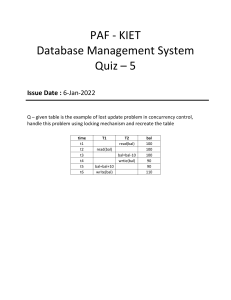

BENITEZ, Jewel Ann Q. Block 6 Problems I – STATEMENT OF LIQUIDATION; INSTALLMENT SCHEDULE OF SAFE PAYMENTS AND CASH PAYMENT PRIORITY PROGRAM 1.) Assume T, U, V and W are partners sharing profits of 40%, 20%, 20%, 20%, respectively. On January 1, 20x4, they agree to liquidate. A balance sheet is prepared on this date is shown as follows: ASSETS Noncash assets …………………………………P 181, 800 TotaL…………………………………………………P 181, 800 20X4 LIABILITIES AND CAPITAL Liabilities ………………………………….…………..P 84,000 A, loan……………………………………………………….6, 000 D, loan……………………………………………………… 3, 000 A, Capital………………………………………………….26, 400 B, Capital………………………………………………….25, 800 C, Capital………………………………………………….20, 400 D, Capital…………………………………………………16, 200 Total…………………………………………………..P 181,800 CASH BOOK CASH PAYMENT PROCEEDS VALUE OF LIQUIDATION TO ON SALE OF NONCASH EXPENSES CREDITORS NONCASH ASSETS PAID ASSETS SOLD January P 72, 000 P 90, 000 P 1, 200 P 66, 000 February 21, 600 30, 000 1, 320 18, 000 March 19, 200 24, 000 1, 440 -April 6, 000 19, 800 4, 800 -May 2, 400 18, 000 960 -Distribution of cash to partners are normally done at month-end. CASH WITHHELD P 4, 800 1, 800 1, 200 600 -- PAYMENT TO PARTNERS P 5, 280 18, 360 1, 800 Required: 1. Prepare statement of liquidation for the month of January to May 20x4. 2. Prepare schedule of safe payments to support the distribution of cash payment for the month January to May 20x4. 3. Prepare cash payment (pre-distrubution) priority program indicating the cash payment to each partner for the month of January to May 20x4. 4. Using cash payment priority program, indicate the vulnerability rankins for each in the event of loss suffered by the partnership. Solution: CASH 72, 000 (1, 200) (66, 000) Bal. 4,800 21, 600 (1, 320) (18, 000) Bal. 7,080 NON CASH ASSETS 181, 800 (90, 000) 91, 800 (30, 000) LIABILITIES A, LOAN D, LOAN A, CAPITAL (40%) B, CAPITAL (20%) C, CAPITAL (20%) D, CAPITAL (20%) 84, 000 6, 000 3, 000 26, 400 (7, 200) (480) 25, 800 (3, 600) (240) 20, 400 (3, 600) (240) 16, 200 (3, 600) (240) (66, 000) 18, 000 6, 000 3, 000 18, 720 (3, 360) (528) 21, 960 (1, 680) (264) 16, 560 (1, 680) (264) 12, 360 (1, 680) (264) 20, 016 (5, 280) 14, 736 (960) (288) 14, 616 10, 416 14, 616 (960) (288) 10, 416 (960) (288) 13, 488 (5, 688) 7, 800 (2, 760) (960) 13, 368 (5, 568) 7, 800 (2, 760) (960) 9, 168 (1, 368) 7, 800 (2, 760) (960) (18, 000) 61, 800 0 6, 000 3, 000 14, 832 (5, 280) Bal. 1,800 19, 200 (1, 440) 61, 800 (24, 000) 0 6, 000 3, 000 14, 832 (1, 920) (576) Bal.19,560 37, 800 0 37, 800 (19, 800) 0 6, 000 (2, 736) 3, 264 3, 000 (3, 000) 0 12, 336 (18, 360) Bal. 1,200 6, 000 (4, 800) 18, 000 0 3, 264 (720) 0 4, 896 4, 080 (360) 4, 080 (360) 4, 080 (360) 18, 000 (18, 000) 0 2, 544 0 3, 720 (3, 120) (192) 3, 720 (3, 120) (192) 