Business Law

CML1001F

1

1. What is law?

Law is a body of rules governing human behaviour which is recognised and enforced by the state

When a rule of law is disobeyed, the state will punish the offender or provide a remedy

The state = government

It is divided into three areas:

The legislature – makes the law = parliament

The executive – enforces law = president, ministers, civil service (e.g. the police force)

The judiciary – applies and interprets the law = courts, i.e. judges and magistrates

2. The South African legal system

COURT STRUCTURE

Constitutional Court (CC)

Supreme Court of Appeal (SCA)

Before 1994 known as Appellate Division (AD)

High Court

Local Divisions of High Court

Provincial Divisions of High Court

Magistrates Court (cannot be an

appeal court)

Regional Magistrates Court

District Magistrates Court

Definition of appeal:

Taking a case from an inferior court to a superior court, in the hope of getting a different judgement

In other words, it is used as a mechanism for getting a second opinion on the judgement of an

inferior court

If found guilty in a magistrates court – does not affect decision in high court (provided that a valid

appeal is made, e.g. with the provision of new concrete evidence…)

Definition of jurisdiction:

Can have 2 meanings:

2

o The powers which a court has… e.g. a court with a criminal jurisdiction has the power to

hear only criminal matters

o The geographical areas over which the court has power… e.g. The Cape Provincial Division

of the High Court has jurisdiction over the Western Cape. This means that is has the power to

hear matters only arising in the Western Cape

2.1) Constitutional Court (CC) – can use abbreviations in tests & exams

We now have a written constitution in South Africa since 1996 (not present in England)

It is an act of parliament

It is divided into various chapters (book)

It protects human rights (e.g. the right to the freedom of speech, right to privacy and the right to life

etc.)

Matters that deal with the protection of human rights and how the country must be governed, are

known as constitutional matters

The constitutional court only has jurisdiction to hear constitutional matters

Only deals with constitutional matters (matters that affect human rights etc.)

In most cases, matters are brought on appeal to the constitutional court (mainly used as an appeal

court)

It can, however, also be a court of first instance or a trial court (this means that the case first starts

in that court)

This court building sits in Braamfontein, Johannesburg and has jurisdiction over the whole country

(all constitutional matters in all areas of South Africa are dealt with here)

It has 11 judges, of which at least 8 judges must be on the bench or sitting to hear a case

An abortion case usually has 10 / 11 judges

All 11 judges is a full bench (this means that it is a very serious matter)

If there is a tie – the judge president has the last say or the casting vote

2.2) The Supreme Court of Appeal (SCA)

Prior to 1994, known as Appellate Division (AD)

This is purely an appeal court (as the name suggests)

Never ever a court of first instance or trial court

Final court of appeal in all matters that are not constitutional

E.g. You have a thief found guilty in the Magistrates Court. He appeals to the High Court and is also

found guilty there; this causes him to appeal again to the Supreme Court of Appeal. He is also found

guilty at the SCA and is sent straight to jail. This is because he cannot appeal to the Constitutional

Court, because this is a criminal matter and not a constitutional matter… HOWEVER, if he is given

the death sentence, he can appeal to the CC but ONLY about the death sentence, NOT AGAINST

THE VERDICT

There are 20 SCA judges

But you only need 3-5 judges on the bench to hear a case

The court sits in Bloemfontein and also has jurisdiction over the whole country

2.3) High Court

2.3.1 Provincial Divisions (each division only has jurisdiction over their geographical area)

i.

Cape Provincial Division (C) (of the High Court) – Court sits in Queen Victoria Street of Cape

Town

ii.

Eastern Cape Provincial Division (E) – Grahamstown

iii. Northern Cape Provincial Division (NC) – Sits in Kimberly and has jurisdiction over the entire

Northern Cape region

iv.

Transvaal Provincial Division (T) – sits in Pretoria and has Jurisdiction over the Gauteng region

3

v.

vi.

vii.

viii.

ix.

x.

Natal Provincial Division (N) – sits in Pietermaritzburg

Orange Free State Provincial Division (O) – sits in Bloemfontein

Bophuthatswana High Court (B) – sits in Mmabatho and has jurisdiction over the North West

province

Ciskei High Court (Ck) – sits in Bisho and has jurisdiction over part of the Eastern Cape

Transkei High Court (Tk) – sits in Umtata and has jurisdiction over a part of the Eastern Cape

Venda High Court (V) – sits in Thohoyandou and has jurisdiction over part of the Limpopo

Province

2.3.2 Local Divisions (of the High Court) – have the same status as the Provincial Divisions

- Created for convenience (cover a smaller geographical area)

i.

Witwatersrand Local Division (W) – court sits in Johannesburg and covers or has jurisdiction

over the Witwatersrand area (Johannesburg, Midrand etc) (The Transvaal Provisional Division

(T) also has jurisdiction over the same area, but they are based in Pretoria; so it’s once again a

matter of convenience)

ii.

Durban and Coast Local Division (D) – court sits in Durban

iii. South Eastern Cape Local Division (SE) – sits in Port Elizabeth

2.3.3 Powers of Provincial and Local Divisions

Only have the power to hear cases that fall in their geographical area jurisdiction

They can hear all kinds of matters – civil (commercial law, including divorce etc), criminal and

constitutional matters

The provincial and local divisions can be courts of first instance (or trial courts)

When sitting as a court of first instance, normally only one judge on the bench

In criminal cases, however, there will be 1 judge and 2 assessors

Assessors are not judges (but they are rather there to aid in the decisions made by the judges)

The provincial divisions can also be appeal courts

Local divisions cannot be appeal courts, except for W (Witwatersrand Local Division), due to

the fact that Gauteng has far too many cases to deal with all the time and this actually assists in

overcoming the backlog

In an appeal from an inferior court, i.e. Magistrates Court, at least 2 judges must reside on the

bench

The provincial divisions (but not the W) can also hear appeals from a single judge, in the same

division or a local division in its geographical area

In these appeals, there must be 3 judges on the bench (in this case, this is a full bench, meaning

that this is the maximum number of judges that can sit in the high court)

2.4) Magistrates Court

2.4.1 Types of Magistrates Courts

South Africa is divided into various magisterial districts (same as Zimbabwe and England etc)

Each magisterial district actually encompasses about 4 to 5 suburbs

E.g. Wynberg Magisterial District – Wynberg, Rondebosch, Newlands, Claremont, Kenilworth

Each magisterial district, has district magistrates courts

Some magisterial districts also have a regional magistrates court

Each magistrates court has jurisdiction over their area

E.g. if you crash your own car in Rondebosch main road, you must go to the Wynberg not the

Cape Town magistrates court

2.4.2 Powers of District Magistrates Courts

4

In criminal cases, they cannot hear murder, rape or treason (treason is any crime against the state,

be it terrorism, planning to overthrow the government etc). This means that they deal with

robbery, assault etc.

In cases that are not criminal, they cannot hear a case where the value of the claim is more than

R100 000

E.g. if someone owes you R200 000 due to a breach of contract, it cannot be considered in the

district magistrates court, but rather the case goes straight to the high court

No constitutional jurisdiction

No appeal jurisdiction (no other court is below this court)

2.4.3 Powers of Regional Magistrates Courts

o They have jurisdiction over their specific geographical areas

o They only hear criminal cases (not civil or constitutional) BUT NOT TREASON (considered

too big therefore case taken straight to the high court, which becomes the court of first

instance)

o No appeal jurisdiction

EXAM TYPE EXAMPLES

e.g.1

X who lives in Cape Town is charged with murder. Where will his case be heard? What are his avenues

of appeal?

