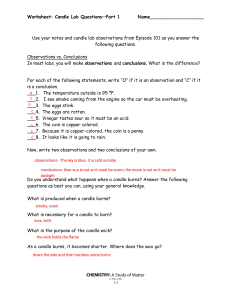

Limitless Forex Academy Candlesticks Crash Course Candlestick charts are the most common when technically analysing forex charts, meaning it is important your understanding of them is thorough. This education will provide a complete explanation of candlesticks, how they form, what data they provide to us as traders, as well as some key candlestick patterns you should know. The Anatomy of a Candlestick The candlestick may seem confusing at first, but it has a very simple anatomy that shows us a lot of data. By checking the images below, you will see that the candle shows us the opening price, closing price, high and low of each session (‘session’ means the time period of the candle). For example, a candle on the 4h time frame will show us the price that the 4h candle opened at, the price it closed at after those 4 hours, the highest price reached during those hours and finally the lowest price reached during those hours. The candle body shows the difference between the opening price and the closing price - if the closing price is lower than the opening price, then the candle is bearish, and vice versa, a closing price higher than the opening price means the candle is bullish. Generally speaking a larger body means that price movement was stronger during the session, whereas a smaller body means that price movement was weaker. The distance between the candle bodies and the session highs/ lows is illustrated by wicks and these are perhaps the most useful data shown in candlesticks, but more on that below. Most traders choose red and green for their candles (red is usually a bearish candle and green is usually a bullish candle), but the colour you choose does not matter as long as they make sense to you. The Significance of Wicks Wicks are very useful to a trader because they show exhaustion in the market, due to how the wick forms. For a wick to form, price must have pushed to that session high or low, before pulling back and closing the session away from that high or low. Consider this example: Price is pushing up to retest a broken structure. The 4h candle pushes up strongly in to our zone we have drawn on the broken structure - it pushes up high, and then suddenly bulls begin to lose strength and the 4h candle closes back below the zone, with a big wick Limitless Forex Academy formed in to the zone. What can we learn from this? The bulls were strong, they pushed up in to the zone, but in the end there was not enough bullish strength to close the session strongly, instead they had exhausted and closed lower than the session high. This is now a great indication that bulls become weak at this zone in the market because there is a big wick in the zone, showing bulls pushed high but then became weak as a result of the zone. This exhaustion is also known as rejection. As a result, the wick gives us an indication that bears may take control of price in this zone, allowing us to potentially take sell trades and profit from this bearish pressure. Key Candlestick Patterns There are countless different candlestick patterns, ranging from single candles to multiple candles, and they are all used by some traders as part of their strategies. However, you do not need to learn what every single candle pattern is because they are simply not all necessary. I want to keep you focused and make this education as easy to understand as possible for you, so here are the most important, common and effective candlesticks and patterns in forex trading. Pin Candles/ Pin Bars The pin bar/ pin candle is a, very useful, single candle that shows rejection/ exhaustion of price during the session. As I talked about in the wicks section, a large wick shows price has attempted to push hard, before ultimately failing, and this can be evident on charts through multiple wicks forming at the same point, or through a clear pin bar with a nice big wick. Bearish and bullish pin bars look the same, except for the direction of the wick; a bearish pin bar will have a wick that pushes up in to a level/ zone, whereas a bullish pin bar will have a wick that pushes down in to a level/ zone. Note that with pin bars, the colour of the bar (i.e. if it has a bearish or bullish close) does not matter. Instead we decide the bias of the pin bar based off the direction of the wick to the level (see the image below). Engulfing Candles The engulfing candle is often misunderstood, so I want to be very clear about this important candle pattern. The engulfing candle is a two candle pattern (it is often misunderstood to mean more than two candles), where the second candle body engulfs the first candle body. These two candles must also have differing biases - so if the first candle is bullish, the second candle must be bearish, and vice versa. See the image below to see the engulfing candle patterns. Limitless Forex Academy The reason this pattern is so strong is due to the market psychology behind it. As you know by now, each candle represents price movement during a particular time session, so an engulfing candle pattern means the bias of the second session has completely engulfed the strength of the previous sessions bias. Take the following example: Price is pushing down, and forms a bearish candle. For this bearish candle to form price must have had a strong bearish session in order to close lower than the session open. For the next candle to be a bullish engulfing candle, the next candle session must be so strongly bullish that the entire bearish strength of the last candle is wiped out and closed higher than. This makes the engulfing candle a strong candlestick pattern because it represents a strong swing in market bias, so strong that the original bias is completely reversed by the second candle. Doji Candles Doji candles, also known as dojis, are useful for spotting indecision in the market. They are a single candle pattern and are very easy to spot (see the image below). Dojis are a candle with a very small body, or no simply a line for the body, and similar sized wicks up and down. They show indecision during that session because price tried to push both up and down (shown by the wicks) but price failed to close far from the open (shown by the very small or no body). When found at a level, the doji indecision candle suggests to traders that price is perhaps ready to reverse. Limitless Forex Academy Candlestick Summary Candlesticks/ candles are the most common form of viewing price action charts because they show a lot of data in a condensed and easy to understand way. Through wicks, patterns and overall candle shapes we can gain a clear view of the market and its most likely moves. However, candles alone are not enough to accurately forecast market moves, we also need to understand the markets structures, levels and overall conditions, but now that you have a good understanding of candlesticks, you have a strong foundation of knowledge to build on.