3, 720 (3, 120) (192) 0 4, 896 (6, 240) (384) 1, 728 0 408 408 408 0 0 408 (408) 408 (408) 408 (408) 0 0 0 0 Bal. 2,400 Bal. 1, 800 600 (1, 728) Bal. 2, 400 12, 336 (5, 520) (1, 920) (960) Bal. 2040 (2040) Bal. 0 0 0 0 0 Schedule of Safe Payment A (40%) 14, 832 6, 000 Bal. 20, 832 (24, 720) (720) Bal. (4, 608) 4, 608 Bal. 0 B (20%) 20, 016 C (20%) 14, 616 20, 016 (12, 360) (360) 7, 296 (1, 536) 5, 760 (420) 5, 340 (60) 5, 280 14, 616 (12, 360) (360) 1, 896 (1, 536) 360 (420) (60) 60 0 A (40%) 12, 336 6, 000 Bal.18, 366 (15, 600) B (20%) 13, 488 C (20%) 13, 368 13, 488 (7, 800) 13, 368 (7, 800) D (20%) 9, 168 3, 000 12, 168 (7, 800) Bal. 2, 736 5, 688 5, 568 4, 368 A (40%) 4, 896 (3, 264) Bal. 8, 160 (7, 440) Bal. 720 B (20%) 4, 080 C (20%) 4, 080 D (20%) 4, 080 4, 080 (3, 720) 360 4, 080 (3, 720) 360 4, 080 (3, 720) 360 A (40%) 26, 400 6, 000 32, 400 ÷ .40 Bal. 81, 000 (first) B (20%) 25, 800 C (20%) 20, 400 25, 800 ÷ .20 129, 000 (fourth) 20, 400 ÷ .20 102, 000 (third) D (20%) 16, 200 3, 000 19, 200 ÷ .20 96, 000 (second) Bal. 0 D (20%) 10, 416 3, 000 13, 416 (12, 360) (360) 696 (1, 536) (840) 840 0 First Priority: 84, 000 Liability Second Priority: B (129, 000 – 102, 000) X .20 = Third Priority: B (102, 000 – 96, 000) X .20 = C (102, 000 – 96, 000) X .20 = Fourth Priority: B (96, 000 – 81, 000) X .20 = C (96, 000 – 81, 000) X .20 = D (96, 000 – 81, 000) X .20 = 84, 000 5, 400 1, 200 1, 300 3, 000 3, 000 3, 000 TOTAL 100, 800 A B C FEBRUARY TOTAL 5, 280 5, 280 MARCH 120 1, 200 3, 000 1, 368 5, 688 TOTAL 2, 736 2, 736 D 1, 200 3, 000 1, 368 5, 568 PRIORITY 1 3, 000 1, 368 4, 368 2 3 P&L II. STATEMENT OF LIQUIDATION – INSTALLMENT; SCHEDULE OF SAFE PAYMENTS On January 1, 20x4, partners AA, BB and CC, who share profits and losses in the ration of 5:3:2 decide to liquidate their partnership. The partnership trial balance at this date is as follows: Accounts Cash Accounts receivable Inventory Machinery and equipment Accounts payable AA, Capital BB, Capital CC, Capital Debit Credit P 18, 000 66, 000 52, 000 189, 000 TOTAL 325, 000 P 53, 000 88, 000 110, 000 74, 000 325, 000 The partners plan a program of piecemeal conversion of assets to minimize liquidation losses. All available cash, less amount retained to provide future expenses, is to be distributed to the partners at the end of each month. A summary of the liquidation transactions is as follows: January 20x4 1.) 2.) 3.) 4.) P 51, 000 was collected on accounts receivable; the balance is uncollectible. P 38, 000 was received for the entire inventory. P 2, 000 liquidation expenses were paid. P 50, 000 was paid to creditors after offset of a P 3, 000 credit memorandum received on January 11, 20x4. 