BY1 OL Unit02-MFRD March2022 Task2 Report Samaabdulmajeed ST5205

advertisement

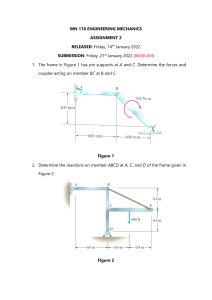

Maldives Business School Cover Page ASSESSMENT BRIEF Bachelor’s Degree Year 1 The student must fill the relevant parts of the following table. Student First Name Student Last Name Student ID Task No. Date submitted 8thMay 2022 Date issued Sama abdul majeed ST5205 02 13th March 2022 Statement of authenticity I, the above named student, hereby confirm that this assignment is my own work and not copied or plagiarized. It has not previously been submitted as part of any assessment. All the sources, from which information has been obtained for this assignment, have been referenced in the Harvard format. I further confirm that I have read and understood the Maldives Business School rules and regulations about plagiarism and copying and agree to be bound by them. Assignment summary information Unit Unit 2: Managing financial resources and decisions Specialization Core Assignment type This is an individual assignment. Tasks Submit on NA Task 1: Examination: LO3, LO4. th 8 May 2022 Task 2: Report: LO1, LO2. Extensions Late submissions Resubmissions: Assessor(s): Modality OL Do on 16 April 2022 8th May 2022 th An extension must be applied for in writing by individual students and will only be granted for valid reasons. Late submissions will be marked for all grades but will incur a fine of MVR 250 per task(report & examination). Each report resubmission will be charged MVR 100 & re-sit/retake for examination will be charged MVR 250. Fathimath Naseem Internal verifier: Prof. Sandeep Sing Sikewar Assessor(s) please fill the table below AFTER the evaluation. Assessment criteria Task Maximum Marks 1.1 2 14 1.2 2 10 2.1 2 12 2.2 2 14 3.1 1 12 3.2 1 12 4.1 1 12 4.2 1 14 Total Marks 100 Assessor’s Name Marks Obtained IV Comments Signature Date __/__/__ This is the cover page for your assignment. Each task must have this cover page. A missing cover page will require you to resubmit the task and a fee of MVR 100 will be charged. Read the document titled “Additional Guidance on Assignments” for help on the general report format, general presentation format and referencing. Evidences required to achieve each criterion are given just below each criterion. End of cover page. Statement of Grades: Marks 85 & Above 75 to 84 65 to 74 50 to 64 Below 50 Page 1 Sama Abdul Majeed Representative Grade A* A B C F Grade Interpretation Higher Distinction Distinction Merit Pass Fail Bachelor’s Degree Year 1 Analyzing of Financial resources Heidelberg Cement Company Sama Abdul Majeed Bachelor of Business Administration Maldives Business School Date:08th May 2022 2500 Words Page 2 Sama Abdul Majeed Bachelor’s Degree Year 1 Abstract This Report seek to conduct to analyzing the various sources of finance available and propose of Financial resources Heidelberg Cement Company. And in this report, I have highlighted the sources of finance which are needed in the company and the effects of those identified sources. Moreover, identifying the cost difference of the different sources with the information needs of different decision makers at the company Page 3 Sama Abdul Majeed Bachelor’s Degree Year 1 Table of Contents ASSESSMENT BRIEF ................................................................................................................................ 1 Abstract .............................................................................................................................................................. 3 Introduction ................................................................................................................................................... 5 Sources of finance available to a business.................................................................................................. 5 The effects of the different sources of finance ............................................................................................ 6 Analyze the costs of different sources of finance ...................................................................................... 7 The information needs of different decision makers .................................................................................. 7 Conclusion ..................................................................................................................................................... 8 References ......................................................................................................................................................... 9 Page 4 Sama Abdul Majeed Bachelor’s Degree Year 1 Introduction Heidelberg Cement Company located in Germany is one of the world’s largest building material companies. In line with their global expansion and growth strategy they are planning to enter into Maldives due to the enormous growth in construction industry witnessed in last five years and with huge future potential with ever growing demand from housing sector. For the purpose of this report identifying and analyzing (Merashi, 2019) the various sources of finance available and propose the company which are the most suitable sources. Finance is a broad term that describes activities associated with banking, leverage or debt, credit, capital markets, money, and investments. Basically, finance represents money management and the process of acquiring needed funds. Finance also encompasses the oversight, creation, and study of money, banking, credit, investments, assets, and liabilities that make up financial systems. Importance of