a) Calculate the partnership profit for the year ended 31 December 2013 before Additional information appropriation. 7 On 1 January 2014 a new partnership agreement came into force which stated that Bill and Charles will share profits and losses in the ratio of 3:2. Bill will receive $6000 salary per annum, Additional information and Charles $5200 salary per annum. On 1 January 2014 a new partnership agreement came into force which stated that Bill and The ratewill of interest on capital is to be 8% ratio per annum interest on$6000 drawings is to charged at Charles share profits and losses in the of 3:2. and Bill will receive salary perbeannum, 11% per annum. and Charles $5200 salary per annum. Bill willoncontinue $2000 each month. Theand rateCharles of interest capital istotowithdraw be 8% per annum andper interest on drawings is to be charged at [7] 11% per annum. Goodwill was valued at $48 000 but is not to be retained in the books of account. Bill and Charles will continue to withdraw $2000 each per month. (e) (i) State two reasons why the partners are charged interest on drawings. The net profit for the 6 months ended 30 June 2014 was $12 000. Goodwill was valued at $48 000 but is not to be retained in the books of account. 1 REQUIRED The net profit for the 6 months ended 30 June 2014 was $12 000. 8 (b) Prepare the capital accounts of Bill and Charles for the six months ended 30 June 2014. REQUIRED 9 2 the partnership appropriation account for the six months ended 30 June 2014. (c) Prepare [7] (b) accounts BillBill and for the six months ended2014. 30 June 2014. (d) Prepare Preparethe thecapital current accountofof forCharles the 6 months ended 30 June [2] (e) (i) State two reasons why the partners are charged interest on drawings. (ii) State two reasons why the partners receive interest on capital. 1 (Nov14/P22/Q2) 1 (5+7+7+7+2+2) [5] 2 2 [2] [2] (ii) State two reasons why the partners receive interest on capital. OMAIR MASOOD CEDAR COLLEGE 197 [Total: 30] 1 ©©UCLES UCLES2014 2014 9706/22/O/N/14 9706/22/O/N/14 [Turn over 6 Q8 2 Aiden and Beatrice are in partnership. They share profits and losses in the ratio 2:1 and prepare financial statements to 31 March. Their balances at 31 March 2013 were: Aiden Beatrice Capital accounts $ 38 500 27 600 Current accounts $ 4 250 Cr 2 975 Cr On 1 April 2013 Charles was admitted to the partnership on the following terms. 1 He introduced $100 000 capital in cash and it was agreed that he would receive the same level of profits as Beatrice. The profit sharing ratio between Aiden, Beatrice and Charles would be 2:1:1. 2 Goodwill was valued at $120 000 and it was decided that goodwill was not to be retained in the books of account. 3 Each partner was to receive an annual salary of $30 000. 4 Interest on capital was to be paid at 8% per annum. 5 No interest was to be charged on drawings up to $50 000. Interest at 6% per annum was to be charged on any additional drawings. For the year ended 31 March 2014: 1 The partnership made a profit of $325 000 before adjusting for the following items: A debt of $5000 which had been written off as irrecoverable in the previous year was recovered. A cheque for $15 000 received from a debtor in January 2014 was dishonoured and the debt is to be written off. During the year Charles took a family holiday costing $2500. This was paid from the partnership bank account and shown as an expense. 2 Total drawings for the year were Aiden $707500; Beatrice $46 900; Charles $34 750. REQUIRED 8 (a) Prepare the partners’ capital accounts for9the year ended 31 March 2014. (b) Prepare the appropriation account for the year ended 31 March 2014. (c) Prepare the partners’ current accounts for the year ended 31 March 2014. (7+11+12) (Nov14/P21/Q2) OMAIR MASOOD © UCLES 2014 CEDAR COLLEGE 9706/21/O/N/14 198 www.maxpapers.com 6 Q9. For Examiner's Use Amina and Nizam are in partnership sharing profits and losses in the ratio of 3:5. Their accounting year ended on 31 December 2011. 2 The partnership agreement also states that: 1 Amina receives a salary of $24 450 annually; 2 Interest on drawings is charged at 5% on annual drawings; 3 Interest on capital is payable at the rate of 4% per annum. The following balances were extracted from the books on 1 January 2011. Amina Nizam Capital account $140 000 $240 000 Current account $8 400 Dr $3 200 Dr On 1 July 2011, Amina paid an additional $20 000 capital into the business bank account. Drawings for the year were Amina $26 000, Nizam $35 000. Profit for the year before appropriations was $120 000. REQUIRED www.maxpapers.com www.maxpapers.com For www.maxpapers.com Examiner's Prepare the appropriation account for 7 Amina and Nizam for the year ended 31 December 2011. (b) Prepare the current accounts for 8Amina and Nizam for the year ended 31 December 2011. 8 On 1 January 2012, Amina and Nizam agree to admit Sarah as a partner. (a) Use For Examiner's Use For Onthat 1 January 2012, Amina and Nizam to admit Sarahwere as aalso partner. At date goodwill was valued at $40agree 000. The following agreed about the new partnership: At that date goodwill was valued at $40 000. The following were also agreed about the new partnership: 1 Goodwill would not remain in the books; 1 2 2 3 Examiner's Use GoodwillNizam would and not remain the books; Amina, Sarah inwould share profits and losses in the ratio 3:5:2 respectively; Amina, Nizam and Sarah would share profits and losses in the ratio 3:5:2 respectively; Sarah would put $70 000 cash into the business; 3 4 Sarah would $70into 000the cash into the business; Sarah would put bring partnership inventory at a value of $30 000 and a motor vehicle valued at $20 000. 4 Sarah would bring into the partnership inventory at a value of $30 000 and a motor vehicle valued at $20 000. REQUIRED REQUIRED (c) Prepare the capital accounts for Amina, Nizam and Sarah at 1 January 2012. (Nov12/P22/Q2a-c) (c) Prepare the capital accounts for Amina, Nizam and Sarah at 1 January 2012. OMAIR MASOOD © UCLES 2012 CEDAR COLLEGE 9706/22/O/N/12 (6+6+6) [6] 199 5 Q10. 2 Jackie and Kim are in partnership sharing profits and losses in the ratio of 3:2. The following statement of financial position was provided on 30 April 2012. Statement of Financial Position at 30 April 2012 $ $ Non-current assets at net book value Premises Fixtures and fittings $ 120 000 72 000 192 000 Current assets Inventory Trade receivables Bank 30 000 20 000 16 000 66 000 Current liabilities Trade payables Wages accrued 12 000 1 000 13 000 53 000 245 000 Net current assets Net assets Capital accounts Jackie Kim 141 000 94 000 Current accounts Jackie Kim 6 000 4 000 235 000 10 000 245 000 Maura is a long-term employee of the partnership. Her current annual salary is $16 500. She recently inherited a sum of $60 000 and is considering an invitation from Jackie and Kim to invest $50 000 in the business in return for becoming a partner on 1 May 2012. If she agrees, the following terms would apply: 7 1 (b) 2 Maura is to be paid a partnership salary of $11 000 per year. Prepare Maura’s current account for the year ended 30 April 2013. All partners are to receive interest on capital of 3% per year. For Examiner's Use 3 All partners are permitted to withdraw up to $10 000 per year. 4 All partners are to pay interest on annual drawings at 5% per year. 5 Maura is to receive a 10% residual share of profits and losses. The remaining profit or loss is to be divided between the other partners in ratio to their capital. 6 Jackie and Kim will withdraw the full amount available to them while Maura will withdraw $5 500. 6 The profit for the year ended 30 April 2013 is forecast to be $121 000. For Examiner's Use REQUIRED 9706/21/M/J/12 an estimated profit and loss appropriation account for the year ended[Turn over 7 30 April 2013, assuming Maura accepts the invitation to join the partnership. [5] © UCLES (a) 2012 Prepare (b) (c) Prepare Maura’s current account for the year ended 30 April 2013. For Examiner's Use Instead of investing in the partnership Maura could bank her $50 000 at an annual interest rate of 5%. Using appropriate figures calculated in (a) and (b), advise Maura whether or not to accept the offer of a partnership. (11+5+6) (June12/P21/Q2a-c) OMAIR MASOOD CEDAR COLLEGE 200 DISSOLUTION DISSOLUTION OF A PARTNERSHIP: OF PARTNERSHIP Q1.Dougal and Florence, who have been in partnership for many years, decided to retire and dissolve the partnership on 30 September 2003. profits and losses were shared in the ratio of 2:1. The partnership Statement of Financial position at 30 September 2003 was as follows. Non-Current assets(net $ $ $ book values) Building 104 000 Fixtures and fittings 35 000 Motor Vehicles 26 000 165 000 Current Assets Inventory Trade Receivables Bank 10 500 17 230 950 Current liabilities Trade Payables 28 680 9230 Capital accounts Dougal Florence 80 000 40 000 Current accounts Dougal Florence 14 430 (2580) 19 450 184 450 120 000 11 850 Loan from Dougal 52 600 184 450 The partnership ceased trading on 30 September 2003 and the assets were realized $ Buildings 100 000 Fixtures and fittings 37 000 One motor vehicle 15 000 One vehicle was taken by Dougal at 9500 valuation Inventory 5200 All debts were collected and banked except for bad debts totalling $900. Discounts allowed amounted to $200. Trade Payables were paid in full. Dissolution expenses of $1200 were paid by cheque. Dougal’s loan was repaid from the bank account. REQUIRED: (a) Dissolution (Realisation) account. (b) Partners’ capital accounts in columnar form. (c) The partnership bank account. OMAIR MASOOD CEDAR COLLEGE 201 Q2. King, Queen and Jack have been conducting business in partnership for several year sharing profits in the ratio 3:2:1. On 31 May 1993 they decide to dissolve their partnership. Non-Current assets Leasehold premises Delivery vans Fixtures and fittings Office equipment Cost $ 120 000 47 000 11 000 15 500 Depn. To date $ 36 000 17 000 8 500 4000 Current assets Inventory Trade Receivables Bank 32000 17 800 4 300 Current liabilities Trade Payables Net Book Value $ 84 000 30 000 2 500 11 500 128000 54 100 182 100 36900 145 200 Less loan from solo 80 000 $65 200 CAPITALS King Queen Jack 28 000 10 000 12 000 CURRENT ACCOUNTS King Queen Jack 8 700 (3 700) 10 200 50 000 15 200 $65 200 ! ! The following arrangements were made in connection with the dissolution: - Jack to take ownership of one of the two delivery vans – at a valuation of $12 000. The van’s original cost was $22 000 and the written down value was $11 000. - King to take ownership of Inventory – cost price $8 000 at a valuation of $6 700. The remaining assets realized the following amounts when sold on 1 June 1993. $ Leasehold premises 79 000 Delivery van 13 500 Fixtures and fittings 1 500 Office equipment 9 900 Trade Receivables 16 600 Inventory 20 500 All Trade Payables were paid and discounts received amounted to $1 350. The expenses of dissolution amounted to $1 910 REQUIRED: (a) The entries to record the above events in: (i) (ii) (iii) the realisation account; the partners’ capital accounts (use columnar form); the firm’s bank account OMAIR MASOOD CEDAR COLLEGE ! 202 Q3. Apple, Beech and Cherry have been trading for several years and sharing profit on the basis 2:2:1. They decided to dissolve their partnership on 1 October 1994 because of bad trading conditions. The Statement of Financial position of the business at 30 September 1994 showed: Non-Current assets(at written down value) Plant machinery Motor vehicles Current assets Inventory Investments Trade Receivables Bank Less: Current liabilities Trade Payables $ 55 000 27 000 82 000 12 000 33 000 45 000 4 000 94000 29000 Financed by Capital accountApple Beech Cherry 40 000 30 000 40 000 Current accountApple Beech Cherry 5 000 6 500 7 500 Loan Beech 65000 $147000 110 000 19 000 129 000 18 000 $147 000 The loan from Beech was repaid, the Plant & Machinery was sold at auction for a net $41000 and Apple took over a car (written down value $4000) for an agreed value of $5500. The remaining vehicles were sold for $19,200. Inventory realized $10,200 and Trade Receivables realized $38,700. The Trade Payables of $29000 were paid off with cheques totalling $28100 and the investments realized $3,7000. Dissolution expenses incurred were $1,910. REQUIRED: (a) the Bank account; (b) the Realization account; (c) the Partners’ accounts (Combining capital and current items); to cover the dissolution of the Partnership. ! ! ! ! ! ! ! OMAIR MASOOD CEDAR COLLEGE 203 Q4. Lilley, Dilley, and Willey have been carrying on business in partnership for some years sharing profits in the ratio 3:2:1. On 31 December 19-3 they decided to dissolve the partnership.On that date the firm’s Statement of Financial position was as follows: Cost Depreciation NBV $ $ $ Non-Current assets: Plant and equipment 25000 13000 12000 Motor vehicles 18000 15000 3000 Office machinery 3000 2400 600 46000 30400 15600 Current assets: Inventory Trade Receivables Bank Current liabilities: Trade Payables 21000 6400 3800 31200 ( 2700) Less Loan from Lilley Capitals: Lilley Dilley Willey 20000 10000 2000 Current accounts: Lilley Dilley Willey 4000 5000 (1900) 28500 44100 5000 39100 32000 7100 39100 Willey retained his car which was valued at $4000. The remaining assets were sold for $ 10000 Plant and equipment Motor cars 5000 Office machinery 400 Inventory 24000 Trade Receivables 6200 All Trade Payables were paid and discounts received amounted to $74 and dissolution expenses amounted $800 Required: Show the following accounts to record the dissolution of the partnership: (i) Realisation account (ii) The partners’ capital accounts in columnar form (iii) The firm’s bank account ! ! ! ! ! ! ! OMAIR MASOOD CEDAR COLLEGE 204 Q5.The partnership of Allegro, Lento and Largo, sharing profits/losses in the ration 4:3:2 has been in business for many years. Recently, the firm’s market share has been declining, and thus, when Largo decides to retire on 31 May 19-8, the partnership is dissolved. The final Statement of Financial position of the partnership is: Non-Current assets (net) $ $ $ Premises 103500 Motor vehicles 20360 Office equipment 26000 149860 Current assets Inventory 12628 Trade Receivables 14734 Bank 5282 32644 Current liabilities Trade Payables 15510 15510 17134 166994 Long term liability 15% bank loan Capital: 50000 116994 Allegro Lento Largo 50000 20000 40000 110000 Current a/cs: Allegro Lento Largo 10358 (12341) 8977 6994 116994 Allegro feels that he could run a similar business successfully on a smaller scale from his own home, and therefore elects to take some of the partnership’s assets at agreed valuations as follows: Motor vehicle $5200 Office equipment $7850 The premises realize $120000 the remaining vehicles and office equipment $2080 and $3160 respectively, and the Inventory is sold for $2810. Trade Receivables settle for $11455 and dissolution costs amount to $1277. Trade Payables accept $14750 in full settlement. REQUIRED: (i) The realization account, bank account and partner’s capital accounts, showing the closing entries of the business. ! ! ! ! ! ! OMAIR MASOOD CEDAR COLLEGE 205 Q6. Nursultan, Katia and Avtandil are in partnership sharing profits and losses in the ratio of 3:2:1. The following balances were available on 31 March 2012: Capital accounts Nursultan Katia Avtandil $ 10 000 20 000 58 000 Current accounts Nursultan Katia Avtandil 5 350 Dr 6 250 21 100 Property Motor vehicle Inventories Trade receivables Trade payables Bank overdraft 90 000 19 000 20 000 16 800 14 600 21 200 On 31 March 2012 the partners dissolved the partnership as follows: 1 Avtandil agreed to take over the motor vehicle at $17 000 and the inventories at $19 120. 2 The property was sold for $80 000. 3 The credit customers paid their accounts after receiving a 5% discount. 4 The credit suppliers agreed to give the partnership a 10% discount because all debts were settled immediately. 5 The cost of dissolution was $5 620. REQUIRED Explain how a debit balance may arise on a partner’s current account. State three possible reasons why the partners may have decided to dissolve the partnership Prepare the partners’ capital accounts to record the dissolution of the partnership. Show all workings including the bank account. ! ! ! ! ! ! ! ! ! OMAIR MASOOD CEDAR COLLEGE 206 Q7. Anton, Bassini and Cartwright are in partnership with a profit sharing ratio of 2: 1: 1. The partnership balance sheet at 30 June 2011 was as follows: Anton, Bassini and Cartwright Statement of financial position (balance sheet) at 30 June 2011 $ Non-current assets Land and buildings Fixtures and fittings Motor vehicles $ 180 000 28 000 14 500 Current assets Inventories Trade receivables Cash at bank 222 500 25 450 13 900 8 350 47 700 Current liabilities Trade payables 10 200 Non-current liabilities Loan account – Anton Financed by: Capital Accounts Current Accounts 37 500 260 000 35 000 225 000 Anton Bassini Cartwright 100000 50 000 50 000 Anton Bassini Cartwright 19 532 7 623 (2 155) 200 000 25 000 225 000 On 1 July 2011 the partners decided to dissolve the partnership. ! Anton acquired one of the motor vehicles at a valuation of $6 000 and Bassini acquired the other one at an agreed value of $4 500. ! The other assets were sold after valuations as follows: Land and buildings Fixtures and fittings Inventories $ 142 500 22 500 18 750 The proceeds were banked together with $13 500 collected from trade receivables. The partnership settled the trade payables at $10 000. Dissolution expenses of $1 500 were paid. On 30 June 2011 the current accounts were closed and the balances transferred to the capital accounts. REQUIRED Prepare the following accounts to the show the closure of the partnership. (a) The dissolution account (b) The partners’ capital accounts in columnar format (c) The bank account ! ! Q8. Chang, Foo and Seet were in partnership sharing profit in the following proportions: Chang one half, Foo one-third, and Seet one-sixth. The Statement of Financial position of the partnership as at 30 September 1987 was as follows: $ $ $ 150000 Capitals Freehold land & buildings Chang 130000 Plant & machinery 42000 OMAIR MASOOD CEDAR COLLEGE 207 8 Q8.! 2 Amit and Binu are in partnership sharing profits and losses in the ratio 3 : 2 respectively. The partnership statement of financial position at 30 June 2016 is as follows: $ $ Non-current assets Premises Machinery Motor vehicles 40 000 32 000 18 000 90 000 Current assets Inventory 18 600 9 31 700 Trade receivables 13 100 Total assets 121 700 REQUIRED Capital accounts (a) Amit Prepare the realisation account30on the dissolution of the partnership. 000 Binu 20 000 50 000 Realisation account Current accounts Amit 33 200 Binu 18 400 51 600 101 600 Current liabilities Trade payables 9 800 20 100 Bank overdraft 10 300 Total capital and liabilities 121 700 The partners agreed to dissolve the partnership on 30 June 2016. This resulted in the following: 1 Trade receivables realised $12 600. 2 Trade payables were settled in full for $9800. 3 Inventory was sold for $15 000. 4 The machinery was sold for $35 000. 5 Amit agreed to take over the premises at an agreed valuation of $30 000. 6 Binu agreed to take over one of the motor vehicles at an agreed valuation of $6500. The remaining motor vehicle was sold for $12 000. 7 The costs of dissolution were $6300. 10 9 ! (c)REQUIRED State two reasons why a partnership may be dissolved. 1 (a) Prepare the realisation account on the dissolution of the partnership. [6] ! Realisation account (b) Prepare a statement to show how much Binu will receive when the partnership bank account 2 is closed. 10 [2] (c) State two reasons why a partnership may be dissolved. 1 (d) Explain what would happen if the dissolution of the partnership resulted in a debit balance on a partner’s capital account. © UCLES 2017 9706/21/M/J/17 ! ! ! ! ! (d) ! ! ! 2 [2] Explain what would happen if the dissolution of the partnership resulted in a debit balance on a partner’s capital account. OMAIR MASOOD 208 CEDAR COLLEGE [4] © UCLES 2017 9706/21/M/J/17 [Turn over Q9.! ! Doug,!Elan!and!Fortune!have!traded!in!partnership!for!several!years,!sharing! profits!on!the!basis!2:2:1.!The!Statement!of!Financial!position!of!the!business!at! 31!March!2001!showed:! ! Non-Current Assets (at net book value) Premises Plant and machinery Vehicles $ Current Assets Inventory Trade Receivables $ $ 900000 140000 130000 1170000 85000 45100 130100 TOTAL ASSETS CAPITAL AND LIABLITIES Capital Accounts: D E F Current Accounts: D E F Non Current Liability -Loan from F Current Liabilities Trade Payables Bank Overdraft TOTAL CAPITAL AND LIABLITIES 1300100 500000 300000 250000 24000 (17200) 14300 64000 25000 1050000 21100 140000 89000 1300100 ! The!partners!have!decided!to!dissolve!the!partnership.!Following!information!is! available!regarding!sale!of!assets!and!settlement!of!liabilities.! ! 1. Premises were sold for $980000 the estate agent will charge 1% commission on selling price. 2. Plant and machinery were sold at $134000. 3. One vehicle was taken over by Doug at an agreed value of $30000.The remaining vehicles were sold for $82000. 4. Inventory was sold at a discount of 30%. 5. All debts were collected other then bad debts of $2000. 6. Trade payables were paid $60000 in full settlement. 7. Dissolution expenses amount to $1400. 8. Loan from Fortune was repaid in full from the bank account. REQUIRED:! ! (a)!Realization!Account!!!! (b)!Capital!Accounts!!! (c)!Bank!Account!!!!!!!!! ! ! ! ! OMAIR MASOOD CEDAR COLLEGE 209 Q10.! Chang,!Foo!and!Seet!were!in!partnership!sharing!profit!in!the!following! proportions:!Chang!one!half,!Foo!oneHthird,!and!Seet!oneHsixth.!The!Statement!of! Financial!position!of!the!partnership!as!at!30!September!1987!was!as!follows:! ! $! Freehold!land! $! $! Capitals! ! &!buildings! 150000! Chang! 130000! Plant!&! ! 42000! machinery! Foo! 60000! Motor!cars! ! 30000! Seet! 42000! Inventory! ! 25000! ! 232000! Trade! 18500! ! Receivables! ! ! Bad!debts! 600! 17900! provision! Trade! 13000! ! ! ! Payables! Bank! 19900! ! ! ! overdraft! ! $264900! ! ! $264900! On!30!September!1987!partners!agreed!to!dissolve!their!partnership!and! following!information!is!available:! (i) Chang!wished!to!continue!trading!from!the!premises!n!his!own!behalf! and!he!agreed!to!take!over!some!of!the!assets!i.e.!the!land!and! buildings,!revalued!at!$180000!the!plant!and!machinery,!revalued!at! $35000.! (ii) The!three!partners!were!to!retain!their!individual!motorcars,!which! were!formerly!regarded!as!the!partnership!property.!The!agreed! valuations!and!the!book!values!were!as!follows:! ! ! Valuation! Book!Value! $! $! Chang! 6500! 8000! Foo! 13000! 12000! Seet! 9000! 10000! ! (iii) The!Inventory!was!sold!for!$18000! (iv) Trade!Receivables!realized!$18300!and!Trade!Payables!were!settled! in!full!by!payment!of!$12700.! (v) The!expenses!of!dissolution!totalled!$1200.! Required:! (a) The!realisation!account! (b) The!partner’s!capital!account!recording!all!the!entries!arising!from! the!dissolution.! (c) The!firm’s!bank!account.!(You!may!assume!that!all!required! payments!and!receipts!have!taken!place)! ! OMAIR MASOOD CEDAR COLLEGE 210 11 REQUIRED 11 REQUIRED Q11. 9 b) Prepare the partnership realisation account. (b) Prepare the partnership realisation account. 2 Mira, Sasha and Peta have been trading as a partnership. They share profits and losses in the ratio of 2 : 2 : 1 respectively. The partnership ceased trading on 31 January 2019. REQUIRED (a) State four reasons why a partnership may be dissolved. 10 1 Additional information The following information is available on dissolution of partnership. 1 2 Mira, Sasha and Peta Statement of financial position at 31 January 2019 $ 3 4 Assets Non-current assets Fixtures and fittings Motor vehicles 45 200 22 000 67 200 Current assets Inventory Trade receivables 20 600 42 800 63 400 [4] 130 600 Total assets Capital and liabilities Capital accounts Mira Sasha Peta 13 (d) Prepare the final bank account to show the 45 500 42 800 14 000 closure 102 300 Current liabilities Trade payables Bank overdraft of the partnership. 26 400 1 900 28 300 Total capital and liabilities 130 600 2 Sasha took a motor vehicle at an agreed valuation of $4500. The remaining non-current assets were sold for $64 300. 3 Inventory was sold for $19 800. 4 Received $40 500 from trade receivables. 5 Trade payables were paid $26 000. 11 REQUIRED [5] [5] c) Prepare, on the page, on thethe partners’ capital accounts dissolution. (c)next Prepare, next page, the partners’on13 capital accounts on dissolution.[2] [2] [2] ES 2019 6 The costs of dissolution were $3700. (b) Prepare the partnership realisation account. (d) Prepare the final bank account to show the closure of the partnership. © UCLES 2019 9706/22/F/M/19 [Turn over (e) Suggest two reasons why the trade receivables did not pay the full amount they owed. (4+5+2+2+2) 1 (Mar19/P22/Q2) OMAIR MASOOD © UCLES 2019 © UCLES 2019 2 CEDAR COLLEGE 211 9706/22/F/M/19 9706/22/F/M/19 9706/22/F/M/19 [Turn over [Turn over 8 Q12. 2 2 8 Angela, Beena and Cai were in partnership sharing profits and losses in the ratio of 4 : 3 : 1. They dissolved their partnership September 2017.profits and losses in the ratio of 4 : 3 : 1. They Angela, Beena and Cai wereonin30 partnership sharing dissolved their partnership on 30 September 2017. The following information is available. The following information is available. 1 At that date their statement of financial position was as follows: 1 At that date their statement of financial position was as follows: Assets $ $ $ $ Assets $ $ $ $ Non-current assets Non-current assets Land and buildings 150 000 Land buildings 150 40 000000 Motorand vehicles Motor vehicles 40 60 000000 Machinery Machinery 60250 000000 250 000 Current assets Current assets Inventory 35 000 Inventory 35 45 000000 Trade receivables Trade receivables 45 000 Bank 4 500 Bank 4 500 84 500 84 500 Total assets assets Total Capital and and liabilities liabilities Capital 334334 500500 Capital account account Capital Current account account Current Angela Angela 100000 000 100 000 55 000 Beena Beena 000 7575 000 4 000 4 000 CaiCai 000 200200 2525 000 000000 000) 8 000 (1 (1 000) 8 000 Total Total 105000 000 105 000 7979 000 000 2424 000 Non-currentliabilities liabilities Non-current 10% 10% loan loanfrom fromBeena Beena 10 208208 000000 100100 000000 Current Current liabilities liabilities (b) Calculate the amount to be paid to Beena on dissolution of 26 the26 partnership. Trade 500 Trade payables payables 500 2 2 Total Total liabilities liabilities 126126 500500 Total Total capital capitaland andliabilities liabilities 500500 334334 The The following followingassets assetswere weresold soldfor forcash. cash. Land and buildings Land and buildings Machinery Machinery Inventory Inventory $ $ 200 000 200 000 55 150 55 150 33 750 33 750 3 3 Angela took a motor vehicle at an agreed valuation of $20 000. Angelatook tookthe a motor vehicle at an agreed valuation $20 000. Beena remaining motor vehicle at an agreed of valuation of $13 000. Beena took the remaining motor vehicle at an agreed valuation of $13 000. 4 An amount of $40 500 was received from trade receivables in full settlement of their 4 accounts. An amount of $40 500 was received from trade receivables in full settlement of their accounts. 5 An amount of $25 000 was paid to trade payables in full settlement of their accounts. 5 An amount of $25 000 was paid to trade payables in full settlement of their accounts. 9 6 Dissolution costs of $2300 were paid from the bank. 6REQUIRED Dissolution costs of $2300 were paid from the bank. 10 (a) Prepare the realisation account on dissolution of the partnership. © UCLES 2018 [3] 9706/23/O/N/18 (b) Calculate the amount to be paid Realisation to Beena on dissolution of the partnership. account © UCLES 2018 9706/23/O/N/18 11 (c) State two items which may be included in a partnership agreement. $ $ (d) Explain why partners may each have a separate capital account and current account. 1 (6+3+2+4) (Nov18/P23/Q2) 2 OMAIR MASOOD CEDAR COLLEGE [2] 212 11 11 Q13. 33 Wang and and Yuan, Yuan, Wang partnership. Their partnership. Their follows: follows: who share share profits who profits and and losses losses in in the the ratio ratio 22::1, 1, decided decided to to dissolve dissolve their their summarised statement of financial position at 30 September 2015 summarised statement of financial position at 30 September 2015 was was as as $ $ Non-current assets assets Non-current Land and buildings Land and buildings Motor vehicles Motor vehicles 60 60 000 000 10 10 000 000 70 70 000 000 Current assets Current assets Inventory Inventory Trade receivables Trade receivables 14 000 14 000 16 000 16 000 30 000 30 000 Total assets Total assets 100 000 100 000 Capital and liabilities Capital and liabilities Capital accounts Capital accounts Wang Wang Yuan Yuan 40 000 40 000 25 000 25 000 65 000 65 000 Current accounts Current accounts Wang Wang Yuan Yuan 12 (10 000) (10 000) 13 000 13 000 3 000 3 000 REQUIRED Current liabilities (a) Prepare the partnership realisation account. Current liabilities Trade payables Trade Bank payables Bank 26 000 26 000 6 000 6 000 32 000 32 000 Total capital and liabilities Total capital and liabilities 100 000 100 000 Additional information Additional information 1 1 Land and buildings were sold for $70 000. Land and buildings were sold for $70 000. 2 2 Yuan took one vehicle at an agreed value of 13$3000 and the remaining vehicle was sold for Yuan $3500.took one vehicle at an agreed value of $3000 and the remaining vehicle was sold for $3500. (c) reasons why a $15 partner 3 State Trade two receivables realised 000. may have an overdrawn current account. 3 Trade receivables realised $15 000. 4 4 5 5 6 6 1Trade payables were paid after taking a discount of $1500. Trade payables were paid after taking a discount of $1500. The inventory was sold for $12 000. The inventory was sold for $12 000. The expenses of dissolution were $1700. The expenses of dissolution were $1700. 12 2 REQUIRED [5] (a) Prepare the partnership realisation account. (b) Calculate the amount due to each partner 13 when the bank account is closed on dissolution. [2] (c) State two reasons why a partner may have an overdrawn current account. (d) State why partnerships maintain separate capital accounts for each partner. (5+7+2+1) 1 (June16/P21/Q3) (June16/P23/Q3) © UCLES 2016 © UCLES 2016 OMAIR MASOOD 2 9706/21/M/J/16 9706/21/M/J/16 CEDAR COLLEGE [Turn over [Turn over 213 [1] [Total: 15] LIMITED!COMPANIES! LIMITED COMPANIES THEORY ( Limited(companies(are(business(organizations,(whose(owners’(liabilities(are(limited(to(their(capital$ contributed(or(guarantees$made.( ( CHARACTERISTICS!OF!LIMITED!COMPANIES! 1. Separate(legal(entity:( 2. Limited(liability:( 3. Perpetual(succession:( 4. 5. 6. 7. 8. Number(of(members:( Capital:( Profit(distribution:( Retained(profits:( Legislation:( A(company(is(regarded(as(a(separate(person(from(its(owners(and( managers.(As(a(result,(it(can(sue(or(be(sued,(it(can(own(property.( This(concept(is(often(referred(to(as(veil(of(incorporation.( Shareholders’(liability(is(limited(to(what(they(have(paid(for( shares.( Unlike(partnership(and(sole(trader,(a(company(does(not(cease(to( exist(on(the(death(or(retirement(of(any(of(the(owners.(Owners( can(buy(and(sell(their(shares(without(affecting(the(running(of(the( business.( There(is(no(limit(as(to(the(number(of(members( Company’s(capital(is(raised(through(the(issuance(of(shares( Profits(are(distributed(to(members(through(dividends.( The(retained(profits(are(capitalized(are(reserves.( Companies(are(highly(regulated.(They(are(required(to(comply( with(the(requirements(of(Company’s(ACT(as(well(as(Financial( Reporting(Standards.( ( ADVANTAGES!OF!OPERATING!AS!A!LIMITED!COMPANY:! 1. The(liability(of(the(shareholders(is(limited.(Therefore,(in(case(of(company(going(bankrupt,(the( individual(assets(of(the(owners(will(not(be(used(to(meet(the(company’s(debts.(Only(shareholders( who(have(only(partly(paid(for(their(shares(can(be(forced(to(pay(the(balance(owing(on(the(shares,( but(nothing(else.( 2. There(is(a(formal(separation(between(the(ownership(and(management(of(the(business.(This( helps(in(clearly(identifying(the(responsible(persons.( 3. Ownership(is(vastly(shared(by(many(people,(hence(diversifying(risk,(and(funds(become(available( is(substantial(amounts.( 4. Shares(in(the(business(can(be(transferred(relatively(easily.( ( DISADVANTAGES:! 1. Formation(costs(are(normally(very(high.( 2. Companies(are(highly(regulated.( 3. Running(costs(are(also(very(high(i.e.(preparation(and(submission(of(annual(returns,(audit(fees( etc.( 4. Profit(distribution(is(also(subject(to(some(restrictions.(Not(all(surpluses(from(the(business( transactions(can(be(distributed(back(to(the(shareholders.( 5. Company(accounts(must(be(available(for(inspection(to(the(public.( OMAIR MASOOD CEDAR COLLEGE 214 There(are(two(types(of(limited(companies:( There(are(two(types(of(limited(companies:( 1. Public$limited$companies:$ 1. Public$limited$companies:$ a5 They(have(the(abbreviation(Plc(of(public(limited(company(at(the(end(of(their(names( a5 They(have(the(abbreviation(Plc(of(public(limited(company(at(the(end(of(their(names( b5 Their(minimum(allotted(share(is(required(to(be(£50(000.( b5 Their(minimum(allotted(share(is(required(to(be(£50(000.( c5 They(can(invite(the(general(public(to(subscribe(for(their(shares( c5 They(can(invite(the(general(public(to(subscribe(for(their(shares( d5 Their(shares(may(be(traded(in(the(stock(exchange(i.e.(they(can(be(quoted(with(the(stock( Their(shares(may(be(traded(in(the(stock(exchange(i.e.(they(can(be(quoted(with(the(stock( d5 exchange.( exchange.( 2. Private$limited$companies:( 2. Private$limited$companies:( a5 They(have(the(abbreviation(‘Ltd’(for(limited(at(the(end(of(their(names.( They(have(the(abbreviation(‘Ltd’(for(limited(at(the(end(of(their(names.( a5 b5 They(are(not(allowed(to(invite(general(public(for(the(subscription(of(their(share(capital.( They(are(not(allowed(to(invite(general(public(for(the(subscription(of(their(share(capital.( b5 ( COMPANY!FINANCE! COMPANY!FINANCE! ( As(is(a(case(with(sole(traders(and(partnerships,(companies(also(have(two(main(sources(of(finance,( As(is(a(case(with(sole(traders(and(partnerships,(companies(also(have(two(main(sources(of(finance,( namely;(capital(and(liabilities.(The(difference(is(on(naming(and(classification(of(these(terms.( namely;(capital(and(liabilities.(The(difference(is(on(naming(and(classification(of(these(terms.( (( When(the(company(is(formed,(it(normally(issues(shares(to(be(subscribed(by(the(potential(members.( When(the(company(is(formed,(it(normally(issues(shares(to(be(subscribed(by(the(potential(members.( People(who(subscribe(and(buy(company’s(shares(are(known(as(shareholders,(and(they(become(the(legal$ People(who(subscribe(and(buy(company’s(shares(are(known(as(shareholders,(and(they(become(the(legal$ owners$of(the(company(depending(in(the(proportion(and(type(of(shares(they(hold.(They(receive( owners$of(the(company(depending(in(the(proportion(and(type(of(shares(they(hold.(They(receive( dividends$as(return(on(their(invested(capital.(Dividends(are,(therefore,(appropriations$of(the(profits.( dividends$as(return(on(their(invested(capital.(Dividends(are,(therefore,(appropriations$of(the(profits.( (( On(the(other(hand,(the(company(can(borrow(funds(from(other(people(who(are(not(owners.(The(main( On(the(other(hand,(the(company(can(borrow(funds(from(other(people(who(are(not(owners.(The(main( form(of(company(borrowings(is(by(issuing(debenture,(which(is(a(written(acknowledgement(of(a(loan(to(a( form(of(company(borrowings(is(by(issuing(debenture,(which(is(a(written(acknowledgement(of(a(loan(to(a( company,(given(under(the(company’s(seal.(The(debenture(holders(are(not(owners(of(the(company(but( company,(given(under(the(company’s(seal.(The(debenture(holders(are(not(owners(of(the(company(but( they(are(liabilities.(Debenture(holders(receive(a(fixed$percentage$of$interest$on(the(loan(amount.( they(are(liabilities.(Debenture(holders(receive(a(fixed$percentage$of$interest$on(the(loan(amount.( Debenture(interest(is(a(business$expense,$which(must(be(paid(when(is(due.(Other(forms(of(borrowings( Debenture(interest(is(a(business$expense,$which(must(be(paid(when(is(due.(Other(forms(of(borrowings( include(trade(creditors(and(bank(overdrafts.( include(trade(creditors(and(bank(overdrafts.( ( (The(difference(between(shareholders(and(debenture(holders(can(be(analyzed(in(terms(of:( The(difference(between(shareholders(and(debenture(holders(can(be(analyzed(in(terms(of:( 1. Ownership;(and( 1. 2. Ownership;(and( Return(on(investment((Debenture(holders(will(get(it(even(if(the(company(makes(losses)( 2. Return(on(investment((Debenture(holders(will(get(it(even(if(the(company(makes(losses)( ( (SHARE!CAPITAL! SHARE!CAPITAL! Share(capital(is(normally(of(two(types:( Share(capital(is(normally(of(two(types:( 1. Ordinary(share(capital;(and(((the(real(shareholders)( 2. Ordinary(share(capital;(and(((the(real(shareholders)( Preference(share(capital( 1. ( Preference(share(capital( 2. ( (( (( (( ( OMAIR MASOOD CEDAR COLLEGE 215 What!are!the!different!Types!of!Preference!Shares?! 1. NonAcumulative!Preference!shares:!In(case(company(doesn’t(pay(enough(profits,(these( shareholders(will(get(no(dividends(in(the(year(and(that(amount(of(dividend(will(never(be(given.( 2. Cumulative!Preference!Shares:!In(case(company(doesn’t(have(enough(profits,(these( shareholders(will(get(no(dividend(in(the(year(and(that(amount(of(dividend(will(be(carried( forward(to(next(year,(when(the(company(makes(enough(profit,(the(entire(amount(will(be( payable(as(dividend.( 3. Participating!!Preference!Shares!: Preference(shares(which,(in(addition(to(paying(a(specified( dividend,(entitle(preference(shareholders(to(participate(in(receiving(an(additional(dividend(if( ordinary(shareholders(are(paid(a(dividend(above(a(stated(amount.( 4. Redeemable!Preference!Shares:!(Preference(shares(which(can(be(bought(back(by(the(company( at(a(given(date(((They(are(treated(like(liability(and(not(equity().(The(dividends(given(to(them(are( treated(like(interest(expense.( Their(difference(is(summarized(in(the(table(below:( Aspect$ Ordinary$shares$ Preference$shares$ Voting(power( Carry(a(vote( Limited(or(no(voting(power( Dividends( 1. Vary(between(one(year(to( 1. Fixed(percentage(of(the(nominal( another,(depending(on(the( value.( profit(for(the(period.( 2. Cumulative.(If(not(paid(in(the( 2. Rank(after(preference( year(of(low(or(no(profits,(it(is( shareholders.( carried(forward(to(the(next(years.( 3. Not(cumulative.( 3. They(may(be(non5cumulative.( Liquidation( Entitled(to(surplus(assets(on( 1. Priority(of(payment(before( (Company(closing( liquidation,(after(all(liabilities(and( ordinary(shareholders,(but(after( down)( preference(shareholders(have(been( all(other(liabilities.( paid.(Whatever(is(left,(go(to( 2. Not(entitled(to(surplus(assets(on( Ordinary(shareholders.( liquidation.( SHARE!CAPITAL!STRUCTURE! Authorized(share(capital:( Issued(share(capital:( Called5up(capital:( Paid5up(capital:( ( Uncalled(capital:(( OMAIR MASOOD the(maximum(share(capital(that(the(company(is(empowered(to(issue(per( its(memorandum(of(association.(It(is(sometimes(called(as(registered( capital.( The(total(nominal(value(of(share(capital(that(has(actually(been(issued(to( the(shareholders.( This(is(a(part(of(issued(capital(that(the(company(has(already(asked(the( shareholders(to(pay.(Normally(when(the(company(issues(shares,(it(does( not(require(its(shareholders(to(pay(the(full(price(on(spot.(Rather(it(calls( the(installments(from(time(to(time.(It(is(the(amount(that(is(included(in( the(balance(sheet.( This(is(the(total(amount(of(the(money(already(collected(from(the( shareholders(to(date.(Dividend(is(paid(on(this.( This(is(the(part(of(issued(capital,(which(the(company(has(not(yet( requested(its(shareholders(to(pay(for.( CEDAR COLLEGE 216 ( ( The!distinctions!between!reserves,!provisions!and!liabilities! The(distinctions(between(reserves,(provisions(and(liabilities(are(of(the(utmost(importance(and(must(be( learned.( ( Provisions(are:( amounts(written(off(or(retained(by(way(of(providing(for(depreciation,(renewals(or(diminution(in( the(value(of(assets.(( Or,( retained(by(way(of(providing(for(nay(known(liability(of(which(the(amount(cannot(be(determined( with(substantial(accuracy.( Increases(and(decreases(in(provisions(are(debited(or(credited(in(the(Profit(and(Loss(account(and(credited( to(a(Provision(account.( ( Reserves(are:( any(other(amounts(set(aside(out(of(profits(by(debiting(Profit(and(Loss(Appropriation(account(and( crediting(the(relevant(provision(accounts,( and( amounts(placed(to(capital(reserve(in(accordance(with(the(Companies(Act(such(as(share( premium,(unrealized(surpluses(on(the(revaluation(of(non(current(assets,(and(amounts(set(aside( out(of(distributable(reserves(to(maintain(capital(when(shares(are(redeemed.( Liabilities!are(:amounts(owing(which(can(be(determined(with(substantial(accuracy.( ISSUE OF SHARES Public Issue: This is normal issue of shares to general public. A company can issue shares to public to raise more capital , this is done at the market price. Public issues have higher cost of issue ( this means the company has to incur high expenses when issuing the shares I.e. advertising and administration ). The main advantage of issuing shares is that no interest has to be paid on it and the company only have to provide a return when they actually make profits. Rights Issue : A rights issue represents the offer of shares to the existing shareholders in proportion to their existing holding at a lower price compared to the market value. Advantages of Rights Issue over Public issue • Rights issue are cheaper to administer and less risky way of raising capital • Shareholders will get some incentive as they will get shares at a lower price. Disadvantages • Market price will fall • The company could have raised more funds through a public issue Bonus Issue: Is the issue of shares to existing shareholders for free .When the company is short of cash and can’t give dividends so they give out shares for free to the ordinary shareholders. Other reasons for bonus issue include. • To utilize the capital reserves OMAIR MASOOD CEDAR COLLEGE • To increase confidence in the company’s future prospects as it is normally taken as a signal of strength by the general public. When doing bonus issue company will always use capital reserves first and then the revenue 217 Disadvantages • Market price will fall • The company could have raised more funds through a public issue Bonus Issue: Is the issue of shares to existing shareholders for free .When the company is short of cash and can’t give dividends so they give out shares for free to the ordinary shareholders. Other reasons for bonus issue include. • To utilize the capital reserves • To increase confidence in the company’s future prospects as it is normally taken as a signal of strength by the general public. When doing bonus issue company will always use capital reserves first and then the revenue reserves i.e. We use share premium first and then revaluation reserve but if we don’t have enough balance in both of these reserves then we will move to • General Reserve • Profit and Loss. ( Retained Earnings) DEBENTURES! (( A(debenture(is(a(document(containing(details(of(a(loan(made(to(a(company.(The(loan(may(be(secured(on( A(debenture(is(a(document(containing(details(of(a(loan(made(to(a(company.(The(loan(may(be(secured(on( the(assets(of(the(company,(when(it(is(known(as(a(mortgage$debenture.(If(the(security(for(the(loan(is(on( the(assets(of(the(company,(when(it(is(known(as(a(mortgage$debenture.(If(the(security(for(the(loan(is(on( certain(specified(assets(of(the(company,(the(debenture(is(said(to(be(secured(by(a(fixed$charge$on(the( certain(specified(assets(of(the(company,(the(debenture(is(said(to(be(secured(by(a(fixed$charge$on(the( assets.(If(the(assets(are(not(specified,(but(the(security(is(on(the(assets(as(they(may(exist(from(time(to( assets.(If(the(assets(are(not(specified,(but(the(security(is(on(the(assets(as(they(may(exist(from(time(to( time,(it(is(known(as(a(floating$charge$on(the(assets.(An(unsecured(debenture(is(known(as(a(simple$or$ time,(it(is(known(as(a(floating$charge$on(the(assets.(An(unsecured(debenture(is(known(as(a(simple$or$ naked$debenture.( naked$debenture.( Debentures(carry(the(right(to(a(fixed(rate(of(interest(which(forms(part(of(the(subscription(of(the( Debentures(carry(the(right(to(a(fixed(rate(of(interest(which(forms(part(of(the(subscription(of(the( debentures..(The(interest(must(be(paid(whether(or(not(the(company(makes(a(profit.(This(is(one(of(the( debentures..(The(interest(must(be(paid(whether(or(not(the(company(makes(a(profit.(This(is(one(of(the( distinctions(between(debentures,(and(shares(on(which(dividends(may(only(be(paid(if(profits(are( distinctions(between(debentures,(and(shares(on(which(dividends(may(only(be(paid(if(profits(are( available.(Debenture(interest(is(debited(as(an(expense(in(the(Profit(and(Loss(account(to(arrive(at(the( available.(Debenture(interest(is(debited(as(an(expense(in(the(Profit(and(Loss(account(to(arrive(at(the( profit(before(tax.( profit(before(tax.( (( RESERVES( The(net(assets(of(the(company(are(represented(with(capital(and(reserves.(While(capital(represents(the( The(net(assets(of(the(company(are(represented(with(capital(and(reserves.(While(capital(represents(the( claim(that(owners(have(because(of(the(number(if(shares(they(own,(reserves(represent(the(claim(that( claim(that(owners(have(because(of(the(number(if(shares(they(own,(reserves(represent(the(claim(that( owners(have(because(of(the(wealth(created(by(the(company(over(the(years(but(not(distributed(to(them.( owners(have(because(of(the(wealth(created(by(the(company(over(the(years(but(not(distributed(to(them.( There(are(two(main(types(of(reserves:( There(are(two(main(types(of(reserves:( Revenue!Reserve!! Revenue!Reserve The(reserves(which(arise(from(profit((Trading(activities(of(the(company).(These(are(transferred(from(the( The(reserves(which(arise(from(profit((Trading(activities(of(the(company).(These(are(transferred(from(the( Appropriation(account.(Examples(include(General(Reserve(and(Retained(Profit((Profit(and(Loss).( Appropriation(account.(Examples(include(General(Reserve(and(Retained(Profit((Profit(and(Loss).( Dividends(can(only(be(paid(to(the(amount(of(revenue(reserve(on(the(balance(sheet.(i.e.(the(maximum( Dividends(can(only(be(paid(to(the(amount(of(revenue(reserve(on(the(balance(sheet.(i.e.(the(maximum( dividend(possible(is(the(sum(of(both(revenue(reserves.( dividend(possible(is(the(sum(of(both(revenue(reserves.( Capital!Reserve! Capital!Reserve! These(are(reserves(which(the(company(is(required(to(set(up(by(law(and(cannot(be(distributed(as( These(are(reserves(which(the(company(is(required(to(set(up(by(law(and(cannot(be(distributed(as( dividends.(They(normally(arise(out(of(capital(transactions.(These(include(Share(Premium(and(Revaluation( dividends.(They(normally(arise(out(of(capital(transactions.(These(include(Share(Premium(and(Revaluation( 218 Reserve.( MASOOD OMAIR CEDAR COLLEGE Reserve.( Share!Premium! Share!Premium! Share(premium(occurs(when(a(company(issues(shares(at(a(price(above(its(nominal((par)(value.(This( Share(premium(occurs(when(a(company(issues(shares(at(a(price(above(its(nominal((par)(value.(This( excess(of(share(price(over(nominal(value(is(what(is(known(as(share(premium.( excess(of(share(price(over(nominal(value(is(what(is(known(as(share(premium.( Revenue!Reserve! Revenue!Reserve! The(reserves(which(arise(from(profit((Trading(activities(of(the(company).(These(are(transferred(from(the( The(reserves(which(arise(from(profit((Trading(activities(of(the(company).(These(are(transferred(from(the( Appropriation(account.(Examples(include(General(Reserve(and(Retained(Profit((Profit(and(Loss).( Appropriation(account.(Examples(include(General(Reserve(and(Retained(Profit((Profit(and(Loss).( Dividends(can(only(be(paid(to(the(amount(of(revenue(reserve(on(the(balance(sheet.(i.e.(the(maximum( Dividends(can(only(be(paid(to(the(amount(of(revenue(reserve(on(the(balance(sheet.(i.e.(the(maximum( dividend(possible(is(the(sum(of(both(revenue(reserves.( dividend(possible(is(the(sum(of(both(revenue(reserves.( Capital!Reserve! Capital!Reserve! These(are(reserves(which(the(company(is(required(to(set(up(by(law(and(cannot(be(distributed(as( These(are(reserves(which(the(company(is(required(to(set(up(by(law(and(cannot(be(distributed(as( dividends.(They(normally(arise(out(of(capital(transactions.(These(include(Share(Premium(and(Revaluation( dividends.(They(normally(arise(out(of(capital(transactions.(These(include(Share(Premium(and(Revaluation( Reserve.( Reserve.( Share!Premium! Share!Premium! Share(premium(occurs(when(a(company(issues(shares(at(a(price(above(its(nominal((par)(value.(This( Share(premium(occurs(when(a(company(issues(shares(at(a(price(above(its(nominal((par)(value.(This( excess(of(share(price(over(nominal(value(is(what(is(known(as(share(premium.( excess(of(share(price(over(nominal(value(is(what(is(known(as(share(premium.( What(are(the(uses(of(Share(Premium?( What(are(the(uses(of(Share(Premium?( 1. Issue(Bonus(Shares( 1. Write(off(Formation((Preliminary(Expenses)( Issue(Bonus(Shares( 2. 3. 2. Write(off(Goodwill.( Write(off(Formation((Preliminary(Expenses)( 3. Write(off(Goodwill.( Revaluation!Reserve!! Revaluation!Reserve!! (When(value(of(Assets(go(up(,(companies(are(allowed(to(revalue(them(upwards(but(gain(has(to( (When(value(of(Assets(go(up(,(companies(are(allowed(to(revalue(them(upwards(but(gain(has(to( be(recorded(in(a(reserve(rather(then(income(statement(.(This(reserve(can(only(be(used(to(issue( be(recorded(in(a(reserve(rather(then(income(statement(.(This(reserve(can(only(be(used(to(issue( bonus(shares(or(devalue(the(same(asset(which(was(revalued(upwards(before( bonus(shares(or(devalue(the(same(asset(which(was(revalued(upwards(before( OMAIR MASOOD CEDAR COLLEGE 219 Q1 EXAMPLE 1 LIMITED COMPANIES (WORKSHEET) Following Trial Balance is available for Dab Limited as at 31st December 2019. Dr $1 Share Capital Sales Purchases Rent General Expenses 8% Bank Loan Loan Interest Paid Inventory at Start Motor Van Provision for Depreciation-Motor Van Machine Provision for Depreciation-Machine Trade Receivables Trade Payables Cash and Cash Equivalents Provision for Doubtful Debts Land Retained Earnings Cr 90,000 110,000 60,000 8,000 12,000 30,000 1,800 10,200 50,000 15,000 35,000 25,000 16,000 20,000 14,000 2,000 90,000 297,000 5,000 297,000 Additional Information i. ii. iii. iv. v. vi. vii. viii. ix. x. xi. Inventory at 31st December 2019 was $15,000. Loan interest has not been paid in full. Rent owing amounted to $1,000. $1,700 of General Expenses were paid in advance. Machine is depreciated using 40% Reducing Balance Method. Motor Van is depreciated at 10% of Cost. Provision for doubtful debt should amount to 10%. Tax Rate is 20% Land was revalued at $100,000. During the year, dividend of $0.1 per share was paid and at the end, dividends of $0.15 per share was announced. $3,000 were transferred to General Reserve. REQUIRED a) Income Statement b) Statement of Changes in Equity c) Statement of Financial Position OMAIR MASOOD CEDAR COLLEGE 220 EXAMPLE 2 Following(Trail(Balance(is(for(Cedax(Ltd(on(30(April(2006.( ( ( $" (Shares(of($1(each(fully(paid( 1800000( Premises( 2300000( Motor(vehicles(( 500000( Fixtures(and(fittings( 190000( Provision(for(depreciation(on(motor(vehicles( 375000( Provision(for(depreciation(on(fixtures(and(fittings( 102000( Gross(profit( 1585600( InventoryM(30(April(2006( 204000( Administrative(expenses( 460000( Selling(and(distribution(expenses( 486000( 6%(debentures(( 100000( Debentures(interest(paid( 3000( Profit(on(sale(of(motor(vehicle( 2000( Retained(Earnings—1(May(2005( 190000( Cr Trade(Receivables( 132000( Trade(Payables( 116000( Bank( 26800( Cr Cash( 400( Dividend(paid( 75000( Provision(for(doubtful(debts( 3000( General(Reserve( 50000( ( Additional"information"at"30"April"2006:" Admin(expenses(prepaid($8000( Selling(and(distribution(expenses(accrued($23000( Provision(for(doubtful(debts(to(be(maintained(at(2%(Trade(Receivables( Premises(were(revalued(at($2500000( Depreciation(to(be(provided(as(follows:( ( Motor(vehicles(40%(per(annum(reducing((diminishing)(balance( ( Fixtures(and(fittings(20%(per(annum(on(cost( $10000(were(transferred(to(general(reserve( The(following(is(proposed:( Final(dividend(of($0.10(per(share(is(to(be(paid(to(shareholders.( REQUIRED:" (a) Income(Statement((( (b) (Statement(of(Changes(in(Equity( (c) Statement(of(financial(position((Balance(Sheet)(as(at(30(April(2006( ( OMAIR MASOOD CEDAR COLLEGE 221 EXAMPLE'3' ! Following!Trial!Balance!is!available!for!Gastro!Ltd!as!at!31st!December!2019.! ! ! Revenue! Purchases! $5!Share!Capital! Inventory!at!1st!Jan! Sundry!Expenses! General!Reserve! Rent!&!Rates! Selling!Expenses! Retained!Earnings! Freehold!Land! Plant!&!Machinery! Provision!for!Depn!on!Plant!&!Machinery! Motor!Van! Provision!for!Depn!on!Motor!Van! Trade!Recievebles! Trade!Payables! 10%!Debentures! Debenture!Interest!Paid! Bad!debts! Cash!at!Bank! Debit'(DR)'($)' ! 100000! ! 32000! 18000! ! 13000! 12000! ! 180000! 70000! ! 60000! ! 21000! ! ! 4000! 5000! 25000! Credit'(CR)'($)' 250000! ! 100000! ! ! 20000! ! ! 40000! ! ! 50000! ! 12000! ! 18000! 50000! ! ! ! ! ! ! ! Additional!Information.! ! 1. Inventory!at!31st!December!was!$40000.! 2. Provision!for!doubtful!debts!of!!5%!should!be!created! 3. Land!was!revalued!at!$200000.! 4. Motor!Van!is!depreciated!by!20%!RBM!and!Machine!by!30%!RBM.! 5. Tax!rate!is!10%.! 6. Debenture!interest!is!outstanding!partly.! 7. Rent!of!$300!is!in!owing!and!$500!of!Selling!expenses!are!prepaid.! 8. $5000!are!to!be!transferred!to!general!reserve! 9. Dividend!of!0.8!per!share!was!paid!during!the!year! 10. Dividend!of!$1.2!per!share!is!announced.! ! REQUIRED:' (a) INCOME'STATEMENT' (b) STATEMENT'OF'CHANGES'IN'EQUITY' (c) STATEMENT'OF'FINANCIAL'POSITION' OMAIR MASOOD CEDAR COLLEGE 222 EXAMPLE'4' Following(Trial(Balance(is(available(for(Hydro(Ltd(as(at(31st(December(2019.( ( Additional(Information.( ( Revenue( Purchases( 8%PDebentures( Inventory(at(1st(Jan( General(Expenses( General(Reserve( Rent(&(Rates( Gain(on(Disposal( Retained(Earnings( Premises( Plant(&(Machinery( Provision(for(Depn(on(Plant(&(Machinery( Trade(Recievebles( Trade(Payables( $1(Share(Capital( Debenture(Interest(Paid( Revaluation(Reserve( Cash(at(Bank( Dividends(paid( ( Debit'(DR)'($)' ( 250000( ( 19000( 23000( ( 4000( ( ( 260000( 34000( ( 21000( ( ( 3000( ( 6000( 4000( Credit'(CR)'($)' 400000( ( 50000( ( ( 6000( ( 1000( 23000( ( ( 14000( ( 6000( 120000( ( 4000( ( ( 1. Inventory(at(31st(December(was($25000.( 2. Provision(for(doubtful(debts(of((should(cover(for(specific(debt(of$1000( and(3%(on(remainder( 3. Premises(was(revalued(at($300000.( 4. Plant(and(Machine(is(depreciated(by(20%(RBM(( 5. Debenture(interest(is(outstanding(partly.( 6. $5000(are(to(be(transferred(to(general(reserve( 7. 10000(Shares(of($1(each(are(issued(at($1.8(each.( 8. Dividend(of($0.2(per(share(is(announced.( ( REQUIRED:' (a) INCOME'STATEMENT' (b) STATEMENT'OF'CHANGES'IN'EQUITY' (c) STATEMENT'OF'FINANCIAL'POSITION' OMAIR MASOOD CEDAR COLLEGE 223 Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( (((((((((((((((((OMAIR(MASOOD( EXAMPLE 5# The following balances were extracted from the books of Lightyear plc. on 31 March 2003. Debit Credit $ $ Purchases 700,000 Sales 1,800,000 Inventory at 1 April 2002 35,000 Discounts 8,000 10,000 Sales returns 20,000 10 % Debentures 30,000 $5 Share Capital 500,000 General administration expenses 320,000 General distribution costs 230,000 Trade Receivables 90,000 Trade Payables 60,000 Retained Earnings 190,000 Land and buildings 662,500 Delivery vehicles 200,000 Office equipment 120,000 Provision for doubtful debts 3,500 Salaries 110,000 Bank 130,000 Provision for depreciation – Office equipment 20,000 Provision for depreciation – Delivery vehicles 50,000 General reserve 12,000 Dividends Paid 50000 Additional Information: (i) The closing Inventory was valued at $30,000. (ii) General administration expenses owing; $3600 General distribution costs prepaid: $3300 (iii)The provision for doubtful debts account is to be reduced to $1800. (iv) Depreciation is to be provided as follows: (a) delivery vehicles 20% reducing balances (b) office equipment 15% on cost. (v) Interest on Debentures is outstanding for the year. (vi) The directors have decided to transfer $15,000 to the general Reserve Account. (vii) Lightyear plc. has had its land and buildings revalued to $800,000 and an adjustment must be made in the books to reflect the revaluation. (viii) Corporation tax for the year on profit from ordinary activities is estimated to be $180,000. (ix) On 31st March 2003 30000 Shares of $5 each were issued at $7 each. REQUIRED: (a) The Income Statement (Profit and Loss Account) for the year ended 31 March 2003. (b) Statement of Changes in Equity for the year ended 31 March 2003 (c) The Statement of Financial position (Balance Sheet) as at 31 March 2003. OMAIR MASOOD # 191# CEDAR COLLEGE 224 3 3 3 3 33 3 3 ACCOUNT'FOR'LIMITED'COMPANIES'(WS'1)' ! Q1.! The!Following!information!is!available!for!HotSpurs!Ltd!as!at!1st!January!2019! ! ! $! Shares!of!