Accounting Recording Process: Debits, Credits, Journals, Ledgers

advertisement

CHAPTER

2

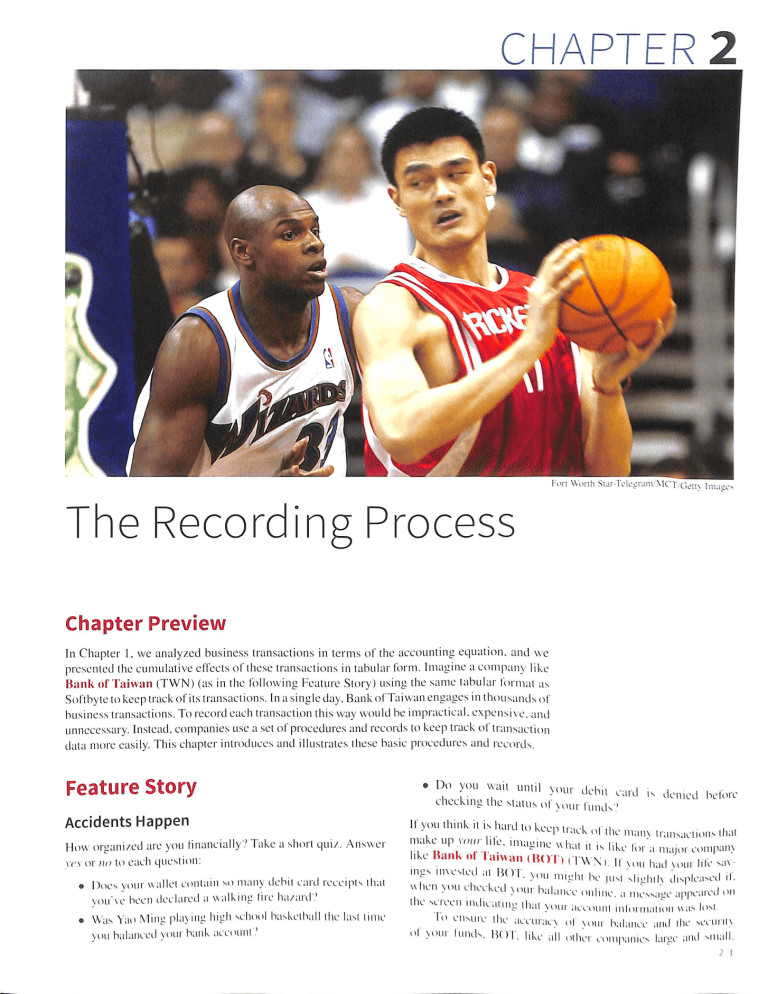

The Recording Process

Chapter Preview

In Chapter I , we analyzed business transactions in te rm s of th e accounting eq uation. and we

presented th e cumulative effec ts o r th ese transactions in tabular form. Imagine a compan y like

Bank of Taiwan (TWN) (as in the following Feature Story) using the same tabular format as

Softhyte to keep track o f its transactions. In a single day. Bank of Taiwan e ngages in thou sa nd s of

business transactions . To record each tran saction this way would he impractical. e xpe ns ive . and

unnecessa ry. In stead, companies use a set o f procedures and reco rd s to kee p track of transaction

data more easily. This chapte r introduces and illustrates th ese basic procedures and record s .

Feature Story

• Do yo u w ait until )'llur 1 111.

·

Le t L·arL1 ' " Lk niL·d lx·fprt'

checking the statu s ur \' llllr I'Utl I ·)

-

Accidents Happen

Huw organi zed arc you financiall y'.' Tah:e a short qui ; .. A nswe r

rc.1 or no to each qu es tion:

• Due s yuur vvallet cuntaill Sll man y dehit L·a rd rcL·e ipt s th a t

yu u\·c hL'L'n declared a walh:ing lire ha;a rd ''

• Was Yao M in g playin g hi g h sc huul ha skL·thall the last tilllL'

you ha lanced yu m hank accuutl t''

l " .

If yuu thin\.: it is ha rd to kee 11 tr·t . 1 1. 1

..

• L" u t lL' man\ tr~ll1 -. aL· tiun .., that

mah:c up \D urltlc . ima!!inc \\h· t . . 1. , . . .

cl 1t "' 1"-L' tur a m;qpr L'llll1J1<In)

11\..:c

Bank

of I atwan ( B< )T ) (T"v \ : N l . I1. \ uu I1aL I \'· t lltr 11. 1.l . _•.•,. ,, ._

.

.

111!2_S 111\l' '- ted dt BOT '

.

.

..

) llll 11lt t: ht lw Jll '> t '> it !! htl\ d 1.., pka ... L·d tl .

L·kcd

,

uu

.

1

.

I·

..

.

'

·

w he n -you chL'

.

. J

I lcl dllll \lllllllC . ;t ll1L'.'o'o; I!2_L' ilJ1JlL';l i'L'd ll ll

till' O.,L't'el'll llldt l' ~ ltlll<'t:- tl1 d· t )'llllt . ~IL' L'll llll( ·lllilll'

· lll;l(lllll \\ 'it."Jp:-; 1.

Tu L' ll sUrL' th l· •L

-1 •LlltdL

. .·

. .. .

) u 1 1uur hai <lll L'L' a11d tilL' ... L'Llllll\

ur JV l)Lil l'tlll l Is. B<rl-.. 1'1

·

.

.

1,L. all utlll'r L'lllllJ1<IlltL'S largL' a11d '> tll<tll.

•

•

•

•

•

•

•

•

L

L

·L

2 1

2 -2

CHAPTER 2

T h e Rec ord in g P r ocess

relje<, on a ~ o p hi ~t i cate d acc o u ntin g i nform at i on ~y..,te m . T h at· ..,

not to ..,ay that B OT o r an y o th er co mpan y i '> erro r- f ree . I n fac t.

if you'vt...: eve r o verdraw n y our h an k account h cc au ..,e y ou fai led

to track y ou r dt...:hi t card p u rch a~e .., prope rl y . y o u may tak e ~om e

comfort from om; ac cou n tan t·.., m i ..,take at Fidelity Jnvestmcnb

(U S A) ., o ne o f th t...: l arge~t mutu al fu nd i n vc ~ t m c nt f i r m ~ in th e

world . Tht...: ac c ou ntan t fail ed to i nc l ude a m i nu ~ ~ i g n w hi le do i ng

a calcu lation , m a ki n g w h at wa..., ac tu all y a S 1.3 h il l io n Jo .,.., loo k

like a C::, 1.3 h i l li o n- yc <.,, hillinn-gain ' Fort un ately . li kc m o ..,t

accou n t in g er ror<.,, it w a.<, detected hc fo rc any real h ar m wa ~ do ne .

:\o o ne cxpccl'- tha i 1-.tnd of llll"l;tl-.c

;II

a Ullllp;IIJ~ lil-.c

F id e l i ty. w hi ch ha.., ... ophi-.ticatcd co l liiHIIL'f ..,~ -.tc tn" ;11H i1 o p in ve.., t m c nl m an ager-.. I n L'\plaining the tni..,lal--c Ill "han: IHl ldcr" .

a .., p ok c.., p c r -.on "ro tc . ··some pc,,plc ha\c ;t..,l-.ed IHl\\ . in thi~

age o f tec hn o l og) . -.uch

;1

mi-.tal-.e undd he Jll;td e. \ \ .h i k lllally

of ou r procc..,-.c-. arc computcri ; ul. ;tcco unt i n_:! ") " lell l" :trc

c omple x and di cl;tlc th ai -.omc -.tcp-. lllll " l he h andled nl;tnu all y hy our m an age r -. an d accnu ni ;J Jll " . :llld p eo ple C lll rn a"L'

111 i ..,, ak e-. ."·

Ch a pter Outline

L EARNIN G OBJECTIVES

LO 1 Describe how accounts

·Th e acco u nt

'

de b its, and credits are used to

record b usin ess transacti o ns.

·D ebi t s a nd c redi t s

LO 2 In d icate how a j o urna l is used

in th e recording p ro cess.

·Th e reco rdin g proc ess

LO 3 Exp lain ho w a led ge r an d

·Th e led ge r

posting he lp in the reco rding

process .

·Postin g

DO IT!

1

Norma l Accou nt Ba lances

DO IT!

2

Recordin g Busin ess

Act ivi t ies

DO IT!

3

Postin g

DO IT!

4

Trial Balance

· Summ ary o f d ebit/ c red it rul es

·Th e journ al

·Chart of accounts

·Th e recordin g proce ss illu strated

·Summary illu stration of journalizin g

and posting

LO 4 Pre pare a tria l balance.

• Limitation s of a trial balance

• Locating errors

·Currency signs and und erlining

Go to the Review and Practice section at the end of the chapter for a review of key concepts

and practice applications with solutions.

Accounts, Debits, and Cred its

LEARNING OBJECTIVE 1

Describe how accounts , debits, and credits are used to record bu sin ess transa ction s.

The Account

A·. nh .l

account

!! record 11f in...

. . ~ dnc

. 1 Le

I · u. .ca~

. L·~ ·111 a ~ pc ulr

.. L· ·t.., '>L'I

_ i ~ an

, .· indi v idu

. al

. acc uuntin

_

li L: d'.c

1 rt y. 1>1 !lWil el " eljLllt y ll c m . .f- or c xalll i11L' · ·So ft hy t L, ( II1c, Lo

. nlpdny

.

1l et

.

l 1l·'.c u -."c d in ( 'h 1 1' ..

·r I .I

'v\ ou ld ha\c \ Cp ar atc acc o unt '. l!l r Ca .., h · A cc () LJill " I>

.

.

,

·

..

A

<I

J

L

1

1

'c u : J\dl c .

CUl lllll " Pa y ~ thlc . S L' J"\ IL'L'

L

Accou nts. Debi ts. and Credits

Ren:nue. Sa lari es and Wages Expe nse . and so o n. (. lo tc that \\·hen e Ye r \\·e arc referring to a

spec ifi c acco unt. \\ ·e capitali ze the nam e.)

In its s impl e st form. an account consis ts of tim~ ~:.' parts: ( I ) a title. (2) a le ft l)r debit s ide .

and (3) a right o r credit s ick. Becau ~e the fo rm at of an acnnmt rese mble s the letter T . \\·e refer

to it as a T -account. Illustration 2 . 1 shm\·s the bas iL· form of an account.

ILLUSTRATION 2.1

Title of Account

Left or debit side

Basic form of account

Right or credit side

We usc thi s form often through ou t thi s book to explain basic accounting re lati o nships.

Debits and Credits

The te rm debit indicat es th e le ft s ide of an account. and uedit indicates th e right side . They

are co mmonl y abbrev iated as 01". for debit and Cr. for credit. They do not m ea n innease or

decrease . as is commonly thought. We use the te rm s debit and credit repe at ed ly in the recording proces s to descr ibe where e ntri es are mad e in accounts. For exa mpl e . the act of ent e rin g

an amount on th e left side of an account is called debiting the account. Mak ing an e ntry o n

the right side is c1·editing th e account.

When comparing th e total s of the two sid es. an account sho\YS a debit balance if the

total ol.the debit amounts excee ds the credits. A n acco unt shm\·s a credit balance if th e credit

amounts exceed the debits. Note the position of th e debit side and credit side in lllustration 2. 1.

