CHAPTER ONE

INTRODUCTION TO COST AND MANAGEMENT ACCOUNTING

1.1.

Basic definitions:

Cost: the amount of expenditure incurred on, or attributable to a given thing or the

resources consumed to accomplish a specified objective, or the value of a benefit

forgone in achieving a specific objective.

Cost object: this is any activity, operation, service or product for which we are trying to

ascertain the cost. Examples of cost objects could be a unit of product, e.g., a tablet

of soap, a unit of service, e.g., a one-way taxi hire, etc.

Cost unit: this is a basic measure or unit of production, service, time or a combination

of these in relation to which costs may be ascertained or expressed. Examples of cost

units include miles/hour, patient per day (for a hospital), cost/flight (for airlines) etc. it is

simply a unit at which costs are measured.

Examples of cost units in different industries

Industry sector

Cost unit

Brewing

Barrel

Brick-making

1,000 bricks

Coal mining

Tonne/ton

Electricity

Kilowatt hour (Kwh)

Engineering

Contract, job

Oil

Barrel, tonne, litre

Hotel/Catering

Room/meal

Professional services

Chargeable hour, job, contract

Education

Course, enrolled student, successful student

Hospitals

Patient day

Cost centre: this is a department, function or other unit within an organization to which

costs may be charged for accounting purposes. It is simply a centre where cost items

or elements are accumulated before they are analysed further to be transferred to

the cost objects. Examples of cost centres could be production departments,

administration departments, etc.

Cost driver: this is any factor which significantly determines or changes the cost of an

activity. For example, in purchasing, all the costs incurred in ordering depend on the

number of orders placed in that particular period. The number of orders therefore will

be the cost driver for the costs incurred by the activity of purchasing.

Cost pool: this is a collection or grouping of costs that are related on the basis of the

activities causing them and not on the basis of departments which incur them. For

example, a cost pool of “despatch costs” could be a collection of all costs incurred

on despatching activities. A cost pool may be related to a cost centre except that a

cost centre collects all costs incurred by it regardless of the activities behind the costs.

Cost accounting: This is part of management accounting which involves collecting,

recording and accumulating data and producing information about costs for the

products produced by an organisation and/or the services it provides.

Management accounting: It is the presentation of accounting information in such a

way as to assist management in the creation of policy and the day to day operation

of the undertaking. Management accounting is much broader than cost accounting

as it involves providing invaluable information to management for decision making.

Cost and/or management accounting is much concerned with assisting

management in the following ways:

a) Establishing cost of goods sold or services provided, cost of a department or

work station, as well as revenues from goods, services or departments. This

enables management to:

i.

Assess the profitability of products, services or departments

ii.

Set selling prices of products or services with regard to costs incurred

iii.

Value closing stocks (raw materials, work in progress and finished goods)

b) Estimating the future costs of goods and services through budgeting which is an

integral part of cost/management accounting

c) Making a comparison of actual costs incurred (or revenues earned) with what

was budgeted or expected through variance analysis.

d) Providing quality information to management in order to make sensible

decisions about costs and profits.

1.2.

Differences between management (Cost) accounting and financial accounting

Internal vs. External Uses

Management accounting focuses on providing information for internal users such as

supervisors, managers etc. Financial accounting concentrates on providing

information to both internal users and external users such as shareholders, creditors,

etc.

Emphasis on the Future

Management accounting provides information which is about the present and the

future whereas financial accounting information is mostly historical

Use of Generally Accepted Accounting Principles (GAAP) and other frameworks

Financial Accounting statements are prepared in accordance with GAAP (such as the

Accounting standards), as they provide consistency and comparability and are relied

on by outsiders for information regarding the company. Management Accounts on

the other hand, are not governed by GAAP or any other framework. Managers set

their own rules on the form and content of information. Whether these rules conform

to GAAP is immaterial.

2

Organizational Focus

Financial accounting is primarily concerned with the reporting on business activities of

a company as a whole. Management accounting, by contrast, focuses less on the

company as a whole and more on the parts or segments of a company. These

segments may be the product lines, sales territories, divisions, departments, etc.

Freedom of Choice

Financial accounting is mandatory for business organizations. Organisations are

compelled to maintain financial records as per various legal statutes like Companies

Act, Taxation Act, etc. By contrast, Management Accounting is not mandatory. There

are no regulatory bodies specifying what is to be done and how it is to be done and

presented. Thus in Management Accounting, the usefulness of the information is more

important than its requirement

1.3.

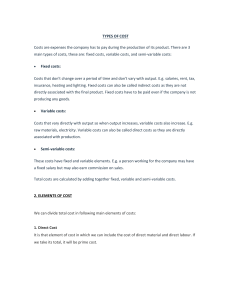

Classification of costs

Cost classification is the process of grouping costs according to their common

characteristics. The classification of costs can be done in the following ways:

1.3.1. Element

The costs are classified under the category of element based on the actual item that

brings about the cost. These costs are divided into three categories i.e. Materials,

Labour and Overheads (or other costs)

Materials are the principal substances that go into the production process and are

transformed into finished goods.

Labour refers to the human effort required to produce goods and services.

Other Expenses/ overheads: all other costs which are not materials or labour

The total cost of a product or service therefore consists of:

Cost of materials consumed + cost of wages and salaries of employees involved in

production or provision of service + cost of other expenses incurred in production

Example 1.1: Cost Classification-Element

A company incurred the following costs in the production of 200 units of product R:

Raw materials purchases

K69, 700

Labour cost (direct wages)

K6, 600

Other costs

K15, 000

After the production period, raw materials costing K5,900 were still in stock. Calculate

the total cost of producing one unit of product R.

3

Solution:

Based on element, the cost of a product will be made up of materials used, wages

(labour) and other expenses. Therefore the costs will be as follows:

Materials

(69,700 – 5,900)*

63,800

Labour

6,600

Other expenses

15,000

Total cost

85,400

Cost per unit = 85,400/200 = K427.00

*Materials used in production will be the difference between what was bought and

what is remaining as closing inventory.

1.3.2. Nature

This classification is based on how the cost relates to the product produced or service

provided. The costs can be directly or indirectly related to a product or service being

produced or provided.

Direct costs are those costs which are incurred for and may be conveniently identified

with or easily traced to a particular cost centre or cost object.

For example, wood is a direct material for furniture as it is directly associated with the

product, in this case furniture.

The aggregate of all direct costs is called Prime cost.

Indirect costs are those costs which are incurred for the benefit of a number of cost

centres or cost objects and cannot be conveniently identified with a particular cost

centre or object.

For example, in the production of furniture, electricity can be consumed but this cost is

not directly associated with furniture as it is incurred for a number of purposes in the

business.

The aggregate of all indirect costs is called Overhead cost.

The total production cost of a product or service is therefore the sum of prime costs

and overhead costs.

Example 1.2: Cost Classification-Direct and Indirect

Consider the following account balances for Piedmont Ltd:

1 January 2017

K

65,000

Nil

123,000

Direct materials inventory

Work in Process Inventory

Finished goods inventory

4

31 December 2017

K

34,000

Nil

102,000

Purchases of direct materials

128,000

Direct manufacturing labour

106,000

Indirect manufacturing labour

48,000

Indirect materials

14,000

Plant insurance

2,000

Depreciation-plant, buildings and equipment

21,000

Plant utilities

12,000

Repairs and maintenance of plant

8,000

Equipment leasing cost

32,000

Marketing, distribution and customer service costs

62,000

General and administrative costs

34,000

Required

a) Compute the prime cost for the year ended 31 December 2017

b) Compute the production overhead cost for the year ended 31 December 2017

c) The company always sells its products at a gross profit margin of 25%. Calculate

the amount of sales revenue made for the ended 31 December 2017

Solution

a) Prime cost:

Direct materials used in production (65,000 +128,000 – 34,000)

Direct labour cost

Total prime cost

b) Production overhead cost:

Indirect labour

Indirect materials

Plant insurance

Depreciation

Plant utilities

Repairs and maintenance

Leasing costs

Total production overhead costs

159,000

106,000

265,000

48,000

14,000

2,000

21,000

12,000

8,000

32,000

137,000

c) Sales revenue for the year

With a margin of 25%, sales revenue will be cost of sales x 100/75

Cost of sales is composed of:

Opening inventory of finished goods

123,000

Cost of production (265,000 + 137,000)

402,000

(102,000)

Less closing inventory of finished goods

423,000

Total cost of sales

Sales revenue = 423,000 x 100/75 = K564,000

5

1.3.3. Function

This means grouping of costs according to the broad divisions or functions of a

business undertaking or basic managerial activities. According to this classification

costs are divided as follows:

Manufacturing and Production Costs: This category includes the total of costs incurred

in manufacture, construction and fabrication of units of production. The

manufacturing and production costs comprise of direct materials, direct labour and

factory overheads.