In tests and exams, you must always state both options or whatever other possibilities you can think of

Option 1:

1. Cape Town Regional Magistrates Court – Guilty

2. Cape Provincial Division of High Court – 2 judges – Guilty

3. Supreme Court of Appeal – Guilty and Death sentence

DOES NOT GO TO C with 3 judges, because it only has jurisdiction to hear appeals from a single

judge of the same division or another division in the same geographical area

There can, however, be once more appeal after the Supreme Court of Appeal…

He can go to the Constitutional Court – BUT ONLY ABOUT THE DEATH PENALTY – not about the

guilty verdict

Option 2:

1. Cape Provincial Division – 1 judge and 2 assessors – guilty

2. Cape Provincial Division – 3 judges – guilty

3. Supreme Court of Appeal - +- 8 judges – guilty and hence nowhere else to go!!!

e.g.2

X enters into a contract with Y to buy Y’s car for R1 million

They both live and work in Cape Town

X does not pay on the due date, and Y wants to sue him for the money (sale contract – type of

agreement)

Is this a crime? - - - NO! (Murder, rape, treason etc are regarded as crime, not this situation)

5

Which court will Y sue in and what are his avenues of appeal?

Answer:

1. Cape Provincial Division – 1 judge (no assessors) – Finds in favour of X (never ever say “not

guilty” – only used in criminal cases)

2. Cape Provincial Division – 3 judges (regarded as a full bench) – Finds against Y (basically in favour

of X, as above)

3. Supreme Court of Appeal – Y wins the case

--- The above process actually takes about 5 years, from the Court of first instance to the final verdict

in the Supreme Court of Appeal

BUT WHO PAYS THE COST? – normally the lose pays his own fees as well as the fees of the winner!

3. Sources of South African Law

3.1) Legislation and Interpretation of statutes

3.1.1 What is legislation?

o Legislation is the same thing as a statute or acts of parliament

o Legislation takes precedence over all other laws derived from other sources

o E.g. until 1988 – the matrimonial power act (legislation), where the husband and wife were regarded

with equal footing, came into power and took precedence over the previous marital law

o The constitution is also a piece of legislation and that takes precedence over everything, even other

forms of legislation

o Add Note: our laws are all derived from Roman-Dutch law (some laws fall into abrogation – where

they are useless or no longer relevant to the respective time period)

3.1.2 Types of legislation

i) The constitution

o The supreme law of South Africa

o Anything in conflict with the constitution is invalid

o Constitutional matters consists of human rights issues and how the country must be

governed

ii) Original Legislation

o There are actually 2 types of legislation (A and B)

o A

o Theses are acts of parliament or statutes

o These are the laws passed by parliament

o E.g. the Guardianship Act of 1993 (the year it became law)

o B

o This is the law passed by the provincial legislatures

o Each province has its own provincial government

o They can pass laws relating to certain matters like education or health (to a certain

extent) – e.g. different matric final exams in Gauteng and KZN and different school terms

and holidays

iii) Delegated legislation

6

o

o

o

o

o

o

o

o

o

o

There are 2 types of bodies that will pass delegated legislation

A

Local authorities (like city councils etc)

Legislation passed by city councils is always referred to as by-laws (not “acts of

parliament” or “statutes”)

E.g. Parliament passes a piece of legislation (original) which states that the Cape

Metropolitan Council (CMC) can make laws regarding the building of a residential home.

The CMC will then pass a by-law which states that residential homes in the cape can only

have walls that are 2 metres high

Another e.g. – in Johannesburg there is currently a by-law from the city council that

states that any swimming pool in a residential home, must be surrounded by a fence and a

new by-law is in the pipelines to state that all swimming pools must be covered by a net.

The consequences of not abiding to these by-laws can be a fine or possible imprisonment

B

Laws passed by government departments are known as regulations

Parliament passed an act known as the Companies Act (this is a piece of original

legislation)

In terms of the Companies Act, the department of trade and industry or the department of

finance or any other government department can make regulations regarding South

African companies (delegated legislation)

iv) Importance of Distinction

o The courts cannot refuse to apply the constitution

o With original legislation, it will be declared invalid if it conflicts with the constitution

and hence the courts cannot apply it

o With delegated legislation, the courts will only apply those laws (by-laws and

regulations) if they fall within the area delegated to them

o E.g. continued from before – the city council has the right to make laws regarding

residential buildings – this is an example of what happens when they make a law about

commercial buildings – e.g. make a law saying that all buildings must be painted yellow

(by-law); the court doesn’t have to follow this or abide by this law, because it only has

the jurisdiction over residential areas and not commercial areas!!!

3.2) Roman-Dutch Law (common law)

The common law is the basis of our entire legal system

Constitution is definitely not made from the common law

Our common law is made up of:

i. Roman law

ii. Dutch law

iii. English law

Our common law is the same as Zimbabwe, and Louisiana in America

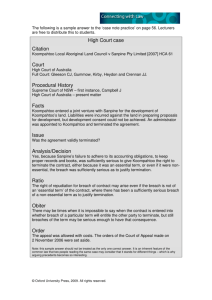

3.3) Judicial precedent (case law)

3.3.1 What is judicial precedent and case law?

Judicial precedent and case law are synonyms for each other

It is the law that is made by judges in applying the law to the facts of the case before them

E.g. – based on a true case

Shopkeeper – shop broken into on a regular basis (weekly) – 1970’s

7

He set a trap – i.e. if you tampered with any of the shop doors or windows, then a mechanism

gets released, which is attached to a loaded gun… The gun would be triggered and the thief

will be shot.

Shortly after this, a thief broke into the shop, and was shot dead using this mechanism

The issue before the court was this: Was the shopkeeper guilty of murder or was he not

guilty, because you can kill in defence of property?

The court looked at the existing law on the subject and they found something in the Roman /

common law and applied it (applying an existing common law and making it a case law)

The court held that the shopkeeper was not guilty of murder and that you can kill in defence

of property.

Using that decision – the court made a law that you can kill in defence of property.

The judges decision here is known as the ratio decidendi (decision – this becomes law)

It is the ratio decidendi that becomes law

In the same case, the judge also said that warning signs must be put up etc. (like electric

fence warnings) or about the fact that precautions should have been taken in order to protect

the general public, i.e. innocent people or children

The part of the decision about the warning signs is known as the Obiter dictum (deals with

side issues – the original issue was “can you kill in defence of property or not?”, hence this

is a side issue) – it is not directly relevant to the main issue and hence does not actually

become law

Add note: judges decisions are +- 50 pages long – this shows that they also deal with quite a

few side issues

Class question: Why bother if already in the common law? Well, the common law is not

directly the law in issue, so it re-instates this as case law

Another e.g. – Divorce case (hypothetical – not how it works now) – The wife is having an

affair – this is grants for divorce (adultery – ratio decidendi), but her husband now sues her

for R10 million as deformation of character etc. – this is a side issue, therefore it cannot be

made law or else every single divorce case in the future where the wife has committed

adultery will demand R10 million from the wife! – this is the obiter dictum

3.3.2 Stare Decisis

The way that the judges decision or the ratio becomes law, is through the principle of stare

decisis (translated – “let the decision stand”)

The principle of stare decisis says that a judge or magistrate must always follow the decision

(the ratio) of a higher court where the facts of the cases are similar, and the legal issues are

the same

Lets go back to the shopkeeper e.g.