The procedure of record ing debits and credit s in an account is shown in lllus tJ·ation 2 . 2

for th e transactions affecting th e Cas h acc o unt of Softbyte . The data are take n from the Cash

column of the tabular summary in Illu stration 1. 8.

ILLUSTRATION 2.2

Tabular Summary

Account Form

Cash

€15,000

-7,000

1,200

1,500

- 1,700

- 250

600

-1 ,300

€ 8,050

(Debits)

Balance

(Debit)

Cash

15,000

(Credits)

1,200

1,500

600

8,050

7,000

1,700

250

1,300

Every positive it e m in the tabular summary represent s a receipt of cash. Eve ry negative

amount represe nt s a payment of cash. Notice that in the account fonn . we •·eco•·d the ine~·eases

in cash as debits and the deueases in cash as c•·edits. For exa mple . the € 15 .000 receipt of cash

(in blue) is debi ted to Cash. and the - €7.000 paymentuf L·as h (in red) is LTL'dited tu Cash .

Having incre ases on une .s ide a nd decrea ses un the other redu L·es rL'L"llrd in g e rrurs <ll ld lll'lps

in determining th e totals of eac h s ide uf the acL·uunt as vv·L·II as thL' ctL'L"OUilt hctLllll'e . ThL' hal<ll1l'L'

is dete rmined hy netting the two s1des (s ubtrac tin g one amount from th e other) . ThL' ctL"L"Ullllt h<li a 1Ke. a deb it of €~.0.'\ 0. ind 1ca te s th at Surtbyte had € ~.0.'\ () nH lrL' 1nLTL'aSl''- than d e nL'~tse" 111 L·,1sh .

In otlll'r wurd;, . Sort byte '> tarlL'd \.\ 1th a halallL"L' uf IL'm and lhl\\ ha" €~. !))!1 111 1t s C·as h aL·L·\ 1unt

Tabular summary and account

form for Softbyte"s Cash

account

2 -3

4

C HAPTEP 2

TheR e co r d i ngP r occss

Debit and Credit Procedure

HE LP F LL HI .V f

Rules for acc ounti n g f o r <.,pt: «.:ific cv~:nh <; ornet i rn t:.<., d if f'~: r

aL'TOS" count. rit:'> . fh: '->p i t ~.: the

diff'crenct:<.,, the d o uh l e- en t ry

accounting " Y"tcm J.<., th e

ba.'>i.'> of acc ounting '>Y'>lt:m'>

world wide .

I n Ch a pt e r I . y o u lea rn ed th e e !'k c t of

<t

tr;tJJ <.,;tction on the h;t-.,ic al·unt llllll 12 equa ti <•n. I ~L' fllL'Ill ·

h e r th a t eac h tran .., act i o n fl1Lf <., t ;tlfc c t t \~,, or m ore ;~ccount' to 1-.eepthe h;t-.,iL· ;tL'c<H flllfll 12 L·qu;t tion in h a l a n ce . In o th e r W() rd " . fo r c<tc h tr;n J.., ac ti on . debit... lllll ' t equ;tl nedih . Th e equ;t lit:

()f d eh i t .., a nd c re d i h p ro v id e.., th e h;t" i " for th e doul>le - cntl·.' " ·' <.,lcm '' ' rn·n rdi11 12 tr;lfl -.,; tL·tilltl'

( <.,ee

Helpful H int ).

Lnd e r th e douhlc - e n tr y ..,y.., te n J.th e du a l (t\\o - .., idnl l e ffect <lf. c;tl· h tr ;lfl-.,; tc ti<lll i -., reL·PrLkd

i n a pprop ri a t e acc <>u nt <., . Thi .., "Y" te m pro \' i ([c ., ;t l<l 12 ica lm cthod !'nr reL·<• rdin 12 tr; tn-.,;tL· ti<lll ' ;tnd

a [.,,, h e l p .., e n sure t h e accu r <tcy o f th e rec ()rded

;~nwt fllt '-

a-. \\e ll ;t-. th e d e tec tion

,,r e rrllr '

If

e v e r y t r an .., ac tion i .., r ec o rd e d w ith equ ;tl debit ' ;tJHI cred it .... . th e -., ulll ,,f ;ti l t he Lkhi t ' to t he

a ccounh mu st e q u u l th e <., LJ Jll o f a ll th e cre di t....

T he do u ble -e n tr y ... y ... te lll fo r d c tc r m i n in g t h e eq u ;tlit )

or th e acuH tlltin 12

equ ;tt l tl ll i-., il lli Lh

more e ffi c i e nt t han th e plu ..,/ lllinu -. pn1cc d u re u -. e d in Chapter I . Th e !'n il '''' i11 12 di -.,L' l' " ' tlll

illu <.,t r a tc .., d e h it a n d cred it p roc e du re-. in t h e douhlc -c n t r ) -.y-. tc nl.

Dr./Cr. Procedures for Assets and Liabilities

I n l i Ju .., tru ti o n

2.2 fo r S o fth y te. in crc< t'- C'- in C;t-. h - ;tn ;t..,-. c t- ;tre e n te red 011 th e IL'I't .., id e . ;tllll

d ecrea ses in Cu .., h ur e e nt e r e d on th e ri 12 ht -. id e. '0/ e 1-; n o\\ th <t t both -., id e-. o f th e ha .., ic l· qu:ttion

( As.,e t s = Li a biliti e s + O w n e r· .., Lquit ; ) mu -. t h e equal. It th e rcf'o re !'u llm\<, th <tt incre ;t<, e<, ;tnd

dec r eu se.., in li a biliti e s h <tv e t o h e r ec< >rd ed opposite r.-om in c re a<,e<, a nd deLTl'< t"e" in ;t <,<, L't ~.

T h u s. i ncrea se.<., in Ji a hiliti c-. ar c e nt ere d on th e ri !.! ht o r credit ... id e . ;tnd d en e<t "e" in liahiliti e..,

ar c en tered o n th e left o r d ebit .., id e . Th e cfkct ; th a t d e hi h <tnd credit " h;t\ e on a..,.., et .., ;tnd

li a biliti e s ar c .., u mmari /e d in Illustrat ion 2 .J .

.

.

'l ILLUSTRATION

2.3"'

~

-

Dehit and cre dit effects- a ssets

and liabilitie s

Debits

Credits

ln c n.: a<,t: a'> <,Cl '>

D cc rca .,c li ahiliti c'>

Dccrc a.,c a.,.,ch

lncrca.,c liahiliti c.,

A sset accounts normally show debit balances. That i s. debit s to a spccilic a~ s ct account

"> h o uld ex ceed credit s to that account. Lil-; ew i se. liability accounts nonnally show

cn.~dit

balances . That i s. credit s to a liability account should e xc eed debit s to that account. The

normal balan c e of an account i s on the side w h e re an incre a se in the account is rcconkd.

Illust r ation 2 .4 show s th e normal balance s for assets and liabilitie s.

[.ILLUSTRATION 2.4

-'ormal halances - a ssets and

1iahi I ities

Assets

Debit fo r Cre dit fo r

increase

d e crease

Normal

balance

l

l

Liabilities

D e bit for Credit for

d ecrease Increase

Normal

balance

Kno w in g th e norm a l balanc e in an account m ay help y ou trace errors. For cx ampk. a

c r e dit b a lan ce In an a sse t account such as Land or a debit bal a nce in a liabilit y account ~uch

<~'> S<tl a n cs Lt nd W ages Payable u su a lly indi c at es an error. Oc c a ~ ionall y . thou g h. an ahnurn1al

h <tlan ce m ay h e co rrec t . Th e C a sh ac count. for ex ample . w ill ha ve a c redit balanc e w hen a

c ompan y h a..., o ve rdra w n it s hank balanc e h y ~ p e ndin g more than it ha s in it s ac c ount.

Dr. / Cr. Procedures for Ow n e r 's Equity

\-.,C

h a pt e r I tnd1 ca t c d . ow ne r ·" in vc -.tnJ Cilh· '·1nd r"'- V''-' IJLI'"

- y. () w ne i-· "

_

'- ·' IIl l' t''"l

'-' ·'' •''- (l""'' ll CI-· \ equtt

d i LlY\ Ill !!'- ;llld e\ p e il '-C' d ClT Ca ... e () Wil e r ' " equit y C olllpa ni e., k ee p acc ount<, for eac h ur thL' " L'

t\ ! 1~· -., "' tr ;lll -.,< lL·ti< llh

Accounts . Debits . nd Cre its

Owner's Capital.

lnYc stmcnt s by 0\\·ncrs arc credited to the 0 \\·ncr· s Ca pit a l account.

C redit s in c rease thi s acc o unt. and debit s decrease it. \\.hen an 0\\·ncr im·cs ts cts h in the'

business . th e c o mpany debit s (increase s) C as h and credit s (increases) 0 \\·ncr· s Cap it a l. \\" hen

the O\\"llcr· s inYestmcnt in the bu s ine ss is reduc ed . 0 \\·ncr·s C apital is debited (ckcrc a scd ).

Illustration 2.5 shO\\"S the rules

debit and cre dit

the 0\\ner's C apital ac c o un t.

or

rnr

Debits

Credits

ILLUSTRATION 2.5

Debit and credit t'tft•ctsOwner's C apital

We can d iagram the no rmal balance in 0\\·ncr· s C apital as shmn1 in Ill ustration 2.6.

ILLUSTRATION 2.6

Owner's Capital

Debit fnr

C n:dit for

d e crea ~e

1ncre ~ 1 ~e

1\ormal

balance

t

:\ormal balance-Owner's

Capital

Ow ner's Drawi ngs. An owner may \\ ithdra\\ cash or other assets for personal usc . \\"ithdrawal s could be de bit ed directl y to Owner's Capital to indicate a decre as e in O\\ ncr's equit y.

Howe ver. it is prckrabk to usc a separate account. L·alkd 0\Yncr·s Ora\\ in gs. Thi s separate

account makes it e asier to determin e total \\·ithdra\\·als for each accounting peri od. 0 \\ner·s

Dravving s is incre ased by debit s and decre ased by credits . formall y. th e dra\\·ing s account \\·ill

have a de bit balance.

lll ustt·ation 2.7 shows the rule s of de bit and credit fo r the 0\\·ner·s Dra\\ings ~ll'count.

Debits

Credits

Increase Own er' s Draw ings

Decrease Owner· s Draw ing s

ILLUSTRATION 2. 7

Debit and credit effectsOwner·s Drawinos

"'

We ca n diagram the normal balance as s hown in Ill ustra tion 2.8.

Ownet·'s Drawings

Debit for

increase

C redit ror

decrease

ILLUSTRATION 2.8

1\onnal balancL'-Owner·s

Drawings

Normal

balance

The Owner's Drawings account deneases ownet·'s equity. It is not an income statement account like •·evenues and expenses.

Revenues and Expenses.

The purpose of e arnin g re venues is to benefit the uwncr( -.)

of thL' busine ss. When a company recog.nite s reve nue-. . owner·" equit y illLTl' che -.. There fore. the eH'ect of debits and ct·edits on •·evenue accounts is the same as their effect on

Owner's Capital. That is . re venu e account s arc inne ascd by crcdih and dccrca -. cd b y debit"

HE I.I'IT I. Ill !\' T

('-e e Helpful Hint).

