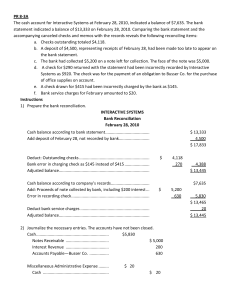

CASH AND CASH EQUIVALENTS Easy: 1. Cash equivalents are a. Short-term and highly liquid investments that are readily convertible into cash and so near their maturity that they represent insignificant risk of changes in value because of changes in interest rate. b. Short-term and highly liquid investments that are readily convertible into cash. c. Short-term and highly liquid investments that are readily convertible into cash and so near their maturity that they represent significant risk of changes in value because of changes in interest rates d. Short-term and highly liquid investments that are readily convertible into cash with remaining maturity of three months. 2. Which is normally deducted from the bank statement balance in preparing bank reconciliation? a. b. c. d. Certified check Deposit in transit Outstanding check Reduction of loan charged to the account of the depositor 3. A bank statement a. shows the activity that increased or decreased the depositor's account balance. b. is a credit reference letter written by the depositor's bank. c. is a bill from the bank for services rendered. d. lets a depositor know the financial position of the bank as of a certain date. 4. A person authorized to write checks drawn on a checking account at a bank must sign and have on file with the bank a a. b. c. d. checkbook bank card signature card deposit ticket 5. A bank reconciliation should be prepared periodically because a. b. c. d. the depositor's records and the bank's records are in agreement the bank has not recorded all of its transactions the bank must make sure that its records are correct any differences between the depositor's records and the bank's records should be determined, and any errors made by either party should be discovered and corrected 6. Which one of the following term best describes the amount of cash or cash equivalents that could currently be obtained by selling an asset in an orderly disposal? a. b. c. d. Realizable value Fair value Residual value Value in use 7. Which of the following is true? a. Lapping is the transfer of cash from one bank to another bank to conceal a shortage. b. Sinking fund can be classified as a current asset under certain circumstances. c. The practice of opening books of accounts beyond the close of the accounting period is called kiting. d. Misappropriation of collections from customers is called window dressing. 8. Which of the following is likely considered as cash and cash equivalents for financial reporting purposes as of December 31, 2012? a. b. c. d. Trust fund with original maturity of 120 days Bank overdraft Treasury bills acquired December 1, 2012, maturing on March 1, 2013. Post dated checks 9. A voucher a. is normally prepared in the Accounting Department b. system is an internal control procedure to verify that the assets in the ledger are the ones the company owns c. is received from customers to explain the purpose of a payment d. system is used to control cash receipts 10.Deposits held as compensating balances a. Usually do not earn interest b. If legally restricted and held against short-term credit may be included as cash c. If unrestricted as to withdrawal may be included as cash d. If legally restricted and held against long-term credit may be included among current assets 11.The bank reconciliation a. b. c. d. is sent to the bank for verification is part of the internal control system is for information purposes only should be prepared by an employee who records cash transactions 12.Which of the following would be subtracted from the balance per books on a bank reconciliation? a. b. c. d. Notes collected by the bank Outstanding checks Deposits in transit Service charges 13.What is the major purpose of an Imprest petty cash fund? a. b. c. d. To To To To effectively plan cash inflows and outflows ease the payment of cash to vendors effectively control cash disbursements determine the honesty of the petty cashier 14.Procedures designed to protect cash from theft and misuse from the time it is received until it can be deposited in a bank are called a. b. c. d. detective controls cash controls preventive controls accounting controls 15.Which of the following is usually considered cash? a. b. c. d. Money market savings certificates Checking accounts Certificates of deposit Postdated check 16.All of the following are necessary components of internal control over cash, except: a. b. c. d. Daily deposit of all receipts in the company's bank account Bank reconciliation Petty cash system Cash reserve 17.The objectives of internal control are to a. provide control over "internal-use only" reports and employee internal conduct b. prevent fraud, and promote the social interest of the company c. control the internal organization of the accounting department personnel and equipment d. provide reasonable assurance that operations are managed to achieve goals, financial reports are accurate, and laws and regulations are complied with 18.Which one of the following term best describes the amount of cash or cash equivalents that could currently be obtained by selling an asset in an orderly disposal? a. b. c. d. Value in use Residual value Fair value Realizable value 19.Which of the following would be added to the balance per books on a bank reconciliation? a. b. c. d. Outstanding checks Service charges Deposits in transit Notes collected by the bank 20.The reconciliation of the cash register tape with the cash in the register is an example of a. b. c. d. other controls. establishment of responsibility. independent internal verification. segregation of duties. 21.A bank statement provides information about all of the following, except a. b. c. d. NSF checks Bank charges for the period Check cleared during the period Errors made by the company 22.Credit memorandums from the bank a. b. c. d. decrease a bank customer's account show the bank has collected a note receivable for the customer show that a company has deposited a customer's NSF check are used to show a bank service charge 23.Which of the following is not an effective system to control cash? a. Preparing monthly bank reconciliation b. Securing an approved voucher before issuing check c. Making payments from daily receipts before making any deposits to minimize withdrawals and check issuances d. Deposits of receipts intact at the bank 24.In reimbursing the petty cash fund, which of the following is true? a. Cash is debited b. Petty cash is debited c. Petty cash is credited d. Expense accounts are debited 25.Cash deposited in a bank experiencing financial DIF is written down to a. b. c. d. Maturity value Estimated realizable value Value in use Present value 26.The cash account in the depositor's ledger is a(n) a. b. c. d. liability with a credit balance asset with a credit balance asset with a debit balance liability with a debit balance 27.If the petty cash fund is not replenished and an adjustment entry is not made accordingly a. b. c. d. Cashier is irresponsible Expenses are overstated, cash is understated Complete audit on cash is required Cash and income are overstated 28.Which of the following should not be considered cash by an accountant? a. b. c. d. travelers' checks bank checking accounts money orders postage stamps 29.Which one of the following below is not an element of internal control? a. b. c. d. information and communication monitoring risk assessment behavior analysis 30.The payment of accounts payable made after the close of the accounting period are recorded as if it were made at the end of the current period. a. b. c. d. Lapping Fishing Window dressing Kiting 31.Cash denominated in foreign currency shall be translated to Philippine peso using a. b. c. d. Passing rate Average rate Exchange rate Historical rate 32.A voucher is usually supported by a. b. c. d. a purchase order a supplier's invoice all of the above a receiving report 33.Which of the following will not require an adjusting entry on the depositor's books? a. Loan proceeds credited to the depositor's account b. DAIF check from a customer c. Deposit of another entity credited by the bank to the account of the depositor d. Collection from a customer amounting to P90,000 recorded by depositor as P900,000. 34.An element of internal control is a. b. c. d. controlling accounts journals subsidiary ledgers risk assessment 35.All of the following would be regarded as financial instruments, except a. b. c. d. Notes payable Bank overdraft Cash Equipment 36.LMN Company issued a note solely in exchange for cash. Assuming that the items below differ in amount the present value of note at issuance is equal to the a. Face amount discounted at the prevailing interest rate for similar notes b. Proceeds received c. Proceeds received, discounted at the prevailing interest rate for similar notes d. Face amount 37.During a bank reconciliation process, a. Outstanding checks are added and deposits in transit are subtracted to the bank statement balance. b. Outstanding checks and deposits in transit are added to the bank statement balance. c. Outstanding checks are subtracted and deposits in transit are added to the bank statement balance. d. Outstanding checks and deposits in transit are subtracted from the bank statement balance. 