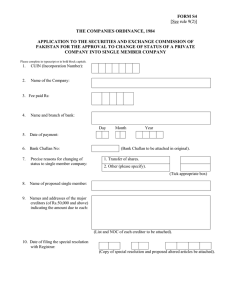

TASK 1.1 Theory: Basic concepts relating to Companies CONCEPT 1. Shareholders. 2. Directors. 3. Independent auditor. 4. Directors’ fees. 5. Audit fees. 6. Shares. 7. Dividends. 8. Companies Act No. 71 of 2008. 9. Limited liability. Separation of ownership from 10. control of a company. 11. Memorandum of Incorporation. Companies and Intellectual 12. Property Commission. TASK 1.2 DESCRIPTION G D A K B J C L E F H I Theory: Concepts relating to companies 1.2.1 What is meant by the concept of ‘limited liability’ and ‘separate legal identity’ in connection with companies? Limited liability: The owners of the company (shareholders) are not liable for debts of the company beyond the amount invested by them in the form of capital. Separate legal identity: A company has a legal personality of its own – in the eyes of the law it is regarded as a person – this concept results in limited liability for owners (i.e. one person cannot be held liable for the debts of another). 1.2.2 Why could the concept of limited liability not be allowed in the cases of businesses operating as doctors, lawyers or accountants? These people perform professional services – they cannot be protected by the concept of limited liability as their decisions have far-reaching consequences (due care is necessary). 1.2.3 Why are big companies important to a country? They provide employment, they assist with regard to foreign exchange, they address the needs and wants of the country, and they pay large amounts of tax. CSR & CSI. GDP. 1.2.4 How does the concept of limited liability assist big companies to exist in a country? If this concept did not exist, shareholders would not want to invest in companies over which they have no direct control. RISK FACTOR TOO BIG = SUFFER BIG LOSSES if not limited liability The companies would not exist. 1.2.5 Why it is important for companies to contain the word ‘LIMITED’ in their names. So that people dealing with them are forewarned that they can claim payment of debts only from the company itself, not its owners. Trust the businesses potential to succeed: meet requirements to be registered as a LTD. 1.2.6 Why does a company pay Income tax, yet a sole proprietor or partnership does not? A. A company is a LEGAL person. Company pays Income Tax. Rate is 28% Company exists separate from its owners. B. Sole Traders & Partners get taxed on the profits they receive in their own private capacity. Not all persons in a country pay tax. only if you earn enough. See SARS website. 1.2.7 What role does a director of a company fulfil, and what is meant by the ‘separation of ownership from control’ in respect of a company? He acts as the arms, ears, eyes and legs of the company. He performs tasks on behalf of the company. Separation of ownership from control: The shareholders own the company, the directors control it. 1.2.8 In your opinion, what personal characteristics should a director of a company possess? Explain why each of these characteristics is important. Honesty, integrity, intelligence, expertise. Ethical. Adhere to corporate governance. They perform a fiduciary or stewardship duty, i.e. they are entrusted with the use of assets owned by others. 1.2.9 What are the advantages of a company over a partnership? 1. Limited liability, 2. large amounts of capital, 3. maybe the tax rate is favourable (28%) in comparison to tax the partners would pay individually. 4. Continuity, 5. suited for growth 1.2.10 What are the advantages of a partnership over a company? 1. Direct personal control by the owners, 2. direct relationship with customers, 3. maybe partners would pay less tax personally than a company would (depends on profit level). 