Ex pen se s ha ve the oppos it e c fkct. Ex pe nses decre a-. c ov.-ncr·s L'quit y. Since e x pe n ses

dc LTCase net incom e and revenues increase it. it is lug iL·al that th e innL' Ll '- L' and d e crc a"e " id es

llf ex pense <.ll'Ullllll s s hould he th e (lppos it e of revenu e acc ount '- . Thu '- . C'< IK' nse ac c ount " arc

irK-rea"ed hy de hit " a nd denc ascd hy ned it " Illu stration 2 .'J -. hm\-. th e ruk -. llf Lkhits and

LTL'dit ~ fur rL'\ e11ll l''- a nd e \ ]1Cll '-.l'S

Bl'l'ause l'l'H'IIU l'S itHTt'aSl'

O\\ lll't··s L'quit~· . a n.'H'IIIIl'

an:ount has the same dehit /

LTedit ntiL's as thl' (hHIL'r·~

Capital accou111. Expt•nst•s

hm t' llw opposite dft•cl.

2-5

2 -6

CHAPT E R 2

Th eRe co rdin g Proces s

l iLLUSTRATION 2.9

Deb it a nd c re dit effectsreve nues an d ex p enses

D e hits

Cre dit.'>

Dcc n:a!-.c n.:,·c nu c "

I nc n.:a '> c ex pc n'> e '>

l n c re~~'>e rc\ e ll liL"'Decre;!'>e e xpe n"e'

C red it s to n .:ve nu c acco unt s sho ul d ex cee d d c hit '> . D ch i t'> to c x rc n ..,c ;tcu lll lll " -, h(l uld L'\l"L'L'd

c red i ts. Thu s. re ve nu e acco unts no r ma ll y sho w c redi t h;tl ance .., . ~tnd c x r c n ..,c ;tL"L"l ll tll h lllli" Jll ;tll:

sh ow de bit b a l ance s. lllustr;.~tion 2 . 10 sho w s the norm a l h ala nce .., fo r rc \ c nu c .., :llld L'\ j1L' Il "L''-.

Re venues

l iLLUSTRATION 2.10

Dc hit fo r

dcc rca!-.c

:'-lcwma l ba la n ces- revenu es

an d expenses

E x p e nscs

C re d it for

in crca"c

C re dit f() r

d ec rc';!'>c

Norm<o~l

Normal

halancc

hahwcc

Investor Insight

Brother Elephants

Keeping Score

Th e Brother Elephants (TW N ) ha!-.c ha ll !ca m pro ba bl y ha !-. th c :-.c m a jo r rc ,·c nu c and c xpc n;, c ;tcu lllltt ;,:

Re venues

Expenses

Ac.l m i;,s io ns (ti cke t sa le s )

C on cc s;, io n;,

Tc lcv i:-. in n a nJ radi o

Advc rti ;, in g

Pl aye rs· sa la ri c :-.

1\dmini stra ti vc.: ;,a la ri c :-.

T ravc l

Stadi um mai n t~..:n a n cc

Do you think that the Manchester United (GBR) foothall (socce•·J cluh would he likcly to ha\l' the

same major re venue and ex pense accounts as B1·other Elephants'? (Go to the hook's companion website for this a ns wer and additional questions.)

'VI and y Che ng/AFP/G ett y I m ages

Summary of Debit/Credit Rules

HELPFUL HINT

Yo u m ay want to bookmark

Illust ra t ion 2. 11. You probably will refer to it often.

:ILLUSTRATION 2.11

Illustration 2.11 sho ws a s umm a r y o f the d e bit/cre dit rul e s a nd e ffe ct s on each ty pe or

acco unt. Study thi s di ag ra m c are fully. It will he lp y o u unde rstand th e fundamental s or the

d o ubl e-e ntry syste m (see He lpful H int) .

Summary of d e bit/credit rules

Basic

Equation

Asset s

= Liabi lit ies

+

Expanded

!Equation

Asse ts

Liabilities

+

Debit I Credit

!Effects

~

-

Owner's Equity

Owner's

C apital

T T

+

+

Owner' s

Drawings

~

-

+

Revenues

T

+

Expenses

~

-

The Jourr a l

DO IT! 1

I

Normal Account Balances

A CT IO~ P LA~

Juli e Loeng ha ~ ju~t re nt ed ~pace in a shopping mall. In thi~ s pace. she ,,·ill open a hair sa lo n to h •

called .. Hair It ~s.·· A friend has ad, · i ~ed Juli e to se t up a clnubk-entry set of ~IL'L'tlunting reL·nrd s in

,,·hich to record all o f her bu s in es~ tran sact ions.

Id e ntify the state me nt of tinancial position accou nt s tlut Julie ,,·ill likely need tu reco rd the

tran sac ti o ns needed to ope n her bu s iness. In d ic ate w hether the norm a l halanL·e of each accuunt is a

debit o r a c red it.

Solu t ion

Julie \Hlu ld likel y need the following accounts in ,,·hi c h to ren1rd the tran sac t in ns IlL'CL'ssary to read '

her hair sal on fo r opening day :

Cas h (debit balance)

Equipm e nt (debit

If she bo rW\\·s m u ney:

(crL·dit balan ce)

bal ~lll L· e )

~otes

Payabk

• Dcr crmint• the type~ of

accounts n e-e ded. Julit• wi ll

n e-t:'d asst't account~ for

t:'ac h dilfc re m typ e of as,, ct

she inYesb in t.he busint•.ss

a nd liabiliry alTounr~ fo r

any debts she in cun- .

• l -nd crs tand the type~ of

owner's cq uir~ acnmnt~.

Only Owner's Capiral

''ill be n e·t•dt'-d when Julie

begins the bu sint\'.!'- Other

owner's t•quity ac coun t~

"ill bt• n et•dt•d latt-r.

0\\·ner·s Cap ital (credit halarK L' )

Supplies (debit balance)

Acco unt s Payable (credit balance )

Re lated exercise· material: llE2.1. llE2.2. DO IT! 2.1. E2.1. E2.2. and E2A.

The Journal

LEARNING OBJECTIVE 2

Indicate how a journal is used in the recording process.

ANALYZE

Journalize the

transactions

POST

TRIAL

ADJUSTING

BALANCE

ENTRIES

ADJUSTED

TRIAL

BALANCE

FI NAN CIAL

CLOS IN G

POST-C LOS ING

STATE M EN TS

EN T RI ES

TRIAL BALAN CE

The Recording Process

Although it is poss ible to enter tran saction information direc tly into th e accounts. few businesses do so. Practically eve ry business use s the basic steps shown in Illustration 2 . 12 in th e

recordin g process (an integ ral part of th e accounting cycle):

I. Analyze eac h transaction in te rm s of its e ffect on th e accounts.

2. Enter the transaction information in a j o urnal.

3. Transfer the journal information to th e appropriat e accounts in the le dge r.

ILLUSTRATION 2.12

The •·ecm·ding pmeess

The Recording Process

I . Analyze transaction

2. Enter transa ction in journal

3 . Transfer jour n a l info r m a tion

to ledge r accounts

2-7

-8

C HAPTE R 2

Th e Re c o rdin g Pr oc ess

E T HIC S :'\OTE

O uts o u r c in ~

Inte rn a t ional

Services , I , I ,C wa s a ccu<.,ed

of '> uh rn i tti n~ fr a udul e nt

sto r e c oupon s t o co rn pan i e_.,

fo r n: irnhur'> cmc nt of <--1'>

mu c h a s ~ 25 0 mi lli o n. Lse of

p r ope r hu si nc '> s d ocum e nt<,

reduce '> the like li h ood of

fr audu lent acti vity.

Th e '> tep '> in th e rcco rdin t! procc <.,'> occur rc p c:t tcd l: h n : E thics :\ oll' l. In Ch :tpiL-r I_ 11c

iliu '> tr<JtC d th e fir'>! '> te p . th e an<.ti y '> i<., of tran .., a c tion " . ;tnd \\ ill g i1·c furth e r C\d lll j)k" in thi --. ;t tlll

1<-J tcr cha pt e r '> . Th e o th e r tw o ...rep" in th e rc u> rdin g pmu: .., .., arc c\ pb in c d in th e ll L'\ l --.cc t il> tl .., _

The Journa

Com p a nie '> init ia ll y rec ord tra n -. ac tion '> in c hronol o g ical orde r (t h e o rucr in " hi l·h the: oc c ur ).

Thu '> . th e journal i'> rek rn.: d to a '> th e hoo k of ori g in a l e ntr y. Fo r c :~ c h tLtn ..,;tc lil>n . th e _jl>um :tl

'> ho w'> th e dchi t an d c re dit e ffect '> on -. p c c ifi c acun tnl '> .

Compani c'> ma y U'> e v a riou -. k ind '> o r journ a l.... h ut c\L' r) co nlp :t ny h:~ ... th e llH >"l h ;t'-. IL'

fo r m ofjourna l. <.t general journal. T y pi ca ll y. :1 gc nc r:tl _joum a l h:t '-> " P<tcc --. r1>r d :~ t c--. . :tn·ount

title '> anu e x p lanat io n -. . re ferenc e -. . anu [\-\'()amount c olumn -. . S ec th e rorlll <ll o r th e _JOUrn :tl in

Illu .., tration 2.\ l . Whc !U '\ 'c r \ t'l' u se !lw !cnn "juunwl" in !l1i.1 !c.r! l ){)u/.:. 11'1 ' 11 1< ' 1111 !Ill' .~ l ' lll ' l"lil

jounw l u nl e ss

\\ 'l'

Sfh'f·ij~\- u!l!cnt ·i sc .

Th e _journ a l mak e-. '> e vc ral -. ig nitic a nt co ntribution -. to the reco ruin g pn>cC'-. '-. :

1. It Ji -.c lo -.e 'o in on e plac e th e complete efl"ects or a tJ·ansaction.

2. It pro v iu c'> a chronological record of tran -.:tct ion -.

3. It h e lp '> to prevent or locate errors h ecau -.e the d c hit <tnu credit <lllH>unt -. lor each en tr y

ca n h e ca-. il y compared.

Journalizing

E nterin g tran ... action data in the _journal i-. kno w n a -. journalizing. C ompanic -. make se p:tr<ttc

JOU rn a l cn tri c-. for e ach tran-.a ction. !\ co nlpletc entr y co n -. i-. h or ( I ) the date or th e tr:tll S: ll'tion. ( 2) the account -. and amount -. to h e dchit c d and credit e d . and (ll a hrid e x pl<tnation l>r

the tra n '>a ction.

lllu '> tra tion 2.1 3 -. ho ws the techniqu e or journali z ing . u s ing the lirs t tw u tran -. actiuns ()r

Sof'thy tc . Recall that on Septc:m her I . Ra y Nea l in vc-.tcd € 15.000 cash in the bu s in ess . ;tnd

Softhy tc purcha'>cd computer equipment I'm € 7.000 cash. The number .II indi ca te -, th :t t these

t w o c ntri e-. arc record ed on the fir-.t page or the _journal. lllust1·ation 2. 13 shows th e s lalllbrd

fo rm o fjournal entries for the se t wo tran sac tion -.. (The ho xcd numbers co rrespond to e x planati o n s in the li s t helow the illustration. J

I

•

,ILLUSTRATION 2.13

GENERALJOURNAL

Jl

T echniqu e of journalizing

Account Titles and Explanation

Date

Ref.

Debit

Credit

!Kl

2020

Se pt.

