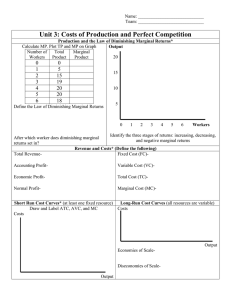

Lecture 2: Production, costs and supply Reading: NW Ch.7 & 8 Online Quiz 1 – week 3 • • • • • Access on BUSS1040 Canvas Starts Monday – keep an eye on email and Canvas You have a week to complete 10 multiple choice questions, covering material from weeks 1-2 Shortly after the quiz closes, correct answers will be available on Canvas • Schedule enough time to work through the quiz! • All questions appear on one page. As long as you have saved (but not submitted) your answers, you can return to the quiz and change your answers – once submitted your answers are FINAL! • Make sure you submit your answers before end of the quiz, otherwise NO marks (zero). • Important: once submitted, I expect you receive a message confirming you submitted. You will not see your mark, neither what you got right/wrong. Your mark will be available in MyGrades after the quiz closes. Questions with answers will be available on Canvas after the quiz closes. • ADVICE: save a screenshot before submitting your answers. BUSS1040 - Lecture 2 2 Introduction • Now we focus on how firms operate. o We want to describe firm behaviour with a view on understanding firm and market supply 1. we examine the ideas of short and long run for a firm's production process; o In the short run the firm has at least one fixed input of production, whereas in the long run all inputs can be adjusted if the firm wishes to. 2. we analyse the relationship between a firm's inputs and its outputs – that is, its production function. 3. we examine how a firm's output is related to its costs in the short run and in the long run. o There is a one-to-one relation between production and costs BUSS1040 - lecture 2 3 Economic profit versus accounting profit • We assume that firms aim to maximise profits, where profit = Economic profit • Economic profit may differ from accounting profit • Accounting profits are revenues minus all explicit costs • Economic profits are revenues minus total opportunity cost BUSS1040 - lecture 2 4 Economic profit Total revenue – the amount a firm receives for the sale of its output Total cost – the amount a firm pays to buy the inputs of production + forgone opportunities = total opportunity cost of producing goods/services o Opportunity costs include explicit costs (that are not sunk) = direct payments for inputs or factors of production implicit costs (value of foregone opportunities) e.g. forgone wages, interest earnings Profit – total revenue minus total costs π = TR – TC Example: Helen uses $300 000 of savings, interest rate at 5 % Thus Helen gives up $15 000 per year in interest Not an explicit cost – but it is an opportunity cost while she is running the firm, so needs to be included in costs (and measures of economic profit). Zero economic profit – revenues just cover opportunity costs BUSS1040 - lecture 2 5 Economic profit versus accounting profit How an economist views a firm How an accountant views a firm Economic profit Revenue Accounting profit Implicit opp. costs Revenue Explicit costs Explicit costs BUSS1040 - lecture 2 6 Economic Profit – Example Tom recently opened a restaurant. This requires Tom to (temporarily) give up a job working as a lecturer at the university that pays $20 000 a year. The restaurant is located in a house he inherited from his grandmother, of which he is the sole owner. The house would otherwise be rented out at a price of $30,000 a year. This year, the restaurant has revenue of $200 000, personnel costs of $50 000 and costs of food inputs of $20 000. What is Tom’s economic profit of running his restaurant this year? (a) $80 000 (b) $90 000 (c) $110 000 (d) $130 000 (e) None of the above 7 • Answer: (a) $80,000 • Explanation: Economic profit = Total revenue – Explicit costs – Implicit costs • Here, revenue = $200,000 • Explicit costs = $50,000 (personnel costs) + $20,000 (food inputs) = $70,000 • Implicit costs = $20,000 (forgone wages) + $30,000 (forgone rental income) = $50,000 • Therefore, Economic profit = $200,000 - $70,000 - $50,000 = $80,000 RMIT University©4/08/2022 8 The short run and long run • What is a firm? • A firm, using the available technology, converts inputs – labour, machinery (often called capital), natural resources (typically called land) – into output that is sold in the marketplace. o Typically, a firm will require more than one input to produce its final output. • We define the short run and the long run of a firm in relation to whether or not any of the factors of production (inputs) are fixed o An input is ‘fixed’ if it cannot be changed regardless of the output produced BUSS1040 - lecture 2 9 The Short and long run • The