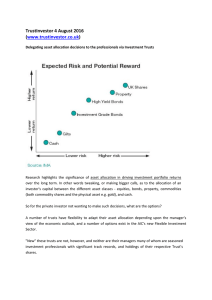

Risk and Return- SML Importance of diversification: portfolio diversification is the investment in several different asset classes or sectors; diversification is not just holding a lot of assets; having 50 stocks that span 20 different industries mean you are diversified; diversification can substantially reduce the variability of returns without an equivalent reduction in expected returns; this reduction in risk arises because worse than expected returns from one asset are offset by better than expected returns from another Systematic x unsystematic risk o Total risk = systematic + unsystematic o Systematic: risk factors that affect a large number of assets; also known as nondiversifiable risk or market risk; includes such things as changes in GDP, inflation, interest rates etc.; diversification does not eliminate this; there is reward for bearing risk o Unsystematic risk: risk factors that affect a limited number of assets; also known as unique risk and asset-specific risk; includes such things as labor strikes, part shortages, etc; can be eliminated by combining assets into a portfolio; is specific to the firm o Measuring systematic risk you use beta: A beta of 1 implies the asset has the same systematic risk as the overall market. A beta < 1 implies the asset has less systematic risk than the overall market. A beta > 1 implies the asset has more systematic risk than the overall market Capital Structure Theories Modigliani and Miller Irrelevance Theory (1958): suggests that capital structure will not determine the firm value, debt-equity ratio is not relevant to determine WACC, has two assumptions- no corporate taxes, no bankruptcy costs; graph is horizontal straight line Modigliani and Miller Tax Shield (1962): interest is tax deductible; the WACC decreases as the debt-equity ratio increases; has two assumptions-corporate taxes, no bankruptcy costs; this theory suggest that taking more debt reduce their tax burden, therefore increasing the firm value; graph is positive slope for debt tax shield and straight horizontal for no taxes Static Theory: interest is tax deductible; however as debt-equity ratio increases the probability of bankruptcy increases as well increasing your cost of debt; the additional benefit associated with the interest tax shield will be offset by the increase in bankruptcy costs; two assumptionscorporate taxes, bankruptcy costs; graph is a mix of both ^ Find Optimal Capital Structure Levered beta: reflects the financial leverage due to choice between debt and equity financing Unlevered beta: the beta a company would have if it had no debt, used to estimate the cost of equity at different capital structures; a measure of a firm’s “basic business risk” Investment Companies: Types of Investment Companies o Mutual funds: regulated investment products offered to the general public; can’t make high-risk investments; fund managers are required to report their holdings quarterly; they can be both passively or actively managed by fund mangers o o o o o o Open-end: are most common; dominate asset holdings; stand ready to by (redeem) or sell their shares at NAV; no limit to the number of shares issued Closed-end: have a fixed number of shares outstanding like any publicly traded corporation; shares are traded and priced in the market; may sell at a premium or (more often) at a discount to NAV (sometimes as much as 10%) Exchanged trades funds (ETF’s): first introduced in 1993 had tremendous growth since then; shares traded on organized exchanged like closed-end funds; have a unique creation and redemption feature that prevents large premiums or discounts from the NAV; redemption in form of stock portfolio; most track a stock index; low expense ratios, ease of buying/selling, and ease of tracking prices Hedge funds: not considered investment companies; according to SEC they are exempt from registering as investment companies; not highly regulated; not “safer” investment alternatives; carry higher risk than traditional investments; typically only available to “sophisticated investors” (qualified investors) and target high-net worth individuals, and institutional investors; pay managers based on their performance; typically have a “2 and 20” fee arrangement; considered an alternative investment vehicle that use a variety of methods such as short-selling, leveraged positions, other speculative strategies to earn a return that outperforms the broader market; Largest Hedge Fund Investors: Pension Funds, Sovereign Wealth Funds, Central Banks, University Endowments, and other institutional investors Private equity funds: designed to invest in private firms (non-public firms); offered to sophisticated investors Leverage Buyouts - Often referred to as "going private" transactions, funds acquire public firms that become no longer publicly traded. Venture Capital - investment in very early-stage of the firms (Startups). For example, Angel Investing, Seed-stage, Early-stage financing, or Later-stage (before IPO) Development Capital - investment in solid private firms that need financing for business expansion Distressed Investing - investment in troubled companies Real estate investment trusts (REIT): investment fund selling shares and investing in real-estate related assets Mortgage REITS, which invest primarily in Mortgage – similar to fixed income investments Equity REITS, which invest primarily in commercial or residential properties – similar to direct equity investment Passive Funds: or index funds, managers attempt to match the return from a particular market index, such as the S&P500 index. Funds track a specific benchmark Managers don’t have to worry about selecting stocks or bonds that they believe will outperform the market or reduce the risk of their portfolio. Therefore, these funds typically offer very low fees Active Funds: in an actively managed investment funds, managers attempt to outperform a specific benchmark. Managers select stocks or bonds that they believe will outperform the benchmark. In case, funds usually have a performance fee which is a percentage of funds’ outperformance relative to the benchmark. Compute NAV: value of shares is net asset value; (NV assets – Nv liabilities)/# of shares Compute value of redemption: redemption amount = initial investment x (1 + annualized returns)^#of years x ∑(1+ annual fees)^#of years Fund Strategy and Risk: Income funds: seeks to obtain higher equity income by investing in stocks with relatively high dividend yield; seeks a balanced return consisting of both capital gains and current income Growth funds: the investment goal of a growth fund is capital appreciation; seeks a balanced return consisting of both capital gains and current income Aggressive growth funds: seeks speculative investments that strive for big profit from capital gains Corporate bond funds: invest in the debt issued by corporations; usually hold investment grade bonds High-yield bond funds: invest in non-investment grade bonds, with higher default risk, which results in higher promised yields Money market mutual funds: invest in very liquid, short-term assets whose prices are not significantly affected by changes in market interest rates (short duration)