I 5 ,000

ITJ

I 5.000

Owner's Capita l

(Ow ne r' s in vestme nt of cash in business)

Equipm e nt

Cash

(Purchase of e quipme nt fo r cash)

7.000

7.000

[I] The dat e or the tran s action is entered in the Date column.

rn

The d e bit account title (that is . the account to he debited) is entered lirst at the ex treme

left margin of the column h eaded "Accoun t Titles and Exp lanation." and th e amount of

the dehit is recorded in the Debit column.

The credit accuunt title (that is. the acc ount to he credited ) is indented and entered 011 the

ne x t lin e in the column headed " A ccount Title\ and Ex planatiun." and the :tnH>Uill or tilt:

cre dit is recorded in th e C rc u1t cu lumn .

A bri e f ex planation of th e tran sa ction a11 I1cars· on th e lin e hclow tl1•·.... l'l'"ll.lt

.

....

<Iecount t 1' tl LA s 11ace 1s ldt hetwec n journal entri es . The hl<tnk '> j1'1l'e "'J1'tl·· 1t··' 1·11 ll.1Yll

· 1ua 1 1ourn

·

1

<1

e ntnc s and mak es th e e nllre JOUrnal ea-.icr to read.

·

_

:

_

•

L

·' ' -

L

"

' - ·'

The co lumn titled Rd. ( w hi c h s tand -. for Rde rencel i-, le ft hl a nk w hen thcjournal e ntr y 1--.

lllad e . Th t-, l' l> lu mn I'> u . . c d lat e r w he n th e _Jl>Urn <tl e 111r1 es arc tran s krre u to the indi v idu :tl

dl l' ! >U Ill \ _

The Jo 1rnal

2-9

It is important to use correct and specific account titles in journalizing. Erroncou~

account titles lead to incorrect financial sta tement s. Hm\c\·cr. so me flexibility exi~b initially

in selecting account title s. The main c riterion is that each titk must appropriately de~cribc

th e co nt e nt o f the account. Once a compan y c hooses the spccit ic title to usc. it shouiJ rL'Cl1rU

under that account title all later tran sac tion~ inYoh · in~ the account. I n ho/1/(' ll ·ork Jlrohlcm s.

\DII should use .\}lec i(ic occounr rirles ,,·hen rhn· ure gi 1·en. \:.. ·hen account title~ :lre m1t

given . you may select account title s that identify the nature and content or each ~IL'cnunt. T he

account title s used in journali z ing should not contain e xplanation s such as Cas h Paid or Ca~h

Received.

Simple and Compound Entries

Some entries in vo ln: onl y two accounts. one debit and one credit. (Sec. for example. the

entries in Illustration 2.13.) This ty pe or entr y is called a si mple l'Htry. Sl1 111e tr atbactions. how eve r. require more than t\H) aL·counts in _iournali z in~ ..-\n L'ntry that rL'quirc~

three or more accounts is a compound en tr y. To illu s trate. assume that on July I. Butler

Shipping purchases a delivery truck costing £1-LOOO. It pays UUHlO cas h nm\ and a~rees

to pay th e re maining £6.000 on account (to be paid later). Illustration 2 . 1-t s iW\\ s the

compound e ntr y.

GENERALJOURNAL

Date

2020

Jul y I

Ref.

Account Titles and Explanation

ILLUSTRATION 2.14

Jl

Compound journal e ntry

C redit

Debit

1-l-.000

Equipmen t

Cash

Accounts Payable

(Purchase d truck for cash with balance

o n account)

8.000

6.000

In a compound e ntry. the standard format requires that all debits he list ed before the credits.

l

Accounting Across the Organization

Hain Celestial Group

It Starts with the Transaction

Reco rding financial tran s actions in a company's records should be straightforward. lf a cumpany det e rmines that a tran sac tion in vo lves reve nue . it record s

reve nue. lf it has an expense. then it reco rds an

ex pense . Howeve r. so metimes this is difficult to do.

For exa mple. for more than a year. Hain Celestial

Group (USA) (an organic food company) did not

pro v ide income informatiun to in vcs turs and regula tors. The reaso n gi ven- th e organic food company

discove red revenue irreg ulariti es and said it cuuld

Ke ith Ho111an/

not release financial results until it d e termined when

Shulln, tuck

and ho w tu recurd re ve nue for certain transactiun ~.

Vv" hen Hain mi ssed four deadlines for reporting earnings inl\lrma titln. the fuud company su ffered a .~-1'1, drop in its s hare price . As one

anal)~~ noted. it is hard to fathotn w hy a seemingl y s imple re\ 'L'Jlllc'

rL·cognition iss ue took une year to rL· , uiYe.

ln otllL'r ~ ituatiun ~. uutright fraud may llCL·ur. For c.xa n111k . rL' _c'U lator ~ c harged Obs idian Fnerg~ (CAN) fm fraudulent h JlH )\ 1ng

'

millions of dollars in expenst>s fn1m operating expL'nsc'S 111 c·~lp ital

expenditure account s. B y unders tating repurted UJlL'rating t>\pt'nSL'~.

Obsidian mad e it appt>ar that it \\·as managing ih U1Sl\ t>ffiL·iL'ntl) a,

well as increas ing it s income .

These e x amples demonstrate that ··getttng tilL' ha,ic tran,~tL·t ion

right .. is the foundation f\1r rL'k\ ant and rL'itahle financial s t:tte mcnts. Starting w ith an incorrect ur inapprupriatc tratb~tctitl n lead,

to disturtion s in the financial statL' lllenh .

Soun:es: Shawn Tull y. ··TilL· JVI\, tn\

r ;II -1/III<'.J'ill/1

,,f H a tn

CL·k , tiaJ ·, .-\L·L·ot mllll ~.-·

(A ll ~ ll ' l 20. 2 111 hl : a nd KL· Ih Cr\'tknnan. ··t '.S. Char~L''

I )h,idian. l'ormc·rh PL' llll V'\c· ,t.

i\!ui/ t.ltttlc· 21-1. 20171 .

\1

till .-\L"L' Illllllllt~ 1--r;tud.·- / "11 1 • ( ;{o/>c und

\ ·V hy is it impm·tant fo1· companil's to n•conl hnancia l tnms.K tions t·ompll'ld~ · and accuralt'l~ "? ((;o to lht• hool,·s companion

Wl'hsill' for I his ans\H' r and additional qul'sl ions. l

.- 1 0

c

H r~ P

rEf--'

DO I T! 2

2

Recordin g Bu si n ess Act iv it ies

Jull t: '- •• t: ll)! l: ll )!<tt.>ed

hundred .., , :

Ill

the '" ''" '-'- ill)!

acti\ iti e~

in

e ~ t ;d1 li ~ h i n!-'

\(

h e r '; don. I L1JJ It I ' l<tfll<>t lll h

L ( Jpt:n•·d :, h ,·1r1 '·. · , ., .

~

;ILL IJU!I t

c

<J ',

1 t ·

tl

f' JJ ·

, .., ( (

r • k d l l n 111

1e name''

a 1r I t j .., ;mel d e p c,.... it e d 1 _ (! .)() I

her initia l ill. e'-, tllJefll.

"

t1

1er o\Ul llli!JJ L"~

Ill

tl

l'l'l'OI'Cft-cJ :11J cJ \\ !Jj l'f l cf o

" '

flo !. \ n 1 l h :tl :~fl'l' l'l :t "l'h .

li :~ hifili l'' - Ill' (Il l fl l'l'·,

2. l' urciJ<t <, t:d e quipment'"' <t cc ount I to he pai d i n 3 () da) ' l fu r " l11l ;d c"'l ell Y..J.XIHI .

l'qtli f_\ '-, )]()!1/ c/ hl' J'l'l' OJ'c/ l' c/

in : 1 jotlf'll :t f.

tra n ~ act i " n ~ .

• \ n :d1 n · I h l' df't-c h of'

fi' :Jfl " ll'licll l' on :l "l' l.

liahil i t_l . :~ ncl ll\ l ll l-r· ..,

l' qllif _\ :I('('I)(Jllh .

Solution

;, ~ f( , IJ ,, v. ~ .

.I he th ree act r'. i tr e '> ·;. c,uld he recc Jrd e d

L c ·:"h

r J·;. n c r ·' ( ·;,Jlll : d

r(

2.

) ·;. n c r ·.., lJJ". c..., ruJ c nr

l:P·~ IJ

I

Ill htr

I TJC \ \ J

f ·.tjlllj11 11t: IJI

·\ LLf >IIIJ h

f

- ~-

(Jt

f';>:- :.hlc

l) llrc h(J . ., c qf

_: rJ.IJIJII

I

.: 1/ .IHHI

-l.XIH l

L" (

I

flllj1111t:lll "11 <l l" ll>lll lf l

·" " c nrr:. hcc au , c "" tr· r .

d h .JCI/()fl

l< cbrcd c xcru ..,c llJ<.Jtcn;_,f:

/'/..\ '\

• I nch-r,f :lncl 11 lt iclt

:~cl i 1 if il''> lll'l'cllo ill'

Ill

3 . lnt t: r·-'le'lled t hree pe.,plc for the po.., it ion o f ha ir .., ty fi.., t.

l ' r t:p;t r e the jiJurnal l:lllr le '> to re c "rd t he

--, /()'\,

I

h~l . ., fJCCllrrcd .

2

HI-: .3, BI-:2A, BI-:2. 5 , BE2J1, DO IT! 2.2, I-:2.3. 1-:2.5. L2J>. 1-:2.7. L2.X. and L2.'J.

The Ledger and Posting

LEARNING OBJECTIVE 3

Explain how a ledge r and postin g help in th e recording process.

A N ALY ZE

J O URN AL I ZE

TRIAL

ADJUST ING

BALANCE

ENTRIES

ADJUSTED

TRIAL

BALANCE

FINANCIAL

CLOSING

POST·CLOSING

STATEMENTS

ENTRIES

TRIAL BALANCE

The Ledger

The en tin.: gro u p or :..reco unt -. maintained hy a com pa ny!~ th e ledger·. The ledger provide .~ thL'

balance in each or th e accounts as we ll as keeps tr<~ck ol ch<~ngcs Ill th ese hi!lanccs.

Co rnpun ie s may usc va ri o u-. kinds of l ed ge r.~ . hut eve ry_ com pany hits ~~ gene ral lcdgLT.

A general ledger co nt a im a ll th e asset. liabilit y. and owner .-. cqully accou nt.~. <I S s how n 111

Illustration 2.15. Whenn ·er 11 .e use the ter 111 " /('c/ger" in th is /( '.\!hook . 11 ·e or(' re(erring to t!ti'

f.{ e n e ~0 IL I

ec g e r unless we Sf Jenfv o th en u 'se.

l'he g~ ne ra l ledger, Which

contains all of a l'Oillp·

,

an v s

accounts

·

---------- Asset

Accounts

Liability

Accounts

Owner's Equity

Accounts

Salaries and Wages Expense

Service Revenue

N otes Payable

Owner's Capital

The Led er and P st inc

2-1 1

T he led ge r prov ide s the ba lance in e ac h nf th e an· n u lll s . Fu r e xam p le , th · Cash

ac cou nt s hows th e amou nt u f ca s h aYa ilabk tn m e e t c u r ren t ub li gat iun s. Th e .-\.\.'l'OUnts

Re ce ivab le ac co un t s hm \ s a m o u nts Jue from c us to m e rs . .--\ c cou nt s Payable sh O\\·s anHHtllls

owed to c red it o rs . Eac h acco ulll is num be re d for eas ie r ide nt iticll io n .

