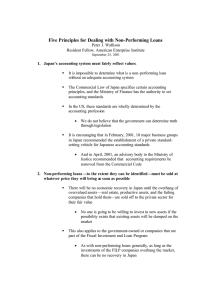

DETERMINANTS OF NONPERFORMING LOAN IN AN ECONOMY Research Topic Determinants of the Non-Performing Loan in an Economy Course Name: Research Methodology Course Code: 4105 Prepared for Md. Atiqur Rahman Assistant Professor Department of Accounting & Information Systems Jahangirnagar University Prepared by Group Number: 01 (ID ending with 0) Serial No. 1 2 3 4 5 6 Name Mostarina Khandaker Arpita Karmaker Md. Fayshal Hossain Nawshad Md. Abid Arif Md. Kayes Ahamed Shaon Md. Akramuzzaman Moon Date Of Submission: October 30, 2022 BBA 8th Batch Department of Accounting & Information Systems Jahangirnagar University i ID No 1570 1580 1600 1610 2040 2610 Acknowledgement of Individual Tasks Completion Group 01 Serial No Chapter Name Name ID No. 1 Abstract Md. Abid Arif 1610 2 Introduction Arpita Karmaker 1580 Md. Abid Arif 1610 Mostarina Khandaker 1570 Md. Kayes Ahamed Shaon 2040 Md. Fayshal Hossain Nawshad 1600 Md. Akramuzzaman Moon 2610 3 Literature Review 4 Research Methodology 5 Findings from the Data 6 Data Interpretation and Discussion 7 Conclusion ii Signature Abstract This report is conducted to find out the possibilities of opening new paths that describe the economic states of countries, and how they are influenced, affected or manipulated through macroeconomic determinants. In this report, we have tried to find out the impacts of different variables on non-performing loans based on different economies of the world. We have selected GDP growth rates, unemployment rates, real interest rates, inflation rates and corruption control scores as key determinants of non-performing loans. This report is prepared based on the secondary dataset of 70 countries. For data analysis, the most accessible tool we found was Microsoft Excel. For primary analysis of the report, we have used descriptive statistics, correlation matrix and ordinary least squared (OLS) regression output. We found some extreme values that form biasness in the entire output of the report. We have tried to come up with results that are significant and unique to the purpose. The dataset we have used is not sufficient. We were only able to use the data from 70 countries which might not represent the entire world economy. In the dataset, countries’ names were missing which was not helpful to indicate a specific area's economy. We could use only five determinants of NPLs. Other determinants could show a bigger picture. Insufficient access to analysis tools and dataset restricts greater findings of the report but leaves an opportunity for further research. Keywords: Non-performing loans, GDP growth, Unemployment, Inflation, Real Interest Rates, Corruption Control Score iii Table of Contents Abstract .......................................................................................................................................... iii Chapter 1: Introduction ................................................................................................................... 1 1.1 Background of the Research Topic ....................................................................................... 1 1.2 Research Rationale................................................................................................................ 2 1.3 Aim of the Research.............................................................................................................. 3 Chapter 2: Literature Review .......................................................................................................... 4 Chapter 3: Research Methodology.................................................................................................. 9 3.1 Research Purpose .................................................................................................................. 9 3.2 Research Theory Building .................................................................................................... 9 3.3 Research Methodology ......................................................................................................... 9 3.4 Research Instruments .......................................................................................................... 10 3.5 Sampling ............................................................................................................................. 10 3.6 Data Collection Resources .................................................................................................. 10 Chapter 4: Findings from the Data................................................................................................ 11 4.1 Samples and Data Collection .............................................................................................. 11 4.2 Study Variables ................................................................................................................... 11 4.3 Dependent Variable ............................................................................................................ 11 4.4 Explanatory Variables ......................................................................................................... 11 4.5 Conceptual framework ........................................................................................................ 14 4.6 Econometric framework...................................................................................................... 14 Chapter 5: Data Interpretations and Discussion............................................................................ 16 5.1 Descriptive statistics ........................................................................................................... 16 5.2 Correlation matrix ............................................................................................................... 17 5.3 Ordinary Least Squared (OLS) Regression Output ............................................................ 18 iv Chapter 6: Conclusion................................................................................................................... 22 6.1 Recommendation ................................................................................................................ 22 Appendices .................................................................................................................................... 24 References ..................................................................................................................................... 