Case was heard in the Supreme Court of Appeal (SCA)

2 years later a case comes before the C (Cape Provincial Division)

This time a drunk driver has killed a pedestrian

The C cannot follow the shopkeeper case, because the facts of the case are not similar and the

legal issues are not the same

Hence, remember always that the facts of the case, as well as the laws applied must be

similar

Magistrates Courts must follow:

“Everybody”

Basically, the magistrates court must follow all the court’s above it, i.e. the SCA, High Court

as well as the Constitutional Court (CC)

8

If there is a conflict between the SCA and the high court- the magistrates court must follow

the SCA

If there is a conflict between the CC and the SCA – then the magistrates court must follow

the CC

Add note: If a case comes to court, where a judges fines you for speaking on your cellphone

while driving. If the court does not rule in your favour and you are fined, and later on the law

is actually abolished, the verdict cannot be changed, as the previous decisions that were made

where relevant to the law at that time

When it comes to following the High Court decisions, they have to follow decisions of all the

divisions. However, if there is a conflict, then they follow the decision made by their division

in their geographical area

E.g. Once again we go back to the shopkeeper example… If the law in N states that you can

kill in defence of property, however the C says that you cannot kill in defence of property;

and a few years down the line a case comes before the Wynberg Magistrates Court – i.e. a

person had shot a thief for stealing his car

The thief is now dead – and what follows if the issue of “can you kill in defence of property

or not? – But which provincial division does he follow? – The Cape Provincial division (C)

Add note: if one law is made in one of the provincial divisions (N) and a conflicting law

is made in C, and there is a case in Johannesburg of the same nature as these conflicting

laws, then applying the law of both C and N would be valid, and this is what lawyers

would debate about in court – the two sides of the case would try and prove that one

law is better than another law…

9

3.3.2 Stare Decisis

Magistrate’s Courts must follow: (looked at this the last time)

Provincial and Local Division of High Court must follow:

The Constitutional Court (CC)

Supreme Court of Appeal (SCA)

If conflict of interest between CC and SCA – follow the CC

Do not follow the Magistrate’s Court under any circumstances

They must follow decisions of their own division if a greater or equal number of judges sat in

the previous case

E.g. – At the C – one judge on the bench – there is a previous decision of a full bench of the

C (3 judges) – is our single judge bound by this previous decision? – YES - HE IS BOUND

E.g. – previous decision of a full bench (3 judges) of the N – in this case our single judge in

the C is NOT BOUND by this previous decision. The C can only be bound by its division –

so N would be bound by this previous decision, not C.

Add note: It is the responsibility of every South African to find out exactly what the civil law

states regarding particular issues – E.g. there was a case where a woman actually went

overseas to purchase diamonds… and when she arrived in South Africa with them, she was

arrested for contravening the Diamond Act, which she was completely unaware of at that

time!

SCA must follow:

o CC

CC must follow:

o Itself

o CC has the power to overturn its own decisions

3.3.3 Law Reports (same reports as the book passed around in lectures)

All decisions made, except those made in the magistrates court (no one follows those), are

reported or recorded in the law reports

There are 4 volumes that are released every year

Cases are identified by what’s known as a case citation or notation

E.g. Jones v Brown 2006 (3) SA 123 (C)

Names of Parties, year is was heard, volume no.3, SA law report page 123, Cape ProvDiv

Plaintiff – person suing – Jones

Defendant – the one being sued – Brown

E.g. – Jones loses the case and he takes it on appeal to the SCA -- -Jones v Brown 2007 (1) SA 49 (SCA) – therefore both of these items are recorded in the

law reports during their respective periods, where a short reference is made to any related

cases and update cases after appeals have taken place etc. The notation also changes to

Brown v Jones if Brown was the person that appealed

Appellant – no longer called the plaintiff – John

Respondent – Brown (responds to the appeal charge)

3.4) African Customary Law (Often this law and the following two are confused – make sure you

specifically understand the differences between each of the laws, as well as be very specific as to which

law you are referring to in tests or exams!!)

10

These are laws that have been followed by black communities for thousands of years

Our court (Magistrates Court, High Court, SCA and CC) can apply African customary law,

only if both parties choose to apply it

E.g. A Divorce case – normally governed by the Divorce Act – however both parties can

Apply African Customary Law – BUT THEY HAVE TO BE BLACK PEOPLE

When there is a clash (i.e. one of the parties wants to apply African Customary Law and the

other party does not want to), then normal civil law must be applied in the case (legislation

and common law)

3.5) Custom

A custom is a rule of conduct, that has been established through a very long use; and it

becomes an unwritten law

One e.g. – 1921 case

There were some commercial fisherman (sell fish) and they passed out their lines

in order to catch some fish

A short while later, a second group of fisherman came along, and they stood in

front of the first group and cast out their lines

What happened, was that the second group actually intercepted the first group (cut

them off) and they caught all the fish

The first group sued the second group for the value of the fish

The judge found in favour of the first group – because there is a custom amongst

fisherman (unwritten law/rule) that is one group have cast out their lines, then

another group cannot cast in front of them.

3.6) Customary International Law

We will deal with this section under International Law – Section 6.1

4. Legal Rights

A legal right is a right that is given and protected by the law

2 kinds of legal rights – real rights and personal rights

4.1) Personal Rights

A personal right, is a right that is enforceable against one or more PARTICULAR people…

(must be a specific person)

E.g. X and Y enter into a contract of sale

X sells his car to Y for R1000

X delivers the car to Y and Y does not pay

Question: Who will X sue for the money?? – Obviously he will sue Y

This is due to the fact that X has a personal right against Y for the money

Can X sue Y’s neighbour or brother for the money? – No, off course not, because X has a

personal right against Y

Add note:

if Y dies – sue the estate

If employer paid Y late – Y’s problem

If Y’s brother has signed surety ship over Y – different case altogether…

4.2) Real Rights

Real rights are enforceable against the whole world – anybody – not against particular people

This is because a real right is a right in a thing itself (a thing is an item in law – a thing refers to

an item of property – even the “law of things” exists)

11

An example of a real right is ownership

E.g. X owns a car

A steals the car from X

A sells the car to B, who buys it in good faith (did not know that be was buying a stolen

car – happens very often in South Africa)

B sells to C, who also buys in good faith

Question: Against who will X have a right to reclaim the car??? – C

Even though X has no personal right against C, he still has a real right to reclaim the car

Would happens from here, is that C would sue B (personal right), and B would sue A

(personal right) and hopefully A would be convicted for the crime!

5. Legal Personality

The law recognises, as legal persons: Natural persons (human beings) and Juristic entities /

persons

Focus is on these specific juristic entities for the rest of this section

Juristic entities are actually groups or associations (e.g. companies, partnerships, close

corporations, universities, sports clubs)

Legal persons in their own right

They have their own rights and obligations, separate from their members or management

They can sue or be sued in their own name

E.g. SAB Limited (Public company) enters into a contract with John, to deliver him 500 crates of

beer

John pays for the beer, but SAB does not deliver the beer

Who will John sue? (MCQ type question)

a) The employee who took the order

b) The manager who forgot to authorise the delivery

c) The directors

d) The shareholders

e) SAB Ltd

Therefore, the case citations would read: John v SAB Ltd

If John wins the case – SAB Ltd is entitled to all legal costs

6. Branches of the Law

6.1) International / National Law

6.1.1 International Law

International Law governs the relations between states or countries (not between individuals

within countries)

So it is states that bear the rights in International Law, not individuals

It deals with matters such as airspace, territorial waters, treatment of diplomats (different law in

each of their countries), and extradition of criminals (to extradite a criminal – send to originating

country at which the crime he has been accused of, was performed)

E.g. during the Apartheid era – airplanes from South Africa were not allowed to fly over the rest

of Africa – if they did, case is country against country in the International Court

SOURCES of International Law

o Customary International Law

Same as CUSTOM LAW, but at an international level

12

Extradition amongst most countries is custom (don’t normally harbour criminals

from other countries or their country of origination)

o Conventional Treaties (like International Legislation)

Most of these are United Nations conventions (UN) – e.g. convention on the law

of the sea – when you have 2 vessels on the high seas (far from the shore – not

owned by a particular country etc)

6.1.2 National Law

This is the internal or domestic law

We have numerous sources of National Law: (as stated previously in notes)

Legislation

Roman-Dutch Law (common law)

Judicial Precedent (case law)

6.2) Public / Private Law

o Public / Private Law forms part of our National Law

o There is a diagram on page 28 of our textbook – don’t learn this! – see diagram below instead

A VERY IMPORTANT THING TO NOTE IS THAT THE ENTIRE PUBLIC LAW AND PRIVATE

LAW, INCLUDING ALL IT’S BRANCHES AND SIDE BRANCHES, ALL FORMS PART OF

CIVIL LAW…

THE ONLY THING THAT DOES NOT FORM PART OF CIVIL LAW IN THE DIAGRAM ON THE

NEXT PAGE, IS CRIMINAL LAW!!!

