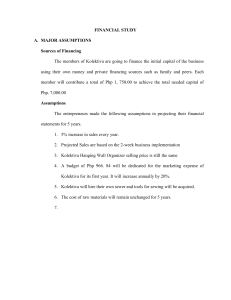

Republic of the Philippines BATANGAS STATE UNIVERISTY BatStateU Rosario Namunga, Rosario, Batangas Exercises in Capital Investment Name: Carla Jane P. Andal Section: FINMGT-1201 PROBLEM 1 The cost of a project is Php 50,000 and it generates cash inflows of Php20, 000, Php15, 000, Php25, 000, and Php10, 000 over four years. Required: Using the present value index method, appraise the profitability of the proposed investment, assuming a 10% rate of discount. (NPV) YEAR 0 1 2 3 4 CASH FLOW -50,000 20,000 15,000 25,000 10,000 DISCOUNT FACTOR PRESENT VALUE 1 -50000 0.9091 +18,181.82 0.826 +12,396.69 0.751 +18,782.87 0.683 +6,830.13 NET PRESENT VALUE : +6,191.52 *DISCOUNT FACTOR IS 10%. What will be the decision? Why? I will accept the project since the computations show that the project earnings generated by a project or investment in current dollars surpass the predicted costs. An investment with a positive net present value of Php 6,191.52 is believed to be profitable over a four-year period. As a result, it indicates that the investment will raise the firm’s value and maximize shareholder wealth. PROBLEM 2 A company is considering whether to purchase a new machine. Machines A and B are available for P80,000 each. Earnings after taxation are as follows: Year 1 2 3 Machine A Php 24,000 32,000 40,000 Machine B Php 8,000 24,000 32,000 4 5 24,000 16,000 48,000 32,000 Required: Evaluate the two alternatives using the following: (a) payback method, (b) net present value method. You should use a discount rate of 10%. A. PAYBACK METHOD MACHINE A Year 1 2 3 4 5 CAPITAL INVESTMENT CASH FLOW Php 80,000 Php 24,000 32,000 40,000 24,000 16,000 NET INVESTMENT REMAINING Php 56,000 24,000 1 year 1 year 0.6 year (1+1+0.6) 2.6 years (0.6 *12 months) 7.2 years (7.2 * 30 days) 216 days 2 years and 216 days or 2.6 years MACHINE B YEAR 1 2 3 4 5 CAPITAL INVESTMENT Php 80,000 CASH FLOW Php 8,000 24,000 32,000 48,000 32,000 NET INVESTMENT REMAINING Php 72,000 48,000 16,000 1 year 1 year 1 year 0.33 year (1+1+1+0.33) 3.33 year (0.33 * 12 months) 3.96 months (3.96 * 30 days) 118.8 days 3 years and 118.8 days or 3.33 years B. NET PRESENT VALUE MACHINE A YEAR CASH FLOW DISCOUNT FACTOR PRESENT VALUE Php Php 0 -80,000 1 -80000 1 24,000 0.9091 +21,818.18 2 32,000 0.826 +26,446.28 3 40,000 0.751 +30,052.59 4 24,000 0.683 +16,392.32 5 16,000 0.621 +9,934.74 NET PRESENT VALUE : +24,644.12 *DISCOUNT FACTOR IS 10% MACHINE B YEAR CASH FLOW 0 1 2 3 4 5 Php -80,000 8,000 24,000 32,000 48,000 32,000 DISCOUNT FACTOR 1 0.9091 0.826 0.751 0.683 0.621 NET PRESENT VALUE: PRESENT VALUE Php -80,000 +7272.73 +19834.71 +24042.07 +32784.65 +19869.48 +23,803.64 *DISCOUNT FACTOR IS 10% Which machine needs to purchase and why? Machine A should be purchased because it makes a higher net present value than Machine B. As shown in the tables, Machine A has a net present value of Php 24,644.12 whereas machine B has Php 23, 803.64. We can say that Machine A has a higher present value because of the computation’s result. In payback period, Machine A will be give back after 2.6 years or 2 years and 216 days, whereas Machine B will be give back after 2.6 years or 2 years and 216 days. As a result, purchasing Machine A is sensible decision because it yields a high net present value and has a shorter payback period than Machine B, despite the fact that both require a Php 80,000 capital investment. PROBLEM 3 Compute the (1) net present value and (ii) internal rate of return of the following capital budgeting projects. The firm’s required rate of return is 12 percent. Year Zeta (Php 50,000) 20,000 15,000 30,000 0 1 2 3 I. Projects Omega (Php 45,000) 42,000 9,000 1,850 NET PRESENT VALUE ZETA YEAR CASHFLOW 0 1 2 3 Php -50,000 20,000 15,000 30,000 DISCOUNT FACTOR PRESENT VALUE 1 0.893 0.79719 0.712 NET PRESENT VALUE : Php -50000 +17,857.14 +11,957.91 +21,353.41 +1,168.46 *DISCOUNT FACTOR IS 12% OMEGA YEAR 0 1 2 3 CASHFLOW Php -45,000 42,000 9,000 1,850 DISCOUNT FACTOR 1 0.893 0.79719 0.712 NET PRESENT VALUE: *DISCOUNT FACTOR IS 12% PRESENT VALUE Php -45,000 +37,500 +7,174.74 +1,316.79 +991.54 II. INTERNAL RATE OF RETURN ZETA YEAR CASHFLOW PRESENT VALUE 0.132605 Php Php Php -50,000.00 20,000.00 15,000.00 30,000.00 NET PRESENT VALUE: IRR: *THE ACTUAL IRR IS 13.26% -50000 +17,857.14 +11,957.91 +21,353.41 +1,168.46 13.26% 0 1 2 3 -50,000.00 17,658.41 11,693.23 20,648.37 0.14 OMEGA YEAR CASHFLOW PRESENT VALUE 0.140335 Php Php Php 0 -45,000.00 -50000 -50,000.00 1 42,000.00 +37,500 17,658.41 2 9,000.00 +7,174.74 11,693.23 3 1,850.00 +1,316.79 20,648.37 NET PRESENT VALUE : IRR: +991.54 0.16 14.03% *THE ACTUAL IRR IS 13.26% Which project should be purchased? Explain why? The Zeta Project is the one that should be purchased because it has a high Net Present Value. When comparing the two projects, the Zeta Project has a larger NPV than the Omega Project. Omega, on the other hand, generates a larger IRR than Zeta. When faced with a difficult decision between two competing projects, it is advisable to choose the one with a higher positive net value by utilizing a cutoff rate or a suitable cost of capital. In addition, the discount rate can be changed to represent a variety of factors, such as market risk, which is an advantage of NPV. Net Present value is a better tool for deciding on future investments because it delivers a dollar return. While, IRR is less effective when making investment decisions because its results do not indicate how much money a project is anticipated to generate.