5.) P 10, 000 cash was retained in the business at the end of the month for potential unrecorded liabilities and anticipated expenses. February 20x4 6.) P 4, 000 liquidation expenses were paid. 7.) P 6, 000 cash was retained in the business at the end of month for potential unrecorded liabilities and anticipated expenses. March 20x4 8.) P 146, 000 was received on sale of all items of machinery and equipment. 9.) P 5, 000 liquidation expenses were paid. 10.) No cash was retained in the business. Inventory Machinery & Equip. Accounts payable 52, 000 189, 000 53, 000 52, 000 (52, 000) 189, 000 53, 000 0 0 189, 000 53, 000 Bal. 105, 000 0 0 189, 000 Bal. 105, 000 0 0 189, 000 0 0 189, 000 53, 000 (3, 000) 50, 000 (50, 000) 0 0 0 189, 000 0 74, 000 10, 000 (4, 000) 0 0 189, 000 0 74, 000 Bal. 6, 000 March 6, 000 146, 000 0 0 189, 000 0 0 0 0 0 0 189, 000 (189, 000) 0 0 0 0 0 0 0 0 0 Cash January 18, 000 51, 000 Bal.69, 000 38, 000 Accounts Receivable Bal. 107, 000 (2, 000) (50, 000) Bal. 55, 000 66, 000 (66, 000) 0 AA, BB, CC, Capital (5) Capital (3) Capital (2) 88, 000 (7, 500) 80, 500 (7, 000) 110, 000 (4, 500) 105, 500 (4, 200) 74, 000 (3, 000) 71, 000 (2, 800) 73, 500 (1, 000) 72, 500 1, 500 74, 000 101, 300 (600) 100, 700 900 101, 600 68, 200 (400) 67, 800 600 68, 400 74, 000 101, 600 (26, 600) 75, 000 68, 400 (18, 400) 50, 000 74, 000 75, 000 (2, 400) 72, 600 50, 000 (1, 600) 48, 400 74, 000 (21, 500) 52, 500 (2, 500) 50, 000 (50, 000) 0 72, 600 (12, 900) 59, 700 (1, 500) 58, 200 (58, 200) 0 48, 400 (8, 600) 39, 800 (1, 000) 38, 800 (38, 800) 0 (45, 000) Bal. 10, 000 February Bal. 152,000 0 (5, 000) Bal. 147, 000 (147, 000) Bal. 0 Schedule of Safe Payment 1ST SCHEDULE 2ND SCHEDULE AA (5) 74, 000 (99, 500) Bal. (25, 500) 25, 500 BB (3) 101, 600 (59, 700) 41, 900 (15, 300) CC (2) 68, 400 (39, 800) 28, 600 (10, 200) Bal. 0 26, 600 18, 400 AA (5) 74, 000 (97, 500) Bal. (23, 500) 23, 500 Bal. 0 BB (3) 75, 000 (58, 500) 16, 500 (14, 100) 2, 400 CC (2) 50, 000 (39, 000) 11, 000 (9, 400) 1, 600 AA (5) BB (3) 88, 000 110, 000 ÷ .05 ÷ .03 1, 760, 000 3, 666, 666. 67 1ST 2ND CC (2) 74, 000 ÷ .02 3, 700, 000 3RD First Priority: Liability Second Priority: CC (3, 700, 000 – 3, 666, 667) X .20 = Third Priority: CC (3, 666, 667 – 1, 760, 000) X .20 = BB (3, 666, 667 – 1, 760, 000) X .30 = 53, 000 6, 667 TOTAL 381, 333 572, 000 1, 013, 000 III – CASH DISTRIBUTION OR PAYMENT PRIORITY PROGRAM The partnership PP, EE, and TT has asked you to assist in winding up its business. You complete the following information. 1.) The trial balance of the partnership on June 30, 20x4 is: Accounts Cash Accounts Receivable (net) Inventory Plant and Equipment (net) Accounts Payable PP, Capital EE, Capital TT, Capital Debit Credit P 6, 000 22, 000 14, 000 99, 000 Total P 141, 000 P 17, 000 55, 000 45, 000 24, 000 P 141, 000 2.) The partners share profits and losses as follows: PP, 50%; EE, 30%; and TT, 20%. 