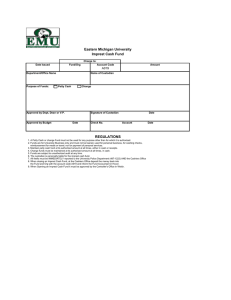

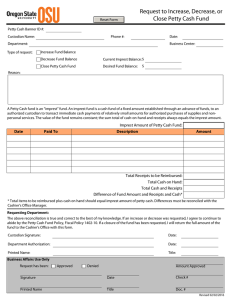

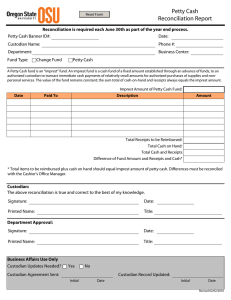

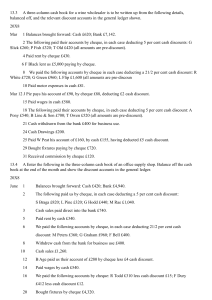

ACCOUNTING MIDTERM TEST There are 6 Multiple choices questions and 4 Fil in the blanks questions. It is better to print it out. Total marks is 40. . Read the questions carefully. Typing Marks with disqualified you. Only writings on exercise paper/book is accept. Use pen not pencil. 1 HR AND 30 MINS 6 MCQ – 6X1-6 MARKS 4 Fill in the blanks -34 Marks 7. Kuda Maposa maintains a petty cash book using the imprest system. REQUIRED (a) State one advantage of the imprest system of petty cash. [1] _____________________________________________________________________________ _____________________________________________________________________________ On 1 March 2015 the balance of Kuda Maposa’s petty cash book was $100 which was equal to the amount of the imprest. Her transactions for the month of March 2015 were as follows. March 6 Paid for postage costs 11 Bought tea and coffee 14 Purchased stationery 18 Paid T Masuka, a credit supplier 21 Received refund for damaged stationery 26 Paid window cleaner 29 Paid P Zhonga, a credit supplier REQUIRED $ 13 5 27 15 10 12 16 (b) Enter these transactions in Kuda Maposa’s petty cash book on the page opposite. Balance the petty cash book and bring down the balance on 1 April 2015 [9] (c) (i) State the amount required to restore the imprest on 1 April 2015. [1] ___________________________________________________________________ (d) (ii) Name the account which would be credited with this amount. [1] __________________________________________________________________ (e) (iii) Name the ledger account in which the transaction of 21 March would be recorded. [1] __________________________________________________________________ 8. Kuda Maposa had the following transactions on 31 March 2015. 1 Took goods costing $300 for personal use. 2 Purchased a motor vehicle, $12 000, for business use, using a cheque drawn on her personal bank account. 3 Received an invoice from Valley Machines for $990. This included $865 for a new machine. The balance was for repairs to existing machine. REQUIRED (a) Prepare journal entries to record the above transactions. Narratives are required. See next page [6] 9 (a) Insert the missing figures in the following document. [3] (b) Name the person who issued the credit note. [1] (c) Suggest one reason for the issue of the credit note. [1] (d) Name the document which would have been issued to request a credit note. [1] (e) Complete the following table to show where the credit note would be recorded. [4] 10. Neel started a business on 1 June. The following transactions took place in June. 1 Opened a business bank account with $8000 of his own money. 2 Received a bank loan, $2000. 3 Bought a delivery van, $5200, from A1 Motors on credit. 4 Bought inventory, $3700, paying by cheque. 5 Paid shop rent, $1000, by standing order. 6 Withdrew cash, $100, to start up an imprest system. REQUIRED (a) Complete the following table showing how these transactions were recorded. The first has been completed as an example. [5]