25 v Chapter 1: Introduction 1.1 Background of the Research Topic The goal of the study is to thoroughly assess the macroeconomic variables that have a substantial impact on non-performing loans. A nonperforming loan is in default because the borrower has failed to make the necessary payments for the stipulated amount of time (NPL). Even though the specifics of nonperforming status may vary based on the conditions of a certain loan, it is generally known that no payment means that there have been no payments of that particular principal and interest. Nonperforming loans frequently occur for several reasons, such as inadequate financial management and supervision, a lack of urgency on the side of lenders, a frail legal system, and a dearth of effective debt-resolution strategies. As noted by Fajar & Umanto (2017), a loan is declared non-performing when at least 90 days have passed without either the principal or the interest being paid. Furthermore, Ghosh (2015), discovered that loans are no longer able to "undertake" or accrue interest when they are routinely past due for more than 90 days. On the other hand, non-performing loans are those for which the banks are unable to collect the whole principle or interest, most often by the dates provided, and for which there is no probability that settlement will occur soon. But this research is based on the IMF's notion of NPLs. Additionally, due to the high inflation rate, shaky fiscal and monetary policies, and growing bank exposure to credit risk, which threatens financial stability, and economic activity. Since rising NPLs have a direct effect on the whole banking system, they are regarded as a significant proxy for credit risk. The NPLs ratio is one of the strong markers of the start of the financial crisis since it significantly undermines general economic stability by reducing loan expansion. An increasing NPLs ratio is an indication of a financial system that is vulnerable, whereas a declining NPLs rate is a sign of sound finances. As per the idea of Sthembiso Msomi (2022), High NPLs hurt each country's commercial banks as well, which ultimately puts the system as a whole and the country's infrastructure at risk due to the commercial banks' concentrations up to credit risk. Undoubtedly, a steady increase in NPLs hurts financial efficiency. Consequently, the possibility of a banking crisis is raised. More specifically, NPLs lessen investment opportunities, limit interest income, and exacerbate the financial collapse that is 1 primarily to blame for an economic system's failure. To ensure economic and financial stability, it is necessary to identify the factors that influence NPLs. According to the analysis conducted by Beck et al. (2013) even though the global financial system experienced the Global Financial Crisis (GFC) in 2007–2008, the major recession primarily hit the United States, countries in the EU nations, Latin American nations such as Argentina, and some countries in Africa. An analysis of the EU28 nations from 2000 to 2013 by Chaibi (2016), found that fiscal consolidation results in a large budget surplus rather than a low budget deficit, which hurts bank portfolios. The study also found a strong positive correlation between NPLs and both the unemployment rate and the budget of government. Khafid et al. (2020) investigated the macroeconomic implications of non-performing loans on the quality of bank portfolios between the debt economies of France and Germany between the years 2005 and 2011. showed a link between the rate of inflation and non-performing loans that were negative, although Singgih et al. (2014) found a negligible positive correlation between the two among the nations that make up Europe. 1.2 Research Rationale According to the authors' understanding, numerous in-depth studies have been undertaken that have looked at the factors that influence non-performing loans across the globe, but none of them has included corruption control score as a contributing factor. The claim explains that this region's financial market differs significantly from that of other nations since it does not suffer from the same problems with corporate governance and financial inclusion that other developed and growing nations do. The study's remaining organizational structure consists of the following. In the literature review section, the research methodology describes the purpose of the research, sampling strategy, and data sources. After that, empirical studies of the macroeconomic factors that influence nonperforming loans are discussed. Incorporating data sources and research variables, creating hypotheses, demonstrating the econometric framework, and talking about analytical methodologies are all covered in the methodology section. While the conclusion part brings the investigation to a close, the results section presents the findings and evaluates them. 2 1.3 Aim of the Research It is feasible to ascertain the important causes of the issue and identify a solution by researching nonperforming loans. This study will assist banks and other local lenders in comprehending how the macro environment affects a nation’s and the global economy, enabling them to take action. Additionally, it would help the borrowers understand how nonperforming loans are a drawback to a robust financial system. In particular, research on nonperforming loans covers a country's whole macroeconomic system. 3 Chapter 2: Literature Review The purpose of the chapter is to bring about the determinants that influence non-performing loans in an economy. In this chapter, we try to investigate the drivers that influence the non-performing loan rates in the banking sectors, and the challenges and limitations from the previous books and journals. As noted by Dewailly (2019), among them, a few thoughts have been conducted on the issuance of credits, the NPL and the comparative default rate. The text is divided into three sections: The main focus of the work has been on describing the NPL using a credit mechanism to highlight the role of macroeconomic variations, administrative excellence, and political decisions. The following section of the article that analyzes the connection between NPL and macro-financial conditions shows that NPL has a favourable impact on the risk of crisis and, thus, highlights the critical role that NPL plays in foreseeing financial emergencies or bank crises. The third area of literature focuses on explaining or forecasting the NPL at a broad scale. These summaries may refer to the entire requirement of credits in one economy or specific categories of credits. Practically speaking, there is no worldwide consensus on what constitutes non-performing loans. According to Nichols & Shibut (2021), non-performing loans (NPLs) are quantities of borrowed money for which the borrower has not made all of the agreed-upon instalment payments for at least 90 days. A nonperforming credit is in default or extremely near to it. Once a credit becomes nonperforming, it is believed to have a much lesser chance of being fully repaid. Though the borrower resumes making payments on a nonperforming advance, the loan becomes a performing loan even if the debtor has not made up all of the past-due instalments. According to Manz (2019), There is noteworthy observational proof concerning the anti-cyclical behaviour of the NPLs. the common clarification is that higher genuine GDP development ordinarily interprets into more income which moves forward the obligation serving capacity of borrowers. The findings are consistent with Tanasković & Jandrić (2015), when there's a deceleration, within the economic level of NPLs is likely to extend as unemployment rises and borrowers confront more noteworthy challenges to reimburse their obligation. As per Pesola (2007), An increase in genuine GDP development leads to a decay in nonperforming loan ratios. Slack in GDP development moreover essentially influences NPL development but with a positive sign. This finding loans bolster the idea that bank resource quality 4 breaks down with slack in reaction to positive development due to free credit guidelines connected