3.) The partners are considering an offer of P 100, 000 for the accounts receivable, inventory, and plant and equipment as of June 30. The P 100, 000 will be paid to creditors and the partners in installments, the number and amounts of which are to be negotiated. Required: prepare a cash distribution or cash payment priority program plan as of June 30, 20x4 showing how much cash each partner will receive if the offer to sell the assets is accepted. PP, EE, AND TT PARTNERSHIP CASH DISTRIBUTION PLAN AS OF JUNE 30, 20X4 Loss Absorption Power PP EE TT Loss on sharing percentage Preliquidation capital balance Loss Absorption Potential (Capital Balance/Loss Ratio) Decrease highest LAP to next highest LAP: Decrease EE by 30, 000 Capital Balance PP EE TT 50% 30% 20% 55, 000 110, 000 150, 000 45, 000 24, 000 120, 000 (30, 000) (9, 000) (Cash distribution: 30, 000* 30%) Balance Decrease highest LAP to next highest level: Decrease EE by 10, 000 110, 000 120, 000 120, 000 55, 000 (10, 000) 36, 000 24, 000 (3, 000) (Cash distribution: 10, 000* 30%) Decrease TT by 10, 000 (10, 000) (2, 000) (Cash distribution: 10, 000* 20%) Balance 110, 000 110, 000 110, 000 55, 000 33, 000 22, 000 IV – STATEMENT OF LIQUIDATION – INSTALLMENT; SCHEDULE OF SAFE PAYMENTS Assuming the same information in PROBLEM III and the partners have decided to liquidate their partnership by installments instead of accepting the offer of P 100, 000. Cash is distributed to the partners at the end of each month; a summary of the liquidation transactions follows: July 1. 2. 3. 4. 5. P 16, 500 collected on accounts receivable; balance is uncollectible. P 10, 000received for the entire inventory. P 1, 000 liquidation expense is paid. P 17, 000 paid to creditors. P 8, 000 cash retained in the business at the end of the month. August 1. P 1, 500 in liquidation expenses paid. 2. As part of payment of his capital, TT accepted an item of equipment that he develop, which had a book value of P 4, 000. The partners agreed that value of P 10, 000 should be placed on this item for liquidation purposes. 3. P 2, 500 cash retained in the business at the end of the month. September 1. P 75, 000 received on sale of remaining plant and equipment. 2. P 10, 000 liquidation expenses paid. No cash retained in the business. Required: Prepare a statement of partnership realization and liquidation with supporting schedules of cash payments to partners. Cash Accounts receivable Inventory Plant and Equipment Accounts payable 22, 000 (22, 000) 0 14, 000 99, 000 17, 000 99, 000 17, 000 0 14, 000 (14, 000) 0 99, 000 17, 000 0 0 99, 000 0 0 99, 000 17, 000 (17, 000) 0 0 0 99, 000 0 49, 750 0 0 99, 000 0 0 0 99, 000 0 49, 750 (750) 49, 000 0 0 99, 000 0 0 0 0 0 0 99, 000 (99, 000) 0 0 0 0 0 0 0 0 0 July 6, 000 16, 500 Bal. 22,500 