$5!each! 200000! Revaluation!Reserve!! 25000! General!Reserve! 20000! Retained!Earnings! 38000! ! ! ! 1. During!the!year!ended!31st!December!2019!the!company!earned!a!net! profit!of!$85000.! 4 2. On!1st!Feb!2019!a!dividend!of!9%!was!paid!(this!was!proposed!last!year!)! 4 4 st!March!2019.! 3. 20000!new!shares!of!$5!were!issued!at!$8!on!1 The following information is available about Whittlesford plc on 31 December 2011. 2. st !December!2019!and!a! 4. A!dividend!of!$0.3!per!share!was!paid!on!31 The following information is available about Whittlesford plc on 31 December 2011. 2. The following information is available about 4Whittlesford plc on 31 December 2011. $ 2. further!dividend!of!!$0.4!per!share!was!announced.! 500 000 ordinary shares of $1 each 500 000 4$ 4 st!December!2019!the!directors!also!decided!to!transfer!$7000!in!to! 5. 0n!31 4$ The500 following information is available about Whittlesford plc on 31 December 2011. Share 200 000 000premium ordinary shares of $1 each 500 000 500 000 ordinary shares of $1 each 500 000 plc plc general!reserve.! TheShare following information about Whittlesford on 31 2011.2011. The following informationisisavailable available about on December 31 December General reserve 70Whittlesford 000 premium 200 000 2.TheShare 4200 following information is available about Whittlesford plc on 31 December 2011. $ 000 premium Retained earnings 298 300 reserve 70 000 !General 500 000 reserve ordinary shares of $1 each 500300 $000 70 Retained earnings 4$000plc on 31 December 2011. 3 !General The following information is available about 298 Whittlesford 2. $ Share premium 200 000 500 000 ordinary shares of $1 each 500 000 Retained earnings 298 300 Further is as follows: 500information 000 ordinary shares of $1 each 500 000 Share premium 200 000 General reserve 000 500 000 ordinary of $1 each 000 TheQ2! following information is available about Whittlesford plc on 31 December 2011. $500 Further information is asshares follows: 470 Share premium 200 000 General reserve 70 000 Retained earnings 298 300 500 000 ordinary shares of ended $1 each31500 000 Share premium 200 0002012 was $122 800. 1 The draft profit for the year December Further information is as follows: General reserve 70 000 3 Retained TheShare following information is available about200 Whittlesford plc on 31 December 2011. premium 000 earnings 298 300 General reserve 70 000 1 The draft profit for the year ended 31 December 2012 was $122 800. $ Retained Generalearnings reserve 70298 000 300 Further information is as follows: Retained earnings 300$520 On 1Retained January 2012 property revalued from 000 was to $780 000. 500 000 ordinary of was $1 each 500 000 12 The draft profit for shares the year ended 31 2012 $122 800. $298 earnings 298December 300 Further information is asshares follows: 2Further On 1information January 2012 property was revalued from $520 000 to $780 000. Share premium 000 500 000 ordinary of $1 each 500 200 000 is as follows: 1 On The draft profit for thea year ended December 2012 was5$122 800. Share premium 200 31 January 2012 rights issue31 of 1000 share for every held was 000. made at a premium of General reserve 70 000 information isis as follows: Further information as follows: 23Further On January 2012 was revalued from $520 000 to 800. $780 The1 draft profit for theproperty year ended 31 December 2012 was $122 General reserve 70 000 31 On 31 January 2012 a rights issue of 1 share for every 5 held was made at a premium of $0.25 each. Retained earnings 298 300 2012 was $122 800. 12 The draft profit for the year ended 31 earnings 298December 300from On The 1Retained January 2012 property was 31 revalued $520 000 to800. $780 000. 1 draft profit for the year ended December 2012 was $122 $0.25 each. The31 draft profit for theayear ended 31ofDecember 2012 was5$122 800. 312 On January 2012 rights 1from share for every held On 30 1 January 2012 property wasissue revalued $520 000 to $780 000.was made at a premium of 42Further On June 2012 an interim dividend of $0.08 per share was paid. information is as follows: Further information is as follows: On 1 January 2012 property was revalued from $520 000 to $780 000. $0.25 each. 2On30 On 1January January property was revalued $520 000 to $780 000. 31June 2012 a rights issue of 1from share every 5 held 43 On 20122012 an interim dividend of $0.08 perforshare was paid.was made at a premium! of 23 On On 1 January 2012 property was revalued from $520 000 to $780 000. at a premium of 31 January 2012 a rights issue of 1 share for every 5 held was made $0.25 each. 5 On 31 October 2012 a abonus issue of shares of every 1 was for every 4 $122 held was The directors 1The The draft profit for the year ended 31of December 2012 $122 800. draft profit for the year ended 31 December 2012 was 800. 3On On 31 January 2012 rights issue 1of share for 5every held was made at made. a made premium 31 January 2012 a rights issue 1 share for 5 held was atofadirectors premium of $0.25 each. 4531 On 30 June 2012 an interim dividend of $0.08 per share was paid. On 31 October 2012 a bonus in issue ofmost shares of 1 for every 4 held was made. The decided to keep the reserves their flexible form. $0.25 each. 34 decided On 31 January 2012 a rights issue of 1 share for every 5 held was made at a premium of $0.25 each. On 30 June 2012 an interim dividend of $0.08 per share was paid. 2 On 1toJanuary 2012 property was revalued $520 form. 000 to $780 000. keep the reserves in their mostfrom flexible 2 On On30 1 January 2012 property was revalued from $520 000 to $780 000. $0.25 each. June 2012 an interim dividend of $0.08 per share was paid. 564 On 31 October 2012 a bonus issue of shares of 1 for every 4 held was made. The 4 31 On 30 June 20122012 an interim dividend $0.08 per share paid. reserve and a final dividenddirectors ! On December $40 000 wasof transferred to was general of 3 30 OnJune 31 January 2012 abonus rights dividend issue ofof1shares share for every 5every held was was made at a premium of directors On 2012 an interim of $0.08 per share paid. On 31 October 2012 a issue of 1 for 4reserve held was made. 645 decided On 31 December 2012 $40 000 was transferred to general and a finalThe dividend of to keep the reserves in their most flexible form. $0.12 per share was proposed. $0.25 each. OnOn 3131 January 2012 abonus rights issue ofof1$0.08 share for share every 5held held was made at adirectors premium of 31 October 2012 aainterim bonus issue shares of 1per for every 4was was made. The 453 $0.12 On 30 June 2012 an dividend paid. 5On October 2012 issue ofofshares of 1 for every 4 held was made. The directors decided to keep the reserves in their most flexible form. per share was proposed. $0.25 each. decided to keep the reserves in their most flexible form. decided to keep the reserves in their most flexible form. On 31 October 2012 a bonus issue shares of 1 was forwho every held was made. The directors 675 On 31 December 2012 $40 000 was transferred to general reserve and final dividend of! 4 5 On 30 June2013 2012 an interim dividend ofof $0.08 share paid. On January it was discovered that aper customer had4owed $4200 atathe year end 6 On December 2012 $40 000 was transferred to general reserve and a final dividend of 5 On 31 October 2012 a bonus issue of shares of 1 for every 4 held was made. The directors decided todeclared keep the reserves in their most flexible form. 7 $0.12 On 5On January 2013 it2012 was discovered that a customer who had owed $4200 at year end had been bankrupt. Itdividend was discovered that goods in inventory at the the per share was proposed. 6On 31 December $40 000 000 was also transferred to per general reserve and aand final adividend ofyear end, 64 had 31 December 2012 $40 transferred toevery general reserve dividend of 30 June 2012 an interim ofdiscovered $0.08 share was paid. $0.12 per share was proposed. 5Onbeen On 31 October 2012 a bonus of shares offlexible 1 for 4goods held was made. The final directors decided to keep the reserves inwas their most form. declared bankrupt. Itissue was also that in inventory at the year end, with $0.12 a cost ofshare $3000, been water damaged and could now only be sold for $600. per washad proposed. $0.12 per share was proposed. decided keep the reserves in theirwas most flexible and form.could with cost ofto$3000, had been water damaged now only be sold for a$600. On 5a 31 December 2012 $40 000 transferred to general reserve and final dividend of 7675 On January 2013 it was discovered that a customer who owed $4200 at the year end On 31 October 2012 a bonus issue of shares of who 1 to forwho every 4had held was made. The directors On 5 January 2013 it was discovered that a customer had owed $4200 at the year end 7 On 5 January 2013 it was discovered that a customer had owed $4200 at the year end 6 On 31 December 2012 $40 000 was transferred general reserve and a final dividend of! $0.12 per share was proposed. 8 had On 17 January 2013itbankrupt. a burglary at the business premises resulted in thedividend loss ofat computer declared Itin was also that goods inventory the end year end, 6decided On 31to December 2012 $40 000 was transferred to general reserve and ain final ofyear On 5been January 2013 was discovered that adiscovered customer who had owed $4200 at keep the reserves their most flexible had been declared bankrupt. was also discovered that goods in inventory at the the year end, had been declared bankrupt. ItItwas also discovered that form. goods in inventory atthe theloss year end, 87 On!31!December!2012,!200000!Ordinary!shares!were!issued!at!$1.8!each.! On 17 January 2013 a burglary at the business premises resulted in of computer $0.12 per share was proposed. equipment, $15 700. per share was proposed. with a$0.12 cost of had been water damaged and could only be sold foryear $600. had been declared bankrupt. It water was also discovered that goods insold inventory at the end, a cost $3000, had been damaged andand could now only be forsold $600. withwith cost ofof$3000, $3000, had been water damaged could nownow only be for $600. $15 700. 7 !equipment, On 5aaJanuary 2013 ithad was discovered that a customer who had owed $4200 at the year end with cost of $3000, been water damaged and could now only be sold for $600. 31 2012 $40 000 was transferred to had general reserve and a final dividend of 7OnOn 5December January 2013 discovered that a customer who owed $4200 at the year end 76 On On 5On January 2013 itit aawas was discovered that apremises customer who had owed the yearend, end had been declared bankrupt. Itatwas also discovered that goods inventory atatthe REQUIRED 17 January 2013 burglary business resulted in thein loss of computer 8REQUIRED 17 January 2013 burglary at the business premises resulted in$4200 the end, loss ofyear computer 8 ! 8On 17 January 2013 aproposed. burglary atthe the business premises resulted in the loss of computer $0.12 per share was had been declared bankrupt. It was also discovered that goods in inventory at the year with a costdeclared of $15 $3000, beenItwater damaged and could now only be sold $600. hadequipment, been was also discovered thatresulted goods in the inventory the year end, 700.bankrupt. 8 equipment, On 17 ahad burglary at the business premises loss for ofatcomputer $15 700. withJanuary a cost of 2013 $3000, had been water damaged and could now only be soldin for $600. equipment, 700. (a) REQUIRED:! Explain what$15 meant keeping reserves in their and mostcould flexible form. with a cost ofis$3000, had been water damaged now only be sold for $600. [3] equipment, 700. by 7 !Explain On 5 January 2013 itby was discovered that customer who had owed $4200 at the year (a) what is meant keeping reserves in a their most flexible form. [3] end REQUIRED 8REQUIRED On burglary business premises loss of computer 8 17 On January 17 January2013 2013 a a burglary at at thethe business premises resulted resulted in the loss in of the computer REQUIRED hadequipment, been declared bankrupt. It was also discovered that goods in inventory at the year end, $15 700. a burglary at the business premises resulted in the loss of computer equipment, $15 8REQUIRED On Explain 17 January 2013 (a) what is700. meant by keeping reserves in their most flexible form. [3] with a cost ofstatement $3000, had been waterindamaged and could now only be sold foryear $600. (b) Prepare the of changes equity for Whittlesford plc for the ended equipment, $15 700. byofkeeping (a) Prepare Explain what is meant reserves in in their flexible form. [3] (b) the statement changes in equity formost Whittlesford plc for the year ended (a) what is meantby bykeeping keeping reserves their most flexible REQUIRED 31 December 2012. [13] [3] (a) Explain Explain what is meant reserves in their most flexible form.form. [3] REQUIRED December 2012. [13] 8 31 On 17 January 2013 a burglary at the business premises resulted in the loss of computer (b) Prepare the statement of changes in equity for Whittlesford plc for the year ended REQUIRED (a) Explain what meant by keeping reserves in their most flexible form. [3] ! equipment, $15is 700. 31 December 2012. [13] (a) meant byofkeeping reserves in their flexible form. (b) Explain Preparewhat the is statement changes in equity for most Whittlesford plc for the year ended [3] (b) the statement changes equity plcorthe for the ended year ended (c) Explain whether the event on 17 January 2013 wasfor an Whittlesford adjusting event a non-adjusting (b) Prepare Prepare the statement ofof changes in in equity for Whittlesford for year (a) Explain what is meant by keeping reserves in was their most flexibleplc form. 31 December 2012. [13] [3] (c) Explain whether the event on 17 January 2013 an adjusting event or a non-adjusting REQUIRED 31 December 2012. event. [2] [13] (b) December Prepare the statement of changes in equity for Whittlesford plc for the year ended 31 2012. [13] (c) Explain whether the event on 17 January 2013 was an adjusting event or a non-adjusting event. [2] 31 December 2012. [13] event. the statement of changes in equity for Whittlesford plc for the [2] year ended (b) Prepare (a) Explain what is meant by keeping reserves in their most flexible form. [3] (c) Explain whether the event of on changes 17 January 2013 was an Whittlesford adjusting event or for a non-adjusting 31 December 2012. [13] (b) Prepare the statement in equity for the year [3] ended OMAIR MASOOD CEDAR COLLEGE (c) Explain whether the event onon 17auditor’s January 2013 was an adjusting eventplc or a non-adjusting (d) State three characteristics of an report. (c) Explain whether the event 17 January 2013 was an adjusting event or a non-adjusting (c) December Explain whether the eventofon January report. 2013 was an adjusting event or a non-adjusting event. [2] [13] (d) State three characteristics an17auditor’s [3] 31 2012. (d) State [3] event. [2] event. [2] event.three characteristics of an auditor’s report. [2] (b) Prepare the statement of changes in equity for Whittlesford plc for the year ended (c) Explain whether the event on 17 January 2013 was an adjusting event or a non-adjusting 31 December 2012. (d) Explain State three characteristics of on an auditor’s report. [3] [13] (c) whether the event 17 January 2013 was an adjusting event or [3] a non-adjusting (d) State three characteristics of an an auditor’s report. (d) event. State three characteristics of auditor’s report. [3] [2] 225 2 2 1 1 1 ! The directors of Aston plc provided the following 2 financial information at 1 June 2013. Q3.! The directors of Aston plc provided the following financial information at 1 June 2013. $000 $000 Ordinary shareofcapital shares) the following 25 000 The directors Aston ($1 plc provided financial information at 1 June 2013. Ordinary share capital ($1 shares) 25 000 Share premium 5$000 000 Share premium 5 000 Revaluation reserve 000 Ordinary share capital ($1 shares) 251 000 Revaluation reserve 1 000 Retained earnings 950 Share premium 52 000 Retained earnings 2 950 Revaluation reserve 1 000 Retained earnings 26 950 Land 000 Land 6 000 Land 6 000 issued. On 1 July 2013 $1 800 000 8% debentures were 800May 0002014 8% debentures were issued. On the 1 July 2013 $1 31 For year ended profit from operations was $3 752 000. 000 8% debentures were issued. On 1tax July 2013 $1 800 For the year ended 31year May 2014 profit from operations was $3 752 000. The charge for the was 25% of the profit before taxation. For the ended operations was taxation. $3 752 000. The taxyear charge for 31 theMay year2014 wasprofit 25%from of the profit before The tax charge for the year was 25% of the profit before taxation. REQUIRED REQUIRED REQUIRED (a) Prepare the income statement for the year ended 31 May 2014. [6] (a) Prepare the income statement for the year ended 31 May 2014. [6] (a) Prepare the income statement for the year ended 31 May 2014. [6] ! Additional information Additional information Additional information On 1 September 2013 a final dividend relating to the previous year of $0.04 per ordinary share was paid. On 1 September 2013a afinal finaldividend dividend relating to the previous of $0.04 per ordinary On 1 September 2013 relating to the previous yearyear of $0.04 per ordinary shareshare was paid. was1 paid. On October 2013, 5 000 000 ordinary shares of $1 each were issued at a premium of $0.10 per share. 000 000ordinary ordinary shares of $1 each were issued a premium of $0.10 On 1 October October2013, 2013,55000 000 shares of $1 each were issued at a at premium of $0.10 per per share. share. On 1 November 2013 a rights issue was made of 1 ordinary share for every 5 ordinary shares at $1 per share. This was fully subscribed. ! owned was made of 1ofordinary share for every 5 ordinary shares On 1 November November2013 2013a arights rightsissue issue was made 1 ordinary share for every 5 ordinary shares ! owned at share. This was fully subscribed. owned at $1 $1per per share. fully subscribed. On 1 February 2014 landThis was was revalued at $7 500 000. 500500 000. On 1 February 2014 land was at at $7$7 On February2014 2014an land wasrevalued revalued On 11February interim dividend of $0.03 per000. ordinary share was paid. On 1 February 2014 an dividend of $0.03 perper ordinary share was was paid.paid. On February 2014 aninterim interim dividend $0.03 ordinary share 000 of was made from retained earnings to a newly formed On 11 March 2014 a transfer of $500 general reserve. On 1 March 2014 a transfer of $500 000 was made from retained earnings to a newly formed On 1 March 2014 a transfer of $500 000 was made from retained earnings to a newly formed general reserve. On 1 April 2014 the directors proposed a final dividend for the year 50% higher per share than general reserve. the year.the directors proposed a final dividend for the year 50% higher per share than On previous 1 April 2014 ! On 1 April 2014 the previous year. the directors proposed a final dividend for the year 50% higher per share than the previous year. ! (b)!Prepare!a!statement!of!changes!in!equity! ! ! ! ! ! ! ! ! ! ! ! ! © UCLES 9706/42/O/N/14 ! 2014 © UCLES 2014 9706/42/O/N/14 ! ! © UCLES 2014 9706/42/O/N/14 ! ! ! OMAIR MASOOD CEDAR COLLEGE 226 ! Q4.! ! 2 6 The directors of Rebuild Limited are preparing the financial statements for the year ended 31 December 2015. The equity section of the statement of financial position at 31 December 2014 was as follows: Ordinary shares of $2 each, fully paid Share premium General reserve Retained earnings $ 240 000 8 000 40 000 75 500 363 500 During the year ended 31 December 2015, the following transactions took place: March 1 Issued 10 000 ordinary shares at $2.10 each March 31 Paid final dividend of 3% on all shares in issue at 31 December 2014 December 31 The directors revalued the company premises upwards by $20 000 The profit for the year ended 31 December 2015 was $47 100. REQUIRED (a) Prepare the statement of changes in equity for the year ended 31 December 2015. ! ! ! [5] © UCLES 2016 OMAIR MASOOD 9706/22/O/N/16 CEDAR COLLEGE 227 ACCOUNTS FOR LIMITED COMPANIES ( WORKSHEET 2) Q1. Q5. Following balances are available for Champions Limited as at 1st January 2014. $ Share Capital ($1) 200000 Share Premium 20000 Revaluation Reserve 5000 General Reserve 6000 Retained Earnings 34000 10% Debentures 50000 Additional Information 1. During the year ending 31st December 2014 the company’s operating profit ( Net profit before interest and tax ) was $50000. The corporation tax applicable is 20%. 2. On 31st March 2014 a dividend of $0.05 per share was paid to shareholders ( This was announced in 2013). 3. On 1st July 2014 , 30000 new shares of $1 were issued at $1.4 each. 4. On 1st Oct 2014, a dividend of $0.03 per share was paid to all shareholders. 5. On 31st December 2014, directors decided to transfer $3000 to General Reserve. 6. On 31st December 2014, Company’s Land was revalued upwards from $19000 to $28000. 7. On 31st December 2014 , directors announced a dividend of $0.1 per share. REQUIRED: (a) A statement to show Net profit after Tax ( Income Statement) (b) A statement of Changes in Owner’s Equity . OMAIR MASOOD CEDAR COLLEGE 228 Q2. Q6. Following balances are available for Magnum Limited as at 1st January 2014. $ Share Capital ($5) 300000 Share Premium 15000 Revaluation Reserve General Reserve 10000 Retained Earnings 90000 10% Debentures 30000 Additional Information • During the year ending 31st December 2014 the company’s operating profit ( Net profit before interest and tax ) was $80000. The corporation tax applicable is 30%. • On 31st March 2014 a dividend of 10 percent was paid to shareholders ( This was announced in 2013). • On 1st July 2014 , 10000 new shares of $5 were issued at $9 each. • On 1st Oct 2014, a dividend of $0.2 per share was paid to all shareholders. • On 31st December 2014, directors decided to transfer $5000 to General Reserve. • On 31st December 2014, Company’s Land was revalued upwards from $19000 to $25000. • On 31st December 2014 , directors announced a dividend of $0.5 per share. REQUIRED: (a)A statement to show Net profit after Tax ( Income Statement) (b) A statement of Changes in Owner’s Equity . OMAIR MASOOD CEDAR COLLEGE 229 ACCOUNTS FOR LIMITED COMPANIES ( WORKSHEET 3) Q1. Q7. ACCOUNTS FOR LIMITED COMPANIES ( WORKSHEET 3) Following balances are available for Kings Limited as at 1st January 2014. Q1. $ for Kings Limited as at 1st January 2014. Following balances are available $ Share Capital ($1) 500000 Share ($1) ShareCapital Premium 500000 120000 Share Premium Revaluation Reserve 120000 15000 Revaluation Reserve General Reserve 15000 6000 General Reserve Retained Earnings 6000 134000 Retained Earnings 10% Debentures 134000 100000 10% Debentures Additional Information 100000 1. During the year ending 31st December 2014 the company’s operating profit ( Net Additional Information profit before interest ) was $250000. Thecompany’s corporation tax applicable 20%. 1. During the year endingand 31sttax December 2014 the operating profit ( isNet st 2. profit On 31before March 2014 a dividend of $0.05 per share was paid to shareholders ( This interest and tax ) was $250000. The corporation tax applicable is 20%. was announced in 2013). st 2. On 31 March 2014 a dividend of $0.05 per share was paid to shareholders ( This 3. was On announced 1st July 2014in 12013). for 5 Bonus Issue was announced. On11ststJuly Sept2014 201411for for54Bonus RightsIssue issuewas wasannounced. announced at $1.4 per share 3.4. On st 5. On 1 st Oct 2014, a dividend of $0.03 per share was paid to all shareholders. 4. On 1 Sept 2014 1 for 4 Rights issue was announced at $1.4 per share st On131 December 2014, directors decided to transfer General Reserve. st 5.6. On Oct 2014, a dividend of $0.03 per share was paid$3000 to all to shareholders. st On31 31st December December2014, 2014,directors Company’s Land was revalued upwards from $19000 to 6.7. On decided to transfer $3000 to General Reserve. $28000. st 7. On 31 December 2014, Company’s Land was revalued upwards from $19000 to 8. $28000. On 31st December 2014 , directors announced a dividend of $0.1 per share. REQUIRED: 8. On 31st December 2014 , directors announced a dividend of $0.1 per share. (a) A statement to show Net profit after Tax ( Income Statement) REQUIRED: (b) AAstatement statementto ofshow Changes in Owner’s Equity . (a) Net profit after Tax ( Income Statement) Q2.$(b) A statement of Changes in Owner’s Equity . Following balances are available for United Limited as at 1st January 2014. Q2.$ Q8. ! Following balances are available for United Limited as at 1st January 2014. $ ! $ Share Capital ($5) 400000 Share ($5) ShareCapital Premium 400000 20000 Share Premium Revaluation Reserve 20000 25000 Revaluation Reserve General Reserve 25000 12000 General Reserve Retained Earnings 12000 125000 Retained Earnings 125000 ! Additional Information ! 1. During the year ending 31st December 2014 the company’s net profit after tax was Additional Information $120000.! 1. During the year ending 31st December 2014 the company’s net profit after tax was 2. On!1st!March!2014!a!1!for!2!Rights!issue!was!announced!at!$7!each.! $120000.! ! 2. On!1stst!March!2014!a!1!for!2!Rights!issue!was!announced!at!$7!each.! 3. On!1 !November!2014!A!dividend!of!$0.6!per!share!was!paid!to!all!shareholders.! ! ! 3. On!1st!November!2014!A!dividend!of!$0.6!per!share!was!paid!to!all!shareholders.! 4. !On!1st!December!2014!Land!was!revalued!upwards!by!$20000.! !! st 4.5. !On!1 st!December!2014!a!1!for!3!Bonus!issue!was!announced.! On!31!December!2014!Land!was!revalued!upwards!by!$20000.! ! REQUIRED$ st 5. On!31 !December!2014!a!1!for!3!Bonus!issue!was!announced.! (a) A!statement!of!Changes!in!Equity! REQUIRED$ (a) A!statement!of!Changes!in!Equity! OMAIR MASOOD CEDAR COLLEGE 230 Q3.! $ Q3.! Q9. $Following balances are available for Qalandars Limited as at 1st January 2014. Following balances are available for Qalandars Limited as at 1st January 2014. ! ! $ $ Share Capital ($0.5) 60000 Share Capital ($0.5) 60000 Share Premium 10000 Share Premium 10000 Revaluation Reserve Revaluation Reserve General Reserve 13000 General Reserve 13000 Retained Earnings 160000 Retained Earnings 160000 ! !Additional Information Additional Information 1. During the year ending 31st December 2014 the company’s net profit after tax was 1. During the year ending 31st December 2014 the company’s net profit after tax was $80000.! 2. $80000.! On!1st!March!2014!a!!1!for!5!Bonus!issue!was!announced.! st!March!2014!a!!1!for!5!Bonus!issue!was!announced.! ! 2. On!1 3. !On!1st!November!2014!A!dividend!of!$0.02!per!share!was!paid!to!all!shareholders.! ! 3. On!1st!November!2014!A!dividend!of!$0.02!per!share!was!paid!to!all!shareholders.! 4. !On!1st!December!2014!Land!was!revalued!upwards!by!$10000.! ! ! 4. !On!1st!December!2014!Land!was!revalued!upwards!by!$10000.! 5. On!31st!December!2014!a!1!for!3!Rights!issue!was!announced!at!$0.9!each! ! REQUIRED$ 5. On!31st!December!2014!a!1!for!3!Rights!issue!was!announced!at!$0.9!each! REQUIRED$ A!statement!of!Changes!in!Equity! ! A!statement!of!Changes!in!Equity! !! !Q4! Q10. Q4! $ $Following balances are available for Zalmis Limited as at 1st January 2014. Following balances are available for Zalmis Limited as at 1st January 2014. ! ! $ $ Share Capital ($1) 80000 Share Capital ($1) 80000 Share Premium 10000 Share Premium 10000 Revaluation Reserve 6000 Revaluation Reserve 6000 Retained Earnings 60000 Retained Earnings 60000 ! !Additional Information Additional Information 1. During the year ending 31st December 2014 the company’s net profit after tax was 1. During the year ending 31st December 2014 the company’s net profit after tax was $30000.! 2. $30000.! On!1st!March!2014!a!!1!for!2!Bonus!issue!was!announced.! st!March!2014!a!!1!for!2!Bonus!issue!was!announced.! 2. On!1 ! 3. !On!1st!April!2014!a!1!for!4!Rights!issue!was!announced!at!a!premium!of!$0.4!each! 3. On!1st!April!2014!a!1!for!4!Rights!issue!was!announced!at!a!premium!of!$0.4!each! ! !! ! 4. On!31st!December!2014!a!dividend!of!!4%!was!paid!to!all!shareholders.! 4. On!31st!December!2014!a!dividend!of!!4%!was!paid!to!all!shareholders.! REQUIRED$ REQUIRED$ A!statement!of!Changes!in!Equity! ! A!statement!of!Changes!in!Equity! !! !! !! !! ! OMAIR MASOOD CEDAR COLLEGE 231 ACCOUNTS(FOR(LIMITED(COMPANIES(((WS(4)( 6 Q1.( Q11. 2 The following is an extract from the statement of financial position of WX Limited at 1 March 2016: Equity Ordinary share capital ($0.50 each) Share premium account Retained earnings $ 150 000 60 000 40 000 The following additional information is available: 1 On 30 April 2016, the non-current assets were revalued from their net book value of $175 000 to $225 000. 2 On 30 June 2016, a bonus issue was made on the basis of three ordinary shares for every ten held. Reserves were kept in the most distributable form. 3 On 30 September 2016, a rights issue was offered on the basis of one ordinary share for every eight held. The ordinary shares were offered at a price of $0.80 per share and the issue was fully subscribed. 4 On 31 December 2016, the company paid a dividend of $0.04 on all shares in issue at that date. 5 Profit for the year ended 28 February 2017 was $50 500. REQUIRED (a) Prepare a statement of changes in equity for the year ended 28 February 2017 (A total column is not required.) WX Limited Statement of Changes in Equity for the year ended 28 February 2017 ( © UCLES 2017 ( ( OMAIR MASOOD Share capital Share premium Retained earnings Revaluation reserve $ $ $ $ ( 9706/23/M/J/17 CEDAR COLLEGE 232 13 Q2.( Additional information ( Q12. On 1 January 2017 the issued share capital of S Limited consists of ordinary shares of $0.40 each. The following information is available for the year ended 31 December 2017: 1 On 1 April 2017 the company issued a 6% debenture of $300 000. 2 On 1 May 2017 the company paid a final dividend of $0.04 per ordinary share. 3 On 1 October 2017 the company made a rights issue of 1 ordinary share for every 4 held. The shares were offered at a 20% discount on the market price of $1.45. The rights issue was fully subscribed. 4 On 15 October 2017 the company paid an interim dividend of $0.015 per share to the shareholders who were on the share register at 1 August 2017. 5 The company’s profit from operations for the year was $268 500. REQUIRED (b) Prepare the statement of changes in equity for the year ended 31 December 2017. S Limited Statement of changes in equity for the year ended 31 December 2017 Ordinary share capital $ Brought forward at 1 January 2017 1 250 000 Share premium General reserve Retained earnings $ $ $ – 130 000 65 000 Total $ 1 445 000 Workings: ( ( ( ( © UCLES 2018 ( ( ( ( ( ( ( OMAIR MASOOD ( [6] 9706/22/O/N/18 CEDAR COLLEGE [Turn over 233 Q3( (Q13. 3 8 The following is an extract from the statement of financial position of Chopin Limited at 30 June 2015: Non-current assets Ordinary shares of $0.25 each Share premium Retained earnings $ 750 000 300 000 20 000 635 210 During the year ended 30 June 2016, the following took place: 1 November 2015 Non-current assets were revalued to $1 000 000. 1 January 2016 A bonus issue of shares was made. The terms of the issue were 1 new share for every 10 shares in existence. Reserves were maintained in the most flexible form. 1 April 2016 Dividend of $0.02 per share was paid. Profit for the year ended 30 June 2016 was $230 809. REQUIRED (a) Prepare a statement of changes in equity for the year ended 30 June 2016. ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( © UCLES ( 2016 ( ( ( ( OMAIR MASOOD ( [7] 9706/21/O/N/16 CEDAR COLLEGE 234 Q4.( Q14. 1 2 Bayliss Limited is a retailer of ladies’ fashion material. The following trial balance has been extracted from the books of account at 31 December 2015: Dr $ 5% debentures (2017) Administrative expenses Cash and cash equivalents Distribution costs Dividends paid General reserve Interest paid Inventory at 1 January 2015 Non-current assets at cost / valuation Land and buildings Plant and machinery Provision for depreciation Buildings Plant and machinery Ordinary shares of $0.50 each fully paid Other payables Other receivables Purchases Retained earnings Revenue Share premium Trade payables Trade receivables Cr $ 80 000 205 000 32 000 197 000 10 000 21 000 13 000 98 000 185 000 204 000 23 000 94 000 140 000 7 000 3 000 480 000 61 000 984 000 3 000 59 000 109 000 1 504 000 1 504 000 Additional information 1 Inventory at 31 December 2015 is valued at a cost of $105 000. 2 Land is included in the trial balance at a value of $135 000. It is to be revalued to $150 000 at 31 December 2015. 3 Depreciation for the year ended 31 December 2015 is to be provided as follows: Buildings – 2% per annum using the straight-line method Plant and machinery – 10% per annum using the reducing balance method. All annual depreciation is to be charged to administrative expenses. 4 Trade receivables includes a debt of $9000 which is to be written off to administrative expenses at 31 December 2015. 5 The directors wish to make provision for doubtful debts of 3% of trade receivables. The adjustment should be charged to administrative expenses. 6 On 31 December 2015, Bayliss Limited made a bonus issue of shares on the basis of one ordinary share for every twenty ordinary shares held. The company policy is to leave reserves in their most flexible form. No entries have been made in the books of account in respect of the bonus issue. 7 Debenture interest has been paid to 30 September 2015. 3 ( REQUIRED © UCLES 2016 9706/21/M/J/16 (a) Prepare the income statement for Bayliss Limited 4for the year ended 31 December 2015. (b) Prepare the statement of changes in equity for Bayliss Limited for the year ended 31 December 2015. 5 ( ( Bayliss Limited (c) Prepare the statement of financial position for Bayliss Limited at 31 December 2015. Statement of changes in equity for the year ended 31 December 2015 OMAIR Share capital MASOOD $000 Balance at 1 January 2015 Share premium $000 CEDAR Revaluation reserve General reserve $000 $000 COLLEGE Retained earnings $000 ( Total $000 235 ACCOUNTS(FOR(LIMITED(COMPANIES((WORKSHEET(5)( ! Q1.! Q15. The trial balance of BLT Limited at 31 December 2006 appeared as follows:! $ $ Ordinary share capital $0.50 each 400,000 Share premium 300,000 8% Debentures 25,000 116,350 199,500 Returns 1,995 1,160 Carriage in 5,800 Discounts 1,250 Purchases and Sales Selling Distribution expenses 10,500 Administrative expenses 18,000 Interest paid 2,000 Premises 300,000 Equipment 100,000 Motor vehicles at cost 50,000 Inventory – 1 January 2006 28,500 Trade Receivables and Trade Payables 45,000 Short-term investment – Bank deposit 245,000 Cash at bank 1,750 35,000 38,015 The following adjustments are to be needed: (i) Inventory at 31 December 2006 was $49,500. (ii) Accrued Selling expenses $1,500 &prepaid Administrative expenses $1,000. (iii) Depreciation on equipment 10% and Motor vehicle 20% (both to be charged to administrative expenses) (iv) A provision for corporate taxes is to be made at 35%. (v) Transfer to General Reserve $5,000. (vi) At 31st December 2006 1 for 4 Bonus issue was announced REQUIRED: (a) Draw up an Income Statement and the Statement of Changes in Equity (for the year ended 31 December 2006. (b) Draw up a Statement of Financial position as at 31 December 2006 OMAIR MASOOD CEDAR COLLEGE 236 Q2.! Q3( ! Q16. 1 1 2016 Mar P22 2 2016 Mar P22 The trial balance of Seema Limited for the 2year ended 30 June 2015 shows these figures: Debit2015 shows theseCredit The trial balance of Seema Limited for the year ended 30 June figures: $ $ Debit $ Revenue Purchases Revenue at 1 July 2014 Inventory Purchases Selling and distribution expenses Inventory at 1 July 2014 Administrative expenses Selling and distribution expenses Provision for doubtful debts Administrative expenses Interest paid Provision for doubtful debts Non-current Interest paid assets at cost Warehouse buildings Non-current assets at cost Motor vehicles Warehouse buildings Office equipment Motor vehicles Office for equipment Provision depreciation Provision for depreciation Warehouse buildings Warehouse buildings Motor vehicles Motor vehicles Office equipment Office equipment Trade receivables Trade receivables Trade payables Trade payables Cash and cash equivalents Cash and cash equivalents 140 000 Ordinary sharesofof each $1$1 each 140 000 Ordinary shares 5% (2021– –2025) 2025) 5% Debentures Debentures (2021 General reserve General reserve Retained earnings Retained earnings Interim ordinary paid Interim ordinarydividends dividends paid Credit $ 526 000 342 000 37 500 342 000 37 510 37 500 36 130 37 510 36 130 526 000 125 625 125 625 300 000 70 000 300 000 25 000 70 000 25 000 12 000 12 00012 500 12 500 1 500 1 500 5 020 5 020 27 200 27 200 8 4008 400 889 385 889 385 6 270 6 270 140 000 140 000 25 00025 000 25 00025 000 140 990 140 990 889 385 889 385 ( Additional information Additional information 1 1 2 2 Inventory on 30 June 2015 was valued at $29 400. Inventory on 30 June 2015 was valued at $29 400. Depreciation is to be charged as follows: Depreciation is to be charged as follows: Warehouse buildings Warehouse Motor vehiclesbuildings Office Motorequipment vehicles Office equipment 4% using straight line method 4% using straight method 25% using straight lineline method 10% using reducing balance method. 25% using straight line method 10% using reducing balance method. 3 The provision for doubtful debts is to be maintained at 5% of the trade receivables. 3 The provision for doubtful debts is to be maintained at 5% of the trade receivables. 4 An irrecoverable debt of $200 should be written off. 56 to per the share. general reserve. The directorshave haveproposed decidedatofinal transfer $25 The directors dividend of000 $0.07 67 The directors have a final dividend of $0.07 per share. The debentures wereproposed issued in 2011. 78 The motor vehicles wereissued used by sales team. The debentures were inthe 2011. 8 The motor vehicles were used by the sales team. 4 5 An irrecoverable debt of $200 should be written off. The directors have decided to transfer $25 000 to the general reserve. ( ( Required:( © UCLES 2016 9706/22/F/M/16 (a) Income(Statement( (b) Statement(of(Changes(in(Equity( © UCLES 2016 9706/22/F/M/16 (c) Statement(of(Financial(Position( ( CEDAR COLLEGE ( ! CEDAR COLLEGE ! OMAIR MASOOD ! CEDAR COLLEGE ( Page 1 ! Page 1 237 30DAY&REVISION&CHALLENGE&&(DAY&16)& ! & Company<&(ISSUE&OF&SHARES&WITH&APPLICATIONS)& & LIMITED COMPANIES (ISSUE OF SHARES WITH APPLICATION) PAPER&2&QUESTIONS! & Q1.& Following!Information!is!available!for!Gucci!Ltd!as!at!1st!January! 2019.! ! ! $& $1!Ordinary!Share!Capital! 90000! Share!Premium! 18000! Balance!at!Bank! 30000!Debit! ! ! On!1st!January!it!was!decided!to!issue!40000!new!ordinary!shares!of! $1!each!at!$1.4!each.!!The!shareholders!were!required!to!pay!in! following!two!installments!! ! !$0.6!on!application! $0.8!on!allotment!and!final!call.! ! The!issue!of!shares!was!oversubscribed!and!the!company!received! applications!for!!55000!shares.! ! At!the!time!of!allotment,!transfers!were!made!to!the!share!capital! account!and!the!share!premium!account!and!monies!were!returned! to!the!unsuccessful!applicants! ! Required:& Prepare!the!following!ledger!accounts!to!show!the!aboveRmentioned! transactions! ! (a) Application!for!Share!Account!(!Share!Issue!Holding! Account)! (b) Bank!Account! (c) Ordinary!Share!Capital!Account! (d) Share!Premium!Account! ! ! ! OMAIR MASOOD CEDAR COLLEGE 238 ! Q2.! Following!Information!is!available!for!Zenga!Ltd!as!at!1st!January! 2019.! ! ! $& $5!Ordinary!Share!Capital! 150000! Share!Premium! 30000! Balance!at!Bank! 4500!Debit! ! ! On!1st!January!it!was!decided!to!issue!10000!new!ordinary!shares!of! $5!each!at!$7!each.!!The!shareholders!were!required!to!pay!in! following!two!installments!! ! !$4!on!application! $3!on!allotment!and!final!call.! ! The!issue!of!shares!was!oversubscribed!and!the!company!received! applications!for!!15000!shares.! ! At!the!time!of!allotment,!transfers!were!made!to!the!share!capital! account!and!the!share!premium!account!and!monies!were!returned! to!the!unsuccessful!applicants! ! Required:& Prepare!the!following!ledger!accounts!to!show!the!aboveRmentioned! transactions! ! (a) Application!for!Share!Account!(!Share!Issue!Holding! Account)! (b) Bank!Account! (c) Ordinary!Share!Capital!Account! (d) Share!Premium!Account! ! ! ! ! ! ! ! ! ! OMAIR MASOOD ! CEDAR COLLEGE 239 ! Q3.! Following!Information!is!available!for!Prada!Ltd!as!at!1st!January! 2019.! ! ! $& $0.5!Ordinary!Share!Capital! 200000! Share!Premium! 40000! Balance!at!Bank! 2000!Credit! ! ! On!1st!January!it!was!decided!to!issue!50000!new!ordinary!shares!of! $0.5!each!at!$1.3!each.!!The!shareholders!were!required!to!pay!in! following!two!installments!! ! !$0.9!on!application! $0.4!on!allotment!and!final!call.! ! The!issue!of!shares!was!oversubscribed!and!the!company!received! applications!for!!75000!shares.! ! At!the!time!of!allotment,!transfers!were!made!to!the!share!capital! account!and!the!share!premium!account!and!monies!were!returned! to!the!unsuccessful!applicants! ! Required:& Prepare!the!following!ledger!accounts!to!show!the!aboveRmentioned! transactions! ! (a) Application!for!Share!Account!(!Share!Issue!Holding! Account)! (b) Bank!Account! (c) Ordinary!Share!Capital!Account! (d) Share!Premium!Account! ! ! ! ! ! ! ! ! ! OMAIR MASOOD ! CEDAR COLLEGE 240 ! Q4.! Following!Information!is!available!for!Tory!Ltd!as!at!1st!January!2019.! ! ! $& $1!Ordinary!Share!Capital! 600000! Share!Premium! 200000! Retained!Earnings! 500000! ! ! On!1st!January!it!was!decided!to!issue!80000!new!ordinary!shares!of! $1!each!at!$2.4!each.!!The!shareholders!were!required!to!pay!in! following!three!installments!! ! !$0.9!on!application! $1!on!allotment!! $0.5!!on!Final!Call! ! The!issue!of!shares!was!oversubscribed!and!the!company!received! applications!for!!95000!shares.! ! At!the!time!of!allotment,!transfers!were!made!to!the!share!capital! account!and!the!share!premium!account!and!monies!were!returned! to!the!unsuccessful!applicants! ! Required:& Prepare!the!following!ledger!accounts!to!show!the!aboveRmentioned! transactions! ! (a) Application!for!Share!Account!(!Share!Issue!Holding! Account)! (b) Bank!Account! (c) Ordinary!Share!Capital!Account! (d) Share!Premium!Account! ! ! ! ! ! ! ! ! ! OMAIR MASOOD ! CEDAR COLLEGE 241 ! D $120 000 Structured questions Q5.! 1 At 1 April 2015, Morecap Limited had the following share capital and reserves: On 1 April 2015 it invites applications from the public for an issue of 100 000 ordinary shares to be issued at $1.50 each. The terms of the issue are as follows: • 1 May 2015: a payment of $1.00 per share to include the full share premium • 1 July 2015: a payment of $0.25 per share • 1 August 2015: a final payment of $0.25 per share. Additional information 1 On 1 May 2015, applications were received for 120 000 shares. 2 On 1 June 2015, unsuccessful applicants were refunded in full the money they had paid. 3 On 1 July 2015, the successful applicants paid the next instalment due. 4 On 1 August 2015, the successful applicants paid the final amount due. Required a Prepare the relevant ledger accounts (including an extract from the bank account) to record these transactions. [7 marks] b Explain the difference between an ordinary share and a debenture. [3 marks] ! Additional information The company’s year end is 31 March 2016. During the year ended 31 March 2016, the following took place: • On 1 January 2016, the company paid an interim dividend of $0.10 on all ordinary shares issued at that date. • Profit for the year ended 31 March 2016 was $180 000. Required c Prepare the statement of changes in equity for the year ended 31 March 2016. [5 marks] Total: 15 ! 2! Pecnut Limited’s trial balance at 31 March 2016 was as follows: OMAIR MASOOD ! CEDAR COLLEGE ! 242 INCOMPLETE!RECORDS:! INCOMPLETE RECORDS THEORY ( Remember(Net(profit(can(be(calculated(using(the(following(formula.(If(a(question(says(make(a(trading( profit(and(loss(account,(than(this(doesn’t(apply.(Only(when(it(says(to(calculate(net(profit(or(make(a( statement(showing(net(profit.( ( ( Opening(Capital(+(Additional(Capital(+(Net(profit(–(Drawings(=(Closing(Capital( ( (I(really(hope(you(can(solve(for(net(profit),(don’t(memorize(the(formula,(it’s(the(equity(section.(!( ( For(the(final(account(questions((where(the(income(statement(and(statement(of(financial(postion(is( required),(always(make(the(following(accounts.((By(always,(I(mean(always).( ( 1. Sales(ledger(control(account((If(business(only(deals(in(cash(sales,(then(don’t)( 2. Purchase(ledger(control(account( 3. Bank(account((if(it(is(already(given(in(the(question,(then(it’s(okay)( 4. Cash(account((only(make(this(when(the(question(gives(cash(balances)( ( Once(you(have(filled(in(your(accounts,(and(then(move(to(the(Final(accounts.(Don’t(panic(if(it(doesn’t( balance,(because(marks(are(for(working.(Don’t(spend(your(entire(lifetime(on(this(question.( ( NEVER!NEVER!NEVER!forget(depreciation.(They(will(usually(give(you(net(book(values(at(start(and(end.( Depreciation(=(( ( ( Opening!NBV!+!Purchase!of!assets!–!Sale!of!assets!(at!NBV)!–!Closing!NBV! ! Also(make(expense(accounts(or(adjust(for(prepaid(and(owings(directly.(But(show(all(working.( ( In(Equity(by(section,(you(will(need(opening(capital.(This(will(come(from(Opening(Assets(–(Opening( Liabilities.(Don’t(forget(to(include(the(opening(balance(of(the(bank(account(in(your(calculation((like(other( idiots).( ( ( ( ( ( ( ( ( OMAIR MASOOD CEDAR COLLEGE 243 MARGINS!AND!MARKAUPS! ( These(are(tools(used(to(compute(the(missing(figures(of(sales,(figures(or(stocks.(If(either(of(these( percentages(is(given( MARGINS( Represent(Gross(Profit(as(a(percentage(of(selling(price.( ( MARK5UP( Represent(Gross(profit(as(a(percentage(of(cost.(( ( Try(to(use(( Sales(–(Cost(=(Profit( ( If(Mark(up(if(given(Profit(is(a(%(of(Cost(and(IF(margin(is(given(Profit(is(a(%(of(Sales( ( For(eg.( ( Sales(=(80000( Cost(=(?( Margin(=(25%( ( Sales(–(Cost(=(Profit( 800005(x(=(25(%(of(80000( ( Cost(=(60000( ( But(if((( Sales(=(80000( Cost(=(?( Markup(=25%( ( Sales(–(Cost(=(Profit( 800005(x(=(25(%(of(X( ( Cost(=(64000( ( ( ( ( ( ( OMAIR MASOOD CEDAR COLLEGE 244 INCOMPLETE RECORDS WORKSHEET INCOMPLETE RECORDS (BASICS) ( WS 1) Q1. Karen Gate owns small shop. Karen pays the takings into the business bank account. Karen operates a manual system of accounts. The following is a summary of the bank account for the year ended 28 February 2006. Bank account summary for the year ended 28 February 2006 $ $ Trade Receivables 60,000 Balance b/d Cash sales 25,000 Rent 8,000 Rates Capital 5,000 6,300 4,100 20,000 Wages 9,700 General expenses 32,000 Trade Payables 3,500 Fixtures 15,000 Drawings The following information is also available: (i) Karen allowed her customers discounts of $1,000 during the year ended 28 February 2006. (ii) Discounts received from suppliers for the year ended 28 February 2006 were $700. (iii) Karen had taken goods at the cost price of $2,000 for her own personal use. (iv) In addition to the items listed above, Karen’s assets and liabilities were as follows. 28 February 1 March 2005 2006 $ $ Trade Receivables 26,000 Inventory at cost 18,000 Rent prepaid 1,000 General expenses owing Trade Payables Fixtures 900 18,000 6,000 Cash in Hand 300 30,000 16,000 1,200 1,300 20,000 8,000 500 REQUIRED: (a) The Income Statement(Trading and Profit and Loss Account) for the year ended 28 February 2006. (b) The Statement of Financial position(Balance Sheet) as at 28 February 2006. OMAIR MASOOD CEDAR COLLEGE 245 Q2.Simon Locke commenced business several years ago selling computer games. Simon has always relied on records of receipts and payments for assessing the progress of his business. He prepared the following receipts and payments details for the year ended 31st December 2005. $ $ Balance b/d 2,500 Cash sales 72,000 Rent 8,000 Rates Trade Receivables Sale of computer 400 32,000 Trade Payables 5,000 13,000 6,000 General expenses 10,000 Wages 12,000 Drawings Computer equipment 2,000 Additional information: (i) The receipts and payments details have been prepared from the business bank account through which all receipts and payments have passed. (ii) Discount allowed to Trade Receivables for the year ended 31st December 2005 were $600. (iii) During the year, Simon took goods at a cost price of $800 from the business for own use. (iv) In addition to the items mentioned above, Simon’s assets and liabilities were as follows: 31st December 2004 $ Inventory at cost 3,200 Trade Receivables 1,200 Trade Payables 1,700 Rent prepaid 600 General expenses owing 500 Wages owing - Computer equipment Cash in hand 1,500 230 31st December 2005 $ 4,600 1,800 2,200 800 300 600 2,500 340 (v) Computer equipment sold had a net book value of $300. (vi) All Cash Sales were banked but $2000 was kept for personal use and $400 was paid for electricity. REQUIRED: (a) The Income Statement(Trading and Profit and Loss Account) for the year ended 31st December 2005. (b) The Statement of Financial position(Balance Sheet) as at 31st December 2005. OMAIR MASOOD CEDAR COLLEGE 246 INCOMPLETE RECORDS ( WORKSHEET 2) Q1. PAGE 266 2 Q3. 1 Iqbal runs a small trading business which has been in operation for several years. Iqbal pays all sales receipts into the business bank account. The following is a summary of the bank account for the year ended 31 March 2011. Bank account summary for the year ended 31 March 2011 Balance b/d Trade receivables Cash sales Capital Loan $ 4 650 85 000 24 000 36 000 14 000 Trade payables Motor expenses Rent Rates Wages Fixtures and fittings $ 37 000 4 100 6 000 2 200 43 000 40 000 Additional information 1 Discounts received from suppliers during the year ended 31 March 2011 were $500. 2 Iqbal allowed his customers discounts of $1400 during the year ended 31 March 2011. 3 Iqbal had taken goods at a cost price of $2400 for his personal use. 4 The loan was received on 1 October 2010 and interest is payable at 10% per annum. 5 The loan is due to be repaid in five years’ time. 6 Iqbal has decided to create a provision for doubtful debts of 3% of the trade receivables outstanding at 31 March 2011. 7 Included in the wages figure in the bank account summary are Iqbal’s drawings of $25 000. The remaining assets and liabilities of Iqbal were: 1 April 2010 $ Inventory at cost 8 000 Fixtures and fittings (Net Book Value) 36 000 Delivery van (Net Book Value) 10 000 Trade receivables 7 200 Trade payables 3 400 Motor expenses owing 300 Rent prepaid 400 Rates owing 200 PAGE 267 Rates prepaid – 3 31 March 2011 $ 9 200 68 000 7 500 8 300 3 700 – 600 – 300 REQUIRED (a) Prepare the income statement (trading and profit and loss account) for Iqbal for the year ended 31 March 2011. PAGE 269 For Examiner’s Use 5 .......................................................................................................................................... (b) Prepare the statement of financial position (balance sheet) for Iqbal at 31 March 2011. For .......................................................................................................................................... Examiner’s .......................................................................................................................................... Use .......................................................................................................................................... © UCLES 2011 .......................................................................................................................................... 9706/21/O/N/11 .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... OMAIR MASOOD CEDAR COLLEGE .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... 247 Q2. PAGE 349 Q4. 2 1 Shaun is a sole trader. He pays all the sales receipts into the business bank account. He provided his accountant with the following information for the year ended 31 December 2011. Bank account summary for the year ended 31 December 2011 Dr. $ Rent received Trade receivables Cash sales Cr. 16 800 203 200 18 510 $ Balance b/d Trade payables General expenses Wages Motor vehicles Equipment Drawings 5 620 122 460 22 000 32 560 19 200 17 400 27 560 Shaun’s remaining assets and liabilities were: 1 January 2011 31 December 2011 $ $ Inventory (at cost) 22 300 17 400 Premises (at cost) 100 000 100 000 PAGE 350 Equipment (net book value) 28 400 27 600 3 Motor vehicles (net book value) 65 000 68 200 Trade receivables 22 400 28 600 REQUIRED Trade payables 17 500 19 470 General expenses prepaid 1 100 900 Rent received prepaid 800 purchased for the year – (a) Calculate the value of Shaun’s sales and ordinary goods Rent received owing 2011. – 1 300 ended 31 December Wages owing 2 400 500 For Examiner's Use Sales (i) Additional information: 1 Shaun allowed his customers discounts of $4000. 2 Discounts received from suppliers were $3100. 3 Shaun has decided to create a provision for doubtful debts of 2% of the trade receivables outstanding at 31 December 2011. 4 General expenses in the bank account summary include an amount of $660 which relates to the payment of Shaun’s private house insurance. Shaun had taken goods at a PAGE cost price 350 of $3700 for his personal use. 5 3 REQUIRED (a) For Examiner's Use Calculate the value of Shaun’s sales and ordinary goods purchased for the year ended 31 December 2011. [4] (i) (ii) © UCLES 2012 Sales PAGE 351 Ordinary goods purchased 9706/23/M/J/12 4 PAGE 352 (b) Prepare Shaun’s income statement for 5 the year ended 31 December 2011. (c) Prepare Shaun's statement of financial position at 31 December 2011. OMAIR MASOOD CEDAR COLLEGE For Examiner's Use For Examiner's Use 248 1 Q3. PAGE 380 Q5. 2 Sharon Woo does not maintain full accounting records but is able to provide the following cash receipts and payments information for the year ended 30 April 2012. Cash receipts Cash sales Receipts from trade debtors Disposal of surplus equipment $ Cash payments 260 000 Payments to credit suppliers 40 000 Equipment 4 800 Wages Drawings Rent $ 216 000 20 000 22 000 48 000 10 000 The following information is also available: 1 Balances 1 May 2011 $ Premises 100 000 Bank 8 000 Trade receivables 26 800 Trade payables 21 200 Equipment 24 000 Rent prepaid 1 200 Inventory 16 800 30 April 2012 $ 100 000 3 200 Cr 24 800 22 400 36 400 1 600 20 800 2 Surplus equipment was sold at a loss of $400 3 The sales figure does not include $18 000 of which Sharon Woo took $6 000 for her own use and the remainder was used to pay wages. 4 Discounts allowed during the year amounted to $7200. 5 381 to $10 800. Discounts received during the yearPAGE amounted 3 REQUIRED PAGE 382 (a) For Examiner's Use Calculate Sharon Woo’s capital at 1 May 2011. 4 (b) Prepare Sharon Woo’s income statement for the year ended 30 April 2012. OMAIR MASOOD © UCLES 2012 CEDAR COLLEGE 9706/22/O/N/12 For Examiner's Use 249 Q4. Q6. 1 2 Patel, a sole trader, does not keep proper books of account. He provided the following information. Land and buildings at cost Fixtures and fittings at valuation Motor vehicles at net book value Trade payables Trade receivables Wages owing Inventory Cash in hand Rent in advance 1 January 2014 $ 50 000 6 000 7 600 16 750 14 670 1 200 21 750 800 1 000 31 December 2014 $ 50 000 4 500 ? 14 900 13 690 1 400 22 450 950 ? Summary of Patel’s bank account for the year showed the following. Receipts $ Balance b/d 16 980 Receipts from credit customers 156 420 Cash sales 20 700 Proceeds from sale of motor vehicle 1 500 ______ 195 600 Payments $ Payments to credit suppliers 109 620 Wages 22 670 Rent 19 000 Electricity 8 650 General expenses 4 750 Purchase of new motor vehicle 16 400 Balance c/d 14 510 195 600 Additional information 1 Before banking his receipts from cash sales Patel took $400 per month for his personal drawings. All other payments were made from the bank. 2 During the year he took goods costing $2600 for his own use. 3 Patel depreciates his vehicles at 20% per annum using the reducing balance method. A full year’s depreciation is charged in the year of purchase. No depreciation is provided in the year of sale. 4 The vehicle sold had a net book value at 1 January 2014 of $2880. 5 A customer has been declared bankrupt and will not pay $750 owing. The amount was included in the trade receivables at 31 December 2014. 6 In addition Patel has decided to create a provision for doubtful debts of 5%. 7 The rent payable is $16 000 per annum. 3 REQUIRED (a) Prepare Patel’s income statement for the year ended 31 December 2014. 4 (b) Prepare Patel’s statement of financial position at 31 December 2014. © UCLES 2015 OMAIR MASOOD 9706/21/M/J/15 CEDAR COLLEGE 250 Q5. 2 Q7. 1 Anton, a sole trader, does not keep proper books of account. He supplies the following information for the year ended 30 September 2015. Office fixtures at net book value Delivery vehicles Cost Accumulated depreciation Trade payables Trade receivables Rent payable owing Cash Inventory Bank 1 October 2014 $ 9 500 30 September 2015 $ 8 600 15 700 4 600 12 670 10 500 1 500 980 24 640 2 400 Credit ? ? 