38.A P100 petty cash fund has cash of P18 and receipts of P80. The journal entry to replenish the account would include a a. b. c. d. debit to Cash for P80. credit to Cash for P80 credit to Petty Cash for P84. debit to Cash Over and Short for P2. 39.What entry is required in the depositor's accounts to record outstanding checks? a. b. c. d. debit Cash; credit Accounts Receivable debit Accounts Receivable; credit Cash debit Cash; credit Accounts Payable none 40.A bank reconciliation is prepared monthly in order for the enterprise to a. b. c. d. Unearth any undetected cash fraud Correct bank errors Correct book errors Arrive at the correct cash balance 41.Which of the following is normally classified as a current liability on the balance sheet? a. b. c. d. Bank overdrafts Customer NSF checks Postdated checks Travel advances 42.Petty cash fund is a. b. c. d. Money kept on hand for making minor disbursements of coins and currency Restricted cash Set aside for the payment of payroll Separately classified as a current asset 43.A firm's internal control environment is not influenced by a. monitoring policies b. personnel policies c. organizational structure d. management's operating style 44.The internal control feature that is specific to petty cash is a. b. c. d. Imprest system Assignment of responsibility Separation of duties Proper authorization 45.EFT a. b. c. d. makes it easier to document purchase and sale transactions means Effective Funds Transfer can process certain cash transactions at less cost than by using the mail means Efficient Funds Transfer 46.A bank reconciliation should be prepared a. to explain any difference between the depositor's balance per books with the balance per bank. b. when an employee is suspected of fraud. c. by the person who is authorized to sign checks. d. whenever the bank refuses to lend the company money. 47.Under the voucher system, every transaction is recorded at the time of a. b. c. d. paying requisitioning ordering incurring 48.Accompanying the bank statement was a debit memorandum for an NSF check received from a customer. This item would be included on the bank reconciliation as a(n) a. b. c. d. addition to the balance per depositor's records addition to the balance per bank statement deduction from the balance per bank statement deduction from the balance per depositor's records 49.Entries are made to the Petty Cash account when a. b. c. d. making payments out of the fund. replenishing the petty cash fund. recording shortages in the fund. establishing the fund. 50.A debit or credit memorandum describing entries in the depositor's bank account may be enclosed with the bank statement. An example of a credit memorandum is a. deposited checks returned for insufficient funds b. notification that a customer's check for P375 was recorded by the depositor as P735 on the deposit ticket c. a promissory note left for collection d. a service charge 51.The amount of cash to be reported on the balance sheet at June30 is the a. b. c. d. adjusted balance appearing in the bank reconciliation for June 30 total of the cash column in the cash receipts journal as of June 30 total of the cash column in the cash payments journal as of June 30 balance as of June 30 on the bank statement 52.Journal entries based on the bank reconciliation are required in the depositor's accounts for a. b. c. d. outstanding checks bank errors deposits in transit book errors 53.Cash equivalents include a. b. c. d. stocks and short-term bonds checks money market accounts and commercial paper coins and currency 54.During the month, a company was informed that a check they had issued was accidentally destroyed. On the bank reconciliation, the company would a. b. c. d. Add the amount to the balance per the depositor's records Add the amount to the balance per the bank statement deduct the amount from the balance per the bank statement deduct the amount from the balance per the depositor's records 55.During 2017, Creative Inc has monthly cash expenses of P150,000. On December 31, 2017, their cash balance is P1,550,000. The ratio of cash to monthly cash expenses is a. b. c. d. 11.1 10.3 10.7 9.7 56.Which of the following would be subtracted from the balance per bank on a bank reconciliation? a. b. c. d. Notes collected by the bank Service charges Deposits in transit Outstanding checks 57.Cash equivalents a. b. c. d. will be converted to cash within two years will be converted to cash within 90 days will be converted to cash within 120 days are illegal in some states 58.Following the completion of the bank reconciliation, an adjusting entry was made that debited cash and credited Interest Revenue. Therefore the bank reconciliation must have included an item that was a. b. c. d. added to the balance per bank statement added to the balance per depositor's records deducted from the balance per bank statement deducted from the balance per depositor's records 59.Cash is generally considered as a a. b. c. d. Depreciable asset Fixed asset Non-monetary asset Financial asset 60.Which of the following is not considered cash for financial reporting purposes? a. b. c. d. Postdated checks and IOUs Money orders, certified checks, and personal checks Coin, currency and available funds Petty cash funds and change funds 61.Which of the following reconciling items does not require a journal entry? a. b. c. d. Bank collection of note receivable NSF check Deposit in transit Bank service charge 62.What happens when a petty cash is in use? a. Petty cash is debited when the fund is replenished b. Most small amounts are paid from cash receipts before they are deposited c. Petty cash is credited when the fund is replenished d. Expenses paid with petty cash are recorded when the fund is replenished 63.As contemplated in accounting, cash includes a. Any negotiable instrument b. Money and any negotiable instrument that is payable in money and acceptable by the bank for deposit and immediate credit c. Money only d. Money and anything negotiable instrument 64.One of the following is least likely classified as cash for financial reporting purposes. a. b. c. d. Bank drafts and money orders Stale checks issued to creditors Post-dated checks from customers Undelivered checks to trade suppliers 65.Internal control does not consist of policies and procedures that a. b. c. d. protect assets from misuse guarantee the company will not go bankrupt ensure that business information is accurate aid management in directing operations toward achieving business goals 66.Accompanying the bank statement was a debit memorandum for bank service charges. On the bank reconciliation, the item is e. f. g. h. an addition to the balance per depositor's records an addition to the balance per bank statement a deduction from the balance per bank statement a deduction from the balance per depositor's records Average: 67.Which will not require an adjusting entry in the depositor's books? a. Check in payment of account payable for P1,000 is recorded by the depositor as P100 b. Bank service charge c. Deposit of another company is credited to the account of the depositor d. NSF check from customer 68.The minimum cash amount that banks often require customers to whom they lead money to maintain in checking accounts is called a. Compensating balance b. Money market fund c. Cash equivalent d. Bank overdraft 69.If a petty cash fund is established in the amount of P2,500, and contains P2,000 in cash and P450 in receipts for disbursements when it is replenished, the journal entry to record replenishment should include credit to the following accounts a. b. c. d. Cash, P450; cash over and short, P50 Petty cash, P450. Cash, P500. Petty cash, P500. 