PUBLIC

LAW

(1st major

division)

Constitutional

Law

Persons and

Family

Company Law

PRIVATE

LAW

nd

(2 major

Administrative division)

Criminal

Law

Law

Mercantile Law

(Commercial

Law)

(Entire

BUS LAW 2!!)

Negotiable

Instruments

Banking

Labour

Law

Law of

Taxation

Property Law

(Law of things)

Law of

Succession

Law of

Obligations

(BUS LAW 1)

Insolvency

Delict

Contract

13

Unjustified

Enrichment

6.2.1 Public Law

o Public Law governs the following: (hence constitutional law falls under Public Law)

1. The relations between the state (govt) and its subjects (you and me – common public) – hence

these only deal with relations between the public and the state

2. Relations between the various organs of state (Legislative, Judiciary and executive)

(e.g. Administration vs Labour Law)

o Criminal Law

A crime is an act that is prohibited by law and is punishable by the state

In a criminal case, it is the state that prosecutes the accused, NOT THE VICTIM

(that is why it is referred to as Public Law)

S v Jones – e.g. – if Jones abused Smith

State versus Jones

All criminal cases, therefore, if we see “S” we immediately know that it is a

criminal case

6.2.2 Private Law

o Deals with the subjects of the state (you and me) and their relationships with each other (that is

why it is referred to as Private Law)

o Common e.g’s – Divorce (Persons and Family Law) and Inheritance (Law of succession)

o People’s relation to each other has nothing to do with the state or the government in these cases

above, therefore they form part of Private Law

6.3) Criminal / Civil Law (section added in on the course outline)

o Criminal Law deals with criminal matters (such as murders, rape etc.)

o ALL OTHER AREAS OF THE LAW, FALL UNDER THE CIVIL LAW

o There are 4 main differences between criminal and civil matters

1. Criminal case – always “S v X” (where X=name of person) - CITATION

The parties are known as the state and the accused (before 1961 – Rex (King) and

Regina (Queen) and therefore all the cases where actually R v Jones etc.)

Civil Case citation: Smith v Jones

Parties are the plaintiff and the defendant

To sue the state in a CIVIL MATTER – X or Jones v President of Republic of SA

We use this name to represent the state, but if it is a CRIMINAL CASE: S v Jones

14

If, as in the Tygerberg Hospital case there is the use of unsterilised equipment, due to the

inadequate supply of cleaning fluids and the person wants to sue the state for being

infected during an operation, due to unclean equipment:

Jones v Minister of Health (this was you get “more money out of it” than by merely suing

the doctor, nurse or hospital at which the operation was performed

Jones v Minister of Justice (if in a car accident with a policemen)

Add note: if caught and captured in another country and abused for no particular reason –

then this forms part of International Law, due to the fact that you are not a citizen in the

country in which you were falsely accused.

2. This part is very important – people often make mistakes here in tests and exams and

hence lose unnecessary marks!!!! – Learn well

In a criminal case, if the court finds out that the accused did commit the crime, we say

that they found the accused guilty

HOWEVER, YOU MUST NEVER EVER EVER EVER USE THE WORD “guilty” in a

CIVIL MATTER

You must state that the judge found in favour of X or the judge found against Y

3. In a criminal case, if the accused is found guilty; he will either go to jail or pay a fine to

the state. The victim gets nothing (from the accused and the state). They only gain the

psychological satisfaction of the criminal going to jail

However in a civil case, if the plaintiff wins, the defendant will have to pay damages or

perform some “act” for the plaintiff – (NB) – must to something for him in return

4. In a criminal case the “burden of proof” {also referred to as the “owness of proof”}, is

beyond reasonable doubt – if you want to convict somebody, you must be absolutely

certain that the person is guilty – as you are taking away somebody’s freedom and

scarring them for life by allowing it to be added to their criminal record

Add Note: A Speeding fine is referred to as a minor criminal offence

In a civil case, the burden is different, where there is a balance of probabilities and

hence there is a lighter burden (only monetary)

6.4) Criminal Law, Delict, Contract and Unjustified Enrichment

6.4.1 Criminal Law – refer back to previous notes

6.4.2 Delict

o Forms part of Civil Law

o Private Law

o Subdivision of Law of Obligations

o A delict is a wrongful [intent or negligence (negligence is completely prohibited in RomanDutch Law)] act that causes harm to a person or their personal property

o Every person has a legal duty not (with intent or negligence) to harm others or their property

o E.g. crashing into another car / someone’s car

Delict – negligent

Parties will be called the Plaintiff and the Defendant

NOT “NOT GUILTY” – not a crime

15

If plaintiff wins, defendant must pay the relevant “damages”

o Another e.g. of Delict – Pick ‘n Pay has wet floors and they don’t put a sign up – person X then

comes along and slips and brakes her back – what happens is that she now sues Pick ‘n Pay for

damages (Add Note: - if intentionally done by someone at Pick ‘n Pay – delict and a crime)

o If “gross negligence” – e.g. mother s a restless sleeper and puts her newborn baby next to her and

at night rolls over the baby and kills it – murder due to this unforgiveable negligence or gross

negligence + drunken driving is also a crime!

6.4.3 Summary of the Differences between a crime and a delict

1. The ACT itself (no hard and fast rule)

Certain things are always regarded as crimes – there is no rule is order to classify whether

the issue is a criminal offence or not – e.g. rape, murder, theft, treason etc.

On the other hand, certain things are always delicts

Sometimes the SAME ACT can be both a crime and a delict

For e.g. – Y deliberately crashes into X’s car numerous times in the parking lot

This is regarded as a DELICT, but also as a CRIME (Malicious damage to

property)

The Delictual case citation: X v Y (in the C) - where X has to “pay Y” for the damages

The Criminal case citation: S v Y (regional or district magistrate court) – where the

outcome can be jail or a fine payable to the state

In this e.g, we have 2 cases running concurrently… BUT YOU MUST REMEMBER

THAT THE CASES ARE COMPLETELY SEPARATE TO ONE ANOTHER (with 2

different set of judges and hence unaffected outcomes)

2. The LEGAL Remedy

Criminal case – remedy – fine payable to the state or jail (imprisonment)

Delict – damages and compensation to the plaintiff, or some “act” must be performed

3. The purpose of the sanction

In criminal law, the purpose of the sanction is to punish the accused and sometimes

protect society (serial killers etc.)

In a delict case, the aim is to simply compensate the other party (not actually punishing

the other person)

e.g. if hand is burnt at McDonald’s – you cannot score by suing them, but you can rather

be compensated for all you medical bills etc.

Add Note: The law previously did not compensate on the basis of emotional damages, as

it is extremely hard to quantify, but from 10 years, there is some sort of compensation for

those that suffer severe or serious emotional loss

4. The burden of proof

Criminal Matters – beyond reasonable doubt (absolutely certain)

Delict – balance of probabilities (Civil Matters)

6.4.4 Contract

Part of Civil Law

Under Private Law – Law of Obligations

The Law of contract deals with agreements between people

Breach of contract occurs when one of the parties does not comply to the terms of the agreement

Balance of probabilities occurs in terms of issues regarding contract

16

6.4.5 Contract and Delict compared

There are 2 main differences between delict and contract:

o 1) In delict, the liability of the wrongdoer (not the “accused” – not a criminal matter)

arises from a wrongful act which causes harm

o The act is wrongful by the operation of law, because each person has a duty not to harm

others

o In contract, it is different, the liability of the wrongdoer arises from an agreement that

has been breached (still a civil matter)

o 2) In delict, the duty not to cause harm, is owed to all people

o In contract, the duty not to breach is owed to the other party of the agreement

o **Although there are differences, sometimes the same act can be both a delict and a

contractual matter

o E.g. – NB – MUST UNDERSTAND THIS!!!!