Administrative Costs: This category includes costs incurred on account of planning,

directing, controlling and operating a company. For example, salaries paid to

managers and other administrative staff.

Selling and Distribution Costs: Selling costs are defined as the cost of seeking to create

and stimulate demand and of securing orders. Examples of selling costs are

advertisement, salesman salaries, etc., whereas, distribution costs are defined as the

cost of sequence of operations which begin with making the packed product

available for dispatch and ends with making it available to the consumers.

1.3.4. Behaviour

The basis for this classification is the behaviour (or response/reaction) of costs in

relation to changes in the level of activity or volume of production. The principle of

cost behaviour is that as the level of activity changes, costs will also change. On this

basis, costs are classified into four groups as follows:

Fixed Costs/ Capacity costs/ Period costs: Fixed costs are those which remain fixed in

total with increase or decrease in the volume of output or activity for a given period of

time or for a given range of output.

These costs are constant in total amount but keep decreasing per unit as production

level keep increasing.

Fixed Cost in Total and Fixed cost/unit

6

Variable Costs: Variable costs are those which vary in total directly in proportion to the

volume of output. These costs remain relatively constant per unit with changes in

volume of production or activity. Thus, variable costs fluctuate in total amount but

tend to remain constant per unit as production level changes.

Variable cost in total and per unit

Semi-variable Costs/mixed costs: Semi-variable costs are those which are partly fixed

and partly variable. They are the most common form of costs incurred by business.

The cost of production therefore will be the cost of Variable costs and the fixed costs.

The formula being 𝑇𝐶 = 𝑉𝐶 + 𝐹𝐶

Illustration

For example, the production cost of company G comprises a fixed cost of K5,000 per

year and variable costs of K7 per unit produced. Calculate the total cost at the

production quantities of 800 and 1200 units.

Solution

At the production of 800 units,

the variable costs will total (800 x7) =

The fixed costs will remain at

Total production cost

K5, 600

K5, 000

K10,600

At the production of 1,200 units, the variable costs will total (1200 x 7) =

The fixed costs will remain at

Total production cost will be

K8,400

K5, 000

13,400

The charts below illustrate the semi variable cost in total and per unit of output.

7

Semi-variable cost in total and per unit

Stepped costs: A stepped cost is a form of a fixed cost which changes its behaviour

when the level of activity exceeds a certain range (also called the relevant range).

This range provides a demarcation between the short and long runs. The stepped

costs remain constant for a certain period, and then they increase and remain

constant again, and increase again, and so on. The chart below demonstrates the

behaviour of such a cost.

Stepped costs

1.4.

The need for cost behaviour

Understanding the behaviour of the business‟ costs greatly helps the management in

planning the business‟ activities in view of the anticipated costs to be incurred. As

most business costs are a combination of fixed and variable costs (semi variable). It is

not possible to estimate a semi variable cost given a level of activity unless it (the semi

variable cost) is split into its separate elements of variable and fixed.

To split a semi variable cost into variable and fixed costs, a number of mathematical

techniques are applied. The three common ones being the High-Low method, the

scatter graph and the least squares method. In cost accounting, however, the high

low method is the most commonly used technique and it is discussed below:

High – low method: This method uses the highest and the lowest observations from a

set of past data to determine the fixed and variable cost element. Any measures

between the highest and lowest extremes are ignored.

The steps in high low method are summarised below:

8

a) To estimate the fixed and variable elements of a mixed cost, records of costs in

previous periods are reviewed and the costs of two periods are selected:

i)

The period with the highest volume of output (high activity level), Q2

ii)

the period with the lowest volume of output (low activity level), Q1

b) The difference between the total cost of the high output and the total cost of the

low output (P2 – P1) will be the total variable cost of the difference in output

levels.

c) The difference in total costs (P2 –P1)) is divided by the difference in level of output

(Q2 – Q2) to get the variable cost per unit.

d) This unit variable cost is then substituted into the highest or lowest level to get the

fixed cost for the year (using the cost formula of TC=Qty(unit cost) + FC or FC = TC

–

Qty (cost per unit))

e) With variable cost and fixed cost calculated, the future period cost can be

estimated (using the same Cost formula) given the expected activity level.

Example 1.3

The following information relates to production months of an entity:

Total cost (K)

Production hours

Month 1

110,000

7,000

2

115,000

8,000

3 111,000 7,700 4

97,000 6,000

Estimate the total cost for month five if production hours are expected to be 7,500.

Solution:

Identify two observations, the highest (Q2) and lowest (Q1) in terms of activity (in

this case, hours)

Highest (Q2)

Lowest (Q1) Difference (Q2 -Q1)

Production hrs

8,000 hrs

6,000hrs

2,000hrs

Total cost

K115,000

K97,000

K18,000

Variable cost per hour

=

K18,000/2,000 = K9/hr

Substitute the variable cost/hr (K9/hr) in either of the two, highest or lowest

observations. Choosing the highest, the cost function will be:

115,000 (TC) = (8,000 hours x K9/hr) + FC

115,000

= 72,000 + FC

FC = 115,000 – 72,000 = K43,000

(Note that if the substitution is to be made in the lowest observation, the fixed

cost would still be the same)

With fixed cost of K43,000 and variable cost of K9/hr, the estimated total cost of

7,500 hrs will be:

TC

= VC + FC

= 7,500(9) + 43,000 = K110,500

This means that if the management plans to operate at 7,500 hours, they should be

prepared for a cost of K110,500.

9

1.4.1. Limitations of the high low method

The high low method may not be a perfect way of estimating the future costs due to

the following drawbacks:

i.

It only considers the highest and lowest extremes ignoring the other levels

ii.

It assumes that the variable cost remains constant for all periods under review

iii.

It assumes that the fixed cost remains constant for all the periods under review

iv.

It only applies in the short run where costs can be classified as variable and fixed

but not in the long run.

1.4.2. Adjusting for inflation

As seen above, the high low method uses past data and as such costs in two different

production years may not be in a common form due to prevailing inflation levels. To

overcome this problem, it is appropriate to adjust all the costs for inflation so that a

comparison is made using only real figures and not the nominal ones.

For instance, if in 2016 the cost is K20,500 and in 2017 it was K22,550, one can easily

conclude that it was expensive to produce the products in 2017 than in 2016. This may

however, not be true if it is discovered that inflation level was at 110 in 2017. (110

means 10% above the base level of 100%).

This therefore calls for all figures to be adjusted to real terms by taking off the inflation

element. In this case, assuming 2016 is the base year, the costs will be:

2016

20,500 x 100/100 = 20,500

2017

22,550 x 100/110 = 20,500

It is now seen that there was no change in production cost except for inflation.