short run is the period of time during which at least one of the factors of production is fixed o for example, the size of a factory might not be able to be changed. • In the long run, all factors of production are variable (that is, not fixed). o Therefore, in when the firm's lease of the factory ends, the firm is free to decide whether or not to renew the lease for that factory. • The short run and the long run is not defined in relation to a set period of time, but rather in relation to how long it takes for all of a firm's inputs to become variable – this will differ between industries. BUSS1040 - lecture 2 10 Production • A firm requires inputs or factors of production (labour, capital, land, etc.) in order to produce its final output (i.e. goods or services). • A production function shows the relationship between quantity of inputs used and the (maximum) quantity of output produced, given the state of technology. BUSS1040 - lecture 2 11 Example of a production function • Jonathan owns a factory that makes umbrellas. • Assume the factory size cannot be changed – that is, we are in the short run. • Jonathan chooses how many workers to use o with one worker, he can make 60 umbrellas; with two workers, 110 umbrellas; three workers, 150 umbrellas; four workers, 180 umbrellas. • The relationship between inputs (number of workers) and output (number of umbrellas) is the production function. • Often a production function is represented using an equation. o For example, q=f(L) where q is the level of output and L the amount of labour. BUSS1040 - lecture 2 12 Example of a production function BUSS1040 - lecture 2 13 Typical production function 𝑞 𝑓(𝐿) 𝐿 BUSS1040 - lecture 2 14 Marginal product • The marginal product (MP) is the change in output when one more input is used. • In the umbrella example above: o o o Hiring one worker (rather than having no workers at all) allows 60 umbrellas to be made rather than 0 – the MP of the first worker is 60. If Jonathan has one worker and hires one additional worker, output increases from 60 to 110 – the MP of the second worker is 110 - 60 = 50. If Jonathan has three workers and hires one additional worker, is output will increase from 150 to 180; the MP of the fourth worker is 30 umbrellas. • MP is the slope of the production function. BUSS1040 - lecture 2 15 Diminishing MP • MP of an input changes as we increase the use of that input. • If the MP becomes progressively smaller, this is called diminishing marginal product. o o In the example above concerning Jonathan's umbrellas, the marginal products of the second, third and fourth workers respectively are 50, 40 and 30, indicating diminishing marginal product; that is, each additional worker contributes less to output than the worker before. BUSS1040 - lecture 2 16 Diminishing MP • Diminishing MP is very common o In the short run there is a fixed input of some kind which creates a capacity constraint; o this will mean that each additional worker will contribute to output less and less than those hired before. • Crucially, diminishing MP is a short-run concept o It relies on the idea that at least one input (like the factory) is fixed. BUSS1040 - lecture 2 17 Production function – Helen’s cakes Number of Output workers (q, cakes per hour) 0 0 1 50 2 90 3 120 4 140 5 150 BUSS1040 - lecture 2 Marginal product of labour 18 Production function – Helen’s cakes Number of Output workers (q, cakes per hour) Marginal product of labour 0 0 1 50 50 2 90 40 3 120 30 4 140 20 5 150 10 BUSS1040 - lecture 2 19 Production function for Helen’s cakes BUSS1040 - lecture 2 20 Production function for Helen’s cakes Output PF 140 120 Note how the function becomes flatter 90 50 No. of workers BUSS1040 - lecture 2 21 Q of output Production function Output increases as inputs Increase, but at a decreasing Rate (eventually) This is due to diminishing Marginal product Units of labour BUSS1040 - lecture 2 22 Production in the LONG RUN • Allow all inputs into the production process to be variable. o In our umbrella manufacturing example, Jonathan can now vary all inputs in production process; he can choose the factory size as well as the amount of labour utilized. • Given all factors of production are variable, we are in the long run. • We are interested in how the quantity of output changes when we change the quantity of all of the factors of production. o production function in the LR: q = f (L,K) BUSS1040 - lecture 2 23 Returns to scale – production in the long run • Returns to scale refers to how the quantity of output changes when there is a proportional change in the quantity of all inputs. o If output increases by the same proportional