There is a surgeon called Dr Phil and he performs an operation on a person, Mrs Zuma.

He was actually supposed to remove her appendix. It is a private hospital (therefore there

can be no constitutional issues – if government hospital than constitutional issues will be

tackled). By mistake, he negligently removed one of her kidneys instead (this means that

infected appendix was not removed!). Mrs Zuma gets an infection and becomes even

more ill than she was before, due to the fact that she now has one less kidney and still has

her appendix, her hospital bills rocket and she is off work for even longer (therefore, her

earnings are further reduced)

NB Addnote – most contracts are not in writing – it is verbal (e.g. buying a Coke – is a

contract of sale!)

He is in breach of contract, and she can sue for damages. Her damages under contract

are only monetary – hospital bills, loss of income etc. (no claim for emotional loss is

allowed)

She could also sue him for delict – negligence that actually caused her harm

BOTH OF THESE ARE CIVIL CASES

In South African Law, you cannot get a double compensation – hence in a case like

this, you cannot “score” or gain a profit

Therefore, she has an option to choose which path she will take – i.e. she can sue under

contract or delict – most people choose the one in which they will reap the greatest

money, and sue under it.

On the other hand, if she dies – then it is a criminal matter (Culporable Homicide)

S v Dr Phil

If government hospital – X v Minister of Health

If there are dependants (i.e. Mrs Zuma is a breadwinner or primary caregiver), then they

can sue for support and help

6.4.6 Unjustified Enrichment

Unjustified Enrichment deals with compensating someone for a benefit which they caused you,

without any legal justification

E.g. Person X believes that he owes person Y R200

BUT, Person X actually owes person Y R180

Person X then pays person Y R200

Hence, Person Y has been “unjustly enriched” by R20

17

If Person Y does not pay Person X back (i.e. compensated him accordingly), then Person Y

would be sued by Person X, under the law of unjustified enrichment

18

PART B: THE LAW OF CONTRACT

1. The formation of a valid contract

In order for a contract to be valid and binding in law, specified requirements have to be met

or must be met

All of the requirements must be met, if one or more is not met, then it is not a valid contract

(void) – can’t sue on it

REQUIREMENTS:

1. The parties must have a contractual capacity

2. The parties must have a serious intention to contract

3. They must communicate their intentions to each other (In law you have to communicate –

both parties must agree, in order to have a contract)

4. The parties must be of the same mind (their must be no mistakes and no misunderstandings)

– must be on the same page!

5. The agreement must be lawful (e.g. is a drug addict orders drugs from his dealer, and the

dealer does not give him the drugs (does not deliver), then he cannot be sued, as it is illegal!)

6. Performance of the contractual obligations must be possible (e.g. can’t plan to build a soccer

stadium on mars!)

7. The agreement must comply with any formalities that are required for that type of contract

(Not all contracts need to be in writing, but some do)

8. The agreement must be “certain” in its terms

1.1) Contractual Capacity

o The general rule, is that every legal person (not necessarily a human being), has full contractual

capacity (i.e. can enter into any contract). There are exceptions, however; i.e. some people have

limited contractual capacity:

a. Minors (under 21) – most of us in this room

b. Married person

c. Mentally Ill

d. Intoxicated persons

e. Insolvents

a) Minors

A minor is an unmarried person below the age of 21, who has not been declared a major by the high

court

A major is an adult, over 21, who can enter into a contract in his own name or possesses contractual

capacity

The legal theory of minors – you cannot make decisions in your own right, therefore the law trusts

your parents to make decisions for you, in your best interests

There are only 2 ways that a minor can become a major before the age of 21 (i.e. possess full

contractual capacity):

i. Get married

ii. Apply to the high court (add note: in criminal matters, all minors are treated as majors –

but sometimes the sentence is lighter)

i) Marriage

A minor becomes a major in marriage, regardless of his or her age

If the marriage is dissolved (either by death or divorce), before the person turns 21, then the

person remains a major

19

ii) Emancipation by the court

A minor who is 18 and over, can apply to the high court in terms of the Age of Majority Act

(a piece of original, not delegated legislation – or else would be called a bylaw), for an order

declaring that he or she is a major. If the court grants the order, then he will be a major of full

contractual capacity

The court will only grant this order, if in the best interest of the minor

This used to be useful in the past – e.g. a family where the father is in the army, and there is a

son over the age of 18 who is supporting the family – he can apply to become a major and

enter into contracts under his own name (have a contractual capacity)

The court looks at the following factors weighed up on a balance of probabilities (all of them

do not have to be satisfied with the balance of the probabilities):

1. Age of the minor - the older he is, the greater the chance

2. Whether he lives with his or parents or not

3. Whether the parents support the application (if they do, the chances are substantially

higher)

4. Whether he or she is financially independent

5. Whether he or she owns immovable property (land, flat, house, office buildings) –

inherited from Roman Law, as there were no shares then, land was the most

important and was a form of investments (but even now, shares are not

considered as immovable property)

e.g.1 We have Thandi, who is 20 ½ years old and she has a Bcom degree; she works as an

office manager full-time and she earns a net salary of R30 000 per month. She lives with her

mother in her mother’s house (father has passed away). She pays for everything – electricity,

telephone, rates etc. The mother is indifferent about the application. Thandi doesn’t own any

immovable property.

Judge – the judges would most likely grant it. She lives with her mother, but doesn’t have to,

as she is financially independent.

Compare this case with Nadia, who has just turned 18 years old, 1st year Bcom student at

UCT, in residence, waitresses part-time and hence provides her own pocket money and

entertainment. But, parents pay fees and residence bills and parents are absolutely indifferent

about the application. Has no immovable property.

Judge – The judge will not grant the emancipation, as Nadia stays in residence (which is

merely a glorified boarding school!), and is not financially independent etc.

Add note: Under criminal law, when a minor is over the age of 7 years old, treated the same as a major

in a criminal case; however, here it is different as this is contractual law!

iii) There is NEW LEGISLATION IN THE PIPELINE:

Children’s Act of 2005

New Act

Passed in 2005

Hasn’t yet become legislation and therefore the existing laws STILL APPLY

The reason why it hasn’t applied yet, is because it affects over 20 legislation, which need to

be amended in order to accommodate for this legislation!) – problem is that lawyers have to

wait until this becomes law!

Hence, this act can come into operation at any time

EXAM WILL ASSUME THAT IT HASN’T YET COME INTO EFFECT

(NBNBNBNBNB)

Changes to be effected by the Act (when it comes into operation) :

20

1. Reduces the age of majority from 21 to 18

2. Application to the court for declaration of majority becomes superfluous and Age of

Majority Act 57 of 1972 will be repealed

3. Does not provide for minors under the age of 18 to bring application for declaration of

majority

4. New definition of a minor:

“An unmarried person below the age of 18”

But existing one is:

“An unmarried person, below the age of 21, who has not been declared a major by the

High Court”

iv) Contractual capacity of minors who have not been married or emancipated by the court, “under the

existing law”

Guardianship = (deals with all important or major stuff, such as whether the minor should go to

University or not; or which school etc.) Guardianship means the control of a minor, as well as assistance

in performing legal acts, such as contracting. Add note: in the case where the parents of a minor dies,

then his or her legal guardian, has control over their entire money including all other possessions, such

as their television and mp3 players.

Custody = Custody – who the child actually lives with and all minor decisions (i.e. what will the child

eat for breakfast, can the child watch a movie or not?)

When you have a divorce case, one parent may have custody, however both parents are legal

guardians

Children of parents who are / were married:

o The father and the mother are equal guardians (until 1993, only the father was the legal guardian of

the minor) of a child born of the marriage

o This means that either parent, without the consent of the other, can carry out the duties of

guardianship (e.g. if you want a motorbike, dad / mom can sign without notifying the other parent!)

o BUT consents of both parents is required for the following:

1. Marriage of the minor child

2. The adoption of the child (i.e. to give the child up for adoption)

3. The removal of the child from South Africa (even if on holiday)

4. Application for the passport of the child, if he or she is under the age of 18

5. Alienation of immovable property belonging to the child (i.e. selling, leasing, mortgaging) – but

if selling shares, only the consent of 1 parents is actually required, as it is not immovable

property!