amid the boom period. At the same time, the by and large effect of GDP development (the whole of the lagged and the contemporaneous coefficient) is negative as anticipated. Typically, a decay in financial movement tends to influence non-performing advances with a time slack of a few quarters. According to Klein (2013), unemployment encompasses a positive effect on NPLs. The common thought is that an increment in the unemployment rate diminishes the acquiring control of families. For example, they are incapable to meet their obligation commitments. According to Ahmed et al. (2021), Today’s economy is characterised by an intense population, high vulnerability to natural disasters and floods, and highly fluctuating political stability. Indeed, if the proportion of NPL doesn’t influence straightforwardly inflation, it influences the loaning arrangement of the banks, such that it is an imperative determinant of the transmission component and is likely to affect the last reaction to changes within the intercession intrigued rates. Regarding particular variables chosen for the return on resources, the change in credits and the credit loss savings to add up to the loan ratio, the macroeconomic parameters include the GDP growth rate, unemployment rate, and real interest rate. After reviewing the previously published journals and books, we discovered that there is a negative correlation between the NPLs and the rate of GDP growth, the productivity of bank resources, and, most notably, the unemployment rate, the amount of credit loss savings that add up to credits, and the real interest rate. The reduction of NPLs can be a crucial requirement for advancing financial growth. The findings of Mileris (2014) disclose that when NPLs retained permanently, these will affect the assets that are encased in unprofitable areas. Hence, NPLs are likely to obstruct financial development and decrease financial proficiency. The stuns to the monetary framework can emerge from components particular to the company or macroeconomic variations. In common, we found that the developed economies have affirmed that macroeconomic conditions influence credit chance. According to Magdalinos & Tsakalos (2021), the integration of non-performing advances and their determinants has greatly expanded since we experience more distributed information at the bank, nation, and total keeping money framework level. The outcomes are about uncovering profitable experiences that approximate the quality of advanced portfolios and the delicacy of banks. The driver of components that influence money-related defencelessness may be a cause of 5 contradiction due to the uncontrolled increment of problem credits. Numerous analysts consider NPL as “financial pollution” with hurtful effects on both financial advancement and the economy. There is another factor that plays a role in affecting bad debt. Meaning that, if there is a positive effect of interest rates on bad loans, this results in a climb up in the debt due to the increase in payments of interest rate. As a result, the amount of non-performing loans rise. The real interest rate is one of the crucial factors driving the non-performing loans down. And there is a wife of interest rates the volume of net loans also increases. As a result, it makes the payment of loans more expensive and difficult. Eventually, this triggers the borrowers to go incapable of paying loans in time as it increases the burden on the borrower. Castro (2013) showed an argument that mentioned about economic growth and real interest rates are crucial determinants of non-performing loans in sub-Saharan countries of the African continent. He showed the interconnection of doubtful loans with the macroeconomic factors in an environment that represents an undiversified culture. Kocisova & Pastayriková (2020) appeared with evidence that GDP growth, credit conditions and real interest rates can be explained by the rate of non-performing loans. Suzuki & Miah (2017) sought to identify the factors that contribute to non-performing loans in various nations. They came to the same conclusion. Due to the real effective exchange rate, they discovered the reverse effect on damaged loans. These findings imply a negative relationship between GDP growth and non-performing loans. It eventually causes the amount of non-performing loans to decline. The findings also showed that wine banks have high anticipation of acquiring defective loans and give out too many loans at high-interest rates. Kennedy (2021), who employed a dynamic panel of 80 nations, concluded that higher interest rates and weak economic development both contribute to an increase in non-performing loans. The link with non-performing loans is improved by the effective interest rate. For further research, Mitchell (2019) used panel data from 75 countries, stock prices, foreign currency exchange rates, real GDP growth and lending interest rate and found a significant effect on NPL ratios. Based on the research they stated that they were able to have a sufficient amount of empirical evidence that interprets the anticyclical behaviour of non-performing loans. Commonly, all the studies directed by these researchers reach a similar conclusion that nonperforming loans are likely to rise when there is a drawback appears in the economy. Like the other factors that influence net-performing loans, the effect of real interest rates is also significant. 6 While GDP growth, unemployment problems and real interest rates play roles as important determinants of affecting the amount of non-performing loans, other factors also need to come into consideration that is associated with this loan crisis. As a purpose of the report, we have tried to bring the idea of decreasing the value of the currency of a country. In an economy, inflation is a common factor that affects the monetary value of its currency. The effect is commonly adverse. Currency depreciation can have a particularly negative and unfavourable effect on the economy when out of the total loans, there is a large amount of money from foreign countries. Studies by Qianying (2017) show that providing loans in countries in foreign currencies to unhedged borrowers might increase non-performing loans. The reason is they earn money typically in local currency so it gives rise to more difficulties for borrowers to pay their debts. On the other hand, in countries that have little mismatches of their local currencies, faceless depreciation and they are it might lead to an increase in their export activities and volumes resulting in considerable improvement in the financial position in the corporate sector and also reducing non-performing loans. According to Shkodra & Ismajli (2017), the effect of inflation on debt is equivocal and ambiguous. When the inflation rate is higher, it can decrease the real value of debts making the loan services easier but at the same time, it can also decrease the actual income of the borrowers and make their wages sticky. Peek et al. (2000) say that, when debt rates vary in countries with higher inflation rates, it can increase the real interest rate resulting from the country's monetary policies. The final determinant affecting non-performing loans to be discussed in this report's literature is the corruption control score. The few studies online have investigated the impact of corruption control of a country on its non-performing loans. Empirically investigated the relationship between non-performing loans and corruption. One of the researches conducted by Gorter et al. (2001) pointed out that when legal institutions enforce legal contracts, a triggers the willingness of the financial institutions to lend more. The reason behind this is the financial institutions are ensured that there will have the legal power to take action against the borrowers to recover the credit amounts using legal powers in case the debtor go defaults. On the other hand, the corruption inside the financial institutions cast the uncertainty of the imposition and payment of legal contracts and on recovery of debited money. 