10

Example 1.4. High-Low method with inflation

From the following information for the past 5 years, estimate the variable cost per unit

and fixed cost per year:

Year

2013

2014

2015

2016

2017

Output (units)

60,000

55,000

68,000

73,000

80,000

Total cost (K)

810,000

884,000

954,000

952,000

1,035,000

Inflation factor

100

104

106

112

115

Solution

Due to the inflation factors, the costs are to be adjusted to base 100 so that they can be

comparable:

Highest

Lowest

Output

82,000

55,000

Total cost

900,000*

850,000*

Variable cost per unit = K50,000/25,000 = K2 per unit

Fixed cost = 900,000 – 82,000(2) = K736,000

11

Difference

25,000

50,000

CHAPTER TWO

COST OF PRODUCTION-MATERIAL COSTS

2.1.

Material control and accounting

The stocks held in any organization are mostly in one or all of the following forms:

a) Raw materials

b)

Work in progress

c)

Spare parts/consumables

d)

Finished goods

The cost incurred on materials is just a component of total costs incurred in

manufacturing and therefore if the materials acquired by a business are not properly

recorded and controlled, the cost of a product may be higher or lower than the actual

cost incurred in terms of materials used.

The scope of stock control system is very wide and it covers the functions of ordering,

purchasing, receiving goods into stores, issuing and maintaining stock at the most

appropriate level.

For each kind of material, a separate record is kept on a bin card which shows in detail

the quantities of all receipts, issues to production and balance of that particular

material under the store keeper‟s control, as shown below:

A sample bin card

12

As the bin card shows only the quantities, the stores ledger is as well prepared and this

shows in addition to the quantities, the monetary values of the materials received,

issued and outstanding in the stores as below:

13

Sample stores ledger card

2.1.1. Ordering, purchasing and receiving materials

The general hierarchical arrangement in most entities is that there is a central

purchasing department responsible for procurement and then a central warehouse

or stores which are responsible for receipting of goods and issuing to the

departments. In some instances, the purchasing department doubles as warehouse

department.

The purchasing department normally buys the materials when they are demanded

by the departments although in very few circumstances, materials are bought for

inventory.

When a department requires new materials, a purchase requisition is

completed by the department and sent to the purchasing department.

The purchasing department then draws a purchase order which is sent to the

supplier.)

The supplier delivers the consignment of materials and the store

keeper/receiving department signs a delivery note for the carrier. If the delivery is

acceptable, the storekeeper prepares a goods received note (GRN). See below:

14

A sample GRN

Where the purchasing department acquires materials for inventory purposes,

departments simply request for materials using a materials requisition note. This is

to request the stores/warehouse to issue the items to the department.

2.1.2. Issuing materials to departments

Materials can only be issued against a materials requisition note. Its purpose is

to authorize the storekeeper to release the goods which have been requisitioned

and to update the stores records.

Any unused materials which are returned to stores are recorded on the

materials returned note

When materials are being transferred from one department to another, they

are recorded in the materials transfer notes.

2.1.3. Stock taking

This involves counting the physical stock on hand at a certain date, and then

checking this against the balance shown in the clerical records. Two methods of

stock taking are as follows:

Periodic stock taking: this is usually carried out annually and the objective is to count

all items of stock on a specific date, for example, at the end of the financial year,

etc.

Continuous stock taking (or perpetual inventory): this involves counting and valuing

selected items of stocks on a daily basis or at frequent intervals. This system of stock

taking has the following advantages:

a)

The long and costly work of stock counting is avoided and the value of

materials can be obtained quickly for interim profit reporting.

b)

The disadvantages of excessive stocks are avoided.

c)

No operation stoppages required in order to carry out a complete

stock count.

15

d)

Discrepancies are readily discovered and localized, giving an

opportunity for preventing recurrence (repetition) in many cases.

Whatever stock taking method is employed, discrepancies might be identified, and

as such, the stores ledger card must be adjusted to reflect the true physical stock

count.

2.1.4. Stock control levels

a) Re-order level: The re-order level is that inventory level at which an order should

be placed to replenish (refill) the inventory. To estimate the re-order level, the

business has to estimate the maximum daily or monthly or weekly consumption of

the materials as well as the maximum lead time (the time lag between ordering

and receiving the materials)

Re-order level = (maximum lead time in days x maximum daily usage) +

Safety (buffer) Stock

Illustration

The annual consumption of material D in a business is 12,000Kg and it takes 7

days for the supplier to bring the materials ordered. In case of scarcity, the

business maintains a safety stock at a level of 120 Kg. Calculate the re-order

level. Assume a 300 day year.

Solution:

Re-order level = (7 x 12,000/300) + 120 = 400Kg. This means that if the materials in

the stores reach the level of 400Kg, a new order must be placed to ensure

continuity of operations.

b) Re-order quantity: this is the quantity of stock which is to be re-ordered when

stock reaches the re-order level.

Re-order qty = maximum level – (re-order level - minimum usage x minimum lead

time)

Illustration

The maximum stock level for material Y is set at 20,000 litres, the minimum daily

usage is 1,200 litres and it takes 8 to 14 days for material to be delivered. The reorder level is currently at 11,000 litres. Calculate the re-order quantity for material

Y.

Solution

Re-order Qty

= 20,000 – {11,000 – (1,200 x 8)}

= 20,000 – {11,000 – 9,600}

= 18,600 litres

c) Maximum level: this represents that level of stock above which the stock should

not be allowed to rise. It is to be fixed keeping in mind unnecessary blocking of

capital in stocks.

16

Maximum level = re-order level + re-order quantity – (minimum usage x minimum

lead time)

Illustration

The re-order level of material Z is 2,000 Kg and the re-order quantity is 9,000 Kg.

the minimum daily usage is 400Kg and the minimum lead time is 6 days.

Calculate the maximum level for material Z.

Solution:

Maximum level = 2,000 + 9,000 – (400 x 6)

= 11,000 – 2,400

= 8,600 Kg

d) Minimum level: this represents a level of stock that draws management attention

to the fact that stocks are approaching a dangerously low level. Stocks should

not be allowed to decrease below this level.

Minimum level = re-order level – (average usage x average lead time)

Illustration

The re-order level of material L is 6,000Kg. The maximum daily usage is 800Kg and

the minimum daily usage is 300 Kg. It takes 6 to 10 days for the suppliers of

material L to deliver. Calculate the minimum level for material L.

Solution

Minimum level =

6,000 – (550 x 8)* = 1,600 Kg

*Explanation: Average usage = (800 + 300)/2, and average lead time = (6 + 10)/2

=8

e) Average level: this represents the average of the starting and closing levels of

stocks assuming a uniform (constant) pattern of stock usage.

Average level of stock = minimum level + ½ re-order quantity.

Illustration

If the minimum stock level and average stock level of raw material A are 4000

and 9000 units respectively, find out its „Re-order quantity‟.

Solution:

Minimum stock level of Material A = 4,000 units and average Stock level = 9,000

units

Since average stock level = Minimum Stock Level + ½ Re order quantity

Then ½ Reorder Quantity = 9000-4000 units = 5000 units

Therefore, Reorder Quantity = 10,000 units

17

2.2.

The Economic Order Quantity (EOQ)

The reorder quantity shows how much is to be ordered whenever it is time to place

the order. However, it is not always necessary to order in large or small quantity

simply because the re-order quantity has been computed so. There are costs

involved with the quantity order and therefore a good balance has to be stricken

between too much and too little.

The recommended quantity to order is the EOQ which is the re-order quantity which

minimizes the total costs associated with holding and ordering stocks. It is the order

quantity where the sum of holding costs and ordering costs are equal and at a

minimum.

Ordering Costs: These include costs incurred in the following activities: requisitioning,

purchase ordering, transporting, receiving, inspecting etc.

Ordering costs increase with the number of orders; thus the more frequently

inventory is acquired, the higher the firm's ordering costs. On the other hand, if the

firm maintains large inventory levels, there will be few orders placed and ordering

costs will be relatively small. Thus, ordering costs decrease with increasing size of

inventory.