Children of parents who were never married: The mother is the sole guardian; the father has no rights of

guardianship

Infans and Pupillus = two categories of minors

Infans…

A child under the age of 7 (infant)

Has no contractual capacity at all

If they want to acquire rights and duties under contract, then it must be entered into by the

guardian on their behalf

The guardian must actually sign the contract

21

E.g.

Sipho is 6 years old and wants to join the gym

His parents were married but are now divorced and he lives with his mother (Both are

hence his guardians)

Only 1 parent needs to consent and the contract must be signed on his behalf by his

mother or his father

Signature clause will look as follows:

Father/Mother’s signature:

xxxxxxxxxxxxxxxxx

(Maria Madisa for Sipho Madisa)

for = on behalf of Sipho Madisa

**NOTE** Sipho is liable for all unpaid fees!!

Pupillus…

A minor between the ages of 7 and 21 years old

Have LIMITED contractual capacity

Can make and sign contracts in their own name provided they are ASSISTED by their guardian

ASSISTANCE = guardian must CONSENT to the contract either before or at the time that it’s

entered into

The consent can be expressed either verbally or written, it can also be implied

To test if there has been implied consent, OBSERVE THE CONDUCT of the guardian, and ask

yourself: “was he/she aware of the contract?” and “did he/she show no objection?”

Guardian can sign on their behalf, but doesn’t have to!!!!

E.g.

Sipho is now 16 years old and leaves a note for his mother that says: “Dear Mother, I’ve

gone to buy a motorbike.”

She says nothing but that day buys a motorbike helmet (hence she did not object!!! –

therefore, because she says nothing she has indirectly consented!)

There is IMPLIED CONSENT, as she has not objected

If she doesn’t consent, then it actually becomes an invalid contract

Effect of an assisted contract

A duly assisted contract is:

In the case of an INFANS, one made ON BEHALF of the minor

In the case of a PUPILLUS, it is a contract made by the minor WITH THE ASSISTANCE of the

guardian or ON THE MINOR’S BEHALF by the guardian

THIS IS ROMAN-DUTCH COMMON LAW!!!

The effect of a duly assisted contract, is that the MINOR IS BOUND and not the guardian

Substantially prejudicial contracts:

If the contract is to the minor’s PREJUDICE, then he may get a COURT ORDER setting it aside

BUT, the prejudice must be substantial and not trivial

E.g. if the guardian paid too much money for something (using the minor’s money), then this is

substantially prejudicial to the minor and not in his or her best interest

Add note: In test and exams, use example to back up your point

Wood v Davies 1934 CPD (or C) 250

In 1934, SA was still a colony – This case can be found in Basic Principles pp.47

The father of Wood (Jnr) bought a house on his behalf from Mr Davies (Price = £1750)

The purchase price was payable in INSTALLMENTS

This is a DULY ASSISTED CONTRACT and is therefore a VALID CONTRACT!!

22

When Wood (Jnr) turned 21 years old, he sued Davies for cancellation of the contract and the

return of the instalments paid up until that point

The court held that it was a valid contract (because it was duly assisted etc.) but, it was

SUBSTANTIALLY prejudicial to Wood (Jnr) for the following reasons:

1) Purchase price was excessive i.e. exceeded market value by £200 (a lot of money,

therefore, not trivial!) – at that time this was quite a substantial amount of money, and

now it still is!

2) It was unnecessary, Wood (Jnr) did not need a house

3) It tied up most of Wood (Jnr)’s money (inherited a lot of money!!)

So the court held that Wood (Jnr) was entitled to cancellation and that each party must

restore to the other what they had received under the contract, i.e.

i.

Wood (Jnr) gives back the house and pays rental for the time that he had stayed there

ii.

Davies gives back the instalment with interest

The COURT ORDERED:

Cancellation

RESTITUTIO IN INTEGRUM = each give back to each other what they received

under the contract and BOTH parties are restored to the position they were in before

the contract

*****NOTE***** - The contract was valid but cancelled because it was bad for the

MINOR!! (This is not the case when 2 adults sign a contract as it only protects minors!!)

Could Wood (Jnr) sue his father ??

Not under breach of contract (as there is no contract)

Perhaps under DELICT (wrongful act that causes harm)

BUT, Wood (Jnr) is not necessarily OUT OF HARM!

Maybe he could sue for Potential Investment Income!

Effect of an unassisted contract

If a minor contracts without the proper assistance of a guardian; then he is not bound under the law

of contract

Even if the contract is to the minor’s benefit, he is not bound under the law of contract

However, the contract is binding on the other party (the adult). As far as the other party is concerned,

there is a valid contract.

Legal term for this type of contract = LIMPING CONTRACT

MINOR

No Contractual Obligation

ADULT

Contractual Obligation

In practical terms, what the limping contract means is that the minor can choose whether or not to

enforce the contract

23

The decision lies solely with the minor, and the adult is bound by the minor’s choice

If the minor chooses to enforce the contract = RATIFICATION

If the minor chooses not to enforce the contract = REPUDIATION

Repudiation:

o (here the minor chooses not to enforce the contract)

o In this case, the minor is not bound, but neither is the other party to the contract

o The effect of repudiation, is as if the contract did not exist (limping contract disappears)

o NEVER EVER EVER EVER USE THE WORD “CANCEL!!” (the minor cannot “cancel”

the contract as there is no contract in the first place – i.e. it is a limping contract, therefore

not initially valid)

o The minor can therefore recover whatever he gave under the contract

o If he paid out money – use a legal action called the CONDICTIO

o For things – REI VINDICATIO (i.e. “things vindicated”)

o ****NOTE**** - This is not the same as RESTITUTIO IN INTEGRUM!! – which is only

applied to valid contracts that are cancelled

o The other party to the contract (the adult / major), can reclaim what was given, under the

LAW OF UNJUSTIFIED ENRICHMENT (e.g. the minor is now sitting with a motorbike

that doesn’t belong to him etc. – as there is no valid contract)

Ratification:

o If the minor chooses to enforce the contract, then both parties are bound, and the contract is

no longer a limping contract, and therefore a VALID CONTRACT

o If he wants to validly ratify, while still under the age of 21 (i.e. still a minor), then he needs

the consent of a legal guardian (consent can be verbal, written or implied)

o The effect of ratification, is that the contract is deemed to be valid; from the date it was

originally entered into (e.g. you are 17 years old, apply on 03/03, but granted 03/04 – to pay

back or backdate from the 03/03 as it is valid on this date!!)

o E.g. enter into a contract at 20 ½ years old, and then turn 21 years old, and then ratify – in

this case no assistance is required by legal guardian (can ratify on his or her own!)

o Ratification can be implied, verbal or written

o Stuttaford v Oberholzer 1921 CPD 855 (example of implied ratification)

(In the old cases, many where about motorbikes etc., now its all about cellphones etc)

Oberholzer bought a motorbike at the age of 20 years, 8 months. The purchase price of the

bike must be paid in instalments. The contract was unassisted (therefore, a limping contract).

After Mr Oberholzer turned 21, he continued to use the motorbike, but he failed to pay the

outstanding instalments

Stuttaford (seller of the motorbike) sued Mr Oberholzer for the amount owed

Oberholzer argued that he was an unassisted minor and therefore not liable under the law of

contract

Judge’s decision – the court held that he had ratified this contract by continuing to use the

motorbike after the age of 21 years of age, and therefore had to pay (he even used the

motorbike to court!!!)