7 Used panel data from 129 countries over 25 years. Their studies showed the strength of the legal protection rights of the creditors. They classified their data: as rich countries and poor countries. They found different results in a different types of countries. The wealthy country possesses strong legal protection rights wherein the poor countries, the creditors have almost no or weak legal protection rights. Extended studies done by Avetisyan (2019), found that strong legal protection rights keep the amount of non-performing loans low. Poor countries where the legal system is weak and vulnerable tend to take advantage of the corrupted system and avoid loans. It is also found that countries that have lower corruption control scores have higher non-performing loans. These studies are an indication that a strong legal system can in hands a firm's market competition and reduce the lending activities derived from corrupted intentions. 8 Chapter 3: Research Methodology 3.1 Research Purpose Towards finding ambiguity of the determinants of nonperforming loans and creating scope to convert those uncertainties into opportunities we are following the exploratory and conclusive pattern of the research type here. As the nonperforming loan is something that seems already turned defaulted or is close to being defaulted, there is less possibility of getting the interest or the principal amount back, according to Khafid et al. (2020). Through exploratory research and conclusive feature, any financial organization will be able to clarify the absolute determinants of nonperforming loans and the way to find a new opportunity to collect those amounts by developing new agreements over its business environment as per the idea of Qianying (2017). And following the liquidity ratio, capital adequacy ratio, bank credit, and return on assets scenario the organizations may their requirement in that agreement. This will lessen the uncertainty of those borrowed amounts at a large margin and that’s the purpose of this assessment. 3.2 Research Theory Building The exploratory pattern doesn’t provide anything conclusive. So, the further research approach is quite mandatory. In that case there for ensuring the amount which has been quite announced as default, the organizations have to ensure the proper development of new thoughts and concepts. And Deductive and Inductive are the results of that need. Singh (2020)conducts that Here for the dataset Deductive build-up will show a specific, true feature against a no-responding scenario. And Inductive reasoning establishes a general proposition based on the observations and this also will help to reduce the loss of a huge amount from nonperforming or standby figures. 3.3 Research Methodology The way that researchers follow to go through their proceeding of collecting, analyzing, and interpreting data is called the research approach. Generally Qualitative, Quantitative, and Mixes these three approaches are followed around. For this assessment, we went for the Quantitative approach and a concern checkout at those data. As per the findings of Chiorazzo et al. (2017), as with the increases in the number of data sets, there is a high chance to get the result at a more accuracy. And here with more and more data about the intention of not being tended to repay the loan amount, just being defaulted, or close to defaulting conquer a great solution to reduce the uncertainty about interest income and the principal figure. 9 3.4 Research Instruments There was descriptive analysis, Correlation, Regression, etc. of those data all around. The descriptive analysis part features a genuine view of the total impact on the bank or a business organization and other parts of society. As conducted by Ahmad & Ariff (2008) that correlation sets the connection and impact on one another where being defaulted seems a great loss in the long run. And regression is there to identify which variables have an impact on a topic of interest. 3.5 Sampling Here the Random Sample is taken from 70 countries’ data about Non-performing Loans, Unemployment Rate, GDP Growth Rate, Corruption Control Score, Real Interest Rate and Inflation Rate. 3.6 Data Collection Resources Here the information is the secondary basement. A secondary way of collecting data is the process of using a support that helps to collect data. The data are collected from a financial report of a bank but are not physically present in their environment. The data have been taken from their website. So, this is via information that constructs the structure of the secondary data collection process. 10 Chapter 4: Findings from the Data 4.1 Samples and Data Collection For a certain period, the article evaluates 70 developing countries. The information was gathered from official websites and websites that give these statistics for several foreign banks. To analyze the outcomes, a panel data technique is utilized. Data, where entity behaviour is tracked over time, are the subject of panel data analysis. Finding patterns in data gathered from many sources and over time is the fundamental goal of panel data analysis. An imbalanced panel data set is used to account for the structural breakdowns in part of the data. Within this time frame, it is analyzed how the independent variable has changed both before and mostly during the financial crisis. 4.2 Study Variables This study takes five macroeconomic factors into account to assess the non-performing loans in these 70 nations. Based on empirical research that significantly affects NPLs that was reviewed in the literature review part, all the study's factors were chosen. The selection of these variables was made to determine if non-performing loans in these nations are causally related to GDP, unemployment rate, inflation, real interest rate, and corruption control score. 4.3 Dependent Variable The amount of borrowed money on which the borrower is unable to make their instalments for at least 90 days is represented by the non-performing loans (NPLs) ratio, according to Khafid et al. (2020), which serves as the dependent variable in the study. When the planned payment is passed late and is no longer anticipated to be made soon, advances and instalment loans cease to be performing. NPLs are the key component for calculating loan loss as a result. This study uses the non-performing loans ratio as a measurable variable and as a stand-in for credit risk because it assesses the bank's financial stability, credit portfolio management, and capital adequacy. 