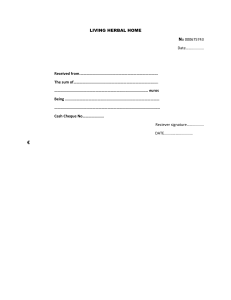

Directorate: Curriculum FET ACCOUNTING PREPARATION FOR GRADE 10 Dear Accounting Learner Congratulations on choosing Accounting as one of your Grade 10 subjects. Your subject choice will no doubt open doors for you. With this subject you will be equipped with valuable skills which include: orderliness thoroughness meticulousness accuracy financial literacy ethical behaviour sound judgement organisation critical, logical and analytical abilities neatness You will learn skills that will prepare you for life, skills that you will be able to apply in any career and very importantly in your own personal life. This is an exciting, interesting and dynamic subject. Decide today, right now to enjoy this subject and even better, to love it! You will need to work regularly, every day; at this subject and I can assure you that if you are prepared to work diligently you will enjoy success. Enjoy this course that has been specially designed for you to prepare you for Grade 10 next year. Have fun. “PASSION + VISION + ACTION is the equation for success” by Marilyn King, US Olympic Pentathlete. Be passionate about Accounting, have a vision of what you would like to achieve with it and act upon your passion and vision by working hard at the subject and you will succeed. Dr GR Schreuder Senior Curriculum Planner: Accounting 2 Accounting: Preparation for Grade 10 MODULE 1: CONCEPTS AND ACCOUNTING CYCLE In Accounting you will come across terminology relating to a business. It is very important that you understand these basic concepts. In your workbook there are two activities that will assess your understanding of basic accounting concepts and terminology. Complete Activities 1.1 and 1.2 in your workbook. The Accounting Cycle Step 1: Transactions Step 2: Source documents Step 6: Financial Statements Step 3: Journals Step 5: Trial Balance Step 4: Ledgers 3 Accounting: Preparation for Grade 10 MODULE 2: THE ACCOUNTING EQUATION ASSETS = OWNER’S EQUITY + LIABILITIES CLASSIFICATION OF ACCOUNTS ASSETS Fixed assets Land and buildings Equipment Vehicles Financial assets Fixed deposits/Investments Current assets Trading stock Debtors’ control Bank Cash float Petty cash Savings account Accrued income (still to be dealt with) Prepaid expenses (still to be dealt with) Non-current liabilities Loans (> 12 months) Consumable stores on hand (still to be dealt with) LIABILITIES Current liabilities Creditors’ control Bank overdraft Loans (< 12 months) Accrued expenses (still to be dealt with) Income received in advance (still to be dealt with) Drawings Expenses Cost of sales Rent expense Salaries and wages Stationery Rates Insurance Water and electricity Advertising Bank charges Telephone Repairs Packing material Interest on bank overdraft Donations Interest on loan OWNERS EQUITY Capital Income Sales Current income Rent income Commission received Interest on current bank account Interest on savings account Interest on fixed deposit 4 Accounting: Preparation for Grade 10 ACCOUNTING PRINCIPLES Dr ASSETS Balance Cr Dr LIABILITIES b/d X Balance - + Dr - Cr b/d X + OWNERS EQUITY Cr Balance b/d X - + (Expenses decrease Owners Equity) (Income increases Owners Equity) Steps when analysing transactions according to the Accounting Equation 1. 2. 3. Identify the accounts Classify the accounts Analyse the effect on the accounting equation by applying the Accounting principles. The expanded accounting equation Owner’s equity = Capital – Drawings + Income – Expenses Therefore Assets = (Capital – Drawings + Income – Expenses) + Liabilities OR Assets + Drawings + Expenses = Capital + Income + Liabilities This expanded equation is very important for your studies in Accounting. It is important that you understand this formula. 5 Accounting: Preparation for Grade 10 Activity 2.1 Enter the following transactions for June 2015 in the columns, indicating an increase with a ‘+’ and a decrease with a ‘-‘: Total the columns. Transactions for June 2015 2 Bought equipment from Tradeau Traders for R10 000 and paid by cheque. 