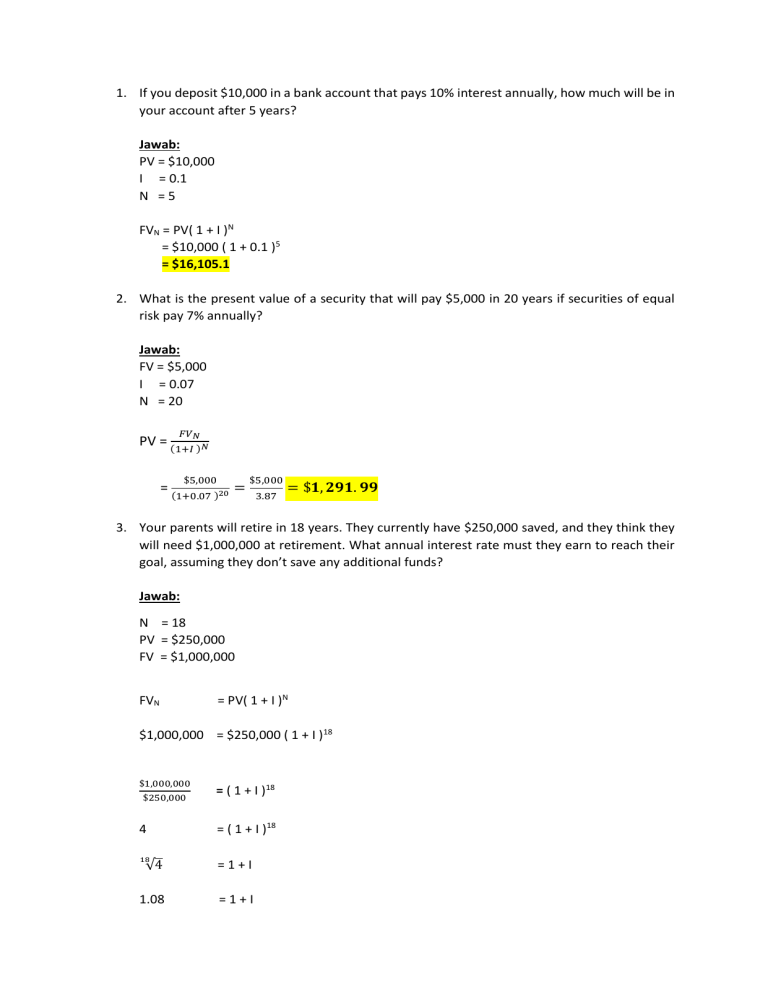

1. If you deposit $10,000 in a bank account that pays 10% interest annually, how much will be in your account after 5 years? Jawab: PV = $10,000 I = 0.1 N =5 FVN = PV( 1 + I )N = $10,000 ( 1 + 0.1 )5 = $16,105.1 2. What is the present value of a security that will pay $5,000 in 20 years if securities of equal risk pay 7% annually? Jawab: FV = $5,000 I = 0.07 N = 20 𝐹𝑉 PV = (1+𝐼𝑁)𝑁 $5,000 = (1+0.07 )20 = $5,000 3.87 = $𝟏, 𝟐𝟗𝟏. 𝟗𝟗 3. Your parents will retire in 18 years. They currently have $250,000 saved, and they think they will need $1,000,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don’t save any additional funds? Jawab: N = 18 PV = $250,000 FV = $1,000,000 FVN = PV( 1 + I )N $1,000,000 = $250,000 ( 1 + I )18 $1,000,000 $250,000 = ( 1 + I )18 4 = ( 1 + I )18 18 √4 =1+I 1.08 =1+I I = 1.08 – 1 = 0.08 = 8% 4. If you deposit money today in an account that pays 6.5% annual interest, how long will it take to double your money? Jawab: Diasumsikan uang saat ini = x PV = x FVN = 2PV = 2x I = 6.5% FVN 2x 2 log(2) = PV( 1 + I )N = x (1 + 0.065 ) N = (1.065) N = N log(1.065) N = log(1.065) = 𝟏𝟏 log(2) Dengan interest rate 6.5%, dibutuhkan 11 tahun agar nilai uangnya menjadi 2x dari nilai saat ini. 5. You have $42,180.53 in a brokerage account, and you plan to deposit an additional $5,000 in the end of every future year until your account totals $250,000. You expect to earn 12% annually on the account. How many years will it take to reach your goal? Jawab: PMT = $5,000 PV = $42,180.53 ∑ 𝐹𝑉 = $250,000 I = 0.12 FVAN = = FVN (1 + 𝐼)𝑁 −1 ) 𝐼 (1 + 0.12)𝑁 −1 $5,000 ( ) 0.12 𝑁 (1.12) −1 $5,000 ( ) 0.12 = PMT ( = PV( 1 + I )N = $42,180.53 ( 1 + 0.12 )N = $42,180.53 ( 1.12 )N ∑ 𝐹𝑉 = FVAN + FVN (1.12)𝑁 −1 ) 0.12 + $42,180.53 ( 1.12 )N $250,000 = $5,000 ( $250,000 = $30,000 = $5,000 (1.12)𝑁 − $5,000 + $5,061.66 ( 1.12 )N $35,000 = $5,000 (1.12)𝑁 + $5,061.66 ( 1.12 )N $35,000 $10,061.66 = 1.12𝑁 1.12𝑁 = 3.4785 $5,000 (1.12)𝑁 −$5,000 + 0.12 $42,180.53 ( 1.12 )N 𝑁 log(1.12) = log(3.4785) N = log(3.4785) = log(1.12) 10,99 ≈ 11 Dengan interest rate 12%, dibutuhkan 11 tahun agar nilai uangnya menjadi $250,000 dari nilai saat ini. 6. What’s the future value of a 7%, 5-year ordinary annuity that pays $300 each year? If this was an annuity due, what would its future value be? Jawab: PMT = $300 I = 0.07 N =5 Future Value of an Ordinary Annuity FVAN (1 + 𝐼)𝑁 −1 ) 𝐼 5 (1 + 0.07) −1 = $300 ( ) 0.07 5 (1.07) −1 = $300 ( ) 0.07 0.4025 = $300 ( 0.07 ) = $𝟏, 𝟕𝟐𝟓. 