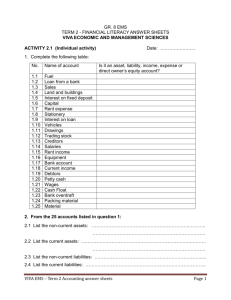

NAME: _______________ CLASS: 9____ GRADE 9 EMS ACCOUNTING BOOKLET 2023 INDEX: 1. NOTES: • • • • • • • Accounting Theory Accounting cycle Accounting Equation Cash Receipts Journal Cash Payments Journal General Ledger Debtors Journal, Debtors Allowance Journal and Debtors Ledger • Creditors Journal, Creditors Allowance Journal and Creditors Ledger • Trial Balance 2. ACTIVITIES ACCOUNTING THEORY ASSETS • • • Owned by the business and has value and can be converted into cash. Non-current / Fixed-Assets: help the business make money and aren’t exchanged for money • Land and buildings • Vehicles • Equipment Current assets: items that can be converted into cash • Trading stock • Amount owing by customers (debtors) • Money in bank • Cash in register • Petty cash OWNER’S EQUITY • Amount the business owes the owner • OE increases when business receives money and vice versa • All income and expenses classified as OE LIABILITIES • Non-current • Mortgage bond • Loans • Current • Money owed by the business to other businesses (creditors • Bank overdraft 1 ACCOUNTING CYCLE 1.Transactions Financial Statements 2. Source Document Trial Balance 3. Subsidiary journals General Ledger GOODS AND SERVICES Sell products/merchandise/trading stock = SALES Offer a service for money = CURRENT INCOME 2 ACCOUNTING EQUATION A = OE + L A: Assets O: Owner’s Equity L: Liabilities SOURCE DOCUMENTS Proof that a payment was made to/by the business If the business RECEIVES money, it goes into the CRJ (Cash Receipts Journal) If the business PAYS money, it goes into the CPJ (Cash Payments Journal) Cash Sales / Cash Register Debit/Credit Card EFT / Internet banking / Directly into bank account Interest Loan Deposited money at the bank CRJ (Received Money) Cash Register Roll (CRR) Cash Register Roll (CRR) CPJ (Paid Money) Cash Register Roll (CRR) Cash Register Roll (CRR) Bank Statement (B/S) Bank Statement (B/S) Bank Statement (B/S) Bank Statement (B/S) Bank Statement (B/S) Bank Statement (B/S) Receipt (REC) Deposit Slip 3 JOURNALS All journals get posted to the ledgers at the end of the month. CRJ, CPJ, DJ, DAJ, CJ, CAJ Cash Receipts Journal [CRJ] 1. Identify the business name. You are the accountant for the business, and for what month you doing the books for. Is it a service business or a Trading business ? 2. In every transaction there are trigger words for the entries in the CRJ e.g. received cash, issued original receipt/cash slip [CRR] 3. Money coming in. 3. 4. 5. Which TWO accounts are affected. If no column it goes to sundry account. Source Document: • number in numerical order. e.g. Receipt or CRR [ Cash Register Roll, CRR for cash sales. Receipt if you require name of who paid you. • EFT or B/S for direct deposit in your account. • When dealing with Services Rendered according to the cash register roll, then the Doc Number is always CRR. 6. Analysis of receipts: • Money received through the till. • Holding spot for the day. • Always underline Analysis of Receipts after the last transaction for that date[day]. • Never total the Analysis of Receipts column. It’s the “till”. It is emptied every day so at the end of the month there isn’t the whole month amount of money in there 7. Details: • When you receive money for services rendered, you write ‘Services Rendered’ in details and record the amount in the Current Income column. [GRADE8] • When you receive a EFT OR payment via internet banking, you will record the name of the person in details. • If it’s a Trading business than in details you write sales and record the amount in the Sales and Cost of Sales columns. 8. Write the total amount of money DEPOSITED for the day in Bank. 9. Clues for CRJ: Received a EFT/issued a receipt/cash received. 10. Always record each transaction in two columns due to the double entry system. 11. At the end of the month total all the columns. All the columns should equal up to the Bank, excluding Cost of Sales. BANK TOTAL = SALES+ DEBTORS CONTROL+ SUNDRY ACCOUNT [ALWAYS EXCLUDE: COST OF SALES] 4 CALCULATION 100 CP = SP X (100+𝑚𝑢) CP = Cost Price (Cost of Sales) SP = CP X MU = SP = Selling Price (100+𝑀𝑈) (𝑆𝑃−𝐶𝑃) 𝐶𝑃 100 MU = Mark up (%) X 100 Link between Cost price, Cost of Sales and gross profit: Cost of sales [CP] + [ Mark Up [MU] Sales - Cost of Sales = Gross Profit e.g. = SELLING PRICE [SP] make up 25% No. Selling Price (in Rands) A 4 500 B Cost Price (in Rants) 45% 5 000 C 12 000 D 11 000 E 130% F 8 500 7 000 G 500 320 H 480 750 K 6800 L M 28% 500 120% 6 750 1 500 360% 10% 900 J 15% 4 000 120 I Mark Up 200% 500 5 CASH RECEIPTS JOURNAL OF KYLIE’S SALON FOR MARCH 2017 DOC DAY DETAILS F O L ANALYSIS OF RECEIPT BANK SALES COST OF SALES [SP] B/S 2 CRR 5 CRR 7 REC3 Kylie Sales SALES L.FOURIE 2000 1200 500 50 000 2000 1700 53 700 DEBTORS CONTROL SUNDRY FOL ACCOUNTS Amount Details 50 000 Capital [CP] 2000 1200 1600 960 3 200 500 2560 500 50 000 Cash Payments Journal [CPJ] 1. Source Document: “is what you holding in your hand when you record a payment we have made?” E.G: BANK STATEMENT, Via internet banking If the transaction states it was directly deposited or paid via EFT then source document is Bank Statement- B/S. 2. Name of Payee: “who did you pay look at the beneficiary list on your bank statement that is whose name of payee 3. Bank column amount in CPJ is the same amount you paid from bank account. You only record the actual amount at the bottom of the bank account the total amount. 