finance in business organizations Finance is one of the very subtle sectors of a business that can make or break entrepreneurs. Ideally, all companies need finances for daily operations, and this is what makes the concept of finance very important as an area for all organizations to cover. In South Africa especially, there is an underlying need to keep a business well financed and managed, in alignment with the economic development goals of the country. Here some of the reasons finance matters to business organization profit creation, operational expenses, asset creation, new products and markets and cashflow management. Sources of finance available to a business Period-based - The period basis is separated into three dub-divisions. Long-Term Funding — This long-term fund is used for a period of more than five years. The money is made up of preference and equity shares, as well as debentures and other debt instruments, and it is gathered from the capital market. Medium-Term Financing — These are short-term funds that last longer than a year but less than five. Borrowings from a public deposit, commercial banks, commercial paper, loans from a financial institute, and lease finance, among other things, are among the sources. Short-Term Funding — These are monies that are only needed for a year. These sources include commercial bank working capital loans and trade credit, to name a few. Based on Ownership - There are two types of financing available based on ownership. Owner's Fund — Also known as owner's capital, this fund is funded by the company's owners. Preference shares, retained earnings, equity shares, and other types of securities are used to raise cash. These are long-term capital funds that serve as a foundation for owners to gain control over the company's administration and operations. Burrowed Funds - These are funds that have been acquired over a period of time through borrowings or loans. This is the most prevalent and widely used source of capital among enterprises. Loans from commercial banks and other financial institutions, for example. Page 5 Sama Abdul Majeed Bachelor’s Degree Year 1 This source of revenue is divided into two groups based on generation. Internal Funding - The money were raised within the company by the owners. This example involves asset sales and retained earnings, among other things. External Source - The money comes from somewhere other than the company. For example, public issuance of stock shares, debentures, commercial bank loans, and so on. Disadvantages of these identified sources are 1. Higher interest rates The biggest drawback to a short-term loan is the interest rate, which is higher—often a lot higher— than interest rates for longer-term loans. The advantage of a long-term loan is a lower interest rate over a longer period of time. 2. Potential damage to credit score While repaying a short-term loan on time according to your agreed upon schedule can be a significant boost to your credit score, failing to do so can cause it to plummet. 3. Debt cycle If you have a problem with spending more than you can afford, taking out a short-term personal loan will only perpetuate the problem because you are short on cash. Advantages of these identified sources are 1. Quick payout If you are in the market for a short-term loan, chances are you need money fast. Luckily, a shortterm loan application can be approved in a matter of hours. 2. Opportunity for borrowers with bad credit Short term loan lenders do not put a huge emphasis on your credit history for approval. More important is proof of employment and a steady income, information about your bank account, and proving that you do not have any outstanding loans. 3. Flexibility Several types of short-term loans offer amazing flexibility, which is helpful if cash is tight right now but you anticipate things getting better financially soon. The effects of the different sources of finance Implication of sources Failure to use appropriate source of finance may lead to a firm being over-reliant on short term finance or on long-term debt. There are two main reasons for raising funds namely: Purchase of fixed assets, or the buying out of another firm. The need for more working capital: for debtors, stocks or cash, that is an increase in current assets. There are implications with the different source of finance. The least risky form of finance, the investor has the highest return for highest risk. The return at the discretion of the directors who can declare payment for dividend or hold back as retained earnings for further investment and development. Shareholders maximization wealth may be ignored to further development of the business. Financial and bankruptcy Page 6 Sama Abdul Majeed Bachelor’s Degree Year 1 Finance managers need to consider many factors when it comes to making the strategic finance choice between alternative sources of finance. All sources of finance serve the same purpose which is to fund business activity. And businesses can obtain their finance from a range of sources including internal sources of finance and external sources of finance. However, different sources of finance are used in different business situations. Effective financial management by managers is necessary for the successful daily running of a business, medium-term growth and long-term prosperity, profitability. This is important because when the business is unable to immediately repay its debts to creditors serious cash-flow problems emerge which may cause liquidation or even bankruptcy. Also, when the business is not profitable, it will not have any