13 460 9 670 2 400 445 40 800 ? Summary of Anton’s bank account is as follows. Bank Account Summary $ Receipts Receipts from credit customers Cash sales banked Sale of delivery vehicle Payments Payments to credit suppliers Wages Rent Electricity General expenses Purchase of delivery vehicle 153 300 12 900 5 400 118 900 17 800 8 500 7 540 4 630 13 600 Additional information 1 The inventory at 30 September 2015 was valued at selling price. Anton applies a mark up of 50%. 2 During the year a delivery vehicle which had cost $9000 on 1 October 2012 was sold for $5400. 3 Delivery vehicles are depreciated at 20% per annum using the reducing balance method. Depreciation is charged in the year of purchase but not in the year of sale. 4 Anton took cash drawings of $600 per month before the cash sales were banked but has not recorded these. He also took goods for his own use which had a sales value of $2763. 5 Total cash sales were $20 476. 6 There are unrecorded delivery vehicle expenses not accounted for. 3 REQUIRED (a) Prepare Anton’s income statement for the year 4ended 30 September 2015. (b) Prepare a statement of financial position at 30 September 2015. © UCLES 2015 OMAIR MASOOD 9706/23/O/N/15 CEDAR COLLEGE 251 Q6. PAGE 70 2 Q8. 1 Suhail is a sole trader who provides the following information. For Examiner's Use Suhail's assets and liabilities, other than bank, were as follows: Premises at cost Fixtures at book value Vehicles at book value Stock Debtors Cash Creditors 1 April 2008 $ 200 000 24 000 30 000 82 150 66 340 510 64 300 31 March 2009 $ 200 000 18 000 22 500 76 500 60 870 510 71 200 There were no purchases or sales of fixed assets during the year ended 31 March 2009. A summary of Suhail's bank statement for the year ended 31 March 2009 is shown below. Dr $ Bank balance at 1 April 2008 Receipts from debtors Payments to creditors Rent and rates Electricity Advertising Wages Sales commission paid Drawings Cr $ 841 030 605 190 12 590 17 145 19 325 65 100 14 250 28 500 Balance $ 61 000 overdrawn 780 030 174 840 162 250 145 105 125 780 60 680 46 430 17 930 Suhail's creditors had allowed him discount of $19 000 during the year. All purchases and sales are on credit. PAGE 71 3 REQUIRED PAGE 72 for the year ended 31 March 2009. (a) Prepare Suhail's trading and profit and loss account 4 For Examiner's Use (b) Prepare Suhail's balance sheet at 31 March 2009. OMAIR MASOOD © UCLES 2009 CEDAR COLLEGE 9706/21/M/J/09 For Examiner's Use 252 1 Jing is a sole trader. He does not maintain full accounting records. All sales and purchases are on credit. He provided the following information for the year ended 30 April 2015. Q7. $ Cheques received from credit customers 96 300 2 Q9. Cheques paid to credit suppliers 73 540 5 500 records. All sales and purchases are 1 Rent Jing paid is a sole trader. He does not maintain full accounting 345 Electricity on credit. paid Carriage inwards 630 He provided the following information for the year ended Carriage outwards 95030 April 2015. 95 Other operating expenses $200 Irrecoverable debts written off Cheques received from credit customers 96 300 Purchases returns 2 480 Cheques paid to credit suppliers 73 540 Rent paid 5 500 Electricity paid 345 Jing had the following assets and liabilities. Carriage inwards 630 Carriage outwards 950 At 30 April 2014 At 30 April 2015 Other operating expenses 95 $ $ Irrecoverable debts written off 200 Equipment ? ? Purchases returns 2 480 Inventory 15 000 11 500 2 250 Trade receivables 3 750 Rent prepaid 500 400 Jing had the following assets and liabilities. 35 40 Electricity owing At 30 April 2014 At 30 April 2015 1 790 Trade payables 3 460 $ $ All equipment was originally purchased for $2700 on 1 May Equipment ? ? 2013. Jing depreciates his equipment using the reducing balance method at a rate of 10% per11annum. Inventory 15 000 500 Trade receivables 3 750 2 250 REQUIRED Rent prepaid 500 400 Electricity owing 35 40 (a) (i) payables Calculate the sales for the year ended 30 April 2015. Trade 3 460 1 790 All equipment was originally purchased for $2700 on 1 May 2013. Jing depreciates his equipment using the reducing balance method at a rate of 10% per annum. REQUIRED (a) (i) Calculate the sales for the year ended 30 April 2015. [2] (ii) Calculate the purchases for the year ended 30 April 2015. 3 (iii) Prepare Jing’s income statement for the year ended 30 April 2015. (ii) Calculate the purchases for the year ended 30 April 2015. Jing Income Statement for the year ended 30 April 2015 [2] [2] © UCLES 2016 9706/22/M/J/16 [2] © UCLES 2016 OMAIR MASOOD 9706/22/M/J/16 CEDAR COLLEGE 253 8. quired: PAGE 106 Q10. 1 2 The following is a summary of Harry's balance sheet at 30 April 2008. $000 Assets Fixed assets Q8. Furniture and equipment at net book value 1 Current assets Stock Debtors Cash Total assets For Examiner's Use $000 PAGE 106 2 208 The following is a summary of Harry's balance sheet at 30 April 2008. Assets Fixed assets Furniture and equipment at net book value 1500 610 6 Current assets Stock Debtors Cash Total assets Equity and liabilities Equity Owner's capital $000 $000 2116 2324 1500 610 61096 Current liabilities Equity and liabilities Creditors for Equity supplies capital Creditors for Owner's expenses Bank overdraft 920 98 210 Current liabilities Creditors for supplies Creditors for expenses Bank overdraft For Examiner's Use 208 2116 2324 1096 1228 2324 920 98 210 1228 2324 The following information is available for the year ended 30 April 2009: $000 1 Amount paid into bank 2950 The following information is available for the year ended 30 April 2009: (This included $50 000 from the sale of furniture and equipment $000 which had a net 1book value of into $48bank 000.) Amount paid 2950 (This included $50 000 from the sale of furniture and equipment which had net book valuefor of $48 2 Cash from Harry's sales wasa used to pay the 000.) following: Expenses 2 Cash from Harry's sales was used to pay for the following: Drawings 152 70 Expenses Drawings 152 70 3 Amounts paid from the bank: Purchases 3 Amounts paid from the bank: Purchases Interest on overdraft Interest on overdraft Expenses 1750 30 1750 30 810 Expenses 810 4 Balances at 30 April 2009: at 30 April 2009: 4 Balances Creditors for supplies Creditors for supplies Creditors for expenses Creditors for expenses Debtors Debtors Stock Stock Cash Cash 510 90 400 720 5 5 During the year, Harry brought into the business a motor vehicle. 5 During the year, Harry brought into the business a motor vehicle. 510 90 400 720 5 12 12 6 A provision for doubtful debts of 4% of debtors is to be made. 6 A provision for doubtful debts of 4% of debtors is to be made. 7 Depreciation on all fixed assets was to be provided for at 25% using the reducing (diminishing) balance method. Full depreciation would be provided for in the year in 7 Depreciation on all which fixed an assets to be provided forwould at 25% using in the asset was was introduced but none be applied thereducing year of disposal. (diminishing) balance method. Full depreciation would be provided for in the year in which an asset was introduced but none would be applied in the year of disposal. Required: © UCLES 2009 9706/22/O/N/09 9706/22/O/N/09 ( a) Income Statement for the year ended 30 April 2009 (b) Statement of financial Position as at 30 April 2009. © UCLES 2009 ) Income Statement for the year ended 30 April 2009 Statement of financial Position as at 30 April 2009. OMAIR MASOOD CEDAR COLLEGE 254 PAGE 157 Q9. 2 PAGE 157 Q11. 2 Jasper, a sole trader, has provided the following summary of his bank receipts and payments For for the year ended 30 April 2010. Examiner’s PAGE 157 1 Jasper, a sole trader, has provided the following summary of his bank receipts and payments Use For 2 for the year ended 30 April 2010. Examiner’s Dr Cr Use 1 Jasper, a sole trader, has provided and payments $ the following summary of his bank receipts $ For Dr Cr for the ended 30 April 2010. Examiner’s Cash andyear cheques 424 000 Machinery 30 400 $ $ Use Payments to creditors 228 000 Cash and cheques 424 000 Machinery 30 400 Rent 24 200 Dr Cr Payments to creditors 228 000 $ $ Insurance 14 200 Rent 24 200 10430 200 Cash and cheques 424 000 Wages Machinery 400 Insurance 14 200 Postage 800 Payments to creditors 228 000 Wages 104 200 Electricity 824 400 Rent 200 Postage 800 Sundries 414 200 Insurance 200 Electricity 8 400 Wages 104 200 Sundries 4 200 Postage 800 Electricity 8 400 Jasper’s year-end balances were as follows: Sundries 4 200 Jasper’s year-end balances were as follows: At 30 April 2009 2010 Jasper’s year-end balances were as follows:$ At 30 April$ 2009 2010 Trade receivables (debtors) 46 400 ? $ $ Inventory (stock) 24 400 At 30 April 30 600 Trade receivables (debtors) 46 400 ? Trade payables (creditors) 292009 200 322010 200 Inventory (stock) 24 400 30 600 $ $ Machinery at net book value 206 400 216 000 Trade payables (creditors) 29 200 32 200 Trade receivables (debtors) ? Rent prepaid –46 400 6 200 Machinery at net book value 206 400 216 000 Inventoryprepaid (stock) 600 Insurance –24 400 330 400 Rent prepaid – 6 200 Trade payables (creditors) 29 200 Bank ? 200 532 400 Cr Insurance prepaid – 3 400 Machinery at net book value 206 400 216 000 Bank ? 5 400 Cr Rentinformation prepaid – 6 200 Additional Insurance prepaid – 3 400 Additional information During Bank the year machinery with a net book value ? of $5600 was 5 400sold Cr for $1000, which was paid into Jasper’s private bank account. During the year machinery with a net book value of $5600 was sold for $1000, which was Additional informationprivate bank account. paid into Jasper tookJasper’s a salary of $28 000 which was included in the wages account. 1 During year machinery with which a net book value of $5600 was sold for $1000, which was Jasperisthe took a salary $28 000 Mark-up calculated asof75% on account. cost. was included in the wages account. paid into Jasper’s private bank Mark-up is calculated as 75% on cost. Jasper took a salary of $28 000 which was included in the wages account. Mark-up is calculated as 75% on cost. PAGE 159 4 (c) Prepare Jasper’s income statement (trading and profit and loss account). PAGE 160 .......................................................................................................................................... 5 (d) Prepare Jasper’s balance sheet at 30 April 2010. .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... OMAIR MASOOD © UCLES 2010 CEDAR COLLEGE 9706/23/M/J/10 .......................................................................................................................................... .......................................................................................................................................... © UCLES 2010 9706/23/M/J/10 .......................................................................................................................................... .......................................................................................................................................... For Examiner’s Use For Examiner’s Use 255 INCOMPLETE*RECORDS*(WORKSHEET*3)* INCOMPLETE*RECORDS*(WORKSHEET*3)* ! Q12. ! Q1.Q1. BaleBale is a sole trader and and the following details relate to histobusiness for the ended 31st31st is a sole trader the following details relate his business for year the year ended December 2004.! December 2004.! BankBank Account summary for the ended 31st31st December 20042004 Account summary for year the year ended December $ $ $ $ CashCash salessales Trade Receivables Trade Receivables 5,000 5,000 2,000 Balance b/d b/d 2,000 Balance 8,000 8,000 72,000 RentRent 72,000 SaleSale of motor car car of motor 18,000 18,000 15001500 General expenses General expenses 9,000 9,000 Drawings Drawings 52,000 52,000 Trade Payables Trade Payables 4,000 4,000 Motor car car Motor The The following information is also available following information is also available 1 January 20042004 1 January $ 31st31st December 20042004 December $ Trade Receivables Trade Receivables 4,500 4,500 Inventory at cost Inventory at cost 3,000 3,000 prepaid RentRent prepaid 300 300 General expense owing General expense owing 900 900 Trade Payables Trade Payables 3,000 3,000 Motor Motor car car 10000 10000 Building Building 50,000 50,000 in Hand CashCash in Hand 200 200 $ $ 7,000 7,000 ? ? 500 500 700 700 18,000 18,000 11000 11000 50,000 50,000 700 700 1.Bale withdrawn a family holiday during the year. recorded 1.Bale has has withdrawn $800$800 for afor family holiday during the year. ThisThis has has beenbeen recorded as a as a general expense. general expense. 2. Gross Profit Markup 2. Gross Profit Markup was was 25%.25%. 3. The Motor Car sold had a book of $1100. 3. The Motor Car sold had a book valuevalue of $1100. 4. Not all Cash banked, $1600 for personal $1400 4. Not all Cash SalesSales werewere banked, $1600 was was keptkept for personal use use and and $1400 was was paidpaid for for Wages. Wages. REQUIRED: REQUIRED: Calculate the closing Inventory at 31st December 2004. (a) (a) Calculate the closing Inventory at 31st December 2004. (b) The Income Statement (Trading and Profit and Loss Account) for the year ended 31st (b) The Income Statement (Trading and Profit and Loss Account) for the year ended 31st December 2004. December 2004. (c) The Statement of Financial position (Balance sheet) as at 31st December 2004. (c) The Statement of Financial position (Balance sheet) as at 31st December 2004. OMAIR MASOOD CEDAR COLLEGE 256 Q2! Q13. 1 2 Khalid owns a wholesale business selling electrical goods. He does not keep proper books of account, but is able to provide the following information. Balances at 1 January 2014 Motor vehicle at cost Motor vehicle provision for depreciation Fixtures and fittings at cost Fixtures and fittings provision for depreciation Trade receivables Trade payables Inventory Prepayment of two months’ property rental 3 General expenses accrued Cashinformation in hand Additional 1 $ 38 400 12 600 41 940 22 680 26 610 19 920 33 500 3 750 410 360 Summary of bank account for the year ended 31 December 2014 For the year ended 31 December 2014: Dr Credit sales $193 400 $ 180 sales $15 BalanceCash at 1 January 2014 4110 Payments to credit suppliers 3 Receipts from credit customers 200 270 Drawings 2 Cash Trade payables $21 590. Property rental sales bankedat 31 December 2014 9 675were Balance at 31 December 2014 11 295 General expenses Additional information 3 All sales are made at 30% gross profit margin. Purchase of motor vehicle 1 For the year ended 31 December 2014: Wages and salaries REQUIRED Motor expenses Credit sales $193 400 225 350 Cash sales $15 180 (b) Calculate the following for the year ended 31 December 2014. REQUIRED 2 Trade at 31 December 2014 were $21 590. (i) payables Sales revenue (a) Calculate Khalid’s opening capital at 1 January 3 2014. Cr $ 134 750 22 185 20 625 6 650 10 100 26 150 4 890 225 350 ! 3 All sales are made at 30% gross profit margin. 3 Additional information ! REQUIRED Additional information 1 For the year ended 31 December 2014: 1 For the ended$193 31 400 Credit sales (b) Calculate theyear following forDecember the year2014: ended 31 December 2014. 400 Creditsales sales $15 $193180 Cash Cash sales $15 180 (i) Sales revenue 2 Trade payables at 31 December 2014 were $21 590. [1] Trade payables at 31 December 2014 were $21 590. 2 (ii) Purchases 3 3 AllAllsales at 30% 30%gross grossprofit profit margin. salesare aremade made at margin. REQUIRED REQUIRED ! Calculatethe the following following for ended 31 31 December 2014.2014. (b)(b)Calculate forthe theyear year ended December Salesrevenue revenue (i)(i) Sales ! [1] [1] (ii) Purchases ! [5] (c) Calculate the value of closing inventory at 31 December 2014. ! [1] [1] (ii) Purchases © UCLES 2015 9706/22/M/J/15 (ii) Purchases [1] [3] (c) Calculate the value of closing inventory at 31 December 2014. [1] OMAIR MASOOD 257 CEDAR COLLEGE (c) Calculate the value of closing inventory at 31 December 2014. (c) Calculate the value of closing inventory at 31 December 2014. [1] 4 Additional information Before banking his receipts from cash sales, Khalid took $400 per month for his personal drawings. The only other cash payments during the year were for motor expenses. Cash in hand at 31 December 2014 was $460. REQUIRED [4] (d) Prepare the cash account for the year ended 31 December 2014 to identify the cash payment made for motor expenses. ! Additional information 1 Khalid allowed a total of $914 discount to credit customers. 2 Motor vehicles are depreciated at 25% per annum using the reducing balance method. A full year’s depreciation is charged in the year of purchase, but none in the year of sale. 3 During the year, a motor vehicle that had cost $16 000 on 1 July 2012 was traded in for $8200. The balance of the purchase price for the new vehicle was paid by cheque. 4 Fixtures and fittings are depreciated at 15% per annum using the reducing balance method. There were no additions or sales of fixtures and fittings during the year. 5 There was no accrual for general expenses at 31 December 2014. 6 Prepaid rent at 31 December 2014 was $1875. 5 ! REQUIRED for the year ended 31 December 2014. ! (e) Prepare Khalid’s income statementPAGE 173 Q3.! 2 ! Additional information ! Q14. [4] ! 9706/22/M/J/15 ! On 1 January 2009 Clara Coyle, a sole trader, had the following balances: For ! 1 Khalid allowed a total of $914 discount to credit customers. Examiner’s Use $ ! 2 Motor vehicles are depreciated at 25% per annum using the reducing balance method. A full Inventory (stock) 24 170 year’s depreciation is charged in the year of purchase, but none in the year of sale. ! Premises 60 000 PAGE 173 ! Fittings and fixtures (net book value) 28 000 3 During the year, a motor vehicle that had 2 cost $16 000 on 1 July 2012 was traded in for Cash and cash equivalents (bank) 4 000 ! $8200. The balance of the purchase price for the new vehicle was paid by cheque. Rates prepaid 440 1 ! On 1 January 2009 Clara Coyle, a sole trader, had the following balances: For Trade receivables (debtors) 3 810 Fixtures and fittings are depreciated at 15% per annum using the reducing balance method. Examiner’s ! 4 Trade payables (creditors) 3 420 Use There were no additions or sales of fixtures and fittings during $ the year. Capital (stock) 117 000 ! Inventory 24 170 ! 5 Premises There was no accrual for general expenses at 31 December 2014. 60 000 !! There was no opening cash or cash equivalent. Fittings and fixtures (net book value) 28 000 !! 6 Cash Prepaid at equivalents 31 December 2014 was $1875. andrent cash (bank) 4 000 accounting records were not kept, but the following information !! Full Rates prepaid 440 was available for the year ended 31 December 2009. Trade receivables (debtors) 3 810 !! Trade payables (creditors) 3 420 !! Bank Account Receipts $ Capital 117 000 !! Loan from uncle (interest free) 10 000 Receipts from trade (debtors) 163 100 no opening cash receivables or cash equivalent. ! There was Cash sales paid into bank 34 000 ! Full accounting Bank Account Payments records were not kept, but the following information was available for the © UCLES 2015 9706/22/M/J/15 ! year ended Payments to trade 2009. payables (creditors) 141 508 31 December Ordinary goods purchased (purchases) by cheque 6 300 ! Bank Account Receipts Rates 2$ 600 258 MASOOD CEDAR COLLEGE !OMAIR Loan from uncle (interest free) 10 3 000 Drawings 650 ! Receipts from trade receivables (debtors) 163 4 100 General expenses 410 Cash sales paid into bank 34 000 Wages 21 300 ! Bank Payments Cash Account payments from cash sales ! © UCLES 2015 1 There was no opening cash or cash equivalent. Fittings fixtures value) Fittings andand fixtures (net (net bookbook value) 28 00028 000 prepaid 440 ! Rates Cash equivalents (bank) Cash andand cashcash equivalents (bank) 4 000 4 000 Trade receivables (debtors) 3 810 accounting records were not kept, but the following 440 information ! Full Rates prepaid 440 was available for the Rates prepaid Trade payables (creditors) 3 420 year ended 31 December 2009. receivables (debtors) 3 810 3 810 Trade receivables (debtors) ! Trade Capital payables (creditors) 3117 420 000 Trade payables (creditors) 3 420 ! Trade Bank Account Receipts $ Capital 117 000 Capital 117 000 ! was no There opening cash (interest or cash equivalent. Loan from uncle free) 10 000 There waswas no opening cash or cash equivalent. Receipts from trade receivables (debtors) 163 100 There no opening cash or cash equivalent. Full accounting were kept, but the following information was available for the Cashrecords sales paid intonot bank 34 000 FullFull accounting records were not kept, but the following information was for the for the year ended 31 December 2009. Bank Account Payments accounting records were not kept, but the following informationavailable was available year ended 31 December 2009. Payments to trade 2009. payables (creditors) 141 508 year ended 31 December Bank Account $ 6 300 OrdinaryReceipts goods purchased (purchases) by cheque Bank Account Receipts $10 000 Loan from uncle (interest free) Bank Account Receipts Rates 2$ 600 Loan from uncle (interest free) 10 000 Receipts from (debtors) 16310 100 Loan from trade uncle receivables (interest free) 000 Drawings 3 650 Receipts from trade receivables (debtors) 163 100 CashReceipts sales paid into bank 34 000 from trade receivables (debtors) 163 100 General expenses 4 410 Cash sales paid into bank 34 000 Bank Payments Cash sales paid into bank 3421 000 Wages 300 BankAccount Account Payments Bank Payments Payments to payables (creditors) Cash Account payments from cash(creditors) sales Payments to trade trade payables 141141 508 508 Payments topurchased trade payables (creditors) 141 508 Ordinary goods purchased (purchases) cheque 6 300 6 300 General expenses 2 680 Ordinary goods (purchases) byby cheque Ordinary goods purchased (purchases) by cheque 6 300 Rates 2 600 Purchases 1 200 Rates 2 600 Rates as at 31 December 2009 2 600 Drawings 3 650 Drawings 3 650 Balances Drawings 34 650 General expenses 4 410 General expenses 4 410 Trade receivables (debtors) 100 General expenses 411 410 Wages 21 300 Wages 21 300 Trade payables (creditors) 850 Wages 21 300 Cashpayments payments from Cash from cash cashsales sales Rates prepaid 240 Cash payments from cash sales General expenses 2 680 General expenses 2 680 400 General expenses owing Purchases 1 200 General expenses 21 680 Purchases 1 200 Wages owing 620 Balances as at 31 December 2009 Purchases 1 200 Balances as and at 31cash December 2009(cash) Cash equivalents 515 Trade receivables (debtors) 4 100 Balances as at 31 December 2009 PAGE 174 Trade receivables (debtors) 4 100 Bank PAGE 174 11 850 4 100? Trade payables (creditors) Trade receivables (debtors) 3 Trade payables (creditors) 11 850 Rates prepaid 240 Trade payables (creditors) 11 850 3 Rates prepaid Additional Information: General 400 240 Ratesexpenses prepaid owing 240 General expenses owing For Wages owing 1 620 400 General expenses owing 400 Examiner’s For 1 The selling price on all goods is based on cost plus 25%. Wages owing 1 620 Cash and cash equivalents (cash) 515 Use Wages owing 1 620 Examiner’s Bank and cash equivalents (cash) ? 515 Cash Use Cash and cash equivalents (cash) 515 REQUIRED 2 During the year Clara Coyle withdrew goods, costing ?$140, from the business, for BankBank ? REQUIRED Additionalher Information: own use. ! (a) Calculate the total sales for the year ended 31 December 2009. Additional Information: Additional Information: The selling all goods is based on plus 25%. (a) 1Calculate theprice totalonsales fordiscounts, the year ended 31 2009. 3 The business allowed $1cost 300, toDecember its trade receivables (debtors). .......................................................................................................................................... 1 The selling price on all goods is based on cost plus 25%. 1 Thethe selling all goods is based cost plus 25%. 2.......................................................................................................................................... During year price Claraon Coyle withdrew goods,on costing $140, from the business, for 4 The business received discounts, $1 600, from its trade payables (creditors). .......................................................................................................................................... her own use. 2 During the year Clara Coyle withdrew goods, costing $140, from the 2 During the year Clara Coyle withdrew goods, costing $140, from thebusiness, business,for for .......................................................................................................................................... 5 No additions or disposals of non-current (fixed) assets took place during the year. her own use. her own use. .......................................................................................................................................... 3 The business allowed discounts, $1 300, to its trade receivables (debtors). Depreciation of $3discounts, 000 is to $1 be provided onits fixtures and fittings. .......................................................................................................................................... 34.......................................................................................................................................... The business allowed discounts, $1600, 300, to its trade receivables (debtors). 3 The business allowed discounts, $1 300, to trade receivables (debtors). The business received from its trade payables (creditors). .......................................................................................................................................... Premises are not depreciated. No orreceived disposals of discounts, non-current (fixed) assets took place during the year. 4 additions The business received 600, from trade payables (creditors). 45.......................................................................................................................................... The business discounts, $1 $1 600, from its its trade payables (creditors). © UCLES 2010 9706/21/O/N/10 PAGE 174 .......................................................................................................................................... Depreciation of is toofbenon-current provided on (fixed) fixtures and fittings. 5 additions No additions or000 disposals of non-current (fixed) assets took place duringthe theyear. year. 5 .......................................................................................................................................... No or $3 disposals assets took place during 3 Premises are not depreciated. .......................................................................................................................................... Depreciation of 000 $3 000 to provided be provided fixtures and fittings. PAGE 174 .......................................................................................................................................... Depreciation of $3 is toisbe on on fixtures and fittings. ! © UCLES! 2010 9706/21/O/N/10 For 3 .......................................................................................................................................... Premises depreciated. Examiner’s Premises are are not not depreciated. .......................................................................................................................................... ! © UCLES 2010 9706/21/O/N/10 © UCLES! 2010 9706/21/O/N/10 .......................................................................................................................................... ! ! Use REQUIRED .......................................................................................................................................... .......................................................................................................................................... (a) Calculate the total sales for the year ended 31 December 2009. For Examiner’s Use .......................................................................................................................................... REQUIRED ! ...................................................................................................................................... [5] ! .......................................................................................................................................... .......................................................................................................................................... (a) Calculate the total sales for the year ended 31 December 2009. ! (b) .......................................................................................................................................... Calculate the total purchases for the year ended 31 December 2009. ! PAGE 175 ! ...................................................................................................................................... [5] .......................................................................................................................................... 4 .......................................................................................................................................... ! .......................................................................................................................................... (b)(c) .......................................................................................................................................... Calculate the total Statement purchases for theand year ended 31 account) December 2009. Prepare the Income (trading profit and loss for Clara Coyle for For .......................................................................................................................................... .......................................................................................................................................... the year ended 31 December 2009. PAGE 175 Examiner’s! PAGE 176 Use 4 .......................................................................................................................................... ! ! .......................................................................................................................................... .......................................................................................................................................... 5 .......................................................................................................................................... .......................................................................................................................................... ! (c) .......................................................................................................................................... Prepare the Income Statement (trading and profit and loss account) for Clara Coyle for For .......................................................................................................................................... (d) .......................................................................................................................................... Prepare Balance Sheet for Clara Coyle at 31 December 2009. .......................................................................................................................................... the yearthe ended 31 December 2009. For Examiner’s .......................................................................................................................................... Examiner’s PAGE 176 !Use ! Use .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... 5 ! .......................................................................................................................................... .......................................................................................................................................... MASOOD CEDAR COLLEGE .......................................................................................................................................... ! OMAIR ! .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... (d) the Balance Sheet for Clara Coyle at 31 December 2009. .......................................................................................................................................... For ! Prepare .......................................................................................................................................... .......................................................................................................................................... Examiner’s .......................................................................................................................................... ! .......................................................................................................................................... !Use .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... ! ! .......................................................................................................................................... .......................................................................................................................................... 259 Q15. Q4.! Lim Soh Ching is in business as a retail trader but she has not kept a full set of books. The tax inspector now requires seeing annual accounts for 1995. To enable these accounts to be prepared, the following incomplete information is available: (i) The bank account entries to 31st December 1995 are: $ Rent paid 4,800 Vehicle expenses 2,900 Wages 9,700 Sundry expenses 1,300 170,600 Trade suppliers Loan from father at 10% per annum (loan taken 1 July 1995) Payment for new delivery vehicle 27,000 see (iii) below (i) The bank paying-in book showing the receipts from debtors paid in cannot be found. There were no other deposits except for the loan from Lim’s father. (ii) Assets and liabilities: Non-Current Assets, at cost Delivery vehicle at 1 January 1995 at 31 December 1995 $ $ 32,000 32,000 5,500 See (iii) below Inventory, at cost Inventory sheets not 18,700 available Trade creditors 11,500 13,200 Trade Receivables 13,400 21,700 2,500 Dr 6,700 Dr 400 800 Bank balance Prepayment – rent OMAIR MASOOD CEDAR COLLEGE 260 (iii) (iv) (v) (vi) In September 1995, Lim purchased a new delivery vehicle paying by cheque. The list price was $19,100, but a trade-in allowance of $4,100 was given for the old vehicle. The new vehicle is to be depreciated by 20% on cost. It is Lim’s practice to provide a full year’s depreciation on NonCurrent Assets in the year of purchase, but none in the year of disposal Lim has taken Inventory which cost $1000 for her own use during the year. All funds received from customers were banked except for $200 for sundry business expenses and $5,000 for Lim’s own non-business expenditure. Lim is confident that her mark-up (gross profit to cost of sales) has been a constant 20% REQUIRED: (a) Prepare the Income Statement (Trading and Profit and Loss Account) for the year ended 31 December 1995. (b) Prepare the Statement of Financial position (Balance Sheet) as at 31 December 1995. ! ! Q16. Q5.!On 1 June 1993 Dawn Birch had the following assets and liabilities:! ! Q5.!On 1 June 1993 Dawn Birch had the following assets $ and liabilities:! ! $ ! 110,000 Premises 110,000 ! Premises ! 25,000 Fixtures and fittings 25,000 ! Fixtures and fittings ! 14,000 Inventory 14,000 ! Inventory 2,700 ! Trade Receivables 2,700 Trade Receivables ! 4,100 ! Trade Payables 4,100 Trade Payables ! ! ! At the same time Birch has $100,000 in the bank account. Additionally she also At the same time Birch has $100,000 in the bank account. Additionally she also ! obtained a bank loan of $25,000, which was dated 1 June 1993, for a fixed term a bank loan of $25,000, which was dated 1 June 1993, for a fixed term ! ofobtained 5 years and bearing interest at a fixed rate of 12% per annum. of 5 years and bearing interest at a fixed rate of 12% per annum. ! ! During the year she was too busy to keep full records of all transactions. During the year she was too busy to keep full records of all transactions. ! However, her part records provide the following information. ! However, her part records provide the following information. ! In the year to 31st May 1994 she drew for her own personal use $200 per week ! In the year to 31st May 1994 she drew for her own personal use $200 per week the business bank account. There were two items paid out from cash ! from from the business bank account. There were two items paid out from cash ! receipts for sales: $1,270 for general expenses and $1,740 for trade purchases: receipts for sales: $1,270 for general expenses and $1,740 for trade purchases: ! All other cash sales were paid into the bank except for a cash balance of $410 All other cash sales were paid into the bank except for a cash balance of $410 retained at 31 May 1994. retained at 31 May 1994. Summary of bank account transactions for the year; Summary of bank account transactions for the year; OMAIR MASOOD CEDAR COLLEGE $ Deposits paid into bank account $ Deposits paid into bank account Cash and cheque paid in (all from sales) 217,650 Cash and cheque paid in (all from sales) 217,650 261 In the year to 31st May 1994 she drew for her own personal use $200 per week from the business bank account. There were two items paid out from cash receipts for sales: $1,270 for general expenses and $1,740 for trade purchases: All other cash sales were paid into the bank except for a cash balance of $410 retained at 31 May 1994. Summary of bank account transactions for the year; $ Deposits paid into bank account Cash and cheque paid in (all from sales) 217,650 Payments from bank account General Expenses Trade Payables 5,040 159,250 Rates and Insurance 3,070 Electricity 1,280 Fixtures and Fittings 4,200 Wages 27,830 At 31st May 1994 there were notes in Birch’s diary relating to 1. Trade Payables – value at year end $21,600 Trade Receivables – value at year end $24,750 2. Birch has paid $240 insurance in advance and she estimates that she will pay $900 to her accountant to prepare her final accounts and returns. 3. During the year Birch has used Inventory, cost price $490, for her own purposes. 4. A provision for depreciation at 10% on cost is to be made on Fixtures and Fittings. 5. Although there are n proper Inventory records Birch has maintained a pricing policy whereby her gross profit was 25% of the selling price of her goods. REQUIRED: (a)The Income Statement (Trading and Profit and Loss Account) for the year ended 31st May 94. (b)The Statement of Financial position (Balance Sheet) as at 31st May 94. ! ! ! ! ! ! ! ! ! ! ! ! OMAIR MASOOD CEDAR COLLEGE ! ! ! ! 262 Q6.! !Q17. 1 2 Maneesh has not maintained a full set of accounting records for the year ended 31 December 2015. The following information has been provided: Assets and liabilities at 1 January 2015 Assets Liabilities $ 83 400 18 500 22 460 1 900 180 Non-current assets at net book value Inventory Trade receivables Prepaid rent Cash in hand Trade payables Accrued general expenses Bank overdraft Balance at 1 January 2015 $ 12 770 1 320 5 640 106 710 126 440 126 440 Summary bank account for the year ended 31 December 2015 Receipts from credit customers Cash sales banked Balance at 31 December 2015 $ 176 750 7 450 17 272 Balance at 1 January 2015 Payments to credit suppliers Non-current assets Drawings General expenses Rent 201 472 Balance at 1 January 2016 $ 5 640 138 132 5 200 14 120 11 280 27 100 201 472 17 272 Additional information 1 Maneesh makes both cash and credit sales. All sales were made at 40% gross margin. 2 Credit sales for the year totalled $184 190. 3 Credit purchases for the year totalled $136 422. There were no cash purchases. 4 The business maintains a cash float of $180. 5 Maneesh withdrew $20 per week from cash sales for drawings, before banking the rest. 6 Maneesh depreciates his non-current assets at 20% per annum using the reducing balance method. 7 The rent charge for the year was $24 600. 8 The general expenses charge for the year was $14 160. 9 Irrecoverable debts of $900 should be written off at 31 December 2015. ! 3 ! REQUIRED © UCLES 2016 9706/23/O/N/16 (a) Prepare the income statement for the year ended 31 December 2015. 4 ! (b) Prepare the statement of financial position at 31 December 2015. ! ! OMAIR MASOOD CEDAR COLLEGE 263 Q7! Q18. ! 1 2 Razia, a sole trader, started her business on 1 July 2015 selling ladies’ clothing. Razia did not keep proper books of account, but was able to provide the following information. Summary of bank account for the year ended 30 June 2016 $ 36 340 78 780 4 330 Capital introduced Cash banked Balance c/d Payments to trade payables Shop rental Shop fixtures and fittings Purchase of motor vehicle Motor expenses Light and heat 119 450 3 $ 80 690 25 200 3 600 5 800 3 140 1 020 119 450 Additional information Additional information 1 Total revenue for the year was $92 600. All sales were made for cash. 1 All sales made a gross margin of 40%. 2 Razia kept no record of her cash drawings. 2 During the year, Razia had taken goods, $640 at cost price, for her own use. 3 The following expenses were paid from cash takings before the money was banked: 3 Inventory at 30 June 2016 had been counted and was valued at cost price $31 900. Razia was aware that some goods$had been stolen during the year. General expenses 950 Assistants’ wages 4 Razia owed $8940 to trade2870 suppliers at 30 June 2016. 4REQUIRED Cash in hand at 30 June 2016 was $1250. REQUIRED (b) Calculate the value of inventory stolen during the year ended 30 June 2016 at cost price. (a) Prepare the cash account, showing clearly the value of Razia’s drawings for the year. ! ! 3 Additional information 1 All sales made a gross margin of 40%. 2 During the year, Razia had taken goods, $640 at cost price, for her own use. 3 Inventory at 30 June 2016 had been counted and was valued at cost price $31 900. Razia was aware that some goods had been stolen during the year. 4 Razia owed $8940 to trade suppliers at 30 June 2016. REQUIRED (b) Calculate the value of inventory stolen during the year ended 30 June 2016 at cost price. [4] ! Additional information 1 [4] At 30 June 2016, the following expenses were accrued: Assistants’ wages Light and heat © UCLES 2 2017 Non-current $ 120 150 9706/22/F/M/17 assets should be depreciated as follows: Shop fixtures and fittings at 15% per annum using the reducing balance method Motor vehicle using the straight-line method over five years. The estimated residual value of the motor vehicle after five years is $400. 3 ! The annual charge for shop rental is $21 600. Additional information 1 [4] ! 4 At 30 June 2016, the following expenses were accrued: REQUIRED Assistants’ wages (c) Prepare Light andthe heatincome © UCLES 2017 ! 2 $ 120 statement for the year 150 9706/22/F/M/17 ended 30 June 2016. [Turn over Non-current assets should be depreciated as follows: ! Shop fixtures and fittings at 15% per annum using the reducing balance method Motor vehicle using the straight-line method over five years. The estimated residual OMAIR MASOOD CEDAR COLLEGE value of the motor vehicle after five years is $400. 3 The annual charge for shop rental is $21 600. 264 INCOMPLETE RECORDS (MARK UP AND MARGIN) Q1 A business sells goods at a margin of 20%. The revenue (sales) for the year was $240,000. What is the cost of sales? Q2 A business sells good at a markup of 33.3%. Information for a year is given. Revenue (Sales) Opening Inventory Closing Inventory $ 600,000 53,000 68,000 What are the total purchases for the year? Q3 A business sells good at a markup of 35% $ Revenue (Sales) 540,000 Purchases 350,000 Closing Inventory 70,000 What was the opening inventory? Q4. A trader made purchases of $300,000 and normally keeps gross margin of 40% before making any sales. If the opening inventory was same as closing inventory for the year. What was the sales/revenue figure for the trader? Q5 A trader provides the following information for the year Inventory at 1st January Inventory at 31st December Ordinary goods purchases Gross profit % on sales/revenue $15,125 $22,185 $65,500 25% What is the value of sales/revenue for the year? OMAIR MASOOD CEDAR COLLEGE 265 Q6 During the month a company lost a quantity of inventory in a burglary. The table shows the company’s results for the month. Opening inventory, at cost Purchases Revenues (Sales) Closing inventory, at cost $ 30,000 210,000 330,000 4,000 A gross profit on all sales(revenues) of 30% had been achieved. What was the cost of the inventory lost in the burglary? Q7 At the beginning of the financial year inventory was valued at $15,000. During the year, sales/revenues of $21,000 and purchases of $18,000 were made. Unfortunately, all inventory was stolen on the last day of the financial year. Goods are marked up by 50% to calculate selling price. What is the cost of the stolen inventory? Q8 A business provides the following information. Revenue (Sales) Opening Inventory Closing Inventory Purchases $ 140,000 22,000 24,500 120,000 Goods are sold at a markup of 25%. The owner has taken goods for own use but has not recorded these as drawings. What is the value of the goods taken for own use? OMAIR MASOOD CEDAR COLLEGE 266 Q9 A company purchases a product that costs $120. The company expects to make a gross profit margin of one-third. What is the company’s mark-up in dollar amount? Q10 A business had current assets and current liabilities as follows. Inventories Trade Receivables Trade Payables Rent receivable $ 1600 3200 2700 800 A fire destroyed the inventories, but 75% of the loss is covered by an insurance claim. What are the current assets after the fire? OMAIR MASOOD CEDAR COLLEGE 267 RATIOS! RATIOS THEORY ( PROFITABILITY! ( GROSS!PROFIT!MARGIN! ! ( ( ( ( ( ! ( (( ( Gross(Profit( x(((100( ((Net(Sales( )( While(the(gross(profit(is(a(dollar(amount,(the(gross(profit(margin(is(expressed(as(a(percentage(of(net( sales.(The(Gross(Profit(Margin(illustrates(the(profit(a(company(makes(after(paying(off(its(Cost(of(Goods( sold.(The(Gross(Profit(Margin(shows(how(efficient(the(management(is(in(using(its(labour(and(raw( materials(in(the(process(of(production((In(case(of(a(trader,(how(efficient(the(management(is(in( purchasing(the(good).(There(are(two(key(ways(for(you(to(improve(your(gross(profit(margin.(First,(you(can( increase(your(process.(Second,(you(can(decrease(the(costs(of(the(goods.(Once(you(calculate(the(gross( profit(margin(of(a(firm,(compare(it(with(industry(standards(or(with(the(ratio(of(last(year.(For(example,(it( does(not(make(sense(to(compare(the(profit(margin(of(a(software(company((typically(90%)(with(that(of(an( airline(company((5%).( ( Reasons(for(this(ratio(to(go(UP((opposite(for(down)( 1. Increase(in(selling(price(per(unit( 2. Decrease(in(purchase(price(per(unit(due(to(lower(quality(of(goods(or(a(different(supplier.( 3. Decrease(in(purchase(price(per(unit(due(to(bulk((trade)(discounts.( 4. Extensive(advertising(raising(sales(volume((units)(along(with(selling(price.( 5. Understatement(of(opening(stock.( 6. Overstatement(of(closing(stock.( 7. Decrease(in(carriage(inwards/Duties((trading(expenses)( 8. Change(in(Sales(Mix((maybe(we(are(selling(some(new(products(which(give(a(higher(margin).( ( NET!PROFIT!MARGIN! ( ( ( ( ! ( ! ( (( ( Operating(Profit( x(((100( (Net(Sales( )( Net(profit(margin(tells(you(exactly(how(the(management(and(operations(of(a(business(are(performing.( Net(Profit(Margin(compares(the(net(profit(of(a(firm(with(total(sales(achieved.(The(main(difference( between(GP(Margin(and(NP(Margin(are(the(overhead(expenses((Expenses(and(loss).(In(some(businesses( Gross(Margin(is(very(high(but(Net(Margin(is(low(due(to(high(expenses,(e.g.(Software(Company(will(have( high(Research(expenses.( ( Reasons(for(this(ratio(to(go(UP((opposite(for(down)( All(the(reasons(for(GP(margin(apply(here.(Additionally( 1. Increase(in(cash(discounts(from(suppliers( 2. A(decrease(in(overhead(expenses( 3. Increase(in(other(incomes(like(gain(on(disposal,(Rent(Received(etc.( OMAIR MASOOD CEDAR COLLEGE 268 Return!on!Capital!Employed!(ROCE)!( This(is(the(key(profitability(ratio(since(it(calculates(return(on(amount(invested(in(the(business.(If(this(ratio( is(high,(this(means(more(profitability((In(exam(if(ROCE(is(higher(for(any(firm(it(is(better(than(the(other( firm(irrespective(of(GP(and(NP(Margin).(This(return(is(important(as(it(can(be(compared(to(other( businesses(and(potential(investment(or(even(the(Interest(rate(offered(by(the(bank.(If(ROCE(is(lower(than( the(bank(interest(then(the(owner(should(shoot(himself.(This(ratio(can(go(up(if(profits(increase(and(capital( employed(remains(the(same.(Also(if(Capital(employed(decreases,(this(ratio(might(go(up.( ( ( ( ((Operating(Profit_(( (Capital(Employed( ( ( ( ( ( x( 100( ((((((((((Net(Profit(before(Interest(and(Tax( ! Return!on!Total!Assets! ( This(shows(how(much(profit(is(generated(on(total(assets((Fixed(and(Current).(The(ratio(is(considered(and( indicator(of(how(effectively(a(company(is(using(its(assets(to(generate(profits.( ( ( ((Operating(Profit_(( (((((((Total(Assets( x( 100( ( Return!on!Shareholders’!Funds/Return!on!Net!Assets/Return!on!Owners!capital! ( Since(all(the(capital(employed(is(not(provided(by(the(shareholders,(this(specifically(calculates(the(return( to(the(shareholders((It’s(almost(the(same(thing(as(ROCE)( ( x( 100( ( Net(Profit(after(Tax( Shareholders(Funds( ( ( ( ( O.S.C(+(P.S.C(+(RESERVES( ( ( ( ( NOTE:! ( Capital(Employed(( =(Non(Current(Assets(+(Current(Assets(–(Current( Liabilities( ( OR! ( =((Total(Equity(+(Non(Current(Liabilities(( ! OMAIR MASOOD CEDAR COLLEGE 269 LIQUIDITY!AND!FINANCIAL! ( As(we(know(a(firm(has(to(have(different(liquidity.(In(other(words(they(have(to(be(able(to(meet(their(day( to(day(payments.(It(is(no(good(having(your(money(tied(up(or(invested(so(that(you(haven’t(enough(money( to(meet(your(bills!(Current(assets(and(liabilities(are(an(important(part(of(this(liquidity(and(so(to(measure( the(firms(liquidity(situation(we(can(work(out(a(ratio.(The(current(ratio(is(worked(out(by(dividing(the( current(assets(by(the(current(liabilities.( ( CURRENT!RATIO! ! ! ! =! ! !!!Current!assets!_( Current!liabilities! ( The(figure(should(always(be(above(1(or(the(form(does(not(have(enough(assets(to(meet(its(liabilities(and( is(therefore(technically(insolvent.(However,(a(figure(close(to(1(would(be(a(little(close(for(a(firm(as(they( would(only(just(be(able(to(meet(their(liabilities(and(so(a(figure(of(between(1.5(and(2(is(generally( considered(being(desirable.(A(figure(of(2(means(that(they(can(meet(their(liabilities(twice(over(and(so(is( safe(for(them.(If(the(figure(is(any(bigger(than(this(then(the(firm(may(be(tying(too(much(of(their(money(in( a(form(that(is(not(earning(them(anything.(If(the(current(ratio(is(bigger(than(2(they(should(therefore( perhaps(consider(investing(some(for(a(longer(period(to(earn(them(more.( ( However,(the(current(assets(also(include(the(firm’s(stock.(If(the(firm(has(a(high(level(of(stock,(it(may( mean(one(of(the(two(things,( 1. Sales(are(booming(and(they’re(producing(a(lot(to(keep(up(with(demand.( 2. They(can’t(sell(all(they’re(producing(and(it’s(piling(up(in(the(warehouse!( ( If(the(second(of(these(is(true(then(stock(may(not(be(a(very(useful(current(asset,(and(even(if(they(could( sell(it(isn’t(as(liquid(as(cash(in(the(bank,(and(so(a(better(measure(of(liquidity(is(the(ACID!TEST!(or! QUICK)!RATIO.!This(excludes(stock(from(the(current(assets,(but(is(otherwise(the(same(as(the(current( ratio.( ( ACID!TEST!RATIO! ! ! ! =! ! Current!assets!–!stock! !!!!Current!liabilities! ( Ideally(this(figure(should(also(be(above(1.5(for(the(firm(to(be(comfortable.(That(would(mean(that(they( can(meet(all(their(liabilities(without(having(to(pay(any(of(their(stock(and(still(have(some(buffer.(This( would(make(potential(investors(feel(more(comfortable(about(their(liquidity.(If(the(figure(is(below(1,(they( may(begin(to(get(worried(about(their(firm’s(ability(to(meet(its(debts.( ( ( ! Note!:!Working!Capital!=!Current!Assets!–!Current!Liabilities! OMAIR MASOOD CEDAR COLLEGE 270 ! Rate!of!Stock!Turnover! ( It(shows(the(number(of(times,(on(average,(that(the(business(will(sell(its(stock(in(a(given(period(of(time.(It( basically(gives(an(indication(of(how(well(the(stock(has(been(managed.(A(high(ratio(is(desirable(because( the(quicker(the(stock(is(turned(over,(more(profit(can(be(generated.(A(low(ratio(indicates(that(stocks(are( kept(for(a(longer(period(of(time((which(is(not(good).( ( ( ! ( ! Cost!of!Goods!Sold! ! !!!!Average!Inventory! =! ____!Times!!!!!(!higher!the!better)! ( ( ( Inventory!Days:! This(is(Rate(of(Inventory(turnover(in(days.(Lower(the(better.( ( ( ( ! ! !!Average!Inventory!!!!!!!x!365!=! Cost!of!Goods!Sold! ____!Days!!!!!!!!!(!lower!the!better)! ! Trade!Recieveables!Days(!Collection!Period)! Shows(how(long(it(takes(on(average(to(recover(the(money(from(debtors.(Lower(the(better.( ( ( ( the!better)! ! ! !!!Closing!Trade!Receiveables!!!!!!x!365! =! ____!Days!!!!!!!!!!!!!!!!!!(lower! !!!!!Credit!Sales! ( Trade!Payables!Days:!(Payment!Period)( Shows(how(long(it(takes(on(average(to(payback(the(creditors.(Higher(the(better.( ( ( ( ! ! !!Closing!Trade!Payables!x!365! !!!!Credit!Purchases! =! ____!Days! ! Note:! ! Average!Inventory! ! ! ! ! ! ! =! ! Opening!+!Closing! !!!!!!!!!!!2! ! ! OMAIR MASOOD CEDAR COLLEGE 271 ! ! Utilization!Ratios!(All!higher!the!better)! ! Total!Asset!utilization!(Total!Asset!Turnover)! ( Shows(how(much(sales(are(being(generated(on(Total(Assets.(Higher(ratio(indicates(better(utilization(of( Total(Assets.( ( ( (((Net!Sales!!! ! ! ! Total!Assets! =! ____!Times! ( ! ! Non!Current!!Asset!Utilization!(Non!Current!Asset!Turnover)! ( Shows(how(much(sales(are(being(generated(on(Non(current(assets.(Higher(ratio(indicates(better( utilization(of.( ( ( (((Net!Sales!!! ! ! ! Non!Current!Assets! =! ____!Times! ( Working!Capital!Utilization!(Working!Capital!Turnover)! ! Sows(how(much(sales(are(being(generated(on(Working(Capital.(Higher(ratio(indicates(better(utilization(of( Working(Capital.( ( ( ((((((((Net!Sales!!!!!!!! ! ! Working!Capital! =! ____!Times! ( Advantages!of!Ratios! 1. 2. 3. 4. Shows(a(trend( Helps(to(compare(a(single(firm(over(a(two(years((time(–(series)( Helps(to(compare(to(similar(firms(over(a(particular(year.( Helps(in(making(decisions( ( ( ( ( ( ( OMAIR MASOOD CEDAR COLLEGE 272 ( ( Disadvantages!(Limitations):! 1. 2. 3. 4. 5. 6. 7. 8. A(ratio(on(its(own(is(isolated((We(need(to(compare(it(with(some(figures)( Depends(upon(the(reliability(of(the(information(from(which(ratios(are(calculated.( Different(industries(will(have(different(ideal(ratios.( Different(companies(have(different(accounting(policies.(E.g.(Method(of(depreciation(used.( Ratios(do(not(take(inflation(into(account.( Ratios(can(over(simplify(a(situation(so(can(be(misleading.( Outside(influences(can(affect(ratios(e.g.(world(economy,(trade(cycles.( After(calculating(ratios(we(still(have(to(analyze(them(in(order(to(derive(a(conclusion.( ( How!to!Comment:! Usually(in(CIE(they(assign(2(marks(for(comment(on(each(ratio.(One(mark(is(for(indicating(if(the(ratio(is( better(or(worse((not(higher(or(lower).(The(second(mark(is(to(explain(the(importance(or(the(reason(of(the( change(in(ratio.(For(e.g.(If(Gross(Profit(Margin(was(40%(and(now(its(50%,(you(should(say(that(the(Gross( profit(Margin(has(improved((rather(than(increased)(and(this(may(be(due(to(an(increase(in(selling(price(or( a(decrease(in(cost(of(goods(sold((depending(upon(the(question).( ( Also(remember(that(the(liquidity(and(utilization(ratios(should(be(close(to(industry(average.(Too(less(or( too(much(liquidity(is(bad!( ( At(the(end(of(your(answer,(always(give(a(conclusion( • When(comparing(a(single(firm(over(two(years(then(do(mention(performance(of(which(year(is( better.((In(terms(of(profitability(and(liquidity)( • When(comparing(two(different(firms(over(the(same(year(do(mention(performance(of(which(firm( is(better.((In(terms(of(profitability(and(liquidity).( ( ( If(the(question(says(evaluate(profitability(then(use((GP(Margin,(NP(Margin(and(ROCE)( ( If(the(question(says(evaluate(liquidity,(use((Current(Ratio,(Acid(Test(and(Rate(of(Stock(Turnover)(( ( If(the(question(says(evaluate(the(performance(it(means(both(profitability(and(liquidity.