4. Wages is paid in cash there for you write cash as the document you will be looking at to pay wages is a bank statement and it will have a cash withdrawal from it. To pay in cash the business draws cash from the ATM to pay the wages, therefore the bank statement is the source document and it will say cash withdrawal. CASH PAYMENTS JOURNAL OF KYLIE’S SALON FOR MARCH 2017 DOC D Name FOL BANK TRADING STATIONTERY A Of STOCK Y Payee B/S CC01 CC02 B/S 2 Nail Supplier 5 Game 8 Telkom SA Ltd 12 Makro CREDITORS CONTROL SUNDRY FOL ACCOUNTS Amount Details 2000 300 Equipment Telephone 4000 4000 2500 300 500 500 7300 4000 500 500 500 2300 6 GENERAL LEDGER ORDER FOR THE GENERAL LEDGER BALANCE SHEET ACCOUNT SECTION OWNERS EQUITY B1- CAPITAL B2- DRAWINGS FIXED ASSET B3- LAND AND BUILDING B4- VEHICLES B5- EQUIPMENT CURRENT ASSETS B6- TRADING STOCK B7- DEBTORS CONTROL B8- BANK B9- CASH FLOAT B10- PETTY CASH NON CURRENT LIABILITY B11 – LOAN CURRENT LIABILITY B12- CREDITORS CONTROL B13- BANK “OVERDRAFT” NOMINAL SHEET ACCOUNT SECTION INCOME N1- CURRENT INCOME OR SALES N2- COST OF SALES N3- OTHER INCOME N4- DEBTORS ALLOWANCE EXPENSES N5- IN ALPHABETICAL ORDER 7 Owners’ Equity Assets Current Trading Stock Money owed by customers (debtors) Money in bank account Cash in cash register Petty Cash Non-current / Fixed Land and Buildings Vehicles Equipment Liabilities Current Total investment the owner has in the business Money business owes to other businesses (creditors) Overdraft Non-current Bond / Mortgage Loan DEBIT D CREDIT Debtors Money is owed to the business from a person who buys on account/credit (Affects a business’s liabilities) E Expenses Rent expense Electricity Water Stationery Salary A D L Personal Use eg. Owner takes trading stock for personal use. Liabilities Bond / Mortgage Loan I Income Current Income Sales Rent Income Interest Received Vehicle Land & Buildings Computers Drawings Creditors Business owes money to another business that was bought on credit (Affects a business’s liabilities) Wages Maintenance Repairs Interest Paid Consumables Assets Bank Equipment Trading Stock Machinery C C Capital Money used to start/maintain a business 8 GENERAL LEDGERS [GL]: 1. For every DEBIT there is a CREDIT and for every CREDIT there is a DEBIT. Trading Business: e.g. Aunty Monty sells chips R 10 [SP] at the heart. [ CP R5] [ you are the accountant for The Heart] The heart’s [Asset] Trading Stock [CHIPS] decreases [credit side] The heart’s [Asset] Bank [MONEY] increases [debit side]. Dr Bank Cr Dr Sales R10 D E A D C L I C Cr R10 DR Trading Stock CR R5 DR Cost of Sales CR R5 2. Remember when posting from Journals to General Ledger indicate in the FOL column in the Journals where you are posting that information too. 3. To add the correct FOL in the General Ledger where are you getting the info from- which journal. CRJ, CPJ, DJ, CJ 4. If the business is a new business [1st month of operation] all journals are 1. e.g. CRJ1, CPJ1, DJ1 and CJ1 OR If the business has been running for more than one month [ you will know this if there are balances from the month before.] Then you can make it any number more than 1 unless its stipulates how many months the business has been running or If not given. e.g. CRJ3, CPJ3, DJ3 and CJ3 5. Steps in recording accounting transactions: • Record opening balances and totals from previous months Trial Balance or opening balances and totals that are given? [only if the business has been open for more than 1 month.] N.B: use DEAD CLIC to determine which side to record balances and totals B accounts “1 Balance b/d” N accounts “ 1 Total b/d” • Read the Transaction! - Determine the TWO Accounts. CASH or CREDIT transaction? If cash then BANK account. 9 - If credit then DEBTOR or CREDITOR replaces Bank. CATEGORISE the TWO accounts: USING DEAD CLIC Has the account & category INCREASED or DECREASED? Refer to the DR CR TABLE to decide whether to debit or credit the TWO accounts. For every DEBIT ENTRY there is an equal & corresponding CREDIT ENTRY. BALANCING • ONLY Balance The balance sheet account section • Once you have posted all information from the journals to the right accounts then you can balance. • C/D AND B/D are always on the opposite side from step 5 and step 6 EXAMPLE:Vehicle R 45 000 -31st March 2016 Vehicle bought by cheque on the -10th April 2016 R85 000 Vehicle sold at cost price on the -20th April 2016 R35 000 Balance for April 2016 Vehicle is an asset. [INCREASE ON DEBIT SIDE AND DECREASES CREDIT SIDE] STEP 1: PLOT ALL INFORMATION [ LOOK - OPENING BALANCES & LOOK AT ALL JOURNALS] Dr Cr A+ VEHICLE A- B4 STEP 2: WHICH SIDE IS BIGGER? THEN TOTAL THAT SIDE. Dr Cr 2016 1 APRIL 10 VEHICLE BALANCE BANK B/D 45 000 CPJ2 85 000 2016 20 APRIL B4 BANK CRJ 2 35 000 10 STEP 3: MAKE THE OTHER SIDE EQUAL DOES NOT EQUAL MAKE IT EQUAL Total minus what you have] Dr Cr 2016 1 APRIL 10 VEHICLE BALANCE BANK B/D CPJ2 45 000 2016 20 APRIL B4 BANK CRJ 2 35 000 85 000 130 000 STEP 4: IT DOES NOT EQUAL THE TOTAL SO MAKE THE OTHER SIDE EQUAL Dr Cr 2016 1 APRIL 10 VEHICLE BALANCE BANK B/D 45 000 CPJ2 85 000 2016 20 APRIL B4 BANK CRJ 2 130 000 35 000 130 000 STEP 5: MAKE THE OTHER SIDE EQUAL [ ALWAYS C/D TO END OF MONTH] Dr Cr 2016 1 APRIL 10 VEHICLE BALANCE BANK 2016 20 APRIL B4 B/D 45 000 BANK CRJ 2 35 000 CPJ2 85 000 95 000 130 000 130 000 STEP 6: BRING THE AMOUNT FORWARD TO THE NEW MONTH [ALWAYS B/D TO THE NEW MONTH Dr Cr VEHICLE B4 2016 1 APRIL 10 BALANCE BANK B/D 45 000 CPJ2 85 000 2016 20 APRIL 30 BANK CRJ 2 35 000 BALANCE C/D 95 000 130 000 130 000 11 NOMINAL SHEET ACCOUNT SECTION Dr Cr 2016 APRIL Cost of Sales 12 16 TRADING CRJ2 STOCK TRADING DJ 2 5 000 8 000 13 000 In the Nominal Account Section write total in pencil as it’s a running total. N2 12 BIG 5 2O18 MARCH 1 BALANCE 31 BANK B/D CPJ 4 1 B/D TRADING STOCK 2018 2000 MARCH 15000 B6 31 COST OF SALES 31 COST OF SALES 31 BALANCE CRJ 4 DJ4 C/D 17 000 APRI L 2018 MARCH APRIL DATE 2018 MARCH BALANCE 1 BALANCE 31 SALES 1 BALANCE DAY DETAILS 1 BALANCE 31 TOTAL RECEI PTS B/D DJ4 B/D FOLS B/D CRJ 4 17 000 11 000 DEBTORS CONTROL 2018 10 000 MARCH 15000 25 000 17 000 BANK AMOUNT DATE 2018 40 000 MARCH 60 000 B7 31 BANK 31 BALANCE DAY DETAILS 31 TOTAL Payments 31 balance CRJ 4 C/D B8 FOL cpj4 c/d 100 000 APRI L 2018 MARCH 1 BALANCE 31 BANK 31 BALANCE B/D CPJ 4 C/D CREDITORS CONTROL 2018 5000 MARCH 1 BALANCE 45 000 31 TOTAL PURCHASES 20000 80 000 B12 B/D CJ4 3000 4000 2000 9 000 20000 30000 50 000 COST OF SALES B/D CRJ4 DJ4 AMOUNT 80 000 APRI L 1 BALANCE 31 TRADI NG STOCK 31 TRADI NG STOCK 8000 17000 25 000 100 000 50 000 2018 MARCH 4000 2000 11 000 1 BALANCE B/D N2 45 000 DEBTORS 13 DEBTORS JOURNAL [DJ] 1. When customers are allowed to buy on credit- CAN’T go in to CRJ it must go into the DJ as money hasn’t been received. 