3 The owner increased her capital by depositing R15 000 into the bank account of the business. 5 Paid for consumable stores purchased from Wonderful Wholesalers by cheque, R4 000. 8 Received fee income of R7 800 for services rendered. 12 Paid R6 500 to Winter Estates for rent of property. 18 Paid wages, R6 800 20 Donated a cheque to the value of R1 000 to the local high school. 22 Bought a vehicle for R105 000 and paid by cheque. 25 Received cash from customers for services rendered, R12 400 30 The owner cashed a cheque for his personal use, R5 000. 6 Accounting: Preparation for Grade 10 Activity 2.2 Lou Chang started a laundry business on 1 January 2015 called Lang Cleaners. REQUIRED: Record the transactions for September in the table provided in your workbook. The totals at the end of August 2015 are as follows: Assets Expenses R132 000 Drawings R96 000 Liabilities Creditors, R4 000 Capital R150 000 Income R220 000 Bank, R112 000 Equipment, R34 000 Transactions: September 2015 5 Issued a cheque to Fast Motors for a new vehicle purchased, R90 000. 7 Cashed a cheque to pay for wages, R1 600. 9 Issued receipts for fee income received from customers, R6 000. 11 Lou Chang cashed a cheque for personal use, R4 000. 15 Settled the account of one of the creditors, R2 000 17 Repairs done to equipment on credit, R3 400. 17 Issued receipts for fee income received from customers, R10 800. 20 Cashed a cheque for wages, R1 600. 25 Issued a cheque for stationery bought, R800. 28 Issued a receipt to Lou Chang for capital contributed, R50 000. 29 Issued a cheque to Pelican Properties to pay for rent, R3 000. Activity 2.3 Complete the table in your workbook by inserting the missing figures as denoted by an *. 7 Accounting: Preparation for Grade 10 DOUBLE ENTRY PRINCIPLE For every debit entry there must be an equal and corresponding credit entry. Double Entry Principle THE GENERAL LEDGER Assets + Drawings + Expenses = Capital + Income + Liabilities: This formula forms the basis of the General Ledger. Assets, Drawings and Expense accounts increase on the debit side of the general ledger while Capital, Income and Liability accounts increase on the credit side. The General Ledger consists of three sections, viz. the Balance Sheet Accounts Section, the Nominal Accounts Section and the Final Accounts Section. Balance Sheet Accounts Section Nominal Accounts Section Capital Drawings Assets Liabilities Dr. (end of accounting period) Income Expenses Trading account Profit and loss account GENERAL LEDGER OF XXXXXX Name of account Date Final Accounts Section Details Fol Amount Date Cr. Fol. Details Fol Amount 8 Accounting: Preparation for Grade 10 Activity 2.4 Goofy Gardener started a gardening service business on 1 January 2015, called Goofy Gardening. REQUIRED: Open the general ledger accounts with the balances/totals on 1 November 2015. Enter the transactions of Goofy Gardening for November 2015 in the General Ledger. Balance the balance sheet accounts and total the nominal accounts on 30 November 2015. The following balances/totals appeared in the General Ledger on 1 November 2015. Assets Bank Savings Equipment Vehicles R24 000 R80 000 R68 000 R140 000 Equity Capital Drawings R300 000 R52 000 Liabilities Creditors’ control Income Interest income Fee income R20 000 R420 000 Expenses Wages Insurance Rent expense Bank charges Fuel Motor vehicle expenses R133 640 R12 800 R36 000 R1 960 R34 000 R45 600 R8 000 Transactions – November 2015 2 Transferred R60 000 from the savings account to the current account. 6 Issued a cheque in favour of Best Motors for a new vehicle purchased, R175 000. 7 Cashed a cheque to pay wages, R3 200. 10 Issued receipts for fee income received from customers, R12 000. 11 Issued a cheque for insurance premium, R2 400. 14 Goofy cashed a cheque for his personal use, R8 000. Cashed a cheque to pay wages, R3 200. 