70.Receipts from cash sales of P9,500 were recorded incorrectly in the cash receipts journal as P5,900. This item would be included on the bank reconciliation as a(n) a. b. c. d. deduction from the balance per depositor's records deduction from the balance per bank statement addition to the balance per depositor's records addition to the balance per bank statement 71.Which of the following is an incorrect application of the imprest system of cash control? a. Cash disbursements must be made in the form of checks, regardless of the amount b. Material cash disbursements must be made in the form of checks c. Cash receipts must be deposited on a regular basis d. Insignificant cash disbursements must be made out of the petty cash fund 72.At the current year-end, a trustee held cash in the sinking fund account representing annual deposits to the fund and the interest earned on these deposits. How should the sinking fund be reported? a. The entire balance in the sinking fund account should appear as current asset b. Only the accumulated deposits should appear as noncurrent asset c. The entire balance in the sinking fund account should appear as noncurrent asset d. The cash in the sinking fund should appear as a current asset 73.Balance per book is more than correct balance. No error was committed. There must be a. b. c. d. Deposits credited by the bank but not yet recorded by the company Deposits in transit Bank charges not yet recorded by the company Outstanding checks 74.All of the following are considered cash, except a. b. c. d. Bank draft Money order Bills and coins Stale check 75.Account of the petty cash fund of Francis Company showed its composition as follows: Coins and currency Paid vouchers: Transportation Gasoline Office supplies Postage stamps Due from employees Manager's check returned by bank marked "NSF" Check drawn by the entity to the order of petty cash custodian 3,300 600 400 500 300 1,200 3,000 1,000 2,700 What is the correct amount of the petty cash fund for statement presentation purposes? a. b. c. d. 7,000 9,000 10,000 6,000 SOLUTION: Coins and currency Check drawn by the entity to the order of the petty cash custodian 3,300 2,700 6,000 The check drawn by the entity to the order of the petty cash custodian is actually a replenishment check and therefore part of cash 76.Which of the following shall not be considered cash for financial reporting purposes? a. b. c. d. Coin, currency and available funds Petty cash funds and change funds Money orders, certified checks and personal checks Postdated checks and IOUs 77.The cash account in Jose Company's ledger showed a balance at December 31, 2009 of P4,415,000 which consisted of the following: Petty cash fund Undeposited receipts, including a postdated customer check for P70,000 Cash in Allied Bank, per bank statement, with a check for P40,000 still outstanding Bond sinking fund - cash Vouchers paid out of collections, not yet recorded IOUs signed by employees, taken from collections 24,000 1,220,000 2,245,000 850,000 43,000 33,000 4,415,000 At what amount should cash be reported in the December 31, 2009 statement of financial position? a. b. c. d. 3,419,000 3,489,000 3,379,000 3,449,000 SOLUTION: Petty cash fund Undeposited receipts (1,220,000 - 70,000) Cash in Allied bank (2,245,000 - 40,000) 24,000 1,150,000 2,205,000 3,379,000 The postdated customer check of P70,000 should be reverted to accounts receivable. The outstanding check of P40,000 is deducted from the Cash in Allied Bank because the cash balance given is per bank statement. The bond sinking fund is shown as a noncurrent investment. The vouchers paid should be recorded as expenses. The IOUs should be shown as advances to employees 78.Under PAS 7, cash equivalents are short-term and highly liquid investments that are a. b. c. d. Readily convertible into cash and acquired one year before maturity Readily convertible into cash and acquired three months before maturity Classified as available-for-sale securities Readily convertible into cash and acquired six months before maturity 79.If the petty cash fund is not replenished and an adjustment entry is not made accordingly, a. b. c. d. Expenses are overstated, cash is understated Cash and income are overstated Cashier is irresponsible Complete audit on cash is required 80.Receipts from cash sales of P9,500 were recorded incorrectly in the cash receipts journal as P5,900. What entry is required in the depositor's accounts? a. b. c. d. debit debit debit debit Accounts Receivable; credit Cash Cash; credit Accounts Receivable Sales; credit Cash Cash; credit Sales 81.Cash equivalents are a. Short-term and highly liquid investments that are readily convertible into cash and acquired three months before maturity b. Short-term and highly liquid marketable equity securities c. Short-term and highly liquid investments that are readily convertible into cash d. Short-term and highly liquid investments that are readily convertible into cash with remaining maturity of three months 82.A bank reconciliation is prepared monthly in order to for the enterprise to a. b. c. d. Correct book errors Unearth any undetected cash fraud Arrive at the correct cash balance Correct bank errors 83.In reconciling the bank balance with the book cash balance, which of the following would not cause the bank balance shown in the bank statement to be lower than the unadjusted book balance? a. b. c. d. Deposits in transit Cash on hand at the company Interest credited to the account by the bank NSF checks from a customer as reported on the bank statement 84.A check drawn by a depositor in payment of a voucher for P725 was recorded in the journal as P257. What entry is required in the depositor's accounts? a. b. c. d. debit debit debit debit Accounts Receivable; credit Cash Cash; credit Accounts Payable Cash; credit Accounts Receivable Accounts Payable; credit Cash 85.Which of the following statements concerning compensating balance agreement is not true? a. b. c. d. They They They They must be disclosed in the financial statements footnotes. always involve legal restrictions on the cash received reduce the amount of cash available to the borrower. increase the effective interest rate to the borrower 86.A bank reconciliation is a. A statement sent by bank to depositor on a monthly basis b. A formal financial statement that lists all of a firm's bank account balances and previously closed bank accounts c. A merger of two previously competing banks currently in the process of reconciliation d. A schedule that accounts for the differences between a firm's bank statement balance (balance per bank) and the balance shown in its general ledger (balance per books) 87.Santos Company gathered the following reconciling information in preparing its August bank reconciliation: Cash balance per books, 8/31 Deposits in transit Notes receivable and interest collected by bank Bank charge for check printing Outstanding checks NSF check P3,500 150 850 20 2,000 170 The adjusted cash balance per books on August 31 is a. b. c. d. 2,310 2,460 4,160 4,010 88.A P100 petty cash fund contains P92 in petty cash receipts, and P6.50 in currency and coins. The journal entry to record the replenishment of the fund would include a a. b. c. d. debit to Cash Short and Over for P1.50 credit to Petty Cash for P93.50 credit to Cash Short and Over for P1.50 credit to Cash for P92 89.There are three parties to a check. The drawer is a. b. c. d. the party to whom payment is to be made a written document signed by the depositor the bank on which the check is drawn is the one who signs the check ordering payment by the bank 90.Jomel Company had the following bank reconciliation on March 31 of the current year: Balance per bank statement, March 31 Deposits in transit Outstanding checks Balance per book, March 31 Data per bank statement for the month of April Deposits 4,650,000 1,000,000 (1,250,000) 4,400,000 6,000,000 Disbursements 5,000,000 All reconciliation items on March 31 cleared through the bank in April. Outstanding checks at April 30 totaled P750,000 and deposits in transit amounted to P1,500,000. What is the amount of cash receipts per book in April a. b. c. d. 5,000,000 6,500,000 5,500,000 7,500,000 SOLUTION: Bank receipts for April Deposit in transit - March 31 Deposits in Transit - April 30 Book receipts for April 6,000,000 (1,000,000) 1,500,000 6,500,000 91.Floyd Company reported the following information as of the end of the current year. Investment securities of P1,000,000. These securities are share investment in entities that are traded in the Philippine Stock Exchange. As a result, the shares are very actively traded in the market. Investment securities of P2,000,000. These securities are government treasury bills. The treasury bills have a 10 year term and purchased on december 31 at which time they had 2 months to go until they mature. Cash of P3,400,000 in the form of coin, currency, saving account and checking account. Investment securities of P1,500,000. These securities are commercial papers. The term of the papers is nine months and they were purchased on December 31 at which time they had 3 months to go until they mature. How much should be reported as cash and cash equivalents at the end of the current year? a. b. c. d. 6,400,000 6,900,000 7,900,000 5,400,000 SOLUTION: Government T bills Cash Commercial papers 2,000,000 3,400,000 1,500,000 6,900,000 The share investments cannot qualify as cash equivalents because they are very actively traded and do not have maturity date. 