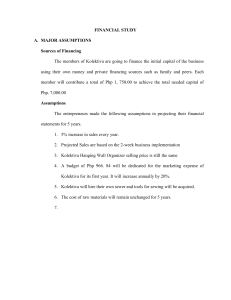

CPAORS-AFAR PARTNERSHIP FORMATION ADVANCED FINANCIAL ACCOUNTING AND REPORTING PARTNERSHIP FORMATION Definition of a Partnership The Partnership Law, Article 1767 states that “ by the article of partnership, two or more persons bind themselves together to contribute money, property, or industry to a common fund with the intention of dividing profits among themselves.” Three distinct factors of a partnership 1. ASSOCIATION OF TWO OR MORE PERSONS 2. TO CARRY ON AS CO-OWNERS 3. BUSINESS PROFIT CHARACTERISTICS OF A PARTNERSHIP Separate legal entity – partnership has a juridical personality separate and distinct from that of each of the partners Ease of formation – partnership may be created by oral or written agreement between two or more persons Co-ownership of partnership property and profits – all assets invested in a partnership becomes the property of the partnership. The right of each partners to possess/use each asset are equal Limited life – any change in the agreement of the partners terminates the partnership contract. A partnership may also expire anytime when there is change in the relationship of the partners Mutual agency –each partner has an equal right to act for the partnership and to enter into contracts binding upon it, as long as he acts within the normal scope of business operations. Unlimited liability – each partner may be held liable for all the debts of the partnership. OCTOBER 2020 ARS.CPA.CMA CPAORS-AFAR PARTNERSHIP FORMATION PARTNERSHIP AGREEMENT The formation of a partnership agreement must be done at the inception of the organization of the partnership. Among the significant points covered by the partnership agreements are: 1. Names of the partners, and the name and nature of the partnership; 2. The date on which the partnership contract takes effect and the duration of the contract; 3. The capital to be invested by each partner, the procedure for valuing noncash contributions, the treatment of any contributions in excess of the agreed amounts, and the penalties for failure to contribute and maintain the agreed amount of capital; 4. The authority, the rights, and duties of each partner 5. The accounting period to be used, nature of accounting records, preparation of FS, and auditing of partnership books 6. The method of sharing profit and losses including the frequency of income measurement and distribution to partners; 7. The drawings or salaries to be allowed to each partner; 8. Provision of the arbitration of disputes and the liquidation of the partnership. The Partner’s Ledger Accounts 1. Capital Accounts 2. Drawing or personal accounts 3. Account for loans to or from partners The transactions that are usually debited and credited to partner’s capital and drawing accounts may be summarized as follows: The capital account is credited for a. Original investment b. Additional investment c. Partner’s share in profits The capital account is debited for a. Permanent withdrawal of capital b. Debit balance of the drawing account at the end of the period c. Partner’s share in losses The drawing account is credited for a. Partnership obligations assumed or paid by the partner b. Personal funds or claims of partner collected and retained by the partnership c. Periodic partner’s salaries depending on the accounting and disbursement procedures agreed upon The drawing account is debited for: OCTOBER 2020 ARS.CPA.CMA CPAORS-AFAR PARTNERSHIP FORMATION a. Withdrawal of assets by the partners in anticipation of net income b. Partner’s personal indebtedness paid or assumed by the partnership c. Funds or claims of partnership collected and retained by the partners ACCOUNTING FOR THE FORMATION OF PARTNERSHIP A partnership may be formed in several ways, namely: 1. Formation of a partnership for the first time 2. Conversion of sole proprietorship into partnership - A sole proprietor allows another