4. Easy to form. 1.2.11 Why is it important for all companies to be registered with the Companies and Intellectual Properties Commission? Members of the public will be investing in the companies. An organisation like CIPRO should exist to control and monitor companies and the people running them because people running the companies could abuse the privilege of limited liability. Numerous investors could lose their money if companies are not well run. TASK 1.3 Theory: The MOI, the Prospectus and forming a company 1.3.1 Make a list of and briefly describe the important steps you will have to go through in forming this company. Use the following key words in your list: Promoters, Company name, Initial price of the share, Prospectus, Companies and Intellectual Properties Commission (CIPRO), Memorandum of Incorporation (MOI), Allotment of shares. Present your list to the rest of the class. Promoters decide to form a company. They compile the Memorandum of Incorporation. CIPRO issues Certificate of Incorporation. Initial shareholders provide capital. CIPRO issues registration number and Certificate of Incorporation. Prospectus published for the Initial Public Offering. Shares allotted to successful applicants. Share certificates issued (hard-copy or electronic format) 1.3.2 Make a list of the important items you would include in a Prospectus which will entice members of the public to buy shares in your company. Present your list to the rest of the class. Prospects for the future. Names of directors. Price of shares. Number of shares offered for sale. Share application forms. Names of auditors. 1.3.3 Make a list of the important items you would include in the MOI which will govern the company, bearing in mind that it is a hotel business. Present your list to the rest of the class. The name of the company. Its objectives, purpose and business activity. Details of contracts which existed prior to incorporation. The amount of authorised share capital and its division into shares, together with special conditions relating to specified classes of shares. Powers and rights of shareholders e.g. right to vote at AGM. Shares, share certificates and share transfers. Shareholders’ meetings and resolutions. The appointment, removal, duties and powers of directors. Borrowing powers. Accounting records and financial statements and audit thereof. Liquidation of the company. Note to Teacher: Be alert for public offerings of shares by companies. These will be advertised in the press and/or by way of brochures issued by the companies concerned. These should be used in the classroom to illustrate the procedures in the raising of capital by public companies. Teachers should encourage awareness in their learners of events in the business world. TASK 1.4 1.4.1 Theory: Shareholders and Auditors 1. Why is it important for a shareholder to attend the AGM of his company? 2. What questions should the shareholder raise at the AGM? 3. In your opinion, why do many shareholders not attend the AGM? https://www.quora.com/What-are-good-questions-shareholders-should-askmanagement-during-the-Annual-General-Meeting http://peterbotting.co.uk/the-agm-speech-15-questions-for-shareholders-to-ask/ 1. Shareholders own the company. They make the most important decisions. They appoint the directors to run the company for them. 2. They must raise incisive questions about how the company is run by the directors. 3.Many shareholders do not attend the AGMs for various reasons: Apathy, lack of interest, satisfaction with the performance of the directors, long distance to travel (especially if the meeting is in another city or country), maybe they have a small minority shareholding which is insignificant with few voting rights. Note to Teacher: Ensure that learners are aware that this sort of lack of interest creates a problem – the shareholders should serve as a check on the ethical conduct of the directors – a number of frauds have occurred because the shareholders did not exercise their voting rights). 1.4.2 Why is it important for the shareholders to appoint the directors and the auditor at the AGM? The directors fill a position of trust in controlling assets belonging to the company, the auditor is the ‘watchdog’ and also fills a position of trust for the shareholders. The auditors must not feel that they work for the directors. They have to be independent and responsible to the shareholders. 1.4.3 What is the difference in roles between an internal auditor and an external, independent auditor? Why can the final annual financial statements not be audited by the internal auditor? The INTERNAL auditor does on-going checks within the company. He is employed by the company, i.e. appointed by the directors. The EXTERNAL (INDEPENDENT) auditor expresses his opinion on the financial statements to the shareholders. Unqualified, Qualified & Disclaimer NB! See pg 266/267 He must not be influenced by employees of the company. The internal auditor might feel beholden to the directors. Hence his opinion might be regarded as unreliable. NO CONFLICT OF INTEREST ! 