2. Source Document: a [Credit] Invoice. TRANSACTION: 6 D.Loubser came in to Kylie’s Salon and bought goods on credit for R3000, I 55 was issued. 10 D Wallace purchased stock from Kylie’s salon & put it on her account. Issued I56. 6. Kylie’s Salon has 25% mark-up on cost. DEBTORS JOURNAL OF KYLIE’S SALON DOC DAY DETAILS FOL SALES COST OF SALE I 55 6 D. Loubser D1 3000 2400 I 56 10 D. Wallace D2 3800 3040 DEBTORS ALLOWANCES JOURNAL [DAJ] 1. Debtor returns goods to supplier [the customer is not happy with the product they received] 2. Source Document: duplicate Credit Note TRANSACTION: D.Loubser was unhappy with the quality of item there for she returned the item to Kylie’s Salon. Debtors allowance journal of Kylie’s Salon DOC DAY DETAILS FOL DEBTORS COST OF ALLOWANCES SALES CN 5 15 D. Loubser 1000 800 DEBTORS LEDGERS [DL] 1. Working out how much each Debtor is still in debt to the company. 2. The business still has R5 300 worth of assets outstanding from debtors. [1500 +3 800] [customers who owe them money] CREDITORS 14 CREDITORS JOURNAL [CJ] 1. Used for items you [ the business] buy on credit from another business. 2. The bank column is replaced by Creditors control as no money was PAID. 3. Total amount of invoice your Business has received is in the creditors control column. 4. Source Document: Original Invoice received. TRANSACTION: Kylie went to Makro and bought on account: stock for R4 500, Consumables R1 000 and a chair for R 1000. CREDITORS JOURNAL OF KYLIE’S SALON FOR MARCH 2017 DO C DA Y DETAIL S I 03 10 Makro FO L CJ1 CREDITOR S CONTROL TRADIN G STOCK CONSUMABLE S SUNDR Y 6 500 4 500 1000 1000 FO L DETAILS Equipmen t CREDITORS ALLOWANCES JOURNAL [CAJ] DEBTORS LEDGER OF KYLIE’S SALON FOR MAY 20.17 D. LOUBSER DAY DETAILS FOL DEBIT 6 Invoice 55 DJ1 3000 10 Receipt 9 CRJ1 15 Credit Note 5 DAJ1 D. Wallace DAY DETAILS FOL DEBIT 6 Invoice 56 DJ1 3800 CREDIT 1500 1000 CREDIT D1 BALANCE 3000 1500 500 D2 BALANCE 3800 1. The value of goods returned to the supplier due to a number of reasons. This reduces the total amount owed to the creditors. 2. Source Document: Duplicate Debit Note TRANSACTION: Kylie was happy with the chair from Makro therefore she returned it the chair to Makro. CREDITORS ALLOWANCE JOURNAL OF KYLIE’S SALON FOR MARCH 2017 DO C DA Y DETAIL S DN 3 15 Makro FO L CREDITOR S CONTROL TRADIN G STOCK CONSUMABLE S 1000 SUNDR Y 1000 FO L DETAILS Equipmen t CREDITORS LEDGER [CL] 1. CL –What your business buys on credit from another business. 2. The bank column is replaced by creditors control as no money was received. CREDITORS LEDGER OF KYLIE’S SALOON DATE 2017 MAR DETAILS MAKRO FOL DEBIT CREDIT 6500 BALANCE 6500 10 MAKRO CJ1 15 MAKRO CAJ1 1000 5500 20 MAKRO CPJ1 1500 5000 th 3. On the 20 March you paid Makro R1500 back therefore, your business still owes R4000 to Makro at the end of March 2017. 15 TRIAL BALANCE 1. 2. 3. 4. Summary of the accounts balances in the General Ledger. Accuracy of the double entry system is tested by doing a Trial Balance The total of the debits should equal the credits Only done at the end of the month. TRIAL BALANCE OF KYLIE SALON ON 31 MARCH 2017 BALANCE SHEET ACCOUNT SECTION OWNERS EQUITY CAPITAL DRAWINGS FIXED ASSETS LAND AND BUILDING VEHICLES FURNITURE EQUIPMENT CURRENT ASSETS TRADING STOCK DEBTORS BANK FOL B1 B2 B3 B4 B5 B6 B7 B8 B9 DEBIT CREDIT FIXED LIABILITY LONG TERM LOAN CURRENT LIABILITY CREDITORS B10 B11 NOMINAL ACCOUNT SECTION SALES COST OF SALES DISCOUNT RECEIVED COMMISSION INCOME RENT INCOME EXPENSES ALPHEBETICAL ORDER N1 N2 N3 N4 N5 N6- PROFITS = INCOME – EXPENSES SALES- COST OF SALES= GROSS PROFIT GROSS PROFIT + OTHER INCOME – ALL OTHER EXPENSES= NET PROFIT 16 ACTIVITIES ACTIVITY 1: Transaction Source document Subsidiary Journal [book of 1st entry] Cash received by us [other than for Sales] Cash Sales Credit sales Credit Purchase EFT issued by you Goods returned by us Goods returned to us ACTIVITY 2: CASH SALES RECORDED IN CRJ TRADING BUSINESS COST PRICE + MARK UP = SELLINGPRICE COST OF SALES (R) = SALES [R] X 100 / (100 + MU) SALES [R] = COST OF SALES [R] X [100 + MU] / 100 Fill in the missing blocks AMY STORES MU ON CP IS 100% WADE STORES MU ON CP IS 50 % SALES COST OF SALES 2000 SALES 1 000 COST OF SALES 6 000 500 2 400 300 300 ALVIN STORES MU ON CP IS 33 1/3% DAISY STORES MU ON CP IS 25 % SALES COST OF SALES SALES COST OF SALES 2 400 6 000 4 000 500 300 MU ON CP IS 33 1/3 % 100/133 1/3 OR 3/4 300 MU ON CP IS 100 % MU ON CP % IS 25 % MU ON CP IS 50 % 100/200 OR ½ 100/125 OR 4/5 100/150 OR 2/3 17 ACTIVITY 3: Working out Mark UP FORMULA:[SP-CP=MU] MU/CPX 100 1. John Deer brought trading stock for the business each item was bought at R450 and sold at R720. Work out John Deer’s mark up. 2. Jimmy Choo bought the latest shoes for R230 and decided to sell the shoes for R900. Work out Jimmy Choo Mark-up. 3. Mr Fourie sells Bar-one chocolates at the girls waterpolo tournament for R11 he bought it from Makro for R8. Work out Mr Fourie’s Mark-up per chocolate. 4. Bought goods for R400 & sold these same goods for R600. ANSWER SPACE: 1.___________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ 2.___________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ 3.___________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ 4.