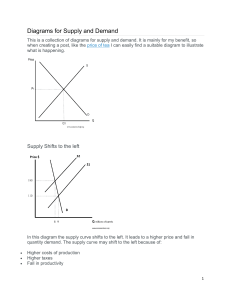

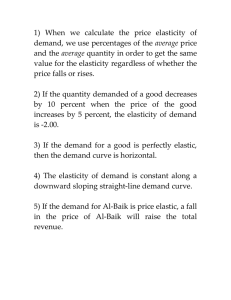

Managerial Economics – MBA BFSI Semester 1 Law of Demand Meghdoot Karnik Director.sbfsim@suas.ac.in What is the Law of Supply and Demand? The law of supply and demand reflects the relationship between demand and supply in that a change in one causes a change in the other. According to the law of supply and demand, when there is higher demand for a commodity, there is a rise in the supply of such commodity and vice versa. The law of supply and demand explains the interaction between the desire for a product and the supply of that product. For instance, if the supply of a product is how and the demand is high, it means such product is scarce and insufficient for the number of people that wants it, hence, it will lead to an increase in the price of the product. How is the Law of Supply and Demand Used? The law of supply and demand is an economic theory that explains how demand and supply are connected and how these two concepts strive to find market balance or equilibrium price. Usually, when there is excess supply in the market and a low demand for the supplied products, there is a decrease in the price of goods. There are many factors that influence demand and supply. Supply and demand can rise for multiple reasons, so also can they decline. The law of supply and demand is connected to almost all economic principles, although there are exceptions. How Do Supply and Demand Create an Equilibrium Price? The impact of equilibrium price is that it allows suppliers sell their goods at a price which buyers are willing to pay. For instance, if a supplier is able to sell all units of products at a predetermined price and buyers are willing to purchase all units at the price, there is equilibrium. Equilibrium price is otherwise called a market-clearing price, supply and demand play a major role in the creation of equilibrium price in the market. Generally, businesses or producers find means to reach an equilibrium, they are often in search of ways to create a balance between the units of goods produced and the desire of consumers for the goods. Factors Affecting Supply There are certain factors that directly affect supply and determines whether there will be high or low supply. The capacity of a producer or company, the costs of producing specific items including cost of materials, labor, and equipment can affect supply. Other factors include the presence of competitors in the market. Also, if the production of an item is determined by weather, for instance, a company that manufactures sweaters, the supply of products will the determined by weather. The supply chain is another factor that affects supply. Factors Affecting Demand Demand on the other hand is also affected by many factors. The common factors that affect demand are; The cost of a product, that is, the price at which the product will be purchased. The availability of other alternatives in the market. The importance of the product, whether it is an inferior good or otherwise. The price of complementary products. These and few others are factors that affect demand. Do Supply and Demand Only Affect Prices? The law of supply and demand is an economic theory that affects diverse economic principles and not just the concept of 'price.' For instance, supply and demand is an important gauge for measuring economic growth and it is important when calculating the gross domestic product (GDP) of a country for a particular time. The rate of employment and unemployed can also be determined. The law of demand and supply is also applicable to wages for labor, business growth, among others. Law of Demand The law of demand is one of the most fundamental concepts in economics. It works with the law of supply to explain how market economies allocate resources and determine the prices of goods and services that we observe in everyday transactions. The law of demand states that the quantity purchased varies inversely with price. In other words, the higher the price, the lower the quantity demanded. This occurs because of diminishing marginal utility. That is, consumers use the first units of an economic good they purchase to serve their most urgent needs first, and then they use each additional unit of the good to serve successively lower-valued ends. Understanding the Law of Demand Economics involves the study of how people use limited means to satisfy unlimited wants. The law of demand focuses on those unlimited wants. Naturally, people prioritize more urgent wants and needs over less urgent ones in their economic behavior, and this carries over into how people choose among the limited means available to them. For any economic good, the first unit of that good that a consumer gets their hands on will tend to be put to use to satisfy the most urgent need the consumer has that that good can satisfy. A market demand curve, is always downward-sloping, like the one shown in the chart below. Each point on the curve (A, B, C) reflects the quantity demanded (Q) at a given price (P). At point A, for example, the quantity demanded is low (Q1) and the price is high (P1). At higher prices, consumers demand less of the good, and at lower prices, they demand more. Factors Affecting Demand So what does change demand? The shape and position of the demand curve can be impacted by several factors. Rising incomes tend to increase demand for normal economic goods, as people are willing to spend more. The availability of close substitute products that compete with a given economic good will tend to reduce demand for that good, since they can satisfy the same kinds of consumer wants and needs. Conversely, the availability of closely complementary goods will tend to increase demand for an economic good, because the use of two goods together can be even more valuable to consumers than using them separately, like peanut butter and jelly. Other factors such as future expectations, changes in background environmental conditions, or changes in the actual or perceived quality of a good can change the demand curve because they alter the pattern of consumer preferences for how the good can be used and how urgently it is needed. The Law of Supply Supply is the total amount of a specific good or service that is available to consumers at a certain price point. As the supply of a product fluctuates, so does the demand, which directly affects the price of the product. The law of supply, then, is a microeconomic law stating that, all other factors being equal, as the price of a good or service rises, the quantity that suppliers offer will rise in turn (and vice versa). Ergo, when demand exceeds the available supply, the price of a product will typically rise. Conversely, should the supply of an item increase while the demand remains the same, the price