Carrying (or holding) costs: These are costs incurred for maintaining a given level of

inventory. They include storage, insurance, taxes, deterioration and obsolescence.

Unlike ordering costs, carrying (or holding) costs increase with increasing stock levels

and decrease with decreasing stock levels as seen in the graph below:

EOQ by graph

18

Mathematically, the Economic Order Quantity (EOQ) can be ascertained by the

equation below:

2𝐶𝐷

𝐻

𝐸𝑂𝑄 =

√

Where C= cost of ordering, D = annual demand and H= holding costs.

Example 2.1: Stock Control levels

Shagoon Ltd provides the following information in respect of material X:

Supply period:

5 to 15 days

Rate of consumption:

Average: 15 units per day

Maximum:

20 units per day

Yearly:

5000 units

Ordering costs are K20 per order

Purchase price per unit is K50

Storage costs are 10% of unit value.

Calculate the following

Re-order Qty (EOQ)

Reorder Level

Minimum level

Maximum level

Solution:

= 200 units

EOQ

Reorder level

=

maximum lead time x maximum daily usage

15 x 20

=

300 units

Minimum level

= reorder level – (average usage x average lead time)

300 - (15 x 10) =

150 units

Maximum level = reorder level + reorder quantity-(minimum usage x minimum

lead time)

300 + 200 –(10 x 5) = 450 units

When a business orders a quantity of Q and the annual demand is D,

𝐷

The cost of ordering for the entire year will be × 𝑐𝑜𝑠𝑡 𝑝𝑒𝑟 𝑜𝑟𝑑𝑒𝑟, and

𝑄

The cost of holding the inventory for the whole year will be:

𝑄

× 𝑜𝑙𝑑𝑑𝑖𝑛𝑔 𝑐𝑜𝑠𝑡 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡 𝑝𝑒𝑟 𝑦𝑒𝑎𝑟

2

Remember that holding cost and ordering cost are always equal only when the

business is at EOQ.

19

Example 2.2: Stock Control levels

A company uses a large quantity of salt in its production process. Annual consumption

is 60,000Kg over a 50week year. It costs K100 to initiate and process an order and

delivery follows two weeks later. Storage costs for the salt are estimated at K0.10 per kg

per year. The current practice is to order twice a year when stocks fall to 10,000Kg.

Required

a) Calculate the re-order level in Kg

b) Calculate the appropriate ordering quantity for the entity and calculate how

much cost will be saved if the company abandons its current strategy for the new

ordering strategy.

Solution

a) Re-order level

= max. weekly usage x maximum lead time

60,000/50 x 2

= 12,400Kg

b)

Appropriate ordering policy (EOQ)

= 10,954 Kg

Costs for the current policy (where ordering is made twice a year), are:

Ordering cost = 60,000/30,000 x 100

=

200

Holding cost =

30,000/2 x 0.1

=

1,500

Total cost

1,700

Costs for the new policy (the EOQ) are:

Ordering costs = 60,000/10,954 x 100

Holding costs = 10,954/2 x 0.1

Total cost

Cost saved then is K1,700 – K1,096 = K604

=

=

548

542

1,096

2.3.

Just-in-time (JIT) system

This is a new approach to operations planning and control based on the idea that

goods and services should be produced only when they are needed. They should

not be produced too early, so that inventories build up, nor too late, so that

consumers have to wait.

Under this system materials arrive exactly at the time they are needed for

production. The just-in-time (JIT) system is used to minimize inventory investment. The

principle is that materials should arrive at exactly the time they are needed for

production.

Because its objective is to minimize inventory investment, a JIT system uses no, or very

little, safety stocks. Extensive coordination must exist between the firm, its suppliers,

and shipping companies to ensure that material inputs arrive on time.

20

Failure of materials to arrive on time results in a shutdown of the production line until

the materials arrive. Likewise, a JIT system requires high-quality parts from suppliers.

When quality problems arise, production must be stopped until the problems are

resolved.

2.3.1. Benefits of JIT system in materials and cost control

a) Reduction in working capital investment in stocks

b) Reduction in materials handling, hence reduction of wastages.

c) More efficient ordering of materials

d) Fewer defective components supplied

e) There are minimal amounts of inventory obsolescence, since the high rate of

inventory turnover keeps any items from becoming old.

f) Since production runs are very short, it is easier to halt (stop) production of

one product type and switch to a different product to meet changes in

customer demand.

g) The very low inventory levels mean that inventory holding costs (such as

warehouse space) are minimized.

2.3.2. Disadvantages of JIT system in material and cost control

a) A supplier that does not deliver goods to the company exactly on time and in

the correct amounts could seriously impact the production process.

b) A natural disaster could interfere with the flow of goods to the company from

suppliers, which could halt production almost at once.

c) An expensive investment in information technology is required to link the

computer systems of the company and its suppliers, so that they can coordinate

the delivery of parts and materials.

d) A company may not be able to immediately meet the requirements of a

massive and unexpected order, since it has few or no stocks of finished goods.

2.4.

Stock (inventory) valuation

For purposes of reporting, both internally and externally, the value of inventory held

in a business must be ascertained at a given day of the year. The main methods

used to value the inventory used in production or value of inventory in stock include:

a) First In First Out (FIFO): This system assumes, for pricing purposes, that the first

materials to arrive in stock are the first ones to be sold or issued to production.

When the FIFO system is operated, the material cost charged to production is

high when prices are falling whereas in inflationary conditions; the material cost

charged to production is low.

Example 2.3: FIFO Valuation

From the information in the table below, Calculate the cost of materials that are

issued to production (or sold) on 5th and 24th June, and hence calculate the

value of the materials remaining in stock at 24th June.

Date

Receipts

Issues / Sales

21

Quantity

Unit cost

1 June

Balance

100

5

3 June

Receipts

300

4.8

5 June

Issues

12 June

Receipts

24 June

Issues

Quantity

Unit cost

220

170

Solution:

Cost of issues

Date of issue (or sale)

5th June

24th June

Cost of remaining materials

24th June

5.2

300

(100 x 5) + (120 x 4.8)*

(180 x 4.8) + (120 x 5.2)**

(50 x 5.2)***

Cost of materials

K1, 076

K1,488

K260

Explanations:

*Out of the first 220 materials that were issued or sold, 100 came from 1 June (at

K5 each) and the remaining 120 came from 3 June (at K4.8 each).

** Out of the 300 materials issued or sold, 180 were the ones remaining from 3

June (at K4.8 each), and 120 materials came from 12 June (at K5.2 each).

*** On 12 June, out of 170 materials, 120 materials were issued or sold on 24 June,

therefore 50 (170 – 120) are remaining in stock each having a cost of K5.2.

b) Average cost method (AVCO): This system assumes that all the materials are

issued at the average cost of the total inventory held regardless of the time they

were received. There are two ways of obtaining the average cost of materials

issued for production and these are:

Periodic weighted average where the average is based on the total cost paid

for all the materials acquired over a particular period, and;

Continuous weighted average where the average is determined the moment a

change arises either in the quantity or cost of the materials.

Using the above information of receipts and issues of materials, below is how the

average cost method is applied:

Periodic weighted average

Total value of materials received = (100 x 5) + (300 x 4.8) + (170 x 5.2) =

K2,824 Total quantity of materials received = (100 + 300 + 170) = 570

Periodic average = K2,824 / 300 = K4.95 per unit of material.

On 5th June the materials issued will cost 220 x 4.95 = K1,089

22

On 24th June, the materials issued will cost 300 x 4.95 = K1,485 The

materials in stock at 24 June will cost 50 x 4.95 = K247.50 Continuous average

By 5 June total cost of materials = (100 x 5) + (300 x 4.8) = K1,940 and

the

quantity of materials = 400. The average cost therefore is K1,940/400 =

K4.85. The cost of the issue on 5 June = 220 x 4.85 = K1,067.