Ethics Insight

Credit Suisse Group

A Convenient

Overstatement

S nm~..· time s

0 Nun o S ilva/ iS tnc kph o tu

~~

~..· umpan y · s

in, · ~..·s t­

me nt sen1riti es su tfc r a permanen t

decline in , - ~tl ue bcl nw the ir n ri g ina l cost. \\"h ~..· n th is n c ~..· urs, th e

cu m pa ny is supposed tu reduce the

re~..· n rded Ya lu e nf the sen1ritie s nn

its state me nt uf fi nancia l pos it iun

("\\Til e th em do,,·n" in l'll tn mo n financ ia l lin go ) and r~..· c md ~ ~l o ss . It

appea rs. hm,·cye r_ th at during the

fi nancia l cri sis of 2008, e m p loyees at some fi nancia l in stit ut illll S

chose to look the u ther ,,·ay as the

va lue of the ir inYcstments sk idded .

.-\ num ber nf \\":til Str · ·t tr:td ·r;; th:ll ' ' ,,r · · I ft,r th · in ' ·s 1 1 ' t t

hank C t·edit Suisse G r oup lCH E l '' ·re d1:1rg ·d '' ith int ·n i,>tu ll:

\lYe rs ta ting the Ya lu · nf s ·~..-uriti ·s th:ll h;td su tr ' t ·d d ·'-· !in-.·s cH.

a ppn,:x im:llel ; : 2.S:'i billion. O n · rcts,,n tlut th ·: m ;t; h;l\' l'l' ·n

re l u ~..· t an t tu r~..·curd the losse ,.. i,.. nut,,f ft.• ;1r tlut th ' 1..'\ H 1p;m; ·,..s h a n.· lw ld e rs ~111d di~..·nts \HlU id p;lni'-· if the; S :l\\ the nug n itu,·c ,,f the

ln ss~..· s . Hm,·e,·e r_ perst,nal self-inter ·st mi ght lu\ ' h;..'<.' ll ' JU:dl ;

tn bLtme- ti1L' b,,nuses of the tr:1d~..·r;; \\ere ti ·d ''' th ' \ :tlu ' ,,f th e

in\·est m e n t securities.

S o ut-ct•: S. Pulli:1111 . .1. 1-: ;l~kslum . :md \ I S l,·u t ,, lti . .. L". S. 1 \:tn ,; C h,u ~<>

u n B,llld 1-'r:tu,J. .. \ \ ill/ Srn ·<I .Iournu l () n .' ll :< 1Fc·hr u: r \ I . 201 2\.

\Y h at ince n t i ves mi g ht em p l o y ee ~ han· had to OH' r->tut e the

valu e of thes e in vcs tm t• nt scc uri t il'!>' o n the com pan~ - ~ tinanL·ial

statem e nts '? (G o to t h e book ' s co m panion webs ite for this an s wet· and additional q ue~ t i o ns . l

Standard Form of Account

T he s im p le T-acco unt fo rm use d in acco un tin g tex tbooks is o ft en ve ry useful ror il lustrat io n

p urposes . H owe ve r. in p ract ice . th e acco unt for m s used in ledge rs are mu c h m ore s tru c tu re J.

Illust r a t ion 2.16 shows a typ ica l fo rm , us in g as s um e d d a ta fro m a cash acco unt.

CASH

Expla na tion

Da te

NO.lOl

R ef.

Debit

c.·edit

B a la n ce

2020

June

I

2

3

9

17

20

30

25 ,000

8,000

4 ,200

7.500

I 1. 700

250

7, 300

25.000

17 ,000

2 1,200

28, 700

17 ,000

16.750

9 A 50

T hi s fo rm a t is ca lled th e thn·e -column fonn of account . It ha s lhrce m un cy cu lum n :-.deh it. cred it. an d ba la nce . T he h a lan L·e in th e accou nt i:-. de termin e d a l'tcr ca d 1 tran:-.aL:t ion .

C ompa ni e s usc th e e x p la nat ion :-. pace a nd rc k rc nc L' L·o lunll h to p rm iLk '- PL'Cia l in fu rm ~ ll iu n

abo ut th e tra nsaL· ti o n .

ILLUSTRATION 2.16

T ht·ee -column for m o f ac co un t

2- ~2

C H / ·P rEP 2

Thc:o R<?cording P r occ:os·,

Posting

T h e rn lce du n .: td tr;lll '> fe rrin 1,' j<Hirn;li e nlrJ L' '> Ill th e IL'll~u ;rl'L'IIllllh ,, l ·:tlkd po-.t in g Tlli'

rh a -. e ()f th e r ec c•rdin ;c f11"1ll'e'" :rCCllllllii;II L'" til L' L'fkL' h "' fill llll :tf ll l'l l IJ:lll'•.IL' IIIIil' llllil till'

i nd i \ ·ilf ua l <ICCO l lll l '>. l'o -. ti ll!l i rl \ td \e' t!J L· flllfll\'.111 ~ ' IL'f1 '

I. I n th e ledger . in th e :rppriJ p rr ;ll e L·o lulllll ' "'the :tl.'L'IIl ll ltl' 1 tkhr tL·d . L'lltt·r til L· d:rll' . l•lllrll:tl

r age . and d eh it am o unt -. llo w n in th e jllllf'll<tl.

2. I n t h e r cfl:n.: nce c o l umn

or th e _jou r nal.

\~rite th e ;tl'L'IIllll l lllllllhn Ill \\ lll c ll til L' tkhit

<t ll HIU nl wa-. po -. tc d .

3. I n th e ledger . i n th e ;,p p n,pr i:llc Ul l unln ' <d th e ;rcC<Illlll f'l c redited . entL·r tilL' d :lle. _il lll rn a l r ug e . an d c r edit <rii H llllll -. 11 <''~ 11 11 1 th e i< Hlrn:tl .

4. I n the r e krc nce c o l umn o f t he joun1al. '' ri te the :rLT <H IIll Jllll llhe r

111

''

ll iL·Il the ncdit

amoun t W<l '> r () '> l elf.

Illustration 2 . 17 -. h " w" tll e -.c 1'11u r -. tep -. U'> lll !! Softhy te· -. fir -. t jo um ;tl en t r ). Til L· h <l \L' d rwrn he r '> i nd ic a te th e -.e qu c n ce o f th e -. tep -. .

,1

P o">tin~ <~

j ou rn<JJ e ntr y

I

I

J1

GENERAL JOURNAL

Date

Acco unt Titles a nd Explan a tJ o o

20 20

Sept. I

Cash

Ow n er's Capi ta l

(Ow n e r's inves tm e nt of

cash in bu s in ess)

R e f.

I OJ

_ __.., 30 1

D e bi t

Credit

15,000

15,000

GENERAL LEDGER

Cash

Explanation

Date

2020

No.101

Ref.

Jl

Sept.l

Debit

Credit

15,000

15,000

Owner's Capital

Explanation

Date

2020

No.301

Ref.

11

Sept.l

Key:

Balance

Debit

C1·edit

15 ,000

Balance

15,000

Ll.--

OJ Pos t to d ebit a cco unt- d a te, journal p age number, a nd amount.

III E nter d e bit a ccount number in journal r efere nce column.

ITJ Pos t to credit account- date, jour nal p age number , a nd amount.

~Enter credit account number in journal reference column.

Postin g should h e rerf'ormed in chronolog ical order. That is . the company should pn-.t all

th e d ebit s and credit s of' on e journ al entry b e fore proc eedin g to the ne x t journal entry. p 0 ..,tirl _!2~

should h e mad e on a timel y ha si s to ensure that th e led ger i s up- to-elate. In hon 1c 11 -11 rk l'rol> -

/(> m s.

\ '(1/f

cunjournuli :.c u/1 /IWI .\UC!ions h l! j(Jre ;wsting om· o(tlwjoumo/ entrie s.

Th e re fe renc e c olumn or a led ge r account indi c ate s the journal page from whidl tilL·

tr a n ~ac tion w as po sted . (After th e las t entry has hec n po sted. th e account ant .s hould SL'<IIl tilL'

rc krence c olumn i n th e jou n la l. to l ·onfirnl that all rustin g~ ha ve hecn lllade . ) The l'X pl ;ul ;l

li o n -. pace or th e led ger acc ount i ~ u "e d infrequ entl y h e c a u ~e an ex planatton alread y aplll'< ll"·

i n th e journ a l

Th e Led oer

n

Chart of Accounts

The number and ty pe of accounts d iffe r for eac h co mpan y. The number or account:-; depL'nd:-:

on the amount o f detail manage me nt cksircs. For example. the managL' ment of o ne company

may wa nt a s ingle account for all types of utilit y expe nse . A nother may keep separat e e-xpen:-:e

acco unt s fo r eac h type of utilit y. suc h as gas. elec tri c it y. and \Ya ter. S imil a rly. a small et1mpany

like So rtby te w ill have kwe r accounts than a g iant company like Hyundai ( KOR ). Softhyte

may be abl e to manage and report it s acti,·iti es in 20 to 30 accounts. \Yhik Hyun da i m ay re quire thou sa nd s or accounts to keep track o r it s world\\ ide acti\·iti es.

Mos t companies haYe a chart of account s . This chart li sb the accmmts and the account

numbers that id e ntify th e ir locati o n in th e ledge r. The numbe ring system th a t identi ties the

accounts us uall y starts with th e state me nt o f finan c ial position accounts and fo ll o ,,·s with th e

inc o me stat e me nt accounts .

In thi s and the nex t t\\O chapters. we exp lain the accounting fm Ya Lici ...'l..d\ertising

(a service company). Accounts 101 - 199 indicate asset accounts : :200-299 indicate liabili ties : 301 -3 50 indic a te m,·ner·s equit y accounts: -1-00---+99. rc\enue s : 60 1-799 . e xpensL':':

R00-899. other re ve nues: and 900-999. o the r e xpenses. Illustration 2 . 18 sh o\\ s Yaz ic i ·s c h art nf

account s . Acco unts listed in red are used in thi s chapter: accounts sho\\·n in black are

explained in late r chapters.

ILLUSTRATION 2.18

Yazici Advertising

Chart of accounts

Chart of Accounts

Assets

10 I C ash

112 Acco unt s Recei vable

126 S uppli es

1.\ 0 Prepaid In surance

157 Eq uipment

I SX Accumulated Depreciation- Equipment

Liabilities

200 No tes Payab le

20 I Acco unts Payable

209 U nearned Se r v ice Revenue

212 Salaries and Wages Payable

230 Int erest Payabl e

Owner's Equity

.'1 0 l 0 \\·ner ·s Capi tal

_1 ()6 (),, n er·~ Dr : m i ng ~

350 lnn)mc S ummar v

Revenues

Expenses

6.\ I S upplies Expe nse

7 1 I Depreciat iun Ex penSL'

7 22 In s urance Expe nse

726 Sa lari es and Wages

Ex pe nse

729 Rent Expense

732 U til iti es Ex pe n se

l)()) Intere st E x pen sc

You will notic e that th e re are gaps in the numbe ring sys te m or th e chart or account s fur

Yaz ic i. Companies leave ga ps to pe rmit th e in serti o n of new accounts as need e d during the

life or th e husin ess.