individual, who has no business of his own to join business - Two or more sole proprietors form a partnership 3. Admission of a new partner Partnership Formation for the First Time Initial Investment in a partnership are recorded in the capital accounts maintained for each partner. Cash/Non cash asset Partner, Capital #to record the initial investment of the partners *when a property other than cash is invested in a partnership, the non-cash property is recorded at Current Fair Market Value of the property at the time of the investment. ILLUSTRATION 1: Assume Carlo and Patrick form a partnership for the first time and their investments are as follows: Carlo Cash Merchandise Inventory Machineries Computer Equipment OCTOBER 2020 Book value 25,000 72,000 Fair value -063,000 125,000 - 132,000 - Patrick Book value Fair value 60,000 -022,000 35,000 110,000 140,000 ARS.CPA.CMA CPAORS-AFAR PARTNERSHIP FORMATION The journal entry to record their investments are as follows: Cash 25,000 Merchandise Inventory 63,000 Machineries 132,000 Carlo, Capital 220,000 #To record initial investment of Carlo. Cash 60,000 Merchandise Inventory 35,000 Computer Equipment 140,000 Patrick, Capital 235,000 #to record initial investment of Patrick BONUS OF GOODWILL ON INITIAL INVESTMENT Bonus or goodwill on initial investment arises when the total contributed capital is different from the total agreed capital. The valuation problem arises when partners agree on capital interests that are not equal to their net assets invested. Total Contributed Capital (TCC) – total actual amount of partners’ contribution to the partnership Total Agreed Capital (TAC) – total agreed amount or proportion of each partners’ initial investment in the partnership. This amount may be equal, less or more than the total actual contributed capital of each partner. For example, if each partner agree to receive equal interest, even though Carlo and Patrick has contributed 220,000 and 235,000 each, they have to adjust their capital accounts in order to meet the agreed condition. To meet the condition, their capital will be adjusted either the Bonus or the Goodwill Method. Under the BONUS Method, No assets will be additionally recorded. To equalize their capital balances, 7,500 will be transferred to Carlo’s capital. Patrick, Capital 7,500 Carlo, Capital OCTOBER 2020 7,500 ARS.CPA.CMA CPAORS-AFAR PARTNERSHIP FORMATION 235,000 + 220,000 = 455,000 / 2 = 227,500 must be the capital balance of each partner after the formation. Under the GOODWILL Method, the equalization of capital assets is accomplished by recording goodwill of Php 15,000 with the corresponding increase in Carlo’s capital account. Journal Entry: Goodwill 15,000 Carlo, Capital 15,000 ILLUSTRATION 2: Will and Adam agreed to form a partnership with the following contributions at their fair values: Will: Cash 25,000 Machinery 120,000 Accounts Payable 10,000 Adam: Cash 45,000 Furniture and Fixture 140,000 Loans Payable 15,000 Case 1: The partners agreed to have a 60:40 ratio of interest on the partnership upon formation. What is the total capital balance of each partners? What is the TCC and TAC? Journal entry upon investment of Will and Adam are as follows: Cash 25,000 Mach 120,000 AP 10,000 Will, Capital 135,000 OCTOBER 2020 ARS.CPA.CMA CPAORS-AFAR PARTNERSHIP FORMATION Cash 45,000 F&F 140,000 LP 15,000 Adam, Capital 170,000 TCC is equal to the total actual capital invested, Php 305,000 TAC is also equal to Php 305,000 But the capital balances of each partner will be adjusted to meet the condition of 60:40 initial interest ratio. Php305,000 x 60% = 183,000 (should be) capital balance of Will. Php305,000 x 40% = 122,000 (should be) capital balance of Adam. JE: Adam, Capital 48,000 Will, Capital 48,000 #to record accomplish adjustment of 60:40 capital interest by recording 48,000 bonus to Will from Adam. Case 2: The partners agreed to have a total