92.The cash balance of Ace Company on January 1, 2013 was P10,000,000. During 2013, the changes in certain accounts were: Accounts receivable Inventory Accounts payable 4,000,000 increase 3,500,000 decrease 5,000,000 decrease Total sales and cost of goods sold were P30,000,000 and P20,000,000 respectively. All sales and purchases were on account. Various operating expenses of P3,000,000 were paid in cash. There were no other transactions during the year. What is the cash balance on December 31, 2013? a. 11,500,000 b. 17,000,000 c. 8,000,000 d. 14,500,000 93.Which of the following will not require an adjusting entry on the depositor's books? a. Collection from a customer amounting to P90,000 recorded by depositor as P900,000. b. Loan proceeds credited to the depositor's account c. DAIF check from a customer d. Deposit of another entity credited by the bank to the account of the depositor 94.Which is not considered as a cash equivalent a. A three-year treasury note maturing on May 30 of the current year purchased by the entity on April 15 of the current year b. A three –year treasury note maturing on May 30 of the current year purchased by the entity on January 15 of the current year c. A 60-day money market placement d. A 90-day T-bill 95.Rafael Company had the following account balances at December 31, 2009: Cash in bank Cash on hand Cash restricted for addition to plant (expected to be disbursed in 2010) 2,250,000 125,000 1,600,000 Cash in bank includes P600,000 of compensating balance against short- term borrowing arrangement. The compensating balance is not legally restricted as to withdrawal by Rafael. In the current assets section of Rafael's December 31, 2009 statement of financial position, total cash should be reported at a. 1,775,000 b. 2,375,000 c. 2,250,000 d. 3,975,000 SOLUTION: Cash in bank Cash on hand Total cash 2,250,0 00 125,00 0 2,375,0 00 A compensating balance is a minimum checking or demand deposit account balance that must be maintained in connection with a borrowing arrangement with a bank. The compensating balance is part of cash if it is not legally restricted as to withdrawal. Otherwise, if it is legally restricted, the compensating balance is excluded from the amount shown as "cash", and shown separately as current or noncurrent asset depending on the bank loan to which it is related. In many instances, compensating balance agreements are informal and therefore, the compensating balances are not legally binding 96.Under the Imprest fund system, the 'petty cash fund' account is debited a. b. c. d. When the fund is created and every time it is replenished When the fund is created and when the size of the fund is increased Only when the fund is created When the fund is abolished and when the size of the fund is decreased 97.Which is normally added to the cash balance per ledger in order to determine the correct cash balance? a. Note receivable collected by bank in favour of the depositor and credited to depositor's account b. NSF customer check c. Service charge d. Erroneous bank debit 98.Which of the following would not be included with the Cash and Equivalents on the Balance Sheet? a. b. c. d. e. Short-Term Receivables Municipal Securities Certificates of Deposit Money Market Mutual Funds Commercial Paper 99.The December 31, 2009 trial balance of Ken Company includes the following accounts: Petty cash fund 50,000 Current account - First Bank Current account - Second Bank (overdraft) Money market placement - Third Bank Time deposit - Fourth Bank 4,000,000 ( 250,000) 1,000,000 2,000,000 The petty cash fund includes unreplenished December 2009 petty cash expense vouchers for P15,000 and an employee check for P5,000 dated January 31, 2010. A check for P 100,000 was drawn against First Bank current account dated and recorded December 29, 2009 but delivered to payee on January 15, 2010. The Fourth Bank time deposit is set aside for land acquisition in early January 2010. The December 31, 2009 statement of financial position should report"cash and cash equivalents" at a. b. c. d. 4,130,000 4,880,000 5,150,000 5,130,000 SOLUTION: Petty cash fund (50,000 - 15,000 - 5,000) Current account - First Bank (4,000,000 + 100,000) Money market placement Total cash and cash equivalents 30,000 4,100,000 1,000,000 5,130,000 In the absence of specific term, money market placement, time deposit and treasury bills are short-term investment of three months or less and therefore qualify as cash equivalents 100. Lann Company's checkbook balance on December 31, 2009 was P5,000,000. In addition, Lann held the following items in its safe on that date: Check payable to Lann, dated January 2, 2010 in payment of a sale made in December 2009, not included in December 31 checkbook balance Check payable to Lann, deposited December 15 and included in December 31 checkbook balance, but returned by bank on December 30 stamped "NSF." The check was redeposited on January 2, 2010 and cleared on January 9, 2010 Check drawn on Lann's account, payable to a vendor, dated and recorded in Lann's books on December 31, 2009 but not mailed until January 10, 2010 2,000,000 500,000 300,000 The proper amount to be shown as "cash" on December 31, 2009 should be a. b. c. d. 4,800,000 5,300,000 6,800,000 6,500,000 SOLUTION: Checkbook balance NSF customer check Undelivered company check Adjusted cash balance 5,000,000 ( 500,000) 300,000 4,800,000 The customer check of P2,000,000 payable to Lann is properly not included in cash because it is postdated January 2, 2010. The NSF customer check of P500,000 should be reverted to accounts receivable on December 31, 2009 because it was redeposited after December 31, 2009. The check of P300,000 drawn by Lann is undelivered on December 31, 2009. Thus, the undelivered check is restored to cash by debiting cash and crediting accounts payable 101. The following data pertain to Thor Company on December 31, 2013: Checkbook balance Bank statement balance Check drawn on Thor’s account, payable to supplier, dated and recorded on December 31 Cash in sinking fund 4,000,000 5,000,000 500,000 2,000,000 On December 31, 2013, how much should be reported as non current investment? a. b. c. d. 6,500,000 4,500,000 5,500,000 2,000,000 SOLUTION: Cash in sinking fund is considered as noncurrent investment. 102. Bank reconciliations are normally prepared on a monthly basis to identify adjustments in the depositor's records and to identify errors. Adjustments should be recorded by the depositor for a. Bank service charges, NSF checks, outstanding checks and deposits in transit b. Bank errors, outstanding checks and deposits in transit c. Book errors and bank errors d. All items, except bank errors, outstanding checks and deposits in transit 103. Bank overdraft, if material, should be a. b. c. d. Reported as a deduction from cash Reported as a deduction from the current asset section Netted against cash and a net cash amount reported Reported as a current liability 104. The petty cash fund of Dindo Company on December 31, 2009, the end of the entity's reporting period, is composed of the following: Currencies Coins Petty cash vouchers: Gasoline payments for delivery equipment Medical supplies for employees Repairs of office equipment Loans to employees A check drawn by the entity payable to the order of Grace de la Cruz, petty cash custodian, representing her salary An employee's check returned by the bank for insufficiency of funds A sheet of paper with names of several employees together with contribution for a birthday gift of a co-employee. Attached to the sheet of paper is a currency of 20,000 2,000 3,000 1,000 1,500 3,500 15,000 3,000 5,000 The petty cash general ledger account has an imprest balance of P50,000. What is the amount of petty cash fund that should be shown in the statement of financial position on December 31, 2009? a. b. c. d. 37,000 22,000 27,000 42,000 SOLUTION: Currencies Coins Check drawn to the order of the petty cash custodian 20,000 2,000 15,000 37,000 The check drawn payable to the order of the petty cash custodian representing her salary is actually an accommodation check. Thus, it isincluded as part of cash 105. Accompanying the bank statement was a credit memorandum for a shortterm note collected by the bank for the customer. What entry is required in the depositor's accounts? a. debit Notes Receivable; credit Cash b. debit Cash; credit Notes Receivable c. debit Accounts Receivable; credit Cash d. debit Cash; credit Miscellaneous Income 106. Ino Company’s bank statement for the month of April included the following information: Bank service charge for April Check deposited by Letty during April was not collectible and has been marked “NSF” by the bank and returned 15,000 40,000 In comparing the bank statement to its own records, Ino found the following: Deposits made but not yet recorded by bank Checks written and mailed but not yet recorded by bank 130,000 100,000 All deposits in transit and outstanding checks have been properly recorded in Ino’s books. Ino Company found a check for P35,000, payable to Ino Company that had not yet been deposited and had not been recorded in Ino’s books. Ino’s books show a cash in bank account balance of P920,000. What is the adjusted cash in bank at April 30? a. b. c. d. 930,000 965,000 900,000 865,000 SOLUTION: Balance per book Unrecorded customer check Bank service charge NSF check Adjusted book balance 107. 