change, there are constant returns to scale – if we double the quantity of all the inputs and output also doubles in quantity. o If output increases by more than the proportional increase in all inputs, we have increasing returns to scale. o If output increases by less than the proportional increase in all inputs, there are decreasing returns to scale. • Note, it is possible that a firm has diminishing MP in the short run, and still has increasing returns to scale in the long run! BUSS1040 - lecture 2 24 SHORT-RUN costs • A cost function is an equation that links the quantity of output with its associated production cost. • For example, TC = f(q), where TC represents total cost and q represents the quantity of output. • Example: Helen’s cakes, wage for a worker is $10. BUSS1040 - lecture 2 25 Total cost and output of Helen’s cakes Number of workers 0 Total cost Output 30 0 1 40 50 2 50 90 3 60 120 4 70 140 5 80 150 BUSS1040 - lecture 2 26 Total cost curve of Helen’s cakes total cost total cost curve Note how the curve becomes steeper q of output BUSS1040 - lecture 2 27 A typical short-run total cost function 𝑇𝐶 𝑓(𝑞) 𝑞 BUSS1040 - lecture 2 28 A typical short-run cost curve • Several points are worth noting: • When output is zero, total cost is positive o this is because, in the short run, some factors of production are fixed and must be paid for. • The total cost curve rises as output increases o costs increase when more inputs are required • The total cost curve rises at an increasing rate o this captures diminishing MP: as output increases, a greater quantity of inputs is needed to increase output by the same amount. BUSS1040 - lecture 2 29 Fixed and variable costs • In the short run, some inputs will be fixed and some inputs will be variable; as a consequence, a firm will have some fixed costs and some variable costs. • Fixed costs (FC) are costs that do not vary with output. When output is zero, all the costs are fixed costs. • By contrast, Variable costs (VC) are costs that vary with output. All costs that are not fixed costs will be variable costs. VC = TC – FC • And hence Total costs (TC) consist of fixed and variable costs: TC = VC + FC BUSS1040 - lecture 2 30 Q of output TC 0 3.00 1 3.30 2 3.80 3 4.50 4 5.40 FC VC AFC AVC BUSS1040 - lecture 2 ATC MC 31 Average costs • Average fixed cost (AFC) is fixed cost per unit of output: AFC = FC/q o Note that the AFC curve is always downward-sloping – why? o Because of diminishing MP, the AVC curve will eventually be upward-sloping. o As ATC = AFC + AVC, its shape is affected by both. At very low levels of output, ATC is usually the decline in AFC dominates, but at higher levels of output, it is usually upward sloping because the increasing AVC dominates. Together, this will give the ATC curve a U-shape (i.e. initially decreasing, but eventually increasing with output). • Average variable cost (AVC) is variable cost per unit of output: that is, AVC = VC/q • Average total cost (ATC) is total cost per unit of output; ATC = TC/q o o BUSS1040 - lecture 2 32 Marginal cost • Marginal cost (MC) is the increase in total cost from an extra unit of output. • Due to diminishing MP, a typical MC curve will eventually be increasing in output; MC often has a positive slope. o o o In our umbrella example, each worker costs the same to hire but produces progressively less than the previous hire (diminishing MP). The extra cost of producing another unit of output (MC) must go up. In the short run diminishing MP implies increasing MC. BUSS1040 - lecture 2 33 Q of output TC FC VC AFC AVC 0 3.00 3.00 0.00 - 1 3.30 3.00 0.30 2 3.80 3.00 0.80 3 4.50 3.00 1.50 4 5.40 3.00 2.40 BUSS1040 - lecture 2 - ATC MC - 34 Q of output TC FC VC AFC AVC ATC MC 0 3.00 3.00 0.00 - - - 1 3.30 3.00 0.30 3.00 0.30 3.30 0.30 2 3.80 3.00 0.80 1.50 0.40 1.90 0.50 3 4.50 3.00 1.50 1.00 0.50 1.50 0.70 4 5.40 3.00 2.40 0.75 0.60 1.35 0.90 BUSS1040 - lecture 2 35 Typical marginal cost curve Short-run average costs (dollars) MC Qty BUSS1040 - lecture 2 36 Typical average cost curves Short-run average costs (dollars) MC ATC AVC AFC Qty BUSS1040 - lecture 2 37 Relationship between ATC, AVC and MC • The relationship between MC, AVC and ATC is important. • As a rule, MC passes through the minimum of ATC and AVC. o o o Think of a student’s test scores: if the next test score (the marginal score) is higher than the student’s average, the average rises; if the next test score (the marginal score) is lower than the average, the average falls. The same logic applies to costs: if MC is above ATC, ATC rises; if MC is less than ATC, ATC is falling; it follows then that MC intersects ATC at the minimum