10, 000 Bal. 32,500 (1, 000) Bal. 31,500 (17, 000) Bal. 14,500 (6, 500) Bal. 8, 000 August 8, 000 (1, 500) Bal. 6, 500 (4, 000) Bal. 2, 500 September 2, 500 75, 000 Bal. 77, 500 (1, 000) Bal. 76, 500 (76, 000) Bal. 0 Schedule of Safe Payment 1ST SCHEDULE PP (50%) 49, 750 (53, 500) Bal. (3, 750) 3, 750 Bal. 0 Bal. 0 EE (30%) 41, 850 (32, 100) 9, 750 (2, 250) 7, 500 (1, 000) 6, 500 TT (20%) 21, 900 (21, 400) 500 (1, 500) (1, 000) 1, 000 0 0 PP, Capital (50%) EE, Capital (30%) TT, Capital (20%) 55, 000 (2, 750) 52, 250 (2, 000) 50, 250 (500) 49, 750 45, 000 (1, 650) 43, 350 (1, 200) 42, 150 (300) 41, 850 24, 000 (1, 100) 22, 900 (800) 22, 100 (200) 21, 900 49, 750 41, 850 (6, 500) 35, 350 21, 900 49, 000 35, 350 (450) 34, 900 (3, 400) 31, 500 21, 900 (300) 21, 600 (600) 21, 000 49, 000 (12, 000) 37, 000 (500) 36, 500 (36, 500) 0 31, 500 (7, 200) 24, 300 (300) 24, 000 (24, 000) 0 21, 000 (4, 800) 16, 200 (200) 16, 000 (16, 000) 0 21, 900 2nd Schedule PP (50%) 49, 000 (50, 750) Bal. (1, 750) 1, 750 Bal. 0 EE (30%) 34, 900 (30, 450) 4, 450 (1, 050) 3, 400 PP (50%) EE (30%) 55, 000 45, 000 ÷ .05 ÷ .03 1, 100, 000 1, 500, 000 1ST 3rd TT (20%) 21, 600 (20, 300) 1, 300 (700) 600 TT (20%) 24, 000 ÷ .02 1, 200, 000 2nd First Priority: Liability Second Priority: EE (1, 500, 000 – 1, 200, 000) x .30 Third Priority: EE (1, 200, 000 – 1, 100, 000) x .30 TT (1, 200, 000 – 1, 100, 000) x .20 17, 000 90, 000 TOTAL 30, 000 20, 000 157, 000 V – STATEMENT OF LIQUIDATION – INSTALLMENT; SCHEDULE OF SAFE PAYMENTS The DSV Partnership decided to liquidate the partnership as of June 30, 20x4. The balance sheet of the partnership as of this date is presented as follows: DSV Partnership Balance Sheet As of June 30, 20x4 ASSETS: Cash Accounts Receivable (net) Inventories Property, Plant, and Equipment (net) TOTAL ASSETS: LIABILITIES Accounts Payable PARTNER’S CAPITAL DD, Capital SS, Capital VV, Capital TOTAL LIABILITES AND CAPITAL P 50, 000 95, 000 75, 000 500, 000 P 720, 000 P 405, 000 100, 000 140, 000 75, 000 P 720, 000 The personal assets (excluding partnership loan and capital interest) and personal liabilities of each partner as of June 30, 20x4, follow: Personal Assets Personal Liabilities Personal Net Worth DD P 250, 000 (270, 000) (20, 000) SS VV P 450, 000 (420, 000) 30, 000 P 300, 000 (240, 000) 60, 000 The DSV Partnership was liquidated during the months of July, August, and September. The assets sold and the amounts realized follow: MONTH ASSETS SOLD July Inventories Accounts Receivable (net) Property Plant and Equipment August Inventories Accounts Receivable (net) September Accounts Receivable (net) Property, Plant, and Equipment CARRYING AMOUNT P 50, 000 60, 000 400, 000 AMOUNT REALIZED P 45, 000 40, 000 305, 000 25, 000 10, 000 18, 000 4, 000 25, 000 100, 000 10, 000 45, 