will go down. Income Effect vs. Substitution Effect: An Overview The income effect expresses the impact of increased purchasing power on consumption, while the substitution effect describes how consumption is impacted by changing relative income and prices. These economic concepts concern changes in the market and how they impact consumption patterns for consumer goods and services. Different goods and services are affected by these changes in the market in different ways. Some products, called inferior goods, generally are purchased less whenever incomes increase. Consumer spending on normal goods typically increases with higher purchasing power, which is in contrast with inferior goods. Income Effect The income effect is the change in the consumption of goods based on income. This means consumers will generally spend more if they experience an increase in income. They may spend less if their income drops. The effect doesn't dictate the kinds of goods consumers will buy. They may opt to purchase more expensive goods in lesser quantities or cheaper goods in higher quantities, depending on their circumstances and preferences. The income effect can be both direct or indirect. When a consumer chooses to make changes to the way they spend because of a change in income, the income effect is said to be direct. For example, a consumer may choose to spend less on clothing because their income has dropped. An income effect becomes indirect when a consumer is faced with making buying choices because of factors not related to their income. For instance, food prices may go up, leaving the consumer with less income to spend on other items. This may force them to cut back on dining out, resulting in an indirect income effect. The marginal propensity to consume explains how consumers spend based on income. It is a concept based on the balance between the spending and saving habits of consumers. The marginal propensity to consume is included in a larger theory of macroeconomics known as Keynesian economics. The theory draws comparisons between production, individual income, and the tendency to spend more of it. Substitution Effect The substitution effect may occur when, due to a change in relative prices and finances, a consumer replaces one product with another. That might mean switching out cheaper or moderately priced items for ones that are more expensive. For example, a good return on an investment or other monetary gains may prompt a consumer to replace the older model of an expensive item for a newer one. The inverse is true when incomes decrease. Substitution in the direction of buying lower-priced items has a generally negative consequence on retailers because it means lower profits. It also may mean that there are fewer options for the consumer. While the substitution effect changes consumption patterns in favor of the more affordable alternative, even a modest reduction in price may make a more expensive product more attractive to consumers. For instance, if private college tuition is more expensive than public college tuition—and money is a concern—consumers will naturally be attracted to public colleges. But a small decrease in private tuition costs may be enough to motivate more students to begin attending private schools. The substitution effect is not limited to consumers. When companies outsource part of their operations, they are demonstrating the substitution effect. Using cheaper labor in a different country or by hiring a third party results in a drop in costs. This nets a positive result for the corporation, but a negative effect for the employees who may be replaced. Key Differences The income effect concerns change in demand for a product due to change in income relative to market prices (purchasing power). The substitution effect concerns change in demand for a product due to a relative change in prices and the availability of substitutable products. In circumstances where prices rise in a market with few products (substitutions), the income effect may have the larger impact. Consumers may decide to stop buying a product altogether. On the other hand, in circumstances where prices rise for products and a market has multiple substitution options available, the substitution effect may have the larger impact. Consumers can choose to buy a similar product that's more affordable. What Is the Substitution Effect? The substitution effect is an economic concept that involves the substitution of one product for another when there's a change in their relative pricing. What Occurs Simultaneously With an Income Effect? The income effect involves a change in purchasing power and a change in demand or consumption. So, for instance, if purchasing power decreases, demand for a product usually decreases. What Is the Substitution Effect of a Price Change? When the price of a product rises relative to alternative products in the same market, consumers will substitute one of the lower priced alternatives for the now higher priced product. Elasticity Elasticity is a measure of a variable's sensitivity to a change in another variable, most commonly this sensitivity is the change in quantity demanded relative to changes in other factors, such as price. In business and economics, price elasticity refers to the degree to which individuals, consumers, or producers change their demand or the amount supplied in response to price or income changes. It is predominantly used to assess the change in consumer demand as a result of a change in a good or service's price. How Elasticity Works When the value of elasticity is greater than 1.0, it suggests that the demand for the good or service is more than proportionally affected by the change in its price. A value that is less than 1.0 suggests that the demand is relatively insensitive to price, or inelastic. Inelastic means that when the price goes up, consumers’ buying habits stay about the same, and when the price goes down, consumers’ buying habits also remain unchanged. If elasticity = 0, then it is said to be 'perfectly' inelastic, meaning its demand will remain unchanged at any price. There are probably no real-world examples of perfectly inelastic goods. If there were, that means producers and suppliers would be able to charge whatever they felt like and consumers would still need to buy them. The only thing close to a perfectly inelastic good would be air and water, which no one controls. Elasticity is an economic concept used to measure the change in the aggregate quantity demanded of a good or service in relation to price movements of that good or service. A product is considered to be elastic if the quantity demand of the product changes more than proportionally when its price increases or decreases. Conversely, a product is considered to be inelastic if the quantity demand of the product