of ATC. The same applies to MC and AVC; MC intersects the minimum of AVC (from below). BUSS1040 - lecture 2 38 Example: MC = 10, 20, 30, 40, 50, 60, 70. FC = 100 ATC(1) = (100 +10)/1 = 110 ATC(2) = (100+10+20)/2 = 65 ATC(3) = (160)/3 = 53.3 ATC(4) = 50 ATC(5) = 50 ATC (6) = 51.7 ATC (7) = 54.3 When MC below ATC, ATC is falling as q increases when MC above ATC, ATC is increasing as q increases BUSS1040 - lecture 2 39 Q 1 2 3 4 5 6 7 8 9 10 AVC 0.30 0.40 0.50 0.60 0.70 0.80 0.90 1.00 1.10 1.20 ATC 3.30 1.90 1.50 1.35 1.30 1.30 1.33 1.38 1.43 1.50 BUSS1040 - lecture 2 MC 0.30 0.50 0.70 0.90 1.10 1.30 1.50 1.70 1.90 2.10 40 A typical firm’s short-run costs curves Costs MC ATC AVC AFC BUSS1040 - lecture 2 𝑞 41 LONG-RUN costs • In the long run, all inputs are variable. • As all production factors are variable o o o If a firm does not want to produce anything, its costs are zero. A firm producing a positive output has more flexibility to adjust all of its inputs, so long-run costs should not be higher than short-run costs (for a given level of output) BUSS1040 - lecture 2 42 Long-run marginal cost • Long-run marginal cost (LR MC) is the marginal cost of increasing output by one unit o must take into account the fact that all inputs can be varied to achieve this increase. • As noted, LR MC will not be more than SR MC. BUSS1040 - lecture 2 43 Long-run average cost • Given the firm’s extra flexibility in the long run, long-run average cost can be no greater than short-run average cost. • As a result of this, the long-run average cost curve will be the lower envelope of all of the short-run average cost curves. See the following figure – it illustrates how to derive a long-run average cost curve from several short-run average cost curves BUSS1040 - lecture 2 44 Long-run Average Cost Curve Unit costs For every plant capacity size there is a short-run ATC curve, and every ATC has a minimum cost ATC-5 ATC-1 ATC-3 ATC-2 20 30 40 50 ATC-4 60 Output 45 Long-run Average Cost Curve Unit costs The long-run ATC just ‘envelops’ all the short-run ATC curves Long-run ATC Output 46 Economies of scale • Economies of scale is when long-run average costs decrease with output. • Diseconomies of scale is when long-run average costs increase with output. • Constant returns to scale is when long-run average costs are constant as output expands. BUSS1040 - lecture 2 47 Economies of scale Costs LRAC Constant average costs Economies of scale Diseconomies of scale BUSS1040 - lecture 2 𝑞 48 Returns to Scale and Economies of Scale • There is a direct relationship between returns to scale and economies of scale • Economies of scale reflect the relationship between output and costs. • Recall that returns to scale refers to how the quantity of output changes when there is a proportional change in the quantity of all inputs. • The relationship arises as the production function (inputs and outputs) is a mirror image of the cost function (relationship between costs and output) Returns to scale & economies of scale • When a firm experiences increasing returns to scale (increasing inputs proportionally leads to a more than proportional increase in outputs), it also experiences ‘economies of scale’ or falling average cost of production. • When a firm experiences decreasing returns to scale (increasing inputs proportionally leads to a less than proportional increase in outputs), it also experiences ‘diseconomies of scale’ or increasing average cost of production. • When a firm experiences constant returns to scale (increasing inputs proportionally leads to a proportional increase in outputs), it experiences neither ‘economies or diseconomies of scale’. That is, average cost of production is constant. • Typically, we think that a firm has regions where it exhibits each of these. 49 Supply BUSS1040 - lecture 2 50 Introduction • Now we use costs to derive an individual firm's supply function and the market supply function. • We focus on competitive markets, in which there are many buyers and sellers, such that no individual buyer or seller has the power to materially affect the price in the market. • As a consequence, both sellers and buyers in the market are price takers. BUSS1040 - lecture 2 51 Firm supply • Firm supply is the quantity of output a firm is willing and able to supply at a certain price. o The supply curve traces out all combinations of (i) market price and (ii) quantities that a firm is willing and able to sell at that price. • Firm supply curve is drawn by changing the price of output, holding everything else that is relevant constant (ceteris paribus). o Examples of factors held constant? Q: Now how much is a firm willing