920,000 35,000 (15,000) (40,000) 900,000 On December 31, 2012, Victor Company had the following cash balances: Cash in bank Petty cash fund (all funds were reimbursed on 12/31/2012) Time deposit (due February 1, 2013) 1,800,000 50,000 250,000 Cash in bank includes P600,000 of compensating balance against short-term borrowing arrangement on December 31, 2012. The compensating balance is legally restricted as to withdrawal by Victor. In the December 31, 2012 statement of financial position, what total amount should be reported as cash and cash equivalents? a. 1,250,000 b. 2,100,000 c. 1,500,000 d. 1,850,000 108. Which will not require an adjusting entry on the depositor’s books? a. Check in payment of account payable amounting to P50,000 is recorded by the depositor as P5,000 b. Deposit of another entity is credited to the account of the depositor c. NSF check from customer d. Bank service charge 109. On December 31, 2009, Gabriel Company had the following cash balances: Cash in bank Petty cash fund (all funds were reimbursed on 12/31/2009) Time deposit (due February 1, 2010) 1,800,000 50,000 250,000 Cash in bank includes P600,000 of compensating balance against short-term borrowing arrangement at December 31, 2009. The compensating balance is legally restricted as to withdrawal by Gabriel. In the current assets section of Gabriel's December 31, 2009 statement of financial position, what total amount should be reported as cash and cash equivalents? a. b. c. d. 1,850,000 1,250,000 2,100,000 1,500,000 SOLUTION: Cash in bank (1,800,000 - 600,000) Petty cash fund Time deposit Total cash 1,200,000 50,000 250,000 1,500,000 Since the compensating balance is legally restricted, it is excluded from the amount shown as cash. In this Gerard, the compensating balance is shown as "cash held as compensating balance" as a current asset because the related loan is short-term. The term of the time deposit is not given. It is assumed that it is three months or less, this being the normal banking practice. Accordingly, the time deposit is a cash equivalent 110. Karlo Company’s checkbook balance on December 31, 2013 was P212,000. In addition, Karlo held the following items in its safe on December 31. A check for P4,500 from Payless Company received December 30, 2013, which was not included in the checkbook balance. An NSF check from Garner Company in the amount of P9,000 that had been deposited at the bank, but was returned for lack of sufficient funds on December 29, 2013. The check was redeposited on January 3, 2014. Coin and currency on hand amounted to P14,500. What is the proper amount to be reported as cash on December 31, 2013? a. b. c. d. 204,000 213,000 207,500 222,000 SOLUTION: Balance per book Customer check NSF check Currency and coins Total cash 111. a. b. c. d. 112. 212,000 4,500 (9,000) 14,500 222,000 The petty cash fund account under the imprest fund system is debited When the fund is created and everytime it is replenished When the fund is created and when the size of the fund is increased When the fund is created and when the fund is decreased Only when the fund is created A bank reconciliation is a. A schedule that accounts for the differences between an entity’s cash balance as shown on its bank statement and the cash balance shown in its general ledger b. A merger of two banks that previously were competitors c. A statement sent by the bank to depositor on a monthly basis d. A formal financial statement that lists all of the bank account balances of an enterprise 113. Significant deposits in a foreign bank subject to foreign exchange restriction should be classified a. b. c. d. 114. As As As As cash and cash equivalents with appropriate disclosure held-to-maturity securities with appropriate disclosure non-trade receivables with appropriate disclosure part of the noncurrent assets with appropriate disclosure Joseph Company had the following account balances at December 31, 2013: Cash in banks Cash on hand Cash legally restricted for additions to plant 2,250,000 125,000 1,600,000 Cash in bank includes P600,000 of compensating balances against short-term borrowing arrangements. The compensating balances are not legally restricted as to withdrawal by Joseph. In the current assets’ section of Joseph’s December 31, 2013 balance sheet, total cash should be reported at a. b. c. d. 3,975,000 1,775,000 2,250,000 2,375,000 SOLUTION: Cash on hand (P125,000) and cash in banks (P2,250,000) are both reported as cash in the current section of the balance sheet because they are both unresticted and readily available for us. Cash legally restricted to additions to plants ar shown in the long-term asset section of the balance sheet as in investment. 115. In reconciling the bank balance with the cash balance, which of the following would not cause the bank balance shown in the bank statement to be lower than the unadjusted book balance? a. b. c. d. NSF checks from a customer, as reported on the bank statement Interest credited to the account by the bank Cash on hand at the company Deposits in transit 116. If the cash balance shown in an entity's accounting records is less than the correct cash balance and neither the entity nor the bank has made any errors, there must be a. b. c. d. Bank charges not yet recorded by the entity Outstanding checks Deposits in transit Deposits credited by the bank but not yet recorded by the company 117. On March 31, 2013, Charisse Company received its bank statement. However, the closing balance of the account was unreadable. Attempts to contact the bank after hours did not secure the desired information. Thus, you had to prepare a bank reconciliation from the available information summarized below: February 28 book balance Note collected by bank Interest earned on note NSF check of customer Bank service charge on NSF check Other bank service charges Outstanding checks Deposit of February 28 placed in night depository Check issued by Jane Company charged to Charisse’s account 1,460,000 100,000 10,000 130,000 2,000 3,000 202,000 85,000 20,000 What is the cash balance per bank statement? a. b. c. d. 1,338,000 1,435,000 1,557,000 1,532,000 SOLUTION: February 28 book balance Note collected by bank Interest earned on note NSF check Bank service charge (2,000 + 3,000) Adjusted book balanc 1,460,000 100,000 10,000 (130,000) (5,000) 1,435,000 Balance per bank statement (squeeze) Deposit in transit Bank error Outstanding checks Adjusted bank balance 1,532,000 85,000 20,000 (202,000) 1,435,000 118. Under PAS 7, cash equivalents are a. Readily convertible to known amounts of cash b. Investments with original maturities of three months or less c. Treasury bills, commercial paper and money market purchased with excess cash. d. All of these 119. To be reported as “cash and cash equivalent”, the cash and cash equivalent must be a. b. c. d. Set aside for the liquidation of long-term debt Deposited in Bank Available for the purchase of property, plant and equipment Unrestricted in use for current operations 120. A debit balance (i;e., shortage) in the 'cash short or over' account at the end of the period that can be attributed to the fault of the petty cashier is treated as a a. b. c. d. Payable to employee Miscellaneous income Receivable from employee Miscellaneous expense 121. Which of the following must be deducted from the bank statement balance in preparing a bank reconciliation which ends with adjusted cash balance? a. b. c. d. Certified check Reduction of loan charged to the account of the depositor Outstanding check Deposit in transit 122. Balance per bank is less than correct balance. No error was committed. There must be a. b. c. d. 123. Deposits credited by the bank but not yet recorded by the company Outstanding checks Bank charges not yet recorded by the company Deposits in transit Which is not a key element of internal control over cash receipts? a. Daily recording of all cash receipts in the accounting records. b. Cash deposit on a regular basis c. Immediate counting by the person opening the mail or using the cash register d. Daily entry in a voucher register 124. In preparing a bank reconciliation, interest paid by the bank on the account is a. b. c. d. 125. Subtracted from the bank balance Subtracted from the book balance