___________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ 18 ACTIVITY 4: Transactions of Saulse Dry Cleaners, owner Peter Saulse INSTRUCTIONS: (a) Show the effect of each of the transactions on assets and/or owner’s equity. Use a + to show an increase and a – to show a decrease. Give the amount concerned and a reason in each case (b) Prepare a cumulative summary of the assets and owner’s equity after each transaction. (c) Calculate the total income. (d) Calculate the total expenses. (e) Calculate the profit. 1 P.Saulse started a business, Saulse Dry Cleaners, by depositing R150 000 in the current bank account of the business; issued receipt 01 2 Paid the local newspaper, Indaba, for advertising; PAID VIA EFT, R400 3 Rented floor space from Fisher Properties; paid by internet banking R1000 4 Bought delivery vehicle from Reeston Motors; paid by EFT, R120 000 5 Bought stationary from CA stores; paid by EFT 004, R370 6 Paid via internet banking R3 500 to MM Distributors for cleaning materials bought 7 Cash received for services rendered, cash register roll, R6 450 8 Paid telephone account to Telkom by EFT, R360 9 Paid by internet banking to Mapede Traders for equipment bought, R15 000 10 Paid Council R 600 by EFT for water and electricity 11 Drew cash from the ATM to pay employees R1 800; for wages 12 Bought motorcycle for local delivery from Restion Motors; paid by EFT, R15 000 A Assets = Owners + Equity Liability Debit Credit 1 2 3 4 5 6 7 8 9 10 11 12 19 b.___Summary:______________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ c.___________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ d.___________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ e.___________________________________________________________________________________ _____________________________________________________________________________________ ACTIVITY 5: AOL Read the transactions and then Record the entries in the table below. Record the amounts and whether it is + or Ex: Issued a cheque to pay wages, R3 000. 1. The owner paid his son’s university fees by EFT, R5 000. 2. Paid via internet banking to pay the business telephone a/c, R1 000. 3. Sold goods for cash to Amy, R400. (Mark up on Cost price is 33 1/3%) 4. Bought a truck from Ford and paid by EFT for R40 000. 5. Received R20 000 from Nedbank as a loan directly into the bank a/c. 6. Received R200 from a tenant to settle his rent of the business store room. 7. Bought merchandise from Amy Stores for R7 000, paid by EFT. 8. Sold goods on credit to Gavin for R2 400. ( Mark up on Cost price is 50%) 9. Bought inventory on credit from Jenny Suppliers for R3000. NO Source Document JNL Ex CC CPJ A/C DEBIT in GL WAGES E + O- A/C CREDIT in GL A= BANK - A- 3 000 O+ -3 000 L 0 1 2 3 3 4 5 20 ACTIVITY 6: AOL Study the given transactions and complete the accounting equation. Note: The bank has a favourable balance. Example: Received R2 500 for the rental of a storage room. Issued receipt 005. 1. 2. 3. 4. Bought equipment on credit from TJ Wholesalers, R27 000. Paid via EFT to repay a R3 000 loan from ABSA Bank. Drew cash from the ATM to pay employees wages, R 5 500. The owner took R300 from the business account to pay for his child Joe’s birthday cake. 5. Received R3250 for sales. Mark up is 35%. 6. Received R7500 for rent. NO Source Document JNL A/C DEBIT in GL Ex CC CPJ WAGES E + O- A/C CREDIT in GL BANK A- A= - 3 000 O+ L -3 000 0 1 2 3 4 5 6 21 ACTIVITY 7: AOL SpongeBob owns a bakery called Krusty Cakes. Enter the transactions into the table below. 1. He pays R120 000 into the business as capital contribution. 2. Purchased stock worth R350. 3. He took out a loan worth R35 000. 4. Bought a fancy new mixer to the value of R12 000. 5. Paid Mr Krabs his salary of R4 500. 6. Sold stock worth R1 000 (cost price R800) 7. Bought stationery to the value of R140. 8. Received R1 400 for rent of property. 9. Received R300 for services rendered. 10. Sold cakes worth R8 000 (cost price R3 800) ACCOUNT DEBIT ACCOUNT CREDIT A OE L 1 2 3 4 5 6 7 8 9 10 22 Activity 8: AOL Enter the transactions into the table below. a) K. Ruby deposited R15 000 directly into the business as capital contribution. b) The business made R700 from services rendered. Customer paid cash. c) Paid off a loan to the amount of R400. d) Paid wages to the workers to the value of R15 000. Paid via EFT. e) Took Trading stock to the value of R6 500 for personal use. f) Received a new loan to the value of R10 000. Steps: 1. Identify the two accounts 2. Identify the asset 3. Is the asset going up (debit) or down (credit) 4. Fill the asset into the correct account column (Debit OR Credit) 5. Fill in the other account column 6. Fill in the asset column (asset going up +, asset going down -) 7. The other account, which column does it belong in? A? L? OE? g) Paid R200 to the municipality for electricity via internet banking. h) Paid R8 800 for merchandise (cost of sales R6000). i) Received R600 for offering a service. Customer paid with debit card j) Received R1 000 cash for merchandise sold at his shop. k) Bought equipment worth R3 000 and paid via EFT. Journal Source Account Account Asset OE Liabilities Document DEBIT CREDIT a b c d e f g h i j k 23 ACTIVITY 9: AOL a) J Harris, owner of Heartfelt Clothing, deposited R20 000 Steps: 8. Identify the two accounts directly into the bank account as her capital contribution. 