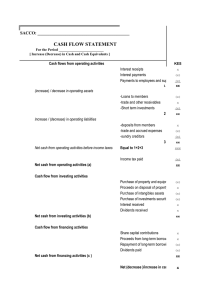

Statement of Cash Flows Ms. Rica Joy B. Estrada Usefulness of the Statement of Cash Flows Primary purpose is to provide information about cash receipts and cash disbursements. Helps investors, creditors, and others assess the following: 1. The entity’s ability to generate future cash flows. 2. The entity’s ability to pay dividends and meet obligations 3. The reason for the difference between net income and net cash provided (used) by operating activities. 4. The cash investing and financing transactions during the period. Classifications of Cash Flows Operating Activities Include the cash effects of transactions that create revenues and expenses. They thus enter the determination of net income. Investing Activities Include (a) acquiring and disposing of investments and property, plant, and equipment, and (b) lending money and collecting the loans. Financing Activities Include (a) obtaining cash from issuing debt and repaying the amounts borrowed, and (b) obtaining cash from shareholders, repurchasing shares, and paying dividends. Operating Activities Income Statement Items Cash inflows: From Sale of Goods or Services From Interest Received and Dividends Received Cash outflows: To Supplies for Inventory. To Employees for Wages. To Government for Taxes. To Lenders for Interest. To Others for Expenses. Investing Activities Changes in Investments and Non-Current Assets Cash inflows: From Sale of Property, Plant, and Equipment. From Sale of Investments in Debt or Equity Securities of Other Entities. From Collections of Principal on Loans to Other Entities. Cash outflow: To Purchase Property, Plant, and Equipment. To Purchase investments in Debt or Equity Securities of Other Entities. To make loans to other entities. Financing Activities Changes in Non-Current Liabilities and Equity Cash inflows: From Sale of Ordinary Shares. From Issuance of Long-term Debt (Bonds and Notes) Cash outflow: To Shareholders as Dividends. To Redeem Long-term Debt or Reacquire Ordinary Shares (Treasury Shares). COMPANY NAME Statement of Cash Flows For the Year Ended December 31, 20xx Cash flows from operating activities (List of Individual items) Net cash provided (used) by operating activities Cash flows from investing activities (List of individual inflows and outflows) Net cash provided (used) by investing activities Cash flows from financing activities (List of individual inflows and outflows) Php xxx Php xxx xxx xxx xxx Net cash provided (used) by financing activities Net increase (decrease) in cash Cash at beginning of period Cash at end of period xxx xxx xxx xxx Note xx Non-cash investing and financing activities (List of individual non-cash transactions) xxx Preparing the Statement of Cash Flows – Direct Method Operating Activities: Cash received from customers Dividend Received Interest Received (Cash paid to suppliers) (Cash paid for operating expenses) (Interest Paid) (Income Tax Paid) Cash provided (used) from Operating Activities Cash received from customers = Net + Sales - Cash paid for = suppliers COGS AR AR UR UR + - + - Cash Paid for Operating Non-cash + = Operating Expenses Expenses Payments - AP AP + - + Recovery - Write-off Inventory Inventory Prepayments + Prepayments - Accrued Liab. Accrued Liab. 1. Net Sales is $10,000,000 Accounts Receivable Unearned Revenue 2019 $1M $950k Cash Received from Customer = 2020 $1.2M $700k $ 9,550,000 2. Cash Received from Customer is $8,000,000 2019 2020 Accounts Receivable $1M $1.4M Unearned Revenue $780k $900k Net Sales = $ 8,280,000 1. Cost of Goods Sold is $1,800,000 2019 Accounts Payable $600k Inventory $200k Cash Paid to Supplier = $ 1,930,000 2020 $550k $280k 2. Cash Paid to Supplier is $2,400,000 2019 Inventory $650k Accounts Payable $870k Cost of Goods Sold = $ 2,210,000 2020 $900k $930k Interest Received = Interest + Income - Dividends Received Interest Receivable Interest Receivable Dividend + = Income - Dividend Receivable Dividend Receivable Interest Interest + = Paid Expense - Discount Amortization Income Tax + Income = Expense Tax Paid + - Interest Payable Interest Payable Prepaid Interest + Prepaid Interest Premium + Amortization Income Tax Payable + Income Tax Payable - Deferred Tax Asset Deferred Tax Asset + - Prepaid Tax Prepaid Tax Deferred Tax Liability Deferred Tax Liability Preparing the Statement of Cash Flows – Indirect Method Operating Activities: Net Income + Loss on disposal of plant assets - Gain on disposal of plant assets + Depreciation Expense, Depletion Expense, Amortization Expense + Decrease in Current Asset (Except Cash) - Increase in Current Asset (Except Cash) + Increase in Current Liability - Decrease in Current Liability Cash provided (used) from Operating Activities From accrual basis to cash basis