( ( Best(way:( ( 3(–(Profitability( 2(–(Liquidity(&( 1(–(Utilization( ( OMAIR MASOOD CEDAR COLLEGE 273 www.maxpapers.com 5 The following is an extract of Chikkadea’s financial statements (final accounts) for the year www.maxpapers.com For www.maxpapers.com ended 30 April 2010. Examiner’s 5 5 Use Q1 Statement (Tradingfinancial and Profit and Loss(final account) 2 The following isIncome an extract of Chikkadea’s statements accounts) for the year For 2 The following is an extract of Chikkadea’s financial statements (final accounts) for the year For for the year ended 30 April 2010 ended 30 April 2010. Examiner’s ended 30 April 2010. Examiner’s Use 2 RATIOS WORKSHEET Income Statement (Trading and Profit and $Loss account) Income Statement (Trading and Profit and Loss account) for the year ended 30 April 2010 Revenue (Sales) for the year ended 30 April 2010 Less cost of sales: $ $ 000 Inventory (Stock) at 1 May 2009 32 Revenue (Sales) Revenue (Sales) purchased (Purchases) Ordinary 281 250 Less costgoods of sales: Less cost of sales: 313000 250 Inventory (Stock) at 1 May 2009 32 Inventory (Stock) at 1 May 2009 32 000 000 Inventory (Stock)purchased at 30 April(Purchases) 2010 Ordinary goods 28128250 Ordinary goods purchased (Purchases) 281 250 Gross profit 313 250 313 250 Less expenses 28 000 Inventory (Stock) at 30 April 2010 28 000 Inventory (Stock) at 30 April 2010 Grossfor profit Profit the year (Net Profit) Gross profit Less expenses Less expenses Balance Sheet at 30 April 2010 Profit for the year (Net Profit) Profit for the year (Net Profit) Assets Balance Sheet at 30 April 2010 Non-current (Fixed) assets Balance Sheet at 30 April 2010 Assets Assets Non-current (Fixed) assets Current assets Non-current (Fixed) assets Inventory (Stock) Current assets Trade receivables (Debtors) Current assets Inventory (Stock) Cash and cash equivalents (Bank) Inventory (Stock) Trade receivables (Debtors) Total receivables assets Trade (Debtors) Cash and cash equivalents (Bank) Cash and cash equivalents (Bank) Total assets Equity and liabilities Total assets $ 375 000 Use $ $ 375 000 375 000 285 250 89 750 285 44 250750 285 250 89 45 750000 89 750 44 750 44 750 $ 45 000 45 000 $ 428 000 $ $ $ $ 428 000 428 000 28 000 22 500 28 000 1 500 52 000 28 000 22 500 480 000 22 500 1 500 52 000 1 500 52 000 480 000 480 000 Equity: Equity and liabilities Equity and liabilities Capital Equity: Equity: Capital Capital Current Liabilities 450 000 450 000 450 000 30 000 480 30 000000 30 000 480 000 480 000 The following have been calculated for Dakeeri, a competitor in the same type of business. Trade payables (Creditors) Current Liabilities Current Liabilities Trade payables (Creditors) Trade payables (Creditors) The following have been calculated for Dakeeri, a competitor in the same type of business. The haveratio been calculated for Dakeeri, a competitor in the same type of business. (i) following Gross profit 20.2% (i) Gross profit ratio 20.2% (i) profitratio ratio 20.2% (ii) Gross Net profit 10% (ii) Net profit ratio 10% (ii) profiton ratio 10%9% (iii) Net Return capital employed (iii) Return on capital employed 9% (iii) employed 9%8% (iv) Return Returnon oncapital total assets (iv) Return on total assets 8% (iv) Return on total assets 8% (v) Current (working capital) ratio 1.5 : 1 (v) Current (working capital) ratio 1.5 : 1 (v) Current (working capital) ratio 1.5 : 1 (vi) Liquid (acid test) ratio 0.7 : 1 (vi) Liquid (acid test) ratio 0.7 : 1 (vi) Liquid (acid test) ratio 0.7 : 1 (vii) (Debtors’turnover) turnover) days (vii) Receivable Receivable days days (Debtors’ 2828 days (vii) Receivable days (Debtors’ turnover) 28 days (viii) (Creditors’turnover) turnover) days (viii)Payable Payable days days (Creditors’ 3535 days (viii) Payable days (Creditors’ turnover) 35 days (ix) (Rateof ofstockturn) stockturn) times (ix) Inventory Inventory turnover turnover (Rate 88 times (ix) Inventory turnover (Rate of stockturn) 8 times ©©UCLES 9706/21/M/J/10 [Turn UCLES2010 2010 9706/21/M/J/10 [Turn overover © UCLES 2010 9706/21/M/J/10 [Turn over OMAIR MASOOD CEDAR COLLEGE 274 10 www.maxpapers.com 6 (c) Explain two advantages of using a sales ledger control account. REQUIRED (i) .................................................................................................................................. (a) Calculate the same ratios for Chikkadea’s business. In order to gain full marks you must .................................................................................................................................. show the formula or your workings for each calculation. For Examiner’s For Use Examiner’s Use www.maxpapers.com .................................................................................................................................. Where possible show your answers to one decimal place. The first answer has been given as an example. 7 (ii) 10 .................................................................................................................................. Gross Profit 89 750 × 100 ended www.maxpapers.com For 100 = =performed 23.9% (b) Explain (i) (i)Name the × business which better during the year (c) two Sales advantages of using a375 sales 000ledger control account. For .................................................................................................................................. 30 April 2010. (i) (b) (i) B Name the business which performed better during the Examiner’s Use year Examiner’s Use ended For 11 .................................................................................................................................. ............................................................................................................................ [2] 30 April 2010. Examiner’s (ii) owns .................................................................................................................................. S Turner a food wholesale business. The following amounts were extracted from Use (ii) Inventory turnover (as 2010. a number of times) .................................................................................................................................. books of account at 31 December For (ii) Justify your answer to (b) (i) by comparing four of the ratios which you have Examiner’s ............................................................................................................................ [2] calculated with the same four ratios given for Dakeeri. Use ........................................................................................................................... .................................................................................................................................. $ 11 (16+2+12) Inventory – 1 January 45 000 (ii) Justify your answer to (b) (i) by comparing four of the ratios which you have .................................................................................................................................. .................................................................................................................................. ........................................................................................................................... 000 Inventory – 31 65Dakeeri. (iii) .................................................................................................................................. (June10/P21/Q2) calculated with theDecember same four ratios given for (ii) Inventory Cost turnover of sales (as a number of times) 880 000 For .............................................................................................................................. [4] Business expenses 130 000 ........................................................................................................................... Examiner’s .................................................................................................................................. .................................................................................................................................. Use ........................................................................................................................... Q2 Trade payables 100 000 Trade receivables 150 000 ........................................................................................................................... S Turner owns a food wholesale business. The following amounts were extracted from .................................................................................................................................. .................................................................................................................................. ........................................................................................................................... Bank overdraft 50 000 books at 31 December 2010. (iv)of account .................................................................................................................................. Capital – 31 December 2010 1 125 000 ....................................................................................................................... [2] ........................................................................................................................... .................................................................................................................................. .................................................................................................................................. $ The mark up on goods is–25%. Inventory 1 January 45 000 (iii) ........................................................................................................................... Liquid (acid test) ratio. .................................................................................................................................. Inventory – 31 December 65 000 (ii) B 7 .................................................................................................................................. .............................................................................................................................. [4] .................................................................................................................................. Cost of sales 880 000 REQUIRED ........................................................................................................................... (v) .................................................................................................................................. ....................................................................................................................... [2] Business expenses 130 000 .................................................................................................................................. .................................................................................................................................. Trade payables 100December 000 (a) Calculate the profit for the year (net profit) ended 31 2010. ........................................................................................................................... (iii) Liquid (acidreceivables test) ratio. Trade 150 000 11 .................................................................................................................................. Bank overdraft 50 000 .................................................................................................................................. .................................................................................................................................. ........................................................................................................................... ........................................................................................................................... Capital – 31 December 2010 1 125 000 (ii) .................................................................................................................................. Inventory turnover (as a number of times) For (vi) .................................................................................................................................. .................................................................................................................................. Examiner’s .................................................................................................................................. ........................................................................................................................... ........................................................................................................................... The mark up on goods is 25%. Use ........................................................................................................................... .................................................................................................................................. .................................................................................................................................. ........................................................................................................................... ........................................................................................................................... .................................................................................................................................. REQUIRED ........................................................................................................................... .................................................................................................................................. .............................................................................................................................. [2] ........................................................................................................................... ........................................................................................................................... .................................................................................................................................. (a) (vii) Calculate the profit for the year (net profit) ended 31 December 2010. ........................................................................................................................... .................................................................................................................................. .................................................................................................................................. (b) Calculate the following ratios, giving your answer to one decimal place. ........................................................................................................................... ....................................................................................................................... .................................................................................................................................. ........................................................................................................................... [2] .................................................................................................................................. 11 .................................................................................................................................. (i) Return on capital employed ........................................................................................................................... .................................................................................................................................. S Turner is....................................................................................................................... considering expanding her business by purchasing another food wholesale [2] (ii).................................................................................................................................. Inventory turnover (as a number of times) For (viii) .................................................................................................................................. .................................................................................................................................. business. ........................................................................................................................... ....................................................................................................................... [2] Examiner’s .................................................................................................................................. (iii) ........................................................................................................................... Liquid (acid test) ratio. Use She has obtained the following information on two possible business purchases. [12][12] .......................................................................................................................... ........................................................................................................................... S Turner is.......................................................................................................................... considering expanding her business by purchasing another food wholesale .............................................................................................................................. [2] ........................................................................................................................... business. ........................................................................................................................... Paradis Jones ........................................................................................................................... [Total: 30] 30] [Total: (b) has Calculate the following ratios, giving youronanswer to one decimal place. She obtained the following information two possible business purchases. Foods Wholesalers ........................................................................................................................... (ix) .................................................................................................................................. ........................................................................................................................... Return on capital employed 15% 6% [16] ........................................................................................................................... (i) Return on capital employed Paradis Jones Current ratio 3.4:1 1.8:1 ........................................................................................................................... ........................................................................................................................... Foods © UCLES 2010 Liquid (acid test) ratio 9706/21/M/J/10 0.5:1 Wholesalers 1.4:1 ....................................................................................................................... [2] ........................................................................................................................... Return on capital employed 15% 6% ....................................................................................................................... [2] ........................................................................................................................... Current ratio 3.4:1 1.8:1 ........................................................................................................................... © UCLES 2011 9706/22/O/N/11 (acid test) ratio 0.5:1 1.4:1 REQUIRED (iii)Liquid Liquid (acid test) ratio. ........................................................................................................................... ........................................................................................................................... ........................................................................................................................... (c) Advise which business, if any, she should purchase on the basis of all of the ........................................................................................................................... REQUIRED information provided. Justify your answer. ........................................................................................................................... ...........................................................................................................................[2] (c) Advise....................................................................................................................... which business, if any, she should purchase on the basis of all of the (2+2+2+2+4) .................................................................................................................................. information provided. Justify your answer. ....................................................................................................................... [2] ........................................................................................................................... (Nov11/P22/Q2B) S Turner is considering expanding her business by purchasing another food wholesale business. .................................................................................................................................. .................................................................................................................................. ........................................................................................................................... OMAIR MASOOD © UCLES 2011 CEDAR COLLEGE 9706/22/O/N/11 She has obtained the following information on two possible business purchases. .................................................................................................................................. ........................................................................................................................... .................................................................................................................................. Paradis Jones ........................................................................................................................... .................................................................................................................................. .................................................................................................................................. Foods Wholesalers Return on capital employed 15% 6% 275 Q3 2 2 6 www.maxpapers.com www.maxpapers.com 6 The following information is available for the Northern Division of Blackford Industrial Ltd: The following information is available for the Northern Division of Blackford Industrial Ltd: Statement of financial position at 30 April 2011 $0002011 $000 $000 Statement of financial position at 30 April $000 $000 $000 Non-current assets at net book value 180 Non-current assets at net book value 180 Current assets Current assets Inventory 40 Inventory 40 35 Trade receivables Trade 35 43 Bank receivables Bank 43118 118 Current liabilities Current liabilities Trade payables 55 Trade 55 23 Otherpayables payables Other payables 23 78 78 Net current assets 40 Net current assets 40 Capital employed 220 Capital employed 220 Equity Equity Ordinaryshare sharecapital capital– –$1$1each each Ordinary Share premium Share premium Retainedearnings earnings Retained 10 10 20 20 Total shareholders’ shareholders’funds funds Total For Examiner’s For Use Examiner’s Use 190190 30 30 220220 Additionalinformation informationfor foryear yearended ended April 2011 Additional 3030 April 2011 $000 $000 480480 240240 60 60 120120 Total Totalrevenue revenue(sales) (sales) Cash Cashpurchases purchases Cash Cashpaid paidtotocredit creditsuppliers suppliers Operating Operatingexpenses expenses At were reported: At 30 30 April April2010, 2010,the thefollowing followingbalances balances were reported: 7 Inventory Inventory Trade payables payables (ii)Trade gross profit and profit for the year (net profit). www.maxpapers.com $000 $000 28 28 15 15 REQUIRED REQUIRED .................................................................................................................................. For Examiner’s Use (a) Calculate the following amounts for the year ended 30 April 2011: .................................................................................................................................. (a) Calculate the following amounts for the year ended 30 April 2011: www.maxpapers.com (i) .................................................................................................................................. cost of sales 7 (i) cost of sales .................................................................................................................................. (ii) ..............................................................................................................................[2] gross profit and profit for the year (net profit). .................................................................................................................................. For Examiner’s Use .................................................................................................................................. An analysis.................................................................................................................................. of the Southern Division of Blackford Industrial Ltd for the year ended 30 April .................................................................................................................................. 2011 yielded the following results. .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. Southern Division .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. 1 Mark-up 40% 2 Gross profit percentage 28.57% ..............................................................................................................................[4] ..............................................................................................................................[2] 3 Expenses to sales 20% ..............................................................................................................................[4] Net profit percentage An4analysis of the Southern8.57% Division of Blackford Industrial Ltd for the year ended 30 April 5 yielded Returnthe on capital employed 2011 following results. 18.00% 6 Rate of inventory (stock) turnover 8.95 times 7 ratio (acid test) 1.1:1 © UCLES 2011 Liquid 9706/22/M/J/11 Southern Division © UCLES 2011 REQUIRED OMAIR 1 MASOOD Mark-up 40% 9706/22/M/J/11 CEDAR COLLEGE 2 Gross profit percentage 28.57% Northern Division 3 Expenses to sales 20% 4 Net profit percentage 8.57% (b) Calculate each of the same ratios for the Northern Division of Blackford Industrial Ltd, 5 Return on capital employed 18.00% 276 3 Expenses to sales 20% ..............................................................................................................................[2] Northern Division 4 Net profit percentage 8.57% (iii) Expenses to sales For ..............................................................................................................................[2] 5 Return on capital employed 18.00% Examiner’s Net profit (b) (iv) Calculate eachpercentage of the same ratios for the Northern Division of Blackford Industrial Ltd, 6for the Rate of inventory (stock) turnover 8.95 times Use .................................................................................................................................. year ended 30 April 2011. The calculations should be correct to two decimal Return on (acid capital employed 7(v) Liquid ratio test) 1.1:1 places. .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. REQUIRED (i) Mark-up .................................................................................................................................. 8 .................................................................................................................................. .................................................................................................................................. Northern Division .................................................................................................................................. .................................................................................................................................. (iii) Expenses to sales For ..............................................................................................................................[2] Examiner’s .................................................................................................................................. .................................................................................................................................. (b) Calculate each of the same ratios for the Northern Division of Blackford Industrial Ltd, Use ..............................................................................................................................[2] .................................................................................................................................. (iv) Net profit percentage for the year ended 30 April 2011. The calculations should be correct to two decimal .................................................................................................................................. ..............................................................................................................................[2] places. (v) Return on capital employed .................................................................................................................................. .................................................................................................................................. (vi) ..............................................................................................................................[2] Rate of inventory (stock) turnover www.maxpapers.com (i) (ii) www.maxpapers.com Mark-up .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. Gross profit percentage 8 .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. ..............................................................................................................................[2] (iii) .................................................................................................................................. Expenses to sales For Examiner’s .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. Use ..............................................................................................................................[2] (iv) .................................................................................................................................. Net profit percentage .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. ..............................................................................................................................[2] (v) Return on capital employed .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. ..............................................................................................................................[2] (vi) ..............................................................................................................................[2] Rate of inventory (stock) turnover .................................................................................................................................. .................................................................................................................................. ..............................................................................................................................[2] .................................................................................................................................. 9 (vii) Liquid ratiopercentage (acid test) (ii) Gross profit .................................................................................................................................. .................................................................................................................................. ..............................................................................................................................[2] .................................................................................................................................. (c) Using theprofit profitability ratios (i) – (v) compare the performance of the Northern and .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. For (iv) .................................................................................................................................. Net percentage ..............................................................................................................................[2] Southern Divisions of Blackford Industries and explain the significance of each ratio. Examiner’s Use ..............................................................................................................................[2] .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. .......................................................................................................................................... (v) Return on capital employed 9706/22/M/J/11 © UCLES 2011 [Turn over (4+2+2+2+2+2+2+2+2+10) (vi) Rate of inventory (stock) turnover .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. ..............................................................................................................................[2] (June11/P22/Q2) .......................................................................................................................................... .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. (vii) ..............................................................................................................................[2] Liquid ratio (acid test) ..............................................................................................................................[2] Q4 .......................................................................................................................................... .................................................................................................................................. 6 ..............................................................................................................................[2] .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. 2 B M .......................................................................................................................................... Reid’s books on of account showed the following figures for the year ended 31 December 2012: For (v) .................................................................................................................................. Return capital employed .................................................................................................................................. Examiner's Use .......................................................................................................................................... ..............................................................................................................................[2] $ .................................................................................................................................. ..............................................................................................................................[2] .................................................................................................................................. Revenue 200 000 © UCLES 2011 9706/22/M/J/11 [Turn over .......................................................................................................................................... (vi) Rate of inventory (stock) turnover Ordinary goods purchased 145 000 .................................................................................................................................. ratio (acid test) © UCLES(vii) 2011 Liquid 9706/22/M/J/11 ..............................................................................................................................[2] Profit from operations 22 500 .......................................................................................................................................... .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. Reid’s balances at 31 December 2012 were: .......................................................................................................................................... Inventory 12 500 ..............................................................................................................................[2] .................................................................................................................................. .................................................................................................................................. Trade receivables 40 000 Cash.................................................................................................................................. and cash equivalents 10 000 (vi) Rate of inventory (stock) turnover .......................................................................................................................................... .................................................................................................................................. Trade payables 25 000 .................................................................................................................................. Finance costs (interest owing) 12 500 .......................................................................................................................................... ..............................................................................................................................[2] ..............................................................................................................................[2] © UCLES 2011 9706/22/M/J/11 Non-current assets at net book value 60 000 .................................................................................................................................. .......................................................................................................................................... (vii) Liquid ratio (acid test) www.maxpapers.com .................................................................................................................................. Additional information: .......................................................................................................................................... .................................................................................................................................. ..............................................................................................................................[2] 1 80% of revenue was on credit .......................................................................................................................................... .................................................................................................................................. 2 Inventory at 1 January 2012 was $17 500 © UCLES 2011 9706/22/M/J/11 (vii) Liquidpayables ratio (acidand test)trade receivables 3 Trade balances were unchanged since .......................................................................................................................................... 1 .................................................................................................................................. January 2012. .................................................................................................................................. .......................................................................................................................................... ..............................................................................................................................[2] .................................................................................................................................. REQUIRED .......................................................................................................................................... .................................................................................................................................. (a) Calculate the following ratios, correct to two decimal places, in each case stating the .......................................................................................................................................... formula used. ..............................................................................................................................[2] .......................................................................................................................................... (i) Mark-up .......................................................................................................................................... © UCLES 2011 9706/22/M/J/11 OMAIR MASOOD CEDAR COLLEGE .......................................................................................................................................... © UCLES 2011 9706/22/M/J/11 .......................................................................................................................................... [3] 277 7 [3] (iv) Operating expenses to revenue ratio (v) Current ratio [3] [3] (vi) Acid test/liquid ratio (ii) Inventory turnover [3] For Examiner's Use 7 (iii) Trade receivables turnover [3] (iv) Operating expenses to revenue ratio 8 [3] (v) Current ratio [3] For the ended 31 December 2011 the following ratios were: (vi) year Acid test/liquid ratio [3] 8 (vii) Non-current [3] Inventory turnover asset turnover. 13 times (iii) Trade receivables turnover For the year ended 31 December 2011 the following ratios were: [3] Trade receivables turnover 70 days [3] Inventory turnover 13 times (v) Current ratio [3] REQUIRED (vi) Acid test/liquid ratio Trade receivables turnover 70 days [3] © UCLES 2013 9706/23/M/J/13 [5] (vii) Non-current asset turnover. [3] (b) Use the above ratios to compare B M Reid’s performance with the year ended 31 December 2012. State possible reasons for the changes. REQUIRED (c) State two limitations of the uses of ratios. [3] (b) Use the above ratios to compare B M Reid’s performance with the year ended (3+3+3+3+3+3+3+5+4) 131 December 2012. State possible reasons for the changes. [3] (June13/P23/Q2) (vi) Acid test/liquid ratio [3] © UCLES 2013 9706/23/M/J/13 2 (vii) Non-current asset turnover. For Examiner's Use For Examiner's Use For Examiner's Use Q5 1 1 2 The following information relates to two businesses, one of which manufactures computers whilst the other is a food wholesaler. All sales and purchases are on credit. The following information relates to two businesses, one of which manufactures computers whilst2the other is a food wholesaler. All sales and purchases are on credit. Business X Business Y (vii) Non-current asset turnover. Business X Gross profit ratio 54% Business Y 30% 6% 30% 0.5:1 6% 3 days 0.5:1 12% 3 days $1 050 000 $4812% 000 $1 050 $14 000 000 $48 $50 000 000 $14 000 $50 000 Net profit ratio 18% Gross profit ratio 54% Current ratio 1.6:1 Net profit ratio 18% Trade receivables turnover 40 days Current ratio 1.6:1 Return on capital employed 5.4% Trade receivables turnover 40 days Cost of sales $248 400 Return oninventory capital employed 5.4% Closing $38 000 Cost of sales $248 Cash and cash equivalents $30400 000 Closing inventory Long-term loan $1$38 000000 000 Cash and cash equivalents $30 000 loanassume a 360-day year. $1 000 000 For Long-term calculations, For Examiner's Use For Examiner's Use [3] [3] [4] [Total: 30] [3] [5] (c) State two limitations the uses of ratios. For calculations, assume aof 360-day year. [5] [Turn over REQUIRED UCLES2013 2013 ©©UCLES 9706/23/M/J/13 9706/23/M/J/13 REQUIRED (a) 1 State and explain which business is the computer manufacturer and which is the food wholesaler. (c) State State two limitations of the uses of computer ratios. 3 manufacturer and which is the food (a) and explain which business is the 3 wholesaler. (b) Prepare, as fully asas the given incomestatements statements both businesses. 1 (b) Prepare, as fully the giveninformation information allows, allows, income forfor both businesses. Income Statements 9706/23/M/J/13 Income Statements Business X Business Y $ $ © UCLES 2013 2 Revenue Business X $ Less Cost of sales [Turn Business Y $ 2 Revenue [4] Gross profit Expenses Less Cost of sales [Total: 30] [8] [Turn[4]over Profit for the year © UCLES 2013 9706/23/M/J/13 Gross profit (c) OMAIR MASOOD Prepare, as fully as 278 COLLEGE the given CEDAR information allows, statements of financial position for both businesses. Expenses [Total: 30] Statements of Financial Position [3] [8] Profit for the year $ Business X $ $ Business Y [3]$ For For Examine Use Examiner's over Use Gross profit Expenses Expenses [8] Profit for the year Profit for the year (c) [8] Prepare, as fully as the given information allows, statements of financial position for (c) Prepare, as fully as the given information allows, statements of financial position for both businesses. both businesses. Statements of Financial Position Statements of Financial Position $ Non-current assets $ Business X $ Business X $ $ $ Business Y $ Business Y $ Current assets Non-current assets Inventory Current assets Trade receivables Inventory Cash and cash equivalents Trade receivables Total assets 4 and cash CurrentCash liabilities equivalents (d) Trade (i) Define the term liquidity. payables Total assets Net assets For Examiner's Use 4 Current liabilities Capital (d) (i) Define the term liquidity. Trade liabilities payables Non-current [2] For Examiner's Use Loan Net assets (ii) employed State which Capital business is more likely to have liquidity problems. 4 Capital (d) (i) Define the term liquidity. Non-current liabilities (ii) State which business is more likely to have liquidity problems. Loan © UCLES 2013 (iii) 9706/22/M/J/13 State which ratio gives most concern and why it does so. Capital employed [12] [2] [1] (3+8+12+2+1+4) 2 [Turn over [12] [1] [2] (June13/P22/Q1) Q6 (iii) (ii) For Examiner's Use 6 to and State which which business ratio givesismost it does so. State moreconcern likely havewhy liquidity problems. Luing Limited’s financial information for the year ended 31 December 2012 revealed the following: © UCLES 2013profit Gross ratio 35% 9706/22/M/J/13 Net profit ratio 14% Rate turnover 10 times (iii)of inventory State which ratio gives most concern and why it does so. Trade payables turnover 42 days Trade receivables turnover 58 days Current ratio 3:1 Inventory at 1 January 2012 $7 800 000 Total revenue (all on credit) for 2012 $85 000 000 All purchases were on credit. For Examiner's Use [Turn [1]over [4] [Total: 30] [4] [Total: 30] REQUIRED (a) For the year ended 31 December 2012, calculate [4] (i) Gross profit [Total: 30] OMAIR MASOOD CEDAR COLLEGE [2] 279 (ii) Cost of sales (iii) Closing inventory 7 [2] [2] 7 [2] (v) Profit for the year 7 Workings: (vi) Expenses (ii) Cost of sales (vii) Trade payables For Examiner's Use [2] [4] Workings: (iii) Closing inventory (iv) Ordinary goods purchased 7 [2] (v) Profit for the year 7 (vi) Expenses 6 Workings: [2] [2] For Examiner's Use [3] [4] (vii) Trade payables (iii) Closing inventory 2 Bradley, a sole trader, provided the following 2014. [3] 8 information for the year ended 31 March (viii) Trade goods receivables (iv) Ordinary purchased [2] $ ratios other than the directors of the (b) Identify three possible users of accounting 000 obtain from the ratios. Revenue 420would company. State what information the users [2] (vi) Expenses Opening inventory © UCLES12013 (Nov13/P23/Q2) Trade payables The (vii) rate of mark up is 40%. 40 000 For Examiner's Use [3] (2+2+4+3+2+2+3+3+9) [4] 9706/23/O/N/13 [3] [3] (viii) Trade receivables (iv) Ordinary goods purchased 6 The rate of inventory turnover is 5 times per annum. Q7 6 [2] 2 REQUIRED Bradley, a sole trader, provided the following information for the year ended 31 March 2014. 2 © UCLES Bradley, following information for the year ended 31 March 2014. 2013 a sole trader, provided the 9706/23/O/N/13 [3] Trade payables $ (a) (vii) Explain what is meant by mark up. $ Revenue 420 000 000 Revenue 420 Opening 40 000 (viii) inventory Trade receivables Opening inventory 40 000 [3] [3] [9] The2rate of mark up is 40%. The rate of mark up is 40%. [3] © UCLES 2013 [9] 9706/23/O/N/13 (c) State formulaturnover for calculating margin. The rate ofthe inventory is 5 times per annum. The rate of inventory turnover is 5 times per annum. (viii) Trade receivables REQUIRED (c) State the formula for calculating margin. REQUIRED [3] [2] (a) Explain what is meant by mark up. (a) Explain what is meant by mark up. (b) Prepare the trading section of the income statement for the year ended 31 March 2014. Additional information [3] (c) State the formula for calculating margin. At 31 March 2014, the net book value of the non-current assets was $550 000. Additional information [2] [9] [2] 3 REQUIRED 9706/23/O/N/13 2014, the net book value of the non-current assets was $550 000. [Turn over 8 turnover measures. (d) (i) Explain what the non-current asset REQUIRED Additional information (ii) State the formula to calculate the non-current asset turnover ratio. Calculate the non-current (d) (i) Explain non-current asset turnover turnoverwhat ratiothe correct to two decimal places. measures. © UCLES asset 2013 9706/23/O/N/13 [Turn over 000. At 31 March 2014, the net book value of the non-current (b) Prepare the trading section of the income statement assets for the was year$550 ended 31 (2+9+2+4+3) March 2014. (b) Prepare the trading section of the income statement for the year ended 31 March 2014. (June15/P21/Q2a-d) Ratio Formula Calculation REQUIRED © UCLES At 312013 March asset turnover (d) (i)non-current Explain what the non-current asset turnover measures. [2] [2] [2] [9] [4] [Total: 30] © UCLES 2013 9706/23/O/N/13 [Turn over [4] © UCLES 2013 9706/23/O/N/13 [Turn over [4] [3] © UCLES 2015 OMAIR MASOOD 9706/21/M/J/15 CEDAR COLLEGE 280 [Turn over (e) Explain why a provision for doubtful debts may be necessary. © UCLES 2015 9706/21/M/J/15 [Turn over Q8 2 6 Alberto is a retailer and has provided the following statement of financial position at 31 August 2014. $ Assets Non-current assets 350 000 Current assets Inventory Trade receivables Total assets 65 000 45 000 110 000 460 000 Capital and liabilities Owner’s capital 420 000 Current liabilities Bank overdraft Trade payables 18 000 22 000 40 000 460 000 Total capital and liabilities The following additional information is also available for the year ended 31 August 2014. $ Inventory at 1 September 2013 50 000 Purchases (all on credit) 280 000 Revenue (all on credit) 425 000 REQUIRED (a) Complete the following table. Ratio Formula Calculation Inventory turnover (in days) Trade receivables turnover (in days) Trade payables turnover (in days) Non-current asset turnover Current ratio [13] OMAIR MASOOD © UCLES 2015 CEDAR COLLEGE 9706/23/M/J/15 281 REQUIRED 7 7 (b) Additional Evaluate Alberto’s performance in respect of the following ratios. Additional information information 7 [3] Inventory turnover (i) terms Credit negotiated withwith bothboth customers andand suppliers are are 30 days net.net. LastLast yearyear Alberto’s Credit terms negotiated customers suppliers 30 days Alberto’s Additional information inventory turnover waswas 60 days. inventory turnover 60 days. (ii) Trade receivables turnover Credit terms negotiated with both customers and suppliers are 30 days net. Last year Alberto’s REQUIRED REQUIRED 8 inventory turnover was 60 days. Evaluate Alberto’s performance in respect of the following ratios. Evaluate Alberto’s performance inextracted respect offrom the following ratios. REQUIRED 2(b) (b) The following information has been the financial statements of Thaw Limited at [3] 31 December 2015. Inventory turnover (i) (b) (i) Evaluate Alberto’s performance in respect of the following ratios. Inventory turnover [3] $ (ii) Trade receivables turnover (i) Inventory turnover Revenue 156 000 (iii) Trade payables turnover Purchases 88 000 (13+3+3+3) Inventory at 31 December 2015 42 000 (June15/P23/Q2a-b) Operating expenses 48 000 [3] [3] Trade receivables 39 000 Q9 8 2 000 Other receivables [3][3] (ii) Trade receivables turnover Cash in Trade hand 1 000 (ii) receivables turnover 2 Trade The following information has been extracted9 from the financial statements of Thaw Limited at [3] payables 29 000 (iii) Trade payables turnover (ii) Trade receivables turnover 31 December 2015. Other payables 8 000 (iii) Trade receivables turnover (days) Bank overdraft 10 000 $ 6 000 8% debenture (2019 – 2021) Revenue 156 000 Purchases 88 000 Additional information Inventory at 31 December 2015 42 000 Operating expenses 48 000 (iii) Trade payables turnover 1 Inventory 1 January 2015 was valued39at000 $34 000. (iii) Trade at payables turnover Trade receivables 9 (iii)receivables Trade payables turnover Other 2 000 2 All sales and purchases were on credit. 1 000 Cash in hand (iii) Trade receivables turnover (days) Trade payables 29 000 REQUIRED Other payables 8 000 (iv) Trade payables turnover (days) Bank overdraft 10 000 8% debenture – 2021) ratios for Thaw Limited. 6 000 (a) Calculate(2019 the following [3] [3] [3] [3] [1] [3] [3] [3] Additional information (i) Current ratio to two decimal places. 1 9 000. Inventory at 1 January 2015 was valued at $34 2 All sales andreceivables purchases were on credit. (iii) Trade turnover (days) (iv) Trade payables turnover (days) REQUIRED [1] [1] (v) Inventory turnover (days) (a) Calculate the following ratios for Thaw Limited. [1] (i) Current ratio to two decimal places. © UCLES 2015 (ii) Liquid (acid test) ratio to two9706/23/M/J/15 decimal 9 places. [Turn over [1] (iii) Trade receivables turnover (days) (iv) Trade payables turnover (days) [1] [1] (v) Inventory turnover (days) (b) Discuss the ratios calculated in part (a) in respect of Thaw Limited’s liquidity and comment [1] 10 9706/23/M/J/15 [Turn over on the overall position. (ii) Liquid (acid test) ratio to two decimal places. [1] (c) Explain three limitations of ratio analysis. © UCLES 2015 (1+1+1+1+1+4+6) (June16/P21/Q2) ((June16/P23/Q2) (iv) Trade payables turnover (days) 9706/23/M/J/15 © UCLES © UCLES 2015 2015 © UCLES 2015 (v) Inventory turnover (days) OMAIR MASOOD 9706/23/M/J/15 9706/23/M/J/15 CEDAR COLLEGE [1] [1] [Turn over [Turn over [1] [Turn over 282 (b) Discuss the ratios calculated in part (a) in respect of Thaw Limited’s liquidity and comment [1] on the overall position. 2 Cash sales were $18 575. All other sales were on a credit basis. 3 All purchases were on a credit basis. 4 Trade receivables at 30 April 2016 were $16 500. 5 Trade payables at 30 April 2016 were $9500. Q10 3 8 Stapleton provided the following information for the year ended 30 April 2016: 6 Inventory turnover was 5 times per annum. REQUIRED Opening inventory Gross profit $ 25 200 37 150 (a) Calculate the trade receivables turnover (days). State the formula used. Additional information Formula 1 All goods were sold to achieve a 20% gross margin. 2 Cash sales were $18 575. All other sales were on a credit basis. 3 Calculation All purchases were on a credit basis. 9 (c) Calculate the trade payables turnover (days). State the formula used. 4 Trade receivables at 30 April 2016 were $16 500. 5 Trade payables at 30 April 2016 were $9500. 6 Inventory turnover was 5 times per annum. Formula Calculation REQUIRED [4] (a) Calculate the trade receivables turnover (days). State the formula used. 9 (b) Formula Calculate closing inventory. [4] (c) Calculate the trade payables turnover (days). State the formula used. (d) State three uses of ratio analysis to a trader. Formula Calculation (4+4+4+3) 1 (June17/P23/Q3) Q11 2 Calculation 2 6 Wiggins has provided the following summary financial information for the year ended [4] [4] 30 April 2017: 3 $ (b) Calculate closing (d) State three usesinventory. of ratio analysis19to000 a trader. Bank overdraft Cash in hand 1 725 Inventory at 1 May 2016 ? 1 Inventory at 30 April 2017 152 000 © UCLES 2017 9706/23/M/J/17 Purchases 860 000 Revenue 1 042 500 Trade receivables 31 275 [4] [3] [Total: 15] 2 Additional information 1 40% of sales are on a cash basis. All remaining sales are on a credit basis. 2 3 purchases are on credit. All 3 The gross margin on all sales was 20%. 