16 Settled a creditor’s account by cheque, R2 800. 18 Purchased equipment on credit from Power Tools and Hardware, R138 000. 17 Issued receipts for fee income received from customers, R20 800. 19 Motor vehicle repairs done on credit by Perfect Motors, R4 800. 21 Cashed a cheque to pay wages, R3 200. 23 Issued receipt to Goofy for extra capital contributed, R220 000. 25 Issued a cheque to Penn Properties for monthly rent, R6 000. 27 Issued a cheque to Apex Garage for petrol, R1 400. 28 Cashed a cheque to pay wages, R3 600. 30 The bank statement reflected bank charges of R670 and interest on current account, R260. 9 Accounting: Preparation for Grade 10 Activity 2.5 You are provided with information relating to Yusuf’s Cellphone Repairs for the month of May 2015. REQUIRED: Analyse the following transactions by completing the table in your workbook. The first entry has been done for you as an example. 1. Paid wages by cheque, R1 500. 2. Bought paper for the office computer, R450 and paid for it by cheque. 3. Transferred R10 000 from Yusuf’s personal banking account to the bank account of the business. 4. Paid for insurance of the business equipment, R2 300. 5. Received R6 000 from clients for services rendered. 6. Paid Home Properties for rent of property, R4 000. 7. Bought equipment from Cell Warehouse and paid by cheque, R6 000. 8. Purchased consumable stores and paid by cheque, R8 300. 9. The owner paid his personal telephone account by cheque, R550. 10. Paid the business telephone account, R1 200. 10 Accounting: Preparation for Grade 10 TRADING BUSINESS: Cost Price: Selling Price: Mark-up: COST OF SALES CALCULATIONS The amount the business pays for the goods. The amount the business charges when the goods are sold. The percentage the business adds to the cost price. Cost of sales = Sales x 100 100 + mark-up% Sales = Cost of sales x 100 + mark-up% 100 Activity 2.6 REQUIRED: Calculate the missing figures in the table below that are indicated by a ‘?’. No. Cost price 1 R3 000 2 R3 000 Profit mark up (%) Selling price ? R4 500 150 ? 3 ? 80 R360 4 ? 20 R4 500 33⅓ ? 5 R1 800 6 R2 500 7 R16,80 8 R1 400 ? R1 680 9 R1 960 ? R2 450 10 R900 ? R7 500 16 66⅔ ? ? 11 Accounting: Preparation for Grade 10 Activity 2.7 Martin Meyer is the owner of MM Superette. All merchandise is sold at a mark-up of 60% on cost price. The following balances/totals appeared in the General Ledger on 1 July 2015. Capital R755 700 Drawings Equipment Cash float R41 250 R750 Cost of sales R150 750 R15 000 Vehicles R196 500 Trading stock R133 050 Rent expense R120 000 Bank (Cr.) Sales R3 000 R241 200 Salaries and wages Stationery R27 600 R315 000 REQUIRED: Open the general ledger accounts with the balances/totals on 1 July 2015. Enter the transactions of MM Superette for July 2015 in the General Ledger. Balance the balance sheet accounts and total the nominal accounts on 31 July 2015. 3 Cashed a cheque for R750 to increase the cash float. 4 Issued a cheque for R7 800 to Makro for a computer and printer. 6 Bought merchandise from Ray Wholesalers and issued a cheque for R78 000 less 10% trade discount. Cashed a cheque to pay wages, R8 000. 10 Cash sales, R36 000. 12 Paid insurance to Metropolitan as follows: On the owner’s private assets, R1 650 On the business assets, R7 000 15 The owner increased his capital by depositing R97 000 in the bank account of the business. 17 Bought stationery from PNA for R630 and paid by cheque. 20 Paid the following charges: Water and electricity to the Municipality, R3 350 Telephone to Telkom, R2 150 24 Cash sales, R24 000. 26 Paid the salary of the manager, R13 200. 30 The owner cashed a cheque for his personal use, R9 000. 12 Accounting: Preparation for Grade 10 Activity 2.8 You are provided with information relating to Thabo’s Gold Shop for June 2015. REQUIRED: Analyse the following transactions by completing the table in your workbook. The first entry has been done for you as an example. 1 Thabo increased his capital contribution by depositing R100 000 in the bank account of the business. 