capital of 350,000 with 60:40 ratio of interest on the partnership. What is the total capital balance of each partners? What is the TCC and TAC? Journal entry upon investment of Will and Adam are as follows: Cash 25,000 Mach 120,000 AP 10,000 Will, Capital 135,000 Cash 45,000 F&F 140,000 LP 15,000 Adam, Capital 170,000 TCC is equal to the total actual capital invested, Php 305,000 OCTOBER 2020 ARS.CPA.CMA CPAORS-AFAR PARTNERSHIP FORMATION TAC will be the total amount of capital that the partners agreed upon, Php 350,000. Partners have to adjust their capital balances too meet the 60:40 initial capital ratio with total capital balance of Php 350,000. Php 350,000 x 60% = 210,000 capital to Will Php 350,000 x 40% = 140,000 capital to Adam Goodwill 45,000 Adam,Capital 30,000 Will, Capital 75,000 #to record GW and the accomplishment of the 60:40 capital interest of the partners. Case 3: The partners agreed to have a 60:40 initial capital interest on the partnership on the basis of Adam’s capital. What is the total capital balance of each partners? What is the TCC and TAC? What is the additional capital needed to be invested or withdrawn by either partner? Will (60%) Adam (40%) TOTAL TCC 135,000 170,000 305,000 Adjustment 120,000 -0120,000 TAC 255,000 170,000 425,000 TAC is computed as 170,000 / 40% = 425,000 JE: Cash 120,000 Will, Capital 120,000 Adjusted capital of the partners are P255,000 (Will) and P170,000 (Adam). Case 4: The partners agreed to have a 60:40 initial capital interest on the partnership on the basis of Will’s capital. What is the total capital balance of each partners? What is the TCC and TAC? What is the additional capital needed to be invested or withdrawn by either partner? TCC Adjustment Will (60%) 135,000 -0Adam (40%) 170,000 (80,000) TOTAL 305,000 (80,000) TAC is computed as 135,000 / 60% = 225,000 OCTOBER 2020 TAC 135,000 90,000 225,000 ARS.CPA.CMA CPAORS-AFAR PARTNERSHIP FORMATION JE: Adam, Capital 80,000 Cash 45,000 F&F 35,000 #entry to record Adam’s withdrawal of excess capital invested. Case 5: The partners agreed to have a 50:50 initial capital interest on the partnership on the basis of Adam’s capital. What is the total capital balance of each partners? What is the TCC and TAC? What is the additional capital needed to be invested or withdrawn by either partner? TCC 135,000 170,000 305,000 Will (50%) Adam (50%) TOTAL Adjustment 35,000 -035,000 TAC 170,000 170,000 340,000 TAC is computed as 170,000 / 50% = 340,000 JE: Cash 35,000 Will, Capital 35,000 #entry to record Will’s additional investment to meet the 50:50 capital requirements Sole Proprietor and Another Individual Form a Partnership Under this formation, the assets and the liabilities of the sole proprietor are transferred to the newly formed partnership. Normally, the partners agree on the revaluation of some of the assets before the transfer. The journal entry will depend on whether the books of the sole proprietorship are to be used for the newly formed partnership or new books are to be opened. Sole Proprietorship’s books are retained for the partnership: The following accounting procedures are used to record the formation of the partnership: 1. Adjust the assets and liabilities to their fair market values as agreed by the partners. Adjustments are to be made to his (sole proprietor) capital account. 2. Record the investment of the new partner. OCTOBER 2020 ARS.CPA.CMA CPAORS-AFAR PARTNERSHIP FORMATION New books are opened for the partnership: If new books are to be used for the partnership, the following accounting procedures may be used to record the formation of the partnership: 1. Adjust the assets and liabilities of the sole proprietor according to the agreement. Adjustment are made on his capital account. 2. Close the books 3. Record the investment of the former proprietor to the new books of the partnership. 