4 The trade payables turnover (days) for the year ended 30 April 2017 was 54.75 days (to two [Total: 15] decimal places). © UCLES 2017 REQUIRED 1 [3] 9706/23/M/J/17 (a) State two limitations of using ratio analysis to analyse the performance of a business. OMAIR MASOOD [4] CEDAR COLLEGE 283 2 All purchases are on credit. 7 1 3 The gross margin on all sales was 20%. (c) Calculate the liquid (acid test) ratio to two decimal places. 4 The trade payables turnover (days) for the year ended 30 April 2017 was 54.75 days (to two decimal places). 2 REQUIRED [2] (a) State two limitations of using ratio analysis to analyse the performance of a business. 7 (b) 1Calculate the current ratio to two decimal places. 8 [1] (c) Calculate the liquid (acid test) ratio to two decimal places. Additional information 8 (d) Calculate the rate of inventory turnover (times). Wiggins wishes to expand his business by taking a bank loan of $30 000 repayable over five 2 Additional years. information [2] Wiggins wishes to expand his business by taking a bank loan of $30 000 repayable over five REQUIRED years. (e) Calculate Advise Wiggins whether ortwo not decimal he should take the loan. Justify your answer. (b) the current ratio to places. REQUIRED (e) Advise Wiggins whether or not he should take the loan. Justify your answer. [1] (2+4+1+4+4) [4] (d) Calculate the rate of inventory turnover (times). Q12 2 1 The directors of AB Limited provide the following financial information: Income Statement (extract) for the year ended 30 April 2016 $ Revenue 300 000 Purchases (80% on credit) 250 000 Expenses 27 0009706/22/M/J/17 © UCLES 2017 [4] All sales earned a uniform gross margin of 20%. Statement of Financial Position at 30 April 2016 [4] $ 3 000 Non-current assets 160 Current assets Inventory 38 000 (b) Suggest two reasons why the balance on35 a 000 retained earnings account may be lower than the Trade receivables profit for the year. Cash and cash equivalents 345 000 118 000 © UCLES 2017 9706/22/M/J/17 [4] Total 278 000 1 assets [4] (b) Equity Suggest reasons why the balance on a retained earnings account may be lower than the andtwo liabilities Equity profit for the year. [Total: 15] 3 000 [Total: 15] Ordinary share capital of $1 each 170 3000 Share premium 5 1 2 Retained (b) Suggest twoearnings reasons why the balance on25 a 000 retained earnings account may be lower than the[4] 200 (b) Suggest two reasons why the balance on a000 retained earnings account may be lower than the profit for the year. Current liabilities [2] profit for the year. Trade payables 27 000 51 000 12 Other payables 1 78 000 (c) Total Calculate equity the andfollowing liabilities ratios. 278 000 [2] REQUIRED (i) Rate of inventory turnover (to two decimal places) 2 2Prepare the income statement for AB Limited for the year ended 30 April 2016 in as much (a) 3 (c) Calculate thepossible. following ratios. detail as [2] [2] (b) reasonsturnover why the (to balance on a retained earnings account may be lower than the [2] (i) Suggest Rate oftwo inventory two decimal places) profit for the year. (ii) Liquid (acid test) ratio (to two decimal places) (c) Calculate the following ratios. the following ratios. 9706/22/M/J/17 (c) 2017 Calculate © UCLES 1 [Turn over (i) (i)Rate of inventory turnover (to(totwo Rate of inventory turnover twodecimal decimalplaces) places) [2] (ii) Liquid (acid test) ratio (to two decimal places) 2 [2] (iii) Trade payables turnover (days) [2] (ii) Liquid (acid test) ratio (to two decimal places) (ii) Liquid (acid test) ratio (to two decimal places) OMAIR MASOOD CEDAR COLLEGE 9706/22/M/J/17 [2] [2] [2] © UCLES 2017 (c) Calculate the following ratios. (iii) Trade payables turnover (days) [2] (i) Rate of inventory turnover (to two decimal places) © UCLES UCLES 2017 2017 © 9706/22/M/J/17 9706/22/M/J/17 [Turn[2] over [2] 284 4 Additional information 3 12 4 The following information is available for XY Limited, a competitor of AB Limited. Additional information Anna has obtained the following data at 31 December 2016 in respect of Ravi, a possible new Ratefollowing of inventory turnover is available 8.75for times customer. The information XY Limited, a competitor of AB Limited. Liquid (acid test) ratio 0.85 : 1 Tradeofpayables turnover (days) 42 days Rate inventory turnover times $8.75 Liquid (acid test) ratio 0.85 : 1 Trade receivables 20 640 REQUIRED Trade turnover (days) 4 840 42 days Cash and payables cash equivalents debit 3 5 Inventory Additional (d) Discuss information the performance of 38 AB100 Limited5 by comparing the ratios calculated in part (c) with REQUIRED 12 Trade payables 28 760 those of XY Limited. CD Limited has been asked by both AB Limited and XY Limited to become their supplier. The Additional information (d) Discuss the performance ofdata AB Limited by comparing the ratios calculated in part (c) with new Anna has obtained theare: following 31 December 2016 respect of Ravi, a possible Other figures obtained Rate of inventory turnover directors of CD Limited only wish to at supply to one of the twoincompanies. those of XY Limited. customer. CD Limited has been asked by both AB Limited and XY Limited to become their supplier. The Sales for theofyear 750 to one of the two companies. directors CD Limited only wish331 to supply REQUIRED Rate of inventory turnover Inventory at 1 January 2016 46 200 $ REQUIRED Trade 640 which company they should supply. Give reasons for your (e)receivables Advise the directors of CD20 Limited Ravi has acash mark-up of 25%. Cash andanswer. equivalents 4 840 debit (e) Advise the directors of CD Limited which company they should supply. Give reasons for your Inventory 38 100 answer. (4+2+2+2+2+6+4) REQUIRED Trade payables 28 760 (June17/P21/Q1a-e) Liquid (acid test) ratio 12 (a) Calculate the following Other figures obtained are: ratios for Ravi’s business to two decimal places: 3 Q13 Anna hasLiquid obtained data at 31 December 2016 in respect of Ravi, a possible new (acid the test)following ratio Sales(i)for Current the yearratio 331 750 12 customer. Inventory at 1 January 2016 46 200 3 Anna has obtained the following data at 31 December 2016 in respect of Ravi, a possible new customer. $ 13 Ravi has a mark-up of 25%. Trade receivables 20 640 $ debit Cash andTrade cashpayables equivalents 4 840 turnover (days) Additional information Trade receivables 20 640 REQUIRED Inventory 38 100 Cash and cash equivalents 4 840 debit Trade payables 28 760 Inventory 38 100 has the alsofollowing obtained the following in respect Yuan, another (a) Anna Calculate ratios for Ravi’sdata business to twoofdecimal places: possible customer. Trade payables turnover (days) Trade payables 28 760 [2] Other figures obtained are: (i) Current ratio Current ratio 3.82 : 1 Other figures obtained are: [6] Sales for the year(acid test) ratio331 750 1.63 : 1 Liquid (ii) Liquid (acid test) ratio Inventory at 1 January 2016 46 200 SalesRate for theofyear 331 7506.69 times per year inventory turnover Inventory at 1 January 2016 46 200 Ravi Anna’s has a mark-up of 25%. when choosing the customer is that they should pay her promptly. main concern [6] [4] Ravi has a mark-up of 25%. [4] REQUIRED REQUIRED REQUIRED (a) Calculate the following ratios for Ravi’s business to 13two decimal places: (a) Calculate the following for Ravi’s two decimal places: (b) Advise Anna whichratios customer shebusiness shouldtochoose. Justify your answer. [2] (i) Current ratio (i) Current ratio Additional information [2] (ii) Liquid (acid test) ratio Anna has also obtained the following data in respect of Yuan, another possible customer. 13 (iii) Rate of inventory turnover Current ratio Additional information 3.82 : 1 Liquid (acid test) ratio 1.63 : 1 AnnaRate has also obtained the following data in on respect of Yuan, another possible customer. of inventory turnover 6.69 times per year Question 1(f) is the next page. Current ratio 3.82 : 1 Anna’s main choosing the is customer is that they Liquid (acidconcern test) ratiowhen Question 1.63 : 1 1(f) on the next page. © UCLES 2017 9706/21/M/J/17 Rate of inventory turnover 6.69 times per year (ii) Liquid (acid test) ratio [2] [2] should pay her promptly. [2] REQUIRED (ii) Liquid (acid test) ratio [5] Anna’s main concern when choosing the customer is that they should pay her promptly. (b) Advise which customer she should choose. Justify your answer. (iii) Rate of Anna inventory turnover REQUIRED © UCLES 2017 9706/21/M/J/17 (c) State three limitations to a business of using ratio analysis. (b) Advise Anna which customer she should choose. Justify your answer. 1 (June18/P21/Q3) © UCLES 2018 OMAIR MASOOD © UCLES 2017 (iii) Rate of inventory turnover 9706/21/M/J/18 CEDAR COLLEGE 9706/21/M/J/17 [3] (2+2+3+5+3) [2] [Turn over [2] (iii) Rate of inventory turnover 2 © UCLES 2017 9706/21/M/J/17 [Turn over 285 3Purchases H Limited the following information for its most recent year of trading. (allprovided credit) 800 (c) Calculate the following77ratios for the year. Purchases returns 1 600 $ 12 Administrative and margin (i) gross Cash sales 10 600 distribution expenses 14 800 Credit salesprovided the following 900 300 Opening inventory 481 3 H Limited information for its most recent year of trading. Purchases (all credit) 77 800 Closing inventory 6 500 13 Purchases returns 1 600 Q14 $ 12 Administrative and H(c) Limited calculates a numberratios of different ratios to analyse its results each year. Cash sales 10 600 Calculate the following for the year. distribution expenses 14 800 3 Credit H Limited provided the following information for its most recent year of trading. sales 900 Opening inventory 481 300 REQUIRED Purchases (all credit) 800 (i) gross margin Closing inventory 677 500 $ 600 Purchases Cash sales returns 101 600 (a) H Explain the difference between Credit sales 81gross 900 margin and mark-up. (ii) expenses to revenue Administrative and Limited calculates a number of different ratios to analyse its results each year. Purchases (all credit) 77 800 distribution expenses 14 800 13 Purchases returns 1 600 Opening inventory 4 300 REQUIRED Administrative and distribution expenses 146 800 inventory 500year. (c) Closing Calculate the following ratios for the Opening inventory 4 300 (a) Explain the difference between gross margin and mark-up. (ii) expenses to revenue Closing inventory 6 500 H Limited calculates a number of different ratios to analyse its results each year. (i) gross margin [3] [3] [2] H Limited calculates a number of different ratios to analyse its results each year. [2] (b) REQUIRED (i) Name one cost recorded in an income statement which would not be included in the REQUIRED calculation of the expenses to revenue ratio. [2] (iii) profit margin (a) Explain the difference between gross margin and mark-up. [3] (a) Explain the difference between gross margin and mark-up. [1] [2] (b)(ii)(i) expenses Name one cost recorded in an income statement which would not be included in the to revenue calculation of the expenses to revenue ratio. [2] profit margin 13 13 in the administrative expenses of a limited (ii) (iii) Name two costs which might be included [2] [1] company. [2] (b) (i) Name one cost recorded in an income statement which would not be included in the (c) Calculate the following ratios for the calculation of the expenses revenue (c) Calculate the following ratios fortoyear. the year. ratio. 1 (b) (ii) (i) Name Name one cost which recorded in an (c) income statement which would not be included[3] in the (d) State how the three calculated are related. (i) gross margin two costsratios might beinincluded in the administrative expenses of a limited[1] (i) gross margin calculation of the expenses to revenue ratio. 2 company. [2] [2] (ii) expenses to revenue (ii) Name two costs which might be included in the administrative expenses of a limited [2] [1] 1company. (iii) profit margin [1] 1 (d) State2 how the three ratios calculated in (c) are related. [2] (ii) Name two costs which might be included in the administrative expenses of a limited 2 [2] (e) Suggest two reasons why H Limited’s gross margin may have been higher than the previous company. year. [2] 1 (2+1+2+3+2+2+1+2) [1] [2] 1 (iii) profit margin (Nov18/P23/Q3) [3] [3] 2 [2] (e) Suggest two reasons why H Limited’s gross margin may have been higher than the previous (d) State how the three ratios calculated in (c) are related. year.expenses to revenue (ii) (ii) expenses to revenue 2 1 [2] [2][1] [Total: 15] (d) ratios calculated in (c) are margin related.may have been higher than the previous 2how the (e)State Suggest twothree reasons why H Limited’s gross [2] [2] year. margin [2] (iii) (iii) profitprofit margin 1 [1] 15] © UCLES 9706/23/O/N/18 [Total: © UCLES 2018 2018 9706/23/O/N/18 © UCLES 2018 9706/23/O/N/18 [Turn over (e) Suggest two reasons why H Limited’s gross margin may have been higher than the previous 9706/23/O/N/18 2 year. [2] [2] [2] 1 (d) 2018 State how the three ratios calculated9706/23/O/N/18 in (c) are related. © UCLES [Turn over (d) State how the three ratios calculated in (c) are related. [Total: 15] © UCLES 2018 2 2018 OMAIR © UCLES MASOOD 286 CEDAR COLLEGE 9706/23/O/N/18 [1] [2] [1] (e) Suggest two reasons why H Limited’s gross margin may have been higher than the previous CONTROL ACCOUNTS THEORY CONTROL!ACCOUNTS! ! What!is!the!difference!between!Sales!Ledger!and!Salas!Ledger!Control!Account?! ! Sales(ledger(is(where(we(make(individual(accounts(of(credit(customers.(It(is(part(of(double(entry(system( and(it(gives(details(of(amounts(owing(by(each(customer.(A(list(of(debtors(is(extracted(from(the(sales( ledger,(which(gives(the(figure(of(debtors(for(the(trial(balance.( Sales(ledger(control(account(on(the(other(hand(is(the(total(debtors(account(in(the(general(ledger.(It(is( not(part(of(the(double(entry(system.(It(I(often(referred(as(total(debtors(account.(All(the(entries(recorded( here(are(totals(taken(from(daybooks(e.g.(Sales(figure(is(the(total(of(the(sales(daybook,(discount(allowed( is(total(discount(allowed(from(the(discount(allowed(account(or(the(column(in(the(cashbook.( ( USES!OF!CONTROL!ACCOUNT! 1. Helps(to(prevent(fraud( 2. Helps(to(detect(errors( 3. Quickly(provide(figures(of(total(debtors(and(creditor.( LIMITATIONS!OF!CONTROL!ACCOUNT! 1. Cant(trace(error(of(omission(( 2. Cant(trace(error(of(original(entry( RECONCILIATION!OF!CONTROL!ACOUNT! In(these(types(of(questions,(two(sets(of(balances(of(debtors(or(creditors(are(known.(One(is(from(the( control(account(and(the(other(is(from(the(sales(ledger((or(list(of(debtors).( They(will(also(give(you(several(errors(and(you(will(have(to(reconcile(both(the(balances.( Errors(can(be(classified(as:( ( 1. If(an(error(is(made(in(the(personal((individual)(debtors(account,(than(it(will(only(affect(the(sales( ledger((list)(balances.(E.g.(Sales(made(not(posted(to(debtor’s(account,(this(means(we(should( increase(the(debtor(balances(in(the(ledger.( 2. If(an(error(is(made(in(any(total(figure(of(the(daybook,(it(will(effect(only(the(control(account( balance,(e.g.(Sales(daybook(undercast,(Total(sales(understated(so(add(it(to(control(account( balance.( 3. If(an(entry(is(completely(omitted(from(the(books,(it(will(affect(both(the(balances.(E.g.(A(sales( invoice(completely(omitted(from(the(books,(add(it(to(both(balances.( 4. If(an(entry(is(originally(recorded(in(the(daybook(with(the(wrong(amount,(it(will(affect(both(the( balances,(as(the(total(will(also(be(wrong.(E.g.(A(sales(invoice(of($500(was(originally(recorded(as( $600,(this(means(the(total(sales(are(overstated(and(also(the(individual(account(of(the(customer( has(been(debited(with($600.(We(should(subtract($100(from(both.( 5. If(a(balance(is(omitted(from(the(list(of(debtors,(it(will(only(affect(the(sales(ledger((list)(balance.(It( cannot(affect(control(account(balance.( ( OMAIR MASOOD CEDAR COLLEGE 287 CONTROL ACCOUNTS AND RECONCILIATION CONTROL ACCOUNTS AND RECONCILATION WITH LEDGERS Q1. The trial balance of Pineapple & Son revealed a difference in the books. It was decided to prepare sales and purchases ledger control accounts to help detect any error(s). The following balances were in the books on 31 May 1990. $ Purchases ledger balances on 1 June 1990 42,944 Sales ledger balances on 1 June 1990 75,500 Totals for the year ended 31 May 1991 were: Purchases Journal 600,750 Sales Journal 842,910 Returns Out Journal 10,770 Returns in Journal 12,150 Cheques paid to Suppliers 580,120 Cheques/Cash from customers 751,950 Discounts allowed 20,120 Discount Received 8,640 Petty cash paid to suppliers 210 Bad debts written off 1,480 Customers cheques dishonoured 350 Balance on sales ledger set off against 4,080 Purchases Ledger REQUIRED: (a) Prepare sales and purchases ledger control accounts (b) Explain three ways in which a business might use control accounts. OMAIR MASOOD CEDAR COLLEGE 288 Q2.The following balances were taken from the books of K. Packer as at 30 April 1990. $ Purchases ledger balances 27,910 Sales ledger balances 45,020 Totals for the year ended 30 April 1990 Returns Out Journal 3,070 Sales Journal 501,510 Returns in Journal 10,440 Purchases Journal 300,450 Petty cash paid to suppliers 230 Cheques received from customers 458,770 Cheques paid to Suppliers 281,990 Cash received from customers 33,330 Bad debts written off 2,090 Discounts Allowed 7,080 Discounts received 6,540 Customer cheques dishonoured 1,790 Balance on sales ledger set off 2,330 against balance on Purchases Ledger NOTE: All Packer’s transactions are carried out on a credit basis. REQUIRED: (a) To prepare Purchases and Sales Ledger Control Accounts for the year ended 30 April 1990 showing clearly the balances on these accounts at 30 April 1990. (b) To explain why control accounts are prepared. Outline the uses to which such accounts are put. OMAIR MASOOD CEDAR COLLEGE 289 Q3.Tripura Limited prepares control accounts at the end of each month. For March 2007, balances and transactions were as follows: $ At 1 March 2007 Sales Ledger Control Account Debit balance Credit balance Purchases Ledger Control Account Debit balance Credit balance 8,760 234 123 16,540 $ Transactions for the month of March 2007 43,210 Credit sales 987 Discount received 870 Sales returns 760 Discount allowed 475 Cheques from customers dishonoured 23,456 Payment to Trade Payables 33,654 Credit purchases 29,876 Cheques from credit customers 234 Cash refund to customers 1,234 Bad debts written off 3,210 Amount settled by contra set-off 1,020 Interest charged on debtor’s overdue account $ At 31 March 2007 Sales Ledger Control Account Credit balance Purchases Ledger Control Account Debit balance 567 321 REQUIRED: From the information given above, prepare for the month of March 2007: (a) Sales Ledger Control Account (b) Purchases Ledger Control Account OMAIR MASOOD CEDAR COLLEGE 290 Q4. The following information has been extracted from the books of G. Elm, trader, for the month of October 1994. $ Sales Ledger Balances at 1 October DR 72,950 CR 1,075 Purchases Ledger Balances at 1 October DR 835 CR 64,410 550 Sales – Cash 620 Purchases – Cash 127,220 Sales – Credit 90,330 Purchases – Credit Sales Returns (Credit Customers) Purchases Returns(Credit Customers) Balance on Bad Debts Provision at 1 October 1,250 2,520 805 Bad Debts Written Off 1,240 Cheque Dishonoured 1,790 Discounts Allowed 1,350 Discounts Received Interest Charged Accounts 970 on Trade Receivables Overdue Receipts from Trade Receivables 210 104,500 81,960 Payment to Trade Payables Sales Ledger Credit Balance at 31 October Purchases Ledger Debit Balance at 31 October 1,110 440 You should note that: 1. The provision for bad debts is to be adjusted to $2,900 2. On the 31 October the balances on P Reid’s account were: • Purchases ledger $1,450 • Sales Ledger $910 The balance in the Sales Ledger is to be offset against the Purchases Ledger balance. REQUIRED: (a) Prepare Sales Ledger and Purchases Ledger Control Accounts for October 1994. (b) List briefly the uses and advantages of Control Accounts. (c) Explain briefly how a contra entry might arise. OMAIR MASOOD CEDAR COLLEGE 291 Q5. An examination of the books of Better and Son reveals that on 30 September 1993 the position was DR $ Trade Receivables Ledger Balances 80,200 Trade Payables Ledger Balances 402 CR $ 179 71,900 During the month of October 1993 the following events were recorded. $ 621,250 Sales 439,200 Purchases 3,650 Bad debts written off 12,110 Returns inwards 1,535 Returns outwards Cash received from Trade Receivables Cash paid to Trade Payables 574,225 399,700 14,750 Discount received 21,050 Discount allowed Cash refund from suppliers Amount due from customer as shown in Trade Receivables ledger, offset against amount due to same customer and included in Trade Payables ledger Allowances made to customers for goods damaged in transit Cash received for debt previously written off as bad Cheques received dishonoured 402 1,220 555 123 740 On 31 October 1993 there were no credit balances in the Trade Receivables ledger there were no debit balances in the Trade Payables ledger. REQUIRED: (a) Prepare Trade Receivables and Trade Payables control accounts for the month of October 1993. (b) Explain the uses of control accounts by management. OMAIR MASOOD CEDAR COLLEGE 292 Q6. The following information relating to the month of August 1992 is taken from the books of Lucy. She maintains both Sales and Purchases (Suppliers) Ledgers Control accounts as part of double entry accounting system. $ Balance on customers’ accounts at 1 August 1992 Debit Credit Balances on supplier’s accounts at 1 August 1992 41,580 600 27,020 Credit sales invoiced during month 46,950 Invoices for good purchased during month 26,380 Contra (set off) settlements between customers’ and suppliers’ accounts 750 Cash sales during month 14,150 Cash paid to suppliers for credit transactions 25,260 Discount Received 590 Provision for doubtful debts at 1 August 1992 950 Customers’ balances written off as bad debts during month 450 Goods returned to suppliers 620 Credit notes issued to customers for goods returned ( sales returns) 1,220 Cash received from credit customers in full settlement of debts of $42,230 41,630 Cash at bank 31 August 1992 5,100 Debit balances on suppliers accounts at 31 August 1992 230 Credit balances on customers’ accounts at 31 August 1992 120 REQUIRED: (a) Using much of the above as is relevant, prepare a Sales Ledger Control account and a Purchases (Suppliers) Ledger Control account, both for the month of August 1992. (b) Explain the ways in which control accounts can be of use to the management of a business. OMAIR MASOOD CEDAR COLLEGE 293 ! Q7.The following balances relate to Mr. Naeem’s business for the month of February 2007 which was the first month of trading:! $ 87,654 Credit sales 23,456 Cash sales 2,654 Credit sales returns 1,234 Cash Sales returns 67,900 Credit Purchases at list price 15,675 Cash Purchases 2,500 Purchases returns at list price 987 Cash purchases returns Cheques received from Trade Receivables 65,423 37,278 Cheques paid to Trade Payables 1,962 Discount received 1,568 Discount allowed Cash refunded to Trade Receivables for over payment Cash received from suppliers for over payment Cheques from Trade Receivables dishonoured 234 432 1,234 2,500 Bad debts written off Bad debts written off previously recovered in cash Interest charged on Trade Receivables’ overdue accounts Interest charged by Trade Payables’ on overdue account Amount settled by contra set-off Credit balance on debtor’s account on 28 February Debit balance on creditor’s account on 28 February 250 987 879 3,456 550 456 The credit purchases are subject to 10% trade discount on list prices. REQUIRED: From the information given above, prepare for the month of February 2007 (a) Sales Ledger Control Account (b) Purchases Ledger Control Account OMAIR MASOOD CEDAR COLLEGE 294 Q8.The Trial Balance as at 31 October 1996 of Buzz Products Ltd. Included the following balances. Cr($) Dr ($) Sales ledger Control Account 371 12,440 Purchases Ledger Control Account 9,846 214 311 Provision for doubtful debts The company’s transactions during the year ended 31 October 1997 are summarized as follows: $ 23,740 Credit sales 783 Credit sales returns 13,471 Credit Purchases 183 Credit Purchases returns 832 Discounts allowed 610 Discounts received 540 Bad debts written off 12,307 Payments to credit suppliers 16,357 Receipts from credit customers 3,100 Receipts from cash customers Additional Information: 1. Payments to suppliers incorrectly included $1630 for wages paid to the employees of Buzz Products Ltd. 2. The Sales ledger Control Account included credit balances at 31 October 1997 for the following customers. $ T. King B Lamb 131 22 3. 4. The Purchases Ledger Account included debit balances at 31 Oct 1997 of $85 for T. Dent. J. Patel is both a supplier and customer of Buzz Product Ltd. On the completion of each year’s final accounts, an appropriate transfer is made in the company’s accounts so that J. Patel has an year-end balance in either the Purchases Ledger or the Sales Ledger. At 31 October 1997, the balances of J. Patel’s accounts were as follows. Purchase Ledger 550 Credit Sales Ledger 710 Debit 5. The Company has decided that the Provision for doubtful debts at 31 October 1997 should be 4% of the amount due from customers. REQUIRED: (i) Sales Ledger Control Account (ii)Purchases Ledger Control Account (iii0Provision for doubtful debts account OMAIR MASOOD CEDAR COLLEGE 295 Q9.!M. House Private Co Ltd. operates an accounting system which includes both Sales and Purchases Ledger Control Accounts.!The Company’s trial balance at the year ended 30 June 1987 included:! DR $ CR $ Sales Ledger Control Account 45,200 760 Purchases Ledger Control Account 1,310 48,440 Below are sub-totals relating to the company dealings with its customers and suppliers during year ended 30 June 1988. $ Sales Gross invoice value Net invoice value (after trade discount) 435,620 395,850 Sales Returns Gross invoice value Net invoice value (after trade discount) 11,950 10,990 Amount receivable from customers Full amount Settled in full by receipt of 402,650 400,550 Debts written off (irrecoverable) 1,210 Purchases Gross invoice value Net invoice value (after trade discount) 325,600 271,500 Purchases Returns Gross invoice value Net invoice value 18,830 15340 Amounts payable to suppliers Full amount Settled in full by payment of 287,720 279,180 1. At 30 June 1988 the sales Ledger included these accounts with credit balances $ H. Holborn 490 K. Cross 1,615 B. Street 885 and the Purchases Ledger included these accounts with debit balances $ M. Arch 1,040 C. Larry 770 QUESTION CONTINUED ON NEXT PAGE OMAIR MASOOD CEDAR COLLEGE 296 2. At 30 June 1988 the personal account balances of B. Side were $ Purchase Ledger 4,550 Sales Ledger 3,210 It was decided to set off B. Side’s balance in the Sales Ledger against his balance in the Purchases Ledger. REQUIRED: (a) Prepare a Sales Ledger Control Account and a Purchases Ledger Control Account for the year ended 30 June 1988. Q10.!!!JR’s sales ledger control account balances at, 1 March 2008 were as follows.! Dr $340,600 Cr $1,960 During March 2008 the following transactions took place. $ 295 000 Credit sales 219 750 Cash sales Sales returns from credit customers Receipts from Trade Receivables 6 480 238 600 3 500 Discounts allowed Additional information for the month of March 2008 1. The receipts from Trade Receivables included a cheque for $3600 in full settlement of a debt of $3800. This was returned by the bank on 28 March marked “insufficient funds”. 2. Eva Little and JR both buy form and sell to each other. At 31 March 2008 Eva owed JR $5000 and JR owed $8600 to Eva. They agreed to offset balances, the net amount being payable by JR on 31 March 2008. 3. It was agreed that a debt of $2300 from Alice Springs was bad and it was written off. 4. The total credit balances in the sales ledger control account at 31 March 2008 were $8340. REQUIRED: (a) Prepare JR’s sales ledger control account for the month of March 2008. (b) State three possible reasons why a debtor’s account might have a credit balance. (c) State three reasons for keeping control accounts. ! OMAIR MASOOD CEDAR COLLEGE 297 Q11.On 31 July 1995, Jeanne Cousseau sales ledger balances totaled $17,040 but, on the same date, the balance of the sales ledger control was $18060 Dr. After investigation, the following errors were found: 1. A Trade Receivable’s balance of $750 had been omitted from the list of Trade Receivables. 2. Although discount allowed of $60 had been entered in the cash book, it had not been posted to the customer’s account. 3. A debt of $200 had proved bad and had been written off. No entry had been made in the control account. 4. T. Ballard was both a customer and a supplier. His purchases ledger balance of $310 had been set off against his sales ledger balance but nothing had been recorded in the control account. 5. Returns inwards $90 had not been entered anywhere in the accounts. 6. M. Ney returned goods worth $70 and this sum was debited to his account. 7. A Trade Receivable’s account was charged with $30 interest but it was not recorded in the control account. 8. The sales day book had been under-casted by $10. REQUIRED: (a) An adjusted Sales Ledger Control Account (b) A statement, suitably headed, showing the reconciliation of the original total of the Sales Ledger balances with the amended Sales Ledger Control Account balance. OMAIR MASOOD CEDAR COLLEGE 298 Q12.The Sales Ledger Control Account for Kaynine Ltd. for the year ended 31st December 2007 has been prepared from the following information. $ Debit balance b/d 1 January 2007 105,000 Credit balance b/d 1 January 2007 6,800 Totals for the year 1 January 2007 to 31 December 2007: Cash sales $ 65,000 Credit sales 750,000 Cash received from Receivables Cheques received from Receivables Trade 5,800 Trade 698,000 Sales return from Trade Receivables 9,200 Contra purchases ledger 18,700 Discounts allowed 16,200 Dishonoured cheques 9,300 The Sales Ledger Control Account balance did not agree with the total shown in the Schedule of Trade Receivables of $114,450. The following errors were discovered: (i) A cheque for $18,300 received from a Trade Receivable had been correctly posted to the Cash Book but omitted from the Sales Ledger. (ii) Two Trade Receivable balances are more than six months old. A. Baker owes $5,250 and S.Briggs owes $4,700. It was decided to make a specific provision for the full amount of A. Baker’s debt and to write off in full the amount owed by S. Briggs as a bad debt. (iii)A credit sale of $8,950 to P. Winter had been correctly recorded in the Sales Journal but had not been posted to the Sales Ledger. (iv) A Cheque for $4,500 received from B Brookes a trade receivable was subsequently dishonoured. This had been correctly recorded in the cash book but the double entry had not been posted to the sales ledger. REQUIRED: (a) A Sales Ledger Control Account before the errors (b) A corrected Sales Ledger Control Account for the year ended 31 December 2007. (c) A statement reconciling the total of the Schedule of Trade Receivables with the corrected balance on the Sales Ledger Control Account. OMAIR MASOOD CEDAR COLLEGE 299 Q13.The following information has been taken from the books of Jo King, for the financial year ended 31 October 1995. $ Sales Ledger Balances at 1 November 1994 29,186 Credit sales for the year 501,920 Credit sales returns 9,985 Payment received from Trade Receivables (all banked) 463,801 Cash sales 15,242 Trade Receivable’s cheque dishonoured 548 Discount allowed on credit sales 20,417 Bad debts written off 9,420 Debit balances transferred to purchase ledger accounts 1,043 The total of Jo King’s sales ledger balances amounts to $29,101 that does not agree with the closing balance in the sales ledger control account. The following errors have been discovered: 1. A debit balance for $2046 had been emitted from the list of Trade Receivables. 2. A page of the Sales Day Book with entries totalling $3942 had been mislaid and not included in total sales: the amount had been posted to the Trade Receivables’ accounts. 3. A sales invoice for $1011 had been completely omitted from the books. 4. A sales ledger account had been understated by $100. 5. Discount allowed account had been overstated by $300. 6. An entry for $806 in the Sales Day Book had not been posted to the Trade Receivable’s account. 7. A debit balance for $702 in the sales ledger had been set off against a contra account in the purchases ledger, but no entry had been made in the control accounts. 8. A receipt of $620 was debited to the Bank account but omitted from the Trade Receivable’s account. 9. A credit note for $360 sent to a Trade Receivable had been entered in the Sales Day Book and posted as a sale to both accounts. 10. A Trade Receivable owing $905 was declared bankrupt during October 1995. The debt had been written off in the control account, but no entry had been made in the Trade Receivable’s account to cancel the debt. REQUIRED: (a) From the original list of balances, draw up the Sales Ledger Control Account for the year ended 31 October 1995 before the errors had been discovered. (b) Take account of the ten errors, and: (i) Show the amendments to be made to the control account and calculate the new balance on it. (ii) Draw up a statement amending the total of the sales ledger balance to agree with the new control balance. OMAIR MASOOD CEDAR COLLEGE 300 Q14. The balance on the Sales Ledger Control Account at 31 December is $61,752. This does not agree with the total of the list of Trade Receivables Ledger balances on that date, which amounts to $61,500. On checking the accounts, you discover the following errors: 1. A balance of $198 has been emitted from the list of Trade Receivables Ledger balances at 31 December. 2. A Trade Receivable’s account has been undercasted by $325. 3. A sales invoice for $2520 has been completely omitted from the books. 4. Sales figure for the month should have been listed as $230,256 not $230,265. 5. A Trade Receivable who owed the business $280 has been declared bankrupt. This has been correctly entered in the control account, but no entry has been made to cancel the debt in the Trade Receivable’s personal account. REQUIRED: (i) Make the necessary entries in the Sales Ledger Control Account to correct it. (ii) Prepare a statement amending the total of the Trade Receivables Ledger balances. OMAIR MASOOD CEDAR COLLEGE 301 Q15.The Purchases Ledger Control Account of Henry Hutton for the year ended 30 November 2006 had been prepared from the following information. $ Credit balance b/d 1 December 2005 174,000 Totals for the year 1 December 2005 to 30 November 2006 964,000 Credit purchases 766,000 Cheques paid to Trade Payables 5,600 Cash paid to Trade Payables Credit purchases returned to suppliers 37,000 19,300 Discounts received 84,200 Contra sales ledger The Purchases Ledger Control Account, which is part of the double entry system, failed to agree with the total Trade Payables of $216,150 as shown by the schedule of Trade Payables. The following errors were subsequently discovered. (i) A purchase of $8600 ad been entered in Jane Blake’s account in the Purchases Ledger as $6800. The correct entry had been made in the Purchases Journal. (ii) The discounts received column in the Cash Book had been overcast by $750. (iii)A credit purchase of $8700 from David Patel was correctly recorded in the Purchases Ledger Control Account, but no other posting had been made. (iv) Henry Hutton had returned goods costing $4600 to a supplier. No entries had yet been made in Henry Hutton’s accounts to record the return of these goods. REQUIRED: (a) A Purchase Ledger Control Account before the errors. (b) A corrected Purchases Ledger Control Account for the year ended 30 November 2006. (c) A statement showing the correct total of the Schedule of Trade Payables for the year ended 30 September 2006. (d) Explain three advantages to Henry Hutton of operating a system of control accounts. OMAIR MASOOD CEDAR COLLEGE 302 Q16.Jean balanced her Purchases Ledger Control Account on 31 May 1994 and it showed a credit balance of $19,950. She then listed the individual suppliers’ balances in the Purchases Ledger and the total came to $18,960 at the same date. When she examined the records, the following errors were found, and subsequently corrected. (i) Goods costing $850 had been bought from North on credit, but no entries had been passed in any of the books. (ii) West had allowed cash discount $20 to Jean. This had been entered on the wrong side of West’s account but entered correctly in the cash book. (iii)The Purchases Returns Day Book showed that a credit note for $60 had been received from East but it had not been posted to East’s account. (iv) The Purchases Day book had been overcast by $1,000. (v) South’s credit balance of $90 had been omitted when the Purchases Ledger balances had been listed. REQUIRED: (a) An adjusted Purchases Ledger Control Account. (b) A Statement, suitably headed, showing the reconciliation of the original total of the Purchases Lodger balances with the new Purchases Lodger Control Account balances. OMAIR MASOOD CEDAR COLLEGE 303 Q17. The sales ledger control account of Kettlewell Ltd. For the year ended 28th February 2006 has been prepared from the following information. $ Debit balance b/d 1 March 2005 51000 Totals for the year 1 March 2005 to 28 February 2006: Credit sales 620000 Cheques received from trade receivables 584000 Cash received from trade receivables 6000 Discount allowed 24200 Bad debts 4000 Dishonoured cheques 5100 Sales returns from trade receivables 6500 Contra purchase ledger 8000 The sales Ledger Control Account balance failed to agree with the total Trade Receivables of $43,600 shown by the schedule of Trade Receivables. The following errors were subsequently discovered. (i) No contra entry had been made in a Trade Receivables account in the sales ledger in respect of purchases by Kettlewell Limited of goods list price $1,000, trade discount 10%. This item had been correctly dealt within the Sales Ledger Control Account. (ii) The discount allowed total shown in the cash book had been undercasted by $700. (iii)A customer had returned goods to Kettlewell Limited at the selling price of $1700. The goods had been bought on credit. No entries had been made to record the return of the goods in the accounts of Kettlewell Limited. REQUIRED: (a) A corrected Sales Ledger Control Account for the year ended 28th February 2006. (b) A statement showing the correct total for the schedule of Trade Receivables for the year ended 28th February 2006. (c) Discuss the advantages that a system of control accounts would bring to a business. OMAIR MASOOD CEDAR COLLEGE 304 Q18.The sales ledger control account of Workitt Ltd. for the year ended 31st December 2000 has been prepared from the following information. $ Debit balance b/d 1st January 1999 56,000 Totals for the year 1st January 1997 to 31st December 2000 800,000 Credit Sales Cheques received from Trade Receivables Cash received from Trade Receivables 676,000 1,000 20,000 Discount allowed 2,000 Dishonoured cheques 4,000 Contra Purchases Ledger The control account Trade Receivables balance failed to agree with the total Trade Receivables of $156,125 shown by the schedule of Trade Receivables. The following errors were subsequently discovered. (i) Workitt Ltd. had sent goods on a sale or return basis to a customer with a selling price of $1,000. The customer had not signified its intention to purchase the goods while Workitt Ltd. Considered them sold, and made the relevant accounting entries. (ii) No contra entry had been made in a Trade Receivables account in the sales ledger in respect of purchase by Workitt Ltd of good list price $500, trade discount 15%. This entry had been correctly dealt within the control account. (iii) The discount allowed total shown in the cash book had been undercasted by $700. (iv) A customer had returned goods to Workitt Ltd. at the selling price of $2,000. These goods had been bought on credit by the customer. No entries had been made to record the return of goods in the accounts of Workitt Ltd. (v) During 1999 Workitt Ltd. received a cheque drawn by a customer for goods sold on credit for $600. The correct double entry was made in the accounts. The cheque was subsequently returned by the bank marked ‘Refer to Drawer’. Workitt ltd. Credited the bank account. The amount was included in the total of dishonoured cheques, but there was no further entry. The company expects the account will be settled in February 2001. REQUIRED: (a) A corrected sales ledger control account for the year ended 31st December 2000 together with a reconciliation statement of the Trade Receivables schedule showing the correct total for the schedule of Trade Receivables. (b) Discuss two advantages of operating a control account system. OMAIR MASOOD CEDAR COLLEGE 305 Q19 (a) The following information was extracted from the books of William Noel for the year ended 30 April 2001. $ Purchases Ledger Balance at 1 May 2000 43,120 Credit purchases for the year 824,140 Credit purchases returns 12,400 Cheques paid to Trade Payables 745,980 Cash purchases 8,940 Discount received on credit purchases 31,400 Credit balances transferred to sales ledger accounts 5,210 REQUIRED: Draw up the Purchases Ledger Control Account for the year ended 30 April 2001 (b) The total of the balances in Noel’s purchases ledger amounts to $67,660, which does not agree with the closing balance in the Control Account. The following errors were then discovered: 1. Discount received had been overstated by $1000. 2. A credit purchases invoice for $2040 had been completely omitted from the books. 3. A purchases ledger account had been understated by $100. 4. A credit balance of $850 in the purchases ledger had been set off against a contra entry in the sales ledger, but no entry had been made in the control accounts. 5. A payment of $1450 had been debited to the Trade Payables account but was omitted from the bank account. 6. A credit balance of $3210 had been omitted from the list of the Trade Payables. REQUIRED: (i) Extract the necessary information from the above list and draw up an amended Purchases Ledger Control account for the year ended 30 April 2001. (ii) Beginning with the given total of $67,660, draw up a table showing the changes to be made in the Purchases Ledger to reconcile it with the new Control account balance. OMAIR MASOOD CEDAR COLLEGE 306 Q20.RW Ltd. uses control accounts to check the accuracy of its Trade Receivables and Trade Payables as shown by its double entry book keeping system. The Sales Ledger Control Account and the Purchases Ledger Control Account for the financial year ended 31st December 2006 have been prepared from the following information. 1st January 2006 balance b/d: $ Sales Ledger Control Account 262,000 Dr Purchases Ledger Control Account 307,000 Cr Totals for the year 1st January 2006 to 31st December 2006: $ Credit sales Credit purchases Sales returns Purchase returns Cheques received from Trade Receivables Cash received from Trade Receivables Cheques paid to Trade Payables Discounts received Discount allowed Dishonoured cheques from Trade Receivables 376,000 287,500 12,700 13,700 327,800 18,200 212,700 7,600 8,800 4,500 At the financial year end 31 December 2006, RW Ltd.’s Schedule of Trade Receivables had a total of $267,000, which differed from its Sales Ledger Control Account balance at the date. At the same date, RW Ltd.’s Schedule of Trade Payables had a total of $324,000, which differed from its Purchases Ledger Account balance at that date. Subsequent investigation revealed the following. (i) The total of sales in the Sales Journal had been undercasted by $66,500. (ii) A cheque received from a Trade Receivable for $2,500, correctly processed through the books, had subsequently been dishonoured. The books have not yet been adjusted to reflect this. OMAIR MASOOD CEDAR COLLEGE 307 (iii)$4,000 purchases made on 31st December 2006 were correctly entered in the (iii)$4,000 purchases made on 31st December 2006 were correctly entered in the Purchases Journal but had not been posted to the individual supplier’s Purchases Journal but had not been posted to the individual supplier’s account in the Purchases Ledger. account in the Purchases Ledger. (iv) A credit sale to T. Cook for $45,200 had been correctly entered in the Sales (iv) A credit sale to T. Cook for $45,200 had been correctly entered in the Sales Journal but had not been posted to T. Cook’s account. Journal but had not been posted to T. Cook’s account. (v) D. Hubbard is both a customer and a supplier to RW Ltd. He purchased (v) D. Hubbard is both a customer and a supplier to RW Ltd. He purchased goods to the value of $62,500 from RW Ltd and supplier RW Ltd with goods to the value of $62,500 from RW Ltd and supplier RW Ltd with goods to the value of $32,500. The correct entries have been made in the goods to the value of $32,500. The correct entries have been made in the Sales Ledger and the Purchases Ledger but no contra entries have been made Sales Ledger and the Purchases Ledger but no contra entries have been made in the control accounts. in the control accounts. (vi) Purchases of $15,300 from a supplier had been found to be unsuitable and (vi) Purchases of $15,300 from a supplier had been found to be unsuitable and were returned onth 14th December 2006. This transaction to record the return were returned on 14 December 2006. This transaction to record the return had not been processed through the books. had not been processed through the books. (vii) A cheque for $6,200 sent to a supplier, for goods received, had been (vii) A cheque for $6,200 sent to a supplier, for goods received, had been returned to RW Ltd as it had not been signed. As at 31 December 2006 a returned to RW Ltd as it had not been signed. As at 31 December 2006 a replacement cheque had not been issued and the return of the original replacement cheque had not been issued and the return of the original cheque had not been recorded in RW Ltd.’s books. cheque had not been recorded in RW Ltd.’s books. (viii) Sales returns of $3,200 had been correctly entered in the Sales Returns (viii) Sales returns of $3,200 had been correctly entered in the Sales Returns Journal but had not been posted to the individual Trade Receivable’s Journal but had not been posted to the individual Trade Receivable’s account. account. REQUIRED: REQUIRED: (a) A Sales Ledger and Purchase Ledger Control Account before the errors. (a) A Sales Ledger and Purchase Ledger Control Account before the errors. (b) Amended Sales Ledger and Purchase Ledger Control Accounts. (b) Amended Sales Ledger and Purchase Ledger Control Accounts. (c) A statement to correct schedule of Trade Receivables. (c) A statement to correct schedule of Trade Receivables. (d) A statement to correct the schedule of Trade Payables. (d) A statement to correct the schedule of Trade Payables. ! ! OMAIR MASOOD CEDAR COLLEGE 308 CONTROL PAST PAPERS CONTROL ACCOUNTS ACCOUNTS-PAST PAPERS Q1. 1 2 Delph started trading on 1 July 2016. For the year ended 30 June 2017 he provided the following information relating to his sales and purchases. $ 39 826 692 74 779 6 813 1 764 Bank payments to credit suppliers Cash purchases Credit purchases Credit purchases returns Discount received At 30 June 2017 Sales ledger control account balance 21 555 Debit 3 REQUIRED Additional (a) Explaininformation two benefits of using control accounts. 3 The following book-keeping errors have been discovered in the sales ledger: 1 Additional information 1The The salesbook-keeping journal total for June 2017 wasdiscovered understated by sales $1470. following errors have been in the ledger: 21 AThe customer’s invoice was was entered in the sales journal as $2190. sales journal totalfor for$2910 June 2017 understated by $1470. 32 Discounts allowed in for June 2017 amounting tothe $435 were debited to the sales ledger control A customer’s invoice $2910 was entered in sales journal as $2190. account. 3 4 2 Discounts allowed in June 2017 amounting to $435 were debited to the sales ledger control Aaccount. sales invoice for $1520 dated 30 June 2017 was omitted from the sales journal. 4 A sales invoice for $1520 dated 30 June 2017 was omitted from the sales journal. REQUIRED 4 REQUIRED (b) Prepare the amended sales ledger control account at 30 June 2017. [4] 4 (b) Prepareinformation the amended sales ledger control account at 30 June 2017. Additional Delph Additional information Amended salesDelph ledger control account At 30 June 2017 there was a debit balance on the purchases ledger account of $384. Amended sales control account At 30 June 2017 there was a debit balance onledger the purchases ledger account of $384. $ $ REQUIRED $ $ REQUIRED (c) Prepare for the year ended 30 June 2017. Balancethe b/dpurchases ledger control 21account 555 Balance the b/d purchases ledger control 21 555 (c) Prepare account for the year ended 30 June 2017. Delph Purchases ledger control account Delph Purchases ledger control account $ $ $ $ OMAIR MASOOD © UCLES 2018 CEDAR COLLEGE 9706/22/F/M/18 309 [5] Additional information Delph has also provided the following information. At 1 July 2016 Capital introduced Loan from the bank (repayable 2021) $ 10 500 3 000 During the year ended 30 June 2017 Bank payments Motor vehicle Loan Drawings 13 560 500 12 625 At 30 June 2017 Inventory Cash in hand Rent Bank Wages 5 3 700 360 650 856 1 890 Debit Debit Debit Credit Credit The motor vehicle is to be depreciated at 25% using the reducing balance method. REQUIRED (d) Prepare the statement of financial position at 30 June 2017. ©(Mar18/P22/Q1a-d) UCLES 2018 (4+5+5+9) Delph 9706/22/F/M/18 Statement of financial position at 30 June 2017 6 Q2. 2 2 2 6 6 Trott provided the following information for the year ended 30 April 2017: Trott provided the following information for the year ended 30 April 2017: Trott provided the following information for the year ended 30 April 2017: $ $ 185 Sales ledger control account balance 93 $185 Sales account balance 9378 Sales ledger ledgercontrol balances 370 Sales account balance 93 Sales ledger ledger control balances 78185 370 Sales ledger balances 78 370 The following errors were identified: The following errors were identified: The following errors were identified: 1 1 1 The sales salesjournal journaltotal totalhad hadbeen beenovercast overcast $30 420. The byby $30 420. The sales journal total had been overcast by $30 420. 3 3 3 Interest charged chargedon onan anoverdue overdueamount, amount, $720, had been completely omitted the books Interest $720, had been completely omitted fromfrom the books Interest charged on an overdue amount, $720, had been completely omitted from the books of account. of account. of account. 4 4 The sales salesreturns returnsjournal journalhad hadbeen been overcast $4560. The overcast byby $4560. The sales returns journal had been overcast by $4560. 5 5 Discount completely omitted from the the books of account. Discountallowed allowedofof$1520 $1520had hadbeen been completely omitted from books of account. Discount allowed of $1520 had been completely omitted from the books of account. 6 6 Receipts in in thethe cash book hadhad been overcast by $18 965.965. Receiptsfrom fromcredit creditcustomers customersentered entered cash book been overcast by $18 Receipts from credit customers entered in the cash book had been overcast by $18 965. 7 77 An irrecoverable debt ofof$1825 had been written off in the sales ledger control account but An irrecoverable irrecoverabledebt debtof $1825 had been written in the sales ledger control account An $1825 had been written off off in the sales ledger control account but but no entry had been made in the customer’s account. noentry entryhad hadbeen beenmade madein in the customer’s account. no the customer’s account. 2 2 2 A dishonoured dishonouredcheque chequefor for$9745 $9745 had been entered in the customer’s account. A had notnot been entered in the customer’s account. A dishonoured cheque for $9745 had not been entered in the customer’s account. REQUIRED REQUIRED REQUIRED (a) Complete the following tables to update the sales ledger control account balance and the (a) Complete Completethe thefollowing followingtables tablesto to update sales ledger control account balance and the (a) update thethe sales ledger control account balance and the sales ledger balances at 30 April 2017. sales April 2017. salesledger ledgerbalances balancesatat3030 April 2017. OMAIR MASOOD Description Description Description Opening balance balance Opening Opening balance Sales ledger control account Sales ledger control account Sales ledger control account 310 CEDAR COLLEGE Add ($) AddAdd ($) ($) Less ($) LessLess ($) ($) Total ($) TotalTotal ($) ($) 93185 185 93 93 185 no entry had been made in the customer’s account. Opening balance 78 370 REQUIRED (a) Complete the following tables to update the sales ledger control account balance and the sales ledger balances at 30 April 2017. Sales ledger control account Description Add ($) Less ($) Total ($) Opening balance 93 185 7 12 Sales ledger balances 3 Meena did not keep full accounting records. She was advised to keep her books of account using Description Add ($) Less ($) Total ($) the double entry system. 12 REQUIRED 3 Opening balance 78 370 [11] Meena did not keep full accounting records. She was advised to keep her books of account using the State double entry (a) threesystem. benefits a business gains from maintaining a system of double entry book-keeping. REQUIRED (b) State four advantages to a business of preparing a sales ledger control account. (a) 1State three benefits a business gains from maintaining a system of double entry book-keeping. (Nov17/P22/Q2) 1 (11+4) 1 Q3. 2 3 12 2 did not keep full accounting records. She was advised to keep her books of account using Meena the 3double entry system. 2 REQUIRED 3 [3] (a) State information three benefits a business gains from maintaining a system of[3]double entry Additional book-keeping. Additional Meena nowinformation uses the double entry system of book-keeping. At the end of January the total of the 1 balances in the sales ledger was $34 524. 9706/22/O/N/17 However, the balance on the sales ledger control 14 © UCLES 2017 Meena now the double entry system of book-keeping. At the end of January the total of the [11] account wasuses $33 205. balances in the sales ledger was $34 524. However, the balance on the sales ledger control 3 wasthree account $33 205. (c) State reasons why there might be a credit balance on a customer’s account in the sales ledger. On investigation she found thetofollowing errors: of preparing a sales ledger control account. 2 four advantages (b) State a business 1 The sales journal had been undercast by14 $1649. 1 1 The sales journal had been undercast by $1649. On investigation she found the following errors: 1 AState 2(c) cheque received been correctly entered in the cash on book as $650 butaccount was entered three reasonshad why there might be a credit balance a customer’s in the in 2 the A cheque received been correctly entered in the cash book as $650 but was entered in sales ledger ashad $560. sales ledger. the 3 sales ledger as $560. 3 An 4 irrecoverable debt, $420, had been written off in the sales ledger but not entered in the 1 2 3 An irrecoverable debt, $420, had been written off in the sales ledger but not entered in the control account. [3] control account. 13 4Additional note issuedfor for$160 $160 had been completely omitted from the books of account. 4 AAcredit credit note issued had been completely omitted from the books of account. information 2 2 3 REQUIRED Meena now uses the double entry system of book-keeping. At the end of January the total of the balances in athereconciliation sales ledgerbetween was $34the 524. However, balance on the ledgerledger control (b) Prepare sales ledger the control account andsales the sales 14 [3] account was at $33 balances 31205. January. 3 (c) State three reasons why there might be a credit balance on a customer’s account in the Additional information On sales investigation errors: Sales ledger control account ledger. she found the following [3] [4] [Total: 15] Meena considering charging onby the$1649. full account balances of her customers who do not 13 1Theissales journal had been interest undercast Additional information Description Add ($) Less ($) Total ($) pay promptly. © UCLES 2017 9706/22/O/N/17 [Turn over 2 A cheque received had been correctly entered in balances the cashofbook as $650 but was entered in Meena is considering charging interest on the full account her customers who do not Opening balance 33 205 REQUIRED the sales ledger as $560. pay promptly. 2 (d) Meena whether or nothad she been should take this course of action. your answer. 3 Advise An irrecoverable debt, $420, written off in the sales ledgerJustify but not entered in the REQUIRED control account. (3+6+3+3) (d) 4 Advise Meena whether or not she should take this course of action. Justify your answer. 