retained fund to grow. Therefore, managers must be fully aware that the strategic choice and control of finance will have impact on the firm’s financial performance. Hence, an effective business strategy must consider the various sources of finance to ensure there are sufficient funds to run the business organization in the short-term, medium-term and long-term. Analyze the costs of different sources of finance Impact of finance on Financial Statements Ordinary shares and preference shares – Increase the value of equity capital in the balance sheet. If the issued shares market price is greater than the nominal value of the share then share premium is also increased in the balance sheet. The number of shares issued is also displayed in the balance sheet and for preference shares the rate of dividend is also shown. The dividends paid to the shareholders are recorded in the appropriation account after tax is deducted from net profit. Debentures – Debt capital the value of debentures along with the rate of interest and the repayment date is presented in the equity and liabilities section of the balance sheet. The interest paid of debentures is reduced from profits before tax is charged. Bank overdraft –This appears in the balance sheet as a current liability since it is a short-term debt and has to be paid back within a year. The interest charges and bank overdraft fee if charged are deducted from the profit and loss account before tax is charged. Loan – Loans are long-term debts and therefore come under long-term liabilities in a balance sheet. The loan when displayed on a balance sheet will usually contain information about the repayment date and the interest charged on the loan. The interest is charged in the profit and loss account. The financial statement should be reliable, understandable, comparable and relevant. The information needs of different decision makers Heidelberg Cement’s target is to enhance the value of the Group through sustainable and resultoriented growth. Earning the cost of capital and achieving sufficient financial performance are the necessary prerequisites to generate returns for shareholders and guarantee the company’s permanent entrepreneurial ability to act, allowing it to invest in innovation and growth as well as in the development of its personnel and the company. Beyond our financial performance, we make our contribution to environmental protection and the development of society. In this respect, we are guided primarily by the expectations and requirements of the people and organizations we are in close contact with: Customers, Shareholders, Employees, Suppliers and other business partners, Society and general public and Company Page 7 Sama Abdul Majeed Bachelor’s Degree Year 1 In Heidelberg Cement’s new “Beyond 2020” Group strategy adopted in September 2020, we defined six areas on which we intend to focus: business excellence, portfolio management, people and organization, sustainability, digital transformation, financial strategy and capital allocation. Within the business organization there are two types of users of information. Internal users -Those who have direct bearing with the organization. managers and owners. to make business decisions, to facilitate financial analysis and formulate contractual terms between your company and other organization. current debt equity ratio vital in raising finance financial statements of other companies provide the appropriate guidelines for channeling resources. The Employees: Use for collective bargaining agreements and discussing promotion, rankings and salary hike. External users – any stakeholders or general public outside the organization. Institutional Investors: to assess the financial strength of your company. A long-term lender will always want to know the gearing ratio of a company while the short-term lender will want to know about the liquidity ratio of the business Financial Institutions. Raising finance, like in your situation to raise a loan you would need to produce the F.S. so that the bank can verify the liquidity and debt level in your company. Conclusion In Conclusion, a deep insight was developed about how to identifying and analyzing the various sources of finance available and propose the Heidelberg Cement Company. And Sources of finance is available from variety of sources but each source has its own cost and benefits. It is important to choose an appropriate and cheap source of finance for the smooth operation of the firm. There are important factors to consider when choosing a source of finance. Page 8 Sama Abdul Majeed Bachelor’s Degree Year 1 References Anon., 2015. ukessays. [Online] Available at: https://www.ukessays.com/essays/finance/the-different-sources-of-finance-and-thereimplications-finance-essay.php [Accessed 08 05 2022]. Anon., 2019. power finance texas. [Online] Available at: https://powerfinancetexas.com/advantages-and-disadvantages-short-termloans/#:~:text=The%20biggest%20drawback%20to%20a,a%20longer%20period%20of%20time. [Accessed 04 05 2022]. heidelbergcement, n.d. heidelbergcement. [Online] Available at: https://www.heidelbergcement.com/en/strategy-and-targets [Accessed 08 05 2022]. Kurt, D., 2022. investopedia. [Online] Available at: https://www.investopedia.com/ask/answers/what-is-finance/ [Accessed 08 05 2022]. Merashi, A., 2019. thesmallbusinesssite. [Online] Available at: https://www.thesmallbusinesssite.co.za/2019/03/25/importance-finance-businessorganizations/ [Accessed 08 05 2022]. (Kurt, 2022) (Anon., 2019) (Anon., 2015) (heidelbergcement, n.d.) Page 9 Sama Abdul Majeed Bachelor’s Degree Year 1