By 24th June, the total cost of materials = (1940 – 1067) + (170 x 5.2) =

K1,757

and the total quantity of materials is (400 – 220 + 170) = 350. The

average cost therefore is K1757/350 = K5.02. The cost of issue on 24th June is

300 x 5.02 = K1,506

The closing stock on 24th June has a cost of 1757 – 1,506 = K251

2.5.

Book keeping recording for materials

Materials held in stock are an asset and are recorded in the Statement of financial

position of a business. All materials are accounted for in the Materials or stores

control account. The well-known entries are as follows:

Opening balance of raw materials is a debit in the Materials control

account

Materials purchased are debited in the materials control account and

credited in the supplier or cash account (depending on whether they are

bought on cash or on credit)

Materials returned to stores are debited in materials control

Direct materials sent from stores to production are credited in the

materials control and debited in the Work in Progress (WIP) account

Indirect materials sent to production are credited in the materials

control and debited in the production overheads account.

Any materials written off or lost are credited in the materials control

and debited in the income statement as an expense

23

Example 2.4: The Stores Control Account

On 1 July, the total value of stocks held in store was K50,000. The following occurred

during July:

Materials purchased from suppliers on credit

120,000

Materials returned to suppliers

3,000

Materials purchased on cash

8,000

Direct materials issued to production department

110,000

Indirect materials issue to production

25,000

Materials written off due to discrepancy

1,000

Direct materials returned to stores from production

4,000

Prepare a materials control account for the month of July.

Solution

(The letters in brackets refer to the transaction)

______________________________________________________________________________________

Balance b/f

50,000

Suppliers (b)

3,000

Suppliers (a)

120,000

Work in progress (d)

110,000

Cash (c)

8,000

Production overheads (e)

25,000

Work in progress (g)

4,000

Profit and loss (f)

1,000

Balance c/d

43,000

182,000

182,00

24

CHAPTER THREE

COST OF PRODUCTION- LABOUR COSTS

3.1.

Direct Labour

Direct labour is that labour which is directly engaged in the production of goods

or services and which can be conveniently allocated to the job, process or

commodity unit.

For example, labour engaged in making the bricks in a kiln is direct labour

because charges paid for making 1,000 bricks can be conveniently allocated to

the cost of 1,000 bricks.

Normally, direct labour is paid for on the basis of hours the worker spent in the

production process. For instance, if the basic rate per hour is K700 and a worker

works for 15 hours, the labour cost in this case will be 700 x 15 = K10,500.

3.2.

Indirect Labour

Indirect labour is that labour which is not directly engaged in the production of

goods and services but which indirectly helps the direct labour engaged in

production. The examples of indirect labour are mechanics, supervisors, foremen,

watchmen, timekeeper, repairers and cleaners, etc.

The cost of indirect labour cannot be conveniently allocated to a particular job,

order, process or article. For example in a production factory, the wages of a

supervisor who oversees all the workers in all the production lines cannot be easily

identified with a particular product; therefore it is an indirect labour cost.

Though indirect, it still remains a production cost as long as it is incurred on

production related activity only that it is not considered directly but through

absorption (to be discussed later)

3.3.

Overtime

Normally, a worker is expected to work for a maximum given number of hours in a

day, week or month. If workers work beyond their normal working hours, the extra

hours (normally above the given maximum) are referred to as overtime.

This overtime is paid for at an additional cost premium (over and above the basic

rate for the normal hours).

For example, if the basic rate per hour for normal hours is K500 and any overtime is

paid at time and a half (that is 500 + 250), then if the normal hours are 40 and the

worker did 43 hours, the total wage will be calculated as follows:

Basic pay for all hours (43 x 500)

Overtime premium (3 x 250)

21,500

750

25

Total pay

The other presentation could be:

Pay for normal hours (40 x 500)

Pay for overtime hours (3 x 750)

22,250

20,000

2,250

22,250

N.B: The most recommended presentation is the first one because it shows the

overtime cost separately from the basic pay. You are therefore advised to use the

first one for labour cost recording and accounting purposes.

The overtime premium (in this case, the K750, and not the K2,250) is to be treated

as an indirect wage cost unless the overtime was specifically requested by the

customer for whom the work was done, in which case it will be a direct wage cost

for that particular job.

3.4.

Control of labour cost

Some of the techniques used to effectively control labour costs include the

following:

a)

Production planning: this involves the preparation of production

planning schedule in advance of production runs with supporting schedule of

man hour requirements.

b)

Labour budget and use of labour standards: a labour budget is simply

a cost estimate of expected labour to be used. A labour standard is a

benchmark (basis of comparison) set in place to represent the hours required

to complete one unit of product given certain conditions. This helps to

measure productivity by comparing actual time taken against an expected

time.

For example, if the standard (expected) hours to produce a unit of product is

7 hours but a worker has taken 10 hours, the reasons for the excess hours have

to be investigated.

c)

Labour performance reports: these reports signal whether control is

needed or not and should be produced periodically. A sample of labour

(employee) performance report form is illustrated below:

26

d)

Wage incentive schemes: Wage incentive refers to performance

linked compensation paid to improve motivation and productivity. It is the

monetary inducements offered to employees to make them perform beyond

the accepted standards. Workers will be more productive and more efficient if

they are sufficiently motivated.

Wage incentive schemes aim at the fulfillment of following objectives:

To improve the profit of a firm through a reduction in the unit costs of labour

and materials or both.

i)

To avoid or minimise additional capital investment for the expansion of

production capacity.

ii) To increase a worker's earnings without dragging the firm into a higher

wage rate structure regardless of productivity.

iii) To use wage incentives as a useful tool for securing a better utilisation

of manpower. Better production scheduling and performance control and

a more effective personnel policy.

3.5.

Measures of labour activity

The activities of workers in the production function can be assessed using the

following ratios.

a)

Efficiency/productivity ratio: this ratio shows the efficiency of workers

by comparing the actual hours taken to complete a given production against

the expected (or standard hours). It measures whether the production output

for a period in a production cost centre took more or less direct labour time

than expected

It is given by the formula:

27

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑜𝑟 𝑠𝑡𝑎𝑛𝑑𝑎𝑟𝑑 𝑜𝑢𝑟𝑠

𝐸𝑓𝑓𝑖𝑐𝑖𝑒𝑛𝑐𝑦 𝑅𝑎𝑡𝑖𝑜 =

𝐴𝑐𝑡𝑎𝑢𝑙 𝑜𝑢𝑟𝑠

× 100%

A

ratio above 100% means the workers are very efficient and this has to

be encouraged. On the other hand, it might mean that the expected or

standard hours were overstated.

b)

Capacity ratio: this ratio (also known as capacity utilisation ratio)

shows how much of the available labour capacity is being used. When

employees are working below capacity, it means the business will not fully

maximise its potential.

This is given the formula:

𝐴𝑐𝑡𝑢𝑎𝑙 𝑜𝑢𝑟𝑠

𝐶𝑎𝑝𝑎𝑐𝑖𝑡𝑦 𝑅𝑎𝑡𝑖𝑜 =

× 100%

𝐵𝑢𝑑𝑔𝑒𝑡𝑒𝑑 𝑜𝑢𝑟𝑠 𝑜𝑟 𝑐𝑎𝑝𝑎𝑐𝑖𝑡𝑦

𝑜𝑢𝑟𝑠

c)

Production volume ratio: this ratio represents the actual output

measured in direct labour hours as a proportion of budgeted output. It is given

by the formula:

𝑆𝑡𝑎𝑛𝑑𝑎𝑟𝑑 𝑜𝑢𝑟𝑠

𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 𝑉𝑜𝑙𝑢𝑚𝑒 𝑟𝑎𝑡𝑖𝑜 =

𝐵𝑢𝑑𝑔𝑒𝑡𝑒𝑑 𝑜𝑢𝑟𝑠

× 100%

Or alternatively;

𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 𝑣𝑜𝑙𝑢𝑚𝑒 𝑟𝑎𝑡𝑖𝑜 = 𝐸𝑓𝑓𝑖𝑐𝑖𝑒𝑛𝑐𝑦 𝑟𝑎𝑡𝑖𝑜 x 𝐶𝑎𝑝𝑎𝑐𝑖𝑡𝑦 𝑟𝑎𝑡𝑖𝑜

A

ratio of more than 100%, say 120%, implies that the actual output,

measured in labour hours is more than the budgeted output by 20%.