3 Thabo bought a vehicle and paid by cheque, R180 000. 5 Purchased merchandise from Excellent Wholesalers, R25 000. 8 Paid R350 by cheque for one advertisement in the local newspaper. 10 Sold goods for cash, R15 000 (cost price, R7 500) 12 Thabo cashed a cheque for his personal use, R2 000. 14 Paid wages by cheque, R12 600. 18 Purchased fuel from Diep River Motors, R850. 21 Received rent from a tenant, R4 800. 24 Sold goods for cash, R22 000 (Cost price, R11 000) 28 Paid Thabo’s gym membership fee, R600. 13 Accounting: Preparation for Grade 10 MODULE 3: CASH TRANSACTIONS Journals (also called subsidiary journals) are books of first entry. It helps to organise transactions in different types (cash receipts and cash payments) and to simplify the orderly transfer information to the next step in the accounting cycle. The first few steps in the accounting cycle: transactions, source documents, journals and ledger. ® Cash Receipts Journal: to record all cash received ® Cash Payments Journal: to record all cash payments Documents used in cash transactions by the business: ® Original Receipt: issued when cash is received for goods or services. ® Cheque: issued when a “cash” payment is made for goods or services ® Cash register slip: issued by the cashier for cash sales ® Deposit slip: to deposit cash and verify deposits Source documents are used to record cash transactions in the books of the business: ® Duplicate receipt: to record cash received ® Cheque counterfoil: to record cash payments ® Cash register tape: to record cash sales ® Bank Statement: to record and verify electronic fund transfers (EFTs). EXAMPLES OF SOURCE DOCUMENTS: RECEIPT 001 ……………….20…. Received from …………………………………………. the sum of ……………………………………………………………………. For ……………………………………………………………………………. ………………………… for Cornel Stores 14 Accounting: Preparation for Grade 10 CHEQUE ACCOUNT DEPOSIT STANDARD BANK CREDIT: 5 0059 (V.2) Address: / Teller’s date stamp and signature Please ensure that your account number is correctly filled in as Standard Bank Ltd. cannot be held responsible for errors resulting from in-correct information furnished. Cheques etc. handed in for collection will be available as cash after payment. While acting in good faith and exercising reasonable care, Standard Bank Ltd. will not accept responsibility for ensuring that depositors / account holders lawful title to cheques etc. collected. /20 Note Nikkel Bronzes Postal orders Total cash Drawer’s name Branch clearing number 1. 2. 4. Account number For Bank use only Effects not cleared Total Paid in by 32-87-41-64 ______________20__ Standard Bank Parow Branch TO __________________ Date ____________________20____ Pay _________________________________________ or Bearer __________________ R_____________________________________________________ FOR _________________ ______________________________________ __________________ ___________________ THEMBI STORES R 001 3456789012 001 15 Accounting: Preparation for Grade 10 Doc no CRR CRR CRR 01 CASH RECEIPTS JOURNAL OF ABEL TRADERS – MAY 2015 Day Details Fol Analysis of Bank receipts 15 Sales 350 00 350 00 25 Sales 840 00 840 00 30 Sales 315 00 Alma Smit 10 000 00 10 315 00 11 505 00 B3 WHAT DOES THIS JOURNAL TELL US? Money was received. WHAT IS THE MAIN COLUMN CALLED? Bank WHAT HAPPENS TO THIS ACCOUNT (MAIN COLUMN)? The money in the bank increases WHAT TYPE OF ACCOUNT IS BANK? An Asset WHAT IS THE RULE FOR ASSETS? It increases on the debit side and decreases on the credit side JINGLE: BANK IS DEBITED (with the words “Total receipts’) AND THE REST IS CREDITED (with the word ‘Bank’), EXCEPT COST OF SALES!!!! Sales 350 00 840 00 315 00 1 505 00 N1 Cost of sales 200 00 480 00 180 00 860 00 B2/N2 CRJ5 SUNDRY ACCOUNTS Amount Fol Details 10 000 00 B1 10 000 00 Capital COST OF SALES HAS ITS OWN JINGLE… COST OF SALES AND TRADING STOCK ALWAYS GOES TOGETHER (BFF’S)!! WE ALWAYS REASON FROM THE POINT OF VIEW OF WHAT IS HAPPENING TO TRADING STOCK WHAT DOES THIS JOURNAL TELL US AGAIN? Money was received. In this case, we received money for Trading stock sold. WHAT HAPPENS TO TRADING STOCK IF WE SOLD SOME OF IT? Trading Stock decreases. WHAT TYPE OF AN ACCOUNT IS TRADING STOCK? Dr(+) TRADING STOCK B.. Cr(-) An Asset 860 WHAT IS THE RULE FOR ASSETS? It increases on the debit side and decreases on the credit side Dr(-) COST OF SALES N.. Cr(+) 860 JINGLE: Trading stock is credited (decreases) and Cost of Sales (its best friend) is debited (the opposite is done in the contra account-best friend account). 