4. Record the investment of the new partner to the partnership. ILLUSTRATION: Josh Company Statement of Financial Position June 30, 2020 ASSETS Cash Accounts Receivable Inventory Equipment Less: Accumulated Dep’n Total Assets LIABILITIES AND EQUITY Account Payable Josh, Capital Total Liabilities and Equity Php 60,000 50,000 70,000 40,000 (4,000) 36,000 216,000 86,000 130,000 216,000 Peter was interested to form partnership with Josh Co. and the later agreed in order to meet the increasing demand and sales as well. They agreed to Form JP Partnership, and had the assets and liabilities of Josh Co. appraised showing the following: 1. 2. 3. 4. Allowance for Doubtful accounts of P5,000 to be provided Inventory is to be recorded at its market value of P80,000 The equipment has a fair value of Php 35,000 Php 2,000 of accounts payable has not been recorded OCTOBER 2020 ARS.CPA.CMA CPAORS-AFAR PARTNERSHIP FORMATION Josh and peter prepared and signed the articles of partnership that include all significant operating policies. On June 30, 2020, Peter contributed Php 100,000 cash for 1/3 capital interest. Case 1: Sole proprietor’s book will be retained for the partnership Journal Entries: Books of Josh (now the partnership books) 1) Inventory 10,000 Accum. Dep’n 4,000 Equipment 5,000 Allow. For D.A. 5,000 Accounts Payable 2,000 Josh, Capital 2,000 #To adjust assets and liabilities of Josh 2) Cash 100,000 Peter, Capital 100,000 #to record investment of Peter Case 2: New books will be used for the partnership Journal Entries: Books of Josh: 1) Inventory 10,000 Accum. Dep’n 4,000 Equipment 5,000 Allow. For D.A. 5,000 Accounts Payable 2,000 OCTOBER 2020 ARS.CPA.CMA CPAORS-AFAR PARTNERSHIP FORMATION Josh, Capital 2,000 #to adjust assets and liabilities of the Josh 2) Accounts payable 88,000 Allowance for D.A. 5,000 Josh, Capital 132,000 Cash 60,000 Accounts Receivable 50,000 Inventory 80,000 Equipment 35,000 #to close all the adjusted balances of the accounts New Books of the Partnership: 1) Cash 60,000 Accounts Receivable 50,000 Inventory 80,000 Equipment 35,000 Accounts Payable 88,000 Allowance for D.A. 5,000 Josh, Capital 132,000 #to record investment of Josh 2) Cash 100,000 Peter, Capital 100,000 #to record investment of Peter OCTOBER 2020 ARS.CPA.CMA CPAORS-AFAR PARTNERSHIP FORMATION Two Proprietors Form a Partnership The accounting procedure described in the preceding section are also applicable when two or more proprietors form a partnership. There should be an agreement on the determination of the partners’ interest on the partnership. It is also important to agree on the values of the assets and liabilities to be assigned and assumed by the new partnership. The books of one of the sole proprietors may be used for the newly formed partnership, or a new set of partnership books may be used. REVIEW QUESTIONS: 1. A partner’s withdrawal of assets from a partnership that is considered permanent reduction in the partner’s equity is debited to the partner’s: a. Drawing account b. Retained earnings account c. Capital account d. Loan receivable account 2. The partner’s drawing accounts are used: a. To record the partners salaries b. To reduce the partner’s capital account balances at the end of the period c. In the same manner as the partner’s loan accounts d. To record the partner’s share of net income or loss for an accounting period 3. A partner’s drawing account is a. An expense account b. A capital account c. A contra-capital account d. A liability account 4. A partnership is an association of two or more persons who carry on as coowners of a business for profit. The persons who form the partnership may be: I. Individuals II. Corporations III. Fraternal Non-profit organization a. I only b. I and III c. I,II, and III d. I and II OCTOBER 2020 ARS.CPA.CMA CPAORS-AFAR PARTNERSHIP FORMATION 5. Partnership is a(an): I. Accounting entity II. Taxable entity a. I only b. I and II c. Neither I nor II d. II only 