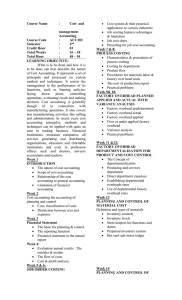

JOB ORDER SYSTEM- is used in those manufacturing situations where many different products, jobs, or batches of production are being produced each period. Examples of industries that would typically use manufacturing, ship building, and equipment manufacturing. Job order costing is also used as extensively in the service industries. Hospitals, law firms, advertising agencies, and repair shops, for example, all use job order costing to accumulate costs for accounting and billing purposes. Because the output of firms involved in the industries mentioned tends to be heterogenous, managers need a costing system in which costs can be accumulated by job (or by client or by customer) and which distinct unit cost can be determined for each job completed. Characteristics of a job order costing system: 1. It collects all manufacturing costs and assigns them to specific jobs or batches of product. 2. It measures cocts for each completed job, rather than for set time period. 3. It uses just one Work In Process Inventory Control account in the general ledger. Major source documents for job order costing 1. Job cost sheet a. These records accumulate product costs of specific units or small batches of units for both product costing and control purposes. b. The file of job cost records for uncompleted jobs serves as a perpetual book inventory and the subsidiary ledger Process account. for Work in 2. Materials stock card a. These records are the perpetual book inventory of costs and quantities of materials on hand. b. The file of material stock cards for unissued materials is the subsidiary ledger for Material Control. 3. Finished goods stock card a. These records are the perpetual book inventory of costs and quantities of completed books. b. The file of finished goods stock card for unsold goods is the subsidiary ledger of Finished Goods Control. 4. Factory overhead cost record a. These records accumulate detailed manufacturing cost by department. b. The file of these records for the accounting period is the subsidiary ledger for Factory Overhead Control. 5. Material requisition, time ticket, and clock card a. The source documents for charging cost to jobs and departments. b. To aid in fixing responsibility for control and usage of labor and materials. Spoiled goods are partially or fully completed units with imperfections that are not correctible either because it is not possible to correct them or because it is not economical to correct them. 1. Spoilage due to customer’s specification- if spoilage occurs because of actions taken by the customer, then the loss on the spoiled units is charged to the specific job. The factory overhead rate does not include an allowance for spoiled work. Work In Process account and deducted from the material cost of the job. 2. Spoilage caused by an internal failure- if spoilage occurs because of an internal failure, such as an error by the employee or defective materials or machinery, the unrecovered cost of the spoiled goods should be charged to Factory Overhead Control. The overhead rate will include an allowance for spoiled work; therefore the predetermined factory overhead rate will be higher. 3. If the scrap results from defective materials or broken parts, it should be considered an internal failure which management should try to reduce or eliminate. 2. If the scrap is traceable to indirect materials, the amount realized from the sale of the scrap is credited to Factory Overhead Control. JUST-IN-TIME means that raw materials are received just in time to be assembled into products are completed just in time to be shipped to customers. Defective units are units with imperfections that can be corrected by reprocessing the units. Just-in-time (JIT) costing differs from traditional costing with regards to the accounts used and the time of cost recording. There are basically three major differences. 1. Rework due to customer’s specifications- if the rework is caused by the customer, the additional costs incurred to reprocess the units are charged to the job will cause an increase in the unit cost. 1. Instead of using separate accounts for Materials and Work In Process as in traditional costing, JIT costing combines these into Raw and In-Process account. 2. Rework caused by an internal failure- if the rework is caused by an internal failure, the cost should be charged to Factory Overhead Control. 