4.4 Explanatory Variables As explanatory variables, the GDP growth rate, unemployment rate, corruption control score (WGI), inflation rate and real interest rate are all taken into consideration. Numerous studies conducted by a large number of scholars focused on the elements that determine NPL based on either macroeconomic conditions or bank-specific characteristics. For bank-specific issues, panel 11 data analysis from the sample of the largest banks in one region or one nation is frequently used, although researchers frequently use panel information across different countries to explain the effects of macroeconomic variables. The following criteria served as a guide for choosing the variables: 1) That factors that are important for NPLs, particularly in emerging markets, should be considered 2) that data are available for all the variables for all the chosen nations; and 3) that the literature has contradictory findings regarding their effect on NPLs. As per the study of Limajatini et al. (2019), the empirical studies demonstrate the close relationship between NPLs and the economic and business cycles, demonstrating that macroeconomic elements, such as declines in overall economic activity, are always present in every financial crisis. As identified in the literature, a key component of the macroeconomic environment that gauges economic progress is the GDP Growth Rate (GDP). The economic cycle and banks' exposure to credit risk has a dialectical connection. Financial intermediaries often face more credit risk during economic stagnation or recessions because it is more difficult for the economy to sustain targeted levels of employment, prices, and outputs. On the other hand, during an economic boom, the rising economic activity causes both families' and enterprises' cash volumes to rise. Once again, increased income levels for borrowers enhance their ability to repay the debt and raise confidence among depositors and investors for investment projects. Consequently, the cumulative effects result in a decrease in credit risk for the banking industry. Hence, this study formulates the following hypothesis, H1 GDP growth rate has negatively related to NPLs. One of the most significant measures of the NPLs ratio is UNR. The UNR variable shows the fraction of the labour force that is made up of unemployed people. As per the findings of Siakoulis (2017) A greater unemployment rate is anticipated to cause the rate of NPLs to increase. The economic downturn and banks' exposure to credit risk have a dialectical connection. Financial intermediaries often face more credit risk during economic stagnation or recessions because it is more difficult for the economy to sustain targeted effects on employment, prices, and supplies. On 12 the other hand, during an economic boom, the rising economic activity causes both families' and enterprises' cash volumes to rise. So, the purpose of the study is, H2 Unemployment rate is positively related with NPLs A price rising for commodities and services over a given period in a specific economy is referred to as inflation, as per the literature. As a result of depreciating the initial worth of money, high inflation raises borrowing costs and loan interest rates, increasing the borrower's obligations and raising the risk of default. According to Hong (2016), whereas low inflation promotes economic growth, excessive inflation lowers the borrower's real income and reduces their capacity to repay the loan. In contrast, a rising inflation rate reduces the total amount of loans and, as a result, enhances the borrower's capacity to make timely payments on their debts, thus lowering the chance of default. Because of this, it is possible that non-performing loans do not have a clear connection with inflation. It formulates the following hypothesis, H3 Inflation is either positively or negatively related to NPLs. The real interest rate (RIR) imposes an implicit penalty on bank-issued credit that has an impact on loan defaults. As a result of many banks refusing to lend, a large percentage of non-performing loans (NPLs) will impede economic growth. Thus, it formulates, H4 Real Interest Rate is positively related to NPLs Another important concern for banks in developing nations is the Corruption Control Score (WGI). It encompasses views on the extent to which public authority is utilized for personal gain, including both small-scale and large-scale corruption, as well as the "ownership" of something like the government by people and business interests. This variable is incorporated into the study as a result. This results in the following hypothesis, H5 Corruption Control Score is negatively related to NPLs 13 4.5 Conceptual framework The following is an illustration of the conceptual framework which is appropriate for the paper: Figure 1: Conceptual Framework Source: Author’s Compilation 4.6 Econometric framework The determinants of NPLs have been estimated using the following equation: NPLit = β0 + β1UNPit + β2GDPit + β3RIit + β4INFit + β5CCSit + εit Here, NPL = Non-Performing Loans UNP = Unemployment Rate GDP = GDP growth rate RI = Real Interest Rate INF = Inflation Rate CCS = Corruption Control Score Subscript i = The examined country Subscript t = The examined time 14 According to the analysis of Cetin (2019), The equation was further transformed into a logarithm model in this study to condense the information because a huge sample cannot predict an important outcome. Log transformation occasionally produces very accurate results. Due to the tiny dataset's low variance, the result is consistent and cohesive. As a result, the natural log of NPLs, where NPLs, UNP, GDP, RI, INF, and CCS are concerned, is used in the study. The Intercept is 0, the respective coefficient terms are 1, 2,…., 6, the country count is 1, 2,..., 8, and the time interval is 1, 2,..., 12. It reads: Random Error 15 Chapter 5: Data Interpretations and Discussion 5.1 Descriptive statistics Table 1 illustrates the descriptive analysis of both dependent and explanatory drivers for 70 developing nations with a total of 70 observations. According to descriptive data, the average amount of non-performing loans (NPLs) in the nations was 6.79%, with an SD of 0.901% and a range of significant differences across the countries between 0.95% and 49.9%. Table 1 | Descriptive Statistics of the Data Set in Brief Variables Non-Performing Loan Unemployment Rate Observations Mean Std. Dev Minimum Maximum 70 6.791369867 0.901195894 0.953674 49.90132291 70 10.03665714 5.435399825 3.38 21.02899933 GDP growth Rate 70 3.907200206 3.005250082 -5.717683 11.34339697 Real Interest Rate 70 Inflation Rate Corruption Control Score (WGI) 5.89032 3.635151303 70 4.770663826 4.569674408 0.0932 12.14 -1.403608 30.69531299 70 0.011270753 1.164665019 -1.636177 1.611609817 Source: Author’s calculations The GDP had a substantial-high degree of variability, with lowest and maximum values of 5.71% and 11.34%, respectively, and a lower standard deviation of 3.0% and an average GDP growth rate of 3.91%. Since the mean value of the GDP growth rate is relatively low and the minimum value is negative, some of those nations likely had decreasing trend throughout the database period. The average inflation rate (INFL) was reported to be 4.77%, with a standard deviation of 4.57% and a range for the inflation rate of -1.40% to 30.69%. Moreover, during the same period, the unemployment rate is relatively high which will take values in the range of 3.38% and 21.03%. The data for the inflation rate has a standard deviation of 5.43% and varies from -1.4% to 30.7%. Among other things, the large oscillations in the economies of the chosen nations may be seen as a result of the standard deviation of macroeconomic indicators. 