4 3A credit note issued for $160 had been completely omitted from the books of account. (June17/P21/Q3) © UCLES 2017 © UCLES 2017 Additional 9706/21/M/J/17 information [3] 9706/21/M/J/17 OMAIR MASOOD CEDAR COLLEGE Meena is considering charging interest on the full account balances of her customers who do not pay promptly. REQUIRED [4] [Total: 15] 311 6 6 Q4. 2 2 Raheem is a trader who makes all his sales on credit. He prepared the following sales ledger Raheem is a trader who makes all his sales on credit. He prepared the following sales ledger control account for the month of December 2015: 7 control account for the month of December 2015: $ $ $ reconcile theSales (b) Prepare to original totaljournal of sales ledger Balance b/d a statement 22 380 returns 1$440balances of $18 740 with Balance b/d balance16 22 380 journal account. 1 440 thejournal closing on910 the amended Sales sales returns ledger control Sales Bank 17 380 Sales journal 16 910 Bank 17 Balance c/d 20380 470 Balance c/d 20 39 290 39470 290 39 470 290 39 290 Balance b/d 20 Balance b/d 20 470 Raheem extracted a list of customer account balances from the sales ledger at Raheem extracted list of customer ledger at control account. 31 December 2015atotaling $18 740. account This did balances not agreefrom with the the sales balance on the 31 December 2015 totaling $18 740. This did not agree with the balance on the control account. The following errors were found: The following errors were found: 1 A sales invoice for $960 had been correctly recorded in the sales journal, but had not been 1 posted A salestoinvoice for $960 ledger had been correctly 7recorded in the sales journal, but had not been the customer’s account. posted to the customer’s ledger account. (b) a statement to reconcile the original salesoffledger of $18 740 with 2 Prepare A customer’s irrecoverable debt of $250 had not total been of written in anybalances of Raheem’s books 2 the A customer’s irrecoverable debt of $250 had not been written off in any of Raheem’s books closing balance on the amended sales ledger control account. of account. of account. 3 A cheque received, $670, from a customer had been correctly recorded in the cash book. It 3 had A cheque received, fromside a customer had beenledger correctly recorded in the cash book. It been entered on$670, the debit of the customer’s account as $760. [5] had been entered on the debit side of the customer’s ledger account as $760. 4 A cheque received, $200, from a customer had been returned unpaid by the customer’s 4 bank. A cheque received, $200,offrom a customer had had been returned byRaheem’s the customer’s No entry in respect the returned cheque been made unpaid in any of books bank. No entry in respect of the returned cheque had been made in any of Raheem’s books (c) State three advantages to a business of maintaining a sales ledger control account. of account. of account. 5 1Discounts allowed of $830 had not been entered in the control account. They had been 5 entered Discounts allowed of $830 had accounts. not been entered in the control account. They had been in the customers’ ledger entered in the customers’ ledger accounts. 6 A contra to the purchases ledger of $1370 had been entered in the customer’s sales ledger 6 account, A contra but to the ledger ofin$1370 had been entered in the customer’s sales ledger hadpurchases not been included the control account. 2account, but had not been included in the control account. REQUIRED REQUIRED (a) Prepare the updated sales ledger control7 account for the month of December 2015. Start (a) 3your Prepare the with updated sales ledger control for the month of December 2015. Start answer the balance brought downaccount of $20 470. your answer with the balance brought down of $20 470. (b) Prepare a statement to reconcile the original total of sales ledger balances of $18 740 with Sales ledger control account [3] the closing balance on the amended ledger control account. Salessales ledger control account [5] (c) State three advantages to a business of maintaining a sales ledger control account. (d) State two types of errors that will not be identified by producing a sales ledger control 1 account. 1 (Nov16/P21/Q2) (5+5+3+2) 2 2 3 [2] [Total: 15] [5] [3] [5] [5] (d) State two types of errors that will not be identified by producing a sales ledger control account. © UCLES 2016 9706/21/O/N/16 © UCLES 2016 9706/21/O/N/16 (c) State three advantages to a business of maintaining a sales ledger control account. 312 OMAIR CEDAR COLLEGE 1 MASOOD 1 © UCLES 2016 9706/21/O/N/16 [Turn over 8 8 22 Q5. Section Answer Section A A and and Section Section B. B. Answer For 8 For The schedule of trade receivables (deb Examiner’s ForExaminer’s Examiner’sUse Use A The sales ledger control account of Dream Beds for the year ended 31 December 2010 Answer Section A and Section B. A The sales ledger control account of Dream Beds for the year ended 31 31December December 2010Usetotalled $61 140. For 2010 2 2 5 8 A Answer Section A and Section B. The sales ledger control account of Dream Beds for the year ended 31 December 2010 Examiner’s isAshown shown below. is below. Use The sales ledger control account of Dream Beds for the year ended 31 December 2010 is shown below. is shown below. The following errors were subsequentl $$ $ $ $ $ $ $ Jan Jan Balance returns 28 510 Jan 11 Balance b/d 43 900 Dec 31 Sales 1 Balance b/d 43 900 Dec 31 Sales returns 28 510 Jan 31 1 Balance b/d 43 900 Dec 31 Sales returns 28 510 Dec Sales 522 650 Bank 1 A436 sale300 of $750 had been en Dec 31 Sales 522 650 Bank 436 300 Dec 31 Sales Dec 31 Sales 522 650 Bank 436 300 Bank (dishonoured cheques) 2 200 Discount allowed 28 800 Bank (dishonoured cheques) 2 200 Discount allowed 28 800 Bank(dishonoured cheques) Bank 2 200 Discount allowed 28 800 $570. The correct entry had b 568 750568 750 568 750 Bad Debts Bad Debts 8 400 Bad Debts 8 400 8 400 PLCA PLCA 3 210 3 210 2 An entry PLCA 3 210of $850 was correctl Balance Balance c/d c/d 63 530 63 530 Balance c/d 63 530 closing the account owing to 568 750 568 750 The schedule of trade receivables (debtors) extracted from the sales ledger at The schedule of trade receivables (debtors) extracted from the sales ledger at 31 December 2010 totalled $61 140. 568 750 made. The schedule schedule 31 December 2010 receivables totalled $61 140. The of trade (debtors) extracted from the sales ledger 3 at A 31 December December The following errors were subsequently discovered: 31 2010 totalled $61 140. The following errors were subsequently discovered: sum of $120 discount allow sales ledger. The correct entr 1 A sale of $750 had been entered in John’s account in the sales ledger as The following following The errors were subsequently discovered: $570. correct entry had been in the 1 The A sale of $750 had been made entered in sales John’sjournal. account in the sales ledger as 21 9 $570. The correct entry had been made in the sales journal. 4 At 31 December 2010 the ba An washad correctly entered in Samera’s account in the sales Aentry saleofof$850 $750 been entered in John’s account in theledger, sales ledger REQUIRED closing the account owing to Samera’s bankruptcy. No other journal. entry had been correct had been madeininSamera’s the sales 2$570. AnThe entry of $850entry was correctly entered account in the sales ledger, made. as For Examiner’s closing the account owing to Samera’s bankruptcy. No other entry had been Use corrected sales ledger control account for the year ended 31 December 2010. (a) Prepare the Purchases made. entry of $850 wasallowed correctly in Samera’s account ininthe ledger, Ledger 32 AAn sum of $120 discount hadentered been debited to Beach’s account thesales sales ledger. correct entry made inbankruptcy. the cash book. closing theThe account owinghad tobeen Samera’s No other entry had been closing the account owing to Samera’s bankruptcy. No other entry had been .......................................................................................................................................... 3 A sum of $120 discount allowed had been debited to Beach’s account Sales in the Ledger made. 4 At 31 December 2010 the balances in had Richard’s were: sales ledger. The correct entry been accounts made in the cash book. .......................................................................................................................................... to Beach’s in the It was decided to set off Ri 3 4A sum of December $120 discount allowed hadinbeen debited $ At 31 2010 the balances Richard’s accounts were: account Purchases Ledger 2680had been made Credit sales ledger. The correct entry in the cash book. .......................................................................................................................................... balance in the purchases led $ Sales Ledger 1980 Debit2 Answer Section A and Section B. .......................................................................................................................................... Ledger 2680 Credit were: 4 At 31Purchases December 2010 the balances in Richard’s accounts It was decided to set off Richard’s balance in the sales ledger against the 5 balance in theLedger purchases ledger. No entries had been made. Debit A The sales Sales 1980 Goods to the value of $800 w ledger control account of Dre .......................................................................................................................................... had not yet been paid. Interes $ is shown below. 5 Goods to the value of $800 were sold to Claire in June 2010, and the account It was decided the Creditledger against Purchases Ledgerto set off Richard’s 2680balance in the sales account, but no entries for thi .......................................................................................................................................... had not yet been Interest charges $30entries are to be on the overdue balance in paid. the purchases ledger.ofNo hadapplied been made. account, no entries for this had yet been Sales but Ledger 1980recorded. Sales Ledger 1980 Debit Balance .......................................................................................................................................... 5 Goods to the value of $800 were sold to Claire in JuneJan 2010,1and the account Inb/d addition a provision for43d In addition a provision for doubtful debts of 10% on the new outstanding Dec 31ledger Sales 522 sales against the It was decided to set off Richard’s balance in the had not yet been paid. Interest charges of $30 are to be applied on the overdue balance is to be created. balance is tocheques) be created. 2 .......................................................................................................................................... Bank (dishonoured account, but no entries for this had yet been recorded. balance in the purchases ledger. No entries had been made. 6 Dream Beds had sent goods with a selling price of $400 on a sale or return .......................................................................................................................................... In Majit. addition ahad provision doubtful of to10% on the outstanding to Majit not$800 yet for signified any debts intention thenew goods. 6 theDream Beds had sent goods 2010, and account 5 basis Goods to the value of were sold to Claire inpurchase June Dreambalance Beds had is to considered be created.the goods as sold, and made the relevant overdue had not yet been paid. Interest charges of $30 are to be applied on thebasis to Majit. Majit had not y accounting entries. .......................................................................................................................................... account, but no entries for this had yet been recorded. 9 a selling price of $400 on a sale or Dream 6 Dream Beds had sent goods with return Beds had considere 7 A page in the journal in October 2010 had been undercast by 568 basis to sales Majit. returns Majit had not 9 yet signified any intention to purchase the goods. .......................................................................................................................................... accounting entries. $1600. No correction had yet been made. REQUIRED on the new In addition a provision for doubtful debts as of sold, 10% and Dream Beds had considered the goods made the outstanding relevant For REQUIRED Examiner’s For accounting entries. The schedule of [6] trade receivables (debt balance is to be created. ...................................................................................................................................... Examiner’s Use 31December December 2010. (a) Prepare the corrected sales ledger control account for the year ended31 2010 in totalled $61 returns 140. 7Use A page the sales account for the year ended 31 December 2010. (a) Prepare the corrected sales ledger control © UCLES 2011 9706/22/O/N/11 7 A page in the sales returns journal in October 2010 had been undercast by (b) Prepare a statement reconciling the schedule of trade receivables (debtors) total with or return 6 Dream Beds had sent goods with selling price of $400 on a sale $1600. 10 amade. No correction had yet .......................................................................................................................................... $1600. No correction had ledger .......................................................................................................................................... the corrected in thehad sales control account. following errors were subsequently purchase the goods. basis to balance Majit. Majit notyet yetbeen signified any intention to The Dream Beds hadofconsidered goods as account. sold, and made the relevant For (c) Explain two advantages using a salesthe ledger control .......................................................................................................................................... .......................................................................................................................................... (6+8+4) .......................................................................................................................................... 1 A sale of $750 Examiner’shad been ent accounting entries. © UCLES 2011 9706/22/O/N/11 Use .......................................................................................................................................... (Nov11/P22/Q2A) $570. The correct entry had be (i) .................................................................................................................................. .......................................................................................................................................... © UCLES 2011 970 .......................................................................................................................................... 7 A page in the sales returns journal in October 2010 had been .......................................................................................................................................... undercast by 313correctly .................................................................................................................................. OMAIR MASOOD .......................................................................................................................................... 2 An entry of $850 was $1600. No correction hadCEDAR yet been COLLEGE made. .......................................................................................................................................... .......................................................................................................................................... closing the .................................................................................................................................. .......................................................................................................................................... made. .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .................................................................................................................................. © 9706/22/O/N/11 © UCLES UCLES 2011 2011 (ii) .......................................................................................................................................... account owing to S REQUIRED (a) Prepare Harvey Rabbit’s sales ledger control account for the year ended 31 March 2010. www.maxpapers.com .......................................................................................................................................... www.maxpapers.com 6 6 .......................................................................................................................................... 2 Q6. The following information has been extracted from the accounts of Harvey Rabbit for the For 2 year The.......................................................................................................................................... following has been extracted from the accounts of Harvey Rabbit for the ended 31 information March 2010. For Examiner’s year ended 31 March 2010. Examiner’s Use Use .......................................................................................................................................... $ $29 040 Sales ledger balance at 1 April 2009 Sales ledger balance at 1 April 2009 29 040 .......................................................................................................................................... Credit sales 499 892 Credit sales 499 892 Cash sales 14 634 Cash sales 14 634 .......................................................................................................................................... Credit sales returns 9 878 Credit sales returns 9 878 Receipts from debtors, banked 462 680 Receipts from debtors, banked 462 680 .......................................................................................................................................... Discount oncredit creditsales sales 21 404 Discount allowed allowed on 21 404 Bad debts written off 9 510 .......................................................................................................................................... Bad debts written off 9 510 Debtors’ cheques dishonoured Debtors’ cheques dishonoured 662662 Contra entries 1 153 .......................................................................................................................................... Contra entries 1 153 www.maxpapers.com .......................................................................................................................................... REQUIRED REQUIRED 8 (a) Prepare Prepare Harvey Harvey Rabbit’s control account for the yearyear ended 31 March 2010.2010. ....................................................................................................................................[10] (a) Rabbit’ssales salesledger ledger control account for the ended 31 March (ii) Beginning with Harvey Rabbit’s sales ledger balance of $26 845, prepare a .......................................................................................................................................... The .......................................................................................................................................... total of Harvey Rabbit’s sales ledger balances at 31 March 2010 was $26 845, which statement the total the sales to agree with did not agree with theamending closing balance of hisofsales ledger ledger control balance account. On checking histhe new control account balance. .......................................................................................................................................... accounts he discovered the following errors. .......................................................................................................................................... 1 2 For Examiner’s Use .......................................................................................................................................... .................................................................................................................................. A credit note for $420 which had been sent to a debtor had been entered in the sales .......................................................................................................................................... journal (day book) and posted as a sale to both accounts. .......................................................................................................................................... .......................................................................................................................................... .................................................................................................................................. A.......................................................................................................................................... debit entry in the sales ledger for $698 had been set off as www.maxpapers.com a contra entry in the 7 made in the control accounts. purchases ledger, but no entry had been .......................................................................................................................................... .................................................................................................................................. 3 .......................................................................................................................................... The discount allowed account had been overstated by $310. 4 A.......................................................................................................................................... sales invoice for $998 had been completely omitted from the accounts. 5 A.......................................................................................................................................... debit.................................................................................................................................. balance of $2102 had been omitted from the list of debtors. 6 A debtor who owed $896 had been declared bankrupt during March 2010. The debt For .......................................................................................................................................... Examiner’s .................................................................................................................................. Use .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .................................................................................................................................. © UCLES 2010 9706/23/M/J/10 had been written off in the control account, but no entry had been made in the debtor’s account. .......................................................................................................................................... .......................................................................................................................................... .................................................................................................................................. 7 A receipt for $630 had been debited to the bank account but omitted from the debtor’s .......................................................................................................................................... account. ....................................................................................................................................[10] 8 ....................................................................................................................................[10] An entry for $816 in the sales journal (day book) had not been posted to the debtor’s Theaccount. total of Harvey Rabbit’s sales ledger balances at 31 March 2010 was $26 845, which .................................................................................................................................. did not agree with the closing balance of his sales ledger control account. On checking his .................................................................................................................................. The total of Harvey Rabbit’s sales ledger balances at 31 March 2010 was $26 845, which did not agree with the closing balance of his sales ledger control account. On checking his .................................................................................................................................. accounts he discovered the following errors. 10 of the for sales journal (day with to entries totalling $3856 had been omitted 1 AApage credit note $420 which had book) been sent a debtor had been entered in the sales heledger discovered thehad following 9 accounts A sales account been errors. understated by $200. 1 from total(day sales. Theand amounts been posted to the debtors’ accounts. journal book) postedhad, as ahowever, sale to both accounts. .................................................................................................................................. A credit note for $420 which had been sent to a debtor had been entered in the sales journal posted as for a sale bothbeen accounts. A debit(day entrybook) in theand sales ledger $698tohad set off as a contra entry in the REQUIRED 2 (b) 2 www.maxpapers.com ledger, entry had been which made in thehave control accounts.in (a), prepare a .................................................................................................................................. (i)purchases Beginning withbut thenoclosing balance you calculated 8 A debit entry showing in the sales ledger for $698 on had setaccount. off as a contra entry in the statement the amended balance thebeen control purchases ledger, but no entry had been made in the control accounts. .................................................................................................................................. (ii) Beginning with Harvey Rabbit’s ledger account balance of $26 845, prepare a Amendments to sales sales ledger control For statement amending the total of the sales ledger balance to agree with the new Examiner’s Use .................................................................................................................................. control account balance. ..............................................................................................................................[8] .................................................................................................................................. .................................................................................................................................. 9706/23/M/J/10 three advantages of keeping control accounts. © UCLES (c) 2010 State .................................................................................................................................. (10+6+8+6) .................................................................................................................................. (June2010/P23/Q2) .......................................................................................................................................... © UCLES 2010 9706/23/M/J/10 .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. .......................................................................................................................................... .................................................................................................................................. .................................................................................................................................. OMAIR MASOOD CEDAR COLLEGE .......................................................................................................................................... .................................................................................................................................. .................................................................................................................................. .......................................................................................................................................... .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. .......................................................................................................................................... 314 ERRORS AND SUSPENSE THEORY ERRORS!AND!SUSPENSE! Error!not!affecting!the!Trial!Balance:!! 1. Error(of(complete(omission:(When(nothing(has(been(recorded(in(the(books.(To(correct(this,( simply(record(the(transaction.( 2. Error(of(original(entry:(Where(correct(double(entry(is(passed(but(with(the(wrong(amount.(To( correct(this,(adjust(for(the(difference.( 3. Error(of(principal:(Where(a(wrong(type(of(account(has(been(debited(or(credited(instead.(For( example,(we(have(debited(Rent(instead(of(Motor(Van.( 4. Error(of(commission:(Where(a(wrong(account(but(of(same(type((usually(debtors(or(creditors)(has( been(debited(or(credited(instead.(For(example,(we(have(credited(Mr.(A(instead(of(Mr.(B.( 5. Error(of(complete(reversal:(Where(a(completely(opposite(entry(is(passed(with(the(right(amount.( To(correct(this,(pass(the(correct(entry(with(double(amounts.( 6. Compensating(error:(Where(one(error(compensates(for(other.(Like(a(debit(item((say(purchase)( and(a(credit(item((say(sales)(are(both(undercast(with(same(amounts.((don’t(worry(about(this(too( much(:P)( ( All(the(above(errors(do(not(affect(the(Trial(Balance(because(in(all(situations(the(total(debits(are(equal(to( total(credits.( ( Errors!can!be!made!which!can!lead!to!disagreement!of!the!trial!balance.! This(is(when(either(we(have(only(debited(something(and(forgot(to(credit((Incomplete(double(entry)(or( we(have(debited(something(with(a(correct(amount(and(credited(the(other(with(the(wrong(amount( (Incorrect(double(entry).(And(it(can(also(happen(if(any(daybook(is(over(or(under(cast.(E.g.(Sales(daybook( is(undercast.(In(these(situations(Suspense(account(comes(into(the(picture.(Since(sales(daybook(is( undercast,(this(means(only(the(total(sales(were(wrong((understated),(so(we(need(to(amend(the(sales( accounts.( ( ( ( ( Debit:(Suspense( ( ( ( ( ( Credit:(Sales( ( Also(sometimes(an(error(is(made(in(the(list(of(debtors(or(creditors.(Like(a(debit(balance(is(excluded(from( the(list(of(debtors.(This(makes(the(debtors(figure(in(the(trial(balance(understated.(Logically(we(should( ( ( ( Debit:(Debtors( ( ( ( ( Credit:(Suspense( But(guys(do(you(realize(that(only(the(list(of(debtors(is(wrong((which(is(not(an(account),(so(we(should( ( ( ( Debit:(NO(DEBIT(ENTRY( ( ( ( ( Credit:(Suspense( ( What!if!there!is!still!balance!left!in!the!suspense!account?! ! This(means(all(the(errors(are(still(not(found.(If(the(balance(comes(on(the(debit(side,(then(treat(it(as(a( current(asset(in(the(balance(sheet,(if(it(comes(on(the(credit(side(then(treat(it(as(a(current(liability.( OMAIR MASOOD CEDAR COLLEGE 315 Correction)of)Errors)Worksheet))1) Correction of Errors ! ! Q1.! ! F002 Q1. ! CORRECTION OF ERRORS WORKSHEET Jun 2007 J Savill Question 3 ! ! ! ! ! ! Q2.! 2501 Jun 2007 Viktoria Question 2 ! ! !Q2. ! ! ! ! ! ! ! ! ! ! ! ! ! ! Correction of Errors AS Level Accounting Correction of Errors ! !OMAIR MASOOD CEDAR COLLEGE ! ! 2501 Q3.! Jan 2006 Paul Okan Question 1 ! 21 of 270 ! 316 ! Correction of Errors ! ! ! 2501 Q3.! Jan 2006 Paul Okan Question 1 !Q3. ! ! Correction of Errors ! ! ! Q4.! 2501 Jan 2002 Blakelock Question 1 !! Q4. 24 of 270 ! 26 of 270 AS Level Accounting AS Level Accounting ! ) OMAIR MASOOD ! CEDAR COLLEGE ! 317 Correction of Errors ( worksheet 2) Accounts(–(9706(( Accounts(–(9706(( Q1. AS(–(Level(( AS(–(Level(( ( ( ( ( ( ( ( ( ( ( ( ( (((((((((((((((OMAIR(MASOOD( (((((((((((((((OMAIR(MASOOD( Q5. inexperienced bookkeeper drawn followingtrial trialbalance: balance: Q5. Q5. An An inexperienced bookkeeper hashas drawn upup thethe following Accounts(–(9706(( AS(–(Level(( ( ( ( ( ( ( Trial Balance April1999 1999 Trial Balance at at 3030 April (((((((((((((((OMAIR(MASOOD( Dr. Dr. $$ 108,330 108,330 Cr. Cr. $$ Sales Sales Purchases 73,308 Purchases 73,308 Corrected Trial Balance Return 350 Return outout 350 Return 450 Dr. Cr. 450 Return in in Trade Receivables 7,300 $ $ Trade Receivables 7,300 Trade Payables 3,456108,330 Trade Payables 3,456 Sales General expenses 27,616 General expenses 27,616 Purchases 73,308 Rent 240 Rent out 240 Return 350 Discount allowed 1,000 Discount 1,000 Return in allowed 450 Discount received 750 Discount received 750 Trade Receivables 7,300 Balance at bank (overdrawn) 1,528 3,456 Balance at bank (overdrawn) 1,528 Trade Payables Non-Current Assets at cost 73,200 Non-Current Assets at cost 73,200 General expenses 27,616 Provision depreciation 11,200 Rent 240 Provision forfor depreciation 11,200 Provision for doubtful debts 360 Discount 1,000 Provisionallowed for doubtful debts 360 Inventory 1 May 1998 14,800 Discount 750 Inventoryreceived 1 May 1998 14,800 Inventory 30 April 1999 11,840 Balance at bank (overdrawn) 1,528 Inventory 30 April 1999 11,840 Capital 102,440 Non-Current Assets at cost 73,200 Capital 102,440 Drawings 30,96011,200 Provision for depreciation Drawings 30,960 Suspense 75,972 Provision for doubtful debts 360 Suspense 75,972 Inventory 1 May 1998 14,800 272,550 272,550 272,550 272,550 Capital 102,440 Drawings 30960 Suspense 460 (a) Prepare a corrected trial balance, giving an amended figure for the Suspense (a) Prepare a corrected trial balance, giving an228,874 amended228,874 figure for the Suspense Account balance. Account balance. (b) After the trial balance in (a) has been corrected, the following errors were found: # # 1. Additional Non-Current Assets costing $1440 had been bought. The purchases account has been debited. 2. An expense payment of $864 was entered in the accounts as $846. 3. A cheque for $320 was sent to a creditor. The bank and the creditor’s account were both credited with this amount. 4. The total of the Purchases Day Book had been under-added by $480. 5. A credit note for $148 was sent to a customer but it had not been put through the books. 6. Postage expenses of $300 had not been posted from the cash book to the ledger account. 7. Owner had taken $250 of goods during the year for personal use. No entry had been made in the accounts. 8. Returns outwards had been entered in the trial balance as $350. The correct amount was $250. 76#wrongly as $600 in his account. 9. A sale of $500 to C White was entered 76# 10. A debit balance of $870 of A Fleming’s account was brought down as $780. This latter figure was included in the total Trade Receivables. 11. An item of $120 had been debited twice in the General Expense Account. Accounts(–(9706(( AS(–(Level(( OMAIR # ( ( MASOOD ( ( ( 77# CEDAR ( (((((((((((((((OMAIR(MASOOD( COLLEGE 12. The Sales Day Book had been over-added by $200. 13. A banker’s order for $240 for payment of rent had been posted on the wrong side of Bank Account. 318 10. A debit balance of $870 of A Fleming’s account was brought down as $780. 10. A debit of $870 of A Fleming’s account brought down as $780. Thisbalance latter figure was included in the total Tradewas Receivables. This latter figure was included in the total Trade Receivables. 11. An item of $120 had been debited twice in the General Expense Account. Accounts(–(9706(( ( been( debited( twice in ( the General ( (((((((((((((((OMAIR(MASOOD( 11. An item of( $120 had Expense Account. Accounts(–(9706(( ( ( ( ( (77# ( (((((((((((((((OMAIR(MASOOD( AS(–(Level(( AS(–(Level(( 77# # 12. The Sales Day Book had been over-added by $200. # 12. The Sales Day Book by $200. 13. A banker’s orderhad forbeen $240over-added for payment of rent had been posted on the wrong 13. A banker’s order for $240 for payment of rent had been posted on the wrong side of Bank Account. side of Bank 14. The totalAccount. of the Discount Received column in the Cash Book of $250 had been 14. The debited total of to thethe Discount Received Cash Book of $250 had been Discount Allowedcolumn Accountininthe error. debited to theNon-Current Discount Allowed error. 15. Surplus Assets Account were soldinfor $310 during the year and the proceeds 15. Surplus Non-Current Assets were sold for $310 during the year and the proceeds credited to the sales account. credited to the sales account. 16. Purchases of $300 from J Tipper had been debited to T Topper account. 16. Purchases of $300 from Tipperbalance had been Topperhad account. 17. A purchases LedgerJcredit of debited $180 fortoWT Aston been omitted from 17. A purchases credit balance of $180 for W Aston had been omitted from the list ofLedger Trade Payables. the of Trade Payables. 18.list P Rose’s account in Sales Ledger has been debited $145 for goods return by 18. P Rose’s account in Sales Ledger has been debited $145 for goods return by him. him. REQUIRED: REQUIRED: REQUIRED: Prepare Journal entries to correct each of these errors. REQUIRED: Prepare Journal entries correct each of these errors. (Narrations are not to required) CORRECTION(OF(ERRORS(((WORKSHEET(2)( (a) Journal Entries to correct the above errors (Narrations are not required) (a) Journal Entries to correct the above errors ( (b) Suspense Account (b) Q1.(Suspense Account Q2.Q6. ( AS!Level!accounting! AS!Level!accounting! Omair!Masood! Omair!Masood! ## Q7.G. Carpenter runsruns a small engineering company, Q7.G. Carpenter a small engineering company,and andhashasprepared preparedthe thefollowing followingTrial Trial ( Balance at 31 March 1992. Balance at 31 March 1992. $ $ $$ Capital 50,000 Capital 50,000 Motor vehicles 8,000 Motor vehicles 8,000 Page!|!88! Page!|!88! Equipment andand fittings 10,300 Equipment fittings 10,300 Inventory 1 April 1991 11,810 Inventory 1 April 1991 11,810 Purchases 169,400 Purchases 169,400 Sales 264,030 Sales 264,030 Premises 65,000 Premises 65,000 Trade Receivables 28,045 Trade Receivables 28,045 Trade Payables 31,040 Trade Payables 31,040 Discount allowed 600 Discount allowed 600 Discount received 1,250 Discount received 1,250 Wages and salaries 38,000 Wages and salaries 38,000 Sales returns 130 Sales returns 130 Purchases returns 210 Purchases returns 210 Drawings 640 Drawings 640 Insurance 720 Insurance 720 General expenses 2,760 General expenses 2,760 Bank 11,205 Bank 11,205 Suspense Suspense 8080 346,610 346,610 346,610 346,610 319 ! SE! # # Mr. Carpenter was unable to agree the Trial Balance and has entered the difference in a Mr. Carpenter was unable to agree the Trial Balance and has entered the difference in a Suspense Account. He asks you to check the account for him, and you find the following Suspense Account. He asks you to check the account for him, and you find the following errors: errors: (i) Equipment and fittings bought during the year for $7,000 have been debited to the (i) Equipment and fittings bought during the year for $7,000 have been debited to the Purchases account. The company 78# does not provide for depreciation in the year of Purchases account. The company does not provide for depreciation in the year of purchase on Non-Current Assets. 78# purchase on Non-Current Assets. (ii) Discount allowed of $40 has been posted to the credit side of Discount received. OMAIR MASOOD CEDAR COLLEGE (ii) Discount allowed of $40 has posted to the credit side but of Discount (iii)A cheque for $155 from a been debtor has been dishonoured, no recordreceived. has been made of (iii)A cheque for $155 from a debtor has been dishonoured, but no record has beenbemade this in the accounts. There is no reason to believe that payment will not madeofin this April. in the accounts. There is no reason to believe that payment will not be made in April. (iv) Purchase returns of $50 have been posted to the debit of Sales returns. Drawings Purchases returns Purchases returns Insurance Insurance Drawings Drawings General expenses General expenses Insurance Insurance Bank General expenses Bank General expenses Suspense Bank Suspense Bank 640 Suspense Suspense Continued Nest (a) Journal entries and aQuestion Suspense Account to correctOn the the errors. CorrectionofofErrors Errors Correction Page Chapter:!ERRORS!AND!SUSPENSE! Chapter:!ERRORS!AND!SUSPENSE! Mr. Carpenter was unable to agree the Trial Balance and has entered the difference in a Mr. Carpenter was was unable to to agree Balanceand andhashas entered the difference Mr. Carpenter unable agreethe theTrial Trial Balance entered the difference in a in a Suspense Account. He asks you the to check the account forentered him, and find the Mr. Carpenter was unable to agree Trial Balance and has the you difference in afollowing Suspense Account. you check the the account andand youyou find find the following Suspense Account. He He asksasks you totocheck accountforforhim, him, the following Suspense Account. He asks you to check the account for him, and you find the following errors: errors: errors: errors: (i) (i)Equipment boughtduring during $7,000 been debited Equipmentand and fittings fittings bought thethe yearyear for for $7,000 have have been debited to the to the (i) (i) Equipment and fittings boughtduring duringthethe year for $7,000 have been debited Equipment and fittings bought year for $7,000 have been debited to the to the Purchases The company companydoes does provide for depreciation Purchasesaccount. account. The notnot provide for depreciation in the in yeartheof year of Purchases account. The company doesnotnot provide for depreciation theofyear of Purchases The company provide for depreciation in the in year purchase on Assets.does purchaseaccount. onNon-Current Non-Current Assets. purchase on Non-Current Assets. purchase on Non-Current Assets. Discount allowed of of $40 has to the credit side side of Discount received. (ii)(ii) Discount allowed $40 hasbeen beenposted posted to the credit of Discount received. Discount allowed of $40 $40 has been posted to to the credit side side of Discount received. (ii) (ii) Discount allowed of has been posted the credit of Discount received. (iii) A cheque for $155 from a debtor has been dishonoured, but no record has been (iii)A cheque for $155 from a debtor has been dishonoured, but no record hasmade beenofmade of (iii) A cheque for $155 from a debtor has been dishonoured, but no record has been made ofmade this in the accounts. There is no reason to believe that payment will not be made in (iii)A cheque for $155 from aThere debtor been dishonoured, but payment no recordwill hasnot beenbe thisininthe theaccounts. accounts. is has no reason to believe that madeofin this April. There is no reason to believe that payment will not be made in this April. in the accounts. There is no reason to believe that payment will not be made in April. (iv) Purchase returns of $50 have been posted to the debit of Sales returns. April. (iv)Purchase Purchase returns of $50 posted the debit Sales returns. (iv) of1992, $50 have beenbeen posted to theto debit of Sales returns. (v) Duringreturns March Mr.have Carpenter remembered that of theofinsurance already paid, $60 (iv)(v) Purchase returns of $50 have been posted to the debit of Sales returns. (v)During During March 1992, Mr. Carpenter remembered that of the insurance already March 1992, Mr. Carpenter remembered that of the insurance already paid, $60paid, $60 related to a private insurance premium. In an attempt to correct the accounts, he made (v) During March 1992, Mr. Carpenter remembered that of the insurance already paid, $60 related a private insurance In an attempt to correct the accounts, he made related toto a debit private insurance In anaccount, attempt to correct theentry accounts, he made another entry of $60 npremium. the premium. Insurance with no other being made. AS!Level!accounting! another entry of $60 n thenpremium. Insurance account, with nowith other being made. related to debit a debit private insurance In anaccount, attempt to correct accounts, he (made another entry of $60 the Insurance noentry otherthe entry being made. AS!Level!accounting! ( another debit entry of $60 Question Continued On the Nest n the Omair!Masood! Insurance account, with noPage other entry being made. ( # Omair!Masood! Question Continued On the Nest Page ( Question Continued On the Nest Page REQUIRED: # Chapter:!ERRORS!AND!SUSPENSE! Chapter:!ERRORS!AND!SUSPENSE! 210 720 210 720 640 640 2,760 2,760 720 720 11,205 2,760 11,205 2,760 11,205 8080 11,205 346,610 80 346,610 80 346,610 346,610 346,610 346,610 346,610 346,610 REQUIRED: (b) A Corrected trial balance (a)All!Rights!Reserved!©! Journal entries and a Suspense Account to correct the errors. ! (c) If errors had not been discovered prior to the preparation of the final accounts, how All!Rights!Reserved!©! ! (b) A Corrected trial balance might the Suspense Account balance have been dealt with (Page!|!89! !All!Rights!Reserved!©! (c) If errors had not been discovered prior to the preparation of the final accounts, ! how ! ( Q8 All!Rights!Reserved!©! ! 2501 Jan 2005 Meyer Question 2 ( might the Suspense Account balance have been of Financial position at 31 2501 2005 Statement Meyer Question 2 dealtaswith (Page!|!89! ! Q7 Jan December 2002 ! ( Q8 $ $ ( Statement of Financial position as at 31 Non-Current Assets (net) 80,000 December 2002 $ $ Current Assets Non-Current Assets (net) 15,000 80,000 Inventory Trade Receivables Bank Assets Current Suspense Account Inventory Trade Receivables Current Liabilities Bank Trade Payables Suspense Account Working capital FinancedLiabilities by Current CapitalPayables Trade Add Net Profit Working capital Less Drawings Financed by Capital Add reveals: Net Profit Further examination 8,000 10,000 4,000 15,000 37,000 8,000 10,000 7,000 4,000 30,000 37,000 110,000 7,000 130,000 20,000 30,000 150,000 110,000 40,000 110,000 130,000 20,000 150,000 (i) The Sales Account has been undercasted by $2000. Less Drawings (ii) The wages total for the year of $80,000 has been entered as 40,000 $75,000. 110,000 (iii)A cheque for $3,000 from Davey Builders, a debtor, has been entered correctly in the Chapter:!ERRORS!AND!SUSPENSE! S!AND!SUSPENSE! account of Davey Builders but has been entered as $1,500 in the Bank Account. Further examination reveals: (iv) Discount received of $250 has been entered as a debit to the Discount Allowed (i) TheAccount. Sales Account has been undercasted by $2000. REQUIRED: (ii) The wages total for the year of $80,000 has been entered as $75,000. Journal entries to correct theDavey errors. (Narratives not required) (iii)(a) A cheque for $3,000 from Builders, aaredebtor, has been entered correctly in the (b) The Suspense Accounting showing the opening balance and correcting entries. account of Davey Builders but has been entered as $1,500 in the Bank Account. (c) Calculate the revised net profit for the year ended 31 December 2002 (iv)(d) Discount received $250 beenwhich entered asnot a affect debit the to balancing the Discount Identify and explainofthree typeshas of error would of a trialAllowed Account. OMAIR CEDAR COLLEGE balance.MASOOD REQUIRED: (a) Journal entries to correct the errors. (Narratives are not required) All!Rights!Reserved!©! ! (b) The Suspense Accounting showing the opening balance and correcting entries. 320 Correction of Errors 2501 Q8 Jan 2004 Focus Question 2 34 of 270 OMAIR MASOOD AS Level Accounting CEDAR COLLEGE 321 Correction CorrectionofofErrors Errors 2501 2003 Mary BrookeQuestion Question 11 2501 JanJan 2003 Mary Brooke Q9 Correction of Errors 2501 Jan 2003 Mary Brooke Question 1 continued 36 of 270 AS Level Accounting 36 of 270 OMAIR MASOOD AS Level Accounting CEDAR COLLEGE 322 3 David, a sole trader, has prepared a trial balance at 31 December 2017 which did not balance. He entered the difference in a suspense account. REQUIRED 2 13 (a) State two other uses of a suspense account. REQUIRED [2] CORRECTION OF ERRORS-PAST PAPERS 1 (c) Prepare the suspense account at 31 December 2017 clearly showing the opening balance (b) State four types of error that will not be revealed by the trial balance. account. Q1. on the 12 1 Suspense account 3 David, a sole trader, has prepared a trial balance at 31 December 2017 which did not balance. 2 He entered the difference in a suspense account. 2 $ $ [2] REQUIRED 3 (a) State two other uses of a suspense account. 4 [4] (b) State four types of error that will not be revealed by the trial balance. 1 1 information Additional On checking the financial records, David discovered the following errors. 2 2 1 The 3 credit balance on the bank current account of $1650 had been entered in the trial [2] balance as a debit balance. 4 total of the purchases returns journal of $960 had been debited to the returns inwards 2 The (b) account. State four types of error that will not be revealed by the trial balance. [4] information 3Additional A 1prepayment of $450 for telephone charges at 1 January 2017 had not been brought down as an opening balance. On checking the financial records, David discovered the following errors. 2 13 4 The balance on sales ledger control account at 31 December 2017 of $13 625 had been [6] carried down as $13 652. 1 The 3 credit balance on the bank current account of $1650 had been entered in the trial REQUIRED balance as a debit balance. 4 [4] REQUIRED (c) Prepare the suspense account at 31 December 2017 clearly showing the opening balance 2 on The total of the purchases returns journal of $960 had been debited to the returns inwards the account. account. (d) State three benefits to a business of preparing annual financial statements. Additional information Suspense account (2+4+6+3) 3 A (June18/P23/Q3) 1 prepayment of $450 for telephone charges at 1 January 2017 had not been brought down $ On checking the financial records, David discovered the following errors. as an opening balance. $ Q2. 14 The balance on the bankcontrol current2account account at of 31 $1650 had been entered in 625 the had trial been The credit balance on sales ledger December 2017 of $13 balance a debit balance. carried as down as $13 652. Ross, a sole trader, owns a business selling computer equipment. He prepared the following 2 Thestatement total of the returns journal2017, of $960 hadcontained been debited to the returns inwards income for purchases the year ended 31 March which errors. account. 2 Ross 3 A prepayment of $450 for telephone charges 1 January 2017 had not been brought down Income Statement for the year at ended 31 March 2017 © UCLES 2018 9706/23/M/J/18 as an opening balance. $ $ 4 The balance on sales ledger control account at 31 December 2017 of96$13 Revenue 520625 had been as $13 652. Add:carried Returnsdown outwards 440 96 960 3 Cost of sales Inventory at 31 March 2017 23 400 Purchases 38 950 Carriage outwards 1 090 [3] 63 440 Inventory at 1 April 2016 (21 640) 41 800 [6] [Total: 15] Gross profit 55 160 © UCLES 2018 9706/23/M/J/18 1 Less expenses: REQUIRED Property rental paid 16 240 Returns inwards 240 OMAIR COLLEGE (d) StateMASOOD three benefits to a businessCEDAR of preparing annual financial 1statements. Drawings 8 600 © UCLES 2018 9706/23/M/J/18 Heating 1 940 1 and lighting Travel expenses 2 060 © UCLES 2018 expenses 9706/23/M/J/18 General 6 690 323 [Turn over Cost of sales Inventory at 31 March 2017 Purchases Carriage outwards 23 400 38 950 1 090 63 440 (21 640) Inventory at 1 April 2016 Gross profit Less expenses: Property rental paid Returns inwards Drawings Heating and lighting Travel expenses General expenses Shop fittings – accumulated depreciation at 31 March 2017 41 800 55 160 16 240 1 240 8 600 1 940 2 060 6 690 3 320 40 090 15 070 Profit for the year Additional information The following notes also need to be taken into account when correcting the income statement. 1 Revenue includes goods sent on a sale or return basis to a customer who has not yet accepted the goods. The goods cost $2500 and had been invoiced for $4000. 2 Depreciation on shop fittings for the year ended 31 March 2017, $1490, had been entered in the books of account. 3 A prepayment of $1160 for property rental 5paid at 31 March 2017 had been incorrectly entered in the books of account as an accrual. 4 A customer owing Ross $1250 has been declared bankrupt. This debt should have been written off in these accounts, but no entry has yet been made. 5 3 REQUIRED 4 (a) Prepare the corrected income statement for the year ended 31 March 2017. 4 Additional information Ross Additional information Income information Statement for the his yearassets endedand 31 liabilities March 2017 Ross provided the following about at 31 March 2017: Ross provided the following information about his assets and liabilities at 31 March 2017: $ Accruals 1$960 580 Bank loan Accruals 18960 610 Bank overdraft 2580 Bank loan 8 © UCLES 2017 9706/22/O/N/17 950 Capital at 1 April 2016 10 Bank overdraft 2 610 930 Shop fittings – cost at 31 March 2017 11950 Capital at 1 April 2016 10 080 Prepayments Shop fittings – cost at 31 March 2017 112930 440 Trade payables 6 Prepayments 2 080 870 Trade receivables 12 Trade payables 6 440 Trade receivables 12 870 No adjustment had been made to any of these balances in respect of errors discovered in the income statement notesmade 1 to 4toon page 2. No adjustment hadorbeen any of these balances in respect of errors discovered in the income statement or notes 1 to 4 on page 2. Ross introduced capital of $3000 into the business bank account on 31 March 2017. No entries for thisintroduced have yet been made in theinto books account. Ross capital of $3000 the of business bank account on 31 March 2017. No entries for this have yet been made in the books of account. One half of the bank loan is repayable in the year ending 31 March 2018. The remainder is due for repayment date. One half of theafter bankthat loan is repayable in the year ending 31 March 2018. The remainder is due for repayment after that date. REQUIRED REQUIRED [13] (b) Prepare the statement of financial position at 31 March 2017 taking account of all relevant [13] information from part (a). at 31 March 2017 taking account of all relevant (b) information Prepareinformation theand statement of financial position Additional information and information from part (a). Additional information At present Ross does not make any provisionRoss for doubtful debts. Statement Financial Position at debts. 31 March 2017 Ross At present Ross does not make anyofprovision for doubtful Statement of Financial Position at 31 March 2017 REQUIRED REQUIRED (c) Advise Ross whether or not he should create a provision for doubtful debts. Justify your (c) answer. Advise Ross whether or not he should create a provision for doubtful debts. Justify your answer. (13+13+4) (Nov17/P22/Q1) OMAIR MASOOD CEDAR COLLEGE 324 (a) (i) State the use of a suspense account. 10 REQUIRED 3 Contador, a sole trader, has provided the following extract from the trial balance for the year ended 31 March 2015. He does not maintain control accounts as part of his accounting records. (b) Prepare journal entries to correct all of the errors identified. Narratives are not required. 3 $ [1] Debit balances 112 375 Q3 10 Credit balances 120 835 (ii) State three advantages to a business of maintaining a sales ledger control account. Contador, a sole trader, has provided the following extract from the trial balance for the year REQUIRED 1 March 2015. He does not maintain control accounts as part of his accounting records. ended 31 (a) (i) State the use of a suspense account. $ Debit balances 112 375 2 Credit balances 120 835 REQUIRED 2 (a) (i) 3State the use of a suspense account. (ii) State three advantages to a business of maintaining a sales ledger control account. [3] 6 1 Additional information Alex and Barry have been in partnership for many years. The terms of the partnership agreement are following as follows. The errors have been identified: [1] [1] Interest payable tobeen the partners loan accounts at 10% per annum. 2 isjournal 11 The sales had overcaston bytheir $26 350. 2 (ii) Interest onthree capital is allowed at rate of 5% annum. a sales ledger control account. State advantages to the a business of per maintaining Barry expenses is entitled of to a salaryhad of $6000 per annum. 23 Motor $5270 been posted to the motor vehicles account. Motor vehicles 4 had Interest drawings is the rate of 4% on the annual drawings. been depreciated at charged 20% per at annum. 1 on 5 Profits and losses are shared in the ratio of 3:1. 11 3 3 Interest received of $8945 had been debited to both the bank account and the interest Thereceived followingaccount. balances were taken from their books of account at 31 May 2014. REQUIRED [3] [8] 2 Alex Barry (b) Prepareinformation journal entries to correct all Additional $ $ of the errors identified. Narratives are not required. 