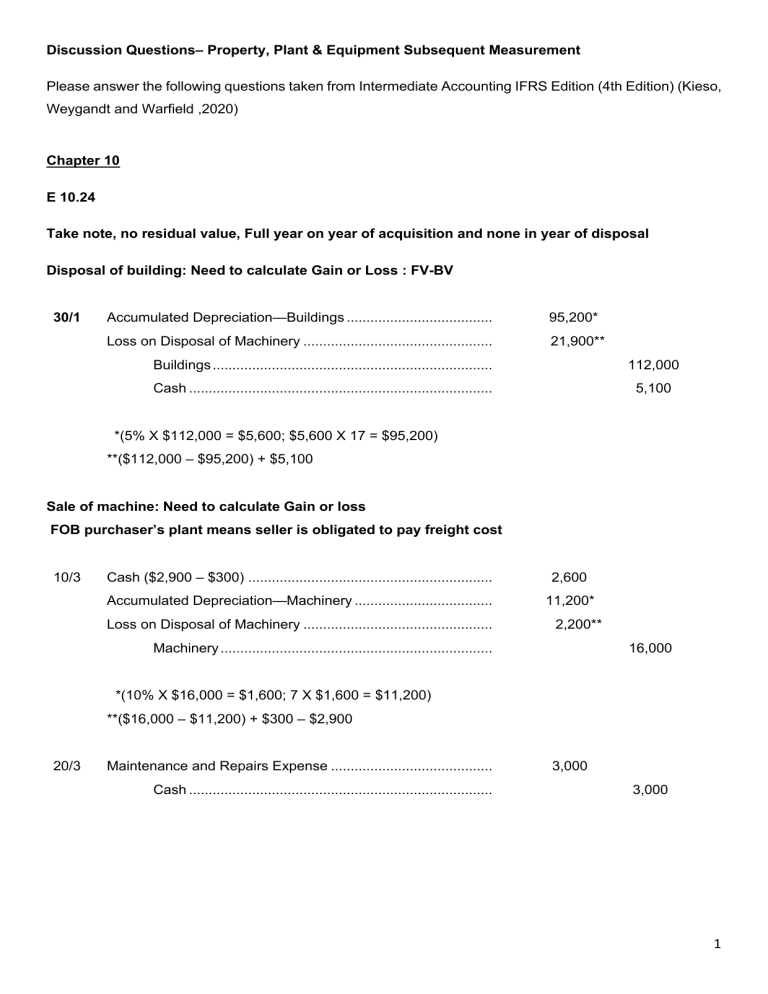

Discussion Questions– Property, Plant & Equipment Subsequent Measurement Please answer the following questions taken from Intermediate Accounting IFRS Edition (4th Edition) (Kieso, Weygandt and Warfield ,2020) Chapter 10 E 10.24 Take note, no residual value, Full year on year of acquisition and none in year of disposal Disposal of building: Need to calculate Gain or Loss : FV-BV 30/1 Accumulated Depreciation—Buildings ..................................... 95,200* Loss on Disposal of Machinery ................................................ 21,900** Buildings ....................................................................... 112,000 Cash ............................................................................. 5,100 *(5% X $112,000 = $5,600; $5,600 X 17 = $95,200) **($112,000 – $95,200) + $5,100 Sale of machine: Need to calculate Gain or loss FOB purchaser’s plant means seller is obligated to pay freight cost 10/3 Cash ($2,900 – $300) .............................................................. 2,600 Accumulated Depreciation—Machinery ................................... 11,200* Loss on Disposal of Machinery ................................................ 2,200** Machinery ..................................................................... 16,000 *(10% X $16,000 = $1,600; 7 X $1,600 = $11,200) **($16,000 – $11,200) + $300 – $2,900 20/3 Maintenance and Repairs Expense ......................................... Cash ............................................................................. 3,000 3,000 1 Remove cost of old base and include cost of new base 18/5 Machinery ................................................................................. 5,500 Accumulated Depreciation—Machinery ................................... 2,400* Loss on Disposal of Machinery ................................................ 1,600** Machinery ..................................................................... 4,000 Cash ............................................................................. 5,500 *(10% X $4,000 = $400; 6 X $400 = $2,400) **($4,000 – $2,400) 6/23 Maintenance and Repairs Expense ......................................... 6,900 Cash ............................................................................. 6,900 Chapter 11 EXERCISE 11.12 (a) 1996–2005—(€1,900,000 – €60,000) ÷ 40 = €46,000/yr. (b) 2006–2023—Building (€1,900,000 – €60,000) ÷ 40 = Addition (€470,000 – €20,000) ÷ 30 = €46,000/yr. €15,000/yr. €61,000/yr. (c) No adjusting entry required. (d) Revised annual depreciation Building Book value: (€1,900,000 – €1,288,000*) .................................... €612,000 Residual value ............................................................................. (60,000) 552,000 Remaining useful life.................................................................... ÷ 32 years Annual depreciation ..................................................................... € 17,250 *€46,000 X *28 years = €1,288,000 Addition Book value: (€470,000 – €270,000**) ......................................... €200,000 Residual value ............................................................................. (20,000) 2 180,000 Remaining useful life.................................................................... ÷ 32 years Annual depreciation ..................................................................... € 5,625 **€15,000 X 18 years = €270,000 Annual depreciation expense—building (€17,250 + €5,625) €22,875 EXERCISE 11.25 Value at Other Comprehensive Accumulated Other Income Comprehensive Income December 31 2020 2021 2022 Recognized in Net Income ¥50,000 ¥50,000 (50,000) — — — (¥40,000) — 25,000 2023 10,000 10,000 2024 50,000 60,000 15,000 — EXERCISE 11.26 December 31, 2020 Land (¥450,000 – ¥400,000) .............................................................. 50,000 Unrealized Gain on Revaluation—Land ................................... 50,000 December 31, 2021 Unrealized Gain on Revaluation—Land ............................................. 50,000 Loss on Impairment (¥400,000 – ¥360,000)....................................... 40,000 Land (¥450,000 – ¥360,000) .................................................... 90,000 December 31, 2022 Land (¥385,000 – ¥360,000) .............................................................. 25,000 Recovery of Impairment Loss .................................................. 25,000 December 31, 2023 Land (¥410,000 – ¥385,000) .............................................................. 25,000 Recovery of Impairment Loss (¥40,000 – ¥25,000) .............................................................. 15,000 Unrealized Gain on Revaluation—Land ................................... 10,000 December 31, 2024 Land (¥460,000 – ¥410,000) .............................................................. Unrealized Gain on Revaluation—Land ................................... 50,000 50,000 3