Added to the bank balance Added to the book balance Deposits held as compensating balances a. Usually do not earn interest. b. None of these. c. If legally restricted and held against long-term credit may be included among current assets. d. If legally restricted and held against short-term credit may be included as cash. 126. a. b. c. d. 127. Bank statements provide information about all of the following except Bank charges for the period NSF checks Checks cleared during the period Errors made by the depositor The ‘Cash Short or Over’ account a. Is contra-cash account b. Is debited upon reimbursement when the petty cash funds proves out short c. Is debited upon reimbursement when the petty cash funds proves out over d. Is a real account 128. In preparing a monthly bank reconciliation, which of the following items would be added to the balance per bank statement to arrive at the correct cash balance? a. b. c. d. A customer’s note collected by the bank on behalf of the depositor Bank service charge Deposits in transit Outstanding checks 129. The cash account in the current assets section of the statement of financial position of Maria Company consisted of the following: Bond sinking fund cash Checking account in FEBTC (A P320,000 check is still outstanding per bank statement) Currency and coins awaiting deposit Deposit in a bank closed by BSP Petty cash fund (of which P 10,000 in is the form of paid vouchers) Receivables from officers and employees 1,500,000 3,155,000 1,135,000 500,000 50,000 175,000 6,515,000 The correct cash balance should be a. b. c. d. 5,830,000 4,330,000 4,440,000 4,830,000 SOLUTION: FEBTC Currency and coins Petty cash fund (50,000 - 10,000) Total 3,155,000 1,135,000 40,000 4,330,000 The outstanding check of P320,000 is not deducted from the FEBTC checking account because the FEBTC account is believed to be the balance per book. The term "bank statement" appearing on the problem simply signifies that the outstanding check was determined from the bank statement. It does not mean that the checking account in FEBTC is the balance per bank statement. The deposit in bank closed by BSP is shown as noncurrent asset 130. If the cash balance in an entity's bank statement is less than the correct cash balance and neither the entity nor the bank has made any errors, there must be a. Deposits in transit b. Deposits credited by the bank but not yet recorded by the entity c. Outstanding checks d. Bank charges not yet recorded by the entity Difficult: 131. Rommel Company keeps all its cash in a checking account. An examination of the company’s accounting records and bank statement for the month ended June 30, 2013 revealed the following information: The cash balance per book on June 30 is P8,500,000. A deposit of P1,000,000 that was placed in the bank’s night depository on June 30 does not appear on the bank statement. The bank statement shows on June 30, the bank collected note for Rommel and credited the proceeds of P950,000 to the Company’s account. Checks outstanding on June 30 amount to P300,000. Rommel discovered that a check written in June for P200,000 in payment of an account payable, had been recorded in the Company’s records as P20,000. Included with the June bank statement was NSF check for P250,000 that Rommel had received from a customer on June 26. The bank statement shows a P20,000 service charge for June. The cash in bank to be shown in the statement of financial position on June 30, 2013 is a. b. c. d. 9,000,000 9,360,000 8,300,000 9,180,000 SOLUTION: Balance per book Note collected by bank Book error (200,000 - 20,000) NSF check Service charge Adjusted book balance 132. a. b. c. d. 133. 8,500,000 950,000 (180,000) (250,000) (20,000) 9,000,000 A proof of cash would be useful for Discovering Discovering Discovering Discovering time lag in making deposits cash receipts that have been recorded but not been deposited an inadequate separation of incompatible duties of employees cash receipts that have not been recorded in the journal Reconciliation of Jam Company’s bank account at May 31 is: Balance per bank statement Deposits outstanding Checks outstanding Correct cash balance 2,100,000 300,000 (30,000) 2,370,000 Balance per book Bank service charge Correct cash balance 2,372,000 (2,000) 2,370,000 June data are as follows: Checks recorded Deposits recorded Collection by bank (P400,000 note plus interest) NSF check returned with the June 30 statement Balances Bank 2,300,000 1,620,000 420,000 10,000 1,830,000 Book 2,360,000 1,800,000 1,810,000 The check outstanding on June 30 amounted to a. b. c. d. 60,000 30,000 0 90,000 SOLUTION: Check outstanding - May 31 Checks recorded in June Total Checks recorded by bank in June Check outstanding - June 30 30,000 2,360,000 2,390,000 (2,300,000) 90,000 134. The following statements pertain to accounting for petty cash fund. Which statement is false? a. Each disbursement from petty cash should be supported by a petty cash voucher b. With the establishment of an imprest petty cash fund, one person is given the authority and responsibility for issuing checks to cover minor disbursements c. At any time, the sum of the cash in the petty cash fund and the total of petty cash vouchers should equal the amount for which the imprest petty cash fund was established d. The creation of a petty cash fund requires a journal entry to reflect the transfer of fund out of the general cash account 135. Which is false concerning measurement of cash and cash equivalents? a. If a bank or financial institution holding the funds of the company is in bankruptcy or financial difficulty, cash should be written down to estimated realizable value b. Cash is measured at face value c. Cash in foreign currency is measured at the current exchange rate d. Cash equivalents should be measured at maturity value, meaning face value plus interest 136. Which of the following items must be added to the cash balance per ledger in preparing a bank reconciliation which ends with adjusted cash balance? a. NSF customer check b. Note receivable collected by bank in favor of the depositor and credited to the account of the depositor c. Erroneous bank debit d. Service charge 137. a. b. c. d. Which of the following statements is false? A certified check should not be included in the outstanding checks A certified check is one drawn by a bank upon itself A certified check is a liability of the bank certifying it A certified check will be accepted by many persons who would not otherwise accept a personal check 138. Cash data related to Ron Company for the month of January of the current year are shown below: Balance per book, January 31 Balance per bank statement, January 31 Collections on January 31 but undeposited NSF check received from a customer returned by the bank on February 5 with the January bank statement Checks outstanding on January 31 Bank debit memo for safety deposit box rental not recorded by the depositor A creditor’s check for P30,000 was incorrectly recorded in the depositor’s book as A customer’s check for P200,000 was recorded by the depositor as The depositor neglected to make an entry in its books for a check drawn in payment of an accounts payable What is the adjusted cash in bank on January 31? a. b. c. d. 2,950,000 3,130,000 3,400,000 3,500,000 3,130,000 3,500,000 550,000 50,000 650,000 5,000 300,000 20,000 125,000 SOLUTION: Balance per book Overstatement of creditor’s check Understatement of customer’s check NSF check Bank debit memo for safety deposit box Unrecorded check Adjusted book balance 3,130,000 270,000 180,000 (50,000) (5,000) (125,000) 3,400,000 Balance per bank Undeposited collections Checks outstanding Adjusted bank balance 3,500,000 550,000 (650,000) 3,400,000 139. In your audit of Jose Inc.’s cash account as of December 31, 2013, you ascertained the following information. The book keeper’s bank reconciliation on November 30, 2013, is as follows: Bank balance per bank statement, November 30 Add: Deposit in transit Total Less: Outstanding checks No. 3408 3413 3414 3416 3417 Balance Add: Bank service charge for Nov Balance per books *Entered in check register in Dec. 24,298 3,648 27,946 440 300 6,820 3,924 800 12,284 15,662 36* 15,698 The cash receipts journal shows a total receipts for December of P371,766. The check register reflects total checks issued in December of P377,632. A collection of P5,912 was recorded on company books on Dec. 31 was not deposited until Jan. 2, 2014. The balance per bank statement at Dec. 31, 2013 is P17,516. The statement shows total receipts of P373,502 and checks paid of P380,284.Your examination revealed the following additional information: Check no.3413 dated Nov. 24, 2013, was entered in the Check Register as P300. Your examination of the paid returned with the December bank statement reveals that the amount of