Therefore, Mr Oberholzer is bound on the date of the contract originally entered into (not on

the court date!!)

v) Cases where the minor incurs (obtains or gets) valid legal obligations, without the assistance

of the guardian:

24

­ When a minor enters into an unassisted contract, but it is not later ratified, then he will not be

bound under the law of contract

­ BUT – he may be bound under some other area of the law (THIS IS WHERE THE

INTRODUCTION SECTION COMES IN…)

­ He can be bound by:

1. Enrichment (The Law of unjustified enrichment – civil, private law)

2. Delict / Fraudulent Misrepresenation (pretend to be over 21 etc)

3. Statutory exceptions (e.g. bank account – unassisted but still binding if over 16 years

of age)

4. Tacit emancipation – different from emancipation by the court under the Age of

Majority Act

1) Unjustified Enrichment

E.g. Brian is 18 years old and he buys a motorbike from Bob (assume that Bob is an adult / major –

normally this assumption must be made in tests and exams if not clearly stipulated!!!); the contract is

unassisted, no fraud (Bob knows that he is contracting with an unassisted minor); the purchase price

of the motorbike is payable in monthly instalments of R1000. Brian uses his motorbike for 6 months,

without his parents’ knowledge. This is not ratification, as he is under 21 and parents do not know

(not ratification) that he uses the bike for 6 months. He decides that he does not want to use the

motorbike anymore and hence, he fails to pay the outstanding instalments amounting to R6000.

Discuss:

ANSWER:

o Valid, void or limping? – Limping

o Has not been ratified

o Brian can repudiate the contract

o Brian says to Bob – that he does not want the bike anymore

o The court will not award restitution in integrum (as it is NOT a valid contract – it’s as if it did

not exist)

o Bob is not going to get motorbike back or R6000 under the law of contract

o Brian will be ordered to give the motorbike back to Bob under the law of unjustified

enrichment (as Brian is unjustly enriched by the bike) – BUT, Brian is not enriched by

R6000 as it is his own money

o Add note: He could be said to be enriched by bus or taxi fare saved by using the bike as an

alternative mode of transport

o Brian would get back his already paid instalments under the condictio

o Add note : if Brian was in an accident prior to this, then the damages bike must be given back

to Bob as this it he only thing that Brian was enriched by, according to the law of unjustified

enrichment!!

E.g. Mohammed is 18 years old and goes to a jewellery store and buys a diamond ring for R500 000

(pays a deposit of R50 000 and the balance is due in 1 month’s time)

o Gives the ring to his girlfriend as a gift

o His girlfriend and him break up and she goes to Australia with the ring

o He now repudiates the contract and does not want to pay the balance of R450 000 (parents

have no clue as to what’s going on)

ANSWER:

o Limping contract

o No ratification (even if given to her), can repudiate

o No liable under the law of contract to pay R450 000 and under the law of contract no

restitution in integrum.

o He is also not liable under the law of unjustified enrichment – as he is NOT enriched

o Therefore, the shop gets nothing

25

o However, if this is done deliberately in order to try and make a “cut” = fraud

o Mohammed will repudiate contract and can get back R50 000 under the legal action called

the condictio.

2) Delict / Fraudulent Misrepresentation

Legal term for a lie

The minor can fraudulently misrepresent himself in the following ways:

1. He can pretend to be over 21 years of age

2. He could pretend that he has the guardian’s consent

3. He could pretend that he is married or emancipated

If he does this, and the other person is reasonably deceived (can’t be reasonably deceived if a 12

year old is mistaken for a 21 year old etc) and induced or enticed in entering the contract and

suffers a loss, then the minor will incur a legal obligation under the law of delict.

3) Statutory Exceptions

Basic Principles pg 49, paragraph 2.1.1.5:

Minor’s contracts for which no assistance is required

There are a number of contracts that minors have the capacity to enter without assistance. Their

capacity to enter these contracts derived not from the common law, but from statute.

For example, s 87(1) of the Banks Act 94 of 1990 permits minors over the age of 16 to open and

operate deposit accounts without assistance.

Under the new Children’s Act 38 of 2005 (not yet in force), children over the age of 12 can

consent to non-invasive medical treatment, but need parental assistance to consent to surgical

operations.

4) Tacit Emancipation

Tacit Emancipation is different to emancipation from the high court in terms of the Age of

Majority Act

Tacit Emancipation is done informally (no application to court etc)

It occurs with the consent of the legal guardian of the minor

A minor of any age, can be tacitly emancipated; to be emancipated by the court – must be over

the age of 18 years old

Tacit Emancipation normally occurs where a minor is allowed by a guardian to carry on some

business or occupations

Therefore, when a minor is TE (Tacitly Emancipated), he can enter into valid contracts without

the assistance of a guardian, but only in connection with his particular business or occupation –

he can’t contract outside that sphere without the consent of the guardian (law still very

unsettled – due to conflicting decisions between provinces)

Limited contractual capacity – according to business occupation

However, sometimes the extent of the tacit emancipation has been held to reach further than just

the business or occupation of the minor (contradictory to above statement)

BUT, one thing is certain: no matter how far reaching the emancipation, the minor will never be

able to marry or alienate immovable property without the guardians’ consent (if emancipated by

the court in terms of the Age of Majority Act, can marry and alienate immovable property

without the consents of the legal guardian; therefore, tacit emancipation can be very limited!)

To determine whether TE has actually taken place, and the extent of the emancipation, you have

to look at the facts of the case.

E.g. Pam is 20

26

o In her 1st year of university when she was 17, she starts her own business, selling

sandwiches on campus

o This was done with the guardian’s consent

o The business is very successful, and she uses the money to pay her university fees, her

pocket money and a rental to her parents (she lives at home)

o One day, she enters into an unassisted contract with Pick ‘n Pay for the delivery of 26

loaves of bread

o The bread is to be used for the business for making sandwiches

o She fails to pay, and so they sue her for the amount owed

o Pam argues that she was an unassisted minor and therefore not liable under the law of

contract (limping – can choose to repudiate!)

o Pick ‘n Pay concede that she was an unassisted minor (i.e., they agreed with her), but

they argue that she has been tacitly emancipated and therefore liable under the law of

contract. [BUT == “He who alleges must prove!”]

o Hence, PnP must prove that she was tacitly emancipated and get her money from court

o Must show that: Guardian has consented to release of the minor from his / her power

o To ascertain this, the courts look at:

1) Age of the minor

2) Does the minor live away from home

3) Does he manage his own business or pursue an occupation / trade – if yes, what

type and how long?

4) Relationship between the minor and the guardian

5) Is the minor financially independent (cannot be emancipated if cannot pay for

herself)

o Pam is quite old (in favour of emancipation)

o Technically not living at home – paying rent to parents

o Has her own business from 17 years old

o Financially independent

o Therefore, under a balance of probabilities – she has been tacitly emancipated.

o PnP will sue Pam for unjustified enrichment though, and may claim for the money gained

from the sandwiches sold that were produced from the loaves of bread!

Under the same e.g. Pam takes an unassisted gym contract – not liable even if tacitly

emancipated… This is because the gym contract has nothing to do with her specific trade or

business – hence, it is a regular limping contract and if she doesn’t pay membership – then she

cannot be claimed against under the law of unjustified enrichment, as she is not enriched in any

specific way. Hence, she is not liable at all as the extent of the tacit emancipation does not extend

further than the realm of the business. BUT – Pam cannot get married without consent of both

guardians, or be responsible for the alienation of immovable property!

…We are still looking at people with limited contractual capacities…

b) Married persons

In South Africa, there are 3 different ways that you can be married (choices = hence, we can

make an informed decision):

o ICOP – In community of Property

o OCP – Out of Community of Property

o OCP with accrual – Out of Community of Property with accrual – in SA only -- -- Part of

legislation (not Roman-Dutch) = everything belongs to each spouse independently, but

upon dissolution of the marriage, then an accrual calculation is performed.

o MOST COMMONWEALTH COUNTRIES – only have the 1st 2 options above

27

Textbook – pg 49 (only 2 options)

In order to be married OCP of OCP with accrual, have to enter into an Antenuptial contract

(ANC!)