000 Capital account 90of (c) Assess the effect these errors60 on000 the profit for the year. (1+3+8+3) The following errors have Current account 14 000been Cr identified: 12 500 9Dr (Nov16/P22/Q3) 16 000 Loan account 15 000 3 1 The sales journal had been overcast by $26 350. Additional information 9 During the year ended 31 May 2015, drawings for Alex totalled $5000 and for Barry $12 000. [3] Q4 2 Motor expenses of $5270 been posted the motor vehicles account. Motor vehicles When the books of account werehad finally checked thetofollowing errors were discovered. Additional information depreciated at 20% per annum. Afterhad the been deduction of loan interest, the draft profit for the year ended 31 May 2015 was $90 000. Additional information 1 The sales day book had been undercast by $20 000. When the books of account were the following errors 2 Closing inventory valued at finally cost $5000debited had a net value of $3000. and the interest 3 Interest received of $8945 hadofchecked been to realisable both thewere bankdiscovered. account REQUIRED The errors beenofidentified: 3 following Repairs motorhave vehicles $7000 had been wrongly debited to the motor vehicles at cost [3] receivedtoaccount. 1 The sales (Ignore day book had been undercast by $20 000. any depreciation.) (a) account. Prepare the partnership appropriation account for the year ended 31 May 2015. 2 Closing inventory valued at cost of $5000 had net realisable value of $3000. 14 The sales journal been overcast $26a350. A purchase invoicehad of $4000 had beenbywrongly entered in the books as $400. [Total: 15] 3 Repairs to motor vehicles of $7000 9706/22/O/N/16 had been wrongly debited to the motor vehicles at cost © UCLES 2016 account. (Ignore any depreciation.) 2REQUIRED Motor expenses of $5270 had been posted to the motor vehicles account. Motor vehicles 4 A purchase invoice of $4000 had been wrongly entered in the books as $400. had been depreciated at 20% per annum. (e) Prepare a statement to show the corrected 6 profit for the year ended 31 May 2015. REQUIRED (5) interest 3 Interest received of $8945 had been debited to both the bank account and the 6 (Nov15/P21/Q2e) received (e) Prepare aaccount. statement to show the corrected profit for the year ended 31 May 2015. Additional information Additional information The financial statements of AB Limited for the year ended 30 April 2017 showed a draft profit for Q5 the year of $71 000. A review of the books of account revealed the following errors: The financial statements of AB Limited for the year ended 30 April 2017 showed a draft profit for the year of $71 000. A review of the books of account revealed the following errors: 1 A sales invoice for $234 had been recorded as $324. 1 A sales invoice for $234 had been recorded as $324. outwards account had been overcast by $100. 9706/22/O/N/16 2 2016 Returns © UCLES © UCLES 2016 2 3 9706/22/O/N/16 Returns outwards account had been overcast by $100. Inventory of $1200 had been omitted from closing inventory. [Turn over 3 Inventory of $1200 had been omitted from closing inventory. REQUIRED REQUIRED (f) Calculate the revised profit for the year ended 30 April 2017. (c) Assess the of these errors on the profit30forApril the2017. year. (June17/P21/Q1f) (f) Calculate theeffect revised profit for the year ended © UCLES 2016 9706/22/O/N/16 OMAIR MASOOD CEDAR COLLEGE [8] (4) [5] [Total: [5] 30] [Total: 30] 325 8 2 Q6 The following is the statement of financial position of Francis Flintoff at 31 December 2014. 8 8 $ Flintoff at 31 December $ The following is is the statement of financial position of Francis 2014. 2 2Non-current The following assetsthe statement of financial position of Francis Flintoff at 31 December 2014. Premises at valuation $ Office equipment at book value Non-current assets Non-current Motor assets vehicles at book value Premises at valuation Premises at valuation Office equipment at book value Motor vehicles at book valuevalue Current assets Office equipment at book $ $254 000 74 500 $ 40 500 254 000 369 000 254 000 74 500 40 500 74 500 65 600 369 000 40 500 14 800 369 000 65 600 14 200 94 600 Inventory Motor vehicles at book value Current assets Trade receivables Inventory Cash and Current assets cash equivalents Trade receivables 14 800 14 200 65 600 94 600 463 600 Inventory Trade receivables Total assets Cash andliabilities cash equivalents Capital and and cash equivalents TotalCash assets 14 800 463 600 14 200 94 600 348 200 Capital at 1 January 2014 Capital and liabilities Total assets Profit for year 2014 Capital at the 1 January 463 600 53 400 348 200 401 600 53 400 401 600 Profit for the year Non-current liability Capital and liabilities 6% Loan Non-current liability Capital at 1repayable January 2021 2014 6% Loan repayable Profit for the year 2021 24 000 348 200 24 000 Current liabilities Current liabilities Trade payables 53 400 401 600 38 000 Non-current liability Trade payables 6% Loan 2021 Total capitalrepayable and liabilities 38 000 463 60024 000 Total capital and liabilities 463 600 Current liabilities Additional information Additional information Trade payables 38 000 After preparation of this statement the following were discovered. After preparation of this statement the following were discovered. Total capital and liabilities 1 1 463 600 Goodswhich whichwere wereincluded included inventory at their of $1900 had been damaged Goods in in thethe inventory at their costcost priceprice of $1900 had been damaged andcould could besold soldforforonly only $360. and be $360. Additional information 2 Interest at 6% had not been paid on the loan. No entry had been made for this. 2 Interest at 6% had not been paid on the loan. No entry had been made for this. After preparation of this statement the following were discovered. 1 3 4 4 2 3 000 forfor thethe year ended 30 September 20152015 had not paid and Insurance 000 year ended 30 September hadbeen not been paidhad and had Insurancecosting costing$12 $12 Goods which were included inthe the inventory at their cost price of $1900 had been damaged been omitted from the accounts. beencompletely completely omitted from accounts. and could be sold for only $360. Depreciation 31 31 December 2014 had had beenbeen charged correctly. The The Depreciation for forthe theyear yearended ended December 2014 charged correctly. book-keeper had also entered a charge for motor vehicles for the year ended book-keeper a charge forloan. motorNo vehicles thebeen year made ended for this. Interest at 6% had hadalso not entered been paid on the entry for had 31 31 December December2015 2015ininerror. error. for the yearatended September 2015 had not been paid and had Insurance costing $12 000 Depreciation is charged on motor vehicles 10% on30 a reducing balance basis. Depreciation is charged motor 9at910% on a reducing balance basis. been completely omittedon from thevehicles accounts. REQUIRED 4 REQUIRED Depreciation for the year ended 31 December 2014 had been charged correctly. The book-keeper had also entered a charge for motor vehicles for the year ended (a) (a) Complete the 2015 thefollowing following tableto toshow show thethe correct correct profit profit for for the the year year ended ended 31 Complete December in error.table 31 December 2014. 31 December 2014. Depreciation is charged on motor vehicles at 10% on a reducing balance basis. Add Deduct Total Add Deduct Total ($)($) ($) ($) ($) ($) Original profit year Original profit for for thethe year © UCLES 2015 © UCLES (b)2015 Prepare 10 9706/22/O/N/15 11 9706/22/O/N/15 the corrected statement of financial position at 31 December 2014. (c) Name five external users of accounting information and state their interest in the information. (10+10+10) 1 (Nov15/P22/Q2) OMAIR MASOOD © UCLES 2015 CEDAR COLLEGE 9706/22/O/N/15 326 Q7 11 22 The The following following is is the the draft draft statement statement of of financial financial position position ofof Chan Chan Ya Ya Wen, Wen, aa sole sole trader, trader,atat 31 May 2014. 31 May 2014. Statement Statementof ofFinancial FinancialPosition Positionatat31 31May May2014 2014 $000 $000 Assets Assets Non-current Non-current assets assets Buildings Buildings at at valuation valuation Equipment Equipment at at net net book book value value Motor Motor vehicles vehicles at at net net book bookvalue value 500 500 240 240 400 400 1140 1140 Current Current assets assets Inventories Inventories Trade Trade receivables receivables Other Other receivables receivables Cash Cash and and cash cash equivalents equivalents 55 55 34 34 44 22 95 95 Total Total assets assets 1235 1235 Capital Capital and and Liabilities Liabilities Opening Opening capital capital Add profit for the year Add profit for the year 900 900 250 250 1150 1150 75 75 1075 1075 Less drawing Less drawing Closing capital Closing capital Non-current liabilities Non-current liabilities Loan Loan 100 100 Current liabilities Current liabilities Trade payables Trade payables Other payables Other payables 52 52 8 8 60 60 Total capital and liabilities Total capital and liabilities 1235 1235 Additional information Additional information After preparation of the draft statement of financial position the following errors were discovered: After preparation of the draft statement of financial position the following errors were discovered: 1 1 A purchase credit note received for $12 000 had been completely omitted from the books. A purchase credit note received for $12 000 had been completely omitted from the books. 2 2 Inventory at 31 May 2014, cost $6000, was found to be damaged. A customer has agreed to Inventory at 31for May 2014, cost $6000, found to be damaged. A customer has agreed to buy the goods $2500. Delivery costs was will be $250. buy the goods for $2500. Delivery costs will be $250. 3 3 The loan was received on 1 December 2013. Loan interest of 4% per annum has not been The loan was received on 1 December 2013. Loan interest of 4% per annum has not been paid. paid. During the year vehicle repairs of $2000 had been incorrectly debited to the motor vehicles During the yearvehicles vehicle have repairs of $2000 had been incorrectly debited toyear the motor vehicles account. Motor been depreciated by 25% per annum on the end value. account. Motor vehicles have been depreciated by 25% per annum on the year end value. 4 4 OMAIR MASOOD © UCLES 2014 © UCLES 2014 CEDAR COLLEGE 9706/21/O/N/14 9706/21/O/N/14 327 3 5 On 1 May 2014 a motor vehicle with a net book value of $16 000 had been badly damaged in a collision. No entry has yet been made in the accounts for this. The insurance company has agreed to pay $13 000 in compensation. The trader will receive a further $1200 for the scrap value. 6 On 27 May 2014 a credit customer was declared bankrupt and it was decided to write off the $8000 owing. No record in the accounts has yet been made. REQUIRED 4 (a) Prepare a statement to show the corrected profit for the year ended 31 May 2014. (b) Prepare a corrected statement of financial position at 31 May 2014. (Nov14/P21/Q1a-b) Q8 (10+12) 6 6 2 The following is the draft statement of financial position of George Grosz, a sole trader, at 2 The following is the draft statement of financial position of George Grosz, a sole trader, at 30 June 2012. 30 June 2012. Statement of Financial Position at 30 June 2012 Statement of Financial Position at 30 June 2012 $ $ $ $ $ $ Non-current assets Non-current assets Buildingsatatvaluation valuation Buildings 108 000 108 000 Equipmentatat net book value 7 000 Equipment net book value 7 000 Motorvehicles vehicles book value Motor at at netnet book value 35 000 35 000 150 000 150 000 Current Currentassets assets Inventory 21 000 Inventory 21 000 Trade receivables 18 000 Trade receivables 18 000 Cash and cash equivalents 8 000 Cash and cash equivalents 8 000 60 000 Other receivables 13 000 Other receivables Current liabilities Current liabilities Trade payables 60 000 13 000 42 000 Trade payables 42 000 Non-current liabilities Loan Non-current liabilities 18 000 168 000 18 000 168 000 50 000 Loan 50 000 118 000 90 000 118 000 30 000 120 000 90 000 2 000 30 000 118 000 120 000 Capital at 1 July 2011 Add Draft profit for the year Capital at 1 July 2011 Less Add Drawings Draft profit for the year Less Drawings 2 000 118 000 Additional information: 1 Provision for depreciation on motor vehicles for the year ended 30 June 2012 had not Additional yet beeninformation: charged. Depreciation is charged at 10% on the net book value at the year end. 1 Provision for depreciation on motor vehicles for the year ended 30 June 2012 had not 2 Items included in inventory and valuedisatcharged their costatprice of on $9500 damaged andat the year yet been charged. Depreciation 10% thewere net book value [10] had an estimated net realisable value of $2000. end. 3 A purchase invoiceinfor goods valued $2000 been omitted the books. included inventory and at valued athad their cost pricefrom of $9500 were damaged 9706/21/O/N/14 [Turnand over 4 Sales invoices for goods valued at $4000 had been omitted from the books. 53 A purchase invoice for at $2000 had omitted fromend thehad books. The loan was received at 1goods Marchvalued 2012. Loan interest of been 6% due at the year not yet been paid. 2 2014 Items © UCLES had an estimated net realisable value of $2000. 4 Sales invoices for goods valued at $4000 had been omitted from the books. OMAIR MASOOD 5 CEDAR COLLEGE The loan was received at 1 March 2012. Loan interest of 6% due at the year end had not yet been paid. 328 7 [7] REQUIRED For Examiner's Use (a) Prepare a statement to show the corrected profit for the year ended 30 June 2012. (b) Calculate Grosz’s capital at 30 June 2012. (7+2) www.maxpapers.com (June13/P22/Q2a-b) 9 www.maxpapers.com For Examiner's Use In July 2012, Amina, Nizam and Sarah discovered 9 several errors that had been made in their accounts. Their trial balance failed to agree and the difference was entered into a Q9 suspense account. In July 2012, Amina, Nizam and Sarah discovered several errors that had been made in their accounts. Their trial balance failed to agree and the difference was entered into a 1 The revenue (sales) account had been overcast by $18 200. suspense account. 21 For Examiner's Use Discounts received $9 600 had had been been overcast entered on The revenue (sales)ofaccount by the $18debit 200. side of the discounts allowed account. 2 3 [2] Discounts received of $9 600 had been entered on the debit side of the discounts Simon, a debtor, had paid a cheque for $9 400 to clear his account. His account allowed account. had been credited for this amount but no entry had been made in the cash book. 3 Simon, a debtor, had paid a cheque for $9 400 to clear his account. His account REQUIRED had been credited for this amount but no entry had been made in the cash book. www.maxpapers.com REQUIRED (d) Prepare journal entries to correct each 10 of the errors which had been discovered (narratives are not required). Prepare journal the suspense the balance brought Prepare entries account, to correctclearly each showing of the errors which had been forward. discovered (8+4) (narratives are not required). (Nov12/P22/Q2d-e) (e) (d) For Examiner's Use www.maxpapers.com Q10 1 2 [7] The following is the draft balance sheet of Marshall Klingsman, a sole trader, at 30 April 2011. (b) Calculate Grosz’s capital at 30 June 2012. Balance Sheet at 30 April 2011 $ © UCLES 2013 Non-current assets $ [Turn over 300 000 540 000 330 000 1 170 000 Current assets Inventories Trade receivables Other receivables Cash and cash equivalents 70 000 19 000 2 000 4 000 95 000 57 000 3 000 35 000 1 205 000 Non-current liabilities Loan Net assets 200 000 1 005 000 Financed by: Capital at start Add Profit for the year (net profit) [4] 1 000 000 80 000 1 080 000 75 000 1 005 000 Less Drawings Capital at end OMAIR MASOOD [2] 60 000 Net current assets Additional information: $ 9706/22/M/J/13 Buildings at valuation Equipment at book value Motor vehicles at book value Current liabilities Trade payables Other payables For Examiner’s Use [Total: 30] [8] [8] CEDAR COLLEGE 329 After preparation of the draft balance sheet the following errors were found. © UCLES 2013 1 9706/22/M/J/13 Goods in inventory at 30 April 2011, valued at cost $15 000, were found to be damaged. The estimated net realisable value is $8 000. [Turn over Capital at start Add Profit for the year (net profit) 1 000 000 80 000 1 080 000 75 000 1 005 000 Less Drawings Capital at end Additional information: www.maxpapers.com 5 After(i) preparation of the draft balance sheetcost the following errors were found. (c) Explain two differences between and net realisable value. 1 2 3 (c) (i) (ii) 4 Goods in inventory at 30 April 2011, valued at cost $15 000, were found to be .................................................................................................................................. damaged. The estimated net realisable value is $8 000. .................................................................................................................................. Loan interest of 4% per annum had been omitted from the accounts. .................................................................................................................................. 5 No provision for depreciation on equipment had been made for the year. Depreciation .................................................................................................................................. should have been provided at 5%cost per annum the reducing Explain two differences between and netusing realisable value. balance method. For Examiner’s Use www.maxpapers.com Discuss the accounting treatment theper damaged in item Motor vehicles are depreciated by of 10% annum.inventory During the year 1. vehicle repairs .................................................................................................................................. of $10 000 had been incorrectly debited to the motor vehicles account. .................................................................................................................................. .................................................................................................................................. 5 On 28 April 2011 a credit customer, who owed $3600, was declared bankrupt. It 5 full. No record of this has been made in the .................................................................................................................................. was decided to write off this amount 3in .................................................................................................................................. accounts. (c) (i) .................................................................................................................................. Explain two differences between cost and net realisable value. REQUIRED .................................................................................................................................. For Examiner’s Use www.maxpapers.com www.maxpapers.com For For Examiner’s Examiner’s Use Use www.maxpapers.com www.maxpapers.com ..............................................................................................................................[4] .................................................................................................................................. (a) (ii) Prepare a statement to show the corrected profit for the year (net 1.profit) ended Discuss the accounting treatment of6the damaged inventory in item 30 April 2011. (d) Using.................................................................................................................................. your answers to (a) and (b) calculate 4 the following ratios to two decimal places: (e) State .................................................................................................................................. four ways in which Klingsman could improve his working capital. For .......................................................................................................................................... Examiner’s (i) current (b) Prepare the ratio corrected balance sheet at 30 April 2011. .................................................................................................................................. For Use © UCLES 2011 9706/23/M/J/11 .......................................................................................................................................... .................................................................................................................................. 5 Examiner’s .......................................................................................................................................... Use .................................................................................................................................. .......................................................................................................................................... .................................................................................................................................. (c) .......................................................................................................................................... (i) .................................................................................................................................. Explain two differences between cost and net realisable value. For .......................................................................................................................................... Examiner’s .......................................................................................................................................... (ii) .................................................................................................................................. Discuss the accounting treatment of the damaged inventory in item 1. Use .......................................................................................................................................... .................................................................................................................................. ..............................................................................................................................[4] .......................................................................................................................................... .................................................................................................................................. .......................................................................................................................................... .................................................................................................................................. (d) .......................................................................................................................................... Using.................................................................................................................................. your answers to (a) and (b) calculate the following ratios to two decimal places: .......................................................................................................................................... ..............................................................................................................................[2] .......................................................................................................................................... .................................................................................................................................. .......................................................................................................................................... (i) current ratio .................................................................................................................................. .......................................................................................................................................... (ii) liquid ratio (acid test). .......................................................................................................................................... 6 .................................................................................................................................. .......................................................................................................................................... .................................................................................................................................. .................................................................................................................................. .......................................................................................................................................... .................................................................................................................................. .......................................................................................................................................... (e) State four ways in which Klingsman could improve his working capital. ..............................................................................................................................[4] For ......................................................................................................................................[4] .................................................................................................................................. (ii) Discuss the accounting treatment of the damaged inventory in item 1. .......................................................................................................................................... Examiner’s .................................................................................................................................. Use .......................................................................................................................................... .......................................................................................................................................... Using your (a) and (b)test) calculate the following to two decimalthan places: (f)(d) Explain why answers the liquidtoratio (acid is a more reliable ratios indicator of liquidity the .................................................................................................................................. .................................................................................................................................. .......................................................................................................................................... current ratio. .................................................................................................................................. .......................................................................................................................................... .......................................................................................................................................... (i) ..............................................................................................................................[2] current ratio (9+7+2+2+2+2+4+2) .................................................................................................................................. .......................................................................................................................................... .......................................................................................................................................... (June11/P23/Q1) ..............................................................................................................................[2] .......................................................................................................................................... .......................................................................................................................................... .................................................................................................................................. (ii) liquid ratio (acid test). .................................................................................................................................. .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .................................................................................................................................. .................................................................................................................................. .......................................................................................................................................... ..............................................................................................................................[4] .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... .................................................................................................................................. .................................................................................................................................. .......................................................................................................................................... (d) Using your answers to (a) and (b) calculate the following ratios to two decimal places: .......................................................................................................................................... .......................................................................................................................................... .......................................................................................................................................... ..............................................................................................................................[2] .................................................................................................................................. .......................................................................................................................................... (i) current ratio .......................................................................................................................................... .......................................................................................................................................... ......................................................................................................................................[4] (ii) liquid ratio (acid test). ..............................................................................................................................[2] .......................................................................................................................................... .................................................................................................................................. .......................................................................................................................................... .......................................................................................................................................... (f) Explain why the liquid ratio (acid test) is a more reliable indicator of liquidity than the .................................................................................................................................. .......................................................................................................................................... .................................................................................................................................. current ratio. .......................................................................................................................................... .......................................................................................................................................... 330 .................................................................................................................................. OMAIR MASOOD CEDAR COLLEGE .......................................................................................................................................... .................................................................................................................................. .......................................................................................................................................... .......................................................................................................................................... .................................................................................................................................. ......................................................................................................................................[9] © UCLES 2011 9706/23/M/J/11 [Turn over ..............................................................................................................................[2] .......................................................................................................................................... .......................................................................................................................................... ..............................................................................................................................[2] www.maxpapers.com www.maxpapers.com BANK RECONCILIATION STATEMENTS THEORY BANK!RECONCILIATION!STATEMENTS! ( Cashbook(is(owner’s(record((Debit(means(+(balance,(Credit(means(–(balance)( Bank(statement(is(bank’s(record((Credit(means(+(balance,(Debit(means(–(balance)( ( Some(entries(which(are(recorded(in(the(bank(statement(but(not(in(the(cashbook:( For(these,(we(will(have(to(correct(the(cashbook( ( 1. Credit(transfer((Bank(Giro):(Money(deposited(by(customer(directly(in(the(bank(account( (We(should(add(it(to(cashbook(balance)( 2. Standing(order/(Direct(Debit:(Money(paid(to(supplier(directly(by(the(bank.( (We(should(subtract(this(from(cashbook(balance)( 3. Bank(Charges/(Interest(Charged:(Money(deducted(directly(by(the(Bank.( (We(should(subtract(this(from(cashbook(balance)( 4. Interest(Received/(Dividends(Received:(Money(added(to(the(bank(account(in(form(of( interest(or(dividend((We(should(ad(it(to(the(cashbook(balance)( 5. Dishonored(Cheque:(A(cheque(received(from(customer(but(not(acknowledged(by(the( bank((We(should(subtract(this(from(cashbook(balance(because(we(need(to(cancel(the( entry(made(when(the(cheque(was(received).( ( Some(entries(which(are(recorded(in(the(cashbook(but(not(on(the(bank(statement.( ( For(this,(we(will(have(to(correct(the(bank(statement:( ( 1. Unpresented!Cheque:!Cheques(written(by(us(to(a(creditor(but(not(yet(presented(to(the( bank(for(payment,(so(the(bank(has(not(deducted(money(from(our(account.( (We(should(subtract(this(from(bank(statement(balance)( 2. Uncredited!Cheque!(Lodgments):!Cheques(received(by(us(but(not(yet(deposited(in(the( bank,(so(the(bank(has(not(increased(the(bank(balance.((We(should(add(this(to(the(bank( statement(balance)( ( FOR!MCQ’s!remember! ! Balance(as(per(Bank(statement(+(Uncredited(Cheques(–(Unpresented(Cheques(=(Balance(as( per(corrected(Cashbook.( ( If(balance(as(per(corrected(cashbook(is(given(in(the(question,(simply(ignores(the(entries( which(will(affect(the(cashbook(balance.(( ( If(there(is(an(overdraft((for(either(cashbook(or(bank(statement),(take(it(as(a(negative(figure( in(the(equation.( OMAIR MASOOD CEDAR COLLEGE 331 Accounts – 9706 AS – Level Accounts – 9706 AS – Level– 9706 Accounts AS – Level OMAIR MASOOD BANK RECONCILIATION OMAIR MASOOD OMAIR MASOOD BANK RECONCILIATION WORKSHEET BANK RECONCILIATION Q1. Ahmed’s cash book at 30th April 1992 had a debit balance of $1120. On the same date, BANK RECONCILIATION Q1. the Bank Statement had a credit balance of $720. th Q1. After Ahmed’s cash book at 30 April 1992the had a debit balancethe of $1120. Ondifferences the same date, checking the Cash Book against Bank Statement, following were th Q1. Ahmed’s cash book at 30 April 1992 had a debit balance of $1120. On the same date, the Bank Statement had a credit balance of $720. found. the Bank Statement had Book a credit balance $720. After checking the Cash against theof Bank Statement, the following differences were After checking the Cash Book against the Bank Statement, the following differences were found. (i) The bank had paid a bankers order (standing order) for insurance of $360. found. (i) The The bank bank had had paid a bankers ordertransfer (standing order) forthe insurance $360. (ii) received by credit (bank giro) sum of of $170 due to Ahmed (i) The bank had paid a bankers order (standing order) for insurance of $360. from Leroy. (ii) The bank had received by credit transfer (bank giro) the sum of $170 due to Ahmed (ii) The had received by credit transfer (bank giro) the sum of $170 due to Ahmed frombank Leroy. (iii)Cheques issued for $220 had not been presented for payment. from Leroy. (iii)Cheques issued for $220 had not been presented for payment. (iv) paidissued into the didpresented not appear the Bank Statement. (iii)$180 Cheques forbank $220by hadAhmed not been foronpayment. (iv) $180 paid into the bank by Ahmed did not appear on the Bank Statement. (v) cheque issued Ahmed as $760 in the Cash (iv)A $180 paid for into$670 the bank by by Ahmed didhad not been appearentered on the wrongly Bank Statement. but correctly Bank (v) Book A cheque for $670 on issued byStatement. Ahmed had been entered wrongly as $760 in the Cash (v) A cheque for $670 issued by Ahmed had been entered wrongly as $760 in the Cash Book but correctly on Bank Statement. (vi) Bank charges $40 had been debited on Book but correctly on Bank Statement. the Bank Statement. (vi) Bank charges $40 had been debited on the Bank Statement. (vii) A cheque $300 by Ahmed and paid into the bank had been returned (vi) Bank chargesfor$40 hadreceived been debited on the Bank Statement. Ahmed had received not yet made any entries to deal cheque. (vii) unpaid; A cheque for $300 by Ahmed and paid intowith the this bankreturned had been returned (vii) A cheque for $300 by Ahmed and paid into thethis bank had been returned unpaid; Ahmed had received not yet made any entries to deal with returned cheque. unpaid; Ahmed had not yet made any entries to deal with this returned cheque. REQUIRED: REQUIRED: (a) Bring the Cash Book (Bank Columns) up to date starting with the balance given above REQUIRED: (a) and Bring the Cashas Book (Bank Columns) up to date starting with the balance given above amending necessary. (a) Bring the Cash Book (Bank and amending as necessary.Columns) up to date starting with the balance given above and amending as necessary. (b) Prepare a statement, under its proper title, to reconcile the difference between your (b) amended Prepare aCash statement, itsand proper title, to reconcile the difference Book under balance the given Bank Statement balance. between your (b) Prepare a statement, under its proper title, to reconcile the difference amended Cash Book balance and the given Bank Statement balance. between your amended Cash Book balance and the given Bank Statement balance. OMAIR MASOOD CEDAR COLLEGE 332 Accounts –– 9706 9706 Accounts Accounts – 9706 AS – Level AS – Level AS – Level Q2. OMAIR MASOOD MASOOD OMAIR OMAIR MASOOD Q2. T. T. Howard’s Howard’s Cash Cash Book Book at at 30 30thth September September 1990 1990 showed showed aa debit debit balance balance at at the the bank bank of of Q2. Q2. T. Howard’s Cash Book at 30th September 1990 showed a debit balance at the bank of some date date had had aa credit credit balance balance of of $131. $131. $612 but the Bank Statement of the some $612 but the Bank Statement of the some date had a credit balance of $131. Bank Statement, Statement, the the following following differences differences were were After comparing the Cash Book with a Bank After comparing the Cash Book with a Bank Statement, the following differences were noted. noted. bank had had not not yet yet appeared appeared on on the the Statement. Statement. (i) An amount of $171 paid into the bank (i) An amount of $171 paid into the bank had not yet appeared on the Statement. (ii) Bank interest $30 in respect of an earlier earlier overdraft overdraft had had been been charged charged by by the the bank. bank. (ii) Bank interest $30 in respect of an earlier overdraft had been charged by the bank. (iii)Cheques issued for $280 had not been been presented presented for for payment. payment. (iii)Cheques issued for $280 had not been presented for payment. (iv) A cheque for $400 which had been been paid paid into into the the bank bank had had been been returned returned unpaid unpaid (iv)because A cheque for $400 which had been paid into thebybank had to been returned unpaid of lack of funds. No action had been taken Howard deal with this because of lack of funds. No action had been taken by Howard to deal with this item. item. because of lack of funds. No action had been taken by Howard to deal with this item. (v) (v) Funds Funds of of $560 $560 paid paid into into the the bank bank had had been been entered entered in in the the Cash Cash Book Book as as $500. $500. (v) Funds of $560 paid into the bank had been entered in the Cash Book as $500. (vi) (vi)The The bank bank had had made made aa banker’s banker’s order order payment payment for for insurance insurance of of $240 $240 which which had had not not (vi)been The bank had made a banker’s order payment for insurance of $240 which had not recorded by Howard. been recorded by Howard. been recorded by Howard. (vii) (vii) The The bank bank had had received received by by direct direct credit credit transfer transfer (bank (bank giro) giro) aa payment payment of of $20 $20 due due to to (vii) Howard The bank had received by direct credit transfer (bank giro) a payment of $20 due to from G. Keith. Howard from G. Keith. Howard from G. Keith. REQUIRED: REQUIRED: REQUIRED: (a) Open a Bank Account in the Cash Book; make any necessary additional entries and (a) Open a Bank Account in the Cash Book; make any necessary additional entries and corrected balance. (a) show Open the a Bank Account in the Cash Book; make any necessary additional entries and show the corrected balance. show the corrected balance. (b) Prepare a bank reconciliation statement. (b) Prepare a bank reconciliation statement. (b) Prepare a bank reconciliation statement. OMAIR MASOOD CEDAR COLLEGE 333 Accounts – 9706 AS – Level–– 9706 Accounts 9706 Accounts AS––Level Level AS Q3 Q3 Q3 OMAIR MASOOD OMAIROMAIR MASOOD MASOOD Q3. Mohan is a trader. On 24 April 2011 he had a bank overdraft of $150.The following transactions took place24during the week ended 30 April 2011.of $150.The following Mohan is 2011 he had a bank overdraft Mohan is aa trader. trader.On On 24April April 2011 he had a bank overdraft of $150.The following transactions took place during the week ended 30 April 2011. transactions took $200, place by during thefor week endeduse. 30 April 2011. April 25 Withdrew cheque, personal April 25 Withdrew $200, by cheque, for personal use. April Withdrew $200, cheque, use. to: April 25 26 Paid by cheque theby balances on for the personal accounts owed April 26 Paid by cheque the balances on the accounts owed to: $400,on less cash discount April 26 Paid by cheque theKerai, balances the3% accounts owed to: Kerai, $400, less 3% cash discount Susan, $750, lessless 4% 3% cashcash discount. Kerai, $400, discount Susan, $750, less 4% cash discount. April 27 Cash sales, $630, paid Susan, into the $750, bank. less 4% cash discount. April 27 27 Cash Cash sales, sales, $630, $630, paid paid into into the the bank. bank. April April 28 Received a cheque from Lenny for the balance of her account, $2000, less April 27 Cash sales, $630, from paid Lenny into theforbank. April 28discount. Received cheque the balance balance of of her her account, account, $2000, $2000, less less April 28 Received aa cheque from Lenny for the 4% cash 4% cash cash discount. discount. 4% April 28 Cashed Received a cheque Lenny April 30 cheque to payfrom wages, $430.for the balance of her account, $2000, less 4% cash April 30 discount. Cashed cheque cheque to to pay pay wages, wages, $430. $430. April 30 Cashed April 30 Cashed cheque to pay wages, $430. REQUIRED REQUIRED REQUIRED (a) Prepare the bank columns of Mohan’s cash book for the week ended 30 April (a) Prepare Prepare the bank columns of Mohan’s Mohan’s cash book for the the week week ended ended 30 30 April April (a) columns of book for 2011. Showthe thebank balance brought down on cash 1 May 2011. REQUIRED 2011. Show the balance brought down on 1 May 2011. 2011. Show the balance brought down on 1 May 2011. On Prepare 1 May 2011 Mohancolumns receivedof the followingcash bank statement: (a) the bank for the week ended 30 April On 11 May May 2011 2011 Mohan received received the theMohan’s following bank bankbook statement: On Mohan following statement: 2011. Show the balance brought Bank downStatement on 1 May 2011. Bank Statement Bank Statement On 1 May 2011 Mohan received the following bank statement: DR $ CR $ Balance $ DR $ CR $$ Balance $$ DR $ CR Balance April 24 Balance 150 DR April 24 24 Balance Balance 150 DR DR Bank Statement April 150 April 25 Cheque 200 350 DR DR April 25 Cheque 200 350 April 25 Cheque 200 350 DR April 28 Cheque 388DR $ 738 DR DR CR $ 738 Balance $ April 28 28 Cheque Cheque 388 738 April 388 DR April 29 Cheque 720 1458 DR April 24 Balance 150 DR April 29 29 Cheque Cheque 720 1458 DR DR April 720 1458 April 29 Credit Transfer 24 1434 DR April 29 29 Credit Transfer 24 1434 DR DR April 25 Credit Cheque 200 350 DR April Transfer 24 1434 (Dividend) (Dividend) April 28 Cheque 388 738 DR (Dividend) April 29 Deposit 630 804 DR DR April 29 Deposit 630 804 April 29 630 804 DR April 29 Deposit Cheque 720 1458 DR April 29 Credit Transfer 24 1434 DR (Dividend) (b) Starting with the closing balance from (a) (a) update update the the bank bank columns columns in in the the cash cash (b) Starting with with the the closing closing balance balance from from (b)April Starting (a) update the bank columns cash804 DR 29 Deposit 630 in the book. Bring down the amended balance. book. Bring Bring down down the the amended amended balance. balance. book. (c) Prepare the bank reconciliation statement at at 1 May May 2011. 2011. (c) Prepare Prepare the the bank bank reconciliation reconciliation statement statement (c) at 11 May 2011. (b) Starting with the closing balance from (a) update the bank columns in the cash book. Bring down the amended balance. (c) Prepare the bank reconciliation statement at 1 May 2011. OMAIR MASOOD CEDAR COLLEGE 334 BANK%RECONCILIATION%(%WORKSHEET%2)% 10 of $12 000. Their bank statement, however, showed that the partnership hadMASOOD $9000 in the Accounts – 9706 OMAIR 10statement On the cash book with the bank the following differences were found: ! comparing Accounts – 9706 OMAIR MASOOD Q4. at that date. ASbank – Level At 30 April 2011 Robbie and Liza had a debit balance in the bank column of their cash book PAGE 254 Q1.% For ASAt– 30 Level April 2011 Robbie and Liza had a debit balance in the bank column of their cash book BANK%RECONCILIATION%(%WORKSHEET%2)% For of $12 Their bankofstatement, however, showed that the partnership $9000 in the 1 000. Bank charges $250 appeared in the bank statement but had nothad been entered in Examiner’s ! ! 000. 10statement of $12 Their bank statement, however, showed that the partnership had $9000 in the were Examiner’sUse On comparing cash book with the bank the following differences found: bank at that date.the the cash book. Use Q4.atBANK%RECONCILIATION%(%WORKSHEET%2)% bank that date. PAGE in 254 Q1.% BANK%RECONCILIATION%(%WORKSHEET%2)% At 30 April 2011 Robbie and Liza had a debit balance the bank column of their cash book For On comparing the cash book with the bank statement the differences were ! 2 Cheques received from customers amounting tofollowing $3750 had been entered inin the 1 Bank charges of $250 appeared in the bank statement butwere had notfound: been in of $12 000. Their book bank with statement, however, showed that the partnership had $9000 theentered Examiner’s On comparing the cash the bank statement the 10 following differences found: Q4. ! ! Q4. Q4. cash book but had not been credited by the bank. Use PAGE 254 Q1.% the cash book. at that date. PAGE 254bank statement but had not been entered in Q1.% bank 1 Bank charges of $250 appeared in the ! 1 Bank charges of $250 appeared in the bank statement butin had been enteredofintheir cash book At 30 April 2011 Robbie and Liza had a 10 debit balance thenot bank column ! 10 cash book. 3the Athe cheque forcash $600 received from a debtor hadthe been entered in the cash book but On comparing the book with the bank statement following differences were found: cash book. 2 Cheques received from customers amounting to $3750 had been entered of $12 000. Their bankbystatement, however, showedfunds that for thepayment’. partnership had $9000 inin the the had been returned the bank marked ‘insufficient At 30 April 2011 Robbie and Liza had a debit balance in the bank column of their cash book cash book but had not been credited by the bank. For At 30bank April 2011 Robbie and Liza hadcustomers a debit balance in the to bank column ofbeen their entered cash book at that date. For 2 Cheques received from amounting $3750 had in the ofCheques $12 000. Their bank however, showed that partnership thehad partnership had $9000 in the 1 Their Bank charges ofstatement, $250 appeared in the bank butbeen had not been entered in Examiner’s received from customers amounting to statement $3750 entered in of2 $12 000. bank statement, however, showed that the had $9000 in the the Examiner’s cash book but had not credited bybank. the bank. 4cashCheques issued bybeen the been business amounting to $1600, recorded in the cash book, Use Use bank at that date. the cash book. book but had not credited by the bank On at3that date. cheque for $600 received from a debtor hadthe been entered in the cash book but comparing the cash book with the bank statement following differences were found: didAnot appear in April’s bank statement. had been returned by the bank marked ‘insufficient funds for payment’. 3 A cheque for $600 received from a debtor had been entered in the cash book but On comparing the cash book with thea bank statement theto following differences were found: 2 Cheques received customers amounting $3750 entered in the 3 comparing A cheque forcash $600 received from debtor hadthe been entered inhad thebeen cash book but On the book withfrom the bank statement following differences were found: been returned by the bank marked ‘insufficient for payment’. 1had Bank charges of $250 appeared inthe thebank. bankfunds statement but had not been entered in REQUIRED cash book but not been credited by had been returned byhad the bank marked ‘insufficient funds for payment’. issued by the business amounting to in the cash book, 1 Cheques Bank charges of $250 appeared the bank statement but not hadrecorded not been entered the cash 1 4 Bank charges of book. $250 appeared in theinbank statement but$1600, had been entered in in 4 Cheques issued by the business amounting to $1600, recorded in the cash book, cash book. 3the Athe cheque forand $600 received from afor debtor had been entered thecash cashbook, book but did not appear inLiza’s April’s bank statement. (c) Update Robbie cash book the month of April 2011. 4 (i) Cheques issued by the business amounting to $1600, recorded ininthe cash book. not appear in April’s bank statement. been by the bank marked ‘insufficient funds payment’. did not appear inreturned April’s bank statement. 2didhad Cheques received from customers amounting tofor $3750 had been entered in the 2.................................................................................................................................. Cheques received from customers amounting to $3750 entered in the 2 Cheques received fromhad customers amounting to had had beenbeen entered in the REQUIRED cash book but not been credited by$3750 the bank. REQUIRED cash book but had not been credited by the bank. 4 Cheques issued by the business amounting to $1600, recorded in the cash book, REQUIRED cash book but had not been credited by the bank. did not appear in April’s bank statement. 3Update cheque for $600 received from afor debtor had been entered in the cash book but (c) (i) 3.................................................................................................................................. Robbie and Liza’s cash thebeen month of April 2011. AAcheque forLiza’s $600 received abook debtor had entered the cash (c) 3Update (i) Robbie and Liza’s cash for the month of April 2011. A Update cheque forand $600 received from abook debtor had been entered in thein cash bookbook but but (c) (i) Robbie cash bookfrom for the month of April 2011. had been returned by the bank marked ‘insufficient funds for payment’. had been returned bybank the bank marked ‘insufficient for payment’. had been returned by the marked ‘insufficient fundsfunds for payment’. REQUIRED .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. 4 Update Cheques issued by business the business toApril $1600, recorded in book, the cash book, 4.................................................................................................................................. Cheques issued byLiza’s the amounting to $1600, recorded in cash the cash 4 (i) Cheques issued by the business amounting to $1600, recorded in the book, (c) Robbie and cash book for amounting the month of 2011. did.................................................................................................................................. not appear in April’s statement. did not appear in April’s bank statement. did not appear inbank April’s bank statement. .................................................................................................................................. .................................................................................................................................. ! .................................................................................................................................. .................................................................................................................................. ! REQUIRED REQUIRED .................................................................................................................................. REQUIRED .................................................................................................................................. .................................................................................................................................. ! .................................................................................................................................. ..............................................................................................................................[4] (c) Update Robbie and Liza’s cash cash bookbook for the of April April 2011. (c) (i).................................................................................................................................. Update Robbie and Liza’s formonth the month ! (i) .................................................................................................................................. (c) (i).................................................................................................................................. Update Robbie and Liza’s cash book for the of month 2011. of April 2011. .................................................................................................................................. ! (ii) .................................................................................................................................. Prepare a bank reconciliation statement at 30 April 2011 to reconcile the bank! .................................................................................................................................. ! .................................................................................................................................. ! .................................................................................................................................. .................................................................................................................................. statement balance with the updated cash book balance. .................................................................................................................................. !! .................................................................................................................................. ! .................................................................................................................................. .................................................................................................................................. ! ..............................................................................................................................