6. Partner X Contributed equipment to the XYZ partnership. The equipment cost Php60,000 with Accumulated depreciation of Php10,000 but had a fair value of Php70,000 at the date of the partnership formation. At what amount should the equipment be reported? a. Php 50,000 b. Php 60,000 c. Php 70,000 d. Php 10,000 7. The partner’s interest in a partnership is generally equal to: a. The unamortized cost of the assets of the partners b. The sum of the fair values of the assets the partners contributed to the firm, increased by any liabilities of other partners assumed and decreased by any personal liabilities that are assumed by other partners c. The fair value of net assets at the date of formation d. The sum of the bases of the individual assets the partner contributed to the firm, decreased by the partner’s share in partnership liabilities 8. Which of the following statements about a partnership is true? a. A partnership is a legal entity separate and distinct from the individual partners b. Individual partners are jointly liable for the debts and obligations of a partnership c. Income tax is levied on the individual partners’ share of the net income of the partnership and is reported in their personal tax returns d. All of the above are true 9. Partners Olive, Marie, and Grace formed OMG Partnership with the following initial cash investment: Php 150,000; Php 220,000, and Php 180,000. They agreed to have a 3:5:2 initial interest in the partnership. What is the total contributed capital? a. 500,000 b. 520,000 c. 440,000 d. 900,000 OCTOBER 2020 ARS.CPA.CMA CPAORS-AFAR PARTNERSHIP FORMATION 10.Using OMG Partnership, if the partners agreed on a 3:5:2 initial interest in the partnership using the Olive’s capital as the basis, that is the total agreed capital? a. 520,000 b. 500,000 c. 440,000 d. 750,000 11.Refer to # 10, what is the adjusted capital of Grace? a. 150,000 b. 180,000 c. 100,000 d. 250,000 Trisha, Lizz, and Chin formed TLC Partnership and had the following cash investments: Php 80,000, Php 120,000, Php 100,000. 12.What is the total agreed capital if the partners agree on an equal interest in the partnership capital? a. 240,000 b. 300,000 c. 320,000 d. 360,000 13.What is the total agreed capital if the partners agreed on a 4:3:3 initial capital interest on the partnership using Chin’s capital as the basis? a. 400,000 b. 200,000 c. 300,000 d. 333,333 14.What is the adjusted capital of Trisha if the partners agreed on a 4:3:3 initial capital interest on the partnership using Lizz’s capital as the basis? a. 120,000 b. 160,000 c. 80,000 d. 133,333 15. What is the adjusted capital of Lizz if the partners agreed on a 4:3:3 initial capital interest on the partnership using Lizz’s capital as the basis? a. 120,000 b. 100,000 c. 110,000 d. 80,000 OCTOBER 2020 ARS.CPA.CMA CPAORS-AFAR PARTNERSHIP FORMATION Ingrid, May, and Gaye formed IMG Partnership and invested the following: Cash Machineries Inventory Accounts Payable Ingrid 15,000 50,000 20,000 5,000 May 30,000 30,000 0 10,000 Gaye 10,000 60,000 30,000 0 16. What is the total contributed capital? a. 215,000 b. 200,000 c. 230,000 d. 250,000 17.What is the total agreed capital if the partners agreed on an equal initial capital interest in the partnership? a. 215,000 b. 200,000 c. 230,000 d. 250,000 18. What is the total agreed capital if the partners agreed on a 3:2:5 initial capital interest using May capital as the basis? a. 250,000 b. 266,667 c. 200,000 d. 230,000 19. Using number 18 assumption, what is the adjusted capital of Ingrid? a. 80,000 b. 90,000 c. 75,000 d. 60,000 20.James and Dave agreed to form a partnership and they invested Php 75,000 and Php 125, 000. Both agreed that ¾ of the total partnership interest goes to Dave. What is the adjusted capital of James and the bonus received by Dave? a. 150,000 ; none b. 150,000 ; 25,000 c. 75,000 ; 25,000 d. 50,000 ; 25,000 OCTOBER 2020 ARS.CPA.CMA