16 Accounting: Preparation for Grade 10 CASH PAYMENTS JOURNAL OF ABEL TRADERS – MAY 2015 Doc Day Details Fol Bank Stationery no 12 10 B&B Books 350 00 350 00 13 14 XYZ Stores 1 500 00 14 17 Telkom 550 00 15 22 Fine Foods 900 00 3 300 00 350 00 B3 N3 CPJ5 Trading stock SUNDRY ACCOUNTS Amount Fol Details 1 500 00 550 00 N4 900 00 2 400 00 B2 Telephone 550 00 WHAT DOES THIS JOURNAL TELL US? Money was paid. The business spent money. WHAT IS THE MAIN COLUMN CALLED? Bank WHAT HAPPENS TO THIS ACCOUNT (MAIN COLUMN)? The money in the bank decreases – becomes less. WHAT TYPE OF ACCOUNT IS BANK? An Asset WHAT IS THE RULE FOR ASSETS? It increases on the debit side and decreases on the credit side JINGLE: BANK IS CREDITED (with the words: “Total payments”) AND THE REST IS DEBITED (with the word “Bank”). 17 Accounting: Preparation for Grade 10 . Activity 3.1 You are provided with information relating to Purdon Tyre Shop for the month of September 2015. REQUIRED: Analyse the following transactions in your workbook. The first entry has been done for you as an example. 01 Paid the wages by cheque, R3 250. 03 The owner increased his capital contribution from R130 000 to R175 000 and received a receipt from the bookkeeper. 04 Sold goods according to the cash register roll, R3 000. Profit mark-up on cost price was 50 %. 06 Paid the office rent of R4 050. 11 Paid the telephone account to Telkom, R4 500. 13 Placed an advertisement in Country Post and pay, R427 by cheque. 17 Bought goods from Audrey Suppliers, R3 700, as well as equipment to the amount of R1 800. 19 Issued a cheque to Dean Repairs for repair work to equipment, R2 500. 20 Cashed a cheque for cash float, R550. 21 Bought an invoice book and other necessities at Paper & Books, R345 and paid by cheque. 25 Paid the water and electricity account to the municipality, R3 283. R1 904 was for the water and electricity account of the business and the rest was for the owner’s home. 28 Issued a receipt to A van Vuuren for rent of part of the building, R4 800. 18 Accounting: Preparation for Grade 10 Activity 3.2 Mary Mürtz is the owner of Mürtz Stores. During April 2015 the following transactions took place: REQUIRED: Record the following transactions in the Cash Receipts Journal and Cash Payments Journal Activity 3.2 in your workbook. You must cast the journals at the end of the month. Transactions April 2015 1 Cash sales of merchandise, R8 000 (cost price R6 000). 3 Mary Mürtz increased her capital contribution by paying R30 000 to the cashier. Issued receipt 10. 5 Issued cheque 37 to Total Insurers for the annual insurance premium, R3 444. 6 Paid the weekly wages, R1 500. 15 Received a cheque from E Joubert, R4 800 for rent of offices in the building. 18 Issued a cheque to Suzaan Traders for the following: trading stock, R3 500; equipment, R5 000 and stationery, R400. 27 The owner took R1 500 for personal use. 19 Accounting: Preparation for Grade 10 Activity 3.3 Talitha Stores sells their products at a mark-up of 25% on cost price. REQUIRED: 3.3.1 Record the following transactions in the Cash Receipts Journal and Cash Payments Journal. 3.3.2 Post from the cash journals to the General Ledger. Transactions – March 2015 1 Received R120 000 from the owner, Talitha Venter as her capital contribution. Issued receipt no. 001 5 Purchased a computer and filing cabinet from Anina Furnishers and paid by cheque no. 001, R9 000. 