9. Identify the asset b) Cash sales on trading stock worth R800 (cost of sales R320) 10. Is the asset going up (debit) or down (credit) c) Paid R9000 for rent via EFT. 11. Fill the asset into the correct d) Paid wages to staff via EFT worth R9 500. account column (Debit OR Credit) e) Sales of clothing worth R900. Customer paid my debit 12. Fill in the other account card. column f) Paid R2150 to the municipality for electricity via internet 13. Fill in the asset column (asset going up +, asset banking going down -) g) Bought equipment for R8600 via EFT. 14. The other account, which column does it belong in? h) Sold trading stock to the value of R750 (cost of sales R300) A? L? OE? i) Received R1600 for rent of a store room. Received payment via EFT. j) J Harris took trading stock worth R240 for personal use. k) Bought stationery worth R475 and paid via internet banking. l) Services rendered to the value of R900. Customer paid by credit card. Journal Source Document Account DEBIT Account CREDIT Assets Owner’s Equity Liabilities a) b) c) d) e) f) g) h) i) j) k) l) 24 ACTIVITY 10: CRJ & CPJ Enter the following transactions into the Cash Receipts Journal and the Cash Payment Journal for Steers in Humewood for month end August 2.21. Mark-up is 40% All columns should be added up and the totals should be written down in each column at the end of the month. Make sure that all columns balance at the end of the month. CRJ: Analysis of receipts, Bank, Current Income, Sundry Account CPJ: Bank, Equipment, Trading Stock, Wages, Sundry Account Transactions for August 2.19 1 L Kondile, the owner, deposited R100 000 into the bank account of the business as his capital contribution. The business issued him with receipt 78. L Kondile paid the owner of the building, S Reid, R4 000 for rental of the building and paid via EFT. Purchased consumables from Makro via EFT, R12 000. According to the Cash Register Roll, the business received R59 000 for sales. Mr J Cooper paid the business R31 500 for services rendered. Paid via EFT. 10 Paid Core Suppliers for equipment purchased. Paid R2 300 via EFT. Paid Finn Cash & Carry for consumable purchased for the shop for R5 000 via credit card. Paid Waltons for stationery purchased and paid R500. Paid via internet banking. 16 Paid wages of R6 000 in cash. 19 Cash Sales R28 000. L Kondile invested another R65 000 as part of his capital contribution and the business issued him with a receipt. 24 Cash sales of R42 000. Purchased consumables from G Rogers for R60 000 and paid via debit card. 29 Paid cash for wages of R6 000. Paid the manager, P Dube, his salary of R9 000 via EFT. 25 Cash Receipts Journal of _______________________________________________________ SUNDRY ACCOUNTS ANALYSIS DOC. DAY DETAILS OF FOL. RECEIPTS BANK COST OF SALES SALES AMOUNT FOL. DETAILS Cash Payments Journal of _____________________________________________________ SUNDRY ACCOUNTS NAME OF DOC. DAY PAYEE FOL. BANK AMOUNT FOL. DETAILS 26 ACTIVITY 11: GL & TRIAL BALANCE Take the CRJ and CPJ totals from the CRJ and CPJ for Steers Humewood and post them to the General Ledger GENERAL LEDGER OF STEER HUMEWOOD FOR AUGUST 2021 BALANCE SHEET ACCOUNT SECTION DATE DAY DETAILS FOL AMOUNT DATE DAY DETAILS FOL AMOUNT 27 GENERAL LEDGER OF STEER HUMEWOOD FOR AUGUST 2021 NOMINAL SHEET ACCOUNT SECTION DATE DAY DETAILS FOL AMOUNT DATE DAY DETAILS FOL AMOUNT 28 ACTIVITY 12: CRJ & CPJ Enter the following transactions into the Cash Receipts Journal and the Cash Payment Journal for Mr Price Sport for month end December 2.21. Mark-up is 70% All columns should be added up and the totals should be written down in each column at the end of the month. Make sure that all columns balance at the end of the month. CRJ: Analysis of receipts, Bank, Current Income, Sundry Account CPJ: Bank, Equipment, Stationery, Salary, Sundry Account Transactions for December 2.19 1 R Andrews, the owner, deposited R500 000 into the bank account of the business as his capital contribution. Issued receipt 01. The owner, R Andrews, paid the owner of the building, M Grey, R7 000 for rental of part of the building and paid via EFT. Purchased stationery from CNA. Paid R85 000 via EFT. 6 According to the Cash Register Roll, the business received R60 000 for sales. L Meyer paid cash to the business R1 200 for sales. 10 Paid Shop4U for equipment purchased totalling R8 500 via EFT. Paid S Daniels her salary of R20 000. Paid via EFT. Paid R Stevens for materials purchased and paid R100 000 via EFT. 16 Paid wages of R70 000 via EFT 19 Cash Sales of R56 000. R Andrews invested another R250 000 as part of his capital contribution and the business issued him with a receipt. 24 Fees received for sales, according to the Cash Register Roll, totalled R22 000. Paid the manager, A Jackson, his salary of R30 000 and paid via EFT. 29 Cash Receipts Journal of _______________________________________________________ SUNDRY ACCOUNTS ANALYSIS DOC. DAY DETAILS OF FOL. RECEIPTS BANK COST OF SALES SALES AMOUNT FOL. DETAILS Cash Payments Journal of _____________________________________________________ SUNDRY ACCOUNTS NAME OF DOC. DAY PAYEE FOL. BANK AMOUNT FOL. DETAILS 30 ACTIVITY 12: GENERAL LEDGER AND TRIAL BALANCE Take the CRJ and CPJ totals from the CRJ and CPJ for Mr Price Sport and post them to the General Ledger General Ledger of _______________________ Dr Date Day Details Fol Amount Date Day Details Fol Cr Amount Fol Cr Amount BALANCE SHEET ACCOUNTS SECTION 31 Date Day Details Fol Amount Date Day Details NOMINAL SHEET ACCOUNTS SECTION 32 Activity 13: CRJ & CPJ Brian Bands is a sport shop in Gqeberha that sells a variety of sporting equipment. All merchandise is sold at a mark-up of 80% REQUIRED 1. Enter the transactions in the cash Receipts and Cash Payments Journal for May 2.21 CRJ: Analysis of Receipts, Bank, Sales, Costs of Sales and Sundry Accounts. CPJ: Bank, Trading Stock, Wages, Stationery and Sundry Accounts. TRANSACTIONS 1 Owner, Peter Brian, paid R50 000 as his capital contribution and paid directly into the business bank account. 3 Paid R5 500 for wages and paid via EFT. Bought trading stock from sports world to the value of R7 800 and paid via EFT. 5 Cash sales of merchandise for R3 600 Received payment from A Saunders for rent of a building, R3 900 and paid via EFT. 9 Paid R5 500 for wages and paid cash. 10 Bought stationery to the value of R400 to PNA and paid by debit card. 11 Paid for rent of a storage facility, R800 and paid cash. 13 Cash sales of merchandise for R600 Standard Bank issued bank statement for interested earned of R140. 