16 Figure 2: Bar Chart of Mean Source: Author’s Compilation The fact that the real interest rate is lower, at 0.09%, indicates that some institutions did not make the best choices. The standard deviation of the real interest rate was 3.63%, while the average was 5.89%. The Corruption Control Score (WGI) average, which runs from a minimum of -1.63% to a high of 1.61% with a standard deviation of 1.16%, indicates that nearly all of the nations have lower levels of corruption control. 5.2 Correlation matrix The correlation between the independent variables is described in Table 2. The multi-collinearity issues in the dataset are shown by the correlation matrix. Table 2 | The Correlation Matrix Non-Performing Loan (%) Unemployment Rate (%) GDP growth Rate (%) Real Interest Rate (%) Inflation Rate (%) Corruption Control Score (WGI) NPLs (%) UNP (%) GDP (%) 1 0.2382 -0.135 0.3476 -0.0424 1 -0.139 0.0839 -0.053 1 -0.25 0.0202 1 0.1851 1 -0.4337 -0.071 -0.222 -0.603 -0.4474 17 RI (%) INF (%) CCI (%) 1 Source: Author’s calculations As shown in Table 2, the link between non-performing loans and the unemployment rate and real interest rate is favourable. That indicates that changes in these two factors proportionally influenced the likelihood of having NPLs. The rate of NPLs will rise if the rate of these factors rises. And if the rate of these factors falls, so will the rate of NPLs. The non-performing loan, on the other hand, has a negative correlation with the GDP growth rate, inflation rate, and corruption control score (WGI). However, there is only a very weakly negative correlation with the inflation rate (-0.04). Therefore, it rarely harms the likelihood of having a non-performing loan. But there is a significant inverse relationship (-0.43) between the corruption control score and the NPL. Accordingly, there is a good chance that when the WGI rate rises, the non-performing loan will be reduced to practically half of its present ratio, which is now 6.91% on average. Additionally, the GDP growth rate has a negative correlation (-0.135) with non-performing loans. Again, in the correlation matrix, the relationships of the variable with each other are also shown. Table 2 has shown how the variables are affecting each other with their positive and negative increment. The GDP growth rate, corruption level, and inflation rate are all negatively correlated with the unemployment rate. Thus, a rise in the unemployment rate results in a decline in the rates of all three variables. Additionally, it positively correlates with the real interest rate. The only two variables that have a positive correlation are inflation and GDP growth rates, thus when GDP increases, inflation also rises. Additionally, it is negatively correlated with the other three factors. The real interest rate and GDP have a positive association with the inflation rate. Additionally, there is a poor association between the unemployment rate and the corruption control score. Additionally, all of the factors that were employed as the independent variable had a negative association with Corruption Control Score It is because only the increasement in the rate of corruption control scale can reduce all of the problems related to the non-performing loan. It highly affects the inflation rate and the non-performing loan. Though it has a weak relationship with the unemployment rate, an increase in the corruption control scale decreases its rate. 5.3 Ordinary Least Squared (OLS) Regression Output Although a pooled OLS model was used in the past to investigate the multi-collinearity issue, this model has some serious drawbacks since it overlooks the uniqueness and heterogeneity of the data. Dependent Variable: Non-Performing Loans (NPL) 18 Table 3 | Results from the Panel Regression of All Countries Intercept Unemployment Rate (%) GDP growth Rate (%) Real Interest Rate (%) Inflation Rate (%) Corruption Control Score (WGI) R2 Adjusted R Square Standard Error Significance F Observations Coefficient s 11.18 Standard Error t Stat 3.563 3.1381 0.196 -0.706 -0.178 -0.524 0.143 1.3706 0.307 -2.298 0.307 -0.579 0.191 -2.737 -4.402 0.35 0.299 6.311 1.057 ρ -value 0.003 -4.165 0.175 0.025 0.564 0.008 0.00009 5 Lower 95% 4.0626 Upper 95% 18.3 -0.09 -1.32 -0.792 -0.906 0.482 -0.09 0.436 -0.14 -6.513 -2.29 0.00003322 70 Refers ρ<0.05 Source: Author’s Calculation As per the regression model, the model for the overall dataset is, NPLit = β0 + β1UNPit + β2GDPit + β3RIit + β4INFit + β5CCSit + εit = 11.28 + 0.196 UNPit + (-0.706) GDPit + (-0.178) RIit + (-0.524) INFit + (-4.402) CCSit Here is the ρ-value for the overall F test, defined as significance F. The table also shows the coefficients, intercepts and slopes. here is a ρ-value for the partial slop. These will use to do the individual partial slope t-test. In this table are the confidence intervals for the partial slopes for coefficients in general and some more kinds of multiple things. In the table, there is a result of the r square and it got a very low value which is 0.35 which means that roughly 35% of the variability of the dependent variable which is the non-performing loans can be explained by the entire set of independent variables that was the unemployment rate GDP growth, corruption control score, real interest, and inflation. Though 35% result in the r square is not the greatest result, in some fields that might not be the worst thing. Generally, a higher r square is considered to be a great result for any kind of data set. According to Guerard (2012), A high r 19 square suggests that the multiple regression model has some predictive potential. Except for adjusting the r square for the sample size and the number of independent features utilized in independent variables, adjusted R squares are relatively comparable. So, increasing the sample size can give a better result in this case. So, the adjusted R Square is always smaller than the r square. Observation for the research was 70 which means 70 different countries’ data has been taken to conduct the research. The ρ-value, although it doesn't get labelled ρ-value for the overall F. This number is Ho and H1. The null hypothesis was that in all the partial slopes that means in this case there are five independent features so all the partial slopes there are 5 of them are equal to zero and the alternative is at least One of these variables is not equal to zero. Ho: β1UNPit = β2GDPit = β3RIit = β4INFit = β5CCSit =0 H1: β1UNPit = β2GDPit = β3RIit = β4INFit = β5CCSit ≠0 So then now the hypothesis says that there is no useful linear relationship between any of those 5 independent features. And the alternative hypothesis says that there is at least one useful relationship between one of them or at least one of the independent features. In this case, the ρvalue is 0.00003322. So, if the level of significance is, α = 0.05, the ρ-value is lower than the value