the check is P30. Check no. 3417 was mutilated and returned by the payee. A replacement check(no.3453) was issued. Bothe checks were entered in the Check register but no entry was made to cancel check no. 3417. The Dec. bank statement includes an erroneous bank charge of P480. On Jan. 3, 2014, the bank informed your client that a Dec. bank charge of P423 was omitted from the statement. Your examination of the bank credit memo accompanying the Dec. bank statement discloses that it represents proceeds from the note collection in Dec. for P4,000. The outstanding checks at Dec. 31,2013, are as follows: No. 3468 No.3417 No.3418 No.3419 440 800 2,814 5,788 What is the total outstanding checks at Dec.31? a. b. c. d. 9,072 9,842 8,602 9,042 140. You are conducting an audit of the MART CORPORATION for the year ended December 31, 2013. The internal control procedures surrounding cash transactions were not adequate. Jane Quipit, the bookkeeper-cashier handles cash receipts, maintains accounting records and prepares the monthly reconciliations of the bank account. She prepared the following reconciliation at the end of the year: Balance per bank statement Add Deposit in transit Note collected by bank Balanc e Less Outstanding checks Balance per general ledger 315,000 157,725 13,500 171,225 486,225 222,075 264,150 In the process of your audit, you gathered the following: At December 31, 2013, the bank statement and the general ledger showed balances of P315,000 and P264,150 respectively. The cut off bank statement showed a bank charge on January 02, 2014 for P35,250 representing a correction of an erroneous bank credit. Included in the list of outstanding checks were the following: A check payable to a supplier, dated December 29, 2013, in the amount of P13,275, released on January 05, 2014. A check representing advance payment to a supplier in the amount of P33,489, the date of which is January 04, 2014, and released in December 2013. On December 31, 2013, the company received and recorded customer’s postdated check amounting to P45,000. Compute the adjusted deposit in transit as of December 31, 2013. a. b. c. d. 112,500 202,725 112,725 157,725 141. Jason Company provided the following information with respect to its cash and cash equivalents on December 31, 2009. Checking account at First Bank Checking account at Second Bank Treasury bonds Payroll account Value added tax account Foreign bank account - restricted (in equivalent pesos) Postage stamps Employee's postdated check IOU from president's brother Credit memo from a vendor for a purchase return Traveler's check Not-sufficient-fund check Petty cash fund (P20,000 in currency and expense receipts for P30,000) Money order ( 200,000) 3,500,000 1,000,000 500,000 400,000 2,000,000 50,000 300,000 750,000 80,000 300,000 150,000 50,000 180,000 What amount would be reported as unrestricted cash on December 31, 2009? a. b. c. d. 6,900,000 4,900,000 4,600,000 5,900,000 SOLUTION: Checking account at Second Bank Payroll account Value added tax account Traveler's check Petty cash fund Money order Total unrestricted cash 3,500,000 500,000 400,000 300,000 20,000 180,000 4,900,000 142. Jason Company provided the following information with respect to its cash and cash equivalents on December 31, 2009. Checking account at First Bank Checking account at Second Bank Treasury bonds Payroll account Value added tax account Foreign bank account - restricted (in equivalent pesos) ( 200,000) 3,500,000 1,000,000 500,000 400,000 2,000,000 Postage stamps Employee's postdated check IOU from president's brother Credit memo from a vendor for a purchase return Traveler's check Not-sufficient-fund check Petty cash fund (P20,000 in currency and expense receipts for P30,000) Money order 50,000 300,000 750,000 80,000 300,000 150,000 50,000 180,000 What amount would be reported as unrestricted cash on December 31, 2009? a. b. c. d. 6,900,000 4,600,000 4,900,000 5,900,000 SOLUTION: Checking account at Second Bank Payroll account Value added tax account Traveler's check Petty cash fund Money order Total unrestricted cash 3,500,000 500,000 400,000 300,000 20,000 180,000 4,900,000 143. The plan of organization and all the methods and measures adopted within an entity to safeguard its assets, check the accuracy of its accounting data, promote operational efficiency, and encourage adherence to managerial policies is called a. b. c. d. 144. Administrative control Internal control Managerial control Accounting control Which of the following statements are correct? 1 2 3 a. b. c. d. A certificate of deposit is an example of a money market instrument Money market deposits are short-term loans between organizations such as banks Treasury bills are bought and sold on a discount basis 1 and 3 only 2 and 3 only 1 and 2 only 1, 2 and 3 145. On December 31, 2009, Ally Company's "cash account" balance per ledger of P3,600,000 includes the following: Demand deposit Time deposit - 30 days NSF check of customer Money market placement due on June 30, 2010 Saving deposit IOU from an employee Pension fund Petty cash fund Customer check dated January 31, 2010 Customer check outstanding for 18 months 1,500,000 500,000 20,000 1,000,000 50,000 30,000 400,000 10,000 60,000 30,000 3,600,000 Check of P 100,000 in payment of accounts payable was dated and recorded on December 31, 2009 but mailed to creditors on January 15, 2010. Check of P50,000 dated January 31, 2010 in payment of accounts payable was recorded and mailed December 31, 2009. The entity uses the calendar year. The cash receipts journal was held open until January 15, 2010, during which time P200,000 was collected and recorded on December 31, 2009. The "cash and cash equivalents" on December 31, 2009 should be a. b. c. d. 2,010,000 1,510,000 1,960,000 1,860,000 SOLUTION: Demand deposit Time deposit - 30 days Saving deposit Petty cash fund Total cash and cash equivalents 1,450,000 500,000 50,000 10,000 2,010,000 Demand deposit per book Undelivered check Postdated check delivered Window dressing of collection Adjusted balance 1,500,000 100,000 50,000 ( 200,000) 1,450,000 146. Daina Company provided the following information with respect to its cash and cash equivalents on December 31, 2013: Checking account at First Bank (200,000) Checking account at Second Bank Treasury bonds Payroll account Value added tax account Foreign bank account - restricted Postage stamps Employee’s postdated check IOU from president’s brother Credit memo from a vendor for a purchase return Traveler’s check NSF check Petty cash (P20,000 in currency and expense receipts for P30,000) Money order 3,500,000 1,000,000 500,000 400,000 2,000,000 50,000 300,000 750,000 80,000 300,000 150,000 50,000 180,000 What amount should be reported as unrestricted cash on December 31, 2013: a. b. c. d. 5,900,000 4,900,000 4,600,000 6,900,000 SOLUTION: Checking account at Second Bank Payroll account value added tax account Traveler’s check Petty cash fund Money order 3,500,000 500,000 400,000 300,000 20,000 180,000 4,900,000 147. If material, deposits in foreign bank which are subject to foreign exchange restriction shall be classified a. b. c. d. As part of cash and cash equivalents Separately as noncurrent asset with appropriate disclosure Separately as current asset, with appropriate disclosure Be written off as an extraordinary loss 148. At end of the current the year, an entity had cash accounts at three different banks. One account balance is segregated solely for payment into a bond sinking fund. A second account, used for branch operations, is overdrawn. The third account, used for regular corporate operations, has a positive balance. How should these accounts be reported in the year-end classified statement of financial position? a. The segregated and regular accounts should be reported as current assets net of the overdraft b. The segregated account should be reported as a noncurrent asset, the regular account should be reported as a current asset, and the overdraft should be reported as a current liability c. The segregated account should be reported as a noncurrent asset, and the regular account should be reported as a current asset net of the overdraft d. The segregated and regular accounts should be reported as current assets, and the overdraft should be reported as a current liability 149. Bank reconciliation are normally prepared on a monthly basis to identify adjustments needed in the depositor’s records and to identify bank errors. Adjustments on the part of the depositor should be recorded for a. b. c. d. Bank errors, outstanding checks and deposits in transit Book errors, bank errors, deposits in transit and outstanding checks Outstanding checks and deposits in transit All items except bank errors, outstanding checks and deposits in transit 150. Cagas Corporation is negotiating with