Must be signed BEFORE the marriage, in the presence of a Notary public and 2 witnesses

If you do not have an antenuptial contract, the marriage is automatically an ICOP by default (In

Zimbabwe and England, default is OCP)

Antenuptial contract is known as a Prenuptial contract in America

1) Marriage In Community of Property (ICOP = default)

a. Effect of a marriage ICOP

i. The assets belonging to each spouse before the marriage, are merged into a single

estate upon marriage, and they become joint owners of each other’s assets.

e.g = if you have a house (even if the house is only your name or one of the

spouses names), and you get married, now jointly owned – i.e. each spouse now

owns “half”

ii. The liabilities of each spouse before the marriage become the joint liabilities upon

marriage

iii. Any property acquired during the marriage, becomes joint property (who’s name

it is on becomes irrelevant!)

iv. Liabilities also acquired during the marriage becomes jointly liable by each

spouse

v. Upon dissolution of the marriage by death or divorce, the joint estate is divided

and each gets half.

e.g. if R500, wife gets half (R250) if husband dies – other half is given according

to the will

It is a mission to change matrimonial association (application to the high court)

and advertise in papers for any objections etc. (Add note: the Law of Domicile

governs marriage – i.e. where you live etc)

b. Contractual Capacity of spouses

o In terms of Matrimonial Property Act of 1984

o Both parties have full contractual capacity (husband and wife), without the

other’s consent; BUT there are certain exceptions, where the consent of

both spouses is required

Some definitions first:

Alienate = sell, mortgage, lease out, give away

Cede = manner of alienating, usually used for incorporeal assets (assets that do not take up space or do

not physically exits – such as airtime, shares (even though you have a share certificate), patents,

intellectual property)

Pledge = to give something as security (same as collateral) – e.g. give a person your cellphone as a

security that you will pay back R1000 to your creditor etc

Formal consent

Written consent from the other spouse, signed before 2 witnesses and must be given for each separate

act

1. Alienate or mortgage immovable property – must acquire husbands consent even if on your name

(BUT can buy without consent)

2. Buy residential land in instalments **

3. Enter into, as a credit receiver, a credit agreement (e.g. credit at a bank or a Woolworths credit card)

**

28

4. Bind him / herself as surety **

e.g. X owes Y R100, Mr B stands surety for X’s debt. If X doesn’t pay, Y sues B - - THE MORAL

OF THE STORY IS = NEVER STAND AS SURETY FOR SOMEBODY ELSE!

For (2) and (3) above – consent can be given by ratification, but it must still be in writing before 2

witnesses (must be afterwards)

** for (2), (3) and (4)

Consent is not required, if it is done in connection with the spouse’s business or occupation

E.g. you have doctor B who is in partnership with doctor A. Doctor A buys an X-ray machine for the

practice on credit (Doctor A is unmarried). Doctor B is married ICOP and he stands surety for Doctor A

for the purchase price of the machine.

Doctor B does not need consent with his wife to bind himself as surety – as it is in the normal course of

the business

Written consent

­ Formal consent in writing (therefore, do not need 2 witnesses)

­ Can be given as a general consent (note for each separate act, as in the case of formal consent,

therefore lighter)

1. Alienate, cede or pledge any shares, stocks, insurance policies or any fixed deposit (all investment

assets) or any other investment at a financial institution

General consent e.g. – You own 1000 shares in a company and want to sell 100 shares to 10

different people – You can get ONE letter from your wife for all the sales – this is general consent

(In the case of formal consent – a written letter is required for EACH SALE and it must be done in

the presence of 2 WITNESSES

You don’t need consent for alienating the following investments:

A. Shares that are listed on the stock exchange (JSE) – public company; but shares in a private

company DOES require consent

B. You don’t need consent to deal with a deposit held at a bank or building institution

2. You need written consent to alienate, or pledge jewellery, coins or painting etc – ALL ITEMS

THAT ARE HELD AS “capital assets”

3. Withdraw any money held in the name of the other spouse in a bank, building society or post office

(Your money anyway)

Consent for all of them (points 1-3) can be given by ratification – but MUST BE IN WRITING (if

other spouse refuses this – then what happens is explained later in the notes)

Informal consent

Verbal – can I do this? YES!!

1) Alienating or pledging household furniture and effects

2) To receive money due to the other spouse as a result of:

­ Their trade, business or occupation

­ Inheritance, donation, bursary or prize (even if given to you – what’s yours is yours and

what’s mine is mine!!)

3) Large donations from the joint estate (e.g. with the lotto – both win it!!)

CONSENT FOR ALL 3 ABOVE CAN BE GIVEN BY RATIFICATION!!

29

Transactions made without consent

General rule – if a spouse enters into a contract without the required consent, it is going to be

VOID!!!

There is one exception

o If a 3rd party did not know that the required consent had not been given, then the contract

is valid

o E.g. – If husband sells furniture (supposed to be verbal consent) – 3rd party won’t know if

consent had been given

If the contracting spouse knew that he or she would not get consent, and the estate suffers a loss;

then an adjustment will be made, in favour of the other spouse upon dissolution

E.g. John and Jill are married ICOP – John sells expensive jewellery (THEREFORE, written

consent required!) – he didn’t have Jill’s consent (didn’t ask her), and he knew that he wouldn’t

get her consent. He shows the buyer a letter consenting that he sells the jewellery (from Jill)

where he forges the signature. Therefore, this is a VALID CONTRACT

The true value of the jewellery is R1000; John sold it for R500 (he is dishonest and a bad

bargainer!). John and Jill later get divorced. If they got divorced and John DID NOT sell the

jewellery – each would receive R 500 (assuming that the jewellery is their only asset)… BUT, he

sold it for R500 – therefore, each only get R250

Hence, Jill suffered a loss of R250 and therefore John must pay her R250 on dissolution

If John had sold it for R2000 – nothing more would be paid to Jill (did not suffer a loss!)

There are negative consequences to be married ICOP – it is all about personal choice

Add note: SOMETIMES, lawyer’s fees are even more than 50 / 50 split in the case of a divorce

ii) Marriages out of community of Property (OCP) or out of community of Property with accrual (OCP

with accrual) (NEED ANC FOR THIS!)

a) Effect of marriage OCP:

Exact opposite of ICOP

1) Each party (spouse) retains, as their own separate property, whatever they acquired before

the marriage and whatever they individually acquire during the marriage

2) Each party is liable for their own debts, which they incurred before or during the marriage –

i.e. they are not liable for each other’s debts

3) Upon dissolution of the marriage, each party retains their own separate assets and neither is

liable for the other’s debts and neither has a claim against the other (CHILDREN and

MAINTENANCE IS AN ENTIRELY SEPARATE ISSUE HERE)

It is up to the 3rd party to find out if a person is married ICOP or OCP

Because of this, there is now a middle ground to avoid the maintenance from a husband – as under OCP,

a housewife can end up with nothing, if brought nothing to the marriage

b) Effect of a marriage OCP with accrual:

Exactly the same as OCP, but with one main difference

The spouse, whose estate has shown the smaller accrual (only growth), has the right to half

of the difference between the accruals of both spouses upon dissolution of the marriage

NB e.g.

o John and Jill got married in 2000 and NET ASSETS (Assets – Liabilities):

JILL

JOHN

30

R500

R1000

2000

R10500

R1000

2007

Accrual

R10000

R0

(The theory behind this concept is – “Jill would not have been as successful without John”)

Therefore, difference between accruals = R10 000 – R0 = R10 000

And John gets R5 000 from Jill

NB – CASH CLAIM FOR THE ACCRUAL (not joint owner of the house or any other asset) – if one

of the spouses cannot afford to pay the accrual to the other, then some of their assets must be sold or

property mortgaged in order to finance the cash amount owed to the spouse upon dissolution of the

marriage. This takes into account ALL ASSETS AND LIABILITIES (when doing the accrual

calculation), but CASH GRANT…

If:

JILL

JOHN

R500

R1000000

2000

R10500

R1000000