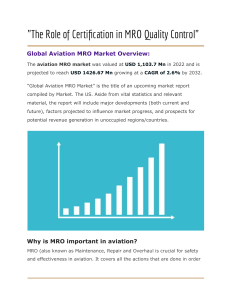

Airlines industry breakdown value chain Inbound Logistics Route Selection Yield Management Fuel Flight/Crew Scheduling Aircraft Acquisition Aircraft Lease Operations Ticket Counter/ Kiosk Gate & Aircraft Operations Onboard Services Baggage Handling Ticket Offices Outbound Logistics Baggage System Flight Connections Rental Car & Hotel Reservation System Marketing & Sales Promotion/ Advertising Frequent Flyer Travel Agent Programs Group Sales Electronic Tickets Service Lost Baggage Service Complaint Follow-up Support Centre Key Drivers Revenue Cost Growth Passenger tickets, inflight sales Aviation fuel (40%) Post-COVID trade and tourism Freight services, other VAS Equipment rentals, hangar cost (15%) Rising disposable incomes Tours and packages Maintenance and overhaul (10%) Government policies Industry Dynamics Key Customer Segment Growth Passenger - Domestic 11-12% Passenger - International 9-10% Freight 7-8% PORTER'S 5 FORCE ANALYSIS Supplier Power: (High) Aircraft and engine producers are concentrated oligopolies. Barriers to Entry: (High) High CAPEX, costintensive and need for economies of scale. Threat of Substitutes: (Medium) Fast Trains, Video conferencing reducing the need for business travel etc. Buyer Power: (High) Low switching costs for most customers since relatively standardized service Rivalry: (High) Limited differentiation and opportunities for economies of scale Industry Challenges High fuel prices account for 40% of costs. Government policies and interference to keep a cap on the ticket prices Growing climate change awareness leads to lesser demand. Post-COVID travel hesitation sections of the society in Financing - High capex, opex industry certain Market Trends Robust Demand: Rising working group and widening middle-class demography is expected to boost demand Opportunities in MRO: Expenditure in Maintenance, Repair & Overhaul (MRO) accounts for 12-15% of the total revenues - it is the second-highest expense after fuel cost. By 2031, the MRO industry is likely to grow over $4 billion from $1.7B in 2021 Policy Support: Foreign investment up to 49% is allowed under the automatic route. Under Union Budget 2021-22, the government lowered the custom duty from 2.5% to 0% on components or parts, including engines, for manufacturing of aircrafts by the MoD. Market Trends Increasing Investments: Investment to the tune of INR 420-450 billion is expected in India's airport infrastructure in the next 3 years UDAN (Ude Desh Ka Aam Nagrik): Under this regional connectivity scheme, airfare for a one-hour journey of 500 km has been capped at INR 2500 Public-Private Partnerships: $3 billion investment in greenfield airports in Navi Mumbai and Goa CAREER EDGE CONSULTING FELLOWSHIP Mentors from 2.5 or 6 months, 10 mentors, and 30+ hours of course content from making your CV to getting an offer Hands-on, Live Consulting project Industry breakdown with domain experts Free CV templates and interview preparation resources Referrals & Placement Assistance from our mentors Exclusive networking opportunity with MBB consultants Regular Job Updates from consulting firms & 1:1 Mentorship SIGN UP (Registration Link in comments)