6 Purchased goods from Lianie Suppliers for R7 000 less 10% trade discount and paid by cheque. 8 Issued cheque for R300 to Mirrah Stationers for stationery purchased. 12 Sold goods for cash R2 500. 19 Purchased a second-hand delivery vehicle from Nettie Garage and paid by cheque, R34 000. Cash a cheque to pay wages, R750. 23 Purchased packing material from Pacmar Ltd for R200 and paid by cheque. 25 Received a cheque from X Factor Travel Agency for rent for the month, R2 500. Received cash for merchandise sold, R1 500. 28 Cashed a cheque to pay wages, R750. 31 Issued a cheque to City Treasurer to pay water and electricity, R400 and rates, R300. Paid the salary of the manager, G Schreuder, R5 500. 20 Accounting: Preparation for Grade 10 Activity 3.4 You are provided with information relating to Larah Traders, owned by Larah Fernandez. REQUIRED: 3.4.1 Use the information provided to post to the accounts in the General Ledger. 3.4.2 Prepare a Trial Balance on 31 May 2015. Balances/Totals on 1 May 2015 Capital R75 000 Drawings R23 500 Trading stock R15 800 Bank R50 100 Sales R72 000 Cost of sales R57 600 CASH RECEIPTS JOURNAL OF LARAH TRADERS - MAY 2015 Doc. No. 121 CRT 11 CRT 12 122 D Details 1 Larah Fernandez 16 27 F Analysis of Receipts Bank 140 000 140 000 Sales/Cash 9 600 9 600 Sales/Cash 2 400 Capricorn Traders 5 000 CRJ 5 Sales Cost Of Sales Amount 140 000 9 600 7 680 2 400 1 920 7 400 157 000 Sundry Accounts 5 000 12 000 9 600 Fol Details Capital Rent income 145 000 21 Accounting: Preparation for Grade 10 CASH PAYMENTS JOURNAL OF LARAH TRADERS - MAY 2015 D 181 5 Cash 8 000 182 12 Leo Traders 8 000 8 000 Virgo Transport 6 540 6 540 Eskom 2 120 183 184 24 Details F Bank Trading Stock Doc CPJ 5 Sundry Accounts Wages Stationery Amount 29 Pisces Motors 186 30 M Moon Mill Stationers Details 8 000 1 400 720 185 Fol Water and electricity Drawings 65 000 65 000 Vehicles 7 600 7 600 Salaries 548 97 808 548 14 540 8 000 548 74 720 22 Accounting: Preparation for Grade 10 MODULE 4: CREDIT TRANSACTIONS Credit transaction: the exchange of goods or services where the payment is postponed to a date in the future. Debtor: The customer/ person TO whom the business sells goods or services on credit. Creditor: The person / business / supplier FROM whom the business purchases goods or services on credit. Source documents and Journals used to record credit transactions Debtors Source documents Journals Type of transaction Duplicate invoice Debtors Journal Credit sales Duplicate receipt Cash Receipts Journal Payments received from debtors Duplicate Credit Note Debtors Allowances Journal Returns from and allowances to debtors Creditors Source documents Journals Type of transaction Original Invoice Creditors Journal Credit purchases Cheque counterfoil Cash Payments Journal Payments made to creditors Dupliate debit note/ Original credit note Creditors Allowances Journal Returns to and allowances from creditors General Ledger Debtors' Control account: records the total owing by debtors Creditors' Control account: records the total owing to creditors Subsidiary Ledgers Debtors' Ledger: a collection of the individual accounts of the debtors. The sum of the final balances of the individual debtors equals the balance of the Debtors' control account. Final balances of each debtor is captured in a Debtors List. Creditors' Ledger: a collection of the individual accounts of the creditors. The sum of the balances of the individual creditors equals the balance of the Creditors' control account. Final balances of each ceditor is captured in a Creditors' list. 23 Accounting: Preparation for Grade 10 – Training Manual Activity 4.1: Analysis of transactions You are provided with transactions from the books of Kenyon Stores for October 2015. Analyse these transactions according to the columns provided. Example: Bought stationery from PNA and paid R500 by cheque. TRANSACTIONS: 1. Purchased goods on credit from Sharks Traders for R3 000. 