The Recording Process Illustrated

Illustrations 2.19 throu g h 2 .2X s lww the bas ic step s in th e recording pmce ss. u s in~ the

Ouuber transaction s or Ya l. ici Adverti s ing. Ya;ici ' s aL'Cllllnting periud is a 111\lnth . In ~hL'SL'

illustration s. a ba s ic analysis. an equation analysis. and a d e bit -cre dit anal ys is precc d L· th e

juurnal e ntry and postin g or e ach trans ac tiun. Fo r s implicit y. we USL' till' T -aCU)LIIlt rnrm tu

s illl W th e pnstin g ill StL'a d or th e Standard aCCOUil( fnrlll .

Study these tran sac tion anal ysL's L·arL· full y. Tht:> purpost:' of lnmsaction analysis is tit·st

to idt•ntif~ tht' t~pt' of account imoht:'d. and tht:'n to dett•rmint:' wlwtht••· to makt:' a dt•hit

Po st i n ""

2 - 13

-1. 4

C H f,

~

T - t"' /

or <I cn: dit to th c a cc ount. Y<lll o., lll >t d d ; ll \\ ; 1~' p~..·rfl>rll l till '- I ~ J k'l >f ; tll.d ~''' hd<>IL' prc p ar in ~

; 1 j, , u r 11 ; !I c 11 t r ) . I ) , , i 11 ,!..! .., 1 , v. 1II 11 c Ip : 1 , ll 111 H k 1 .., t; 111 d t 11 ~..· 1• , 11 r 11 ; d ~..- 11 t r 1~..· " d 1"~..· 11 ""nl 111 t 11 1" ~..· II ; 1pI cr

;, .., \ '-e ll <t "> !llo r c Cllfllplc x )"Ur11 ;d c rlt fl c' 111 l;~t c r L·ll ;!ptu·,

-

'"LT

In vc ..,t.rn c nt of ·;;s"> h h y o Y'. n t: r

Tra n sact io n

(rr. h f/r.)!J on()/;·.r· ·. ·,h (; •;; rhr ·

Jrn r.~ rF. I r.~f ':(Jrh lrnn ~ ur_I J r~ n fJII

r_rr.h.

Basic

A nal ys is

On O c to be r I . C. R. By rd trwc s t s t I 0. 000 c:~ s h

company c:~ ll c d Y:~ z ,cr Ad vc r rsmg .

Li a bili t ies

+

Equation

A nalysis

Cas h Flows

+t l 0.000

+ t l 0.000

D e b its in c rease assets : d e bi t Cash t I 0,000.

Cre di ts in crease o wn e r 's e quity: c re di t Own e r's

Capi ta l t I 0,000.

D e bi t- Cre di t

A na lys is

lfi:'\T

F ollow thc">e record i n~ ">teps :

I. Dctcrrnine \~hat t_~- pe of

<:~<.:count

i"> in\ohed.

\~ h<:~t item-,

Oct. I

Jou r nal

Entry

Cas h

O wne r-'s Ca pit;J I

(Own e r's inves tm ent of

cas h in busin ess )

in<.:re<:l">ed or delTe<:l">ed

<:~nd hy hoY\ much .

3. Tr<:~n "> l<:~te the increa '-> e'>

<:~nd

Own e r 's Equity

Own er's

CJ p•t ~

- I fJ fJII>

2 . Determine

decre<:t'>c"> i nto deh i h

credit'> .

:~ n :~d v c nr smg

1n

The asset Cash increases i:,l 0,000: owner's equity

(specifically, Owner's Capital) increases t, I 0.000.

A sse t s

lfF LP~T L

I.

~

ILLUSTRATION 2.19

<:~nd

lfl'lpftr l H i nt

Cas h

Posting

Oct. I

10.000

I

101

1 10.000

I 0.000

Own er's Capital

301

I

10,000

/Oct. I

!ILLUSTRATION 2.20

P urcha s e of office e quipment

On October I, Yazici purch as e s o ffic e e quipment co sting

t, S,OOO by signing a 3-month, 12%. t S.OOO note payable.

Transaction

The asset Equipment increases tS ,OOO;

the liability Notes Payable increases tS ,OOO.

Bas ic

Analysis

Equipm ent

Liabilities

Notes

Payabl e

+t- 5.000

+t-5 .000

Assets

C as h Flows

no eft"ed

Equation

Analysis

Debit-Credit

Analysis

+

Owner's Equity

J

Debits increase assets: debit Equipment tS,OOO.

Credits increase liabilities: credit Notes Payable 1/5,000.

[

journal

Entry

O ct

Equipme nt

Notes Paya bl e

(I ss ued 3-month. I 2% note

fo r offi ce equipm ent)

Equipment

Posting

Oct. I

-

---

157

5,0001

- - ---- -- --

--

-

157

200

5.000

5.000

Notes Payable

200

I Oct. I

5,000

The Led ""er an

Post in :::-

ILLUSTRATION 2.21

On October 2. Yazici ,-eceives a 'b l.200 cash advance from

R. Kno x. a client. for advenising se1·vices that are expected

to be completed by December 3 I .

Transaction

R e c eipt of ca s h for futu re

service

\ lany liabilitit'S ha n'

the word "payable" in

their titl e . But. n o t e that

l 'nearne d Scn·ict' R e vcnut'

i~ consid er e d a liability

even though tht' word

pay able i~ not u~ed.

The asset Cash increases 'b l ,200; the liability Unearned Service

Revenue increases 'b l .200 because the service has not been

performed yet. That is, when Yazici receives an advance

payment, it should record an unearned revenue (a liability) in

order to recognize the obligation that exists.

Basic

Analysis

=

C as h

Liabilities

Unearn e d Se rv ice

Reve nu e

+1:, 1.200

+1:, 1.200

Assets

Equation

Analysis

Owner's Equity

+

Debits increase assets: debit Cash t l ,200.

Credits increase liabilities: credit Unearned Service Reven ue t-1.200.

Debit-Credit

Analysis

J

Cash Flo w s

- I .:: t)(l

[

Journal

Entry

Oct. 2

C ash

Unearned Service Rev e nue

(Received cash from

R. Kno x for future servic es)

101

Cash

Posting

Oct. I

2

10.000

1,200

I

I0 I

209

1.200

I .200

Unearned Service Revenue

I

Oct. 2

209

1,200

ILLUSTRATION 2.22

On October 3, Yazici pays office rent for October in

cash, t900.

Transaction

Payment of monthly rent

The expense account Re nt Expense increas es 1;,900 because

the payment pertains on ly to the current month ; t he asset

Cash dec reases {:,900.

Basic

Analysis

=

"---·------

Liabilities

Cash

Owner's Equity

Rent

Ex pense

-t900

-t- 900

Assets

Equation

Analysis

+

Cash Flows

_ l ) ( )l )

Debits increase expenses: debit Rent Expense {:,900.

Credits decrease assets: credit Cash {:,900.

Debit-Credit

Analysis

[

Journal

Entry

Oct 3

Rent Expense

Cash

(Paid cash for O ctober office rent)

Cash

Posting

Oct. I

2

I 0,000

1,200

IOct. 3

900

I0 I

Rent Expense

101

900

729

Oct. 3

729

2 - 15

2-16

CH I F'T E P 2

Payme n t for

T h<2 , e:co rdi ngP ro cc::, ',

in '> ur <.~ n ce

Tra n sa ct ion

Bas ic

Analys is

On October· 4. ( ,1 / ICI p.1y~ t600 fo r :t 0 11 ·-yc.1r r11sur .111cc

p o lrc y h:-t

n il C: / pu·c: nc:x yc.1r· 0 11 Scp crnbc:r 30

The asse Prepard Insurance rncreases !,600 because the

paymem extends co more than the current month: the asset

Cash decreases 1;,600. Payments of expenses that will benefrt

more chan one accouncmg period are prepard expenses or

p re payments. When a company makes a payment. it debits

a n a.sset account in o r der to show the service o r benefit cha t

will b e r eceived in the future.

A ssets

Cas h Flo ws

Debit-Credit

Analysis

Pu rchase of supplies on credit

Transaction

Bas ic

Analysis

Debits increase assets: debit Prepaid Insurance t 600.

Credits decrease assets: credit Cash t 600.

On October 5, Yazici purch ases an es tim ated 3-month suppl y

o f advertis ing materials on acco unt fr om Aero Sup pl y for 1/2.500.

The asset Supplies increases t,2,500; the liability

Accounts Paya ble inc reas es 'b2,500.

Debit-Credit

An alysis

journal

Entry

Li a bilities

Suppli es

+t-2.500

+t-2.500

+

Own er's Equity

Debits increase assets: debit Supplies t,2,500.

C r edits increase liabilities: credit Accounts Payable t,2,500.

Oct. S

Supp li es

Accounts Paya bl e

(Purchased supp li es on

acco unt from Aer·o Supply)

Supplies

Posti ng

=

Accounts

Payab le

Equation

Analysis

n o cl"l"ect

O wn e r 's Equity

+

• t6 00

Assets

Cash Flows

Lia b ili ti es

l n:. u r ~ncc

- t600

_ (,/j()

=

P rcp~rrl

Equation

Analysis

O ct. 5

126

126

201

2.SOO

2.SOO

Accounts Payable

I

Oct. 5

2.5001

----

201

2,500

The Led""er

nd Post ir ""

ILLUSTRATION 2.25

Event

O n O ctobe r 9. Yaz ici hires four em pl oyees t o begin work on

O cto ber IS . Eac h em pl oyee is to rece ive a week ly sa lary of t. SOO

fo r a 5-day work week. paya bl e every 2 weeks- fir st payment

made o n Octo ber 26.

Hiring of e m p l oyt· e~

Cash Flo ws

!Hl l'fTL' l ' t

Basic

Analysis

A business transaction has not occurred. There is on ly an

agreement between the employer and the employees to ente r

into a business t ra nsaction beginning on Octobe r IS. T hus, a

debit-credit analysis is not needed because there is no acco unting

entry (see October 26 t ra nsaction fo r fir-st entry).

ILLUSTRATION 2.26

Transaction

Basic

Analysis

On O ctober 20 . C. R. Byrd w ithd raws '\:, 500 cash for

pe rso nal use.

The owner's equity account Owner's D rawings increases

t. SOO; the asset Cash decreases t.SOO.

Ass e ts

Equation

Analysis

Debit-Cred it

An alysis

Journal

Entry

Posting

\Y it h drawa l of cash by owner

=

Liabilities

+

Owner's Equity

Cas h

Owne r·'s

Dr·awings

-t 5oo

- MOO

Cash Flo ws

- ~ llll

Debits inc rease d raw ings: debit Owne r's D raw ings t.SOO.

C redits decrease assets: cre dit C ash t SOO.

Oc t. 20

Oct. I

2

Owne r's Dr·awings

Cas h

(Withdrew cas h fo r

persona l use)

Cash

101

10.000 Oct. 3

1,200

4

20

900

600

500

306

101

500

O wner's Drawings

Oct. 20

5001

500

306

2-1 7

z- 1 8

CHhPTE P 2

Th e Reco r dingProc e: s s

ILLUSTRATION 2.27

Pay m e n t of -;a lari c s

Tra n sactio n

Basic

Ana lysis

On Octob e r 26. Yazrcr owes employee sala n cs o f t4.000

and pays th em m cash (sec October 9 event)

T he ex pense account Salaries and Wages Expense increases

t 4,000; the asset Cash decreases t 4,000.

=

A ss e t s

Cas h Flows

Equation

Analysis

Li a b ili ti es

+

Ca sh

O wn e r' s Equity

S.11:Jnes .1nd w,ges

Expen se

t 4.000

- t4.000

- -1 (j( )l )

D eb it- Cre d it

Ana lys is

Journal

Entry

Posting

J

D ebits increase expenses: debit Salaries and

W ages Expense t, 4,000.

