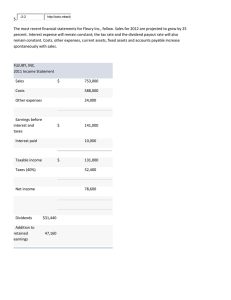

Long-Term Financial Planning and Growth Chapter 4 0 Role of Financial Planning Explore options – give management a systematic framework for exploring its opportunities Avoid surprises – help management identify possible outcomes and plan accordingly The types and amounts of assets a firm plans on purchasing must be considered along with the firm’s ability to raise the capital 1 Elements of Financial Planning • Investment in new assets – determined by capital budgeting decisions (Chapter 9, 10, 11, 14, 15) • Degree of financial leverage – determined by capital structure decisions (Chapter 16) • Cash paid to shareholders – determined by dividend policy decisions (Chapter 17) • Liquidity requirements – determined by net working capital decisions (Chapter 18,19, 20-Covered in Fin 340) 2 Financial Planning Process Horizon - divide decisions into short-run decisions (usually next 12 months) and long-run decisions (usually 2 – 5 years) • Planning Make realistic assumptions about important variables Based on those assumptions, the model generates predicted values for many other variables. 3 Financial Planning Model Ingredients • Sales/ Revenue Forecast – many cash flows depend directly on the level of sales/revenue • Economic Assumptions – explicit assumptions about the coming economic environment Pro Forma Statements – A financial plan will have a forecast balance sheet, income statement, and statement of cash flows. • Asset Requirements – the additional assets that will be required to meet sales projections • Financial Requirements – the amount of financing needed to pay for the required assets • Plug Variable – determined by management deciding what type of financing will be used to make the balance sheet balance • Suppose Summit needs to come up with an additional $200 million for a project • How to finance that amount? Percent of Sales Approach Some items vary directly with sales, while others do not Income Statement Costs may vary directly with sales - if this is the case, then the profit margin is constant Depreciation and interest expense may not vary directly with sales – if this is the case, then the profit margin is not constant Dividends are a management decision and generally do not vary directly with sales – this affects additions to retained earnings Balance Sheet Initially assume all assets, including fixed, vary directly with sales Accounts payable will also normally vary directly with sales Notes payable, long-term debt and equity generally do not vary directly with sales because they depend on management decisions about capital structure The change in the retained earnings portion of equity will come from the dividend decision 5 Example 1: Income Statement Tasha’s Toy Emporium Tasha’s Toy Emporium Pro Forma Income Statement, 2022 Income Statement, 2021 % of Sales Sales Less: costs 6 5,000 60% EBT 2,000 Less: taxes (40% of EBT) (800) Net Income 1,200 600 Add. To RE 600 5,500 Less: costs (3,000) Dividends Sales (3,300) EBT 2,200 40% Less: taxes (880) 16% Net Income 1,320 24% Dividends 660 Add. To RE 660 Assume Sales grow at 10% Dividend Payout Rate = 50% No increase in LT debt, Equity is plug in variable Example 1: Balance Sheet Tasha’s Toy Emporium – Balance Sheet Current Pro Forma Current Pro Forma Liabilities & Owners’ Equity ASSETS Current Assets Current Liabilities Cash $500 $550 A/P $900 $990 A/R 2,000 2,200 N/P 2,500 2,500 Inventory 3,000 3,300 Total 3,400 3,490 5,500 6,050 LT Debt 2,000 2,000 Total Owners’ Equity Fixed Assets Net PP&E 4,000 4,400 CS 2,000 2,200 Total Assets 9,500 10,450 RE 2,100 2,760 4,100 4,760 9,500 10,450 Total Total L & OE 7 % of Sales Plug variable Plug variable: the source(s) of external financing needed to deal with any shortfall (or surplus) in financing and thereby bring the pro forma balance sheet into balance. Summit needs an additional $200 million for a project Choose plug variable ($200 million external fin.) Borrow more short-term Borrow more long-term Sell more common stock Decrease dividend payout, which increases the additions to retained earnings 8 Example 2: Historical Financial Statements Gourmet Coffee Inc. Gourmet Coffee Inc. Income Statement For Year Ended December 31, 2006 Balance Sheet December 31, 2006 Assets 1000 Debt 400 Revenues Equity Total 9 1000 Total 2000 600 1000 Less: costs (1600) Net Income 400 Example 2: Pro Forma Income Statement Initial Assumptions Revenues will grow at 15% (2,000*1.15) All items are tied directly to sales Consequently, all other items will also grow at 15% Gourmet Coffee Inc. Pro Forma Income Statement For Year Ended 2007 Revenues 2,300 Less: costs (1,840) Net Income 10 460 Example 2: Pro Forma Balance Sheet Case I Gourmet Coffee Inc. Debt is the plug variable and no 11 dividends are paid Debt = 1,150 – (600+460) = 90 Assets Repay 400 – 90 = 310 in debt Total Pro Forma Balance Sheet Case I 1,150 Debt Equity 1,150 Total 90 1,060 1,150 Continued • Case II Gourmet Coffee Inc. Equity is expected to increase by 50 (Retained earnings) and other assumptions will remain same. So dividend will be (460-50)=410 Assets Equity Total 12 Pro Forma Balance Sheet Case II 1,150 Debt 1,150 Total 500 650 1,150 Growth and External Financing At low growth levels, internal financing (retained earnings) may exceed the required investment in assets As the growth rate increases, the internal financing will not be enough and the firm will have to go to the capital markets for money Examining the relationship between growth and external financing required is a useful tool in longrange planning 13 The Internal Growth Rate The internal growth rate tells us the maximum growth the firm can achieve without external financing of any kind. Using the information from Tasha’s Toy Emporium ROA = 1200 / 9500 = .1263 Plowback ratio, B = .5 Plowback ratio measures the amount of earnings retained after dividends have been paid out. ROA b 1 - ROA b .1263 .5 .0674 1 .1263 .5 6.74% Internal Growth Rate 14 The Sustainable Growth Rate The sustainable growth rate tells us the maximum growth the firm can achieve without external equity financing and maintaining a constant debt equity ratio. Using Tasha’s Toy Emporium ROE = 1200 / 4100 = .2927 Plowback ratio, b = .5 ROE b 1 - ROE b .2927 .5 .1714 1 .2927 .5 17.14% Sustainabl e Growth Rate 15 Determinants of Growth Profit margin – An increase in profit margin will increase the firm’s ability to generate funds internally and thereby increase its sustainable growth • Total asset turnover – asset use efficiency • Financial leverage – choice of optimal debt ratio • Dividend policy – choice of how much to pay to shareholders versus reinvesting in the firm 16 End of Chapter 17