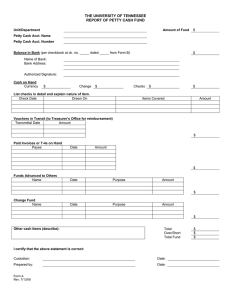

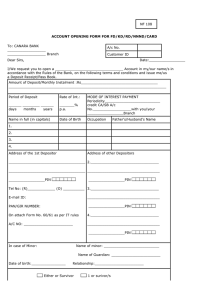

JPIA-PLM Academic Assessment 1 2nd Year Kindly answer the questions at the best of your knowledge. Points: 26/32 1 Student No. * 202001142 2 Which is not a purpose of having a Conceptual Framework? * (1/1 Point) To enable the profession to more quickly solve emerging practical problems. To provide a foundation from which to build more useful standards. To enable the standard setting body to issue more useful and consistent pronouncements over time. To assist regulatory agencies in issuing rules and regulations for a particular industry. 3 The economic entity assumption * (1/1 Point) Is inapplicable to unincorporated businesses Recognizes the legal aspects of business organizations Requires periodic income measurement Is applicable to all forms of business organizations 4 Fundamental qualitative characteristics of accounting information are * (1/1 Point) Relevance and comparability Comparability and consistency Faithful representation and relevance Neutrality and verifiability 5 During the lifetime of an entity, accountants produce financial statements at arbitrary or artificial points in time in accordance with which basic accounting concept? * (1/1 Point) Objectivity Time period assumption Materiality Economic entity 6 All of the following may be included in cash, except * (1/1 Point) Currency Money market instrument Checking account balance Saving account balance 7 In reimbursing the imprest petty cash fund, which of the following statements is true? * (1/1 Point) Cash is debited Petty cash is debited Petty cash is credited Expense accounts are debited 8 If the cash balance shown in the accounting records is less than the correct cash balance and neither the entity nor the bank had made any errors, there must be * (1/1 Point) Deposits credited by the bank but not yet recorded by the depositor Deposits in transit Outstanding checks Bank charges not yet recorded by the depositor 9 The internal control feature specific to petty cash is * (1/1 Point) Separation of duties Assignment of responsibility Proper authorization Imprest system 10 On December 31, 2019, Nexus Company reported cash of P9,950,000 which comprised the following: On December 31, 2019, what total amount should be reported as cash and cash equivalents? * (2/2 Points) 8,050,000 11 In preparing the bank reconciliation on December 31, 2020, EUNOIA Company provided the following data: * (2/2 Points) 7,111,000 12 FOB Company showed a cash account balance of P4,000,000 at the monthend. The bank statement did not include a deposit of P230,000 made on the last day of the month. The bank statement showed a collection by the bank of P94,000 for the depositor and customer check for P32,000 returned because it was NSF. A customer check for P45,000 was recorded by the depositor as P54,000 and a check written for P79,000 was recorded as P97,000. What amount should be reported as cash in bank? * (2/2 Points) 4,071,000 13 LSS’ checkbook balance on December 31, 2015 was P160,000. On the same date, LSSS held the following items in its safe. A P5,000 check payable to LSS, dated January 2, 2016 was included in the December 31 checkbook balance. A P3,500 check payable to LSS which was deposited December 19 and included in the December 31 checkbook balance, was returned by the bank on December 30 marked NSF. The check was re-deposited on January 2, 2016 and cleared on January 9, 2016. In its December 31, 2015 statement of financial position, how much should LSS report as cash? * (0/2 Points) 151,500 Correct answers: P176,500,176,500 14 EUNOIA Company had the following account balance at year-end: Cash in bank 2,250,000 Cash on hand 125,000 Cash restricted for addition to plant and expected to be disbursed next year 1,600,000 Cash in bank included P600,000 of compensating balance against short-term borrowing arrangement. The compensating balance is not legally restricted as to withdrawal. What total amount of cash should be reported under current assets at yearend? * (2/2 Points) 2,375,000 15 TAXccession Company provided the following information for the current year: * (2/2 Points) 1,800,000 16 FOB Company provided the following information on December 31, 2019: * (2/2 Points) 5,150,000 17 In preparing the bank reconciliation for the month of December, NEXUS Company provided the following data: * (2/2 Points) 3,605,000 18 In preparing the bank reconciliation for the month of December, NEXUS Company provided the following data: * (2/2 Points) 3,660,000 19 Retrospect Company showed a cash account balance of P4,500,000 at the month-end. The bank statement did not include a deposit of P230,000 made on the last day of the month. The bank statement showed a collection by the bank of P94,000 for the depositor and a customer check for P32,000 returned because it was NSF. A custom check for P45,000 was recorded by the depositor as P54,000 and a check written for P79,000 was recorded as P97,000. What amount should be reported as cash in bank? * (2/2 Points) 4,571,000 20 FOB Company provided the following accounts abstracted from the unadjusted trial balance at year-end: * (0/2 Points) 110,000 Correct answers: P190,000,190,000 21 IntAccelerate Company provided the following information for the current year: * (0/2 Points) 983,000 Correct answers: P413,000,413,000 Go back to thank you page This content is created by the owner of the form. The data you submit will be sent to the form owner. Microsoft is not responsible for the privacy or security practices of its customers, including those of this form owner. Never give out your password. Powered by Microsoft Forms | Privacy and cookies | Terms of use