C redi ts decrease assets : credit Cash t, 4,000.

__O_c_t___2_6-,-S-a-la-r·-rc_s_a_n_d_W

__a_g_c_s_E_x_p_c _ns_c________r 7_2_6-,-4-.0- 0-0-,----Ca sh

(Pard sala n cs w d.1tc)

Oct. I

2

Cas h

I 0,000 Oct. 3

1,200

4

20

26

101

900

600

500

4,000

I0I

4.000

Sa laries and

W ages Expense

726

Oct. 26

I

,ILLUSTRATION 2.28

Re ceipt of cash

.

· f'or serv ices

performed

·

Transaction

Basic

Analysis

On October 3 I, Yazi ci receives t I 0,000 in cash from Cop a

Company for advertising services periormed in October·.

The asset Cash increases tl 0,000; the revenue account

Service Revenue increases t I 0,000.

Cash Flows

+ !()_()( )()

D e bit-Credit

Analysis

Jou r nal

Entry

=

Liabilities

Cash

+'bl 0,000

+t iO,OOO

Debits increase assets: debit Cash tl 0,000.

Credits increase revenues: credit Service Revenue tl 0,000.

Oct. 31

Cash

Se rvi ce Revenue

(Received cash for

services per·formed)

Cash

Posting

+

Owner's Equ ity

Service

Revenue

Assets

Equation

Analysis

Oct. I

2

31

10,000 Oct. 3

1,200

4

10,000

20

26

101

900

600

500

4,000

101

400

10,000

10,000

Service Revenue

I

Ooc 31

400

10,000

The Led ~ er nd P

Summary Illustration of Journalizing and Posting

Illustration 2 .29 sho ws the journal for Ya z ic i .-\(he n isi ng fnr OL· tobcr.

GENERALJOURNAL

Date

2020

Oct.

Account Titles and Explanation

Cash

Owner's Capita l

(Owner's investment of cash in business)

Equi pment

Notes Payabl e

(Issued 3-month. 12'7c note fo r o f'li ce

equipment )

2

3

4

5

20

26

31

PAGEJl

Ref.

Debit

10 1

30 1

10.000

!57

5.000

C r edit

10.000

5.000

200

Cash

Unearned Service ReYenu e

(Rece ived cash from R. Knox fo r

future services)

10 1

209

1.200

Rent Expense

Cash

(Paid cas h fo r October offi ce rent )

729

101

900

Prepaid In surance

Cash

(Paid o ne-year poli cy: e ffecti ve dale

Oct obe r I)

130

10 1

600

Supp lies

Accounts Payabl e

(Purchased suppli es on account fro m

Aero Supp ly)

126

201

2.500

Owner's Drawings

Cash

(Withdrew cash fo r persona l use)

306

\01

500

Salaries and Wages Expense

Cash

(Paid salaries to elate)

726

101

4,000

Cash

Service Reve nue

(Received cash for servi ces perfo rmed )

101

400

10,000

1.200

900

600

2.500

500

4.000

10.000

ILLUSTRATION 2.29

G enera l journa l

entri e ~

in~

2 -19

2-20

r:. H f.

PTE P 2

T h e Reco r di n g Procr,:;s

Illu'>tration 2 . 30 '> h() \\'-. th e ledger.\\ rlh ;til h;d.trl<.. c '

f

r

111

rnl

·~~.

ILLUSTRATION 2.30

( ~ e nera l ledge r

GENERAL LEDGER

.'\lo. J 0 1

Ex planation

D ate

I l<cf.

D e hit

Cn.:d ir

B ~1bnn:

<)( )()

I IJ.OIJIJ

I I .21HJ

I I J.1 1JO

lJ.71J()

l) 200

:\o. 20 1

D ale

~xpla n;al ~~-lll

2020

2()2()

JI

JI

JI

JI

JJ

JJ

JJ

I

2

() ct.

l

4

20

26

11

I 0.000

I ,200

(,()()

5 ()()

Expl a nation

D ate

/ Ref.

I

2020

O ct. 5

D ate

0

5 , 2 ()()

4. 1J(J()

D e hit

Credit

D ate

B a lance

202 0

O c t. I

D ate

Ba lance

2020

O ct. 20

Deb it

.I I

Credit

Explanat io n

Ref.

2020

Oct. J

J1

D eb it

C re d it

Ba la nce

2020

O c t. 1 1

5 000

Notes Paya b le

Exp la na tio n

R e f.

Deb it

Cred it

1

J1

Da te

Ba lance

2020

O c t. 26

5,000

1: x planation

J:x p la na tion

B:danL·t:

I 0.0( HJ

I 0.000

:\o. 306

Cred it

D c h il

Rc f.

E x p lan a t io n

De hit

.J I

N o . .tOO

C re d it

Ba l:llll'L'

I O.CHHJ

I 0.000

C re di t

D e b it

J1

N o. 726

B: da nn :

.t,()()()

4. 000

Re f.

B:!LlllL't:

:'00

) ()()

JJ

Ex p la nat io n

No. 729

C red it

<JOO

Ba lan ce

')()()

ACTION PLAN

2.2XO

2.2XO

Se r v ice Reve n ue

Sa la r ic, and Wages Ex pe nse

-100

Cas h

4 00

U til itie, Ex pe nse

<,12

Cas h

Pos t these e nt r ies to th e Cas h accou nt of the oe ne ra l led ge r to de te rm ine it s e ndin g ba la nce. T he

beg inni ng ba la nce o f' Cas h o n M a rc h I was ¥600.

Solution

C as h

l < v l ;~i< · d

Credi t

Re nt Ex p e n se

I Cas h

.V I H a l.

D eb it

l ~c f.

E x p la na! io n

J uli e Loeng recorde d the fo ll ow ino transacti

. in a ge ne ra l j o urna l d u r ing til e mo nth o f March

(a mo un ts an hund re d s) .

'"'

o ns

I

:\'o. JOI

l khit

.J I

DO IT! 3 I Posting

IY

Rd .

Ret'.

2020

0 ct. 3

I

I .200

0

JJ

5,()0()

Da te

I :1

J 200

Sa laries and W a ges E xp ense

No. 200

2020

lbl:lllL"l:

S e1· vi<.:e R eve nu e

D a le

5,000

( ·n:drt

O w n e r·'s D r a w in gs

J 57

0.

Jkhal

.J J

()00

600

l<cl.

:\0. 209

O w n e r 's Cu pit a l

No. I 2fi

E q u ipm e nt

Oct.

2

o. I30

Re f.

1-..xp lanati'"'

2.:'00

20 20

O ct.

P r e p a id Ins ura n c e

2020

Oct. 4

D ate

D 41 1C

2,500

.I 1

2 .."00

JJ

l .n ea rn ed S e n ic c I< c ' ·n uc

2.500

Explanat io n

Date

S

O ct.

15,200

1() .000

Sup p lies

\11 a r. -i

B.d.llk"t:

6 ()()

V-+

2.2XO

V\ I Ha l.

2 ..1XX

l it 5

l/ l l)

,.".,., ' "' lll; ll c' ' ' "l BF2 .7. BF2.X. DO IT! 2.J . F 2 . 11 , and F2.1-l.

400

92

• Reca ll th a t po.-;ti ng

invol ves t nmsfe JTing t h e

jounu lli zed deh it s a n d

I.Ted its to specific acco unt s

in t h e ledge•··

o

J>etenn ine the e ndin g

h a lance hy nl'lt in g t h e to ta l

dehits and cred its.

The Tri .I Ba lan ce

The Trial Balance

LEARNING OBJECTIVE 4

Prepare a trial balance.

ANALYZE

JOURNALIZE

Prepare a

trial balance

POS

ADJUSTING

ADJUSTED

TRIAL

ENTRIES

BALANCE

FINANCIAL

CLOSI N G

POST- CLOS IN G

STATEMENTS

EN TRIES

TR IA L B A L AN CE

or

A trial balance is a li st

accounh a nd their balances at a giYcn time. Cl1 mpani cs usual ly

prepa re a trial balance at th e e nd of an accounting period. They li st accoums in the orde r in

w hi c h they appear in the ledger. Debi t bala nces appear in the left co lumn and credit ba bnct.'S

in th e right column . The totals of the two columns must equal.

T he tdal balance proves the mathematical equality of debits a nd credits after

posting. U nder the d ou bl e -e ntry sys te m. thi s eq ualit y occurs \Yhen th e s um of the de b it

account balances eq uals the sum of th e cre dit account balances. r\ trial balance may also

uncovet· enors in journalizing and posting. For c xampk. a tri a l ba lan ce may \\ell ha\c

detect ed th e e rror at F idelity Investments (USA) discussed in the Fea ture S tnry. In addition.

a tdal balance is useful in the prepat·ation of financial statements. as \\ e \\·ill ex plain in

the nex t two chapt e rs.

The steps for preparing a trial b a lance arc:

I. List th e account titles a nd th e ir balances in the appropriate debit or credit co lumn.

2. Tota l th e debi t and credit column s.

3. Ver ify the e qualit y of the two co lumn s.

Illustration 2.31 shows th e trial ba lan c e prepared from Yaz ic i Ad ve rtising' s ledge r. N ote

that th e total de bits eq ual th e total c re dit s.

ILLUSTRATION 2.31

Yazici Advertising

Trial Balance

October 31, 2020

A t.-ia l b a lan ce

Debit

C as h

Supp li es

Prepaid In suranc e

Eq u i pmcnt

No te .' Pa yable

Ac ullln ts Paya ble

U nea rn e d Se rv ice Reve nu e

Owner·s Ca pital

0\·Vnt.-r·s Dra w ing s

Sen il·L· Rt.'\ l' llliL'

Salari es ~ 111d Wagl' ' l ·: xpt.' il 'L'

Re nt Lxpl' nst.'

Credit

t l5 .2()()

2.50()

6()()

5. ()()()

t

5. ()()()

2.5()()

I . 200

I O.t HJO

5()()

I O.t H)( l

..L()()(l

l )( )( l

t 2S.700

t2 S.700

2-21

2-22

CH I PTE P 2

Th<::: Pccording Proce ss

1\ tri a l h a la n ce i.., a nece'>'>: tr) c hechpoint f(,r un eo1L·ri11 !,! L'L' ti; 1111 1 ~ Jll'' ., 1 L.,.,,., _ FPr

exa m p le . if o n ly th e d e b it p o rt io n o f :t jou rn :tl entr~ h:t '> lx·en po .., tcd. thL· tn;tl h:ti :111 L·l· 1\Pll !d

hrin c<> thi '> e rror to li )l ht .

Limitations of a Trial Balance

1\ tri a l h a la n c c doc'> no t g ua ra nt ee freedom frot n rcco rdin ~ e rro r .... JH, IInc r t-..cL· E thic-.. .'\ oil' I.

.'\ um c rou '> e r rors may ex i'> t e\·c n th ou g h the to t;tl " o l th e tri :tl h:ti:IIJ L'C u ,J 111 111 1, : t ~ rn·. FPr

exa mple . th e tri a l ba la nce m ay ba la nce ne n v\ he n :

E T H JCS '\;0TJ·:

:\n e r ro r i'> the r e '>u lt o f u n

un in te ntiomtl mi'>t u ke; it i'>

ne it h e r e th ica l n o r u n et hi ca l.

