Inflation: Definition, Types, Impacts & Control Policies

advertisement

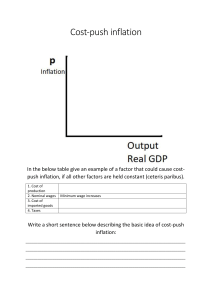

Inflation Inflation is defined as a sustained increase in the general price level. Now, two things should be noted in this regard. Firstly, inflation describes the situation of rising price level. If the general price level remains to be stable at a high level without having any occurrence of increase in price level, the situation will not be considered to be an inflationary situation. Again, if the price level slightly rises from a low level to slightly a high level, although there happens to be a slight increase in price level, it will be said that inflation has occurred. Secondly, inflation does not imply that the prices of all goods and services are rising without exception. Since a large number of different categories of goods and services are produced in an economy, it may happen that prices of some goods and services are falling at some point of time. However an inflationary situation describes an upward trend in the aggregate (general/average) price level. That is if there happens to be an increase in the average price level (despite of the fact that prices of some commodities have fallen), it will be regarded as an inflationary situation. Just in the opposite manner, if there happens to be a fall in the aggregate price level, the situation will be regarded as a deflationary situation. Inflation is calculated as the weighted average of the prices of different commodities. In this regard, the two mostly used measures are Consumer Price Index (CPI) and GDP deflator. The inflation rate can be expressed as the percentage change in the general price level, that is, 𝝅𝒕 = 𝑷𝒕 −𝑷𝒕−𝟏 𝑷𝒕−𝟏 × 𝟏𝟎𝟎 Demand-pull and Cost-push inflation: In Economics, we broadly talk about two types of inflation, namely, the demand-pull and the cost-push inflation. Demand-pull inflation is caused by the pressure of excess demand in the market. From the basic microeconomic theory, it is already known that the price of any commodity is determined from the intersection (equality) of the demand and supply. If there develops a situation of excess demand, it puts an upward pressure on price. This simple microeconomic logic can be extended to the context of macroeconomics also. In a macroeconomic sense, the aggregate price level in the economy is determined from the intersection (equalization) of aggregate demand (AD) of goods and services and aggregate supply (AS) of goods and services. So, if the AD exceeds the AS, there will be an upward pressure on the aggregate price level. This type of inflation (increase in price level) is called the demand-pull inflation. Demand-pull inflation is illustrated in the below figure. Initially, equilibrium was taking place at point E where the aggregate demand curve DD0 and the aggregate supply curve SS intersected each other. Correspondingly, the price level was OP0. Now because of any demand-pull factors (such as increase in the population or national income in a country) the AD curve shifts rightward from DD0 to DD1. Now, given the supply curve SS, there happens to be an increase in price level from OP0 to OP1. In this case, inflation stops only when the aggregate price level reaches the equilibrium shown by F. On other hand, if there appears to be increase in the cost of production because of say, increase in the prices of inputs/raw materials, according to the microeconomic theory, supply curve would be shifted leftward. This implies, the suppliers are ready to supply the same quantity at a higher price than before. This in effect causes a reduction in equilibrium output. Now, if this microeconomic concept is extended to the field of macroeconomics, it can be clearly pointed out that any increase in the cost of production will cause a leftward shift in the AS schedule. And as an immediate consequence, the aggregate level of output will fall and the aggregate price level will increase. Since this type of inflation is caused by an increase in the cost of production, this is known as cost-push inflation. Cost-push inflation is depicted in the below diagram. The initial equilibrium was taking place at point A where the demand curve DD0 and the supply curve SS0 intersected. Now if the cost of production rises due to increase in wages of the workers and/or due to increase in the costs of raw materials and/or due to imposition of sales tax or excise duties by the govt., the sellers would not be willing to sell the same quantity at the previous price level. Thus the same quantity will be sold a higher price than before. This implies the supply curve will be shifted upward. Therefore, given the unchanged AD, the equilibrium price level would be rising. This upward increase in price level due to supply side factors can be regarded as the cost-push inflation. In the figure, the suppliers will be willing to sell the OQ0 amount of quantity at a much higher price causing the supply curve to shift upward from SS0 to SS1. As a result, the equilibrium price will rise from OP0 to OP1. Impacts of inflation: (i) (ii) Fall in real income: Real income defines the purchasing power of money income. This can be expressed as – Real income = Nominal income / price level. Now if there happens to be a sustained rise in the price level causing inflation, there would be a fall in the real income for the given nominal (money) income of the fixed income groups. In this way, inflation affects workers, salaried employees and also the pension beneficiaries. Inequality in the distribution of income: Inflation causes an increase in the profit incomes of business men and entrepreneurs, but it chokes off the real income of the salaried people. So inflation also has a contribution in raising inequality in the distribution of income and wealth. (iii) Upsets the planning process: Inflationary pressure upsets the entire planning process in an economy. When the prices of goods, materials and factor services increase continuously, then more money needs to be spent up for the completion of any investment project. If sufficient financial resources are not raised by the government, plan targets are to be curtailed. (iv) Adverse effect on capital accumulation: If the inflation lasts for a prolonged period causing sustained decline in the purchasing power of money, people will find it more preferable to hold goods and services compared to money. Because they would fear that the purchasing power would money will be continuously falling in the future. This, in effect, will cause people to have immediate consumption instead of consumption in future. So, their desire