2. Direct labor is usually considered a minor cost item in a JIT setting so no separate account for direct labor is created. Direct labor and factory overhead are usually charged to Cost of Goods Sold account. Scrap includes (1) fillings or trimmings remaining after processing the materials, (2) defective materials that cannot be used or returned to vendors, and (3) broken parts resulting from employee or machine failures. 1. If the scrap is directly traceable to specific job, the amount realized from the sale of the scrap is credited to the 3. In traditional costing overhead is applied to products as they are being produced and is recorded into the Work In Process account. In JIT costing, overhead is not applied to production until they are completed. When products are completed under JIT costing, conversion cost is charged to Cost of Goods Sold, since the goods are sold soon after production is completed. Problem 1 The ZAMBALES MANUFACTURING COMPANY had the following inventories on August 1, 2013. Finished Goods Work in Process Materials P75,000 55,500 66,000 The work in process account controls two jobs Materials Labor FOH Job 401 P9,000 7,500 6,000 P22,500 Job 402 P 16,800 9,000 7,200 P33,000 The following information pertains to August operations: 1. Materials purchased on account P84, 000. 2. Materials issued for production, P75,000. Of thi00s amount, P9,000 was for indirect materials; the difference was distributed: P16,500 to Job 401; P21,000 to Job 402; and P28,500 to Job 403. 3. Materials returned to the warehouse from the factory, P2,400, of which P900 was for indirect materials, the balance from Job 403. 4. Materials returned to vendors, P3,000. 5. Payroll after deducting P9,075 for withholding taxes, P4,800 for SSS Premiums, P1,125 for PhilHealth, and P3,600 for Pag-ibig, was P98,400. The payroll due the employees was paid during the month. 6. The payroll was distributed as follows: P31,200 to Job 401; P37,500 to Job 402, P31,500 to Job 403 and the balance represents indirect labor. 7. The share of the employer for payroll was recorded- P6,000 for SSS Premiums, P1,125 for Philhealth Contributions, and P3,600 for Pag-ibig Funds. 8. Factory overhead, other than any previously mentioned, amounted to P45,000. Included in this figure were P9,000 fore depreciation of factory building and equipment, and P2,850 for expired insurance on the factory. The remaining overhead was unpaid at the end of August. 9. Factory overhead was applied to production at the rate of 80% of direct labor cost. 10. Job 401 was shipped and billed at a gross profit of 40% of the cost of goods sold. 12. Cash collections from accounts receivable during August were P105,000. Requirements: 1. Journal entries to record above transactions. 2. Job order cost sheet. 3. Cost of goods sold statement. Problem 2 BATAAN MANUFACTURING COMPANY charges factory overhead to production at a predetermined rate based on direct labor cost. The rate has remained the same for the last two years. The following data are given in its production: Job 1 Job 2 Job 3 Job 4 WIP Jan. 1 DM P8,000 P15,000 DL 3,200 6,500 AOH 1,920 3,900 Total estimated and inventory account balances are adjusted. Raw materials cost is back-flushed from RIP to Finished Goods. WIP Jan.1 DM P23,000 DL 9,700 AOH 5,820 Cost added -January DM 3,000 DL 1,200 8,500 18,000 9,500 3,150 7,500 2,700 Total 39,000 14,550 Job 1, 2 and 3 were completed during the month. Job 1 and 3 were sold at 180% of cost. The balance of the factory overhead control account is P 11,640. The variance is allocated between cost of goods sold, finished goods, and work in process. Required: 1. Predetermined factory overhead rate. 2. The cost of Jan. 1 Work in Process inventory 3. The amount of factory overhead applied to production 4. The cost of goods completed and tranferred to finished goods inventory 5. The cost of goods sold (actual) 6. The cost of finished goods inventory end. 7. The cost of the work in process inventory end. Problem 3 The PANGASNAN MANUFACTURING COMPANY has a cycle of 5.0 days, uses an in process (RIP) account and charges all conversion costs to Cost of goods Sold. At conversion cost components are Beginning balance of RIP account, including P18,600 of conversion cost P42,000 Beginning balance of FG account, including