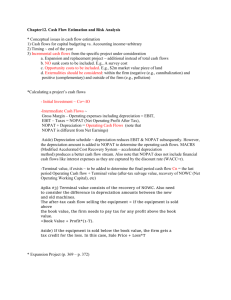

1 Finc 421 week 6 Name Instructor Subject April 15, 2022 2 Finc 421 week 6 1. Discuss the difference between NOPAT and net income and explain which one is the better measure of a company's performance, and why? Net Operating Profit after Tax (NOPAT), also known as net operating profit after deduction of taxes, is the operating profit of an organization after the deduction of taxes. A profit and loss statement is a tool used to determine its profitability. When there is no debt funding, it aids the firms in calculating their profits. In the event of NOPAT, the corporation is unable to claim a tax deduction for interest paid on loan financing. It may also be computed using the following formula: NOPAT = Operating Profit (1 – tax rate) + Net Operating Profit Net Income is defined as the number of net profits (positive amount) that remains after subtracting all costs, interest, taxes, and preferred stock dividend from Gross Profit. It is referred to as the bottom line or the net growth in the shareholder's equity in certain circles. In addition to transferring a portion of net Income to Reserves & Surplus, the remaining net Income is dispersed to the company's owners. The opposite is true if the amount remaining after subtracting the costs mentioned above is negative, in which case it will be referred to as a Net Loss. The distinction between NOPAT and Net Income may be easily distinguished based on the following factors: 3 NOPAT is used to compare the performance of several companies, while net income is used to evaluate the success of a single business. It is not feasible to claim a tax deduction for interest in the case of NOPAT, although the interest deduction is accessible in the case of Net Income. NOPAT is the amount left over after subtracting taxes from operating profit. On the other hand, Net Income is the amount left over after all costs, gains, taxes, and dividends have been deducted (S, 2018). Calculate the Economic Value Added for the company that you selected for the Company Analysis Project and critically evaluate the result? A company's financial performance is measured by removing its cost of capital from its operating profit and then correcting for taxes on an after-tax basis, which is known as economic value added (EVA) (Ramana, 2005). EVA is the difference between a company's cost of capital and its rate of return (RoR). It is used to quantify the value that a firm creates from cash investment. Having a negative EVA indicates that the firm is not creating value from its money. On the other hand, EVA suggests that a firm generates value for the money invested in it. EVA is calculated using the following formula: 4 EVA = NOPAT - (Capital Invested * WACC) Non-operating profit after taxation (NOPAT) Debt plus capital leases plus stockholders' equity equals invested capital. WACC stands for "Weighted Average Capital Cost." EVA calculations for Apple. 12 months ended: Sep 25, 2021 Sep 26, 2020 Sep 28, 2019 Sep 29, 2018 Sep 30, 2017 Sep 24, 2016 Net operating profit after taxes (NOPAT)1 91,417 52,072 Cost of capital2 58,457 53,325 25,136 46,539 15.24% 15.09% 14.71% 14.47% 14.24% 46,064 39,606 54,225 30,068 51,146 84,397 52,479 45,349 20,784 44,789 14.08% Invested capital3 40,704 Economic profit4 40,807 5 Calculation Economic profit = NOPAT – Cost of capital × Invested capital = 91,417 – 15.24% × 46,064 = 84,397 Should the company that you selected for the Company Analysis Project borrow more money because of the tax benefit from interest payments? Why or why not (use actual financial data to support the analysis)? The company I selected for analysis is Apple. Yes Apple borrow more money because the interest rate on Apple's new loan is so cheap, it comes to Apple's $2.5 billion in five-year notes, which bear a lower after-tax interest expense for Apple than the after-tax cost of the cash dividend that it pays its ordinary shareholders. That's because Apple doesn't want to pay the 35 percent corporation taxes necessary to bring it back to the United States. On the other hand, Apple plans to borrow in the United States to meet its $30 billion in dividends and stock buybacks. According to Credit Sights, Apple owes $8 billion in debt due in 2020, with the majority of that debt coming from the United States and Japan. A financing fee is the amount of money you'll have to pay in order to take out a loan. Simple interest is the most common kind of interest charged by lenders. The basic interest formula is: principle x rate x time Equals interest. 6 4. Most Important Things Learned – What are the most important things you learned from the study of this week's readings, discussions, and assignments? This week's discussion and assessment have taught me a great deal, such as the difference between NOPAT and net income and how they are calculated. I understand Economic Value Added (EVA) and how to calculate EVA for businesses. I also learn about the tax advantages and available interest payments. References 7 1. Ramana, D. V. (2005). Market Value Added and Economic Value Added: Some Empirical Evidences. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.871404 2. S, S. (2018, 26 juli). Difference Between NOPAT and Net Income (with Comparison Chart). Key Differences. Geraadpleegd op 25 april https://keydifferences.com/difference-between-nopat-and-net-income.html 2022, van