2. Received a cheque from B. Bull, a debtor, in full settlement of his account of R600. 3. Merchandise sold on credit to Y. Tale, R2 400. The business uses a profit mark-up of 33 ⅓ % on cost. 4. Y. Tale claimed an allowance for an overcharge on the credit sales, R200. 5. Returned goods not according to order to Sharks Traders, R900. 6. Issued a cheque to Whale Stores, a creditor, for payment on their account, R5 800. 24 Accounting: Preparation for Grade 10 – Training Manual Activity 4.2: Journals Lucky Star owns a business, Lucky Traders, that buys and sells household appliances. They sell merchandise for cash and on credit and use a profit mark up of 25% on cost price. Debtors' and Creditors' List on 1 March 2015: Debtors S. Sardien H. Harder Creditors R3 450 R2 890 Bocom Wholesalers Prawn Traders R8 250 R4 500 REQUIRED: 4.2.1 Record the following transactions in the DJ, DAJ, CRJ, CJ, CAJ, CPJ. Use the journals provided for Activity 4.2 in the work book. 4.2.2 Close off the journals at the end of the month. TRANSACTIONS for March 2015 3 Purchased trading stock, R2 400 on credit from Bocom Wholesalers. Received invoice A533 (renumbered 113) together with the consignment. 5 Trading stock not according to order, was returned to Bocom Wholesalers, together with a debit note for R300. Bocom Wholesalers issued a credit note no CN56 (renumbered 42). 6 Bought consumable stores, R320 and trading stock, R2 120 from Bocom Wholesalers and paid by cheque no. 345. These goods are subject to 10% cash discount. 7 Sold goods on credit to S. Sardien, R1 525. Issued invoice 201. 8 Received invoice 908 from Prawn Traders for consumable stores, R470. 10 Cash a cheque to pay wages, R8 200. S. Sardien claimed an allowance for damaged items, R125. Sardien agreed to keep the items. Issued credit note no 54 to him. 13 Issued an invoice to H. Harder for goods sold to her, R840. Returned consumable stores, R150 to Prawn Traders, together with a debit note. Prawn Traders confirmed these returns by issuing credit note BN891. 14 Received a cheque from H. Harder to settle her account as on 1 March 2015. Issued receipt no 37. 16 The owner increased his capital from R55 000 to R80 000. Issued a receipt. 25 Accounting: Preparation for Grade 10 – Training Manual 18 Paid Bocom Wholesalers R900 by cheque in part payment of our account. 19 Issued cheque to Prawn Traders to settle the amount owing to date Sold goods for cash to H. Harder, R600. (CRT 9) 22 Purchased a new cash register on credit from Bocom Wholesalers for R6 500, subject to a trade discount of 5%. 27 Bought the following on credit from Prawn Traders: merchandise, R1 200 consumable stores, R800. 28 S. Sardien paid R1 200 in part payment of his account. Received a cheque from K Powell for office space let to him for the month. Annual rental amounts to R36 000. 30 H. Harder purchased goods to the value of R1 800 on credit. Paid electricity by cheque to the municipality, R650. 31 H. Harder returned damaged items, R400. Issued a credit note to her. 26 Accounting: Preparation for Grade 10 – Training Manual Activity 4.3: Post to Ledgers; Trial Balance The information below relates to Sushi Traders, who buy and sell for cash and on credit. REQUIRED: 4.3.1 Use the relevant information from the journals below to post to the accounts in the General, Debtors' and Creditors' Ledgers. Balance or close off all the accounts in the General Ledger. 