An irreg ul a rity i.'> a n in te n tiona l rni.'> state ment , wh ich i<>

viewed a <; un e thica l.

J. A tran '> ac ti on i'> no t j our na li / e d.

2. A co rre ct journ a l e n try is no t p m tc d.

3. A j o urn a l e ntry i'> p os te d tw ice.

4 . Inc orrec t accou n t.'> a rc U'> e d in journ a li/in g o r p m tin g .

5. Olfsc tti ng e r ro r.'> a rc m ad e in re co rd in g th e ~tm o unt of ~ ~ tr~tn '> : t ct i o n .

A s lon g a .'> e y ua l d cb ih a nd c rc di h a rc p o :-, tc d . c\·c n to th e \\' ron ~ :tCL't lllllt o r in til e \\ n>n ~

a moun t. th e tota l d c bi ts will c yu a lth c to ta l c re dit '> . The trial balance docs not pmvc that thl'

comp:wy has recorded all transactions or that the ledger is correct.

Locating Errors

E r rors in a tr ia l b a la n ce gene ra ll y res ult from m a th c m a ti c :.tl mi :-, t<tKC '>. incorrcl'l pn,till ~" ·

o r s im pl y tra n s c ribin g d<tt a in co r rec tl y . W h <t t d o yo u do if yo u ~Ire f<t cc d \\·ith ~ ~ tri:tl bal a n ce th a t d oc .'> n o t b a la n ce? F ir:-, !. d e te rmine th e a mount o f the differen ce be tw een thL' tl\·o

co lum ns o f th e tri a l b a la nc e. A ft e r thi s amount i:-, kno w n . th e follmv in g :-, tep ~ :trc often

h e lpful:

1. If th e e rror is € I. € I 0. € I 00. o r € 1.000. rc -a dd th e trial bal a nc e column s a nd rec onJplltL'

th e a ccount b a la nc es .

2. If th e e rror is di v is ible by 2. s c a n the trial balanc e to sec w he ther a balance equal to h:tll'

th e e rror ha s he en e nt e re d in th e w ron g column.

3. If the erro r is di v is ible hy CJ . re trace th e ac c ount ba lances on th e trial ba lan c e to se c w hether

th e y a rc in c orre ctl y co pi e d fro m th e led g er. F or e xa mple . if a balan ce wa .~ € 12 a nd Jt

was li ste d as €2 1, a €9 error ha s bee n m a d e. Re ve rsin g the order o f numbers is c all e d a

transposition error.

4

· If the e rro r is no t di v is ibl e by 2 o r 9, sc a n th e le d ge r to see w h e ther an a cco unt balan ce in

th e a m o unt o f th e e rror h a s bee n o mitte d from th e tri a l bal a nce . and sc an th e journal to

se e Whe th er a po stin g o f th a t a m o unt ha s bee n omitt e d .

Currency Signs and Underlining

Note tha t CLt1·1·e nc y Sla

· ns d

.

· .

.·

. 11 Y

·

.

"" · 0 no t dp pca r tn Journ a l.., or lcd ue r.~ . C urren cy st g n .~ a re ty pt c; t

use d

1

.

o n y In th e tr w ! ha l· · . .

.

_.

onl y l'o r th . f . . .

. a nce ctnd th e hn a nc ta l :-, ta te m e nt s. Gc nc r;tll y. a c urre ncy s 1g n ,.., , hP 11 11

c li st tte m In th e co lu

.

. I .

t·tl in u rul e) is 1• • , 1

mn a nd lor th e to tal of th a t c olumn . A s tn g e ltnc (<I to '

P dC<..:<. unde r th e co l

· .

..

dou h le -und e rlin ' It . _,...

umn o l hg ur<..: s to he a J J c d or s ubtra c te d. Tot a l a mounts ; IlL

e<. o tllui Cdtc th e y a re 1.1 . .

n<~ 1 s um s.

L

L

•

.

.

.

The Tri a l 6alance

Investor Insight

2-23

Hypo Real Estate Holding

dt,me:-;tiL· produL·t. Si nL·e the hank lud bee n 11 ' \ it>u~l ~ t:tk ·n ' " "-' r y

the Germ an f"' ·e rnm ·nt. the ' ITUr had n> ult ·d in an ''' · ):tate. 1 ·nt

ur the ll.'de ral debt ,, r € :'1:'1.5 bill inn .

Why Accuracy Matters

Recently. the German Fin anL·e

mini ster. \\"n lt'fa n~ SL'Ilauhle.

sa id that ··qa ti sticll :1nd cu mmu nicati n n prob lem s" ,,·e re to hl:tmL'

for a €55.5 hilli,,n e rro r in the

accnun ts o f n:lt iun:ll i7ed pmperty lender Hypo Real E state

Holding (DELi ). 1\lr. Sc hauble

referred to th e e rrnr :1s "an annn yi n ~ mi stake ... This see ms t''

he a considerable understatL·ment

cnnsiderin~ that the error reprL' sented 2.6"; of the G erman ~wss

In order for thi ~ company to prepare and i~Ul' fi nanci a l

statements. its accounting eq u ation t debi ts a n d cre dit_.; ) mus t

han· been in balanl·e at year-e n d . How nmld this e rror h~n t'

occurred '? lGo to th e book ' s companion \\Tbsite for thb a nS\HT

and additional questions. )

O jJ1a Jl)l)<JiiSI<KJ,.phnlll

DO IT! 4 I Trial Balance

A C TIO:\ PL.-\:\

The foll ow ing accounts come from the ledger of Bali Beach S uppl y at December 31. 2020 .

157

306

201

726

11 2

400

Equipm e nt

Owner's Drawings

Acco unt s Payab le

Salaries and Wages

Expe nse

Accounts Rece ivabl e

Service Reve nue

R $8~. 000

301

8.000

22 .000

2 12

200

-1-2 .000

-1-.000

95.000

732

130

101

Q,,·ne r· s C apital

Sal:!ri es and \Vages

Payable

Nutes Payable (due in 3 months )

Utilities Expe nse

Prepaid In surance

Cas h

RS20.000

2.000

19 .000

3.000

6.000

7.000

Prepare a trial balance in good form.

Bali Beach Supply

Trial Balance

December 31, 2020

Debit

R$

Credit

7.000

-1-0 ()()()

6.000

8~ .000

R$ ll). 000

22.()()()

2.0()()

:2( ).()( )()

~. ()()()

L) ')_( )( )( )

_\. ()()()

-1-.2.()()()

Ri. l )~_ ()()()

l<c· i<II L'd ,. ,,· rci'l' llLII c'I Lii ·

Determine normal

balances and list al·c o u nts

in the order tlw~ appt•a r in

the lt•dger.

• Accounts with debit

balances appear in t h e left

column. and those with

lTedit bal a nces in the righ t

column.

• Total the debit and credi t

columns to prow equalit y.

Solution

C as h

Accounts Rece ivabl e

Prepaid Insurance

Equipment

Notes Paya ble

Account s Payab le

Salarie s and Wages Payable

Owner· ., C apital

0\\ nc r' s Drawin gs

Sen icc Revenu e

Utiliti es Ex pen se

SalariL'" and Wage" Fxpcnse

o

l{ i. l )~.( )()()

BE2 .9. BE2.10. DO IT! 2A. 1-:2.11. L2 . 12. L2.1J. I-:2.15. and L2. 1h.

2-24

CHAPTER 2

TheR eco rdin gP rocess

Rev iew and Practice

Learnin g Obj ect ives Review

"r I< J<.:alc '> crr!IJ<, hcL·arr .., c ril e dehrl :111d unl 11 ;rrll<Hlllh '"' c.r,·h

1

Describe h o w accoun ts , d ebi t s, and cr edits a r e u se d to

r ecord bus i ness tra n sac ti o ns.

c nlr ) c;r n he c;r'-> rl _\ l"" lllpared

3

Ex p la in h o w a led ge r a n d po st i n g h el p in th e r ecord in g

p r o cess .

An account j .., a n ;cord of in c rea<.,c <. and dccrca '-> C'-> in '-> pcc ili c a'->'-><.: 1.

liahi li ty. and o w ner·., eyuity itcm '-> . T he te rm '-> dchit <J nd credit arc

..,y nonymou'-> w ith left and ri ght. A<.'->Ct'-> . draw in g'-> . a nd cx pcmc'-> arc

increa.-.e d by dchit'> and decrca '->cd hy crcdih. l .iah ili tic '-> . ownc r ·.., ca p -

Th e led ger i '-> rh e c nrire ):! roup uf :rccorJJII.., rll ;JJ JJ(; rinc d h: ;r L'<llllp;II J\ .

ital. and re venue<. arc incrca'>c d h y crcd i h and dccrc<J '>t.:d hy dch i h.

Th e ledge r pnl\ id e.., I he h;rlan cc 111 eac h of I he ;rcL-Illllll .., ;r.., \\L'II :1'

kecp .., tr;rck uf c h; u1 ge.., i n rh e..,e h;rl ;uJ ce.., . fJ,J .., Iin g i.., lh L· rr:r rhkr <lf

juurna l c nlri e'-> I<J lh e led ge r ;r cu Jtllll ..,_ T IJi .., ph :l'e of rile rL'L'llrt illl !,!

2

Indicate how a journa l i s used in the recording proces s.

pwc c.., .., ;rcc umul ;rle '-> lh e clkch o l jor rrrJ :r l i;nl lr:ll r.., :rl·lrllrh 111 ih l'

indi , ·idu ;rl acc< Hlll h .

The ha<.ic <.tep'-> i n the recording procc ..,.., are (a) ana ly zc c<Jc h tram a<.:tion for it'> cffe<.:t'> on the accounl\. (h) en ter the tran <., act i o n info r -

4

mation in a journal. and (c) tran <., l(;r the journa l informa ti on to the

appro priate acc o unt <. in the l edgcr.

The initial accounting record of a t r an<.,act ion i .'-> cn tc r ed in

a journa l hei( Jrc thc data arc ent ered in t hc acco unt \ . ;\ journal

Ia) di..,clo..,e<.

in <>ne pl"<.:e

th c· comp Jetc c 1·1·cch o f· a tran '> actron.

·

·

·

u

(h) prov ide<., a chronological record

of trama<.:t ion <.,, and (c) prcvc nt <.

Prepare a trial balance.

;\ rri ;rl h;rl;rn cc i .., ;r Ji .., t o f ;rccou nl '-> ;rml th eir h;rLuJc e.., ;rt

;r

!:' " L' ll liiii L'.

if'> prim ;rr y p u rp<l\C i .., Ill pr<l \ ·e rh c equ ;rlir y of dehi h :urd LTL'drt' :rl'rl-r

po .., tin g. ;\ trial h;rlance a l \ tl un cm·er.., erro r " illj<lllrll :rlr ;i rl !:' :r11d

Jl""'-

in g and i \ U\ c ful in prcp;rrin g lin an c i ;rl .., l ;rl e rll c' rll ..,_

Glossa ry Review

Account A renw' 0 1.. . .

.

..

or

.

. u

rncrea'>e'> and decrca..,e.'> rn '->pcc rlr c a.'->'>e l. liahilir y.

o.w ner .., Clj ur ty i tem<,_ ( p. 2-2)

Chart of acc ount<; A I. .

.. . .

.

tify their

.. .

.

rst ot acco unt.<. and th e acco unl numher <., I hal rdcn 1

,

ocatJon rn the ledge r. ( p. 2-l.lr

Compound entr y A journa l erlt · h .