1.4.4 What qualifications does an external independent auditor require? Chartered Accountant, i.e. CA (SA). 1.4.5 Obtain a copy of an independent auditor’s report from a published set of financial statements or from the business reports in a newspaper. List the important points made in this report. Scope of the audit, test basis, express opinion on fair presentation – on the Income Statement, Balance Sheet and Cash Flow. TASK 1.5 ABC Ltd: Initial public offering (IPO) 1.5.1 How many shares will be allocated to you on 1 July 20.1? 30 000 x 400 000/480 000 = 25 000 shares 1.5.2 What amount will be refunded to you on 1 July 20.1? R60 000 – R50 000 = R10 000 DR BANK CR Ordinary Share Capital 1.5.3 What effect will the issue of shares have on the Accounting Equation of the company? A +800 000 O +800 000 CRJ DR BANK A + CR ORDINARY SHARE CAPITAL O + 1.5.4 What will you pay for your 12 000 new shares on 1 July 20.2? 12 000 shares x R2.80 = R33 600 1.5.5 What effect will the second issue of shares have on the Accounting Equation of the company? A +280 000 O +280 000[500 000–400 000] 100 000 shares x R2.80 per share = R280 000 1.5.6 What is your % shareholding in the company on 2 July 20.2? 25 000 + 12 000 = 37 000 shares this is 7.4% of the total shares of the company 1.5.7 On 31 August 20.2 you decide to sell all your shares through the Securities Exchange for 320 cents each. The commission to be paid to the stock broker is 4% of the selling price. How much will you receive for the sale of the shares, how much commission will you pay and how much profit will you make on the sale of your shares? Gross proceeds = 37 000 shares x R3.20=R118 400 Commission [R118 400 x 4/100] =(R4 736) Brokerage Net proceeds [R118 400 – R4 736] = R113 664 Cost of shares = R50 000 + R33 600 = (R83 600) Profit = R30 064 1.5.8 When you sell your shares on 31 August 20.2, how much will ABC Ltd receive? Explain your answer. ABC Ltd receives nothing–the exchange is between the new shareholder & the previous shareholder. 1.5.9 What will ABC Ltd be required to enter in their records on 31 August 20.2? Explain your answer. ABC Ltd will change the name in their share register–name of a new shareholder replaces the previous shareholder. TASK 1.6 XYZ Ltd: Buying shares through the JSE 1.6.1 What is the maximum number of shares you can buy in XYZ Ltd on the JSE? R40 000 ÷ R6.30 = 6 349.2 “round off down to get lots of 100” 6 300 shares can be bought. 1.6.2 How much will be spent on the shares? How much cash will be left over? You decide to place this amount in a savings account. Spent on shares = 6 300 shares x R6.30 = R39 690 Amount left over R40 000 – R39 690 = R310 1.6.3 Analyse your investment portfolio as follows: Investment Portfolio Value of shares in XYZ Ltd Amount in savings account Total portfolio 10 Jan 20.5 R39 690 R310 R40 000 1.6.4 You decide to check your portfolio on the 10th day of each month. On 10 February 20.5 the price of XYZ Ltd shares on the JSE is reflected at 590 cents. You decide to keep the shares despite the drop in value. Revalue your portfolio on 10 February 20.5 as follows: Investment Portfolio Value of shares in XYZ Ltd Amount in savings account Total portfolio 10 Jan 20.5 R39 690 R310 R40 000 10 Feb 20.5 R37 170 R310 R37 480 1.6.5 On 10 March 20.5 the price of XYZ Ltd shares on the JSE is reflected at 720 cents. Revalue your portfolio on 10 February 20.5 as follows: Investment Portfolio Value of shares in XYZ Ltd Amount in savings account Total portfolio 10 Jan 20.5 R39 690 R310 R40 000 10 Feb 20.5 R37 170 R310 R37 480 10 Mar 20.5 R45 360 R310 R45 670 1.6.6 What causes the price of shares to fluctuate on the JSE? If the price of the shares of XYZ Ltd drops in April, would you sell your shares? Explain. Demand for the shares determines the price. Decision to keep or sell depends on perception of prospects for the future. 1.6.7 On 10 April 20.5 the price of XYZ Ltd shares on the JSE is 740 cents. You decide to sell all your shares in the company. How much profit or loss have you made overall? Proceeds of shares: 6 300 shares x R7.40= R46 620 Cash on hand = R310 Total portfolio = R46 930 Original investment = R40 000 Profit = R6 930