[4] ! ..............................................................................................................................[4] ! .................................................................................................................................. .................................................................................................................................. !! .................................................................................................................................. ..............................................................................................................................[4] .................................................................................................................................. ! .................................................................................................................................. (ii) Prepare a bank reconciliation statement at 30atApril 20112011 to reconcile the bank ! (ii) Prepare a bank reconciliation statement 30 April to reconcile the bank .................................................................................................................................. .................................................................................................................................. statement balance with the updated cash book balance. ..............................................................................................................................[4] statement balance with the updated cash book balance. (ii) Prepare a bank reconciliation statement at 30 April 2011 to reconcile the bank ! .................................................................................................................................. .................................................................................................................................. ! statement balance with the updated cash book balance. ! .................................................................................................................................. (ii) Prepare a bank reconciliation statement at 30 April 2011 to reconcile the bank ! .................................................................................................................................. .................................................................................................................................. ! ! ! .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. statement balance with the updated cash book balance. ! ! ! .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. ! .................................................................................................................................. ..............................................................................................................................[4] .................................................................................................................................. ! ..............................................................................................................................[4] .................................................................................................................................. ! !! .................................................................................................................................. ! .................................................................................................................................. Prepare a bank reconciliation statement at 30 April 2011 to reconcile the bank .................................................................................................................................. ! !! (ii).................................................................................................................................. ..............................................................................................................................[4] (ii) Prepare a bank reconciliation statement at 30 April 2011 to reconcile the bank .................................................................................................................................. ! statement balance with the updated cash book balance. ! ! .................................................................................................................................. statement balance with the updated cash book balance. ..............................................................................................................................[4] ! ! .................................................................................................................................. .................................................................................................................................. (ii) Prepare a bank reconciliation statement at 30 April 2011 to reconcile the bank !! .................................................................................................................................. .................................................................................................................................. ! ! statement balance with the updated cash book balance. .................................................................................................................................. ! ! .................................................................................................................................. .................................................................................................................................. .................................................................................................................................. ! ! .................................................................................................................................. .................................................................................................................................. ! .................................................................................................................................. ! ! ! ..............................................................................................................................[4] .................................................................................................................................. ! ..............................................................................................................................[4] .................................................................................................................................. ! ! .................................................................................................................................. .................................................................................................................................. ! .................................................................................................................................. ! ! .................................................................................................................................. Examiner’s Use For Examiner’s Use ! ! ..............................................................................................................................[4] .................................................................................................................................. ..............................................................................................................................[4] ! !! .................................................................................................................................. ! ! ! .................................................................................................................................. ! © UCLES 2011 9706/23/M/J/11 .................................................................................................................................. ! ! ! ! .................................................................................................................................. .................................................................................................................................. ! ! !! ..............................................................................................................................[4] ! ..............................................................................................................................[4] ! ! ! © UCLES 2011! 9706/23/M/J/11 .................................................................................................................................. ! ! © UCLES 9706/23/M/J/11 !! 2011 ! !! ..............................................................................................................................[4] ! © UCLES 2011 9706/23/M/J/11 ! ! ! © UCLES 2011 9706/23/M/J/11 !! ! ! © UCLES 2011 ! OMAIR MASOOD © UCLES 2011 © UCLES 2011 9706/23/M/J/11 9706/23/M/J/11 CEDAR COLLEGE 9706/23/M/J/11 335 Accounts – 9706 – 9706 Accounts AS – Level AS – Level AS – Level AS – Level OMAIR MASOOD OMAIR MASOOD Q5. Q2.% Q5. Q2.% Q5. Q5. %Q2.% Q5. Kylie!Johnson’s!cash!book!(bank!columns)!had!a!debit!balance!of!$460!on! Q2.% %Q2.% Q5. Kylie!Johnson’s!cash!book!(bank!columns)!had!a!debit!balance!of!$460!on! % Kylie!Johnson’s!cash!book!(bank!columns)!had!a!debit!balance!of!$460!on! 30!April!2006.!! The!bank!statement!at!the!same!date!showed!that!Kylie!had! %30!April!2006.!! Kylie!Johnson’s!cash!book!(bank!columns)!had!a!debit!balance!of!$460!on! The!bank!statement!at!the!same!date!showed!that!Kylie!had! Kylie!Johnson’s!cash!book!(bank!columns)!had!a!debit!balance!of!$460!on! 30!April!2006.!!% The!bank!statement!at!the!same!date!showed!that!Kylie!had! a!balance!at!bank!of!$323.! 30!April!2006.!! The!bank!statement!at!the!same!date!showed!that!Kylie!had! a!balance!at!bank!of!$323.! 30!April!2006.!! The!bank!statement!at!the!same!date!showed!that!Kylie!had! a!balance!at!bank!of!$323.! a!balance!at!bank!of!$323.! On!checking!the!cash!book!against!the!bank!statement!the!following! a!balance!at!bank!of!$323.! On!checking!the!cash!book!against!the!bank!statement!the!following! a!balance!at!bank!of!$323.! On!checking!the!cash!book!against!the!bank!statement!the!following! On!checking!the!cash!book!against!the!bank!statement!the!following! differences!were!found.! On!checking!the!cash!book!against!the!bank!statement!the!following! differences!were!found.! On!checking!the!cash!book!against!the!bank!statement!the!following! differences!were!found.! !differences!were!found.! differences!were!found.! differences!were!found.! !! ! (1) A!receivable,!Nancy!Tan,!paid!$80!directly!into!the!Bank.!This!had! !(1) (1) A!receivable,!Nancy!Tan,!paid!$80!directly!into!the!Bank.!This!had! ! A!receivable,!Nancy!Tan,!paid!$80!directly!into!the!Bank.!This!had! (1) A!receivable,!Nancy!Tan,!paid!$80!directly!into!the!Bank.!This!had! not!been!entered!in!the!cash!book.! (1) A!receivable,!Nancy!Tan,!paid!$80!directly!into!the!Bank.!This!had! not!been!entered!in!the!cash!book.! (1) A!receivable,!Nancy!Tan,!paid!$80!directly!into!the!Bank.!This!had! not!been!entered!in!the!cash!book.! %not!been!entered!in!the!cash!book.! not!been!entered!in!the!cash!book.! % not!been!entered!in!the!cash!book.! % % (2) Bank!charges,!$50,!were!included!on!the!bank!statement!but!had! %Bank!charges,!$50,!were!included!on!the!bank!statement!but!had! (2) % (2) Bank!charges,!$50,!were!included!on!the!bank!statement!but!had! (2) Bank!charges,!$50,!were!included!on!the!bank!statement!but!had! not!been!recorded!in!thecash!book.! (2) Bank!charges,!$50,!were!included!on!the!bank!statement!but!had! not!been!recorded!in!thecash!book.! (2) Bank!charges,!$50,!were!included!on!the!bank!statement!but!had! not!been!recorded!in!thecash!book.! %not!been!recorded!in!thecash!book.! not!been!recorded!in!thecash!book.! % not!been!recorded!in!thecash!book.! % % (3) Insurance!paid,!$32,!was!recorded!on!the!bank!statement!but!not! %Insurance!paid,!$32,!was!recorded!on!the!bank!statement!but!not! (3) % (3) Insurance!paid,!$32,!was!recorded!on!the!bank!statement!but!not! (3) Insurance!paid,!$32,!was!recorded!on!the!bank!statement!but!not! in!the!cash!book.! (3) Insurance!paid,!$32,!was!recorded!on!the!bank!statement!but!not! in!the!cash!book.! (3) Insurance!paid,!$32,!was!recorded!on!the!bank!statement!but!not! in!the!cash!book.! %in!the!cash!book.! in!the!cash!book.! % in!the!cash!book.! % % (4) A!cheque,!$140,!sent!to!a!payable!had!not!yet!been!presented!to! %A!cheque,!$140,!sent!to!a!payable!had!not!yet!been!presented!to! (4) % (4) A!cheque,!$140,!sent!to!a!payable!had!not!yet!been!presented!to! (4) A!cheque,!$140,!sent!to!a!payable!had!not!yet!been!presented!to! the!bank!for!payment.! (4) A!cheque,!$140,!sent!to!a!payable!had!not!yet!been!presented!to! the!bank!for!payment.! (4) A!cheque,!$140,!sent!to!a!payable!had!not!yet!been!presented!to! the!bank!for!payment.! %the!bank!for!payment.! the!bank!for!payment.! % the!bank!for!payment.! % % (5) A!transfer!of!$125!from!the!business!bankaccount!to!Kylie’s! %A!transfer!of!$125!from!the!business!bankaccount!to!Kylie’s! (5) % (5) A!transfer!of!$125!from!the!business!bankaccount!to!Kylie’s! (5) A!transfer!of!$125!from!the!business!bankaccount!to!Kylie’s! private!bank!account!had!been!entered!in!the!cash!book!but!not!on! (5) A!transfer!of!$125!from!the!business!bankaccount!to!Kylie’s! private!bank!account!had!been!entered!in!the!cash!book!but!not!on! (5) A!transfer!of!$125!from!the!business!bankaccount!to!Kylie’s! private!bank!account!had!been!entered!in!the!cash!book!but!not!on! private!bank!account!had!been!entered!in!the!cash!book!but!not!on! the!bank!statement.! private!bank!account!had!been!entered!in!the!cash!book!but!not!on! the!bank!statement.! private!bank!account!had!been!entered!in!the!cash!book!but!not!on! the!bank!statement.! %the!bank!statement.! the!bank!statement.! % the!bank!statement.! % % (6) An!amount!of!$400!paid!into!the!bank!on!29!April!did!not!appear! %An!amount!of!$400!paid!into!the!bank!on!29!April!did!not!appear! (6) % (6) An!amount!of!$400!paid!into!the!bank!on!29!April!did!not!appear! (6) An!amount!of!$400!paid!into!the!bank!on!29!April!did!not!appear! on!the!bank!statement.% (6) An!amount!of!$400!paid!into!the!bank!on!29!April!did!not!appear! on!the!bank!statement.% (6) An!amount!of!$400!paid!into!the!bank!on!29!April!did!not!appear! on!the!bank!statement.% on!the!bank!statement.% % on!the!bank!statement.% % on!the!bank!statement.% % %% REQUIRED% REQUIRED% % REQUIRED% %REQUIRED% REQUIRED% % REQUIRED% %(a) Starting!with!the!balance!on!30!April!2006,!update!the!cash!book! %%(a) Starting!with!the!balance!on!30!April!2006,!update!the!cash!book! % (a) Starting!with!the!balance!on!30!April!2006,!update!the!cash!book! (a) Starting!with!the!balance!on!30!April!2006,!update!the!cash!book! and!bring!down!the!amended!balance.! ! !! !! (a) Starting!with!the!balance!on!30!April!2006,!update!the!cash!book! and!bring!down!the!amended!balance.! ! (a) Starting!with!the!balance!on!30!April!2006,!update!the!cash!book! and!bring!down!the!amended!balance.! ! ! ! and!bring!down!the!amended!balance.! ! !and!bring!down!the!amended!balance.! !! !! !!!!!!!!![6]! ! ! !! ! ! !!!!!!!!![6]! ! ! ! ! !and!bring!down!the!amended!balance.! ! !!!!!!!!![6]! !!!!!!!!![6]! %! !% ! ! !! !!!!!!!!![6]! ! ! ! ! !!!!!!!!![6]! % (b) Prepare!the!bank!reconciliation!statement!to!reconcile!the! %%Prepare!the!bank!reconciliation!statement!to!reconcile!the! (b) % (b) Prepare!the!bank!reconciliation!statement!to!reconcile!the! (b) Prepare!the!bank!reconciliation!statement!to!reconcile!the! adjusted!cash!book!balance!with!the!bank!statement!balance!at!30! (b) Prepare!the!bank!reconciliation!statement!to!reconcile!the! adjusted!cash!book!balance!with!the!bank!statement!balance!at!30! (b) Prepare!the!bank!reconciliation!statement!to!reconcile!the! adjusted!cash!book!balance!with!the!bank!statement!balance!at!30! adjusted!cash!book!balance!with!the!bank!statement!balance!at!30! April!2006.! ! !! !! !!!!!!!!![7]! adjusted!cash!book!balance!with!the!bank!statement!balance!at!30! April!2006.! !!!!!!!!![7]! adjusted!cash!book!balance!with!the!bank!statement!balance!at!30! April!2006.! ! ! ! !!!!!!!!![7]! April!2006.! !! !!!!!!!!![7]! % April!2006.! ! ! ! !!!!!!!!![7]! % April!2006.! ! ! ! !!!!!!!!![7]! % (c) Explain!how!the!following!would!appear!in!the!ledger!accounts!of! %%Explain!how!the!following!would!appear!in!the!ledger!accounts!of! (c) % (c) Explain!how!the!following!would!appear!in!the!ledger!accounts!of! (c) Explain!how!the!following!would!appear!in!the!ledger!accounts!of! Kylie!Johnson:% (c) Explain!how!the!following!would!appear!in!the!ledger!accounts!of! Kylie!Johnson:% (c) Explain!how!the!following!would!appear!in!the!ledger!accounts!of! Kylie!Johnson:% Kylie!Johnson:% % Kylie!Johnson:% % Kylie!Johnson:%! % %% (i) Bank!overdraft;! !! ! ! ! (i) Bank!overdraft;! ! % (i) ! ! !! !! !! (i) Bank!overdraft;! !Bank!overdraft;! !Bank!overdraft;! !!!!!!!!![2]% (i) ! ! ! ! !! ! ! !!!!!!!!![2]% Bank!overdraft;! ! ! ! ! ! ! !(i) !!!!!!!!![2]% !!!!!!!!![2]% (ii) Short!term!loan!from!the!business!to!Kylie!Johnson.! !Short!term!loan!from!the!business!to!Kylie!Johnson.! !! !!!!!!!!![2]% (ii) ! ! !!!!!!!!![2]% (ii) (ii) !Short!term!loan!from!the!business!to!Kylie!Johnson.! Short!term!loan!from!the!business!to!Kylie!Johnson.! !Short!term!loan!from!the!business!to!Kylie!Johnson.! (ii) !(ii) !!!!!!!!![2]% !Short!term!loan!from!the!business!to!Kylie!Johnson.! !!!!!!!!![2]% ! ! !!!!!!!!![2]% !!!!!!!!![2]% ! !! !! !!!!!!!!![2]% ! ! ! !!!!!!!!![2]% !! !! ! ! !! !! ! ! !! !! ! ! !! !! ! ! !! !! ! ! ! !! ! OMAIR MASOOD CEDAR COLLEGE 336 AS – Level Accounts – 9706 AS – Level OMAIR MASOOD !!! Q3.% Q3.% Q3.% ! Q6. Q6. Q6.!!! Q3.% Lim!Janet’s!Cash!Book!(Bank!columns!only)!for!the!month!of!September!2000! Q6. Q6. Lim!Janet’s!Cash!Book!(Bank!columns!only)!for!the!month!of!September!2000! Lim!Janet’s!Cash!Book!(Bank!columns!only)!for!the!month!of!September!2000! !was!as!follows:! was!as!follows:! was!as!follows:! Lim!Janet’s!Cash!Book!(Bank!columns!only)!for!the!month!of!September!2000! %% Dr.% %was!as!follows:! % %% Dr.% %% %% %% %% %% %% %% %% % %% %%%%%%Cr.% %%%%%%Cr.% % Dr.% % % % % % % % % % % £% % £% % £% % £% % 2000! %%%%%%Cr.% ! 2000! ! !! 2000! Sept! Sept! !! !! !! !! 1! 1! 2000! 12! 12! Sept! 24! 24! !30! 30! ! ! ! ! % Balance!b/f! 1!200! Balance!b/f! 1!200! Curry! !!!450! Curry! !!!450! 1! Balance!b/f! Casper! !!!120! Casper! 12! Curry! !!!120! Jacques! 2!150! Jacques! 24! Casper! 2!150! ! 30! Jacques! ! 2000! £% Sept! Sept! ! !! 1!200! ! ! !!!450! ! ! !!!120! ! ! 2!150! ! 3! 3! 2000! 19! 19! Sept! 23! 23! !30! 30! ! ! ! ! Lim! % !!!180! Lim! !!!180! Stefan! !!!540! Stefan! !!!540! 3! Desai! Lim! 2!100! Desai! 2!100! 19! Balance!Stefan! 1!100! Balance! 23! Desai! 1!100! ! 30! Balance! ! £% ! !!!180! !!!540! 2!100! 1!100! ! !!! The!following!Bank!Statement!for!September!was!received!in!early! The!following!Bank!Statement!for!September!was!received!in!early! ! October!2000:! October!2000:! The!following!Bank!Statement!for!September!was!received!in!early! !! October!2000:! Details% Payments% Receipts% Balance% Payments% Receipts% Balance% Details% ! 2000! £% £% £% £% Payments% £% Receipts%£% Balance% 2000! Details% Sept! 1! Balance!b/f! 1!200! !! !! Sept! 1! Balance!b/f! 2000! £% £% 1!200! £% ! 13! Curry! !! 450! 1!650! 450! 1!650! ! 13! Curry! Sept! 1! Balance!b/f! ! ! 1!200! ! 18! Lim! 180! 1!470! 180! !! ! 18! Lim! !20! 13! Curry! ! 450! 1!470! ! Banker’s!Order!–!Rent! 200! ! 1!270! 1!650! 200! 180! ! 1!270! ! 20! Banker’s!Order!–!Rent! ! 18! Lim! ! ! 22! Stefan! 540! !!!730! 1!470! 540! !! !!!730! ! 22! Stefan! ! 20! Banker’s!Order!–!Rent! 200! ! ! 24! Casper! 120! !!!850! 1!270! !! 120! !!!850! ! 24! Casper! ! 22! Stefan! 540! ! ! 29! Unpaid!Cheque!–! 120! !!!730! !!!730! 120! !! !!!730! ! 29! Unpaid!Cheque!–! ! 24! Casper! ! 120! !!!850! Casper!! Casper!! Casper!! ! 29! Unpaid!Cheque!–! 120! ! ! 30! Dividend! 180! !!!910! !!!730! 30! Dividend! !!! 180! !!!910! !! 30! 180! !!!910! Casper!!Dividend! ! !! ! !! (a) (a) (a) (b) (b) (b) (c) (c) !! !! ! ! !! !! !! ! ! ! ! ! ! ! 30! Dividend! ! 180! !!!910! !Bring!the!Cash!Book!up!to!date,!starting!with!the!balance!at!30! Bring!the!Cash!Book!up!to!date,!starting!with!the!balance!at!30! Bring!the!Cash!Book!up!to!date,!starting!with!the!balance!at!30! !September!2000.! !!!!!!!!![5]! September!2000.! !!!!!!!!![5]! September!2000.! !!!!!!!!![5]! (a) Bring!the!Cash!Book!up!to!date,!starting!with!the!balance!at!30! %%% September!2000.! !!!!!!!!![5]! Prepare!a!statement,!under!its!correct!title,!to!reconcile!the! Prepare!a!statement,!under!its!correct!title,!to!reconcile!the! Prepare!a!statement,!under!its!correct!title,!to!reconcile!the! % difference!between!your!amended!Cash!Book!balance!and!the! difference!between!your!amended!Cash!Book!balance!and!the! difference!between!your!amended!Cash!Book!balance!and!the! (b) Prepare!a!statement,!under!its!correct!title,!to!reconcile!the! balance!in!the!Bank!Statement!on!30!September!2000.! balance!in!the!Bank!Statement!on!30!September!2000.! !!! balance!in!the!Bank!Statement!on!30!September!2000.! difference!between!your!amended!Cash!Book!balance!and!the! ! ! ! ! ! !!!!!!!!![7]! !!!!!!!!![7]! !! !!balance!in!the!Bank!Statement!on!30!September!2000.! !! !! !! !!!!!!!!![7]! ! %%% ! ! ! ! ! !!!!!!!!![7]! State!the!amount!of!bank!balance!that!would!appear!in!the! State!the!amount!of!bank!balance!that!would!appear!in!the! % Statement!of!Financial!Position!on!30!September!2000.! ! Statement!of!Financial!Position!on!30!September!2000.! ! (c) State!the!amount!of!bank!balance!that!would!appear!in!the! !!!!!!!!![1]% !! !!Statement!of!Financial!Position!on!30!September!2000.! !!!!!!!!![1]% ! ! ! !!!!!!!!![1]% OMAIR MASOOD CEDAR COLLEGE 337 AS––9706 Level Accounts AS – Level OMAIR MASOOD Q7. Q7. !! Q7. ! Q7. Q7.Q4.% !Q4.% Q4.% Vigo’s!cash!book!(bank!columns)!showed!the!following!entries.! Vigo’s!cash!book!(bank!columns)!showed!the!following!entries.! Vigo’s!cash!book!(bank!columns)!showed!the!following!entries.! !Q4.% !Vigo’s!cash!book!(bank!columns)!showed!the!following!entries.! ! VIGO% VIGO% VIGO% !% Dr.% % % % %%%%%%%%%%%%Cash%Book% %% %% %% % Dr.% % % % %%%%%%%%%%%%Cash%Book% % Dr.% % % % VIGO% %%%%%%%%%%%%Cash%Book% % % %% %%%Cr.% %%%Cr.% % % % % %%%%%%%%%%%%Cash%Book% % % % %Dr.% %%%Cr.% !! $! !! $! % %%%Cr.% ! $!July! 7! ! July!! 1! Balance!b/d! 1!450! Singh! % $! $! 920! July!! 1! Balance!b/d! 1!450! July! 7! Singh! 920! $! !! $! July!! Cash! 1! Balance!b/d! 1!450! July! 7! Singh! 480! !!! 10! !!!500! 16 10! Cash! !!!500! ! 16 480! July!! 1! Balance!b/d! 1!450! !!!500! July! 7! Singh! 920! ! 10! Cash! ! 16 !! Robinson! Robinson! 10! Cash! !!!500! !! 16 480! ! Robinson! !!! 19! Parker! !!!260! 24! Kings! 220! 19! Parker! !!!260! ! 24! Kings! 220! !! Robinson! !31! 19! Parker! !!!260! ! 24! Kings! !! 31! Cash! !!!200! %% Cash! !!!200! ! ! 19! Parker! !!!260! ! 24! Kings! 220! ! 31! Cash! !!!200! ! !! ! Cash! !!!200! ! % ! 31! The!following!bank!statement!was!received!by!Vigo.! $! 920! 480! 220! % The!following!bank!statement!was!received!by!Vigo.! The!following!bank!statement!was!received!by!Vigo.! !!! The!following!bank!statement!was!received!by!Vigo.! Date% Details% Withdrawn% Balance% ! Details% Withdrawn% Paid%in% Paid%in% Balance% ! ! Date% Date% Details% ! $% Withdrawn%$% Paid%in%$% Balance% ! Date% ! Details% $% $% $% Withdrawn% Paid%in% Balance% July!! !! !! !1! Balance!b/f! $% $% 1!450! July!! 1! Balance!b/f! ! 1!450! $% !Balance!b/f! $%! $% $% !!! 10! 500! July!! 1! ! ! 1!950! 10! Cash! Cash! ! 500! 1!950! 1!450! 1! Balance!b/f! ! ! 1!450! !July!! 12! Singh! 920! ! 1!030! !12! Singh! 10! Cash! ! 500! 1!030! 1!950! ! 920! ! 10! Cash! !! 500! !!! 19! 260! 1!290! !19! Parker! 12! Singh! 920! ! 1!950! Parker! ! 260! 1!290! 1!030! !! 12! Singh! 920! ! 1!030! 21! Robinson! 480! ! !!!810! ! 19! Parker! ! 260! ! 21! Robinson! 480! ! !!!810! 1!290! 19! Dishonored!cheque!–! Parker! ! 260! 1!290! !!! 22! 260! ! !!!550! !22! Dishonored!cheque!–! 21! Robinson! 480! ! 260! ! !!!550! !!!810! ! 21! Parker!! Robinson! 480! ! !!!810! ! 22! Dishonored!cheque!–! 260! ! !!!550! Parker!! 22! Dividend! Dishonored!cheque!–! 260! ! !!!550! !!! 25! !! !!!25! !!!575! Parker!! 25! Dividend! !!!25! !!!575! Parker!! !! 31! !!!20! !! !31! Bank!charges! 25! Dividend! ! !!!25!!!!555! Bank!charges! !!!20! !!!555! !!!575! ! 25! Dividend! ! !!!25! !!!575! !! ! 31! Bank!charges! !!!20! ! !!!555! ! 31! Bank!charges! !!!20! ! !!!555! REQUIRED% !!! !!! ! ! REQUIRED% ! REQUIRED% %!% REQUIRED% REQUIRED% (a) Calculate!the!cash!book!balance!on!31!July.!Prepare!and!update!the! %Calculate!the!cash!book!balance!on!31!July.!Prepare!and!update!the! (a) % cash!book.!Bring!down!the!balance.! !! !! !! !! cash!book.!Bring!down!the!balance.! (a) Calculate!the!cash!book!balance!on!31!July.!Prepare!and!update!the! (a) Calculate!the!cash!book!balance!on!31!July.!Prepare!and!update!the! !! !!!!!!!!![5]! !!!!!!!!![5]! cash!book.!Bring!down!the!balance.! ! ! !! !! !! %cash!book.!Bring!down!the!balance.! %! !!!!!!!!!![5]!!!!!!!!!![5]! (b) (b) Prepare!a!bank!reconciliation!statement!to!reconcile!the!adjusted! % %Prepare!a!bank!reconciliation!statement!to!reconcile!the!adjusted! cash!book!balance!with!the!bank!statement!balance!at!31!July! cash!book!balance!with!the!bank!statement!balance!at!31!July! (b) Prepare!a!bank!reconciliation!statement!to!reconcile!the!adjusted! (b) Prepare!a!bank!reconciliation!statement!to!reconcile!the!adjusted! 2004.! !! !!!!!!!!![6]! 2004.! !!!!!!!!![6]! cash!book!balance!with!the!bank!statement!balance!at!31!July! %cash!book!balance!with!the!bank!statement!balance!at!31!July! %2004.! !2004.! !!!!!!!!![6]! ! !!!!!!!!![6]! (c) Explain!how!the!cash!book!is!both!a!book!of!prime!entry!and!a! (c) Explain!how!the!cash!book!is!both!a!book!of!prime!entry!and!a! % % ledger!account.! !!!!!!!!![2]% ledger!account.! !!!!!!!!![2]% ledger!account.! !!!!!!!!![2]% (c) Explain!how!the!cash!book!is!both!a!book!of!prime!entry!and!a! (c) Explain!how!the!cash!book!is!both!a!book!of!prime!entry!and!a! ledger!account.! ledger!account.! !!!!!!!!![2]%!!!!!!!!![2]% ! ! OMAIR MASOOD CEDAR COLLEGE 338 ( INVENTORY VALUATION THEORY ! INVENTORY!VALUATION!(!STOCK)! ( Remember(stock(is(valued(at(lower(of(cost(or(net(realisable(value((N.R.V).(This(is(basically(the(current( market(value(of(the(stock(after(deducting(any(repair(cost.(This(is(application(of(the(prudence(concept.( E.g.(If(a(piece(of(stock(costing($40(is(damaged.(Now(it(can(be(sold(for($48(but(only(if($10(of(repair(is( undertaken.(This(means(the(NRV(of(stock(is(38((48(–(10).(Since(NRV((38)(is(lower(than(the(cost((40),(we( should(value(it(as(38.(It(lets(say(the(NRV(was($41,(then(than(the(stock(would(have(been(valued(at($40.( ( Assumptions!in!Stock!Valuations! ! FIFO! Advantages! 1. Good(representation(of(sound(storekeeping(as(oldest(stock(is(issued(first.( 2. Stock(is(shown(close(to(the(current(market(value((because(it(is(valued(at(most(recent(price)( 3. This(method(is(acceptable(by(accounting(regulations( Disadvantages! 1. In(inflation(stock(is(valued(the(highest(and(it(overstates(profit( 2. Since(the(value(of(stock(issued(fluctuates,(this(will(lead(to(a(different(cost(for(an(identical(unit.( AVCO! Advantages! 1. Since(the(value(of(stock(issued(does(not(fluctuate,(this(will(lead(to(a(same(cost(for(an(identical( unit.( 2. This(method(is(acceptable(by(accounting(regulations.( Disadvantages! 1. Difficult(to(calculate.( 2. Average(price(does(not(represents(the(true(value(of(stock( ( ( ( ( ( ( ( ( ( ( ( ( OMAIR MASOOD CEDAR COLLEGE 339 INVENTORY VALUATION WORKSHEET Q1 Q2 OMAIR MASOOD CEDAR COLLEGE 340 Q5. Q1.! Accounts(–(9706(( ( ( ( ! AS(–(Level(( Inventory at Start 60 Units @$10 each INVENTORY)VALUATION)(WORKSHEET)2)) Purchases ! Q5. Q1.! Q3. January 70 units @ $11 each ! 80 units @ each $12 each Inventory atFebruary Start 60 Units @$10 March 120 units @ $15 each Purchases May 90 units @ $16 each ( ( ( (((((((((((((((((((OMAIR(MASOOD( Sales January 50 units @ $20 each February 40 units @ $21 each March 60 units @ $21 each Sales April 30 units @ $22 each May5030units units@@ $25 each January $20 each June 70 units @ $25 each February 40 units @ $21 each January 70 units @ $11 each February 80 units @ $12 each March 120 units @ $15 each March 60 units @ $21 each ! ! (a)Calculate the May 90 units @ $16 each April 30 units @ $22 each value of closing Inventory using Periodic Approach of FIFO and AVCO ! May 30 units @ $25 each ! June 70 units @ $25 each ! (b)Calculate the value of closing Inventory using Perpetual Approach of FIFO, LIFO! and ! AVCO REQUIRED:! (a)Calculate the value of closing Inventory using Periodic Approach of FIFO and AVCO !! ! (a) Calculate!the!value!of!closing!inventory!using!FIFO!(perpetual)! the value of closing Inventory using Perpetual Approach of FIFO, LIFO and ! (b)Calculate (b) Calculate!the!value!of!closing!inventory!using!AVCO!(perpetual)! AVCO ! REQUIRED:! Q6. ! ! (a) Calculate!the!value!of!closing!inventory!using!FIFO!(perpetual)! John Jones commenced trading on 1 January 1987 as a dealer in KT Formula 1 High ! (b) Calculate!the!value!of!closing!inventory!using!AVCO!(perpetual)! Performance cars; his( initial( capital( was $500,000 which was used to open a business Accounts(–(9706(( ( ( ( (((((((((((((((((((OMAIR(MASOOD( !! AS(–(Level(( Q6. bank account. Q2.! ! John Jones commenced year, trading 1 Januarytransactions 1987 as a dealer in KT Formula 1 High !Q4. During the succeeding theon following took place: ! Performance his( of initial $500,000 which was used open Accounts(–(9706(( ( ( ( capital ( wasthe ( following (((((((((((((((((((OMAIR(MASOOD( ! Janice Jersey’s Q3. first 6cars; months trading showed purchases and to sales of a business AS(–(Level(( 1 January Bought 4 cars at $60,000 each bank account. Q2.! inventory. 1 FebruaryPurchases Sold 1 car forSales $90,000 ! During the following transactions took place: 1990the succeeding year, 1 April Sold 1 car for $100,000 Q3. Janice Jersey’s first 6 months 280 of trading January @ $65showed each the following purchases and sales of 1 January Bought 4 cars at Bought 3140 cars at $70,000 each @ $60,000 $82 eacheach inventory. February 1 June 1 February Sold 1 car for $90,000 1 July 100 2 cars soldSales for $110,000 each March @ $69 each 1990 Purchases 1 April Sold 1 car for $100,000 $115,000 April 190for @ $85 each January 1 September 280 @ $65 each1 cars sold 1 June Bought 3 cars $70,000 May 220 @ $72 each February 140 @ at $82 each each 1 July 2 cars sold200 for $110,000 March @ $69the each June $90 eacheach John Jones expenses100 during year ended 31@December 1987 totalled $10,000. 1 September 1 cars sold for $115,000 April 190 @ $85 each REQUIRED: ! May 220 @6$72 each ended 30 June 1990 using the following ! Calculate Janice’s profit for the months REQUIRED: 200 @December $90 each 1987 totalled $10,000. (a) Calculate!the!value!of!closing!inventory!using!FIFO!(perpetual)! John Jones expenses during thenet year ended methods ofJune inventory valuation (Perpetual Methods) (a) Statements, showing the profit for31 the year ended 31 December 1987 for each of REQUIRED: ! (b) Calculate!the!value!of!closing!inventory!using!AVCO!(perpetual)! ! Calculate the following of inventory perpetual) Janice’s profit formethods the 6 months ended 30valuation. June 1990( using the following REQUIRED: ! (a) FIFO (First In First Out) (a) Calculate!the!value!of!closing!inventory!using!FIFO!(perpetual)! of (i) inventory first Ivaluation first out(Perpetual (FIFO) Statements, showing the netMethods) profit for the year ended 31 December 1987 for each of ! methods(a) (b) Calculate!the!value!of!closing!inventory!using!AVCO!(perpetual)! (ii) Average Cost Method ( AVCO) the following methods of Calculate inventory perpetual) (Weighted Cost). tovaluation. 2 decimal( places. ! (b) (a) AVCO FIFO (First In First Average Out) (i) first I first out (FIFO) ! (ii) Average Cost Method ( AVCO) (b) AVCO (Weighted Average Cost). Calculate to 2 decimal places. Q4. Julie Ash commenced in business on 1 January 1994 as a specialist surf board supplier. During the first six months of trading her transaction were recorded as follows: Q4. Julie Ash commenced in business on 1 January 1994 as a specialist surf board supplier. During the first six months of trading her transaction were recorded as follows: PURCHASES SALES Jan 6 @ $150 each 4 @ $310 each PURCHASES SALES Feb 7 @ $160 each 7 @ $330 each 248$ Jan 6 @ $150 each 4 @ $310 each Mar 6 @ $165 each 4@ $340 each $ Feb 7 @ $160 each 7 @ $330 each 248$ April 9 @ $165 each 5 @ $350 each Mar 6 @ $165 each @ $340 each $ May 7 @ $180 each 411 @ $350 each April 9 @ $165 each 5 @ $350 each June 10 @ $170 each 9 @ $360 each May 7 @ $180 each 11 @ $350 each Her OMAIR business expenses for the six monthsCEDAR totalled $4,750. All transactions were on a cash MASOOD COLLEGE June 10 @ $170 each 9 @ $360 each basis. Her business expenses for the six months totalled $4,750. All transactions were on a cash REQUIRED: basis. (a) Calculate the net profit for the six months ending 30 June 1994 using three methods REQUIRED: 341 Q5 Alan is a retailer of board markers. He has supplied the following information for the month of May 2018. Date 2 May 5 May 12 May 19 May 29 May Purchases Quantity Price per unit ($) 20 45 30 47 25 48 20 48 17 Date 2 May 6 May 15 May 23 May 27 May Sales Quantity 30 20 30 12 15 50 All sales were made at $90 per item. Alan had an opening inventory of 20 board markers at $42 each on 1 May 2005. (a) Calculate the closing inventory of board markers at 31 May 2018 under the following methods of inventory valuation (periodic): (i) FIFO (ii) AVCO (b) Calculate the closing inventory of board markers at 31 May 2018 under the following methods of inventory valuation (perpetual): (iii) FIFO (iv) AVCO Q6 Bradley commenced trading on 1 January 2019 as a dealer for cycle; during the year, following transactions took place. 1 January 1 Feb 1 April 1 June 1 June 1 August 1 October 1 November 1 Dec Bought 125 cycles @ $600 each Sold 65 cycles @ $1000 each Sold 40 cycles @ $1050 each Bought 80 cycles @ $650 each Sold 75 cycles @ $1100 each Bought 90 cycles @$550 each Sold 60 cycles @$1100 each Sold 40 cycles @ $1050 each Bought 25 cycles @$620 each (a) Calculate the closing inventory of cycles at 31 December 2019 under the following methods of inventory valuation (periodic): (i) FIFO (ii) AVCO (b) Calculate the closing inventory of cycles at 31 December 2019 under the following methods of inventory valuation (perpetual): (i) FIFO (ii) AVCO OMAIR MASOOD CEDAR COLLEGE 342 9 9 Q7 3 3 At 1 January 2013, Brahms had opening inventory of 50 teddy bears at a purchase price of At 1 each. January 2013, Brahms had opening inventory of 50 teddy bears at a purchase price of $30 $30 each. His transactions for the first three months of 2013 were: His transactions for the first three months of 2013 were: Date Date Jan Jan 8 8 10 10 12 12 21 21 28 28 Feb Feb 1 1 14 14 23 23 March March 1 1 4 4 19 19 23 23 27 27 Purchases Purchases (units) (units) Purchase price Purchase (per unit) price (per unit) 100 100 $30.00 $30.00 120 120 $30.50 $30.50 150 150 $31.00 $31.00 120 120 $31.50 $31.50 100 100 $32.00 $32.00 For For Examiner's Examiner's Use Use Sales Sales (units) (units) 30 30 80 80 90 90 50 50 100 100 30 30 120 120 120 120 No other transactions took place during these months. No other transactions took place during these months. Each teddy bear was sold for $50. Each teddy bear was sold for $50. REQUIRED REQUIRED (a) Calculate the value of the inventory at 31 March 2013 using the following methods of (a) Calculate the value of the inventory at 31 March 2013 using the following methods of valuation. valuation. FIFO FIFO (i) (i) 10 (ii) AVCO. For Examiner's Use (Perpetual) (June 13/P23/Q3) www.maxpapers.com 8 Q8 2 Paula Bridgewater, a retailer, supplied the following information on purchases and sales for the month of February 2009. For Examiner’s Use At 1 February 2009 Paula Bridgewater had an opening inventory (stock) of 500 units valued at $14 each. [3] Date Purchase of goods for resale Revenue (purchases) (sales) (b) Using each method of valuation, calculate the gross profit for the three months ending Quantity Cost price Quantity Selling price 31 March 2013. (i) FIFO February 2 (units) per unit ($) 2 000 15 1 500 18 2 000 20 3 10 14 18 © © UCLES UCLES 2013 2013 19 9706/23/M/J/13 9706/23/M/J/13 (units) per unit ($) [3] [3] 2 300 30 1 300 32 2 100 34 [Turn over over [Turn REQUIRED [5]FIFO (a) Calculate the closing inventory (stock) valuation at 28 February 2009 using the method of inventory (stock) valuation (perpetual). (ii) AVCO. (Nov10/P23/Q2a) .......................................................................................................................................... .......................................................................................................................................... OMAIR MASOOD CEDAR COLLEGE .......................................................................................................................................... .......................................................................................................................................... 343 ( ACCOUNTING!CONCEPTS! ( TABLE/SUMMARY/SNAPSHOT(OF(ACCOUNTING(CONCEPTS/CONVENTION( ( Accounting!period! Concept! ( Accrual!Concept!/! Matching! ( Business!Entity! ( Consistency!Concept! OMAIR MASOOD ( Also(known(as(Time(Period(where(business(operation(can(be( divided(into(specific(period(of(time(such(as(month,(a(quarter(or(a( year((accounting(period)( ( Final(accounts(are(prepared(at(the(end(of(the(accounting(period,( i.e.(one(year.(Internal(accounts(can(be(prepared(monthly,( quarterly(or(half(yearly.( ( ( Requires(all(revenues(and(expenses(to(be(taken(into(account(for( the(period(in(which(they(are(earned(and(incurred(when( determining(the(profit(/((loss)(of(the(business.(The(net(profit(/( (loss)(is(the(difference(between(the(revenue(EARNED(and(the( expenses(INCURRED(and(not(the(difference(between(the(revenue( RECEIVED(and(expenses(PAID.( Major(application(of(this(concept(is(( 1. prepayments(and(accruals( 2. Depreciation(of(Non(current(Assets( 3. Bad(debts(and(Provision(for(doubtful(debts( 4. Capitalization(of(development(cost( ( ( Also(known(as(Accounting(Entity(or(Separate(Entity(convention( which(states(that(the(business(is(an(entity(or(body(separate(from( its(owner.(Therefore(business(records(should(be(separated(and( distinct(from(personal(records(of(business(owner.( Major(application(of(this(concept(is(( 1. Capital(accounts(and(Drawings(account(are(kept(for(the( owner( 2. Owners(personal(transactions(are(not(recorded(in(business( books(( ( ( According(to(this(convention,(accounting(practices(should(remain( unchanged(from(one(period(to(another(unless(there(is(a(proper( need(to(change(them.(For(example,(if(depreciation(is(charged(on( non(current(assets(according(to(a(particular(method,(it(should(be( done(year(after(year.(This(is(necessary(for(purpose(of(comparison.( But(if(a(wrong(policy(has(been(applied(in(the(previous(years(like( straight(line(method(for(Machinery(then(we(can(change(the(policy( to(reducing(balance(method(((the(change(must(be(disclosed(in(the( accounts(to(the(stakeholders)( CEDAR COLLEGE 344 ( Dual!Aspect!Concept! ( Going!Concern!Concept! ( Historical!Cost!Concept! ( ( Double(entry(system.(For(every(debit,(there(is(a(credit(entry(of(an( equal(amount.(All(transactions(in(accounting(are(recorded(in(this( form.( ( ( The(business(will(follow(accounting(concepts(and(methods(on(the( assumption(that(business(will(continue(its(operation(to(the( foreseeable(future(or(for(an(indefinite(period(of(time.(The(major( application(of(this(concept(is(that(we(record(our(assets(at(cost(less( estimated(deprecation(rather(then(the(market(values(.(Since(we( know(that(the(market(values(will(keep(on(changing(and(we(have(to( continue(our(business(.(BUT(if(the(business(is(about(to(shut(down( then(the(Non(current(assets(must(be(shown(at(market(values((( disposal(values)(( ( Business(should(report(its(activities(or(economic(events(at(their( actual(costs.(For(example,(Non(current(assets(are(recorded(at(their( cost(in(account(except(for(land(which(can(be(revalued(due(to( appreciation( ( ( Materiality!Concept! The(concept(of(materiality!recognises(that(some(types(of( expenditure(are(less(important(in(a(business(context(than(others.( So,(absolute(precision(in(the(recording(of(these(transactions(is(not( absolutely(essential.(( For(example(:(A(business(purchases(a(ruler.(The(ruler(costs($0.45.( It(estimated(that(the(ruler(should(last(for(three(years.(Technically,( the(ruler(is(a(non5current(asset(and(should(therefore(be(classified( as(capital(expenditure.(To(do(this(would(be(rather(silly(for(such(a( trivial(amount.(The($0.45(would(be(treated(as(revenue( expenditure(and(would(be(debited(to(either(general(expenses(or( office(expenses.(This(treatment(is(not(going(to(have(a(significant( impact(on(profits(or(the(valuation(of(net(assets(on(a(statement(of( financial(position(–(the(absolute(accuracy(of(its(treatment(is(not( material.(( ( Money!Measurement! Concept! ( OMAIR MASOOD ( Also(known(as(Monetary(unit.(Transactions(related(to(the( business,(and(having(money(value(are(recorded(in(the(books(of( accounts.(Events(or(transactions(which(cannot(be(expressed(in( term(of(money(do(not(find(a(place(in(the(books(of(accounts.(For( example(motivation(/(skill(/(morale(of(employees(cannot(be( recorded(in(accounts.(Also(the(internally(generated(goodwill(of(the( business(should(be(written(off(immediately(( ( ( CEDAR COLLEGE 345 Prudence!/!Conservatism! Take(into(account(unrealized(losses,(not(unrealized(profits/gains.( Concept! Assets(should(not(be(over5valued,(liabilities(under5valued.( Provisions(are(example(of(prudence(or(conservatism(concept.(Also( under(this(prudence/conservatism(concept,(stock/inventory(is( value(at(lower(of(cost(or(market(value.(This(concept(guides( accountants(to(choose(option(that(minimize(the(possibility(of( overstating(an(asset(or(income.(Major(Applications(include( 1. Provision(for(doubtful(debts( 2. Provision(for(depreciation( 3. Valuation(of(inventory( 4. Writing(off(goodwill( ( ( ( Substance!Over!Form! Real(substance(takes(over(legal(form(namely(we(consider(the( economic(or(accounting(point(of(view(rather(than(the(legal(point( of(view(in(recording(transactions.(Major(application(is(when(we( are(leasing(the(assets(we(don’t(have(the(legal(ownership(but(the( economic(benefits(do(flow(towards(the(firm(so(it(is(recorded(as((an( asset(.( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( OMAIR MASOOD CEDAR COLLEGE 346 ! FINANCIAL ACCOUNTING IMPORTANT KEYPOINTS Financial(Accounting( ( 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 Written(down(value(or(net(book(value(means(after(depreciation.( Only(assets(and(expenses(and(drawings(have(debit(balances,(all(the(other(things(in(the(world(will( have(a(credit(balance.( Sales(invoice(would(mean(good(sold(on(credit.( If(bad(debt(is(inside(the(trial(balance(then(it(means(that(it(has(already(been(subtracted(from(the( Trade(Receivables(( Everything(outside(the(Trial(Balance(has(to(come(TWICE.( Provision(for(depreciation(is(a(Contra(Asset(Account.(It(is(NOT(AN(EXPENSE,(since(its(balance(is( brought(down.( All(the(balance(c/d(go(to(the(Statement(of(Financial(Position.( All(the(expenses(and(incomes(are(in(the(Income(Statement( Revenue(=(Sales.( If(NOTHING(is(specified(about(the(policy(of(Depreciation,(then(you(account(for(it(MONTHLY.( Every(Asset(has(an(Opening(Debit(balance(and(Closing(Credit(balance.( Every(Liability(has(an(Opening(Credit(balance(and(closing(Debit(balance.( The(Amount(of(Loan(interest(still(owing(and(not(paid((which(was(to(be(paid(this(year)(comes(in( the(Current(Liabilities.( Departmental(Account:(If(given(with(prepayment(any(expenses,(then(we(SHOULD(FIRST(ADJUST( the(accruals(and(prepayments,(and(then(divide(them(into(%(of(EACH(department.( Control(Account(is(not(part(of(the(double(entry.(It(is(THE(THIRD(ENTRY.( List(price(is(the(price(WITHOUT(deducting(TRADE(DISCOUNT.( Set(off(always(reduces(the(Control(Account!( Credit(Notes(received(=(Purchases(Returns( Credit(Notes(sent(=(Sales(Returns( BAD(DEBTS(recovered(comes(on(the(debit(side(of(the(Sales(Ledger(Control(Account((S.L.C.A)(and( even(on(the(credit(side.( Whenever(you(receive(a(cheque(from(BANK(marked(‘REFER(TO(DRAWER’(then(it(is(CHEQUE( DISHONOURED( FIX(NET(PROFIT:(In(the(Journal,(if(the(account(doesn’t(go(in(the(balance(sheet,(then(if(something( is(being(CREDITED(it(will(INCREASE(N.P,(or(if(it(DEBITED,(then(it(will(DECREASE(N.P.( To(find(the(opening(balance(in(the(Suspense(LEAVE(THE(FIRST(two(lines(empty.( The(amount(of(stationery(used,(goes(in(the(Profit(and(Loss(as(an(expense.( Sundry(Expense(means(miscellaneous(expenses.( Whatever(goes(in(the(Income(statement(is(REVENUE(EXPENDITURE.( Whatever(goes(in(the(BALANCE(SHEET(is(CAPITAL(EXPENDITURE.( CAPITAL(EMPLOYED((Sole(Trader)(=(CAPITAL(OWNED(+(LONG5TERM(LOAN.( CAPITAL(OWNED((Sole(trader)(=(Assets(–(Liabilities.( OMAIR MASOOD CEDAR COLLEGE 347 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 CAPITAL(EMPLOYED((COMPANY)(=(OSC(+(PSC(+(RESERVES((share(premium,(Retain(profits,(all( reserves)(+(Long(Term(Liabilities.( REFUND(FROM(Supplier(is(recorded(on(the(Credit(side(of(the(Purchase(Ledger(Control(Account.( In(closing(Assets,(you(write(the(Bet(Book(Value((N.B.V)( DRAWINGS(ARE(Neither(AN(Asset(NOR(A(LIABILITY.( If(they(ask(you(to(make(a(STATEMENT(TO(find(Profit(or(Loss,(then(just(make(that(financed(by( (Opening(capital(+(Net(Profit((x)(+(Capital(Introduced(–(Drawings(=(Capital(at(end)( If(they(say(make(final(accounts,(then(make(Income(Statemet(and(Statement(of(financial(position.( Closing(Stock(has(a(direct(relation(with(profit.(If(closing(stock(is(overstated,(profit(will(be( overstated.( Opening(stock(has(an(inverse(relation(with(profit.(If(opening(stock(is(overstated,(profit(will(be( understated.( Goods(sent(on(sale(or(return(basis(should(not(be(counted(as(sale(unless(accepted(by(the( customer.(Infact(they(should(be(included(in(the(stock.( If(no(account(is(wrong,(like(there(is(an(error(in(the(list(of(debtors(then(we(only(correct(it(through( suspense(account((its(only(one(entry,(e.g.(Debit:(Suspense,(Credit:(–()( We(only(double(the(amount(if(it(is(written(on(the(wrong(side(of(the(account.( If(we(find(purchases/sales(through(control(account(we(will(still(have(to(subtract(returns( Unpresented(cheques(are(payment(by(us.( Uncredited(cheques(are(receipts(by(us((also(called(LODGMENTS).( If(you(can’t(find(the(average(inventory,(use(closing(figure(instead(of(instead(of(average.( If(nothing(is(specified,(we(can(assume(all(sales(and(purchases(are(on(credit(basis.( Provision(for(bad(debt(is(a(separate(account.(We(can(record(the(provision(in(debtors(account,( net(debtors(mean(after(deducting(provision.( We(only(take(the(change(in(provision(in(the(Income(statement( Cashbook(is(both(a(daybook(and(a(ledger.( We(only(record(credit(sales(and(purchases(in(the(Sales(and(Purchase(Daybook,(cash(and(bank( transactions(are(in(the(cashbook.( If(a(daybook(is(overcast(only(that(amount(will(be(wrong.(E.g.(if(Sales(daybook(is(undercast,(this( means(only(the(Sales(account(is(wrong.( If(profit(is(given(inside(the(trial(balance,(the(stock(should(be(closing(stock((because(we(don’t( need(the(opening(stock).( Similarly(if(depreciation(for(the(year(is(inside(the(trial(balance,(the(provision(for(depreciation( would(already(include(this(year’s(depreciation.( Gross(profit(ratio(will(not(change(because(of(sales(volume((number(of(units),(but(net(profit(ratio( will(increase.( Net(Assets(=(Assets(–(Liabilities,(but(in(some(cases(CIE(uses(Net(Assets(as(Capital(Employed( which(is(Assets(–(Current(Liabilities.( Sale(or(Purchase(is(recorded(when(the(goods(are(accepted(not(when(the(invoice(is(sent(or(the( payment(is(made.( If(only(net(book(values(are(available(Depreciation(for(the(year(=(Opening(Net(Book(Value(+( Purchase(of(Asset(–(Sale(of(Asset((Nbv)(–(Closing(Net(book(value.( OMAIR MASOOD CEDAR COLLEGE 348 5 5 5 5 5 5 5 5 5 5 In(most(question(they(don’t(mention(depreciation,(that(doesn’t(mean(there(is(no(depreciation,( use(the(above(formula(to(determine.((Don’t(forget(the(depreciation(like(idiots).( Cash(banked(will(come(on(the(debit(side(of(bank(and(credit(side(of(cash(account.( Loan(is(as(long(term(liability(unless(payable(within(one(year.(If(nothing(is(written,(assume(long( term.( POOP(is(for(expenses.( OPPO(is(for(incomes.( Net(realizable(value(=(current(selling(price(–(any(expenses((repairs)( We(always(ignore(replacement(cost(in(stock(valuation.( Perpetual(methods(are(those(where(we(make(a(table.( Markup(is(on(cost((cost(is(100)( Margin(is(on(sales((Sales(is(100)( ( ( COST(ACCOUNTING( ( 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 Cost(centre(means(departments.( If(a(business(doesn’t(split(overheads(into(different(departments,(they(will(only(have(one( Overhead(absorption(rate(for(the(whole(factory((also(called(blanket(OAR).( Absorption(costing(means(total(costing.(It(is(used(to(calculate(total(cost.( We(only(use(OAR(to(calculate(the(overheads(for(a(unit/job/order/batch.( OAR(can(be(calculated(on(any(basis(like(machine(hours,(labour(hours,(unit,(labour(cost((direct( wages),(material(cost(etc.( If(no(basis(are(given(use(either(labour(hours(or(machine(hours(depends(on(what(is(more( (intensity).( Absorbed(Overheads(=(OAR(x(Actual(Activity.( Over(absorbed(means(Absorbed(are(more(than(actual(overheads( Under(absorbed(means(Absorbed(are(less(than(actual(overheads.( Usually(if(actual(activity(is(above(budget,(we(will(OVER(ABSORB( If(actual(activity(is(below(budget,(we(will(UNDER(ABSORB( Total(cost(is(cost(of(Production(+(the(non5production(cost.( Stocks(can(only(include(production(cost.(In(absorption(costing,(we(use(total(production(cost( whereas(in(marginal(we(use(only(variable(production(cost.( Marginal(costing(is(about(decision(making.( Decisions(are(based(on(contribution(not(profits.(It(is(assumed(that(fixed(cost(will(still(be( incurred.( (contribution/unit(x(#(of(units)(–(Fixed(Cost(=(Profit.( Lower(breakeven(point(is(better.(Higher(margin(of(safety(is(better.( Positive(contribution(product(or(department(should(never(be(closed(down.( Positive(contribution(product(should(be(accepted(under(idle(capacity.( OMAIR MASOOD CEDAR COLLEGE 349 FORMATS!! Financial statements of a sole trader – trading business Income statement Sole Trader (Name) Income statement for the year ended 31 December 2013 $000 $000 $000 Revenue (sales) 520 Less Sales returns 3 517 Less Cost of sales Opening inventory 46 Purchases 196 Less Purchase returns 4 192 Less Goods for own use 2 190 Carriage inwards 5 195 241 Less closing inventory 56 185 Gross profit 332 Discount received 2 Rent received 14 Commission received 4 * Profit on disposal of non-current assets ** Reduction in provision for doubtful debts 352 Less Expenses Wages and salaries 84 Office expenses 52 Rent and rates 26 Insurance 19 Motor vehicle expenses 28 Selling expenses 22 Loan interest 2 * Loss on disposal of non-current assets 7 ** Provision for doubtful debts 3 Depreciation of fixtures and fittings 9 Depreciation of office equipment 6 Depreciation of motor vehicles 8 266 *** Profit for the year 86 Notes: * If only one asset was sold during the year only one of these items will appear. ** If the provision reduces, the surplus amount is added to the gross profit: if the provision increases, the amount required is included in the expenses. *** If the expenses exceed the gross profit plus other income, the resulting figure is described as a net loss. ( OMAIR MASOOD CEDAR COLLEGE 350 Statement(of(financial(position( Sole Trader (Name) Statement of financial position at 31 December 2013 $000 $000 ASSETS Non-current assets Cost Land and buildings Fixtures and fittings Office equipment Motor vehicles CAPITAL & LIABILITIES Capital Opening balance Add Profit for the year * Deduct drawings Non-current liabilities Bank loan Current liabilities Trade payables Other payables Bank overdraft Total capital and liabilities Depreciation to date 39 16 32 87 50 49 36 85 220 Current assets Inventory Trade receivables Less Provision for doubtful debts Other receivables * Cash at bank Cash on hand Total assets $000 Book value 50 10 10 53 123 56 53 6 47 6 12 2 ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( 123 226 ( ( ( ( ( ( ( ( ( ( ( 21 6 3 ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( 152 86 238 62 176 20 30 226 Note: * If there is a net loss, this will be deducted rather than added. OMAIR MASOOD CEDAR COLLEGE 351 Financial statements (final accounts) of a partnership business Income statement The income statement of a partnership is the same as the income statement of a sole trader. The net profit is then appropriated to the partners as follows. Partnership appropriation account for the year ended……………………… $ $ Profit for the year Add: Interest on drawings Less: Interest on capital Less: Partners’ salaries Profit before appropriation Profit shared OMAIR MASOOD CEDAR COLLEGE 352 Statement of financial position of a partnership ……………………………………………… Statement of financial position at .......................................... $ $ Non-current assets Current assets Total assets $ Capital accounts Current accounts Non-current liabilities Current liabilities $ Total capital and liabilities OMAIR MASOOD CEDAR COLLEGE 353 Income statement of a limited company ………………………………………………………………………… Income statement for the year ended ....................................................... $ Revenue Cost of sales Gross profit Distribution costs Administration expenses Profit / (loss) from operations Finance costs Profit / (loss) before tax Tax Profit for the year Statement of changes in equity for the year ended 31 December 2013 Balance at start of year Share issue Share Share Revaluation Retained capital premium reserve earnings Total $ $ $ $ $ 150,000 5,000 30,000 3,000 20,000 58,000 Revaluation 30,000 Dividends paid OMAIR MASOOD 180,000 8,000 283,000 33,000 Profit for the year Balance at end of the year 108,000 50,000 CEDAR COLLEGE 58,000 30,000 (12,000) (12,000) 154,000 392,000 354 XYZ Limited Statement of financial position at 31 December 2013 ASSETS Non-current assets Goodwill Property, plant & equipment Current assets Inventories Trade and other receivables Cash and cash equivalents Total assets EQUITY & LIABILITIES Capital and reserves Issued capital Share premium General reserve Retained earnings Non-current liabilities Bank loan Current liabilities Trade and other payables Tax liabilities Total equity and liabilities OMAIR MASOOD CEDAR COLLEGE 2013 $000 2012 $000 7,700 100,000 107,700 8,000 92,100 100,100 1,000 5,000 500 6,500 800 4,000 300 5,100 114,200 105,200 40,000 2,000 10,000 52,500 104,500 40,000 2,000 10,000 43,000 95,000 5,000 5,200 1,200 3,500 4,700 114,200 1,000 4,000 5,000 105,200 355 ! EXAM!TIPS! ! PAPER!1! ! You(have(60(minutes(of(30(mcqs.(2(minutes(for(each.( ( First(only(attempt(those(questions(which(you(are(100%(sure(of(and(skip(others.( ( Read(the(MCQ(carefully,(because(CIE(likes(to(play(around.( ( Now(spend(time(on(these(questions.( ( If(you(are(stuck(try(to(eliminate(the(most(obvious(wrong(answer.( ( 556(questions(are(theoretical,(at(least(read(them(thrice.( ( Sometimes(it’s(best(to(use(the(answer(to(check(if(it’s(wrong(or(right.( ( If(you(see(something(in(the(answer(choice(which(you(haven’t(heard(of((that(can(never(be(the(answer).( ( Please(don’t(leave(it(blank.(Take(an(educated(guess.(There(is(no(negative(marking.( ( PAPER!2! ( You(have(90(minutes(for(90(marks.(( ( Always(attempt(the(question(which(you(know(the(best(out(of(4(first.(This(will(give(you(confidence(and( save(time.(You(will(end(up(spending(time(and(getting(it(wrong(if(you(do(the(toughest(one(first.( ( Don’t(panic,(usually(in(every(paper(one(question(is(tricky.(Do(it(at(last.( ( You(won’t(get(any(award(if(you(balance(the(balance(sheet.(If(the(balance(sheet(is(off(by(a(large(amount,( that(doesn’t(mean(everything(is(wrong,(might(be(a(single(big(figure(which(you(have(missed.(DON’T( WASTE(YOUR(TIME.( ( Remember(you(don’t(have(to(get(90(on(90.(Go(for(the(maximum.( ( HOPE!THIS!HELPS!!! OMAIR MASOOD CEDAR COLLEGE 356