P28,500 of conversion cost 54,000 Raw materials purchased on credit 1,050,000 Ending RIP inventory, including P44,100 conversion cost estimate 67,200 Ending FG inventory, including P31,500 conversion cost estimate 59,400 Conversion costs are P375,000 for direct labor and P516,000 overhead 891,000 Required: Journal entries to record the given information. Problem 4 PAMPANGA MANUFACTURING COMPANY received an order’s exacting specifications, it is anticipated that defective and spoiled units will exceed the normal rate. the material cost per unit is P240, labor is P582, and factory overhead is applied at 100% of direct labor cost. During production, 10 were found to be defective and required the following total additional costsmaterials- P291, labor- P375. On final inspection, 4 units were classified as seconds and sold for P1,200 each, the proceeds being credited to the order. The buyer has agreed to accept the remaining good machines, although the acceptable units are fewer than the number ordered. Required: 1. Cost of the completed units 2. Entries to record the given transactions. 3. Assuming the imperfection is due to internal failure, compute the cost of the completed units and give the entries to record the given transactions. Problem 5 BULACAN MANUFACTURING COMPANY allocates service department budgeted costs to production departments as a matter of company policy. The production departments are S1 and S2, and the monthly data are: the factory overhead rate for P1 is computed based on 20,000 direct labor hours and P2 based on 15,000 machine hours. the overhead rate for each production activity that causes overhead costs, the resulting product costs will reflect an accurate measure of overhead cost. The direct material cost is P120 per unit. The budgeted hours are 8,030 direct labor hours. The accountant has identified activity centers to which overhead costs are assigned. The cost pool amounts for these centers and their selected activity drivers for 2013 are shown below. ACTIVITY CENTERS Material handling Scheduling and set-ups COST ACTIVITY DRIVERS P60,000 80,000 Design section Budgeted FOH P1 P2 S1 S2 P564,000 510,000 135,000 105,600 Services provided by S1 S2 40% 50% 50% 30% 20% 10% Required: Compute the factory overhead rate P1 and P2 after distribution of service department costs using: 1. Direct method 2. Step method- start with S1 3. Simultaneous method (algebraic method) Problem 6 For many years TARLAC MANUFACTURING COMPANY has used a manufacturing overhead based on direct labor hours. a new plant accountant suggested that the company may be able to assign overhead costs to products more accurately by using an activity based costing system. The accountant explains that by computing No. of parts 10,750 50,000 P200,750 1,200 times handled 400 setups 100 changes 500 parts The company’s products and other operating statistics follows Prod Qty DLH DL No. No. No. No. Prod used cost of of of of times parts design setup handled A B 50 100 100 2k 20 400 8k 50 charges 10 15 2 5 5 8 Required: 1. Compute the unit cost for each product using direct labor hours as the overhead application rate. 2. Compute the unit cost for each product using activity based costing. Multiple Choice Lara Company has a cycle time of 3 days, uses a raw and in process (RIP) account, and charges all conversion cost to Cost of Goods Sold. At the end of each month, all inventories are counted, their conversion cost components are estimated, and inventory account balances are adjusted. Raw materials cost is backflushed from RIP to Finished Goods. The following information is for June. Beginning balance of RIP account, including P3,000 of conversion cost P29,250 Beginning balance of finished goods account, including P10,000 of conversion cost 30,000 Raw materials received on credit 562,500 Direct labor cost, P375,000 ,factory overhead applied P450,000 Ending RIP inventory per physical count, including P4,500 conversion cost 32,000 Ending finished goods inventory per count, including P8,750 conversion cost 26,250 1. The material cost of (1) the units completed and (2) the units sold are: a. (1) P561,250 (2) P563,750 The accounting records for 2013 of EGGS Manufacturing Company showed the following information: Increase in raw materials inventory P45,000 Decrease in Finished Goods inventory 150,000 Increase in Work in Process inventory 60,000 Raw materials purchased 1,290,000 Direct labor payroll 600,000 Factory overhead 900,000 Freight out 135,000 2. The cost of raw materials used for the period amounted to: a. P1,245,000 A company has identified the following overhead costs and cost drivers for the coming year OH item Cost driver Budgeted Activity Budgeted OH 200 P20,000 InspecNo. 