4.3.2 Prepare a Trial Balance on 30 April 2015. INFORMATION The following journals were taken from the books of Sushi Traders after their first month of trading. Cash Receipts Journal of Sushi Traders – April 2015 Doc no 1 Mr Nigiri Analysis of Receipts 200 000 CRT1 6 002 Sales S. Rose 6 960 750 7 710 003 001 D Fol Bank Debtors Control Sales Cost of Sales 6 960 4 640 70 000 70 000 Sales 18 160 18 160 18 160 12 107 CRT3 22 Sales 5 360 5 360 5 360 3 573 004 H. Meyer 2 300 Rita Estates 8 000 4 16 25 Details 3 050 30 480 D Fol S. Rose H. Meyer H. Meyer 10 18 Details Capital 70 000 Capital 8 000 Rent Income Fol S. Rose H. Meyer 20 320 278 000 DJ1 Sales Cost of Sales 1 470 1 565 1 452 980 1 043 968 4 487 2 991 Debtors Allowances Journal of Sushi Traders – April 2015 Doc no C1 C2 Details 200 000 10 300 Debtors Journal of Sushi Traders – April 2015 D Fol 2 300 311 530 Doc no 01 02 03 Amount 750 Mr Nigiri 26 Sundry Accounts 200 000 CRT2 14 005 12 Details CRJ1 Debtors Allowances 244 345 589 DAJ1 Cost of Sales 163 230 393 27 Accounting: Preparation for Grade 10 – Training Manual Cash Payments Journal of Sushi Traders – April 2015 Doc no D 0001 1 Gordon Traders 8 900 0002 2 PD Wholesalers 12 100 0003 5 Municipality 0004 10 Shaun Traders 2 400 0005 16 Safe Insurance 2 650 0006 Name of Payee Fol Bank Trading Stock CPJ1 Wages Creditors Control 8 900 850 22 Snowy Traders 0008 24 Cash 9 800 0009 26 AB Stores 5 152 0010 28 Waqa Stores 1 932 0011 30 MJ Simba 1 932 12 600 12 600 3 890 3 440 3 440 74 114 20 692 19 600 Creditors’ Journal of Sushi Traders – April 2015 Fol Creditors’ control 4 332 Trading Stock D N1 8 Shaun Traders 4070 4070 N2 13 Waqa Stores 2 176 2 176 N3 21 Gordon Traders 4 200 N4 24 Waqa Stores Stationery 6 246 300 Creditors’ Allowances Journal of Sushi Traders – April 2015 29 Waqa Stores Sundry Accounts Amount Fol Details Equipment 300 10 746 E2 Electricity 29 490 4 200 300 Creditors’ Fol control Salaries CJ1 Doc no Shaun Traders Stationery 5 152 Terry Traders 11 Drawings 9 800 0013 E1 1 200 600 3 890 Details Insurance 600 Municipality D 1 450 9 800 0012 Details Rates 2 400 9 800 0007 Equipment 12 100 850 Cash Doc no Sundry Accounts Amount Fol Details Trading Stock 104 CAJ1 Stationery Sundry Accounts Amount Fol Details 104 40 144 4 200 40 104 40 28 Accounting: Preparation for Grade 10 – Training Manual Activity 4.4: Posting to selected General Ledger accounts REQUIRED Use the given information to post to the following accounts in the General Ledger of Eddy Traders. Close off the accounts in the balance sheet section. Balances on 1 May 2015: Trading Stock Debtors' Control Creditors' Control Sales Cost of Sales Debtors' Allowances Stationery B6 B7 B8 N1 N2 N3 N4 10 500 6 250 8 440 13 230 8 820 2 300 800 Note: Goods are sold at cost plus 50%. The following totals appeared in the journals as on 31 May 2015: Cash Receipts Journal of Eddy Traders – May 2015 Bank Sales R14 600 CRJ 10 Cost of Sales R4 500 Debtors control ? R2 190 Cash Payments Journal of Eddy Traders – May 2015 Bank Trading Stock R14 600 Stationery ? Sales R7 910 CPJ 10 Creditors control R240 Debtors Journal of Eddy Traders – May 2015 Sundry accounts Wages R7 500 R2 400 DJ 10 Cost of sales ? R2 100 Debtors Allowances Journal of Eddy Traders – May 2015 Debtors Allowances DAJ 10 Cost of sales R780 ? Creditors Journal of Eddy Traders – May 2015 Creditors Control Trading Stock ? CJ 10 Stationery R5 000 Sundry Accounts R350 Creditors Allowances Journal of Eddy Traders – May 2015 Creditors Control R1 415 Trading Stock CAJ 10 Stationery ? R2 450 Sundry Accounts 90 R475 29 Accounting: Preparation for Grade 10 – Training Manual Activity 4.5: Final assessment You are provided with information relating to Easy Traders for July 2015. REQUIRED: Analyse the following transactions by completing the table in Activity 4.5 in your workbook. The first entry has been done for you as an example. 1. Paid the telephone account to Telkom, R2 800. 2. Bought stock on credit from PT Traders, R24 000. 3. Cash sales amounted to R18 000. (Cost of sales, R9 000) 4. Returned unsatisfactory goods to PT Traders, R1 300. 5. D. Dean bought goods on credit from Easy Traders for R3 600. A mark up of 20% on cost applied to these goods. 6. Paid R8 300 to PT Traders as part payment on their account. 7. D. Dean returned goods with which he is dissatisfied, R120. See transaction no. 5. 8. Paid R240 000 to Moby Motors for a new delivery vehicle. 9. Received a cheque from D. Dean in settlement of his account. 30 Accounting: Preparation for Grade 10 – Training Manual