changes very little when its price fluctuates. For example, insulin is a product that is highly inelastic. For people with diabetes who need insulin, the demand is so great that price increases have very little effect on the quantity demanded. Price decreases also do not affect the quantity demanded; most of those who need insulin aren't holding out for a lower price and are already making purchases. On the other side of the equation are highly elastic products. Spa days, for example, are highly elastic in that they aren't a necessary good, and an increase in the price of trips to the spa will lead to a greater proportion decline in the demand for such services. Conversely, a decrease in the price will lead to a greater than proportional increase in demand for spa treatments. Types of Elasticity Elasticity of Demand The quantity demanded of a good or service depends on multiple factors, such as price, income, and preference. Whenever there is a change in these variables, it causes a change in the quantity demanded of the good or service. Price elasticity of demand is an economic measure of the sensitivity of demand relative to a change in price. The measure of the change in the quantity demanded due to the change in the price of a good or service is known as price elasticity of demand. Income Elasticity Income elasticity of demand refers to the sensitivity of the quantity demanded for a certain good to a change in real income of consumers who buy this good, keeping all other things constant. The formula for calculating income elasticity of demand is the percent change in quantity demanded divided by the percent change in income. With income elasticity of demand, you can tell if a particular good represents a necessity or a luxury. Cross Elasticity The cross elasticity of demand is an economic concept that measures the responsiveness in the quantity demanded of one good when the price for another good changes. Also called cross-price elasticity of demand, this measurement is calculated by taking the percentage change in the quantity demanded of one good and dividing it by the percentage change in the price of the other good. Price Elasticity of Supply Price elasticity of supply measures the responsiveness to the supply of a good or service after a change in its market price. According to basic economic theory, the supply of a good will increase when its price rises. Conversely, the supply of a good will decrease when its price decreases. Factors Affecting Demand Elasticity There are three main factors that influence a good’s price elasticity of demand. Availability of Substitutes In general, the more good substitutes there are, the more elastic the demand will be. For example, if the price of a cup of coffee went up by $0.25, consumers might replace their morning caffeine fix with a cup of strong tea. This means that coffee is an elastic good because a small increase in price will cause a large decrease in demand as consumers start buying more tea instead of coffee. However, if the price of caffeine itself were to go up, we would probably see little change in the consumption of coffee or tea because there may be few good substitutes for caffeine. Most people, in this case, might not willingly give up their morning cup of caffeine no matter what the price. We would say, therefore, that caffeine is an inelastic product. While a specific product within an industry can be elastic due to the availability of substitutes, an entire industry itself tends to be inelastic. Usually, unique goods such as diamonds are inelastic because they have few if any substitutes. Necessity As we saw above, if something is needed for survival or comfort, people will continue to pay higher prices for it. For example, people need to get to work or drive for a number of reasons. Therefore, even if the price of gas doubles or even triples, people will still need to fill up their tanks. Time The third influential factor is time. For instance, if the price of cigarettes goes up to $2 per pack, someone with a nicotine addiction with very few available substitutes will most likely continue buying their daily cigarettes. This means that tobacco is inelastic because the change in price will not have a significant influence on the quantity demanded. However, if that person who smokes cigarettes finds that they cannot afford to spend the extra $2 per day and begins to kick the habit over a period of time, the price of cigarettes for that consumer becomes elastic in the long run. The Importance of Price Elasticity in Business Understanding whether or not the goods or services of a business are elastic is integral to the success of the company. Companies with high elasticity ultimately compete with other businesses on price and are required to have a high volume of sales transactions to remain solvent. Firms that are inelastic, on the other hand, have goods and services that are must-haves and enjoy the luxury of setting higher prices. Beyond prices, the elasticity of a good or service directly affects the customer retention rates of a company. Businesses often strive to sell goods or services that have inelastic demand; doing so means that customers will remain loyal and continue to purchase the good or service even in the face of a price increase. Examples of Elasticity There are a number of real-world examples of elasticity we interact with on a daily basis. One interesting modern-day example of the price elasticity of demand many people take part in even if they don't realize it is the case of Uber's surge pricing. As you might know, Uber uses a "surge pricing" algorithm during times when there is an above-average amount of users requesting rides in the same geographic area. The company applies a price multiplier which allows Uber to equilibrate supply and demand in real-time. The COVID-19 pandemic has also shone a spotlight on the price elasticity of demand through its impact on a number of industries. For example, a number of outbreaks of the coronavirus in meat processing facilities across the US, in addition to the slowdown in international trade, led to a domestic meat shortage, causing import prices to rise 16% in May 2020, the largest increase on record since 1993. Another extraordinary example of COVID-19's impact on elasticity arose in the oil industry. Although oil is generally very inelastic, meaning demand has a little impact on the price per barrel, because of a historic drop in global demand for oil during March and April, along with increased supply and a shortage of storage space, on April 20, 2020, crude petroleum actually traded at a negative price in the intraday futures market. In response to this dramatic drop in demand, OPEC+ members elected to cut production by 9.7 million barrels per day through the end of June, the largest production cut ever.