6,500 tion of inspect tion 130,000 Machine No. set-up of set up Material handling Engrng Total No. 8,000 of material moves 80,000 No. 1,000 of engineering hrs. 50,000 P280,000 The following information was collected on three jobs that were completed during the year: J1 J2 J3 DM P5,000 P12,000 P8,000 DL 2,000 2,000 4,000 Units completed 100 50 200 No. of set ups 1 2 4 No. of inspections 20 10 30 No. of material moves 30 10 50 No. of engineering hrs 10 50 10 Direct material was requisitioned as follows for each job, respectively: 30%, 25%, and 25%, the balance of the requisitions were considered indirect. Direct labor hours per job are 2,500, 3,100, and 4,200 respectively. Indirect labor is P33,000. Other actual overhead costs totaled P36,000. Budgeted direct labor cost was P100,00 and budgeted direct material cost was P280,000. 3. if the company used activity-basedcosting, how much overhead cost should be assigned to Job 103 (J3)? b. P2,000 5. What is the total amount of actual factory overhead? c. P93,000 The following information pertains to Alma Co. manufacturing process 2013 March 1 March 31 6. If Job 503 is completed and transferred, how much is the total cost transferred to Finished Goods Inventory? c. P108,540 Inventories DM P36,000 P30,000 WIP 18,000 12,000 FG 54,000 72,000 Additional information for the month of March: DM purchased 84,000 DL payroll 60,000 DL rate per hour 7.50 FOH rate per DLH 10.00 4. How much must be the prime cost, conversion cost, and cost of goods manufactured for the month? Prime Conversion COGM Cost Cost d. 150,000 140,000 236,000 Adams Company used a job order costing system and the following information is available from the records. The company has 3 jobs in process: 501, 502, 503. Raw materials used P120,000 DL per hour 8.50 OH applied based on DL cost 120% Miracle Company provides you with the following information Jan. 1, 2013 Inventories: Materials P ? WIP 80,000 FG 60,000 January transactions: Purchases of materials, FOH (75% of DL cost) Selling & adm. exp. (12.5% of sales) FOH Control Net Income for Jan. Indirect materials used Jan. 31, 2013 P50,000 95,000 78,000 P46,000 63,000 25,000 62,800 25,200 1,000 7. Compute for materials inventory, Jan. 1 COGM and COGS (normal) for the month of January, 2013. d. Materials Invty. COGM COGS Jan. 1 40,000 168,000 150,000 c. P 25,560 Job no. 41 (consisting of 5,000 units) was started in September, 2013 and it is special in nature because of its per unit and includes a P.05 provision for defective work. The prime cost incurred in September are: Direct materials, 9,000 and direct labor, P 4,800. Upon inspection, 80 units were found with following reprocessing costs, direct materials, P 1,500 and direct labor, P 800. 8. The unit cost of Job 41, upon completion is: c. P 3.98 Work in process of Alonzo Corporation on July 1, 2013 (per general ledger) is P 22,800 Per cost sheets: Job 101 Job 102 DM P 6,000 P 8,000 DL 3,000 2,500 Amount charged to Work in process for July, 2013 DM DL Job101 Job102 P3,000 1,000 P2,000 1,500 Job103 Job104 P6,000 P4,500 2,600 2,000 Factory overhead is applied to production based on direct labor cost. Jobs 101 and 103 are completed during the month. 9. Cost of goods put into process must be: d. P 49,660 10. The cost of goods manufactured for the month of July is Marco Corporation has a job order cost system. The following debits (credits) appeared in the general ledger account work-in-process for the month of September, 2013: Sept. 1 Balance Sept. 30, DM Sept. 30, DL Sept. 30, FOH Sept. 30, to finished goods P12,000 40,000 30,000 27,000 (100,000) Marco applies overhead to production at a predetermined rate of 90% based on the direct labor cost. Job no. 232, the only job still in process at the end of September, 2013, has been charged with factory overhead of P 2,250. 