Example 3.1: Measuring labour activity.

A company budgets to make 25,000 standard units of output during a budget

period of 100,000 hours. Actual output was 27,000 units which took 120,000 hours.

The above three ratios are calculated as below:

Efficiency ratio =

4hours

Expected hours per unit = 100,000/25,000 =

Total expected hours = 27,000 x 4 = 108,000 hours

Actual hours = 120,000 hours

Efficiency ratio = 108,000/120,000 x 100% = 90%

Capacity ratio =

Actual hours are 120,000 hours

Budgeted hours are 100,000 hours

Capacity ratio = 120,000/100,000 = 120%

Production volume ratio= Expected (standard hours) = 108,000

28

Budgeted hours = 100,000

Production volume ratio = 108,000/100,000 = 108%

3.6.

Labour turnover

Labour turnover is a measure of the number of employees leaving or being

recruited in a period of time as a percentage of the total labour force.

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑙𝑒𝑎𝑣𝑒𝑟𝑠 𝑟𝑒𝑞𝑢𝑖𝑟𝑖𝑛𝑔 𝑟𝑒𝑝𝑙𝑎𝑐𝑒𝑚𝑒𝑛𝑡

𝐿𝑇𝑂 =

× 100%

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑒𝑚𝑝𝑙𝑜𝑦𝑒𝑒𝑠

Example 3.2: Labour Turn over

In a certain factory, the following data was gathered for the year:

Employees at the beginning of the year

72

Employed during the year

14

Left during the year

11

Employees at the end of the year

75

Calculate the labour turnover rate for the year

Solution

In this case, the labour turn over will be:

(14 + 11)/2

(72 + 75)/2

= 17%

This means that for every 100 workers in a year, 17 workers leave and need to be

replaced.

Management should do all it can to minimise labour turnover because it is significantly

costly.

3.6.1. Cost of Labour Turnover

The cost of labour turnover can be divided under two classes as follows:

Preventive costs: These are costs which are incurred to prevent excessive labour

turnover. The aim of these costs is to keep the workers satisfied so that they may

not leave the factory. These costs may include:

a)

Cost of providing good working conditions.

b)

Cost of providing medical, housing and recreational facilities to

workers.

c)

Cost of providing educational facilities to the children of the workers.

d)

Cost of providing Subsidised meals.

e)

Cost of providing safety measures against working conditions. Etc.

Replacement costs: These costs are associated with replacement of workers and

include:

a)

Cost of recruitment of new workers.

b)

Cost of training new workers.

c)

Loss of production due to interruption in production, and inefficiency of

new workers.

d)

Loss of profit due to loss of production.

29

3.6.2. Reduction of Labour Turnover

The following steps may be taken to reduce the labour turnover and its associated

costs:

a)

Paying satisfactory wages

b)

Offering satisfactory hours and conditions of work

c)

Creating a good informal relationship between fellow workers and

between supervisors and subordinates

d)

Offering good training schemes and a well-known transparent

promotion ladder

e)

Improving the content of jobs to create job satisfaction.

3.7.

Accounting for labour costs

All labour costs, whether direct or indirect are accounted for in the wages

control/labour account where all total wages paid are debited and credited in

the cash or bank account.

The labour costs must then be categorised into direct and indirect and all the

direct labour costs are then credited from the labour account and debited into

the Work in Progress (WIP) account, whereas all the indirect labour costs are

credited from the labour/wages control account but debited in the production

overheads account.

The summary below provides the journal entries for labours costs:

a) Total labour costs incurred or paid: Dr

Cr

b) Direct labour costs

c) Indirect labour costs

Dr

Cr

Dr

Cr

Wages/Labour Control account

Cash/Bank account

Work In Progress (WIP) account

Wages Control account

Production Overheads account

Wages Control account

Example 3.3: Labour cost bookkeeping

The following relates to labour costs for the month:

Direct workers

Basic pay for normal time

Overtime: basic wage

Premium

Shift allowance

Sick pay

Idle time

36,000

8,700

4,350

3,465

950

3,200

30

indirect

22,000

5,430

2,715

1,830

500

total

58,000

14,130

7,065

5,295

1,450

3,200

56,665

32,475

89,140

Prepare the wages control account for the month

Solution:

Bank (wages paid)

Wages control account

89,140

Work in progress

Production overheads

Indirect labour

Overtime premium

Shift allowance

Sick pay

Idle time

89,140

44,700*

27,430

7,065

5,295

1,450

3,200

89,140

*The only direct wage expense to go straight to the WIP account is the basic pay for

normal and overtime for direct workers. The overtime premium, shift allowance, sick

pay, and idle time were indeed paid to direct workers but the costs are not directly

related to any product, hence they are indirect labour costs.

31

CHAPTER FOUR

PRODUCTION COSTS-OVERHEAD ABSORPTION

4.1.

Introduction

Production overheads, by their nature cannot be identified or associated with a

particular product or service because they may be incurred for a number of

purposes and not just for the product being produced or service being provided.

Because of their indirect nature, overhead costs must be included to the cost of a

product or service by means of a systematic method or approach. Currently the

most popular approaches of dealing with overheads are the traditional approach or

Absorption Costing, and the Activity Based Costing (ABC).

When dealing with overheads using the absorption costing system, the costs are

taken into the product or service cost on the basis of volume of production where as

in Activity based costing, the costs are taken into the product or service cost on the

basis of activities causing the costs.

4.2.

Overhead absorption

Overhead absorption can be defined as the inclusion of fixed production overheads

into the cost of a product or service using a predetermined rate (called the

overhead absorption rate).

The overhead absorption rate (OAR) can be determined using a number of bases

which measure the volume of the business activities. Such bases may be but not

limited to direct labour hours, machine hours, total units produced, total direct

wages or total direct materials.

𝑇𝑜𝑡𝑎𝑙 𝑏𝑢𝑑𝑔𝑒𝑡𝑒𝑑 𝑜𝑣𝑒𝑟𝑒𝑎𝑑𝑠

𝑂𝐴𝑅 =

𝑇𝑜𝑡𝑎𝑙 𝑎𝑚𝑜𝑢𝑛𝑡 𝑜𝑓 𝑡𝑒 𝑏𝑎𝑠𝑒

Example 4.1: Full product costing

Product K requires 5Kg of materials which are bought at K89/Kg, 6 hours of direct

labour paid for at K35/hr. Fixed overheads are estimated to be K18, 000 and will be

absorbed on the basis of labour hours. If it is expected that 1,000 units of product K

will be produced, what is the total cost to produce one product of K?

Solution:

Total cost of one product

Direct Materials (5 x 89)

Direct labour (6 x 35)

Fixed overhead

Total cost

Explanation:

K

445

210

18*

673

32

*Since the fixed overheads are absorbed on the basis of labour hours, we need to

identify all the labour hours expected. In this case they are (1,000units x 6hours/unit)

= 6,000 hours. This means that the rate of absorption is (K18,000/6,000 hours) = K3/hr.

Since each product requires 6 labour hours, then each product will get a share of

(K3/hr x 6hrs) = K18.