a bank for a P300,000 one-year loan. The loan is discounted with a 9 percent interest rate and a 20% compensating balance. Suppose that Cagas Corporation requires the entire amount of P300,000 as net proceeds, how much is the Loans required compensating balance? a. b. c. d. 60,000 84,507 65,934 75,000 SOLUTION: (300,000 / (100% - 9% - 20%)) 20%: P84,507 151. You are conducting an audit of the MART CORPORATION for the year ended December 31, 2013. The internal control procedures surrounding cash transactions were not adequate. Jane Quipit, the bookkeeper-cashier handles cash receipts, maintains accounting records and prepares the monthly reconciliations of the bank account. She prepared the following reconciliation at the end of the year: Balance per bank statement Add Deposit in transit Note collected by bank Balanc e Less Outstanding checks Balance per general ledger In the process of your audit, you gathered the following: 315,000 157,725 13,500 171,225 486,225 222,075 264,150 At December 31, 2013, the bank statement and the general ledger showed balances of P315,000 and P264,150 respectively. The cut off bank statement showed a bank charge on January 02, 2014 for P35,250 representing a correction of an erroneous bank credit. Included in the list of outstanding checks were the following: A check payable to a supplier, dated December 29, 2013, in the amount of P13,275, released on January 05, 2014. A check representing advance payment to a supplier in the amount of P33,489, the date of which is January 04, 2014, and released in December 2013. On December 31, 2013, the company received and recorded customer’s postdated check amounting to P45,000. Compute the adjusted outstanding checks as of December 31, 2013. a. b. c. d. 152. 255,564 235,350 175,311 222,075 Kareen Company had the following bank reconciliation on June 30, 2010: Balance per bank statement, June 30 Deposit in transit Outstanding check Balance per book, June 30 3,000,000 400,000 (900,000) 2,500,000 The bank statement for the month of July showed the following: Deposits (including P200,000 note collected for Kareen) Disbursements (including P140,000 NSF check and P10,000 service charge) 9,000,000 7,000,000 All reconciling items on June 30 cleared through the bank in July. The outstanding checks totaled P600,000 and the deposit in transit amounted to P1,000,000 on July 31. What is the amount of cash disbursements per book in July? a. b. c. d. 6,850,000 7,300,000 6,700,000 6,550,000 SOLUTION: Disbursements per bank statement for July NSF check in July Service charge in July Outstanding checks-June 30 7,000,000 (140,000) (10,000) (900,000) Outstanding checks-July 31 Cash disbursements per book for July 600,000 6,550,000 153. The following statements pertain to the cash short or over account. Which statement is true? a. If the cash short or over account has a debit balance at the end of the period it must be debited to an expense account b. The entry to account for daily cash sales for which a small amount of cash shortage existed would include a debit to cash short or over account c. A credit balance in a cash short or over account should be considered a liability because the short changed customer will demand return of this amount d. It would be impossible to have cash shortage or overage if employees were paid in cash rather than by check 154. If the balance shown on an entity’s bank statement is less than the correct cash balance and neither the entity nor the bank made any errors, there must be a. b. c. d. 155. Outstanding checks Deposits created by the bank but not yet recorded by the entity Deposits in transit Bank charges not yet recorded by the entity Which of the following statements is incorrect? a. The responsibility for receiving merchandise and paying for it should usually be given to one person b. Certain clerical personnel in an entity should be rotated among various jobs c. The accounting function should be separated from the custodianship of entity assets. d. An entity’s personnel should be given well-defined responsibilities 156. The checkbook balance of JR Company on December 31, 2009was P4,000,000. Data about certain cash items follow: A customer check amounting to P200,000 dated January 2, 2010 was included in the December 31, 2009 checkbook balance. Another customer check for P500,000 deposited on December 22, 2009 was included in its checkbook balance but returned by the bank for insufficiency of fund. This check was redeposited on December 26, 2009 and cleared two days later. A P400,000 check payable to supplier dated and recorded on December 30, 2009 was mailed on January 16, 2010. A petty cash fund of P50,000 with the following summary on December 31, 2009: Coins and currencies Petty cash vouchers 5,000 43,000 Return value of 20 cases of soft drinks 2,000 50,000 A check of P43,000 was drawn on December 31, 2009 payable to Petty Cash. What is the "cash" balance on December 31, 2009? a. b. c. d. 4,205,000 4,200,000 3,748,000 4,248,000 SOLUTION: Checkbook balance Postdated customer check Undelivered check payable to supplier Adjusted cash in bank Petty cash: Coins and currencies Replenishment check Total 4,000,000 ( 200,000) 400,000 4,200,000 5,000 43,000 48,000 4,248,000 The return value of the soft drink bottles is shown as refundable deposit as a current asset. The NSF check is redeposited and cleared before December 31, 2009. Thus, the same is not deducted anymore from the checkbook balance 157. The following data pertain to the cash transactions and bank account of James Company for May of the current year: Cash balance per accounting record Cash balance per bank statement Bank service charge Debit memo for the cost of printed checks delivered by the bank; the charge has not been recorded in the accounting record Outstanding checks Deposit of May 30 not recorded by bank until June 1 Proceeds of a bank loan on May 30, not recorded in the accounting record, net of interest of P30,000 Proceeds from a customer’s promissory notes, principal amount of P800,000 collected by the bank not taken up in the accounting record with interest Check no 1086 issued to a supplier entered in the accounting record as P210,000 but deducted in the bank statement at an erroneous amount of Stolen check lacking an authorized signature deducted from James’s account by bank in error Customer’s check returned by the bank marked NSF, indicating that the customer’s balance was not adequate to cover the check; no entry has been made in the accounting record to record the 1,719,000 3,195,000 10,000 12,000 685,000 500,000 570,000 810,000 120,000 80,000 77,000 returned check. The adjusted cash in bank is a. b. c. d. 2,990,000 3,000,000 2,910,000 3,080,000 SOLUTION: Balance per book Service charge Debit memo for printed checks Proceeds of bank loan Proceeds of customer’s note NSF check Adjusted book balance 1,719,000 (10,000) (12,000) 570,000 810,000 (77,000) 3,000,000 Balance per bank Outstanding checks Deposit in transit Bank error in recording check Stolen check deducted by bank in error Adjusted bank balance 3,195,000 (685,000) 500,000 (90,000) 80,000 3,000,000 158. At the end of the current year, an entity had various checks and papers in its safe. Which item should not be included in its cash account in the current yearend statement of financial position? a. Past due promissory note issued in favor of the entity by its President b. The entity’s undelivered check payable to a supplier dated December 31 of the current year c. Another entity’s P150,000 check payable to the entity dated December 15 of the current year d. P20,000 cash 159. Kenny Company had the following bank reconciliation on June 30, 2013: Balance per bank statement, June 30 Deposit in transit Outstanding check Balance per book, June 30 3,000,000 400,000 (900,000) 2,500,000 The bank statement for the month of July showed the following: Deposits (including P200,000 note collected for Kenny) Disbursements (including P140,000 NSF check and P10,000 service charge) 9,000,000 7,000,000 All reconciling items on June 30 cleared through the bank in July. The outstanding checks totaled P600,000 and the deposit in transit amounted to P1,000,000 on July 31. What is the amount of cash receipts per book in July? a. b. c. d. 9,800,000 9,600,000 8,600,000 9,400,000 SOLUTION: Deposits per bank statement for July Note collected by bank Deposit in transit-June 30 Deposit in transit-July 31 Cash receipts per book for July 9,000,000 (200,000) (400,000) 1,000,000 9,400,000 160. If the cash balance shown on entity’s accounting records is less than the correct cash balance and neither the entity nor the bank has made any errors, there must be a. b. c. d. Bank charges not yet recorded by the entity Deposits in transit Deposits created by the bank but not yet recorded by the entity Outstanding checks