11. What was the amount of direct materials charged to Job 232 as at the end of September, 2012? c. P 4,250 Justine Company budgeted total variable costs at P 180,000 for the current period. In addition, they budgeted costs for factory rent at P 215,000, costs for depreciation on office equipment at P 12,000, costs for office rent at P 92,000, and costs for depreciation of factory equipment at P 38,000. All these costs were based upon estimated machine hours of 80,000. Actual factory overhead for the period amounted to P 387,875 and machine hours used totaled 74,000 hours. 12. What was the over or underapplied factory overhead for the period? a. P 12,650 overapplied Multiple Choice Tudors, Inc purchases and resells a single item of product. Inventory at the beginning of September, 2013 was 400 units, values at P 1.80 each. Further receipts and sales during the month were as follows: Units Sept. 8 Rcpts 600 Sept. 14 Rcpts 500 Sept. 25 Sales 1,250 Pesos Per Unit P 2.10 ? 4.00 The company uses FIFO. Gross margin for September was P 2,500 1. What was the cost per unit of the 500 units received on Sept. 14? a. P 2.08 c. P 1.94 b. P 2.00 d. P 1.04 The accounting records for 2013 of Wagner Co. showed the following: Decrease in RM inventory Decrease in FG inventory RM purchased DL Payroll Factory overhead Freight out P 45,000 150,000 1,290,000 600,000 900,000 135,000 2. The cost of raw materials used for Job No. 2468, which is being carried out by Flexy Co. to meet a customer’s order. Dept. A Dept. B DM used P 5,000 P 3,000 DLH employed 400 200 DL rate per hour P 4.00 P 5.00 OH rate per hour P 4.00 P 4.00 Adm. and other OH 20% of full production cost Profit mark-up 25% of selling price . 3. The selling price to the customer of Job 2468 is: a. P 16,250 c. P 17,333 b. P 20,800 d. P 19,500 Ronald Factory provides for an incentive scheme for its factory workers which features a combined minimum guaranteed wage and a piece rate. Each worker is paid P 11.25 per piece with a minimum guaranteed wage of P 875 per week. Production report for the week show: Employee R O L A N D Units produced 67 78 80 82 72 75 4. The portion of the weekly payroll that should be charged to factory overhead is a. P 5,325.00 c. P 5, 217.50 b. P 5,275.00 d. P 217.50 Worley Co. has overapplied overhead of P 45,000 for the year ended Dec 31, 2013, balances from Worley’s records are as follows: COGS 720,000 Inventories: DM 36,000 WIP 54,000 FG 90,000 Under Worley’s cost accounting system, over or underapplied overhead is allocated to appropriate inventories and cost of good sold based on year-end balances. 5. In its 1023 income statement, Worley should report cost of goods sold at a. P 682,500 c. P 684,000 b. P 756,000 d. P 757,500 b. (P 23,562.50) The following were taken from the books of Marvin Company. RM WIP FG Jan. 1 P268,000 0 43,000 (100 units) Materials purchased DL FOH Sales March 31 P 167,000 0 ? (200 units) P 1,946,700 2,125,800 764,000 (12,400 units at P 535) The company uses the FIFO method for costing inventories. 6. The number of units manufactured is: a. 11,900 c. 12,500 b. 12,000 d. 15,200 7. The cost of good manufactured per unit is: a. P 300 c. P 395 b. P 350 d. P 420 8. The cost of goods sold is: a. P 4,091,500 c. P 4,901,500 b. P 4,109,500 d. P $,910,500 Rumors Company applied factory overhead as follows: Department Fabricating Spreading Gossiping FOH Rate P 7.75 per Machine hour 15.10 per Machine hour 2.125 per machine hour Actual machine hours are : 19,000 hours for fabricating; 27,500 hours for spreading and 5,500 hours for gossiping. 9. If the actual FOH cost for the period is P 574,375, how much is over (under) applied FOH? a. (P 11,875.00) c. ( P 187.50) d.( P 76,125.00) Hamilton Company uses a job order costing. FOH is applied to production at a budgeted rate of 150% of direct labor costs. Any overapplied or underapplied factory overhead is closed to the cost of goods sold account at the end of the month. Additional information is available as follows: Job 101 was the only job in process at January 31, 2013 with accumulated costs as follows: DM DL FOH P 4,000 2,000 3,000 P 9,000 Jobs 102, 103 and 104 were started during February. Direct materials requisitions for Februry totaled P 26,000. Actual factory overhead was P 32,000 for February. The only job still in process at the end of February was Job 104, with costs of P 2,800 for direct materials and P 1,800 for direct labor. 10. The cost of goods manufactured for February was: a. P 77,700 c. P 78,000 b. P 79,700 d. P 85,000