Example 4.2: Computation of OARs

A production process passes through three stages/departments, all of which are

cost centres. The information relating to a period is as follows:

Department allocated OH

machine Hrs (budget) labour Hrs(budget)

A K56,000

16,000

nil

B

K48,000

nil

24,000

C K32,000

1,000

1,000

The estimated production is 16,000 units. Department A is machine intensive and the

department B is labour intensive. The absorption rate for department C is based on

level of production. Each product requires 1 machine hour in department A and 1.5

labour hours in B.

Calculate the overhead absorption rate for each of the three departments and the

total overhead cost to be incorporated in the production cost of the product.

Solution

Using the above information, the absorption rates will be as follows:

Dept A (basis is machine hrs)

56,000/16,000 machine hrs = K3.5/machine hr

B (basis is labour hours)

48,000/24,000 labour hours = K2/labour hr

C(basis is production volume) 32,000/16,000

products

=

K2/unit

of

production.

This means that the overheads per unit produced will be:

Department: A

1 hour x K3.5 /hr

=

B

1.5 hours x K2/hr

=

K3

C 1 unit x K2/unit

=

K2

K3.5

K8.5

The K8.5 will be added to the prime cost per unit to get the total cost per unit of a

product.

NB: The basis of absorption depends on the nature of the department. If it is more

machine intensive, machine hours could be the most appropriate basis and if it is

labour intensive, labour hours make a good basis. Otherwise, you will have to be

advised as to which basis to use in the departments.

4.3.

Costing procedures

The stages involved in assigning overhead costs to a product or service are as

follows:

33

4.3.1. Cost allocation

This is a process where cost items are charged direct to a cost centre. The cost is (or

will be) incurred for a particular cost centre or department. In this case, the

overheads are directly attributable to a particular department (not products) and as

such they just have to be assigned to where they belong. For instance, if

department A incurs overheads of K400,000, it will simply be allocated these

overheads as they are easily traced to the department.

However, there are some overheads that are incurred for the business as a whole

and cannot be easily associated with a single department. In such a situation, the

next stage follows.

4.3.2. Cost apportionment

This is the process where cost items or cost centre costs are divided between several

other cost centres in a fair proportion. What determines the proportion is the arbitrary

usage of the cost incurred by each department concerned.

The table below provides a suggestion (not a rule) of the bases to use when

apportioning various overheads to centres:

Overhead

Suggested basis

Rent ,rates, repairs, lighting and Floor area occupied by each cost

depreciation of buildings or factory

centre or department.

Depreciation, insurance of equipment

Cost or book value of equipment

Personnel office, canteen, welfare, etc Number of employees in each cost

centre

Heating etc

Volume of space occupied by each

centre

There are no strict rules of choosing the basis of apportionment but reasonableness

and fairness should prevail when determining the bases. For instance, it may not be

reasonable to apportion depreciation cost based on number of employees in the

department. The most reasonable basis could be the value of equipment in the

department as depreciation is based on the value.

Example 4.3: Overhead allocation and apportionment

The following production overheads were incurred by an entity:

Indirect materials: Dept A

3,000

Dept B

2,500

Dept X

500

Dept Y

750

Indirect labour

Dept A

400

Dept B

750

Dept X

600

Dept Y

180

Factory depreciation

1,000

34

Factory repairs and maintenance

Factory office costs

Depreciation of equipment

Insurance of equipment

Heating

Lighting

Canteen

600

1,500

800

200

390

100

900

14,170

Information relating to the production departments A and B; and service

departments

X and Y is as follows:

Dept A

Dept B

Dept x

Dept Y

Floor space

(sq m)

1,200

1,600

800

400

Volume (cub m)

3,000

6,000

2,400

1,600

Number of employees

30

30

15

15

Book value of equipment (K) 30,000

20,000

10,000

20,000

Hours used from X

100

70

30

Hours used from Y

50

10

20

Show how the overheads will be apportioned to the four departments A, B, X

and Y.

Solution:

(See explanations below)

Item

basis

A

B

X

Y

Indirect materials

allocated

3,000

2500 500

750

Indirect labour

allocated

400

750

600

180

Factory depreciation

floor area

300

400

200

100(a)

Factory repairs

floor area

180

240

120

60(b)

Factory office costs

no. of employees 500

500

250 250(c)

Equip depreciation

book value

300

200

100 200(d)

Insurance of equip

book value

75

50

25 50(e)

Heating

volume

90

180

72 48(f)

Lighting

floor area

30

40

20 10(g)

Canteen

no. of employees 300

300

150 150(h)

5,175

5,160 2,037 1,798

Explanations:

a) The term factory represents all the infrastructure or premises within which

the business is situated, that is, the buildings within. The area of the whole

factory is 4,000m2. Department A will therefore get a proportion of 1,200/4,000

of K1,000; B will get a share of 1,600/4,000 of K1,000; etc.

b)

Factory repairs will be shared on the same basis of floor space or area.

A will then get 1,200/4,000 x 600; etc.

c)

Factory office costs will be apportioned on the basis of number of

employees. Total number of employees is 90. A will therefore be apportioned

30/90 x 1500; etc.

35

d) Depreciation of equipment will be apportioned on the basis of book value of

equipment. Total book value is K80,000. A will get a proportion equal to

30,000/80,000 of 800; etc.

e) Insurance of equipment will also be apportioned using book value of equipment.

Department A gets 30,000/80,000 of K200, etc.

f) Heating cost will be apportioned on the basis of volume and the factory has got

a total volume of 13,000m3. Department A will be apportioned 3,000/13,000 of K390,

etc.

g) Lighting will be apportioned based on floor area and therefore A will get

1,200/4,000 of K100.

h) Canteen costs will be apportioned based on number of employees and

Department A will get a share of 30/90 of K900.

4.3.3. Re-apportionment of service costs:

Our main goal is to get the cost of production and production departments should

be our areas of focus. But as we see in the above example, two other departments,

X and Y are not involved in production but some overheads have been apportioned

to them. We need now to transfer those overheads to the production centres A and

B where absorption takes place. This is called re-apportionment of costs to

production centres from service centres.

The service centre costs can be re apportioned to the production centres using any

of the following methods:

Direct Method:

This is where the costs of service departments are directly apportioned to production

departments without taking into account any service rendered by one service

department to another service department. This can be done by estimating how

much of the overheads in the service centres must be transferred to production

centres but not to another service centre. It is assumed in this case that the service

centres are not servicing each other.

Example 4.4. Re-apportionment using the direct method

Continuing from the above analysis sheet in example 4.3 you are requested to

reapportion the service costs to the production costs using the following basis:

Service X

Service Y

Production A

40%

80%

Production B

60%

20%

Solution

A

B

X

Y

Apportioned costs

5,175

5,160

2,037

1,798

X- Re-apportioned

815 1,222

(2,037) - Y- Re-apportioned 1,438

360

(1,798)

7,428

6742

This shows that the total overheads in X of 937 have been shared by A and B in the

given proportions or percentages. (40% of 937 goes to A and 60% goes to B, and so

on)

36

Repeated (continuous) distribution method:

Under this method, the re-apportionment goes on continuously, using the

appropriate bases until the service costs become equal to zero or become

negligible. The emphasis is mostly on how each department benefits from a

particular service centre. With this approach, it is acknowledged that a service

centre can service another service centre in addition to serving the production

centres.

Example 4.5: Re-apportionment using continuous distribution

Continuing from the above analysis sheet in example 4.3, reapportion the service

costs to production centres using continuous distribution method.

