Forms of Organization & Stakeholder Management in Technopreneurship

advertisement

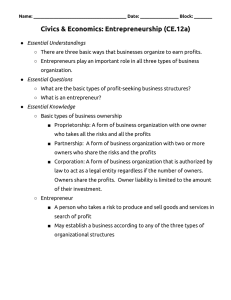

NAME: IMPERIAL, JAYSON S. YEAR AND SECTION: BSIT 3-1 SUBJECT: TECHNOPRENUERSHIP FORMS OF ORGANIZATION Sole Proprietorship The simplest and most common form of business ownership, sole proprietorship is a business owned and run by someone for their own benefit. The business’ existence is entirely dependent on the owner’s decisions, so when the owner dies, so does the business. Advantages of sole proprietorship: All profits are subject to the owner There is very little regulation for proprietorships Owners have total flexibility when running the business Very few requirements for starting—often only a business license Disadvantages: Owner is 100% liable for business debts Equity is limited to the owner’s personal resources Ownership of proprietorship is difficult to transfer No distinction between personal and business income Partnership These come in two types: general and limited. In general partnerships, both owners invest their money, property, labor, etc. to the business and are both 100% liable for business debts. In other words, even if you invest a little into a general partnership, you are still potentially responsible for all its debt. General partnerships do not require a formal agreement—partnerships can be verbal or even implied between the two business owners. Limited partnerships require a formal agreement between the partners. They must also file a certificate of partnership with the state. Limited partnerships allow partners to limit their own liability for business debts according to their portion of ownership or investment. Advantages of partnerships: Shared resources provides more capital for the business Each partner shares the total profits of the company Similar flexibility and simple design of a proprietorship Inexpensive to establish a business partnership, formal or informal Disadvantages: Each partner is 100% responsible for debts and losses Selling the business is difficult—requires finding new partner Partnership ends when any partner decides to end it Corporation Corporations are, for tax purposes, separate entities and are considered a legal person. This means, among other things, that the profits generated by a corporation are taxed as the “personal income” of the company. Then, any income distributed to the shareholders as dividends or profits are taxed again as the personal income of the owners. Advantages of a corporation: Limits liability of the owner to debts or losses Profits and losses belong to the corporation Can be transferred to new owners fairly easily Personal assets cannot be seized to pay for business debts Disadvantages: Corporate operations are costly Establishing a corporation is costly Start a corporate business requires complex paperwork With some exceptions, corporate income is taxed twice Limited Liability Company (LLC) Similar to a limited partnership, an LLC provides owners with limited liability while providing some of the income advantages of a partnership. Essentially, the advantages of partnerships and corporations are combined in an LLC, mitigating some of the disadvantages of each. Advantages of an LLC: Limits liability to the company owners for debts or losses The profits of the LLC are shared by the owners without double-taxation Disadvantages: Ownership is limited by certain state laws Agreements must be comprehensive and complex Beginning an LLC has high costs due to legal and filing fees STAKEHOLDER MANAGEMENT Stakeholder management is the process by which you organize, monitor and improve your relationships with your stakeholders. It involves systematically identifying stakeholders; analyzing their needs and expectations; and planning and implementing various tasks to engage with them. A good stakeholder management process will be the means through which you are able to coordinate your interactions and asses the status and quality of your relationship with various stakeholders. Most definitions of stakeholder management tend to focus around the idea that you can “manage your stakeholders (in order to get them to do what you want)”. The emphasis is placed on creating a stakeholder management plan that maps the level of interest and influence of stakeholders and list various levels of engagement for the different groups. A plan that is usually created at the start of the project and then filed away to gather dust. This guide takes a different focus. We’re not going to show you how to herd sheep, put them in neat little pens and then pretend that they are all heading in the direction you want. In most cases there is a legal and a strategic objective to undertaking stakeholder engagement/consultation/management. You might have a statutory or legal requirement to consult. And you hopefully have a clear idea of the strategic benefits you might derive from doing it well. This guide will show you how you can achieve both those objectives. INVESTORS An investor is a person that allocates capital with the expectation of a future financial return (profit) or to gain an advantage (interest). Through this allocated capital most of the time the investor purchases some species of property. Types of investments include equity, debt, securities, real estate, infrastructure, currency, commodity, token, derivatives such as put and call options, futures, forwards, etc. This definition makes no distinction between the investors in the primary and secondary markets. That is, someone who provides a business with capital and someone who buys a stock are both investors. An investor who owns a stock is a shareholder. There are two types of investors, retail investors and institutional investors: • Individual investors (including trusts on behalf of individuals, and umbrella companies formed by two or more to pool investment funds) • Businesses that make investments, either directly or via a captive fund • Endowment funds used by universities, churches, etc. • Mutual funds, hedge funds, and other funds, ownership of which may or may not be publicly traded (these funds typically pool money raised from their owner-subscribers to invest in securities) Investors might also be classified according to their styles. In this respect, an important distinctive investor psychology trait is risk attitude. COMPETITION Rivalry where multiple parties strive for a goal which cannot be shared Competition is a rivalry where two or more parties strive for a common goal which cannot be shared: where one’s gain is the other’s loss (an example of which is a zero-sum game). Competition can arise between entities such as organisms, individuals, economic and social groups, etc. The rivalry can be over attainment of any exclusive goal, including recognition: (e.g. awards, goods, mates, status, prestige), leadership, market share, niches and scarce resources, or a territory. A regulatory agency (also regulatory body or regulator) is a government authority that is responsible for exercising autonomous dominion over some area of human activity in a licensing and regulating capacity. These are customarily set up to strengthen safety and standards, and/or to protect consumers in markets where there is a lack of effective competition. Examples of regulatory agencies that enforce standards include the Food and Drug Administration in the United States and the Medicines and Healthcare products Regulatory Agency in the United Kingdom; and, in the case of economic regulation, the Office of Gas and Electricity Markets and the Telecom Regulatory Authority in India. REGULATORY AGENCIES Regulatory agencies are generally a part of the executive branch of the government and have statutory authority to perform their functions with oversight from the legislative branch. Their actions are often open to legal review. Regulatory agencies deal in the areas of administrative law, regulatory law, secondary legislation, and rulemaking (codifying and enforcing rules and regulations, and imposing supervision or oversight for the benefit of the public at large). The existence of independent regulatory agencies is justified by the complexity of certain regulatory and directorial tasks, and the drawbacks of political interference. Some independent regulatory agencies perform investigations or audits, and other may fine the relevant parties and order certain measures. In a number of cases, in order for a company or organization to enter an industry, it must obtain a license to operate from the sector regulator. This license will set out the conditions by which the companies or organizations operating within the industry must abide.