to save will be reduced. At the same time, their ability to save will also be reduced as given their nominal (money) income; they need to spend more on their preferred baskets of goods and services. When both ability and willingness to save get reduced, smaller amount of fund will be available for investments. Therefore, the process of capital accumulation will be adversely affected. (v) Increase in speculative investment: As the price level tends to rise, people may express their desire to make investment on purchasing shares, land etc for gaining some quick profits. Even though this can help in the growth process, but it cannot really create productive capital in the economy. (vi) Lenders will lose: In case of loan contract, inflation causes a loss to the lenders and gain to the borrowers. Because as the purchasing power of money is falling, the money received by the lenders will be of lesser value. (vii) Adverse effect on export income: If inflation causes an increase in the prices of export items, then the demand for export items may fall in the foreign market casing a fall in export income for the domestic country. (viii) Greater tendency of hoarding: Some dishonest businessmen may hoard essential commodities at the time of inflation in order to create artificial crisis in the market and thereby they earn quick profits. Inflation control policies: In order to control inflation, it is important to know what the reason behind inflation is. Inflation can occur from the excess demand situation arising in the commodity market (known as the demand-pull inflation) and from the lack of supply in the market due to increase in costs of production (known as the cost-push inflation). These two types of inflation cannot be controlled by the same set of policies. Demand-pull inflation can be controlled by reducing the pressure of aggregate demand (AD) in the economy. This is done in two ways – 1. Monetary policies This kind of policies talks about controlling the supply of money in the economy and thereby reducing the pressure of inflation. Now, the supply of money can be reduced in many ways. It can be reduced by withdrawing the paper notes and coins from circulation. But usually this kind of step is not taken as the major portion of money supply consists of bank deposits or bank credits. So, the government more focuses on restricting the flow of credit in the economy utilising its various credit control measures – (i) Bank rate: The bank rate refers to the discount rate at which the central bank rediscounts the bills of exchange submitted by the commercial banks to take loans from the central bank. In India, it indicates the interest rate at which the commercial banks borrow credit money from the RBI. So, bank rate is the cost of borrowing credit money from the commercial banks. During the period of inflation or upswing in economic activities, the central bank raises bank rate. An increase in bank rate causes the commercial banks to take fewer loans from the central bank as it would be more costly for the commercial banks to take loans from the central bank as they need to pay high rates of interest. So, when the commercial banks will give loans to the public, they will again charge high rates of interest. So, increase in bank rate also causes an increase in market interest rate, hence people will also be taking lesser loans. As a result, supply of credit money will be reduced and this will cause a reduction in aggregate demand also. (ii) Open market operations: This refers to the purchase and sale of government securities or treasury bills in the open market by the central bank to the non-bank public, or the commercial banks or the non-bank financial institutions. During the period of inflation or upswing in economic activities, the central bank sells the securities in the open market. This causes the commercial banks to lose their excess reserves. So their credit creation capacity gets reduced. And thereby by controlling the volume of credit the central bank helps to reduce the pressure of aggregate demand in the economy. (iii) Cash reserve ratio: Each and every commercial bank has to maintain a stipulated proportion of their total deposits as the required reserve with the central bank. This proportion is known as the cash reserve ratio (CRR). During the periods of inflation, the central bank raises the CRR. This causes a fall in the credit creation capacity of the commercial banks and therefore, the total volume of credit in the economy gets reduced. (iv) Statutory liquidity ratio: Along with CRR, the commercial banks also need to maintain a given portion of their total liquid assets with the central bank. This is known as SLR. During the phases of inflation or economic boom, the central bank raises the SLR to reduce the volume of credit and thereby the money supply in the economy. 2. Fiscal policies Fiscal policy refers to the government’s policy instrument of changing the tax rates and government expenditure in order to control the economy. In order to control the inflationary pressure, government can either increase the tax rates or can reduce the government expenditure. An increase in tax rate would be causing people to have lesser amount of money in their hands. So they will be cutting down their consumption expenditures. As a result, the AD will also go down and thereby reducing the inflation. On the other hand, a reduction in government expenditure can take place through reduction in government transfer and subsidy payments (for instance, pension, unemployment benefits, fuel subsidy etc) and will also cause a reduction in AD as government expenditure is one of the major determining factors of AD. With a fall in the AD, the inflationary pressure in the economy can also be reduced. These polices of cutting government expenditure or raising the tax rates are known as contractionary fiscal policies as they reduce employment and income opportunities in the economy. Now, as mentioned earlier the above measures are typically implemented for controlling demand-pull inflation. In case of the cost-push inflation, there are some direct measures such as – (i) Direct control: It refers to the measures such as wage freeze, putting upper limits on the prices of imported inputs such as electricity, coal etc. (ii) Other measures Under this category, one can mention the policies such as augmenting the supplies of commodities in the domestic market by increasing imports, increasing domestic production etc. But it should be kept in mind that if the imports exceed the exports, then the country will face BOP deficit which is not desirable for the economy.