of α. That means there is no sufficient evidence to reject the null hypothesis. So, it can be said that there is at least one useful relationship between one of the variables or at least one of the independent features. As the test failed to reject the null hypothesis, the individual t-test can be done through the ρ-value that is given in the table. For t-test of each of the independent variables follows the same hypothesis as before, So, for the t-test, the individual variables are likely to be considered by the following hypothesis Ho: βi=0; have no significant relationship with NPL H1: βi≠0; have some significant relationship with NPL 20 The ρ-value indicates whether or not the results are statistically significant if it is less than the significance threshold (0.05), otherwise, it will be considered that the results are statistically insignificant. From the table, we found that the ρ-value for the GDP growth rate, Inflation rate and corruption control score is 0.025, 0.008 and 0.000095 respectively which are less than the significance level of 0.05. That means for these variables the results are statistically significant. So, there has some significant relationship. But for the unemployment rate and real interest rate ρ-value are 0.175 and 0.564 which are greater than the significance level. And that makes to think that the results are statistically insignificant and these variables have no significant relationship with non-performing loans. As per the literature review, it has been said that the unemployment rate and the interest rate significantly influence non-performing loans. But from the database, it has been found that there is so significant relationship between these two variables with the NPLs. From the findings, we have found that there is an extreme value of the rate of NPLs in the country with the code number 1 which is 49.90132291%. This value is much higher than the entire dataset of the sample. In this case, we try to recalculate the ρ-value by eliminating the data of country code 1 (see Appendix A) and the results show that without the extreme value, The results are statistically significant since each independent variable's ρ-value is below the 0.05 threshold of significance. Even if the unemployment rate's ρ-value is 0.052, which is higher but nearer the α = 0.05 level of significance, it is still greater than this figure. The conclusion in this instance will be that there is insufficient evidence to rule out the null hypothesis. Additionally, the R2 value is much greater than the previous value, which was 45.4%. This indicates that by excluding that particular data, 10% more of the dependent variable's variability can be explained by all of the independent variables. As a result, the entire dataset is skewed because of the high NPLs rate that country code 1 has. 21 Chapter 6: Conclusion The study explores the effect of some macroeconomic factors on non-performing loans. As nonperforming loans affect the economic stability of a country, this study is significant for finding the main reasons behind non-performing loans to get out of this situation. So, we considered five factors into account to study non-performing loans in 70 countries. These factors have a positive and negative relation with non-performing loans and also among them. GDP growth rate has negative relation with non-performing loans. So, if the GDP growth rate increases, the nonperforming loans will decrease. Similarly, the corruption control score has also negative relation with non-performing loans. But the corruption control score is weak in our represented countries. So, increasing the GDP growth rate and corruption control score will decrease non-performing loans. On the other hand, the Unemployment rate and real interest rate have a positive relation with non-performing loans. So, increasing unemployment and interest rates will result in higher non-performing loans in a country. From the study, we can also see that the inflation rate doesn't have much significant impact on non-performing loans. The relations among the variables show that the unemployment rate has negative relation with the inflation rate, GDP growth rate and corruption control score. Inflation and GDP growth rate show a positive relationship between them. But GDP has negative relation with corruption control score and real interest rate. The corruption control score shows a negative relationship with all the independent variables. So, the target is to increase the negatively related variables and decrease the positively related variables. So that, the non-performing loans can be reduced to a minimum. After all, this study can also be continued further with much more samples and considering other variables that affect nonperforming loans. 6.1 Recommendation From our study on factors that affect non-performing loans, we have some recommendations to improve the condition of non-performing loans in a country. 1. As reducing unemployment will reduce non-performing loans, we recommend focusing on this factor. Reducing unemployment is a challenge for a country. As per the study, by increasing the GDP growth rate and corruption control score, the unemployment rate can be reduced. It follows as lowering the interest rate will result in a lower unemployment 22 rate. Our recommendation is to take different policies and steps which will reduce the unemployment rate. 2. Another recommendation for reducing non-performing loans is to increase the corruption control score in a country. It has negative relation with non-performing loans. Controlling corruption is a challenge for developing countries. Making sure transparency and accountability can reduce corruption. It will also have a significant effect on other variables like GDP and the unemployment rate. So, our recommendation is to control corruption. 3. Interest rate should be managed and set with much more caution because it has an impact on non-performing loans. Reducing interest rates will reduce non-performing loans. But it affects other factors too. So, the recommendation is to reduce the interest rate and manage it properly regarding other socio-economic factors. 4. Increasing the GDP growth rate will reduce non-performing loans. So, we recommend taking steps that increase the GDP growth rate. To increase GDP lowering the interest rate, unemployment etc. are recommended. As the factors are correlated and one affects another, we finally recommend increasing the GDP growth rate along with reducing unemployment and interest rates and making sure of better corruption control. 