15 Paid stationery to PNA, R500, using a credit card. 16 Paid Engen R660 for petrol. Paid cash. 17 Took R850 for the bosses daughters birthday present. 20 Cash sales of merchandise worth R5 850. Received R500 for services rendered. Customer paid cash. 21 Paid NMB Municipality R1 800 for rates and taxes and paid via EFT. Paid Eskom R1 200 for electricity and paid via EFT. 24 Received merchandise from Simon’s Sports values at R45 000 and paid via EFT. 25 Cash sales of R2 350. 29 Cash sales of R6 000. 30 Owner, Peter Brian, increased his contribution to the business by R6 000 in the form of capital via EFT . 33 CASH RECEIPTS JOURNAL OF FOR DOC DAY DETAILS FOL ANALYSIS BANK SALES COST SUNDRY ACCOUNT OF OF RECEIPTS SALES AMOUNT FOL DETAILS CASH PAYMENTS JOURNAL FOR DOC DAY NAME OF FOL PAYEE BANK FOR SUNDRY ACCOUNT AMOUNT FOL DETAILS 34 ACTIVITY 14: GENERAL LEDGER AND TRIAL BALANCE Take the CRJ and CPJ totals from the CRJ and CPJ for Brian Bands and post them to the General Ledger General Ledger of _______________________ Dr Date Day Details Fol Amount Date Day Details Fol Cr Amount BALANCE SHEET ACCOUNTS SECTION 35 Dr Cr Date Day Details Fol Amount Date Day Details Fol Amount NOMINAL SHEET ACCOUNTS SECTION 36 Trial Balance for DETAILS FOL DEBIT CREDIT 37 ACTIVITY 15: GL Using the information below to complete the following general ledger accounts for July 2.18 for Checkers Newton Park: Note: All accounts must be closed off properly at the end of the month. Cash Receipts Journal (CRJ6): Cash Payments Journal (CPJ6): Bank Sales Cost of Sales Equipment Date Day Details R100 000 R24 000 R16 000 R12 000 Bank Equipment Trading Stock Wages Fol Amount Date R45 700 R 3 000 R40 500 R2 200 Day Details Fol Amount BALANCE SHEET ACCOUNTS SECTION EQUIPMENT B5 TRADING STOCK B6 BANK B8 NOMINAL SHEET ACCOUNTS SECTION Sales N1 38 Cost of Sales Wages N2 N3 39 ACTIVITY 16: GL Using the information below to complete the following General ledger accounts for January 2.18 for The General Store: Note: All accounts must be closed off properly at the end of the month. The following balances (amongst others) appeared in the books of Newton Park Spar on 1 January 2018: Trading Stock R9 200 Bank (favourable) R14 000 Favourable means positive Extracted Totals of Journals on 31 January 2018: Cash Receipts Journal (CRJ16): Cash Payments Journal (CPJ16): Bank R31 500 Bank R13 500 Current Income R22 000 Trading Stock R11 500 Rent Income R 7 500 Water & Electricity R2 000 Date Day Details Fol Amount Date Day Details BANK TRADING STOCK Fol Amount B1 B2 NOMINAL SHEET ACCOUNTS SECTION CURRENT INCOME RENT INCOME WATER & ELECTRICITY N1 N2 N3 40 ACTIVITY 17: The Heart is a cafeteria/tuckshop run within Alex High School. They sell a variety of food, treats and beverages to the students. The mark-up is 40%. REQUIRED: Enter the transactions in the Cash Receipts and Cash Payments Journal for June 2.21 CRJ: Analysis of Receipts, Bank, Sales, Cost of Sales and Sundry Accounts CPJ: Bank, Trading Stock, Wages, Consumables. TRANSACTIONS 1 The owner, A Smith, paid R6 000 directly into the business bank account as his capital contribution. 2 Cash sales of R1 250. Received R1 500 for rent of The Atrium by K Glover who paid via EFT. 4 Paid wages of R2 400 and paid EFT. Received trading stock worth R5 400 from Coca-Cola and paid via EFT. 6 Cash sales of R2 300. 9 Paid Makro for trading stock of R4 000 and R400 for consumables and paid via EFT. Received R800 for sales of merchandise. 12 Cash sales of R550. 13 Paid wages of 2400 via EFT. 18 Cash received for services provided, R50. 19 Paid the Municipality R800 for water and electricity. 21 Cash sales of R6 900. 24 Paid wages for R2 400 and paid cash. 26 Bought trading stock from WestPack for R680 and paid using a credit card. 29 Cash sales of R900. Services rendered for R150 and customer paid cash. 30 Took R900 for personal use. Paid via EFT. 41 CASH RECEIPTS JOURNAL OF FOR DOC DAY DETAILS FOL ANALYSIS BANK SALES COST SUNDRY ACCOUNT OF OF RECEIPTS SALES AMOUNT FOL DETAILS CASH PAYMENTS JOURNAL FOR DOC DAY NAME OF FOL PAYEE BANK FOR SUNDRY ACCOUNT AMOUNT FOL DETAILS 42 Activity 18: GL Take the CRJ and CPJ totals from the CRJ and CPJ – Activity 1 (page 19) for The Heart and post them to the General Ledger. GENERAL LEDGER OF __________________________________________________________ Date Day Details Fol Amount Date Day Details Fol Amount 43 44 DATE DAY DETAILS FOL AMOUNT DATE DAY DETAILS FOL Activity 19: CASH RECEIPT JOURNAL, CASH PAYMENTS JOURNAL AND DEBTORS JOURNAL AMOUNT Kevin and Gavin opened a Tennis gear shop, called Match Point. 1. Enter the following transactions into the correct journals. HINT: You must remember to enter all the cash received into the Cash Receipts Journal and all credit sales into the Debtors Journal. 2. NOTE: You will need: • Cash Receipts journal with columns for: Document, Day, Details, Analysis of Receipts, Bank, Sales Cost of Sales, Debtors Control and Sundry Account • Cash Payments Journal with columns for: Document, Day, Name of Payee Bank, Trading Stock, Wages and Sundry Account • Debtors Journal with the columns: Document number, Day, Details, Sales, Cost of Sales. • General Ledger • Trial Balance TRANSACTIONS FOR DECEMBER 2019 DAY 1 3 Stock was delivered by T. Ree paid R2 800 via eft. Goods with a selling price of R82 were sold to X Mas on account. Invoice no 42 issued. Cost Price was R49. Bought R1500 worth of Equipment FROM MAKROO and paid by EFT. 7 Paid employees their wages with cash, R5500, withdrawn from the bank. 9 Merchandise was sold on account to A N Gel. The selling price was R250 and the cost price was R180 as per invoice 43. 