000 Required: Prepare a statement of partnership realization and liquidation for the DSV Partnership for the three-month period ended September 30, 20x4. DD, SS, and VV share profits and losses in the ratio 50:30:20. The partners wish to distribute available cash at the end of each month after reserving P 10, 000 of cash at the end of July and August to meet unexpected liquidation expenses. Actual liquidation expenses incurred and paid each month amounted to P 2, 500. Support each cash distribution to the partners with a schedule of safe installment payments. Cash July 50, 000 390, 000 Bal. 440,000 (2, 500) Bal. 437, 500 (405, 000) Bal. 32, 500 (22, 500) Bal. 10, 000 August 10, 000 22, 000 Bal. 32, 000 (2, 500) Bal. 29, 500 (19, 500) Bal. 10, 000 September 10, 000 55, 000 Bal. 65, 000 65, 000 (2, 500) Bal. 62, 500 (62, 500) Bal. 0 Bal. Accounts Receivab le (net) Inventories Property, Plant, and Equipment (net) Accounts Payable 95, 000 (60, 000) 35, 000 75, 000 (50, 000) 25, 000 500, 000 (400, 000) 100, 000 405, 000 35, 000 25, 000 100, 000 35, 000 25, 000 100, 000 405, 000 (405, 000) 0 35, 000 25, 000 100, 000 0 38, 750 35, 000 (10, 000) 25, 000 25, 000 (25, 000) 0 100, 000 0 100, 000 0 25, 000 0 100, 000 0 38, 750 (6, 500) 32, 250 (1, 250) 31, 000 25, 000 0 100, 000 0 31, 000 25, 000 (25, 000) 0 0 0 0 100, 000 (100, 000) 0 0 0 0 0 31, 000 (35, 000) (4, 000) 4, 000 0 0 0 0 0 0 0 0 0 0 0 405, 000 0 DD, Capital (50%) SS, Capital (30%) VV, Capital (20%) 100, 000 (60, 000) 40, 000 (1, 250) 38, 750 140, 000 (36, 000) 104, 000 (750) 103, 250 75, 000 (24, 000) 51, 000 (500) 50, 500 38, 750 103, 250 (22, 500) 80, 750 50, 500 80, 750 (3, 900) 76, 850 (750) 76, 100 (13, 700) 62, 400 50, 500 (2, 600) 47, 900 (500) 47, 400 (5, 800) 41, 600 62, 400 (21, 000) 41, 400 (2, 400) 39, 000 (1, 500) 37, 500 (37, 500) 0 41, 600 (14, 000) 27, 600 (1, 600) 26, 000 (1, 000) 25, 000 (25, 000) 0 50, 500 Schedule of Safe Payment 1ST SCHEDULE DD (50%) 38, 750 (85, 000) Bal. (46, 250) 46, 250 SS (30%) 103, 250 (51, 000) 52, 250 (27, 750) VV (20%) 50, 500 (34, 000) 16, 500 (18, 500) Bal. 0 24, 500 (2, 000) 22, 500 (2, 000) 2, 000 0 SS (30%) 76, 100 (40, 500) 35, 600 (21, 900) 13, 700 VV (20%) 47, 400 (27, 000) 20, 400 (14, 600) 5, 800 Bal. 0 2ND SCHEDULE DD (50%) 31, 000 (67, 500) Bal. (36, 500) Bal. 0 DD (50%) SS (30%) 100, 000 140, 000 ÷ .05 ÷ .03 2, 000, 000 4, 666, 667 1ST 3RD VV (20%) 75, 000 ÷ .02 3, 750, 000 2ND First Priority: Liability Second Priority: SS (4, 666, 667 – 3, 750, 000) x .30 Third Priority: SS (3, 750, 000 –2, 000, 000) x .30 VV (3, 750, 000 –2, 000, 000) x .20 405, 000 275, 000 525, 000 350, 000 TOTAL 1, 555, 000 DSV PARTNERSHIP SCHEDULE OF SAFE PAYMENTS TO PARTNERS DD SS 50% 30% Schedule 1, July 31, 20x4 July, 20x4: Sale of Assets and distribution of loss VV 20%