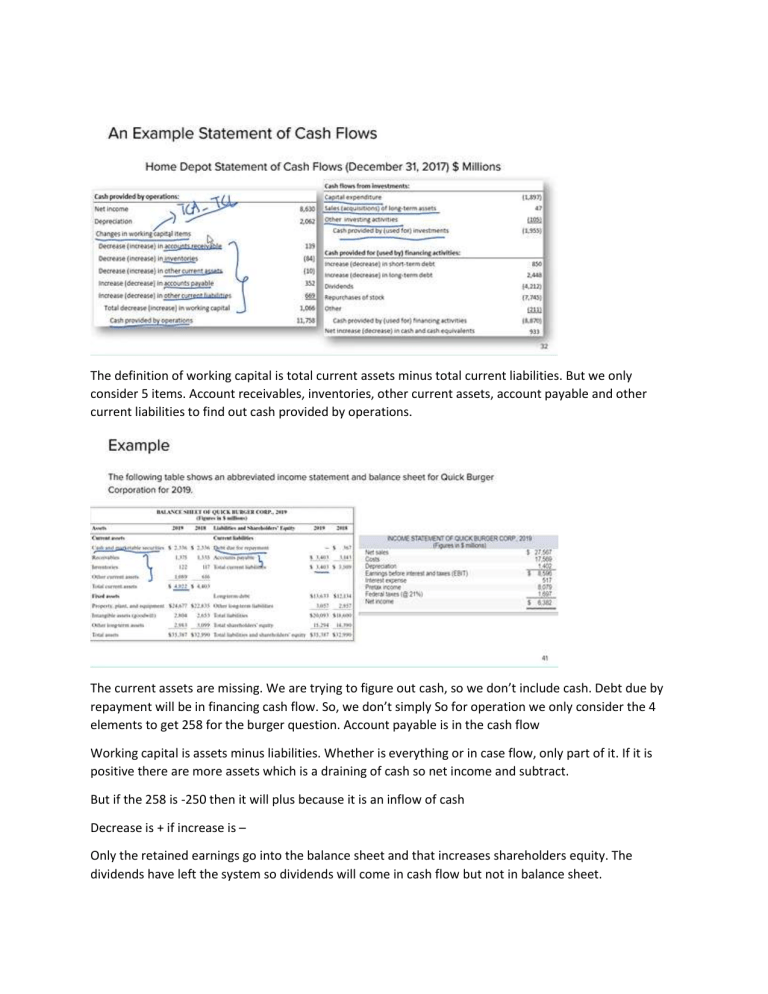

The definition of working capital is total current assets minus total current liabilities. But we only consider 5 items. Account receivables, inventories, other current assets, account payable and other current liabilities to find out cash provided by operations. The current assets are missing. We are trying to figure out cash, so we don’t include cash. Debt due by repayment will be in financing cash flow. So, we don’t simply So for operation we only consider the 4 elements to get 258 for the burger question. Account payable is in the cash flow Working capital is assets minus liabilities. Whether is everything or in case flow, only part of it. If it is positive there are more assets which is a draining of cash so net income and subtract. But if the 258 is -250 then it will plus because it is an inflow of cash Decrease is + if increase is – Only the retained earnings go into the balance sheet and that increases shareholders equity. The dividends have left the system so dividends will come in cash flow but not in balance sheet. Both of the metric is comparing the market, the current value to the book ratio. Telling our shareholder that you gave us this much money which is the book value today and it is worth this much market value. Market value depend on two kind of decisions, investment decision and financing decisions. Investment is why do I invest as a company, what is the return I get? Should I even invest or should just give money back to the shareholder? Financing question is there are all these invesmtent, if I want to do, how am I going to do it? where is the money coming from. These 2 are the sources of value which create shareholder value. To measure how good an invesment is through economic value added and return on capital assets. Drill down further is depend on 2 aspeci one is efficient use of assets and the other is the profits from sales. Example Hot pot in hawker center and Hai Di Lao Hot pot will sell 500 plates Hai Di Lao will sell 100 plates But sales will be higher for HDL case So, we can measure based on the efficient use, how much sales are you generating with the assets you have The other is what’s the profit you get from individual sales Market cap If market value same but market to book ratio is big. For example, Walmart, it means the scale of Walmart is much better. The amount which the company generates in terms of market value is higher for Coke. Income statement. Have revenue, expenses, interest rate. Pay the tax and is the net income. It is called after tax operating income. It is not the same net income. The net income ignores the money your debt holder gets. So, when we do this cost of capital into total capitalization. I want you to make note of this total capitalization. Definition is long term debt plus share holder equity. You can't take only the net income figure because the net income ignores the interest which these debt holders have gotten. I assume the company is equity financed. I want to find out my total income if my company is 100% financial equity. Key Calculate the total money you will get if the company is 100% equity financed and the number is net income + 1 – tax Cost of capital depend on the risk of the business. Walmart 2.8 only because it is far less risky compared to apple. Apple customers expect at least 7.1 percentage. Total long-term capital which is shareholder equity + long term debt ROA has a higher num and dem Use book value so it ignore intangible stuff which cannot be quantified like use a lot of money in marketing to establish its brand