Solution:

the departments are enjoying the services of service centres X and Y as follows:

A

B

X

Y

Services of X (in hours)

100 (50%)

70 (35%)

30 (15%)

Services of Y (in hours)

50 (62.5%)

10 (12.5%)

20 (25%)

Below is how the repeated distribution works (starting with service centre with higher

costs, in this case X)

A

B

X

Y

Apportioned costs

5,175.00

5,160.00

2,037

1,798.00

X (2,037 in the ratio100:70:30)

1,019.00

712.95

(2,037)

305.55

6,194.00

5,872.95

2,103.55

Y (2,103.55, ratio 50:10:20)

1,314.72

262.94

525.89

(2,103.55)

7,508.72

6,135.89

525.89

X (525.89 in ratio100:70:30)

262.95

184.06

(525.89)

78.88

7,771.67

6,319.95

78.88

Y (78.88 in ratio 50:10:20)

49.30

9.86

19.72

(78.88)

7,820.97

6,329.81

19.72

X (19.72 in ratio 100:70:30)

9.86

6.90

(19.72)

2.96

7,830.83

6,336.71

2.96

Y (2.96 in ratio 50:10:20)

1.85

0.37

0.74

(2.96)

7,832.68

6,337.08

0.74

To this end the remaining overhead costs of K0.74 in department X could as well be

ignored as negligible and therefore the final overhead costs will be K7,832.68 for A

and K6,337.08 for B. (you may wish to continue with the distribution if in your opinion

the K0.74 is material).

37

Linear algebra method:

Under this method, simultaneous equations are applied after considering how the

service centres are serving the production departments.

Firstly, we need to establish the proportion of service the service centres are

providing to the other centres (or to themselves in extreme cases). These proportions

will help to create the linear equations to be used in re-apportioning the costs

To understand the development of the linear equations, the analysis is redrawn here

for reference:

A

B

X

Y

Apportioned overheads

5,175

5,160

2,037

1,798

Dept X (proportion of hours used)

50%

35%

15%

Dept Y (proportion of hours used)

62.5%

12.5%

25%

-

Points to note:

Out the 200 hours of X, 30 hours (or 15%) are used by Y

Out of 80 hours of Y, 20 hours (or 25%) are used by X

This means that the overheads to be apportioned from X will be 2,037

plus 25% of Y‟s, that is X = 2,037 + 0.25Y (equation 1).

This also means that the overheads to be apportioned from Y will be

1,798 plus 15% of X‟s, that is Y = 1,798 + 0.15X (equation 2).

These two equations can then be solved algebraically to give the actual values of X

and Y to be taken by A and B.

Solving for X and Y, the values become Y = K2,185.51 and X = K2,583.38.

The cost of X (2,583.38) will then be apportioned to A and B as 50% to A and 35% to B

and that of Y (K2,185.51) will be apportioned to A and B as 62.5% to A and 12.5% to

B.

The total overhead cost for Department A and Department B will therefore be:

A

B

Apportioned overheads

5,175.00

5,160.00

Share of X (50%, 35%)

1,291.69

904.18

Share of Y (62.5%, 12.5%)

1,365.94

273.19

7,832.63

6,337.37

4.3.4. Overhead absorption or recovery

This is where costs of cost centres are added to unit, job or process to come up with

a complete cost of production using the bases already explained above.

For example, using the results from the linear algebra method, if in Department A the

overheads were to be absorbed on the basis of labour hours and in B on the basis of

machine hours; and given 4,000 labour hours in A and 3,000 machine hours in B, then

the absorption rates would be as follows (using the final overhead amounts):

A

B

Overhead cost

K7,832.63

K6,337.37

Basis

4,000 labour hours

3,000 machine hours

38

OAR

K1.96/labour hr

K2.11/machine hour

This means that if one product spends 4 hours in department A and 9 hours in B, the

total overhead cost for one product would be:

In Department A

(4 hours x K1.96/hr)

7.84

In Department B

(9 hours x K2.11/hr)

18.99

26.83

4.4.

Over/under absorption of overheads

The rate of absorption (OAR) is based on estimates of costs and activities (budgets)

and therefore the actual fixed overheads absorbed are not always equal to the

fixed overheads incurred over the production period.

It must be noted here that in absorption costing, the cost of a product is that which

has been absorbed and not that which has been incurred. Take for instance,

overhead cost incurred of K42 but due to the OAR in use of say K8/hour, if the

product uses 6 hours, then the cost of the product will be 6 x 8 = 48 (absorbed), and

not the actual cost incurred of K42.

4.4.1. Under absorption

This occurs when the actual overheads absorbed into the production costs are

lower than the actual overhead cost incurred.

For instance, absorbing K10,000 into the cost of the product but actually incurring

say K15,000. The difference of K5,000 is an under absorption (meaning that the

production has absorbed less overheads than what has been incurred in making it)

The under absorption of overheads is an expense in the income statement of the

business.

Example 4.6: Under-absorption

The budgeted overhead costs for a period are K28,000 for a budgeted machine

time of 4,000 hours. If actual overheads incurred are K31,500 for 4,200 machine

hours. Calculate the under absorbed overheads.

Solution

From the budgeted information, the pre-determined absorption rate

(OAR)= 28,000/4,000 = K7/hour.

Multiplying the K7/hr with the actual hours worked, we get the

absorbed overheads of K29,400.

Since the overheads incurred (31,500) are greater than the ones

absorbed (K31,500), there has been an under absorption of K2,100.

4.4.2. Over absorption

This occurs when the actual overheads absorbed into the production cost are

greater than the actual overhead costs incurred.

For instance having absorbed K13,000 into a cost of a product but having incurred

only K10,000. The difference of K3,000 in this case is the over absorption (meaning

39

that the product has absorbed more overheads than what has been incurred in

making it)

The over absorption of overheads is an income in the profit and loss account

(income statement) of the business.

Example 4.7: Over-absorption

Budget

Overheads

K148,750

Labour hours

8,500

Calculate the overheads over absorbed.

Actual

K146,200

9,200

Solution

The pre-determined overhead absorption rate is 148,750/8,500 = K17.5

/hr (it is always based on budgets)

The actual overheads absorbed are K17.5 x 9,200 = K161,000

Since the overheads incurred (146,200) are less than the one absorbed

(161,000), there has been an over absorption of K14,800.

4.5.

Plant wide (Blanket) absorption rates

As discussed above, every production centre is assigned its own overhead

absorption rate. However, most businesses prefer to use a plant wide absorption rate

which is used for all products regardless of the departments they go through in the

production process.

A blanket overhead absorption rate is a rate used throughout the factory and for all

the jobs, and units of output irrespective of the department in which they were

produced.

To illustrate the use of blanket rates, let us look at the illustration below:

Department 1

Budgeted overheads

K360,000

Budgeted direct labour hrs

200,000 hrs

Department 2

K200,000

40,000hrs

In this case the overhead absorption rate per department will be:

Department 1

K360,000/200,000

=

K1.8/labour

Department 2

K200,000/40,000 = K5/labour hour.

Total

K560,000

240,000hrs

hr

On the other hand, if the blanket overhead absorption rate were to be used, the

rate would be (560,000/240,000) = K2.33/labour hour.

Now let us see how the two approaches determine the overhead cost of a product.

Assume that a product spends 4 hours in department 1 and 6 hours in department 2.

Using the departmental absorption rate, the overhead cost of the product will be:

Department 1

(4 hours x 1.8/hour) = 7.2

Department 2

(6 hours x 5/hour) = 30.0

40

Total overhead cost/unit

37.2

Alternatively, if the blanket absorption rate is used, the overhead cost for one unit

will be (10 hours x K2.33/hr) = K23.3.

A blanket overhead rate is not a satisfactory method of allocating overheads in a

situation where a factory consists of a number of different production centres and

the products consume cost centre overheads in different proportions.

4.6.

Accounting for overheads

The following are some of the basic accounting entries required for overheads:

All production overhead costs incurred are debited in the production

overheads account.

All overheads absorbed are credited from the overheads account and

debited in the WIP account.

Any under absorbed overheads are credited from overheads account

and debited in the profit and loss account as an expense

Any over absorption is debited in the overheads account and credited

in the profit and loss account as an income.

41