and able to supply at a given price? BUSS1040 - lecture 2 52 Firm supply • A firm should sell up until P = MC BUSS1040 - lecture 2 53 Firm supply • A firm should sell up until P = MC • The marginal revenue (MR) for each unit that the firm sells is the price, P. o o MR = P (competitive market) Remember, a competitive firm is a price taker – it cannot affect market price. This means price is unchanged, regardless as to how much an individual firm sells. • First, if a firm supplies a quantity where P > MC for the last unit sold (and this is true for at least one additional unit), profits rise when increasing its output by one unit. o it will increase its profit since the additional revenue from selling that extra unit (P) outweighs the MC. • Second, if a firm is producing where P < MC for the last unit made, the firm can increase profit by not making that last unit o The extra revenue (P = MR) is less than the extra costs that are incurred. BUSS1040 - lecture 2 54 Firm supply • Consequently, a firm should sell up until P = MC. • Now if price P changes – from P1 to P2 in the next figure. o As price rises, so does the firm’s MR o it now continues to produce until P = MC for the last unit produced. o As MC is often increasing, the quantity supplied in the market is higher when price is higher. • A movement along the supply curve when output price changes is called a ‘change in the quantity supplied’ o if output price is increasing it is ‘an increase in the quantity supplied’ o for a decrease in output price ‘a decrease in the quantity supplied’. BUSS1040 - lecture 2 55 Firm supply 𝑃 𝑀𝐶 𝑝2 𝑝1 𝑞1 BUSS1040 - lecture 2 𝑞2 𝑞 56 The law of supply • This means is that a firm's supply curve is given by its MC curve! • MC curve is upward sloping due to diminishing marginal product. • This gives a positive relationship between the price of a good and the quantity of that good supplied: o Other things being equal (ceteris paribus), the higher the price of a good, the greater is the quantity supplied. • This positive relationship is known as the law of supply. o Note, the law does not always hold, but it often does. BUSS1040 - lecture 2 57 Shifts in supply • The firm's supply curve is derived by assuming that only the price and quantity supplied of the product can change. o We assume that all other relevant factors are held constant (ceteris paribus). • If any other relevant factors change, the supply curve itself will shift. o o These factors include the cost of inputs, technology and expectations about the future. At any given output price, the quantity supplied changes. • If there is a change in one of these factors there will be a ‘change in supply’, either: o o ‘an increase in supply’ for shifts of the supply curve to the right (S1 to S2); or ‘a decrease in supply’ for shifts of supply to the left (S2 to S1). BUSS1040 - lecture 2 58 Shifts or changes in supply 𝑃 𝑆1 𝑆2 𝑞 BUSS1040 - lecture 2 59 Market supply • Given that an individual firm's supply curve is given by its MC curve, we can use this to derive the market supply curve. • The market supply curve shows the quantity supplied in a market at different market prices, holding everything else constant. o o Suppose the market price of carrots is $1 and the market consists of 2 suppliers only. At this price, Jackson is willing to sell five carrots and Jared is willing to sell eight carrots. This means that, at $1, the total quantity supplied in the market is 13 carrots. Repeat this for every price to derive the market supply curve. • Graphically, the market supply curve is the horizontal summation of the individual supply curves. o The individual MC curves summed horizontally along the q-axis. BUSS1040 - lecture 2 60 Market supply – two examples of horizontal summation of individual S curves 𝑃 𝑆1 𝑆2 𝑃 𝑆𝑀 𝑝 𝑆1 𝑆2 𝑆𝑀 𝑝 𝑝̅ 𝑞1 𝑞2 𝑞1 + 𝑞2 𝑞2 𝑄, 𝑞 𝑞1 𝑞2 BUSS1040 - lecture 2 𝑞1 + 𝑞2 𝑞2 𝑄, 𝑞 61 Market supply • The law of supply also holds for the market supply curve. • We also use the term ‘change in the quantity supplied’ to refer to movements along the market supply curve, • The term ‘change in supply’ again refers to a shift of the supply curve itself. BUSS1040 - lecture 2 62 Summary • Production • SR vs. LR • Production function, total product, marginal product • diminishing MP, returns to scale • Costs of production • SR vs. LR • TC = FC + VC; average costs, marginal cost • LR average costs and economies of scale • Firm supply • Competitive firm produces units until P=MC; supply curve • Change in quantity supplied vs. change in supply (shift) • Market supply BUSS1040 - Lecture 2 63 Next week • Demand • Market equilibrium • Elasticity BUSS1040 - lecture 2 64