14 Paid employees their wages with cash, R5500. 15 Cash sales were R600 according to the cash register roll. The cost price was R300. 17 C Arol bought goods worth R270 on account. These goods had been marked up by 50% on the cost price invoice 44 issued to C Arol. 21 Merchandise was sold on account to A N Gel. The Selling Price was R350 and the cost price was R280 as per invoice 45. Paid employees their wages with cash, R5500. 23 Sold goods to C Arol with a selling price of R900 as per cash register roll. These goods were marked up by 100%. 25. Paid Telkom the telephone account R 1000 and the owners private cellphone account R 850, via EFT. 29 X Mas arrived at the store to pay for goods purchased on credit earlier in the month. X Mas was given receipt no 29. 31 Sold goods for cash. R650. These goods were marked up by 25% on cost. A N Gel settled her account as per, rec 30 given. 31 Collected R80 commission from Jingle Bells. 45 CASH RECEIPTS JOURNAL OF FOR DOC DAY DETAILS FOL ANALYSIS BANK SALES COST SUNDRY ACCOUNT OF OF RECEIPTS SALES AMOUNT FOL DETAILS CASH PAYMENTS JOURNAL FOR DOC D NAME OF F BANK A PAYEE O Y L FOR CREDITOR SUNDRY ACCOUNT S CONTROL AMOUNT F DETAILS O L 46 DEBTORS JOURNAL OF ________________________________________________ DOC. DAY DETAILS FOL. SALES COST OF SALES 47 GENERAL LEDGER OF ____________________________________________ DATE DAY DETAILS FOL AMOUNT DATE DAY DETAILS FOL AMOUNT 48 Trial Balance for DETAILS FOL DEBIT CREDIT 49 Activity 20: CASH RECEIPT JOURNAL, CASH PAYMENTS JOURNAL AND DEBTORS JOURNAL 3. Enter the following transactions into the correct journals of Season Retailers for the month of October 2018. HINT: You must remember to enter all the cash received into the Cash Receipts Journal and all credit sales into the Debtors Journal. 4. Merchandise is sold at cost price plus 25%. All documents are issued in sequence. 5. At the end of September 2018 the business had the following amounts owing to them by debtors. Frosty Winter R600 Sunny Summer R400 Chilly Autumn R300 Pretty Spring R100 6. NOTE: You will need: • Cash Receipts journal with columns for: Document, Day, Details, Analysis of Receipts, Bank, Sales Cost of Sales, Debtors Control and Sundry Account • Cash Payments Journal with columns for: Document, Day, Name of Payee Bank, Trading Stock, wages and Sundry Account • • • Debtors Journal with the columns: Document number, Day, Details, Sales, Cost of Sales. General Ledger Trial balance TRANSACTIONS FOR OCTOBER 2018 DAY 3 Bought more stock from luckylips for R4300 and paid via internet banking. 7 Received Payment via Debit Card from S Summer for R400 to settle his account. Cash Sales of Merchandise, R5000. 10 Issued receipt no 13 to P Spring for the amount outstanding on 30 September. Sold goods to F Winter on credit for R 340 [IV 10]. 12 Received Payment via internet banking from F Winter, R 600 to settle his account as at 1 October. Sold Merchandise on credit to S Summer, R360. 14 Cash Sales of goods as per CRR R 850. Paid employees their wages with cash, R8500. 16 Sold goods to C Autumn on credit for R290. 18 Paid via EFT to luckylips for merchandise R6500. 20 O Neer, the owner, increased his capital contribution by R 10 000, which he deposited directly into the bank account of Season Retailers. 25 Paid Nelson Mandela Bay Municipality for Rates & Taxes R 1500 and Water and Electricity R1200 and paid via EFT. 26 Cash Sales of goods as per CRR, R 1050. 30 C Autumn settled all amounts owed, receipt was issued. Paid employees their wages with cash, R8500. 50 CASH RECEIPTS JOURNAL OF_________________________________________________ SUNDRY CASH D PAYMENTS JOURNAL OF__________________________________________________ ACCOUNTS A DOC Y DETAILS NAME OF PAYEE DOC. DAY SUNDRY ANALYSI F COST OF DEBTORS ACCOUNTS FO S OF O L RECEIPT BANK SALES SALES CONTROL AMOUNT L. DETAILS FOL. BANK AMOUNT FOL. DETAILS 51 DEBTORS JOURNAL OF________________________________________________ DOC. DAY DETAILS FOL. SALES COST OF SALES 52 General Ledger of _______________________ Dr Date Day Details Fol Amount Date Day Details BALANCE SHEET ACCOUNTS SECTION Fol Cr Amount 53 Dr Date Day Details Fol Amount Date Day Details NOMINAL SHEET ACCOUNTS SECTION Fol Cr Amount 54 Trial Balance for DETAILS FOL DEBIT CREDIT 55 Activity 21: Amy sells cans of cool drink. She calls her business Amy’s SLURPEES. She Buys cans at R3 and sells them at R5. 1. Record the following transactions in the journals of Amy’s Slurpees. You will need to draw up a: I. Cash Receipt Journal (include columns for Sales, Cost of sales and debtors control) II. Cash Payments Journal (include columns for Trading Stock and Creditors control) III. Debtors Journal IV. Creditors Journal (include column for trading Stock) TRANSACTIONS FOR JULY 2017 1. Amy starts her business, Amy’s Slurpees, by depositing R350 into the firm’s bank account. Issued receipt 1. 1. Amy buys 10 cans of cola on credit for R30. She receives invoice 01 from Zondi Suppliers. 3. Amy buys 10 cans of cola for R30 cash. She pays Cash & Carry with cheque 001. 4. Amy uses a cheque to pay Advertco R50 to advertise her business. 5. Amy sells 8 cans of cola for R40 on account. She issues invoice 1 to Sally Zulu. 8. Amy sells 9 cans of cola for cash, R45 as per cash register roll 01. 10. Amy buys 12 cans of cola on credit, R36. She receives invoice 02 from Zondi Suppliers. 10. Mark buy 6 cans of cola from Amy’s Slurpees on credit. 13 Amy sells 2 cans of cola on account. She issues invoice 3 to Precious King. 16 Amy gives a cheque to P Renter to pay the rent for her shop, R60. 12. Amy pays Zondi Suppliers the amount owing to them. 19. Mark paid for 2 of the cans he bought on the 10th 23. Amy sells 1 can of cola for R5 for cash. She rings this up on the cash register. 