23 Appendices Appendix A: Pooled OLS estimation (without Country 1) Table 4 Particulars Intercept Unemployment Rate (%) GDP growth Rate (%) Real Interest Rate (%) Inflation Rate (%) Corruption Control Score (WGI) Multiple R R Square Adjusted R Square Standard Error Observations Coefficients 11.884 Standar d Error 2.373444 t Stat 5.007097 P-value 0.0000047 Lower 95% 7.141114 Upper 95% 16.627 0.1886 0.095235 1.980202 0.05205 -0.00173 0.3789 -0.83 0.205018 -4.04963 0.00014 -1.23994 -0.421 -0.428 -0.365 0.206377 0.128693 -2.07323 -2.83887 0.04225 0.00609 -0.84028 -0.62252 -0.015 -0.108 -3.969 0.6737 0.4539 0.705323 -5.62766 4.5E-07 -5.3788 -2.56 0.4106 4.2022 69 Refers ρ<0.05 Source: Author’s Calculation 24 References Ahmad, N. H., & Ariff, M. (2008). Multi-country study of Bank Credit Risk Determinants. International Journal of Banking and Finance, 3(11), 64–77. https://doi.org/10.32890/ijbf2008.5.1.8362 Ahmed, S., Majeed, M. E., Thalassinos, E., & Thalassinos, Y. (2021). The impact of bank specific and macro-economic factors on non-performing loans in the banking sector: Evidence from an emerging economy. Journal of Risk and Financial Management, 14(5), 205–217. https://doi.org/10.3390/jrfm14050217 Avetisyan, S. (2019). Regional-specific determinants of non-performing loans. SSRN Electronic Journal, 6(2), 45–66. https://doi.org/10.2139/ssrn.3398897 Beck, R., Jakubik, P., & Piloiu, A. (2013). Non-performing loans: What matters in addition to the economic cycle? SSRN Electronic Journal, 5(1), 102–115. https://doi.org/10.2139/ssrn.2214971 Castro, V. (2013). Macroeconomic determinants of the credit risk in the banking system: The case of the gipsi. Economic Modelling, 31(5), 564–605. https://doi.org/10.1016/j.econmod.2013.01.027 Cetin, H. (2019). The relationship between non-performing loans and selected EU members Banks Profitabilities. International Journal of Trade, Economics and Finance, 10(2), 52–55. https://doi.org/10.18178/ijtef.2019.10.2.637 Chaibi, H. (2016). Determinants of problem loans: Non-performing loans vs. Loan Quality Deterioration. International Business Research, 9(10), 86–98. https://doi.org/10.5539/ibr.v9n10p86 Chiorazzo, V., Masala, F., & Morelli, P. (2017). NPLs in Europe: The role of systematic and idiosyncratic factors. SSRN Electronic Journal, 6(2), 65–89. https://doi.org/10.2139/ssrn.2903851 Dewailly, B. (2019). A predominant banking and financial sector. Atlas of Lebanon, 12(2), 32–45. https://doi.org/10.4000/books.ifpo.13238 Fajar, H., & Umanto. (2017). The impact of macroeconomic and bank-specific factors toward nonperforming loan: Evidence from Indonesian Public Banks. Banks and Bank Systems, 12(2), 37– 56. https://doi.org/10.21511/bbs.12(1).2017.08 25 Ghosh, A. (2015). Banking-industry specific and regional economic determinants of nonperforming loans: Evidence from US states. Journal of Financial Stability, 20(1), 75–96. https://doi.org/10.1016/j.jfs.2015.08.004 Gorter, C., & Bloem, A. M. (2001). The treatment of nonperforming loans in macroeconomic statistics. IMF Working Papers, 01(209), 1–29. https://doi.org/10.5089/9781451874754.001 Guerard, J. B. (2012). Regression analysis and multicollinearity: Two case studies. Introduction to Financial Forecasting in Investment Analysis, 5(2), 73–96. https://doi.org/10.1007/978-1-46145239-3_4 Hong, H. (2016). Macroeconomic factors and model instability: Implications on bank stress testing. SSRN Electronic Journal, 3(1), 45–60. https://doi.org/10.2139/ssrn.2896974 Kennedy, H. (2021). Determinants of bank credit growth in Ethiopian private commercial banks. Developing Country Studies, 5(3), 64–76. https://doi.org/10.7176/dcs/11-2-03 Khafid, M., ., F., & Anisykurlillah, I. (2020). Investigating the determinants of non-performing loan: Loan Monitoring as a moderating variable. KnE Social Sciences, 10(1), 30–38. https://doi.org/10.18502/kss.v4i6.6592 Khafid, M., ., F., & Anisykurlillah, I. (2020). Investigating the determinants of non-performing loan: Loan Monitoring as a moderating variable. KnE Social Sciences, 5(2), 40–62. https://doi.org/10.18502/kss.v4i6.6592 Khafid, M., ., F., & Anisykurlillah, I. (2020). Investigating the determinants of non-performing loan: Loan Monitoring as a moderating variable. KnE Social Sciences, 6(1), 33–42. https://doi.org/10.18502/kss.v4i6.6592 Klein, N. (2013). Non-performing loans in CESEE: Determinants and impact on Macroeconomic Performance. SSRN Electronic Journal, 22(3), 125–154. https://doi.org/10.2139/ssrn.2247224 Kocisova, K., & Pastyriková, M. (2020). Determinants of non-performing loans in European Union countries. Proceedings of the 13th Economics & Finance Virtual Conference, Prague, 10(3), 65–78. https://doi.org/10.20472/efc.2020.013.005 26 Limajatini, L., Murwaningsari, E., & Sellawati, S. (2019). Analysis of the effect of loan to deposit ratio, non performing loan & Capital adequacy ratio in profitability. ECo-Fin, 1(2), 30–54. https://doi.org/10.32877/ef.v1i2.121 Magdalinos, P., & Tsakalos, I. (2021). Macroeconomic and financial determinants of nonperforming loans: Evidence from Piigs. Bulletin of Applied Economics, 7(2), 34–49. https://doi.org/10.47260/bae/826 Manz, F. (2019). 2 determinants of non-performing loans: What do we know? Non-Performing Loans, 38(2), 26–68. https://doi.org/10.5771/9783748905929-26 Mileris, R. (2014). Macroeconomic factors of non-performing loans in commercial banks. Ekonomika, 93(3), 30–59. https://doi.org/10.15388/ekon.2014.0.3024 Mitchell, D. W. (2019). Some regulatory determinants of Bank Risk Behavior: Reply. Journal of Money, Credit and Banking, 23(1), 100–128. https://doi.org/10.2307/1992769 Nichols, J., & Shibut, L. (2021). Determinants of losses on construction loans: Bad loans, Bad Banks, or bad markets? SSRN Electronic Journal, 13(3), 26–29. https://doi.org/10.2139/ssrn.3911426 Peek, J., Rosengren, E. S., & Tootell, G. M. B. (2000). Identifying the macroeconomic effect of loan supply shocks. SSRN Electronic Journal, 12(2), 64–76. https://doi.org/10.2139/ssrn.222168 Pesola, J. (2007). Financial Fragility, macroeconomic shocks and Banks' loan losses: Evidence from Europe. SSRN Electronic Journal, 9(3), 56–68. https://doi.org/10.2139/ssrn.1018637 Qianying, Q. (2017). The factors influence non-performing loan and methods to ameliorate nonperforming loan. Topics in Economics, Business and Management (EBM), 7(2), 35–56. https://doi.org/10.26480/wsebm.01.2017.26.27 Qianying, Q. (2017). The factors influence non-performing loan and methods to ameliorate nonperforming loan. Topics in Economics, Business and Management (EBM), 8(12), 65–89. https://doi.org/10.26480/wsebm.01.2017.26.27 27 Shkodra, J., & Ismajli, H. (2017). Determinants of the credit risk in developing countries: A case of kosovo banking sector. Banks and Bank Systems, 12(4), 90–97. https://doi.org/10.21511/bbs.12(4).2017.08 Siakoulis, V. (2017). Fiscal policy effects on non-performing loan formation. SSRN Electronic Journal, 5(2), 58–69. https://doi.org/10.2139/ssrn.4192683 Singgih, M. L., Syairudin, B., & Suhariyanto, T. T. (2014). Designing citizen business loan model to reduce non-performing loan: An agent-based modeling and simulation approach in Regional Development. Asia Pacific Management and Business Application, 2(3), 106–128. https://doi.org/10.21776/ub.apmba.2014.002.03.1 Singh, D. (2020). EU non-performing loans and loan loss provisioning. European Cross-Border Banking and Banking Supervision, 11(3), 84–105. https://doi.org/10.1093/oso/9780198844754.003.0005 Sthembiso Msomi, T. (2022). Factors affecting non-performing loans in commercial banks of selected West African countries. Banks and Bank Systems, 17(1), 9–19. https://doi.org/10.21511/bbs.17(1).2022.01 Suzuki, Y., & Miah, M. D. (2017). China’s non-performing Bank Loan Crisis. Banking and Economic Rent in Asia, 20(4), 68–90. https://doi.org/10.4324/9781315558677-6 Tanasković, S., & Jandrić, M. (2015). Macroeconomic and institutional determinants of nonperforming loans. Journal of Central Banking Theory and Practice, 4(1), 47–62. https://doi.org/10.1515/jcbtp-2015-0004 28