𝟐𝟐 = PMT ( Future Value of an Annuity Due FVAdue = FVAN (1 + I) = $1,725.22 (1 + 0.07) = $1,845.98 7. Lin Shan is about to retire and is exploring the possibility of investing a lump sum in an annuity so that she gets 50% of her last drawn salary at the end of every month for 15 years. She estimates her last-drawn salary to be ¥60,000. The quotation she obtained from Ping Tan Insurance requires her to invest a lump sum of ¥1 million. Calculate the return that Lin Shan is earning on her annuity. Jawab: PMT = ¥60,000 n = 15 i = 0.5 Total Contribution = invest awal + PMT (N) (jumlah bulan) = ¥1,000,000+ (¥60,000 (15)(12)) = ¥11,800,000 (1 + 𝑖)𝑛 −1 ) 𝑖 (1 + 0.5)15 −1 ¥60,000 ( ) 0.5 = PMT ( FV = = ¥26,273,633.42 Return = (FV – Total Contribution)/12 = (¥26,273,633.42 - ¥11,800,000)/12 = ¥1,206,136 pertahun 8. An investment will pay $100 at the end of each of the next 3 years, $200 at the end of Year 4, $300 at the end of Year 5, and $500 at the end of Year 6. If other investments of equal risk earn 8% annually, what is its present value? Its future value? Jawab: FV = 100; 100; 100; 200; 300; 500 I = 0.08 N = 1; 2; 3; 4; 5; 6 NPV = ∑ ( 𝐹𝑉𝑁 1+𝐼 )𝑁 $100 = (1+0.08 )1 + $100 (1+0.08 )2 + $100 (1+0.08 )3 + $200 (1+0.08 )4 + $300 (1+0.08 )5 + $500 (1+0.08 )6 = 92.5926 +85.7339 +79.3832 + 147.006 +204.1749 +315.0848 = $923.9754 FVN = PV( 1 + I )N = $923.9754 (1+0.08)6 = $1,466.2328 9. You want to buy a car, and a local bank will lend you $20,000. The loan will be fully amortized over 5 years (60 months), and the nominal interest rate will be 12% with interest paid monthly. What will be the monthly loan payment? What will be the loan’s EAR? Jawab: Monthly rate = i = 0.12 / 12 = 0.1 Yearly rate = I = 0.12 N of months = N = 60 Compound = M = 12 1 (1+𝑖)𝑁 1− PVAN = PMT ( 𝑖 $20,000 = PMT ( 1− ) 1 (1+0.1)60 0.1 ) $20,000 = PMT (9.9671) $20,000 = 9.9671 PMT = $2,006.60 EAR = [1 + ] − 1 𝑀 𝐼 𝑀 = [1 + 0.12 12 ] 12 = 1.1268 – 1 = 0.1268 −1