25. Mark settled his account 56 CASH RECEIPTS JOURNAL OF___________________________________________________ SUNDRY ACCOUNTS DOC DAY DETAILS F ANALYS O IS OF L RECEIPT BANK COST OF DEBTORS FO SALE SALES CONTROL AMOUNT L. DETAILS 57 CASH PAYMENTS JOURNAL OF ________________________________________________ DEBTORS JOURNAL OF__________________________________________________ SUNDRY ACCOUNTS NAME OF DOC. DAY PAYEE DOC. DAY FOL. BANK DETAILS FOL. SALES AMOUNT FOL. DETAILS COST OF SALES 58 CREDITORS JOURNAL OF_______________________________________________________ SUNDRY ACCOUNTS DOC. DAY DETAILS CREDITORS FOL. CONTROL AMOUNT FOL. DETAILS ACTIVITY 22: Opening Balances for Keketsi Suppliers on 30 April 20.6 Capital R 360 000, Drawings R1 500, Buildings R154 000, Vehicles R80 600, Equipment R 19 900, Trading Stock R47 618, Bank R51 813, Cash Float R 700, Sales R22 314, Cost of Sales R14 792, Rent Expense R2 225, Stationery R200, Advertising R3 090, Insurance R1 150, Water and Electricity R 526, Salaries R4 200. Open the accounts in the General leger of Keketsi Suppliers with the balances given in the Trial balance on 30 April 20.06. [a] Cash Receipt Journal [CRJ5], with analysis columns for Analysis of receipts, Bank, Sales, Cost of Sales and Sundry Account. [b] Cash Payments Journal [ CPJ5], with analysis columns for Bank Trading Stock, Stationery, Wages and Sundry Account. [c] Close off the Journals on 31 May and post to the General Ledger. Show folio numbers. Balance the ledger accounts where necessary. Prepare the Trial Balance on 31 May 20.06 Transactions: May 20.06 1 B. Keketsi inherited R260 000; deposited this money in current bank account of Keketsi Suppliers as capital; receipt 020 issued. 2 Received title deeds for building bought; paid Rainbow Builders R205 000 by EFT. Sold merchandise for cash to A. Beyers, R10 500 (profit mark-up on all goods is 50%on cost price) 4 Paid wages by drawing cash from the ATM, R2 860. Cash sales as per cash register roll, R4 800. 7 Bought delivery vehicle from GM Motors by internet banking, R80 000. 8 Bought stationery from Paper & Co. R153 paid by EFT. 9 Paid by EFT to Prima Services for repairs to equipment, R631. 10 Cash sales as per cash register roll, R16 500 11 Paid wages cash that was drawing out the ATM, R2 860 14 Bought new computer from Officequip, R9 600; paid by internet banking. 15 B. Keketsi drew out of the businesses bank account for personal use, R1 200. 16 Sold goods for cash to P.Ponie for R7 200. 18 Cash sales as per cash register roll, R8 400. Bought merchandise from Leo Suppliers by EFT, R19 200. 59 19 Paid wages cash taking from bank account, R2 860 22 Paid rent by EFT to AA Estates, R 3150 25 Paid Wages with cash from the ATM, R2 860 26 Cash sales as per cash register roll, R6 000. 28 Paid A. Vermaak, Manager, salary of R 5 120 via EFT. B. Keketsi drew CASH for personal use, R 2 650. 31 Paid EFT to Telkom SA Ltd for Telephone, R481. Paid via internet banking as an investment of R15 000 on a fixed deposit with Protea Bank for 12 months at 10% interest per annum; interest payable every 6 months CASH RECEIPTS JOURNAL OF___________________________________________________ SUNDRY ACCOUNTS DOC DAY DETAILS F ANALYS O IS OF L RECEIPT BANK COST OF DEBTORS FO SALE SALES CONTROL AMOUNT L. DETAILS 60 61 CASH PAYMENTS JOURNAL OF ________________________________________________ SUNDRY ACCOUNTS DOC. DAY NAME OF PAYEE FOL. BANK AMOUNT FOL. DETAILS General Ledger of _______________________ Dr Date Day Details Fol Amount Date Day Details BALANCE SHEET ACCOUNTS SECTION Fol Cr Amount 62 Date Day Details Fol Amount Date Day Details NOMINAL SHEET ACCOUNTS SECTION Fol Amount 63 Trial Balance for DETAILS FOL DEBIT CREDIT 64 ACTIVITY 23: ACCOUNTING REVISION ACCOUTING REVISION – CRJ, CPJ, DJ, CJ, GL, TB Mark up of 80% CASH RECEIPTS JOURNAL OF J Adams CLOTHING FOR FEBRUARY 2.20 CRJ 5 DOC NO DAY DETAILS REC56 1 J Adams REC57 3 Sales FOL ANALYSIS OF RECEIPTS 26580 * 4 R Rein * CRR526 12 Sales * 14 IOU Bank REC59 19 C. Cronje CRR527 Sales REC60 26 REC61 28 S.A Melane B Overmeyer SALES Debtors Control 220000 * B/S B/S BANK COST OF SALES * * 80000 * * * Current Income * Loan: IOU bank 18700 7400 * 7400 12600 * DETAILS * * * * FOL 21580 * 2900 * * AMOUNT * 30000 * SUNDRY ACCOUNT * * * * * 65 CASH PAYMENTS JOURNAL OF J Adams CLOTHING FOR FEBRUARY 2.20 CPJ 5 DOC NO CC65 DA Y DETAILS Remax Estate CC66 1 2 CC67 4 Sewing Dealers CC68 6 Central News CC69 CC70 9 Linen & Cotton BANK TRADING STOCK WAGES CREDITOR S CONTROL 95 000 * SUNDRY ACCOUNT AMOUN FO T L DETAILS Land & 95 000 Buildings 9 000 14 950 * * Cash Calista Wholesalers 1250 5000 Advertising 5000 9 690 * CC71 13 Cash B/S 20 J Adams CC72 21 Telkom CC73 25 Geo's Fabrics 13 456 * CC74 26 Pinns Retailers 7 033 * * * Equipment 5000 12 500 12500 * 2 355 2355 * * * * * 66 DEBTORS JOURNAL OF J Adams Clothing for Feb 2.20 DOC NO INV31 INV32 INV33 INV34 DAY 11 24 25 26 DETAILS B Overmeyer C Cronje SA Melane B Overmeyer FOL SALES * COST OF SALES 13135 17528 * * 2400 15600 * * * CREDITORS JOURNAL OF J Adams for Feb 2.20 DOC NO INV15 INV16 INV17 INV18 INV19 DAY 2 10 19 22 24 DETAILS Calista Wholesalers Linen & Cotton Geo's Fabrics Calista Wholesalers Pinn's Retailers CREDITORS CONTROL STATIONERY 1523 * 43541 26800 16864 40000 * TRADING STOCK SUNDRYACCOUNT AMOUNT FOL DETAILS 108750 Equipment * * 864 * 974 * * * * Drawings Vehicles 67 General ledger of J Adams Clothing for February 2.20 BALANCE SHEET ACCOUNT SECTION Date DR Day Details Fol Amount Date Day Details Fol Amount CAPITAL B1 CR DRAWINGS B2 LAND AND BUILDINGS B3 VEHICLES B4 EQUIPMENT B5 68 TRADING STOCK B6 DEBTORS CONTROL B7 BANK B8 CREDITORS CONTROL B9 LOAN: IOU BANK B10 69 NOMINAL ACCOUNT SECTION SALES N1 COST OF SALES N2 CURRENT INCOME N3 ADVERTISING N4 STATIONERY N5 TELEPHONE N6 WAGES N7 70 TRIAL BALANCE OF J Adams Clothing for 28 February 2.20 BALANCE SHEET ACCOUNT SECTION FOL DEBIT R CREDIT R NOMINAL ACCOUNTS SECTION 71